SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SOUTHEASTERN BANKING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

SOUTHEASTERN BANKING CORPORATION

1010 Northway Street

Darien, Georgia 31305

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of

Southeastern Banking Corporation:

Notice is hereby given that the Annual Meeting of Shareholders (the “Meeting”) of Southeastern Banking Corporation (the “Company”) will be held at Southeastern Bank, 1010 Northway Street, Darien, Georgia 31305, on Tuesday, June 17, 2003 at 3:00 p.m. local time, for the following purposes:

| | 1) | | To elect eight directors to serve for one year terms expiring at the next Annual Meeting of Shareholders in 2004; |

| | 2) | | To set the Board of Directors (the “Board”) at a twelve member maximum with four to remain vacant until the elected Board deems it in the Company’s best interest to fill one or more of such vacancies; |

| | 3) | | To approve the appointment of independent auditors by the Audit Committee for the fiscal year 2003; and |

| | 4) | | To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The Board is not aware of any other business to come before the Meeting.

Any action may be taken on the foregoing proposals at the Meeting on the date specified above, or on any date or dates to which the Meeting may be adjourned or postponed. Only shareholders of record at the close of business on March 18, 2003 will be entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof.

It is important that your shares be represented and voted at the Meeting. You can vote your shares by completing and returning the enclosed proxy card.Regardless of the number of shares you own, your vote is important. Please act today.

Your attention is directed to the Proxy Statement accompanying this Notice of Meeting for more complete information on the matters to be acted upon at the Meeting.

By Order of the Board of Directors,

WANDA D. PITTS

Secretary

May 23, 2003

IMPORTANT: Whether or not you plan to attend the Meeting, please complete, sign, date, and return the accompanying proxy in the postage paid envelope provided. The giving of the proxy will not affect your right to vote at the Meeting if the proxy is revoked as set forth in the accompanying Proxy Statement.

1

SOUTHEASTERN BANKING CORPORATION

1010 Northway Street

Darien, Georgia 31305

912.437.4141

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, JUNE 17, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Southeastern Banking Corporation (the “Company”) for use at the Annual Meeting of Shareholders of the Company (the “Meeting”) to be held at Southeastern Bank, 1010 Northway Street, Darien, Georgia, on Tuesday, June 17, 2003 at 3:00 p.m. or any adjournment or postponement thereof. This Proxy Statement and enclosed form of proxy are first being mailed to shareholders on or about May 23, 2003.

All shares of the Company’s Common Stock, par value $1.25 per share (the “Common Stock”), represented at the Meeting by properly authorized proxies received prior to or at the Meeting, and not revoked, will be voted at the Meeting in accordance with the shareholder’s instructions. If no instructions are indicated, properly executed proxies will be votedFOR the proposals set forth in this Proxy Statement. A majority of the shares of Common Stock entitled to vote at the Meeting, represented in person or by proxy, will constitute a quorum.

The Company does not know of any matters, other than described in the Notice of Meeting, that are to come before the Meeting. If any other matters are properly presented at the Meeting for action, the persons named in the enclosed form of proxy and acting thereunder will vote on such matters as the Board of Directors recommends.

A shareholder may revoke his or her proxy and change his or her vote at any time prior to the voting thereof on any matter (without, however, affecting any vote taken prior to such revocation) by: (i) signing and returning another proxy with a later date; (ii) giving written notice of revocation of the shareholder’s proxy to the Secretary of the Company prior to the Meeting at the address below; or (iii) voting in person at the Meeting. Any written notice revoking a proxy should be delivered to Wanda D. Pitts, Secretary, Southeastern Banking Corporation, at P.O. Box 455, Darien, Georgia 31305, if by mail, and at 1010 Northway Street, Darien, Georgia 31305, if by courier. The presence of a shareholder at the Meeting will not automatically revoke such shareholder’s proxy.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Shareholders of record at the close of business on March 18, 2003 will be entitled to one vote for each share then held. As of March 18, 2003, the Company had 3,333,139 shares of Common Stock issued and outstanding. The Common Stock constitutes the only voting securities issued by the Company.

The following table sets forth certain information regarding beneficial ownership of the Common Stock as of March 18, 2003 by: (i) each person known by the Company to be the beneficial owner of more than 5% of the outstanding shares of Common Stock; (ii) each director, nominee, and executive officer (as defined below under “Executive Compensation and Other Information”); and (iii) all directors, nominees, and executive officers as a group. The Company believes that the individuals listed each have sole voting and investment power with respect to such shares, except as otherwise indicated in the footnotes to the table.

2

Unless otherwise indicated below, the business address of each beneficial owner of more than 5% of Common Stock is: c/o Southeastern Banking Corporation, P.O. Box 455, 1010 Northway Street, Darien, Georgia 31305.

| | | Shares Beneficially Owned

|

Name of Beneficial Owner

| | Amount of Beneficial Ownership (1)

| | Percentage of Ownership

|

Alyson G. Beasley | | 815,978 | | 24.48 |

Mark L. Belcher | | 760 | | * |

Leslie H. Blair | | 8,340 | | * |

David H. Bluestein | | 14,655 | | * |

Gene F. Brannen | | 25,349 | | * |

Rodney P. C. Burney | | 100 | | * |

William Downey (2) | | 182,914 | | 5.49 |

Cornelius P. Holland, III | | 6,781 | | * |

Alva J. Hopkins, III | | 34,398 | | 1.03 |

G. Norris Johnson | | 8,500 | | * |

E. Amanda Kirby | | 100 | | * |

R. Lanier Miles | | 1,100 | | * |

All directors, nominees, and executive officers as a group (12 persons) | | 1,098,975 | | 32.97 |

| (1) | | The number of shares as to which each nominee has shared voting and investment power is as follows: Alyson G. Beasley – 2,613; Leslie H. Blair – 3,000 shares; Gene F. Brannen – 19,296; William Downey – 29,700; Cornelius P. Holland, III – 612; and Alva J. Hopkins, III – 1,980. |

| (2) | | Mr. Downey’s business address is: c/o Golden Isles Realty Company, Inc., 330 Mallory Street, St. Simons Island, Georgia 31522. |

PROPOSALS ONE AND TWO - ELECTION OF DIRECTORS

A Board of Directors (the “Board”) consisting initially of eight directors will be elected at the Meeting for a one-year term or until their successors are elected and qualified. The Board has unanimously approved the nominees named below, all of whom are members of the current Board.

Unless otherwise instructed, it is the intention of the persons named in the accompanying form of proxy to vote for the election of the eight nominees named. Although the Board anticipates that all nominees will be available to serve as directors of the Company, should any one or more of them not accept the nomination, or otherwise be unwilling or unable to serve, the proxies will be voted for the election of a substitute nominee, or nominees, as the Board recommends.Except as disclosed in this proxy statement, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

None of the nominees has been involved in legal proceedings related to bankruptcies, criminal proceedings, or securities law violations. All nominees have been engaged in their respective principal occupation and have been associated with their respective employers for the last five years.

The Board recommends that shareholders vote in favor of all the nominees.

Nominees for Directorship

The table on the next page sets forth certain information with respect to each nominee for election to the Board.

3

| | | Age

| | Director Since

|

Alyson G. Beasley Vice President and Assistant Secretary of the Company Controller, Southeastern Bank | | 36 | | 1999 |

|

Leslie H. Blair Vice President, Gowen Timber Company, Inc. | | 62 | | 1978 |

|

David H. Bluestein Mayor, City of Darien | | 61 | | 1984 |

|

Gene F. Brannen Retired, Brannen Seafood Company, Inc. | | 68 | | 1984 |

|

William Downey President, Golden Isles Realty Company, Inc. Treasurer of the Company | | 69 | | 1976 |

|

Cornelius P. Holland, III President of the Company President and Chief Executive Officer, Southeastern Bank President, SBC Financial Services, Inc. | | 47 | | 1997 |

|

Alva J. Hopkins, III Attorney-at-Law President, Toledo Manufacturing Company, Inc. | | 50 | | 1978 |

|

G. Norris Johnson President, Johnson Brothers Hardware, Inc. | | 67 | | 1979 |

All directors have served continuously since their respective election. There are no family relationships among the Director nominees or executive officers of the Company or its subsidiaries.

Approval is sought to increase the number of directors to twelve by allowing the eight elected directors to approve four additional directors to be elected at any time the Board deems it to be in the Company’s best interest to fill same.The Board recommends a vote for this proposal.

Meetings and Committees of the Board. The Board conducts its business through meetings of the Board and through the activities of its committees, including subsidiary Boards and committees. The Company’s Board regularly meets quarterly and other times as needed. During the year ended December 31, 2002, the Board of Directors held 7 meetings. All the Company’s directors attended at least 75% of the Board and committee meetings, including subsidiary Board of Directors and committee meetings, on which they served.

The Executive Committee of the Board of Directors consists of Messrs. Brannen, Downey, Holland, Hopkins, and Mrs. Beasley. This committee evaluates potential acquisitions and handles other Company matters on an as-needed basis. The Executive Committee held no meetings during 2002.

The Board of Directors of Southeastern Bank, the Company’s bank subsidiary, meets monthly, and its Executive Committee, normally twice a month. All members of the Company’s Board also serve on the Southeastern Bank Board of Directors. The Southeastern Bank Board held 12 meetings during 2002. Messrs. Blair, Bluestein, Brannen, and Holland also serve on the Southeastern Bank Executive Committee. This committee primarily reviews and approves loans but is also empowered to act on other bank matters in the absence of the bank Board. The Southeastern Bank Executive Committee held 21 meetings in 2002.

Messrs. Brannen, Hopkins, and Johnson serve on the joint Audit Committee of the Company and Southeastern Bank. The primary functions of this committee are to appoint the independent auditors for the

4

Company and its subsidiaries; review external audit scope, findings, and recommendations; approve the annual financial statements, preparation of which is the responsibility of management; evaluate internal accounting policies and procedures; and review and approve the annual plan for the internal audit department, as well as summary reports of such department’s findings and recommendations. The Audit Committee’s responsibilities are set forth in its Charter, a copy of which is attached to this Proxy Statement as Exhibit A. The “Audit Committee Report” on the Company’s financial statements for the year ended December 31, 2002 is located on page 7. The current members of the Audit Committee are independent, as defined by Rules of the National Association of Securities Dealers, Inc. The Audit Committee held 5 meetings in 2002.

The Compensation Committee of Southeastern Bank is responsible for approving the compensation arrangements for the Company’s executive officers. The current members of the Compensation Committee are Messrs. Downey, Holland, and Hopkins and bank-only directors Archie C. Davis, Jr. and Lawrence F. Jacobs. The Compensation Committee held 2 meetings during 2002.

Messrs. Bluestein, Holland, and Mrs. Beasley serve on the Board of Directors of SBC Financial Services, Inc., the Company’s insurance and investment subsidiary. This Board evaluates the financial performance, approves marketing programs, and establishes policy. Four meetings were held by the SBC Financial Services, Inc. Board in 2002.

The Company’s Board acts as a nominating committee for the annual selection of nominees for election as Company directors. While the Board will consider nominees recommended by shareholders, it has not established any procedures for this purpose.

Director Compensation. Non-employee directors of the Company receive a fee of $500.00 per meeting. No fees are paid to members of committees appointed by the Company Board for their service on Company committees. Non-employee directors of Southeastern Bank are paid a director’s fee of $500.00 per month, and, if on the Executive Committee, an additional $450.00 per month. Audit Committee members are paid $200.00 for each meeting attended except for the Chairman of that Committee who is paid $250.00 for his attendance. Non-employee directors of SBC Financial Services, Inc. are paid $100.00 per meeting attended. No fees are paid to directors employed by the Company and its subsidiaries for their attendance at any Board or committee meetings.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

Executive officers are elected annually by the Board. The table below sets forth the name of each executive officer of the Company and its subsidiaries and the principal positions and offices each holds with the Company. Unless otherwise indicated, each of these officers has served as an executive officer of the Company or its subsidiaries for at least five years.

Name

| | Information about Executive Officers

|

Cornelius P. Holland, III | | President of the Company. Mr. Holland is also Chairman, Chief Executive Officer, and since April 2002, President of Southeastern Bank and SBC Financial Services, Inc. |

|

R. Lanier Miles | | Executive Vice President and chief lending officer of Southeastern Bank since December 30, 2002. From 1963 – September 2002, Mr. Miles held various positions at SunTrust Bank, Brunswick, Georgia, most recently Executive Vice President/Senior Lender. Mr. Miles is 60. |

|

Rodney P.C. Burney | | Senior Vice President of Southeastern Bank since July 30, 2001 with operational and lending oversight of various branch locations. From May 1997 – September 1998, Mr. Burney served as President and Chief Executive Officer of First State Bank & Trust, Cordele, Georgia. Mr. Burney is 56. |

5

E. Amanda Kirby | | Senior Vice President and an executive officer of Southeastern Bank since April 2002. As a regional executive, Mrs. Kirby’s responsibilities include lending and operational oversight of various bank locations. Prior to April 2002, Mrs. Kirby was Vice President – Loan Administration of Southeastern Bank. Mrs. Kirby is 43. |

|

Alyson G. Beasley | | Vice President of the Company and Controller of Southeastern Bank with responsibility for various finance-related functions. Mrs. Beasley was appointed an executive officer of Southeastern Bank in April 2002. |

|

Mark L. Belcher | | Chief Technology Officer of Southeastern Bank. Mr. Belcher was appointed an executive officer of the Company in July 2002. Mr. Belcher is 39. |

Summary of Cash and Certain Other Compensation

All executive compensation is paid by the Company’s subsidiaries. The following table sets forth the compensation of executive officers of the Company’s subsidiaries whose annual compensation exceeded $100,000 in 2002:

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation

| | All Other Compensation |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | (2)(3)(4)

|

Cornelius P. Holland, III President of the Company | | 2002 2001 2000 | | $ | 203,795 198,824 198,824 | | $ | 30,983 16,569 16,569 | | $ | 24,213 23,302 22,904 |

|

W. Daniel Burkhalter (1) | | 2002 2001 2000 | | $ | 109,000 109,000 105,482 | | $ | 9,083 11,633 8,790 | | $ | 18,535 17,113 17,089 |

| (1) | | Resigned effective December 31, 2002. Prior to his resignation, Mr. Burkhalter served as a Senior Vice President of Southeastern Bank. |

| (2) | | The Company’s subsidiaries maintain a qualified profit-sharing plan which covers executive officers and other employees who have completed one calendar year of service. A participant’s interest vests 20% each year beginning after the third year of service, with 100% vesting in seven years. The profit-sharing contribution set aside for these executive officers approximated $31,000, $30,000, and $29,000 in 2002, 2001 and 2000. |

| (3) | | The Company provides group medical and life insurance for officers and employees. Additionally, executive officers are entitled to a $100,000 executive life insurance policy. The premium amount for these policies is included in this total. |

| (4) | | This compensation amount does not include the value of any personal benefit that might be derived from the use of an automobile. |

Employment Contracts. In 2002, the Company executed an employment contract with Mr. Miles. Following a change in control or termination of employment by the Company without cause, Mr. Miles will receive severance benefits. These benefits, all payable within 30 days of termination, would include: (i) a lump sum payment of one year’s base salary and bonus; (ii) one year’s additional benefits under the Company’s benefit plans, such as health and life insurance; and (iii) certain other nominal perquisites. This agreement requires Mr. Miles not to use or disclose any of the Company’s confidential business information and, subject to certain limitations, not to compete with the Company. The employment agreement confers no benefits upon termination of employment pursuant to cause, death, or disability. The Company does not currently have employment contracts or change in control agreements with any other executive officers.

6

Stock Options, Warrants, or Rights

The Company has not issued and does not have outstanding any stock options, warrants, or rights.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board has oversight responsibility for the Company’s financial reporting process and the quality of its financial reporting. In connection with the December 31, 2002 financial statements, the Audit Committee:

| | 1) | | Reviewed and discussed the audited financial statements with management, who represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles; |

| | 2) | | Discussed with the Company’s independent auditors the matters required by Statement on Auditing Standards No. 61 (Communications with Audit Committees); |

| | 3) | | Received the written independence disclosures from the independent auditors required by Independence Standards Board No. 1 (Independence Discussions with Audit Committees), and discussed with the independent auditors their independence; and |

| | 4) | | Discussed with the independent auditors the quality of the Company’s financial reporting. |

Based upon these reviews and discussions, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission (the “SEC”).

THE AUDIT COMMITTEE:

Alva J. Hopkins, III, Chairman

Gene F. Brannen

G. Norris Johnson

The foregoing report of the Audit Committee shall not be deemed to be incorporated by reference in any previous or future document filed by the Company with the SEC under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates the report by reference in any such document.

PROPOSAL THREE – APPOINTMENT OF AUDITORS

Subject to approval by a majority of the shares represented at the Meeting, the Audit Committee shall be given authority to appoint the auditors of the Company for 2003. The Audit Committee considers a number of factors in making its appointment, including audit continuity, proposed audit scope, and estimated fees. The Board expects that the Audit Committee will appoint Mauldin & Jenkins, LLC (“M&J”) as the Company’s independent auditors for 2003. M&J audited the Company’s financial statements for the most recent fiscal year.

During 2002, M&J provided services in the following categories and amounts:

Fees for audit of the Company’s financial statements | | $ | 69,258 |

All other fees | | | — |

Prior Auditors. On November 26, 2002, the Company dismissed its prior independent certifying accountants, BDO Seidman, LLP (“BDO”), and appointed M&J. This determination followed the Company’s decision to seek proposals from independent accountants to audit its financial statements for the fiscal year ending December 31, 2002. The decision to dismiss BDO and retain M&J was made by the Audit Committee.

BDO’s audit reports on the Company’s financial statements as of and for the fiscal years ended December 31, 2001 and 2000, the two most recent years preceding the date of dismissal, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit

7

scope, or accounting principles. Additionally, during the last two fiscal years preceding the date of dismissal and the interim period from December 31, 2001 to November 26, 2002, there were no disagreements between the Company and BDO on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to BDO’s satisfaction, would have caused them to make a reference to the subject matter of the disagreements in connection with their reports.

None of the “reportable events” described in Item 304(a)(1)(v) of Regulation S-K occurred within the two most recent fiscal years and the subsequent interim period through November 26, 2002.

During the last two fiscal years and the subsequent interim period through November 26, 2002, the Company did not consult M&J regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

During 2002, BDO provided services in the following categories and amounts:

Fees for limited reviews of the Company’s interim financial statements | | $ | 14,415 |

Fees for report of predecessor accountant | | | 15,725 |

All other fees (1) | | | 5,000 |

| (1) | | The Audit Committee did not consider the provision of these other services to be incompatible with BDO’s independence. |

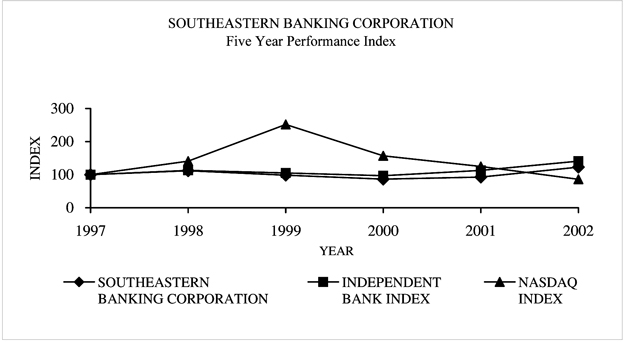

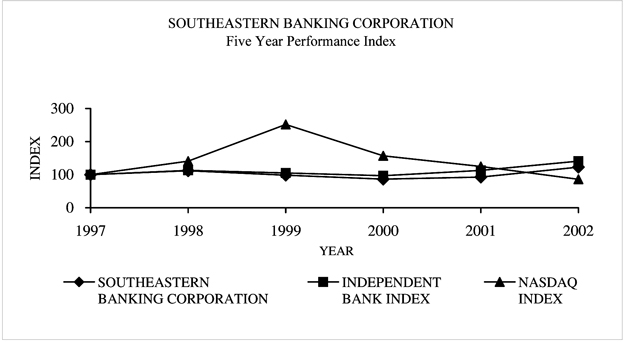

SHAREHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on Southeastern Banking Corporation common stock against the cumulative total return of the NASDAQ stock index and The Carson Medlin Company’s Independent Bank Index (the “IBI”). The IBI comprises a group of 22 independent community banks located in the southeastern United States.

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

SOUTHEASTERN BANKING CORPORATION | | 100 | | 112 | | 99 | | 87 | | 93 | | 123 |

INDEPENDENT BANK INDEX | | 100 | | 113 | | 105 | | 97 | | 113 | | 141 |

NASDAQ INDEX | | 100 | | 141 | | 252 | | 157 | | 125 | | 86 |

8

OTHER DIRECTOR AND EXECUTIVE OFFICER INFORMATION

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of Southeastern Bank establishes the base salary, cash bonuses, and other compensation for executive officers. Messrs. Downey, Holland, and Hopkins served as members of the Compensation Committee during 2002. Mr. Holland is currently President of the Company and its two subsidiaries. Mr. Downey is Treasurer of the Company but receives no salary or other remuneration besides director’s fees for serving in that capacity.

During 2002, the Company’s bank subsidiary engaged in customary banking transactions and had outstanding loans to certain directors, executive officers, principal shareholders, and their affiliates, including members of immediate families, of the Company and its subsidiaries. These loans were made in the ordinary course of business on substantially the same terms and conditions, including interest rates and collateral, as those prevailing at the same time for comparable transactions with other customers and did not, in the opinion of management, involve more than normal credit risk or present other unfavorable features. Such persons are expected to continue these transactions in the future. Additionally, in the ordinary course of business, the Company buys goods and services from directors who are not employees. Such purchases were not material during 2002.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Section 16(a)”), requires the Company’s directors, executive officers, and persons who own 10% or more of the Company’s common stock to file reports of ownership and changes in ownership with the SEC. To the Company’s knowledge, based solely on a review of the copies of 16(a) reports furnished to the Company during fiscal year 2002, all directors, executive officers, and 10% shareholders complied with all Section 16(a) filing requirements, except Messrs. Belcher, Burney, and Mrs. Kirby inadvertently did not timely file initial reports of ownership with the SEC after becoming executive officers of Southeastern Bank and S. Michael Little, a former director and Executive Vice President of the Company, did not file a report for 120 shares purchased prior to his resignation in April 2002.

ADDITIONAL INFORMATION

Shareholder Proposals

In order to be eligible for inclusion in the Company’s proxy materials for next year’s Annual Meeting of Shareholders, any shareholder proposal to take action at such meeting must be received at the Company’s principal administrative office no later than January 23, 2004. Shareholder proposals should be delivered to Southeastern Banking Corporation, Attention: Corporate Secretary, at P.O. Box 455, Darien, Georgia 31305, if by mail, and at 1010 Northway Street, Darien, Georgia 31305, if by courier. Any such proposal shall be subject to the requirements of the proxy rules adopted under SEC rules and regulations and, as with any shareholder proposal (regardless of whether included in the Company’s proxy materials), the Company’s Articles of Incorporation and Bylaws as well as Georgia law. Under the proxy rules, in the event that the Company receives notice of a shareholder proposal to take action at the next annual meeting that is not submitted for inclusion in the Company’s proxy materials, or is submitted for inclusion but is properly excluded from such proxy materials, the persons named in the form of proxy sent by the Company to its shareholders will vote on such proposal as the Board recommends without any discussion of the proposal in the 2004 Proxy Statement if notice of the proposal is not received at the principal administrative office of the Company by April 9, 2004.

Proxy Solicitation

The cost of soliciting proxies will be borne by the Company. The Company will reimburse brokerage firms and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company’s Common Stock. In addition to solicitation by

9

mail, directors, officers, and other employees of the Company may solicit proxies personally or by telegraph or telephone, without additional compensation. The Company may also retain the services of a proxy solicitation firm, whose fees and expenses would be paid by the Company, although the Company has no present intention to retain any such firm.

Other Matters

The Board knows of no other matters which will be brought before the Meeting. If other matters are properly introduced, the persons named in the enclosed proxy will vote on such matters as the Board recommends.

By Order of the Board of Directors,

WANDA D. PITTS

Secretary

May 23, 2003

UPON WRITTEN REQUEST BY ANY SHAREHOLDER TO SOUTHEASTERN BANKING CORPORATION, P.O. BOX 455, 1010 NORTHWAY STREET, DARIEN, GEORGIA 31305, ATTENTION: CORPORATE SECRETARY, A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K WILL BE PROVIDED UPON PAYMENT OF REASONABLE COST, IF ANY, OF REPRODUCTION AND DELIVERY.

10

Exhibit A

SOUTHEASTERN BANKING CORPORATION

AUDIT COMMITTEE CHARTER

Committee’s Purpose

The Audit Committee (Committee) is appointed by the Board of Directors (Board) to assist the Board in monitoring (1) the integrity of the Company’s financial statements, (2) the Company’s compliance with legal and regulatory requirements, (3) the independent auditor’s qualifications and independence, (4) performance of the Company’s internal and independent auditors, and (5) the Company’s business practices and ethical standards. The Committee is also directly responsible for (a) the appointment, compensation, retention, and oversight of the work of the Company’s independent auditors, and (b) the preparation of the report that the Securities and Exchange Commission (Commission) requires to be included in the Company’s annual proxy statement. While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements and disclosures are presented fairly in all material respects in accordance with generally accepted accounting principles. These are the responsibility of management and the independent auditor.

Committee Membership

Independence. The Committee shall consist of three or more independent members of the Board of Directors. Independence shall be determined as to each member by the full Board. To be considered independent, each Committee member must (1) meet the independence requirements of the National Association of Securities Dealers, Inc., the Sarbanes-Oxley Act of 2002, and the rules and regulations of the Commission, (2) not accept any compensation from the Company either directly or indirectly other than compensation as a Board or Committee member, and (3) not be an affiliated person of the Company or any of its subsidiaries.

Financial Literacy. All members of the Committee shall be financially literate as defined by the Commission, or must become financially literate within a reasonable period of time after their appointment to the Committee, and at least one member of the Committee shall be an audit committee financial expert, as determined in the judgment of the Board.

Committee Composition

The members of the Committee shall be nominated and elected by the Board at its annual organizational meeting and shall serve until their successors shall be duly elected and qualified.

Chairman & Vice Chairman. Unless elected by the full Board, the members of the Committee shall designate a Chair and Vice Chair by majority vote of all the Committee members.

Meetings

The Committee shall meet at least four times annually or more frequently as circumstances dictate. Meetings may be in person or by telephone as needed to conduct the business of the Committee. The Committee may take action by the unanimous written consent of the members in the absence of a meeting. The Committee shall meet periodically with management, the internal auditors, and the independent auditor in separate executive sessions.

Authority of the Committee

The Audit Committee shall have the authority to (1) exercise all powers with respect to the appointment, compensation, retention, and oversight of the work of the independent auditor for the Company and its subsidiaries, (2) retain special legal, accounting, or other consultants to advise the Committee, and (3)

A-1

approve funds to pay the fees for such advisors. As part of its oversight role, the Committee may investigate any matter brought to its attention, with the full power to retain outside counsel or other experts for this purpose. The Audit Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any member of, or consultant to, the Committee.

Responsibilities

The Audit Committee shall:

Financial Statement and Disclosure Matters

| | 1. | | Review and discuss prior to public dissemination the annual audited and quarterly unaudited financial statements with management and the independent auditor, including major issues regarding accounting, disclosure, and auditing procedures and practices as well as the adequacy of internal controls that could materially affect the Company’s financial statements. In addition, the review shall include the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Based on the annual review, the Committee shall recommend inclusion of the financial statements in the Annual Report on Form 10-K to the Board. For purposes of the quarterly review, the Chair of the Committee, and in the absence of the Chair, the Vice Chair, may represent the entire Audit Committee and consult with other Committee members as he or she deems necessary. |

| | 2. | | Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including any significant changes in the Company’s selection or application of accounting principles, any major issues as to the adequacy of the Company’s internal controls, and any special procedures adopted in light of material control deficiencies. |

| | 3. | | Review and discuss reports from the independent auditors on: |

| | A. | | All critical accounting policies and practices used. |

| | B. | | All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramification of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor. |

| | C. | | Other material written communications between the independent auditor and management, such as any management letter. |

| | 4. | | Discuss with management the Company’s earnings press releases as well as financial information and earnings guidance. Such discussion may be general, encompassing the types of information to be disclosed and the types of presentations to be made. |

| | 5. | | Discuss with management and the independent auditor the effect on the Company’s financial statements of significant regulatory and accounting initiatives as well as off-balance sheet structures. |

| | 6. | | Discuss with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. |

| | 7. | | Review with the independent auditor any audit problems or difficulties and management’s response, including, but not limited to (1) any restrictions on the scope of the auditor’s activities, (2) any restrictions on the independent auditor’s access to requested materials, (3) any significant |

A-2

disagreements with management, and (4) any audit differences that were noted or proposed by the auditor but for which the Company’s financial statements were not adjusted (as immaterial or otherwise). The Committee will resolve any disagreements between the auditors and management regarding financial reporting.

| | 8. | | Review disclosures made to the Audit Committee by the Company’s CEO and CFO during their certification process for the Form 10-K and Form 10-Q about any significant deficiencies in the design or operation of disclosure controls and procedures and any fraud involving management or other employees who have a significant role in the Company’s internal controls. |

| | 9. | | Discuss at least annually with the independent auditor the matters required to be discussed by Statement of Auditing Standards No. 61 — Communication with Audit Committees. |

| | 10. | | Prepare the report that the Commission requires to be included in the Company’s annual proxy statement and review the matters described in such report. |

| | 11. | | Obtain quarterly assurances from the senior internal auditor and management that the system of internal controls is adequate and effective. If required, obtain annually a report from the independent auditor, with attestation, regarding management’s assessment of the effectiveness of the internal control structure and procedures for financial reporting. |

Responsibility for the Company’s Relationship with the Independent Auditor

| | 12. | | Be solely responsible for the appointment, compensation, retention, and oversight of the work of the independent auditors employed by the Company. The independent auditor shall report directly to the Audit Committee. If the appointment of the independent auditors is submitted for any ratification by stockholders, the Audit Committee shall be responsible for making the recommendation of the independent auditors. |

| | 13. | | Review, at least annually, the qualifications, performance, and independence of the independent auditor. In conducting such review, the Committee shall obtain and review a report by the independent auditor describing (1) the firm’s internal quality-control procedures, (2) any material issues raised by the most recent internal quality-control review, or peer review, of the firm or by any formal investigation by governmental or professional authorities regarding services provided by the firm which could affect the financial statements of the Company, and any steps taken to deal with any such issues, and (3) all relationships between the independent auditor and the Company that could be considered to bear on the auditor’s independence. This evaluation shall include the review and evaluation of the lead partner of the independent auditor and shall ensure the rotation of partners in accordance with Commission rules and securities laws. In addition, the Committee shall consider the advisability of regularly rotating the audit firm in order to maintain the independence between the independent auditor and the Company. |

| | 14. | | Approve in advance any audit or permissible non-audit engagement or relationship between the Company and the independent auditors. The Committee shall establish guidelines for the retention of the independent auditor for any permissible non-audit services. The Committee hereby delegates to the Chairman of the Committee the authority to approve in advance all audit or non-audit services to be provided by the independent auditor if presented to the full Committee at the next regularly scheduled meeting. |

| | 15. | | Review the audit plan, engagement letter, and management letter comments of the independent auditor. |

| | 16. | | Recommend to the Board policies for the Company’s hiring of employees or former employees of the independent auditor who participated in any capacity in the audit of the Company. |

A-3

Oversight of the Company’s Internal Audit Function

| | 17. | | Review the appointment of the senior internal auditor. |

| | 18. | | Review the activities and organizational structure of the internal audit department and the significant reports to management prepared by the internal audit department and management’s responses. |

| | 19. | | Discuss with the independent auditor and management the internal audit department responsibilities, budget and staffing and any recommended changes in the planned scope of the internal audit department. |

Compliance Oversight Responsibility

| | 20. | | Obtain from the independent auditor assurance that Section 10A(b) of the Securities Exchange Act of 1934, as amended, has not been implicated. |

| | 21. | | Obtain reports from management and the Company’s senior internal auditor that the Company is in conformity with applicable legal requirements and the Company’s Code of Ethics. Review disclosures required to be made under the securities laws of insider and affiliated party transactions. Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s Code of Ethics. |

| | 22. | | Promote and support the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting, internal controls, or auditing matters. |

| | 23. | | Discuss with management and the independent auditor any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding the Company’s financial statements or accounting policies. |

| | 24. | | Review at least annually with the Company’s counsel any legal matters that could have a significant impact on the financial statements, compliance with applicable laws and regulations, and inquiries received from regulators or governmental agencies. |

Other

| | 25. | | Report regularly to the Board any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the Company’s independent auditors, or the performance of the internal audit department. |

| | 26. | | Review and reassess the adequacy of this Charter annually and recommend changes to the Board for approval. |

| | 27. | | Perform an annual performance evaluation of the Committee. |

| | 28. | | Perform any other activities consistent with this Charter, the Company’s by-laws, and governing law, as the Committee or the Board deems necessary or appropriate. |

A-4

x | | PLEASE MARK VOTES AS IN THIS EXAMPLE | | SOUTHEASTERN BANKING CORPORATION PROXY | | For All Nominees | | Withhold Authority | | For All Except |

|

| | | | | | | 1. | | PROPOSAL TO ELECT AS DIRECTORS: | | ¨ | | ¨ | | ¨ |

|

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 17, 2003 THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS. | | | | | | | | Alyson G. Beasley, Leslie H. Blair, David H. Bluestein, Gene F. Brannen, William Downey, Cornelius P. Holland, III, Alva J. Hopkins, III, G. Norris Johnson INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name on the line below.

|

The undersigned, revoking previous proxies, hereby appoints Cornelius P. Holland, III and Alyson G. Beasley, and each of them, proxies with full power of substitution, to vote all shares of Common Stock of Southeastern Banking Corporation (the “Company”) which the undersigned is entitled to vote at the Annual Meeting of Shareholders (the “Meeting”) to be held at Southeastern Bank, 1010 Northway Street, Darien, Georgia on Tuesday, June 17, 2003 at 3:00 p.m. local time or any adjournment or postponement thereof, upon the matters described below and in the accompanying Proxy Statement dated May 23, 2003, and upon any other business that may properly come before the Meeting or any adjournment or postponement thereof. | | | | | | | |

| | | | | | | | | | For | | Against | | Abstain |

| | | | | | 2. | | PROPOSAL TO SET THE NUMBER OF DIRECTORS AT 12. | | ¨ | | ¨ | | ¨ |

| | | | | | | | | | | | | | |

| | | | | | | | | | For | | Against | | Abstain |

| | | | | | 3. | | PROPOSAL TO APPROVE THE APPOINTMENT OF INDEPENDENT AUDITORS BY THE AUDIT COMMITTEE. | | ¨ | | ¨ | | ¨ |

| | | | | | | | | | | | | | |

| | | | | | | | | | | WHEN PROPERLY EXECUTED, THIS PROXY WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ITEMS 1, 2, AND 3. |

| | | |

| | | | | | | | | | | | | | |

| | | Please be sure to sign and date this Proxy in the box below. | | Date | | | | | | | | | | | | | | |

| |

| | | | | | |

| | | Stockholder sign above | | Co-holder (if any) sign above | | | | | | Pursuant to the Proxy Statement, said proxies are directed to vote as indicated on the Proxy and otherwise as the Board of Directors recommends with respect to any other business that may properly come before the Meeting or any adjournment or postponement thereof. By executing this Proxy, I acknowledge receipt of the Notice of Meeting, the accompanying Proxy Statement, and the Company’s 2002 Annual Report. |

| |

| | | | | | |

é Detach above card, sign, date, and mail in postage paid envelope provided.é

NOTE: Please sign exactly as your name appears on the Proxy; if shares are held jointly, all joint owners must sign. An executor, administrator, trustee, guardian, or other person signing in a representative capacity must give his or her full title. A corporation must sign in full corporate name by its president or other authorized officer. A partnership must sign in partnership name by an authorized person.

PLEASE ACT PROMPTLY

SIGN, DATE, & MAIL YOUR PROXY CARD TODAY

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW, AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.