Exhibit 99.1

Exhibit 99.1

Arthur J.Gallagher & Co.

1

January, 2008

2

Safe Harbor Statement

Except for the historical information and discussions, certain statements contained herein relating to future results may constitute “forwardlooking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks,

uncertainties and other factors that could cause actual results to differ materially from those expected, as discussed in Gallagher’s filings

with the U.S. Securities and Exchange Commission, including but not limited to the following: Gallagher’s commission revenues are highly

dependent on premiums charged by insurers, which are subject to fluctuation; lower interest rates reduce Gallagher’s income earned

on invested funds; alternative insurance markets continue to grow which could unfavorably impact commission and favorably impact fee

revenue, though not necessarily to the same extent; Gallagher’s revenues vary significantly from period-to-period as a result of the timing

of policy inception dates and the net effect of new and lost business production; the insurance brokerage industry is subject to a great

deal of uncertainty due to investigations into its business practices by various governmental authorities and related private litigation; the

general level of economic activity can have a substantial impact on Gallagher’s renewal business; Gallagher’s operating results, returns

on investments and financial position may be adversely impacted by exposure to various market risks such as interest rate, equity pricing,

foreign exchange rates and the competitive environment; Gallagher’s revenues and net earnings will continue to be subject to reduction

due to the elimination of certain contingent commission arrangements on January 1, 2005 and related developments in the insurance

industry; and Gallagher’s effective income tax rate may be subject to increase as a result of changes in income tax laws, unfavorable

interpretations of past, current or future tax laws or changes in crude oil prices or developments resulting in the loss or unavailability of

IRC Section 29-related Syn/Coal Credits. Gallagher’s ability to grow has been enhanced through acquisitions, which may or may not be

available on acceptable terms in the future and which, if consummated, may or may not be advantageous to Gallagher. Accordingly,

actual results may differ materially from those set forth in the forward-looking statements. For a further discussion of certain of the matters

described above see Item 1A, “Risk Factors” in Gallagher’s Annual Report on Form 10K for the year ended December 31, 2007.

Arthur J.Gallagher & Co.

3

Certain Non-GAAP Financial Measures

• This presentation includes certain information that may be considered “non-GAAP financial measures” within the

meaning of SEC regulations because it is derived from Gallagher’s consolidated financial information but is not

required to be presented in financial statements that are prepared in conformity with U.S. generally accepted

accounting principles (GAAP). Consistent with SEC regulations, a description of such information is provided below

and a reconciliation of certain of such items to GAAP is provided on our web-site at www.ajg.com.

• Pretax earnings from continuing operations for 2006 and 2005 were adjusted in this presentation to add back

charges related to litigation and contingent commission matters and claims handling obligations and to eliminate the

impact of medical and pension plan changes. Charges in 2006 related to retail contingent commission related

matters and medical plan changes totaled $9.0 million (or $5.4 million after tax) and $7.5 million (or $4.5 million after

tax), respectively. Charges in 2005 related to retail contingent commission matters and claims handling obligations

totaled $73.6 million (or $44.2 million after tax) and $5.2 million (or $3.6 million after tax), respectively. In addition,

Gallagher recognized a pension curtailment gain of $10.0 million (or $6.0 million after tax) in 2005. There were no

such charges or gains in 2001 to 2004. These adjustments, which Gallagher believes are for non-recurring items,

were made to GAAP earnings from continuing operations in 2006 and 2005 in order to calculate earnings from

continuing operations before litigation and contingent commission related matters, claims handling obligations and

medical and pension plan changes. In addition, total revenues and pretax earnings from continuing operations

exclude retail contingent commissions and are on an as originally reported basis for all periods presented in this

presentation. The term EBITDA used herein represents pretax earnings from continuing operations (excluding the

impact of the non-recurring items discussed above and retail contingent commissions) before interest, depreciation

and amortization expenses.

• Gallagher believes the “non-GAAP financial measures” included in this presentation provide meaningful additional

information, which may be helpful to investors in assessing certain aspects of Gallagher’s operating performance

and financial condition that may not be otherwise apparent from GAAP. Industry peers provide similar supplemental

information, although they may not use the same or comparable terminology and may not make identical

adjustments. This non-GAAP information should be used in addition to, but not as a substitute for, the GAAP

information.

Arthur J.Gallagher & Co.

4

About Arthur J. Gallagher & Co.

• 4th Largest Insurance Broker

– Retail & Wholesale – 88% US 12% International

• 5th Largest Domestic Wholesaler

• Fastest Growing Lloyds Wholesaler (5 yrs)

• Largest P&C Third Party Administrator

– Adjusting WC, Liability & Property Claims

• More Background in Investor Profile Handout and

the Gallagher Way Book

Arthur J.Gallagher & Co.

5

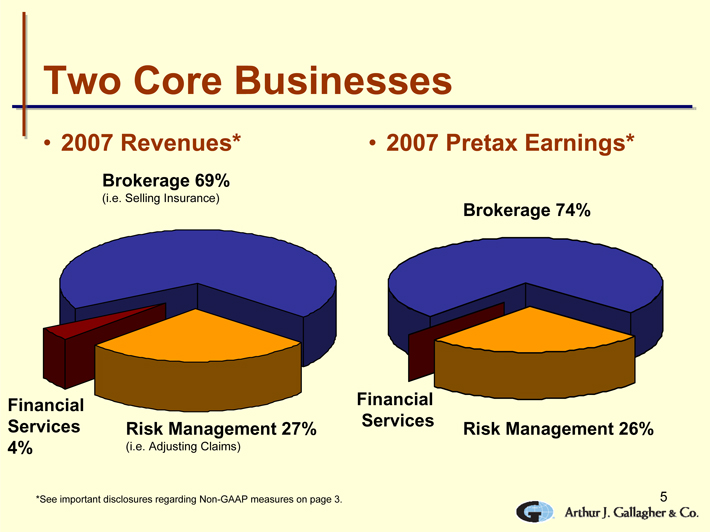

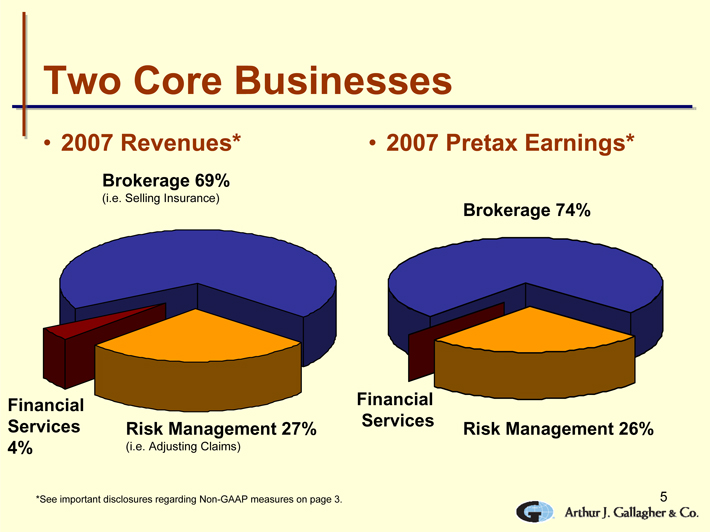

Two Core Businesses

• 2007 Revenues* • 2007 Pretax Earnings*

Brokerage 69%

(i.e. Selling Insurance)

Risk Management 27%

(i.e. Adjusting Claims)

Financial

Services

4%

*See important disclosures regarding Non-GAAP measures on page 3.

Brokerage 74%

Risk Management 26%

Financial

Services

Arthur J.Gallagher & Co.

6

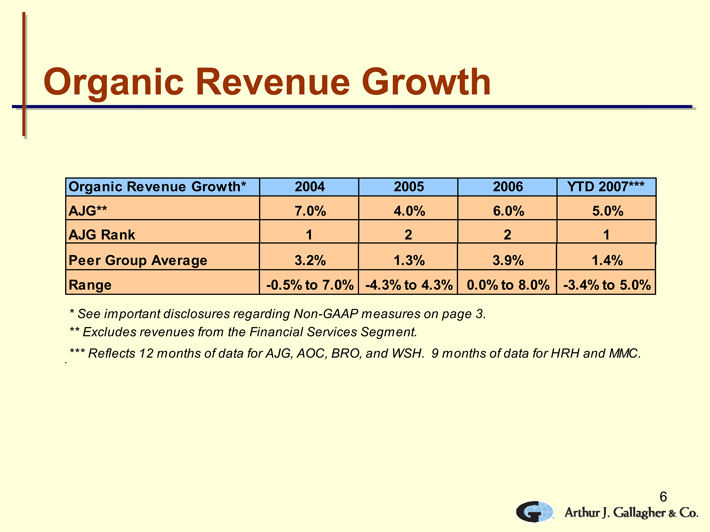

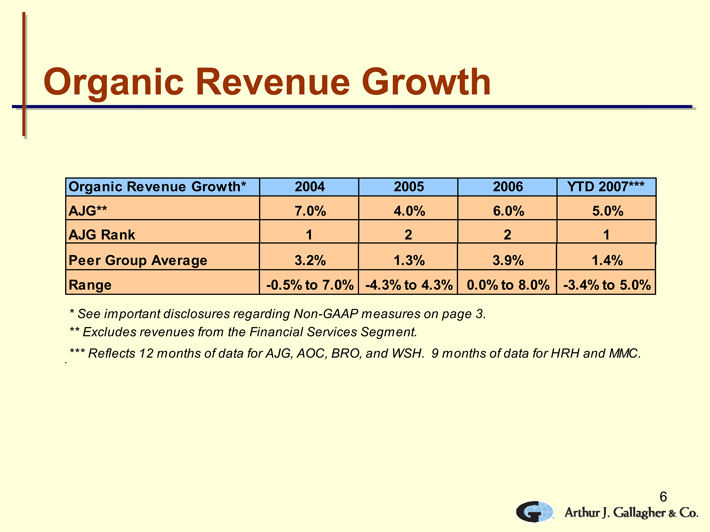

Organic Revenue Growth

Organic Revenue Growth* 2004 2005 2006 YTD 2007***

AJG** 7.0% 4.0% 6.0% 5.0%

AJG Rank 1 2 2 1

Peer Group Average 3.2% 1.3% 3.9% 1.4%

Range -0.5% to 7.0% -4.3% to 4.3% 0.0% to 8.0% -3.4% to 5.0%

* See important disclosures regarding Non-GAAP measures on page 3.

** Excludes revenues from the Financial Services Segment.

*** Reflects 12 months of data for AJG, AOC, BRO, and WSH. 9 months of data for HRH and MMC.

Arthur J.Gallagher & Co.

7

Current Environment

• Fighting a Headwind

– Soft P&C Market (i.e. too much supply)

• Some predict another 2 to 4 years

– Teetering Economy (i.e. slowing demand)

• Business cutbacks?

• Slowing employee counts?

• Energy and wage inflation?

• U.S. and Even Global Recession?

Arthur J.Gallagher & Co.

8

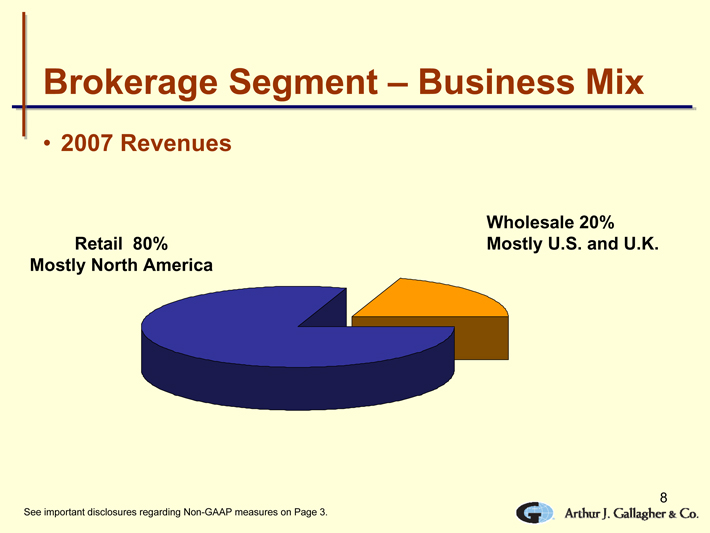

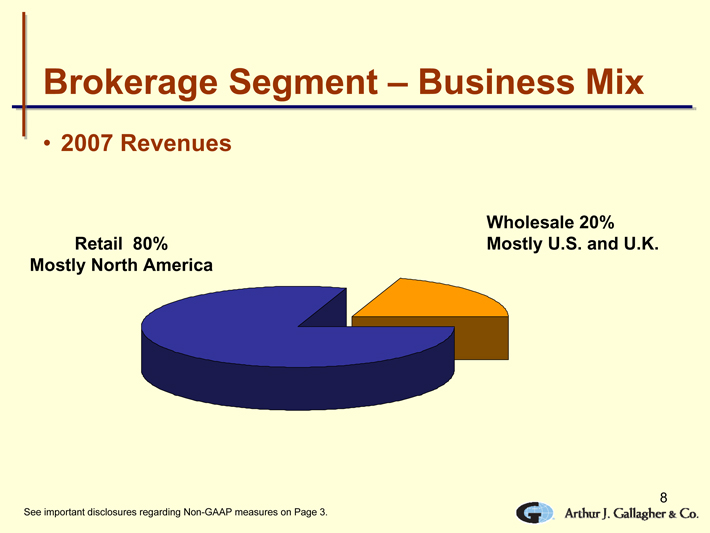

Brokerage Segment – Business Mix

• 2007 Revenues

Retail 80%

Mostly North America

See important disclosures regarding Non-GAAP measures on Page 3.

Wholesale 20%

Mostly U.S. and U.K.

Arthur J.Gallagher & Co.

9

• Rapidly Expand - Domestic

– Geographical

– Expertise

• Selectively Expand - International

– Broaden Network Partners

– Targeted Acquisitions

• Profitability – Stay in Our Sweet Spot

– Middle to Upper Commercial Market

Brokerage Segment Strategy

Arthur J.Gallagher & Co.

10

•Sell

•Hire

•Develop

•Acquire

Domestic Brokerage Expansion

Arthur J.Gallagher & Co.

11

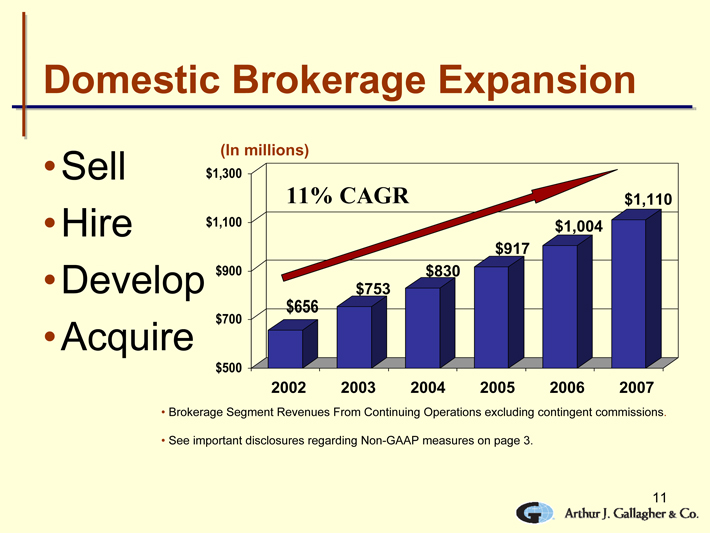

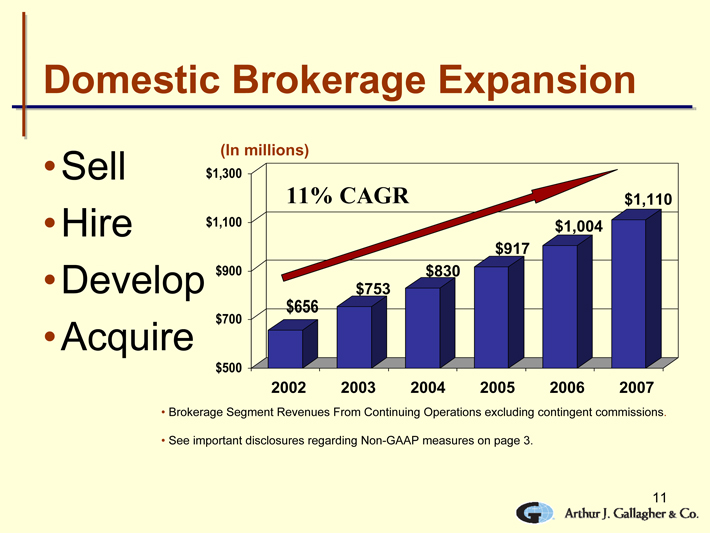

•Sell

•Hire

•Develop

•Acquire

Domestic Brokerage Expansion

• Brokerage Segment Revenues From Continuing Operations excluding contingent commissions.

• See important disclosures regarding Non-GAAP measures on page 3.

(In millions)

$500

$700

$900

$1,100

$1,300

11% CAGR

$753

$830

$917

$1,004

$1,110

2002 2003 2004 2005 2006 2007

$656

Arthur J.Gallagher & Co.

12

•Producers that want to sell

•Producers that want access to our

network, expertise and niches

•Producers that want to be

supported by our infrastructure

•Must fit into our culture!

Domestic Expansion - Hire

Arthur J.Gallagher & Co.

13

•Producers that want to sell

•Producers that want access to our

network, expertise and niches

•Producers that want to be

supported by our infrastructure

•Must fit into our culture!

Domestic Expansion - Hire

“I joined Gallagher because I focus on

Colleges and Universities and Gallagher

has the best Higher Education professionals

in the brokerage business”

“Gallagher’s benefits team was

innovative and their supporting technology

was exactly what I needed to grow

my book of business.”

Arthur J.Gallagher & Co.

14

•Internships

•Career Launch

•Must fit into our culture!

Domestic Expansion - Develop

Arthur J.Gallagher & Co.

15

•Internships

•Career Launch

•Must fit into our culture!

Domestic Expansion - Develop

“I was an econ and stats major, but I

thought I could sell too. I did my first

year as an intern after my sophomore

year. I was hooked!”

“Many of Gallagher’s senior execs and

field leaders came through the internship.

I like the idea of having customers but

also some day I can run a branch.”

Arthur J.Gallagher & Co.

16

•Over 20,000 retail and wholesale

brokerages and agencies (P&C

and Benefits)

•Most owned by baby boomers

•Small number of consolidators

Domestic Expansion - Acquire

Arthur J.Gallagher & Co.

17

•Gallagher has done over 180

deals in the last 20 years

•Typical deal is $2 to $10 million in

revenues

•2 to 5 producers supported by a

professional staff of 10 to 20

•Must fit into our culture!

Domestic Expansion - Acquire

Arthur J.Gallagher & Co.

18

•Gallagher has done over 180

deals in the last 20 years

•Typical deal is $2 to $10 million in

revenues

•2 to 5 producers supported by a

professional staff of 10 to 20

•Must fit into our culture!

Domestic Expansion - Acquire

“I had the relationships with many

larger prospects, but I didn’t have the

resources to get their business. Sold

to Gallagher, brought in the experts

and now they are my client!”

“It was simple – my son and I wanted

to be a part of a global player. My son

wanted to be part of a team and I thought

I was going to slow down. Ha, I’m

rejuvenated and I’m having a blast!”

Arthur J.Gallagher & Co.

19

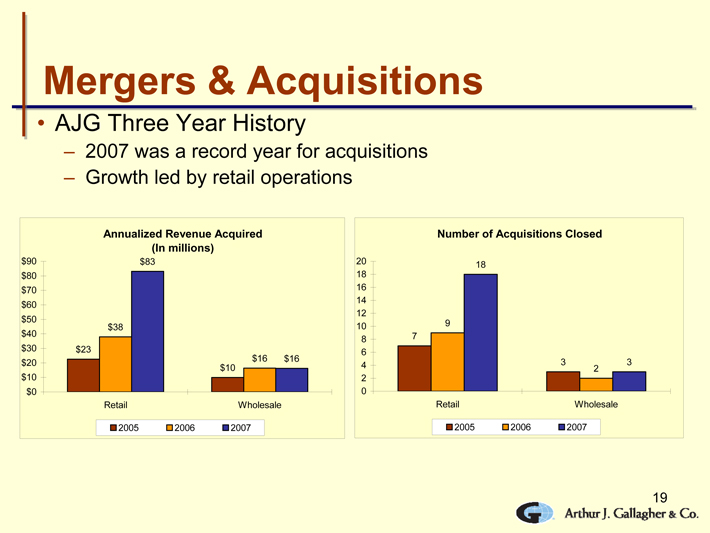

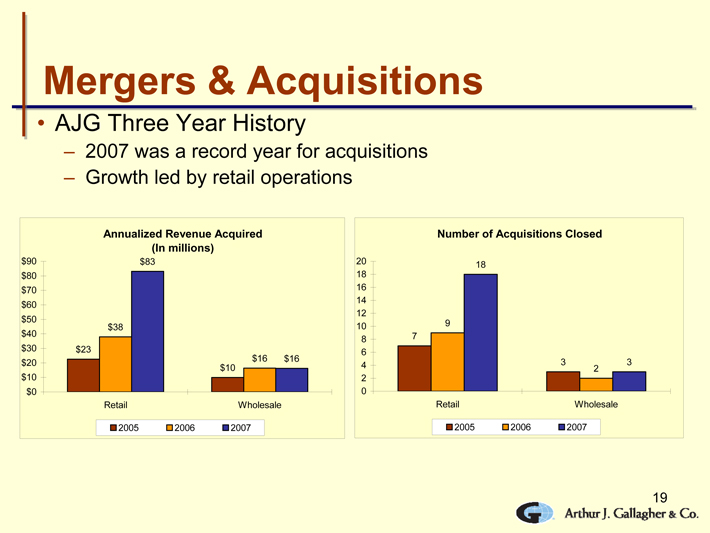

Mergers & Acquisitions

• AJG Three Year History

– 2007 was a record year for acquisitions

– Growth led by retail operations

Annualized Revenue Acquired

(In millions)

$23

$10

$38

$16

$83

$16

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Retail Wholesale

2005 2006 2007

Number of Acquisitions Closed

7

3

9

2

18

3

0

2

4

6

8

10

12

14

16

18

20

Retail Wholesale

2005 2006 2007

Arthur J.Gallagher & Co.

20

Where We Are – Retail Locations

ID

MT

WA

CA

UT

NV

AZ

NM

TX

OK

KS

NE

MN

WI

MO

AR

LA

TN

IL

WV

PA

NY

NH

ME

MA

CT

NJ

DE

MD

IA

CO

WY

SD

ND

OR

OH

MI

KY

MS AL GA

FL

SC

NC

VA

VT

RI

IN

AK

HI

Arthur J.Gallagher & Co.

21

Growth Opportunities

Source for Acquisition Targets: Hales & Co., Inc. and D&B

Larger Cities Where We Are NOT

ID

67

MT

57

WA

248

CA

1,656

UT

115

NV

97

AZ

218

NM

63

TX

971

OK

175

KS

167

NE

127

MN

290

WI

308

MO

287

AR

103

LA

203

TN

305

IL

689 WV

72

PA

883

NY

1,429

NH

112

ME

113

MA

627

CT

316

NJ

706 DE

43

MD

298

IA

194

CO

187

WY

16

SD

37

ND

41 OR

170

OH

576

MI

506

KY

197

MS

105 AL

188

GA

437

FL

985

SC

169

NC

388

VA

275

VT

57

RI

84

IN

307

AK

27 HI

43

DC

25

Arthur J.Gallagher & Co.

22

•Substantial London operation

•Attract experienced teams

•Opportunistic with acquisitions

•Network of independent brokers in

over 100 countries

International Expansion

Arthur J. Gallagher & Co.

Arthur J. Gallagher & Co.

23

Field

•Full-time training & career

development teams

•Full-time M&A teams

•Full-time niche & product support

teams

Brokerage – Supporting the Growth

Arthur J. Gallagher & Co.

24

Back Office

• Centralized corporate systems

– General Ledger, T&E, HR, Real Estate and

Planning

• Created supporting service centers

– However, NOT client facing

• Branch manager now can focus on:

– Sell - Develop - Client service

– Hire - Acquire - Strategy

Brokerage – Supporting the Growth

Arthur J. Gallagher & Co.

25

“Soft Market Play Book”

• Existing Plays

– Headcount and Wage Controls (non-production

layers)

– Expense Management

– Experienced Teams Must Quickly Deliver

Brokerage – Profitable Growth

Arthur J. Gallagher & Co.

26

“Soft Market Play Book”

• New Plays

– Leveraging Scale

– Leveraging Technology

– Centralizing and Shifting Work to Lower Cost

Labor Locations

Net Effect - Headcount reduction through

attrition

Brokerage – Profitable Growth

Arthur J. Gallagher & Co.

27

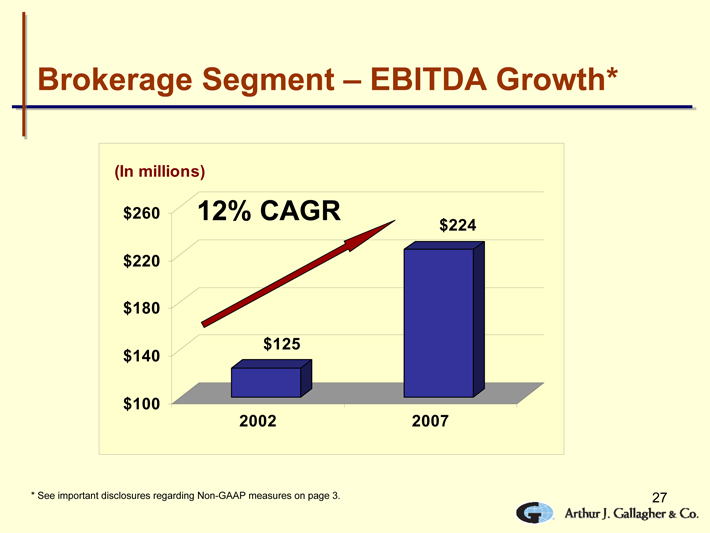

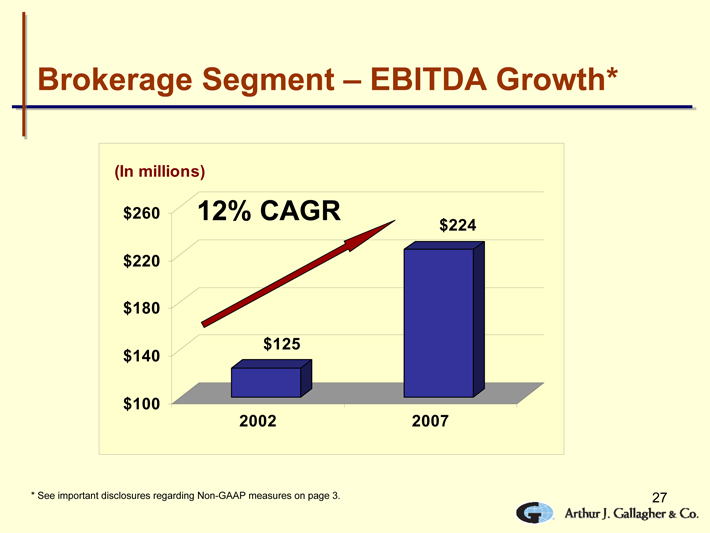

Brokerage Segment – EBITDA Growth*

$125

$224

$100

$140

$180

$220

$260

2002 2007

(In millions)

12% CAGR

* See important disclosures regarding Non-GAAP measures on page 3.

Arthur J. Gallagher & Co.

28

• Domestic & International

• Trend Towards Unbundling

• Network vs. Dedicated Units

• Profitability

Risk Management Segment Strategy

Arthur J. Gallagher & Co.

29

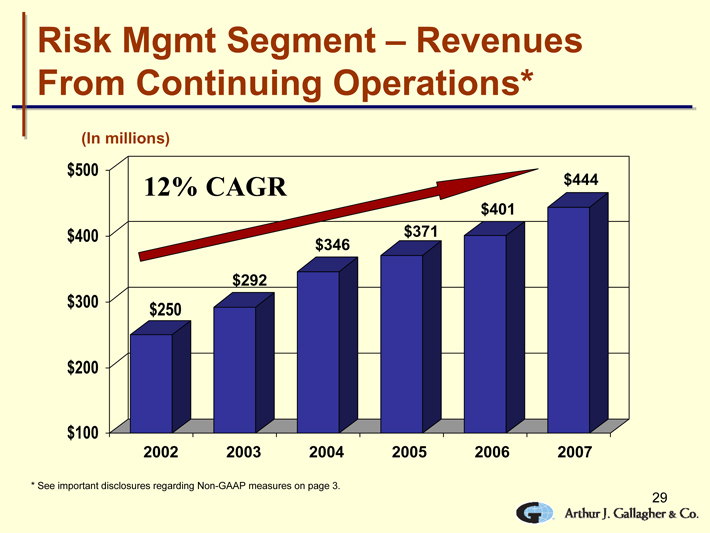

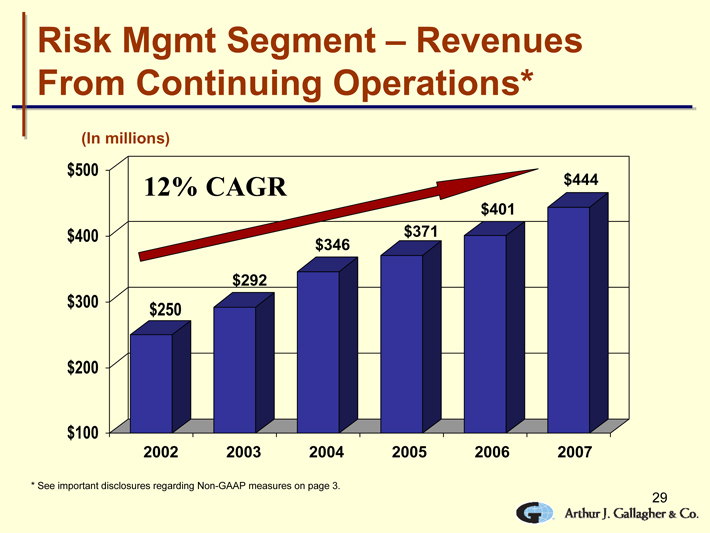

Risk Mgmt Segment – Revenues

From Continuing Operations*

* See important disclosures regarding Non-GAAP measures on page 3.

(In millions)

$100

$200

$300

$400

$500 12% CAGR

$292

$346

$371

$401

$444

2002 2003 2004 2005 2006 2007

$250

Arthur J. Gallagher & Co.

30

• Revenue growth is all organic

• Targeting Fortune 1000 but standard

platform enables profitable service to much

smaller accounts as well

• Differentiate through client intimacy,

commitment to quality and technology

• International presence largely public entity

but leveraging US expertise to penetrate

commercial clients

Risk Mgmt – Domestic & International

Arthur J. Gallagher & Co.

31

• A growing company has needs that

can often best be met in alternative

markets

• We can tailor service to clients needs

• Include on-site when appropriate

• Hard markets accelerate the drive to

alternative markets

• Soft market has slowed pace but

opportunities still exist

Risk Mgmt – Unbundling Trend

Arthur J. Gallagher & Co.

32

• Leverage global technology and

standard processes to provide service

anywhere in the country

• Broaden market opportunity to smaller

clients where we don’t need to be onsite

• Move to regional operations and to

lower cost locations where possible

Risk Mgmt – Network Philosophy

Arthur J. Gallagher & Co.

33

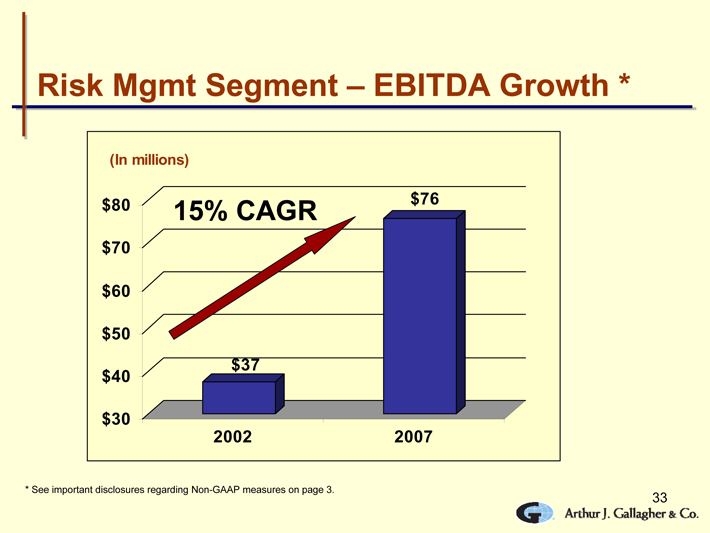

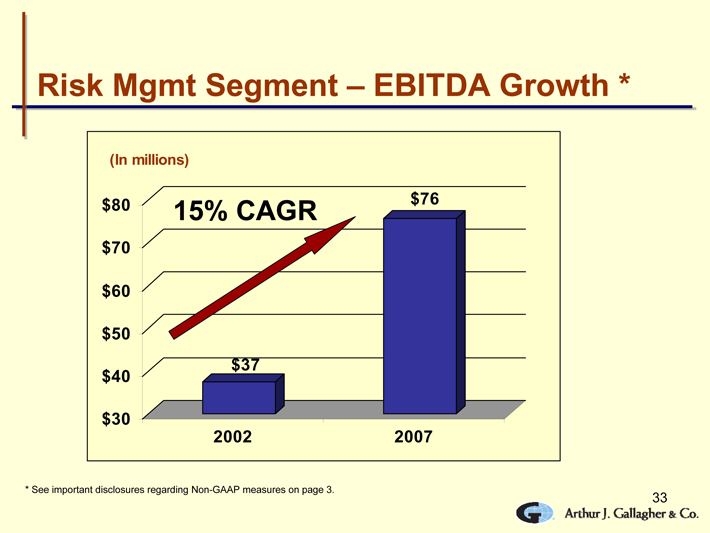

Risk Mgmt Segment – EBITDA Growth *

$37

$76

$30

$40

$50

$60

$70

$80

2002 2007

(In millions)

15% CAGR

* See important disclosures regarding Non-GAAP measures on page 3.

Arthur J. Gallagher & Co.

34

Cash, Cash & Cash

• Both Brokerage & Risk Management

Businesses Generate Substantial

Cash Flow

• Neither Need Substantial Capital or

Cap Ex

Arthur J. Gallagher & Co.

35

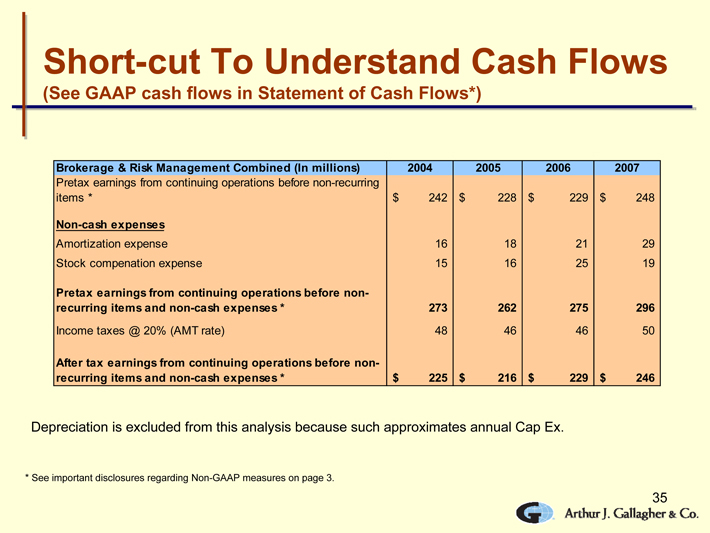

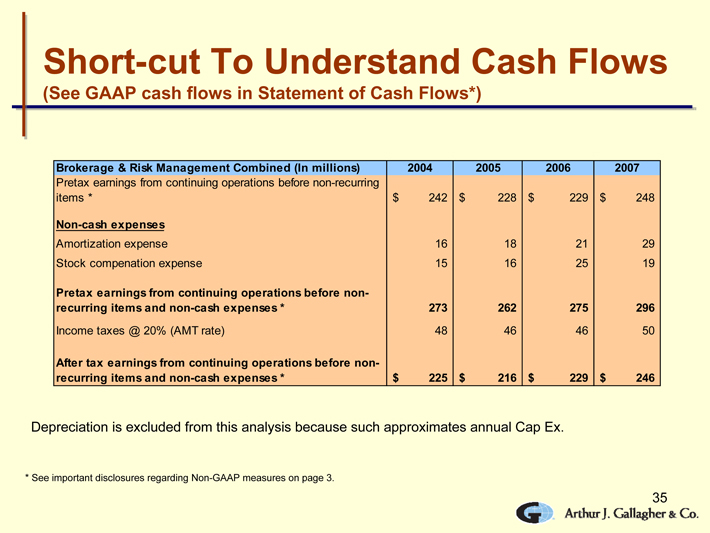

Short-cut To Understand Cash Flows

(See GAAP cash flows in Statement of Cash Flows*)

Brokerage & Risk Management Combined (In millions) 2004 2005 2006 2007

Pretax earnings from continuing operations before non-recurring

items *$ 242 $ 228 $ 229 $ 248

Non-cash expenses

Amortization expense 16 18 21 29

Stock compenation expense 15 16 25 19

Pretax earnings from continuing operations before nonrecurring

items and non-cash expenses * 273 262 275 296

Income taxes @ 20% (AMT rate) 48 46 46 50

After tax earnings from continuing operations before nonrecurring

items and non-cash expenses *$ 225 $ 216 $ 229 $ 246

Depreciation is excluded from this analysis because such approximates annual Cap Ex.

* See important disclosures regarding Non-GAAP measures on page 3.

Arthur J. Gallagher & Co.

36

Cash, Cash & Cash

• Pay Dividend

– Long-cycle Industry

– Shareholders need returns while holding

��� Buy Brokers

• Repurchase Shares

• Modest Debt Levels

Arthur J. Gallagher & Co.

37

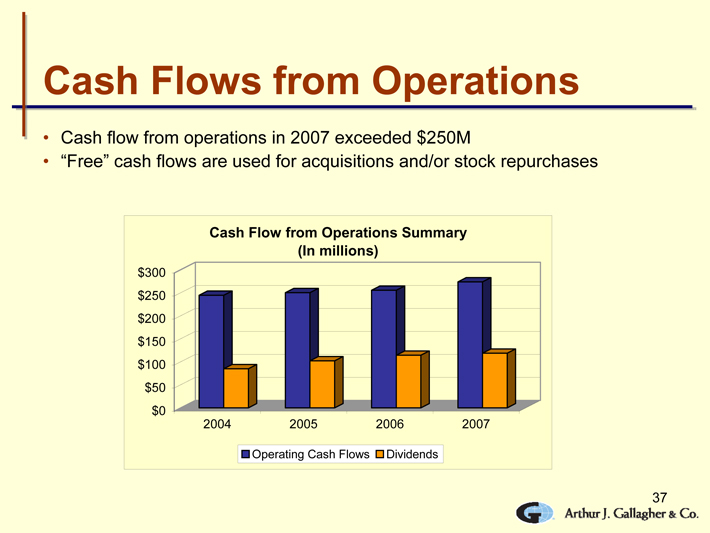

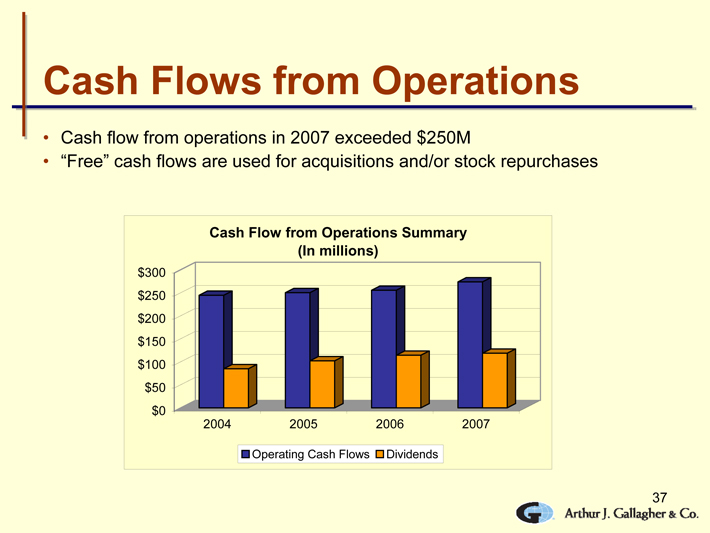

Cash Flows from Operations

• Cash flow from operations in 2007 exceeded $250M

• “Free” cash flows are used for acquisitions and/or stock repurchases

$0

$50

$100

$150

$200

$250

$300

2004 2005 2006 2007

Cash Flow from Operations Summary

(In millions)

Operating Cash Flows Dividends

Arthur J. Gallagher & Co.

38

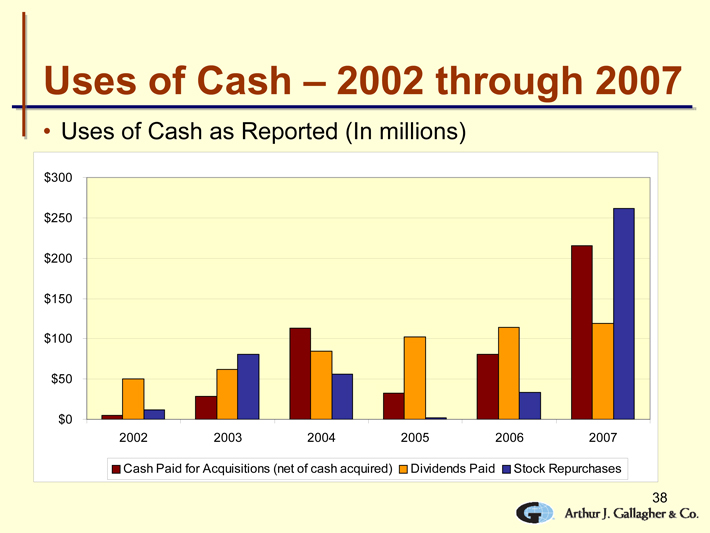

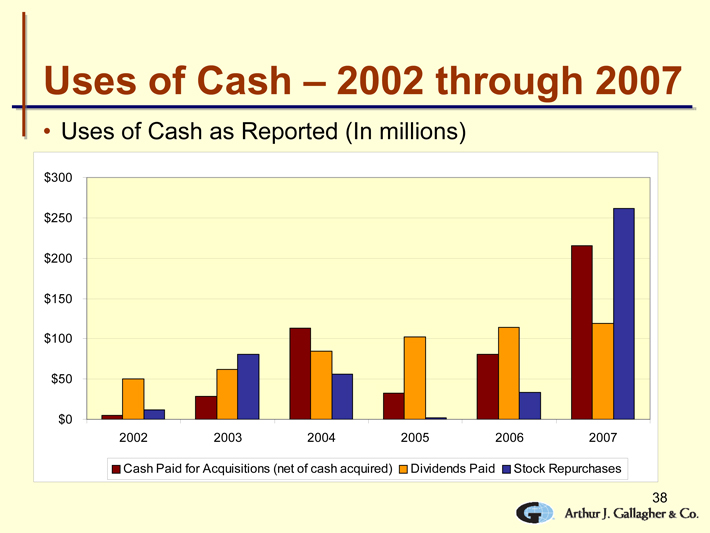

Uses of Cash – 2002 through 2007

• Uses of Cash as Reported (In millions)

$0

$50

$100

$150

$200

$250

$300

2002 2003 2004 2005 2006 2007

Cash Paid for Acquisitions (net of cash acquired) Dividends Paid Stock Repurchases

Arthur J. Gallagher & Co.

39

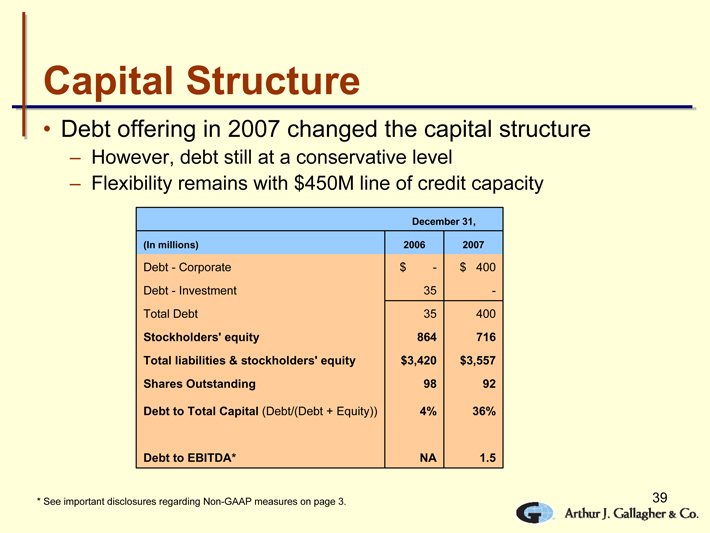

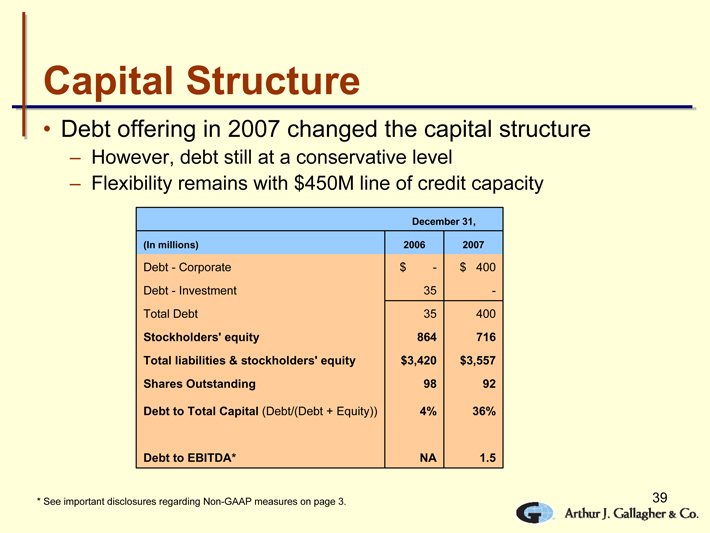

Capital Structure

• Debt offering in 2007 changed the capital structure

– However, debt still at a conservative level

– Flexibility remains with $450M line of credit capacity

1.5 NA Debt to EBITDA*

36% 4% Debt to Total Capital (Debt/(Debt + Equity))

92 98 Shares Outstanding

$3,557 $3,420 Total liabilities & stockholders’ equity

716 864 Stockholders’ equity

400 35 Total Debt

- 35 Debt - Investment

$ 400 $ - Debt - Corporate

2007 2006 (In millions)

December 31,

* See important disclosures regarding Non-GAAP measures on page 3.

Arthur J. Gallagher & Co.

40

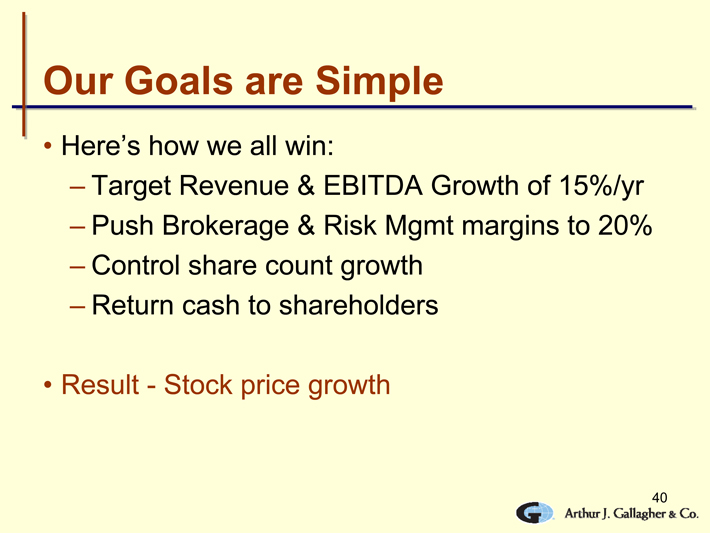

Our Goals are Simple

• Here’s how we all win:

– Target Revenue & EBITDA Growth of 15%/yr

– Push Brokerage & Risk Mgmt margins to 20%

– Control share count growth

– Return cash to shareholders

• Result - Stock price growth

Arthur J. Gallagher & Co.

41

Conclusion

•Questions & Answers

Arthur J. Gallagher & Co.

42

Website: www.ajg.com

Email: investor_relations@ajg.com

Marsha_Akin@ajg.com

Phone: 630-773-3800

For Additional Information