|

Exhibit 99.1

|

Investor Presentation

September 2016

Information Regarding Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “anticipates,” “believes,” “contemplates,” “see,” “should,” “could,” “will,” “estimates,” “expects,” “intends,” “plans” and variations thereof and similar expressions, are intended to identify forward-looking statements. Examples of forward-looking statements in this presentation include, but are not limited to, statements regarding: (i) improvements in our new business production; (ii) “tuck-in” M&A activity; (iii) global brand recognition; (iv) completion of large UK M&A integration efforts and expense; (v) the leveraging of internal resources across divisions and borders; (vi) our status as the premier provider of claims management services; (vii) our global presence in the claims space; (viii) our ability to stay in front of improvements in technology; (ix) commercial P&C pricing; (x) drivers and expected levels of our organic growth; (xi) future M&A opportunities, including bolt-on acquisitions to our international “platforms”; (xiii) increasing productivity and quality; (xiv) our management team; (xv) our use of leverage; (xvi) our balance sheet; (xvii) our use of stock in M&A, (xviii) our total shareholder return and (xix) earnings impact from our clean energy investments. Important factors that could cause actual results to differ materially from those in the forward-looking statements include: declines in premiums or other adverse trends in the insurance industry; an economic downturn (including as a result of Brexit); competitive pressures in our businesses; failure to successfully or cost-effectively integrate recently acquired businesses; risks to our acquisition strategy, including continuing consolidation in our industry and increased interest in acquiring insurance brokers by private equity firms; our failure to attract and retain key executives and other personnel; risks arising from our international operations, including political and economic uncertainty and regulatory and legal compliance risk; concentration of large amounts of revenue with certain clients in our risk management segment; failure to apply technology effectively in our businesses; business continuity and cybersecurity risks; damage to our reputation; and failure to comply with regulatory requirements, including the FCPA, other anti-corruption laws, and data privacy laws. See page 1 of the CFO commentary as of July 28, 2016 for risks affecting (xix) above. Please refer to Gallagher’s filings with the SEC, including Item 1A, “Risk Factors,” of its Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and its Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, for a more detailed discussion of these and other factors that could impact its forward-looking statements.

Information Regarding Non-GAAP Measures

This presentation includes references to Adjusted EBITDAC, Adjusted EBITDAC margin, Adjusted Revenues, Adjusted Operating Expense Ratio and Organic Growth, which are measures not in accordance with, or an alternative to, the GAAP information provided herein.

Earnings Measures—Gallagher believes that each of Adjusted EBITDAC and Adjusted EBITDAC margin, as defined below, provides a meaningful representation of its operating performance and improves the comparability of Gallagher’s results between periods by eliminating the impact of certain items that have a high degree of variability.

Adjusted EBITDAC is defined as net earnings before interest, income taxes, depreciation, amortization and the change in estimated acquisition earnout payables (EBITDAC), further adjusted to exclude gains realized from sales of books of business, acquisition integration costs, earnout related compensation charges, workforce related charges, lease termination related charges, client runoff/bankruptcy impact, South Australia and claim portfolio transfer ramp up fees/costs, acquisition related adjustments and the period-over-period impact of foreign currency translation, as applicable.

Adjusted EBITDAC margin is defined as Adjusted EBITDAC divided by Adjusted Revenues (defined below).

The most directly comparable GAAP measure for these non-GAAP earnings measures is net earnings. For the two segments (Brokerage Segment & Risk Management Segment) on a combined basis, net earnings was $174 million, $199 million, $253 million, $306 million, $325 million, $333 million and $362 million in 2011, 2012 , 2013, 2014, 2015, on a trailing twelve month basis as of 6/30/15 and on a trailing twelve month basis as of 6/30/16, respectively. For the Brokerage Segment, net earnings were $284 million and $308 million on a trailing twelve month (TTM) basis as of 6/30/15 and 6/30/16, respectively. For the Risk Management Segment, net earnings were $49 million and $54 million on a trailing twelve month (TTM) basis as of 6/30/15 and 6/30/16, respectively.

Revenue and Expense Measures—Gallagher believes that Adjusted Revenues and Adjusted Operating Expense Ratio, each as defined below, provides stockholders and other interested persons with useful information that will assist such persons in analyzing Gallagher’s operating results as they develop a future outlook for Gallagher. Gallagher believes that Organic Growth provides a comparable measurement of revenue growth that is associated with the revenue sources that will be continuing in 2016 and beyond. Gallagher has historically viewed organic revenue growth as an important indicator when assessing and evaluating the performance of its Brokerage and Risk Management segments. Gallagher also believes that using this measure allows financial statement users to measure, analyze and compare the growth from its Brokerage and Risk Management segments in a meaningful and consistent manner.

Adjusted Revenues is defined as revenues, adjusted to exclude gains realized from sales of books of business, New Zealand earthquake claims administration fees, South Australia ramp up fees and the impact of client bankruptcy , as applicable.

Adjusted Operating Expense Ratio is defined as operating expense, adjusted to eliminate lease termination and abandonment charges, acquisition related adjustments and integration costs, costs related to New Zealand earthquake claims administration, South Australia and claim portfolio transfer ramp up costs, and the impact of foreign currency translation, as applicable, divided by Adjusted Revenues, as applicable.

The most directly comparable GAAP measure for Adjusted Operating Expense Ratio is reported operating expense, which was $247 million and $637 million in 2008 and on trailing twelve month (TTM) basis at 6/30/16, respectively, for the Brokerage Segment and $126 million and $179 million in 2008 and on trailing twelve month (TTM) basis at 6/30/16, respectively, for the Risk Management Segment.

Organic Growth is defined as organic change in commission and fee revenues (including supplemental and contingent commissions), and excludes the first twelve months of net commission and fee revenues generated from acquisitions accounted for as purchases and the net commission and fee revenues related to operations disposed of in each year presented. These commissions and fees are excluded from organic revenues in order to help interested persons analyze the revenue growth associated with the operations that were a part of Gallagher in both the current and prior year. In addition, change in organic growth excludes the period-over-period impact of foreign currency translation. The amounts excluded with respect to foreign currency translation are calculated by applying current period foreign exchange rates to the corresponding prior periods.

The most directly comparable GAAP measure for Adjusted Revenues and Organic Growth is reported revenues. For the Brokerage Segment, reported revenues were $533 million, $679 million, $783 million, $863 million, $946 million, $1,007 million, $1,114 million, $1,188 million, $1,276 million, $1,329 million, $1,544 million, $1,812 million, $2,126 million, $2,896 million, $3,324 million and $1,765 million in 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015 and the first half of 2016, respectively. Additionally, for the Brokerage Segment, reported revenues were $3,231 million and $3,452 million on a trailing twelve month (TTM) basis as of 6/30/15 and 6/30/16, respectively. For the Risk Management Segment, reported revenues were $712 million and $716 million on a trailing twelve month (TTM) basis as of 6/30/15 and 6/30/16, respectively. On a combined basis (Brokerage Segment & Risk Management Segment) reported revenues were $3,943 million and $4,168 million on a trailing twelve month (TTM) basis as of 6/30/15 and 6/30/16, respectively.

Reconciliations – For other reconciliations, please see the appendix at the back of this presentation and the examples set forth in “Reconciliation of Non-GAAP Measures and supplemental quarterly financial data “ on Gallagher’s Web site at ajg.com/IR.

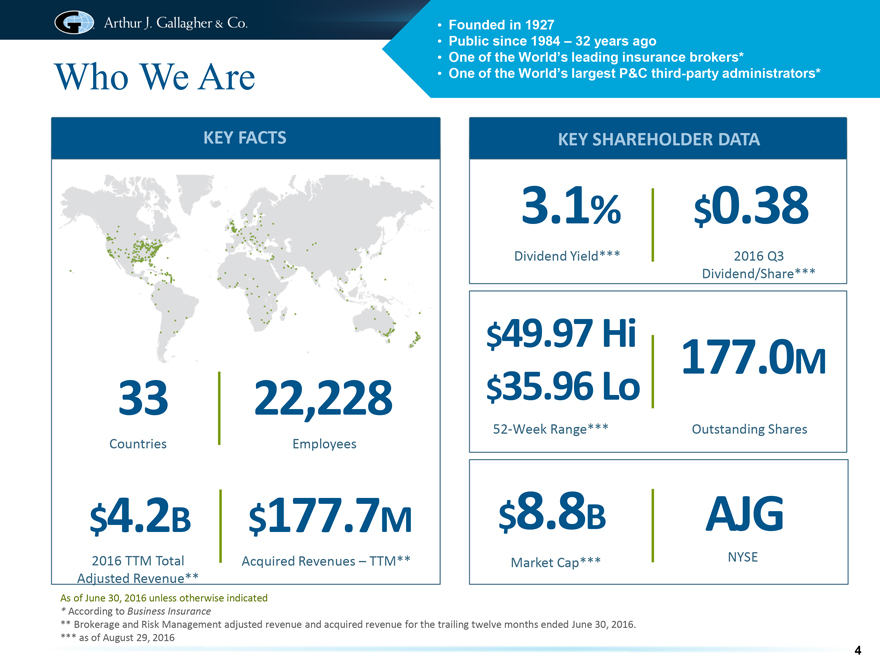

Who We Are

Founded in 1927

Public since 1984 – 32 years ago

One of the World’s leading insurance brokers*

One of the World’s largest P&C third-party administrators*

KEY FACTS

33 22,228

Countries Employees

$4.2B $177.7M

2016 TTM Total Acquired Revenues – TTM** Adjusted Revenue**

KEY SHAREHOLDER DATA

3.1% $0.38

Dividend Yield*** 2016 Q3 Dividend/Share***

$49.97 Hi 177.0M $35.96 Lo

52-Week Range*** Outstanding Shares

$8.8B AJG

Market Cap*** NYSE

As of June 30, 2016 unless otherwise indicated

* According to Business Insurance

** Brokerage and Risk Management adjusted revenue and acquired revenue for the trailing twelve months ended June 30, 2016.

*** as of August 29, 2016

4

Snapshot of Core Operations

BROKERAGE

SEGMENT

RISK MANAGEMENT

SEGMENT

83% of revenue*

We sell insurance and consult on insurance programs P&C and benefits Retail and wholesale Primarily middle-market commercial clients and individuals 79% of C&F revenue is commission – 21% is fee-based

17% of revenue*

We adjust claims and help companies and carriers reduce their losses Workers’ compensation, liability, managed care, property and auto Modest amount of storm/quake claims Primarily Fortune 1000 clients 90% of revenue* from non-affiliated brokerage customers and their clients

*Brokerage and Risk Management adjusted revenue for the trailing twelve months (TTM) ended June 30, 2016.

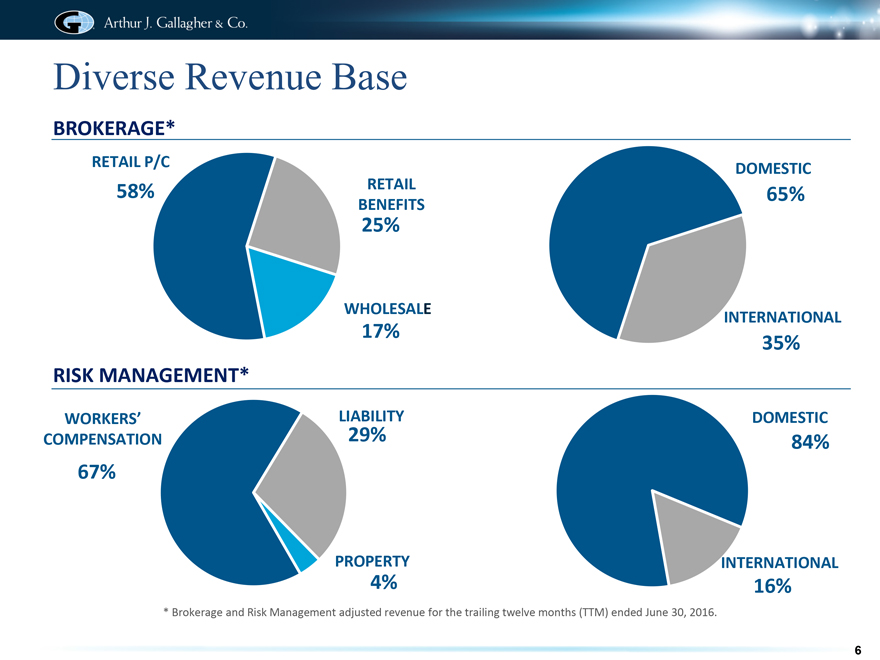

Diverse Revenue Base

BROKERAGE*

RETAIL P/C

58% RETAIL BENEFITS

25%

WHOLESALE

17%

DOMESTIC

65%

INTERNATIONAL

35%

RISK MANAGEMENT*

WORKERS’ COMPENSATION

67%

LIABILITY

29%

PROPERTY

4%

DOMESTIC

84%

INTERNATIONAL

16%

* Brokerage and Risk Management adjusted revenue for the trailing twelve months (TTM) ended June 30, 2016.

6

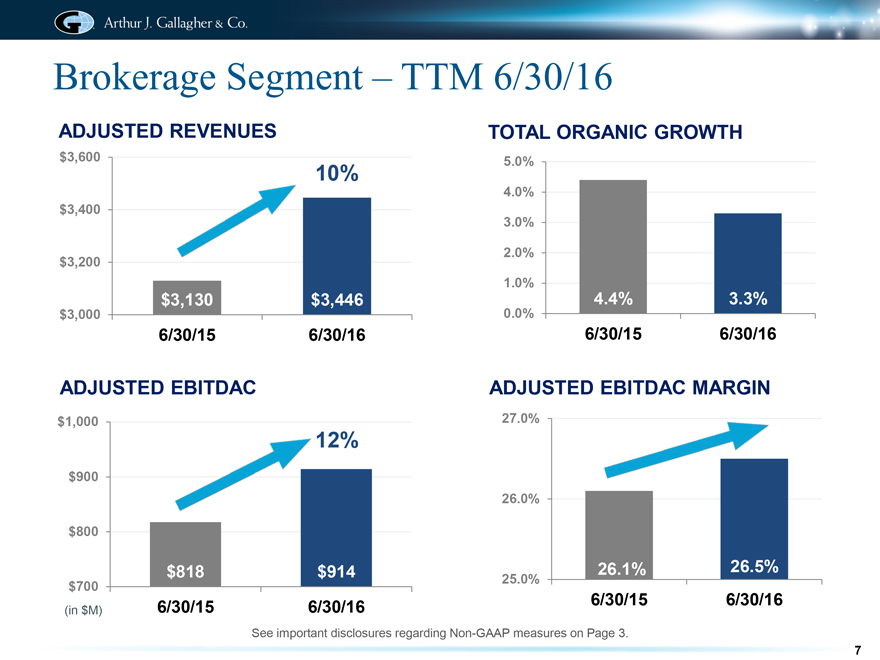

Brokerage Segment – TTM 6/30/16

ADJUSTED REVENUES

$3,600

10%

$3,400

$3,200

TOTAL ORGANIC GROWTH

$3,000 $3,130 $3,446

6/30/15 6/30/16

5.0% 4.0% 3.0% 2.0%

1.0% 4.4% 3.3%

0.0%

6/30/15 6/30/16

ADJUSTED EBITDAC

$1,000

12%

$900

$800

$700 $818 $914

(in $M) 6/30/15 6/30/16

ADJUSTED EBITDAC MARGIN

27.0%

26.0%

26.1% 26.5%

25.0%

6/30/15 6/30/16

See important disclosures regarding Non-GAAP measures on Page 3.

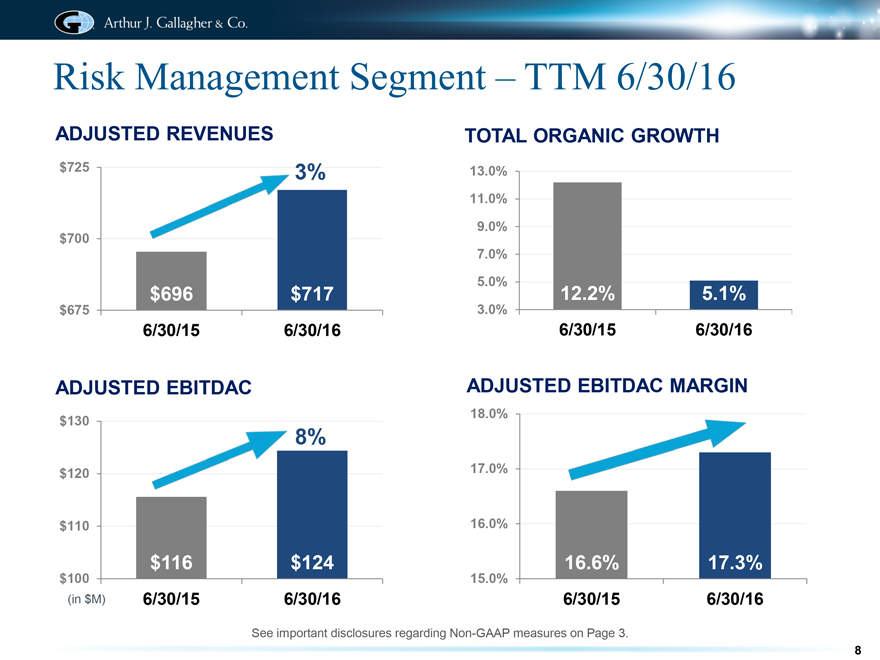

Risk Management Segment – TTM 6/30/16

ADJUSTED REVENUES

$725 3%

$700

$675 $696 $717

6/30/15 6/30/16

TOTAL ORGANIC GROWTH

13.0% 11.0% 9.0% 7.0% 5.0%

3.0% 12.2% 5.1%

6/30/15 6/30/16

ADJUSTED EBITDAC

$130

8%

$120

$110

$100 $116 $124

(in $M) 6/30/15 6/30/16

ADJUSTED EBITDAC MARGIN

18.0%

17.0%

16.0%

15.0% 16.6% 17.3%

6/30/15 6/30/16

See important disclosures regarding Non-GAAP measures on Page 3.

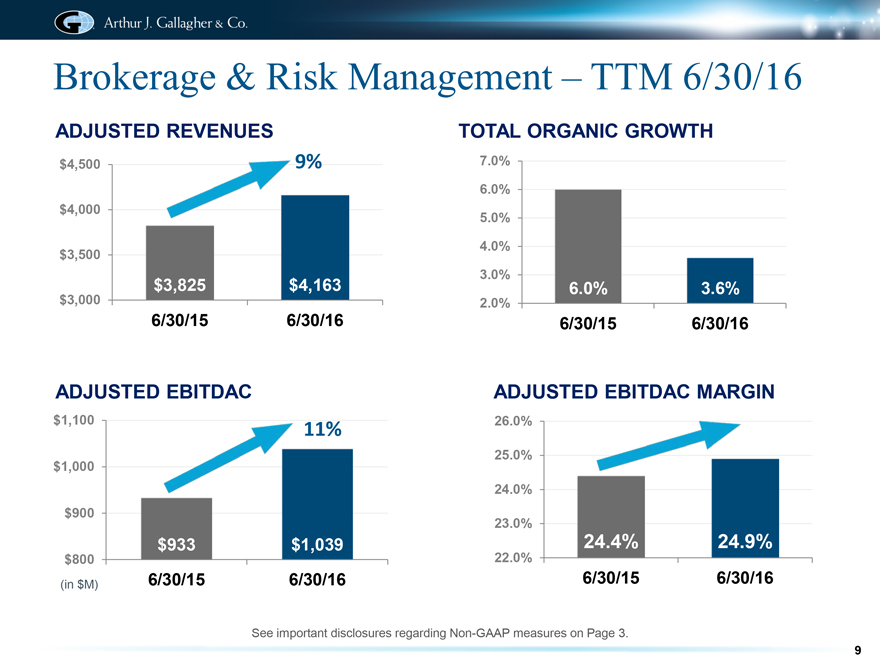

Brokerage & Risk Management – TTM 6/30/16

ADJUSTED REVENUES

$4,500 9%

$4,000

$3,500

$3,000 $3,825 $4,163 6/30/15 6/30/16

ADJUSTED EBITDAC

$1,100 11% $1,000

$900

$800 $933 $1,039 (in $M) 6/30/15 6/30/16

TOTAL ORGANIC GROWTH

7.0%

6.0%

5.0%

4.0%

3.0%

2.0% 6.0% 3.6%

6/30/15 6/30/16

ADJUSTED EBITDAC MARGIN

26.0% 25.0% 24.0%

23.0% 24.4% 24.9%

22.0%

6/30/15 6/30/16

See important disclosures regarding Non-GAAP measures on Page 3.

9

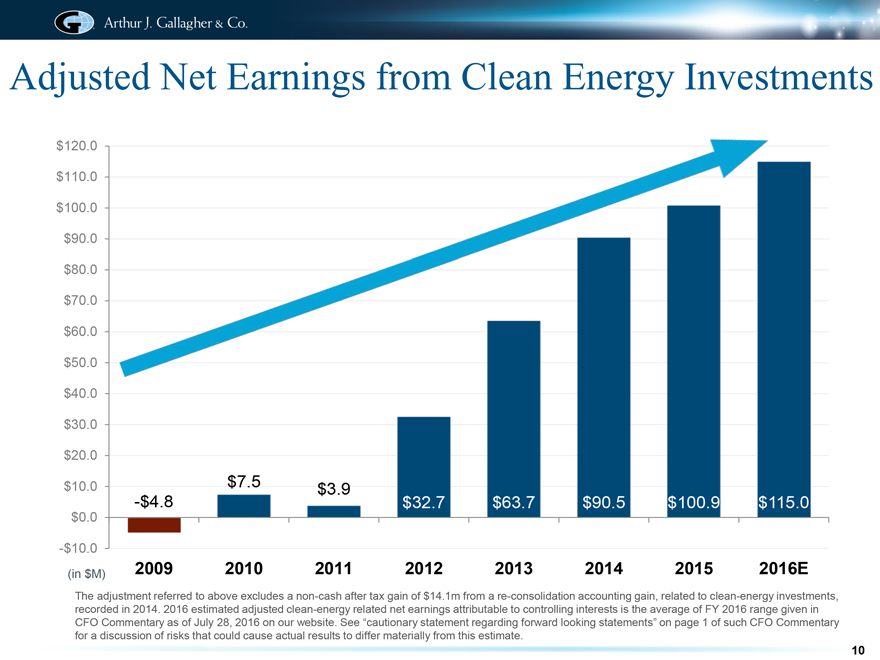

Adjusted Net Earnings from Clean Energy Investments

$120.0 $110.0 $100.0 $90.0 $80.0 $70.0 $60.0 $50.0 $40.0 $30.0

$20.0

$10.0 $7.5 $3.9

-$4.8 $32.7 $63.7 $90.5 $100.9 $115.0

$0.0

-$10.0

(in $M) 2009 2010 2011 2012 2013 2014 2015 2016E

The adjustment referred to above excludes a non-cash after tax gain of $14.1m from a re-consolidation accounting gain, related to clean-energy investments, recorded in 2014. 2016 estimated adjusted clean-energy related net earnings attributable to controlling interests is the average of FY 2016 range given in CFO Commentary as of July 28, 2016 on our website. See “cautionary statement regarding forward looking statements” on page 1 of such CFO Commentary for a discussion of risks that could cause actual results to differ materially from this estimate.

10

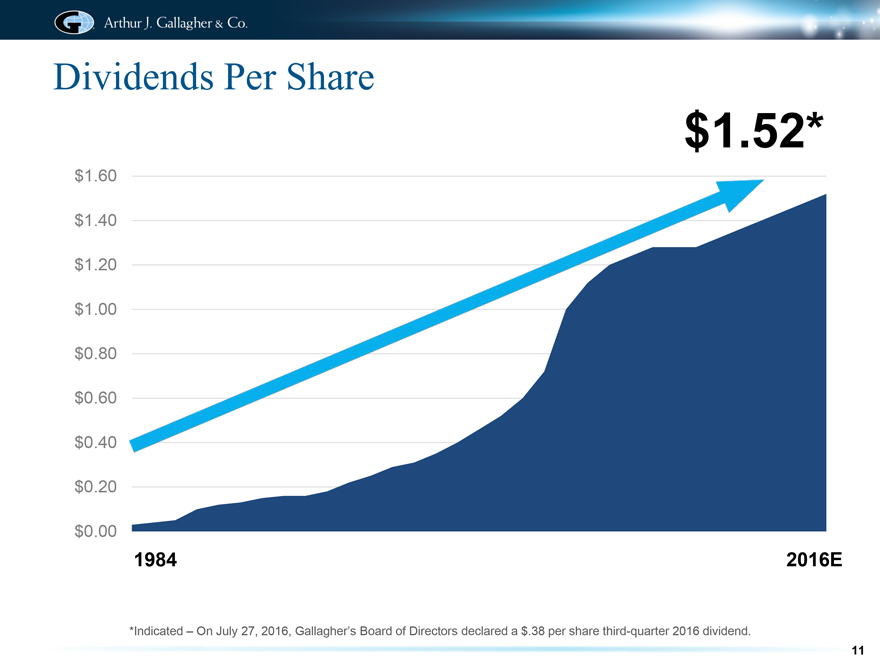

Dividends Per Share

$1.52*

$1.60

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

1984 2016E

*Indicated – On July 27, 2016, Gallagher’s Board of Directors declared a $.38 per share third-quarter 2016 dividend.

11

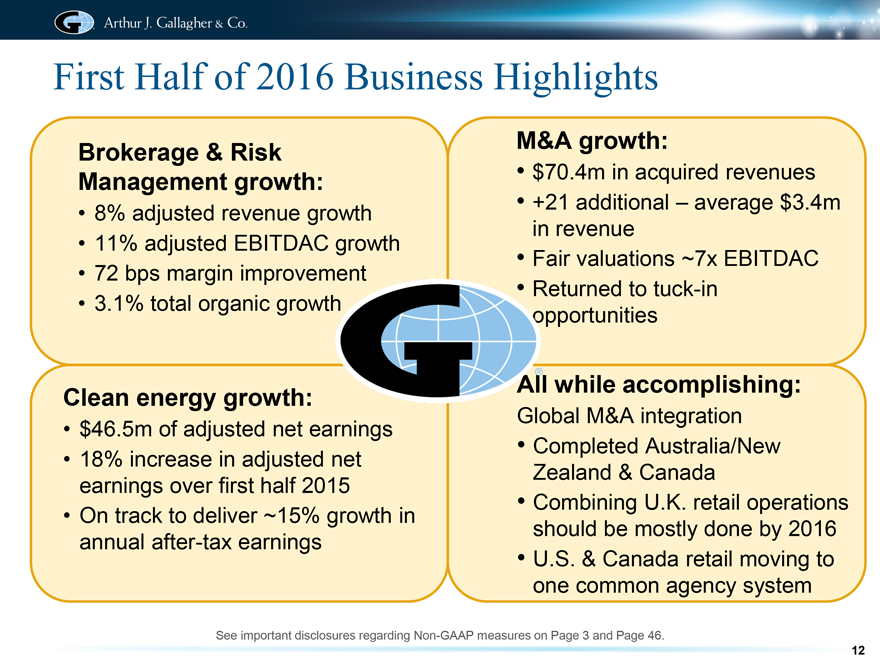

First Half of 2016 Business Highlights

Brokerage & Risk Management growth:

8% adjusted revenue growth

11% adjusted EBITDAC growth

72 bps margin improvement

3.1% total organic growt

Clean energy growth:

$46.5m of adjusted net earnings

18% increase in adjusted net earnings over first half 2015

On track to deliver ~15% growth in annual after-tax earnings

M&A growth:

$70.4m in acquired revenues

+21 additional – average $3.4m in revenue

Fair valuations ~7x EBITDAC eturned to tuck-in opportunities

l while accomplishing:

Global M&A integration

Completed Australia/New Zealand & Canada

Combining U.K. retail operations should be mostly done by 2016

U.S. & Canada retail moving to one common agency system

See important disclosures regarding Non-GAAP measures on Page 3 and Page 46.

12

Where We’re Going

Improving new business production Continuing tuck-in M&A

Increasing global brand recognition Completing large U.K. M&A integration Leveraging internal resources and processes across divisions

To be premier provider of claims management services with superior outcomes Increasing global presence in claims space

U.S. clients with global operations Expanding via M&A/new partners

Staying in front of improving technology Increasing brand recognition globally Leveraging resources across borders

BROKERAGE

SEGMENT

RISK MANAGEMENT

SEGMENT

13

Indicators for U.S. P/C Carriers – Shallow Rate Environment

COMBINED RATIOS

120 118.3

115 110 105

100 97.1

95 92.3

90

PREMIUM/STATUTORY SURPLUS

1.6x

1.4x

1.2x

1.0x

0.8x

0.6x

Source for calendar year combined ratio data: AM Best. Data excludes certain large mortgage insurance and personal lines companies.

Source for data : Total US P/C Industry from Best’s Statement File P/C US for 2001 – 2015. Prior to 2001, sources are A.M. Best and ISO via the Insurance Information Institute.

INVESTMENT YIELDS

8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0%

Source for data : Total US P/C Industry from Best’s Statement File P/C US for 2001 – 2015. Prior to 2001, sources are A.M. Best and ISO via the Insurance Information Institute.

STATUTORY SURPLUS

$800 $700 $600 $500 $400 $300 $200 $100

($Billions) Source for data : Total US P/C Industry from Best’s Statement File P/C US for 2004 – 2015. Prior to 2004, sources are A.M. Best and ISO via the Insurance Information Institute.

14

Commercial P&C Pricing Shows Shallow Cycle

160 150 140 130 120 110 100 90 80

CPI 137

Rates 94

Commercial Rate Index reflects the cost of P&C premiums relative to the year 2000. Constructed using Counsel of Insurance Agents and Brokers (CIAB) data. CPI index uses data from the Bureau of Labor Statistics.

15

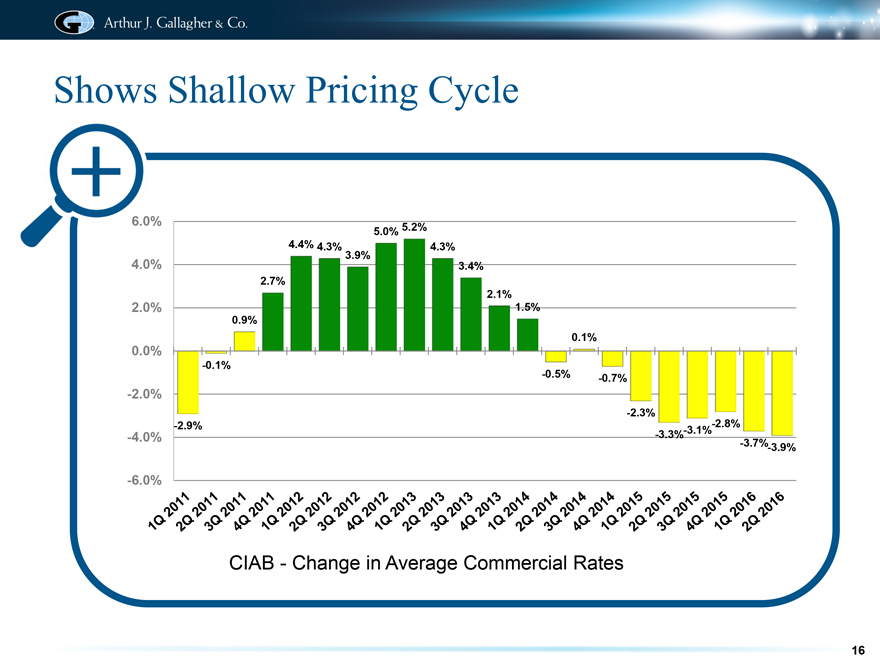

Shows Shallow Pricing Cycle

6.0% 5.2%

5.0%

4.4% 4.3% 3.9% 4.3%

4.0% 3.4%

2.7%

2.1%

2.0% 1.5%

0.9%

0.1%

0.0%

-0.1%

-0.5% -0.7%

-2.0%

-2.3% -2.8%

-2.9% -3.1%

-4.0% -3.3%

-3.7%-3. 9%

-6.0%

CIAB—Change in Average Commercial Rates

16

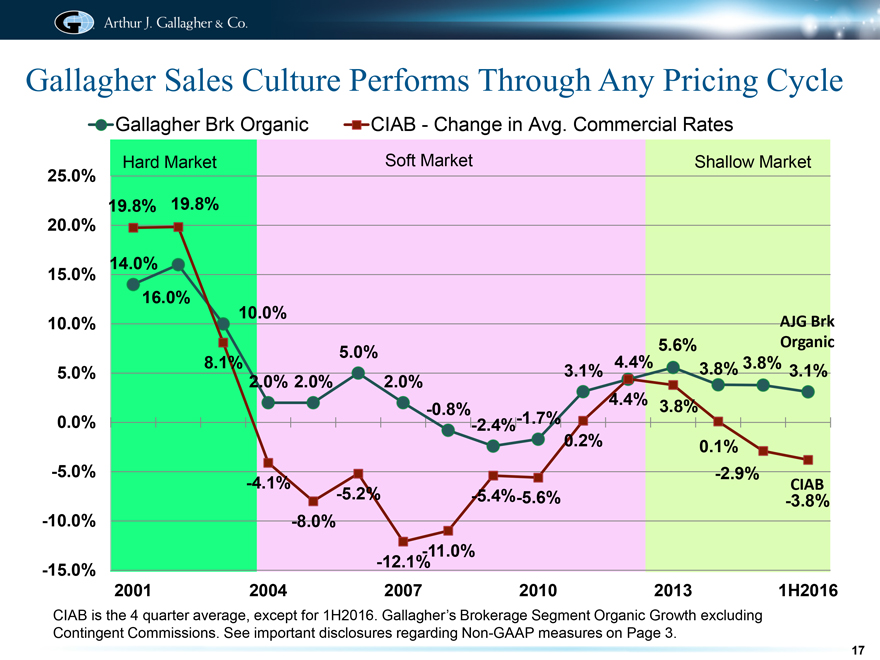

Gallagher Sales Culture Performs Through Any Pricing Cycle

Gallagher Brk Organic CIAB—Change in Avg. Commercial Rates

25.0% 20.0% 15.0% 10.0% 5.0% 0.0% -5.0% -10.0% -15.0%

2001 2004 2007 2010 2013 1H2016

Soft Market

Hard Market Shallow Market

19.8% 19.8%

14.0%

16.0%

10.0% AJG Brk

5.6% Organic

5.0%

8.1% 3.1% 4.4% 3.8% 3.8%

3.1%

2.0% 2.0% 2.0%

4.4%

-0.8% 3.8%

-2.4% -1.7%

0.2% 0.1%

-2.9%

-4.1% CIAB

-5.2% -5.4%-5.6% -3.8%

-8.0%

-11.0%

-12.1%

CIAB is the 4 quarter average, except for 1H2016. Gallagher’s Brokerage Segment Organic Growth excluding Contingent Commissions. See important disclosures regarding Non-GAAP measures on Page 3.

17

Shallow Rate Cycle Is Better for:

CLIENTS

CARRIERS

& BROKERS

18

How We’re Getting There-Consistent Growth Strategy

19

Consistent Growth Strategy – Organic

20

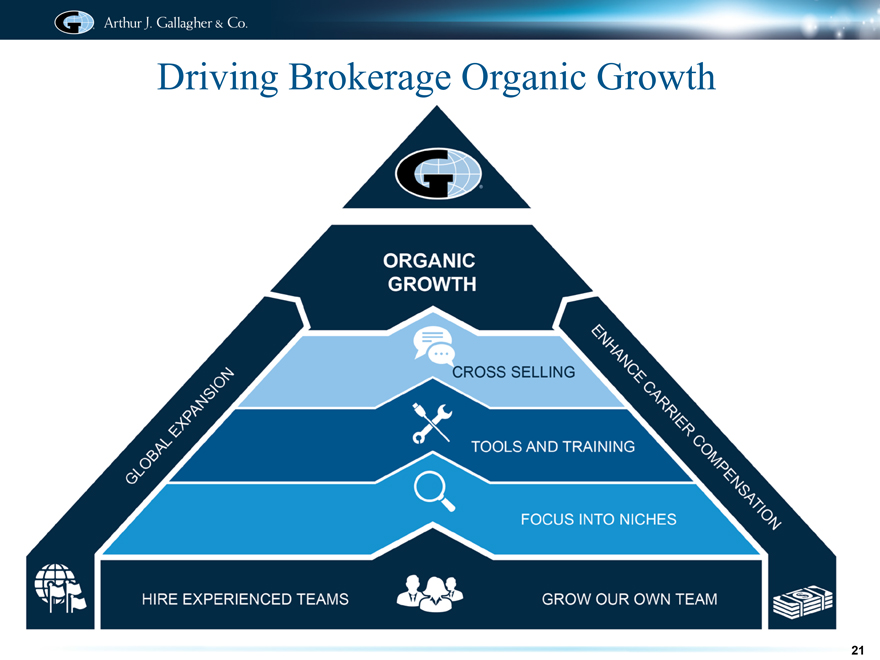

Driving Brokerage Organic Growth

21

Niche Expertise Teams – Brokerage

Affinity Manufacturing Agribusiness Marine Automotive Personal Aviation & Aerospace Private Equity Construction Professional Groups Energy Public Entity Entertainment Real Estate Environmental Religious/Nonprofit Global Risks Restaurant Healthcare Scholastic Higher Education Technology/Telecom Hospitality Trade Credit/ Life Sciences Political Risk Life Solutions Transportation

22

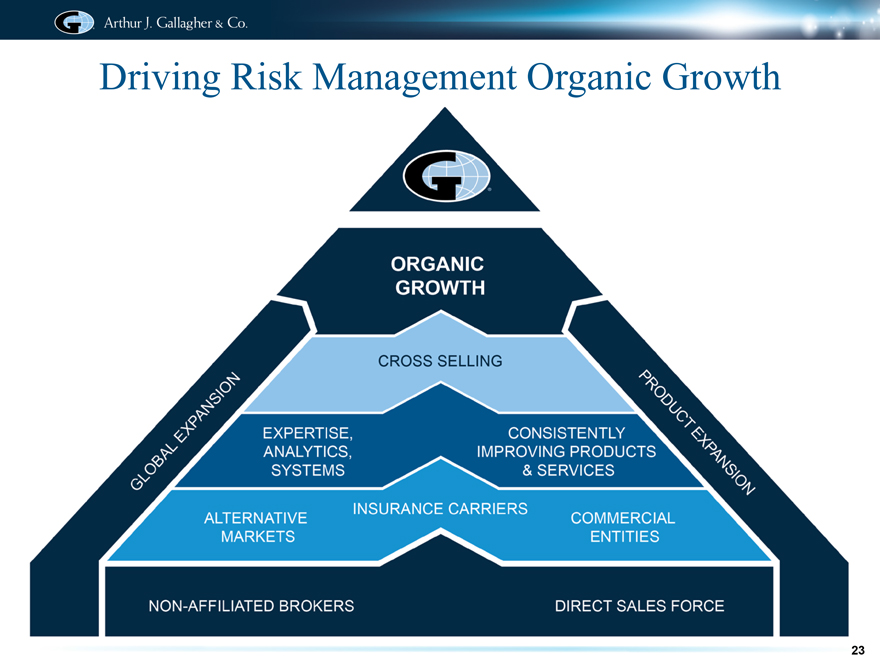

Driving Risk Management Organic Growth

23

Risk Mgmt Growth Focuses on Four Market Segments

PUBLIC SECTOR ALTERNATIVE ENTITIES MARKET

PARTICIPANTS

LARGE

INSURANCE COMMERCIAL

CARRIERS ENTITIES

24

Consistent Growth Strategy – M&A

25

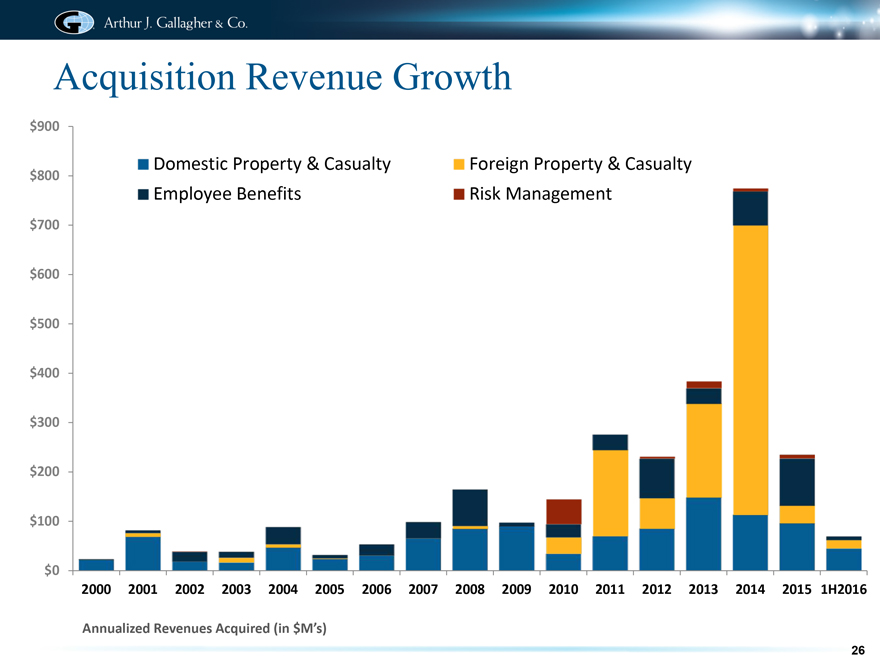

Acquisition Revenue Growth

$900 $800 $700 $600 $500 $400 $300 $200 $100 $0

Domestic Property & Casualty Employee Benefits

Foreign Property & Casualty Risk Management

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1H2016

Annualized Revenues Acquired (in $M’s)

26

M&A Opportunities Continue

Vast Pipeline

Domestic and international markets highly fragmented 18,000+ agents/ brokers just in the U.S.

Baby boomers looking for exit strategy Need Gallagher’s expertise

Acquisition Units

Retail P&C Wholesale Benefits International MGA MGU Captive

Limited Consolidators

Core Competency

Culture Proven history Ability to integrate

27

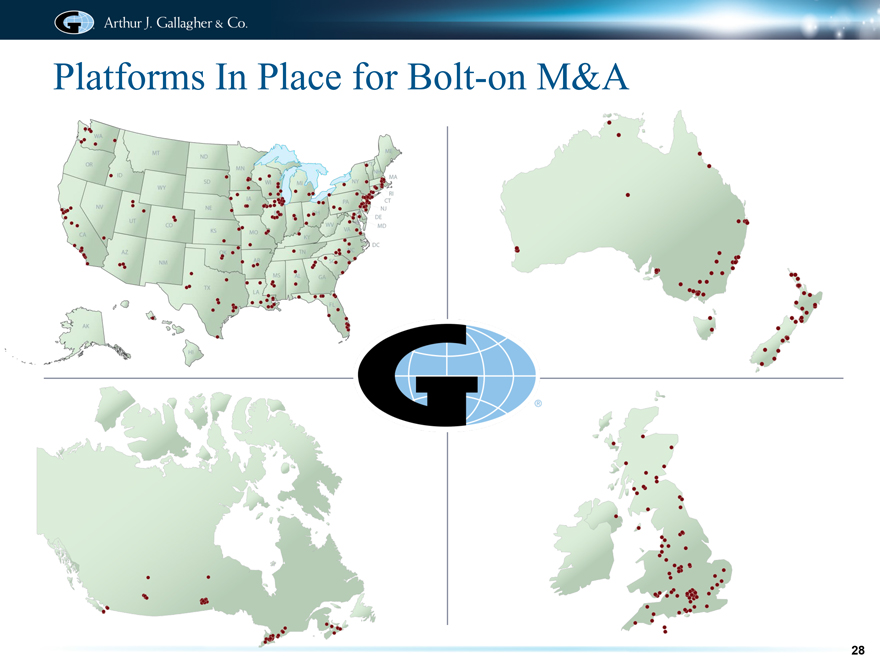

Platforms In Place for Bolt-on M&A

28

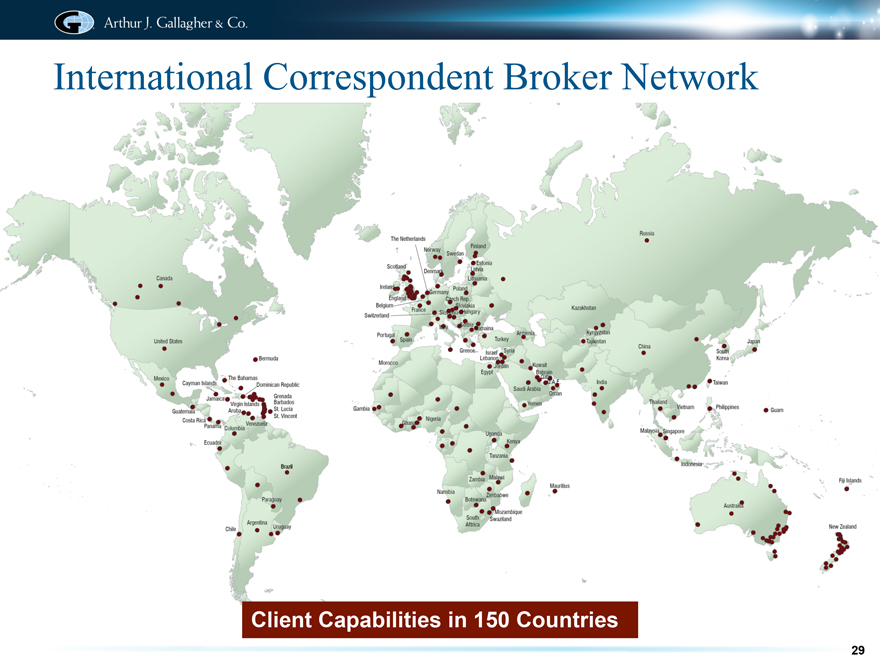

International Correspondent Broker Network

Client Capabilities in 150 Countries

29

Productivity and Quality Initiatives

30

Focus Continues:

Optimizing Productivity & Quality

Utilizing

Controlling Offshore Headcount Centers of Excellence

Leveraging Utilizing Sales Force Sourcing to Management Manage Tools Expenses Building Investing in roductivity Business ools – DMS Intelligence d Workflow

Optimizing Standardizing Real Estate Processes and Footprint Systems

31

Benefits Continue:

From Offshore Centers of Excellence

Reduce Costs

Foster Innovation

Increase

Speed to Market Focus on Core

Improve Quality

32

Client-Facing Efforts

BUILDING CLIENT SERVICE OPERATIONS

Process and deliver consistent client service

Technology and tools improve operating efficiencies

Staffed by dedicated service professionals that:

Generate client applications and proposals ?Handle client requests ?Manage renewal cycles

Improves turn-around time on client requests

Supports production teams

Can still customize for niche practice areas

Easily integrated for new acquisition partners to utilize

33

Behind the Scenes Efforts

OFFSHORE CENTERS OF EXCELLENCE UPDATE

We now have more than 2,500 associates in four locations

Responsible for processes such as:

Policy checking Policy issuance

Certificates of insurance Renewal support Claims support Accounting support

Substantially improved quality and reduce both operating and E&O costs

Easy for new acquisition partners to leverage

34

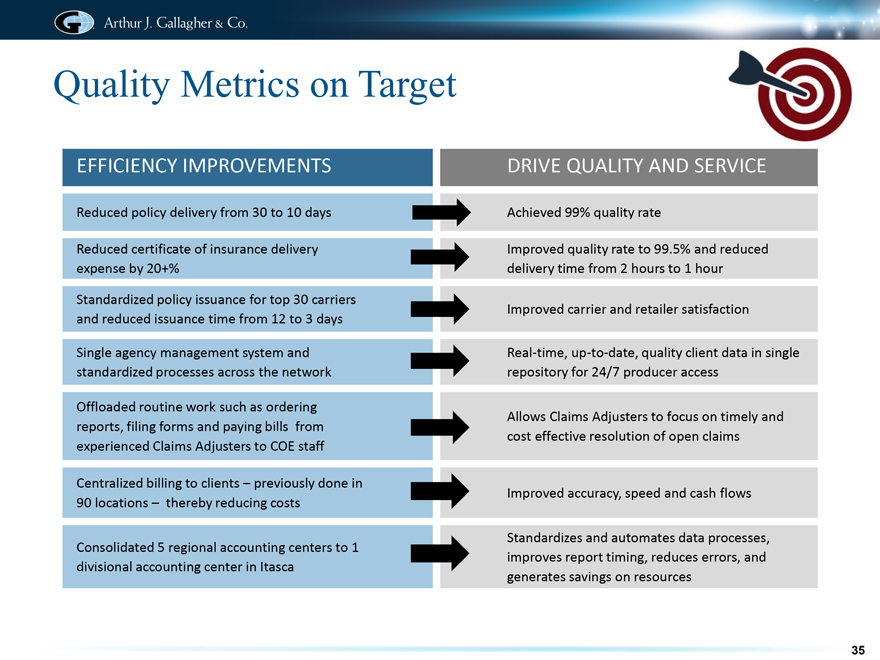

Quality Metrics on Target

EFFICIENCY IMPROVEMENTS

Reduced policy delivery from 30 to 10 days

Reduced certificate of insurance delivery expense by 20+% Standardized policy issuance for top 30 carriers and reduced issuance time from 12 to 3 days

Single agency management system and standardized processes across the network

Offloaded routine work such as ordering reports, filing forms and paying bills from experienced Claims Adjusters to COE staff

Centralized billing to clients – previously done in 90 locations – thereby reducing costs

Consolidated 5 regional accounting centers to 1 divisional accounting center in Itasca

DRIVE QUALITY AND SERVICE

Achieved 99% quality rate

Improved quality rate to 99.5% and reduced delivery time from 2 hours to 1 hour

Improved carrier and retailer satisfaction

Real-time, up-to-date, quality client data in single repository for 24/7 producer access

Allows Claims Adjusters to focus on timely and cost effective resolution of open claims

Improved accuracy, speed and cash flows

Standardizes and automates data processes, improves report timing, reduces errors, and generates savings on resources

35

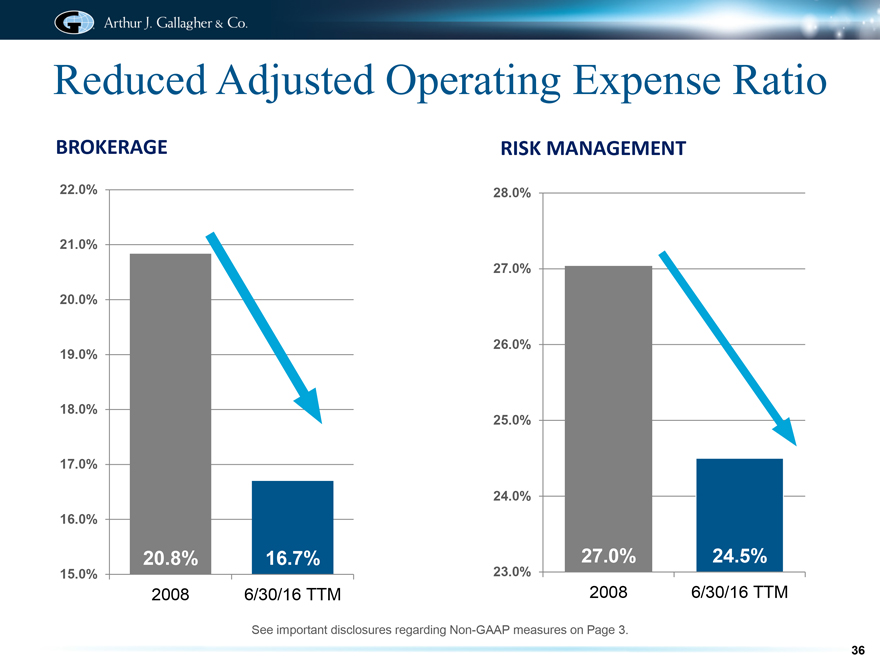

Reduced Adjusted Operating Expense Ratio

BROKERAGE

22.0% 21.0% 20.0% 19.0% 18.0% 17.0% 16.0% 15.0%

2008 6/30/16 TTM

28.0% 27.0% 26.0% 25.0% 24.0% 23.0%

RISK MANAGEMENT

27.0% 24.5%

2008 6/30/16 TTM

See important disclosures regarding Non-GAAP measures on Page 3.

36

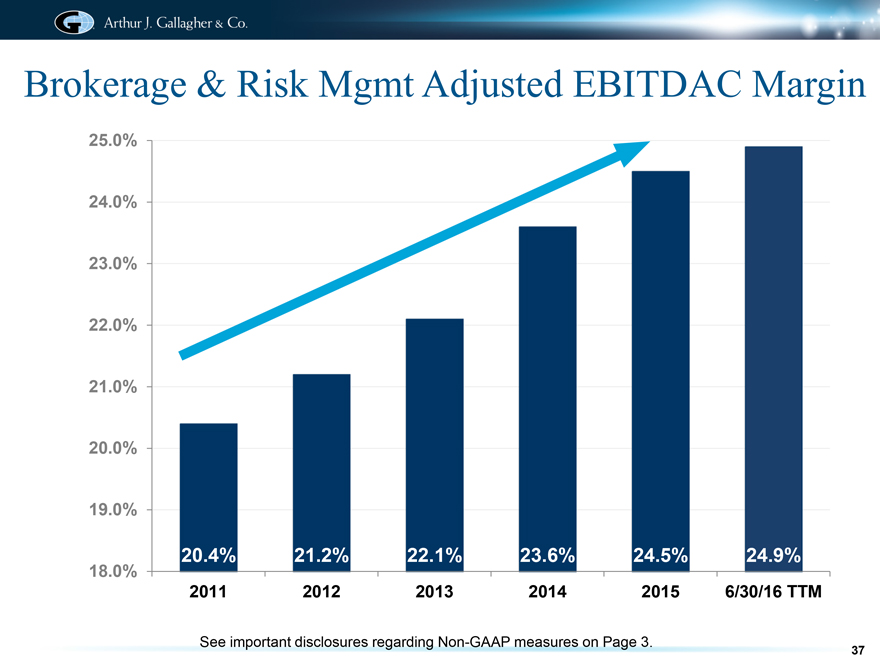

Brokerage & Risk Mgmt Adjusted EBITDAC Margin

25.0% 24.0% 23.0% 22.0% 21.0% 20.0% 19.0% 18.0%

20.4% 21.2% 22.1% 23.6% 24.5% 24.9%

2011 2012 2013 2014 2015 6/30/16 TTM

See important disclosures regarding Non-GAAP measures on Page 3.

37

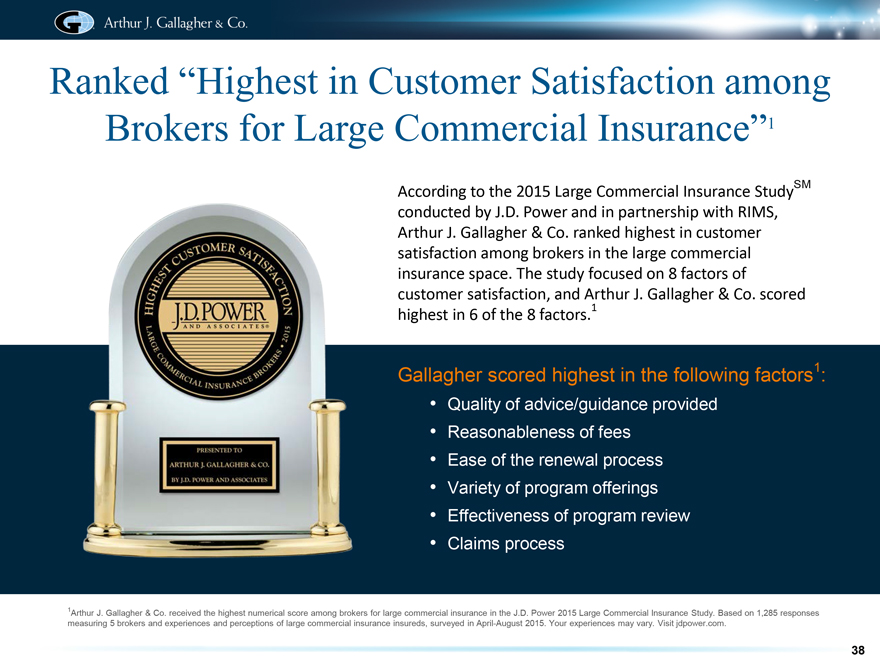

Brokers for Large Commercial Insurance“1

According to the 2015 Large Commercial Insurance StudySM conducted by J.D. Power and in partnership with RIMS, Arthur J. Gallagher & Co. ranked highest in customer satisfaction among brokers in the large commercial insurance space. The study focused on 8 factors of customer satisfaction, and Arthur J. Gallagher & Co. scored highest in 6 of the 8 factors.1

Gallagher scored highest in the following factors1:

Quality of advice/guidance provided

Reasonableness of fees

Ease of the renewal process

Variety of program offerings

Effectiveness of program review

Claims process

1Arthur J. Gallagher & Co. received the highest numerical score among brokers for large commercial insurance in the J.D. Power 2015 Large Commercial Insurance Study. Based on 1,285 responses measuring 5 brokers and experiences and perceptions of large commercial insurance insureds, surveyed in April-August 2015. Your experiences may vary. Visit jdpower.com.

38

Relentless Focus on Quality and Customer Service

Best UK Employee Benefit Consultant – 2016

REWARD GUIDE VIB AWARDS CEREMONY

Best Companies for Leaders – 2016

CHIEF EXECUTIVE MAGAZINE

UK Healthcare Adviser of the Year – 2016

UK CORPORATE ADVISER

Shilling Named Best Member Communication Strategy – 2016

UK CORPORATE ADVISER

Artex Named Captive Manager of the Year – 2016

WORKPLACE CAPTIVE REVIEW

Best Sales/Leadership Program (non-store/restaurant) – 2016

LEADERSHIP EXCELLENCE – PART OF HR.COM

Voted Best UK Broker for Service – 2015

STRATEGIC RISK’S UK FTSE SURVEY

America’s Best Employers – 2015

FORBES MAGAZINE

Best TPA in Casualty Claims Handling – 2015

ADVISEN CLAIMS SATISFACTION SURVEY

UK Employee Benefits Consultancy of the Year – 2015

WORKPLACE SAVINGS AND BENEFITS MAGAZINE

Leadership 500 Excellence Award – 2015

HR.COM

Corporate Champion for Board Gender Balance – 2015

WOMEN’S FORUM OF NEW YORK

39

Maintaining Culture

40

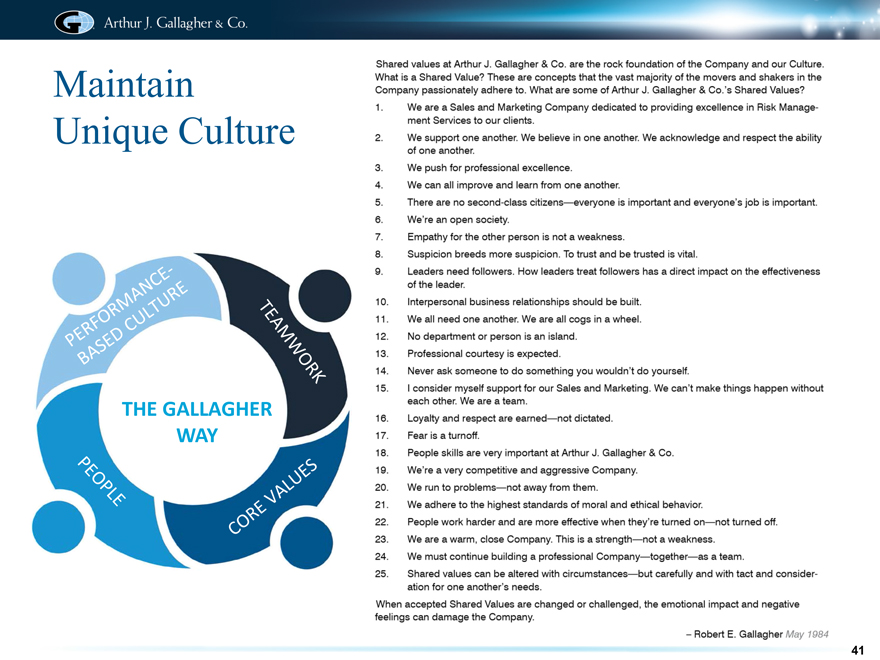

Maintain Unique Culture

41

One of the World’s Most Ethical Companies

as Recognized by Ethisphere five years in a row

Industry-leading commitment to

ethics and dedication to integrity

Chosen for:

Promoting ethical business

standards and practices

Exceeding legal compliance standards

Innovating to benefit the public

Demonstrating that corporate

citizenship is tied to company success

Industry-leading commitment to

ethics and dedication to integrity

Chosen for:

Promoting ethical business

standards and practices

Exceeding legal compliance standards

Innovating to benefit the public

Demonstrating that corporate

citizenship is tied to company success

42

Why invest?

You believe Our Company Has:

Right management Unique culture Proven growth strategy Continuing M&A opportunities

Increasing productivity Higher quality Good use of leverage strong balance sheet

Excellent return to shareholders

43

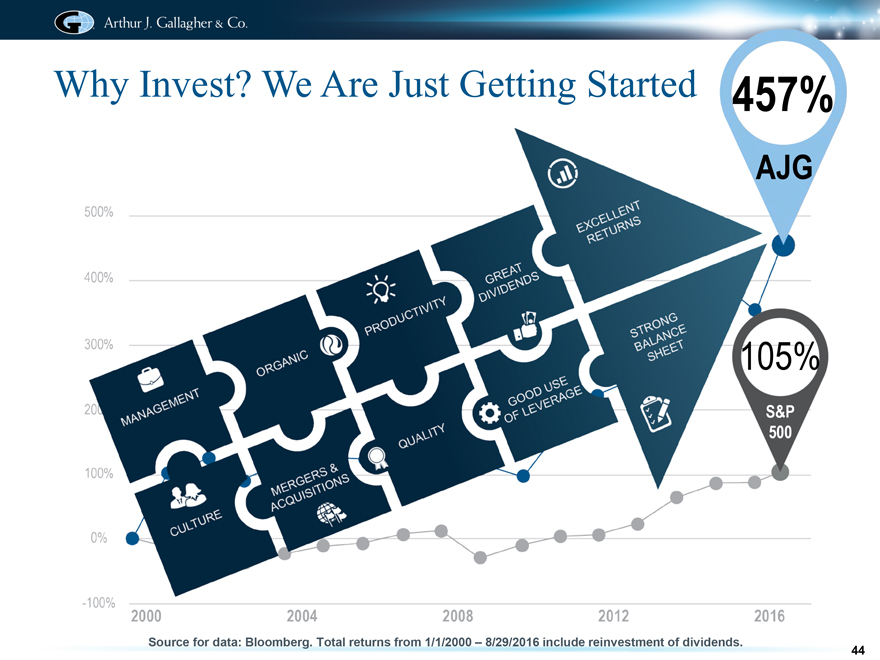

Why Invest? We Are Just Getting Started

457%

AJG

105%

S&P 500

Source for data: Bloomberg. Total returns from 1/1/2000 – 8/29/2016 include reinvestment of dividends.

44

For Additional Information:

Ray Iardella Marsha Akin

VP – Investor Relations Director – Investor Relations Ray_Iardella@ajg.com Marsha_Akin@ajg.com

Phone: 630-285-3661 Phone: 630-285-3501

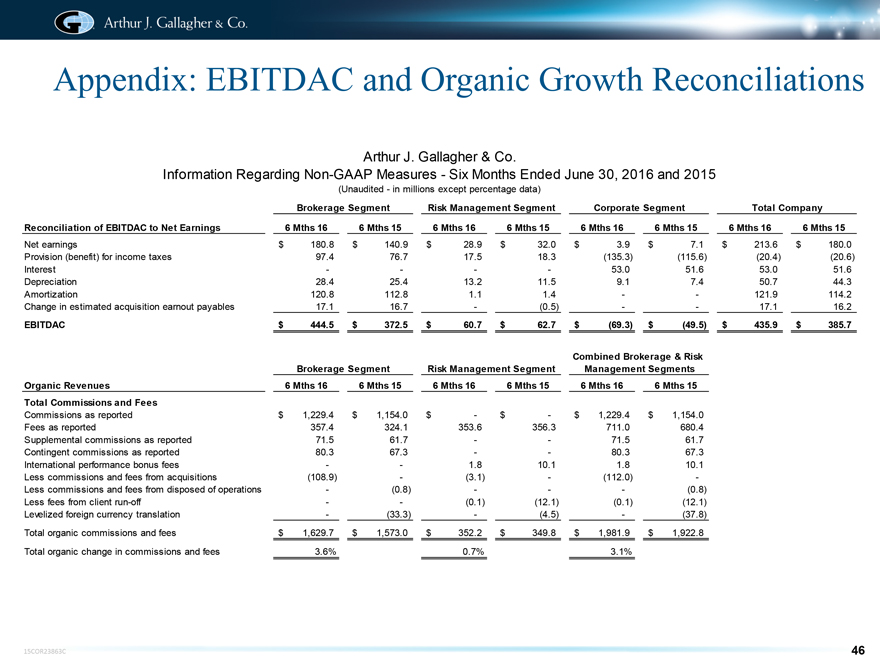

Appendix: EBITDAC and Organic Growth Reconciliations

Arthur J. Gallagher & Co.

Information Regarding Non-GAAP Measures—Six Months Ended June 30, 2016 and 2015

(Unaudited—in millions except percentage data)

Brokerage Segment Risk Management Segment Corporate Segment Total Company

Reconciliation of EBITDAC to Net Earnings 6 Mths 16 6 Mths 15 6 Mths 16 6 Mths 15 6 Mths 16 6 Mths 15 6 Mths 16 6 Mths 15

Net earnings $ 180.8 $ 140.9 $ 28.9 $ 32.0 $ 3.9 $ 7.1 $ 213.6 $ 180.0

Provision (benefit) for income taxes 97.4 76.7 17.5 18.3 (135.3) (115.6) (20.4) (20.6)

Interest ———— 53.0 51.6 53.0 51.6

Depreciation 28.4 25.4 13.2 11.5 9.1 7.4 50.7 44.3

Amortization 120.8 112.8 1.1 1.4 —— 121.9 114.2

Change in estimated acquisition earnout payables 17.1 16.7 — (0.5) —— 17.1 16.2

EBITDAC $ 444.5 $ 372.5 $ 60.7 $ 62.7 $ (69.3) $ (49.5) $ 435.9 $ 385.7

Combined Brokerage & Risk

Brokerage Segment Risk Management Segment Management Segments

Organic Revenues 6 Mths 16 6 Mths 15 6 Mths 16 6 Mths 15 6 Mths 16 6 Mths 15

Total Commissions and Fees

Commissions as reported $ 1,229.4 $ 1,154.0 $—$—$ 1,229.4 $ 1,154.0

Fees as reported 357.4 324.1 353.6 356.3 711.0 680.4

Supplemental commissions as reported 71.5 61.7 —— 71.5 61.7

Contingent commissions as reported 80.3 67.3 —— 80.3 67.3

International performance bonus fees —— 1.8 10.1 1.8 10.1

Less commissions and fees from acquisitions (108.9) — (3.1) — (112.0) —

Less commissions and fees from disposed of operations — (0.8) ——— (0.8)

Less fees from client run-off —— (0.1) (12.1) (0.1) (12.1)

Levelized foreign currency translation — (33.3) — (4.5) — (37.8)

Total organic commissions and fees $ 1,629.7 $ 1,573.0 $ 352.2 $ 349.8 $ 1,981.9 $ 1,922.8

Total organic change in commissions and fees 3.6% 0.7% 3.1%

46