UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-03193

_Franklin Tax-Exempt Money Fund

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:(650) 312-2000

Date of fiscal year end: 7/31

Date of reporting period: 1/31/12

Item 1. Reports to Stockholders.

| 1

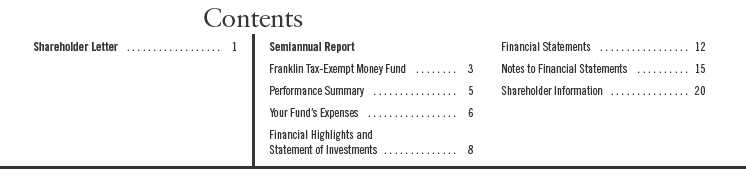

Semiannual Report

Franklin Tax-Exempt Money Fund

Your Fund’s Goal and Main Investments: Franklin Tax-Exempt Money Fund seeks to provide as high a level of income exempt from federal income taxes as is consistent with prudent investment management and preservation of capital.1 The Fund invests at least 80% of its total assets in high-quality, short-term municipal securities free from federal income taxes, including the federal alternative minimum tax, as it seeks to maintain a stable $1.00 share price.

Performance data represent past performance, which does not guarantee future results. Investment return will fluctuate. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency or institution. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This semiannual report for Franklin Tax-Exempt Money Fund covers the period ended January 31, 2012.

Performance Overview

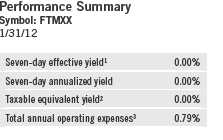

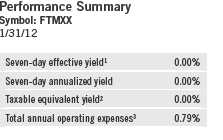

In an effort to promote continued economic growth, the Federal Reserve Board (Fed) held short-term interest rates at a historically low level during the period under review. As a result, the Fund’s seven-day effective yield was unchanged at 0.00% from July 31, 2011, to January 31, 2012.

Economic and Market Overview

During the six months under review, Fed policymakers maintained historically low interest rates while adopting a more restrained view of the economy, largely because of the persistent European sovereign debt crisis and signs the U.S. economic expansion lacked momentum. In October, the Fed began its plan designed to boost the economy by driving down long-term interest rates, which involves the sale of $400 billion in short-term securities and the purchase of an equal amount of long-term securities. Near period-end, the Fed anticipated it would keep short-term rates near zero through late 2014.

The economy grew slowly during the first half of the period. Home foreclosures increased, but federal lawmakers made efforts to strengthen the real estate market by removing some eligibility restrictions and charges associated with refinancing. The pace of economic expansion accelerated in the second half of

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 9.

Semiannual Report | 3

the period, largely due to stronger consumer spending and manufacturing growth. In January, the unemployment rate fell to its lowest level since early 2009, driven by private sector job gains. Some economists expressed more optimism near year-end 2011 about the economy’s prospects.

Geopolitical instability in some oil-producing regions and investor concerns about weak economic data contributed to volatility in crude oil prices. After prices reached a period high of $103 per barrel on January 4, 2012, they fell to $98 by period-end. Heightened volatility roiled global financial markets amid U.S. lawmakers’ protracted debate and eventual compromise on the debt limit, independent credit rating agency Standard & Poor’s downgrade of the long-term U.S. credit rating to AA+ from AAA, and fears of sovereign debt crisis contagion in Europe. During the six months under review, fixed income markets, as measured by the BC U.S. Aggregate Index, and U.S. stocks, as measured by the Standard & Poor’s® 500 Index, posted modest returns.2 Overall for the period, however, many investors sought the perceived safety of U.S. Treasuries, which drove their prices higher and yields lower.

Investment Strategy

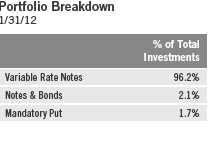

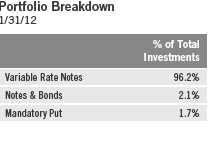

We invest predominantly in high-quality, short-term municipal securities. Although the Fund tries to invest all of its assets in tax-free securities, it is possible, although not anticipated, that up to 20% of its assets may be in securities that pay taxable interest, including interest that may be subject to federal alternative minimum tax. We maintain a dollar-weighted average portfolio maturity of 60 days or less and a dollar-weighted average life of 120 days or less.

Manager’s Discussion

During the six months under review, short-term municipal bond yields remained relatively low as the Federal Open Market Committee kept rates unchanged, maintaining the federal funds target rate in a range of 0% to 0.25% and the discount rate at 0.75%. In addition, the Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index, a weekly index of variable rate securities, which make up a large portion of Franklin Tax-Exempt Money Fund, also stayed relatively low. The SIFMA rate ranged from a high during the reporting period of 0.21% on August 24, 2011, to 0.06% on January 11, 2012, which was an all-time low.3 At period-end, the rate was 0.08%.3

2. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC. Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product.

3. Source: SIFMA.

4 | Semiannual Report

During the period, variable rate demand note (VRDN) issuance was extremely low compared to recent years, and demand for well-structured VRDNs supported their low rates. We continued to be very selective in purchasing what we considered to be high-quality securities, which resulted in a 0.00% yield for the six-month period.

During the review period, the Fund participated in several issues including VRDNs from Massachusetts State General Obligation and Fairfax County, Virginia, Industrial Development Authority for Inova Health System, as well as a mandatory put from New York Liberty Development Corporation for the World Trade Center Project.

Thank you for your continued participation in Franklin Tax-Exempt Money Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of January 31, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

1. Seven-day effective yield assumes the compounding of daily dividends, if any.

2. Taxable equivalent yield assumes the 2012 maximum regular federal income tax rate of 35.00%.

3. The figure is as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figure shown. In efforts to prevent a negative yield, the investment manager and Fund administrator have voluntarily agreed to waive or limit their respective fees, assume as their own expense certain expenses otherwise payable by the Fund, and if necessary, make a capital infusion into the Fund. These waivers, expense reimbursements and capital infusions, which are not reflected in the table above, are voluntary and may be modified or discontinued by the investment manager or Fund administrator at any time, and without further notice. There is no guarantee the Fund will be able to avoid a negative yield.

Annualized and effective yields are for the seven-day period ended 1/31/12. The Fund’s average weighted life and average weighted maturity were each 8 days. Yields reflect Fund expenses and fluctuations in interest rates on portfolio investments.

Performance data represent past performance, which does not guarantee future results. Investment return will fluctuate. Current performance may differ from figures shown. Please go to franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Semiannual Report | 5

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

6 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| | | Value 8/1/11 | | Value 1/31/12 | | Period* 8/1/11–1/31/12 |

| Actual | $ | 1,000 | $ | 1,000.00 | $ | 0.55 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,024.58 | $ | 0.56 |

*Expenses are calculated using the most recent six-month annualized expense ratio, net of voluntary expense waivers, of 0.11%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period.

Semiannual Report | 7

aAmount rounds to less than $0.001 per share.

bTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

cRatios are annualized for periods less than one year.

dRounds to less than 0.01%.

8 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

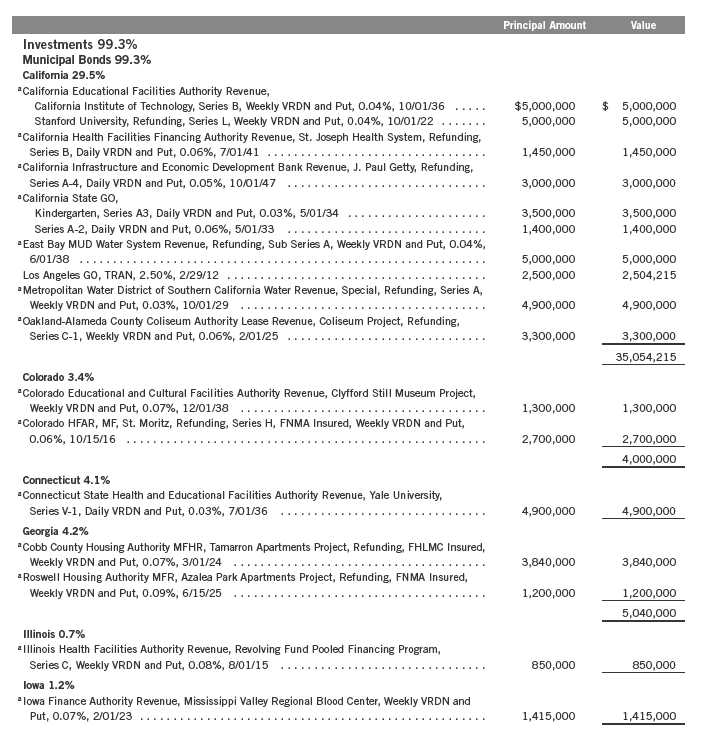

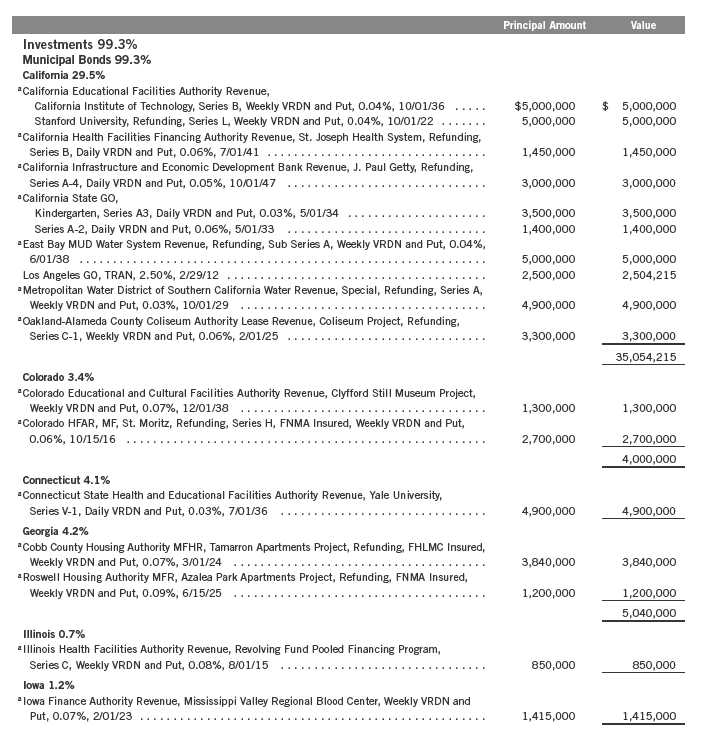

Franklin Tax-Exempt Money Fund

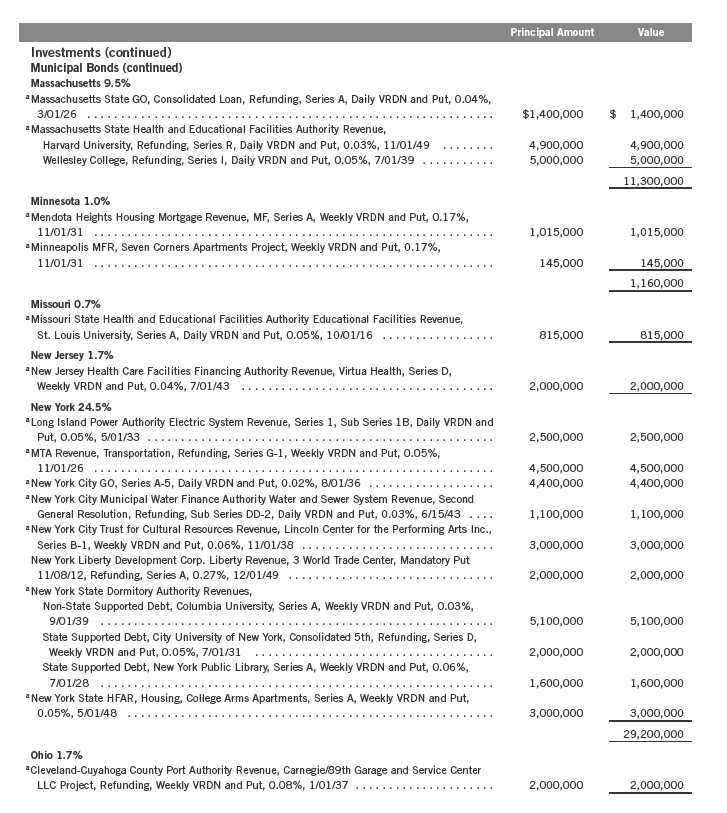

Statement of Investments, January 31, 2012 (unaudited)

Semiannual Report | 9

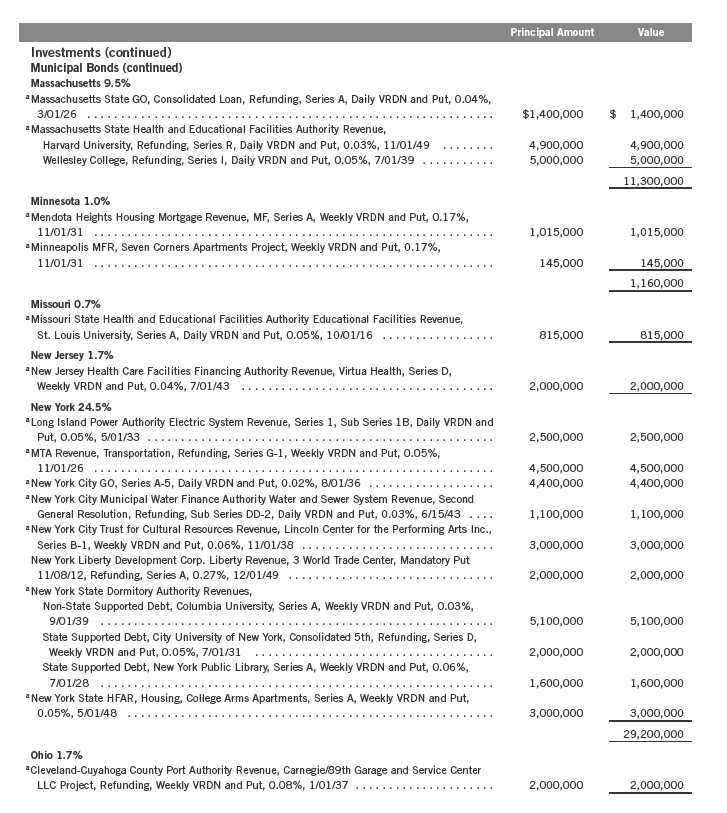

Franklin Tax-Exempt Money Fund

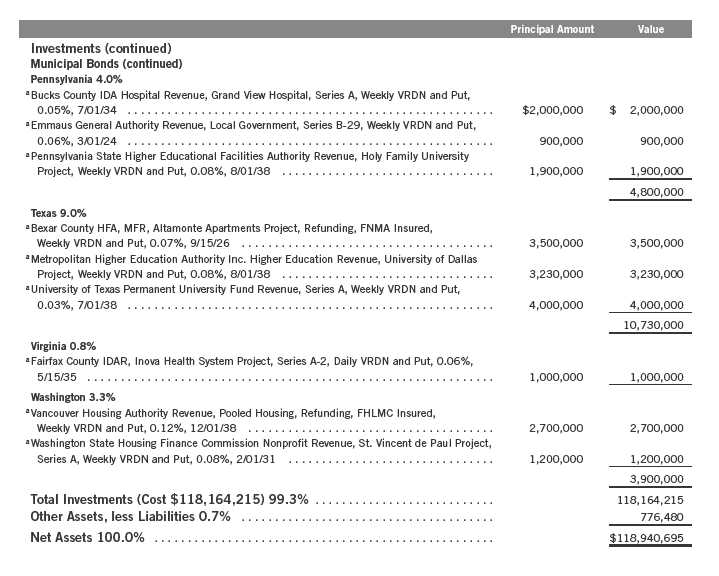

Statement of Investments, January 31, 2012 (unaudited) (continued)

10 | Semiannual Report

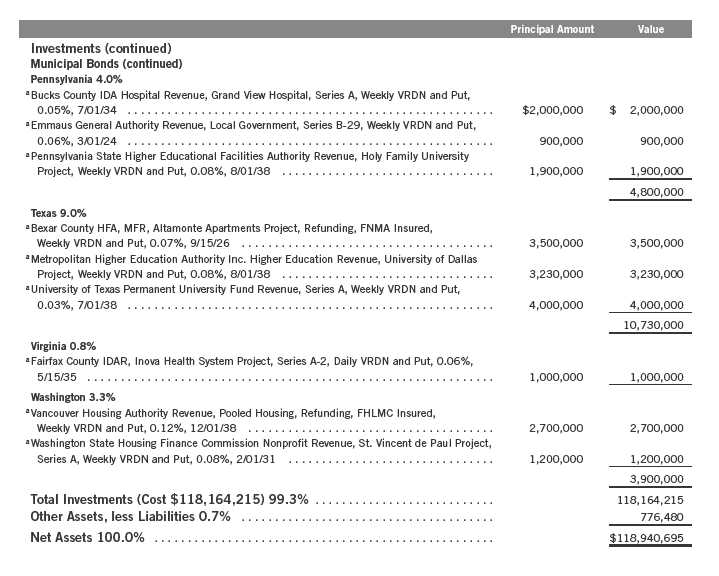

Franklin Tax-Exempt Money Fund

Statement of Investments, January 31, 2012 (unaudited) (continued)

See Abbreviations on page 19.

aVariable rate demand notes (VRDNs) are tax-exempt obligations which contain a floating or variable interest rate adjustment formula and an unconditional right of demand to

receive payment of the principal balance plus accrued interest at specified dates. The coupon rate shown represents the rate at period end.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 11

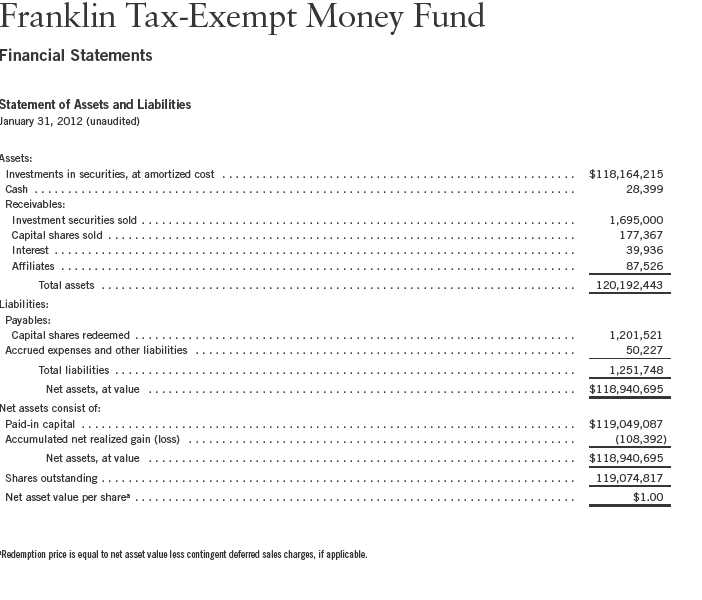

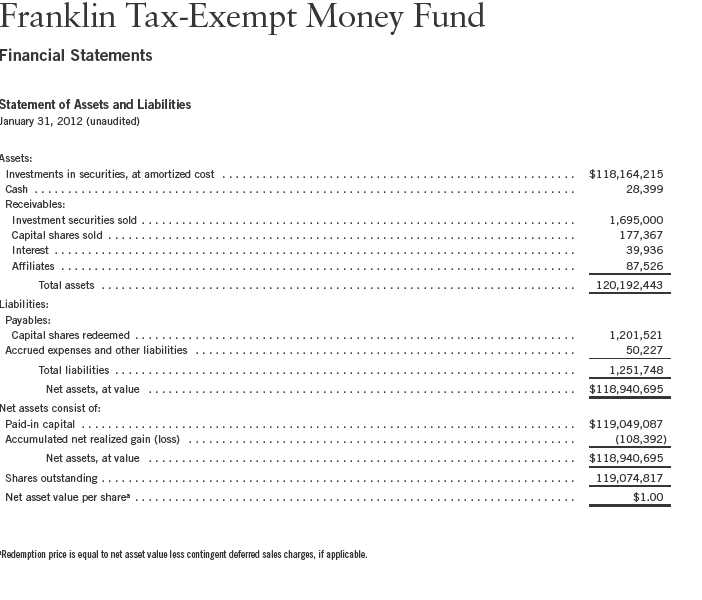

12 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 13

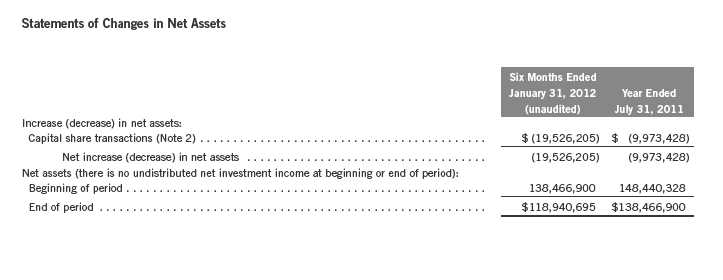

Franklin Tax-Exempt Money Fund

Financial Statements (continued)

14 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Tax-Exempt Money Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

Securities are valued at amortized cost, which approximates market value. Amortized cost is an income-based approach which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

b. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of January 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

c. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Semiannual Report | 15

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Accounting Estimates |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

e. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

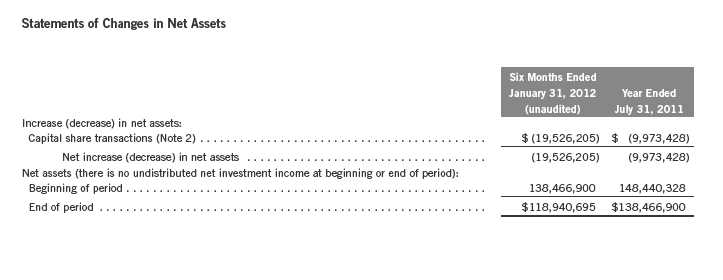

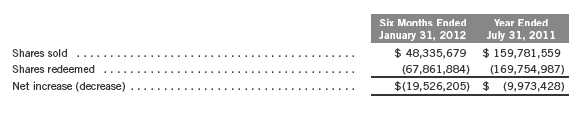

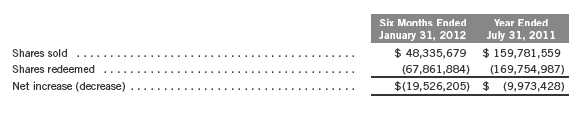

2. SHARES OF BENEFICIAL INTEREST

At January 31, 2012, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares at $1.00 per share were as follows:

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| |

| Subsidiary | Affiliation |

| Franklin Advisers, Inc. (Advisers) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

16 | Semiannual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (unaudited) (continued)

3. TRANSACTIONS WITH AFFILIATES (continued) a. Management Fees

The Fund pays an investment management fee to Advisers based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.625 | % | Up to and including $100 million |

| 0.500 | % | Over $100 million, up to and including $250 million |

| 0.450 | % | Over $250 million, up to and including $7.5 billion |

| 0.440 | % | Over $7.5 billion, up to and including $10 billion |

| 0.430 | % | Over $10 billion, up to and including $12.5 billion |

| 0.420 | % | Over $12.5 billion, up to and including $15 billion |

| 0.400 | % | Over $15 billion, up to and including $17.5 billion |

| 0.380 | % | Over $17.5 billion, up to and including $20 billion |

| 0.360 | % | In excess of $20 billion |

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on average daily net assets, and is not an additional expense of the Fund.

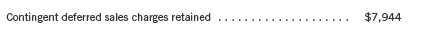

c. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

d. Transfer Agent Fees

For the period ended January 31, 2012, the Fund paid transfer agent fees of $57,343, of which $38,197 was retained by Investor Services.

e. Waiver and Expense Reimbursements

In efforts to prevent a negative yield Advisers has voluntarily agreed to waive or limit its fees, assume as its own expense certain expenses otherwise payable by the Fund and if necessary, make a capital infusion into the Fund. These waivers, expense reimbursements and capital infusions are voluntary and may be modified or discontinued by Advisers at any time, and without further notice. There is no guarantee that the Fund will be able to avoid a negative yield.

Semiannual Report | 17

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (unaudited) (continued)

4. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any.

At July 31, 2011, the capital loss carryforwards were as follows:

| | |

| Capital loss carryforwards subject to expiration: | | |

| 2012 | $ | 17,134 |

| 2013 | | 932 |

| 2014 | | 282 |

| 2015 | | 17,051 |

| 2016 | | 12,900 |

| 2017 | | 60,093 |

| | $ | 108,392 |

At January 31, 2012, the cost of investments for book and income tax purposes was the same.

5. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. Money market securities may be valued using amortized cost, in accordance with the 1940 Act. Generally, amortized cost reflects the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2 inputs.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At January 31, 2012, all of the Fund’s investments in securities carried at fair value were in Level 2 inputs.

18 | Semiannual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (unaudited) (continued)

6. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Fund believes the adoption of this ASU will not have a material impact on its financial statements.

7. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

| | |

| FHLMC | - | Federal Home Loan Mortgage Corp. |

| FNMA | - | Federal National Mortgage Association |

| GO | - | General Obligation |

| HFA | - | Housing Finance Authority/Agency |

| HFAR | - | Housing Finance Authority Revenue |

| IDA | - | Industrial Development Authority/Agency |

| IDAR | - | Industrial Development Authority Revenue |

| MF | - | Multi-Family |

| MFHR | - | Multi-Family Housing Revenue |

| MFR | - | Multi-Family Revenue |

| MTA | - | Metropolitan Transit Authority |

| MUD | - | Municipal Utility District |

| TRAN | - | Tax and Revenue Anticipation Note |

Semiannual Report | 19

Franklin Tax-Exempt Money Fund

Shareholder Information

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

20 | Semiannual Report

This page intentionally left blank.

This page intentionally left blank.

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer, Chief Accounting Officer and Treasurer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer, Chief Accounting Officer and Treasurer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FRANKLIN TAX-EXEMPT MONEY FUND

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date March 28, 2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date March 28, 2012

By /s/GASTON GARDEY

Gaston Gardey

Chief Financial Officer and

Chief Accounting Officer

Date March 28, 2012