UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03231

SEI Liquid Asset Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

CT Corporation

101 Federal St.

Boston, MA 02110

(Name and address of agent for service)

Copies to:

Richard W. Grant, Esq.

Morgan, Lewis & Bockius LLP

1701 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: 1-800-342-5734

Date of fiscal year end: June 30, 2010

Date of reporting period: June 30, 2010

| Item 1. | Reports to Stockholders. |

SEI Liquid Asset Trust

Annual Report as of June 30, 2010

Prime Obligation Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

SEI LIQUID ASSET TRUST — JUNE 30, 2010

To Our Shareholders:

For much of the period, markets continued their remarkable rebound from the lows reached in March 2009, as governments and central banks around the world coordinated efforts to stimulate their faltering economies. Although investors left the perceived safe havens of government bonds and cash to invest in riskier assets during the latter half of 2009 and early 2010, a cautious tone returned in the second quarter of 2010. Sentiment became increasingly negative due to concerns surrounding the European sovereign debt crisis, Chinese central-bank tightening and sluggish U.S. growth.

Companies that had the highest levels of debt strongly outperformed at the beginning of the review year. Since the third quarter of 2009, many companies have reported better-than-expected results, and this trend is expected to continue throughout 2010. However, as the rally has cooled in recent months, SEI believes this will result in companies with stable earnings growth and quality management teams becoming favored by the market.

In response to the widespread financial crisis, global central banks slashed interest rates and established bond-buying programs, helping inject liquidity into the financial system. At the same time, governments created stimulus packages to encourage growth. Hopeful signs emerged at the beginning of the period in the form of better-than-expected corporate earnings and a pick-up in manufacturing activity in Europe and the U.S. The Chinese central bank implemented more restrictive monetary controls through increasing bank reserve requirements and raising interest rates, which investors feared would cause a renewed global economic slowdown. The labour market remained weak, causing investors to become more cautious regarding the pace of economic growth for upcoming quarters.

All in all, SEI’s long-term outlook for growth is positive, although setbacks along the way are expected. On behalf of SEI Investments, I want to thank you for the confidence you have in the SEI Liquid Asset Trust. We are working every day to maintain that confidence, and we look forward to serving your investment needs in the future.

Sincerely,

Robert A. Nesher

President

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 1 |

SCHEDULE OF INVESTMENTS

Prime Obligation Fund

June 30, 2010

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

| |

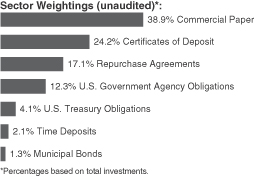

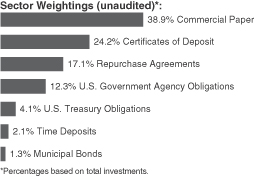

COMMERCIAL PAPER (A) (B) — 38.9% | | | |

Atlantis One Funding (C) | | | | | | |

0.150%, 07/01/10 | | $ | 15,000 | | $ | 15,000 |

0.280%, 07/06/10 | | | 2,000 | | | 2,000 |

0.310%, 07/07/10 | | | 6,000 | | | 6,000 |

0.305%, 07/13/10 | | | 3,000 | | | 3,000 |

0.310%, 07/19/10 | | | 3,000 | | | 3,000 |

BNZ International Funding (C) | | | | | | |

0.601%, 08/27/10 | | | 2,000 | | | 1,998 |

Cancara Asset Securitisation (C) | | | | | | |

0.310%, 07/19/10 | | | 2,000 | | | 2,000 |

0.310%, 07/20/10 | | | 3,000 | | | 3,000 |

Chariot Funding (C) | | | | | | |

0.400%, 07/20/10 | | | 3,000 | | | 2,999 |

0.380%, 07/29/10 | | | 3,000 | | | 2,999 |

Citigroup | | | | | | |

0.330%, 07/26/10 | | | 2,000 | | | 2,000 |

Clipper Receivables (C) | | | | | | |

0.280%, 07/01/10 | | | 5,000 | | | 5,000 |

Edison Asset Securitization (C) | | | | | | |

0.481%, 09/20/10 | | | 2,000 | | | 1,998 |

Fairway Finance (C) | | | | | | |

0.450%, 08/09/10 | | | 1,000 | | | 1,000 |

0.460%, 08/10/10 | | | 2,000 | | | 1,999 |

0.491%, 09/02/10 | | | 2,000 | | | 1,998 |

Falcon Asset Securitization (C) | | | | | | |

0.210%, 07/01/10 | | | 3,000 | | | 3,000 |

0.400%, 07/20/10 | | | 15,000 | | | 14,997 |

0.380%, 07/29/10 | | | 2,000 | | | 1,999 |

0.461%, 08/24/10 | | | 5,000 | | | 4,997 |

0.430%, 09/24/10 | | | 2,000 | | | 1,998 |

FCAR Owner Trust | | | | | | |

0.310%, 07/01/10 | | | 16,000 | | | 16,000 |

0.310%, 07/02/10 | | | 1,000 | | | 1,000 |

0.310%, 07/12/10 | | | 750 | | | 750 |

0.390%, 08/03/10 | | | 1,250 | | | 1,250 |

0.521%, 09/01/10 | | | 2,000 | | | 1,998 |

0.521%, 09/07/10 | | | 2,000 | | | 1,998 |

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

Gemini Securitization (C) | | | | | | |

0.551%, 08/26/10 | | $ | 4,000 | | $ | 3,997 |

0.551%, 08/27/10 | | | 2,000 | | | 1,998 |

0.501%, 09/28/10 | | | 3,000 | | | 2,996 |

General Electric Capital | | | | | | |

0.235%, 07/02/10 | | | 11,000 | | | 11,000 |

0.260%, 07/09/10 | | | 8,000 | | | 8,000 |

0.400%, 08/13/10 | | | 4,000 | | | 3,998 |

0.420%, 08/17/10 | | | 6,000 | | | 5,997 |

0.481%, 08/25/10 | | | 5,000 | | | 4,996 |

0.481%, 09/02/10 | | | 4,500 | | | 4,496 |

0.420%, 10/01/10 | | | 3,000 | | | 2,997 |

Grampian Funding (C) | | | | | | |

0.320%, 07/19/10 | | | 18,000 | | | 17,997 |

0.490%, 08/02/10 | | | 5,000 | | | 4,998 |

Liberty Street Funding (C) | | | | | | |

0.430%, 07/19/10 | | | 3,000 | | | 2,999 |

0.501%, 09/03/10 | | | 1,000 | | | 999 |

0.420%, 09/24/10 | | | 1,000 | | | 999 |

Market Street Funding (C) | | | | | | |

0.300%, 07/19/10 | | | 2,000 | | | 2,000 |

0.440%, 08/10/10 | | | 1,024 | | | 1,024 |

0.471%, 08/23/10 | | | 2,000 | | | 1,999 |

0.501%, 09/02/10 | | | 1,000 | | | 999 |

MetLife Short Term Funding (C) | | | | | | |

0.270%, 07/09/10 | | | 4,000 | | | 4,000 |

0.521%, 08/23/10 | | | 4,000 | | | 3,997 |

0.471%, 08/30/10 | | | 2,000 | | | 1,998 |

0.531%, 09/07/10 | | | 5,500 | | | 5,495 |

Nestle Capital | | | | | | |

0.300%, 09/07/10 | | | 5,000 | | | 4,997 |

0.310%, 10/04/10 | | | 1,000 | | | 999 |

Nestle Finance International | | | | | | |

0.270%, 08/24/10 | | | 4,000 | | | 3,998 |

Old Line Funding (C) | | | | | | |

0.481%, 09/01/10 | | | 1,000 | | | 999 |

0.481%, 09/02/10 | | | 3,000 | | | 2,997 |

Royal Park Investments Funding (C) | | | | | | |

0.300%, 07/07/10 | | | 1,250 | | | 1,250 |

0.300%, 07/09/10 | | | 5,000 | | | 5,000 |

0.320%, 07/15/10 | | | 6,000 | | | 5,999 |

0.320%, 07/20/10 | | | 7,000 | | | 6,999 |

Santander Central Hispano Finance | | | | | | |

0.280%, 07/21/10 | | | 10,000 | | | 9,998 |

Societe de Prise de Participation de l’Etat (C) | | | |

0.571%, 08/26/10 | | | 5,000 | | | 4,996 |

Straight-A Funding (C) | | | | | | |

0.350%, 07/16/10 | | | 18,000 | | | 17,997 |

0.350%, 07/16/10 | | | 5,000 | | | 4,999 |

0.410%, 08/24/10 | | | 5,000 | | | 4,997 |

Thunder Bay Funding (C) | | | | | | |

0.340%, 08/02/10 | | | 2,000 | | | 1,999 |

0.471%, 08/20/10 | | | 10,000 | | | 9,993 |

| | |

| 2 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

0.481%, 09/01/10 | | $ | 1,000 | | $ | 999 |

0.481%, 09/02/10 | | | 2,000 | | | 1,998 |

Total Capital Canada (C) | | | | | | |

0.451%, 09/01/10 | | | 2,000 | | | 1,998 |

Toyota Credit Canada (C) | | | | | | |

0.601%, 08/23/10 | | | 3,000 | | | 2,997 |

0.571%, 09/03/10 | | | 1,000 | | | 999 |

0.561%, 09/13/10 | | | 2,000 | | | 1,998 |

Toyota Financial Services de Puerto Rico | | | | | | |

0.581%, 09/07/10 | | | 1,000 | | | 999 |

Toyota Motor Credit | | | | | | |

0.400%, 07/02/10 | | | 4,500 | | | 4,500 |

0.410%, 07/12/10 | | | 19,000 | | | 18,998 |

0.400%, 07/14/10 | | | 4,000 | | | 3,999 |

0.581%, 09/13/10 | | | 8,000 | | | 7,990 |

Variable Funding Capital (C) | | | | | | |

0.400%, 08/09/10 | | | 1,000 | | | 1,000 |

0.481%, 09/01/10 | | | 2,000 | | | 1,998 |

Victory Receivables (C) | | | | | | |

0.380%, 08/03/10 | | | 3,000 | | | 2,999 |

| | | | | | |

Total Commercial Paper

(Cost $347,646) ($ Thousands) | | | | | | 347,646 |

| | | | | | |

| |

CERTIFICATES OF DEPOSIT (B) — 24.2% | | | |

Bank of Nova Scotia | | | | | | |

0.470%, 09/01/10 | | | 15,000 | | | 15,000 |

Bank of Tokyo-Mitsubishi | | | | | | |

0.550%, 09/07/10 | | | 5,500 | | | 5,500 |

0.550%, 09/10/10 | | | 4,300 | | | 4,300 |

0.550%, 09/24/10 | | | 5,000 | | | 5,000 |

Barclays Bank | | | | | | |

0.300%, 07/09/10 | | | 1,000 | | | 1,000 |

0.400%, 09/13/10 | | | 750 | | | 750 |

BNP Paribas | | | | | | |

0.570%, 09/02/10 | | | 8,700 | | | 8,700 |

0.630%, 09/13/10 | | | 10,000 | | | 10,000 |

0.630%, 09/14/10 | | | 8,000 | | | 8,000 |

Caisse de depot | | | | | | |

0.320%, 07/13/10 | | | 3,000 | | | 3,000 |

0.320%, 07/15/10 | | | 4,000 | | | 4,000 |

0.320%, 07/26/10 | | | 10,000 | | | 10,000 |

0.450%, 10/13/10 | | | 3,000 | | | 3,000 |

0.460%, 10/15/10 | | | 4,000 | | | 4,000 |

0.470%, 10/20/10 | | | 6,000 | | | 6,000 |

Credit Agricole | | | | | | |

0.300%, 07/26/10 | | | 10,000 | | | 10,000 |

0.300%, 07/29/10 | | | 10,000 | | | 10,000 |

0.320%, 08/19/10 | | | 10,000 | | | 10,000 |

Credit Industriel et Commercial | | | | | | |

0.580%, 08/16/10 | | | 9,000 | | | 9,000 |

Credit Suisse | | | | | | |

0.420%, 07/27/10 | | | 5,000 | | | 5,000 |

Deutsche Bank | | | | | | |

0.300%, 07/20/10 | | | 12,000 | | | 12,000 |

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

HSBC | | | | | | |

0.320%, 08/25/10 | | $ | 11,000 | | $ | 11,000 |

National Australia Bank | | | | | | |

0.435%, 10/01/10 | | | 1,000 | | | 1,000 |

0.435%, 10/01/10 | | | 2,000 | | | 2,000 |

Nordea Bank Finland | | | | | | |

0.510%, 09/03/10 | | | 3,000 | | | 3,000 |

Societe Generale | | | | | | |

0.345%, 08/02/10 | | | 6,000 | | | 6,000 |

0.340%, 08/02/10 | | | 6,000 | | | 6,000 |

0.340%, 08/04/10 | | | 4,000 | | | 4,000 |

Sumitomo Mitsui Banking | | | | | | |

0.420%, 07/01/10 | | | 4,000 | | | 4,000 |

0.490%, 09/29/10 | | | 4,000 | | | 4,000 |

Svenska Handelsbanken | | | | | | |

0.520%, 08/30/10 | | | 6,000 | | | 6,000 |

0.470%, 09/22/10 | | | 4,000 | | | 4,001 |

Toronto Dominion Bank | | | | | | |

0.260%, 07/14/10 | | | 5,000 | | | 5,000 |

UBS | | | | | | |

0.550%, 08/26/10 | | | 2,000 | | | 2,000 |

0.570%, 08/30/10 | | | 12,000 | | | 12,000 |

0.590%, 09/17/10 | | | 2,000 | | | 2,000 |

| | | | | | |

Total Certificates of Deposit

(Cost $216,251) ($ Thousands) | | | | | | 216,251 |

| | | | | | |

|

U.S. GOVERNMENT AGENCY OBLIGATIONS — 12.3% |

FFCB (D) | | | | | | |

0.215%, 07/20/10 | | | 5,000 | | | 5,000 |

FHLB (D) | | | | | | |

0.148%, 07/30/10 | | | 4,000 | | | 4,000 |

0.160%, 08/07/10 | | | 8,000 | | | 7,999 |

FHLB DN (A) | | | | | | |

0.200%, 07/14/10 | | | 3,000 | | | 3,000 |

FHLMC (D) | | | | | | |

0.341%, 07/07/10 | | | 17,200 | | | 17,203 |

0.388%, 07/30/10 | | | 1,000 | | | 1,001 |

0.204%, 08/01/10 | | | 11,000 | | | 11,001 |

0.607%, 09/09/10 | | | 30,000 | | | 30,046 |

FHLMC DN (A) | | | | | | |

0.200%, 07/02/10 to 07/06/10 | | | 6,000 | | | 6,000 |

0.180%, 07/07/10 | | | 7,000 | | | 7,000 |

0.195%, 07/19/10 | | | 2,000 | | | 2,000 |

0.210%, 07/23/10 | | | 5,000 | | | 4,999 |

0.311%, 11/10/10 | | | 4,000 | | | 3,995 |

0.300%, 11/23/10 | | | 5,000 | | | 4,994 |

FNMA DN (A) | | | | | | |

0.210%, 07/12/10 | | | 500 | | | 500 |

0.250%, 10/01/10 | | | 1,000 | | | 999 |

| | | | | | |

Total U.S. Government Agency Obligations

(Cost $109,737) ($ Thousands) | | | | | | 109,737 |

| | | | | | |

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 3 |

SCHEDULE OF INVESTMENTS

Prime Obligation Fund (Continued)

June 30, 2010

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

| |

U.S. TREASURY OBLIGATIONS — 4.1% | | | |

U.S. Cash Management Bill (A) | | | | | | |

0.150%, 07/15/10 | | $ | 6,000 | | $ | 6,000 |

U.S. Treasury Bills (A) | | | | | | |

0.200%, 07/01/10 | | | 4,000 | | | 4,000 |

0.180%, 08/26/10 | | | 7,000 | | | 6,998 |

0.230%, 09/23/10 | | | 4,000 | | | 3,998 |

0.265%, 10/07/10 | | | 5,000 | | | 4,996 |

U.S. Treasury Notes | | | | | | |

2.000%, 09/30/10 | | | 7,000 | | | 7,028 |

1.250%, 11/30/10 | | | 3,000 | | | 3,012 |

| | | | | | |

Total U.S. Treasury Obligations

(Cost $36,032) ($ Thousands) | | | | | | 36,032 |

| | | | | | |

| | |

TIME DEPOSITS — 2.1% | | | | | | |

Royal Bank of Canada | | | | | | |

0.150%, 07/01/10 | | | 19,000 | | | 19,000 |

| | | | | | |

Total Time Deposits

(Cost $19,000) ($ Thousands) | | | | | | 19,000 |

| | | | | | |

| | |

MUNICIPAL BONDS (D) — 1.3% | | | | | | |

| | |

Colorado — 0.3% | | | | | | |

City of Colorado Springs Colorado, Utilities Revenue Authority, Sub-Ser C, RB | | | | | | |

0.350%, 07/01/10 | | | 500 | | | 500 |

Colorado State, Housing & Finance Authority, Multi-Family Housing Program, Ser A-1, RB | | | | | | |

0.310%, 07/07/10 | | | 1,000 | | | 1,000 |

Colorado State, Housing & Finance Authority, Single-Family Housing Program, Ser B-2, RB | | | | | | |

0.330%, 07/07/10 | | | 990 | | | 990 |

| | | | | | |

| | | | | | 2,490 |

| | | | | | |

| | |

Connecticut — 0.1% | | | | | | |

Connecticut State, Housing & Finance Authority, Sub-Ser A-5, RB | | | | | | |

0.316%, 07/01/10 | | | 600 | | | 600 |

| | | | | | |

| | |

Iowa — 0.4% | | | | | | |

Iowa State, Finance Authority, Ser M, RB | | | | | | |

0.330%, 07/01/10 | | | 950 | | | 950 |

Iowa State, Finance Authority, Ser C, RB | | | | | | |

0.316%, 07/01/10 | | | 3,080 | | | 3,080 |

| | | | | | |

| | | | | | 4,030 |

| | | | | | |

| | |

Kentucky — 0.1% | | | | | | |

Kentucky State, Housing Development Authority, Ser J, RB | | | | | | |

0.410%, 07/01/10 | | | 335 | | | 335 |

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | |

Kentucky State, Housing Development Authority, Ser O, RB | | | | | | |

0.410%, 07/01/10 | | $ | 300 | | $ | 300 |

| | | | | | |

| | | | | | |

| | | | | | 635 |

| | | | | | |

| | |

Texas — 0.4% | | | | | | |

Texas State, GO | | | | | | |

0.380%, 07/06/10 | | | 350 | | | 350 |

Texas State, Ser B, GO | | | | | | |

0.350%, 07/01/10 | | | 1,215 | | | 1,215 |

Texas State, Ser A-2, GO | | | | | | |

0.310%, 07/07/10 | | | 2,000 | | | 2,000 |

| | | | | | |

| | | | | | 3,565 |

| | | | | | |

| | |

Wisconsin — 0.0% | | | | | | |

Wisconsin State, Housing & Economic Development Authority, Ser D, RB | | | | | | |

0.400%, 07/07/10 | | | 520 | | | 520 |

| | | | | | |

Total Municipal Bonds

(Cost $11,840) ($ Thousands) | | | | | | 11,840 |

| | | | | | |

| |

REPURCHASE AGREEMENTS (E) — 17.1% | | | |

BNP Paribas

0.240%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $14,000,093 (collateralized by Republic of Brazil, par value $11,084,000, 8.875%, 10/14/19, with a total market value $14,700,001) | | | 14,000 | | | 14,000 |

BNP Paribas

0.030%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $45,000,038 (collateralized by various FNMA obligations, ranging in par value $26,276,284-$44,132,791, 5.500%-6.000%, 03/01/23-04/01/35, with a total market value $45,900,000) | | | 45,000 | | | 45,000 |

Citigroup

0.080%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $13,509,030 (collateralized by various FNMA obligations, ranging in par value $1,063,816-$12,284,859, 5.000%-5.314%, 10/01/38-07/01/40, with a total market value $13,779,181) | | | 13,509 | | | 13,509 |

Deutshe Bank

0.210%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $3,000,018 (collateralized by Regions Financial, par value $2,955,572, 7.750%, 11/10/14, with a total market value $3,150,001) | | | 3,000 | | | 3,000 |

| | |

| 4 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

SCHEDULE OF INVESTMENTS

Prime Obligation Fund (Concluded)

June 30, 2010

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

Goldman Sachs (F)

0.460%, dated 06/30/10, to be repurchased on 07/21/10, repurchase price $8,009,302 (collateralized by Expedia and Motorola, ranging in par value $3,674,000-$4,118,407, 7.625%-8.500%, 11/15/10-07/01/16, with a total market value $8,407,983) | | $ | 8,000 | | $ | 8,000 |

| | | | | | |

Goldman Sachs (F)

0.500%, dated 06/30/10, to be repurchased on 07/30/10, repurchase price $5,006,111 (collateralized by Motorola, par value $4,864,689, 6.000%, 11/15/17, with a total market value $5,254,302) | | | 5,000 | | | 5,000 |

Goldman Sachs (F)

0.480%, dated 06/30/10, to be repurchased on 07/09/10, repurchase price $5,004,000 (collateralized by Motorola, par value $4,864,077, 6.000%, 11/15/17, with a total market value $5,253,641 | | | 5,000 | | | 5,000 |

JPMorgan Chase (F)

0.450%, dated 06/30/10, to be repurchased on 07/09/10, repurchase price $4,001,500 (collateralized by Rockies Express, par value $3,945,000, 0.000%, 07/15/13, with a total market value $4,200,084) | | | 4,000 | | | 4,000 |

JPMorgan Chase

0.450%, dated 06/30/10, to be repurchased on 07/06/10, repurchase price $2,001,000 (collateralized by Rockies Express, par value $1,975,000, 0.000%, 07/15/13, with a total market value $2,102,704) | | | 2,000 | | | 2,000 |

JPMorgan Chase

0.030%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $45,000,038 (collateralized by various FHLMC obligations, ranging in par value $5,000-$113,227,623, 0.000%-0.000%, 06/01/19-05/01/40, with a total market value $45,901,748) | | | 45,000 | | | 45,000 |

JPMorgan Chase

0.260%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $7,000,051 (collateralized by Arrow Electronics and Teco Finance, ranging in par value $2,820,000-$3,605,000, 6.750%-6.875%, 07/01/13-05/01/15, with a total market value $7,352,543) | | | 7,000 | | | 7,000 |

| | | | | | |

| Description | | Face Amount

($ Thousands) | | Value

($ Thousands) |

| | | | | | |

UBS

0.210%, dated 06/30/10, to be repurchased on 07/01/10, repurchase price $1,000,038 (collateralized by MNSLM and SLM, ranging in par value $379,000-$715,000, 5.375%-8.000%, 01/15/13-03/25/20, with a total market value $1,051,790) | | $ | 1,000 | | $ | 1,000 |

| | | | | | |

Total Repurchase Agreements

(Cost $152,509) ($ Thousands) | | | | | | 152,509 |

| | | | | | |

Total Investments — 100.0%

(Cost $893,015) ($ Thousands) | | | | | $ | 893,015 |

| | | | | | |

Percentages are based on Net Assets of $892,905 ($ Thousands).

| (A) | | The rate reported is the effective yield at time of purchase. |

| (B) | | Securities are held in connection with a letter of credit issued by a major bank. |

| (C) | | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” These securities have been determined to be liquid under guidelines established by the Board of Trustees. |

| (D) | | Floating Rate Instrument. The rate reflected on the Statement of Investments is the rate in effect on June 30, 2010. The demand and interest rate reset features give this security a shorter effective maturity date. |

| (E) | | Tri-Party Repurchase Agreement. |

| (F) | | Securities considered illiquid. The total market value of such securities as of June 30, 2010 was $22,000 ($ Thousands) and represented 2.5% of Net Assets. |

DN — Discount Note

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GO — General Obligation

RB — Revenue Bond

Ser — Series

The accompanying notes are an integral part of the financial statements.

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 5 |

Statement of Assets and Liabilities ($ Thousands)

as of June 30, 2010

| | | | |

| | | Prime Obligation

Fund | |

ASSETS: | | | | |

Investments, at value (Cost $740,506) | | $ | 740,506 | |

Repurchase agreement, at value (Cost $152,509) | | | 152,509 | |

Cash | | | — | |

Accrued income | | | 233 | |

Prepaid expenses | | | 26 | |

Total Assets | | | 893,274 | |

LIABILITIES: | | | | |

Payable due to administrator | | | 169 | |

Payable due to investment adviser | | | 38 | |

Payable for income distribution | | | 1 | |

Chief Compliance Officer fees payable | | | 1 | |

Trustees fees payable | | | 1 | |

Accrued expenses | | | 159 | |

Total Liabilities | | | 369 | |

Net Assets | | $ | 892,905 | |

NET ASSETS CONSIST OF: | | | | |

Paid-in Capital | | $ | 892,905 | |

Distributions in excess of net investment income | | | (1 | ) |

Accumulated net realized gain on investments | | | 1 | |

Net Assets | | $ | 892,905 | |

Net Asset Value, Offering and Redemption Price Per Share — Class A | | | | |

($892,905,177 ÷ 892,905,968 shares) | | | $1.00 | |

Amounts designated as “—” have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | |

| 6 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

Statement of Operations ($ Thousands)

For the year ended June 30, 2010

| | | | |

| | | Prime Obligation

Fund | |

Investment Income: | | | | |

Interest Income | | $ | 3,277 | |

Expenses: | | | | |

Administration Fees | | | 4,432 | |

Shareholder Servicing Fees — Class A | | | 2,638 | |

Investment Advisory Fees | | | 486 | |

Trustees’ Fees | | | 25 | |

Chief Compliance Officer Fees | | | 4 | |

Printing Fees | | | 206 | |

Treasury Expense | | | 155 | |

Professional Fees | | | 123 | |

Custodian/Wire Agent Fees | | | 55 | |

Registration Fees | | | 49 | |

Insurance Expense | | | 18 | |

Other Expenses | | | 21 | |

Total Expenses | | | 8,212 | |

Less, Waiver of: | | | | |

Administration Fees | | | (2,423 | ) |

Shareholder Servicing Fees — Class A | | | (2,638 | ) |

Net Expenses | | | 3,151 | |

Net Investment Income | | | 126 | |

Net Realized Gain on Investments | | | 1 | |

Net Increase in Net Assets Resulting from Operations | | $ | 127 | |

The accompanying notes are an integral part of the financial statements.

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 7 |

Statements of Changes in Net Assets ($ Thousands)

For the years ended June 30,

| | | | | | | | |

| | | Prime Obligation

Fund | |

| | | 2010 | | | 2009 | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 126 | | | $ | 15,272 | |

Net Realized Gain (Loss) on Investments | | | 1 | | | | (32,778 | ) |

Payment by Affiliate* | | | — | | | | 35,912 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments and Affiliated Investment | | | — | | | | 1,919 | |

Net Increase in Net Assets Resulting from Operations | | | 127 | | | | 20,325 | |

Dividends From: | | | | | | | | |

Net Investment Income: | | | | | | | | |

Class A | | | (122 | ) | | | (14,645 | ) |

Total Dividends | | | (122 | ) | | | (14,645 | ) |

Capital Share Transactions (all at $1.00 per share): | | | | | | | | |

Class A: | | | | | | | | |

Proceeds from Shares Issued | | | 4,604,832 | | | | 6,674,906 | |

Reinvestment of Dividends | | | 107 | | | | 12,787 | |

Cost of Shares Redeemed | | | (5,005,637 | ) | | | (6,579,317 | ) |

Increase (Decrease) in Net Assets Derived from Capital Share Transactions | | | (400,698 | ) | | | 108,376 | |

Net Increase (Decrease) in Net Assets | | | (400,693 | ) | | | 114,056 | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 1,293,598 | | | | 1,179,542 | |

End of Year | | $ | 892,905 | | | $ | 1,293,598 | |

Distributions in excess of Net Investment Income | | $ | (1 | ) | | $ | (5 | ) |

| * | | See Note 3 in Notes to Financial Statements |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | |

| 8 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

Financial Highlights

For the years ended June 30,

For a Share Outstanding Throughout each Year

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

Beginning

of Year | | Net

Investment

Income(1) | | Net Realized

and

Unrealized

Gains (Losses)

on Securities | | | Payment

by

Affiliate | | Total

from

Investment

Operations | | Dividends

from Net

Investment

Income | | | Total

Dividends | | | Net Asset

Value, End

of Year | | Total

Return† | | | Net Assets

End of Year

($ Thousands) | | Ratio of

Expenses

to Average

Net Assets | | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Waivers) | | | Ratio of Net

Investment

Income

to Average

Net Assets | |

Prime Obligation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2010 | | $ | 1.00 | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | 1.00 | | 0.01 | % | | $ | 892,905 | | 0.30 | %* | | 0.78 | % | | 0.01 | % |

2009 | | | 1.00 | | | 0.01 | | | (0.03 | ) | | | 0.03 | | | 0.01 | | | (0.01 | ) | | | (0.01 | ) | | | 1.00 | | 1.12 | †† | | | 1,293,598 | | 0.48 | ** | | 0.79 | | | 1.10 | |

2008 | | | 1.00 | | | 0.04 | | | — | | | | — | | | 0.04 | | | (0.04 | ) | | | (0.04 | ) | | | 1.00 | | 3.96 | | | | 1,179,542 | | 0.44 | | | 0.75 | | | 3.76 | |

2007 | | | 1.00 | | | 0.05 | | | — | | | | — | | | 0.05 | | | (0.05 | ) | | | (0.05 | ) | | | 1.00 | | 5.05 | | | | 805,530 | | 0.44 | | | 0.76 | | | 4.94 | |

2006 | | | 1.00 | | | 0.04 | | | — | | | | — | | | 0.04 | | | (0.04 | ) | | | (0.04 | ) | | | 1.00 | | 3.88 | | | | 855,597 | | 0.44 | | | 0.76 | | | 3.82 | |

| * | | The expense ratio includes the Treasury Guarantee Program expense. The Administrator has voluntarily agreed to waive and reduce their fee and/or reimburse certain expenses of the Fund in order to limit the one-day net income yield of the Fund to not less than 0.01% of the Fund’s daily average net assets. Had these waivers and the Treasury Guarantee Program expense been excluded, the ratio would have been at the expense cap figure of 0.44%. See Note 3 of the Notes to Financial Statements. |

| ** | | The expense ratio includes the Treasury Guarantee Program expense. Had this expense been excluded, the ratio would have been 0.44%. |

| † | | Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| †† | | The total return includes payment by affiliate. Had the payment been excluded the total return would have been (1.61)%. See Note 3 of Notes to Financial Statements. |

| (1) | | Per share calculations were performed using average shares. |

| | | Amounts designated as “—” are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 9 |

Notes to Financial Statements

June 30, 2010

1. ORGANIZATION

SEI Liquid Asset Trust (the “Trust”) was organized as a Massachusetts business trust under a Declaration of Trust dated July 20, 1981.

The Trust is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company with one fund: the Prime Obligation Fund (the “Fund”). The Trust is registered to offer Class A shares of the Fund. A description of the Fund’s investment objectives, policies, and strategies are provided in the prospectus.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Trust.

Use of Estimates — The preparation of financial statements, in conformity with U.S. generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation — Investment securities are stated at amortized cost which approximates market value. Under this valuation method, purchase discounts and premiums are accreted and amortized ratably to maturity and are included in interest income. The Fund’s use of amortized cost is subject to its compliance with certain conditions as specified by Rule 2a-7 of the 1940 Act.

In accordance with U.S. generally accepted accounting principles, Fair Value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy has been established to maximize the use of the observable market data and minimize the use of unobservable inputs and to establish classification of the fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

Level 1 — quoted prices in active markets for identical investments

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risks, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The valuation techniques used by the Fund to measure fair value during the year ended June 30, 2010 maximized the use of observable inputs and minimized the use of unobservable inputs.

As of June 30, 2010, all of the Fund’s investments are Level 2. During the year ended June 30, 2010, there were no significant transfers between Level 1 and Level 2.

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2010-6, Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements. ASU No. 2010-6 enhances and clarifies existing fair value measurement disclosure requirements and is effective for interim and annual periods beginning after December 15, 2009. The Trust adopted ASU No. 2010-6 on January 1, 2010. The adoption of ASU No. 2010-6 did not have any impact on the Trust’s financial statements.

For the year ended June 30, 2010, there have been no significant changes to the fair valuation methodologies.

Illiquid Securities — A security is considered illiquid if it cannot be sold or disposed of in the ordinary course of business within seven days or less for its approximate carrying value on the books of the Fund. Valuations of illiquid securities may differ significantly from the values that would have been used had an active market value for these securities existed. At June 30, 2010, the Fund held Repurchase Agreements considered illiquid in the amount of $22,000 ($ Thousands). Please refer to the Schedule of Investments for more information.

Restricted Securities — Throughout the year, the Fund owned private placement investments that were purchased through private offerings or acquired through initial public offerings that could not be sold without prior registration under the Securities Act of 1933 or pursuant to an exemption there from. In addition, the Fund had generally agreed to further restrictions on the disposition of certain holdings as set forth in various agreements entered into in connection with the purchase of those investments. These investments were valued at amortized cost as determined in accordance with the procedures approved by the Board of Trustees. At June 30, 2010, the Fund did not own any restricted securities.

Repurchase Agreements — The Fund invests in tri-party repurchase agreements. Securities held as collateral for tri-party repurchase

| | |

| 10 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

agreements are maintained in a segregated account by the broker’s custodian bank. Provisions of the agreements and the Trust’s policies ensure that the market value of the collateral, including accrued interest thereon, is sufficient to cover interest and principal in the event of default by the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited. At June 30, 2010, the Fund held Repurchase Agreements in the amount of $152,509 ($ thousands). Please refer to the Schedule of Investments for more information.

Expenses — Expenses that are directly related to the Fund are charged directly to the Fund.

Security Transactions and Investment Income — Security transactions are accounted for on the trade date. Costs used in determining realized gains and losses on the sale of investment securities are on the basis of specific identification. Interest income is recognized using the accrual basis of accounting.

All amortization is calculated using the straight line method over the holding period of the security. Amortization of premiums and accretion of discounts are included in interest income.

Dividends and Distributions to Shareholders — Dividends from net investment income are declared on a daily basis and are payable on the first business day of the following month. Any net realized capital gains of the Fund are distributed to the shareholders of the Fund annually.

3. AGREEMENTS AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Advisory Agreement — SIMC serves as the Trust’s investment adviser and “manager of managers” under an investment advisory agreement. For its services, SIMC receives an annual fee equal to .075% of the Trust’s average daily net assets up to $500 million and .02% of such net assets in excess of $500 million.

Columbia Management Advisors, LLC (“Columbia”), serves as sub-advisor to the Fund under an investment sub-advisory agreement. Columbia is paid by SIMC. SIMC compensates Columbia out of the fee it receives from the Fund.

Administration and Transfer Agency Agreement — SEI Investments Global Funds Services (the “Administrator”) provides administrative services to the Trust for an annual fee, which is calculated daily and paid monthly, of .42% of the average daily net assets of the Fund.

The Administrator has contractually agreed to waive fees and to reimburse expenses, in order to keep total operating expenses, net of SEI Investments Management Corporation (“SIMC”) and SEI Investments Distribution Co.’s (the “Distributor”) fee waivers, from exceeding .44% of the average daily net assets of the Fund. The expense cap excludes the Treasury Guarantee Program expense and acquired fund fees. The Distributor is a wholly-owned and operated subsidiary of SEI Investments Company and a registered broker-dealer.

The Administrator has voluntarily agreed to waive and reduce their fee and/or reimburse certain expenses of the Fund in order to limit the one-day net income yield of the Fund to not less than 0.01% of the Funds’ average daily net assets. For the year ended June 30, 2010, the amount of this waiver totaled $1,645,948.

Temporary Guarantee Program — On September 18, 2008 the U.S. Treasury Department (the “Treasury”) commenced the Temporary Guarantee Program for Money Market Funds (the “Program”). The Trust’s Board of Trustees approved the participation of the Prime Obligation Fund in the Program from its commencement on September 18, 2008 through April 30, 2009. The Treasury offered funds participating in the Program an extension until September 18, 2009.

Under the Program, the Treasury guaranteed the share price of a participating fund’s shares outstanding as of September 19, 2008 at $1.00 per share if the fund’s net asset value per share (NAV) falls below $0.995. The Program did not protect investors who were not shareholders of a participating fund after September 18, 2008. The cost of participating in the Program and the Program extensions was borne by the Fund, and was not subject to any expense limitation or reimbursement agreement.

Distribution and Shareholder Servicing Agreements — The Distributor acts as the distributor of the shares of the Trust under a Distribution Agreement. The Trust has adopted a shareholder servicing plan for its Class A shares (the “Class A Plan”) pursuant to which a shareholder servicing fee of up to .25% of the average daily net assets attributable to Class A shares will be paid to the Distributor. Under the Class A Plan the Distributor may perform, or may compensate other service providers for performing, certain shareholder and administrative services. The Distributor has waived, on a voluntary basis, all of its shareholder servicing fee.

Under the Class A Plan, the Distributor may retain as a profit any difference between the fee it receives and the amount it pays to third parties.

Other — Certain officers and/or trustees of the Trust are also officers and/or directors of the Administrator, the Distributor or SIMC. Compensation of officers and affiliated trustees of the Trust is paid by the Administrator and/or the Distributor.

The services provided by the Chief Compliance Officer (“CCO”) and his staff, whom are employees of the Administrator, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s advisor, sub-advisors and service providers as required by SEC regulations. The CCO’s services have been approved by and are reviewed annually by the Board.

Other Affiliated Transactions — For the year ended June 30, 2009, an affiliate of SIMC purchased from the Fund all of the notes issued by Axon Financial Funding, LLC (“Axon”), Gryphon Funding Limited (“Gryphon”), Issuer Entity, LLC (“Issuer”), Stanfield Victoria Finance, LLC (“Stanfield”), and Wickersham Issuer Entity, LLC (“Wickersham”)

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 11 |

Notes to Financial Statements (Unaudited) (Concluded)

June 30, 2010

that were held by the Fund. This transaction was effected pursuant to Rule 17a-9 under the Investment Company Act of 1940 (the “Act”), which permits an affiliate to purchase a security from a money market fund if that security is no longer an Eligible Security pursuant to Rule 2a-7 under the Act. Axon, Gryphon, Issuer, Stanfield and Wickersham were not Eligible Securities at the time of the transaction. The transaction is deemed as “Payment by Affiliate” on the Statement of Changes in Net Assets for the year ended June 30, 2009, in the amount of $35,912 ($ Thousands).

4. FEDERAL INCOME TAXES

It is the Fund’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income. Accordingly, no provision for Federal income taxes is required. The timing and characterization of certain income and capital gains distributions are determined annually in accordance with Federal tax regulations which may differ from U.S. generally accepted accounting principles. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for the reporting period may differ from distributions during such period. These book/tax differences may be temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital, undistributed net investment income or accumulated net realized gain, as appropriate, in the period that the differences arise.

Accordingly, no permanent differences have been reclassified during the year ended June 30, 2010, as there were none.

The tax character of dividends paid to Class A shareholders during the years ended June 30, 2010 and June 30, 2009 were as follows ($ Thousands):

| | | |

| | | Ordinary Income |

2010 | | $ | 122 |

2009 | | $ | 14,645 |

As of June 30, 2010, the components of accumulated losses on a tax basis were as follows ($ Thousands):

| | | | |

Undistributed Ordinary Income | | $ | 8 | |

Capital Loss Carryforwards | | | (1 | ) |

Other Temporary Differences | | | (7 | ) |

| | | | |

Total Accumulated Losses | | $ | — | |

| | | | |

For Federal income tax purposes, capital loss carryforwards represent realized losses of the Fund that may be carried forward for a maximum period of eight years and applied against future capital gains. At June 30, 2010, the Fund had $650 in capital loss carryforwards expiring in 2016.

During the year ended June 30, 2010, the Fund utilized $1,124 of capital loss carryforward to offset capital gains.

The cost basis of securities for Federal income tax purposes is equal to the cost basis used for financial reporting purposes.

Management has analyzed the Fund’s tax positions taken on the federal tax returns for all open tax years and has concluded that as of June 30, 2010, no provision for income tax is required in the Fund’s financial statements.

5. RESTRUCTURING FUND

At a meeting held on June 29, 2007, the Board approved the liquidation of the Trust in connection with a limited restructuring of some SEI Funds, in which case it was planned that nearly all of the Prime Obligation Fund’s shareholders would become shareholders of a Prime Obligation Fund that is being established within another trust in the SEI Funds Complex. However, in light of recent volatility in the money markets, the liquidation has been postponed. The adviser and the Board will continue to monitor the situation to determine when and if the restructuring and the related liquidation of the Trust should proceed. Unless and until such liquidation occurs, the Fund will continue to operate normally.

Accounting rules require that financial statements for entities in liquidation, or for which liquidation appears imminent, be prepared on a liquidation basis of accounting. Liquidation basis of accounting requires the Fund to record assets and liabilities at values expected to be achieved in liquidation. A change to the liquidation basis of accounting would not have a material effect on the Fund’s carrying value of assets and liabilities nor its operations.

6. SUBSEQUENT EVENTS

The Company has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were available to be issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

| | |

| 12 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

SEI Liquid Asset Trust:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of SEI Liquid Asset Trust, comprising the Prime Obligation Fund (the “Fund”), as of June 30, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2010, by correspondence with the custodians and brokers or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the SEI Liquid Asset Trust, comprising the Prime Obligation Fund, as of June 30, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

August 30, 2010

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 13 |

TRUSTEES AND OFFICERS OF THE TRUST (Unaudited)

The following chart lists Trustees and Officers as of June 24, 2010.

Set forth below are the names, addresses, ages, position with the Trust, Term of Office and Length of Time Served, the principal occupations for the last five years, number of portfolios in fund complex overseen by trustee, and other directorships outside the fund complex of each of the persons currently serving as Trustees and Officers of the Trust. The Trust’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-800-342-5734.

| | | | | | | | | | |

Name

Address,

and Age | | Position(s)

Held with

Trusts | | Term of

Office and

Length of

Time Served1 | | Principal Occupation(s)

During Past Five Years | | Number of

Portfolios in

Fund Complex

Overseen

by Trustee2 | | Other Directorships

Held by Trustee |

| INTERESTED TRUSTEES |

Robert A. Nesher

One Freedom

Valley Drive,

Oaks, PA 19456

63 yrs. old | | Chairman of the Board of Trustees* | | since 1982 | | Currently performs various services on behalf of SEI for which Mr. Nesher is compensated. | | 81 | | Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, Director of SEI Global Master Fund, plc, SEI Global Assets Fund, plc, SEI Global Investments Fund, plc, SEI Investments Global, Limited, SEI Investments — Global Fund Services, Limited, SEI Investments (Europe), Limited, SEI Investments — Unit Trust Management (UK), Limited, SEI Global Nominee Ltd., SEI Structured Credit Fund, L.P. |

William M. Doran

One Freedom

Valley Drive,

Oaks, PA 19456

69 yrs. old | | Trustee* | | since 1982 | | Self-employed consultant since 2003. Partner, Morgan, Lewis & Bockius LLP (law firm) from 1976 to 2003, counsel to the Trust, SEI, SIMC, the Administrator and the Distributor. Secretary of SEI since 1978. | | 81 | | Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, Director of SEI since 1974. Director of the Distributor since 2003. Director of SEI Investments — Global Fund Services, Limited, SEI Investments Global, Limited, SEI Investments (Europe), Limited, SEI Investments (Asia) Limited, SEI Global Nominee Ltd., Limited, SEI — Unit Trust Management (UK) Limited and SEI Asset Korea Co., Ltd. |

| TRUSTEES |

James M. Storey

One Freedom

Valley Drive,

Oaks, PA 19456

78 yrs. old | | Trustee | | since 1995 | | Attorney, sole practitioner since 1994. Partner, Dechert Price & Rhoads, September 1987- December 1993. | | 81 | | Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, and U.S. Charitable Gift Trust. |

George J. Sullivan, Jr.

One Freedom

Valley Drive

Oaks, PA 19456

66 yrs. old | | Trustee | | since 1996 | | Self-Employed Consultant, Newfound Consultants Inc. since April 1997. | | 81 | | Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, Bishop Street Funds, State Street Navigator Securities Lending Trust, and SEI Structured Credit Fund, L.P., member of the independent review committee for SEI’s Canadian registered mutual funds. |

| | *Messrs. | Nesher and Doran are Trustees who may be deemed as “interested” persons of the Trust as that term is defined in the 1940 Act by virtue of their affiliation with SIMC and the Trust’s Distributor. |

| | 1Each | trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

| | 2The | Fund Complex includes the following Trusts: SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust and SEI Alpha Strategy Portfolios, L.P. |

| | |

| 14 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

| | | | | | | | | | |

Name

Address,

and Age | | Position(s)

Held with

Trusts | | Term of

Office and

Length of

Time Served1 | | Principal Occupation(s)

During Past Five Years | | Number of

Portfolios in

Fund Complex

Overseen

by Trustee2 | | Other Directorships

Held by Trustee |

| TRUSTEES (continued) |

Rosemarie B. Greco

One Freedom

Valley Drive

Oaks, PA 19456

63 yrs. old | | Trustee | | since 1999 | | Director, Governor’s Office of Health Care Reform, Commonwealth of Pennsylvania since 2003. | | 81 | | Director, Sonoco, Inc.; Director, Exelon Corporation; Trustee, Pennsylvania Real Estate Investment Trust. |

Nina Lesavoy

One Freedom

Valley Drive,

Oaks, PA 19456

52 yrs. old | | Trustee | | since 2003 | | Founder and Managing Director, Avec Capital since 2008. Managing Director, Cue Capital from March 2002-March 2008. | | 81 | | Director of SEI Structured Credit Fund, L.P. |

James M. Williams

One Freedom

Valley Drive, Oaks, PA 19456

62 yrs. old | | Trustee | | since 2004 | | Vice President and Chief Investment Officer, J. Paul Getty Trust, Non-Profit Foundation for Visual Arts, since December 2002. | | 81 | | Trustee/Director of Ariel Mutual Funds, and SEI Structured Credit Fund, L.P. |

Mitchell A. Johnson

One Freedom Valley Drive,

Oaks, PA 19456

67 yrs. old | | Trustee | | since 2007 | | Private Investor since 1994. | | 81 | | Trustee of the Advisors’ Inner Circle Fund, The Advisor’s Inner Circle Fund II, and Bishop Street Funds. |

Hubert L. Harris, Jr.

One Freedom

Valley Drive,

Oaks, PA 19456 66 yrs. old | | Trustee | | since 2008 | | Retired since December 2005. Chief Executive Officer, INVESCO North America, August 2003-December 2005. Director, Colonial BancGroup, Inc., 2003-2009. Chair of the Board of Trustees, Georgia Tech Foundation, Inc. (nonprofit corporation), 2007-2009. | | 81 | | Director of St. Joseph’s Translational Research Institute; Board of Councilors of the Carter Center. |

| OFFICERS |

Robert A. Nesher

One Freedom

Valley Drive,

Oaks, PA 19456

63 yrs. old | | President & CEO | | since 2005 | | Currently performs various services on behalf of SEI for which Mr. Nesher is compensated. | | N/A | | N/A |

Stephen F. Panner One Freedom

Valley Drive,

Oaks, PA 19456 40 yrs. old | | Controller and Chief Financial Officer | | since 2005 | | Fund Accounting Director of the Administrator since 2005. Fund Administration Manager, Old Mutual Fund Services, 2000-2005. | | N/A | | N/A |

Russell Emery

One Freedom

Valley Drive

Oaks, PA 19456

47 yrs. old | | Chief Compliance Officer | | since 2006 | | Chief Compliance Officer of the Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust, SEI Daily Income Trust, The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II, and Bishop Street Funds, since March 2006. Chief Compliance Officer of SEI Structured Credit Fund, LP and SEI Alpha Strategy Portfolios, LP since June 2007. Director of Investment Product Management and Development of SIMC, February 2003-March 2006. | | N/A | | N/A |

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 15 |

TRUSTEES AND OFFICERS OF THE TRUST (Unaudited) (Concluded)

| | | | | | | | | | |

Name

Address, and Age | | Position(s)

Held with

Trusts | | Term of

Office and

Length of

Time Served1 | | Principal Occupation(s)

During Past Five Years | | Number of

Portfolios in

Fund Complex

Overseen

by Trustee2 | | Other Directorships

Held by Trustee |

| OFFICERS (continued) |

Timothy D. Barto

One Freedom

Valley Drive

Oaks, PA 19456

42 yrs. old | | Vice President and Secretary | | since 2002 | | General Counsel, Vice President and Secretary of SIMC and the Administrator since 2004. Vice President and Assistant Secretary of SEI since 2001. Vice President of SIMC and the Administrator since 1999. | | N/A | | N/A |

James Ndiaye

One Freedom

Valley Drive

Oaks, PA 19456

41 yrs. old | | Vice President and Assistant Secretary | | since 2005 | | Vice President and Assistant Secretary of SIMC since 2005. | | N/A | | N/A |

Aaron Buser

One Freedom

Valley Drive

Oaks, PA 19456

39 yrs. old | | Vice President and Assistant Secretary | | since 2007 | | Vice President and Assistant Secretary of SIMC since 2007. Associate at Stark & Stark (2004-2007). | | N/A | | N/A |

David F. McCann

One Freedom

Valley Drive

Oaks, PA 19456

33 yrs. old | | Vice President and Assistant Secretary | | since 2008 | | Vice President and Assistant Secretary of SIMC since 2008. Attorney, Drinker Biddle & Reath, LLP, May 2005-October 2008. | | N/A | | N/A |

John J. McCue

One Freedom

Valley Drive

Oaks, PA 19456

46 yrs. old | | Vice President | | since 2004 | | Director of Portfolio Implementations for SIMC since 1995. Managing Director of Money Market Investments for SIMC since 2003. | | N/A | | N/A |

Andrew S. Decker

One Freedom

Valley Drive

Oaks, PA 19456

46 yrs. old | | Anti-Money Laundering Compliance Officer | | since 2008 | | Compliance Officer and Product Manager, SEI 2005-2008. Vice President, Old Mutual Capital, 2000-2005. | | N/A | | N/A |

Keri E. Rohn

One Freedom

Valley Drive

Oaks, PA 19456

29 yrs. old | | Privacy Officer | | since 2009 | | Compliance Officer of SEI Investments Company, since 2003. | | N/A | | N/A |

| | 1Each | trustee shall hold office during the lifetime of this Trust until the election and qualification of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Trust’s Declaration of Trust. |

| | 2The | Fund Complex includes the following Trusts: SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust and SEI Alpha Strategy Portfolios, L.P. |

| | |

| 16 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

Disclosure of Fund Expenses (Unaudited)

All mutual funds have operating expenses. As a shareholder of a mutual fund, your investment is affected by these ongoing costs, which include (among others) costs for portfolio management, administrative services, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.

Operating expenses such as these are deducted from a mutual fund’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of a mutual fund’s average net assets; this percentage is known as a mutual fund’s expense ratio. The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your Fund’s costs in two ways:

• Actual Fund return. This section helps you to estimate the actual expenses after fee waivers that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your ending account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

• Hypothetical 5% return. This section helps you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other mutual funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | | | | | | | | | | | |

| | | Beginning

Account

Value

1/1/10 | | Ending

Account

Value

6/30/10 | | Annualized

Expense

Ratios | | | Expenses

Paid

During

Period* |

Prime Obligation Fund — Class A | | | | | | | | | | | | |

Actual Fund Return | | $ | 1,000.00 | | $ | 1,000.10 | | 0.28 | % | | $ | 1.39 |

Hypothetical 5% Return | | | 1,000.00 | | | 1,023.41 | | 0.28 | | | | 1.40 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown). |

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 17 |

Board of Trustees Considerations in Approving the Advisory and Sub-Advisory Agreements (Unaudited)

SEI Liquid Asset Trust (the “Trust”) and SEI Investments Management Corporation (“SIMC”) have entered into an investment advisory agreement (the “Advisory Agreement”). Pursuant to the Advisory Agreement, SIMC oversees the investment advisory services provided to the series of the Trust (the “Fund”) and may manage the cash portion of the Fund’s assets. Pursuant to separate sub-advisory agreements (the “Sub-Advisory Agreements” and, together with the Advisory Agreement, the “Investment Advisory Agreements”) with SIMC, and under the supervision of SIMC and the Trust’s Board of Trustees (the “Board”), the Sub-Advisers are responsible for the day-to-day investment management of all or a discrete portion of the assets of the Fund. The Sub-Advisers also are responsible for managing their employees who provide services to the Fund. The Sub-Advisers are selected based primarily upon the research and recommendations of SIMC, which evaluates quantitatively and qualitatively the Sub-Advisers’ skills and investment results in managing assets for specific asset classes, investment styles and strategies.

The Investment Company Act of 1940, as amended (the “1940 Act”) requires that the initial approval of, as well as the continuation of, the Fund’s Investment Advisory Agreements must be specifically approved: (i) by the vote of the Board of Trustees or by a vote of the shareholders of the Fund; and (ii) by the vote of a majority of the Trustees who are not parties to the Investment Advisory Agreements or “interested persons” of any party (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval. In connection with their consideration of such approvals, the Fund’s Trustees must request and evaluate, and SIMC and the Sub-Advisers are required to furnish, such information as may be reasonably necessary to evaluate the terms of the Investment Advisory Agreements. In addition, the Securities and Exchange Commission (“SEC”) takes the position that, as part of their fiduciary duties with respect to a mutual fund’s fees, mutual fund boards are required to evaluate the material factors applicable to a decision to approve an Investment Advisory Agreement.

Consistent with these responsibilities, the Trust’s Board of Trustees calls and holds meetings each year that are dedicated to considering whether to renew the Investment Advisory Agreements between the Trust and SIMC and SIMC and the Sub-Advisers with respect to the Fund of the Trust. In preparation for these meetings, the Board requests and reviews a wide variety of materials provided by SIMC and the Sub-Advisers, including information about SIMC’s and the Sub-Advisers’ affiliates, personnel and operations. The Board also receives extensive data provided by third parties. This information is in addition to the detailed information about the Fund that the Board reviews during the course of each year, including information that relates to Fund operations and Fund performance. The Trustees also receive a memorandum from Fund counsel and independent counsel to the Independent Trustees regarding the responsibilities of Trustees in connection with their consideration of whether to approve the Trust’s Investment Advisory Agreements. Finally, the Independent Trustees receive advice from independent counsel to the Independent Trustees, meet in executive session outside the presence of Fund management and participate in question and answer sessions with representatives of SIMC and the Sub-Advisers.

Specifically, the Board requested and received written materials from SIMC and the Sub-Advisers regarding: (a) the quality of SIMC’s and the Sub-Advisers’ investment management and other services; (b) SIMC’s and the Sub-Advisers’ investment management personnel; (c) SIMC’s and the Sub-Advisers’ operations and financial condition; (d) SIMC’s and the Sub-Advisers’ brokerage practices (including any soft dollar arrangements) and investment strategies; (e) the level of the advisory fees that SIMC and the Sub-Advisers charge the Fund compared with the fees each charge to comparable mutual funds; (f) the Fund’s overall fees and operating expenses compared with similar mutual funds; (g) the level of SIMC’s and the Sub-Advisers’ profitability from their Fund-related operations; (h) SIMC’s and the Sub-Advisers’ compliance systems; (i) SIMC’s and the Sub-Advisers’ policies on and compliance procedures for personal securities transactions; (j) SIMC’s and the Sub-Advisers’ reputation, expertise and resources in domestic and/or international financial markets; and (k) the Fund’s performance compared with similar mutual funds.

At the March 25-26, 2009 meetings of the Board of Trustees, the Trustees, including a majority of the Independent Trustees, approved the Investment Advisory Agreements and approved the selection of SIMC and the Sub-Advisers to act in their respective capacities for the Fund. The Board’s approval was based on its consideration and evaluation of a variety of specific factors discussed at the meetings and at prior meetings, including:

| • | | the nature, extent and quality of the services provided to the Fund under the Investment Advisory Agreements, including the resources of SIMC and the Sub-Advisers and their affiliates dedicated to the Fund; |

| | |

| 18 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

| • | | the Fund’s investment performance and how it compared to that of other comparable mutual funds; |

| • | | the Fund’s expenses under each Investment Advisory Agreement and how those expenses compared to those of other comparable mutual funds; |

| • | | the profitability of SIMC and the Sub-Advisers and their affiliates with respect to the Fund, including both direct and indirect benefits accruing to SIMC and the Sub-Advisers and their affiliates; and |

| • | | the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Investment Advisory Agreements reflect those economies of scale for the benefit of Fund investors. |

Nature, Extent and Quality of Services. The Board of Trustees considered the nature, extent and quality of the services provided by SIMC and the Sub-Advisers to the Fund and the resources of SIMC and the Sub-Advisers and their affiliates dedicated to the Fund. In this regard, the Trustees evaluated, among other things, SIMC’s and the Sub-Advisers’ personnel, experience, track record and compliance program. The Trustees found the level of SIMC’s professional staff and culture of compliance satisfactory. Following evaluation, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of services provided by SIMC and the Sub-Advisers to the Fund and the resources of SIMC and the Sub-Advisers and their affiliates dedicated to the Fund supported renewal of the Investment Advisory Agreements.

Fund Performance. The Board of Trustees considered Fund performance in determining whether to renew the Investment Advisory Agreements. Specifically, the Trustees considered the Fund’s performance relative to their peer groups and appropriate indices/benchmarks, in light of total return, yield and market trends. As part of this review, the Trustees considered the composition of each peer group and selection criteria. In evaluating performance, the Trustees considered both market risk and shareholder risk expectations for the Fund. The Trustees found Fund performance satisfactory, and where performance was below the benchmark, the Trustees were satisfied that appropriate steps were being taken. Following evaluation, the Board concluded that, within the context of its full deliberations, the performance of the Fund supported renewal of the Investment Advisory Agreements.

Fund Expenses. With respect to the Fund’s expenses under the Investment Advisory Agreements, the Trustees considered the rate of compensation called for by the Investment Advisory Agreements and the Fund’s net operating expense ratio in comparison to those of other comparable mutual funds. The Trustees also considered information about average expense ratios of comparable mutual funds in the Fund’s peer group. The Trustees further considered the fact that the comparative fee analysis either showed that the various fees were below average or that there was a reasonable basis for the fee level. Finally, the Trustees considered the effects of SIMC’s voluntary waiver of management and other fees and the Sub-Advisers’ fees to prevent total Fund expenses from exceeding a specified cap and that SIMC and the Sub-Advisers, through waivers, have maintained the Fund’s net operating expenses at a competitive level for its distribution channels. Following evaluation, the Board concluded that, within the context of its full deliberations, the expenses of the Fund are reasonable and supported renewal of the Investment Advisory Agreements.

Profitability. With regard to profitability, the Trustees considered all compensation flowing to SIMC and the Sub-Adviser and their affiliates, directly or indirectly. The Trustees considered whether the varied levels of compensation and profitability under the Investment Advisory Agreements and other service agreements were reasonable and justified in light of the quality of all services rendered to the Fund by SIMC and the Sub-Advisers and their affiliates. The Trustees found that profitability was reasonable and that the margin was not increasing despite growth in assets. When considering the profitability of the Sub-Advisers, the Board took into account the fact that the Sub-Advisers are compensated by SIMC, and not by the Fund directly, and such compensation with respect to any Sub-Adviser reflects an arms-length negotiation between the Sub-Adviser and SIMC. Based on this evaluation, the Board concluded that, within the context of its full deliberations, the profitability of SIMC and the Sub-Advisers are reasonable and supported renewal of the Investment Advisory Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale and whether those were passed along to the Fund’s shareholders through a graduated investment advisory fee schedule or other means, including any fee waivers by SIMC and its affiliates. Based on this evaluation, the Board concluded that, within the context of its full deliberations, the Fund obtains reasonable benefit from economies of scale.

Based on the Trustees’ deliberation and their evaluation of the information described above, the Board, including all of the Independent Trustees, unanimously approved the continuation of the Investment Advisory Agreements and concluded that the compensation under the Investment Advisory Agreements is fair and reasonable in light of such services and expenses and such other matters as the Trustees considered to be relevant in the exercise of their reasonable judgment. In the course of their deliberations, the Trustees did not identify any particular information that was all-important or controlling.

| | |

| SEI Liquid Asset Trust / Annual Report / June 30, 2010 | | 19 |

Notice to Shareholders (Unaudited)

For shareholders that do not have a June 30, 2010 taxable year end, this notice is for informational purposes only. For shareholders with a June 30, 2010 taxable year end, please consult your tax adviser as to the pertinence of this notice.

For the fiscal year ended June 30, 2010, the Fund is making the following dividend designations with regard to distributions paid during the year as follows:

| | | | | | |

(A) Long Term Capital Gains Distributions (Tax Basis) | | (B) Ordinary Income Distributions (Tax Basis) | | Total Distributions (Tax Basis) | | (C) Dividends Qualifying for Corporate Dividends Rec. Deduction (1) |

| 0.00% | | 100.00% | | 100.00% | | 0.00% |

(D) Qualifying Dividend Income (2) | | (E) U.S. Government Interest (3) | | Interest Related Dividend (4) | | Short-Term Capital Gain Dividends (5) |

| 0.00% | | 4.74% | | 99.71% | | 0.00% |

| (1) | Qualifying dividends represent dividends which qualify for the corporate dividends received deduction. |

| (2) | The percentage in this column represents the amount of “Qualifying Dividend Income” and is reflected as a percentage of “Ordinary Income Distributions.” |

| (3) | “U.S. Government Interest” represents the amount of interest that was derived from direct U.S. Government obligations and distributed during the fiscal year. This amount is reflected as a percentage of “Total Ordinary Income.” Generally, interest from direct U.S. Government obligations is exempt from state income tax. However, for Fund shareholders who are residents of California, Connecticut or New York, the statutory threshold requirements were not satisfied to permit exemption of these amounts from state income. |

| (4) | The percentage in this column represents the amount of “Interest Related Dividends” and is reflected as a percentage of net investment income distributions that is exempt from U.S. withholding tax when paid to foreign investors. This provision of the IRC will be expiring for years beginning after December 31, 2009. |

| (5) | The percentage in this column represents the amount of “Short-Term Capital Gains Dividends” and is reflected as a percentage of short-term capital gain distributions that is exempt from U.S. withholding tax when paid to foreign investors. This provision of the IRC will be expiring for years beginning after December 31, 2009. |

Items (A) and (B) are based on the percentage of the Fund’s total distribution.

Items (C) and (D) are based on the percentage of ordinary income distributions of the Fund.

Item (E) is based on the percentage of gross income of the Fund.

Please consult your tax adviser for proper treatment of this information. This notification should be kept with your permanent tax records.

| | |

| 20 | | SEI Liquid Asset Trust / Annual Report / June 30, 2010 |

SEI LIQUID ASSET TRUST ANNUAL REPORT JUNE 30, 2010

Robert A. Nesher, Chairman

Trustees

William M. Doran

James M. Storey

George J. Sullivan, Jr.

Rosemarie B. Greco

Nina Lesavoy

James M. Williams

Mitchell A. Johnson

Hubert L. Harris, Jr.

Officers

Robert A. Nesher

President and Chief Executive Officer

Stephen F. Panner

Controller and Chief Financial Officer

Russell Emery

Chief Compliance Officer

Timothy D. Barto

Vice President, Secretary

James Ndiaye

Vice President, Assistant Secretary

Aaron Buser

Vice President, Assistant Secretary

David F. McCann

Vice President, Assistant Secretary

John J. McCue

Vice President

Andrew S. Decker

Anti-Money Laundering Compliance Officer

Keri E. Rohn

Privacy Officer

Investment Adviser

SEI Investments Management Corporation

Administrator

SEI Investments Global Funds Services

Distributor

SEI Investments Distribution Co.

Legal Counsel

Morgan, Lewis & Bockius LLP

Independent Registered Public Accounting Firm