As filed with the Securities and Exchange Commission on January 6, 2021

Registration No. 33-

(Investment Company Act Registration No. 811-00215)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

| | Pre-Effective Amendment No. | | ☐ |

| | Post-Effective Amendment No. | | ☐ |

Fidelity Hastings Street Trust

(Exact Name of Registrant as Specified in Charter)

Registrant’s Telephone Number (617) 563-7000

245 Summer St., Boston, MA 02210

(Address Of Principal Executive Offices)

Cynthia Lo Bessette, Secretary

245 Summer Street

Boston, MA 02210

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933.

The Registrant has registered an indefinite amount of securities under the Securities Act of 1933 pursuant to Section 24(f) under the Investment Company Act of 1940; accordingly, no fee is payable herewith because of reliance upon Section 24(f).

It is proposed that this filing will become effective on February 5, 2021, pursuant to Rule 488.

FIDELITY® EXPORT AND MULTINATIONAL FUND

A SERIES OF

FIDELITY SUMMER STREET TRUST

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544 (RETAIL CLASS)

1-800-835-5092 (CLASS K)

To the Shareholders of Fidelity® Export and Multinational Fund:

Enclosed is important information concerning your investment in Fidelity® Export and Multinational Fund. We wish to inform you that the Board of Trustees (the Board) of Fidelity Summer Street Trust (the Trust), after careful consideration, has approved an Agreement and Plan of Reorganization providing for the transfer of all of the assets of Fidelity® Export and Multinational Fund to Fidelity® Fund, a series of Fidelity Hasting Street Trust, that has the same investment objective and substantially similar investment strategies, in exchange solely for corresponding shares of beneficial interest of Fidelity® Fund and the assumption by Fidelity® Fund of Fidelity® Export and Multinational Fund’s liabilities, in complete liquidation of Fidelity® Export and Multinational Fund.

The attached combined Prospectus/Information Statement describes the Reorganization in greater detail and contains important information about Fidelity® Fund. The Board of each Trust believes that this Reorganization will benefit shareholders.

Following the close of business on April 16, 2021, Fidelity® Export and Multinational Fund will be reorganized into Fidelity® Fund.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE TRANSACTION WILL NOT REQUIRE ANY ACTION ON YOUR PART. You will automatically receive shares of Fidelity® Fund in exchange for your shares of Fidelity® Export and Multinational Fund as of the closing date. If, after reviewing the information contained in the enclosed Prospectus/Information Statement, you do not wish to receive shares of the Fidelity® Fund pursuant to the Reorganization, you may redeem your shares of the Fidelity® Export and Multinational Fund at any time prior to the close of business on April 16, 2021. Keep in mind that any such redemption may have tax consequences and you should consult your tax advisor. If you have questions, you may contact us at 1-800-544-8544 (Retail Class) or 1-800-835-5092 (Class K). If you invest through another financial institution, such as a brokerage firm, please contact your financial institution should you have any questions.

By order of the Board of Trustees,

CYNTHIA LO BESSETTE, Secretary

March 5, 2021

FIDELITY® EXPORT AND MULTINATIONAL FUND

A SERIES OF

FIDELITY SUMMER STREET TRUST

FIDELITY® FUND

A SERIES OF

FIDELITY HASTINGS STREET TRUST

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-800-544-8544 (RETAIL CLASS)

1-800-835-5092 (CLASS K)

INFORMATION STATEMENT AND PROSPECTUS

MARCH 5, 2021

This combined Information Statement and Prospectus (Information Statement) is furnished to shareholders of Fidelity® Export and Multinational Fund, a series of Fidelity Summer Street Trust, in connection with a separate Agreement and Plan of Reorganization (the Agreement) for Fidelity® Export and Multinational Fund that has been approved by the Board of Trustees (the Board) of Fidelity Summer Street Trust.

As more fully described in the Information Statement, the transaction contemplated by the Agreement is referred to as the Reorganization. When the Reorganization occurs, each shareholder of Fidelity® Export and Multinational Fund will become a shareholder of Fidelity® Fund. Fidelity® Export and Multinational Fund will transfer all of its assets to Fidelity® Fund in exchange solely for shares of beneficial interest of Fidelity® Fund and the assumption by Fidelity® Fund of Fidelity® Export and Multinational Fund’s liabilities in complete liquidation of the fund. The total value of your fund holdings will not change as a result of the Reorganization. The Reorganization is currently scheduled to take place as of the close of business of the New York Stock Exchange (the NYSE) on April 16, 2021, or such other time and date as the parties may agree (the Closing Date).

Fidelity® Fund (together with Fidelity® Export and Multinational Fund, the funds), an equity fund, is a diversified series of Fidelity Hastings Street Trust, an open-end management investment company registered with the Securities and Exchange Commission (the SEC). Fidelity® Fund seeks long-term capital growth. Fidelity® Fund seeks to achieve its investment objective by normally investing primarily in common stocks.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS INFORMATION STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Information Statement sets forth concisely the information about the Reorganization and Fidelity® Fund that shareholders should know. Please read it carefully and keep it for future reference.

The following documents have been filed with the SEC and are incorporated into this Information Statement by reference, which means they are part of this Information Statement for legal purposes:

(i) the Statement of Additional Information dated March 5, 2021, relating to this Information Statement;

(ii) the Prospectus for Fidelity® Fund dated August 29, 2020, relating to Fidelity® Fund shares, a Retail Class of Fidelity® Fund, a copy of which, if applicable, accompanies this Information Statement;

(iii) the Prospectus for Fidelity® Fund dated August 29, 2020, relating to Class K shares, a copy of which, if applicable, accompanies this Information Statement;

(iv) the Statement of Additional Information for Fidelity® Fund dated August 29, 2020, relating to Fidelity® Fund shares, a Retail Class of Fidelity® Fund;

1

(v) the Statement of Additional Information for Fidelity® Fund dated August 29, 2020, relating to Class K shares;

(vi) the Prospectus for Fidelity® Export and Multinational Fund dated October 30, 2020, as supplemented, relating to Fidelity® Export and Multinational Fund shares, a Retail Class of Fidelity® Export and Multinational Fund;

(vii) the Prospectus for Fidelity® Export and Multinational Fund dated October 30, 2020, as supplemented, relating to Class K shares;

(viii) the Statement of Additional Information for Fidelity® Export and Multinational Fund dated October 30, 2020, relating to Fidelity® Export and Multinational Fund shares, a Retail Class of Fidelity® Export and Multinational Fund; and

(ix) the Statement of Additional Information for Fidelity® Export and Multinational Fund dated October 30, 2020, relating to Class K shares.

You can obtain copies of the funds’ current Prospectuses, Statements of Additional Information, or annual or semiannual reports without charge by contacting Fidelity Summer Street Trust or Fidelity Hastings Street Trust at Fidelity Distributors Company LLC (FDC), 900 Salem Street, Smithfield, Rhode Island 02917, by calling 1-800-544-8544 (Retail Class) or 1-800-835-5092 (Class K), or by logging on to www.fidelity.com (Retail Class) or visiting www.401k.com and logging in (Class K).

Fidelity Summer Street Trust and Fidelity Hastings Street Trust are subject to the informational requirements of the Securities and Exchange Act of 1934, as amended. Accordingly, each must file proxy material, reports, and other information with the SEC. You can review and copy such information at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington D.C. 20549, the SEC’s Northeast Regional Office, 200 Vesey Street, Suite 400, New York, NY 10281-1022, and the SEC’s Midwest Regional Office, 175 W. Jackson Blvd., Suite 1450, Chicago, IL 60604. Such information is also available from the EDGAR database on the SEC’s web site at http://www.sec.gov. You can also obtain copies of such information, after paying a duplicating fee, by sending a request by e-mail to publicinfo@sec.gov or by writing the SEC’s Public Reference Room, Office of Consumer Affairs and Information Services, Washington, DC 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-202-551-8090.

An investment in the funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the funds.

2

TABLE OF CONTENTS

3

SYNOPSIS

The following is a summary of certain information contained elsewhere in this Information Statement, in the Agreement, and/or in the Prospectuses and Statements of Additional Information of Fidelity® Export and Multinational Fund and Fidelity® Fund, which are incorporated herein by reference. Shareholders should read the entire Information Statement and the Prospectus of Fidelity® Fund carefully for more complete information.

What is involved in the Reorganization?

As more fully described in “The Transaction” below, the Board of Fidelity Summer Street Trust has approved the Reorganization of Fidelity® Export and Multinational Fund into Fidelity® Fund, a series of Fidelity Hastings Street Trust. You are receiving this Information Statement because you are a shareholder of Fidelity® Export and Multinational Fund and will be impacted by the Reorganization.

When the Reorganization occurs, each shareholder of Fidelity® Export and Multinational Fund will become a shareholder of Fidelity® Fund instead. Fidelity® Export and Multinational Fund will transfer all of its assets to Fidelity® Fund in exchange solely for shares of beneficial interest of Fidelity® Fund and the assumption by Fidelity® Fund of Fidelity® Export and Multinational Fund’s liabilities in complete liquidation of the fund. Each shareholder of Fidelity® Export and Multinational Fund will receive shares of the corresponding class of Fidelity® Fund. The Reorganization is currently scheduled to take place as of the close of business of the NYSE on the Closing Date.

For more information, please refer to the section entitled “The Transaction – Agreement and Plan of Reorganization.”

Has the Board of Trustees approved the Reorganization?

Yes. The fund’s Board of Trustees has carefully reviewed and approved the Agreement and the Reorganization.

What am I being asked to vote on?

We are not asking you for a proxy and you are requested not to send us a proxy.

What are the reasons for the Reorganization?

The Board of Trustees considered the following factors, among others, in determining to approve the Agreement:

| | • | | The Reorganization will permit Fidelity® Export and Multinational Fund shareholders to pursue the same investment objective in a larger and more successful fund. |

| | • | | Fidelity® Export and Multinational Fund’s investment thesis is outdated in an increasingly global economy, while Fidelity® Fund is managed similarly by the same portfolio manager against the same benchmark, and has slightly broader investment strategies. |

| | • | | Fidelity® Export and Multinational Fund shareholders are expected to benefit from an expense reduction, including a decrease of 21 basis points in management fees due to the benefit of Fidelity® Fund’s lower management fee and from spreading fixed costs over a larger asset base. |

| | • | | The Reorganization will qualify as a tax-free Reorganization for federal income tax purposes. |

For more information, please refer to the section entitled “The Transaction – Reasons for the Reorganization.”

How will you determine the number of shares of Fidelity® Fund that I will receive?

Although the number of shares you own will most likely change, the total value of your holdings will not change as a result of the Reorganization. As provided in the Agreement, Fidelity® Export and Multinational Fund will distribute shares of Fidelity® Fund to its shareholders so that each shareholder will receive the number of full and fractional shares of Fidelity® Fund equal in value to the net asset value of shares of Fidelity® Export and Multinational Fund held by such shareholder on the Closing Date.

4

For more information, please refer to the section entitled “The Transaction – Agreement and Plan of Reorganization.”

What class of shares of Fidelity® Fund will I receive?

Holders of Fidelity® Export and Multinational Fund (Retail Class) and Class K shares of Fidelity® Export and Multinational Fund will receive Fidelity® Fund (Retail Class) and Class K shares of Fidelity® Fund, respectively.

Is the Reorganization considered a taxable event for federal income tax purposes?

No. Each fund will receive an opinion of counsel that the Reorganization will not result in any gain or loss for federal income tax purposes to either fund or to the shareholders of either fund, except that Fidelity® Export and Multinational Fund may recognize gain or loss with respect to assets (if any) that are subject to “mark-to-market” tax accounting.

For more information, please refer to the section entitled “The Transaction – Federal Income Tax Considerations.”

How do the funds’ investment objectives, strategies, policies, and limitations compare?

The funds have the same investment objective. Each fund seeks long-term capital growth. Each fund’s investment objective is non-fundamental and does not require shareholder approval to change.

Although the funds have substantially similar principal investment strategies, there are some differences of which you should be aware. The following compares the principal investment strategies of Fidelity® Export and Multinational Fund and Fidelity® Fund:

| | |

Fidelity® Export and Multinational Fund | | Fidelity® Fund |

| |

| Fidelity Management & Research Company LLC (FMR or the Adviser) normally invests the fund’s assets primarily in common stocks. | | Same principal strategy. |

| |

| No corresponding principal strategy. | | The Adviser may from time to time invest a portion of the fund’s assets in bonds, including lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds). |

| |

| The Adviser normally invests the fund’s assets primarily in securities of export and multinational companies. The Adviser defines export companies to include companies that derive, or the Adviser anticipates will derive, 10% or more of their annual revenues from sales of exported goods or services or that engage in export-related businesses, such as export trading or export management companies. The Adviser defines multinational companies to include | | No corresponding principal strategy. |

5

| | |

| companies that derive a substantial portion of their revenues or profits from foreign operations or that have a substantial portion of their assets abroad. | | |

| |

| No corresponding principal strategy. | | The Adviser may invest the fund’s assets in securities of foreign issuers in addition to securities of domestic issuers. |

| |

| The Adviser may also invest the fund’s assets in securities of foreign issuers and in securities of U.S. companies that are not export or multinational companies. | | No corresponding principal strategy. |

| |

| The fund’s strategy is based on the premise that U.S. export and multinational companies may be well positioned for growth because they often offer products or services that are unique, of higher quality, or less expensive than comparable products or services. | | No corresponding principal strategy. |

| |

| The Adviser is not constrained by any particular investment style. At any given time, the Adviser may tend to buy “growth” stocks or “value” stocks, or a combination of both types. In buying and selling securities for the fund, the Adviser relies on fundamental analysis, which involves a bottom-up assessment of a company’s potential for success in light of factors including its financial condition, earnings outlook, strategy, management, industry position, and economic and market conditions. | | Same principal strategy. |

For a comparison of the principal risks associated with the funds’ principal investment strategies, please refer to the section entitled “Comparison of Principal Risk Factors.”

Although the funds have substantially similar fundamental and non-fundamental investment policies and limitations, there are some differences of which you should be aware. The following summarizes the investment policy and limitation differences between Fidelity® Export and Multinational Fund and Fidelity® Fund:

| | |

Fidelity® Export and Multinational Fund | | Fidelity® Fund |

| |

| Fundamental policies and limitations (subject to change only by shareholder vote) | | Fundamental policies and limitations (subject to change only by shareholder vote) |

| |

| Concentration. The fund may not purchase the securities of any issuer | | Concentration. The fund may not purchase the securities of any issuer |

6

| | |

| (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, more than 25% of the fund’s total assets would be invested in the securities of companies whose principal business activities are in the same industry. | | (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities) if, as a result, more than 25% of the fund’s total assets would be invested in the securities of companies whose principal business activities are in the same industry. |

| |

| No corresponding policy or limitation. | | Investing for Control or Management. The fund may not invest in companies for the purpose of exercising control or management. |

| |

| Pooled Funds. The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company with substantially the same fundamental investment objective, policies, and limitations as the fund. | | Pooled Funds. The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund. |

| |

| Non-Fundamental Policies and Limitations | | Non-Fundamental Policies and Limitations |

| |

| Pooled Funds. The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company with substantially the same fundamental investment objective, policies, and limitations as the fund. | | Pooled Funds. The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund. |

Except as noted above, the funds have the same fundamental and non-fundamental investment policies and limitations.

For more information about the funds’ investment objectives, strategies, policies, and limitations, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations“ section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Following the Reorganization, the combined fund will be managed in accordance with the investment objective, strategies, policies, and limitations of Fidelity® Fund.

7

How do the funds’ management and distribution arrangements compare?

The following summarizes the management and distribution arrangements of Fidelity® Export and Multinational Fund and Fidelity® Fund:

Management of the Funds

The principal business address of FMR, each fund’s investment adviser, is 245 Summer Street, Boston, Massachusetts 02210.

As the manager, FMR has overall responsibility for directing the funds’ investments and handling their business affairs. As of January 1, 2020, FMR had approximately $2.6 trillion in discretionary assets under management, and as of December 31, 2019, approximately $3.2 trillion when combined with all of its affiliates’ assets under management.

FMR Investment Management (UK) Limited (FMR UK), at 1 St. Martin’s Le Grand, London, EC1A 4AS, United Kingdom; Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), at Floor 19, 41 Connaught Road Central, Hong Kong; and Fidelity Management & Research (Japan) Limited (FMR Japan), at Kamiyacho Prime Place, 1-17, Toranomon-4-Chome, Minato-ku, Tokyo, Japan are sub-advisers to Fidelity® Export and Multinational Fund and Fidelity® Fund. As of December 31, 2019, FMR UK had approximately $23.9 billion in discretionary assets under management. As of December 31, 2019, FMR H.K. had approximately $16.5 billion in discretionary assets under management. As of March 31, 2020, FMR Japan had approximately $4.2 billion in discretionary assets under management.

FMR is expected to continue serving as manager, and FMR UK, FMR H.K, and FMR Japan are expected to continue serving as sub-advisers of the combined fund after the Reorganization.

Jean Park is portfolio manager of Fidelity® Export and Multinational Fund and Fidelity® Fund, which she has managed since July 2020 and April 2017, respectively. She also manages other funds. Since joining Fidelity Investments in 2006, Ms. Park has worked as a research analyst and portfolio manager.

Ms. Park who is currently the portfolio manager of each fund, is expected to continue to be responsible for portfolio management of the combined fund after the Reorganization.

For information about the compensation of, any other accounts managed by, and any fund shares held by a fund’s portfolio manager(s), please refer to the “Management Contract(s)” section of each fund’s Statements of Additional Information, which are incorporated herein by reference.

Each fund has entered into a management contract with FMR, pursuant to which FMR furnishes investment advisory and other services.

Fidelity® Export and Multinational Fund and Fidelity® Fund each pay a management fee to the Adviser. The management fees are calculated and paid to the Adviser every month. Each fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the relevant fund’s average net assets throughout the month. The group fee rate is based on the average net assets of a group of mutual funds advised by FMR. This rate cannot rise above 0.52%, and it drops as total assets under management increase. For June 2020, the group fee rate for Fidelity® Export and Multinational Fund and Fidelity® Fund was 0.23%. The individual fund fee rate for Fidelity® Export and Multinational Fund is 0.30%. The individual fund fee rate for Fidelity® Fund is 0.09%.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for Fidelity® Export and Multinational Fund is available in the fund’s semi-annual report for the fiscal period ended February 29, 2020.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for Fidelity® Fund is available in the fund’s annual report for the fiscal period ended June 30, 2020.

The combined fund will retain Fidelity® Fund’s management fee structure.

For more information about fund management, please refer to the “Fund Management” section of the funds’ Prospectuses, and to the “Control of Investment Advisers” and “Management Contracts” sections of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

8

Expense Arrangements

For more information about the funds’ fees and operating expenses, please refer to the funds’ Prospectuses, which are incorporated herein by reference, and to “Annual Fund and Class Operating Expenses” below.

Distribution of Fund Shares

The principal business address of FDC, each fund’s principal underwriter and distribution agent, is 900 Salem Street, Smithfield, Rhode Island, 02917.

Each fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (1940 Act) that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. A fund’s Distribution and Service Plan does not authorize payments by the fund other than those that are to be made to FMR under the fund’s management contract.

The Distribution and Service Plan for the combined fund will remain unchanged.

For more information about fund distribution, please refer to the “Fund Distribution” section of the funds’ Prospectuses, and to the “Distribution Services” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

How do the funds’ fees and operating expenses compare, and what are the combined fund’s fees and operating expenses estimated to be following the Reorganization?

The following tables allow you to compare the fees and expenses of each fund and to analyze the pro forma estimated fees and expenses of the combined fund.

Annual Fund and Class Operating Expenses

The following tables show the fees and expenses of Fidelity® Export and Multinational Fund, and Fidelity® Fund for the 12 months ended June 30, 2020, and the pro forma estimated fees and expenses of the combined fund based on the same time period after giving effect to the Reorganization. Annual fund or class operating expenses are paid by each fund or class, as applicable.

As shown below, the Reorganization is expected to result in lower total annual operating expenses for shareholders of Fidelity® Export and Multinational Fund.

Retail Class

Shareholder Fees (paid directly from your investment)

| | | | | | |

| | | Fidelity® Export

and Multinational

Fund | | Fidelity® Fund | | Fidelity® Fund

Pro forma

Combined |

Maximum sales charge (load) on purchases

(as a % of offering price) | | None | | None | | None |

Maximum contingent deferred sales charge

(as a % of the lesser of original purchase price or redemption proceeds) | | None | | None | | None |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity® Export

and Multinational

Fund | | Fidelity® Fund | | Fidelity® Fund

Pro forma

Combined |

Management fee | | 0.53% | | 0.32% | | 0.32% |

Distribution and/or Service (12b-1) fees | | None | | None | | None |

Other expenses | | 0.21% | | 0.16% | | 0.16% |

| | | | | | |

Total annual operating expenses | | 0.74% | | 0.48% | | 0.48% |

9

Class K

Shareholder Fees (paid directly from your investment)

| | | | | | | | | | | | |

| | | Fidelity® Export and Multinational Fund | | | Fidelity® Fund | | | Fidelity® Fund

Pro forma

Combined | |

Maximum sales charge (load) on purchases (as a % of offering price) | | | None | | | | None | | | | None | |

Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | | | None | | | | None | | | | None | |

Annual Class Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| | | | | | |

| | | Fidelity® Export

and Multinational Fund | | Fidelity® Fund | | Fidelity® Fund

Pro forma Combined |

Management fee | | 0.53% | | 0.32% | | 0.32% |

| Distribution and/or Service (12b-1) fees | | None | | None | | None |

Other expenses | | 0.09% | | 0.08% | | 0.07% |

| | | | | | |

Total annual operating expenses | | 0.62% | | 0.40% | | 0.39% |

Examples of Effect of Fund Expenses

The following tables illustrate the expenses on a hypothetical $10,000 investment in each fund under the current and pro forma (combined fund) expenses calculated at the rates stated above, assuming a 5% annual return after giving effect to the Reorganization. The tables illustrate how much a shareholder would pay in total expenses if the shareholder sells all of his or her shares at the end of each time period indicated.

Retail Class

| | | | | | | | | | | | |

| | | Fidelity® Export and

Multinational Fund | | | Fidelity® Fund | | | Fidelity® Fund

Pro forma

Combined | |

1 year | | $ | 76 | | | $ | 49 | | | $ | 49 | |

3 years | | $ | 237 | | | $ | 154 | | | $ | 154 | |

5 years | | $ | 411 | | | $ | 269 | | | $ | 269 | |

10 years | | $ | 918 | | | $ | 604 | | | $ | 604 | |

10

Class K

| | | | | | | | | | | | |

| | | Fidelity® Export and Multinational Fund | | | Fidelity® Fund | | | Fidelity® Fund Pro forma

Combined | |

1 year | | $ | 63 | | | $ | 41 | | | $ | 40 | |

3 years | | $ | 199 | | | $ | 128 | | | $ | 125 | |

5 years | | $ | 346 | | | $ | 224 | | | $ | 219 | |

10 years | | $ | 774 | | | $ | 505 | | | $ | 493 | |

These examples assume that all dividends and other distributions are reinvested and that the percentage amounts listed under Annual Operating Expenses remain the same in the years shown. These examples illustrate the effect of expenses, but are not meant to suggest actual or expected expenses, which may vary. The assumed return of 5% is not a prediction of, and does not represent, actual or expected performance of any fund.

Do the procedures for purchasing and redeeming shares of the funds differ?

Except as discussed below, the procedures for purchasing shares of the funds are the same.

On December 31, 2020, Fidelity® Export and Multinational Fund closed to new accounts pending the Reorganization. Shareholders of Fidelity® Export and Multinational Fund as of that date can continue to purchase shares of the fund. Shareholders of Fidelity® Export and Multinational Fund may redeem shares of the fund through the Closing Date of the fund’s Reorganization.

Aside from the closing of Fidelity® Export and Multinational Fund, the procedures for purchasing and redeeming shares of the funds are the same. The procedures for purchasing and redeeming shares of the combined fund will remain unchanged.

For more information about the procedures for purchasing and redeeming the funds�� shares, including a description of the policies and procedures designed to discourage excessive or short-term trading of fund shares, please refer to the “Additional Information about the Purchase and Sale of Shares” section of the funds’ Prospectuses, and to the “Buying, Selling, and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Do the funds’ exchange privileges differ?

No. The exchange privileges currently offered by the funds are the same. The exchange privileges offered by the combined fund will remain unchanged.

For more information about the funds’ exchange privileges, please refer to the “Exchanging Shares” section of the funds’ Prospectuses, and to the “Buying, Selling, and Exchanging Information” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Do the funds’ dividend and distribution policies differ?

The fund’s dividend and distribution policies differ. Fidelity® Export and Multinational Fund normally pays dividends and capital gain distributions in October and December, while Fidelity® Fund normally pays dividends and capital gain distributions in August and December. The dividend and distribution policies of the combined fund will be the same as the current dividend and distribution policies of Fidelity® Fund.

On or before the Closing Date, Fidelity® Export and Multinational Fund may declare additional dividends or other distributions in order to distribute substantially all of its investment company taxable income and net realized capital gain.

Fidelity® Export and Multinational Fund is required to recognize gain or loss on any assets subject to “mark-to-market” tax accounting held by the fund on the last day of its taxable year, which is August 31st,, gains or losses on such assets held on the Closing Date by Fidelity® Export and Multinational Fund may be required to be recognized on the Closing Date.

11

For more information about the funds’ dividend and distribution policies, please refer to the “Dividends and Capital Gain Distributions” section of the funds’ Prospectuses, and to the “Distributions and Taxes” section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

Who bears the expenses associated with the Reorganization?

Fidelity® Export and Multinational Fund will bear the cost of the Reorganization.

For more information, please refer to the section entitled “Additional Information about the Funds – Expenses.”

COMPARISON OF PRINCIPAL RISK FACTORS

Many factors affect each fund’s performance. Developments that disrupt global economies and financial markets, such as pandemics and epidemics, may magnify factors that affect a fund’s performance. A fund’s share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. A fund’s reaction to these developments will be affected by the types of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund’s level of investment in the securities of that issuer. When you sell your shares they may be worth more or less than what you paid for them, which means that you could lose money by investing in a fund.

The following is a summary of the principal risks associated with an investment in the funds. Because the funds have identical investment objectives and substantially similar strategies as described above, the funds are subject to substantially similar investment risks. Because the funds have some different principal investment strategies as described above, the funds are also subject to some different investment risks, of which you should be aware.

What risks are associated with an investment in both of the funds?

Each fund is subject to the following principal risks:

| | • | | Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments. |

| | • | | Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. |

| | • | | Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. |

What additional risks are associated with an investment in Fidelity® Export and Multinational Fund?

Fidelity® Export and Multinational Fund is subject to the following principal risks, which are not principal risks generally associated with an investment in Fidelity® Fund:

| | • | | Export and Multinational Company Exposure. Export and multinational companies can be significantly affected by political, economic, and regulatory developments in foreign markets. |

12

| | • | | High Portfolio Turnover. High portfolio turnover (more than 100%) may result in increased transaction costs and potentially higher capital gains or losses. The effects of higher than normal portfolio turnover may adversely affect the fund’s performance. |

What additional risks are associated with an investment in Fidelity® Fund?

Fidelity® Fund is subject to the following principal risks, which are not principal risks generally associated with an investment in Fidelity® Export and Multinational Fund:

| | • | | Issuer-Specific Changes. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments. |

| | • | | Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease. |

For more information about the principal risks associated with an investment in the funds, please refer to the “Investment Details” section of the funds’ Prospectuses, and to the “Investment Policies and Limitations“ section of the funds’ Statements of Additional Information, each of which are incorporated herein by reference.

How do the funds compare in terms of their performance?

The following information is intended to help you understand the risks of investing in the funds. The information illustrates the changes in the performance of each fund’s shares from year to year and compares the performance of each fund’s shares to the performance of a securities market index over various periods of time. The index description appears in the “Additional Index Information” section of the funds’ Prospectuses. Past performance (before and after taxes, if applicable) is not an indication of future performance.

Year-by-Year Returns

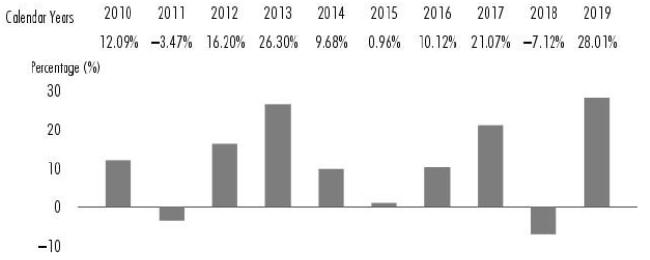

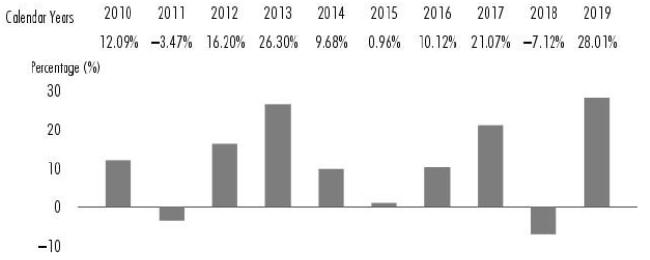

Fidelity® Export and Multinational Fund – Retail Class

13

| | | | | | | | |

| During the periods shown in the chart: | | Returns | | | Quarter ended | |

Highest Quarter Return | | | 13.39 | % | | | March 31, 2012 | |

Lowest Quarter Return | | | (14.95 | )% | | | September 30, 2011 | |

Year-to-Date Return | | | (15.32 | )% | | | September 30, 2020 | |

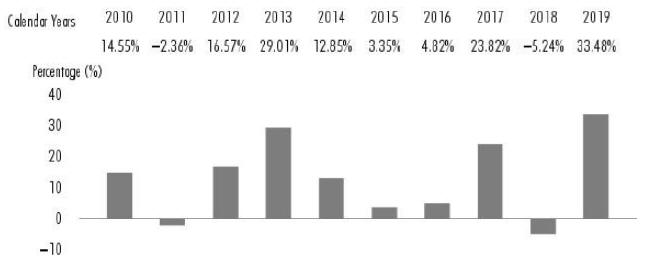

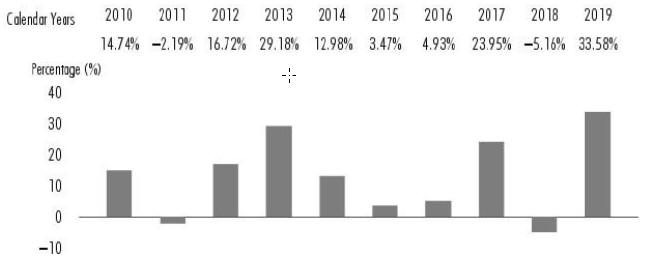

Fidelity® Export and Multinational Fund – Class K

| | | | | | | | |

| During the periods shown in the chart: | | Returns | | | Quarter ended | |

Highest Quarter Return | | | 13.46 | % | | | March 31, 2012 | |

Lowest Quarter Return | | | (14.87 | )% | | | September 30, 2011 | |

Year-to-Date Return | | | (15.23 | )% | | | September 30, 2020 | |

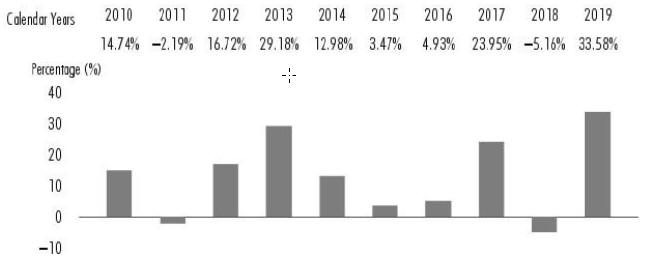

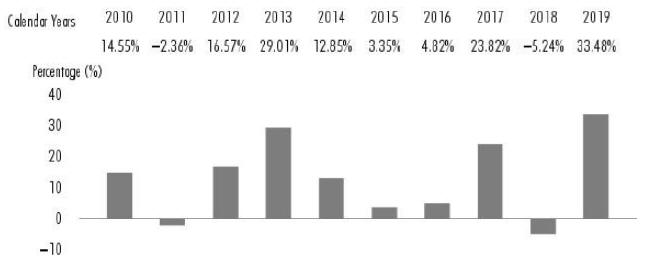

Fidelity® Fund – Retail Class

14

| | | | | | | | |

| During the periods shown in the chart: | | Returns | | | Quarter ended | |

Highest Quarter Return | | | 14.19 | % | | | March 31, 2012 | |

Lowest Quarter Return | | | (15.07 | )% | | | September 30, 2011 | |

Year-to-Date Return | | | 16.67 | % | | | September 30, 2020 | |

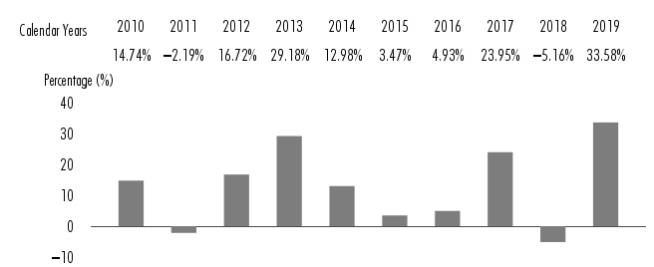

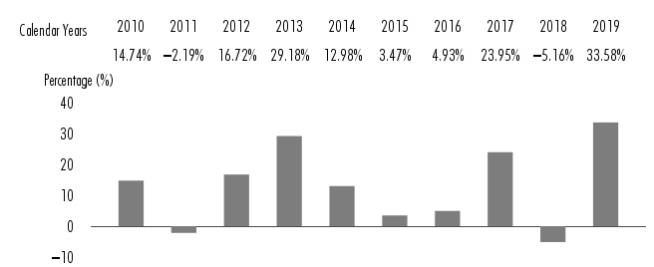

Fidelity® Fund – Class K

| | | | | | | | |

| During the periods shown in the chart: | | Returns | | | Quarter ended | |

Highest Quarter Return | | | 14.23 | % | | | March 31, 2012 | |

Lowest Quarter Return | | | (15.04 | )% | | | September 30, 2011 | |

Year-to-Date Return | | | 16.76 | % | | | September 30, 2020 | |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

15

Fidelity® Export and Multinational Fund

| | | | | | | | | | | | |

| For the periods ended December 31, 2019 | | Past 1 year | | | Past 5 years | | | Past 10 years | |

| Fidelity® Export and Multinational Fund - Retail Class | | | | | | | | | | | | |

Return Before Taxes | | | 27.97 | % | | | 9.73 | % | | | 10.64 | % |

Return After Taxes on Distributions | | | 26.28 | % | | | 7.30 | % | | | 8.33 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 17.53 | % | | | 7.11 | % | | | 8.13 | % |

Fidelity® Export and Multinational Fund - Class K | | | 28.01 | % | | | 9.86 | % | | | 10.79 | % |

S&P 500® Index

(reflects no deduction for fees, expenses, or taxes) | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % |

Fidelity® Fund

| | | | | | | | | | | | |

| For the periods ended December 31, 2019 | | Past 1 year | | | Past 5 years | | | Past 10 years | |

Fidelity® Fund - Retail Class | | | | | | | | | | | | |

Return Before Taxes | | | 33.48 | % | | | 11.15 | % | | | 12.41 | % |

Return After Taxes on Distributions | | | 31.71 | % | | | 9.30 | % | | | 10.88 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 20.92 | % | | | 8.50 | % | | | 9.94 | % |

Fidelity® Fund - Class K | | | 33.58 | % | | | 11.26 | % | | | 12.54 | % |

S&P 500® Index

(reflects no deduction for fees, expenses, or taxes) | | | 31.49 | % | | | 11.70 | % | | | 13.56 | % |

16

THE TRANSACTION

AGREEMENT AND PLAN OF REORGANIZATION BETWEEN FIDELITY® EXPORT AND MULTINATIONAL FUND AND FIDELITY® FUND.

Agreement and Plan of Reorganization

The terms and conditions under which the transaction may be consummated are set forth in the Agreement. Significant provisions of the Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Agreement, a copy of which is attached as Exhibit 1 to this Information Statement.

The Agreement contemplates (a) Fidelity® Fund acquiring as of the Closing Date all of the assets of Fidelity® Export and Multinational Fund in exchange solely for shares of Fidelity® Fund and the assumption by Fidelity® Fund of Fidelity® Export and Multinational Fund’s liabilities; and (b) the distribution of shares of Fidelity® Fund to the shareholders of Fidelity® Export and Multinational Fund as provided for in the Agreement.

The value of Fidelity® Export and Multinational Fund’s assets to be acquired by Fidelity® Fund and the amount of its liabilities to be assumed by Fidelity® Fund will be determined as of the close of business of the NYSE on the Closing Date, using the valuation procedures set forth in Fidelity® Fund’s then-current Prospectuses and Statements of Additional Information. The net asset value of a share of Fidelity® Fund will be determined as of the same time using the valuation procedures set forth in its then-current Prospectuses and Statements of Additional Information.

As of the Closing Date, Fidelity® Fund will deliver to Fidelity® Export and Multinational Fund, and Fidelity® Export and Multinational Fund will distribute to its shareholders of record, shares of Fidelity® Fund so that each Fidelity® Export and Multinational Fund shareholder will receive the number of full and fractional shares of Fidelity® Fund equal in value to the aggregate net asset value of shares of Fidelity® Export and Multinational Fund held by such shareholder on the Closing Date; Fidelity® Export and Multinational Fund will be liquidated as soon as practicable thereafter. Each Fidelity® Export and Multinational Fund shareholder’s account shall be credited with the respective pro rata number of full and fractional shares of Fidelity® Fund due that shareholder. The net asset value per share of Fidelity® Fund will be unchanged by the transaction. Thus, the Reorganization will not result in a dilution of any shareholder’s interest.

Any transfer taxes payable upon issuance of shares of Fidelity® Fund in a name other than that of the registered holder of the shares on the books of Fidelity® Export and Multinational Fund as of that time shall be paid by the person to whom such shares are to be issued as a condition of such transfer. Any reporting responsibility of Fidelity® Export and Multinational Fund is and will continue to be its responsibility up to and including the Closing Date and such later date on which Fidelity® Export and Multinational Fund is liquidated.

Fidelity® Export and Multinational Fund will bear the cost of the Reorganization, including professional fees, expenses associated with the filing of registration statements, which will consist principally of printing and mailing Prospectuses and the Information Statement.

All of the current investments of Fidelity® Export and Multinational Fund are permissible investments for Fidelity® Fund. Nevertheless, FMR may sell certain securities held by the funds and purchase other securities. Any transaction costs associated with portfolio adjustments to Fidelity® Export and Multinational Fund and Fidelity® Fund due to the Reorganization that occur prior to the Closing Date will be borne by Fidelity® Export and Multinational Fund and Fidelity® Fund, respectively. Any transaction costs associated with portfolio adjustments to Fidelity® Export and Multinational Fund and Fidelity® Fund due to the Reorganization that occur after the Closing Date and any additional merger-related costs attributable to Fidelity® Fund that occur after the Closing Date will be borne by Fidelity® Fund. The funds may recognize a taxable gain or loss on the disposition of securities pursuant to these portfolio adjustments.

17

The consummation of the Reorganization is subject to a number of conditions set forth in the Agreement, some of which may be waived by a fund. In addition, the Agreement may be amended in any mutually agreeable manner.

Reasons for the Reorganization

In determining whether to approve the Reorganization, each fund’s Board of Trustees (the Board) considered a number of factors, including the following:

| | (1) | the compatibility of the investment objectives, strategies, and policies of the funds; |

| | (2) | the historical performance of the funds; |

| | (3) | the fees and expenses and the relative expense ratios of the funds; |

| | (4) | the potential benefit of the Reorganization to shareholders of the funds; |

| | (5) | the costs to be incurred by each fund as a result of the Reorganization; |

| | (6) | the tax consequences of the Reorganization; |

| | (7) | the relative size of the funds; and |

| | (8) | the potential benefit of the Reorganization to FMR and its affiliates. |

FMR proposed the Reorganization to each fund’s Board at a meeting of the Board held on November 18, 2020. In proposing the Reorganization, FMR advised the Board that the Reorganization would permit Fidelity® Export and Multinational Fund’s shareholders to pursue the same investment objective in a larger and more successful fund. The Board considered that Fidelity® Export and Multinational Fund’s investment thesis is outdated in an increasingly global economy, while Fidelity® Fund is managed similarly by the same portfolio manager against the same benchmark, and is more likely to grow over time. The Board also considered that Fidelity® Export and Multinational Fund’s shareholders are expected to benefit from an expense reduction, including a decrease of 21 basis points in management fees due to the benefit of Fidelity® Fund’s lower management fee and from spreading fixed costs over a larger asset base. The Reorganization will qualify as a tax-free exchange for federal income tax purposes.

Each fund’s Board carefully reviewed the proposal and determined that the Reorganization is in the best interests of the shareholders of each fund and that the Reorganization will not result in a dilution of the interests of the shareholders of either fund.

Description of the Securities to be Issued

Holders of Fidelity® Export and Multinational Fund (Retail Class) and Class K shares of Fidelity® Export and Multinational Fund will receive, respectively, Fidelity® Fund (Retail Class) and Class K shares of Fidelity® Fund.

Fidelity® Fund is a series of Fidelity Hastings Street Trust. The Trustees of Fidelity Hastings Street Trust are authorized to issue an unlimited number of shares of beneficial interest of separate series. Each share of Fidelity® Fund represents an equal proportionate interest with each other share of the fund, and each such share of Fidelity® Fund is entitled to equal voting, dividend, liquidation, and redemption rights. Each shareholder of Fidelity® Fund is entitled to one vote for each dollar of net asset value of the fund that shareholder owns, with fractional dollar amounts entitled to a proportionate fractional vote. Shares of Fidelity® Fund have no preemptive rights. Shares are fully paid and nonassessable, except as set forth in the “Description of the Trust(s) – Shareholder Liability” section of the fund’s Statements of Additional Information, which are incorporated herein by reference.

Fidelity Hastings Street Trust does not hold annual meetings of shareholders. There will normally be no meetings of shareholders for the purpose of electing Trustees unless less than a majority of the Trustees holding office have been elected by shareholders, at which time the Trustees then in office will call a shareholder meeting for the election of Trustees. Under the 1940 Act, shareholders of record of at least two-thirds of the outstanding shares of an investment company may remove a Trustee by votes cast in person or by proxy at a meeting called for that purpose. The Trustees are required to call a meeting of shareholders for the purpose of voting upon the question of removal of any Trustee when requested in writing to do so by the shareholders of record holding at least 10% of the trust’s outstanding shares.

18

For more information about voting rights and dividend rights, please refer to the “Description of the Trust(s) – Voting Rights” and the “Distributions and Taxes” sections, respectively, of Fidelity® Fund’s Statements of Additional Information, which are incorporated herein by reference. For more information about redemption rights and exchange privileges, please refer to the “Additional Information about the Purchase and Sale of Shares” and the “Exchanging Shares” sections, respectively, of Fidelity® Fund’s Prospectuses, which are incorporated herein by reference.

Federal Income Tax Considerations

The exchange of Fidelity® Export and Multinational Fund’s assets for Fidelity® Fund’s shares and the assumption of the liabilities of Fidelity® Export and Multinational Fund by Fidelity® Fund is intended to qualify for federal income tax purposes as a tax-free Reorganization under the Internal Revenue Code (the Code). With respect to the Reorganization, the participating funds will receive an opinion from Dechert LLP, counsel to Fidelity® Export and Multinational Fund and Fidelity® Fund, substantially to the effect that:

(i) The acquisition by Fidelity® Fund of substantially all of the assets of Fidelity® Export and Multinational Fund in exchange solely for Fidelity® Fund shares and the assumption by Fidelity® Fund of all liabilities of Fidelity® Export and Multinational Fund followed by the distribution of Fidelity® Fund shares to the Fidelity® Export and Multinational Fund shareholders in exchange for their Fidelity® Export and Multinational Fund shares in complete liquidation and termination of Fidelity® Export and Multinational Fund will constitute a tax-free Reorganization under Section 368(a) of the Code;

(ii) Fidelity® Export and Multinational Fund will recognize no gain or loss upon the transfer of substantially all of its assets to Fidelity® Fund in exchange solely for Fidelity® Fund shares and the assumption by Fidelity® Fund of all liabilities of Fidelity® Export and Multinational Fund, except that Fidelity® Export and Multinational Fund may be required to recognize gain or loss with respect to contracts described in Section 1256(b) of the Code or stock in a passive foreign investment company, as defined in Section 1297(a) of the Code;

(iii) Fidelity® Export and Multinational Fund will recognize no gain or loss upon the distribution to its shareholders of the Fidelity® Fund shares received by Fidelity® Export and Multinational Fund in the Reorganization;

(iv) Fidelity® Fund will recognize no gain or loss upon the receipt of the assets of Fidelity® Export and Multinational Fund in exchange solely for Fidelity® Fund shares and the assumption of all liabilities of Fidelity® Export and Multinational Fund;

(v) The adjusted basis to Fidelity® Fund of the assets of Fidelity® Export and Multinational Fund received by Fidelity® Fund in the Reorganization will be the same as the adjusted basis of those assets in the hands of Fidelity® Export and Multinational Fund immediately before the exchange;

(vi) Fidelity® Fund’s holding periods with respect to the assets of Fidelity® Export and Multinational Fund that Fidelity® Fund acquires in the Reorganization will include the respective periods for which those assets were held by Fidelity® Export and Multinational Fund (except where investment activities of Fidelity® Fund have the effect of reducing or eliminating a holding period with respect to an asset);

(vii) The Fidelity® Export and Multinational Fund shareholders will recognize no gain or loss upon receiving Fidelity® Fund shares in exchange solely for Fidelity® Export and Multinational Fund shares;

(viii) The aggregate basis of the Fidelity® Fund shares received by a Fidelity® Export and Multinational Fund shareholder in the Reorganization will be the same as the aggregate basis of the Fidelity® Export and Multinational Fund shares surrendered by the Fidelity® Export and Multinational Fund shareholder in exchange therefor; and

(ix) A Fidelity® Export and Multinational Fund shareholder’s holding period for the Fidelity® Fund shares received by the Fidelity® Export and Multinational Fund shareholder in the Reorganization will include the holding period during which the Fidelity® Export and Multinational Fund shareholder held Fidelity® Export and Multinational Fund shares surrendered in exchange therefor, provided that the Fidelity® Export and Multinational Fund shareholder held such shares as a capital asset on the date of the Reorganization.

19

In the Reorganization, Fidelity® Export and Multinational Fund shareholders could be transitioning into a fund with significantly larger net unrealized gains. In addition the Reorganization could trigger tax rules that would impose an annual limit on Fidelity® Fund’s ability to use Fidelity® Export and Multinational Fund’s net realized and/or net unrealized losses (if any at the time of the Reorganization) to offset gains following the Reorganization. As a result of the foregoing, Fidelity® Export and Multinational Fund shareholders could end up receiving capital gain distributions sooner and/or in larger amounts than they would if Fidelity® Export and Multinational Fund continued as a standalone fund.

The table below shows each fund’s approximate net assets, net realized gains/losses (including capital loss carryforwards) and net unrealized gains/losses as of November 30, 2020. The actual impact of the Reorganization on the funds’ losses and on future capital gain distributions will depend on each fund’s net assets, net realized gains/losses and net unrealized gains/losses at the time of the Reorganization, as well as the timing and amount of gains and losses realized by Fidelity® Fund following the Reorganization, and thus cannot be determined precisely at this time.

Tax Position as of November 30, 2020 ($M)

| | | | | | | | | | | | | | | | |

Fund Name | | Fiscal

Year End | | | Net Assets | | | Net

Realized Gains/

(Losses),

including

capital loss

carryforwards | | | Net

Unrealized

Gains/

(Losses) | |

Fidelity® Export and Multinational Fund | | | August | | | $ | 1,213.1 | | | ($ | 106.7 | ) | | $ | 143.0 | |

Fidelity® Fund | | | June | | | $ | 5,235.9 | | | $ | 18.3 | * | | $ | 2,870.5 | |

| * | Does not include net realized gains that were distributed in December 2020. |

Shareholders of Fidelity® Export and Multinational Fund should consult their tax advisers regarding the effect, if any, of the Reorganization in light of their individual circumstances. Because the foregoing discussion relates only to the federal income tax consequences of the Reorganization, those shareholders also should consult their tax advisers as to state and local tax consequences, if any, of the Reorganization.

Forms of Organization

Fidelity® Export and Multinational Fund is a diversified series of Fidelity Summer Street Trust, an open-end management investment company organized as a Massachusetts business trust on March 23, 1977. Fidelity® Fund is a diversified series of Fidelity Hastings Street Trust, an open-end management investment company organized as a Massachusetts business trust on September 27, 1984. The trusts are authorized to issue an unlimited number of shares of beneficial interest. Because the funds are series of Massachusetts business trusts, governed by substantially similar Declarations of Trust, the rights of the security holders of Fidelity® Export and Multinational Fund under state law and the governing documents are expected to remain unchanged after the Reorganization.

For more information regarding shareholder rights, please refer to the “Description of the Trust(s)” section of the funds’ Statements of Additional Information, which are incorporated herein by reference.

20

Operations of Fidelity® Fund Following the Reorganization

FMR does not expect Fidelity® Fund to revise its investment policies as a result of the Reorganization. In addition, FMR does not anticipate significant changes to Fidelity® Fund’s management or to entities that provide the fund with services. Specifically, the Trustees and officers, the investment adviser, distributor, and other entities will continue to serve Fidelity® Fund in their current capacities. Jean Park, who is currently the portfolio manager of Fidelity® Fund and Fidelity® Export and Multinational Fund, is expected to continue to be responsible for portfolio management of the combined fund after the Reorganization.

Capitalization

The following table shows the capitalization of Fidelity® Export and Multinational Fund and Fidelity® Fund as of November 30, 2020, and on a pro forma combined basis (unaudited) as of that date giving effect to the Reorganization. As of November 30, 2020, the net assets of Fidelity® Export and Multinational Fund were $1,212,549,195, or 23.2% of Fidelity® Fund.

Fidelity® Export and Multinational Fund(a)

| | | | | | | | | | | | |

| | | Net Assets | | | Net Asset Value Per Share | | | Shares Outstanding | |

Fidelity® Export and Multinational Fund (Retail Class) | | $ | 1,069,330,139 | | | $ | 19.15 | | | | 55,843,007 | |

Class K | | $ | 143,219,056 | | | $ | 19.10 | | | | 7,496,771 | |

Fidelity® Fund

| | | | | | | | | | | | |

| | | Net Assets | | | Net Asset Value Per Share | | | Shares Outstanding | |

Fidelity® Fund (Retail Class) | | $ | 4,901,412,765 | | | $ | 61.88 | | | | 79,206,086 | |

Class K | | $ | 333,067,374 | | | $ | 61.89 | | | | 5,381,887 | |

Fidelity® Fund Pro Forma

| | | | | | | | | | | | |

| | | Net Assets | | | Net Asset Value Per Share | | | Shares Outstanding | |

Fidelity® Fund (Retail Class) | | $ | 5,970,742,904 | | | $ | 61.88 | | | | 96,486,793 | |

Class K | | $ | 476,286,430 | | | $ | 61.89 | | | | 7,695,977 | |

| (a) | Fidelity® Export and Multinational Fund’s estimated one-time Reorganization costs is $63,000. |

21

The table above assumes that the Reorganization occurred on November 30, 2020. The table is for information purposes only. No assurance can be given as to how many Fidelity® Fund shares will be received by shareholders of Fidelity® Export and Multinational Fund on the date that the Reorganization takes place, and the foregoing should not be relied upon to reflect the number of shares of Fidelity® Fund that actually will be received on or after that date.

Conclusion

The Agreement and the Reorganization were approved by the Board of Trustees of Fidelity Summer Street Trust and Fidelity Hastings Street Trust at a meeting held on November 18, 2020. The Board of Trustees determined that the Reorganization is in the best interests of shareholders of Fidelity® Export and Multinational Fund and Fidelity® Fund and that the interests of existing shareholders of Fidelity® Export and Multinational Fund and Fidelity® Fund would not be diluted as a result of the Reorganization. In the event that the Reorganization does not occur, Fidelity® Export and Multinational Fund will continue to engage in business as a fund of a registered investment company and the Board of Trustees of Fidelity Summer Street Trust may consider other proposals for the Reorganization or liquidation of the fund.

22

ADDITIONAL INFORMATION ABOUT THE FUNDS

Fidelity® Fund’s financial highlights for the fiscal year ended June 30, 2020, which are included in the fund’s Prospectus and incorporated herein by reference, have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report thereon is included in the Annual Report to Shareholders.

Fidelity® Export and Multinational Fund’s financial highlights for the fiscal year ended August 31, 2020, which are included in the fund’s Prospectus and incorporated herein by reference, have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report thereon is included in the Annual Report to Shareholders.

The financial highlights audited by PricewaterhouseCoopers LLP have been incorporated by reference in reliance on their reports given on their authority as experts in auditing and accounting.

Expenses

The expenses in connection with preparing this Information Statement and its enclosures will be paid by Fidelity® Export and Multinational Fund.

The fund will reimburse brokerage firms and others for their reasonable expenses in forwarding material to the beneficial owners of shares. The costs are allocated on a pro rata basis to each class of a fund based on the net assets of each class relative to the total net assets of the fund.

For a free copy of Fidelity® Export and Multinational Fund’s annual report for the fiscal year ended August 31, 2020 call 1-800-544-8544 (Retail Class) or 1-800-835-5092 (Class K), log-on to www.fidelity.com (Retail Class) or visit www.401k.com and log in (Class K), or write to FDC at 900 Salem Street, Smithfield, Rhode Island 02917.

For a free copy of Fidelity® Fund’s annual report for the fiscal year ended June 30, 2020 call 1-800-544-8544 (Retail Class) or 1-800-835-5092 (Class K), log-on to www.fidelity.com (Retail Class) or visit www.401k.com and log in (Class K), or write to FDC at 900 Salem Street, Smithfield, Rhode Island 02917.

Share Ownership

As of December 31, 2020, shares of each class of Fidelity® Export and Multinational Fund and Fidelity® Fund issued and outstanding were as follows:

| | | | |

| | | Number of Shares | |

Fidelity® Export and Multinational Fund - Retail Class | | | [ | ] |

Fidelity® Export and Multinational Fund - Class K | | | [ | ] |

Fidelity® Fund - Retail Class | | | [ | ] |

Fidelity® Fund - Class K | | | [ | ] |

[As of December 31, 2020, the Trustees, Members of the Advisory Board (if any), and officers of each fund owned, in the aggregate, less than 1% of each class’s total outstanding shares, with respect to the fund.]

[As of December 31, 2020, the following owned of record and/or beneficially 5% or more of the outstanding shares:]

| | | | | | | | |

Class Name | | Owner Name | | City | | State | | Ownership % |

[ ] | | [ ] | | [ ] | | [ ] | | [ ]% |

| (1) | The ownership information shown above is for a class of shares of the fund. |

23

[As of December 31, 2020, the following owned of record and/or beneficially 25% or more of the outstanding shares:]

| | | | | | | | |

Fund Name | | Owner Name | | City | | State | | Ownership % |

[ ] | | [ ] | | [ ] | | [ ] | | [ ]% |

[A shareholder owning of record or beneficially more than 25% of a fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting than votes of other shareholders.]

[To the knowledge of each trust, no shareholder owned of record and/or beneficially 5% or more of the outstanding shares of each fund on that date.] [It is not anticipated that any of the above shareholders will own of record and/or beneficially 5% or more of the outstanding shares of the combined fund as a result of the Reorganization.] [If the Reorganization became effective on December 31, 2020, [ ] would have owned of record and/or beneficially [ ]% of the outstanding shares of the combined fund.]

MISCELLANEOUS

Legal Matters

Certain legal matters in connection with the issuance of Fidelity® Fund shares have been passed upon by Dechert LLP, counsel to Fidelity Hastings Street Trust.

Experts

The audited financial statements of Fidelity® Export and Multinational Fund and Fidelity® Fund are incorporated by reference into the Statement of Additional Information relating to this Information Statement and have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose reports thereon are included in the funds’ Annual Reports to Shareholders for the fiscal year ended August 31, 2020 (Fidelity® Export and Multinational Fund) and June 30, 2020 (Fidelity® Fund). The financial statements audited by PricewaterhouseCoopers LLP have been incorporated by reference in reliance on their reports given on their authority as experts in auditing and accounting.

Notice to Banks, Broker-Dealers and Voting Trustees and Their Nominees

Please advise the Trust, in care of Fidelity Investments Institutional Operations Company LLC, 245 Summer Street, Boston, Massachusetts, 02210, whether other persons are beneficial owners of shares for which the Information Statement is being mailed and, if so, the number of copies of the Information Statement and Annual Report you wish to receive in order to supply copies to the beneficial owners of the respective shares.

24

Exhibit 1

FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the Agreement) is made as of November 18, 2020, by and between Fidelity Summer Street Trust, a Massachusetts business trust (the Acquired Trust), on behalf of its series Fidelity Export and Multinational Fund (the Acquired Fund), and Fidelity Hastings Street Trust, a Massachusetts business trust (the Acquiring Trust), on behalf of its series Fidelity Fund (the Acquiring Fund). The Acquired Trust and the Acquiring Trust may be referred to herein collectively as the “Trusts” or each individually as a “Trust.” The Trusts are duly organized business trusts under the laws of the Commonwealth of Massachusetts with their principal place of business at 245 Summer Street, Boston, Massachusetts 02210. The Acquiring Fund and the Acquired Fund may be referred to herein collectively as the “Funds” or each individually as the “Fund.”

This Agreement is intended to be, and is adopted as, a plan of Reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the Code). The Reorganization will comprise: (a) the transfer of all of the assets of the Acquired Fund to the Acquiring Fund solely in exchange for shares of beneficial interest in the Acquiring Fund (the Acquiring Fund Shares) and the assumption by the Acquiring Fund of the Acquired Fund’s liabilities; and (b) the constructive distribution of such shares by the Acquired Fund pro rata to its shareholders in complete liquidation and termination of the Acquired Fund, all upon the terms and conditions set forth in this Agreement. The foregoing transactions are referred to herein as the “Reorganization.”

In consideration of the mutual promises and subject to the terms and conditions herein, the parties covenant and agree as follows:

1. REPRESENTATIONS AND WARRANTIES OF THE ACQUIRED FUND. The Acquired Fund represents and warrants to and agrees with the Acquiring Fund that:

(a) The Acquired Fund is a series of the Acquired Fund Trust, a business trust duly organized, validly existing, and in good standing under the laws of the Commonwealth of Massachusetts, and has the power to own all of its properties and assets and to carry out its obligations under this Agreement. It has all necessary federal, state, and local authorizations to carry on its business as now being conducted and to carry out this Agreement;

(b) The Acquired Fund Trust is an open-end, management investment company duly registered under the Investment Company Act of 1940, as amended (the 1940 Act), and such registration is in full force and effect;

(c) The Prospectuses and Statements of Additional Information of the Acquired Fund dated October 30, 2020, as supplemented, previously furnished to the Acquiring Fund, did not and do not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading;

(d) Except as disclosed in writing to the Acquiring Fund, there are no material legal, administrative, or other proceedings pending or, to the knowledge of the Acquired Fund, threatened against the Acquired Fund which assert liability on the part of the Acquired Fund. The Acquired Fund knows of no facts which might reasonably form the basis for the institution of such proceedings, except as otherwise disclosed to the Acquiring Fund;

(e) The Acquired Fund is not in, and the execution, delivery, and performance of this Agreement will not result in, violation of any provision of its Amended and Restated Declaration of Trust or By-laws, or, to the knowledge of the Acquired Fund, of any agreement, indenture, instrument, contract,

25

lease, or other undertaking to which the Acquired Fund is a party or by which the Acquired Fund is bound or result in the acceleration of any obligation or the imposition of any penalty under any agreement, judgment or decree to which the Acquired Fund is a party or is bound;

(f) The Statement of Assets and Liabilities, the Statement of Operations, the Statement of Changes in Net Assets, Financial Highlights, and the Schedule of Investments (including market values) of the Acquired Fund at August 31, 2020, have been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, and have been furnished to the Acquiring Fund. Said Statement of Assets and Liabilities and Schedule of Investments fairly present the Acquired Fund’s financial position as of such date and said Statement of Operations, Statement of Changes in Net Assets, and Financial Highlights fairly reflect the Acquired Fund’s results of operations, changes in financial position, and financial highlights for the periods covered thereby in conformity with generally accepted accounting principles consistently applied;

(g) The Acquired Fund has no known liabilities of a material nature, contingent or otherwise, other than those shown as belonging to it on its statement of assets and liabilities as of August 31, 2020 and those incurred in the ordinary course of the Acquired Fund’s business as an investment company since August 31, 2020;

(h) The registration statement (Registration Statement) filed with the Securities and Exchange Commission (Commission) by Acquiring Fund Trust on Form N–14 relating to the shares of the Acquiring Fund issuable hereunder and the information statement of the Acquired Fund included therein (Information Statement), on the effective date of the Registration Statement and insofar as they relate to the Acquired Fund (i) comply in all material respects with the provisions of the Securities Act of 1933, as amended (the 1933 Act), the Securities Exchange Act of 1934, as amended (the 1934 Act), and the 1940 Act, and the rules and regulations thereunder, and (ii) do not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading; and at the time of the shareholders’ meeting referred to in Section 7 and on the Closing Date (as defined in Section 6), the prospectus contained in the Registration Statement of which the Information Statement is a part (the Prospectus), as amended or supplemented, insofar as it relates to the Acquired Fund, will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading;

(i) No consent, approval, authorization, or order of any court or governmental authority is required for the consummation by the Acquired Fund of the transactions contemplated by this Agreement, except such as have been obtained under the 1933 Act, the 1934 Act, the 1940 Act, and state securities or blue sky laws (which term as used in this Agreement shall include the District of Columbia and Puerto Rico);

(j) The Acquired Fund has filed or will file all federal and state tax returns which, to the knowledge of the Acquired Fund’s officers, are required to be filed by the Acquired Fund and has paid or will pay all federal and state taxes shown to be due on said returns or provision shall have been made for the payment thereof, and, to the best of the Acquired Fund’s knowledge, no such return is currently under audit and no assessment has been asserted with respect to such returns;

(k) The Acquired Fund has met the requirements of Subchapter M of the Code for qualification and treatment as a regulated investment company for all prior taxable years and intends to meet such requirements for its current taxable year ending on the Closing Date;

26

(l) All of the issued and outstanding shares of the Acquired Fund are, and at the Closing Date will be, duly and validly issued and outstanding and fully paid and nonassessable as a matter of Massachusetts law (except as disclosed in the Acquired Fund’s Statements of Additional Information), and have been offered for sale and in conformity with all applicable federal securities laws. All of the issued and outstanding shares of the Acquired Fund will, at the Closing Date, be held by the persons and in the amounts set forth in the list of shareholders submitted to the Acquiring Fund in accordance with this Agreement;

(m) As of both the Valuation Time (as defined in Section 4) and the Closing Date, the Acquired Fund will have the full right, power, and authority to sell, assign, transfer, and deliver its portfolio securities and any other assets of the Acquired Fund to be transferred to the Acquiring Fund pursuant to this Agreement. As of the Closing Date, subject only to the delivery of the Acquired Fund’s portfolio securities and any such other assets as contemplated by this Agreement, the Acquiring Fund will acquire the Acquired Fund’s portfolio securities and any such other assets subject to no encumbrances, liens, or security interests (except for those that may arise in the ordinary course and are disclosed to the Acquiring Fund) and without any restrictions upon the transfer thereof; and

(n) The execution, delivery, and performance of this Agreement will have been duly authorized prior to the Closing Date by all necessary corporate action on the part of the Acquired Fund, and this Agreement constitutes a valid and binding obligation of the Acquired Fund enforceable in accordance with its terms.

2. REPRESENTATIONS AND WARRANTIES OF THE ACQUIRING FUND. The Acquiring Fund represents and warrants to and agrees with the Acquired Fund that:

(a) The Acquiring Fund is a series of the Acquiring Fund Trust, a business trust duly organized, validly existing, and in good standing under the laws of the Commonwealth of Massachusetts, and has the power to own all of its properties and assets and to carry out its obligations under this Agreement. It has all necessary federal, state, and local authorizations to carry on its business as now being conducted and to carry out this Agreement;

(b) The Acquiring Fund Trust is an open–end, management investment company duly registered under the 1940 Act, and such registration is in full force and effect;