- AJG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Arthur J. Gallagher & Co. (AJG) 8-KRegulation FD Disclosure

Filed: 8 Sep 11, 12:00am

Exhibit 99.1

Investment Presentation

August 2011

Information Regarding Forward-Looking

Statements

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “anticipates,” “expects,” “believes,” “should,” “could,” “estimates,” “expects,” “intends,” “plans” and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements in this presentation include, but are not limited to, statements relating to: (i) Gallagher’s capabilities for growth and expansion; (ii) Gallagher’s acquisition strategy and planned levels of acquisition activity; (iii) the integration of recent acquisitions (including GAB Robins and Heath Lambert); (iv) the revenue and earnings impact of such acquisitions; (v) drivers of organic growth in the Brokerage and Risk Management Segments; (vi) anticipated future results or performance (including margins) of any segment or Gallagher as a whole; (vii) Gallagher’s stock performance (including dividend payments); (viii) future debt levels; (ix) expected uses of cash; (x) international opportunities; (xi) productivity and expense reduction initiatives; and (xii) potential future developments in, and income and tax credits that could be generated by, Gallagher’s clean-energy investments.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include the following:

•changes in worldwide and national economic conditions, changes in premium rates and insurance markets generally, changes in the insurance brokerage industry’s competitive landscape, and the difficulties inherent in combining the cultures and systems of different companies could impact (i) through (xi) above; and

•uncertainties related to Gallagher’s clean-energy investments, including uncertainties related to receipt and maintenance by Gallagher’s utility partners of long-term permits, Gallagher’s ability to find operating sites and co-investors for its non-operating and future operations, potential IRS challenges to Gallagher’s ability to claim tax credits under IRC Section 45, utilities’ future use of coal to generate electricity, operational risks at Gallagher’s clean-energy operations, business risks relating to Gallagher’s co-investors and partners, intellectual property risks and environmental risks, could impact (xii) above.

Please refer to Gallagher’s filings with the SEC, including Item 1A, “Risk Factors,” of its Annual Report on Form 10-K for the fiscal year ended December 31, 2010, for a more detailed discussion of these and other factors that could impact its forward-looking statements.

Information Regarding Non-GAAP Measures

This presentation includes references to EBITDAC, Adjusted EBITDAC, Adjusted EBITDAC margin, Adjusted Revenues and Organic Growth, which are performance measures not in accordance with, or an alternative to, the GAAP information provided herein.

Earnings Measures—Gallagher believes that each of EBITDAC, Adjusted EBITDAC and Adjusted EBITDAC margin, as defined below, provides a meaningful representation of its operating performance. Gallagher considers EBITDAC as a way to measure financial performance on an ongoing basis. Adjusted EBITDAC and Adjusted EBITDAC margin are presented to improve the comparability of Gallagher’s results between periods by eliminating the impact of certain items that have a high degree of variability.

EBITDAC is defined as earnings from continuing operations before interest, income taxes, depreciation, amortization and the change in estimated acquisition earnout

payables.

Adjusted EBITDAC is defined as EBITDAC adjusted to exclude gains realized from sales of books of business, supplemental commission timing amounts, workforce

related charges, lease termination related charges, acquisition related integration costs and litigation settlements.

Adjusted EBITDAC margin is defined as Adjusted EBITDAC divided by total revenues, as adjusted to exclude gains realized from sales of books of business and

supplemental commission timing amounts.

The most directly comparable GAAP measure for these non-GAAP earnings measures is earnings from continuing operations. For the Brokerage Segment, the Risk Management Segment, and the two segments on a combined basis, earnings from continuing operations was $136 million, $31 million, and $167 million, respectively, in 2010, $61 million, $17 million, and $78 million, respectively, for the 6 months ended June 30, 2010 and $62 million, $13 million, and $75 million, respectively, for the 6 months ended June 30, 2011.

Revenue Measures—Gallagher believes that Adjusted Revenues, as defined below, provides stockholders and other interested persons with useful information that will assist such persons in analyzing Gallagher’s operating results as they develop a future outlook for Gallagher. Gallagher believes that Organic Growth provides a comparable measurement of revenue growth that is associated with the revenue sources that will be continuing in 2011 and beyond. Gallagher has historically viewed Organic Growth as an important indicator when assessing and evaluating the performance of its Brokerage and Risk Management Segments. Gallagher also believes that using this measure allows financial statement users to measure, analyze and compare the growth from its Brokerage and Risk Management Segments in a meaningful and consistent manner. Adjusted Revenues is defined as revenues adjusted to exclude gains realized from sales of books of business and supplemental commission timing amounts. Organic Growth is organic change in commission, fee and supplemental commission revenues, which excludes the first twelve months of net commission, fee and supplemental commission revenues generated from acquisitions accounted for as purchases and the net commission and fee revenues related to operations disposed of in each year presented. These commissions and fees are excluded from organic revenues in order to determine the revenue growth that is associated with the operations that were a part of Gallagher in both the current and prior year. In addition, organic growth excludes the impact of contingent commission revenues and the period-over-period impact of foreign currency translation. The amounts excluded with respect to foreign currency translation are calculated by applying 2011 foreign exchange rates to the same periods in 2010.

The most directly comparable GAAP measure for Adjusted Revenues and Organic Growth is revenues. For the Brokerage Segment, the Risk Management Segment, and the two segments on a combined basis, revenues were $1,341 million, $462 million, and $1,803 million, respectively, in 2010, $651 million, $222 million, and $873 million, respectively, for the 6 months ended June 30, 2010 and $721 million, $264 million, and $985 million, respectively, for the 6 months ended June 30, 2011. For the Brokerage Segment, revenues were $780 million, $849 million, $926 million, $1,001 million, $1,071 million, $1,114 million, $1,188 million, $1,276 million, $1,341 million, $317 million and $404 million, in 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, first quarter 2011 and second quarter 2011, respectively.

Reconciliations—Please see “Reconciliation of Non-GAAP Measures” on Gallagher’s Web site at www.ajg.com under “Investor Relations” for a reconciliation of non-GAAP measures to the most directly comparable GAAP measures.

Arthur J. Gallagher & Co.

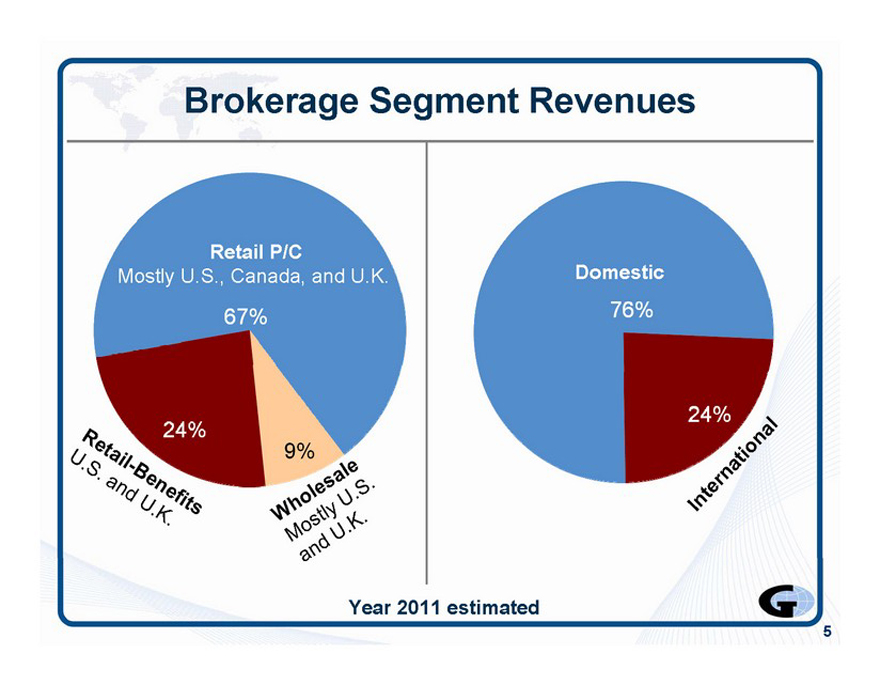

• Brokerage Segment—74% of Revenue

We sell insurance and consult on insurance programs

Retail P&C, benefits and wholesale

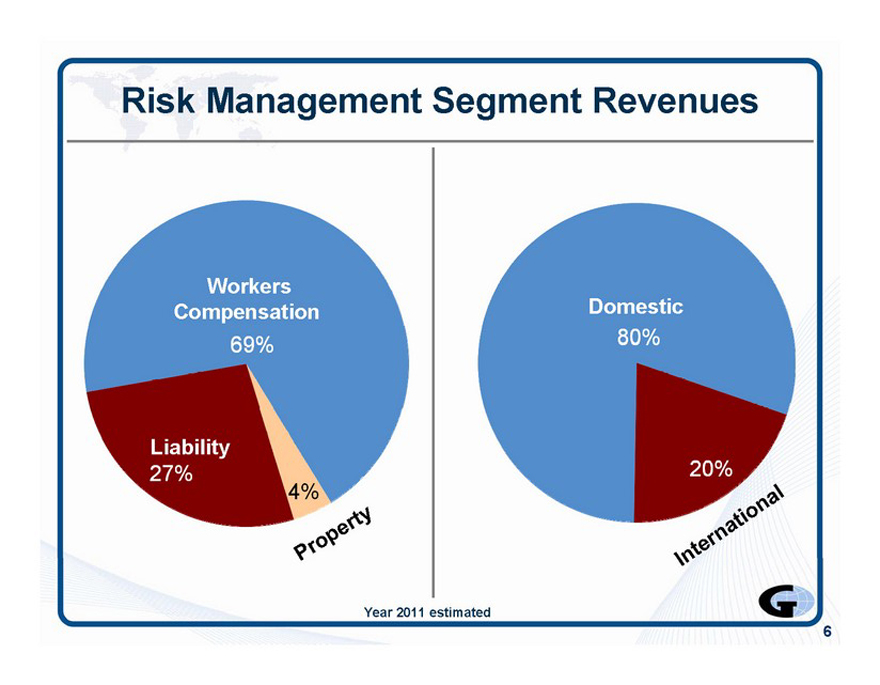

• Risk Management Segment—26% of Revenue

We adjust claims and help companies reduce their losses

Workers Comp, liability, managed care & property

Modest amount of storm/quake claims

QJ

4 |

|

Brokerage Segment Revenues

Retail P/C

Mostly U.S., Canada, and U.K.

Domestic

76%

%%

9% J

Year 2011 estimated

5 |

|

Risk Management Segment Revenues

6 |

|

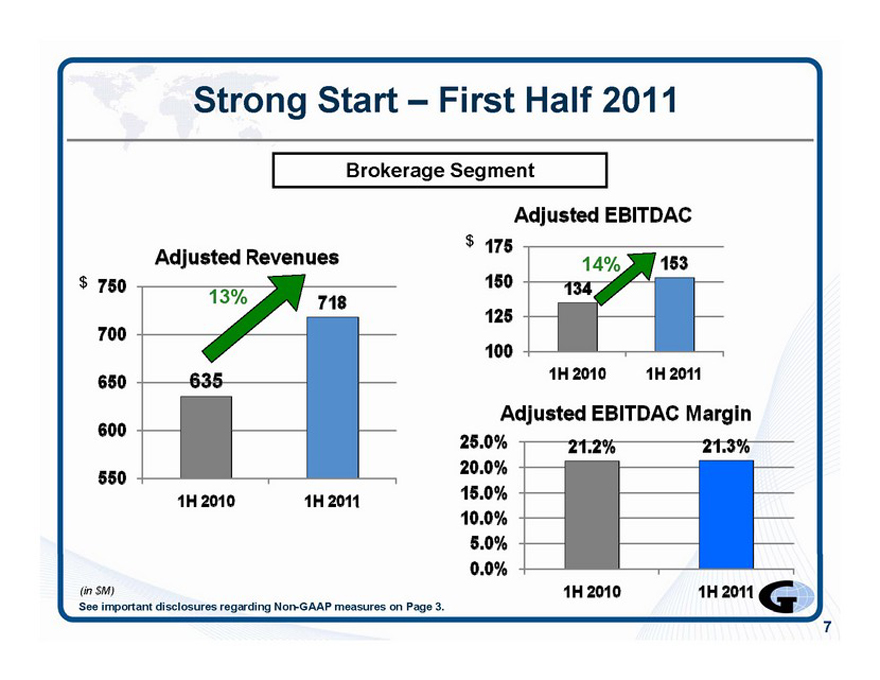

Strong Start—First Half 2011

Brokerage Segment

Adjusted Revenues

$ 750

700

650

600

550

1H2011

1H2010

(in $M)

See important disclosures regarding Non-GAAP measures on Page 3.

Adjusted EBITDAC

7 |

|

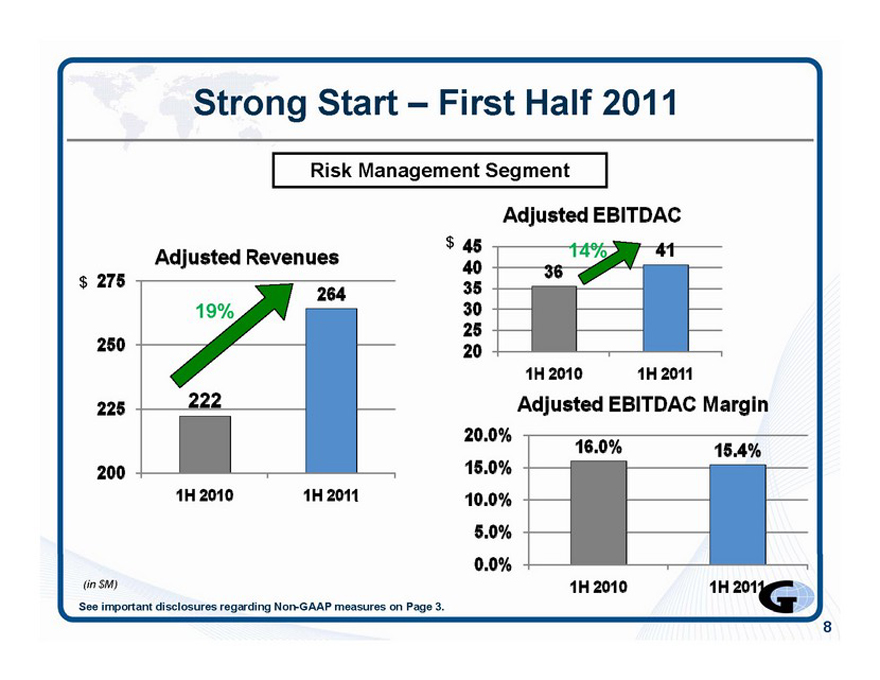

Strong Start—First Half 2011

Risk Management Segment

$ 275

Adjusted Revenues

250

264

225

222

200

1H2011

1H2010

(in $M)

See important disclosures regarding Non-GAAP measures on Page 3.

Adjusted EBITDAC

8 |

|

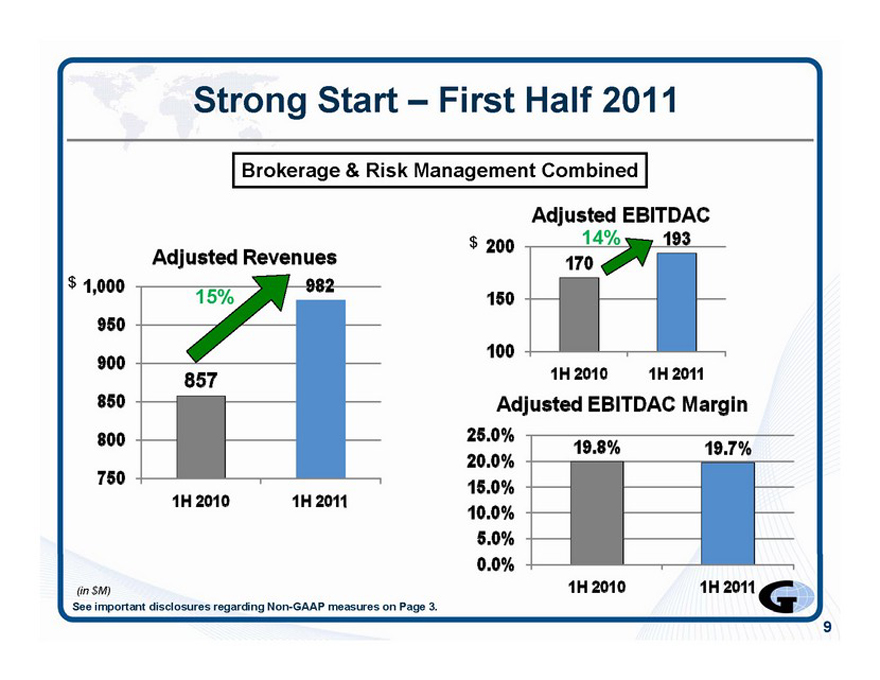

Strong Start—First Half 2011

Brokerage & Risk Management Combined

19.7%

1H2011

Adjusted Revenues

(in $M)

See important disclosures regarding Non-GAAP measures on Page 3.

Adjusted EBITDAC

9

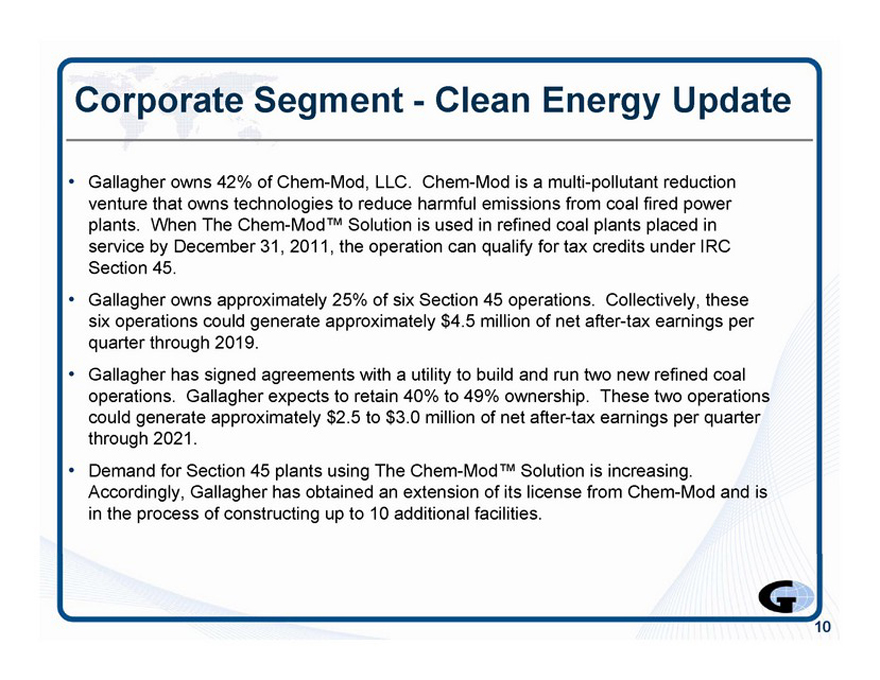

Corporate Segment—Clean Energy Update

Gallagher owns 42% of Chem-Mod, LLC. Chem-Mod is a multi-pollutant reduction venture that owns technologies to reduce harmful emissions from coal fired power plants. When The Chem-Mod™ Solution is used in refined coal plants placed in service by December 31, 2011, the operation can qualify for tax credits under IRC Section 45.

Gallagher owns approximately 25% of six Section 45 operations. Collectively, these six operations could generate approximately $4.5 million of net after-tax earnings per quarter through 2019.

Gallagher has signed agreements with a utility to build and run two new refined coal operations. Gallagher expects to retain 40% to 49% ownership. These two operations could generate approximately $2.5 to $3.0 million of net after-tax earnings per quarter through 2021.

Demand for Section 45 plants using The Chem-Mod™ Solution is increasing. Accordingly, Gallagher has obtained an extension of its license from Chem-Mod and is in the process of constructing up to 10 additional facilities.

10

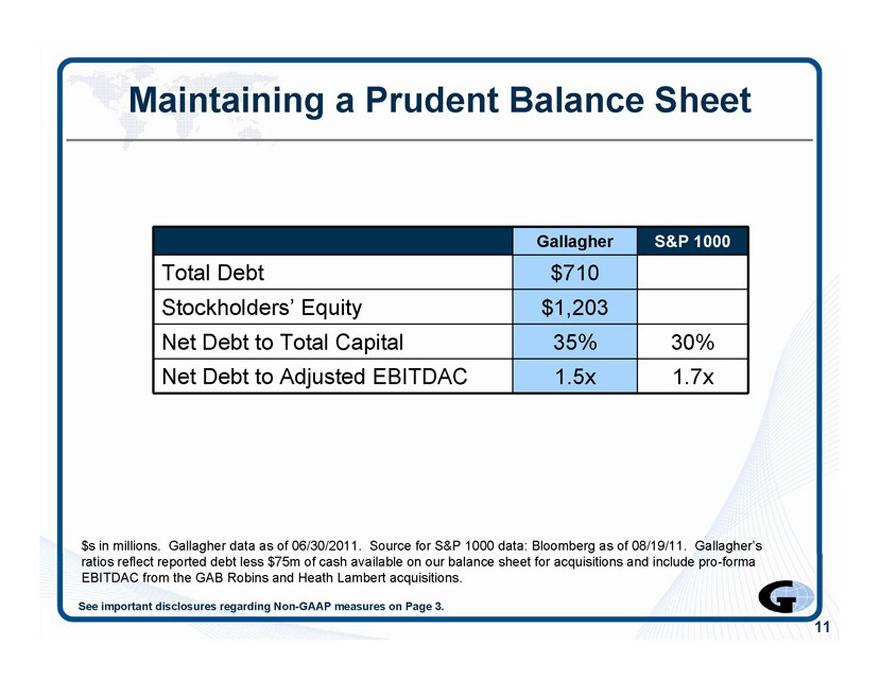

Maintaining a Prudent Balance Sheet

Gallagher S&P 1000

Total Debt $710

Stockholders’ Equity $1,203

Net Debt to Total Capital 35% 30%

Net Debt to Adjusted EBITDAC 1.5x 1.7x

G

$s in millions. Gallagher data as of 06/30/2011. Source for S&P 1000 data: Bloomberg as of 08/19/11. Gallagher’s ratios reflect reported debt less $75m of cash available on our balance sheet for acquisitions and include pro-forma EBITDAC from the GAB Robins and Heath Lambert acquisitions.

See important disclosures regarding Non-GAAP measures on Page 3.

11

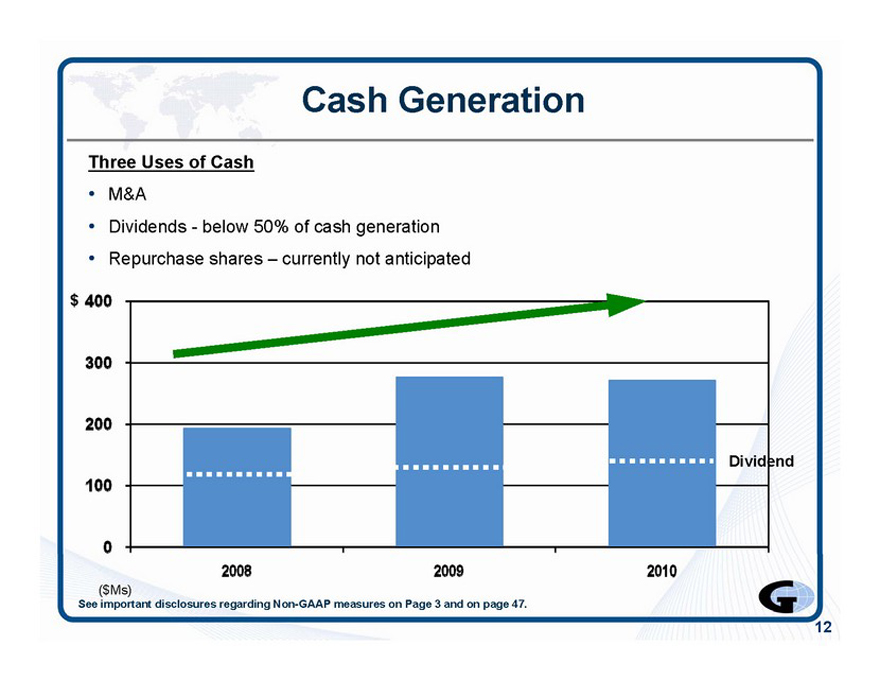

Cash Generation

Three Uses of Cash

• M&A

Dividends—below 50% of cash generation

• Repurchase shares—currently not anticipated

$ 400

300

200

100

Dividend

2008

2009

($Ms)

See important disclosures regarding Non-GAAP measures on Page 3 and on page 47.

2010

G

12

Looking Forward

View of operating environment Plan for growth

13

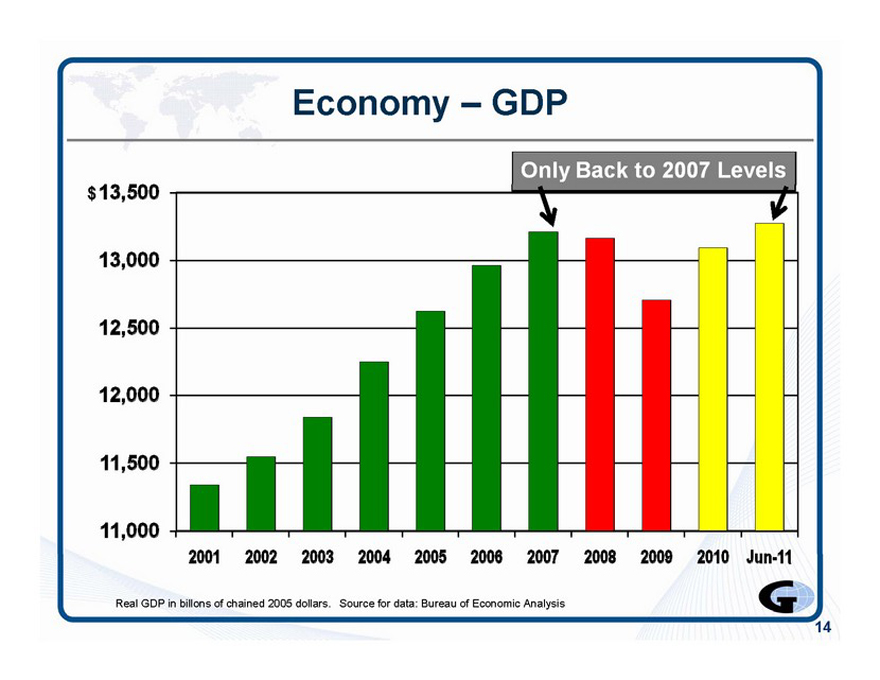

Economy – GDP

Real GDP in billons of chained 2005 dollars. Source for data: Bureau of Economic Analysis

14

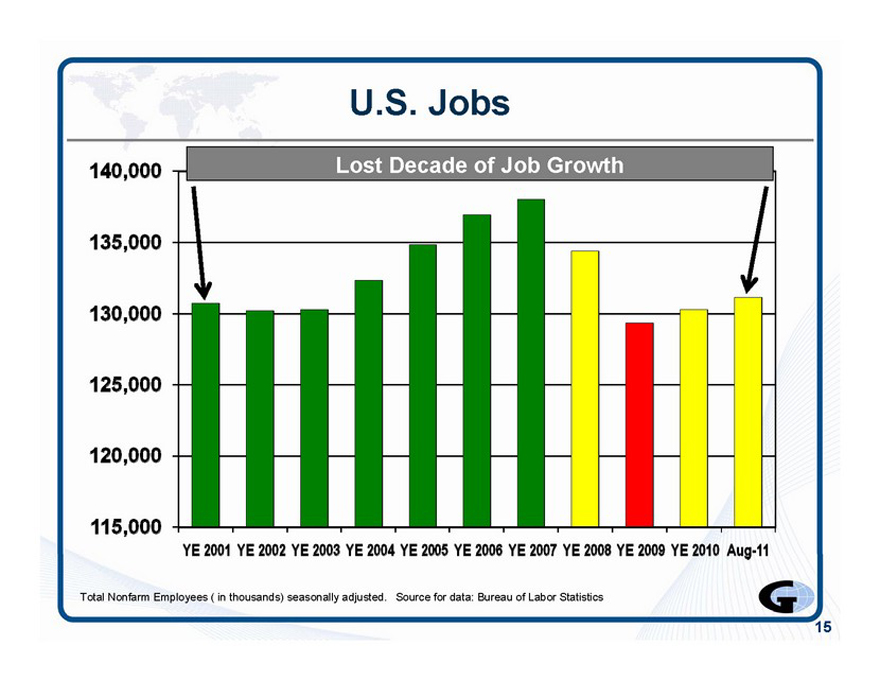

U.S. Jobs

140,000 T

Lost Decade of Job Growth

135,000

130,000

JL

125,000

120,000

115,000

YE 2001 YE 2002 YE 2003 YE 2004 YE 2005 YE 2006 YE 2007 YE 2008 YE 2009 YE 2010 Aug-11

Total Nonfarm Employees ( in thousands) seasonally adjusted. Source for data: Bureau of Labor Statistics

G

15

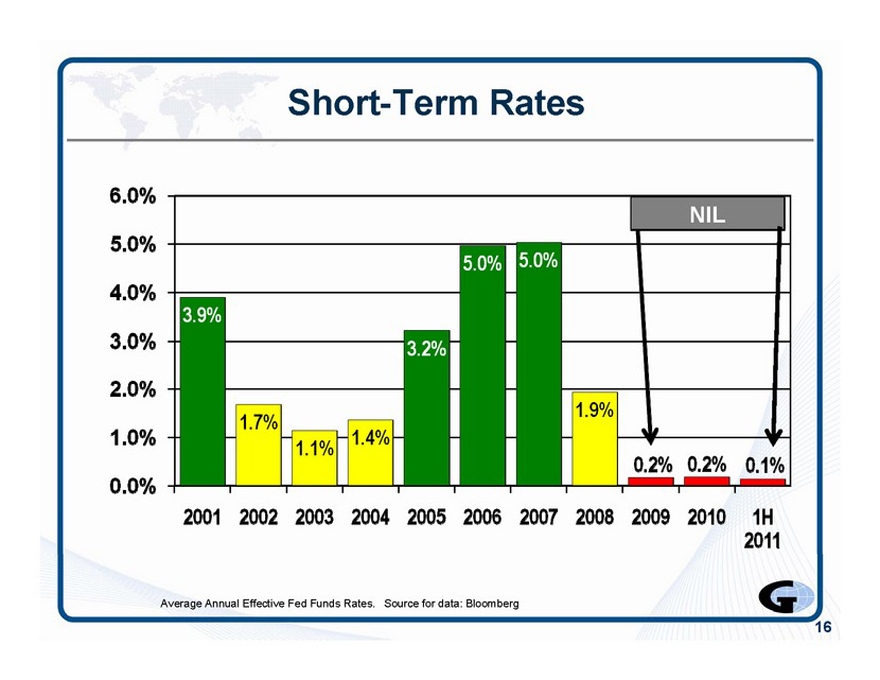

Short-Term Rates

•EBHttE

6.0%

5.0%

4.0%

3.0%

2.0% 4

1.0% \

0.0%

3.9%

1.7%

1.1%

hl.4%

1.9%

0.2% 0.2% 0.1%

r r

Hi i

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1H

2011

Average Annual Effective Fed Funds Rates. Source for data: Bloomberg

G

16

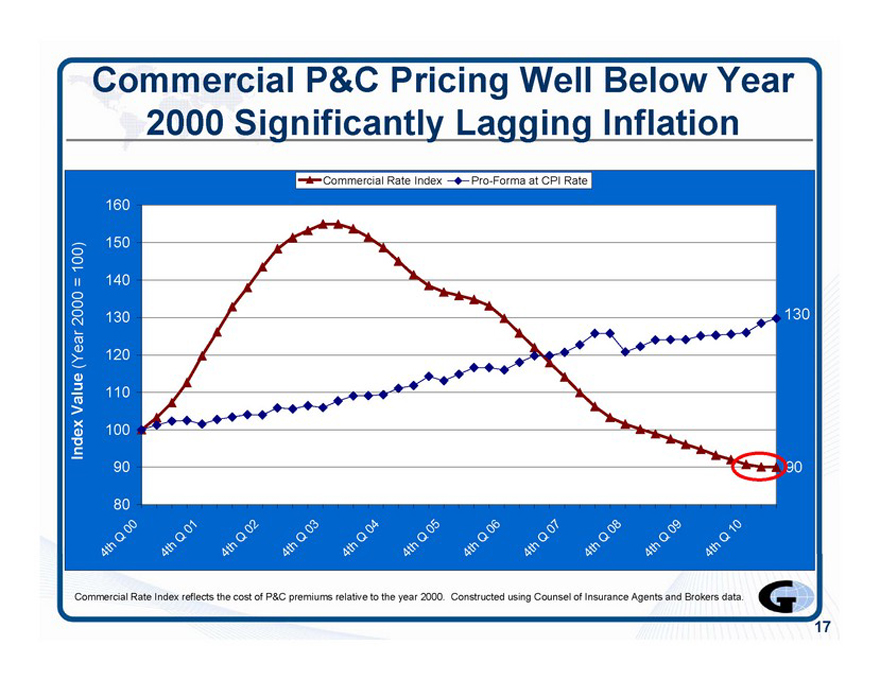

Commercial P&C Pricing Well Below Year 2000 Significantly Lagging Inflation

17

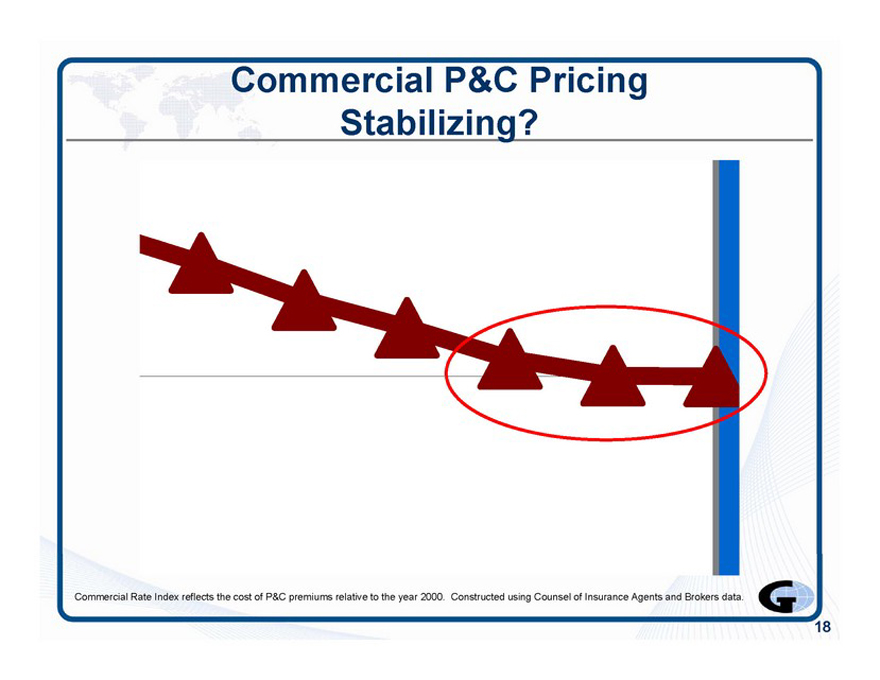

Commercial P&C Pricing Stabilizing?

18

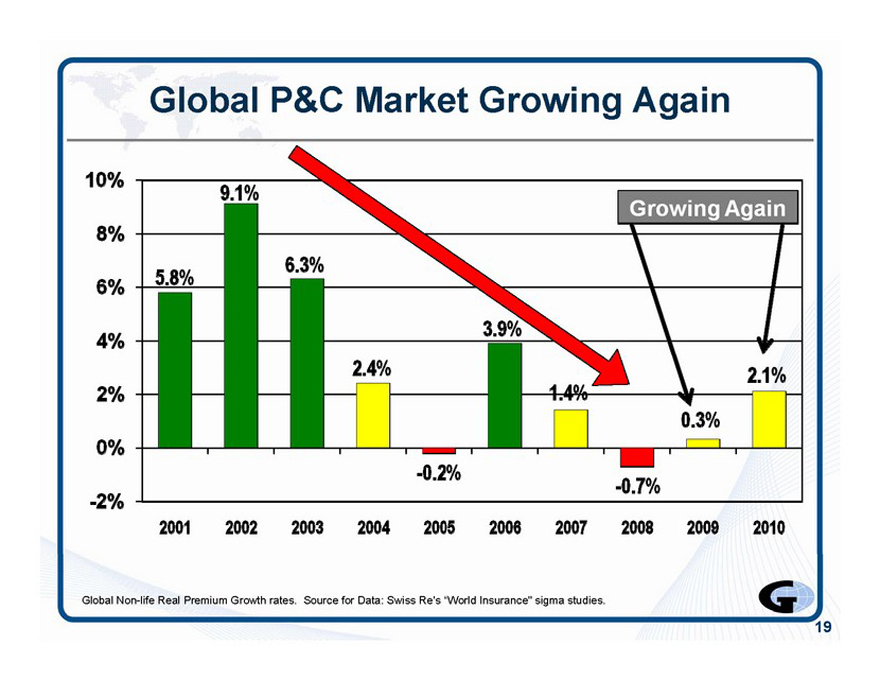

Global P&C Market Growing Again

19

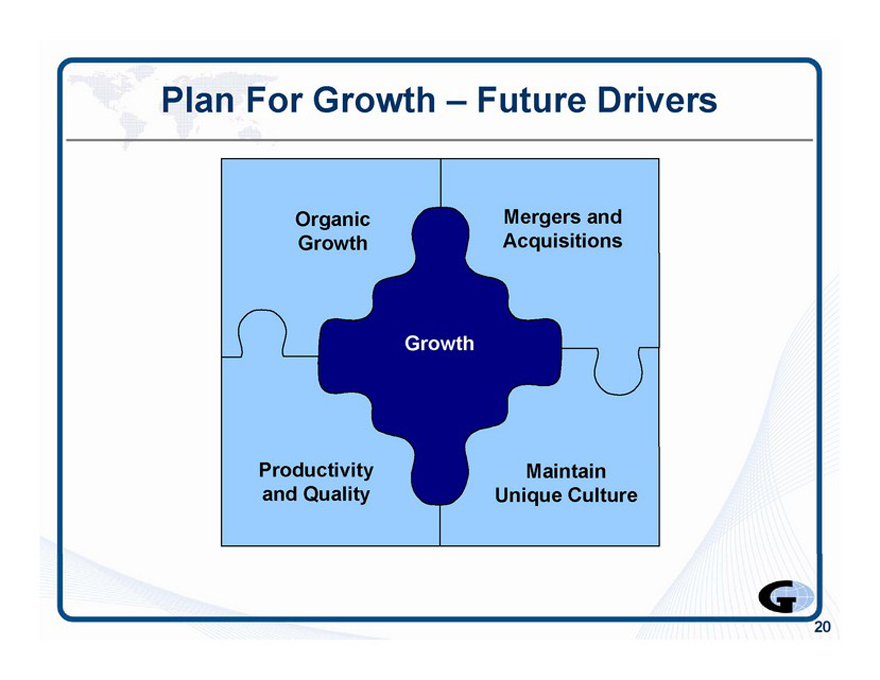

Plan For Growth—Future Drivers

Organic A Growth Mergers and Acquisitions

Growth

Productivity and Quality Maintain W Unique Culture

G

20

Plan For Growth—Future Drivers

Organic A Growth Mergers and Acquisitions

Growth

Productivity and Quality Maintain W Unique Culture

21

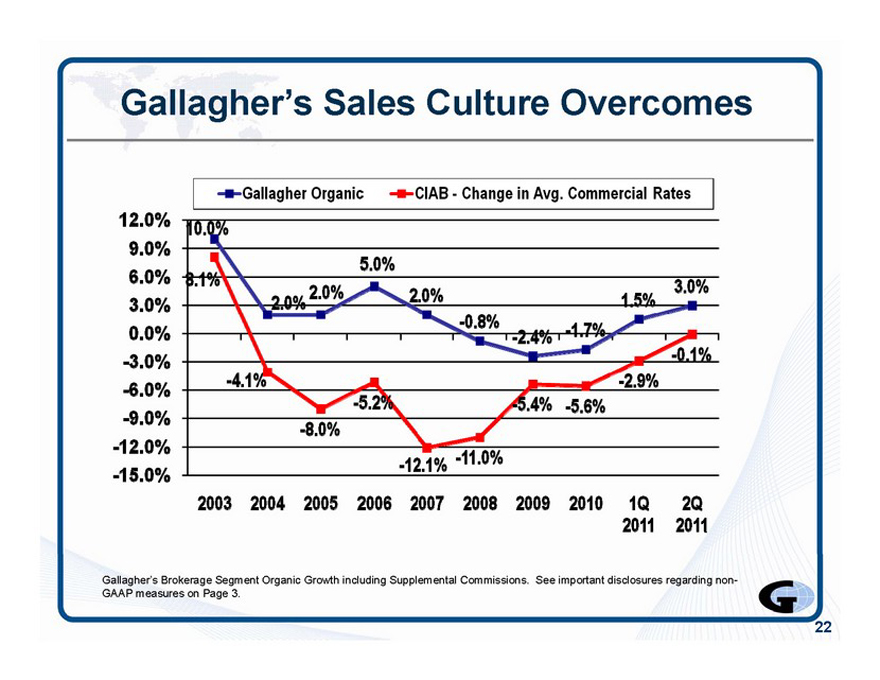

Gallagher’s Sales Culture Overcomes

•Gallagher Organic -a-ClAB—Change in Avg. Commercial Rates

12.0%

9.0%

6.0%

3.0%

0.0%

-3.0%

-6.0%

-9.0%

-12.0%

?15.0%

2003 2004 2005 2006 2007 2008 2009 2010 1Q 2Q

2011 2011

Gallagher’s Brokerage Segment Organic Growth including Supplemental Commissions. See important disclosures regarding non-GAAP measures on Page 3.

G

22

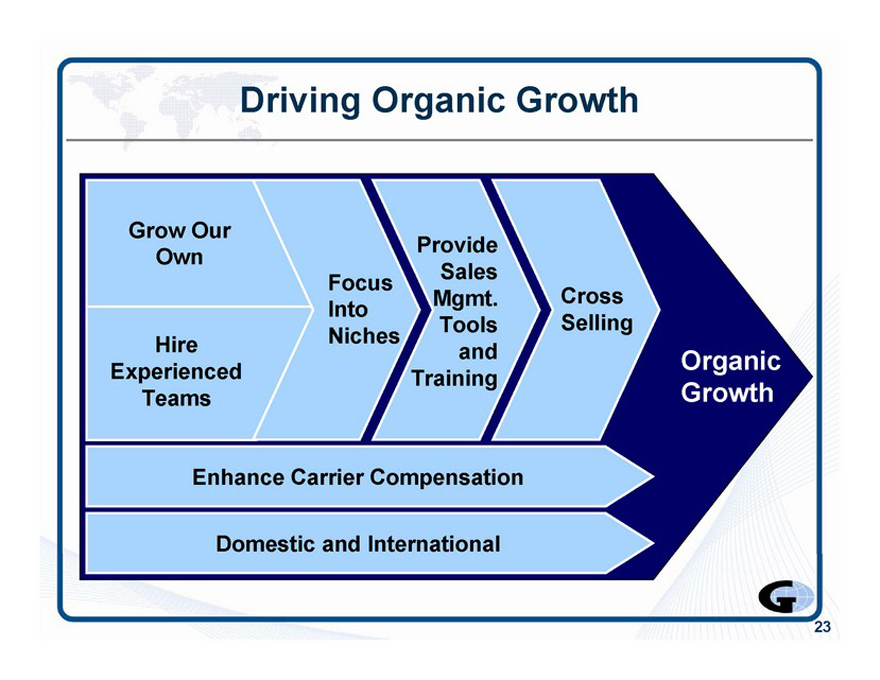

Grow Our Own

Driving Organic Growth

Hire Experienced Teams

Focus Into Niches

Provide Sales Mgmt.

Tools and Training

Cross Selling

Organic Growth

Enhance Carrier Compensation

Domestic and International

23

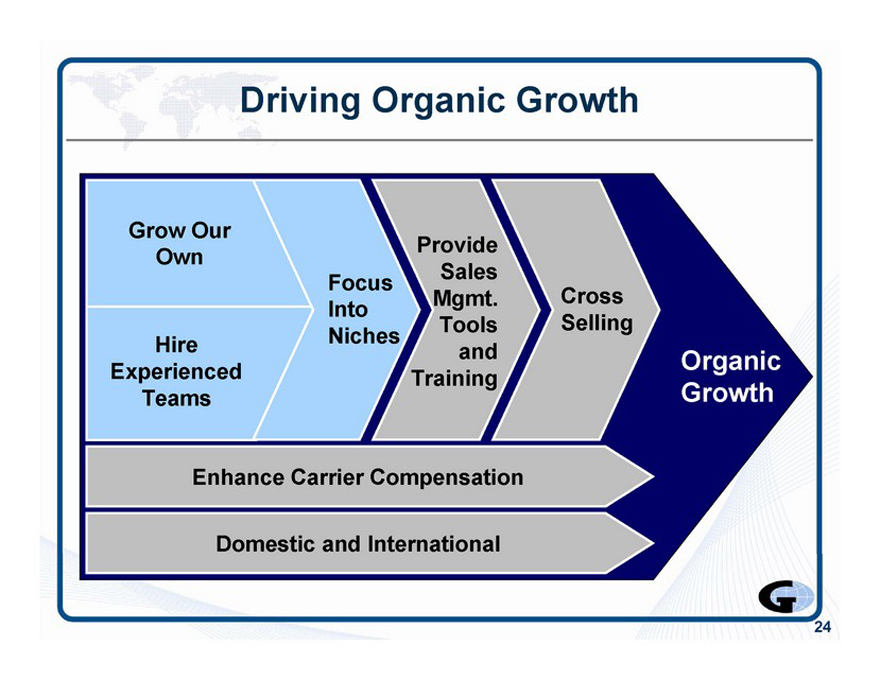

Driving Organic Growth

Grow Our Own

Hire Experienced Teams

Focus Into Niches

Provide Sales Mgmt.

Tools and Training

Cross Selling

Organic Growth

Enhance Carrier Compensation

Domestic and International

24

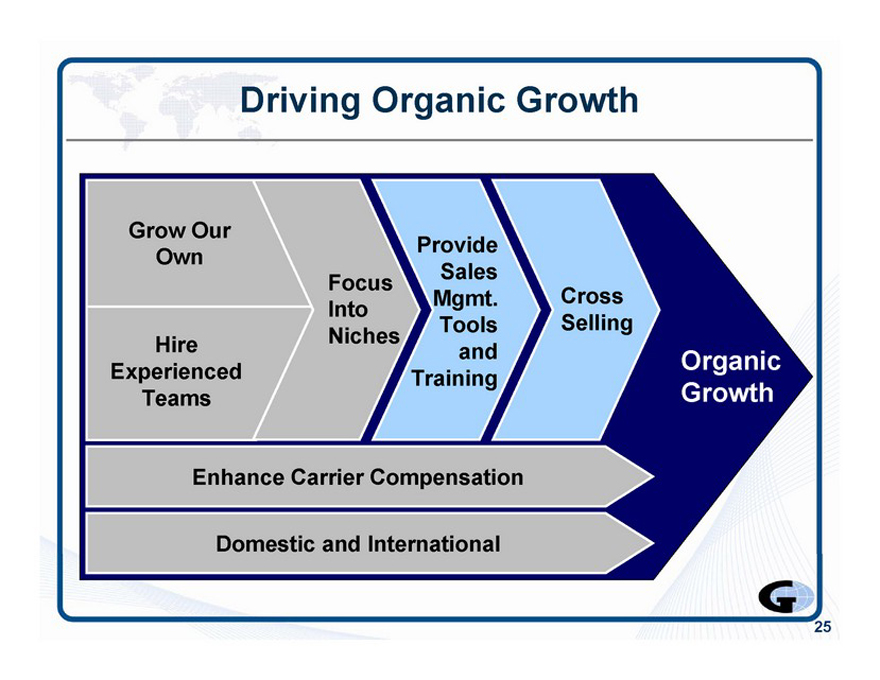

Driving Organic Growth

Grow Our

Provide Own Sales Focus

Mgmt. Cross Into Tools Selling Hire Niches

Experienced and Organic Training

Teams Growth

Enhance Carrier Compensation

Domestic and International

25

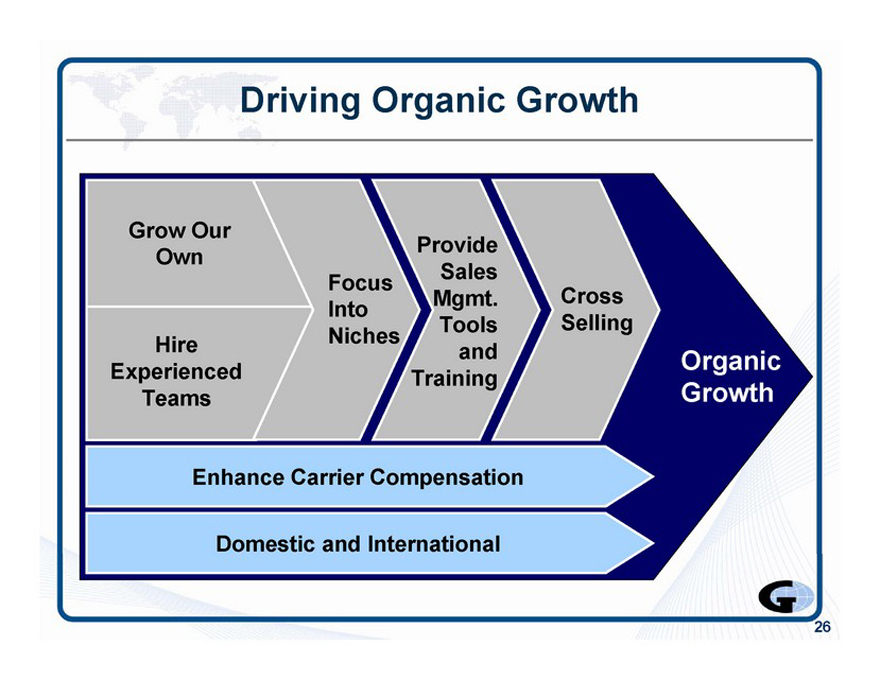

Driving Organic Growth

Grow Our

Provide Own Sales Focus

Mgmt. Cross Into Tools Selling Hire Niches

Experienced and Organic Training

Teams Growth

Enhance Carrier Compensation

Domestic and International

26

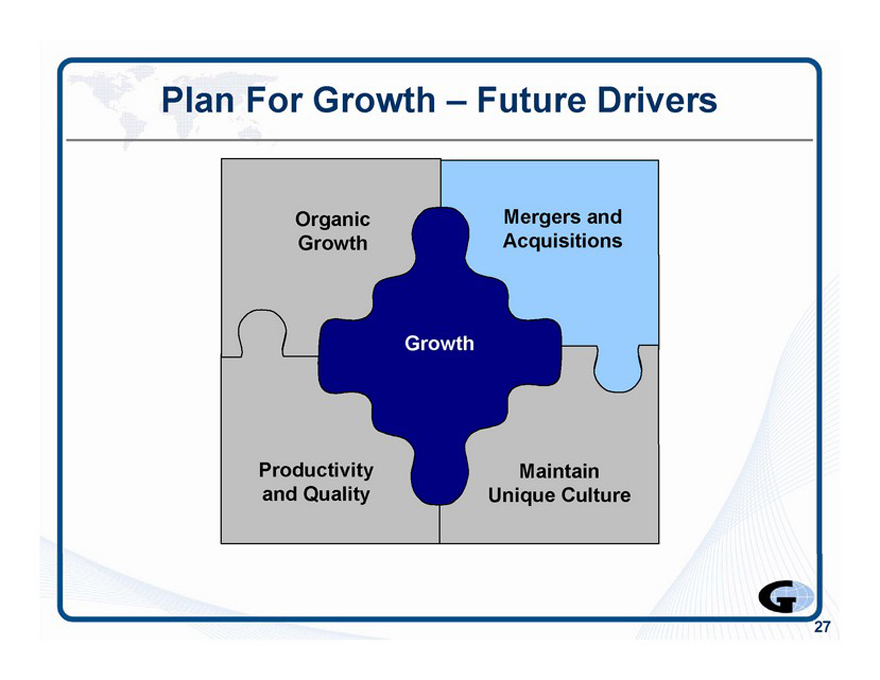

Plan For Growth—Future Drivers

Organic A Growth Mergers and Acquisitions

Growth

Productivity and Quality Maintain W Unique Culture

27

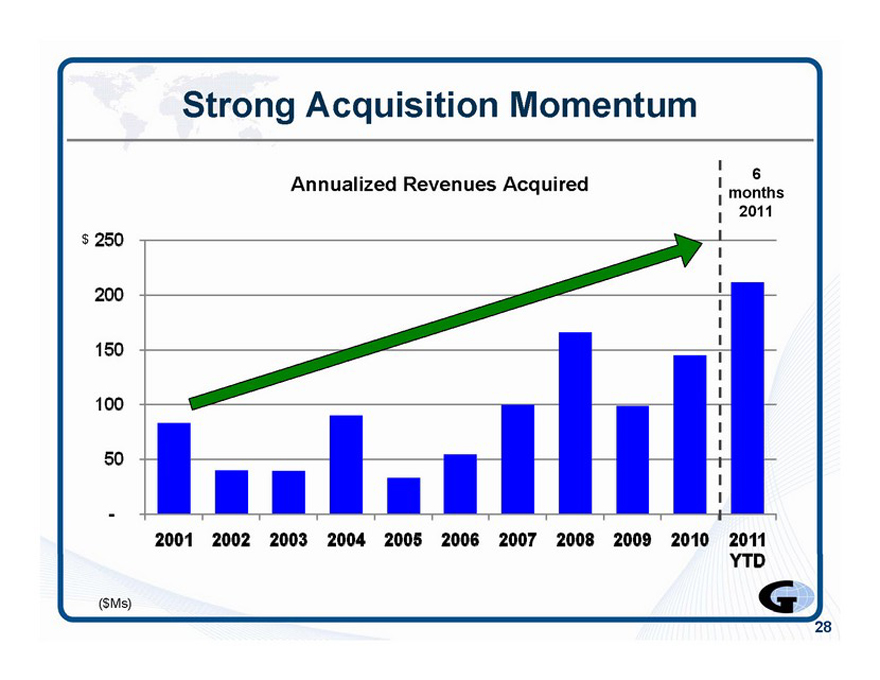

Strong Acquisition Momentum

28

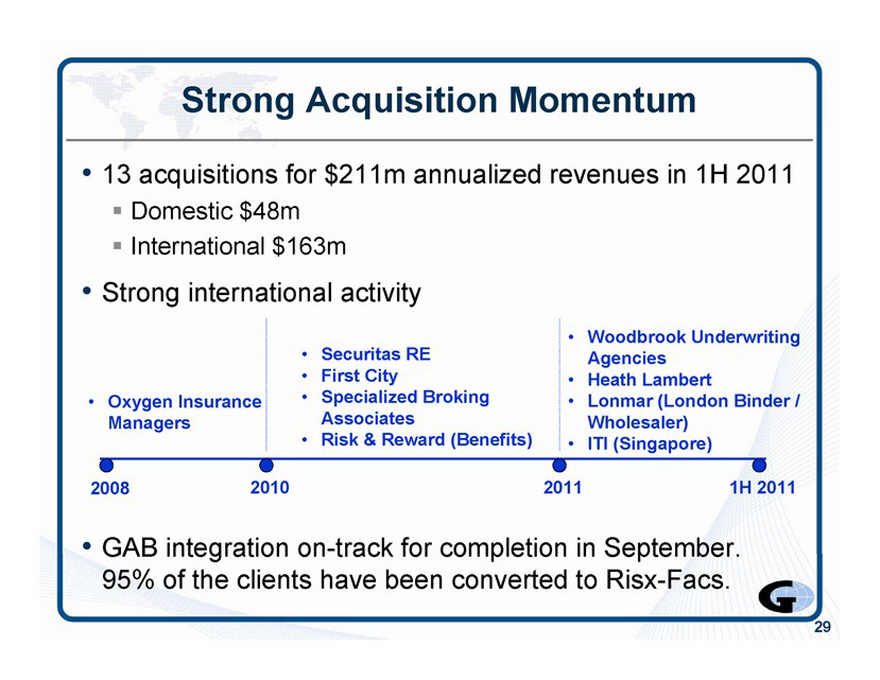

Strong Acquisition Momentum

13 acquisitions for $211m annualized revenues in 1H 2011 ? Domestic $48m International $163m

Strong international activity

• Oxygen Insurance Managers

Securitas RE

First City

Specialized Broking

Associates

Risk & Reward (Benefits)

Woodbrook Underwriting Agencies

Heath Lambert

Lonmar(London Binder / Wholesaler)

ITI (Singapore)

2008

2010

2011

1H 2011

•

GAB integration on-track for completion in September. 95% of the clients have been converted to Risx-Facs.

G

29

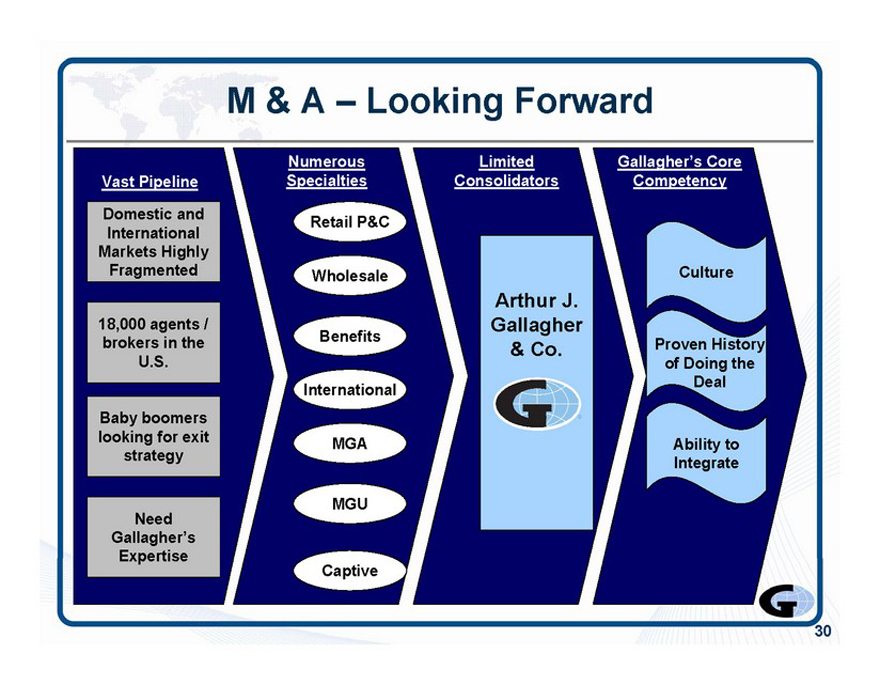

M & A—Looking Forward

Vast Pipeline

Domestic and International Markets Highly Fragmented

18,000 agents / brokers in the U.S.

Baby boomers looking for exit strategy

Need Gallagher’s Expertise

Numerous Specialties

Retail P&C Wholesale Benefits International MGA

MGU

Captive

Limited Consolidators

Arthur J. Gallagher

& Co.

Gallagher’s Core Competency

Culture

Proven History of Doing the Deal

Ability to Integrate

30

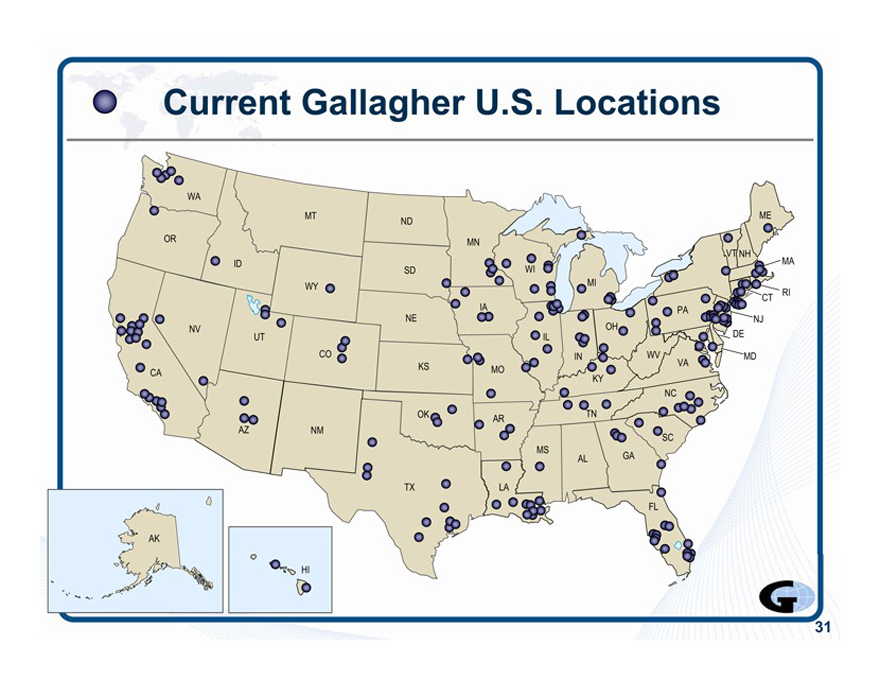

Current Gallagher U.S. Locations

31

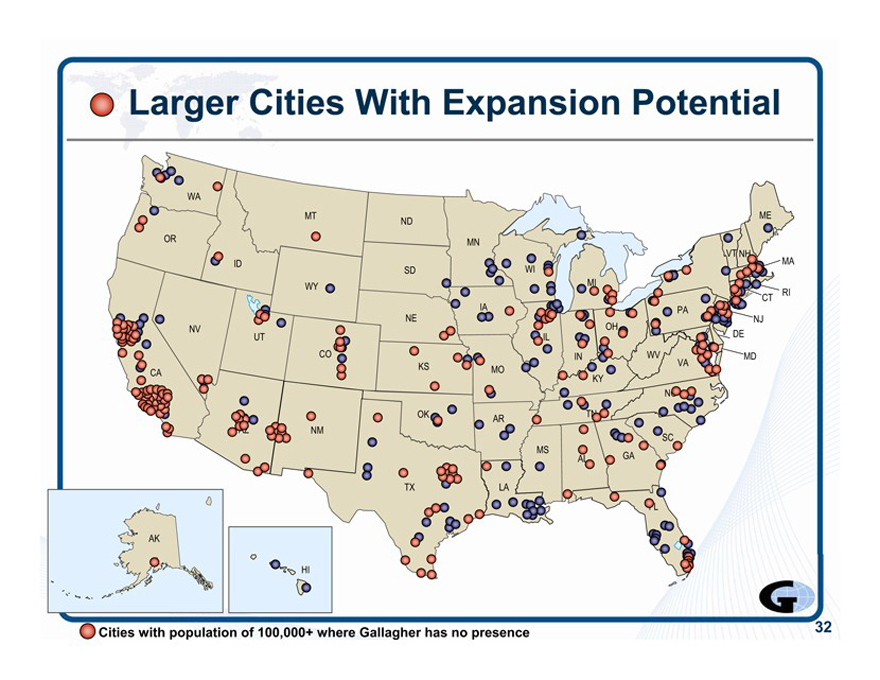

Larger Cities With Expansion Potential

Cities with population of 100,000+ where Gallagher has no presence

32

Gallagher Global Alliance Creates Pipeline

33

Plan For Growth—Future Drivers

Organic Growth Mergers and Acquisitions

Growth productivity & quality Maintain Unique Culture

34

Productivity & Quality

Established

Offshore

Centers of

Excellence

Controlling Headcount

Reducing Real Estate

Leveraging

Sales Force

Management

Tools

Investing in

Business

Intelligence

Improving Productivity

and Quality

Standardizing

Processes and Systems

Managing Expenses

Building

Productivity

Tools—DMS

and

Workflow

35

Relentless Focus on Quality & Customer Service

EMPLOYEE BENEFIT CONSULTANT W THE BRITISH

I INSURANCE

1 |

| AWARDS |

1 |

| 2010 |

\ WINNER

&S G

20 0 5

THIRD-PARTY CLAIMS ADMINISTRATOR—PROPERTY/CASUALTY

Winner of 2011 Greenwich Excellence Awards in U.S. Large Corporate Insurance Brokerage

SBA Gallagher -ANZZIIF 2011 “Sources to the Community Award”

Australis Group Underwriting -Finalist for the “Underwriting Agency of the Year” award

*fr* C/^

s 2010 «

RETAIL AGENT/BROKER REVENUES >$250M

36

Plan For Growth—Future Drivers

Organic Growth Mergers and Acquisitions

Growth

Productivity and quality Maintain W Unique Culture

37

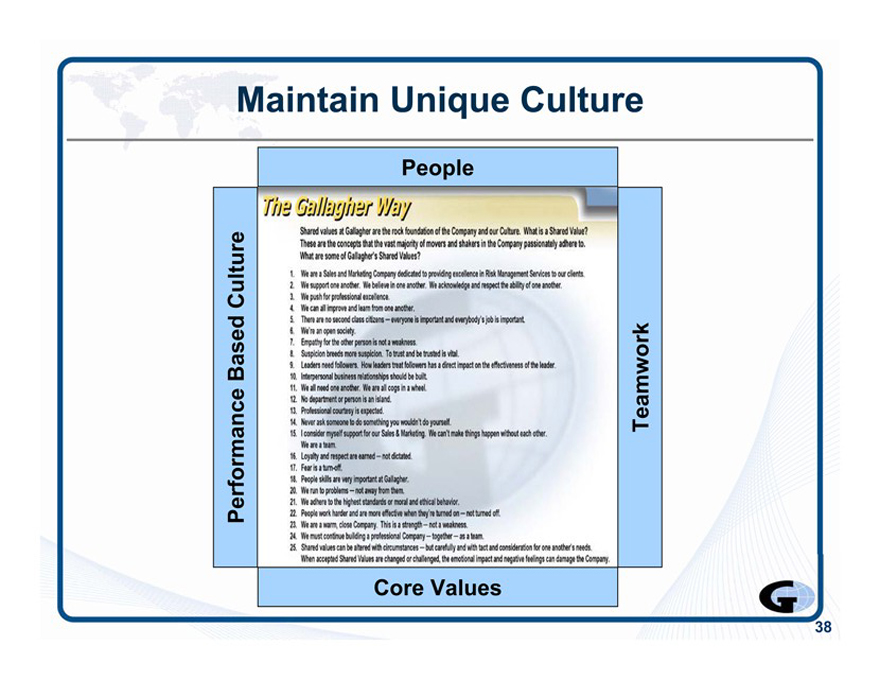

Maintain Unique Culture

People

Core Values

G

38

Why Invest?

You believe in Gallagher’s

Organic growth opportunities M&A opportunities

Productivity and quality gains resulting in margin improvement

Experienced management team

Focus on culture

Solid financial foundation

39

Why Invest?

You like Gallagher’s return to stockholders

Outperformed the S&P 500 in total returns over last decade

Outperformed the S&P 500 in total returns since the Great Recession

?Consistent dividend growth since 1984

40

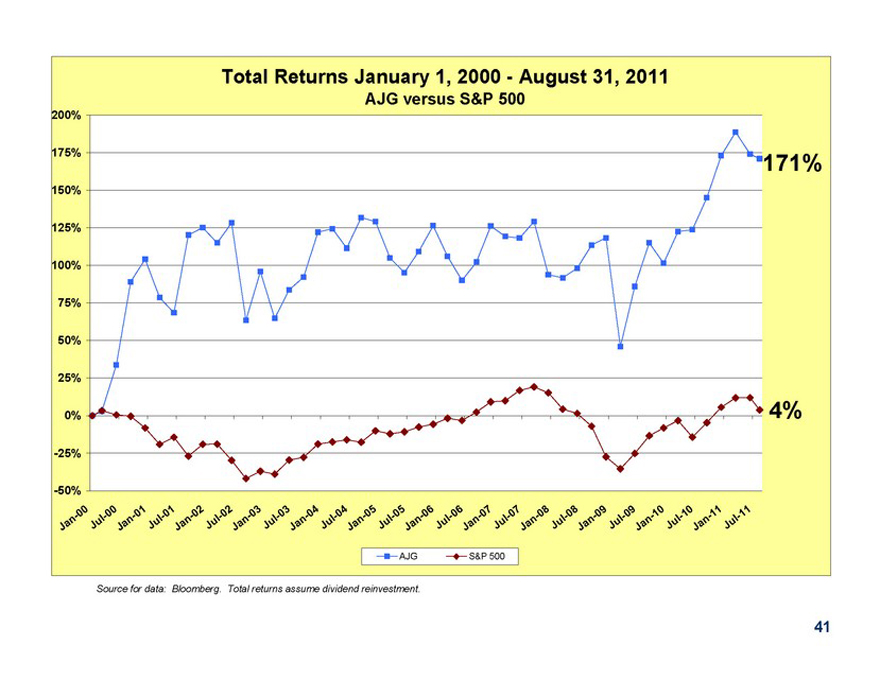

Total Returns January 1, 2000—August 31, 2011

AJG versus S&P 500

200% 175% 150% 125% 100%

75%

50%

25%

0%

-25%

-50%

-AJG ? S&P 500

Source for data: Bloomberg. Total returns assume dividend reinvestment.

41

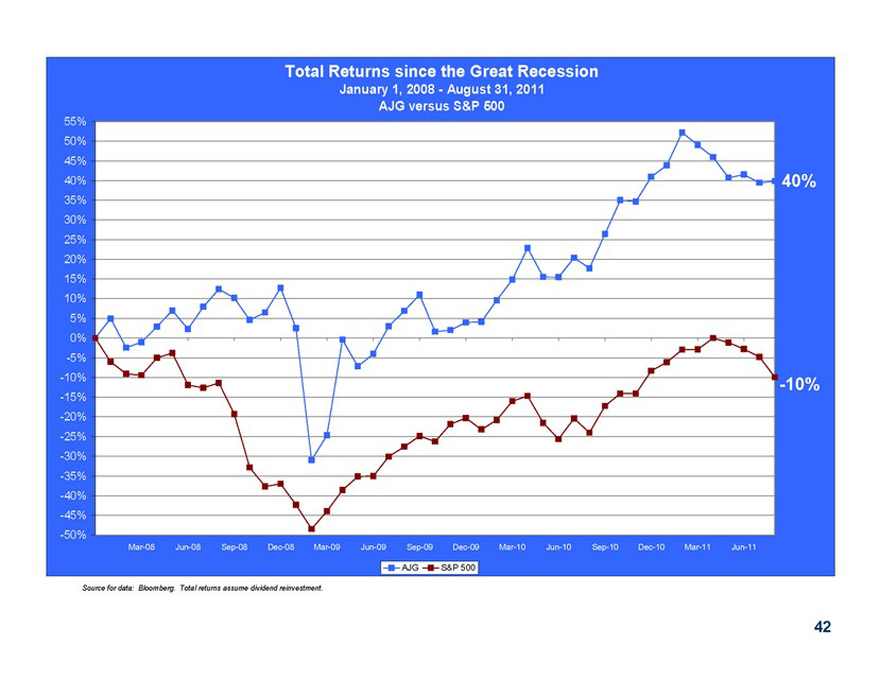

Total Returns since the Great Recession

January 1, 2008—August 31, 2011 AJG versus S&P 500

55%

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

-30%

-35%

-40%

-45%

-50%

-10%

Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11

-AJG

?S&P 500

Source for data: Bloomberg. Total returns assume dividend reinvestment.

42

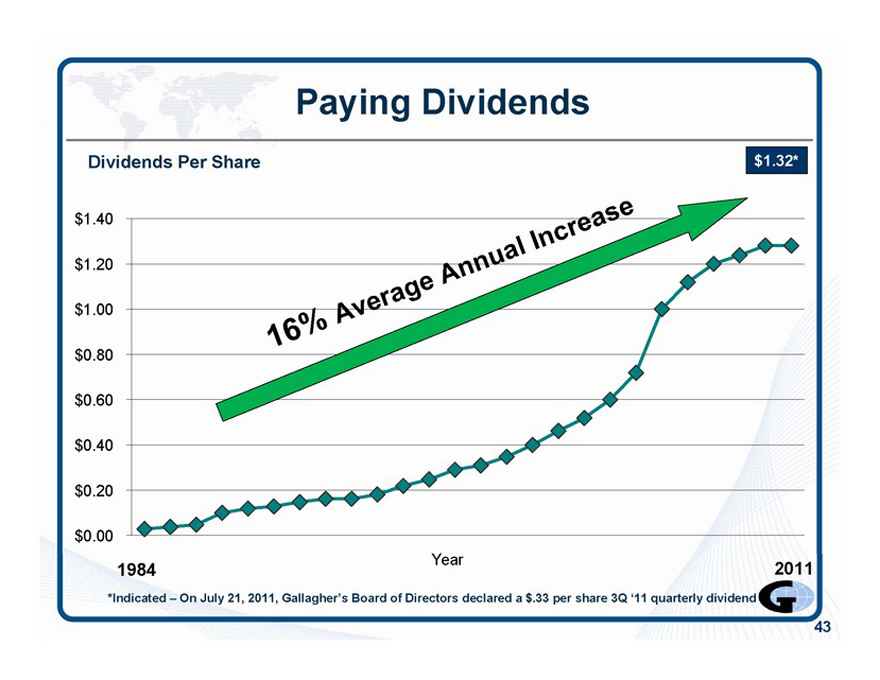

Paying Dividends

Dividends Per Share

$1.32

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

Year

1984 ,v~” 2011

Indicated—On July 21, 2011, Gallagher’s Board of Directors declared a $.33 per share 3Q ‘11 quarterly dividend ff^™

43

44

Questions

& Answers

For Additional Information

Marsha Akin

Director—Investor Relations

Marsha_Akin@ajg.com

Phone: 630-285-3501

45

Appendix

46

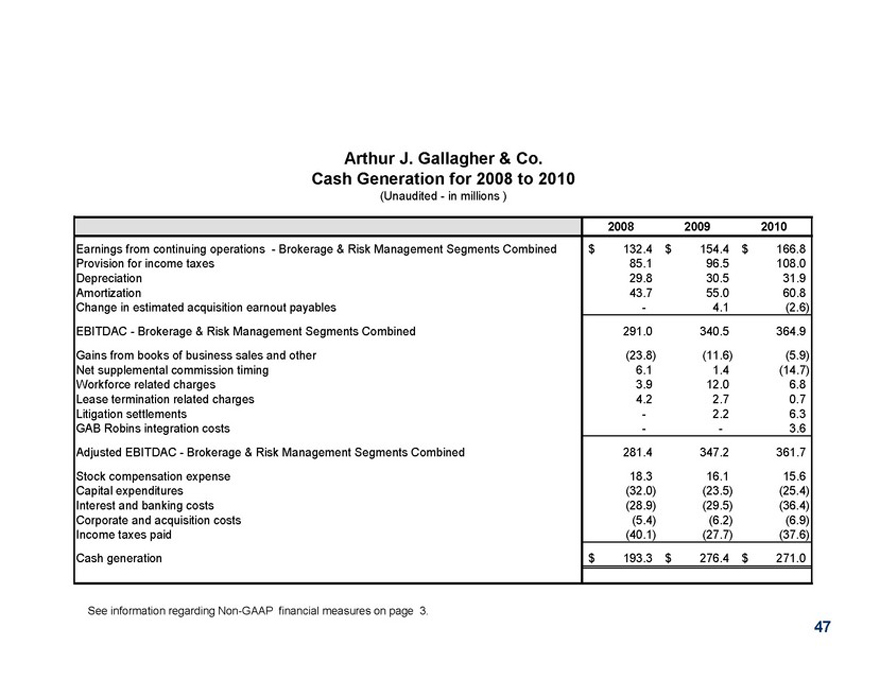

Arthur J. Gallagher & Co. Cash Generation for 2008 to 2010

(Unaudited—in millions )

2008 2009 2010

Earnings from continuing operations—Brokerage & Risk Management Segments Combined

Provision for income taxes

Depreciation

Amortization

Change in estimated acquisition earnout payables

EBITDAC—Brokerage & Risk Management Segments Combined

Gains from books of business sales and other

Net supplemental commission timing

Workforce related charges

Lease termination related charges

Litigation settlements

GAB Robins integration costs

Adjusted EBITDAC—Brokerage & Risk Management Segments Combined

Stock compensation expense Capital expenditures Interest and banking costs Corporate and acquisition costs Income taxes paid

Cash generation $ 132.4 $ 154.4 $ 166.8

85.1 96.5 108.0

29.8 30.5 31.9

43.7 55.0 60.8

4.1 (2.6)

291.0 340.5 364.9

(23.8) (11.6) (5.9)

6.1 1.4 (14.7) 3.9 12.0 6.8

4.2 2.7 0.7 2.2 6.3

3.6

281.4 347.2 361.7

18.3 16.1 15.6

(32.0) (23.5) (25.4) (28.9) (29.5) (36.4)

(5.4) (6.2) (6.9)

(40.1) (27.7) (37.6)

$ 193.3 $ 276.4 $ 271.0

See information regarding Non-GAAP financial measures on page 3.

47