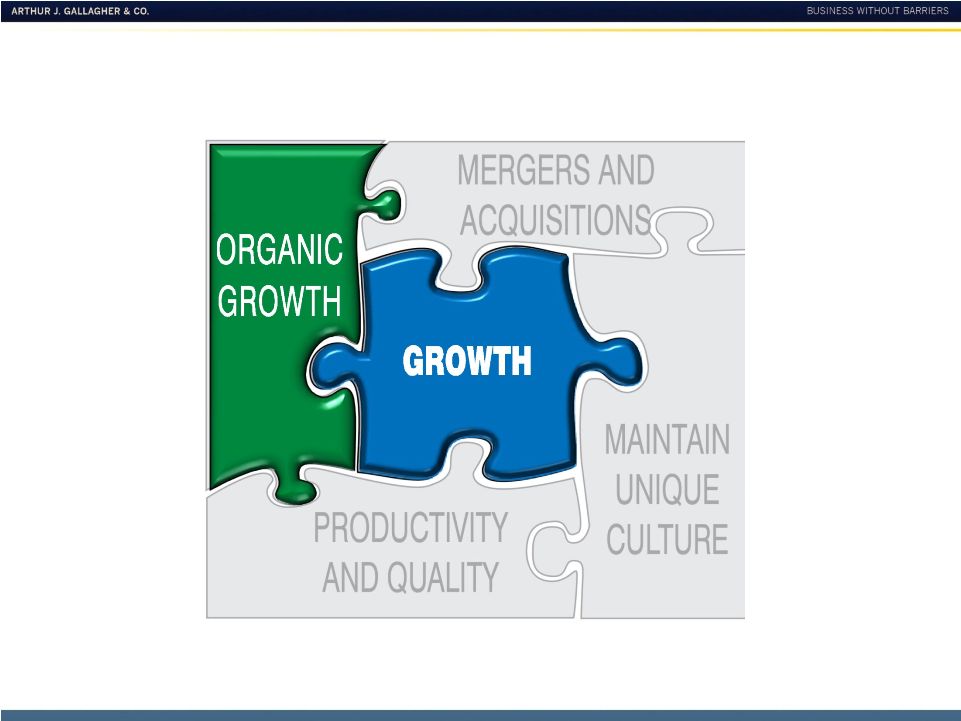

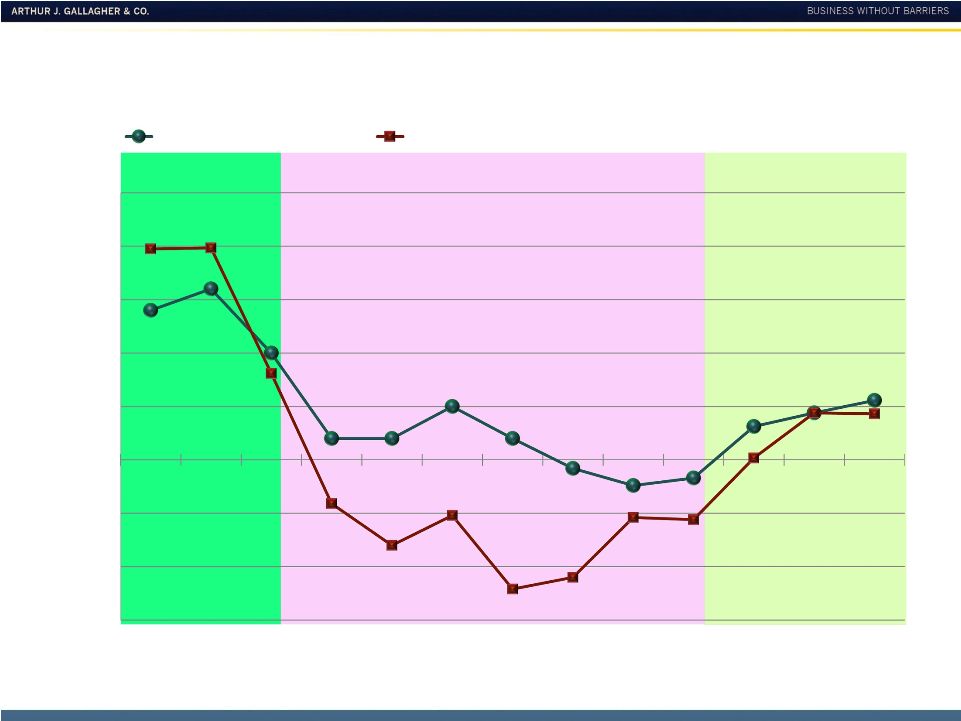

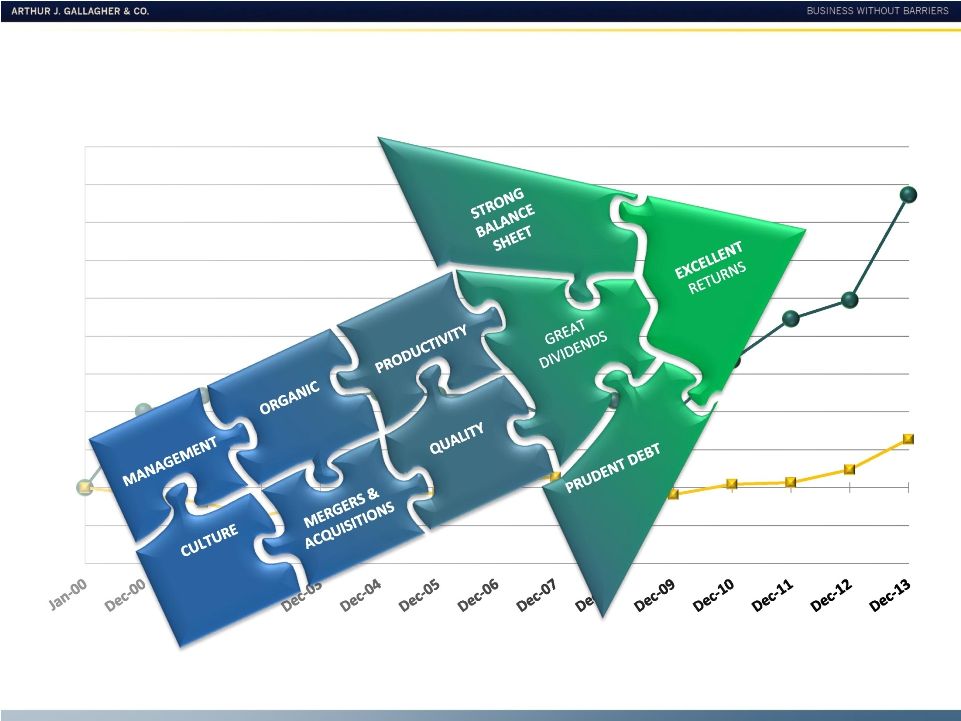

8 Information Regarding Non-GAAP Measures Earnings Measures - Gallagher believes that each of Adjusted EBITDAC and Adjusted EBITDAC margin, as defined below, provides a meaningful representation of its operating performance and Reconciliations – Please see the examples set forth in "Reconciliation of Non-GAAP Measures and supplemental quarterly financial data " on Gallagher's Web site at www.ajg.com/IR. Organic Growth is defined as organic change in base commission and fee revenues, and excludes the first twelve months of net commission and fee revenues generated from acquisitions accounted Adjusted Operating Expense Ratio is defined as operating expense, adjusted to exclude acquisition integration costs, South Australia and claim portfolio transfer ramp up costs, workforce related Adjusted Revenues is defined as revenues, adjusted to exclude gains realized from sales of books of business, revenue from New Zealand earthquake claims administration and South Australia ramp up fees. Revenue and Expense Measures - Gallagher believes that Adjusted Revenues and Adjusted Operating Expense Ratio, each as defined below, provides stockholders and other interested persons with Adjusted EBITDAC margin is defined as Adjusted EBITDAC divided by Adjusted Revenues (defined below). Adjusted EBITDAC is defined as earnings from continuing operations before interest, income taxes, depreciation, amortization and the change in estimated acquisition earnout payables (EBITDAC), This presentation includes references Adjusted EBITDAC, Adjusted EBITDAC margin, Adjusted Revenues, Adjusted Operating Expense Ratio and Organic Growth, which are measures not in accordance with, or an alternative to, the GAAP information provided herein. The most directly comparable GAAP measure for Adjusted Revenues and Organic Growth is revenues. For the Brokerage Segment, the Risk Management Segment, and the two segments on a combined basis, revenues were $1,827 million, $572 million and $2,399 million, respectively, in 2012 and $2,144 million, $611 million and $2,755 million in 2013. For the Brokerage Segment, revenues were $533 million, $679 million, $783 million, $863 million, $946 million, $1,007 million, $1,114 million, $1,188 million, $1,276 million, $1,341 million, $1,556 million, $1,827 million and $2,144 million, in 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012 and 2013, respectively. The most directly comparable GAAP measure for Adjusted Operating Expense Ratio is operating expense, which was $247 million, $313 million and $370 million in 2008, 2012 and 2013, respectively, for the Brokerage Segment and $126 million, $138 million and $146 million in 2008, 2012 and 2013, respectively, for the Risk Management Segment. for as purchases and the net commission and fee revenues related to operations disposed of in each year presented. These commissions and fees are excluded from organic revenues in order to help interested persons analyze the revenue growth associated with the operations that were a part of Gallagher in both the current and prior year. In addition, change in organic growth excludes the impact of supplemental commission and contingent commission revenues, and the period-over-period impact of foreign currency translation. The amounts excluded with respect to foreign currency translation are calculated by applying 2013 foreign exchange rates to the same periods in 2012. For the Risk Management segment, organic change in base domestic and international fee revenues excludes international performance bonus fees and New Zealand earthquake claims administration to improve the comparability of our results between periods by eliminating the impact of the items that have a high degree of variability or due to the limited-time nature of these revenue sources. useful information that will assist such persons in analyzing Gallagher’s operating results as they develop a future outlook for Gallagher. Gallagher believes that Organic Growth provides a comparable measurement of revenue growth that is associated with the revenue sources that will be continuing in 2014 and beyond. Gallagher has historically viewed organic revenue growth as an important indicator when assessing and evaluating the performance of its Brokerage and Risk Management segments. Gallagher also believes that using this measure allows financial statement users to measure, analyze and compare the growth from its Brokerage and Risk Management segments in a meaningful and consistent manner. The most directly comparable GAAP measure for these non-GAAP earnings measures is net earnings. For the Brokerage Segment, the Risk Management Segment, and the two segments on a combined basis, net earnings was $140 million, $33 million and $173 million, respectively, in 2011, $156 million, $42 million and $198 million, respectively, in 2012, and $205 million, $46 million and $251 million in 2013. further adjusted to exclude gains realized from sales of books of business, acquisition integration costs (i.e., Bollinger, Giles and Heath Lambert), earnout related compensation charges, workforce related charges, lease termination related charges, New Zealand earthquake claims administration costs, South Australia and claim portfolio transfer ramp up fees/costs, acquisition related adjustments and the impact of foreign currency translation, as applicable. improves the comparability of Gallagher’s results between periods by eliminating the impact of certain items that have a high degree of variability. charges, lease termination related charges, acquisition related adjustments and the impact of foreign currency translation, as applicable, divided by Adjusted Revenues. |