- NVO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Novo Nordisk A/S (NVO) 6-KCurrent report (foreign)

Filed: 27 Feb 25, 10:58am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 6-K

________________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

February 27, 2025

________________

NOVO NORDISK A/S

(Exact name of Registrant as specified in its charter)

Novo Allé 1

DK- 2880, Bagsvaerd

Denmark

(Address of principal executive offices)

________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

| Form 20-F ☒ | Form 40-F ☐ |

Notice for the Annual General Meeting of Novo Nordisk A/S

Bagsværd, Denmark, 27 February 2025 – The Annual General Meeting of Novo Nordisk A/S will be held on:

Thursday 27 March 2024 at 14.00 (CET)

The Annual General Meeting is held as a partially electronic general meeting. Accordingly, shareholders can choose between participating in person at Bella Center, Center Boulevard 5, DK-2300 Copenhagen S, Denmark or participating virtually via an IT application. We encourage shareholders to exercise their rights by submitting proxies or votes by correspondence in advance of the Annual General Meeting.

Also, Novo Nordisk offers the possibility of viewing the Annual General Meeting via live webcast on Novo Nordisk’s website.

Please refer to the enclosed notice for the Annual General Meeting for further information.

BOARD OF DIRECTORS

All Board members elected by the Annual General Meeting are up for election.

The Board of Directors proposes re-election of Helge Lund as chair of the Board and re-election of Henrik Poulsen as vice chair. Moreover, the Board proposes re-election of the following Board members: Laurence Debroux, Andreas Fibig, Sylvie Grégoire, Kasim Kutay, Christina Law and Martin Mackay as members of the Board.

Page 2 of 2

Novo Nordisk is a leading global healthcare company founded in 1923 and headquartered in Denmark. Our purpose is to drive change to defeat serious chronic diseases built upon our heritage in diabetes. We do so by pioneering scientific breakthroughs, expanding access to our medicines and working to prevent and ultimately cure disease. Novo Nordisk employs about 76,300 people in 80 countries and markets its products in around 170 countries. Novo Nordisk's B shares are listed on Nasdaq Copenhagen (Novo-B). Its ADRs are listed on the New York Stock Exchange (NVO). For more information, visit novonordisk.com, Facebook, Instagram, X, LinkedIn and YouTube.

Contacts for further information

| Media: | |

Ambre James-Brown +45 3079 9289 abmo@novonordisk.com | Liz Skrbkova (US) +1 609 917 0632 lzsk@novonordisk.com |

| Investors: | |

Jacob Martin Wiborg Rode +45 3075 5956 jrde@novonordisk.com | Ida Schaap Melvold +45 3077 5649 idmg@novonordisk.com |

Sina Meyer +45 3079 6656 azey@novonordisk.com | Max Ung +45 3077 6414 mxun@novonordisk.com |

Frederik Taylor Pitter +1 609 613 0568 fptr@novonordisk.com |

Novo Nordisk A/S Investor Relations | Novo Allé 1 2880 Bagsværd Denmark | Telephone: +45 4444 8888 | www.novonordisk.com |

| Company announcement No 10 / 2025 |

ANNUAL GENERAL MEETING 2025 Novo Nordisk A/S – Novo Alle 1, 2880 Bagsværd, Denmark – CVR no. 24256790 A Novo Nordisk employee receiving a tour of our active construction project at our site in Kalundborg, which is a part of our DKK 59 billion investment in new active pharmaceutical ingredient facilities. These significant expansions aim to scale up production of life - changing treatments, including GLP - 1 - based medicines, to benefit many more people living with serious chronic diseases.

Annual General Meeting The Board of Directors invites the shareholders to the 2025 Annual General Meeting The Annual General Meeting of Novo Nordisk A/S (‘Novo Nordisk’ or the 'Company') will be held on Thursday 27 March 2025 at 14.00 (CET). The Annual General Meeting will be held as a partially electronic general meeting. Accordingly, shareholders can choose to: • Participate in person at Bella Center, Center Boulevard 5, DK - 2300 Copenhagen S, Denmark. • Participate virtually by PC or by smartphone/tablet via Computershare Meeting Services. • View the live webcast on Novo Nordisk’s website, www.novonordisk.com. • Grant a proxy or submit a written vote. Informal Shareholders’ Meeting After the completion of the Annual General Meeting, the Company will host an informal Shareholders’ Meeting beginning Thursday 27 March 2025 at 17 . 00 (CET) . Shareholders can choose to : • Participate in person at Bella Center, Center Boulevard 5 , DK - 2300 Copenhagen S, Denmark . • View the live webcast on Novo Nordisk’s website, www . novonordisk . com . 2

Annual General Meeting / Agenda Participate or View 3 Contact Participate at the Annual General Meeting, in person or virtually: Request an admission card via the Investor Portal by Friday 21 March 2025 at 23:59 (CET) at the latest. Grant proxy or vote by correspondence: Fill in the proxy form by Friday 21 March 2025 at 23.59 (CET) at the latest or submit your vote by correspondence by Wednesday 26 March 2025 at 09.00 (CET) at the latest, via the Investor Portal. Participate at the Informal Shareholders’ Meeting: Request an admission card via the Investor Portal by Friday 21 March 2025 at 23.59 (CET) at the latest. View the live webcasts of the Annual General Meeting and the Informal Shareholders’ Meeting: Go to Novo Nordisk’s website: www.novonordisk.com Investor Portal: www.novonordisk.com/investors/Investor - portal.html Novo Nordisk A/S Novo Alle 1, DK - 2880 Bagsværd, Denmark Website: www.novonordisk.com/AGM Phone: +45 4444 8888 Email: AGmeeting@novonordisk.com Computershare A/S Lottenborgvej 26, DK - 2800 Kgs. Lyngby, Denmark Website: www.computershare.dk Phone: +45 4546 0997 weekdays 9.00 - 15.00 (CET) Email: agm@computershare.dk Bella Ce nte r Center Boulevard 5, DK - 2300 Copenhagen S, Denmark Website: www.bellacentercopenhagen.dk Phone: +45 3252 8811 Agenda 1 The Board of Directors’ oral report on the Company’s activities in the past financial year 2 Presentation and adoption of the audited Annual Report 2024 3 Resolution to distribute the profit according to the adopted Annual Report 2024 4 Presentation of and advisory vote on the Remuneration Report 2024 5 Remuneration: 1. Approval of the remuneration of the Board of Directors for 2024 2. Approval of the remuneration level of the Board of Directors for 2025 6 Election of members to the Board of Directors: 1. Election of chair 2. Election of vice chair 3. Election of other members to the Board of Directors 7 Appointment of auditor 8 Proposals from the Board of Directors and/or shareholders: 8.1 Authorisation to the Board of Directors to allow the Company to repurchase own shares 2. Authorisation to the Board of Directors to increase the Company’s share capital 3. Proposal from the shareholder Kritiske Aktionærer on construction contracts 9 Any other business

Annual General Meeting / Elaboration on the items on the agenda 4 Elaboration on the items on the agenda Item 5: Remuneration Item 5.1: Approval of the remuneration of the Board of Directors for 2024 The Board of Directors proposes that the actual remuneration of the Board of Directors for 2024 of DKK 23 million, as reported on page 7 of the Remuneration Report 2024, be approved by the Annual General Meeting, corresponding to the remuneration level approved by the Annual General Meeting in 2024. Item 5.2: Approval of the remuneration level of the Board of Directors for 2025 The remuneration of the Board of Directors was most recently adjusted in 2024. The current Board fee levels are broadly between the upper quartile of Nordic general industry companies and the median of European pharma companies (see the Remuneration Report 2024, page 6). The Board finds that the current remuneration level reflects the Company’s position relative to the Nordic general industry peer group and the European pharma peer group, secures a competitive fee level and fairly reflects the Board member’s role, actual function and responsibilities on the Board. Consequently, the Board proposes to adjust the remuneration level in line with general salary inflation by increasing remuneration by 3%. Thus, the Board proposes that the 2025 base fee be increased from DKK 840,000 to DKK 865,200. In accordance with the Remuneration Policy, the Board members shall receive multiples of the base fee as follows: 1. The chair shall receive 4.00 times the base fee. 2. The vice chair shall receive 2.00 times the base fee. 3. The other Board members shall receive the base fee. The Board committee members shall receive the following (the People & Governance Committee was previously named the Nomination Committee) : 1. The Audit Committee chair shall receive 1 . 00 time the base fee and Audit Committee members shall receive 0 . 50 times the base fee . 2. The Research and Development Committee chair shall receive 0 . 75 times the base fee and the Research and Development Committee members shall receive 0 . 50 times the base fee . 3. Chairs of the People & Governance Committee and the Remuneration Committee shall receive 0.50 times the base fee and committee members of the People & Governance Committee and the Remuneration Committee shall receive 0.25 times the base fee. In addition, the Board of Directors proposes that the travel allowance be similarly adjusted by 3% in line with general salary inflation to the following: 1. For Board meetings and committee - related meetings held in the home country of the Board member with five hours or more air travel, each member shall receive DKK 43,250. 2. For Board meetings and committee - related meetings held outside the home country of the Board member, but on the home continent, each member shall receive DKK 43 , 250 . Item 1: The Board of Directors’ oral report on the Company’s activities in the past financial year The Board of Directors proposes that the oral report on the Company’s activities in the past financial year be noted by the Annual General Meeting. Item 2: Presentation and adoption of the audited Annual Report 2024 The Board of Directors proposes that the audited Annual Report 2024 be adopted by the Annual General Meeting. The Annual Report is available on the Company’s website at novonordisk.com/agm . Item 3: Resolution to distribute the profit according to the adopted Annual Report 2024 The Board of Directors proposes that the final dividend for 2024 be DKK 7.90 for each Novo Nordisk A or B share amount of DKK 0.10. The total dividend for 2024 of DKK 11.40 includes both the interim dividend of DKK 3.50 for each Novo Nordisk A and B share amount of DKK 0.10, which was paid in August 2024, and the final dividend of DKK 7.90 for each Novo Nordisk A and B share amount of DKK 0.10 to be paid in March 2025. The total dividend per share amount of DKK 0.10 is increased by 21% compared to 2023. The total dividend for 2024 corresponds to a pay - out ratio of 50.2%. Item 4: Presentation of and advisory vote on the Remuneration Report 2024 The Board of Directors proposes that the Remuneration Report 2024 be adopted by the Annual General Meeting. The Remuneration Report 2024 is available on the Company’s website at novonordisk.com/agm .

Annual General Meeting / Elaboration on the items on the agenda 5 3 . For Board meetings and committee - related meetings held on another continent than the home country of the Board member, each member shall receive DKK 86 , 500 . The actual remuneration of the Board of Directors for 2025 will be presented for approval at the Annual General Meeting in 2026. Item 6: Election of members to the Board of Directors Item 6.1: Election of chair The Board of Directors proposes re - election for a one - year term of Helge Lund as chair of the Board of Directors. Item 6.2: Election of vice chair The Board of Directors proposes re - election for a one - year term of Henrik Poulsen as vice chair of the Board of Directors. Item 6.3: Election of other members to the Board of Directors The Board of Directors proposes re - election for a one - year term of the following shareholder - elected Board members: Laurence Debroux, Andreas Fibig, Sylvie Grégoire, Kasim Kutay, Christina Law and Martin Mackay. Please see the Appendix for a description of the qualifications, executive and non - executive functions, etc. held in other companies by the nominated candidates. Item 7: Appointment of auditor The Board of Directors proposes appointment of Deloitte Statsautoriseret Revisionspartnerselskab as auditor in accordance with the Audit Committee’s recommendation in respect of statutory financial and sustainability reporting. The recommendation from the Audit Committee is free from influence by third parties and no agreements with third parties which restrict the choice as regards the appointment of a particular statutory auditor or audit firm have been imposed on it. Item 8: Proposals from the Board of Directors and/or shareholders Item 8.1: Authorisation to the Board of Directors to allow the Company to repurchase own shares The Board of Directors proposes that an authorisation of the Board of Directors be granted to allow the Company to repurchase own shares until the Annual General Meeting in 2026, up to a total nominal amount of DKK 44,650,000, corresponding to 10% of the Company’s share capital, subject to a holding limit of 10% of the share capital. The repurchase must take place at a price equal to the share price quoted at the time of the repurchase with a deviation of up to 10%. Novo Nordisk’s guiding principle is that any excess cash should be returned to investors. The dividend policy is to have a dividend level comparable to that of our peers, and this is complemented by share repurchase programmes to ensure the guiding principle is achieved. The Company considers it good corporate governance and consistent with the Company’s strategy for its share repurchase programmes that the mandate to repurchase existing shares is limited in amount and affirmed by the Annual General Meeting on a regular basis. Item 8.2: Authorisation to the Board of Directors to increase the Company’s share capital The Board of Directors’ current authorisation in Article 5.3 of the Articles of Association to increase the share capital expires on 25 March 2026. Therefore, the Board of Directors proposes to extend the authorisation for a period of 1 year until 1 April 2027 and to limit the maximum share capital increase to a total of nominally DKK 44,650,000 for the authorisations under Article 5.3. Article 5.3, subject to adoption of the proposal, will be worded as follows: “(a) Until 1 April 2027, the Board of Directors shall be authorised to increase the share capital in one or more stages with pre - emptive rights for the existing shareholders by up to a total nominal amount of DKK 44,650,000. The capital increase may take place by payment in cash. The capital increase may take place at a subscription price lower than the market price, provided that the capital increase takes place proportionately between A shares and B shares. The holders of A shares shall in such case have a pre - emptive right to subscribe for new A shares, and holders of B shares shall have a pre - emptive right to subscribe for new B shares. If the capital increase takes place at market price, the capital increase may take place by proportionate issuance of A shares and B shares or by issuance of B shares only. In case of issuance of A shares as well as B shares, the holders of A shares shall have a pre - emptive right to subscribe for new A shares, and holders of B shares shall have a pre - emptive right to subscribe for new B shares. In case of issuance of B shares only, the holders of both classes of shares shall have proportionate pre - emptive subscription rights for the new B shares. (b) Until 1 April 2027, the Board of Directors is authorised to increase the share capital in one or more stages without pre - emptive rights for the existing shareholders by issuing B shares for up to a total nominal amount of DKK 44,650,000. The capital increase shall take place at market price and may take place either by payment in cash or by contribution of assets other than cash.

Annual General Meeting / Elaboration on the items on the agenda 6 (c) The authority given to the Board of Directors under Articles 5.3(a) - (b) above can in the aggregate only be exercised to increase the share capital by a maximum nominal amount of DKK 44,650,000.” Item 8.3: Proposal from the shareholder Kritiske Aktionærer on construction contracts Proposal to the Annual General Meeting, submitted by Kritiske Aktionærer: “In contracts with contractors who build for the company, Novo must require that there are collective agreements at the workplaces that cover the employees and that there must be a good working environment. These requirements must be associated with sanctions if they are not complied with and via chain responsibility also apply to subcontractors.” Comments by the Board of Directors: The Board of Directors does not support the proposal. Novo Nordisk strives to have proper and regulated working conditions at our construction sites. This includes construction sites in Denmark as well as outside Denmark. The implementation of these conditions then depends on the applicable country’s legislation and labour market relations, the nature of the specific construction work, as well as the timing and place for the construction work. As an example, contractors, who are to enter into construction contracts in Denmark must ensure that construction work conducted for Novo Nordisk is covered by a collective bargaining agreement. This can be achieved either via a membership of an employer organisation or by an accession agreement to the relevant collective bargaining agreement entered into by the most representative labour market parties in Denmark within the relevant industry. This also implies that the main contractor is responsible for and liable for the compliance with applicable rules and agreements throughout the project, also with subcontractors involved (chain responsibility). Novo Nordisk similarly requires that contractors adhere to a number of Novo Nordisk specific safety standards in addition to complying with safety regulations from national authorities. The Novo Nordisk specific safety standards include how to control high - risk activities such as working at heights, hot work, working on electrified systems, etc. Novo Nordisk's construction contracts contain a number of enforcement measures that can be used if a contractor does not comply with the terms of the construction contract. Novo Nordisk's approach to working conditions on construction sites is not static but is continuously evaluated and developed in line with general societal and regulatory developments.

Annual General Meeting / Additional information 7 Additional information Majority requirements To adopt the proposal under item 8.2 of the agenda, at least two thirds of the total number of votes in the Company shall be present at the Annual General Meeting, and not less than two thirds of the votes cast and share capital represented shall vote for the proposals. All other proposals on the agenda may be adopted by a simple majority of votes. Item 4 is up for advisory vote. Share capital and record date The current share capital of the Company amounts to DKK 446,500,000 divided into A share capital of DKK 107,487,200 and B share capital of DKK 339,012,800. Each A share capital amount of DKK 0.01 carries 10 votes and each B share capital amount of DKK 0.01 carries 1 vote. The record date is Thursday 20 March 2025. Participation and voting rights Anyone who is registered as a shareholder in the register of shareholders at the end of the record date, Thursday 20 March 2025 at 23:59 (CET), or who has made a request to such effect by that date is entitled to participate and vote at the Annual General Meeting. The participation and voting rights are determined by the number of shares held by each shareholder at the end of the record date as per the register of shareholders as well as any notification for registration received by the Company by that time but which has not yet been entered in the register. Shareholders holding Novo Nordisk shares through a nominee must exercise voting rights through the nominee structure. This entails that any votes, including amendment of votes submitted by proxy, must be submitted to the Company by the nominee. How to vote in advance – proxy and correspondence voting Shareholders who wish to vote in advance or who cannot attend the Annual General Meeting are encouraged to submit proxies or votes by correspondence. Proxy voting and correspondence voting: Shareholders may grant proxy to a named third party or to the Board of Directors. Alternatively, shareholders may cast their vote in advance of the meeting (vote by correspondence). Proxies and votes by correspondence may be submitted in the following ways: • via the InvestorPortal. Logging on requires MitID or username and password. The InvestorPortal can be accessed via Novo Nordisk’s website www.novonordisk.com/investors/Investor - portal.html or via Computershare A/S’ website www.computershare.dk , or • by downloading a form from novonordisk.com/AGM . Print, complete, sign and send the form via email to agm@computershare.dk or by ordinary letter to Computershare A/S, Lottenborgvej 26, DK - 2800 Kgs. Lyngby, Denmark. Proxies shall be received by Friday 21 March 2025 at 23.59 (CET). Votes by correspondence shall be received no later than Wednesday 26 March 2025 at 09.00 (CET). Proxies apply to all items discussed at the meeting. In the event that new proposals are submitted, including amendments or proposals for election of members to the Board of Directors or appointment of auditor not on the agenda, the proxy holder will vote according to his/ her best belief . Votes by correspondence will be taken into account if a new proposal is substantially the same as the original . How to ask questions in advance Shareholders may ask questions in advance of the Annual General Meeting: • For questions about participation, admission cards, the InvestorPortal, how/when/where to submit proxies and votes by correspondence, how to use Computershare Meeting Services, registration of shares by name and other technical questions concerning the Annual General Meeting, please contact Computershare A/S by email to agm@computershare.dk or by telephone +45 45 46 09 97 weekdays between 9.00 and 15.00 (CET). • Shareholders having questions to the items on the agenda or about Novo Nordisk in general are encouraged to submit these in advance by email to AGmeeting@novonordisk.com no later than Wednesday 26 March 2025 at 12.00 noon (CET). The questions will as far as possible be answered in writing prior to the Annual General Meeting. A summary of questions and answers will be published on Novo Nordisk’s website, www.novonordisk.com/agm .

Annual General Meeting / Additional information 8 How to participate – participation in person, virtual participation or viewing the webcast Novo Nordisk offers three different ways for the shareholders to participate in or view the Annual General Meeting: • Participation in person. This includes the possibility of voting, expressing opinions and asking verbal questions. • Virtual participation by PC or by smartphone/tablet. This includes the possibility of viewing the broadcast of the meeting, voting, expressing opinions and asking questions in writing. • Viewing the live webcast of the Annual General Meeting on Novo Nordisk’s website. The webcast does not offer possibilities of voting, expressing opinions or asking questions at the Annual General Meeting. The three options are further described below. Participation in person: In person participants will be able to vote, express opinions and ask verbal questions. To participate in person, shareholders should sign up by requesting an admission card by Friday 21 March 2025 at 23.59 (CET) at the latest. For guidance, please refer to the “Admission card” section below. The venue of the Annual General Meeting is Bella Center, Center Boulevard 5, DK - 2300 Copenhagen S, Denmark. Please use Entrance 6. In case of a vote, shareholders participating in person must submit their votes during the meeting via the application named Computershare Meeting Services, and shareholders must bring and use their own PC/ smartphone/tablet to access the application. For guidance, please refer to the “Computershare Meeting Services” section below. Shareholders who are not able to bring and use their own device may borrow one at the venue. Virtual participation: Virtual participants (by PC or by smartphone/tablet) will be able to view the broadcast of the meeting, vote, express opinions and submit written questions. To participate virtually at the Annual General Meeting, shareholders should sign up by requesting an admission card by Friday 21 March 2025 at 23.59 (CET) at the latest. For guidance, please refer to the “Admission card” section below. Virtual participation takes place through the application named Computershare Meeting Services which is accessible by web browser. The application will be accessible one hour before the meeting starts. For guidance, please refer to the “Computershare Meeting Services” section below. Webcast: Shareholders can watch the live webcast in Danish and English on the Company’s website novonordisk.com. The webcast will be accessible one hour before the meeting starts. The recording of the webcast will also be available on the website after the meeting. The webcast does not offer possibilities of voting, expressing opinions or asking questions at the Annual General Meeting. The live webcast is publicly accessible and requires no admission card. Computershare Meeting Services: Computershare Meeting Services will be used for participation in person as well as virtual participation and is accessible by web browser. Accordingly, shareholders should ensure to have available a PC/ smartphone/tablet with a web browser installed and have an adequate and functioning internet connection during the Annual General Meeting. Wi - fi will be available at the venue of the Annual General Meeting. The minimum system requirements are: The latest version of Google Chrome, Safari, Microsoft Edge or Firefox web browser. A User guide for Computershare Meeting Services is available on www.novonordisk.com/agm . Admission card An admission card for the Annual General Meeting is necessary for participating in person as well as virtually. Admission cards are issued electronically and may be obtained: • via the InvestorPortal. Logging on requires MitID or username and password. The InvestorPortal can be accessed via Novo Nordisk’s website www.novonordisk.com/investors/Investor - portal.html or via Computershare A/S’ website: www.computershare.dk , or • by contacting Computershare A/S by phone +45 45 46 09 97 weekdays between 9.00 and 15.00 (CET) or via email: agm@computershare.dk . Admission cards will be sent to the shareholder’s email address specified in the InvestorPortal upon registration and will include a link to the user guide for the Computershare Meeting Services application. Admission cards and Computershare Meeting Services user credentials for advisors/companions will also be sent to the shareholder’s email address but will be separate from admission cards and user credentials for the shareholder. Admission cards will not be sent by ordinary mail. An admission card is not necessary for viewing the webcast on www.novonordisk.com . Language Representatives of the Company and the chair of the Annual General Meeting will conduct their presentations in English. Shareholders participating virtually via the Computershare Meeting Services application or in person at Bella Center may choose to ask questions and express opinions in Danish or English.

Annual General Meeting / Additional information 9 Simultaneous interpretation from English to Danish and from Danish to English will be available to in - person participants at Bella Center, virtual participants in the Computershare Meeting Services application as well as in the webcast . Information on novonordisk.com The following information is available on www.novonordisk.com/agm until and including the date of the Annual General Meeting: • Notice to convene the Annual General Meeting, including the agenda and complete proposals and a description of the nominated Board candidates (Appendix), • The aggregate number of shares and voting rights as of the date of the notice to convene the Annual General Meeting, • The audited Annual Report 2024, • The Remuneration Report 2024, • The proposed revised Articles of Association, • The proxy and voting by correspondence form, • The registration form, • A summary of potential questions received from shareholders and answers from Novo Nordisk, and • User guide for the Computershare Meeting Services application. Dividends The dividend as approved by the Annual General Meeting will be transferred to the shareholders via VP Securities A/S after deduction of withholding tax, if any. Further information on dividends may be found in the Annual Report 2024 under ’Shares and capital structure’. Electronic communication Novo Nordisk do not send out hard copies of notices for general meetings. It is possible to receive the Annual Reports, the quarterly update “Share” and notices of general meetings and shareholders’ meetings electronically by email from Novo Nordisk. Should you wish to receive such communication from us, please register your email address on the InvestorPortal via this link: www.novonordisk.com/investors/ Investor - portal.html . Shareholders’ meeting On Thursday 27 March 2025 at 17.00 (CET), after the Annual General Meeting, the Company will host an informal Shareholders’ Meeting conducted in Danish for its shareholders at Bella Center, Center Boulevard 5, DK - 2300 Copenhagen S, Denmark. A live webcast of the meeting will be available on www.novonordisk.com . An admission card for the Shareholders’ Meeting is necessary for participating in person. Admission cards are issued electronically and may be obtained: • via the InvestorPortal. Logging on requires MitID or username and password. The InvestorPortal can be accessed via Novo Nordisk’s website www.novonordisk.com/investors/Investor - portal.html or via Computershare A/S’ website: www.computershare.dk , or • by contacting Computershare A/S by phone +45 45 46 09 97 weekdays between 9.00 and 15.00 (CET) or via email: agm@computershare.dk . Shareholders who wish to participate in both the Annual General Meeting and the subsequent Shareholders’ Meeting should request separate admission cards for each of the meetings – one for the Annual General Meeting and one for the Shareholders’ Meeting. An admission card to attend the Annual General Meeting does not also give access to the Shareholders’ Meeting. Processing of personal data For information about how Novo Nordisk processes your personal data as a shareholder, see the Company’s Notices of Personal Data Processing on www.novonordisk.com/agm . Best regards, Novo Nordisk A/S The Board of Directors, 27 February 2025

Annual General Meeting / Appendix - Candidates for the Board of Directors Appendix Candidates for the Board of Directors Competences and experience to be represented on the Board (shareholder - elected Board members only) 10 Global corporate leadership Healthcare & Finance & accounting pharma industry Human capital Medicine & science management Business development, M&A & external innovation sourcing Environmental, social & governance (ESG) Technology, data & digital If all proposed candidates are elected to the Board, the Board will collectively possess the desired competences and experience. Diversity ambition The Board believes that diversity in respect of experience and competencies will be achieved through the nomination of individuals who collectively fulfil the competencies set out above. In addition, the Board recognises the benefits of a diverse board with respect to perspectives, style, culture, gender and nationality. The Board has defined the following aspirations for the diversity of the shareholder - elected Board members: • The Board should consist of at least two shareholder - elected Board members with Nordic nationality and at least two shareholder - elected Board members with a nationality other than Nordic. • By 2026, the Board should consist of at least three shareholder - elected Board members who are women and three who are men. With the proposed candidates, the shareholder - elected Board members will consist of two Nordic members and six non - Nordic members. Of these, three members are female and five are male. Thus, the Board of Directors fulfils its nationality and gender ambition. Continuity, renewal and independence In nominating candidates for election or re - election, the Board seeks to achieve a balance between renewal and continuity. Further, the Board seeks to achieve a balance between the number of Board members General considerations All shareholder - elected Board members are to be elected or re - elected each year for a one - year term and the terms for each and all Board members expire at the Annual General Meeting in March 2025. The People & Governance Committee (previously ‘the Nomination Committee’) assists the Board with the identification and nomination of candidates for the Board based on the Board Competency Profile which is available on https://www.novonordisk.com/about/corporate - governance.html . Also, each shareholder - elected Board members should possess integrity, accountability, fairness, financial literacy, commitment, desire for innovation, a corporate social responsible mindset and a collaborative mindset. Additionally, the collective competences of the shareholder - elected Board members should include experience within: representing the main shareholder of the company and other Board members. It is an aspiration that at least half of its shareholder - elected Board members should be independent in accordance with the Danish Corporate Governance Recommendations. Two of the proposed candidates, Mr Poulsen and Mr Kutay, are not considered to be independent of Novo Nordisk as Mr Poulsen holds a board position at Novo Holdings A/S and Mr Kutay is chief executive officer of Novo Holdings A/S, the main shareholder of the Company. If all proposed candidates are elected to the Board, the Board will satisfy the aspiration to have a number of Board members representing the main shareholder and that at least half of the Board members elected by the shareholders shall be independent. After the Annual General Meeting the Board will elect its committee members and e.g. intends to elect members of the Audit Committee who qualify as independent as required and defined by the US Securities and Exchange Commission (SEC) as well as the Danish Act on Approved Auditors and Audit Firms.

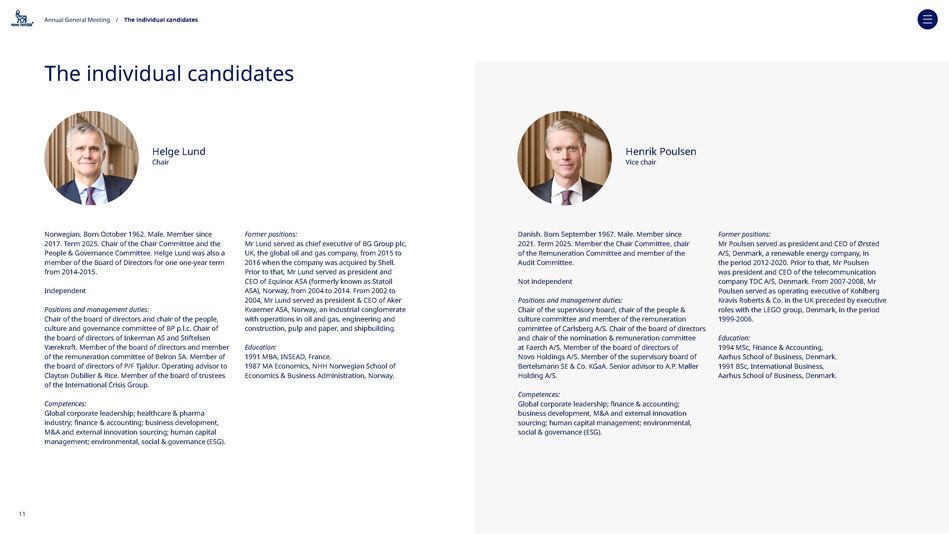

Annual General Meeting / The individual candidates The individual candidates Helge Lund Chair Henrik Poulsen Vice chair Norwegian. Born October 1962. Male. Member since 2017. Term 2025. Chair of the Chair Committee and the People & Governance Committee. Helge Lund was also a member of the Board of Directors for one one - year term from 2014 - 2015. Independent Positions and management duties: Chair of the board of directors and chair of the people, culture and governance committee of BP p.l.c. Chair of the board of directors of Inkerman AS and Stiftelsen Værekraft. Member of the board of directors and member of the remuneration committee of Belron SA. Member of the board of directors of P/F Tjaldur. Operating advisor to Clayton Dubilier & Rice. Member of the board of trustees of the International Crisis Group. Competences: Global corporate leadership; healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). Danish. Born September 1967. Male. Member since 2021. Term 2025. Member the Chair Committee, chair of the Remuneration Committee and member of the Audit Committee. Not independent Positions and management duties: Chair of the supervisory board, chair of the people & culture committee and member of the remuneration committee of Carlsberg A/S. Chair of the board of directors and chair of the nomination & remuneration committee at Faerch A/S. Member of the board of directors of Novo Holdings A/S. Member of the supervisory board of Bertelsmann SE & Co. KGaA. Senior advisor to A.P. Møller Holding A/S. Competences: Global corporate leadership; finance & accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social & governance (ESG). Former positions: Mr Lund served as chief executive of BG Group plc, UK, the global oil and gas company, from 2015 to 2016 when the company was acquired by Shell. Prior to that, Mr Lund served as president and CEO of Equinor ASA (formerly known as Statoil ASA), Norway, from 2004 to 2014. From 2002 to 2004, Mr Lund served as president & CEO of Aker Kvaerner ASA, Norway, an industrial conglomerate with operations in oil and gas, engineering and construction, pulp and paper, and shipbuilding. 11 Education: 1991 MBA, INSEAD, France. 1987 MA Economics, NHH Norwegian School of Economics & Business Administration, Norway. Former positions: Mr Poulsen served as president and CEO of Ørsted A/S, Denmark, a renewable energy company, in the period 2012 - 2020. Prior to that, Mr Poulsen was president and CEO of the telecommunication company TDC A/S, Denmark. From 2007 - 2008, Mr Poulsen served as operating executive of Kohlberg Kravis Roberts & Co. in the UK preceded by executive roles with the LEGO group, Denmark, in the period 1999 - 2006. Education: 1994 MSc, Finance & Accounting, Aarhus School of Business, Denmark. 1991 BSc, International Business, Aarhus School of Business, Denmark.

Annual General Meeting / The individual candidates The individual candidates (continued) Laurence Debroux Member of the Board 12 Andreas Fibig Member of the Board French. Born July 1969. Female. Member since 2019. Term 2025. Chair of the Audit Committee and member of the Remuneration Committee. Independent Positions and management duties: Member of the board of directors, chair of the audit committee and member of the ESG committee of Exor N.V. Member of the supervisory board and chair of the audit committee of Randstad N.V. Member of the board of directors of Institut Mérieux, HEC Paris Business School and Kite Insights Limited (the Climate School). Competences: Global corporate leadership; healthcare and pharma industry; finance and accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social and governance (ESG). German. Born February 1962. Male. Member since 2018. Term 2025. Member of the Research & Development Committee. Independent Positions and management duties: Member of the board of directors of Indigo Agriculture Inc., EvodiaBio ApS and ExlService Holdings, Inc. Honorary director of the German American Chamber of Commerce. Competences: Global corporate leadership; healthcare and pharma industry; technology, data and digital; finance and accounting; business development, M&A and external innovation sourcing; human capital management; environmental, social and governance (ESG). Former positions: From 2015 to 2021, Ms Debroux was group chief financial officer, executive board member, of Heineken N.V. From 2010 to 2015, Ms Debroux held the position as group chief financial officer, executive board member, at JCDecaux SA, France. From 1996 to 2010, Ms Debroux held a number of positions at Sanofi Aventis (previously Sanofi SA), including those of chief strategic officer, chief financial officer and deputy chief financial officer. Education: 1992 Master Degree, HEC Paris, Ecoles des Hautes Etudes Commerciales, France. Former positions: From 2012 to 2022, Mr Fibig was chair and chief executive officer of International Flavors & Fragrances Inc., US. In the period 2008 to 2014, Mr Fibig was president and chair of the board of management of Bayer HealthCare Pharmaceuticals, a division of Bayer AG, Germany. Previously, Mr Fibig held several positions of increasing responsibility at Pfizer, Inc., US, including the roles as senior vice president of the US pharmaceutical operations from 2007 to 2008, and as president of Latin America, Africa and Middle East from 2003 to 2007. Education: 1982 Degree in Marketing, Berlin School of Economics, Germany.

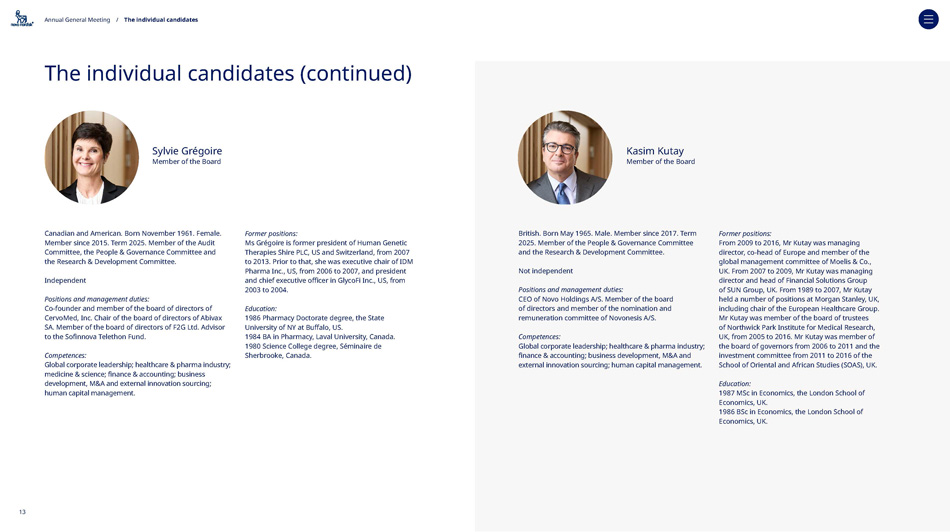

Annual General Meeting / The individual candidates The individual candidates (continued) Sylvie Grégoire Member of the Board 13 Kasim Kutay Member of the Board Canadian and American. Born November 1961. Female. Member since 2015. Term 2025. Member of the Audit Committee, the People & Governance Committee and the Research & Development Committee. Independent Positions and management duties: Co - founder and member of the board of directors of CervoMed, Inc. Chair of the board of directors of Abivax SA. Member of the board of directors of F2G Ltd. Advisor to the Sofinnova Telethon Fund. Competences: Global corporate leadership; healthcare & pharma industry; medicine & science; finance & accounting; business development, M&A and external innovation sourcing; human capital management. British. Born May 1965. Male. Member since 2017. Term 2025. Member of the People & Governance Committee and the Research & Development Committee. Not independent Positions and management duties : CEO of Novo Holdings A/S . Member of the board of directors and member of the nomination and remuneration committee of Novonesis A/S . Competences: Global corporate leadership; healthcare & pharma industry; finance & accounting; business development, M&A and external innovation sourcing; human capital management. Former positions: Ms Grégoire is former president of Human Genetic Therapies Shire PLC, US and Switzerland, from 2007 to 2013. Prior to that, she was executive chair of IDM Pharma Inc., US, from 2006 to 2007, and president and chief executive officer in GlycoFi Inc., US, from 2003 to 2004. Education: 1986 Pharmacy Doctorate degree, the State University of NY at Buffalo, US. 1984 BA in Pharmacy, Laval University, Canada. 1980 Science College degree, Séminaire de Sherbrooke, Canada. Former positions: From 2009 to 2016, Mr Kutay was managing director, co - head of Europe and member of the global management committee of Moelis & Co., UK. From 2007 to 2009, Mr Kutay was managing director and head of Financial Solutions Group of SUN Group, UK. From 1989 to 2007, Mr Kutay held a number of positions at Morgan Stanley, UK, including chair of the European Healthcare Group. Mr Kutay was member of the board of trustees of Northwick Park Institute for Medical Research, UK, from 2005 to 2016. Mr Kutay was member of the board of governors from 2006 to 2011 and the investment committee from 2011 to 2016 of the School of Oriental and African Studies (SOAS), UK. Education: 1987 MSc in Economics, the London School of Economics, UK. 1986 BSc in Economics, the London School of Economics, UK.

Annual General Meeting / The individual candidates The individual candidates (continued) Christina Law (full name: Choi Lai Christina Law) Member of the Board 14 Martin Mackay Member of the Board Chinese. Born January 1967. Female. Member since 2022. Term 2025. Member of the Audit Committee. Independent Positions and management duties: Group CEO of Raintree Group of Companies. Member of the board of directors of Raintree Group Limited, Raintree Investment Pte Ltd. and Air Liquide S.A. Member of the board of directors of La Fondation des Champions. Member of the board of directors and chair of the development committee of National Gallery Singapore. Competences: Global corporate leadership; technology, data & digital; business development, M&A and external innovation sourcing; human capital management. American and British. Born April 1956. Male. Member since 2018. Term 2025. Chair of the Research & Development Committee and member of the Remuneration Committee. Independent Positions and management duties: Co - founder and non - executive chair of the board of directors of Rallybio LLC. Member of the board of directors and member of the science and technology committee and the responsible animal use committee of Charles River Laboratories International, Inc. Member of the board pf directors and member of the compensation committee and research and development committee of SpringWorks Therapeutics, Inc. Scientific Advisor at Pivotal BioVenture Partners. Member of the External Advisory Board of Boston Children’s Hospital. Competences: Global corporate leadership; healthcare & pharma industry; medicine & science; technology, data & digital; business development, M&A and external innovation sourcing; human capital management. Former positions: Ms Law is formerly group president Asia, Middle East, Africa and Latin America for General Mills Inc. and served in the company from 2012 - 2019. Prior to that, Ms Law held a number of executive positions from 2005 - 2012 in Johnson & Johnson Company in Asia Pacific, before assuming the role of vice president for skincare business worldwide. From 1992 - 2003, Ms Law was with The Proctor & Gamble Company and has held various international marketing leadership positions. Education: 1991 MBA, INSEAD, France. 1988 BA of Social Sciences, University of Hong Kong, Hong Kong, China. Former positions: From 2018 to 2023, Mr Mackay was CEO of RallyBio LLC and Executive Chairman of RallyBio LLC from 2018 to 2024. From 2010 to 2013, Mr Mackay was president of global research and development at AstraZeneca plc., UK. Prior to that, Mr Mackay held a number of positions at Pfizer, Inc., US, from 1995 to 2010, including the roles as president and senior vice president within research and development. Mr Mackay was visiting professor at the Department of Pharmacy at King’s College, London, UK, from 1998 to 2006 and at the Department of Biomedical Sciences at the University of Lincoln, UK, from 1998 to 2014. Education: 1984 Doctorate/PhD, University of Edinburgh, UK. 1979 BSc (First Class Honours) in Microbiology, Heriot - Watt University, Edinburgh, UK.

Annual General Meeting / Employee - elected Board members Employee - elected Board members are elected for a four - year term by the employees of Novo Nordisk A/S in Denmark. The most recent election of employee - elected Board members was conducted in February 2022, and the employee - elected Board members took office on the day of the Annual General Meeting on 24 March 2022. The term for the current employee - elected Board members will expire in March 2026. The current employee - elected Board members are listed below. Employee - elected Board members Danish. Born January 1966. Female. Member since 2022.2 Term 2026. Employee - elected board member. Member of the Research & Development Committee. Liselotte Hyveled was also an employee - elected member of the Board of Directors for one four - year term from 2014 - 2018. Not independent Positions and management duties: Chief patient officer and principal vice president of Patient Voice Strategy & Alliances, Novo Nordisk A/S. Member of the board of directors of TriSalus Life Sciences. Competences: Not mapped for employee - elected board members. Education: 2018 Board Leadership Programme, Copenhagen Business School. 2014 Board Leadership Masterclass, Copenhagen Business School. 2011 Master of Medical Business Strategy, Copenhagen Business School. 1992 MSc, Pharmacy, University of Copenhagen Danish. Born November 1965. Female. Member since 2022. Term 2026. Employee - elected Board member. Member of the Remuneration Committee. Not independent Positions and management duties: Full - time union representative in Novo Nordisk A/S. Competences: Not mapped for employee - elected board members. Education: 1989 Laboratory technician from Slagteriskolen in Roskilde, Denmark. Elisabeth Dahl Christensen Member of the Board (employee - elected board member) 15 LiselotteHyveled Member of the Board (employee - elected board member)

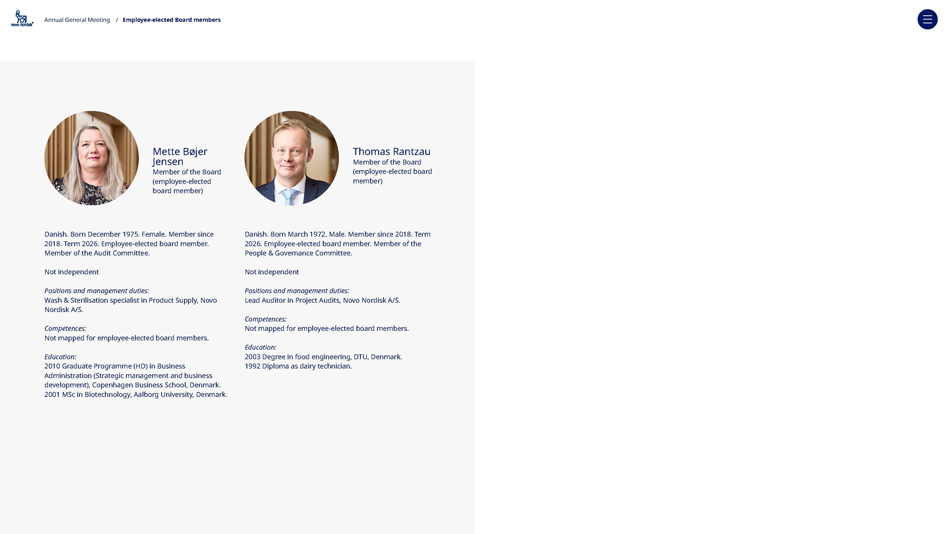

16 Annual General Meeting / Employee - elected Board members Danish. Born March 1972. Male. Member since 2018. Term 2026. Employee - elected board member. Member of the People & Governance Committee. Not independent Positions and management duties: Lead Auditor in Project Audits, Novo Nordisk A/S. Competences: Not mapped for employee - elected board members. Education: 2003 Degree in food engineering, DTU, Denmark. 1992 Diploma as dairy technician. Danish. Born December 1975. Female. Member since 2018. Term 2026. Employee - elected board member. Member of the Audit Committee. Not independent Positions and management duties: Wash & Sterilisation specialist in Product Supply, Novo Nordisk A/S. Competences: Not mapped for employee - elected board members. Education: 2010 Graduate Programme (HD) in Business Administration (Strategic management and business development), Copenhagen Business School, Denmark. 2001 MSc in Biotechnology, Aalborg University, Denmark. Mette Bøjer Jensen Member of the Board (employee - elected board member) Thomas Rantzau Member of the Board (employee - elected board member)

Annual General Meeting 2025 issued by Novo Nordisk A/S – Novo Alle 1, 2880 Bagsværd, Denmark – CVR no. 24256790, +45 4444 8888 (switchboard), novonordisk.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf of the undersigned, thereunto duly authorized.

| Date: February 27, 2025 |

NOVO NORDISK A/S

Lars Fruergaard Jørgensen Chief Executive Officer |