UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3221

Fidelity Charles Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2012 |

Item 1. Reports to Stockholders

Fidelity®

Global Balanced

Fund

Annual Report

October 31, 2012

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Managers' review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

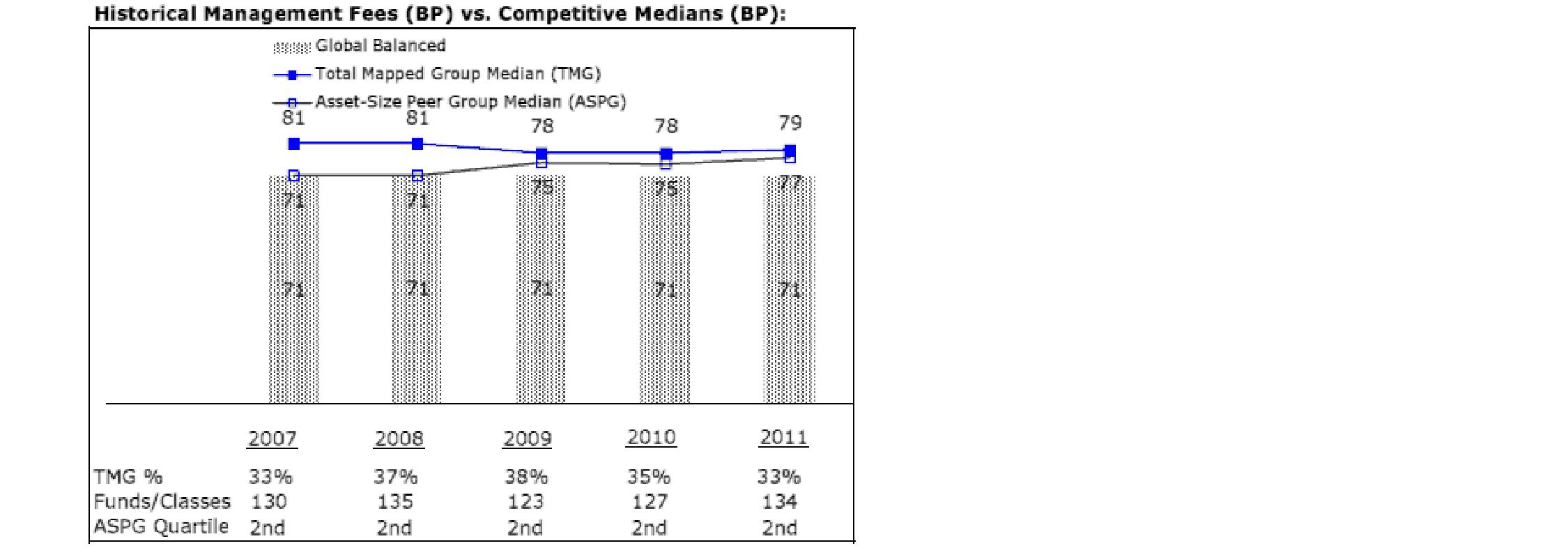

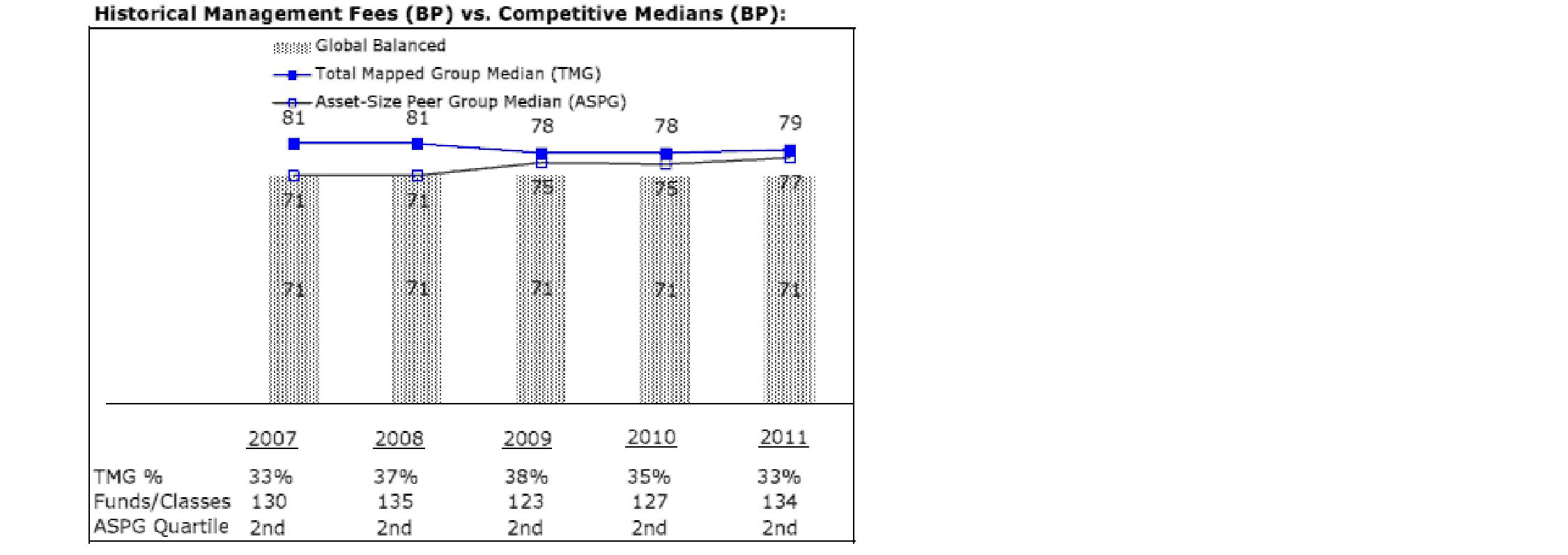

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2012 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

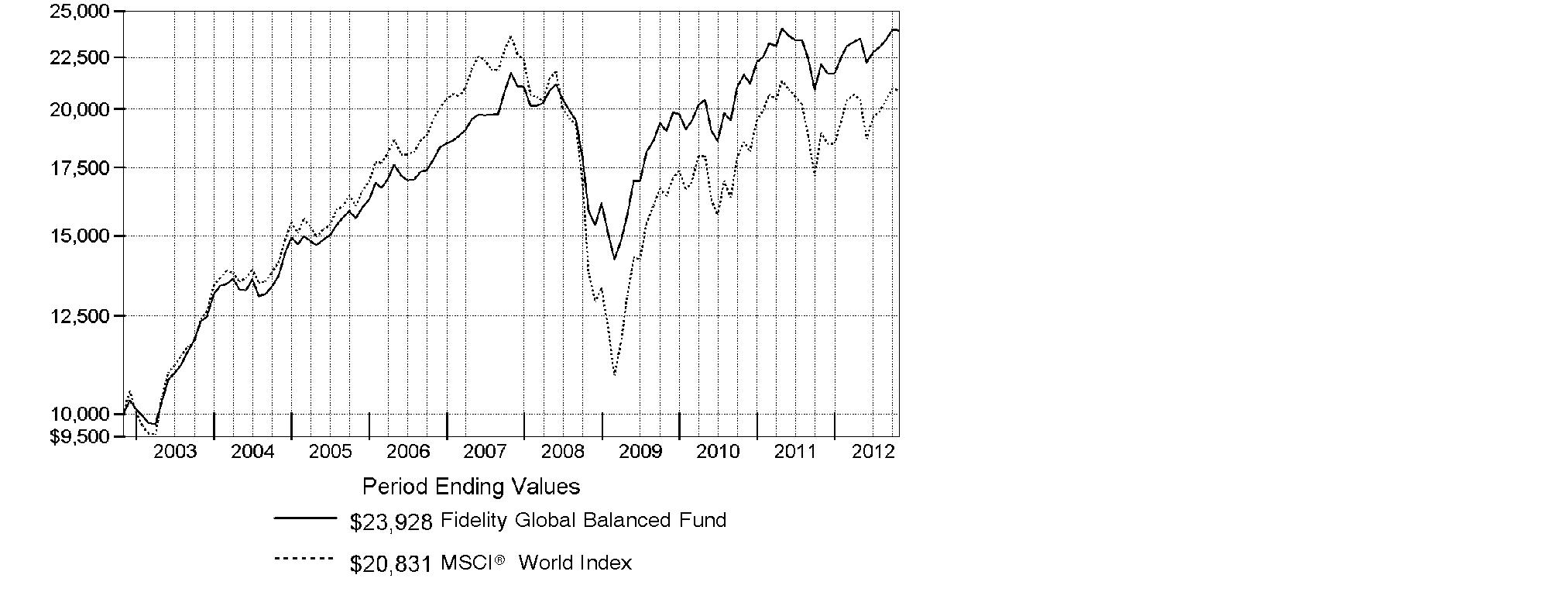

Annual Report

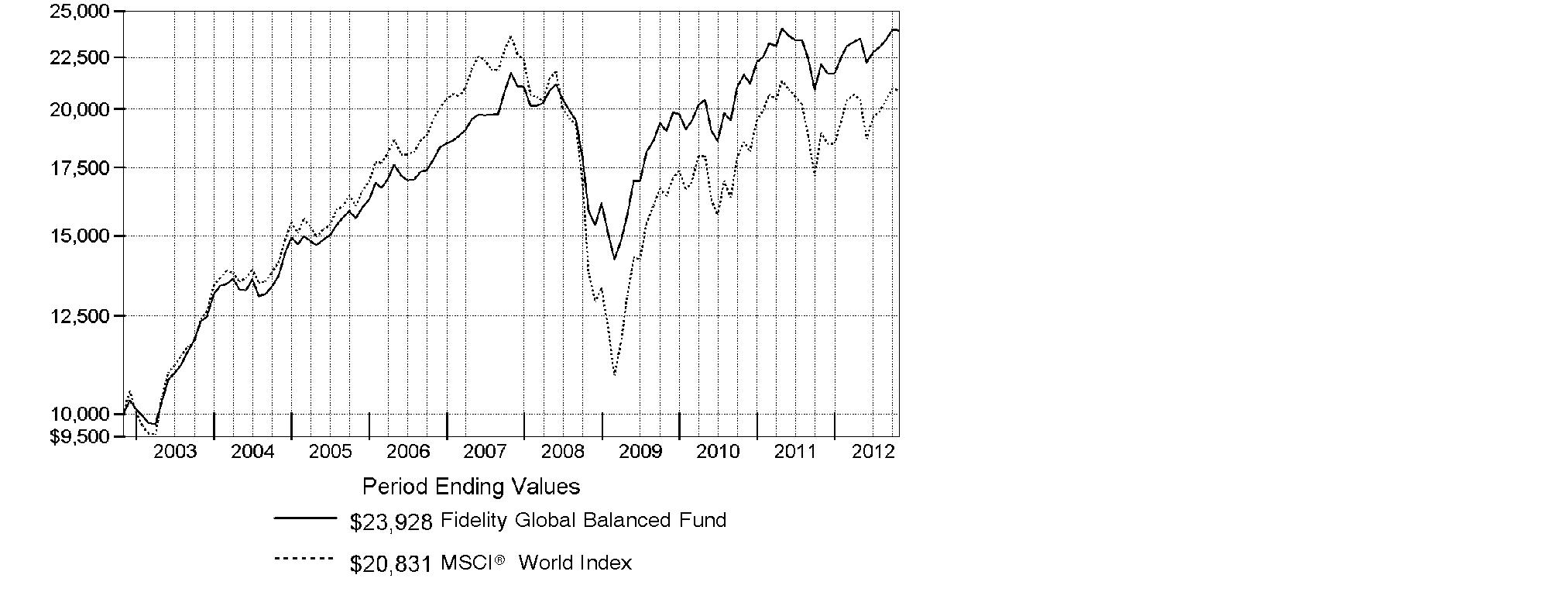

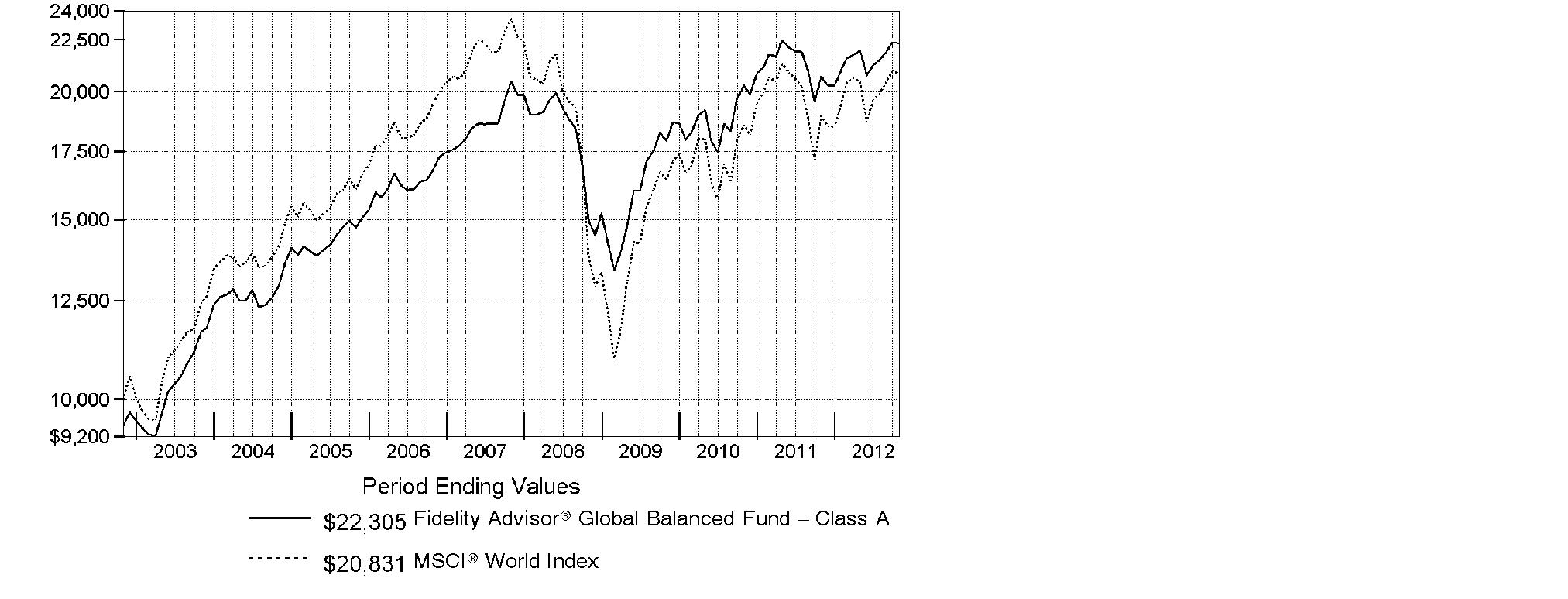

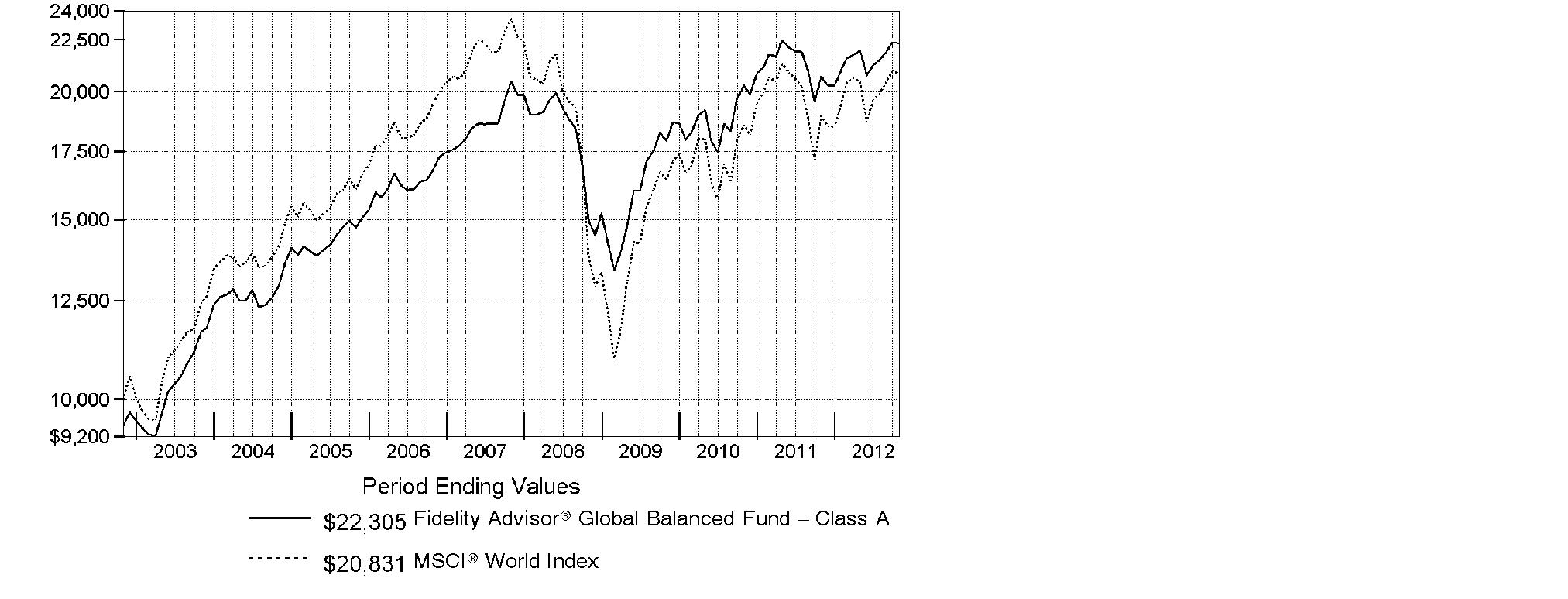

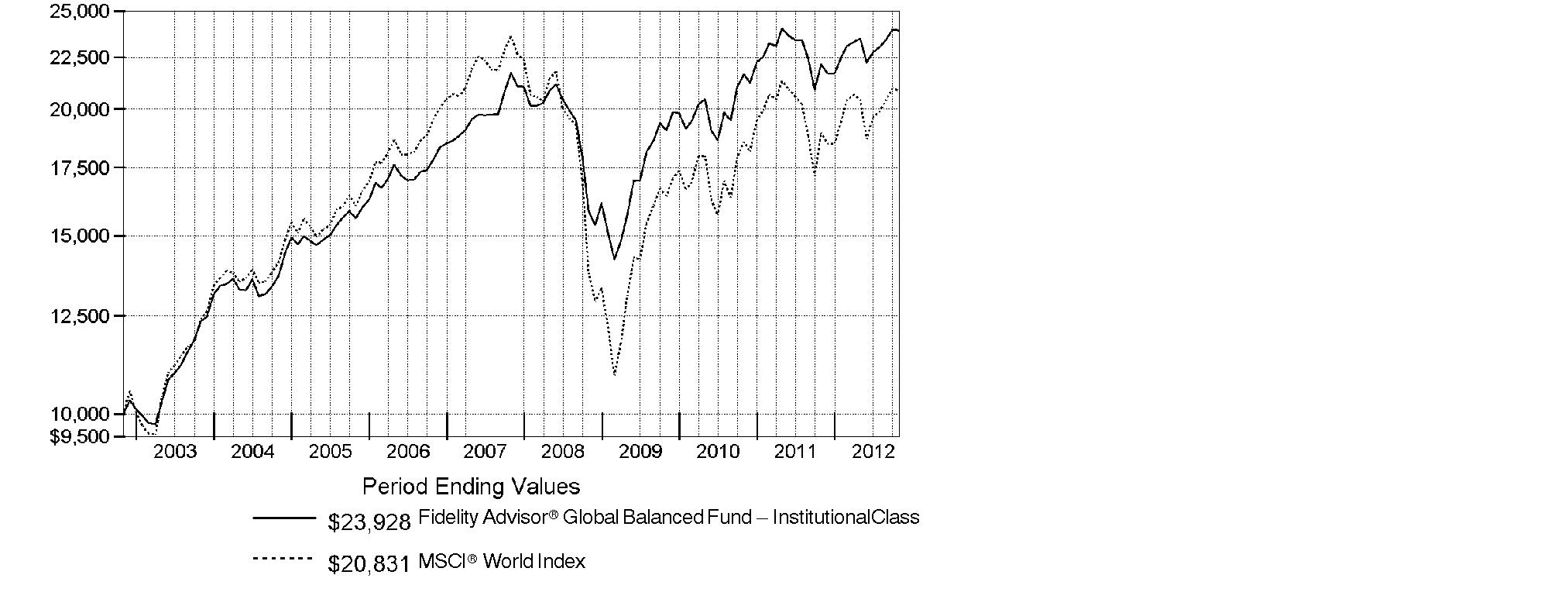

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

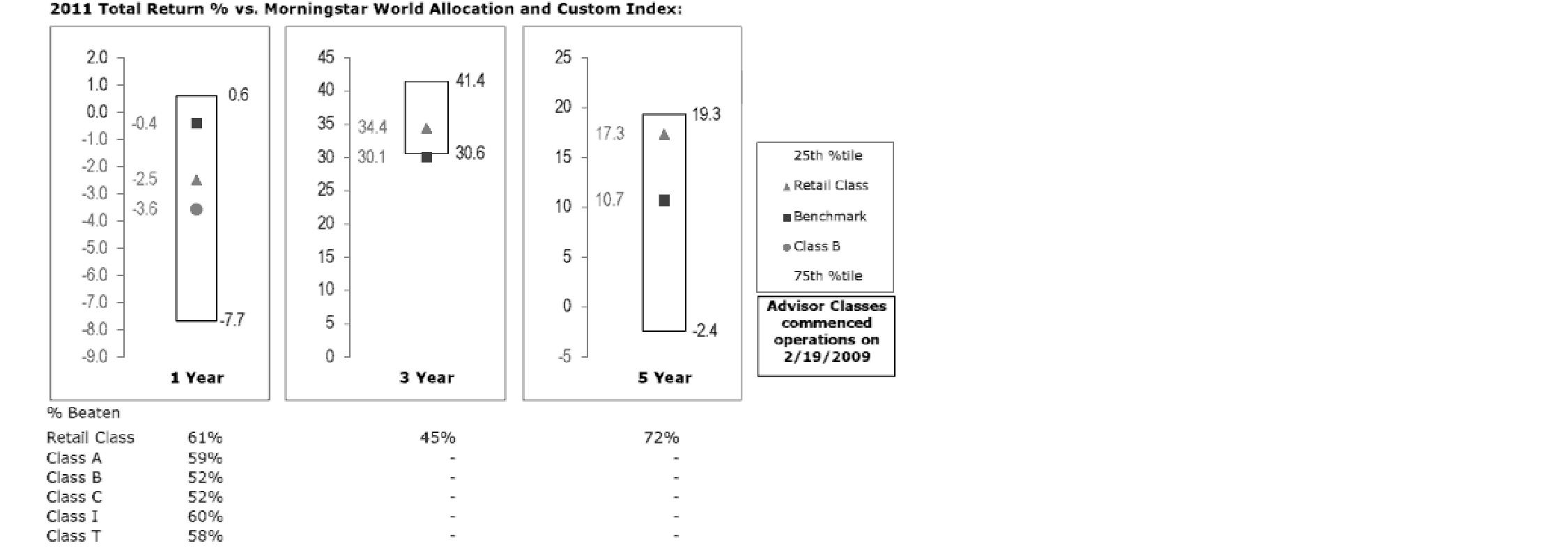

Average Annual Total Returns

Periods ended October 31, 2012 | Past 1

year | Past 5

years | Past 10

years |

Fidelity® Global Balanced Fund | 8.11% | 1.96% | 9.12% |

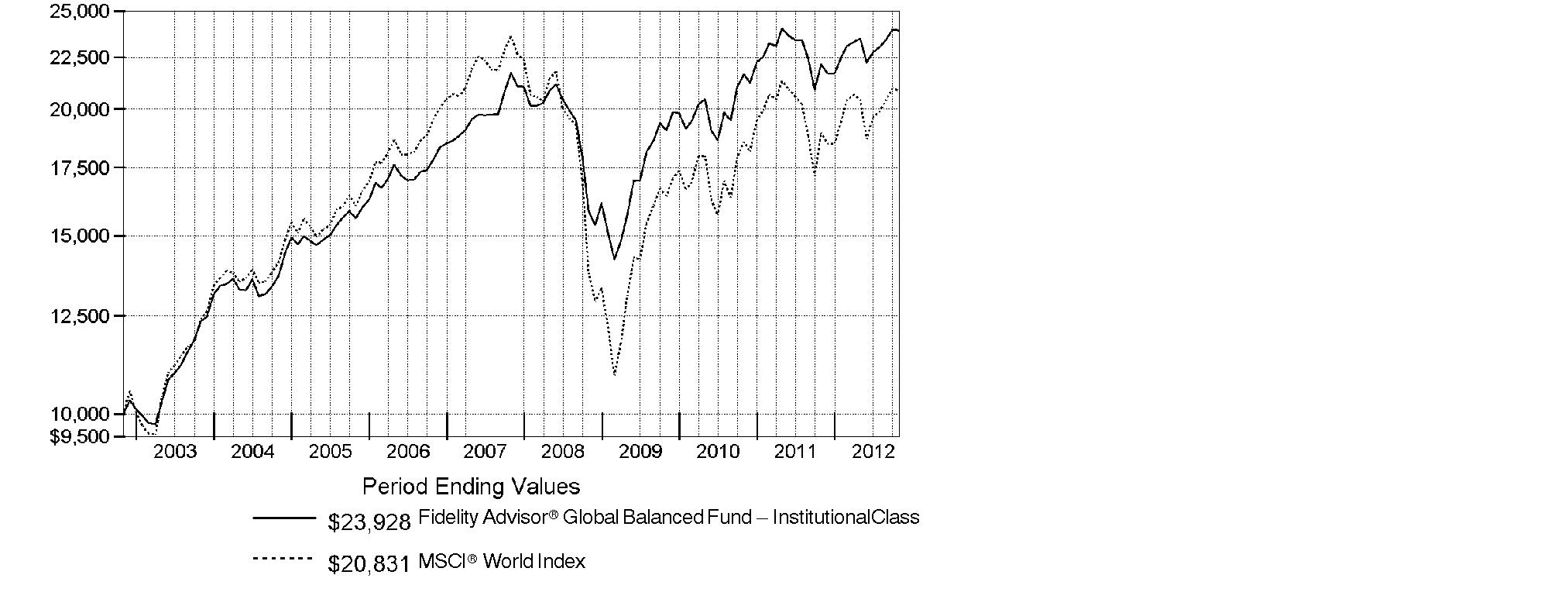

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Global Balanced Fund, a class of the fund, on October 31, 2002. The chart shows how the value of your investment would have changed, and also shows how the MSCI® World Index performed over the same period.

Annual Report

Market Recap: Global equities experienced turbulent swings during the 12 months ending October 31, 2012, but still managed a solid gain. Volatility peppered the past year, as several macroeconomic concerns weighed on investors, including the eurozone debt crisis, the strength of the U.S. economic recovery, and a slowdown in China's growth. But, stocks in the U.S. and overseas were generally resilient, gaining 8.96% for the 12 months, as measured by the MSCI® ACWI® (All Country World Index) Index, largely buttressed by accommodative monetary policy in the United States and Europe. Within the index, U.S. stocks fared best, advancing 15%. Asia-Pacific ex Japan also performed well, gaining roughly 10% on strong returns in Hong Kong and Singapore. Several European markets, most notably Germany (+11%) and Switzerland (+10%), benefited from optimism about the eurozone's ability to resolve its debt woes. However, continued weakness in peripheral Europe caused the region to lag the index overall. Japan, emerging markets and Canada each underperformed, with Japan suffering the most, falling by about 3%. A stronger U.S. dollar dampened results for foreign stocks overall. Global bond markets delivered positive, albeit more-muted returns, with the Barclays® Global Aggregate GDP Weighted Index gaining 4.54%.

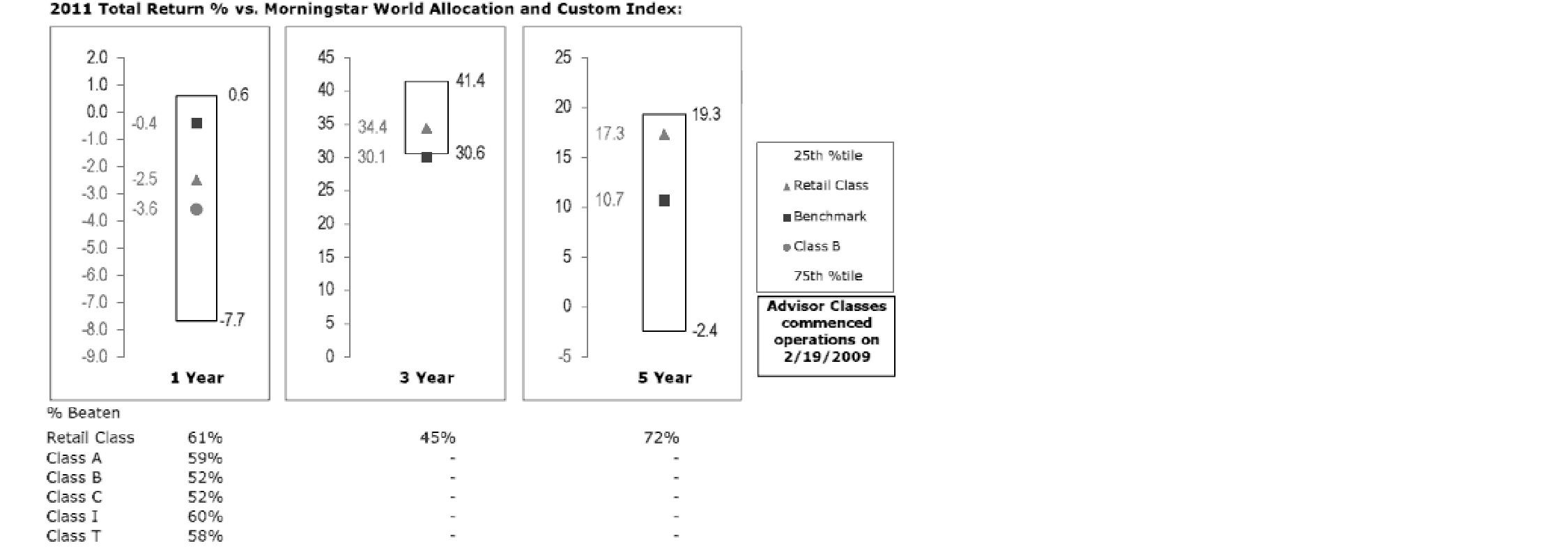

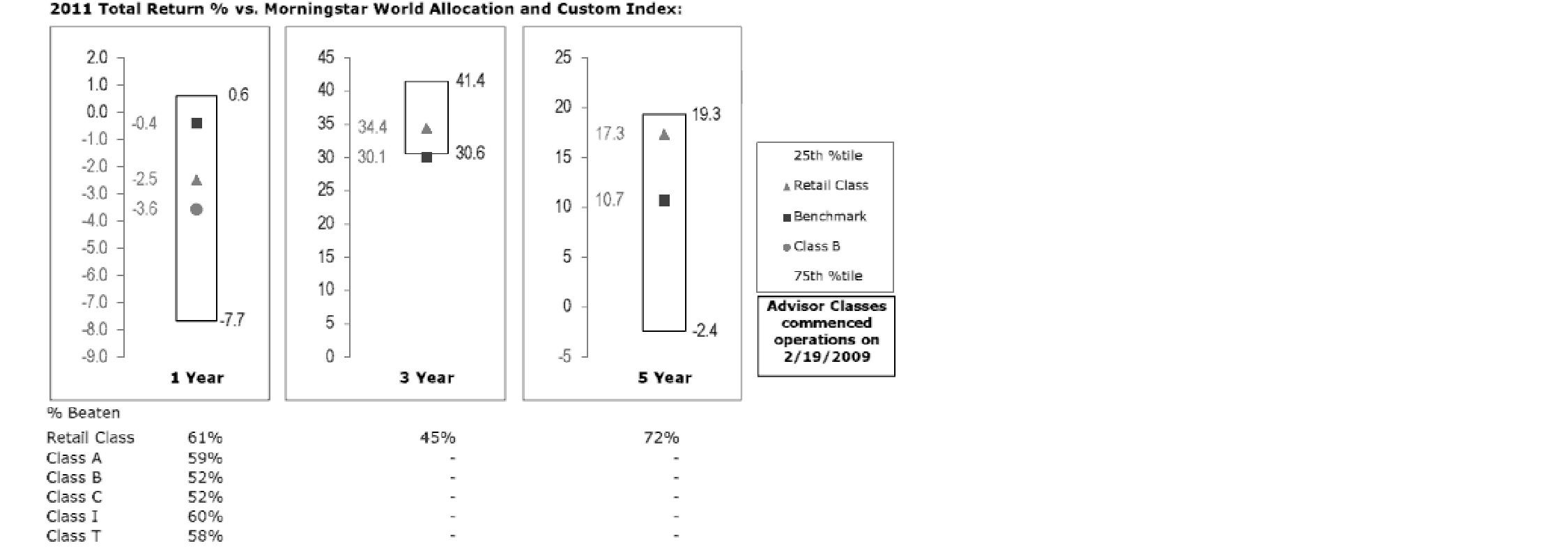

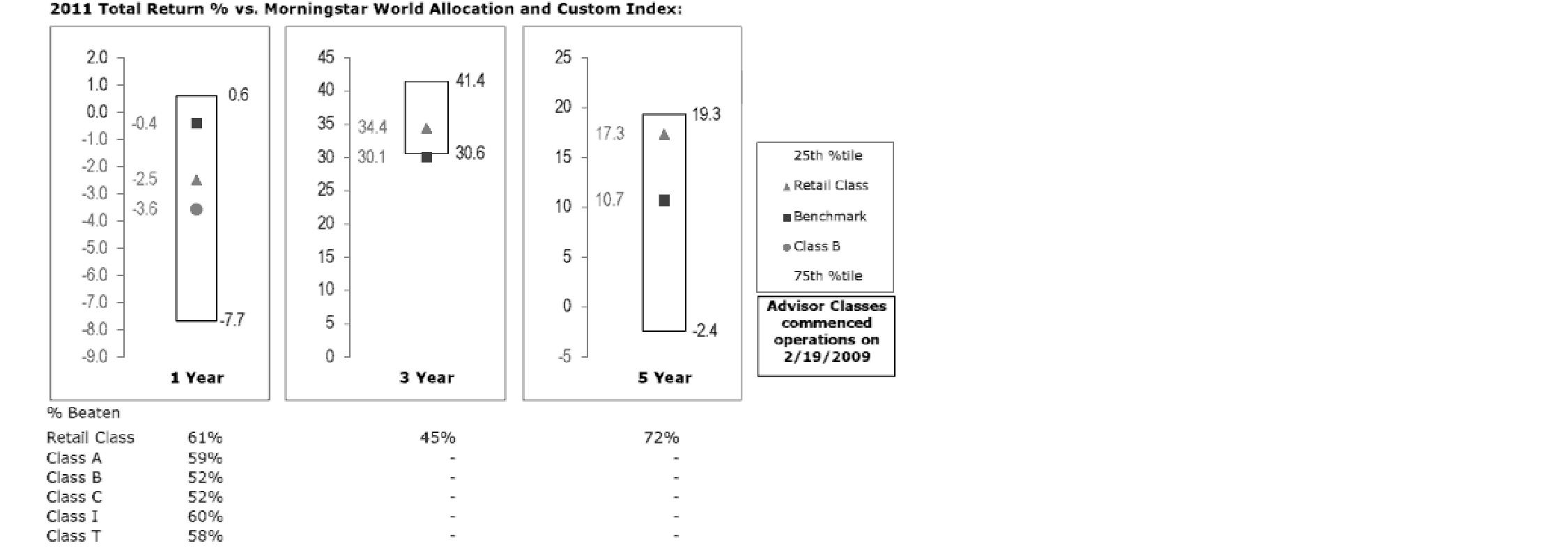

Comments from Ruben Calderon and Geoff Stein, Lead Co-Portfolio Managers of Fidelity® Global Balanced Fund: For the year, the fund's Retail Class shares gained 8.11%, versus 6.92% for the Fidelity Global Balanced Composite IndexSM - a 60%/40% blend of the MSCI® World Index and the Citigroup® World Government Bond Index. Strong security selection and positive overall asset allocation bolstered results. In particular, our choices among investment-grade bonds and beneficial overall positioning in European equities were the main drivers of the fund's performance. Within the investment-grade bond subportfolio, favorable picks among out-of-benchmark corporate bonds were key. As for European stocks, a combination of underweighting the sector, while making adroit stock choices among more-defensive consumer cyclicals and consumer discretionary names, boosted that subportfolio's return. From an asset-allocation perspective, modest, out-of-benchmark stakes in emerging-markets debt and high-yield bonds - via Fidelity central funds - were the biggest contributors, while an underweighting in global equities and an overweighting in investment-grade bonds proved moderately beneficial versus the index. On the downside, unfavorable positioning within the U.S. equity sleeve was the primary detractor.

Note to shareholders: Maria Nikishkova was named Co-Manager, replacing Leon Tucker, effective December 1, 2012.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 to October 31, 2012).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Annualized

Expense Ratio | Beginning

Account Value

May 1, 2012 | Ending

Account Value

October 31, 2012 | Expenses Paid

During Period*

May 1, 2012

to October 31, 2012 |

Class A | 1.32% | | | |

Actual | | $ 1,000.00 | $ 1,017.80 | $ 6.70 |

Hypothetical A | | $ 1,000.00 | $ 1,018.50 | $ 6.70 |

Class T | 1.56% | | | |

Actual | | $ 1,000.00 | $ 1,016.10 | $ 7.91 |

Hypothetical A | | $ 1,000.00 | $ 1,017.29 | $ 7.91 |

Class B | 2.10% | | | |

Actual | | $ 1,000.00 | $ 1,014.00 | $ 10.63 |

Hypothetical A | | $ 1,000.00 | $ 1,014.58 | $ 10.63 |

Class C | 2.12% | | | |

Actual | | $ 1,000.00 | $ 1,013.60 | $ 10.73 |

Hypothetical A | | $ 1,000.00 | $ 1,014.48 | $ 10.74 |

Global Balanced | 1.02% | | | |

Actual | | $ 1,000.00 | $ 1,019.40 | $ 5.18 |

Hypothetical A | | $ 1,000.00 | $ 1,020.01 | $ 5.18 |

Institutional Class | 1.01% | | | |

Actual | | $ 1,000.00 | $ 1,019.50 | $ 5.13 |

Hypothetical A | | $ 1,000.00 | $ 1,020.06 | $ 5.13 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

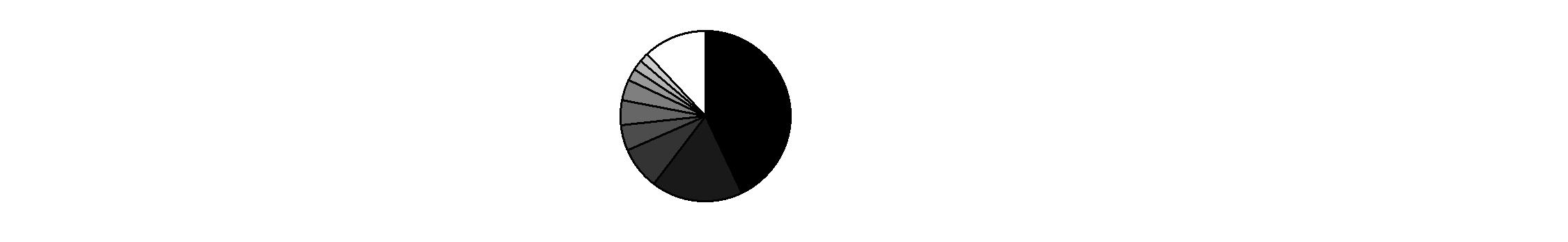

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of its investments in each non-money market Fidelity Central Fund. |

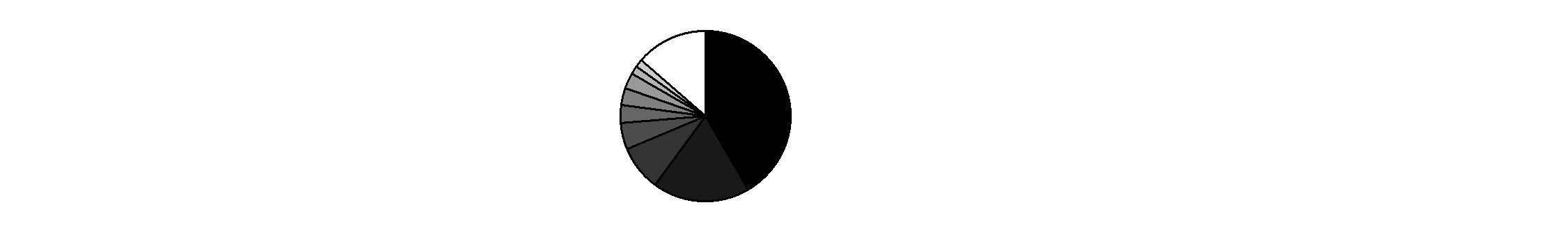

Geographic Diversification (% of fund's net assets) |

As of October 31, 2012 |

| United States of America* 43.0% | |

| Japan 17.5% | |

| United Kingdom 8.0% | |

| Canada 4.9% | |

| Germany 4.7% | |

| Italy 3.9% | |

| France 2.3% | |

| Netherlands 2.0% | |

| Australia 1.8% | |

| Other 11.9% | |

* Includes short-term investments and net other assets (liabilities). |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

As of April 30, 2012 |

| United States of America* 41.6% | |

| Japan 18.5% | |

| United Kingdom 8.6% | |

| Germany 5.0% | |

| Canada 3.4% | |

| Italy 3.3% | |

| France 2.9% | |

| Australia 1.7% | |

| Netherlands 1.5% | |

| Other 13.5% | |

* Includes short-term investments and net other assets (liabilities). |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

Asset Allocation |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks | 53.4 | 54.0 |

Bonds | 42.0 | 41.3 |

Other Investments | 0.2 | 0.3 |

Short-Term Investments and Net Other Assets (Liabilities) | 4.4 | 4.4 |

Top Five Stocks as of October 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

MasterCard, Inc. Class A (United States of America) | 1.6 | 1.5 |

American Tower Corp. (United States of America) | 1.1 | 0.5 |

Amgen, Inc. (United States of America) | 1.1 | 0.3 |

Pioneer Natural Resources Co. (United States of America) | 1.0 | 0.8 |

Gilead Sciences, Inc. (United States of America) | 1.0 | 0.2 |

| 5.8 | |

Top Five Bond Issuers as of October 31, 2012 |

(with maturities greater than one year) | % of fund's

net assets | % of fund's net assets

6 months ago |

Japan Government | 12.0 | 11.3 |

U.S. Treasury Obligations | 3.1 | 1.2 |

German Federal Republic | 3.0 | 3.7 |

Italian Republic | 2.9 | 2.2 |

Canadian Government | 1.4 | 0.4 |

| 22.4 | |

Market Sectors as of October 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 17.4 | 18.9 |

Consumer Discretionary | 10.0 | 11.7 |

Health Care | 7.1 | 5.1 |

Energy | 7.1 | 5.5 |

Industrials | 6.4 | 6.6 |

Information Technology | 6.0 | 9.9 |

Consumer Staples | 5.9 | 6.0 |

Materials | 3.4 | 4.0 |

Telecommunication Services | 2.8 | 1.7 |

Utilities | 1.8 | 1.7 |

A holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. |

Annual Report

Investments October 31, 2012

Showing Percentage of Net Assets

Common Stocks - 53.1% |

| Shares | | Value |

Australia - 1.6% |

Acrux Ltd. | 56,716 | | $ 190,752 |

AMP Ltd. | 127,215 | | 606,135 |

Australia & New Zealand Banking Group Ltd. | 30,549 | | 807,055 |

BHP Billiton Ltd. | 33,362 | | 1,181,197 |

Commonwealth Bank of Australia | 22,952 | | 1,375,912 |

Computershare Ltd. | 61,180 | | 551,884 |

CSL Ltd. | 11,342 | | 559,244 |

Goodman Group unit | 60,971 | | 280,379 |

Iluka Resources Ltd. | 11,087 | | 114,168 |

Macquarie Group Ltd. | 12,848 | | 425,446 |

Origin Energy Ltd. | 25,604 | | 301,929 |

QBE Insurance Group Ltd. | 25,757 | | 352,394 |

Spark Infrastructure Group unit | 185,107 | | 324,734 |

Suncorp-Metway Ltd. | 65,586 | | 639,967 |

Telstra Corp. Ltd. | 127,467 | | 547,793 |

WorleyParsons Ltd. | 9,388 | | 240,414 |

TOTAL AUSTRALIA | | 8,499,403 |

Bailiwick of Jersey - 0.5% |

Experian PLC | 60,600 | | 1,046,388 |

Randgold Resources Ltd. | 4,600 | | 549,873 |

Shire PLC | 16,957 | | 476,824 |

Wolseley PLC | 12,900 | | 563,943 |

TOTAL BAILIWICK OF JERSEY | | 2,637,028 |

Belgium - 0.6% |

Anheuser-Busch InBev SA NV | 29,400 | | 2,458,756 |

KBC Groupe SA | 17,855 | | 419,115 |

UCB SA | 3,200 | | 186,646 |

TOTAL BELGIUM | | 3,064,517 |

Bermuda - 0.1% |

Jardine Strategic Holdings Ltd. | 4,000 | | 145,600 |

Li & Fung Ltd. | 128,000 | | 214,708 |

Pacific Basin Shipping Ltd. | 486,000 | | 260,243 |

TOTAL BERMUDA | | 620,551 |

Canada - 3.4% |

Agnico-Eagle Mines Ltd. (Canada) | 3,200 | | 180,674 |

Agrium, Inc. | 4,000 | | 421,247 |

Alamos Gold, Inc. | 700 | | 13,702 |

Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | 5,500 | | 270,168 |

Athabasca Oil Corp. (a) | 5,200 | | 62,947 |

Common Stocks - continued |

| Shares | | Value |

Canada - continued |

Bank of Montreal (e) | 7,100 | | $ 419,566 |

Bank of Nova Scotia | 8,300 | | 450,839 |

Barrick Gold Corp. | 8,600 | | 347,789 |

Baytex Energy Corp. | 2,900 | | 131,970 |

BCE, Inc. | 7,100 | | 310,374 |

Boardwalk (REIT) | 2,400 | | 154,441 |

Brookfield Asset Management, Inc. Class A | 5,200 | | 179,000 |

Brookfield Properties Corp. | 5,300 | | 81,616 |

Calfrac Well Services Ltd. | 500 | | 11,469 |

Cameco Corp. | 5,000 | | 96,971 |

Canadian Imperial Bank of Commerce | 1,800 | | 141,585 |

Canadian National Railway Co. | 5,100 | | 440,374 |

Canadian Natural Resources Ltd. | 13,400 | | 403,845 |

Canadian Oil Sands Ltd. | 6,600 | | 140,095 |

Canadian Pacific | 35,100 | | 3,229,024 |

Catamaran Corp. (a) | 24,180 | | 1,135,461 |

Celtic Exploration Ltd. (a) | 700 | | 18,279 |

Cenovus Energy, Inc. | 11,500 | | 405,652 |

CGI Group, Inc. Class A (sub. vtg.) (a) | 9,900 | | 259,011 |

CI Financial Corp. | 3,300 | | 77,118 |

Copper Mountain Mining Corp. (a) | 12,400 | | 50,159 |

Corus Entertainment, Inc. Class B (non-vtg.) | 1,900 | | 43,013 |

Crescent Point Energy Corp. | 5,400 | | 224,380 |

Dollarama, Inc. | 3,860 | | 243,832 |

Eldorado Gold Corp. | 15,050 | | 222,416 |

Enbridge, Inc. | 9,300 | | 370,045 |

Finning International, Inc. | 3,100 | | 72,786 |

First Quantum Minerals Ltd. | 5,600 | | 125,877 |

Fortis, Inc. | 100 | | 3,381 |

Goldcorp, Inc. | 13,900 | | 628,370 |

IGM Financial, Inc. | 500 | | 19,840 |

Imperial Oil Ltd. | 2,300 | | 101,764 |

Intact Financial Corp. | 3,250 | | 199,312 |

Keyera Corp. | 823 | | 39,949 |

Manitoba Telecom Services, Inc. | 2,100 | | 70,501 |

Manulife Financial Corp. | 6,500 | | 80,310 |

MEG Energy Corp. (a) | 1,800 | | 65,746 |

Metro, Inc. Class A (sub. vtg.) | 2,000 | | 117,987 |

National Bank of Canada | 2,200 | | 170,009 |

Open Text Corp. (a) | 1,800 | | 96,745 |

Pacific Rubiales Energy Corp. | 2,900 | | 68,206 |

Pembina Pipeline Corp. | 2,300 | | 64,319 |

Common Stocks - continued |

| Shares | | Value |

Canada - continued |

Penn West Petroleum Ltd. | 4,900 | | $ 63,633 |

PetroBakken Energy Ltd. Class A | 7,700 | | 97,219 |

Precision Drilling Corp. (a) | 2,600 | | 18,613 |

Progressive Waste Solution Ltd. | 900 | | 17,419 |

Quebecor, Inc. Class B (sub. vtg.) | 1,200 | | 41,860 |

RioCan (REIT) | 4,800 | | 130,916 |

Rogers Communications, Inc. Class B (non-vtg.) | 6,750 | | 296,290 |

Royal Bank of Canada | 17,100 | | 974,893 |

Silver Wheaton Corp. | 3,300 | | 132,991 |

Sun Life Financial, Inc. | 7,800 | | 193,448 |

Suncor Energy, Inc. | 26,772 | | 898,521 |

Talisman Energy, Inc. | 10,300 | | 116,742 |

TELUS Corp. | 4,000 | | 259,685 |

The Toronto-Dominion Bank | 11,300 | | 919,048 |

Tim Hortons, Inc. (Canada) | 1,500 | | 74,463 |

Tourmaline Oil Corp. (a) | 2,400 | | 79,299 |

TransCanada Corp. | 7,300 | | 328,692 |

Trican Well Service Ltd. | 2,300 | | 27,450 |

Trinidad Drilling Ltd. | 1,300 | | 8,617 |

Valeant Pharmaceuticals International, Inc. (Canada) (a) | 7,400 | | 413,437 |

Vermilion Energy, Inc. | 1,600 | | 76,496 |

Yamana Gold, Inc. | 9,400 | | 189,835 |

TOTAL CANADA | | 17,821,731 |

Cayman Islands - 0.1% |

SouFun Holdings Ltd. ADR | 14,500 | | 262,015 |

Tencent Holdings Ltd. | 13,000 | | 459,610 |

TOTAL CAYMAN ISLANDS | | 721,625 |

Denmark - 0.2% |

Novo Nordisk A/S Series B | 7,475 | | 1,198,358 |

Finland - 0.1% |

Sampo OYJ (A Shares) | 9,829 | | 308,050 |

France - 1.5% |

Arkema SA | 4,600 | | 419,387 |

Atos Origin SA | 5,097 | | 342,282 |

BNP Paribas SA | 19,972 | | 1,004,663 |

Carrefour SA | 16,725 | | 404,080 |

Christian Dior SA | 3,100 | | 445,001 |

Credit Agricole SA (a) | 39,500 | | 297,358 |

Dassault Systemes SA | 3,400 | | 358,238 |

Essilor International SA | 5,125 | | 462,005 |

Common Stocks - continued |

| Shares | | Value |

France - continued |

Eurofins Scientific SA | 2,800 | | $ 432,966 |

PPR SA | 4,800 | | 843,949 |

Sanofi SA | 25,250 | | 2,217,644 |

Vivendi SA | 28,836 | | 589,971 |

TOTAL FRANCE | | 7,817,544 |

Germany - 1.1% |

adidas AG | 5,700 | | 485,617 |

BASF AG | 6,537 | | 541,675 |

Bayer AG | 14,100 | | 1,227,945 |

Brenntag AG | 3,200 | | 403,320 |

Deutsche Boerse AG | 6,000 | | 324,763 |

Fresenius Medical Care AG & Co. KGaA | 5,600 | | 393,480 |

GSW Immobilien AG | 9,600 | | 395,004 |

HeidelbergCement Finance AG | 10,100 | | 535,296 |

KUKA AG (a) | 5,500 | | 164,890 |

SAP AG | 11,482 | | 837,302 |

Software AG (Bearer) | 4,700 | | 188,301 |

Wirecard AG | 15,700 | | 358,763 |

TOTAL GERMANY | | 5,856,356 |

Greece - 0.0% |

Jumbo SA | 26,400 | | 174,514 |

Hong Kong - 0.5% |

AIA Group Ltd. | 168,600 | | 667,869 |

BOC Hong Kong (Holdings) Ltd. | 107,000 | | 329,282 |

Lenovo Group Ltd. | 160,000 | | 128,619 |

SJM Holdings Ltd. | 114,000 | | 248,298 |

Sun Hung Kai Properties Ltd. | 29,000 | | 403,752 |

Techtronic Industries Co. Ltd. | 148,500 | | 282,819 |

Wharf Holdings Ltd. | 97,000 | | 663,976 |

TOTAL HONG KONG | | 2,724,615 |

Ireland - 0.6% |

Accenture PLC Class A | 10,000 | | 674,100 |

Alkermes PLC (a) | 26,000 | | 481,780 |

Elan Corp. PLC (a) | 43,300 | | 471,240 |

Glanbia PLC | 29,500 | | 279,891 |

Ingersoll-Rand PLC | 8,900 | | 418,567 |

James Hardie Industries NV CDI | 47,602 | | 456,084 |

Common Stocks - continued |

| Shares | | Value |

Ireland - continued |

Trinity Biotech PLC sponsored ADR | 11,000 | | $ 155,540 |

XL Group PLC Class A | 7,000 | | 173,180 |

TOTAL IRELAND | | 3,110,382 |

Israel - 0.0% |

Sarin Technologies Ltd. | 170,500 | | 137,680 |

Italy - 0.5% |

Brunello Cucinelli SpA | 8,600 | | 152,155 |

ENI SpA | 48,500 | | 1,116,030 |

Geox SpA (e) | 93,500 | | 266,376 |

Prada SpA | 58,200 | | 474,609 |

Prysmian SpA | 22,200 | | 427,014 |

Saipem SpA | 7,203 | | 323,592 |

TOTAL ITALY | | 2,759,776 |

Japan - 3.7% |

Aeon Mall Co. Ltd. | 16,500 | | 428,053 |

Anritsu Corp. | 9,000 | | 112,965 |

Aozora Bank Ltd. | 41,000 | | 115,558 |

Asahi Kasei Corp. | 121,000 | | 665,401 |

Astellas Pharma, Inc. | 9,200 | | 456,946 |

Canon, Inc. | 24,100 | | 783,242 |

Chiyoda Co. Ltd. | 9,300 | | 266,080 |

Cosmos Pharmaceutical Corp. | 1,100 | | 108,443 |

CyberAgent, Inc. | 70 | | 139,947 |

Daito Trust Construction Co. Ltd. | 6,000 | | 605,787 |

Daiwa House Industry Co. Ltd. | 19,000 | | 287,749 |

Digital Garage, Inc. (e) | 20 | | 38,632 |

Don Quijote Co. Ltd. | 8,400 | | 330,928 |

East Japan Railway Co. | 8,200 | | 562,896 |

Exedy Corp. | 11,300 | | 219,121 |

GREE, Inc. (e) | 16,400 | | 285,968 |

Hitachi High-Technologies Corp. | 5,300 | | 115,985 |

Hitachi Transport System Ltd. | 17,900 | | 268,399 |

Honda Motor Co. Ltd. | 18,300 | | 550,157 |

Japan Tobacco, Inc. | 14,500 | | 400,689 |

JS Group Corp. | 32,900 | | 727,402 |

Kakaku.com, Inc. | 5,500 | | 188,432 |

Kao Corp. | 29,700 | | 834,115 |

KDDI Corp. | 5,800 | | 450,457 |

Kenedix Realty Investment Corp. | 26 | | 88,849 |

Kubota Corp. | 20,000 | | 204,434 |

Common Stocks - continued |

| Shares | | Value |

Japan - continued |

Kuraray Co. Ltd. | 13,200 | | $ 153,281 |

Lawson, Inc. | 4,500 | | 330,891 |

Makita Corp. | 1,800 | | 71,139 |

Marubeni Corp. | 43,000 | | 278,479 |

Mitsubishi Gas Chemical Co., Inc. | 69,000 | | 340,549 |

Mitsubishi Heavy Industries Ltd. | 123,000 | | 517,700 |

Mitsubishi UFJ Financial Group, Inc. | 72,900 | | 329,797 |

Mitsui & Co. Ltd. | 21,600 | | 304,397 |

Mitsui Fudosan Co. Ltd. | 19,000 | | 383,903 |

Namco Bandai Holdings, Inc. | 18,800 | | 295,318 |

NGK Insulators Ltd. | 23,000 | | 256,420 |

NHK Spring Co. Ltd. | 36,900 | | 307,384 |

Nissan Motor Co. Ltd. | 47,400 | | 396,633 |

Nitto Boseki Co. Ltd. | 15,000 | | 49,230 |

Nitto Denko Corp. | 9,600 | | 435,325 |

NTT Urban Development Co. | 110 | | 90,530 |

ORIX Corp. | 3,380 | | 347,188 |

Pioneer Corp. (a)(e) | 86,500 | | 206,959 |

Rakuten, Inc. | 23,200 | | 208,663 |

Sega Sammy Holdings, Inc. | 16,400 | | 309,182 |

Shimadzu Corp. | 22,000 | | 147,989 |

Shin-Etsu Chemical Co., Ltd. | 8,100 | | 456,595 |

Shinsei Bank Ltd. | 68,000 | | 99,662 |

SMC Corp. | 2,900 | | 456,996 |

Softbank Corp. | 10,300 | | 326,044 |

Sony Financial Holdings, Inc. | 17,800 | | 317,515 |

Stanley Electric Co. Ltd. | 11,500 | | 158,462 |

Sumitomo Chemical Co. Ltd. | 213,000 | | 597,670 |

Sumitomo Mitsui Financial Group, Inc. | 26,100 | | 797,538 |

Sumitomo Realty & Development Co. Ltd. | 14,000 | | 386,521 |

Sundrug Co. Ltd. | 12,800 | | 471,241 |

Terumo Corp. | 3,900 | | 168,057 |

Toray Industries, Inc. | 41,000 | | 239,334 |

Toyo Engineering Corp. | 19,000 | | 78,542 |

Universal Entertainment Corp. | 2,600 | | 55,921 |

Yamato Kogyo Co. Ltd. | 2,400 | | 67,373 |

TOTAL JAPAN | | 19,675,063 |

Netherlands - 0.7% |

Aalberts Industries NV | 12,100 | | 219,568 |

AEGON NV | 83,500 | | 466,987 |

ASML Holding NV (Netherlands) | 4,700 | | 258,370 |

Common Stocks - continued |

| Shares | | Value |

Netherlands - continued |

D.E. Master Blenders 1753 NV (a) | 46,400 | | $ 567,073 |

Heineken NV (Bearer) | 6,400 | | 394,569 |

Koninklijke Philips Electronics NV | 18,300 | | 458,343 |

LyondellBasell Industries NV Class A | 8,700 | | 464,493 |

NXP Semiconductors NV (a) | 11,100 | | 269,286 |

Randstad Holding NV | 9,100 | | 297,056 |

TOTAL NETHERLANDS | | 3,395,745 |

New Zealand - 0.0% |

Fletcher Building Ltd. | 21,674 | | 125,543 |

Norway - 0.1% |

DnB NOR ASA | 28,800 | | 359,665 |

Papua New Guinea - 0.1% |

Oil Search Ltd. ADR | 41,280 | | 318,809 |

Singapore - 0.2% |

DBS Group Holdings Ltd. | 6,000 | | 68,372 |

Ezra Holdings Ltd. | 150,000 | | 137,113 |

Great Eastern Holdings Ltd. | 8,000 | | 105,591 |

Keppel Corp. Ltd. | 61,100 | | 533,961 |

TOTAL SINGAPORE | | 845,037 |

South Africa - 0.1% |

Naspers Ltd. Class N | 3,600 | | 233,717 |

Spain - 0.9% |

Amadeus IT Holding SA Class A | 11,600 | | 287,175 |

Banco Bilbao Vizcaya Argentaria SA | 120,650 | | 1,008,146 |

Distribuidora Internacional de Alimentacion SA | 32,700 | | 197,934 |

Grifols SA (a) | 12,900 | | 447,436 |

Grifols SA ADR | 15,850 | | 398,786 |

Inditex SA | 8,685 | | 1,108,145 |

Repsol YPF SA | 35,300 | | 705,528 |

Telefonica SA | 54,976 | | 725,617 |

TOTAL SPAIN | | 4,878,767 |

Sweden - 0.3% |

H&M Hennes & Mauritz AB (B Shares) | 17,178 | | 581,414 |

Swedbank AB (A Shares) | 35,346 | | 655,454 |

Swedish Match Co. AB | 14,600 | | 497,460 |

TOTAL SWEDEN | | 1,734,328 |

Switzerland - 1.5% |

ACE Ltd. | 14,000 | | 1,101,100 |

Common Stocks - continued |

| Shares | | Value |

Switzerland - continued |

Actelion Ltd. | 5,016 | | $ 241,940 |

Adecco SA (Reg.) | 5,743 | | 277,746 |

Credit Suisse Group | 9,881 | | 229,786 |

Credit Suisse Group sponsored ADR | 4,800 | | 112,032 |

Nestle SA | 41,069 | | 2,606,226 |

Schindler Holding AG (participation certificate) | 4,473 | | 589,324 |

Syngenta AG (Switzerland) | 1,930 | | 752,487 |

UBS AG | 73,436 | | 1,101,804 |

UBS AG (NY Shares) | 50,000 | | 751,000 |

TOTAL SWITZERLAND | | 7,763,445 |

United Kingdom - 5.1% |

Antofagasta PLC | 17,900 | | 363,099 |

ASOS PLC (a) | 4,500 | | 163,755 |

Barclays PLC | 225,620 | | 834,283 |

Barratt Developments PLC (a) | 263,300 | | 805,611 |

Bellway PLC | 34,900 | | 569,394 |

BG Group PLC | 28,182 | | 521,868 |

BHP Billiton PLC | 36,439 | | 1,167,916 |

British American Tobacco PLC (United Kingdom) | 27,300 | | 1,354,069 |

British Land Co. PLC | 64,376 | | 549,042 |

Ensco PLC Class A | 6,600 | | 381,612 |

Filtrona PLC | 58,700 | | 542,786 |

Hilton Food Group PLC | 40,200 | | 180,184 |

HSBC Holdings PLC (United Kingdom) | 229,600 | | 2,263,693 |

Intertek Group PLC | 7,700 | | 350,285 |

Kingfisher PLC | 98,200 | | 458,771 |

Lloyds Banking Group PLC (a) | 452,900 | | 298,236 |

Meggitt PLC | 96,600 | | 601,729 |

Michael Page International PLC | 73,800 | | 429,217 |

Next PLC | 11,900 | | 684,801 |

Old Mutual PLC | 186,112 | | 516,582 |

Persimmon PLC | 50,300 | | 645,314 |

Prudential PLC | 54,363 | | 746,600 |

Reckitt Benckiser Group PLC | 16,200 | | 980,353 |

Redrow PLC (a) | 204,400 | | 520,504 |

Rightmove PLC | 5,500 | | 142,986 |

Rolls-Royce Group PLC | 55,961 | | 771,674 |

Rolls-Royce Group PLC Class C | 4,253,036 | | 6,863 |

Royal Dutch Shell PLC Class A (United Kingdom) | 74,194 | | 2,545,800 |

SABMiller PLC | 21,600 | | 925,279 |

Serco Group PLC | 24,078 | | 220,119 |

Common Stocks - continued |

| Shares | | Value |

United Kingdom - continued |

Standard Chartered PLC (United Kingdom) | 24,919 | | $ 588,518 |

Taylor Wimpey PLC | 1,113,900 | | 1,098,307 |

Ted Baker PLC | 28,400 | | 434,473 |

Tesco PLC | 114,000 | | 588,420 |

Unilever PLC | 39,800 | | 1,484,667 |

Vodafone Group PLC | 576,400 | | 1,565,292 |

Whitbread PLC | 13,612 | | 516,210 |

TOTAL UNITED KINGDOM | | 26,818,312 |

United States of America - 29.6% |

Abbott Laboratories | 41,000 | | 2,686,320 |

American International Group, Inc. (a) | 92,000 | | 3,213,560 |

American Tower Corp. | 76,000 | | 5,722,040 |

Amgen, Inc. | 65,000 | | 5,625,425 |

Apple, Inc. | 8,500 | | 5,058,350 |

Beam, Inc. | 16,100 | | 894,516 |

Berkshire Hathaway, Inc. Class B (a) | 30,000 | | 2,590,500 |

Cabela's, Inc. Class A (a) | 76,000 | | 3,405,560 |

Cabot Oil & Gas Corp. | 84,000 | | 3,946,320 |

Capital One Financial Corp. | 50,000 | | 3,008,500 |

Citigroup, Inc. | 95,000 | | 3,552,050 |

Clean Harbors, Inc. (a) | 4,000 | | 233,400 |

Comcast Corp. Class A | 119,000 | | 4,463,690 |

Constellation Brands, Inc. Class A (sub. vtg.) (a) | 16,000 | | 565,440 |

Crown Castle International Corp. (a) | 14,000 | | 934,500 |

Discover Financial Services | 57,400 | | 2,353,400 |

Discovery Communications, Inc. (a) | 71,000 | | 4,190,420 |

DISH Network Corp. Class A | 15,000 | | 534,450 |

Eastman Chemical Co. | 3,000 | | 177,720 |

eBay, Inc. (a) | 92,000 | | 4,442,680 |

Estee Lauder Companies, Inc. Class A | 30,300 | | 1,867,086 |

Facebook, Inc. Class A | 21,000 | | 443,415 |

Foot Locker, Inc. | 21,000 | | 703,500 |

Freeport-McMoRan Copper & Gold, Inc. | 37,000 | | 1,438,560 |

G-III Apparel Group Ltd. (a) | 17,000 | | 628,320 |

General Electric Co. | 236,600 | | 4,982,796 |

Georgia Gulf Corp. | 11,200 | | 396,368 |

Gilead Sciences, Inc. (a) | 81,300 | | 5,460,108 |

GNC Holdings, Inc. | 32,000 | | 1,237,440 |

Home Depot, Inc. | 39,000 | | 2,393,820 |

International Paper Co. | 28,000 | | 1,003,240 |

J.B. Hunt Transport Services, Inc. | 48,300 | | 2,835,210 |

Common Stocks - continued |

| Shares | | Value |

United States of America - continued |

James River Coal Co. (a)(e) | 101,000 | | $ 506,010 |

Johnson & Johnson | 38,000 | | 2,691,160 |

lululemon athletica, Inc. (a) | 600 | | 41,406 |

Lumber Liquidators Holdings, Inc. (a) | 6,000 | | 334,920 |

M&T Bank Corp. | 26,000 | | 2,706,600 |

Marathon Petroleum Corp. | 20,000 | | 1,098,600 |

MasterCard, Inc. Class A | 18,500 | | 8,527,205 |

McGraw-Hill Companies, Inc. | 5,300 | | 292,984 |

Medivation, Inc. (a) | 13,000 | | 664,560 |

Merck & Co., Inc. | 43,000 | | 1,962,090 |

Noble Energy, Inc. | 26,100 | | 2,479,761 |

Ocwen Financial Corp. (a) | 24,000 | | 925,680 |

Onyx Pharmaceuticals, Inc. (a) | 28,000 | | 2,194,080 |

Palo Alto Networks, Inc. | 1,600 | | 87,968 |

Peabody Energy Corp. | 62,000 | | 1,729,800 |

Pfizer, Inc. | 103,000 | | 2,561,610 |

Phillips 66 | 101,000 | | 4,763,160 |

Pioneer Natural Resources Co. | 52,100 | | 5,504,365 |

Prestige Brands Holdings, Inc. (a) | 83,000 | | 1,443,370 |

PulteGroup, Inc. (a) | 109,000 | | 1,890,060 |

PVH Corp. | 14,000 | | 1,539,860 |

Ralph Lauren Corp. | 3,000 | | 461,070 |

Realogy Holdings Corp. | 24,800 | | 881,392 |

salesforce.com, Inc. (a) | 25,100 | | 3,664,098 |

SBA Communications Corp. Class A (a) | 16,000 | | 1,066,080 |

Sempra Energy | 21,700 | | 1,513,575 |

Sirius XM Radio, Inc. (a) | 118,000 | | 330,400 |

The Cooper Companies, Inc. | 8,000 | | 767,840 |

The Travelers Companies, Inc. | 20,000 | | 1,418,800 |

Theravance, Inc. (a) | 6,800 | | 153,068 |

TJX Companies, Inc. | 63,200 | | 2,631,016 |

Toll Brothers, Inc. (a) | 34,000 | | 1,122,340 |

Under Armour, Inc. Class A (sub. vtg.) (a) | 20,200 | | 1,055,652 |

Union Pacific Corp. | 34,800 | | 4,281,444 |

United Rentals, Inc. (a) | 22,000 | | 894,520 |

Urban Outfitters, Inc. (a) | 18,000 | | 643,680 |

USG Corp. (a) | 19,000 | | 507,490 |

Visa, Inc. Class A | 13,700 | | 1,901,012 |

Wal-Mart Stores, Inc. | 63,000 | | 4,726,260 |

Wells Fargo & Co. | 64,000 | | 2,156,160 |

Whirlpool Corp. | 4,000 | | 390,720 |

Common Stocks - continued |

| Shares | | Value |

United States of America - continued |

Workday, Inc. | 7,800 | | $ 378,300 |

Yum! Brands, Inc. | 4,100 | | 287,451 |

TOTAL UNITED STATES OF AMERICA | | 156,166,321 |

TOTAL COMMON STOCKS (Cost $247,796,937) |

279,766,882

|

Nonconvertible Preferred Stocks - 0.3% |

| | | |

Germany - 0.3% |

Porsche Automobil Holding SE (Germany) | 6,600 | | 438,166 |

ProSiebenSat.1 Media AG | 11,800 | | 328,833 |

Volkswagen AG | 3,000 | | 620,597 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $881,288) |

1,387,596

|

Nonconvertible Bonds - 12.1% |

| Principal

Amount (d) | | |

Australia - 0.2% |

Rio Tinto Finance Ltd. (United States) 9% 5/1/19 | | $ 250,000 | | 343,244 |

Westpac Banking Corp. 4.875% 11/19/19 | | 600,000 | | 692,977 |

TOTAL AUSTRALIA | | 1,036,221 |

Bailiwick of Jersey - 0.1% |

Gatwick Funding Ltd. 5.75% 1/23/37 | GBP | 350,000 | | 627,298 |

Belgium - 0.2% |

Anheuser-Busch InBev SA NV 2.875% 9/25/24 | EUR | 850,000 | | 1,130,361 |

British Virgin Islands - 0.1% |

CNOOC Finance 2011 Ltd. 4.25% 1/26/21 | | 400,000 | | 441,220 |

Canada - 0.0% |

The Toronto Dominion Bank 2.375% 10/19/16 | | 250,000 | | 262,761 |

Cayman Islands - 0.2% |

Bishopgate Asset Finance Ltd. 4.808% 8/14/44 | GBP | 191,820 | | 307,824 |

IPIC GMTN Ltd.: | | | | |

5.875% 3/14/21 (Reg S.) | EUR | 175,000 | | 265,387 |

6.875% 3/14/26 | GBP | 150,000 | | 301,973 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

Cayman Islands - continued |

Thames Water Utilities Cayman Finance Ltd. 6.125% 2/4/13 | EUR | 150,000 | | $ 197,130 |

Yorkshire Water Services Finance Ltd. 6.375% 8/19/39 | GBP | 100,000 | | 215,659 |

TOTAL CAYMAN ISLANDS | | 1,287,973 |

France - 0.8% |

Arkema SA 3.85% 4/30/20 | EUR | 300,000 | | 416,565 |

AXA SA 5.25% 4/16/40 (h) | EUR | 500,000 | | 622,421 |

BNP Paribas 2.375% 9/14/17 | | 400,000 | | 402,766 |

BNP Paribas SA 2.5% 8/23/19 | EUR | 400,000 | | 524,773 |

Credit Commercial de France 4.875% 1/15/14 | EUR | 250,000 | | 340,591 |

Credit Logement SA 1.402% (g)(h) | EUR | 250,000 | | 169,820 |

EDF SA 4.625% 9/11/24 | EUR | 150,000 | | 224,268 |

Eutelsat SA 5% 1/14/19 | EUR | 300,000 | | 451,867 |

Iliad SA 4.875% 6/1/16 | EUR | 500,000 | | 693,833 |

Societe Generale SCF 4% 7/7/16 | EUR | 450,000 | | 647,201 |

TOTAL FRANCE | | 4,494,105 |

Germany - 0.3% |

FMS Wertmanagement AoeR 1% 7/18/17 (Reg. S) | EUR | 1,100,000 | | 1,430,886 |

Hong Kong - 0.1% |

Wharf Finance Ltd. 4.625% 2/8/17 | | 400,000 | | 429,718 |

Ireland - 0.1% |

GE Capital UK Funding 4.375% 7/31/19 | GBP | 450,000 | | 787,803 |

Isle of Man - 0.1% |

AngloGold Ashanti Holdings PLC 5.375% 4/15/20 | | 300,000 | | 315,511 |

Italy - 0.5% |

Edison SpA 3.875% 11/10/17 (Reg. S) | EUR | 800,000 | | 1,108,084 |

Intesa Sanpaolo SpA: | | | | |

4.875% 7/10/15 | EUR | 300,000 | | 402,154 |

6.375% 11/12/17 (h) | GBP | 150,000 | | 232,356 |

UniCredit SpA 6.95% 10/31/22 (Reg. S) | EUR | 300,000 | | 390,033 |

Unione di Banche Italiane SCPA 4.5% 2/22/16 | EUR | 200,000 | | 272,870 |

TOTAL ITALY | | 2,405,497 |

Japan - 0.2% |

ORIX Corp. 5% 1/12/16 | | 450,000 | | 485,019 |

Sumitomo Mitsui Banking Corp. 4.85% 3/1/22 (Reg. S) | | 500,000 | | 559,398 |

TOTAL JAPAN | | 1,044,417 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

Korea (South) - 0.4% |

Export-Import Bank of Korea: | | | | |

5% 4/11/22 | | $ 200,000 | | $ 235,180 |

5.875% 1/14/15 | | 500,000 | | 548,858 |

Korea Electric Power Corp. 5.5% 7/21/14 (Reg. S) | | 190,000 | | 203,339 |

Korea Resources Corp. 4.125% 5/19/15 | | 610,000 | | 644,341 |

National Agricultural Cooperative Federation: | | | | |

4.25% 1/28/16 (Reg. S) | | 450,000 | | 482,022 |

5% 9/30/14 (Reg. S) | | 200,000 | | 213,724 |

TOTAL KOREA (SOUTH) | | 2,327,464 |

Luxembourg - 0.5% |

Gaz Capital SA (Luxembourg) 5.364% 10/31/14 | EUR | 150,000 | | 207,799 |

Gazprom International SA 7.201% 2/1/20 | | 143,947 | | 161,221 |

Glencore Finance (Europe) SA: | | | | |

4.125% 4/3/18 | EUR | 400,000 | | 553,249 |

5.25% 3/22/17 | EUR | 250,000 | | 360,087 |

7.125% 4/23/15 | EUR | 150,000 | | 219,861 |

SB Capital SA 5.125% 10/29/22 (Reg. S) | | 600,000 | | 598,500 |

Tyco Electronics Group SA 3.5% 2/3/22 | | 300,000 | | 312,071 |

TOTAL LUXEMBOURG | | 2,412,788 |

Mexico - 0.2% |

America Movil SAB de CV: | | | | |

3% 7/12/21 | EUR | 275,000 | | 366,304 |

5% 3/30/20 | | 400,000 | | 470,204 |

TOTAL MEXICO | | 836,508 |

Multi-National - 0.2% |

European Investment Bank 1.75% 3/15/17 | | 1,000,000 | | 1,036,278 |

Netherlands - 0.8% |

Alliander NV 2.875% 6/14/24 | EUR | 250,000 | | 333,076 |

EDP Finance BV 5.75% 9/21/17 | EUR | 250,000 | | 331,328 |

Heineken NV: | | | | |

1.4% 10/1/17 (f) | | 550,000 | | 552,239 |

2.75% 4/1/23 (f) | | 200,000 | | 201,844 |

HIT Finance BV 5.75% 3/9/18 | EUR | 400,000 | | 559,004 |

ING Verzekeringen NV 2.088% 6/21/21 (h) | EUR | 850,000 | | 1,069,006 |

Linde Finance BV 3.875% 6/1/21 | EUR | 500,000 | | 743,919 |

Volkswagen International Finance NV 2.375% 3/22/17 (f) | | 400,000 | | 413,825 |

TOTAL NETHERLANDS | | 4,204,241 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

Norway - 0.2% |

Eksportfinans ASA 2% 9/15/15 | | $ 850,000 | | $ 807,500 |

Singapore - 0.1% |

CMT MTN Pte. Ltd. 3.731% 3/21/18 (Reg. S) | | 400,000 | | 424,015 |

PSA International Pte Ltd. 4.625% 9/11/19 (Reg. S) | | 250,000 | | 284,676 |

TOTAL SINGAPORE | | 708,691 |

Spain - 0.3% |

BBVA US Senior SAU 4.664% 10/9/15 | | 500,000 | | 504,902 |

MAPFRE SA 5.921% 7/24/37 (h) | EUR | 150,000 | | 145,817 |

Santander Finance Preferred SA Unipersonal 7.3% 7/27/19 (h) | GBP | 100,000 | | 155,162 |

Telefonica Emisiones SAU: | | | | |

4.71% 1/20/20 | EUR | 200,000 | | 263,050 |

5.811% 9/5/17 | EUR | 300,000 | | 427,526 |

TOTAL SPAIN | | 1,496,457 |

Sweden - 0.0% |

Akzo Nobel Sweden Finance AB 2.625% 7/27/22 | EUR | 200,000 | | 256,194 |

United Kingdom - 2.3% |

Abbey National Treasury Services PLC: | | | | |

3.625% 9/8/16 | EUR | 400,000 | | 566,366 |

5.25% 2/16/29 | GBP | 550,000 | | 1,066,002 |

Barclays Bank PLC: | | | | |

4.25% 1/12/22 | GBP | 550,000 | | 995,785 |

6.75% 1/16/23 (h) | GBP | 300,000 | | 504,508 |

BAT International Finance PLC: | | | | |

7.25% 3/12/24 | GBP | 100,000 | | 216,763 |

8.125% 11/15/13 | | 200,000 | | 214,200 |

Centrica PLC: | | | | |

4.25% 9/12/44 | GBP | 250,000 | | 393,535 |

4.375% 3/13/29 | GBP | 350,000 | | 609,995 |

Direct Line Insurance Grup PLC 9.25% 4/27/42 (h) | GBP | 100,000 | | 177,513 |

Eastern Power Networks PLC 4.75% 9/30/21 (Reg. S) | GBP | 100,000 | | 179,880 |

EDF Energy Networks EPN PLC 6.25% 11/12/36 | GBP | 160,000 | | 322,083 |

Eversholt Funding PLC 5.831% 12/2/20 | GBP | 100,000 | | 188,957 |

Experian Finance PLC: | | | | |

2.375% 6/15/17 (f) | | 425,000 | | 435,100 |

4.75% 11/23/18 | GBP | 300,000 | | 543,644 |

First Hydro Finance PLC 9% 7/31/21 | GBP | 320,000 | | 608,960 |

Great Rolling Stock Co. Ltd. 6.25% 7/27/20 | GBP | 350,000 | | 672,312 |

Imperial Tobacco Finance 7.25% 9/15/14 | EUR | 150,000 | | 216,686 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

United Kingdom - continued |

Legal & General Group PLC 4% 6/8/25 (h) | EUR | 150,000 | | $ 187,618 |

Marks & Spencer PLC: | | | | |

6.125% 12/2/19 | GBP | 100,000 | | 182,209 |

7.125% 12/1/37 (f) | | 200,000 | | 222,408 |

Mondi Finance PLC 3.375% 9/28/20 | EUR | 350,000 | | 456,989 |

Motability Operations Group PLC 3.75% 11/29/17 | EUR | 300,000 | | 428,936 |

Royal Bank of Scotland PLC 5.125% 1/13/24 | GBP | 500,000 | | 957,919 |

Severn Trent Utilities Finance PLC 6.25% 6/7/29 | GBP | 300,000 | | 625,586 |

Tesco PLC 5.875% 9/12/16 | EUR | 100,000 | | 152,429 |

Wales & West Utilities Finance PLC 6.75% 12/17/36 (h) | GBP | 150,000 | | 281,395 |

Western Power Distribution PLC 5.75% 3/23/40 | GBP | 150,000 | | 284,818 |

William Hill PLC 7.125% 11/11/16 | GBP | 150,000 | | 265,058 |

TOTAL UNITED KINGDOM | | 11,957,654 |

United States of America - 4.2% |

Altria Group, Inc.: | | | | |

2.85% 8/9/22 | | 500,000 | | 500,920 |

9.25% 8/6/19 | | 204,000 | | 287,692 |

American International Group, Inc. 6.765% 11/15/17 | GBP | 200,000 | | 377,211 |

American Tower Corp. 4.7% 3/15/22 | | 450,000 | | 496,626 |

Aristotle Holding, Inc.: | | | | |

2.1% 2/12/15 (f) | | 480,000 | | 490,911 |

3.9% 2/15/22 (f) | | 1,110,000 | | 1,212,156 |

AT&T, Inc.: | | | | |

4.875% 6/1/44 | GBP | 200,000 | | 347,936 |

5.55% 8/15/41 | | 300,000 | | 380,735 |

Chrysler Group LLC/CG Co-Issuer, Inc. 8% 6/15/19 | | 500,000 | | 531,875 |

Citigroup, Inc.: | | | | |

4.25% 2/25/30 | EUR | 600,000 | | 662,009 |

4.5% 1/14/22 | | 150,000 | | 165,441 |

Comcast Corp. 6.55% 7/1/39 | | 350,000 | | 469,958 |

Credit Suisse New York Branch 5% 5/15/13 | | 400,000 | | 409,607 |

DIRECTV Holdings LLC/DIRECTV Financing, Inc.: | | | | |

4.375% 9/14/29 | GBP | 400,000 | | 648,611 |

5.15% 3/15/42 | | 550,000 | | 573,713 |

Enbridge Energy Partners LP 5.2% 3/15/20 | | 250,000 | | 290,593 |

Frontier Oil Corp. 6.875% 11/15/18 | | 250,000 | | 266,250 |

General Electric Capital Corp. 4.65% 10/17/21 | | 250,000 | | 282,625 |

General Electric Co.: | | | | |

4.125% 10/9/42 | | 200,000 | | 208,916 |

5.25% 12/6/17 | | 550,000 | | 651,399 |

Glencore Funding LLC 6% 4/15/14 (Reg. S) | | 309,000 | | 323,592 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

United States of America - continued |

John Deere Capital Corp. 2.8% 1/27/23 | | $ 600,000 | | $ 622,849 |

JPMorgan Chase & Co. 2.75% 8/24/22 | EUR | 400,000 | | 524,958 |

Marathon Oil Corp. 2.8% 11/1/22 | | 350,000 | | 352,446 |

Marsh & McLennan Companies, Inc. 4.8% 7/15/21 | | 500,000 | | 565,978 |

NBCUniversal Media LLC 4.375% 4/1/21 | | 500,000 | | 571,971 |

Philip Morris International, Inc.: | | | | |

2.125% 5/30/19 | EUR | 100,000 | | 132,997 |

2.875% 5/30/24 | EUR | 150,000 | | 199,739 |

Plains All American Pipeline LP/PAA Finance Corp. 8.75% 5/1/19 | | 100,000 | | 135,520 |

PPL Energy Supply LLC 6.5% 5/1/18 | | 160,000 | | 189,712 |

Procter & Gamble Co.: | | | | |

1.45% 8/15/16 | | 350,000 | | 358,791 |

2% 8/16/22 (Reg. S) | EUR | 250,000 | | 320,623 |

Qwest Corp. 6.75% 12/1/21 | | 650,000 | | 776,766 |

Reynolds American, Inc. 1.05% 10/30/15 | | 200,000 | | 200,570 |

Roche Holdings, Inc. 6% 3/1/19 (f) | | 150,000 | | 188,525 |

SABMiller Holdings, Inc.: | | | | |

2.45% 1/15/17 (f) | | 400,000 | | 419,150 |

3.75% 1/15/22 (f) | | 200,000 | | 219,761 |

Southeast Supply Header LLC 4.85% 8/15/14 (f) | | 300,000 | | 313,857 |

The Coca-Cola Co. 3.3% 9/1/21 | | 350,000 | | 389,681 |

The Dow Chemical Co. 4.125% 11/15/21 | | 950,000 | | 1,037,481 |

Time Warner Cable, Inc.: | | | | |

4.125% 2/15/21 | | 500,000 | | 557,311 |

5.5% 9/1/41 | | 400,000 | | 465,502 |

Tyco Flow Control International Finance SA 1.875% 9/15/17 (f) | | 150,000 | | 150,404 |

U.S. Bancorp 3% 3/15/22 | | 500,000 | | 529,603 |

UBS AG 7.625% 8/17/22 | | 700,000 | | 754,255 |

UnitedHealth Group, Inc. 2.75% 2/15/23 | | 150,000 | | 154,011 |

Ventas Realty LP 4.25% 3/1/22 | | 225,000 | | 241,311 |

Verizon Communications, Inc. 4.75% 11/1/41 | | 250,000 | | 288,997 |

Wal-Mart Stores, Inc. 5.625% 4/15/41 | | 500,000 | | 673,621 |

Wells Fargo & Co.: | | | | |

2.625% 8/16/22 | EUR | 550,000 | | 722,954 |

Nonconvertible Bonds - continued |

| Principal

Amount (d) | | Value |

United States of America - continued |

Wells Fargo & Co.: - continued | | | | |

3.676% 6/15/16 | | $ 450,000 | | $ 488,363 |

Xerox Corp. 2.95% 3/15/17 | | 150,000 | | 154,500 |

TOTAL UNITED STATES OF AMERICA | | 22,280,983 |

TOTAL NONCONVERTIBLE BONDS (Cost $59,303,621) |

64,018,529

|

Government Obligations - 25.1% |

|

Canada - 1.4% |

Canadian Government 3.25% 6/1/21 | CAD | 6,450,000 | | 7,265,977 |

Germany - 3.0% |

German Federal Republic: | | | | |

0% 6/13/14 | EUR | 2,250,000 | | 2,915,404 |

0.5% 4/7/17 | EUR | 150,000 | | 195,389 |

1.75% 10/9/15 | EUR | 700,000 | | 950,593 |

1.75% 7/4/22 | EUR | 600,000 | | 799,185 |

3.25% 7/4/21 | EUR | 1,400,000 | | 2,111,099 |

4% 1/4/18 | EUR | 700,000 | | 1,066,582 |

4.75% 7/4/40 | EUR | 3,000,000 | | 5,856,706 |

5.5% 1/4/31 | EUR | 200,000 | | 388,726 |

5.625% 1/4/28 | EUR | 910,000 | | 1,737,457 |

TOTAL GERMANY | | 16,021,141 |

Italy - 2.9% |

Italian Republic: | | | | |

Inflation-Indexed Bond: | | | | |

2.1% 9/15/16 | EUR | 893,172 | | 1,154,510 |

2.1% 9/15/21 | EUR | 1,807,814 | | 2,122,561 |

4.75% 9/1/21 | EUR | 9,250,000 | | 12,147,647 |

TOTAL ITALY | | 15,424,718 |

Japan - 13.6% |

Japan Government: | | | | |

0.2% 2/15/13 | JPY | 689,550,000 | | 8,639,656 |

1.3% 3/20/15 | JPY | 740,000,000 | | 9,532,318 |

1.3% 6/20/20 | JPY | 1,556,000,000 | | 20,667,032 |

1.7% 12/20/16 | JPY | 345,000,000 | | 4,596,607 |

1.7% 9/20/17 | JPY | 511,000,000 | | 6,868,351 |

Government Obligations - continued |

| Principal

Amount (d) | | Value |

Japan - continued |

Japan Government: - continued | | | | |

1.9% 6/20/16 | JPY | 469,250,000 | | $ 6,254,080 |

1.9% 3/20/29 | JPY | 966,500,000 | | 12,884,899 |

2% 9/20/40 | JPY | 181,000,000 | | 2,309,554 |

TOTAL JAPAN | | 71,752,497 |

Netherlands - 0.3% |

Dutch Government 1% 1/15/14 | EUR | 1,300,000 | | 1,704,204 |

New Zealand - 0.4% |

New Zealand Government Inflation-Indexed Bonds 2% 9/20/25 | NZD | 2,280,000 | | 1,928,207 |

Spain - 0.4% |

Spanish Kingdom 5.5% 4/30/21 | EUR | 1,400,000 | | 1,811,326 |

United States of America - 3.1% |

U.S. Treasury Bonds 3.125% 11/15/41 | | 2,850,000 | | 3,013,875 |

U.S. Treasury Notes: | | | | |

0.625% 9/30/17 | | 3,750,000 | | 3,735,060 |

0.875% 4/30/17 | | 3,000,000 | | 3,030,234 |

1% 3/31/17 | | 1,100,000 | | 1,117,532 |

1.625% 8/15/22 | | 1,525,000 | | 1,514,993 |

2% 2/15/22 | | 3,925,000 | | 4,060,228 |

TOTAL UNITED STATES OF AMERICA | | 16,471,922 |

TOTAL GOVERNMENT OBLIGATIONS (Cost $121,133,646) |

132,379,992

|

Asset-Backed Securities - 0.1% |

|

Clock Finance BV Series 2007-1 Class B2, 0.515% 2/25/15 (h) | EUR | 100,000 | | 128,484 |

Tesco Property Finance 2 PLC 6.0517% 10/13/39 | GBP | 240,967 | | 449,441 |

TOTAL ASSET-BACKED SECURITIES (Cost $529,353) |

577,925

|

Collateralized Mortgage Obligations - 0.4% |

| Principal

Amount (d) | | Value |

Private Sponsor - 0.4% |

Arkle Master Issuer PLC Series 2010-2X Class 1A1, 1.8345% 5/17/60 (h) | | $ 300,000 | | $ 302,800 |

Fosse Master Issuer PLC Series 2011-1 Class A3, 2.2078% 10/18/54 (h) | GBP | 269,527 | | 441,598 |

Granite Master Issuer PLC Series 2005-1 Class A5, 0.29% 12/20/54 (h) | EUR | 187,319 | | 238,788 |

Holmes Master Issuer PLC Series 2010-1X Class A2, 1.7403% 10/15/54 (h) | | 345,742 | | 349,316 |

Storm BV: | | | | |

Series 2010-1 Class A2, 1.233% 3/22/52 (h) | EUR | 500,000 | | 654,573 |

Series 2011-4 Class A1, 1.658% 10/22/53 (h) | EUR | 170,986 | | 221,239 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $2,223,675) |

2,208,314

|

Commercial Mortgage Securities - 0.1% |

|

France - 0.0% |

FCC Proudreed Properties Class A, 0.569% 8/18/17 (h) | EUR | 147,981 | | 178,506 |

Ireland - 0.0% |

German Residential Asset Note Distributor PLC Series 1 Class A, 0.445% 7/20/16 (h) | EUR | 148,764 | | 189,273 |

United Kingdom - 0.1% |

Eddystone Finance PLC Series 2006-1 Class A2, 1.0034% 4/19/21 (h) | GBP | 150,000 | | 216,646 |

REC Plantation Place Ltd. Series 5 Class A, 0.7581% 7/25/16 (Reg. S) (h) | GBP | 95,149 | | 151,782 |

TOTAL UNITED KINGDOM | | 368,428 |

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $736,901) |

736,207

|

Fixed-Income Funds - 4.6% |

| Shares | | |

Fidelity Emerging Markets Debt Central Fund (i) | 1,240,506 | | 13,720,001 |

Fidelity High Income Central Fund 1 (i) | 102,530 | | 10,417,086 |

TOTAL FIXED-INCOME FUNDS (Cost $22,218,989) |

24,137,087

|

Preferred Securities - 0.1% |

| Principal

Amount (d) | | Value |

United Kingdom - 0.1% |

Barclays Bank PLC 4.875% (g)(h)

(Cost $368,999) | $ 350,000 | | $ 325,210 |

Money Market Funds - 4.5% |

| Shares | | |

Fidelity Cash Central Fund, 0.19% (b) | 22,686,168 | | 22,686,168 |

Fidelity Securities Lending Cash Central Fund, 0.19% (b)(c) | 1,127,834 | | 1,127,834 |

TOTAL MONEY MARKET FUNDS (Cost $23,814,002) |

23,814,002

|

TOTAL INVESTMENT PORTFOLIO - 100.4% (Cost $479,007,411) | | 529,351,744 |

NET OTHER ASSETS (LIABILITIES) - (0.4)% | | (2,036,796) |

NET ASSETS - 100% | $ 527,314,948 |

Currency Abbreviations |

CAD | - | Canadian dollar |

EUR | - | European Monetary Unit |

GBP | - | British pound |

JPY | - | Japanese yen |

NZD | - | New Zealand dollar |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Amount is stated in United States dollars unless otherwise noted. |

(e) Security or a portion of the security is on loan at period end. |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $4,820,180 or 0.9% of net assets. |

(g) Security is perpetual in nature with no stated maturity date. |

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(i) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-Q and is available upon request or at the SEC's web site at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 28,737 |

Fidelity Emerging Markets Debt Central Fund | 1,233,994 |

Fidelity High Income Central Fund 1 | 767,275 |

Fidelity Securities Lending Cash Central Fund | 59,148 |

Total | $ 2,089,154 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows: |

Fund | Value,

beginning of

period | Purchases | Sales

Proceeds | Value,

end of

period | % ownership, end of

period |

Fidelity Emerging Markets Debt Central Fund | $ 26,242,783 | $ 2,336,136 | $ 16,506,717 | $ 13,720,001 | 12.1% |

Fidelity Emerging Markets Equity Central Fund | 12,104,910 | - | 11,787,976 | - | 0.0% |

Fidelity High Income Central Fund 1 | 6,226,123 | 9,770,359 | 6,203,930 | 10,417,086 | 1.9% |

Total | $ 44,573,816 | $ 12,106,495 | $ 34,498,623 | $ 24,137,087 | |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of October 31, 2012, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 45,365,726 | $ 44,815,569 | $ 550,157 | $ - |

Consumer Staples | 24,949,167 | 19,651,675 | 5,297,492 | - |

Energy | 30,541,630 | 26,879,800 | 3,661,830 | - |

Financials | 58,230,464 | 50,153,594 | 8,076,870 | - |

Health Care | 36,482,748 | 31,725,202 | 4,757,546 | - |

Industrials | 29,594,027 | 29,135,684 | 458,343 | - |

Information Technology | 31,507,942 | 29,629,028 | 1,878,914 | - |

Materials | 15,498,480 | 11,847,007 | 3,651,473 | - |

Telecommunication Services | 7,142,604 | 4,851,695 | 2,290,909 | - |

Utilities | 1,841,690 | 1,841,690 | - | - |

Corporate Bonds | 64,018,529 | - | 64,018,529 | - |

Government Obligations | 132,379,992 | - | 132,379,992 | - |

Asset-Backed Securities | 577,925 | - | 577,925 | - |

Collateralized Mortgage Obligations | 2,208,314 | - | 2,208,314 | - |

Commercial Mortgage Securities | 736,207 | - | 736,207 | - |

Fixed-Income Funds | 24,137,087 | 24,137,087 | - | - |

Preferred Securities | 325,210 | - | 325,210 | - |

Money Market Funds | 23,814,002 | 23,814,002 | - | - |

Total Investments in Securities: | $ 529,351,744 | $ 298,482,033 | $ 230,869,711 | $ - |

The following is a summary of transfers between Level 1 and Level 2 for the period ended October 31, 2012. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total |

Level 1 to Level 2 | $ 0 |

Level 2 to Level 1 | $ 25,118,006 |

Other Information |

The composition of credit quality ratings as a percentage of net assets is as follows (Unaudited): |

U.S. Government and U.S. Government Agency Obligations | 3.1% |

AAA,AA,A | 24.7% |

BBB | 10.1% |

BB | 1.6% |

B | 1.6% |

CCC,CC,C | 0.5% |

Not Rated | 0.6% |

Equities | 53.4% |

Short-Term Investments and Net Other Assets | 4.4% |

| 100.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

The information in the above table is based on the combined investments of the Fund and its pro-rata share of its investments in each non-money market Fidelity Central Fund. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

| October 31, 2012 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $1,072,106) - See accompanying schedule: Unaffiliated issuers (cost $432,974,420) | $ 481,400,655 | |

Fidelity Central Funds (cost $46,032,991) | 47,951,089 | |

Total Investments (cost $479,007,411) | | $ 529,351,744 |

Foreign currency held at value (cost $1,119,851) | | 1,120,015 |

Receivable for investments sold | | 5,271,189 |

Receivable for fund shares sold | | 541,054 |

Dividends receivable | | 434,213 |

Interest receivable | | 1,690,481 |

Distributions receivable from Fidelity Central Funds | | 11,415 |

Other receivables | | 15,543 |

Total assets | | 538,435,654 |

| | |

Liabilities | | |

Payable to custodian bank | $ 490,639 | |

Payable for investments purchased | 5,562,629 | |

Payable for fund shares redeemed | 3,386,409 | |

Accrued management fee | 314,053 | |

Distribution and service plan fees payable | 24,905 | |

Other affiliated payables | 114,470 | |

Other payables and accrued expenses | 99,767 | |

Collateral on securities loaned, at value | 1,127,834 | |

Total liabilities | | 11,120,706 |

| | |

Net Assets | | $ 527,314,948 |

Net Assets consist of: | | |

Paid in capital | | $ 466,499,666 |

Undistributed net investment income | | 5,608,248 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 4,857,622 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 50,349,412 |

Net Assets | | $ 527,314,948 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

| October 31, 2012 |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($26,714,448 ÷ 1,139,222 shares) | | $ 23.45 |

| | |

Maximum offering price per share (100/94.25 of $23.45) | | $ 24.88 |

Class T:

Net Asset Value and redemption price per share ($13,654,336 ÷ 585,427 shares) | | $ 23.32 |

| | |

Maximum offering price per share (100/96.50 of $23.32) | | $ 24.17 |

Class B:

Net Asset Value and offering price per share ($2,425,691 ÷ 104,486 shares)A | | $ 23.22 |

| | |

Class C:

Net Asset Value and offering price per share ($13,796,760 ÷ 597,601 shares)A | | $ 23.09 |

| | |

Global Balanced:

Net Asset Value, offering price and redemption price per share ($468,757,583 ÷ 19,846,479 shares) | | $ 23.62 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($1,966,130 ÷ 83,393 shares) | | $ 23.58 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended October 31, 2012 |

| | |

Investment Income | | |

Dividends | | $ 5,780,967 |

Interest | | 5,613,699 |

Income from Fidelity Central Funds | | 2,089,154 |

Income before foreign taxes withheld | | 13,483,820 |

Less foreign taxes withheld | | (281,948) |

Total income | | 13,201,872 |

| | |

Expenses | | |

Management fee | $ 3,727,969 | |

Transfer agent fees | 1,121,914 | |

Distribution and service plan fees | 271,671 | |

Accounting and security lending fees | 270,440 | |

Custodian fees and expenses | 169,561 | |

Independent trustees' compensation | 1,951 | |

Registration fees | 95,421 | |

Audit | 81,338 | |

Legal | 3,267 | |

Miscellaneous | 5,591 | |

Total expenses before reductions | 5,749,123 | |

Expense reductions | (48,927) | 5,700,196 |

Net investment income (loss) | | 7,501,676 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 20,854,540 | |

Fidelity Central Funds | 3,916,800 | |

Foreign currency transactions | (245,225) | |

Capital gain distributions from Fidelity Central Funds | 101,156 | |

Total net realized gain (loss) | | 24,627,271 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 7,753,988 | |

Assets and liabilities in foreign currencies | 121,005 | |

Total change in net unrealized appreciation (depreciation) | | 7,874,993 |

Net gain (loss) | | 32,502,264 |

Net increase (decrease) in net assets resulting from operations | | $ 40,003,940 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

October 31,

2012 | Year ended

October 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 7,501,676 | $ 7,224,068 |

Net realized gain (loss) | 24,627,271 | 39,788,338 |

Change in net unrealized appreciation (depreciation) | 7,874,993 | (35,693,976) |

Net increase (decrease) in net assets resulting

from operations | 40,003,940 | 11,318,430 |

Distributions to shareholders from net investment income | (5,592,973) | (5,506,342) |

Distributions to shareholders from net realized gain | (2,173,830) | (2,817,435) |

Total distributions | (7,766,803) | (8,323,777) |

Share transactions - net increase (decrease) | (70,009,704) | (4,897,733) |

Redemption fees | 8,000 | 19,178 |

Total increase (decrease) in net assets | (37,764,567) | (1,883,902) |

| | |

Net Assets | | |

Beginning of period | 565,079,515 | 566,963,417 |

End of period (including undistributed net investment income of $5,608,248 and undistributed net investment income of $5,026,105, respectively) | $ 527,314,948 | $ 565,079,515 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2012 | 2011 | 2010 | 2009 H |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 22.05 | $ 21.88 | $ 19.59 | $ 15.08 |

Income from Investment Operations | | | | |

Net investment income (loss) E | .27 | .22 | .17 | .12 |

Net realized and unrealized gain (loss) | 1.41 | .22 | 2.43 | 4.39 |

Total from investment operations | 1.68 | .44 | 2.60 | 4.51 |

Distributions from net investment income | (.19) | (.17) | (.23) | - |

Distributions from net realized gain | (.09) | (.11) | (.08) | - |

Total distributions | (.28) | (.27) K | (.31) | - |

Redemption fees added to paid in capital E,J | - | - | - | - |

Net asset value, end of period | $ 23.45 | $ 22.05 | $ 21.88 | $ 19.59 |

Total Return B,C,D | 7.74% | 2.04% | 13.40% | 29.91% |

Ratios to Average Net Assets F,I | | | | |

Expenses before reductions | 1.33% | 1.37% | 1.43% | 1.47% A |

Expenses net of fee waivers, if any | 1.33% | 1.37% | 1.43% | 1.47% A |

Expenses net of all reductions | 1.32% | 1.35% | 1.41% | 1.46% A |

Net investment income (loss) | 1.18% | .98% | .83% | .88% A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 26,714 | $ 20,831 | $ 11,096 | $ 2,912 |

Portfolio turnover rate G | 157% | 197% | 178% | 252% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period February 19, 2009 (commencement of sale of shares) to October 31, 2009.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount represents less than $.01 per share.

K Total distributions of $.27 per share is comprised of distributions from net investment income of $.167 and distributions from net realized gain of $.107 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2012 | 2011 | 2010 | 2009 H |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 21.96 | $ 21.81 | $ 19.56 | $ 15.08 |

Income from Investment Operations | | | | |

Net investment income (loss) E | .21 | .17 | .13 | .11 |

Net realized and unrealized gain (loss) | 1.41 | .22 | 2.42 | 4.37 |

Total from investment operations | 1.62 | .39 | 2.55 | 4.48 |

Distributions from net investment income | (.17) | (.13) | (.23) | - |

Distributions from net realized gain | (.09) | (.11) | (.08) | - |

Total distributions | (.26) | (.24) | (.30) K | - |

Redemption fees added to paid in capital E,J | - | - | - | - |

Net asset value, end of period | $ 23.32 | $ 21.96 | $ 21.81 | $ 19.56 |

Total Return B,C,D | 7.46% | 1.80% | 13.17% | 29.71% |

Ratios to Average Net Assets F,I | | | | |

Expenses before reductions | 1.58% | 1.59% | 1.62% | 1.69% A |

Expenses net of fee waivers, if any | 1.58% | 1.59% | 1.62% | 1.69% A |

Expenses net of all reductions | 1.57% | 1.58% | 1.60% | 1.68% A |

Net investment income (loss) | .94% | .75% | .64% | .88% A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 13,654 | $ 10,357 | $ 5,345 | $ 981 |

Portfolio turnover rate G | 157% | 197% | 178% | 252% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period February 19, 2009 (commencement of sale of shares) to October 31, 2009.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount represents less than $.01 per share.

K Total distributions of $.30 per share is comprised of distributions from net investment income of $.226 and distributions from net realized gain of $.075 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2012 | 2011 | 2010 | 2009 H |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 21.80 | $ 21.68 | $ 19.48 | $ 15.08 |

Income from Investment Operations | | | | |

Net investment income (loss) E | .09 | .04 | .02 | .05 |

Net realized and unrealized gain (loss) | 1.41 | .23 | 2.41 | 4.35 |

Total from investment operations | 1.50 | .27 | 2.43 | 4.40 |

Distributions from net investment income | - | (.04) | (.16) | - |

Distributions from net realized gain | (.08) | (.11) | (.08) | - |

Total distributions | (.08) | (.15) | (.23) K | - |

Redemption fees added to paid in capital E,J | - | - | - | - |

Net asset value, end of period | $ 23.22 | $ 21.80 | $ 21.68 | $ 19.48 |

Total Return B,C,D | 6.92% | 1.24% | 12.58% | 29.18% |

Ratios to Average Net Assets F,I | | | | |

Expenses before reductions | 2.12% | 2.15% | 2.18% | 2.21% A |

Expenses net of fee waivers, if any | 2.12% | 2.15% | 2.18% | 2.21% A |

Expenses net of all reductions | 2.11% | 2.13% | 2.16% | 2.20% A |

Net investment income (loss) | .39% | .20% | .08% | .39% A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 2,426 | $ 2,392 | $ 2,199 | $ 526 |

Portfolio turnover rate G | 157% | 197% | 178% | 252% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H For the period February 19, 2009 (commencement of sale of shares) to October 31, 2009.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount represents less than $.01 per share.

K Total distributions of $.23 per share is comprised of distributions from net investment income of $.158 and distributions from net realized gain of $.075 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2012 | 2011 | 2010 | 2009 H |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 21.73 | $ 21.65 | $ 19.49 | $ 15.08 |

Income from Investment Operations | | | | |

Net investment income (loss) E | .09 | .05 | .03 | .05 |

Net realized and unrealized gain (loss) | 1.41 | .22 | 2.40 | 4.36 |

Total from investment operations | 1.50 | .27 | 2.43 | 4.41 |

Distributions from net investment income | (.05) | (.08) | (.20) | - |

Distributions from net realized gain | (.09) | (.11) | (.08) | - |