Second Quarter 2011 Highlights

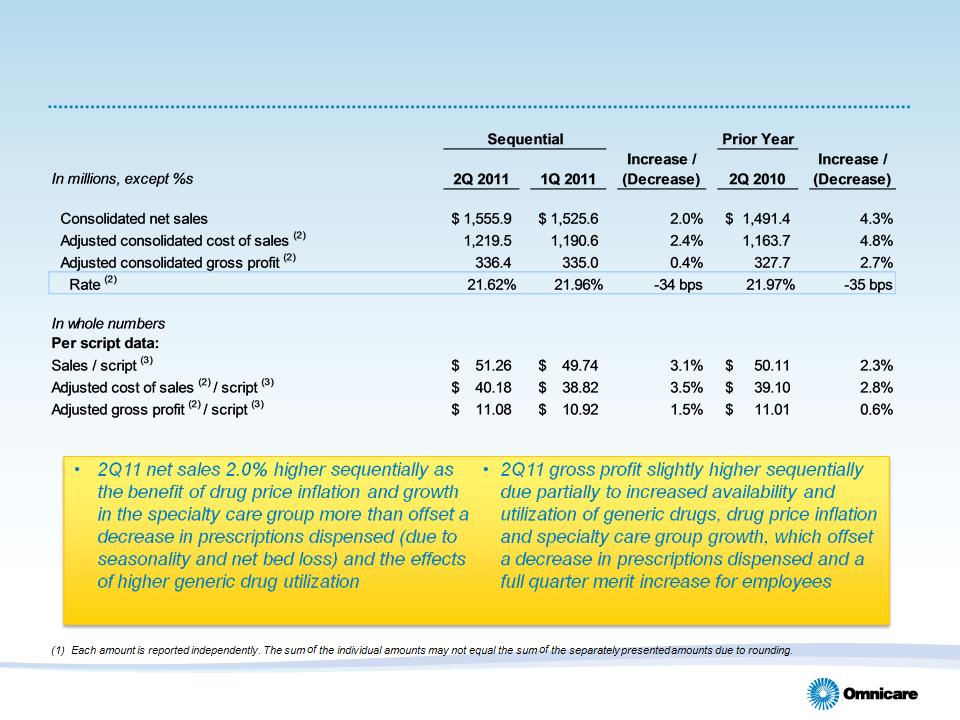

• Gross profit increased 0.4% sequentially to $336.4M on 2.0% increase in sales

– Gross margin sequentially lower by 34 bps to 21.62%, reflecting seasonably weaker

quarter and full quarter impact of merit increase

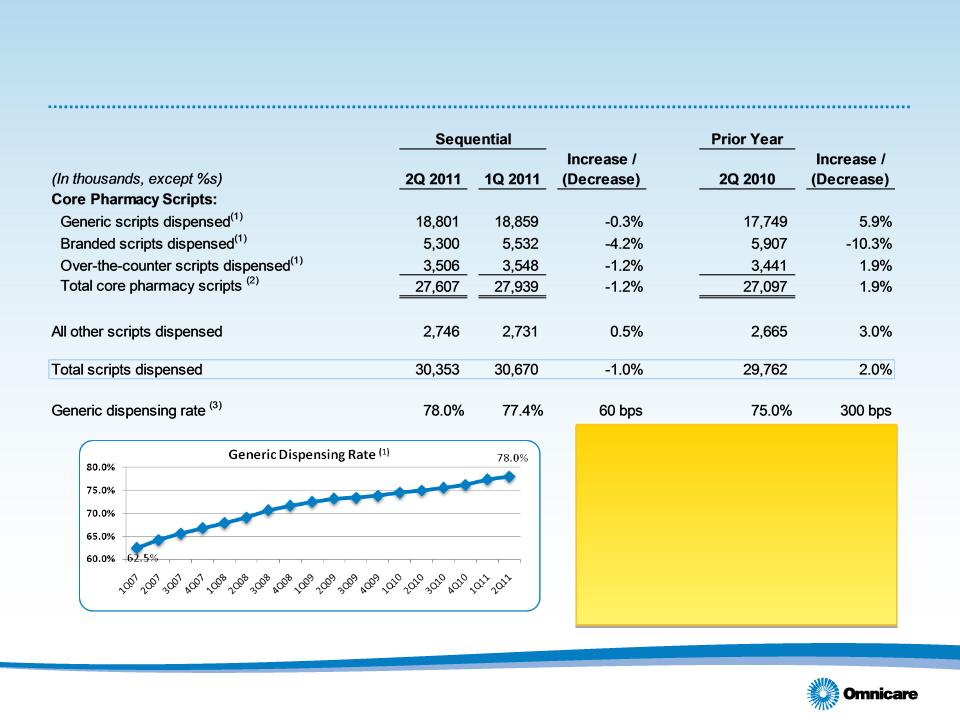

• Scripts increased 2.0% over 2Q10; 1.0% lower than 1Q11

– Utilization, census weaker sequentially due to seasonality

– Generic dispensing rate increased 60 basis points sequentially

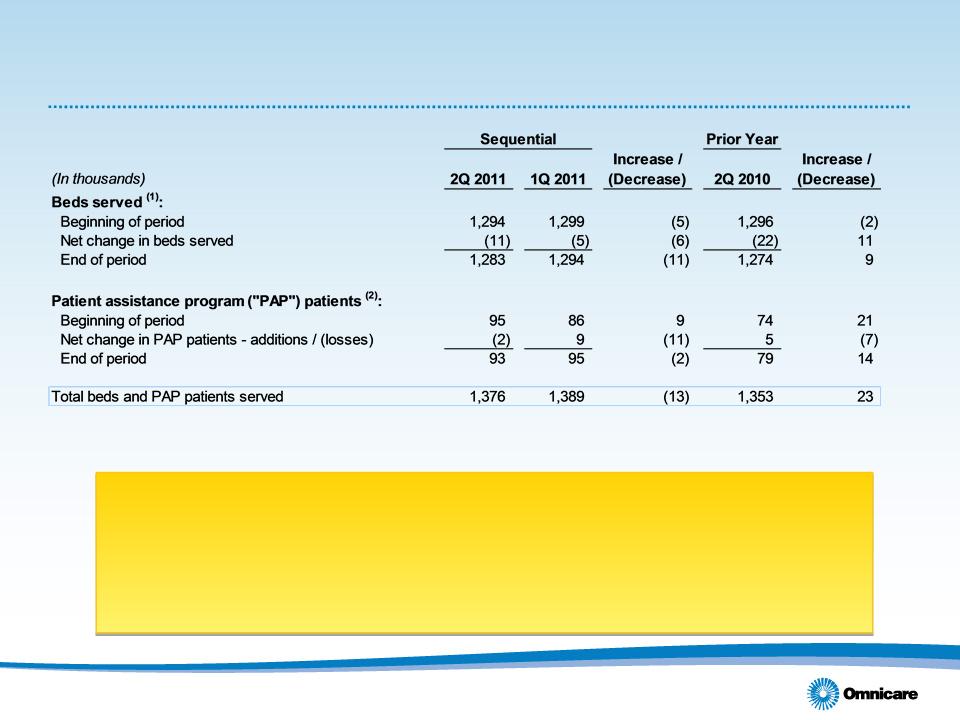

• Qtr. ending number of beds/patient assistance program (PAP) patients up 23,000

year-over-year

– PAP patients up 14,000; Beds 9,000 higher

– Net bed loss of 11,000 relatively even with 1Q11 organic net bed loss of 9,000

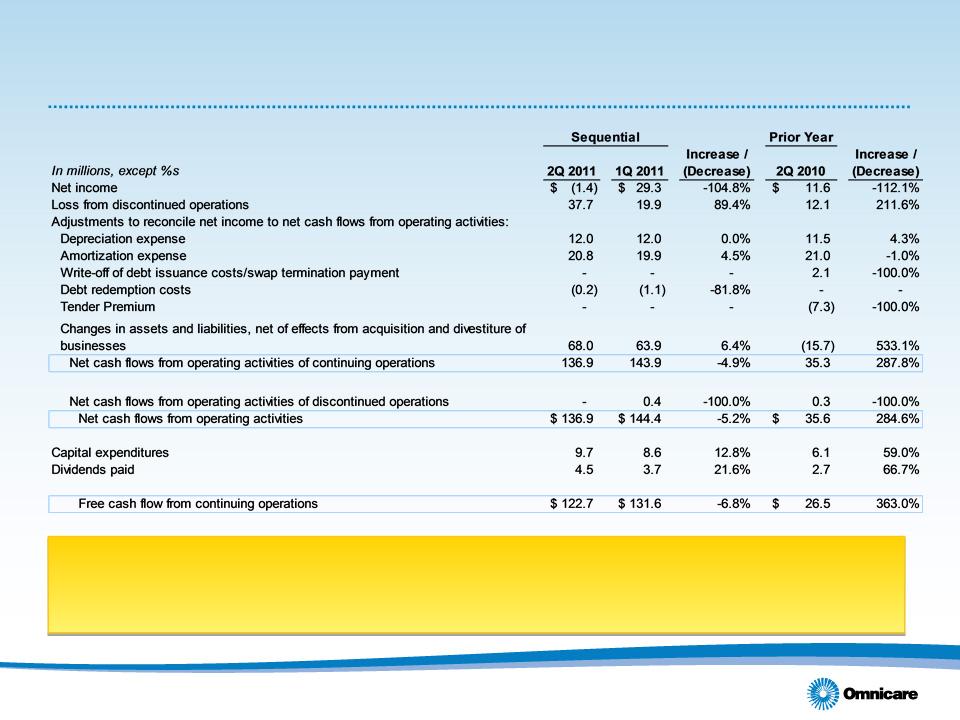

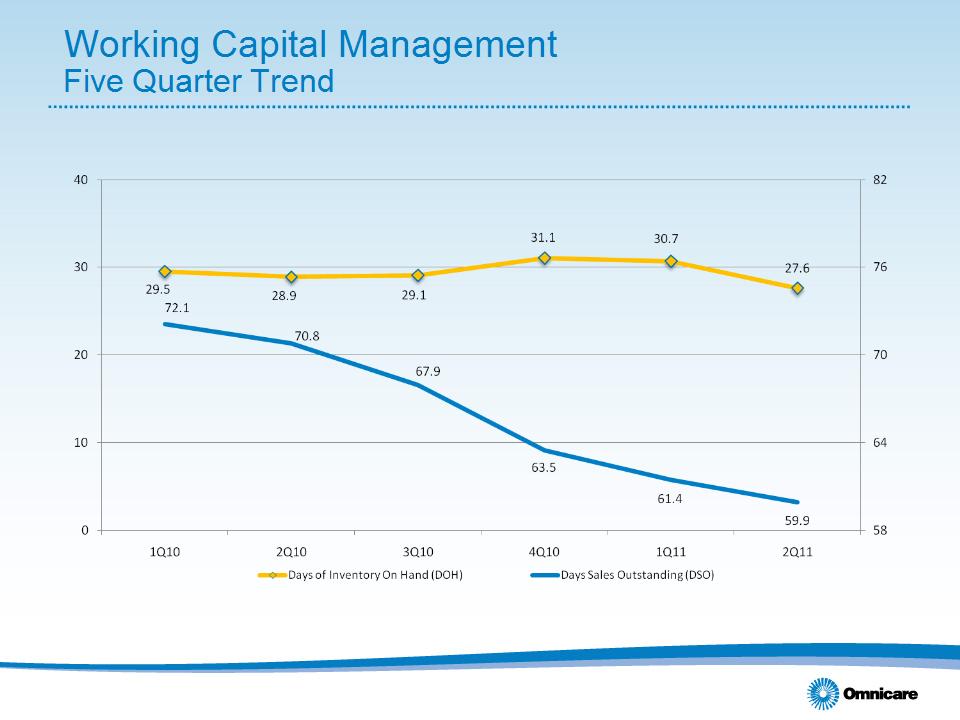

• Cash flows from continuing operations of $136.9M; 2011 YTD cash flows from

continuing operations of $281 million represents highest six-month start to any

year in the company’s history

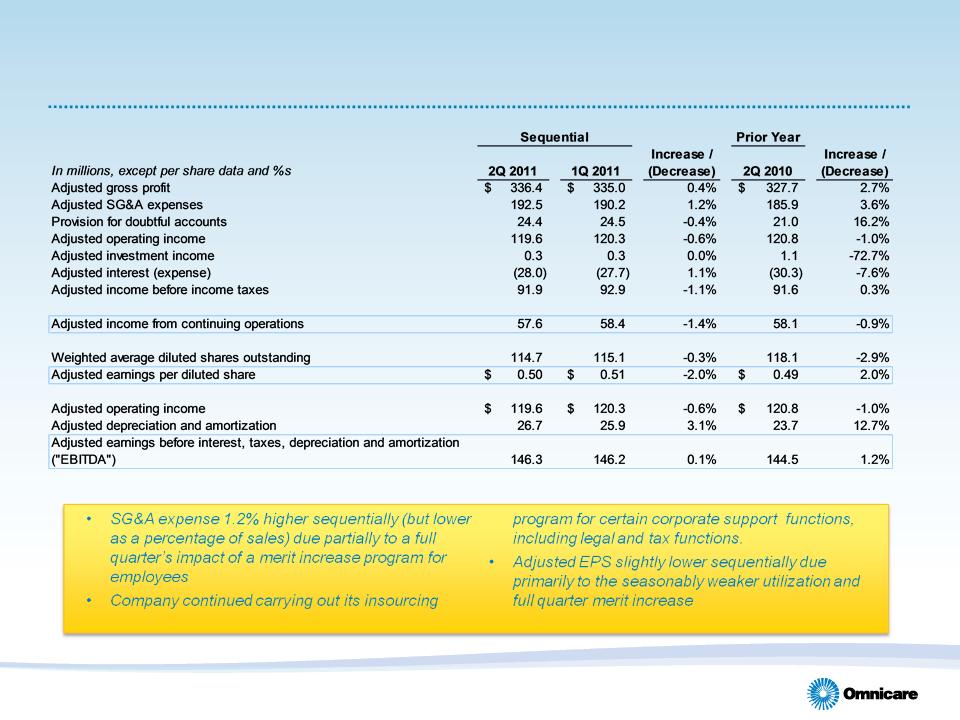

• Sequential adjusted EBITDA(1) relatively even at $146.3 million

• Adjusted EPS(1) of $0.50 as compared to 1Q11 of $0.51 and 2Q10 of $0.49

• Profitable GPO was divested in 2Q11

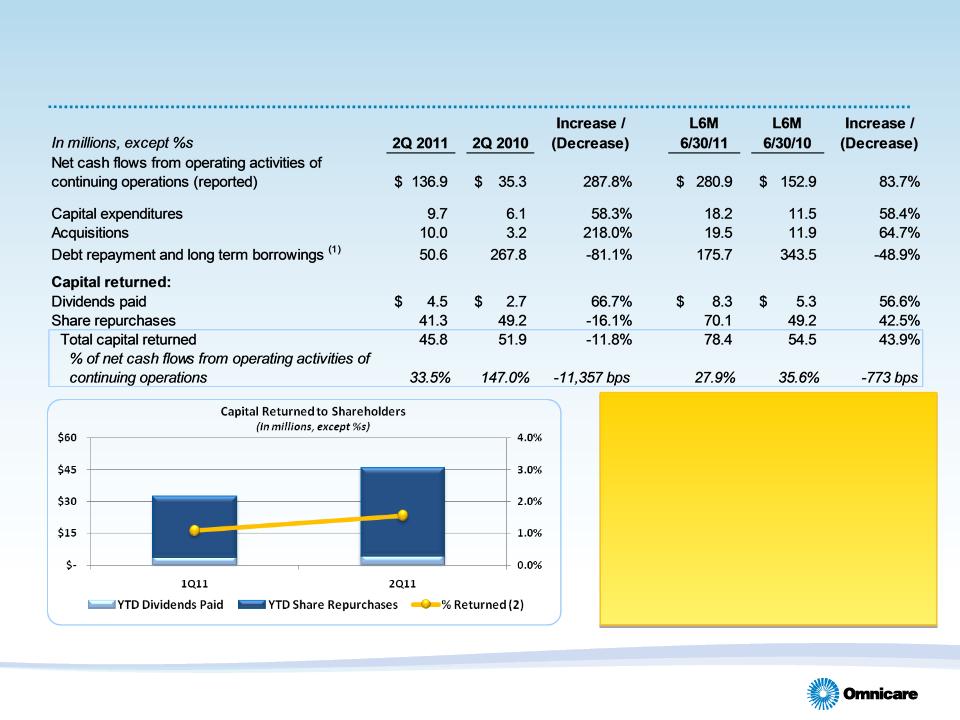

• $45.8 million returned to shareholders through share repurchases and dividends

4

(1) Excludes special items. A reconciliation of non-GAAP information has been attached to our press release and is also available on our Web site under

‘Supplemental Financial Information’ from the ‘Investors’ page.