UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended June 30, 2008

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From To

Commission File Number 001-12075

BOLT TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Connecticut | | 06-0773922 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| Four Duke Place, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (203) 853-0700

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of Each Exchange on Which Registered |

| Common Stock, without par value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ | | Accelerated filer x |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of Common Stock, without par value, held by non-affiliates on December 31, 2007: $213,100,000

As of September 5, 2008 there were 8,636,093 shares of Common Stock, without par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for our 2008 Annual Meeting of Stockholders, which will be filed no later than 120 days after June 30, 2008, are incorporated herein by reference into Part III of this Form 10-K.

Note Regarding Forward-Looking Statements

Forward-looking statements in this Annual Report on Form 10-K, future filings by the Company with the Securities and Exchange Commission, the Company’s press releases and oral statements by authorized officers of the Company are intended to be subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These include statements about anticipated financial performance, future revenues or earnings, business prospects, new products, anticipated energy industry activity, anticipated market performance, planned production and shipping of products, expected cash needs and similar matters. Investors are cautioned that all forward-looking statements involve risks and uncertainty, including without limitation (i) the risk of technological change relating to the Company’s products and the risk of the Company’s inability to develop new competitive products in a timely manner, (ii) the risk of changes in demand for the Company’s products due to fluctuations in energy industry activity, (iii) the Company’s reliance on certain significant customers, (iv) risks associated with a significant amount of foreign sales, (v) the risk of fluctuations in future operating results and (vi) other risks detailed in this Annual Report on Form 10-K and the Company’s other filings with the Securities and Exchange Commission. The Company believes that forward-looking statements made by it are based on reasonable expectations. However, no assurances can be given that actual results will not differ materially from those contained in such forward-looking statements. The words “estimate,” “project,” “anticipate,” “expect,” “predict,” “believe” and similar expressions are intended to identify forward-looking statements.

1

PART I

Preliminary Note: In this Annual Report on Form 10-K, we refer to Bolt Technology Corporation and its subsidiaries as “we,” “our,” “us,” “the registrant” or “the Company,” unless the context clearly indicates otherwise.

The Company, organized as a corporation in 1962, consists of three operating units that manufacture and sell oilfield services equipment (previously referred to as the ��geophysical equipment” segment): Bolt Technology Corporation (“Bolt”), A-G Geophysical Products, Inc. (“A-G”) and Real Time Systems Inc. (“RTS”). Bolt develops, manufactures and sells marine seismic energy sources (air guns) and replacement parts; A-G develops, manufactures and sells underwater cables, connectors, hydrophones and seismic source monitoring systems; and RTS develops, manufactures and sells air gun controllers/synchronizers, data loggers and auxiliary equipment.

In May 2008, the Company sold substantially all of the assets of its wholly-owned subsidiary, Custom Products Corporation (“Custom”), for $5,250,000, subject to adjustments for certain liabilities. Custom, a developer, manufacturer and seller of miniature industrial clutches and brakes and seller of sub-fractional horsepower electrical motors, formerly constituted the Company’s “industrial products” segment. As a result of this sale, amounts related to Custom have been reported as discontinued operations in fiscal year 2008. All prior fiscal year information relating to Custom has been restated as discontinued operations, and all information reported or discussed in this Form 10-K reflects the treatment of Custom as discontinued operations. The Company now operates only in oilfield services.

The Company’s products are mostly used in offshore marine seismic surveys, and sales of the Company’s products are generally related to the level of worldwide oil and gas exploration and development activity, which is dependent, primarily, on oil and gas prices. The recent high price of oil, increased worldwide energy demand and the depletion of proven oil and natural gas reserves have contributed to an increased demand for marine seismic surveys.

The Company provides critical products to the marine seismic exploration industry. Marine seismic exploration typically involves sophisticated ocean-going vessels deployed by large, multi-national firms to acquire data about the geological formations under the ocean bed. The industry standard to acquire such data is to use an energy source to create acoustic waves that penetrate the ocean bed, capture the waves as they reflect back to the ocean surface, transmit data to the seismic vessel and then, using sophisticated computer models, create a picture of the structures under the ocean bed. The picture is interpreted by geoscientists to identify subsurface formations conducive to the retention of hydrocarbons. The Company’s products provide the energy source (marine air gun), underwater cables, connectors and hydrophones as well as the controller that monitors the performance of the energy source. The following discussion contains more information on the Company’s products.

Marine Air Guns

Energy sources, such as our air guns, used in seismic exploration create acoustic waves at frequencies that readily travel to great depths in the earth. As acoustic waves travel through the earth, portions are reflected by variations in the underlying rock layers and the reflected energy is received as signals by devices known as hydrophones. A shipboard unit containing electronic recording equipment converts the signals to digital form. By using computer programs with complex calculations to manipulate the processed seismic data, geoscientists can model and visualize the subsurface through the creation and analysis of spatial representations. The analysis of seismic and other geological data is an important factor in decisions to drill exploratory and development wells. Because of the significant expense associated with drilling oil and gas wells, decisions on whether or where to drill are critical to the overall process. A seismic exploration vessel may tow as many as 96 air guns along with multiple hydrophone streamers of up to approximately 6.2 miles in length. The air guns are fired simultaneously every 75 to 150 feet along the survey line.

2

Improvements in drilling success rates through the use of advanced seismic survey techniques, particularly 3-D techniques, have substantially increased the demand for seismic data. As a result, 3-D surveys utilizing these advanced technologies have gained increasing acceptance in the oil and gas industry as an exploration risk management tool and in field development and reservoir management activities. The precise shot to shot repeatability of our marine air guns and their reliability of operation make them especially useful in 3-D surveys.

The Company sells two types of air guns: “long-life” marine air guns and Annular Port Air Guns (“APG gun”). The long-life marine air gun is made to maximize the period between routine air gun maintenance and to provide characteristics that are advantageous to geoscientists in designing 3-D surveys. The APG gun is designed to maximize operating efficiency and acoustic output through a configuration that permits the implementation of simplified multi-gun arrays. These arrays produce less towing drag and provide ease of deployment and shielding of fragile hoses and cables from the high pressure air blasts released by the air gun. The selling prices are approximately $13,000 and $31,000 for the long-life marine air gun and APG gun, respectively.

After-market revenue from the sale of air gun replacement parts is a significant source of the Company’s revenue.

Underwater Cables, Connectors and Hydrophones

The Company’s marine cables and connectors are injection molded of thermoplastic polyurethane designed for use with marine air gun firing lines, bulkhead connectors and other underwater connectors required in seismic vessel operations. The Company’s signature hydrophones and pressure transducers are designed for use with marine air guns in a high shock environment. The purpose of the hydrophone and pressure transducer is for “near field” measurements of the outgoing energy waveforms from air guns and pressure monitoring.

The Company’s cables and connectors, hydrophones and pressure transducers are used with marine air guns manufactured by the Company as well as air guns manufactured by others.

Marine Air Gun Controllers and Synchronizers

In July 2007, the Company acquired substantially all of the net assets of RTS. RTS develops, manufactures and sells controllers and synchronizers for marine seismic energy sources (air guns). RTS products are designed to control and synchronize up to 96 air guns in a single seismic exploration vessel. The results of operations of RTS have been included in our financial statements from July 1, 2007. See Note 2 to Consolidated Financial Statements for further information concerning the RTS acquisition.

The Company’s marine air gun controllers and synchronizers are used with marine air guns manufactured by the Company as well as air guns manufactured by others.

Long-Lived Assets

Long-lived assets consist of: property, plant and equipment; goodwill; other intangible assets and other non-current assets. All of the Company’s long-lived assets are located in the United States. As of June 30, 2008 and 2007, the Company’s long-lived assets totaled $16,342,000 and $10,957,000, respectively.

Foreign Sales

During fiscal years 2008, 2007 and 2006, approximately 80%, 78% and 78%, respectively, of the Company’s sales were from shipments to customers outside the United States or to foreign locations of United States customers. See Note 13 to the Consolidated Financial Statements for information regarding the geographic distribution of sales.

3

Backlog

Because of the relatively short period (generally less than 60 days) between order and shipment dates for our products, the dollar amount of current backlog is not considered to be a reliable indicator of future sales.

Competition

Our marine air guns compete primarily with marine air guns manufactured by ION Geophysical Corporation and Sercel Inc., a subsidiary of Compagnie Generale de Geophysique-Veritas. The Company’s principal competitor for connectors and cables is ION Geophysical Corporation, and the principal competitor for air gun controllers and synchronizers is Seamap, a division of Mitcham Industries, Inc. We believe that technology, product reliability and durability are the primary bases of competition in the market for our products and that the remaining competitive factors in the industry are field product support and price. The Company also believes that it can compete effectively with respect to each of these factors, although there can be no assurance that the sales of our products will not be adversely affected if current competitors or others introduce equipment with better performance or product support or lower price.

Marketing

The Company’s principal customers are worldwide marine seismic exploration contractors, who operate seismic vessels for collection of seismic data in accordance with their customers’ specifications or for their own seismic data libraries, and foreign national oil and gas companies.

Marketing of our products is principally performed by salaried sales personnel, all of whom are based in the United States. We also use sales agents for individual sales in certain foreign countries. In general, we market our products and services through our sales force, together with our technical services and engineering staffs, primarily to representatives of major geophysical contractors. The principal marketing techniques used are direct sales visits to current and potential customers, product demonstrations and participation at industry trade shows and meetings.

In general, products are sold on standard 30-day credit terms. In certain instances, we require our customers to furnish letters of credit payable upon shipment or provide advance payments. In limited cases, the Company allows customers extended payment terms of up to 12 months. We consider these practices to be consistent with industry practice.

Research and Development

Our ability to compete successfully depends upon, among other things, the development of new products as well as the improvement of our existing products. During fiscal years 2008, 2007 and 2006, we spent $272,000, $270,000 and $289,000, respectively, to develop new products and to improve existing products.

Employees

As of June 30, 2008, we employed 132 people on a full-time basis, all of whom are employed in the United States. The Company is not a party to any collective bargaining agreement and has had no work stoppages. The Company believes that relations with employees are good.

Manufacturing and Raw Materials

The Company manufactures and assembles its products in Norwalk, Connecticut, Cypress, Texas and Fredericksburg, Texas. Our manufacturing and assembly operations consist of machining or molding the necessary components and assembling and testing the final product. We generally maintain adequate levels of

4

inventory to enable us to satisfy customer requirements within a short period of time. The raw materials used in our products, sourced from multiple suppliers, are generally in adequate supply. The costs of certain raw materials, especially the high quality steel required for the Company’s air guns, have increased. The Company monitors its costs and may pass cost increases on to its customers, when necessary.

For some marine air gun orders, we occasionally supply auxiliary equipment such as compressors, winches or other equipment manufactured by others. We have not experienced any supply problems with respect to these auxiliary items. Because we manufacture based on customer orders, we do not generally maintain inventory of fully assembled finished products. We consider our practices to be consistent with industry standards.

Regulatory Matters

We believe that we are currently in compliance with the requirements of environmental and occupational health and safety laws and regulations. Compliance with such laws and regulations has not resulted in significant expense in the past, and we do not foresee the need for substantial expenditures to ensure compliance with such laws and regulations as they currently exist.

Intellectual Property

We seek to protect our intellectual property by means of patents, trademarks and other measures. We currently own 11 patents relating to the manufacture of our products, with expiration dates from 2010 to 2027. Most of these patents are United States patents. Patents have been of value in the growth of our business and may continue to be of value in the future. However, we believe that our business is not primarily dependent upon patent protection, and therefore the expiration of our patents would not have a material adverse effect on our business.

Major Customers

Historically, a significant portion of our sales has been attributable to a small number of customers. The table set forth below indicates the customers accounting for 10% or more of consolidated sales in fiscal 2008 and 2007.

| | | | | | |

| | | Fiscal 2008 | | | Fiscal 2007 | |

Compagnie Generale de Geophysique-Veritas | | 17 | % | | 19 | % |

Schlumberger Limited | | 15 | % | | 10 | % |

Petroleum Geo-Services | | 10 | % | | 8 | % |

Wavefield Inseis | | 7 | % | | 10 | % |

SeaBird Exploration | | 6 | % | | 11 | % |

The loss of any of the above customers or a significant decrease in the amount of their purchases could have a material adverse effect on the Company.

Available Information

The Company maintains an internet website at the following address:www.bolt-technology.com. We make available, free of charge, through our website our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). These reports and amendments to such reports and our other SEC filings are also available on the website maintained by the SEC at www.sec.gov. Alternatively, you may read and copy any materials we file with the SEC at the SEC’s Public Reference Room in Washington, D.C. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

5

An investment in our Common Stock involves various risks. Set forth below are the risks that we believe are material to our investors. When considering an investment in our Common Stock, you should consider carefully all of the risk factors described below, as well as other information included and incorporated by reference in this report. The risks described below could materially and adversely affect our business, financial condition and results of operations and the actual outcome of matters as to which forward-looking statements are made in this report. The risk factors described below are not the only ones we face. Our business, financial condition and results of operations may also be affected by additional factors that are not currently known to us or that we currently consider immaterial or that are not specific to us, such as general economic conditions.

You should refer to the explanation of the qualifications and limitations on forward-looking statements on page 1 of this report. All forward-looking statements made by us are qualified by the risk factors described below.

Industry Related Risks

Technological change in the seismic industry may require us to make substantial research and development expenditures and may render our technology obsolete.

The market for our products is characterized by changing technology and new product introductions. Our air gun technology may become obsolete due to the introduction of a superior technology. We may be required to invest substantial capital to develop and produce successfully and timely new and enhanced products to stay abreast of technological change. We have no assurance that we will receive an adequate rate of return on such investment. If we are unable to stay abreast of technological change, we will be unable to compete in the future. If we are not competitive, our business, our results of operations and financial condition will be materially and adversely affected.

Volatility of oil and natural gas prices, which is affected by factors outside of our control, affects demand for our products.

Sales of our products correlate highly with oil and natural gas price trends, which are typically cyclical. If oil and natural gas prices are high, as is currently the case, marine seismic activity increases. This increases demand for our products. If oil and natural gas prices are low, the level of marine seismic activity decreases. This decreases demand for our products. In extreme cases, when oil and natural gas prices are significantly lower, older seismic vessels may be decommissioned and our equipment on those ships may be removed and put into storage for future use. Under such a scenario, our revenues could further decrease while our customers deplete stored inventories prior to placing new orders. Accordingly, a decrease in oil and natural gas prices could decrease our customers’ activity and decrease demand for our products. Any decrease in demand for our products could have a material adverse effect on our results of operations and financial condition.

Oil and gas prices are typically cyclical and affected by many factors. These include:

| | • | | the level of worldwide oil and gas production and exploration activity |

| | • | | worldwide economic conditions and their effect on worldwide demand for energy |

| | • | | the policies of the Organization of Petroleum Exporting Countries |

| | • | | the cost of producing oil and gas |

| | • | | interest rates and the cost of capital |

| | • | | technological advances affecting hydrocarbon consumption |

| | • | | environmental regulation |

| | • | | level of oil and gas inventories |

6

| | • | | weather-related factors that may disrupt oil and gas exploration |

| | • | | policies of national governments |

| | • | | war, civil disturbances and political instability. |

We expect prices for oil and natural gas to continue to be volatile due to circumstances outside of our control and to continue to affect our customers’ level of activity and the demand for our products.

Company Specific Risks

Loss of any major customer or consolidation among major customers could materially and adversely impact our results of operations and financial condition.

We have a concentration of business with a small number of major customers who are independent contractors performing marine seismic surveys on behalf of major oil companies. Sales to these major customers are significant in relation to our consolidated revenues. In addition, a large percentage of our consolidated accounts receivable balance at the end of any accounting period is from these customers. The loss of any major customer could have a material and adverse impact on our results of operations and financial condition. This risk would increase if consolidation of oil service companies continues. Additional information relating to concentration of business with a small number of major customers is provided in Note 13 to the Consolidated Financial Statements and in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We derive a significant amount of our revenues from foreign sales, which pose additional risks, including economic, political and other uncertainties.

Our foreign sales are significant in relation to consolidated sales. In fiscal 2008, sales outside of the United States accounted for approximately 80% of our consolidated net sales. We believe that export sales will remain a significant percentage of our revenue. Our sales contracts are denominated in U.S. dollars. Fluctuations in foreign exchange rates could make it more difficult for our overseas customers to meet their U.S. dollar obligations. In addition, sales of our products to customers operating in foreign countries that experience political/economic instability or armed conflict could result in difficulties in delivering and installing complete energy source systems within those geographic areas and receiving payment from these customers. These factors could materially adversely affect our results of operations and financial condition. Refer to Note 13 to Consolidated Financial Statements for additional information relating to foreign sales.

We experience fluctuations in operating results.

Complete air gun systems sales, which typically are large dollar amounts, do not occur in every accounting period. In certain periods, several complete air gun system sales may be recorded, and none in other periods. This “uneven” sales pattern is due largely to our customers’ schedules for the anticipated completion date for building a new seismic vessel or the target date for outfitting a conventional vessel to do seismic work. Customer demand for air gun replacement parts, underwater electrical connectors and cables and air gun controllers is ongoing, but the demand level for these products varies based on oil and gas prices and trends. Accordingly, our results of operations can vary significantly from one fiscal quarter to another and from one fiscal year to another. This may cause volatility in the price of the Company’s Common Stock.

An impairment of goodwill could reduce our earnings and stockholders’ equity.

Our consolidated goodwill balance at June 30, 2008 accounts for 17% of consolidated assets at that date. Goodwill is recorded when the purchase price of a business exceeds the fair market value of the tangible and separately measurable intangible net assets of the business. Our goodwill balance relates exclusively to the acquisition of subsidiaries. Generally accepted accounting principles require us to test goodwill for impairment

7

on an annual basis or when events or circumstances occur indicating that goodwill might be impaired. If we were to determine that any of our remaining balance of goodwill was impaired, we would record an immediate non-cash charge to earnings with a corresponding reduction in goodwill. Refer to Notes 1, 2 and 4 to the Consolidated Financial Statements for additional information relating to goodwill.

Weak sales demand or obsolescence of our inventory may require an increase to our inventory valuation reserve.

A significant source of our revenue arises from the sale of replacement parts required by customers who have previously purchased our products. As a result, we maintain a large quantity of parts on hand that may not be sold or used in final assemblies for a lengthy period of time. Management has established an inventory valuation reserve to recognize that certain inventory may become obsolete or supplies may be excessive. The inventory valuation reserve is a significant estimate made by management. The actual results may differ from this estimate, and the difference could be material. The inventory valuation reserve is adjusted at the close of each accounting period, based on management’s estimate of the valuation reserve required. This estimate is calculated on a consistent basis as determined by our inventory valuation policy. Increases to the inventory valuation reserve result in a charge to cost of sales, and decreases to the reserve result in a credit to cost of sales. The inventory valuation reserve is also decreased to reflect scrapped or disposed of items. Weak sales demand or obsolescence may require an increase to the inventory valuation reserve, and such an increase may have a material and adverse impact on our results of operations with a corresponding decrease to inventory. Refer to Notes 1 and 6 to the Consolidated Financial Statements for additional information relating to the inventory valuation reserve.

We may be unable to obtain broad intellectual property protection for our current and future products, which could result in loss of revenue and any competitive advantage we hold.

Certain of the proprietary technologies used in our products are not patent protected. We rely on a combination of patents, common laws, trade secrets, confidentiality procedures and contractual provisions to protect our proprietary technologies. Our competitors may attempt to copy aspects of our products despite our efforts to protect our proprietary rights, or may design around the proprietary features of our products. Policing unauthorized use of our proprietary rights is difficult, and we are unable to determine the extent to which such use occurs. Also, the laws of certain foreign countries do not offer as much protection for proprietary rights as the laws of the United States. Further, obtaining, maintaining or defending intellectual property rights in many countries is costly. The costs of pursuing any intellectual property claim against a third party, whether in the United States or in a foreign country, could be significant.

From time to time third parties may claim that we have infringed upon their intellectual property rights. Any such claims, with or without merit, could be time consuming, result in costly litigation and possible injunctions, require product modifications, cause product shipment delays or require us to enter into royalty or licensing arrangements. Such claims could have a material adverse effect on our results of operations and financial condition.

The loss of any member of our senior management and other key employees may adversely affect our results of operations.

Our success depends heavily on the continued services of our senior management and other key employees. Our senior management consists of a small number of individuals relative to larger companies. These individuals, as well as other key employees, possess sales and marketing, engineering, manufacturing, financial and administrative skills that are critical to the operation of our business. We generally do not have employment or non-competition agreements with members of our senior management or other key employees, except for employment agreements with our Chief Executive Officer and each subsidiary president. There is no assurance that any of our senior management or other key personnel will continue in such capacity for any particular period

8

of time. If we lose the services of one or more of our senior management or other key employees, our operations may be materially adversely affected. We maintain life insurance policies for certain key employees of our subsidiaries with the Company as beneficiary.

Provisions in our certificate of incorporation and bylaws could discourage a takeover attempt, which may reduce or eliminate the likelihood of a change of control transaction and, therefore, the ability of our stockholders to sell their shares for a premium.

Our certificate of incorporation and bylaws contain certain provisions that could have the effect of delaying or preventing a third party from obtaining control of our Company. These provisions may reduce or eliminate our stockholders’ ability to sell their shares of Common Stock at a premium. They include a classified board, regulation of the nomination and election of directors, limiting who may call special stockholder meetings and requiring the vote of the holders of 95% of all shares of our stock to authorize certain business combinations.

Because we have no plans to pay any dividends for the foreseeable future, investors must look solely to stock appreciation for a return on their investment in us.

We have not paid cash dividends on our Common Stock since 1985 and do not anticipate paying any cash dividends in the foreseeable future. We currently intend to retain any future earnings to support our operations and growth, including any possible acquisition(s). Any payment of cash dividends in the future will be dependent on the amount of funds legally available, our earnings, financial condition, capital requirements and other factors that our board of directors may deem relevant. Accordingly, investors must rely on sales of their Common Stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not purchase our Common Stock.

The market price of our Common Stock may be volatile.

The market price of our Common Stock has experienced significant fluctuations and may continue to fluctuate significantly in the future. Many factors cause the market price of our Common Stock to fluctuate, including, but not limited to (i) the volume of trading in our Common Stock and (ii) sales of our Common Stock by large institutional investors and others. These market fluctuations may adversely affect the market price of our Common Stock.

| ITEM 1B. | Unresolved Staff Comments |

None.

The following table sets forth certain information with respect to the Company’s principal properties, all of which are leased, except for the Cypress, Texas facility, which is owned.

| | | | | | |

Location | | Nature of Property | | Approximate

Area (Sq. Feet) | | Expiration Date of

Lease |

Norwalk, Connecticut | | Manufacturing | | 21,600 | | 2013 |

Norwalk, Connecticut | | Administration/Engineering/Sales | | 6,600 | | 2013 |

Houston, Texas | | Sales Office | | 150 | | 2009 |

Fredericksburg, Texas | | Administration/Manufacturing | | 4,000 | | (1) |

Cypress, Texas | | Administration/Manufacturing | | 32,500 | | (2) |

| (1) | The Fredericksburg, Texas lease is on a month-to-month basis. Refer to “Contractual Obligations” in Management’s Discussion and Analysis of Financial Condition and Results of Operations for information relating to relocation to new leased premises in Fredericksburg, Texas. |

| (2) | The Cypress, Texas facility is owned by the Company. |

9

The Company’s products are manufactured and assembled at the Norwalk, Connecticut, Cypress, Texas and Fredericksburg, Texas facilities. In the opinion of the Company’s management, the properties described above are in good condition and repair and are suitable and adequate for the Company’s purposes. The properties are currently fully utilized and, operating in conjunction with second shifts, overtime and strategic outsourcing, provide sufficient productive capacity.

The Company is not aware of any material pending litigation or proceedings to which it or any of its subsidiaries are a party or to which any of its properties are subject.

| ITEM 4. | Submission of Matters to a Vote of Security Holders |

None.

Executive Officers of Bolt Technology Corporation

Set forth below is information with respect to the executive officers of the Company relating to age, as of September 12, 2008, and business experience. With the exception of Mr. Andrews, all of the positions have been held for at least five years.

Prior to joining the Company in September 2007, Mr. Andrews was employed for a total of 13 years by Pitney Bowes Inc., from 1989 to 1999 and from 2005 to 2007. Mr. Andrews served in various capacities within Pitney Bowes Inc., including serving as Director, Finance-Latin America and US Dealer Channels and Director of Compliance and Controls-Finance Shared Services. During 2004, Mr. Andrews was engaged as a consultant. From 1999 to 2003, Mr. Andrews served as a principal at a residential construction and development company.

| | | | |

Name | | Age | | Present Position |

Raymond M. Soto | | 69 | | Chairman, President, Chief Executive Officer and Director |

| | |

Joseph Espeso | | 66 | | Senior Vice President-Finance, Chief Financial Officer, Assistant Secretary and Director |

| | |

Joseph Mayerick, Jr. | | 66 | | Senior Vice President-Marketing, Assistant Secretary and Director |

| | |

William C. Andrews | | 48 | | Vice President-Administration and Compliance and Secretary |

10

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

On November 20, 2007, the Company’s Board of Directors approved a 3-for-2 stock split. The additional shares resulting from the stock split were distributed on January 30, 2008 to shareholders of record on January 16, 2008. Share and per share amounts reflected throughout the Consolidated Financial Statements and notes thereto and elsewhere in this Annual Report on Form 10-K have been restated to reflect the stock split.

In January 2008, the Company’s Common Stock began trading on the NASDAQ Global Select Market under the symbol “BOLT”. Prior to the change, the Company’s Common Stock was listed on the American Stock Exchange under the symbol “BTJ.” The following table sets forth the high and low sales prices for our Common Stock for the quarters indicated:

| | | | | | |

Fiscal 2008 | | High | | Low |

First Quarter | | $ | 39.57 | | $ | 20.67 |

Second Quarter | | | 32.83 | | | 21.77 |

Third Quarter | | | 28.93 | | | 14.67 |

Fourth Quarter | | | 25.22 | | | 17.50 |

| | |

Fiscal 2007 | | High | | Low |

First Quarter | | $ | 13.85 | | $ | 7.47 |

Second Quarter | | | 15.90 | | | 7.33 |

Third Quarter | | | 23.57 | | | 10.67 |

Fourth Quarter | | | 30.83 | | | 20.70 |

The number of stockholders of record at August 29, 2008 was 190. We believe that the number of beneficial owners is substantially greater than the number of record holders, because a large portion of our Common Stock is held of record in broker “street names.”

We have not paid a dividend since 1985. We do not intend to pay cash dividends on our Common Stock in the foreseeable future. Any decision to pay cash dividends will depend upon our growth, profitability, financial condition and other factors that the Board of Directors may deem relevant.

The Company did not make any repurchases of the Company’s equity securities during fiscal 2008.

Equity Compensation Plan Information

The following table sets forth aggregate information for the Bolt Technology Corporation 2006 Amended and Restated Stock Option and Restricted Stock Plan (the “Plan”), which was approved by the Company’s stockholders and is the Company’s only equity compensation plan in effect as of June 30, 2008:

| | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights (a) | | Weighted-average exercise

price of outstanding options,

warrants and rights (b) | | Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities reflected

in column (a)) (c) (1) |

Equity compensation plans approved by security holders | | 108,000 | | $ | 19.74 | | 605,250 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

Total | | 108,000 | | $ | 19.74 | | 605,250 |

| (1) | The Plan provides that of the 750,000 shares of Common Stock that may be used for grants of stock options and restricted stock awards, up to 225,000 shares of Common Stock may be used for restricted stock awards. During fiscal 2008, 36,750 shares of restricted stock were awarded at an average fair value of $18.67 at date of grant. As of June 30, 2008, 188,250 shares of Common Stock remained available for issuance of restricted stock awards under the Plan. |

11

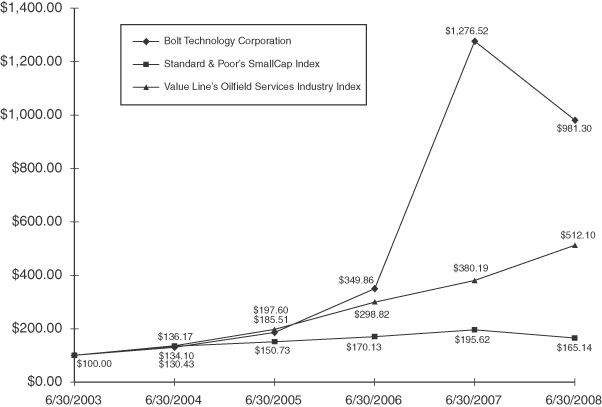

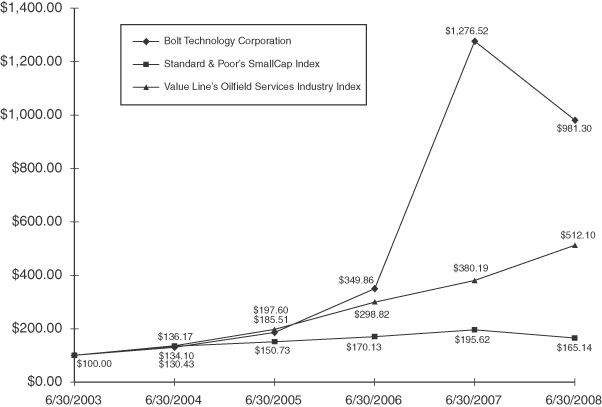

Performance Graph

The following graph and table compare total stockholder return on our Common Stock for the five-year period ending June 30, 2008, with the Standard & Poor’s SmallCap Index and Value Line’s Oilfield Services Industry Index over the same period. This comparison assumes the investment of $100 on June 30, 2003. The information in the graph is being furnished pursuant to Securities and Exchange Commission rules, and the stockholder return set forth is not intended to forecast and is not necessarily indicative of possible future performance.

Comparison of Five-Year Cumulative Total Return

Bolt Technology Corporation, Standard & Poor’s SmallCap Index and Value Line’s

Oilfield Services Industry Index

(Performance Results Through 6/30/2008)

Assumes $100 invested at the close of trading on June 30, 2003 in Bolt Technology Corporation Common Stock, Standard & Poor’s SmallCap Index and Value Line’s Oilfield Services Industry Index.

| | | | | | | | | | | | | | | | | | |

| | | June 30, |

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 |

Bolt Technology Corporation | | $ | 100.00 | | $ | 130.43 | | $ | 185.51 | | $ | 349.86 | | $ | 1,276.52 | | $ | 981.30 |

Standard & Poor’s SmallCap Index | | | 100.00 | | | 134.10 | | | 150.73 | | | 170.13 | | | 195.62 | | | 165.14 |

Value Line’s Oilfield Services Industry Index | | | 100.00 | | | 136.17 | | | 197.60 | | | 298.82 | | | 380.19 | | | 512.10 |

The information included under the caption “Performance Graph” shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

12

| ITEM 6. | Selected Financial Data |

The following table has been derived from the Company’s audited financial statements and sets forth selected consolidated financial data with respect to the Company and its subsidiaries. This information should be read in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements and accompanying notes provided elsewhere in this Form 10-K. This information differs from amounts previously reported on Form 10-K filings for the years ended June 30, 2004 through June 30, 2007 as a result of restatements attributable to the sale of Custom Products Corporation (see Note 3 to Consolidated Financial Statements) and the 3-for-2 stock split to shareholders of record on January 16, 2008 (see Note 1 to Consolidated Financial Statements).

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended June 30, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

(In thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Sales | | $ | 61,635 | | | $ | 46,929 | | | $ | 29,393 | | | $ | 15,551 | | | $ | 11,743 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

Cost of sales | | | 33,164 | | | | 25,347 | | | | 17,226 | | | | 9,148 | | | | 7,419 | |

Research and development | | | 272 | | | | 270 | | | | 289 | | | | 271 | | | | 208 | |

Selling, general and administrative | | | 8,228 | | | | 6,766 | | | | 5,254 | | | | 4,276 | | | | 3,356 | |

Interest income | | | (191 | ) | | | (211 | ) | | | (135 | ) | | | (47 | ) | | | (15 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | 41,473 | | | | 32,172 | | | | 22,634 | | | | 13,648 | | | | 10,968 | |

| | | | | | | | | | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 20,162 | | | | 14,757 | | | | 6,759 | | | | 1,903 | | | | 775 | |

Provision for income taxes | | | 6,453 | | | | 4,758 | | | | 2,352 | | | | 640 | | | | 270 | |

| | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 13,709 | | | | 9,999 | | | | 4,407 | | | | 1,263 | | | | 505 | |

Discontinued operations, net of taxes | | | 860 | | | | 608 | | | | 438 | | | | 396 | | | | 348 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 14,569 | | | $ | 10,607 | | | $ | 4,845 | | | $ | 1,659 | | | $ | 853 | |

| | | | | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Earnings per share—basic | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 1.60 | | | $ | 1.19 | | | $ | 0.54 | | | $ | 0.15 | | | $ | 0.06 | |

Discontinued operations, net of taxes | | | 0.10 | | | | 0.07 | | | | 0.05 | | | | 0.05 | | | | 0.05 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1.70 | | | $ | 1.26 | | | $ | 0.59 | | | $ | 0.20 | | | $ | 0.11 | |

| | | | | | | | | | | | | | | | | | | | |

Earnings per share—diluted | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | $ | 1.60 | | | $ | 1.17 | | | $ | 0.52 | | | $ | 0.15 | | | $ | 0.06 | |

Discontinued operations, net of taxes | | | 0.10 | | | | 0.07 | | | | 0.05 | | | | 0.05 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1.70 | | | $ | 1.24 | | | $ | 0.57 | | | $ | 0.20 | | | $ | 0.10 | |

| | | | | | | | | | | | | | | | | | | | |

Average number of common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 8,581 | | | | 8,416 | | | | 8,196 | | | | 8,128 | | | | 8,122 | |

Diluted | | | 8,587 | | | | 8,524 | | | | 8,446 | | | | 8,300 | | | | 8,233 | |

| | | | | |

Cash dividends | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | |

Financial data at June 30: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 39,175 | | | $ | 26,932 | | | $ | 15,055 | | | $ | 10,450 | | | $ | 9,330 | |

Total assets | | | 61,867 | | | | 47,618 | | | | 34,717 | | | | 27,423 | | | | 22,918 | |

Long term debt | | | — | | | | — | | | | — | | | | — | | | | — | |

Stockholders’ equity | | | 55,517 | | | | 40,686 | | | | 28,332 | | | | 23,075 | | | | 21,392 | |

13

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following management’s discussion and analysis should be read together with the Consolidated Financial Statements and accompanying notes and other detailed information appearing elsewhere in this Form��10-K. This discussion includes forward-looking statements about the demand for our products and future results. Please refer to the “Note Regarding Forward-Looking Statements” section of this Form 10-K.

Overview

Sales of the Company’s products are generally related to the level of worldwide oil and gas exploration and development activity, which is dependent, primarily, on oil and gas prices. The recent high price of oil, increased worldwide energy demand and the depletion of proven oil and natural gas reserves have contributed to an increased demand for marine seismic surveys. As a result, the demand for the Company’s products is strong. The Company’s sales increased 31% in the fiscal year ended June 30, 2008 compared to the year ended June 30, 2007, aided by the acquisition, effective July 1, 2007, of Real Time Systems Inc., a developer, manufacturer and seller of air gun controllers/synchronizers (“RTS”). The Company believes that the oilfield services industry will continue to be strong during fiscal 2009 because of the continued imbalance between supply and demand for hydrocarbons, low reserve replacement rates and high commodity prices. The Company also anticipates continued use of more sophisticated technology, such as 4-D and wide-azimuth seismic exploration surveys. In particular, wide-azimuth surveys create a need for a larger seismic vessel fleet because such surveys require utilization of several vessels working in tandem.

Effective May 31, 2008, the Company sold substantially all of the assets of its wholly-owned subsidiary, Custom Products Corporation (“Custom”). Custom, a developer, manufacturer and seller of miniature industrial clutches and brakes and seller of sub-fractional horsepower electrical motors, formerly comprised the Company’s “industrial products” segment. Custom was the only unit in the industrial products segment. Therefore, due to the sale of Custom, the Company operates only in the oilfield services equipment business. In the Consolidated Financial Statements, amounts relating to Custom have been reported as discontinued operations in fiscal year 2008 and prior fiscal year information relating to Custom has been restated as discontinued operations. See Note 3 to Consolidated Financial Statements for further information concerning discontinued operations.

Primarily due to the increase in oilfield services equipment sales and secondarily due to the sale of Custom’s assets, as described above, the Company’s balance sheet continued to strengthen during fiscal 2008. Working capital at June 30, 2008 was $39.2 million compared to $26.9 million at June 30, 2007.

Liquidity and Capital Resources

As of June 30, 2008, the Company believes that current cash and cash equivalent balances are, and projected cash flow from operations in fiscal 2009 will be, adequate to meet foreseeable operating needs in fiscal 2009 as well as any possible earnout payments associated with the acquisition of RTS. See Note 2 to Consolidated Financial Statements for further information concerning the RTS acquisition.

In May 2007, the Company entered into a $4,000,000 unsecured revolving credit agreement with a bank to provide funds for general corporate purposes should the need arise. During fiscal 2008 and 2007, the Company did not borrow against this facility. See Note 15 to Consolidated Financial Statements for further information concerning the revolving credit agreement.

Year Ended June 30, 2008

At June 30, 2008, the Company had $19,137,000 in cash and cash equivalents compared to $9,988,000 at June 30, 2007.

In fiscal 2008, cash flow from continuing operating activities after changes in working capital items was $9,332,000, primarily due to net income adjusted for depreciation, deferred taxes and stock based

14

compensation expense and partially offset by higher inventories and lower current liabilities. In fiscal 2008, cash flow from discontinued operating activities after changes in working capital items was $846,000.

In fiscal 2008, the Company used $4,472,000, net of $147,000 of cash acquired, for the acquisition of RTS and $1,610,000 for capital expenditures relating to continuing operations. These capital expenditures relate primarily to new and replacement equipment and a small expansion of the Cypress, Texas manufacturing facility. In fiscal 2008, the Company used $73,000 for capital expenditures relating to discontinued operations and received net proceeds from the sale of discontinued operations of $5,078,000.

The Company anticipates that capital expenditures for fiscal 2009 will approximate $1,000,000, which will be funded from operating cash flow. These anticipated capital expenditures will relate primarily to new and replacement production machinery and leasehold improvements relating to a new leased manufacturing facility in Fredericksburg, Texas (refer to “Contractual Obligations” below for additional information regarding this facility).

Since a relatively small number of customers account for the majority of the Company’s sales, the consolidated accounts receivable balance at the end of any period tends to be concentrated in a small number of customers. At June 30, 2008 and June 30, 2007, the five customers with the highest accounts receivable balances represented, in the aggregate, 62% and 67%, respectively, of the consolidated accounts receivable balances on those dates.

Year Ended June 30, 2007

At June 30, 2007, the Company had $9,988,000 in cash and cash equivalents. This amount was $5,408,000 or 118% higher than the amount of cash and cash equivalents at June 30, 2006.

In fiscal 2007, cash flow from continuing operating activities after changes in working capital items was $3,871,000, primarily due to net income adjusted for depreciation and higher current liabilities partially offset by higher accounts receivable and inventories. In fiscal 2007, cash flow from discontinued operating activities after changes in working capital items was $795,000.

In fiscal 2007, the Company used $837,000 for capital expenditures relating to continuing operations for new and replacement equipment and $112,000 for capital expenditures relating to discontinued operations.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet financing arrangements.

Contractual Obligations

The Company had no long-term borrowings, capital leases, purchase obligations or other long-term liabilities at June 30, 2008 or 2007. The Company has an unsecured $4,000,000 revolving credit facility with a bank (see Note 15 to Consolidated Financial Statements for further information regarding this facility). During fiscal 2008 and 2007, there were no borrowings under this facility. The Company is obligated for minimum lease payments as of June 30, 2008 under several operating leases for its facilities as follows:

| | | | | | | | | | | | | | | |

| | | Total | | Payments Due by Period |

Contractual Obligations | | | Less than 1 year | | 1-3 years | | 3-5 years | | More than 5 years |

Operating Lease Obligations | | $ | 1,566,000 | | $ | 348,000 | | $ | 696,000 | | $ | 522,000 | | $ | — |

Such amounts are exclusive of any “additional rent” for taxes, utilities or similar charges, under triple net leases. See Note 12 to Consolidated Financial Statements under “Lease Commitments” for further information regarding future payments and other information relating to such leases.

15

The Company will be relocating the RTS facility to new leased premises (approximately 7,000 square feet) in Fredericksburg, Texas under a five-year, triple net, operating lease. As of June 30, 2008, the Company had not yet finalized a lease with the lessor, which is an affiliate of the President and former owner of RTS. Capital expenditures to be incurred by the Company in fiscal 2009 relating to this facility are estimated to be $120,000.

Results of Operations

Year Ended June 30, 2008 Compared to Year Ended June 30, 2007

Consolidated sales for the year ended June 30, 2008 totaled $61,635,000, an increase of $14,706,000 or 31% from fiscal year 2007 primarily due to higher volume of sales of complete energy source systems, air gun replacement parts, underwater electrical connectors and cables, and effective July 1, 2007, sales of air gun controllers/synchronizers, data loggers and auxiliary equipment. Higher sales reflected continued strength in marine seismic activity and the acquired RTS business, which contributed sales of $5,465,000.

Consolidated gross profit as a percentage of consolidated sales was 46% for the year ended June 30, 2008, unchanged from the year ended June 30, 2007. The gross profit in fiscal 2008 was positively impacted by higher gross profit associated with the acquired RTS business, partially offset by lower gross profit associated with certain foreign sales, which included sales of auxiliary equipment purchased from outside vendors that normally have a lower margin than the Company’s proprietary products.

Research and development costs for the year ended June 30, 2008 increased by $2,000 or 1% from the year ended June 30, 2007. These expenditures were associated with work being done to improve the Company’s Annular Port Air Guns (“APG guns”) and Seismic Source Monitoring System (“SSMS”).

Selling, general and administrative (“SG&A”) expenses increased by $1,462,000 in fiscal year 2008 from fiscal year 2007 due primarily to the SG&A expenses of RTS ($661,000), additional personnel and salary increases ($341,000), bad debt expense ($201,000), stock based compensation expense ($158,000) and shareholder relations expenses ($80,000), partially offset by lower professional fees ($285,000) due primarily to lower Sarbanes-Oxley compliance costs.

The Company conducted an annual impairment test of goodwill balances as of July 1, 2008 and 2007. The results of these tests indicated that there was no impairment of the June 30, 2008 and 2007 goodwill balances.

The provision for income taxes for the year ended June 30, 2008 was $6,453,000, an effective tax rate of 32%. This rate was lower than the federal statutory rate of 35% due primarily to the tax benefit associated with the manufacturer’s deduction. The provision for income taxes for year ended June 30, 2007 was $4,758,000, an effective tax rate of 32%. This rate was lower than the federal statutory rate of 35%, primarily due to the tax benefits associated with export sales and the manufacturer’s deduction, partially offset by state income taxes.

The above mentioned factors resulted in income from continuing operations for the year ended June 30, 2008 of $13,709,000 compared to income from continuing operations of $9,999,000 for the year ended June 30, 2007.

Effective May 31, 2008, substantially all of the assets of Custom Products Corporation (“Custom”), a wholly owned subsidiary of Bolt, were sold for $5,250,000, subject to adjustments for certain liabilities. Custom, a developer, manufacturer and seller of miniature industrial clutches and brakes and seller of sub-fractional horsepower electrical motors, was formerly in the Company’s “industrial products” segment. Custom was the only unit in the industrial products segment; therefore, due to the sale of Custom, the Company now operates only in the oilfield services equipment business. In the Consolidated Financial Statements, reported amounts relating to Custom have been reported as discontinued operations. During the year ended June 30, 2008, the Company recorded as discontinued operations the operating results of Custom for the eleven-month period ending May 31, 2008 of $575,000, net of income taxes, and a gain on the sale of the assets of Custom of

16

$285,000, net of income taxes. In addition, prior year information relating to Custom was restated to report such information as discontinued operations. During the year ended June 30, 2007, income from discontinued operations was $608,000, net of income taxes. See the Consolidated Financial Statements and Note 3 to Consolidated Financial Statements for additional information concerning discontinued operations.

The above mentioned factors resulted in net income for the year ended June 30, 2008 of $14,569,000 compared to net income of $10,607,000 for the year ended June 30, 2007.

Year Ended June 30, 2007 Compared to Year Ended June 30, 2006

Consolidated sales for the year ended June 30, 2007 totaled $46,929,000, an increase of $17,536,000 or 60% from fiscal year 2006 primarily due to higher volume of sales of complete energy source systems, air gun replacement parts, underwater electrical connectors and cables and SSMS. Higher sales reflected continued strength in marine seismic activity.

Consolidated gross profit as a percentage of consolidated sales was 46% for the year ended June 30, 2007 versus 41% for the year ended June 30, 2006. The gross profit improvement was due to higher manufacturing efficiencies associated with the 60% increase in sales and higher pricing, partially offset by higher material and labor costs. In addition, the gross profit for the year ended June 30, 2006 was adversely affected by sales of auxiliary equipment purchased from third party suppliers. Third party auxiliary equipment had significantly lower margin than the Company’s proprietary products.

Research and development costs for the year ended June 30, 2007 decreased by $19,000 or 7% from the year ended June 30, 2006. These expenditures were associated with work being done to improve the Company’s APG guns and SSMS. The decrease was primarily due to lower spending for SSMS.

Selling, general and administrative expenses increased by $1,512,000 for the year ended June 30, 2007 from the year ended June 30, 2006 due primarily to higher professional fees ($713,000), compensation expense ($611,000) and freight out ($125,000). Higher professional fees were primarily due to the incremental expenses incurred to become compliant with Section 404 of the Sarbanes-Oxley Act of 2002. The increase in compensation expense primarily reflected higher incentive compensation, the addition of personnel and salary increases. Higher freight out reflects the 60% increase in consolidated sales.

The Company conducted an annual impairment test of goodwill balances as of July 1, 2007 and 2006. The results of these tests indicated that there was no impairment of the June 30, 2007 and 2006 goodwill balances.

The provision for income taxes for the year ended June 30, 2007 was $4,758,000, an effective tax rate of 32%. This rate was lower than the federal statutory rate of 35% due primarily to tax benefits associated with export sales and the manufacturer’s deduction, partially offset by state income taxes. The provision for income taxes for the year ended June 30, 2006 was $2,352,000, an effective tax rate of 35%. This rate was higher than the federal statutory rate of 34%, primarily due to state income taxes, partially offset by the tax benefits associated with export sales and the manufacturer’s deduction.

The above mentioned factors resulted in income from continuing operations for the year ended June 30, 2007 of $9,999,000 compared to income from continuing operations of $4,407,000 for the year ended June 30, 2006.

During the year ended June 30, 2007, income from discontinued operations was $608,000, net of income taxes, versus $438,000 for the year ended June 30, 2006. See the Consolidated Financial Statements and Note 3 to Consolidated Financial Statements for additional information concerning discontinued operations.

The above mentioned factors resulted in net income for the year ended June 30, 2007 of $10,607,000 compared to net income of $4,845,000 for the year ended June 30, 2006.

17

Critical Accounting Policies

The methods, estimates and judgments the Company uses in applying the accounting policies most critical to its financial statements have a significant impact on the results the Company reports in its financial statements. The Securities and Exchange Commission has defined the most critical accounting policies as the ones that are most important to the portrayal of the Company’s financial condition and results, and requires the Company to make its most difficult and subjective judgments.

Based on this definition, the Company’s most critical accounting policies include: revenue recognition, recording of inventory reserves, deferred taxes, and the potential impairment of goodwill. These policies are discussed below. The Company also has other key accounting policies, including the establishment of bad debt reserves. The Company believes that these other policies either do not generally require it to make estimates and judgments that are as difficult or as subjective, or are less likely to have a material impact on the Company’s reported results of operations for a given period.

Although the Company believes that its estimates and assumptions are reasonable, they are based upon information available at the end of each reporting period and involve inherent risks and uncertainties. Actual results may differ significantly from the Company’s estimates and its estimates could be different using different assumptions or conditions.

See Note 1 to Consolidated Financial Statements for additional information concerning significant accounting policies.

Revenue Recognition

The Company recognizes sales revenue when it is realized and earned. The Company’s reported sales revenue is based on meeting the following criteria: (1) manufacturing products based on customer specifications; (2) delivering product to the customer before the close of the reporting period, whereby delivery results in the transfer of ownership risk to the customer; (3) establishing a set sales price with the customer; (4) collecting the sales revenue from the customer is reasonably assured; and (5) no contingencies exist.

Inventory Reserves

A significant source of the Company’s revenue arises from the sale of replacement parts required by customers who have previously purchased products. As a result, the Company maintains a large quantity of parts on hand that may not be sold or used in final assemblies for an extended period of time. In order to recognize that certain inventory may become obsolete or that the Company may have supplies in excess of reasonably supportable sales forecasts, an inventory valuation reserve has been established. The inventory valuation reserve is a significant estimate made by management. Actual results may differ from this estimate, and the difference could be material.

Management establishes the inventory valuation reserve by reviewing the inventory for items that should be reserved in full based on a lack of usage for a specified period of time and for which future demand is not forecasted and establishes an additional reserve for slow moving inventory based on varying percentages of the cost of the items. The reserve for inventory valuation at June 30, 2008 and 2007 was $406,000 and $524,000, respectively. At June 30, 2008 and 2007, approximately $1,247,000 and $1,401,000, respectively, of the raw materials and sub-assemblies inventory were considered slow moving and subject to a reserve provision equal to all or a portion of the cost, less an estimate for scrap value. In certain instances, this inventory has been unsold for more than five years from date of manufacture or purchase, and in other instances the Company has more than a five-year supply of inventory on hand based on recent sales volume. At June 30, 2008, the cost of inventory for which the Company has more than a five-year supply on hand and the cost of inventory for which the Company has had no sales during the last five years amounted to approximately $780,000. Management

18

believes that this inventory is properly valued and appropriately reserved. Even if management’s estimate were incorrect, that would not result in a cash outlay since the cash required to manufacture or purchase the older inventory was expended in prior years.

The inventory valuation reserve is adjusted at the close of each accounting period, as necessary, based on management’s estimate of the valuation reserve required. This estimate is calculated on a consistent basis as determined by the Company’s inventory valuation policy. Increases to the inventory valuation reserve result in a charge to cost of sales, and decreases to the reserve result in a credit to cost of sales. The inventory valuation reserve is also decreased when items are scrapped or disposed of. During the fiscal year ended June 30, 2008, the inventory valuation reserve was decreased by $118,000, and the Company did not scrap or dispose of any items.

Deferred Taxes

The Company applies an asset and liability approach to accounting for income taxes. Deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect for the years in which the differences are expected to reverse. The recoverability of deferred tax assets is dependent upon the Company’s assessment of whether it is more likely than not that sufficient future taxable income will be generated in the relevant tax jurisdiction to utilize the deferred tax asset. The Company reviews its internal forecasted sales and pre-tax earnings estimates to make its assessment about the utilization of deferred tax assets. In the event the Company determines that future taxable income will not be sufficient to utilize the deferred tax asset, a valuation allowance is recorded. If that assessment changes, a charge or a benefit would be recorded in the consolidated statement of income. The Company has concluded that no deferred tax valuation allowance was necessary at June 30, 2008 and June 30, 2007 because future taxable income is believed to be sufficient to utilize any deferred tax asset.

Goodwill Impairment Testing

As required by SFAS No. 142, “Goodwill and Other Intangible Assets,” the Company reviews goodwill for impairment annually or more frequently if impairment indicators arise. Management tested goodwill for impairment as of July 1, 2008 and 2007 and the tests indicated no impairment of the goodwill balances at June 30, 2008 and 2007.

Goodwill represents approximately 17% of the Company’s total assets at June 30, 2008 and is thus a significant estimate by management. Even if management’s estimate were incorrect, it would not result in a cash outlay because the goodwill amounts arose out of acquisition accounting. See Notes 1, 2 and 4 to Consolidated Financial Statements for additional information concerning goodwill.

Recent Accounting Developments

Business Combinations

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 141 (revised 2007), “Business Combinations” (“SFAS 141(R)”), which is a revision of SFAS 141. SFAS 141(R) continues to require the purchase method of accounting for business combinations and the identification and recognition of intangible assets separately from goodwill. SFAS 141(R) requires, among other things, the buyer to: (1) fair value assets and liabilities acquired as of the acquisition date (i.e., a “fair value” model rather than a “cost allocation” model); (2) expense acquisition-related costs; (3) recognize assets or liabilities assumed arising from contractual contingencies at acquisition date using acquisition-date fair values; (4) recognize goodwill as the excess of the consideration transferred plus the fair value of any noncontrolling interest over the acquisition-date fair value of net assets acquired; (5) recognize at acquisition any contingent consideration using acquisition-date fair values (i.e., fair value earn-outs in the initial accounting for the acquisition); and (6) eliminate the recognition of liabilities for restructuring costs expected to be incurred as a result of the business combination. SFAS 141(R) also defines a “bargain” purchase as a business

19

combination where the total acquisition-date fair value of the identifiable net assets acquired exceeds the fair value of the consideration transferred plus the fair value of any noncontrolling interest. Under this circumstance, the buyer is required to recognize such excess (formerly referred to as “negative goodwill”) in earnings as a gain. In addition, if the buyer determines that some or all of its previously booked deferred tax valuation allowance is no longer needed as a result of the business combination, SFAS 141(R) requires that the reduction or elimination of the valuation allowance be accounted as a reduction of income tax expense. SFAS 141(R) is effective for fiscal years beginning on or after December 15, 2008. The Company will apply SFAS 141(R) to any acquisitions that are made on or after July 1, 2009.

The Fair Value Option for Financial Assets and Financial Liabilities Including an Amendment of FASB Statement No. 115

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities Including an Amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 permits companies to measure many financial instruments and certain other items at fair value. SFAS 159 is effective as of the beginning of the Company’s first fiscal year that begins after November 15, 2007. The Company believes that SFAS 159 will not have an impact on the Company’s consolidated financial statements.

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”), which establishes a framework for measuring fair value under generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS 157 does not require new fair value measurements. The purpose of SFAS 157 is to provide a single definition of fair value and to provide additional guidance relative to fair value measurements. The end result of SFAS 157 application will be consistency and comparability in fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007. The Company believes that it is unlikely that SFAS 157 will have any impact on the Company’s consolidated financial statements because the Company does not deal in transactions requiring complex fair value measurements.

| ITEM 7A. | Quantitative and Qualitative Disclosures about Market Risk |

None.

| ITEM 8. | Financial Statements and Supplementary Data |

The information required under this Item 8 is set forth on pages F-1 through F-23 of this Report.

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

None.

| ITEM 9A. | Controls and Procedures |

The chief executive officer and the chief financial officer, with the assistance of key employees throughout the Company, including its subsidiaries, evaluated the Company’s disclosure controls and procedures as of June 30, 2008. Based upon the results of such evaluation, the chief executive officer and chief financial officer have concluded that such disclosure controls and procedures are effective in providing reasonable assurance that information required to be disclosed by the Company in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by the Company in the reports that it files under the Securities Exchange Act of 1934 is accumulated and communicated to management, including the principal executive and financial officers, as appropriate to allow timely decisions regarding required disclosure.

20

See page F-1 of this Report for Management’s Report on Internal Control Over Financial Reporting and page F-2 of this Report for Report of Independent Registered Public Accounting Firm on the effectiveness of the Company’s internal control over financial reporting.

There have been no changes in the Company’s internal control over financial reporting that occurred during the quarter ended June 30, 2008 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| ITEM 9B. | Other Information |

None.

21

PART III

| ITEM 10. | Directors, Executive Officers and Corporate Governance |

The information required by Item 10 is incorporated by reference to the information appearing under the captions “Election of Directors,” “Management,” “Section 16(a) Beneficial Ownership Reporting Compliance,” and “General Information Relating to the Board of Directors” in the Company’s definitive proxy statement relating to the 2008 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Form 10-K (the “Definitive Proxy Statement”).

| ITEM 11. | Executive Compensation |

The information required by Item 11 is incorporated by reference to the information appearing under the captions “Executive Compensation” and “General Information Relating to the Board of Directors” in the Definitive Proxy Statement.

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The information required by Item 12 is incorporated by reference to the information appearing under the caption “Equity Compensation Plan Information” under Part II, Item 5 of this Form 10-K and the information appearing under the captions “Security Ownership of Certain Beneficial Owners” and “Security Ownership of Management” in the Definitive Proxy Statement.

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence |

The information required by Item 13 is incorporated by reference to the information appearing under the captions “Certain Relationships and Related Transactions” and “General Information Relating to the Board of Directors” in the Definitive Proxy Statement.

| ITEM 14. | Principal Accountant Fees and Services |

The information required by Item 14 is incorporated by reference to the information appearing under the caption “Relationship with Independent Accountants” in the Definitive Proxy Statement.

22

PART IV

| ITEM 15. | Exhibits and Financial Statement Schedules |

The following are being filed as part of this Annual Report on Form 10-K:

(a) Financial Statements and Financial Statement Schedule

Consolidated Financial Statements

Schedules other than the one listed above are omitted because they are not applicable, or the required information is shown in the financial statements or the notes thereto.

(b) Exhibits

| | |