UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-1352

Fidelity Devonshire Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | January 31 |

Date of reporting period: | January 31, 2006 |

Item 1. Reports to Stockholders

| Fidelity® Equity-Income Fund |

| Annual Report January 31, 2006 |

| Contents | ||||

| Chairman’s Message | 4 | Ned Johnson’s message to shareholders. | ||

| Performance | 5 | How the fund has done over time. | ||

| Management’s Discussion | 6 | The manager’s review of fund | ||

| performance, strategy and outlook. | ||||

| Shareholder Expense | 7 | An example of shareholder expenses. | ||

| Example | ||||

| Investment Changes | 8 | A summary of major shifts in the fund’s | ||

| investments over the past six months. | ||||

| Investments | 9 | A complete list of the fund’s investments | ||

| with their market values. | ||||

| Financial Statements | 23 | Statements of assets and liabilities, | ||

| operations, and changes in net assets, | ||||

| as well as financial highlights. | ||||

| Notes | 27 | Notes to the financial statements. | ||

| Report of Independent | 33 | |||

| Registered Public | ||||

| Accounting Firm | ||||

| Trustees and Officers | 34 | |||

| Distributions | 44 | |||

| Board Approval of | 45 | |||

| Investment Advisory | ||||

| Contracts and | ||||

| Management Fees | ||||

| To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company. |

Annual Report 2

| This report and the financial statements contained herein are submitted for the general informa tion of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus. A fund files its complete schedule of portfolio holdings with the SEC for the first and third quar ters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at http://www.fidelity.com/holdings. NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE Neither the fund nor Fidelity Distributors Corporation is a bank. |

3 Annual Report

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind every one where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that some one could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner and in every other. But I underscore again that Fidelity has no so called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee which is returned to the fund and, therefore, to investors to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report 4

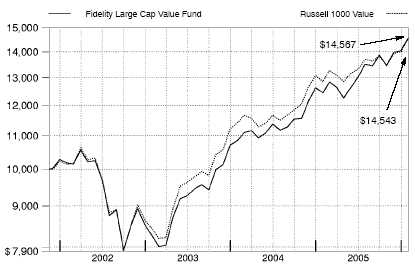

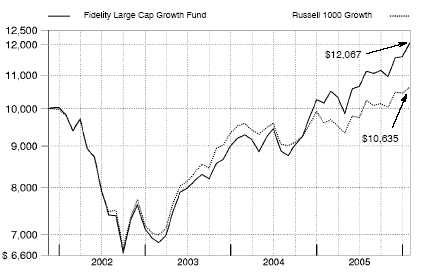

Performance: The Bottom Line

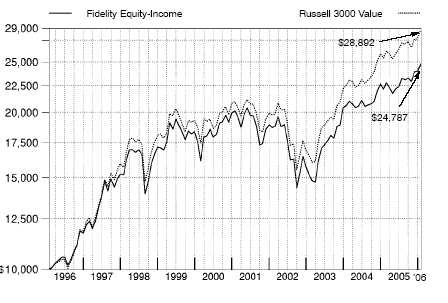

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund’s dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of perfor mance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | ||||||

| Periods ended January 31, 2006 | Past 1 | Past 5 | Past 10 | |||

| year | years | years | ||||

| Fidelity® Equity Income Fund | 11.87% | 4.25% | 9.50% |

$10,000 Over 10 Years

Let’s say hypothetically that $10,000 was invested in Fidelity® Equity Income Fund on January 31, 1996. The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Value Index performed over the same period.

5 Annual Report

5

Management’s Discussion of Fund Performance

Comments from Stephen Petersen, Portfolio Manager of Fidelity® Equity Income Fund

Most major U.S. stock benchmarks had double digit returns for the year ending January 31, 2006. Market performance was driven largely by oil. Heightened demand from the United States and China, among others, plus Hurricane Katrina’s devastation of domestic refining capacity in the Gulf Coast region, propelled oil prices to record highs. The energy compo nent of the Standard & Poor’s 500SM Index soared nearly 46% during the period, while the next closest utilities rose about 17%. The overall return for the S&P 500® was 10.38% . In 2005, the S&P 500 beat the small cap Russell 2000® Index for the first time in six years, but quickly lost that advantage when the Russell benchmark jumped 9% in January, pushing its 12 month return to 18.89% . Mid caps did even better: The 21.45% return of the Russell Midcap® Index doubled the broader market’s performance for the period. The NASDAQ Composite® Index fared well, gaining 12.75%, but the Dow Jones Industrial AverageSM increased only 6.00% .

Fidelity Equity Income Fund gained 11.87% during the past year, trailing the Russell 3000® Value Index, which returned 13.63%, and beating the LipperSM Equity Income Objective Funds Average, which rose 11.00% . The fund lagged the index in an environment where taking larger positions in fewer sectors and in smaller companies would have helped short term performance. The fund’s slight underweighting in energy hurt relative to the Russell index, as did disappointing stock selection in the sector. We also had a poor showing in consumer staples and industrials, and financials disappointed as well, despite favorable positioning on an industry basis. On the plus side, an overweighting in informa tion technology provided a boost, as did good stock picks in telecommunication services, utilities and consumer discretionary. Contributors included French energy holding Total SA and energy services company Schlumberger. Underweighting lagging pharmaceutical company Pfizer also helped relative performance. Conversely, the fund’s overweighting in mortgage giant Fannie Mae detracted, as the company continued to suffer from an ongoing investigation into its accounting practices and concerns that its business fundamentals were slowing. Elsewhere, investors were disappointed by Tyco International’s pace of recovery during the period, and the fund’s relatively sizable out of benchmark position in the industrial conglomerate amplified its drag on performance. Retailing giant Wal Mart, whose revenue growth continued to disappoint investors, also held back returns.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

| Annual Report |

| 6 6 |

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2005 to January 31, 2006).

| Actual Expenses |

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the share holder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Expenses Paid | ||||||||||||

| Beginning | Ending | During Period* | ||||||||||

| Account Value | Account Value | August 1, 2005 to | ||||||||||

| August 1, 2005 | January 31, 2006 | January 31, 2006 | ||||||||||

| Actual | $ | 1,000.00 | $ | 1,066.40 | $ | 3.59 | ||||||

| Hypothetical (5% return per year | ||||||||||||

| before expenses) | $ | 1,000.00 | $ | 1,021.73 | $ | 3.52 | ||||||

* Expenses are equal to the Fund’s annualized expense ratio of .69%; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one half year period).

7 Annual Report

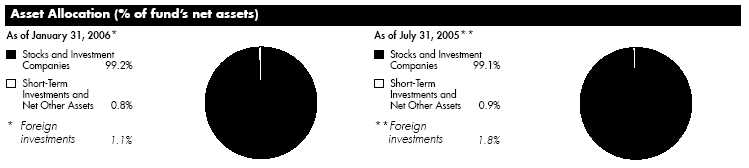

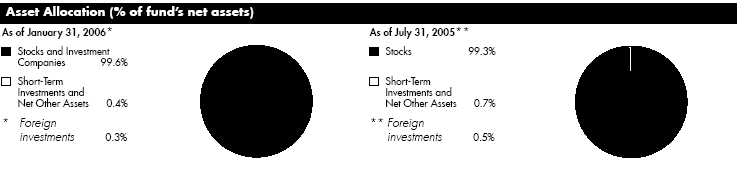

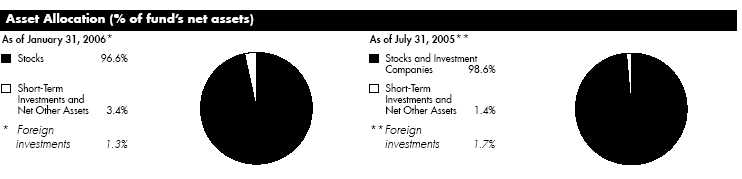

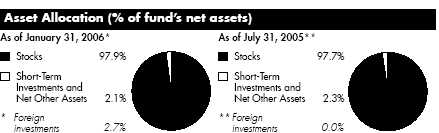

| Investment Changes | ||||

| Top Ten Stocks as of January 31, 2006 | ||||

| % of fund’s | % of fund’s net assets | |||

| net assets | 6 months ago | |||

| Exxon Mobil Corp. | 3.4 | 3.4 | ||

| Bank of America Corp. | 3.0 | 3.0 | ||

| Citigroup, Inc. | 2.5 | 2.4 | ||

| American International Group, Inc. | 2.5 | 2.4 | ||

| Total SA | 2.3 | 2.2 | ||

| JPMorgan Chase & Co. | 2.1 | 2.1 | ||

| AT&T, Inc. | 1.7 | 1.7 | ||

| Schlumberger Ltd. (NY Shares) | 1.6 | 1.2 | ||

| Wachovia Corp. | 1.5 | 1.4 | ||

| Fannie Mae | 1.4 | 1.3 | ||

| 22.0 | ||||

| Top Five Market Sectors as of January 31, 2006 | ||||

| % of fund’s | % of fund’s net assets | |||

| net assets | 6 months ago | |||

| Financials | 27.8 | 27.5 | ||

| Energy | 13.1 | 12.0 | ||

| Consumer Discretionary | 12.2 | 12.2 | ||

| Industrials | 11.0 | 10.9 | ||

| Information Technology | 8.7 | 9.0 | ||

| Annual Report | 8 |

| Investments January 31, 2006 | ||||||||

| Showing Percentage of Net Assets | ||||||||

| Common Stocks 98.3% | ||||||||

| Shares | Value (Note 1) | |||||||

| (000s) | ||||||||

| CONSUMER DISCRETIONARY – 11.6% | ||||||||

| Auto Components 0.3% | ||||||||

| American Axle & Manufacturing Holdings, Inc. | 664,000 | $ | 12,344 | |||||

| Johnson Controls, Inc. | 688,300 | 47,658 | ||||||

| TRW Automotive Holdings Corp. (a) | 531,220 | 13,652 | ||||||

| 73,654 | ||||||||

| Automobiles – 1.0% | ||||||||

| Ford Motor Co. | 1,809,900 | 15,529 | ||||||

| General Motors Corp. (d) | 1,394,900 | 33,561 | ||||||

| Harley Davidson, Inc. | 599,900 | 32,113 | ||||||

| Hyundai Motor Co. | 99,660 | 9,054 | ||||||

| Monaco Coach Corp. | 454,000 | 6,147 | ||||||

| Renault SA | 554,800 | 52,389 | ||||||

| Toyota Motor Corp. sponsored ADR | 1,048,700 | 108,761 | ||||||

| 257,554 | ||||||||

| Diversified Consumer Services – 0.1% | ||||||||

| Service Corp. International (SCI) | 3,269,900 | 26,748 | ||||||

| Hotels, Restaurants & Leisure 0.4% | ||||||||

| Gaylord Entertainment Co. (a) | 199,200 | 8,566 | ||||||

| McDonald’s Corp. | 2,094,900 | 73,342 | ||||||

| Outback Steakhouse, Inc. | 301,400 | 13,934 | ||||||

| 95,842 | ||||||||

| Household Durables – 1.3% | ||||||||

| Koninklijke Philips Electronics NV (NY Shares) | 1,391,200 | 46,842 | ||||||

| Maytag Corp. | 3,700,220 | 63,718 | ||||||

| Newell Rubbermaid, Inc. | 6,171,700 | 145,899 | ||||||

| Sony Corp. sponsored ADR | 298,700 | 14,606 | ||||||

| Whirlpool Corp. | 882,100 | 71,168 | ||||||

| 342,233 | ||||||||

| Leisure Equipment & Products – 0.3% | ||||||||

| Eastman Kodak Co. | 3,516,100 | 88,254 | ||||||

| Media – 5.6% | ||||||||

| CBS Corp. Class B | 3,632,459 | 94,916 | ||||||

| Clear Channel Communications, Inc. | 6,964,400 | 203,848 | ||||||

| Comcast Corp. Class A (a) | 5,931,637 | 165,018 | ||||||

| Discovery Holding Co. Class A (a) | 893,225 | 13,541 | ||||||

| Knight-Ridder, Inc. | 727,500 | 45,287 | ||||||

| Lagardere S.C.A. (Reg.) | 452,497 | 36,075 | ||||||

| Liberty Media Corp. Class A (a) | 8,707,056 | 72,791 | ||||||

| Live Nation, Inc. (a) | 884,062 | 15,692 | ||||||

See accompanying notes which are an integral part of the financial statements.

| 9 Annual Report |

| Investments continued | ||||||

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| CONSUMER DISCRETIONARY – continued | ||||||

| Media – continued | ||||||

| News Corp. Class A | 2,737,884 | $ | 43,149 | |||

| NTL, Inc. (a) | 791,700 | 50,075 | ||||

| The New York Times Co. Class A | 2,255,655 | 63,835 | ||||

| The Reader’s Digest Association, Inc. (non-vtg.) | 3,862,829 | 61,380 | ||||

| Time Warner, Inc. | 14,259,790 | 249,974 | ||||

| Viacom, Inc. Class B (non-vtg.) (a) | 3,632,459 | 150,674 | ||||

| Vivendi Universal SA sponsored ADR | 1,712,600 | 53,622 | ||||

| Walt Disney Co. | 5,684,610 | 143,877 | ||||

| 1,463,754 | ||||||

| Multiline Retail – 1.4% | ||||||

| Big Lots, Inc. (a) | 5,695,500 | 76,149 | ||||

| Dollar Tree Stores, Inc. (a) | 3,270,900 | 81,086 | ||||

| Family Dollar Stores, Inc. | 2,597,700 | 62,215 | ||||

| Federated Department Stores, Inc. | 1,321,800 | 88,072 | ||||

| Kohl’s Corp. (a) | 697,300 | 30,953 | ||||

| Sears Holdings Corp. (a) | 156,744 | 19,035 | ||||

| 357,510 | ||||||

| Specialty Retail – 1.0% | ||||||

| AnnTaylor Stores Corp. (a) | 2,594,300 | 86,442 | ||||

| Gap, Inc. | 3,312,551 | 59,924 | ||||

| RadioShack Corp. | 3,448,800 | 76,563 | ||||

| Tiffany & Co., Inc. | 701,035 | 26,429 | ||||

| 249,358 | ||||||

| Textiles, Apparel & Luxury Goods – 0.2% | ||||||

| Liz Claiborne, Inc. | 1,187,100 | 41,216 | ||||

| VF Corp. | 274,100 | 15,207 | ||||

| 56,423 | ||||||

| TOTAL CONSUMER DISCRETIONARY | 3,011,330 | |||||

| CONSUMER STAPLES 5.7% | ||||||

| Beverages – 0.8% | ||||||

| Anheuser-Busch Companies, Inc. (d) | 3,059,500 | 126,786 | ||||

| Molson Coors Brewing Co. Class B | 298,900 | 18,681 | ||||

| The Coca-Cola Co. | 1,587,700 | 65,699 | ||||

| 211,166 | ||||||

| Food & Staples Retailing – 1.4% | ||||||

| CVS Corp. | 1,504,900 | 41,776 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 10 |

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| CONSUMER STAPLES – continued | ||||||

| Food & Staples Retailing – continued | ||||||

| Safeway, Inc. | 896,100 | $ | 21,005 | |||

| Wal-Mart Stores, Inc. | 6,413,700 | 295,736 | ||||

| 358,517 | ||||||

| Food Products 0.5% | ||||||

| ConAgra Foods, Inc. | 845,900 | 17,536 | ||||

| Corn Products International, Inc. | 1,502,200 | 40,965 | ||||

| Kraft Foods, Inc. Class A | 2,392,800 | 70,444 | ||||

| 128,945 | ||||||

| Household Products – 1.6% | ||||||

| Colgate-Palmolive Co. | 4,842,600 | 265,810 | ||||

| Kimberly Clark Corp. | 1,859,400 | 106,209 | ||||

| Procter & Gamble Co. | 688,218 | 40,763 | ||||

| 412,782 | ||||||

| Personal Products 0.5% | ||||||

| Avon Products, Inc. | 4,632,200 | 131,184 | ||||

| Tobacco 0.9% | ||||||

| Altria Group, Inc. | 3,235,700 | 234,071 | ||||

| TOTAL CONSUMER STAPLES | 1,476,665 | |||||

| ENERGY 13.1% | ||||||

| Energy Equipment & Services – 3.7% | ||||||

| Baker Hughes, Inc. | 2,727,500 | 211,218 | ||||

| BJ Services Co. | 2,203,310 | 89,212 | ||||

| Halliburton Co. | 1,587,400 | 126,278 | ||||

| Noble Corp. | 1,603,780 | 129,008 | ||||

| Schlumberger Ltd. (NY Shares) | 3,247,800 | 413,932 | ||||

| 969,648 | ||||||

| Oil, Gas & Consumable Fuels – 9.4% | ||||||

| Apache Corp. | 1,416,910 | 107,019 | ||||

| BP PLC sponsored ADR | 4,963,404 | 358,904 | ||||

| Chevron Corp. | 5,105,882 | 303,187 | ||||

| ConocoPhillips | 1,568,300 | 101,469 | ||||

| Double Hull Tankers, Inc. | 991,000 | 13,497 | ||||

| El Paso Corp. | 2,263,900 | 30,472 | ||||

| EOG Resources, Inc. | 400,200 | 33,833 | ||||

| Exxon Mobil Corp. | 14,047,174 | 881,458 | ||||

| Kerr-McGee Corp. | 350,800 | 38,725 | ||||

See accompanying notes which are an integral part of the financial statements.

11 Annual Report

| Investments continued | ||||||

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| ENERGY – continued | ||||||

| Oil, Gas & Consumable Fuels – continued | ||||||

| Total SA: | ||||||

| Series B | 443,043 | $ | 122,572 | |||

| sponsored ADR | 3,371,703 | 466,408 | ||||

| 2,457,544 | ||||||

| TOTAL ENERGY | 3,427,192 | |||||

| FINANCIALS – 27.6% | ||||||

| Capital Markets 4.5% | ||||||

| Ameriprise Financial, Inc. | 1,462,800 | 59,521 | ||||

| Bank of New York Co., Inc. | 6,933,934 | 220,568 | ||||

| Charles Schwab Corp. | 1,688,601 | 24,974 | ||||

| Janus Capital Group, Inc. | 2,776,900 | 58,009 | ||||

| Mellon Financial Corp. | 3,732,500 | 131,645 | ||||

| Merrill Lynch & Co., Inc. | 3,514,000 | 263,796 | ||||

| Morgan Stanley | 4,685,060 | 287,897 | ||||

| Nomura Holdings, Inc. | 3,430,500 | 66,929 | ||||

| State Street Corp. | 1,092,567 | 66,057 | ||||

| 1,179,396 | ||||||

| Commercial Banks – 7.1% | ||||||

| Bank of America Corp. | 17,959,645 | 794,355 | ||||

| Comerica, Inc. | 1,353,039 | 75,053 | ||||

| FirstRand Ltd. | 4,484,588 | 14,319 | ||||

| Kookmin Bank sponsored ADR | 934,200 | 74,493 | ||||

| Lloyds TSB Group PLC | 5,140,501 | 46,592 | ||||

| Royal Bank of Scotland Group PLC | 1,452,309 | 44,954 | ||||

| State Bank of India | 758,425 | 16,745 | ||||

| U.S. Bancorp, Delaware | 3,603,502 | 107,781 | ||||

| Wachovia Corp. | 7,108,366 | 389,752 | ||||

| Wells Fargo & Co. | 4,505,868 | 280,986 | ||||

| 1,845,030 | ||||||

| Consumer Finance – 0.6% | ||||||

| American Express Co. | 2,939,400 | 154,172 | ||||

| Diversified Financial Services – 4.8% | ||||||

| CIT Group, Inc. | 881,300 | 47,009 | ||||

| Citigroup, Inc. | 13,907,685 | 647,820 | ||||

| JPMorgan Chase & Co. | 14,258,249 | 566,765 | ||||

| 1,261,594 | ||||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 12 |

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| FINANCIALS – continued | ||||||

| Insurance – 7.5% | ||||||

| ACE Ltd. | 5,345,227 | $ | 292,651 | |||

| Allianz AG sponsored ADR | 2,574,300 | 41,575 | ||||

| Allstate Corp. | 3,084,300 | 160,538 | ||||

| American International Group, Inc. | 9,788,857 | 640,779 | ||||

| Genworth Financial, Inc. Class A (non-vtg.) | 2,974,800 | 97,454 | ||||

| Hartford Financial Services Group, Inc. | 2,304,400 | 189,491 | ||||

| MetLife, Inc. unit | 2,020,300 | 55,558 | ||||

| Montpelier Re Holdings Ltd. | 1,590,900 | 30,704 | ||||

| PartnerRe Ltd. | 1,180,680 | 72,942 | ||||

| Swiss Reinsurance Co. (Reg.) | 780,344 | 58,026 | ||||

| The St. Paul Travelers Companies, Inc. | 5,356,590 | 243,082 | ||||

| Willis Group Holdings Ltd. | 448,500 | 15,567 | ||||

| XL Capital Ltd. Class A | 902,880 | 61,089 | ||||

| 1,959,456 | ||||||

| Real Estate 0.6% | ||||||

| CarrAmerica Realty Corp. | 352,100 | 12,957 | ||||

| Developers Diversified Realty Corp. | 707,500 | 34,851 | ||||

| Equity Office Properties Trust | 1,349,070 | 42,927 | ||||

| Equity Residential (SBI) | 1,318,400 | 55,913 | ||||

| The Mills Corp. | 99,700 | 4,133 | ||||

| 150,781 | ||||||

| Thrifts & Mortgage Finance – 2.5% | ||||||

| Countrywide Financial Corp. | 398,500 | 13,326 | ||||

| Fannie Mae | 6,459,900 | 374,287 | ||||

| Freddie Mac | 2,012,700 | 136,582 | ||||

| Golden West Financial Corp., Delaware | 602,400 | 42,541 | ||||

| Sovereign Bancorp, Inc. | 3,334,000 | 72,681 | ||||

| 639,417 | ||||||

| TOTAL FINANCIALS | 7,189,846 | |||||

| HEALTH CARE – 6.8% | ||||||

| Health Care Equipment & Supplies – 0.9% | ||||||

| Baxter International, Inc. | 5,710,800 | 210,443 | ||||

| Boston Scientific Corp. (a) | 1,095,200 | 23,952 | ||||

| 234,395 | ||||||

| Health Care Providers & Services – 0.3% | ||||||

| Cardinal Health, Inc. | 1,055,100 | 76,009 | ||||

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Investments continued | ||||||

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| HEALTH CARE – continued | ||||||

| Pharmaceuticals – 5.6% | ||||||

| Abbott Laboratories | 1,744,000 | $ | 75,254 | |||

| Bristol-Myers Squibb Co. | 5,549,000 | 126,462 | ||||

| Eli Lilly & Co. | 701,400 | 39,713 | ||||

| GlaxoSmithKline PLC sponsored ADR | 958,100 | 49,093 | ||||

| Johnson & Johnson | 4,356,600 | 250,679 | ||||

| Merck & Co., Inc. | 4,958,000 | 171,051 | ||||

| Novartis AG sponsored ADR | 1,173,500 | 64,730 | ||||

| Pfizer, Inc. | 11,988,800 | 307,872 | ||||

| Schering-Plough Corp. | 8,161,200 | 156,287 | ||||

| Wyeth | 4,809,400 | 222,435 | ||||

| 1,463,576 | ||||||

| TOTAL HEALTH CARE | 1,773,980 | |||||

| INDUSTRIALS – 10.9% | ||||||

| Aerospace & Defense – 2.9% | ||||||

| EADS NV | 2,701,482 | 105,880 | ||||

| Honeywell International, Inc. | 6,268,750 | 240,845 | ||||

| Lockheed Martin Corp. | 2,771,500 | 187,492 | ||||

| The Boeing Co. | 1,053,500 | 71,965 | ||||

| United Technologies Corp. | 2,428,560 | 141,755 | ||||

| 747,937 | ||||||

| Building Products 0.2% | ||||||

| Masco Corp. | 1,743,604 | 51,698 | ||||

| Commercial Services & Supplies – 0.6% | ||||||

| Cendant Corp. | 3,859,300 | 64,605 | ||||

| Waste Management, Inc. | 2,855,500 | 90,177 | ||||

| 154,782 | ||||||

| Electrical Equipment – 0.3% | ||||||

| Emerson Electric Co. | 1,214,200 | 94,040 | ||||

| Industrial Conglomerates – 3.0% | ||||||

| 3M Co. | 1,197,400 | 87,111 | ||||

| General Electric Co. | 11,248,750 | 368,397 | ||||

| Textron, Inc. | 785,800 | 66,369 | ||||

| Tyco International Ltd. | 9,704,861 | 252,812 | ||||

| 774,689 | ||||||

| Machinery – 2.8% | ||||||

| Briggs & Stratton Corp. | 798,300 | 27,773 | ||||

| Caterpillar, Inc. | 1,785,100 | 121,208 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 14 |

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| INDUSTRIALS – continued | ||||||

| Machinery – continued | ||||||

| Deere & Co. | 576,100 | $ | 41,341 | |||

| Dover Corp. | 3,039,500 | 139,604 | ||||

| Eaton Corp. | 400,800 | 26,533 | ||||

| Illinois Tool Works, Inc. | 362,600 | 30,564 | ||||

| Ingersoll-Rand Co. Ltd. Class A | 3,552,992 | 139,526 | ||||

| Navistar International Corp. (a) | 1,161,400 | 31,590 | ||||

| SPX Corp. (e) | 3,583,700 | 170,978 | ||||

| 729,117 | ||||||

| Road & Rail 1.1% | ||||||

| Burlington Northern Santa Fe Corp. | 2,406,600 | 192,817 | ||||

| Laidlaw International, Inc. | 649,300 | 17,661 | ||||

| Union Pacific Corp. | 837,800 | 74,112 | ||||

| 284,590 | ||||||

| TOTAL INDUSTRIALS | 2,836,853 | |||||

| INFORMATION TECHNOLOGY – 8.6% | ||||||

| Communications Equipment – 1.0% | ||||||

| Avaya, Inc. (a) | 1,992,700 | 21,023 | ||||

| Cisco Systems, Inc. (a) | 4,733,600 | 87,903 | ||||

| Lucent Technologies, Inc. (a) | 11,624,900 | 30,690 | ||||

| Lucent Technologies, Inc. warrants 12/10/07 (a) | 17,513 | 9 | ||||

| Motorola, Inc. | 5,899,370 | 133,975 | ||||

| 273,600 | ||||||

| Computers & Peripherals – 2.0% | ||||||

| EMC Corp. (a) | 3,442,500 | 46,130 | ||||

| Hewlett-Packard Co. | 7,611,261 | 237,319 | ||||

| International Business Machines Corp. | 2,391,400 | 194,421 | ||||

| Sun Microsystems, Inc. (a) | 9,038,400 | 40,673 | ||||

| 518,543 | ||||||

| Electronic Equipment & Instruments – 1.1% | ||||||

| Agilent Technologies, Inc. (a) | 2,242,600 | 76,047 | ||||

| Arrow Electronics, Inc. (a) | 1,876,900 | 64,490 | ||||

| Avnet, Inc. (a) | 3,641,100 | 89,025 | ||||

| Solectron Corp. (a) | 13,619,800 | 52,028 | ||||

| Tektronix, Inc. | 127,240 | 3,754 | ||||

| 285,344 | ||||||

See accompanying notes which are an integral part of the financial statements.

15 Annual Report

| Investments continued | ||||||

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| INFORMATION TECHNOLOGY – continued | ||||||

| IT Services – 0.3% | ||||||

| MoneyGram International, Inc. | 2,577,209 | $ | 68,451 | |||

| Office Electronics – 0.3% | ||||||

| Xerox Corp. (a) | 6,101,200 | 87,308 | ||||

| Semiconductors & Semiconductor Equipment – 2.6% | ||||||

| Analog Devices, Inc. | 2,804,800 | 111,547 | ||||

| Applied Materials, Inc. | 5,094,000 | 97,041 | ||||

| Freescale Semiconductor, Inc.: | ||||||

| Class A (a) | 493,400 | 12,414 | ||||

| Class B (a) | 3,891,183 | 98,252 | ||||

| Intel Corp. | 9,562,860 | 203,402 | ||||

| Micron Technology, Inc. (a) | 4,093,800 | 60,097 | ||||

| Samsung Electronics Co. Ltd. | 79,300 | 61,135 | ||||

| Teradyne, Inc. (a) | 1,625,500 | 28,316 | ||||

| 672,204 | ||||||

| Software 1.3% | ||||||

| Citrix Systems, Inc. (a) | 796,900 | 24,576 | ||||

| Microsoft Corp. | 8,191,200 | 230,582 | ||||

| Oracle Corp. (a) | 998,500 | 12,551 | ||||

| Symantec Corp. (a) | 3,337,200 | 61,338 | ||||

| 329,047 | ||||||

| TOTAL INFORMATION TECHNOLOGY | 2,234,497 | |||||

| MATERIALS 5.4% | ||||||

| Chemicals – 3.0% | ||||||

| Air Products & Chemicals, Inc. | 1,512,900 | 93,331 | ||||

| Albemarle Corp. | 850,300 | 37,218 | ||||

| Arch Chemicals, Inc. | 386,150 | 11,971 | ||||

| Ashland, Inc. | 703,100 | 46,348 | ||||

| Celanese Corp. Class A | 1,873,000 | 38,340 | ||||

| Chemtura Corp. | 4,955,665 | 62,293 | ||||

| Dow Chemical Co. | 3,026,900 | 128,038 | ||||

| E.I. du Pont de Nemours & Co. | 1,566,600 | 61,332 | ||||

| Eastman Chemical Co. | 904,200 | 43,591 | ||||

| Georgia Gulf Corp. | 1,697,360 | 58,050 | ||||

| Lyondell Chemical Co. | 4,193,811 | 100,693 | ||||

| PolyOne Corp. (a) | 2,729,700 | 19,545 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 16 |

| Common Stocks continued | ||||||

| Shares | Value (Note 1) | |||||

| (000s) | ||||||

| MATERIALS – continued | ||||||

| Chemicals – continued | ||||||

| Praxair, Inc. | 851,560 | $ | 44,860 | |||

| Rohm & Haas Co. | 500,700 | 25,486 | ||||

| 771,096 | ||||||

| Containers & Packaging – 0.3% | ||||||

| Amcor Ltd. | 4,282,900 | 22,245 | ||||

| Smurfit-Stone Container Corp. (a) | 5,604,421 | 71,681 | ||||

| 93,926 | ||||||

| Metals & Mining – 1.3% | ||||||

| Alcan, Inc. | 1,553,300 | 75,691 | ||||

| Alcoa, Inc. | 5,861,476 | 184,636 | ||||

| Freeport-McMoRan Copper & Gold, Inc. Class B | 866,630 | 55,681 | ||||

| Phelps Dodge Corp. | 223,200 | 35,824 | ||||

| 351,832 | ||||||

| Paper & Forest Products 0.8% | ||||||

| Bowater, Inc. | 753,600 | 20,603 | ||||

| International Paper Co. | 3,091,700 | 100,882 | ||||

| Weyerhaeuser Co. | 1,149,700 | 80,203 | ||||

| 201,688 | ||||||

| TOTAL MATERIALS | 1,418,542 | |||||

| TELECOMMUNICATION SERVICES – 5.4% | ||||||

| Diversified Telecommunication Services – 4.7% | ||||||

| AT&T, Inc. | 17,256,844 | 447,815 | ||||

| BellSouth Corp. | 11,020,201 | 317,051 | ||||

| Consolidated Communications Holdings, Inc. | 950,100 | 12,038 | ||||

| Philippine Long Distance Telephone Co. sponsored ADR | 1,521,600 | 54,458 | ||||

| Qwest Communications International, Inc. (a) | 14,226,800 | 85,645 | ||||

| Verizon Communications, Inc. | 9,329,744 | 295,380 | ||||

| 1,212,387 | ||||||

| Wireless Telecommunication Services – 0.7% | ||||||

| Sprint Nextel Corp. | 5,199,300 | 119,012 | ||||

| Vodafone Group PLC sponsored ADR | 3,473,400 | 73,323 | ||||

| 192,335 | ||||||

| TOTAL TELECOMMUNICATION SERVICES | 1,404,722 | |||||

See accompanying notes which are an integral part of the financial statements.

17 Annual Report

| Investments continued | ||||||||

| Common Stocks continued | ||||||||

| Shares | Value (Note 1) | |||||||

| (000s) | ||||||||

| UTILITIES – 3.2% | ||||||||

| Electric Utilities – 0.4% | ||||||||

| Entergy Corp. | 1,458,500 | $ | 101,380 | |||||

| Independent Power Producers & Energy Traders – 0.8% | ||||||||

| AES Corp. (a) | 2,706,800 | 46,124 | ||||||

| Duke Energy Corp. | 2,212,100 | 62,713 | ||||||

| TXU Corp. | 1,920,822 | 97,270 | ||||||

| 206,107 | ||||||||

| Multi-Utilities – 2.0% | ||||||||

| Dominion Resources, Inc. | 2,547,000 | 192,375 | ||||||

| NorthWestern Energy Corp. | 1,005,600 | 31,516 | ||||||

| Public Service Enterprise Group, Inc. | 2,334,500 | 162,528 | ||||||

| Wisconsin Energy Corp. | 3,164,000 | 131,338 | ||||||

| 517,757 | ||||||||

| TOTAL UTILITIES | 825,244 | |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $18,562,294) | 25,598,871 | |||||||

| Convertible Preferred Stocks 0.8% | ||||||||

| CONSUMER DISCRETIONARY – 0.3% | ||||||||

| Automobiles – 0.2% | ||||||||

| Ford Motor Co. Capital Trust II 6.50% | 976,600 | 31,105 | ||||||

| General Motors Corp.: | ||||||||

| Series B, 5.25% | 863,700 | 14,113 | ||||||

| Series C, 6.25% | 577,800 | 10,476 | ||||||

| 55,694 | ||||||||

| Hotels, Restaurants & Leisure 0.1% | ||||||||

| Six Flags, Inc. 7.25% PIERS | 821,600 | 18,897 | ||||||

| Media – 0.0% | ||||||||

| J.N. Taylor Holdings Ltd. 9.5% (a) | 956,400 | 0 | ||||||

| TOTAL CONSUMER DISCRETIONARY | 74,591 | |||||||

| FINANCIALS – 0.2% | ||||||||

| Capital Markets 0.0% | ||||||||

| State Street Corp. COVERS 4% | 56,801 | 1,049 | ||||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 18 |

| Convertible Preferred Stocks continued | ||||||||

| Shares | Value (Note 1) | |||||||

| (000s) | ||||||||

| Convertible Preferred Stocks continued | ||||||||

| FINANCIALS – continued | ||||||||

| Insurance – 0.2% | ||||||||

| Conseco, Inc. Series B, 5.50% | 323,900 | $ | 9,442 | |||||

| The Chubb Corp. Series B, 7.00% | 274,000 | 9,201 | ||||||

| Travelers Property Casualty Corp. 4.50% | 500,000 | 12,638 | ||||||

| XL Capital Ltd. 6.50% | 1,137,200 | 25,178 | ||||||

| 56,459 | ||||||||

| TOTAL FINANCE | 57,508 | |||||||

| HEALTH CARE – 0.2% | ||||||||

| Health Care Equipment & Supplies – 0.1% | ||||||||

| Baxter International, Inc. 7.00% | 343,300 | 17,759 | ||||||

| Pharmaceuticals – 0.1% | ||||||||

| Schering-Plough Corp. 6.00% | 429,200 | 21,889 | ||||||

| TOTAL HEALTH CARE | 39,648 | |||||||

| INFORMATION TECHNOLOGY – 0.1% | ||||||||

| Office Electronics – 0.1% | ||||||||

| Xerox Corp. Series C, 6.25% | 328,778 | 39,344 | ||||||

| MATERIALS 0.0% | ||||||||

| Chemicals – 0.0% | ||||||||

| Celanese Corp. 4.25% | 157,200 | 4,612 | ||||||

| TOTAL CONVERTIBLE PREFERRED STOCKS | ||||||||

| (Cost $249,444) | 215,703 | |||||||

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Investments continued | ||||||||

| Corporate Bonds 0.6% | ||||||||

| Principal | Value (Note 1) | |||||||

| Amount (000s) | (000s) | |||||||

| Convertible Bonds 0.5% | ||||||||

| CONSUMER DISCRETIONARY – 0.3% | ||||||||

| Hotels, Restaurants & Leisure 0.1% | ||||||||

| Royal Caribbean Cruises Ltd. liquid yield option note 0% | ||||||||

| 2/2/21 | $ | 18,844 | $ | 9,648 | ||||

| Six Flags, Inc. 4.5% 5/15/15 | 8,460 | 16,137 | ||||||

| 25,785 | ||||||||

| Media – 0.2% | ||||||||

| Liberty Media Corp.3.5% 1/15/31 (f) | 24,460 | 25,409 | ||||||

| News America, Inc. liquid yield option note 0% | ||||||||

| 2/28/21 (f) | 49,080 | 29,019 | ||||||

| 54,428 | ||||||||

| TOTAL CONSUMER DISCRETIONARY | 80,213 | |||||||

| FINANCIALS – 0.0% | ||||||||

| Diversified Financial Services – 0.0% | ||||||||

| Navistar Financial Corp. 4.75% 4/1/09 (f) | 5,734 | 5,226 | ||||||

| INDUSTRIALS – 0.1% | ||||||||

| Airlines – 0.0% | ||||||||

| US Airways Group, Inc. 7% 9/30/20 (f) | 7,530 | 10,803 | ||||||

| Industrial Conglomerates – 0.1% | ||||||||

| Tyco International Group SA yankee 3.125% 1/15/23 . | 11,750 | 14,785 | ||||||

| TOTAL INDUSTRIALS | 25,588 | |||||||

| TELECOMMUNICATION SERVICES – 0.1% | ||||||||

| Diversified Telecommunication Services – 0.1% | ||||||||

| Level 3 Communications, Inc. 5.25% 12/15/11 (f) | 28,080 | 28,571 | ||||||

| TOTAL CONVERTIBLE BONDS | 139,598 | |||||||

| Nonconvertible Bonds – 0.1% | ||||||||

| MATERIALS 0.1% | ||||||||

| Chemicals – 0.1% | ||||||||

| Hercules, Inc. 6.5% 6/30/29 unit | 31,600 | 24,076 | ||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $158,845) | 163,674 | |||||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 20 |

| Money Market Funds 0.4% | ||||||||

| Shares | Value (Note 1) | |||||||

| (000s) | ||||||||

| Fidelity Cash Central Fund, 4.46% (b) | 64,704,318 | $ | 64,704 | |||||

| Fidelity Securities Lending Cash Central Fund, | ||||||||

| 4.48% (b)(c) | 30,212,100 | 30,212 | ||||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $94,916) | 94,916 | |||||||

| TOTAL INVESTMENT PORTFOLIO 100.1% | ||||||||

| (Cost $19,065,499) | 26,073,164 | |||||||

| NET OTHER ASSETS – (0.1)% | (30,667) | |||||||

| NET ASSETS 100% | $ | 26,042,497 | ||||||

| Security Type Abbreviation | ||

| PIERS | - | Preferred Income Equity |

| Redeemable Securities | ||

| Legend (a) Non-income producing (b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund’s holdings as of its most recent quarter end is available upon request. |

| (c) Investment made with cash collateral received from securities on loan. (d) Security or a portion of the security is on loan at period end. (e) Affiliated company (f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $99,028,000 or 0.4% of net assets. |

Affiliated Central Funds

Information regarding fiscal year to date income received by the fund from the affiliated Central funds is as follows:

| Fund | Income received | |||

| (Amounts in | ||||

| thousands) | ||||

| Fidelity Cash Central Fund | $ | 4,068 | ||

| Fidelity Securities Lending Cash Central Fund | 2,566 | |||

| Total | $ | 6,634 |

See accompanying notes which are an integral part of the financial statements.

21 Annual Report

Investments continued

Other Affiliated Issuers

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Value, | ||||||||||||||||||||

| Affiliate | beginning of | Sales | Dividend | Value, end of | ||||||||||||||||

| (Amounts in thousands) | period | Purchases | Proceeds | Income | period | |||||||||||||||

| Big Lots, Inc. | $ | 59,770 | $ | 4,801 | $ | — | $ | — | $ | — | ||||||||||

| SPX Corp. | 150,157 | — | — | 3,584 | 170,978 | |||||||||||||||

| Total | $ | 209,927 | $ | 4,801 | $ | — | $ | 3,584 | $ | 170,978 | ||||||||||

Other Information

Distribution of investments by country of issue, as a percentage of total net assets, is as follows:

| United States of America | 87.8% | |

| France | 2.8% | |

| United Kingdom | 2.3% | |

| Netherlands Antilles | 1.6% | |

| Bermuda | 1.6% | |

| Others (individually less than 1%) . | 3.9% | |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report 22

| Financial Statements | ||||||||

| Statement of Assets and Liabilities | ||||||||

| Amounts in thousands (except per share amount) | January 31, 2006 | |||||||

| Assets | ||||||||

| Investment in securities, at value (including securities | ||||||||

| loaned of $29,086) See accompanying schedule: | ||||||||

| Unaffiliated issuers (cost $18,822,980) | $ | 25,807,270 | ||||||

| Affiliated Central Funds (cost $94,916) | 94,916 | |||||||

| Other affiliated issuers (cost $147,603) | 170,978 | |||||||

| Total Investments (cost $19,065,499) | $ | 26,073,164 | ||||||

| Foreign currency held at value (cost $6,923) | 6,942 | |||||||

| Receivable for investments sold | 79,286 | |||||||

| Receivable for fund shares sold | 19,247 | |||||||

| Dividends receivable | 29,531 | |||||||

| Interest receivable | 1,088 | |||||||

| Prepaid expenses | 117 | |||||||

| Other affiliated receivables | 190 | |||||||

| Other receivables | 1,184 | |||||||

| Total assets | 26,210,749 | |||||||

| Liabilities | ||||||||

| Payable for investments purchased | $ | 82,656 | ||||||

| Payable for fund shares redeemed | 40,086 | |||||||

| Accrued management fee | 10,143 | |||||||

| Other affiliated payables | 4,985 | |||||||

| Other payables and accrued expenses | 170 | |||||||

| Collateral on securities loaned, at value | 30,212 | |||||||

| Total liabilities | 168,252 | |||||||

| Net Assets | $ | 26,042,497 | ||||||

| Net Assets consist of: | ||||||||

| Paid in capital | $ | 18,513,314 | ||||||

| Undistributed net investment income | 23,857 | |||||||

| Accumulated undistributed net realized gain (loss) on | ||||||||

| investments and foreign currency transactions | 497,611 | |||||||

| Net unrealized appreciation (depreciation) on | ||||||||

| investments and assets and liabilities in foreign | ||||||||

| currencies | 7,007,715 | |||||||

| Net Assets, for 477,745 shares outstanding | $ | 26,042,497 | ||||||

| Net Asset Value, offering price and redemption price per | ||||||||

| share ($26,042,497 ÷ 477,745 shares) | $ | 54.51 | ||||||

See accompanying notes which are an integral part of the financial statements.

23 Annual Report

| Financial Statements continued | ||||||

| Statement of Operations | ||||||

| Amounts in thousands | Year ended January 31, 2006 | |||||

| Investment Income | ||||||

| Dividends (including $3,584 received from other | ||||||

| affiliated issuers) | $ | 567,469 | ||||

| Interest | 7,948 | |||||

| Income from affiliated Central Funds | 6,634 | |||||

| Total income | 582,051 | |||||

| Expenses | ||||||

| Management fee | $ | 122,426 | ||||

| Transfer agent fees | 52,763 | |||||

| Accounting and security lending fees | 1,870 | |||||

| Independent trustees’ compensation | 115 | |||||

| Appreciation in deferred trustee compensation account | 26 | |||||

| Custodian fees and expenses | 668 | |||||

| Registration fees | 89 | |||||

| Audit | 291 | |||||

| Legal | 144 | |||||

| Interest | 99 | |||||

| Miscellaneous | 344 | |||||

| Total expenses before reductions | 178,835 | |||||

| Expense reductions | (4,123) | 174,712 | ||||

| Net investment income (loss) | 407,339 | |||||

| Realized and Unrealized Gain (Loss) | ||||||

| Net realized gain (loss) on: | ||||||

| Investment securities: | ||||||

| Unaffiliated issuers | 1,282,650 | |||||

| Foreign currency transactions | (467) | |||||

| Total net realized gain (loss) | 1,282,183 | |||||

| Change in net unrealized appreciation (depreciation) on: | ||||||

| Investment securities | 1,218,912 | |||||

| Assets and liabilities in foreign currencies | 56 | |||||

| Total change in net unrealized appreciation | ||||||

| (depreciation) | 1,218,968 | |||||

| Net gain (loss) | 2,501,151 | |||||

| Net increase (decrease) in net assets resulting from | ||||||

| operations | $ | 2,908,490 | ||||

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 24 |

| Statement of Changes in Net Assets | ||||||||

| Year ended | Year ended | |||||||

| January 31, | January 31, | |||||||

| Amounts in thousands | 2006 | 2005 | ||||||

| Increase (Decrease) in Net Assets | ||||||||

| Operations | ||||||||

| Net investment income (loss) | $ | 407,339 | $ | 380,867 | ||||

| Net realized gain (loss) | 1,282,183 | 879,689 | ||||||

| Change in net unrealized appreciation (depreciation) . | 1,218,968 | 528,835 | ||||||

| Net increase (decrease) in net assets resulting | ||||||||

| from operations | 2,908,490 | 1,789,391 | ||||||

| Distributions to shareholders from net investment income . | (414,731) | (390,294) | ||||||

| Distributions to shareholders from net realized gain | (1,034,144) | (801,084) | ||||||

| Total distributions | (1,448,875) | (1,191,378) | ||||||

| Share transactions | ||||||||

| Proceeds from sales of shares | 3,497,358 | 4,643,118 | ||||||

| Reinvestment of distributions | 1,414,736 | 1,162,171 | ||||||

| Cost of shares redeemed | (6,059,215) | (4,365,933) | ||||||

| Net increase (decrease) in net assets resulting from | ||||||||

| share transactions | (1,147,121) | 1,439,356 | ||||||

| Total increase (decrease) in net assets | 312,494 | 2,037,369 | ||||||

| Net Assets | ||||||||

| Beginning of period | 25,730,003 | 23,692,634 | ||||||

| End of period (including undistributed net investment | ||||||||

| income of $23,857 and undistributed net investment | ||||||||

| income of $22,343, respectively) | $ | 26,042,497 | $ | 25,730,003 | ||||

| Other Information | ||||||||

| Shares | ||||||||

| Sold | 66,868 | 92,015 | ||||||

| Issued in reinvestment of distributions | 26,872 | 22,715 | ||||||

| Redeemed | (115,420) | (86,581) | ||||||

| Net increase (decrease) | (21,680) | 28,149 | ||||||

See accompanying notes which are an integral part of the financial statements.

25 Annual Report

| Financial Highlights | ||||||||||

| Years ended January 31, | 2006 | 2005 | 2004 | 2003 | 2002 | |||||

| Selected Per Share Data | ||||||||||

| Net asset value, beginning of | ||||||||||

| period | $ 51.52 | $ 50.27 | $ 38.32 | $ 48.15 | $ 53.91 | |||||

| Income from Investment | ||||||||||

| Operations | ||||||||||

| Net investment income (loss)B | 82 | .79 | .71 | .68 | .71 | |||||

| Net realized and unrealized | ||||||||||

| gain (loss) | 5.14 | 2.93 | 12.88 | (9.69) | (4.53) | |||||

| Total from investment operations | 5.96 | 3.72 | 13.59 | (9.01) | (3.82) | |||||

| Distributions from net investment | ||||||||||

| income | (.84) | (.81) | (.71) | (.68) | (.76) | |||||

| Distributions from net realized | ||||||||||

| gain | (2.13) | (1.66) | (.93) | (.14) | (1.18) | |||||

| Total distributions | (2.97) | (2.47) | (1.64) | (.82) | (1.94) | |||||

| Net asset value, end of period | $ 54.51 | $ 51.52 | $ 50.27 | $ 38.32 | $ 48.15 | |||||

| Total ReturnA | 11.87% | 7.51% | 35.95% | (18.95)% | (7.06)% | |||||

| Ratios to Average Net AssetsC | ||||||||||

| Expenses before reductions | 69% | .70% | .71% | .72% | .69% | |||||

| Expenses net of fee waivers, if | ||||||||||

| any | 69% | .70% | .71% | .72% | .69% | |||||

| Expenses net of all reductions | 67% | .69% | .70% | .71% | .67% | |||||

| Net investment income (loss) | 1.57% | 1.56% | 1.63% | 1.57% | 1.41% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (in | ||||||||||

| millions) | $26,042 | $25,730 | $23,693 | $17,239 | $21,553 | |||||

| Portfolio turnover rate | 19% | 19% | 25% | 23% | 23% | |||||

| A Total returns would have been lower had certain expenses not been reduced during the periods shown. B Calculated based on average shares outstanding during the period. C Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund. |

See accompanying notes which are an integral part of the financial statements.

| Annual Report |

| 26 |

Notes to Financial Statements

| For the period ended January 31, 2006 (Amounts in thousands except ratios) |

1. Significant Accounting Policies.

Fidelity Equity Income Fund (the fund) is a fund of Fidelity Devonshire Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust. The fund may invest in affiliated money market central funds (Money Market Central Funds) which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affili ates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require manage ment to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Debt securities, including restricted securities, for which quotations are readily available, are valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices. Investments in open end mutual funds, are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securi ties markets, reviewing developments in foreign markets and evaluating the perfor mance of ADRs, futures contracts and exchange traded funds. Because the fund’s utilization of fair value pricing depends on market activity, the frequency with which fair

27 Annual Report

| Notes to Financial Statements continued |

| (Amounts in thousands except ratios) |

| 1. Significant Accounting Policies continued |

Security Valuation continued |

value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign denominated assets, including investment securities, and liabilities are trans lated into U.S. dollars at the exchange rate at period end. Purchases and sales of invest ment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transac tion date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex dividend date, except for certain dividends from foreign securities where the ex dividend date may have passed, which are recorded as soon as the fund is informed of the ex dividend date. Non cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securi ties. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are treated as

| Annual Report |

| 28 |

| 1. Significant Accounting Policies continued |

Deferred Trustee Compensation continued |

though equivalent dollar amounts had been invested in shares of the fund or are invested in a cross section of other Fidelity funds, and are marked to market. Deferred amounts remain in the fund until distributed in accordance with the Plan.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex dividend date. Income and capital gain distribu tions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the fund will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), market discount, deferred trustees compensation and losses deferred due to wash sales.

The tax basis components of distributable earnings and the federal tax cost as of period end were as follows:

| Unrealized appreciation | $ | 8,052,346 | ||||||

| Unrealized depreciation | (1,053,547) | |||||||

| Net unrealized appreciation (depreciation) | 6,998,799 | |||||||

| Undistributed ordinary income | 74,555 | |||||||

| Undistributed long term capital gain | 342,415 | |||||||

| Cost for federal income tax purposes | $ | 19,074,365 | ||||||

| The tax character of distributions paid was as follows: | ||||||||

| January 31, 2006 | January 31, 2005 | |||||||

| Ordinary Income | $ | 492,802 | $ | 492,414 | ||||

| Long term Capital Gains | 956,073 | 698,964 | ||||||

| Total | $ | 1,448,875 | $ | 1,191,378 | ||||

29 Annual Report

| Notes to Financial Statements continued | ||

| (Amounts in thousands except ratios) | ||

| 2. Operating Policies. | ||

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non government securities. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Restricted Securities. The fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transac tions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the fund’s Schedule of Investments.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short term securities and U.S. government securities, aggregated $4,884,197 and $6,954,858, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment manage ment related services for which the fund pays a monthly management fee. The manage ment fee is the sum of an individual fund fee rate that is based on an annual rate of .20% of the fund’s average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual man agement fee rate was ..47% of the fund’s average net assets.

Transfer Agent Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, is the fund’s transfer, dividend disbursing and shareholder servicing agent. FSC receives account fees and asset based fees that vary according to account size and type of ac count. FSC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .20% of average net assets.

| Annual Report |

| 30 |

4. Fees and Other Transactions with Affiliates continued

Accounting and Security Lending Fees. FSC maintains the fund’s accounting rec ords. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Affiliated Central Funds. The fund may invest in Money Market Central Funds which seek preservation of capital and current income and are managed by Fidelity Invest ments Money Management, Inc. (FIMM), an affiliate of FMR.

The Money Market Central Funds do not pay a management fee.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $120 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the fund, along with other registered investment companies having management contracts with FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The fund’s activity in this program during the period for which loans were outstanding was as follows:

| Average Daily Loan | Weighted Average | |||||||||

| Borrower or Lender | Balance | Interest Rate | Interest Expense | |||||||

| Borrower | $ | 34,301 | 3.70% | $ | 99 | |||||

| 5. Committed Line of Credit. | ||||||||||

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund share holder redemptions or for other short term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit. During the period, there were no borrowings on this line of credit.

| 6. Security Lending. |

The fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is

31 Annual Report

| Notes to Financial Statements continued |

| (Amounts in thousands except ratios) |

| 6. Security Lending continued |

delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the fund’s Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from affiliated central funds. Net income from lending portfolio securities during the period amounted to $2,566.

| 7. Expense Reductions. |

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $2,928 for the period. In addition, through arrangements with the fund’s custodian and transfer agent, credits realized as a result of uninvested cash balances were used to reduce the fund’s expenses. During the period, these credits reduced the fund’s custody and transfer agent expenses by $1 and $1,194, respectively.

| 8. Other. |

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

| Annual Report |

| 32 |

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Devonshire Trust and the Shareholders of Fidelity Equity Income Fund:

In our opinion, the accompanying statement of assets and liabilities, including the sched ule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Equity Income Fund (a fund of Fidelity Devonshire Trust) at January 31, 2006 and the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereaf ter referred to as “financial statements”) are the responsibility of the Fidelity Equity Income Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at January 31, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

| /s/ PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP Boston, Massachusetts March 14, 2006 |

33 Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund’s activities, review contractual arrangements with companies that provide services to the fund, and review the fund’s performance. Except for William O. McCoy and Albert R. Gamper, Jr., each of the Trustees oversees 326 funds advised by FMR or an affiliate. Mr. McCoy oversees 328 funds advised by FMR or an affiliate. Mr. Gamper oversees 251 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instru ment signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Members may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544.

| Interested Trustees*: |

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

| Name, Age; Principal Occupation Edward C. Johnson 3d (75) |

Year of Election or Appointment: 1985

Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves as Chief Executive Officer, Chairman, and a Director of FMR Corp.; a Director and Chairman of the Board and of the Executive Committee of FMR; Chairman and a Director of Fidelity Research & Analysis Company; Chairman and a Director of Fidelity Investments Money Management, Inc.; and Chairman (2001 present) and a Director (2000 present) of FMR Co., Inc.

| Annual Report |

| 34 |

| Name, Age; Principal Occupation Stephen P. Jonas (53) |

Year of Election or Appointment: 2005

Mr. Jonas is Senior Vice President of Equity Income (2005 present). He also serves as Senior Vice President of other Fidelity funds (2005 present). Mr. Jonas is Executive Director of FMR (2005 present). Pre viously, Mr. Jonas served as President of Fidelity Enterprise Operations and Risk Services (2004 2005), Chief Administrative Officer (2002 2004), and Chief Financial Officer of FMR Co. (1998 2000). Mr. Jonas has been with Fidelity Investments since 1987 and has held various fi nancial and management positions including Chief Financial Officer of FMR. In addition, he serves on the Boards of Boston Ballet (2003 present) and Simmons College (2003 present).

| Robert L. Reynolds (53) |

Year of Election or Appointment: 2003

Mr. Reynolds is a Director (2003 present) and Chief Operating Officer (2002 present) of FMR Corp. He also serves on the Board at Fidelity Investments Canada, Ltd. (2000 present). Previously, Mr. Reynolds served as President of Fidelity Investments Institutional Retirement Group (1996 2000).

* Trustees have been determined to be “Interested Trustees” by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

35 Annual Report

Trustees and Officers - continued

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

| Name, Age; Principal Occupation Dennis J. Dirks (57) |

Year of Election or Appointment: 2005

Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC) (1999 2003). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Com pany (DTC) (1999 2003) and President and Board member of the Nat ional Securities Clearing Corporation (NSCC) (1999 2003). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation (2001 2003) and Chief Executive Officer and Board member of the Mortgage Backed Securities Clearing Corporation (2001 2003). Mr. Dirks also serves as a Trustee and a member of the Finance Committee of Manhattan College (2005 present) and a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006 present).

| Albert R. Gamper, Jr. (63) |

Year of Election or Appointment: 2006.

Trustee of Fidelity Devonshire Trust. Mr. Gamper also serves as a Trustee (2006 present) or Member of the Advisory Board (2005 present) of other investment companies advised by FMR. Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). During his tenure with CIT Group Inc. Mr. Gamper served in numerous senior management positions, includ ing Chairman (1987 1989; 1999 2001; 2002 2004), Chief Executive Officer (1987 2004), and President (1989 2002). He currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2001 present), Chairman of the Board of Governors, Rutgers University (2004 present), and Chairman of the Board of Saint Barnabas Health Care System.

| Annual Report |

| 36 |

| Name, Age; Principal Occupation Robert M. Gates (62) |

Year of Election or Appointment: 1997

Dr. Gates is Chairman of the Independent Trustees (2006 present). Dr. Gates is President of Texas A&M University (2002 present). He was Director of the Central Intelligence Agency (CIA) from 1991 to 1993. From 1989 to 1991, Dr. Gates served as Assistant to the President of the United States and Deputy National Security Advisor. Dr. Gates is a Director of NACCO Industries, Inc. (mining and manufacturing), Parker Drilling Co., Inc. (drilling and rental tools for the energy industry, 2001 present), and Brinker International (restaurant management, 2003 present). Previously, Dr. Gates served as a Director of LucasVarity PLC (automotive components and diesel engines), a Director of TRW Inc. (automotive, space, defense, and information technology), and Dean of the George Bush School of Government and Public Service at Texas A&M University (1999 2001).

| George H. Heilmeier (69) |

Year of Election or Appointment: 2004