UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-215

Fidelity Hastings Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | June 30 |

| |

Date of reporting period: | June 30, 2014 |

Item 1. Reports to Stockholders

Fidelity®

Growth Discovery Fund

Annual Report

June 30, 2014

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2014 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

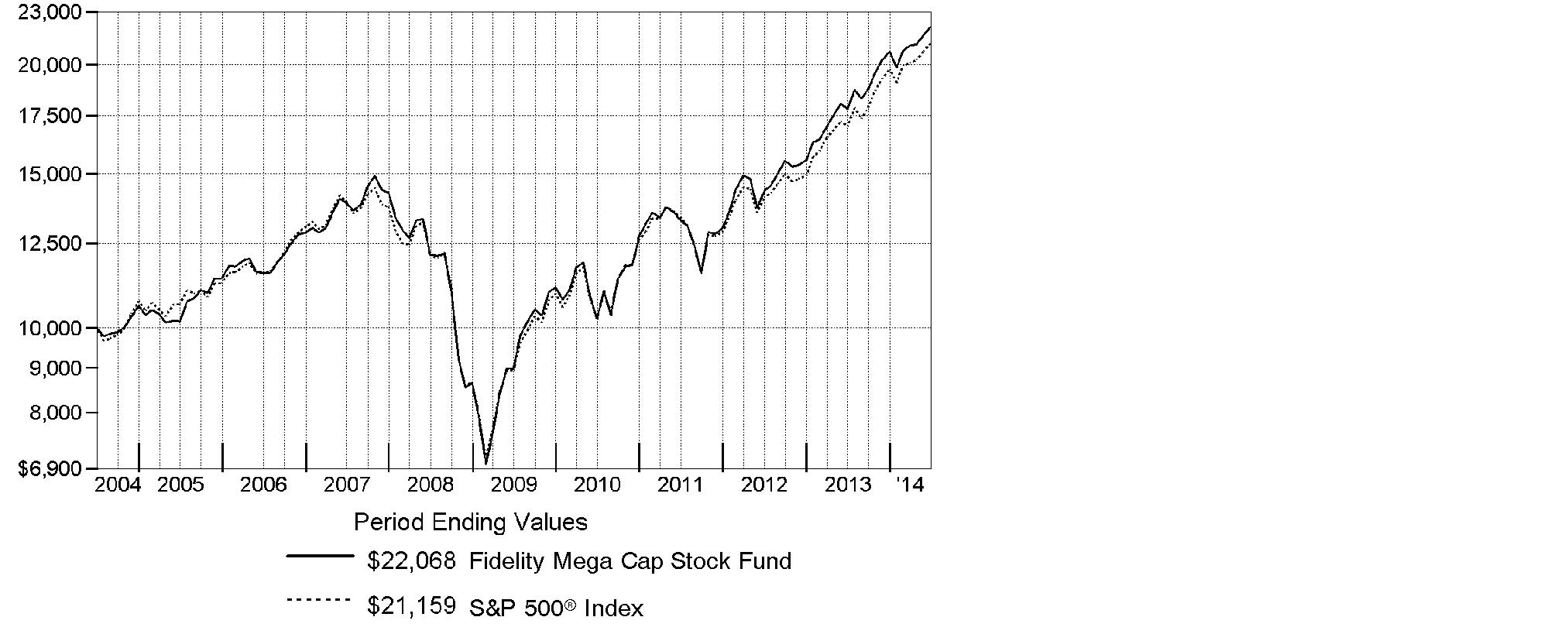

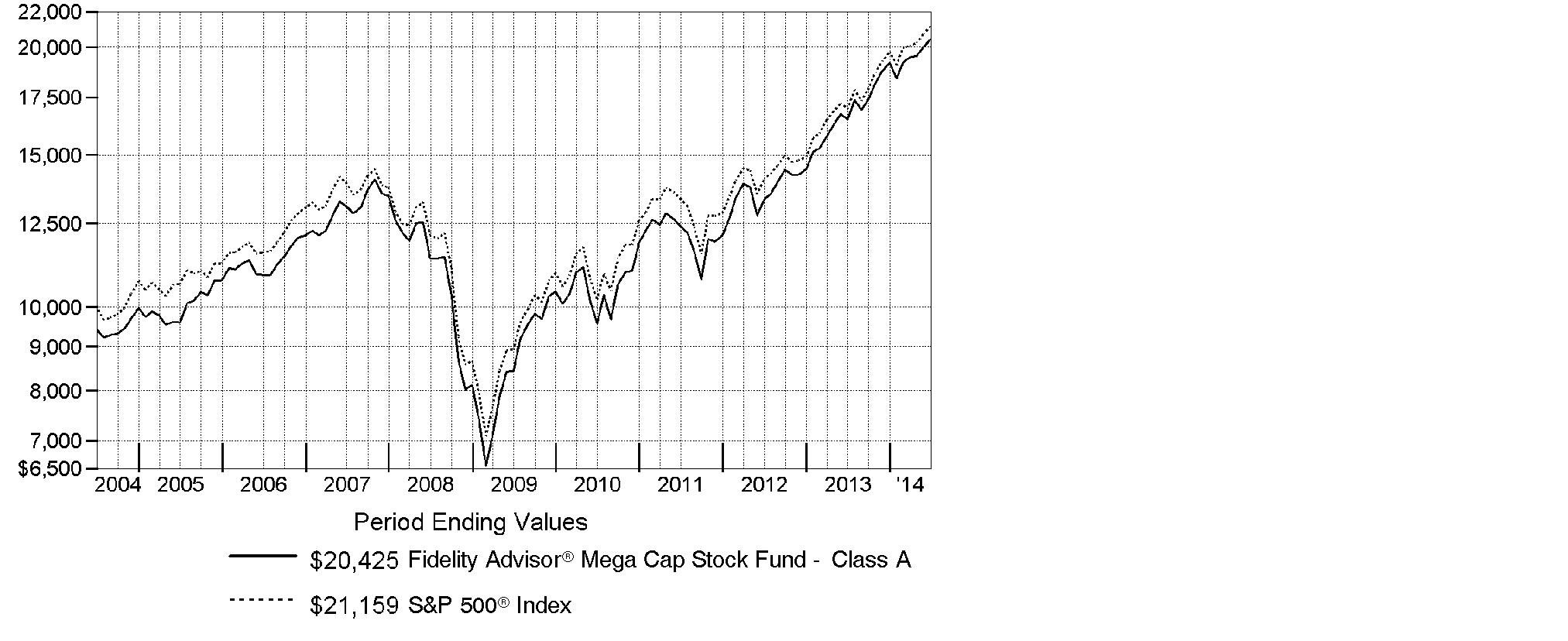

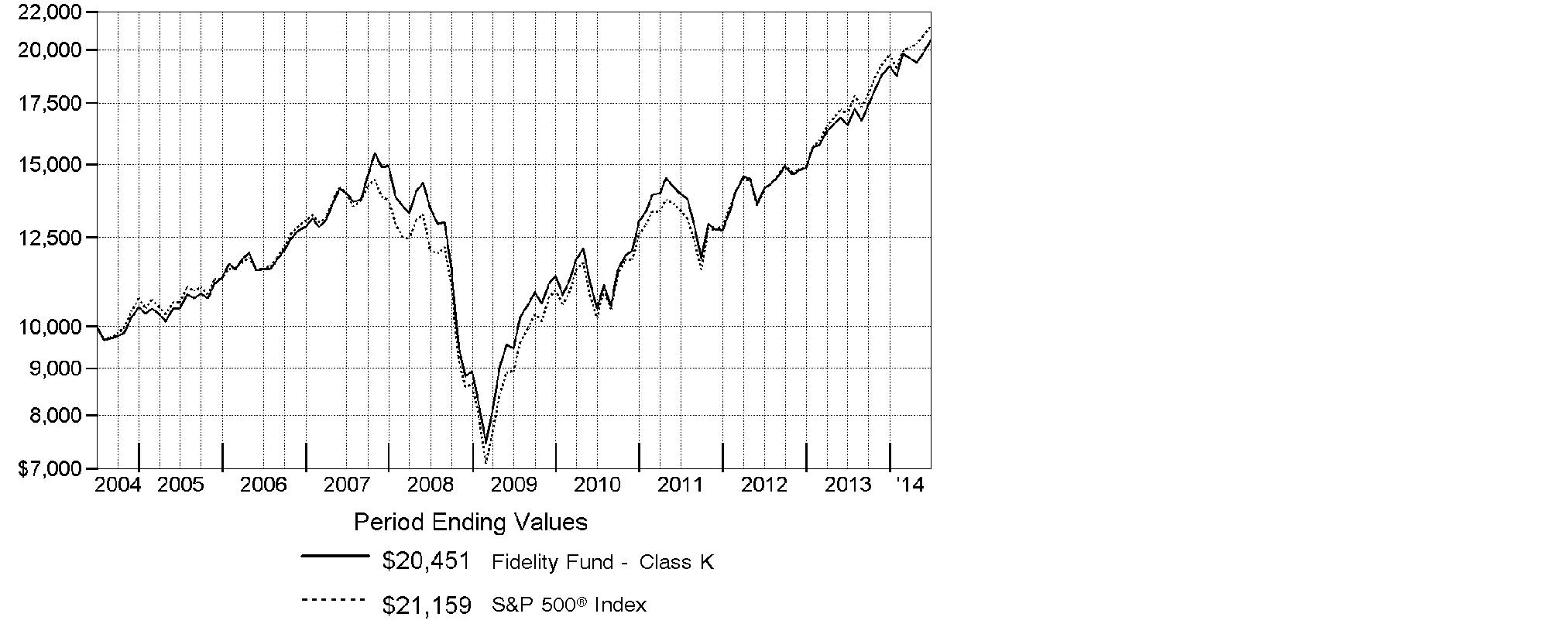

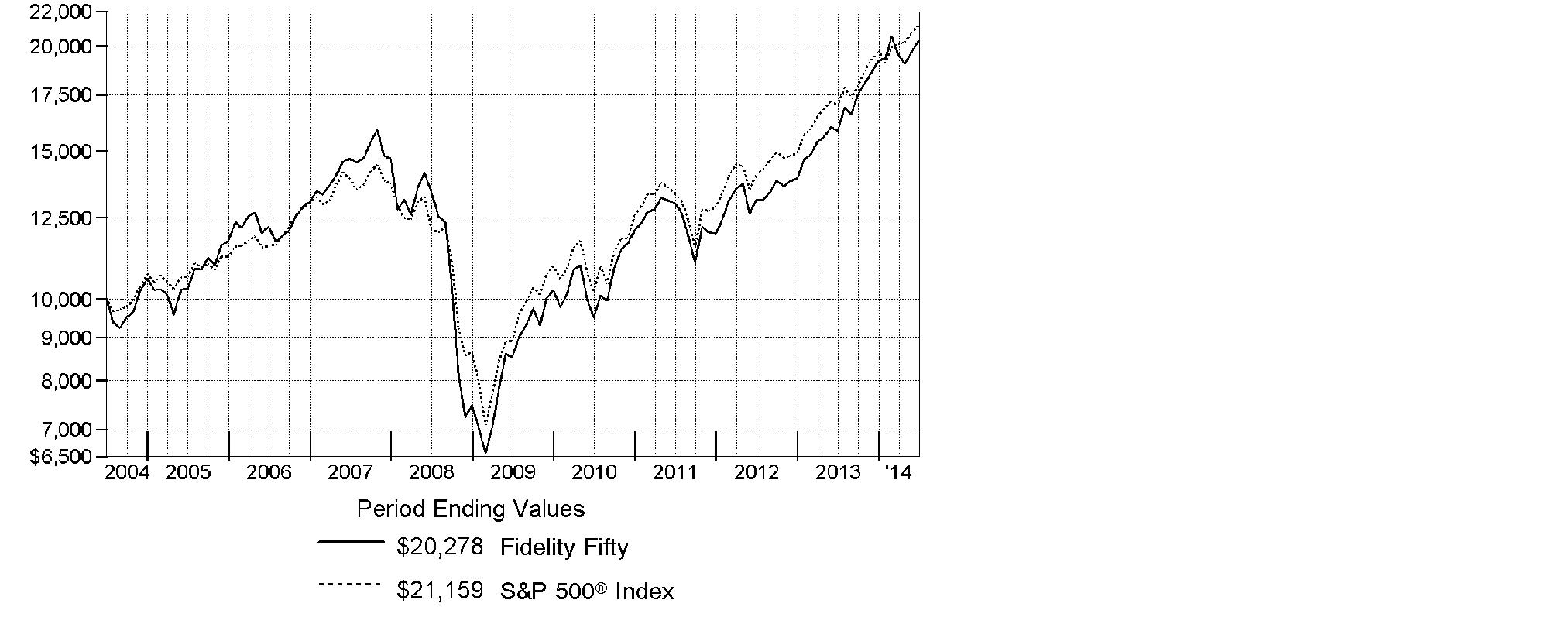

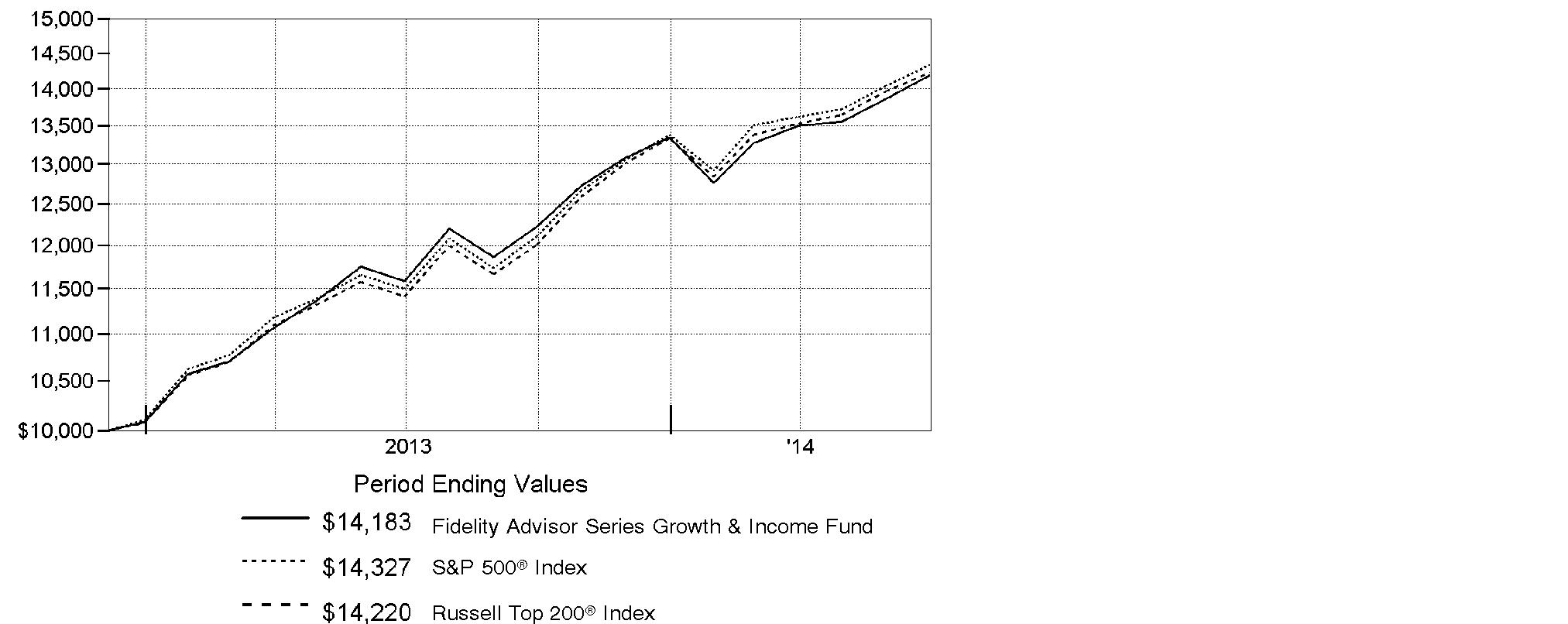

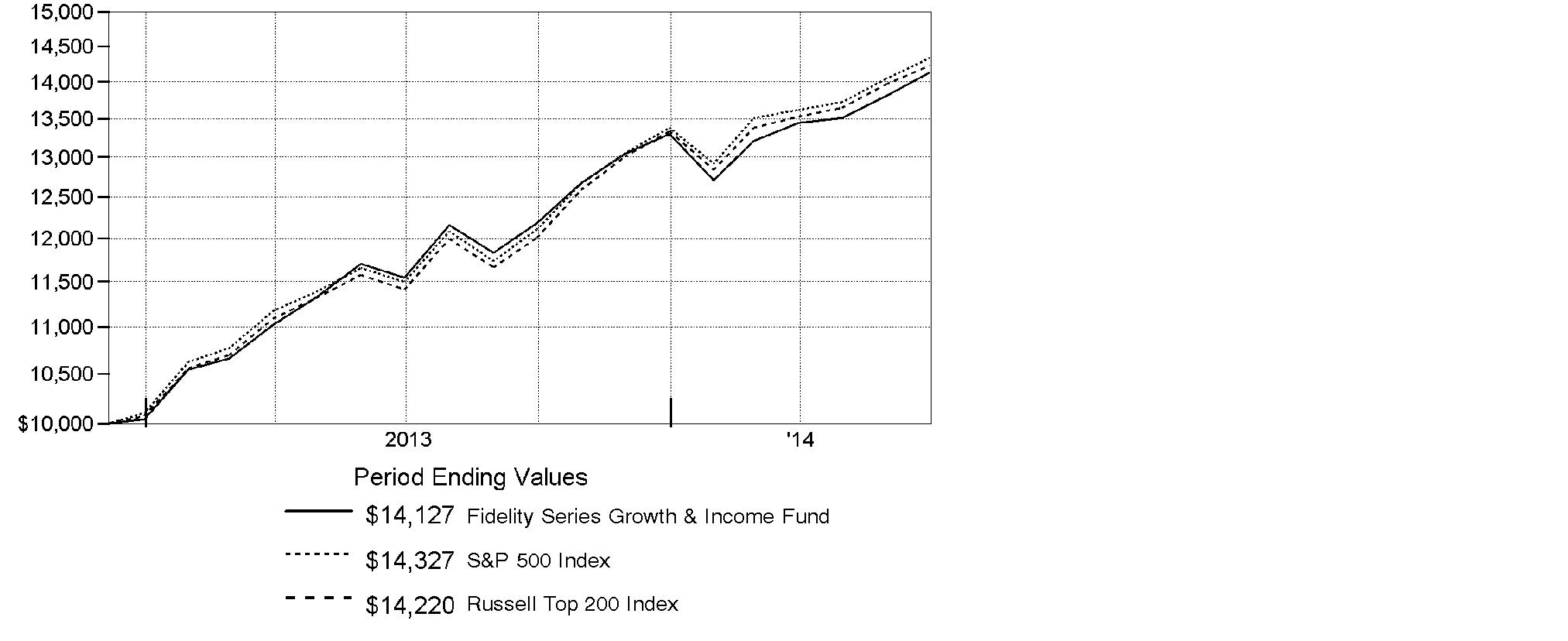

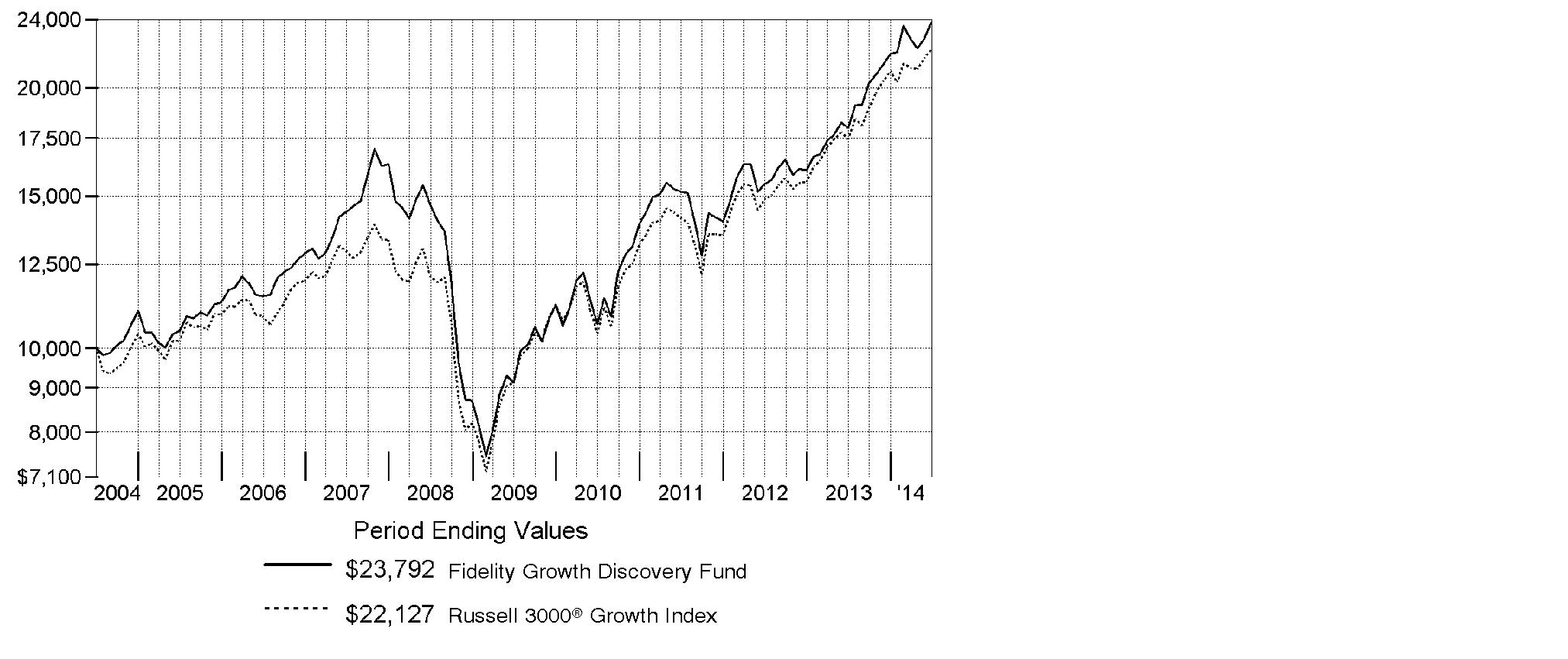

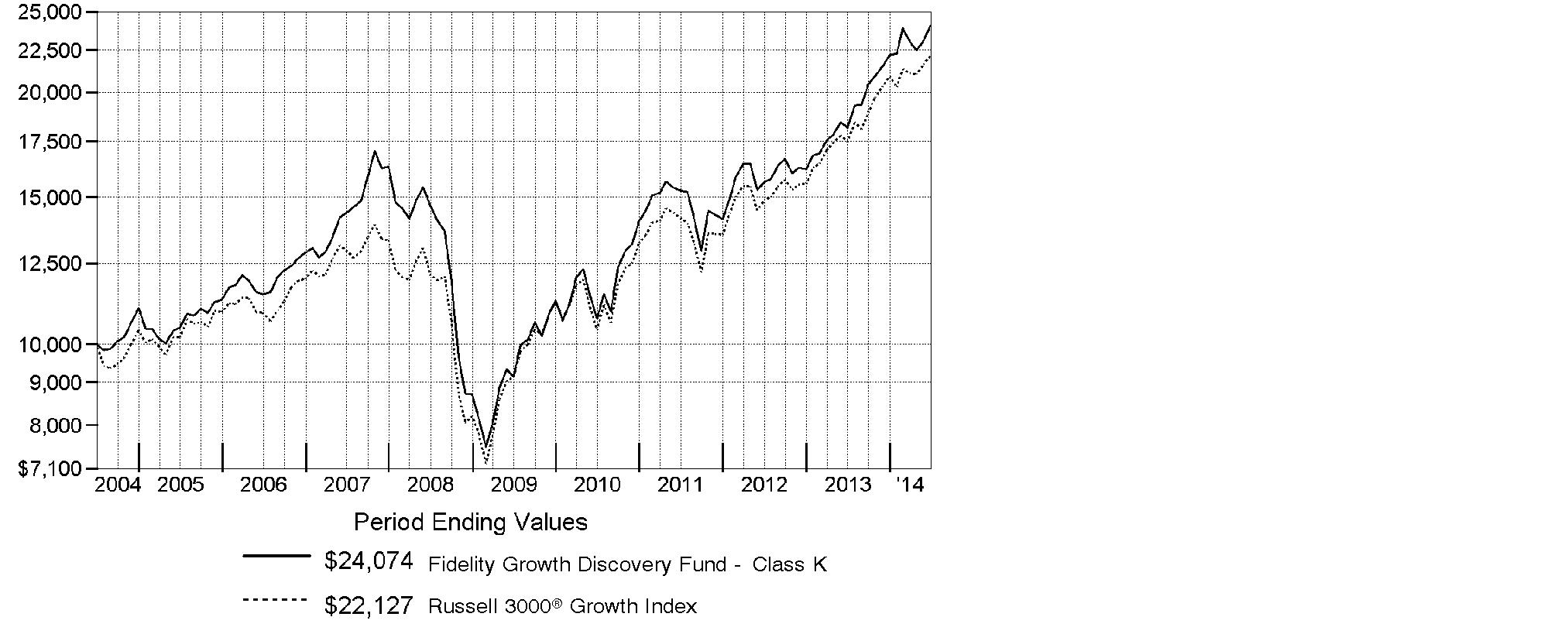

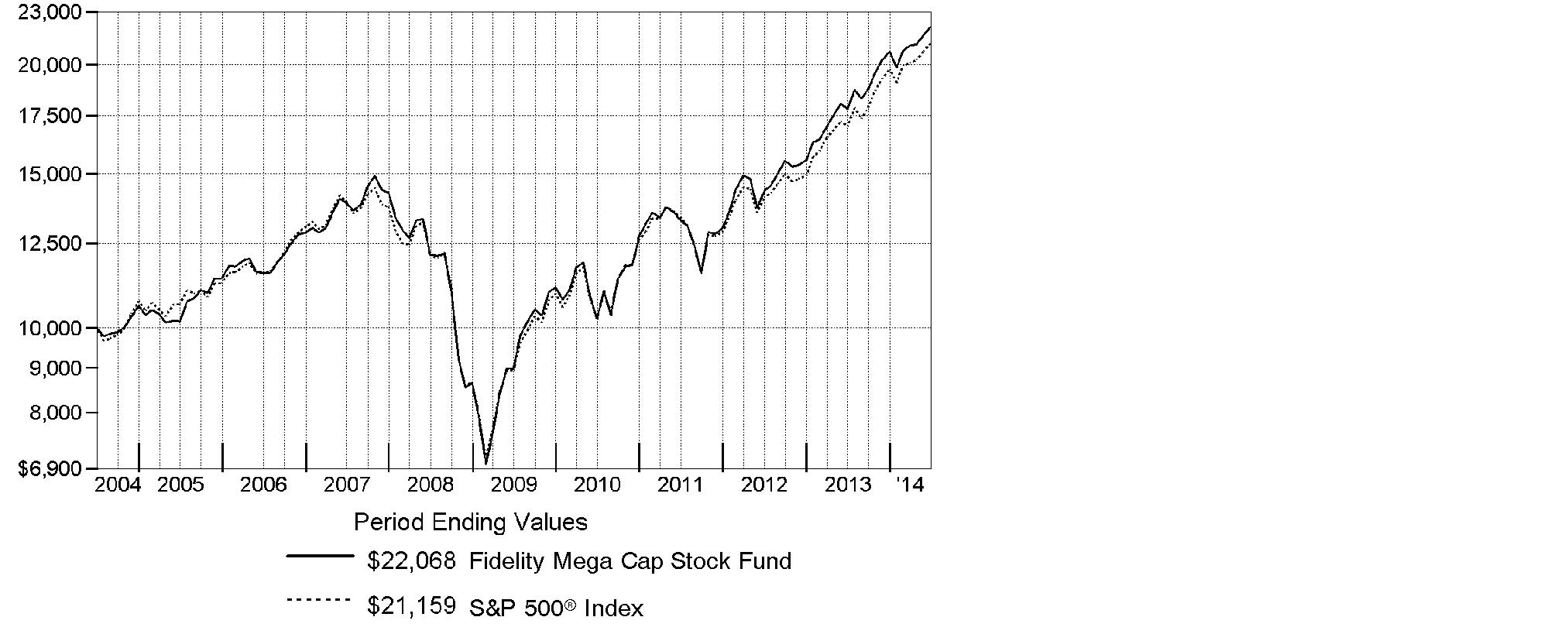

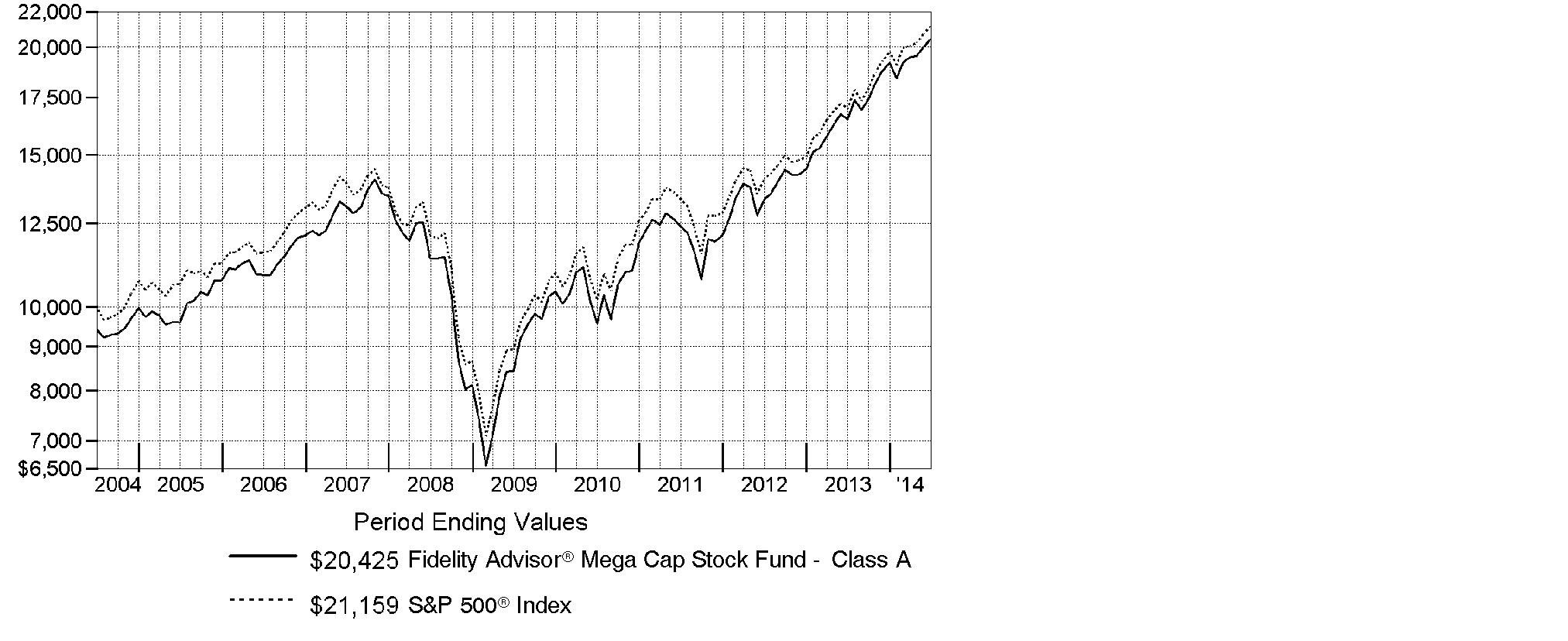

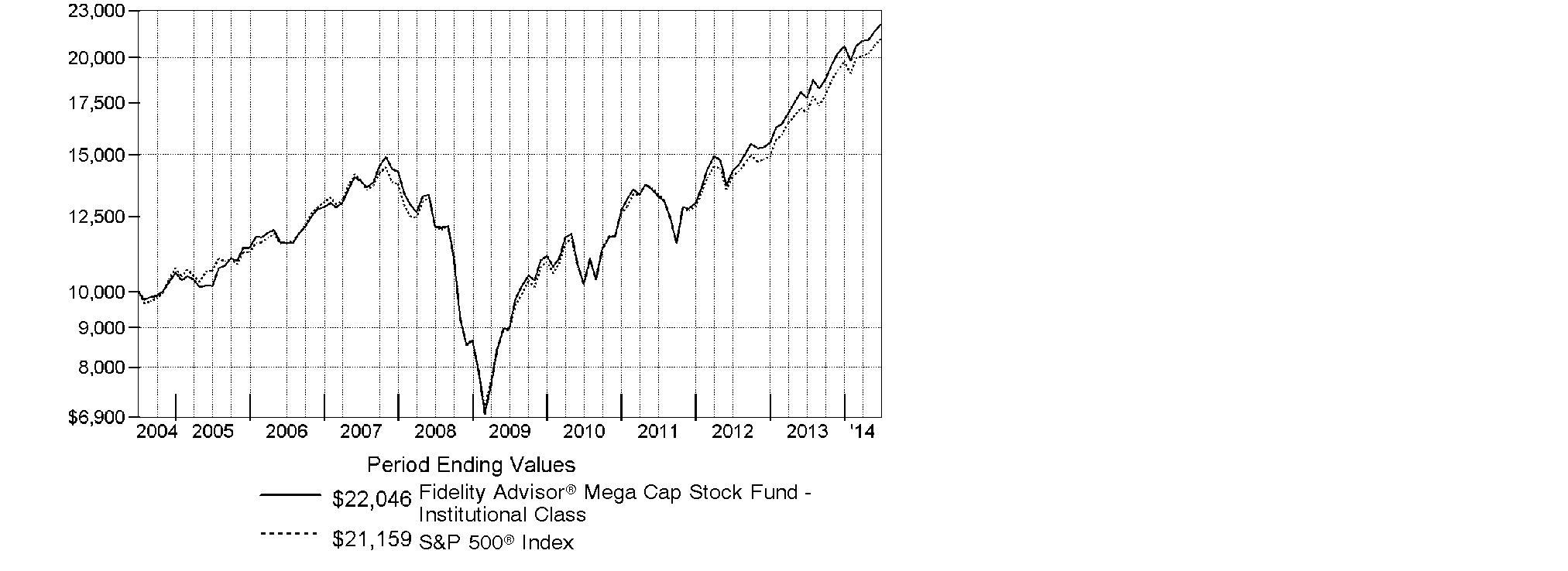

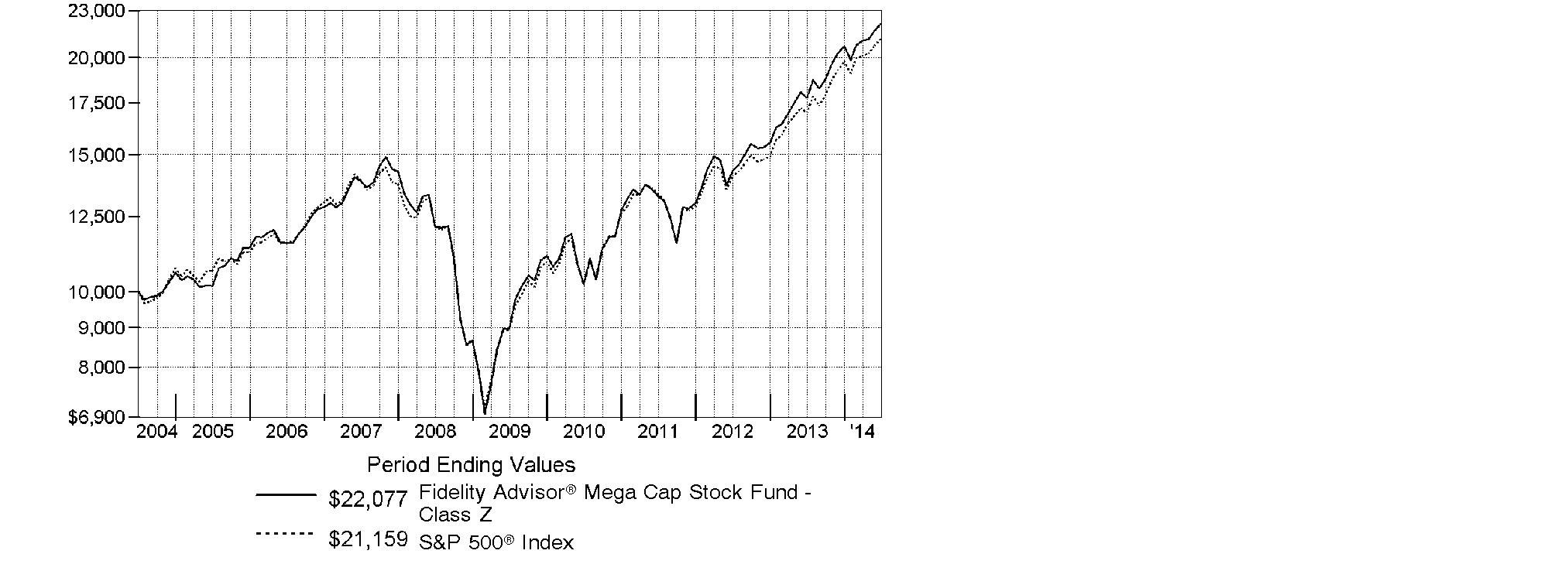

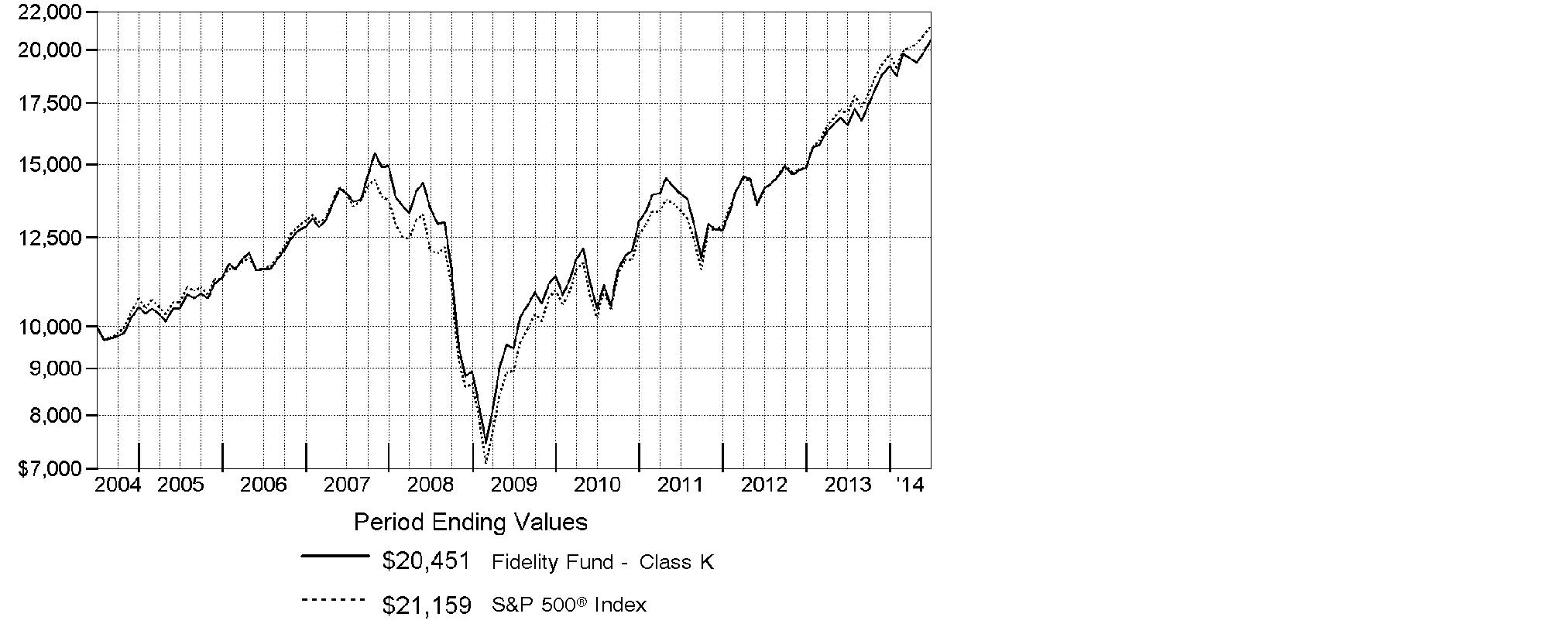

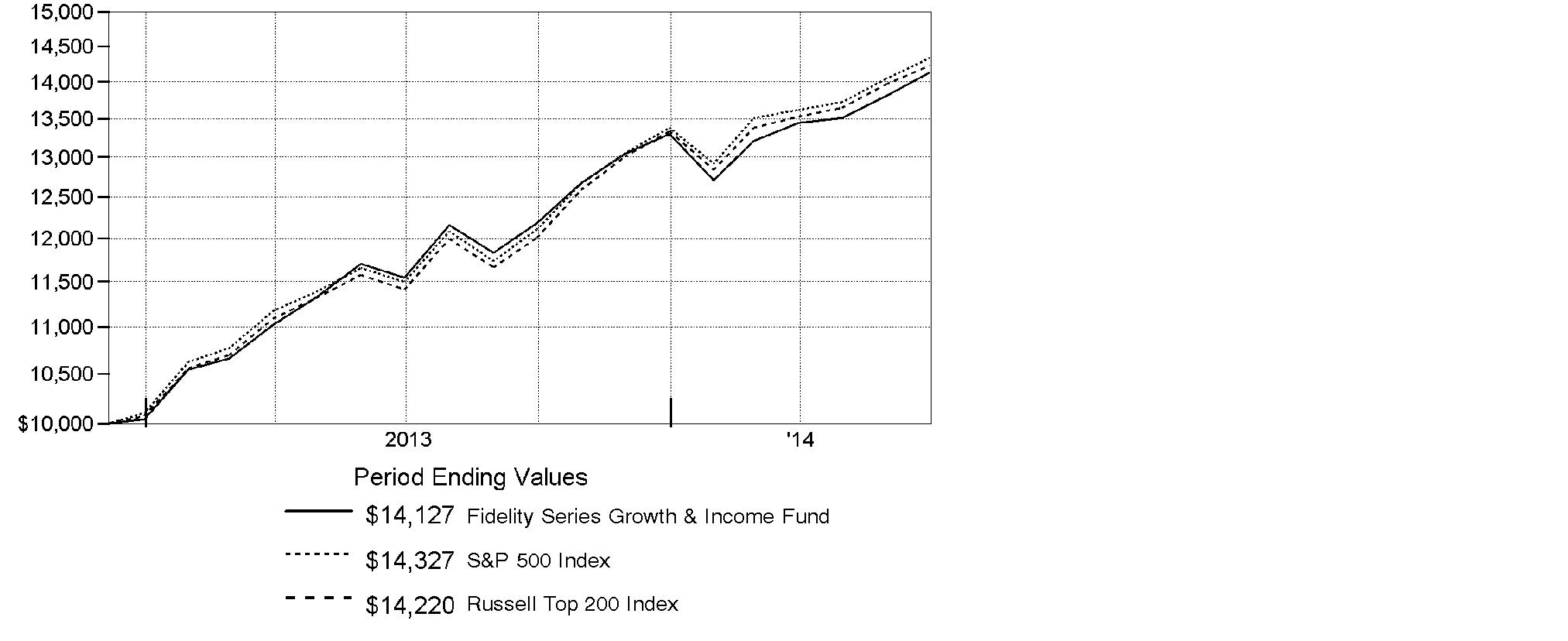

Annual Report

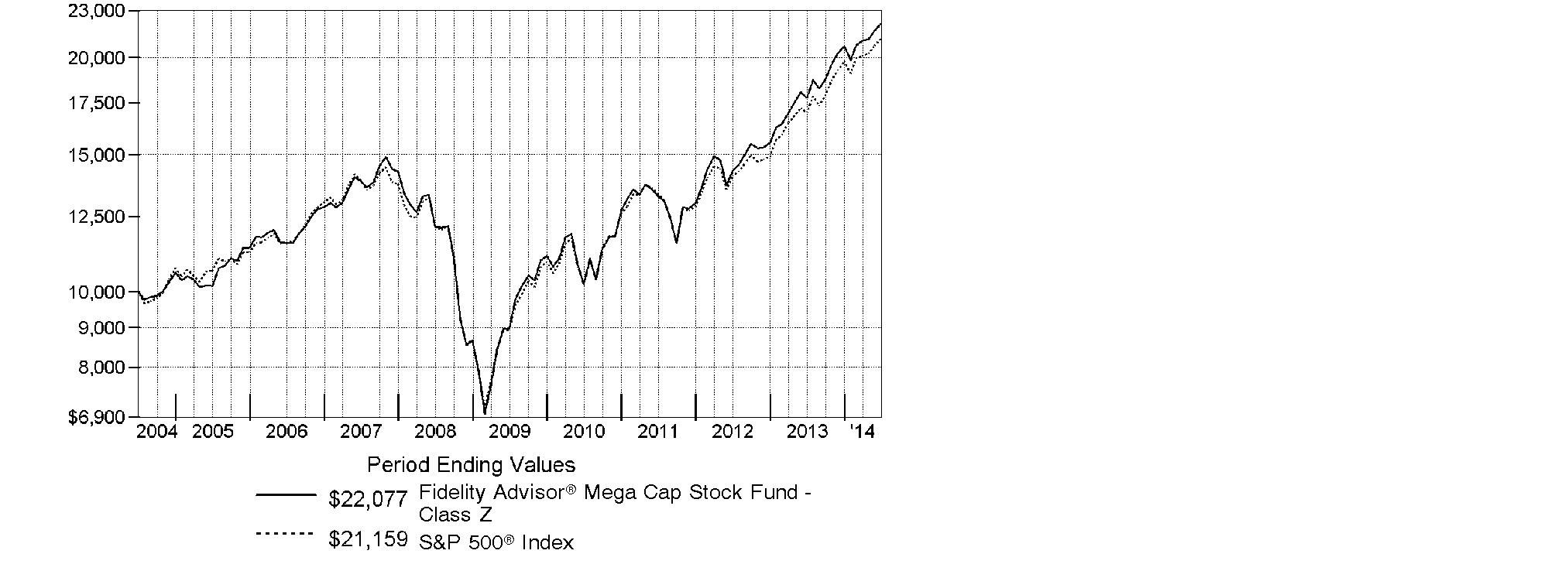

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended June 30, 2014 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® Growth Discovery FundA | 32.40% | 21.13% | 9.05% |

A Prior to February 1, 2007, Fidelity® Growth Discovery Fund operated under certain different investment policies and compared its performance to a different index. The fund's historical performance may not represent its current investment policies.

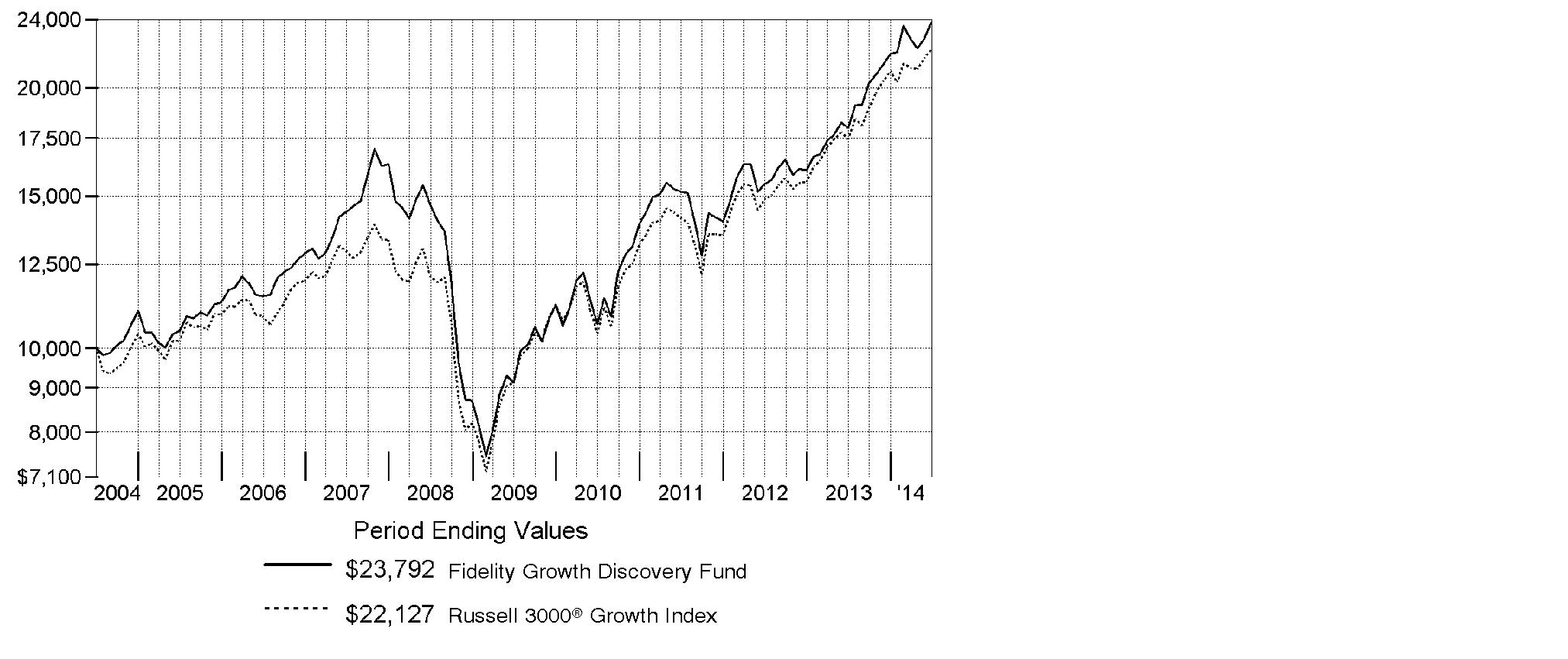

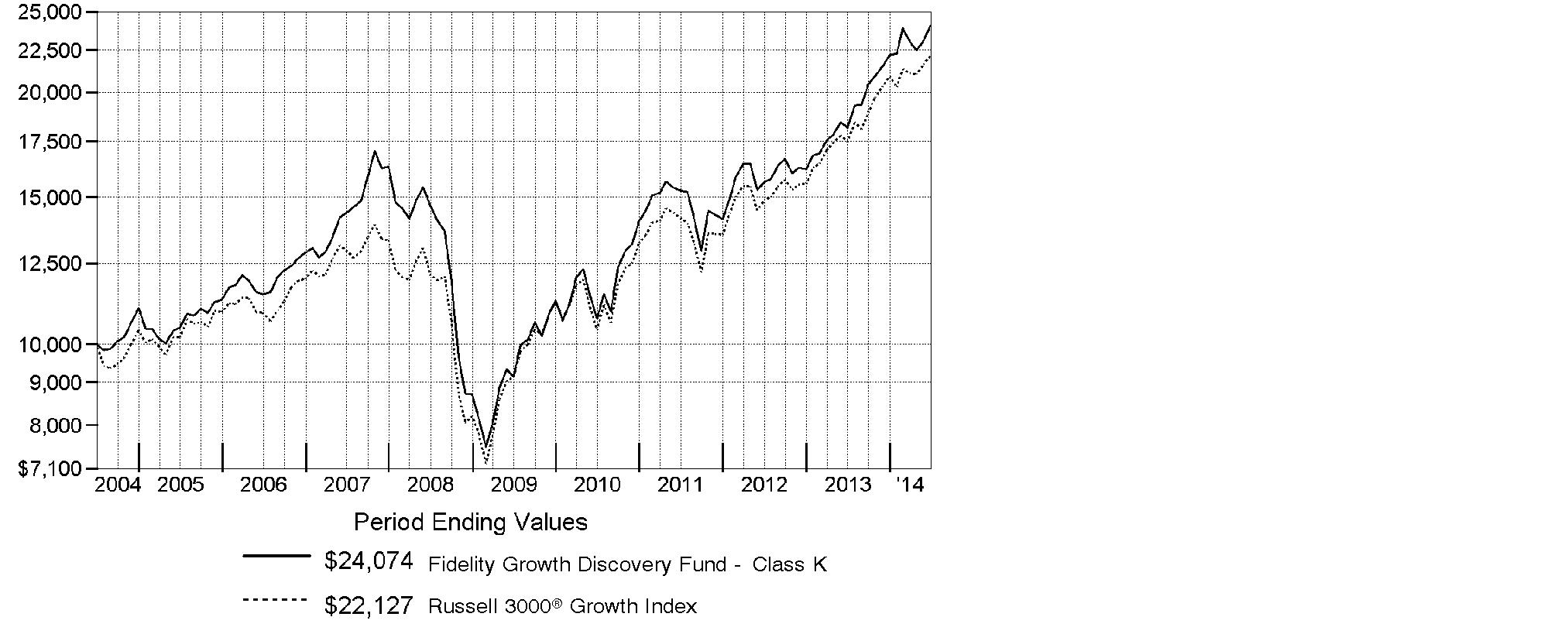

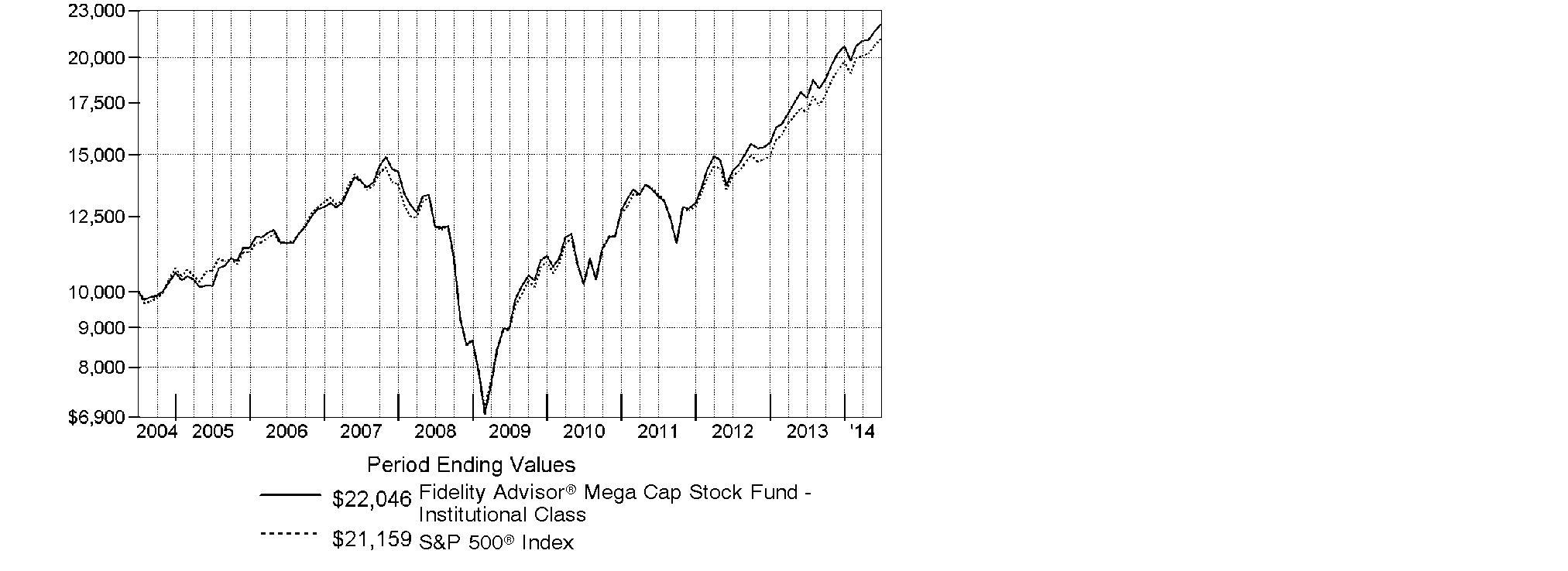

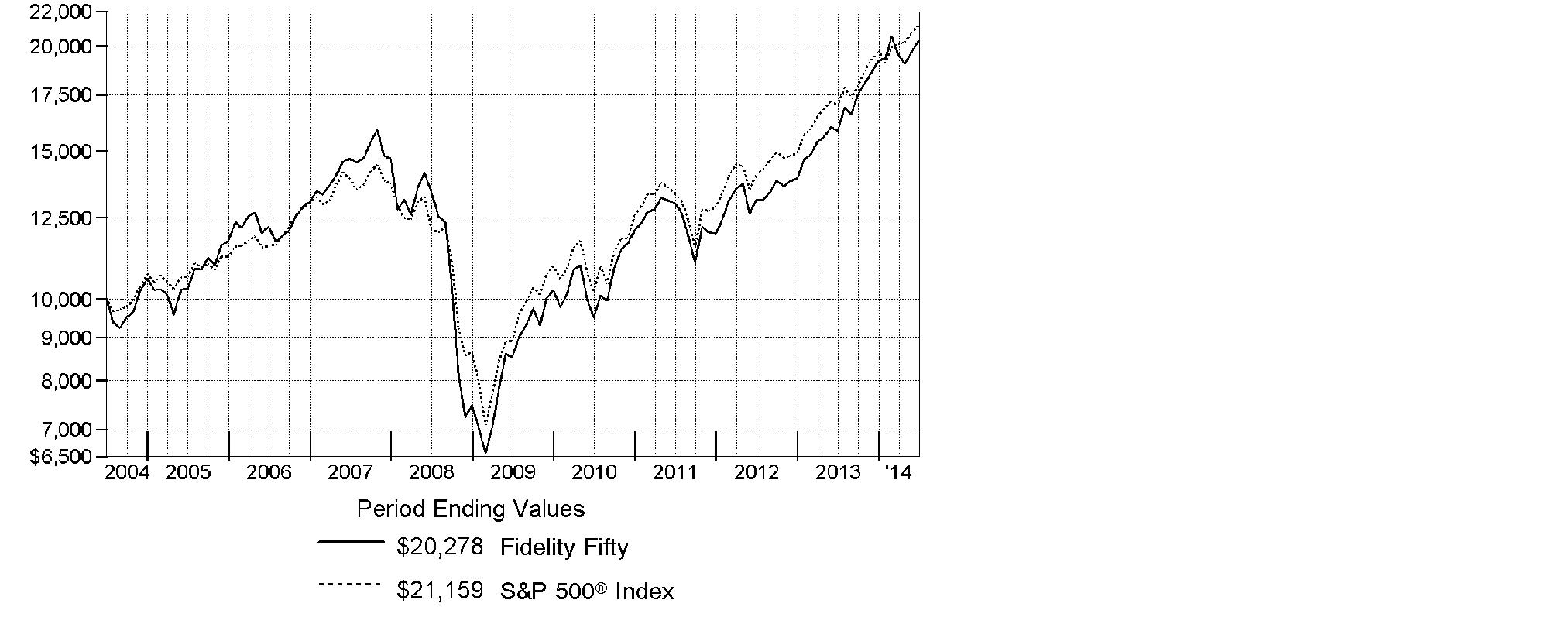

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Growth Discovery Fund, a class of the fund, on June 30, 2004. The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Growth Index performed over the same period.

Annual Report

Market Recap: Despite intermittent volatility driven by geopolitical concerns, stocks posted a series of new highs during the 12 months ending June 30, 2014, amid a decidedly favorable environment for riskier assets. The S&P 500® Index rose 24.61% for the year, helped by a rise in consumer spending and the lowest unemployment rate since 2008. The U.S. Federal Reserve balanced stimulus reductions with continued low interest rates, aiding a broad advance. All 10 S&P 500® market sectors gained, seven by more than 20%. Materials (+33%) was tops, as investors seemed to anticipate sustained economic improvement and renewed infrastructure build-outs. Information technology (+32%) benefited from large cash balances, rising dividends and stock buybacks, and a bevy of innovations. Health care (+30%) was aided by new drugs and predictable reimbursements. Conversely, the biggest laggard, telecommunication services (+5%), battled slow growth and stiff pricing competition. Across size and style segments: overall, investors showed some preference for large-cap stocks over small-caps and growth stocks over value, although market leadership rotated during the year. With the "risk-on" trade alive and well, the growth-oriented Nasdaq Composite Index® flourished, advancing 31.17%, while the blue-chip Dow Jones Industrial AverageSM delivered a more subdued 15.56% return.

Comments from Jason Weiner, Portfolio Manager of Fidelity® Growth Discovery Fund: For the year, the fund's Retail Class shares advanced 32.40%, outpacing the 26.75% gain of the Russell 3000® Growth Index. Versus the Russell index, the software & services segment was a plus. Here, Facebook was the fund's biggest relative contributor by far and easily its largest holding. The social network giant reached an all-time high after posting a 63% increase in revenue for the fourth quarter of 2013, fueled by strong mobile advertising. Investors flocked to the stock as the surge in mobile Internet ad revenue eased concerns about Facebook's ability to evolve into a "mobile first" company. By contrast, an overweighting in Broadcom, on average, was the biggest relative detractor. The firm produces baseband chips that provide Internet connectivity to Apple's iPhone® smartphones and iPad® tablets, as well as some of Samsung Electronics' GalaxyTM mobile devices. Earlier in the period, I was optimistic the business would ride the coattails of the popular products it supports, along with its innovations in Internet connectivity. But the stock lagged, as the firm faced intensifying competition and setbacks in releasing new chips. Shares plummeted last summer after the company issued a lower-than-expected revenue forecast amid slowing smartphone sales. I sold Broadcom prior to period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2014 to June 30, 2014).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Annual Report

| Annualized

Expense RatioB | Beginning

Account Value

January 1, 2014 | Ending

Account Value

June 30, 2014 | Expenses Paid

During Period*

January 1, 2014 to June 30, 2014 |

Growth Discovery | .80% | | | |

Actual | | $ 1,000.00 | $ 1,086.70 | $ 4.14 |

HypotheticalA | | $ 1,000.00 | $ 1,020.83 | $ 4.01 |

Class K | .66% | | | |

Actual | | $ 1,000.00 | $ 1,087.10 | $ 3.42 |

HypotheticalA | | $ 1,000.00 | $ 1,021.52 | $ 3.31 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Ten Stocks as of June 30, 2014 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Facebook, Inc. Class A | 7.4 | 6.6 |

Gilead Sciences, Inc. | 4.2 | 1.6 |

Keurig Green Mountain, Inc. | 3.0 | 2.5 |

Harley-Davidson, Inc. | 3.0 | 3.0 |

Google, Inc. Class A | 2.4 | 4.3 |

Google, Inc. Class C | 2.4 | 0.0 |

Apple, Inc. | 2.3 | 2.5 |

Actavis PLC | 1.9 | 1.1 |

The Blackstone Group LP | 1.9 | 0.9 |

Danaher Corp. | 1.9 | 1.5 |

| 30.4 | |

Top Five Market Sectors as of June 30, 2014 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Information Technology | 28.0 | 29.1 |

Consumer Discretionary | 15.2 | 19.5 |

Health Care | 14.5 | 16.9 |

Industrials | 10.5 | 7.8 |

Consumer Staples | 8.7 | 9.3 |

Asset Allocation (% of fund's net assets) |

As of June 30, 2014 * | As of December 31, 2013 ** |

| Stocks and

Equity Futures 99.4% | |  | Stocks 98.9% | |

| Convertible

Securities 0.3% | |  | Convertible

Securities 0.1% | |

| Short-Term

Investments and

Net Other Assets (Liabilities) 0.3% | |  | Short-Term

Investments and

Net Other Assets (Liabilities) 1.0% | |

* Foreign investments | 11.0% | | ** Foreign investments | 12.6% | |

Annual Report

Investments June 30, 2014

Showing Percentage of Net Assets

Common Stocks - 98.1% |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - 15.1% |

Automobiles - 4.0% |

Harley-Davidson, Inc. | 540,194 | | $ 37,733 |

Tesla Motors, Inc. (a)(d) | 51,610 | | 12,389 |

| | 50,122 |

Distributors - 0.2% |

LKQ Corp. (a) | 109,400 | | 2,920 |

Diversified Consumer Services - 0.5% |

Bright Horizons Family Solutions, Inc. (a) | 61,200 | | 2,628 |

H&R Block, Inc. | 94,188 | | 3,157 |

| | 5,785 |

Hotels, Restaurants & Leisure - 3.4% |

Chipotle Mexican Grill, Inc. (a) | 8,521 | | 5,049 |

Domino's Pizza, Inc. | 10,233 | | 748 |

Dunkin' Brands Group, Inc. | 133,069 | | 6,096 |

Las Vegas Sands Corp. | 31,700 | | 2,416 |

Starbucks Corp. | 213,226 | | 16,499 |

Yum! Brands, Inc. | 143,037 | | 11,615 |

| | 42,423 |

Household Durables - 0.3% |

Mohawk Industries, Inc. (a) | 26,929 | | 3,725 |

Internet & Catalog Retail - 1.0% |

Amazon.com, Inc. (a) | 19,024 | | 6,179 |

TripAdvisor, Inc. (a) | 58,383 | | 6,344 |

| | 12,523 |

Leisure Products - 0.1% |

NJOY, Inc. (f) | 56,145 | | 950 |

Media - 0.7% |

Comcast Corp. Class A (special) (non-vtg.) | 176,643 | | 9,420 |

Specialty Retail - 3.3% |

CarMax, Inc. (a) | 37,952 | | 1,974 |

Five Below, Inc. (a) | 40,900 | | 1,632 |

Home Depot, Inc. | 281,724 | | 22,808 |

Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 88,104 | | 8,054 |

Urban Outfitters, Inc. (a) | 233,757 | | 7,915 |

| | 42,383 |

Textiles, Apparel & Luxury Goods - 1.6% |

ECLAT Textile Co. Ltd. | 332,900 | | 4,034 |

Common Stocks - continued |

| Shares | | Value (000s) |

CONSUMER DISCRETIONARY - continued |

Textiles, Apparel & Luxury Goods - continued |

Michael Kors Holdings Ltd. (a) | 67,300 | | $ 5,966 |

NIKE, Inc. Class B | 134,967 | | 10,467 |

| | 20,467 |

TOTAL CONSUMER DISCRETIONARY | | 190,718 |

CONSUMER STAPLES - 8.7% |

Beverages - 1.2% |

Monster Beverage Corp. (a) | 34,353 | | 2,440 |

SABMiller PLC | 120,224 | | 6,971 |

The Coca-Cola Co. | 136,336 | | 5,775 |

| | 15,186 |

Food & Staples Retailing - 0.9% |

Costco Wholesale Corp. | 53,700 | | 6,184 |

Sprouts Farmers Market LLC | 15,090 | | 494 |

Whole Foods Market, Inc. | 105,351 | | 4,070 |

| | 10,748 |

Food Products - 4.2% |

Keurig Green Mountain, Inc. | 305,872 | | 38,115 |

Mead Johnson Nutrition Co. Class A | 84,329 | | 7,857 |

The Hershey Co. | 77,697 | | 7,565 |

| | 53,537 |

Household Products - 1.6% |

Procter & Gamble Co. | 256,686 | | 20,173 |

Personal Products - 0.8% |

Estee Lauder Companies, Inc. Class A | 25,500 | | 1,894 |

Herbalife Ltd. | 135,333 | | 8,734 |

| | 10,628 |

TOTAL CONSUMER STAPLES | | 110,272 |

ENERGY - 8.7% |

Energy Equipment & Services - 3.4% |

Dril-Quip, Inc. (a) | 42,458 | | 4,638 |

Halliburton Co. | 291,500 | | 20,699 |

Oceaneering International, Inc. | 104,756 | | 8,185 |

Pason Systems, Inc. | 134,806 | | 3,790 |

RigNet, Inc. (a) | 104,061 | | 5,601 |

| | 42,913 |

Common Stocks - continued |

| Shares | | Value (000s) |

ENERGY - continued |

Oil, Gas & Consumable Fuels - 5.3% |

Cheniere Energy, Inc. (a) | 106,700 | | $ 7,650 |

Continental Resources, Inc. (a)(d) | 68,126 | | 10,767 |

EOG Resources, Inc. | 73,500 | | 8,589 |

EQT Midstream Partners LP | 38,200 | | 3,695 |

Golar LNG Ltd. | 161,461 | | 9,704 |

Markwest Energy Partners LP | 46,800 | | 3,350 |

Noble Energy, Inc. | 50,600 | | 3,919 |

Phillips 66 Partners LP | 103,504 | | 7,821 |

Pioneer Natural Resources Co. | 26,700 | | 6,136 |

Targa Resources Corp. | 36,439 | | 5,086 |

| | 66,717 |

TOTAL ENERGY | | 109,630 |

FINANCIALS - 7.6% |

Banks - 0.9% |

HDFC Bank Ltd. sponsored ADR | 259,155 | | 12,134 |

Capital Markets - 5.0% |

BlackRock, Inc. Class A | 23,394 | | 7,477 |

E*TRADE Financial Corp. (a) | 395,759 | | 8,414 |

Fortress Investment Group LLC | 166,100 | | 1,236 |

Harvest Capital Credit Corp. (d) | 26,130 | | 388 |

Invesco Ltd. | 337,384 | | 12,736 |

KKR & Co. LP | 146,609 | | 3,567 |

Legg Mason, Inc. | 98,300 | | 5,044 |

The Blackstone Group LP | 718,619 | | 24,031 |

| | 62,893 |

Consumer Finance - 0.7% |

American Express Co. | 70,084 | | 6,649 |

Shriram Transport Finance Co. Ltd. | 118,502 | | 1,786 |

| | 8,435 |

Diversified Financial Services - 0.8% |

Berkshire Hathaway, Inc. Class B (a) | 23,600 | | 2,987 |

McGraw Hill Financial, Inc. | 87,612 | | 7,274 |

| | 10,261 |

Common Stocks - continued |

| Shares | | Value (000s) |

FINANCIALS - continued |

Real Estate Management & Development - 0.2% |

Leopalace21 Corp. (a) | 73,800 | | $ 381 |

Realogy Holdings Corp. (a) | 47,381 | | 1,787 |

| | 2,168 |

TOTAL FINANCIALS | | 95,891 |

HEALTH CARE - 14.5% |

Biotechnology - 9.5% |

Acceleron Pharma, Inc. | 48,400 | | 1,644 |

Actelion Ltd. | 17,384 | | 2,199 |

Alexion Pharmaceuticals, Inc. (a) | 52,594 | | 8,218 |

Biogen Idec, Inc. (a) | 71,579 | | 22,570 |

BioMarin Pharmaceutical, Inc. (a) | 89,996 | | 5,599 |

Cytokinetics, Inc. warrants 6/25/17 (a) | 288,420 | | 6 |

Enanta Pharmaceuticals, Inc. (a)(d) | 105,984 | | 4,565 |

Gilead Sciences, Inc. (a) | 641,363 | | 53,175 |

Insmed, Inc. (a) | 295,678 | | 5,908 |

Kamada (a) | 45,784 | | 326 |

Ophthotech Corp. | 48,445 | | 2,050 |

uniQure B.V. | 33,635 | | 457 |

Vanda Pharmaceuticals, Inc. (a) | 209,048 | | 3,382 |

Vertex Pharmaceuticals, Inc. (a) | 101,400 | | 9,601 |

| | 119,700 |

Health Care Equipment & Supplies - 0.5% |

AxoGen, Inc. (a) | 27,515 | | 76 |

GI Dynamics, Inc. CDI (a) | 161,679 | | 88 |

The Cooper Companies, Inc. | 45,107 | | 6,113 |

| | 6,277 |

Health Care Providers & Services - 0.4% |

Apollo Hospitals Enterprise Ltd. | 119,708 | | 1,983 |

Qualicorp SA (a) | 246,000 | | 2,906 |

| | 4,889 |

Health Care Technology - 0.1% |

Cerner Corp. (a) | 35,913 | | 1,852 |

Life Sciences Tools & Services - 0.8% |

Illumina, Inc. (a) | 57,526 | | 10,271 |

Pharmaceuticals - 3.2% |

AbbVie, Inc. | 152,602 | | 8,613 |

Actavis PLC (a) | 108,377 | | 24,173 |

Common Stocks - continued |

| Shares | | Value (000s) |

HEALTH CARE - continued |

Pharmaceuticals - continued |

AVANIR Pharmaceuticals Class A (a) | 260,300 | | $ 1,468 |

Perrigo Co. PLC | 40,432 | | 5,893 |

| | 40,147 |

TOTAL HEALTH CARE | | 183,136 |

INDUSTRIALS - 10.5% |

Aerospace & Defense - 2.4% |

TransDigm Group, Inc. | 54,527 | | 9,120 |

United Technologies Corp. | 186,612 | | 21,544 |

| | 30,664 |

Airlines - 0.2% |

Ryanair Holdings PLC sponsored ADR (a) | 36,953 | | 2,062 |

Building Products - 0.4% |

A.O. Smith Corp. | 102,544 | | 5,084 |

Commercial Services & Supplies - 0.5% |

KAR Auction Services, Inc. | 219,398 | | 6,992 |

Construction & Engineering - 0.5% |

Jacobs Engineering Group, Inc. (a) | 99,891 | | 5,322 |

MasTec, Inc. (a) | 18,300 | | 564 |

| | 5,886 |

Electrical Equipment - 0.6% |

AMETEK, Inc. | 88,945 | | 4,650 |

Power Solutions International, Inc. (a) | 34,221 | | 2,463 |

| | 7,113 |

Industrial Conglomerates - 2.4% |

Danaher Corp. | 300,255 | | 23,639 |

Roper Industries, Inc. | 43,614 | | 6,368 |

| | 30,007 |

Machinery - 2.4% |

Allison Transmission Holdings, Inc. | 161,000 | | 5,007 |

Caterpillar, Inc. | 89,034 | | 9,675 |

Manitowoc Co., Inc. | 365,847 | | 12,022 |

Sarine Technologies Ltd. | 564,000 | | 1,162 |

Sun Hydraulics Corp. | 14,500 | | 589 |

Weg SA | 115,960 | | 1,485 |

| | 29,940 |

Common Stocks - continued |

| Shares | | Value (000s) |

INDUSTRIALS - continued |

Professional Services - 0.6% |

Verisk Analytics, Inc. (a) | 103,867 | | $ 6,234 |

WageWorks, Inc. (a) | 28,855 | | 1,391 |

| | 7,625 |

Road & Rail - 0.5% |

J.B. Hunt Transport Services, Inc. | 92,600 | | 6,832 |

TOTAL INDUSTRIALS | | 132,205 |

INFORMATION TECHNOLOGY - 27.8% |

Communications Equipment - 0.5% |

QUALCOMM, Inc. | 74,600 | | 5,908 |

Electronic Equipment & Components - 0.7% |

TE Connectivity Ltd. | 138,863 | | 8,587 |

Internet Software & Services - 15.5% |

Cornerstone OnDemand, Inc. (a) | 63,903 | | 2,941 |

CoStar Group, Inc. (a) | 9,900 | | 1,566 |

Cvent, Inc. (d) | 151,731 | | 4,414 |

Demandware, Inc. (a) | 48,000 | | 3,330 |

Facebook, Inc. Class A (a) | 1,395,991 | | 93,936 |

Google, Inc.: | | | |

Class A (a) | 51,752 | | 30,258 |

Class C (a) | 51,752 | | 29,772 |

Naver Corp. | 11,346 | | 9,362 |

SPS Commerce, Inc. (a) | 62,372 | | 3,941 |

Textura Corp. (d) | 286,739 | | 6,779 |

Xoom Corp. (a) | 16,800 | | 443 |

Yahoo!, Inc. (a) | 246,759 | | 8,669 |

| | 195,411 |

IT Services - 2.1% |

Gartner, Inc. Class A (a) | 97,798 | | 6,897 |

Visa, Inc. Class A | 96,724 | | 20,381 |

| | 27,278 |

Semiconductors & Semiconductor Equipment - 0.3% |

M/A-COM Technology Solutions, Inc. (a) | 23,100 | | 519 |

MediaTek, Inc. | 175,000 | | 2,958 |

| | 3,477 |

Software - 6.2% |

Activision Blizzard, Inc. | 97,687 | | 2,178 |

ANSYS, Inc. (a) | 1,222 | | 93 |

Common Stocks - continued |

| Shares | | Value (000s) |

INFORMATION TECHNOLOGY - continued |

Software - continued |

Computer Modelling Group Ltd. | 138,200 | | $ 3,836 |

Electronic Arts, Inc. (a) | 322,634 | | 11,573 |

Fleetmatics Group PLC (a) | 40,850 | | 1,321 |

Microsoft Corp. | 535,100 | | 22,314 |

salesforce.com, Inc. (a) | 363,864 | | 21,133 |

ServiceNow, Inc. (a) | 27,200 | | 1,685 |

SolarWinds, Inc. (a) | 75,481 | | 2,918 |

Solera Holdings, Inc. | 20,000 | | 1,343 |

SS&C Technologies Holdings, Inc. (a) | 192,320 | | 8,504 |

The Rubicon Project, Inc. | 70,546 | | 906 |

| | 77,804 |

Technology Hardware, Storage & Peripherals - 2.5% |

Apple, Inc. | 307,146 | | 28,543 |

Nimble Storage, Inc. (d) | 104,300 | | 3,204 |

| | 31,747 |

TOTAL INFORMATION TECHNOLOGY | | 350,212 |

MATERIALS - 4.8% |

Chemicals - 2.3% |

FMC Corp. | 94,042 | | 6,695 |

Monsanto Co. | 69,788 | | 8,705 |

Sherwin-Williams Co. | 47,095 | | 9,744 |

Westlake Chemical Corp. | 46,050 | | 3,857 |

| | 29,001 |

Construction Materials - 2.5% |

CaesarStone Sdot-Yam Ltd. | 13,200 | | 648 |

Eagle Materials, Inc. | 194,598 | | 18,347 |

James Hardie Industries PLC sponsored ADR | 52,527 | | 3,434 |

Vulcan Materials Co. | 151,624 | | 9,666 |

| | 32,095 |

TOTAL MATERIALS | | 61,096 |

TELECOMMUNICATION SERVICES - 0.1% |

Diversified Telecommunication Services - 0.1% |

8x8, Inc. (a) | 178,860 | | 1,445 |

Common Stocks - continued |

| Shares | | Value (000s) |

UTILITIES - 0.3% |

Electric Utilities - 0.3% |

ITC Holdings Corp. | 102,774 | | $ 3,749 |

TOTAL COMMON STOCKS (Cost $942,590) |

1,238,354

|

Convertible Preferred Stocks - 0.3% |

| | | |

CONSUMER DISCRETIONARY - 0.1% |

Household Durables - 0.1% |

Blu Homes, Inc. Series A, 5.00% (f) | 239,736 | | 1,108 |

INFORMATION TECHNOLOGY - 0.2% |

Internet Software & Services - 0.2% |

Uber Technologies, Inc. 8.00% (f) | 40,643 | | 2,522 |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $3,630) |

3,630

|

U.S. Treasury Obligations - 0.1% |

| Principal Amount (000s) | | |

U.S. Treasury Bills, yield at date of purchase 0.02% 7/31/14 (e)

(Cost $990) | | $ 990 | |

990

|

Money Market Funds - 4.0% |

| Shares | | |

Fidelity Cash Central Fund, 0.11% (b) | 21,110,428 | | 21,110 |

Fidelity Securities Lending Cash Central Fund, 0.10% (b)(c) | 29,500,646 | | 29,501 |

TOTAL MONEY MARKET FUNDS (Cost $50,611) |

50,611

|

TOTAL INVESTMENT PORTFOLIO - 102.5% (Cost $997,821) | 1,293,585 |

NET OTHER ASSETS (LIABILITIES) - (2.5)% | (31,147) |

NET ASSETS - 100% | $ 1,262,438 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Purchased |

Equity Index Contracts |

168 ICE Russell 1000 Growth Index Contracts | Sept. 2014 | | $ 15,253 | | $ 249 |

12 ICE Russell 2000 Index Contracts | Sept. 2014 | | 1,428 | | 42 |

TOTAL EQUITY INDEX CONTRACTS | | $ 16,681 | | $ 291 |

|

The face value of futures purchased as a percentage of net assets is 1.3% |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $450,000. |

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $4,580,000 or 0.4% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost (000s) |

Blu Homes, Inc. Series A, 5.00% | 6/21/13 | $ 1,108 |

NJOY, Inc. | 9/11/13 | $ 454 |

Uber Technologies, Inc. 8.00% | 6/6/14 | $ 2,522 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 38 |

Fidelity Securities Lending Cash Central Fund | 257 |

Total | $ 295 |

Other Information |

The following is a summary of the inputs used, as of June 30, 2014, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 191,826 | $ 189,768 | $ - | $ 2,058 |

Consumer Staples | 110,272 | 110,272 | - | - |

Energy | 109,630 | 109,630 | - | - |

Financials | 95,891 | 95,510 | 381 | - |

Health Care | 183,136 | 183,130 | 6 | - |

Industrials | 132,205 | 132,205 | - | - |

Information Technology | 352,734 | 350,212 | - | 2,522 |

Materials | 61,096 | 61,096 | - | - |

Telecommunication Services | 1,445 | 1,445 | - | - |

Utilities | 3,749 | 3,749 | - | - |

U.S. Government and Government Agency Obligations | 990 | - | 990 | - |

Money Market Funds | 50,611 | 50,611 | - | - |

Total Investments in Securities: | $ 1,293,585 | $ 1,287,628 | $ 1,377 | $ 4,580 |

Derivative Instruments: | | | | |

Assets | | | | |

Futures Contracts | $ 291 | $ 291 | $ - | $ - |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of June 30, 2014. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Primary Risk Exposure /

Derivative Type | Value

(Amount in thousands) |

| Asset | Liability |

Equity Risk | | |

Futures Contracts (a) | $ 291 | $ - |

Total Value of Derivatives | $ 291 | $ - |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows (Unaudited): |

United States of America | 89.0% |

Ireland | 3.0% |

Bermuda | 1.8% |

India | 1.3% |

Others (Individually Less Than 1%) | 4.9% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | June 30, 2014 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $28,932) - See accompanying schedule: Unaffiliated issuers (cost $947,210) | $ 1,242,974 | |

Fidelity Central Funds (cost $50,611) | 50,611 | |

Total Investments (cost $997,821) | | $ 1,293,585 |

Receivable for investments sold | | 5,110 |

Receivable for fund shares sold | | 2,712 |

Dividends receivable | | 559 |

Distributions receivable from Fidelity Central Funds | | 22 |

Receivable for daily variation margin for derivative instruments | | 27 |

Other receivables | | 28 |

Total assets | | 1,302,043 |

| | |

Liabilities | | |

Payable for investments purchased | $ 8,331 | |

Payable for fund shares redeemed | 945 | |

Accrued management fee | 573 | |

Other affiliated payables | 194 | |

Other payables and accrued expenses | 61 | |

Collateral on securities loaned, at value | 29,501 | |

Total liabilities | | 39,605 |

| | |

Net Assets | | $ 1,262,438 |

Net Assets consist of: | | |

Paid in capital | | $ 1,253,738 |

Undistributed net investment income | | 717 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (288,062) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 296,045 |

Net Assets | | $ 1,262,438 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | June 30, 2014 |

| | |

Growth Discovery:

Net Asset Value, offering price and redemption price per share ($1,072,065 ÷ 46,465 shares) | | $ 23.07 |

| | |

Class K:

Net Asset Value, offering price and redemption price per share ($190,373 ÷ 8,244 shares) | | $ 23.09 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

Amounts in thousands | Year ended June 30, 2014 |

| | |

Investment Income | | |

Dividends | | $ 9,764 |

Income from Fidelity Central Funds | | 295 |

Total income | | 10,059 |

| | |

Expenses | | |

Management fee

Basic fee | $ 6,098 | |

Performance adjustment | 289 | |

Transfer agent fees | 1,805 | |

Accounting and security lending fees | 370 | |

Custodian fees and expenses | 68 | |

Independent trustees' compensation | 5 | |

Registration fees | 58 | |

Audit | 57 | |

Legal | 6 | |

Miscellaneous | 9 | |

Total expenses before reductions | 8,765 | |

Expense reductions | (39) | 8,726 |

Net investment income (loss) | | 1,333 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 168,737 | |

Foreign currency transactions | (31) | |

Futures contracts | 1,344 | |

Total net realized gain (loss) | | 170,050 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 124,386 | |

Futures contracts | 291 | |

Total change in net unrealized appreciation (depreciation) | | 124,677 |

Net gain (loss) | | 294,727 |

Net increase (decrease) in net assets resulting from operations | | $ 296,060 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Year ended

June 30,

2014 | Year ended

June 30,

2013 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 1,333 | $ 4,187 |

Net realized gain (loss) | 170,050 | 115,817 |

Change in net unrealized appreciation (depreciation) | 124,677 | 20,585 |

Net increase (decrease) in net assets resulting

from operations | 296,060 | 140,589 |

Distributions to shareholders from net investment income | (1,240) | (3,920) |

Distributions to shareholders from net realized gain | (308) | - |

Total distributions | (1,548) | (3,920) |

Share transactions - net increase (decrease) | 64,284 | (251,662) |

Total increase (decrease) in net assets | 358,796 | (114,993) |

| | |

Net Assets | | |

Beginning of period | 903,642 | 1,018,635 |

End of period (including undistributed net investment income of $717 and undistributed net investment income of $1,230, respectively) | $ 1,262,438 | $ 903,642 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Growth Discovery

Years ended June 30, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 17.45 | $ 15.09 | $ 14.88 | $ 10.54 | $ 9.04 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .02 | .07 | .04 | .05 | .01 |

Net realized and unrealized gain (loss) | 5.63 | 2.35 | .26 | 4.37 | 1.52 |

Total from investment operations | 5.65 | 2.42 | .30 | 4.42 | 1.53 |

Distributions from net investment income | (.02) | (.06) | (.03) | (.03) | (.03) |

Distributions from net realized gain | (.01) | - | (.06) | (.05) | (.01) |

Total distributions | (.03) | (.06) | (.09) | (.08) | (.03)F |

Net asset value, end of period | $ 23.07 | $ 17.45 | $ 15.09 | $ 14.88 | $ 10.54 |

Total ReturnA | 32.40% | 16.09% | 2.07% | 42.09% | 16.96% |

Ratios to Average Net Assets C, E | | | | | |

Expenses before reductions | .81% | .88% | .81% | .63% | .76% |

Expenses net of fee waivers, if any | .81% | .88% | .81% | .63% | .76% |

Expenses net of all reductions | .81% | .87% | .80% | .62% | .75% |

Net investment income (loss) | .10% | .42% | .27% | .39% | .08% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 1,072 | $ 767 | $ 875 | $ 932 | $ 604 |

Portfolio turnover rateD | 70% | 62% | 74% | 72% | 87% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Total distributions of $.03 per share is comprised of distributions from net investment income of $.027 and distributions from net realized gain of $.005 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class K

Years ended June 30, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 17.45 | $ 15.09 | $ 14.88 | $ 10.55 | $ 9.05 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .05 | .09 | .06 | .08 | .03 |

Net realized and unrealized gain (loss) | 5.63 | 2.36 | .26 | 4.36 | 1.53 |

Total from investment operations | 5.68 | 2.45 | .32 | 4.44 | 1.56 |

Distributions from net investment income | (.04) | (.09) | (.06) | (.06) | (.05) |

Distributions from net realized gain | (.01) | - | (.06) | (.05) | (.01) |

Total distributions | (.04)H | (.09) | (.11)G | (.11) | (.06)F |

Net asset value, end of period | $ 23.09 | $ 17.45 | $ 15.09 | $ 14.88 | $ 10.55 |

Total ReturnA | 32.62% | 16.28% | 2.27% | 42.26% | 17.25% |

Ratios to Average Net Assets C, E | | | | | |

Expenses before reductions | .68% | .72% | .64% | .44% | .53% |

Expenses net of fee waivers, if any | .68% | .72% | .64% | .44% | .53% |

Expenses net of all reductions | .67% | .71% | .63% | .43% | .52% |

Net investment income (loss) | .24% | .58% | .44% | .58% | .31% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 190 | $ 137 | $ 144 | $ 147 | $ 43 |

Portfolio turnover rateD | 70% | 62% | 74% | 72% | 87% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Total distributions of $.06 per share is comprised of distributions from net investment income of $.054 and distributions from net realized gain of $.005 per share.

G Total distributions of $.11 per share is comprised of distributions from net investment income of $.058 and distributions from net realized gain of $.055 per share.

H Total distributions of $.04 per share is comprised of distributions from net investment income of $.036 and distributions from net realized gain of $.006 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended June 30, 2014

(Amounts in thousands except percentages)

1. Organization.

Fidelity Growth Discovery Fund (the Fund) is a fund of Fidelity Hastings Street Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Growth Discovery and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Annual Report

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Investment Valuation - continued

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of June 30, 2014, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified

Annual Report

3. Significant Accounting Policies - continued

Investment Transactions and Income - continued

cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of June 30, 2014, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, foreign currency transactions, partnerships, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 305,020 |

Gross unrealized depreciation | (11,882) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 293,138 |

| |

Tax Cost | $ 1,000,447 |

The tax-based components of distributable earnings as of period end were as follows:

Undistributed ordinary income | $ 717 |

Capital loss carryforward | $ (285,145) |

Net unrealized appreciation (depreciation) | $ 293,128 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Fiscal year of expiration | |

2017 | $ (24,714) |

2018 | (260,431) |

Total capital loss carryforward | $ (285,145) |

The tax character of distributions paid was as follows:

| June 30, 2014 | June 30, 2013 |

Ordinary Income | $ 1,548 | $ 3,920 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

4. Derivative Instruments - continued

Risk Exposures and the Use of Derivative Instruments - continued

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin for derivative instruments in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts." The underlying face amount at value reflects each contract's exposure to the underlying instrument or index at period end and is representative of volume of activity during the period. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

During the period the Fund recognized net realized gain (loss) of $1,344 and a change in net unrealized appreciation (depreciation) of $291 related to its investment in futures contracts. These amounts are included in the Statement of Operations.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $805,090 and $750,433, respectively.

Annual Report

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Growth Discovery as compared to its benchmark index, the Russell 3000 Growth Index, over the same 36 month performance period. For the reporting period, the total annual management fee rate, including the performance adjustment, was .58% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Growth Discovery. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of

Average

Net Assets |

Growth Discovery | $ 1,728 | .18 |

Class K | 77 | .05 |

| $ 1,805 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

6. Fees and Other Transactions with Affiliates - continued

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser or Sub-adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $11 for the period.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $2 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. At period end, there were no security loans outstanding with FCM. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $257, including $2 from securities loaned to FCM.

Annual Report

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $28 for the period.

In addition, the investment adviser reimbursed a portion of the Fund's operating expenses during the period in the amount of $11.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended June 30, | 2014 | 2013 |

From net investment income | | |

Growth Discovery | $ 959 | $ 3,196 |

Class K | 281 | 724 |

Total | $ 1,240 | $ 3,920 |

From net realized gain | | |

Growth Discovery | $ 261 | $ - |

Class K | 47 | - |

Total | $ 308 | $ - |

11. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended June 30, | 2014 | 2013 | 2014 | 2013 |

Growth Discovery | | | | |

Shares sold | 11,432 | 5,161 | $ 240,406 | $ 82,537 |

Reinvestment of distributions | 61 | 198 | 1,152 | 3,039 |

Shares redeemed | (8,980) | (19,383) | (186,625) | (309,727) |

Net increase (decrease) | 2,513 | (14,024) | $ 54,933 | $ (224,151) |

Class K | | | | |

Shares sold | 2,259 | 3,128 | $ 47,861 | $ 49,663 |

Reinvestment of distributions | 17 | 47 | 328 | 724 |

Shares redeemed | (1,868) | (4,878) | (38,838) | (77,898) |

Net increase (decrease) | 408 | (1,703) | $ 9,351 | $ (27,511) |

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Annual Report

To the Trustees of Fidelity Hastings Street Trust and the Shareholders of Fidelity Growth Discovery Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Growth Discovery Fund (a fund of Fidelity Hastings Street Trust) at June 30, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fidelity Growth Discovery Fund's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2014 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

August 11, 2014

Annual Report

The Trustees, Member of the Advisory Board, and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for James C. Curvey, each of the Trustees oversees 173 funds. Mr. Curvey oversees 397 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The officers and Advisory Board Member hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

Experience, Skills, Attributes, and Qualifications of the Fund's Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Annual Report

Board Structure and Oversight Function. James C. Curvey is an interested person (as defined in the 1940 Act) and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's equity and high income funds and another Board oversees Fidelity's investment-grade bond, money market, and asset allocation funds. The asset allocation funds may invest in Fidelity funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity funds overseen by each Board.