Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

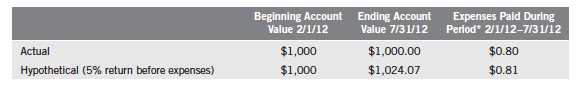

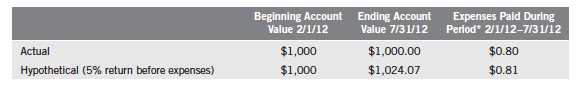

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

6 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not

reflect any transaction costs, such as sales charges. Therefore, the second line of the table is useful

in comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent annualized six-month expense ratio, net of voluntary expense waivers, of 0.16%, multiplied by the

average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 7

8 | The accompanying notes are an integral part of these financial statements. | Annual Report

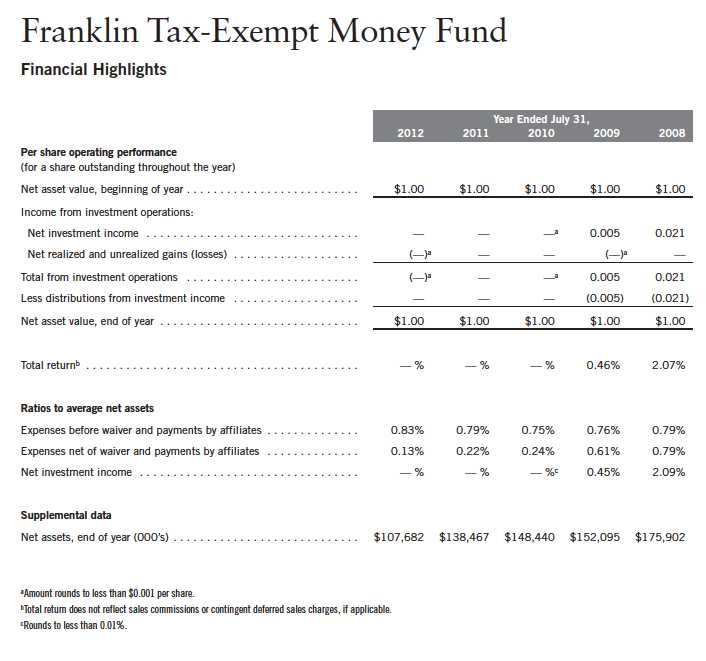

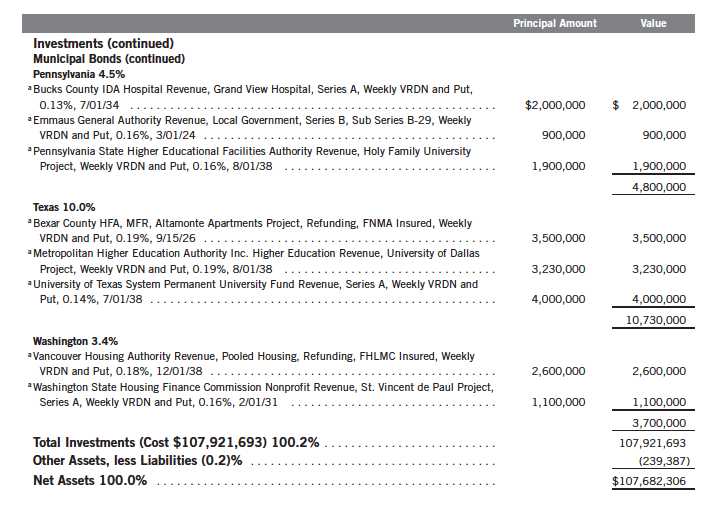

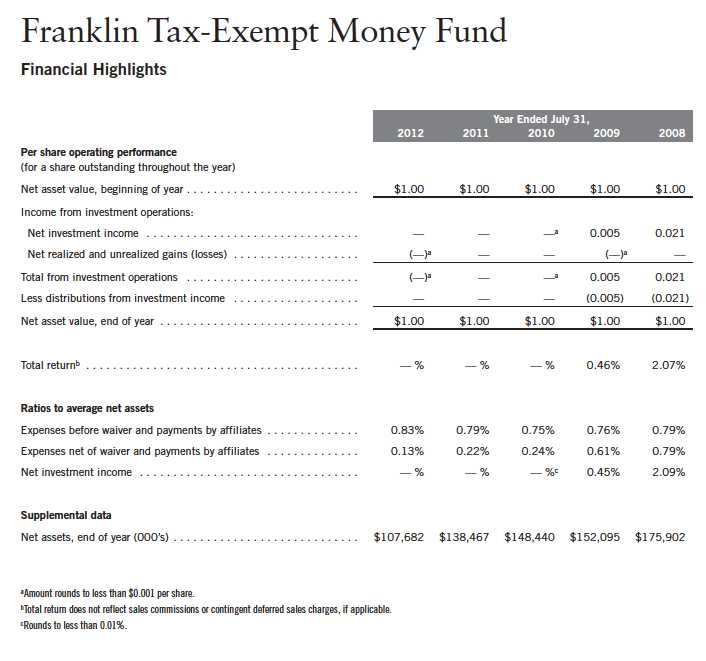

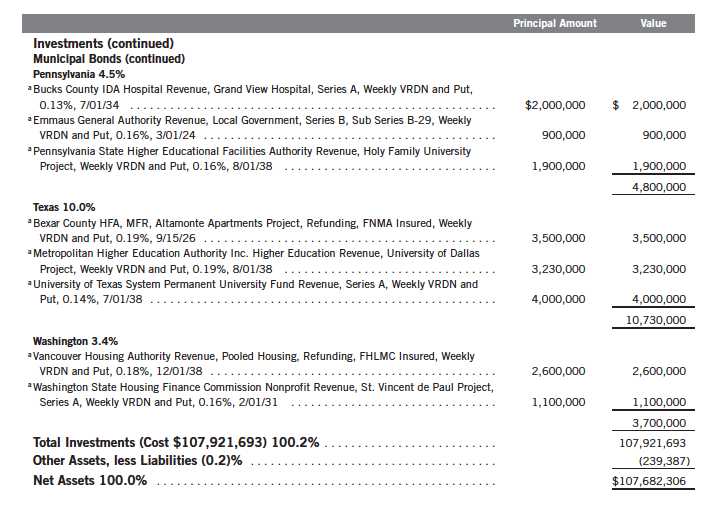

Franklin Tax-Exempt Money Fund

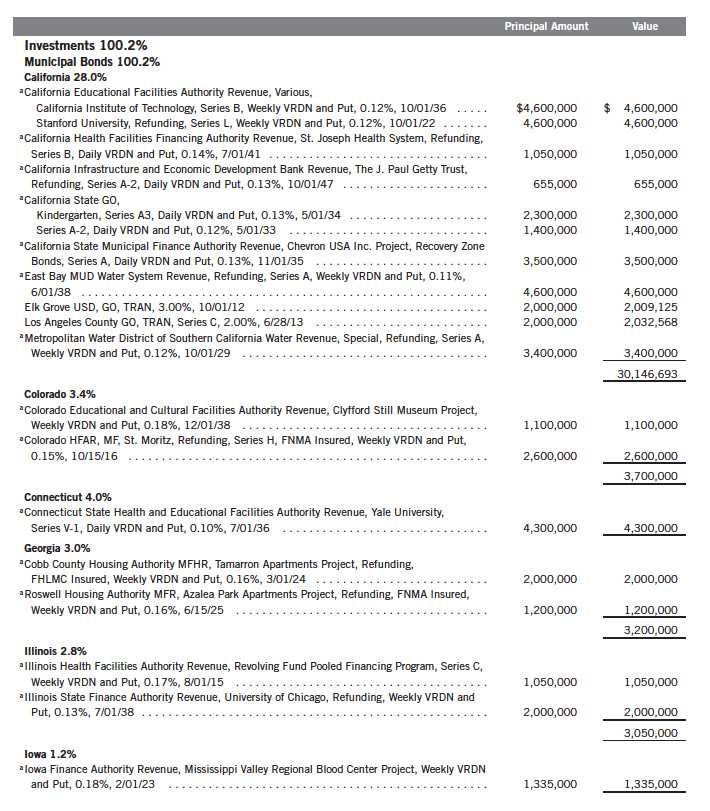

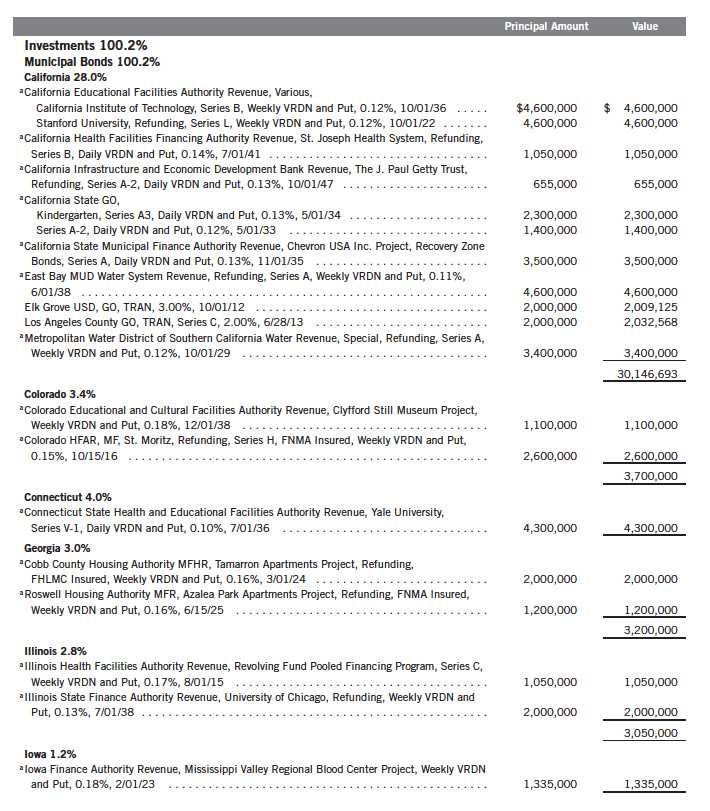

Statement of Investments, July 31, 2012

Annual Report | 9

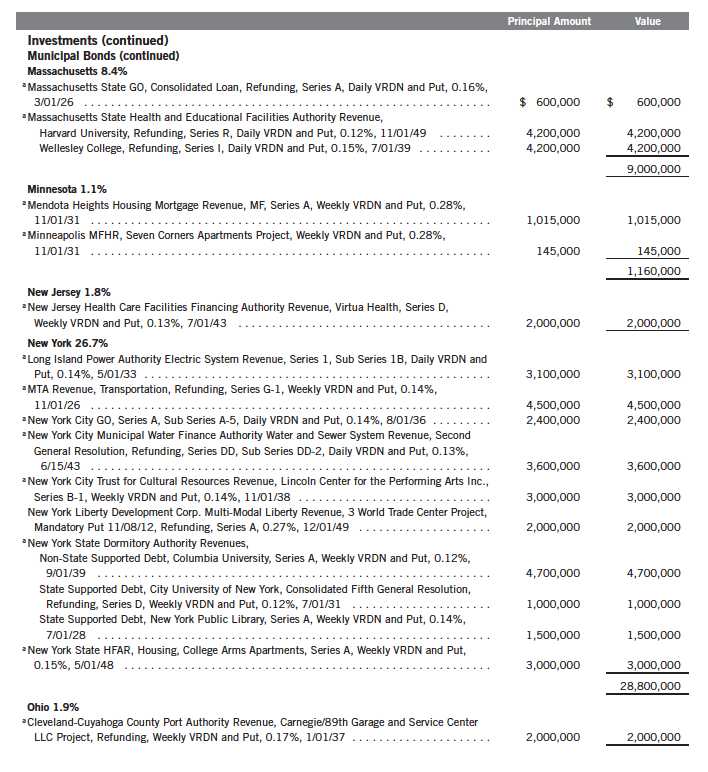

Franklin Tax-Exempt Money Fund

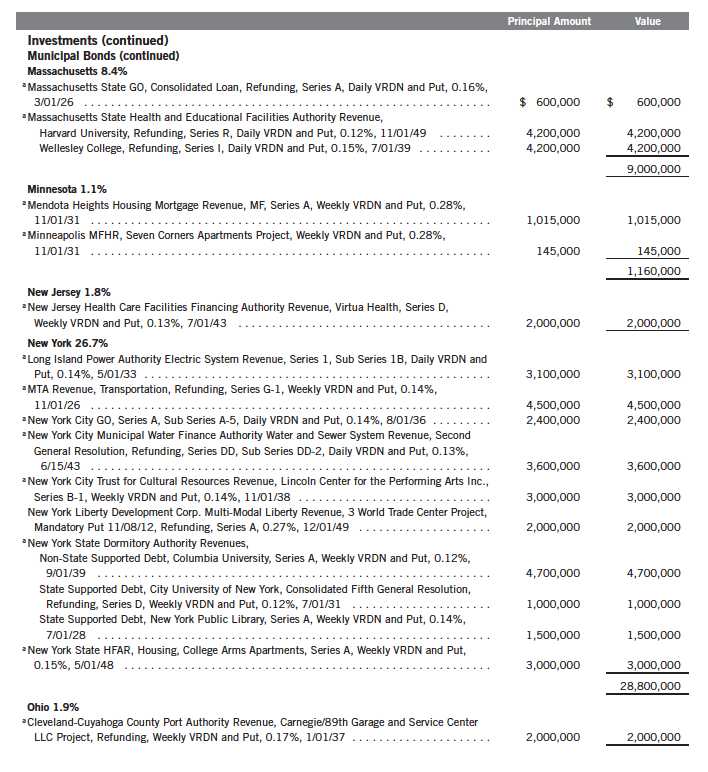

Statement of Investments, July 31, 2012 (continued)

10 | Annual Report

Franklin Tax-Exempt Money Fund

Statement of Investments, July 31, 2012 (continued)

See Abbreviations on page 19.

aVariable rate demand notes (VRDNs) are tax-exempt obligations which contain a floating or variable interest rate adjustment formula and an unconditional right of demand to receive payment of the principal balance plus accrued interest at specified dates. The coupon rate shown represents the rate at period end.

Annual Report | The accompanying notes are an integral part of these financial statements. | 11

12 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 13

14 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements

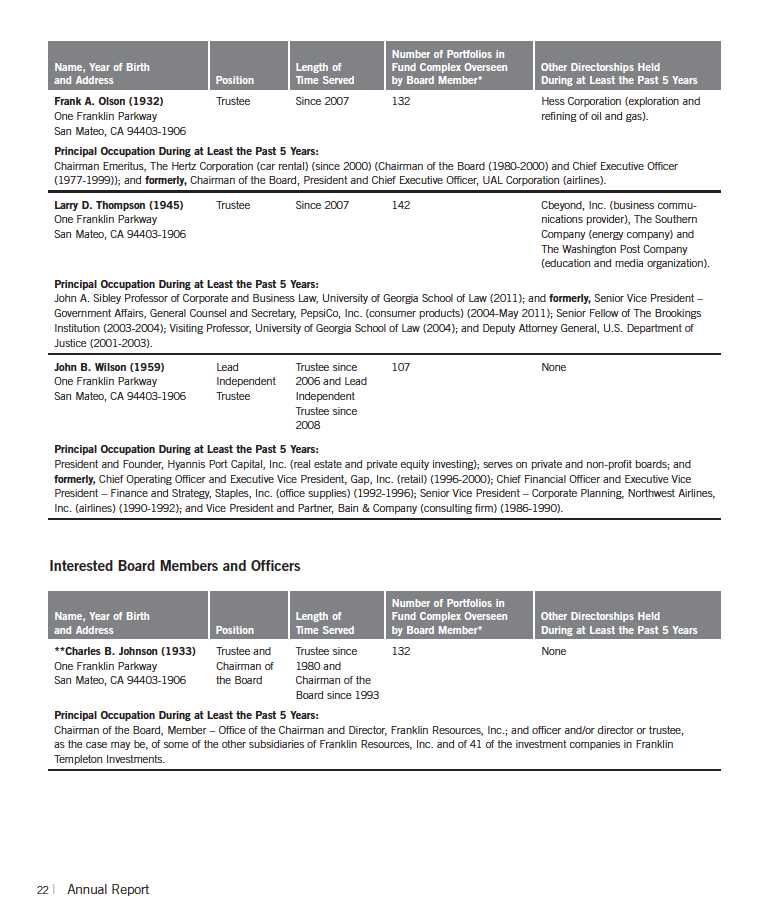

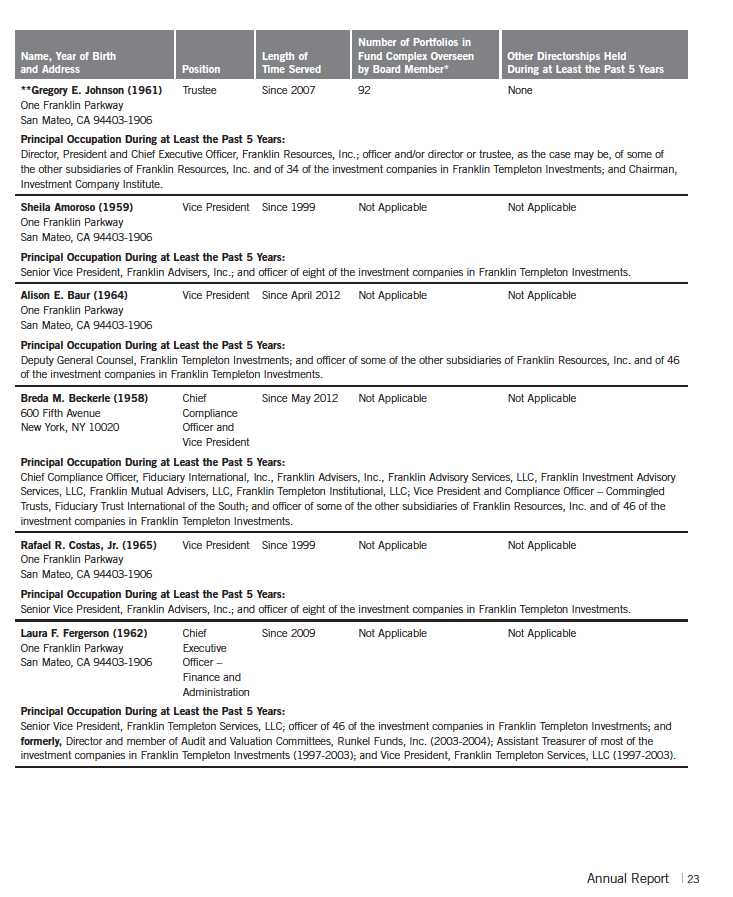

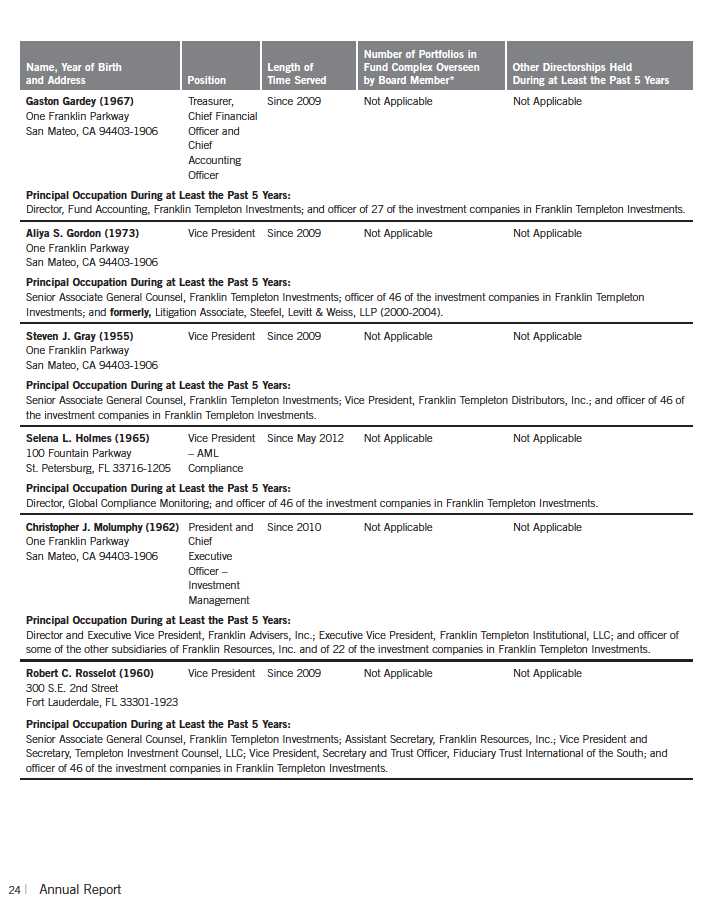

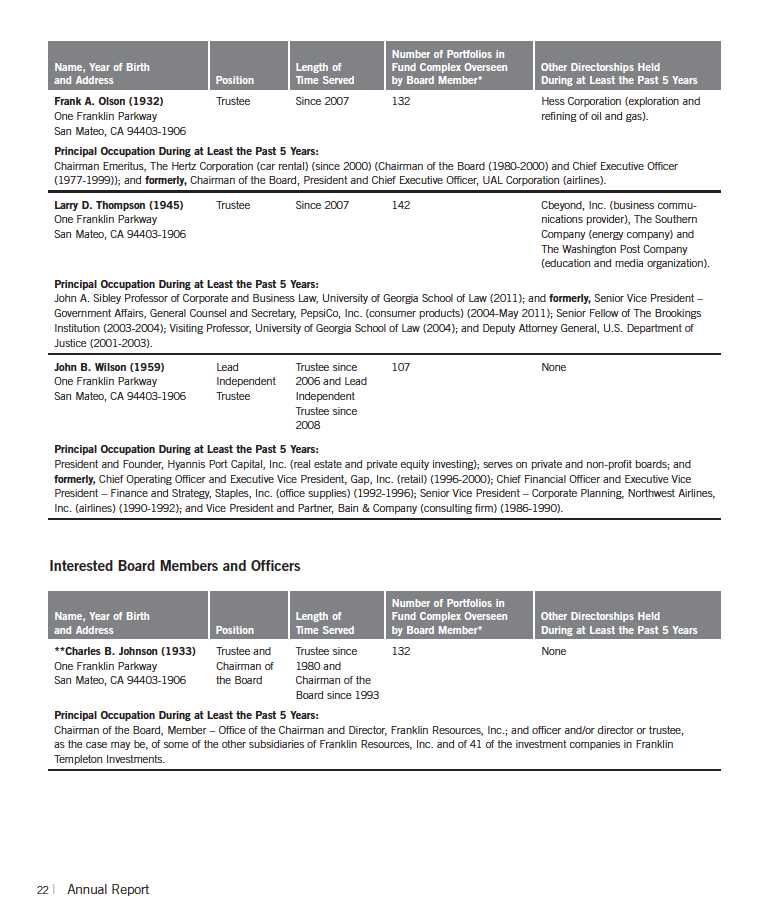

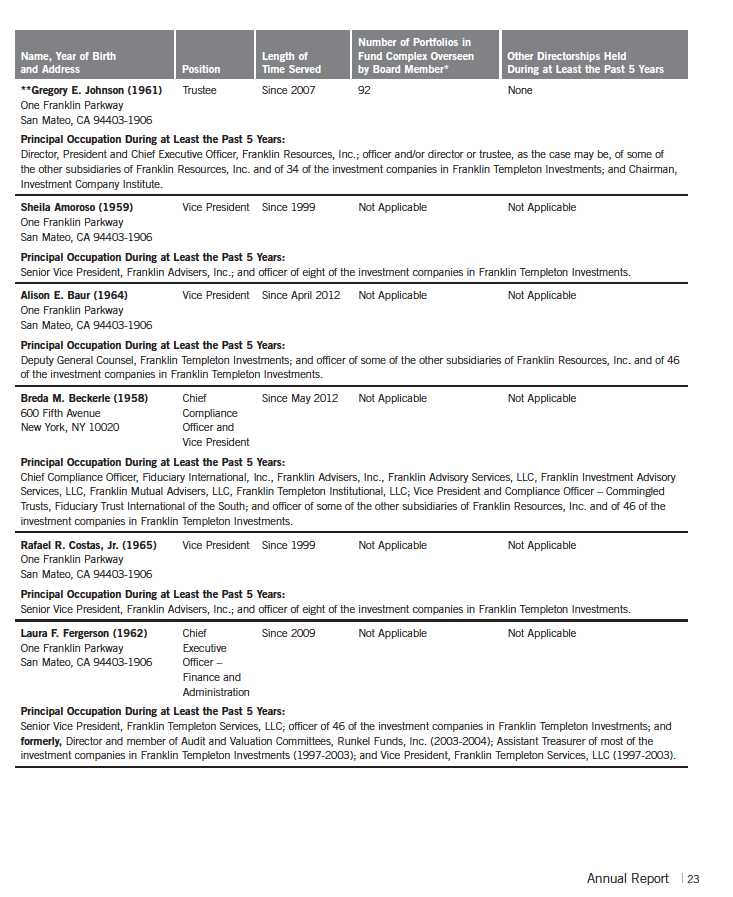

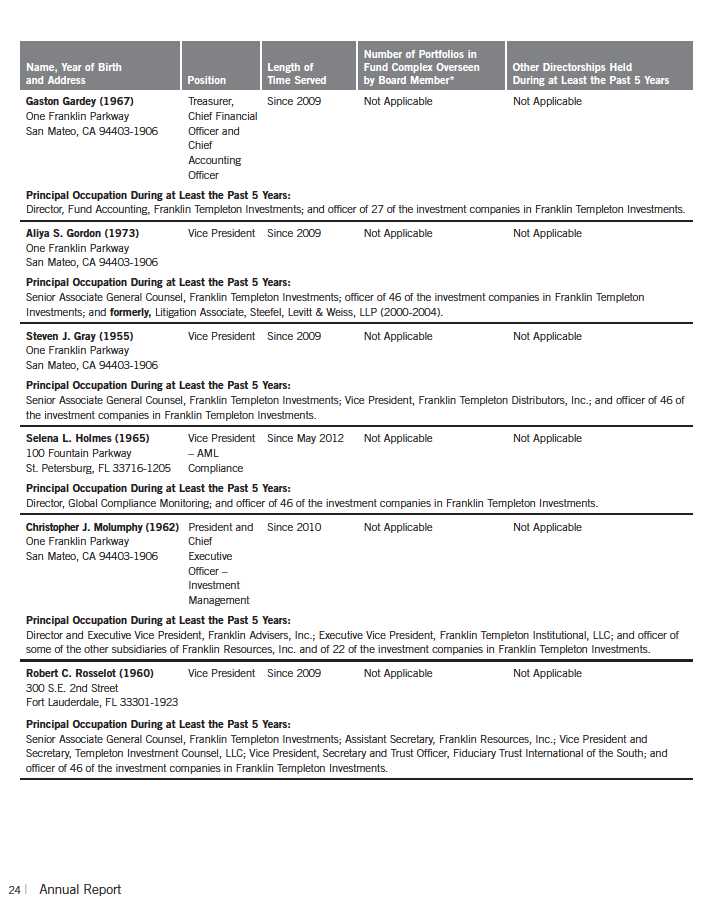

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Tax-Exempt Money Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Securities are valued at amortized cost, which approximates market value. Amortized cost is an income-based approach which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

b. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of July 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

c. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined

Annual Report | 15

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

d. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

e. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

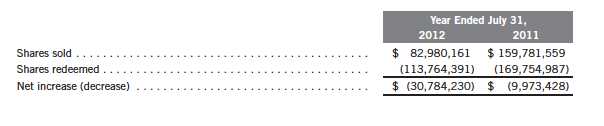

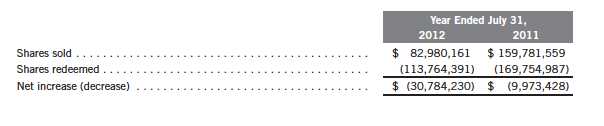

2. SHARES OF BENEFICIAL INTEREST

At July 31, 2012, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares at $1.00 per share were as follows:

16 | Annual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

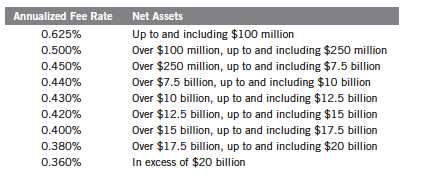

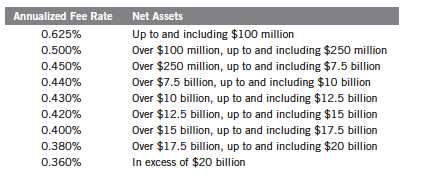

a. Management Fees

The Fund pays an investment management fee to Advisers based on the average daily net assets of the Fund as follows:

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on average daily net assets, and is not an additional expense of the Fund.

c. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

CDSC retained

$11,244

d. Transfer Agent Fees

For the year ended July 31, 2012, the Fund paid transfer agent fees of $108,257, of which $74,648 was retained by Investor Services.

Annual Report | 17

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| e. | Waiver and Expense Reimbursements |

In efforts to prevent a negative yield Advisers voluntarily agreed to waive or limit its fees, assume as its own expense certain expenses otherwise payable by the Fund and if necessary, make a capital infusion into the Fund. These waivers, expense reimbursements and capital infusions are voluntary and may be modified or discontinued by Advisers at any time, and without further notice. There is no guarantee that the Fund will be able to avoid a negative yield.

4. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Fund in taxable years beginning after December 22, 2010 are not subject to expiration and such losses retain their character as either short-term or long-term, rather than being considered short-term as under previous law. Post-enactment capital losses must be fully utilized prior to utilizing any losses incurred in pre-enactment tax years.

At July 31, 2012, the capital loss carryforwards were as follows:

On July 31, 2012, the Fund had expired pre-enactment capital loss carryforwards of $17,134, which were reclassified to paid-in capital.

At July 31, 2012, the cost of investments and undistributed tax exempt income for book and income tax purposes was the same.

18 | Annual Report

Franklin Tax-Exempt Money Fund

Notes to Financial Statements (continued)

5. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. Money market securities may be valued using amortized cost, in accordance with the 1940 Act. Generally, amortized cost reflects the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as a Level 2.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At July 31, 2012, all of the Fund’s investments in securities carried at fair value were in Level 2 inputs.

6. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

Annual Report | 19

Franklin Tax-Exempt Money Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Tax-Exempt Money Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin Tax-Exempt Money Fund (the “Fund”) at July 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

September 17, 2012

20 | Annual Report

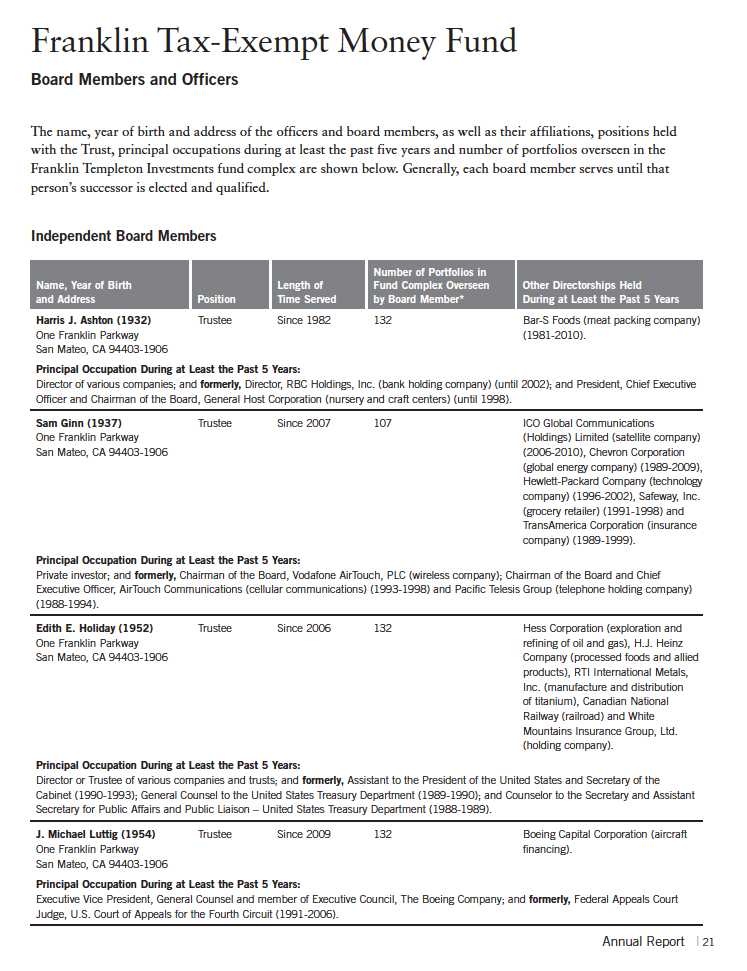

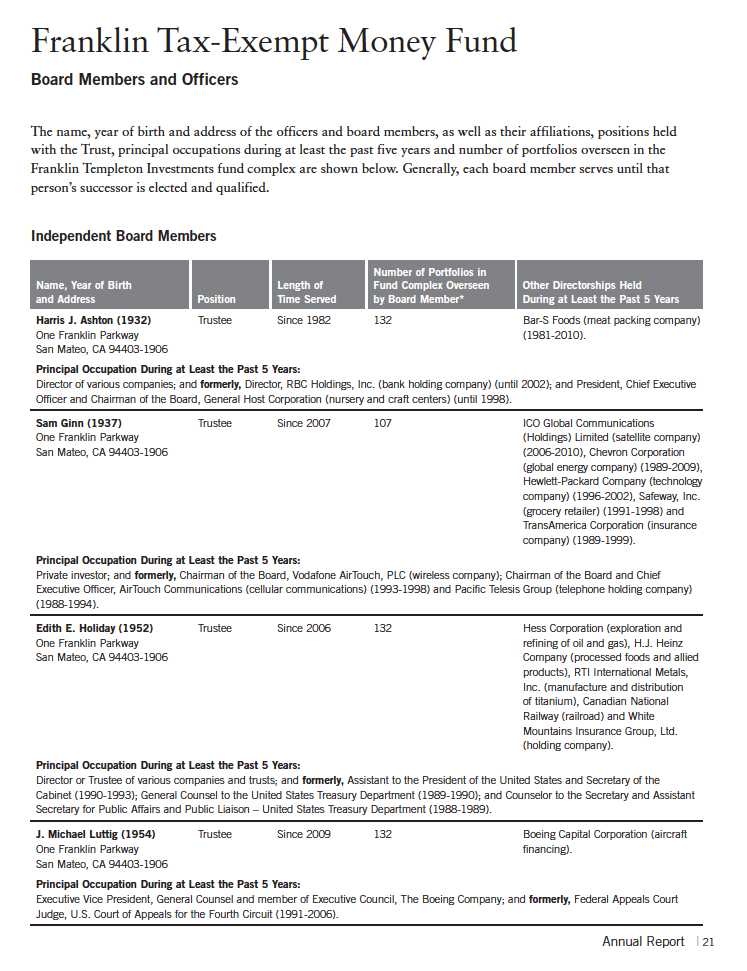

Franklin Tax-Exempt Money Fund

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held February 28, 2012, the Board of Trustees (Board), including a majority of non-interested or independent Trustees, approved renewal of the investment management agreement for the Fund. In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for the Fund, as well as periodic reports on expenses, shareholder services, legal and compliance matters, and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for the Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional material, including a Fund profitability analysis prepared by management. The Lipper report compared the Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Additional material accompanying such profitability analysis included information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant. Such material also included a memorandum prepared by management describing project initiatives and capital investments relating to the services provided to the Fund by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and an analysis concerning transfer agent fees charged by an affiliate of the Manager.

In considering such materials, the independent Trustees received assistance and advice from and met separately with independent counsel. In approving continuance of the investment management agreement for the Fund, the Board, including a majority of independent Trustees, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of the Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICES. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the Board, and the accuracy

26 | Annual Report

Franklin Tax-Exempt Money Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

of net asset value calculations. The Board also noted the extent of benefits provided Fund shareholders from being part of the Franklin Templeton family of funds, including the right to exchange investments between the same class of funds without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings in other funds to obtain a reduced sales charge. Favorable consideration was given to management’s continuous efforts and expenditures in establishing back-up systems and recovery procedures to function in the event of a natural disaster, it being noted that such systems and procedures had functioned smoothly during the Florida hurricanes and blackouts experienced in previous years. Consideration was also given to the experience of the Fund’s portfolio management team, the number of accounts managed and general method of compensation. In this latter respect, the Board noted that a primary factor in management’s determination of a portfolio manager’s bonus compensation was the relative investment performance of the funds he or she managed and that a portion of such bonus was required to be invested in a predes-ignated list of funds within such person’s fund management area so as to be aligned with the interests of shareholders. The Board also took into account the quality of transfer agent and shareholder services provided Fund shareholders by an affiliate of the Manager and the continuous enhancements to the Franklin Templeton website. Particular attention was given to management’s conservative approach and diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments including expanded collateralization requirements. The Board also took into account, among other things, the strong financial position of the Manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds.

INVESTMENT PERFORMANCE. The Board placed significant emphasis on the investment performance of the Fund in view of its importance to shareholders. While consideration was given to performance reports and discussions with portfolio managers at Board meetings during the year, particular attention in assessing such performance was given to the Lipper report furnished for the agreement renewal. The Lipper report prepared for the Fund showed its investment performance for the year ended December 31, 2011, as well as the previous 10 years ended that date in comparison to a performance universe consisting of the Fund and all retail tax-exempt money market funds as selected by Lipper. The Lipper report showed that the Fund’s total return for the one-year period, as well as for the previous three-, five- and 10-year periods on an annualized basis, was in the lowest quintile of such universe. In discussing this comparative performance, management pointed out it reflected the Fund’s conservative policy of seeking safety and liquidity by focusing on short maturities and holding no investments in derivative products or non-rated securities or securities subject to the alternative minimum tax, which generally offer higher yields. The Board found such performance to be acceptable in light of such explanations, noting also that the Fund’s expenses were subsidized by management to avoid net asset value falling below one dollar per share and that the median return within the Lipper universe for the one-year period was one basis point.

Annual Report | 27

Franklin Tax-Exempt Money Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

COMPARATIVE EXPENSES. Consideration was given to a comparative analysis of the management fees and total expense ratio of the Fund compared with those of a group of the Fund and seven other funds selected by Lipper as its appropriate Lipper expense group. Lipper expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Lipper to be an appropriate measure of comparative expenses. In reviewing comparative costs, Lipper provides information on the Fund’s management fee in comparison with the contractual investment management fee that would have been charged by other funds within its Lipper expense group assuming they were similar in size to the Fund, as well as the actual total expense ratio of the Fund in comparison with those of its Lipper expense group. The Lipper contractual investment management fee analysis includes administrative charges as being part of a management fee. The results of such comparisons showed the Fund’s contractual investment management fee rate to be the highest in its Lipper expense group, but its actual total expense ratio to be the lowest in such group. In discussing the expense comparisons, management pointed out that this Fund is not actively marketed and largely serves as an alternative investment vehicle for shareholders of the various Franklin/Templeton/Mutual Series fund families and provides a number of courtesy services to shareholders, including check writing in addition to exchange privileges. Management also pointed out that it was subsidizing the Fund’s expenses. The Board found such comparative expenses to be acceptable, noting the points raised by management.

MANAGEMENT PROFITABILITY. The Board also considered the level of profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board reviewed the Fund profitability analysis that addresses the overall profitability of Franklin Templeton’s U.S. fund business, as well as its profits in providing management and other services to each of the individual funds during the 12-month period ended September 30, 2011, being the most recent fiscal year-end for Franklin Resources, Inc., the Manager’s parent. In reviewing the analysis, attention was given to the methodology followed in allocating costs to the Fund, it being recognized that allocation methodologies are inherently subjective and various allocation methodologies may each be reasonable while producing different results. In this respect, the Board noted that, while being continuously refined and reflecting changes in the Manager’s own cost accounting, the allocation methodology was consistent with that followed in profitability report presentations for the Fund made in prior years and that the Fund’s independent registered public accounting firm had been engaged by the Manager to review the reasonableness of the allocation methodologies solely for use by the Fund’s Board in reference to the profitability analysis. In reviewing and discussing such analysis, management discussed with the Board its belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational

28 | Annual Report

Franklin Tax-Exempt Money Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

cost savings and efficiencies initiated by management. The Board also took into account management’s expenditures in improving shareholder services provided the Fund, as well as the need to implement systems and meet additional regulatory and compliance requirements resulting from statutes such as the Sarbanes-Oxley and Dodd-Frank Acts and recent SEC and other regulatory requirements. In addition, the Board considered a third-party study comparing the profitability of the Manager’s parent on an overall basis to other publicly held managers broken down to show profitability from management operations exclusive of distribution expenses, as well as profitability including distribution expenses. The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services. Based upon its consideration of all these factors and taking into account the fact that the Fund’s expenses were being subsidized, the Board determined that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board also considered whether economies of scale are realized by the Manager as the Fund grows larger and the extent to which this is reflected in the level of management fees charged. While recognizing that any precise determination is inherently subjective, the Board noted that based upon the Fund profitability analysis, it appears that as some funds get larger, at some point economies of scale do result in the Manager realizing a larger profit margin on management services provided such a fund. The Board also noted that economies of scale are shared with a fund and its shareholders through management fee breakpoints so that as a fund grows in size, its effective management fee rate declines. The fee structure under the Fund’s investment management agreement provides an initial fee of 0.625% on the first $100 million of net assets; 0.50% on the next $150 million of net assets; and 0.45% of net assets in excess of $250 million with breakpoints thereafter beginning at the $7.5 billion net asset level. The Fund’s net assets were approximately $138 million at December 31, 2011. The Board believed it problematic that the Manager and its affiliates realized any economies of scale in furnishing advisory and administrative services to the Fund in view of the transitory nature of the Fund’s investment role within the Franklin Templeton fund complex, the services provided its shareholders, and management’s subsidization of expenses.

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Annual Report | 29

Franklin Tax-Exempt Money Fund

Shareholder Information (continued)

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Householding of Reports and Prospectuses

You will receive the Fund’s financial reports every six months as well as an annual updated summary prospectus (prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the financial reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 632-2301. At any time you may view current prospectuses/summary prospectuses and financial reports on our web-site. If you choose, you may receive these documents through electronic delivery.

30 | Annual Report

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its

principal executive officers and principal financial and accounting

officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an

exhibit a copy of its code of ethics that applies to its principal

executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving

on its audit committee.

(2) The audit committee financial expert is John B. Wilson and he is

"independent" as defined under the relevant Securities and Exchange

Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional

services rendered by the principal accountant for the audit of the

registrant’s annual financial statements or for services that are

normally provided by the principal accountant in connection with

statutory and regulatory filings or engagements were $25,153 for the

fiscal year ended July 31, 2012 and $19,769 for the fiscal year ended

July 31, 2011.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and

related services rendered by the principal accountant to the registrant

that are reasonably related to the performance of the audit of the

registrant's financial statements and are not reported under paragraph

(a) of Item 4.

There were no fees paid to the principal accountant for assurance and

related services rendered by the principal accountant to the

registrant's investment adviser and any entity controlling, controlled

by or under common control with the investment adviser that provides

ongoing services to the registrant that are reasonably related to the

performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional

services rendered by the principal accountant to the registrant for tax

compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional

services rendered by the principal accountant to the registrant’s

investment adviser and any entity controlling, controlled by or under

common control with the investment adviser that provides ongoing

services to the registrant for tax compliance, tax advice and tax

planning were $50,000 for the fiscal year ended July 31, 2012 and

$85,000 for the fiscal year ended July 31, 2011. The services for which

these fees were paid included technical tax consultation for capital

gain tax reporting to foreign governments, application of local country

tax laws to investments and licensing securities with local country

offices.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and

services rendered by the principal accountant to the registrant, other

than the services reported in paragraphs (a)-(c) of Item 4 were $43 for

the fiscal year ended July 31, 2012 and $54 for the fiscal year ended

July 31, 2011. The services for which these fees were paid included

review of materials provided to the fund Board in connection with the

investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and

services rendered by the principal accountant to the registrant’s

investment adviser and any entity controlling, controlled by or under

common control with the investment adviser that provides ongoing

services to the registrant, other than services reported in paragraphs

(a)-(c) of Item 4 were $152,407 for the fiscal year ended July 31, 2012

and $144,746 for the fiscal year ended July 31, 2011. The services for

which these fees were paid included review of materials provided to the

fund Board in connection with the investment management contract

renewal process.

(e) (1) The registrant’s audit committee is directly responsible for

approving the services to be provided by the auditors, including:

(i) pre-approval of all audit and audit related services;

(ii) pre-approval of all non-audit related services to be

provided to the Fund by the auditors;

(iii) pre-approval of all non-audit related services to be

provided to the registrant by the auditors to the registrant’s

investment adviser or to any entity that controls, is controlled by or

is under common control with the registrant’s investment adviser and

that provides ongoing services to the registrant where the non-audit

services relate directly to the operations or financial reporting of

the registrant; and

(iv) establishment by the audit committee, if deemed

necessary or appropriate, as an alternative to committee pre-approval

of services to be provided by the auditors, as required by paragraphs

(ii) and (iii) above, of policies and procedures to permit such

services to be pre-approved by other means, such as through

establishment of guidelines or by action of a designated member or

members of the committee; provided the policies and procedures are

detailed as to the particular service and the committee is informed of

each service and such policies and procedures do not include delegation

of audit committee responsibilities, as contemplated under the

Securities Exchange Act of 1934, to management; subject, in the case of

(ii) through (iv), to any waivers, exceptions or exemptions that may be

available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in

paragraphs (b)-(d) of Item 4 were approved by the audit committee

pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for

services rendered by the principal accountant to the registrant and the

registrant’s investment adviser and any entity controlling, controlled

by or under common control with the investment adviser that provides

ongoing services to the registrant were $202,450 for the fiscal year

ended July 31, 2012 and $229,800 for the fiscal year ended July 31,

2011.

(h) The registrant’s audit committee of the board has considered

whether the provision of non-audit services that were rendered to the

registrant’s investment adviser (not including any sub-adviser whose

role is primarily portfolio management and is subcontracted with or

overseen by another investment adviser), and any entity controlling,

controlled by, or under common control with the investment adviser that

provides ongoing services to the registrant that were not pre-approved

pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is

compatible with maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-

End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment

Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management

Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may

recommend nominees to the Registrant's Board of Trustees that would

require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant

maintains disclosure controls and procedures that are designed to

ensure that information required to be disclosed in the Registrant’s

filings under the Securities Exchange Act of 1934 and the Investment

Company Act of 1940 is recorded, processed, summarized and reported

within the periods specified in the rules and forms of the Securities

and Exchange Commission. Such information is accumulated and

communicated to the Registrant’s management, including its principal

executive officer and principal financial officer, as appropriate, to

allow timely decisions regarding required disclosure. The Registrant’s

management, including the principal executive officer and the principal

financial officer, recognizes that any set of controls and procedures,

no matter how well designed and operated, can provide only reasonable

assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on

Form N-CSR, the Registrant had carried out an evaluation, under the

supervision and with the participation of the Registrant’s management,

including the Registrant’s principal executive officer and the

Registrant’s principal financial officer, of the effectiveness of the

design and operation of the Registrant’s disclosure controls and

procedures. Based on such evaluation, the Registrant’s principal

executive officer and principal financial officer concluded that the

Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant

changes in the Registrant’s internal controls or in other factors that

could significantly affect the internal controls subsequent to the date

of their evaluation in connection with the preparation of this

Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a) (1) Code of Ethics

(a) (2) Certifications pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance

and Administration, and Gaston Gardey, Chief Financial Officer and

Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of

2002 of Laura F. Fergerson, Chief Executive Officer - Finance and

Administration, and Gaston Gardey, Chief Financial Officer and Chief

Accounting Officer