Hawaiian Electric Exhibit 99.1

Terms that are not defined in this Exhibit 99.1 have the definitions of such terms as set forth in the 2024 Annual Report on Form 10-K to which this Exhibit is attached and into which this Exhibit is incorporated by reference.

PART III | | | | | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Executive officers of Hawaiian Electric

The executive officers of Hawaiian Electric are listed below. Hawaiian Electric executive officers serve from the date of their initial appointment until the next annual appointment of officers by the Hawaiian Electric Board, and thereafter are appointed for one-year terms or until their successors have been duly appointed and qualified or until their earlier resignation or removal. Hawaiian Electric executive officers may also hold offices with Hawaiian Electric subsidiaries. | | | | | | | | |

| Name | Age | Business experience for last 5 years and prior positions

with Hawaiian Electric and its affiliates |

| Shelee M. T. Kimura | 51 | Hawaiian Electric President and Chief Executive Officer since 1/22 · Hawaiian Electric Senior Vice President, Customer Service and Public Affairs 3/21 to 12/21 · Hawaiian Electric Senior Vice President, Customer Service, 2/19 to 3/21 · Hawaiian Electric Senior Vice President, Business Development & Strategic Planning, 1/17 to 2/19 · Hawaiian Electric Vice President, Corporate Planning & Business Development, 5/14 to 1/17 · HEI Director, Investor Relations, Strategic Planning & Budget, 11/09 to 5/14 · HEI Manager, Corporate Finance and Investments, 8/04 to 11/09 |

| Jimmy D. Alberts | 64 | Hawaiian Electric Senior Vice President and Chief Operations Officer since 1/22 · Hawaiian Electric Senior Vice President, Operations, 1/21 to 12/21 · Hawaiian Electric Senior Vice President, Business Development & Strategic Planning, 2/19 to 3/21 · Hawaiian Electric Senior Vice President, Customer Service, 8/12 to 12/18 · Prior to joining the Company: Kansas City Power & Light, Vice President – Customer Service, 2007-12 |

| Jason E. Benn | 53 | Hawaiian Electric Senior Vice President and Chief Transformation and Administrative Officer since 8/24 · Hawaiian Electric Senior Vice President and Chief Information Officer, 8/21 to 8/24 · Hawaiian Electric Vice President Information Technology Services and Chief Information Officer, 8/17 to 8/21 · Hawaiian Electric Vice President and Acting Chief Information Officer, 5/17 to 7/17 · Hawaiian Electric Manager, Information Technology Services, 8/10 to 5/17 · Hawaiian Electric Director, Information Assurance, 10/07 to 8/10 · Hawaiian Electric IT Program Manager, 4/06 to 9/07 · Hawaiian Electric Senior IT Infrastructure Analyst, 12/01 to 4/06 · Hawaiian Electric Supervisor, Network & Technical Support, 8/01 to 12/01 · Hawaiian Electric Supervisor, Desktop Services, 7/00 to 8/01 · Hawaiian Electric Infrastructure Analyst, 9/97 to 7/00 |

| Colton K. Ching | 57 | Hawaiian Electric Senior Vice President, Planning & Technology since 1/17

· Hawaiian Electric Vice President, Energy Delivery, 1/13 to 1/17

· Hawaiian Electric Vice President, Systems Operation & Planning, 8/10 to 12/12

· Hawaiian Electric Manager, Corporate Planning Department, 8/08 to 8/10

· Hawaiian Electric Director, Strategic Initiatives, 12/06 to 8/08

· Hawaiian Electric Director, Transmission Planning Division, 2/05 to 12/06

· Hawaiian Electric Senior Planning Engineer, 4/00 to 2/05

· Hawaiian Electric Electric Engineer II, 9/96 to 4/00

· Hawaiian Electric Designer II, 1/94 to 9/96

· Hawaiian Electric Designer I, 1/91 to 1/94 |

| | | | | | | | |

| Name | Age | |

| Paul K. Ito | 54 | Hawaiian Electric Senior Vice President, Chief Financial Officer and Treasurer, since 10/23 · HEI Executive Vice President, Chief Financial Officer and Treasurer, 1/23 to 9/23 · HEI Vice President - Tax, Controller and Treasurer and Interim Chief Financial Officer, 7/22 to 12/22 · HEI Vice President - Tax, Controller and Treasurer, 11/19 to 7/22 · HEI Vice President - Tax and Controller, 2/18 to 11/19 · Prior to joining the HEI in 2018: Alexander & Baldwin, Senior Vice President, Chief Financial Officer and Treasurer 2012 - 2018 |

| Joseph P. Viola | 58 | Hawaiian Electric Senior Vice President, Customer, Legal and Regulatory Affairs since 1/22

· Hawaiian Electric Vice President, Regulatory and Business Strategies, 3/21 to 12/21

· Hawaiian Electric Vice President, Regulatory Affairs, 2/14 to 2/21

· Hawaiian Electric Manager, Legal Department, 2/09 to 1/14

· Hawaiian Electric Lead Associate General Counsel, 11/07 to 2/09

· Hawaiian Electric Associate General Counsel, 8/00 to 11/07 |

Hawaiian Electric Board of Directors

The directors of Hawaiian Electric are listed below. Hawaiian Electric directors are elected annually by HEI, the sole common shareholder of Hawaiian Electric, after considering recommendations made by the HEI Nominating and Corporate Governance Committee. Below is information regarding the business experience and certain other directorships for each Hawaiian Electric director, together with a description of the experience, qualifications, attributes and skills that led to the Hawaiian Electric Board’s conclusion at the time of the 2024 Form 10-K, to which this Hawaiian Electric Exhibit 99.1 is attached, that each of the directors should serve on the Hawaiian Electric Board in light of Hawaiian Electric’s current business and structure.

James A. Ajello, age 71, Hawaiian Electric director since 2020

Hawaiian Electric Audit & Risk Committee Member since May 2020

Business experience

•Director, Dimension Renewable Energy, since February 23, 2022

•Senior Vice President Finance, Chief Financial Officer and Treasurer, Portland General Electric (NYSE: POR), January 1, 2021 - August 31, 2023

•Senior Advisor, Portland General Electric (NYSE: POR), November 1, 2020 - December 31, 2020 and July 1, 2023 - August 31, 2023

•Executive Vice President and Chief Financial Officer, Hawaiian Electric Industries, Inc. (HEI), August 2013 - April 2017

•Executive Vice President, Chief Financial Officer and Treasurer, HEI, June 2011 - July 2013

•Senior Vice President, Chief Financial Officer and Treasurer, HEI, January 2009 - June 2011

•Director, American Savings Bank (subsidiary of HEI), 2017-2020

•Director, Crius Energy Trust (TSX: KWH), 2012-2019

Skills and qualifications for Hawaiian Electric Board service

•18 years of executive leadership, financial oversight, risk management, investor relations, tax, accounting, financial and SEC reporting and strategic planning experience from serving as EVP and CFO of HEI, serving as President of Reliant Energy Solutions LLC and Senior Vice President and General Manager of Commercial & Industrial Marketing and Senior Vice President - Business Development of Reliant Energy, Inc.

•14 years of banking industry experience from serving as Managing Director and Head of UBS Chicago and its corporate banking unit, as well as head of UBS’s North American project finance team. Duties focused on corporate finance, capital markets and M & A.

•In-depth knowledge of issues facing American Savings Bank gained from 9 years as EVP and CFO of American Savings Bank's parent company, HEI, and 3 years serving on American Savings Bank board of directors.

•Hawaii business and leadership experience from his more than 10 years of service as a Trustee on the Hawaii Pacific University Board and his 9 years as EVP and CFO of HEI.

Timothy E. Johns, age 68, Hawaiian Electric director since 2005; Chairman since January 1, 2020

Hawaiian Electric Audit & Risk Committee Member since 2006, Chair since 2010

HEI Nominating and Corporate Governance Committee, Non-Voting Representative since 2019

HEI Executive Committee, Non-Voting Representative since 2020

HEI Compensation & Human Capital Management Committee, Non-Voting Representative since 2020

Business experience

•President and Chief Executive Officer, Zephyr Insurance Company, Inc. (hurricane insurance provider in Hawaii), since 2018

•Chief Consumer Officer, Hawaii Medical Service Association (leading health insurer in Hawaii), 2011 - 2017

Skills and qualifications for Hawaiian Electric Board service

•Executive management, leadership and strategic planning skills developed over three decades as a businessperson and lawyer, and currently as President and Chief Executive Officer of Zephyr Insurance Company.

•Business, regulatory, financial stewardship and legal experience from his prior roles as Chief Consumer Officer of HMSA, President and Chief Executive Officer of the Bishop Museum, Chief Operating Officer for the Estate of Samuel Mills Damon (former private trust with assets valued at over $900 million prior to its dissolution), Chairperson of the Hawaii State Board of Land and Natural Resources, Director of the Hawaii State Department of Land and Natural Resources and Vice President and General Counsel at Amfac Property Development Corp.

•Corporate governance knowledge and familiarity with financial oversight and fiduciary responsibilities from his prior experience overseeing the HMSA Internal Audit department, as a director for The Gas Company LLC (now Hawaii Gas) and his current service as a trustee of the Parker Ranch Foundation Trust (charitable trust with assets valued at over $250 million), as a director and Audit Committee Chair for Parker Ranch, Inc. (largest ranch in Hawaii with significant real estate assets), as a director and Audit Committee member for Grove Farm Company, Inc. (privately-held community and real estate development firm operating on the island of Kauai) and on the board of Kualoa Ranch, Inc. (private ranch in Hawaii offering tours and activity packages to the public).

Shelee M. T. Kimura, age 51, Hawaiian Electric director since 2022

Business experience

•Hawaiian Electric President and Chief Executive Officer since January 2022

•Hawaiian Electric Senior Vice President, Customer Service and Public Affairs March 2021 - December 2021

•Hawaiian Electric Senior Vice President, Customer Service, February 2019 - March 2021

•Hawaiian Electric Senior Vice President, Business Development & Strategic Planning, January 2017 - February 2019

•Hawaiian Electric Vice President, Corporate Planning & Business Development, May 2014 - January 2017

Skills and qualification for Hawaiian Electric Board Service

•Executive management, leadership and strategy development and execution skills developed from the wide range of leadership roles at Hawaiian Electric and HEI over the last 20 years including her current role as President and Chief Executive Officer of Hawaiian Electric.

•Operational leadership and extensive stakeholder relations experience which includes all stakeholders from customers, communities, regulators, government and union to institutional investors, analysts and rating agencies gained from her roles at HEI where she led the corporate finance, investments, investors relations and corporate strategy functions, and at Hawaiian Electric where she led the development and execution of the 2014-2020 Transformation Strategy and teams responsible for operational functions (e.g., field services and customer service), innovation (e.g., grid technologies, distributed energy resources, electrification of transportation, and utility-scale renewable generation and storage procurement programs), and corporate functions (e.g., strategy business development, enterprise risk management, and public relations).

•Finance, accounting, auditing, enterprise risk management, and corporate governance experience gained from obtaining a public accounting certification and working as an external and internal auditor, business and risk management consultant, executing of capital market transactions at HEI, as well as her service (September 2013 to June 2022) on the Audit Committee for Kamehameha Schools ($15 billion endowment and Hawaii’s largest private landowner with over 397,000 acres of land on Hawaii island, Maui, Molokai, Oahu, and Kauai) and the board and compensation committee of Alexander & Baldwin (NYSE: ALEX) since 2023

•Recognized business and community leader including the following recognitions: U.S. Department of Energy’s C3E (Clean Energy Education and Empowerment) Business Award, University Hawai‘i Shidler College of Business Hall of Honor, Hawaii Business Magazine’s 20 for the Next 20, Pacific Business News’ Power Leaders, Girl Scouts of Hawai‘i Women of Distinction, YWCA Leader Luncheon Honoree, American Lung Association Outstanding Mother Award, and Hawaii United Okinawan Association Legacy Award.

Mary E. Kipp, age 57, Hawaiian Electric director since 2023

Hawaiian Electric Audit & Risk Committee Member since January 2023

Business experience

•President and Chief Executive Officer, Puget Sound Energy, Inc. since January 2020

•President and Chief Executive Officer, El Paso Electric Company, 2017-2019

•Chief Executive Officer, El Paso Electric Company, 2015-2017

•President, El Paso Electric Company, 2014-2015

Skills and qualifications for Hawaiian Electric Board service

•Executive management, leadership and strategic planning skills developed over nearly three decades as a businessperson and lawyer and currently as President and CEO of Puget Sound Energy, Inc. a 150 year old utility providing electric power and natural gas to 1.5 million customers in the state of Washington.

•Business, regulatory, financial stewardship and legal experience from her prior roles as President and CEO, General Counsel and Chief Compliance Officer and Director of FERC Compliance for El Paso Electric Company, and Senior Enforcement Attorney for the Federal Energy Regulatory Commission.

•Extensive knowledge of the electric utility industry from her 15 years of experience in leadership roles at Puget Sound Energy, Inc. and El Paso Electric Company.

•Corporate governance knowledge and familiarity with financial oversight and fiduciary responsibilities from her service as a director for Boston Properties, Inc., the largest publicly traded developer, owner, and manager of premier workplaces in the United States and prior director of El Paso Electric, an electric utility providing generation, transmission and distribution to customers in west Texas and southern New Mexico.

Toby B. Taniguchi, age 53, Hawaiian Electric director since 2021

Hawaiian Electric Audit & Risk Committee Member since April 2022

Business experience

•President & Chief Executive Officer, KTA Super Stores, 2024-present

•President & Chief Operating Officer, KTA Super Stores, 2014-2024

•Executive Vice President, KTA Super Stores, 2006-2014

•President, K. Taniguchi, Limited, 2019-present

•Vice President, K. Taniguchi Limited, 1999-2019

Skills and qualifications for Hawaiian Electric Board service

•Executive leadership experience as President and Chief Operating Officer of KTA Super Stores where he is responsible for the daily operations of the largest network of retail grocery stores on the island of Hawaii. KTA Super Stores has invested in environmental and social innovations including electric vehicle infrastructure investments, PV system installation, sourcing from locally owned and produced businesses, supporting their marketing and expanded distribution, and philanthropic programs with direct community impact.

•Current knowledge of and experience with the business community on the island of Hawaii, which is serviced by Hawaiian Electric Company’s subsidiary, Hawaii Electric Light Company, from serving in leadership positions for 17 years at KTA Super Stores which has seven retail stores all over the island and is one of the oldest grocers on island, established 105 years ago.

•Extensive corporate and non-profit board leadership experience from his service on private and non-profit boards in the state which include areas of impact such as community development, health and human services, education, business, industry, insurance, and economic development.

•Recognized business and community leader, including recognitions by the Hawaii Business Magazine for his leadership with the “40 Under Forty” distinction and the “20 for the Next 20” award.

Audit & Risk Committee of the Hawaiian Electric Board of Directors

Because HEI has common stock listed on the New York Stock Exchange (NYSE) and Hawaiian Electric is a wholly-owned subsidiary of HEI, HEI is subject to the corporate governance listing standards in Section 303A of the NYSE Listed Company Manual, but Hawaiian Electric is not subject to NYSE listing standards, including Sections 303A.04, 303A.05 and 303A.06, which require listed companies to have nominating/corporate governance, compensation and audit committees, respectively.

Although not required by NYSE rules to do so, Hawaiian Electric has established one standing committee, the Hawaiian Electric Audit & Risk Committee, and voluntarily endeavors to comply with NYSE and SEC requirements regarding audit committee composition. The current members of the Hawaiian Electric Audit & Risk Committee are nonemployee directors Timothy E. Johns (chair), James A. Ajello, Mary E. Kipp, and Toby B. Taniguchi. All committee members are independent and qualified to serve on the committee pursuant to NYSE and SEC requirements. Each of Timothy E. Johns, James A. Ajello, Mary E. Kipp and Toby B. Taniguchi has been determined by the Hawaiian Electric Board to be an “audit committee financial expert” on the Hawaiian Electric Audit & Risk Committee.

The Hawaiian Electric Audit & Risk Committee operates and acts under a written charter approved by the Hawaiian Electric Board which is available on HEI’s website at www.hei.com/govdocs (documents referenced as being available on the Company's website are not incorporated herein). The Hawaiian Electric Audit & Risk Committee is responsible for overseeing (1) Hawaiian Electric’s financial reporting processes and internal controls, (2) the performance of Hawaiian Electric’s internal auditor, (3) risk assessment and risk management policies set by management and (4) the Corporate Code of Conduct compliance program for Hawaiian Electric and its subsidiaries. In addition, the committee provides input to the HEI Audit & Risk Committee regarding the appointment, compensation and oversight of the independent registered public accounting firm that audits HEI’s and Hawaiian Electric’s consolidated financial statements and maintains procedures for receiving and reviewing confidential reports of potential accounting and auditing concerns. To support the Hawaiian Electric Audit & Risk Committee with this oversight responsibility, a non-fiduciary cybersecurity working group comprised of directors from the Company and HEI boards assists the Hawaiian Electric Audit & Risk Committee in monitoring the Company’s cybersecurity program. Among other things, the cybersecurity working group reviews the effectiveness of the Company’s cybersecurity programs and practices and the impact of emerging cybersecurity developments on the Company, and provides reports on its work and findings to the Hawaiian Electric Audit & Risk Committee.

In 2024, the Hawaiian Electric Audit & Risk Committee held six meetings. At each meeting, the committee held executive sessions without management present with the independent registered public accounting firm that audits HEI’s and Hawaiian Electric’s consolidated financial statements.

Attendance at Hawaiian Electric Board and Audit & Risk Committee meetings

In 2024, there were seven regular and 24 special meetings of the Hawaiian Electric Board. All incumbent Hawaiian Electric directors attended at least 80% of the combined total number of meetings of the Hawaiian Electric Board and the Hawaiian Electric Audit & Risk Committee (for those who served on such committee) held during the period for which he or she was a director.

Family relationships; executive officer and director arrangements

There are no family relationships between any executive officer or director of Hawaiian Electric and any other executive officer or director of Hawaiian Electric. There are no arrangements or understandings between any executive officer or director of Hawaiian Electric and any other person pursuant to which such executive officer or director was selected.

Code of Conduct

The HEI Board has adopted a Corporate Code of Conduct that applies to all of HEI’s subsidiaries, including Hawaiian Electric, and which includes a code of ethics applicable to, among others, Hawaiian Electric’s principal executive officer, principal financial officer and principal accounting officer. The Corporate Code of Conduct is available on HEI’s website at www.hei.com/govdocs (documents referenced as being available on the Company's website are not incorporated herein). Hawaiian Electric elects to disclose the information required by Form 8-K, Item 5.05, “Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics,” through this website and such information will remain available on this website for at least a 12-month period.

Insider Trading Policies and Procedures

HEI has an Insider Trading Policy that is designed to promote compliance with insider trading laws, rules and regulations, and the listing standards of the New York Stock Exchange. The Insider Trading Policy prohibits all directors, officers and employees of HEI and its subsidiaries (as well as their spouses, minor children and adult family members sharing the same household (Family Members)) from transacting in Company securities (which includes HEI Common Stock, Hawaiian Electric preferred stock and Hawaiian Electric bonds (Company Securities)), and advising others who may buy or sell Company Securities, when such persons are in possession of material, nonpublic information regarding the Company. For directors, executive officers and certain covered employees of HEI and its subsidiaries and their respective Family Members, the policy also includes preclearance procedures for all transactions in Company Securities, as well as providing for recurring trading blackout periods beginning at the end of each quarter and ending on the second business day after the Company releases information to the public about the prior quarter's financial results. The Company may also implement a blackout on trading at any other time because of information known to the Company and not yet disclosed to the general public. This type of event-specific blackout may apply to all insiders, or a sub-group of individuals. The full text of the Insider Trading Policy is attached as Exhibit 19 to the Company's 2024 annual report on Form 10-K.

Delinquent Section 16(a) Reports

Section 16(a) of the 1934 Exchange Act requires Hawaiian Electric’s executive officers, controller, directors and persons who own more than ten percent of a registered class of Hawaiian Electric’s equity securities to file reports of ownership and changes in ownership with the SEC. Such reporting persons are also required by SEC regulations to furnish Hawaiian Electric with copies of all Section 16(a) forms they file. Based solely on its review of such forms provided to it during 2024, or written representations from some of those persons that no Forms 5 were required from such persons, Hawaiian Electric believes that, each of the persons required to comply with Section 16(a) of the 1934 Exchange Act with respect to Hawaiian Electric, including its executive officers, directors and persons who own more than ten percent of a registered class of Hawaiian Electric’s equity securities, complied with the reporting requirements of Section 16(a) of the 1934 Exchange Act for 2024.

| | | | | |

| ITEM 11. | EXECUTIVE COMPENSATION |

Director compensation

The Hawaiian Electric Board believes that a competitive compensation package is necessary to attract and retain individuals with the experience, skills and qualifications needed to serve as a director on the board of a regulated electric public utility. Customarily, nonemployee director compensation is composed of a mix of cash and HEI Common Stock. However, to address the extreme volatility HEI's Common Stock, the equity component was replaced with a cash award in 2024. Only nonemployee directors receive compensation for their service as directors. Ms. Kimura, the Hawaiian Electric President & CEO, did not receive separate or additional compensation for serving as a Hawaiian Electric director. Although Ms. Kimura was a member of the Hawaiian Electric Board, neither she nor any other executive officer participated in the determination of nonemployee director compensation.

Nonemployee directors of Hawaiian Electric receive compensation in the form of a cash retainer and an HEI stock grant. James A. Ajello, Timothy E. Johns, Mary E. Kipp, and Toby B. Taniguchi are nonemployee directors of Hawaiian Electric. No Hawaiian Electric director is also an HEI director.

The HEI Compensation & Human Capital Management Committee reviews the compensation of Hawaiian Electric nonemployee directors at least once every three years and recommends changes to the Hawaiian Electric Board. In 2022, the HEI Compensation & Human Capital Management Committee asked its independent compensation consultant, Frederic W. Cook & Co., Inc. (FW Cook), to conduct an evaluation of HEI’s nonemployee director compensation practices. FW Cook assessed the structure of HEI’s nonemployee director compensation program and its value compared to competitive market practices of utility peer companies, similar to the assessments used in its executive compensation review. The HEI Compensation & Human Capital Management Committee reviewed the analysis in determining its recommendations concerning the appropriate nonemployee director compensation, including cash retainers, stock awards and meeting fees for HEI directors. As part of this analysis, the HEI Compensation & Human Capital Management Committee reviewed the cash retainers, stock awards and meeting fees for Hawaiian Electric directors and determined that it wouldn’t recommend any changes to the Hawaiian Electric Board compensation for 2023.

The boards of Hawaiian Electric subsidiaries Hawaii Electric Light and Maui Electric are comprised entirely of officers of Hawaiian Electric and/or its subsidiaries who receive no additional compensation for such service.

Cash retainer. Hawaiian Electric nonemployee directors received the cash retainer amounts shown below for their 2024 Hawaiian Electric Board service. Nonemployee directors of Hawaiian Electric who also serve as a member or chair of the Hawaiian Electric Audit & Risk Committee or as a non-voting Hawaiian Electric Board representative who attends meetings of the HEI Compensation & Human Capital Management Committee or the HEI Nominating and Corporate Governance Committee received additional retainer amounts, as indicated below. Cash retainers were paid in quarterly installments. | | | | | |

| | 2024 |

| Hawaiian Electric Director | $ | 51,000 | |

| Hawaiian Electric Chairman of the Board | 45,000 | |

| Hawaiian Electric Audit & Risk Committee Chair | 18,750 | |

| Hawaiian Electric Audit & Risk Committee Member | 7,500 | |

| Hawaiian Electric Non-Voting Representative to HEI Compensation & Human Capital Management Committee | 10,000 | |

| Hawaiian Electric Non-Voting Representative to HEI Nominating and Corporate Governance Committee | 10,000 | |

Extra meeting fees. Nonemployee directors are also entitled to meeting fees for each board or committee meeting attended (as member or chair) after a specified number of meetings. For 2024, directors were entitled to additional fees of $1,000 per meeting after attending a minimum of eight Hawaiian Electric Board meetings during the year, Hawaiian Electric Audit & Risk Committee members were entitled to additional fees of $1,000 per meeting after attending a minimum of six Hawaiian Electric Audit & Risk Committee meetings during the year, and the Hawaiian Electric Board’s non-voting representative to the HEI Compensation & Human Capital Management Committee and HEI Nominating and Corporate Governance Committee each was entitled to an additional fee of $1,500 per meeting after attending six meetings of the respective Committee during the year.

Fees for non-voting members of HEI board committees. Certain director(s) of Hawaiian Electric serve as non-voting members of certain HEI board committees. This currently includes Timothy Johns who serves as a non-voting member of HEI's Nominating and Corporate Governance Committee, the HEI Compensation & Human Capital Management Committee and the HEI Executive Committee. Non-voting members of the HEI Compensation & Human Capital Management Committee and HEI

Nominating and Corporate Governance Committee are paid the same annual retainer as the voting members. See Cash Retainer table below for amounts paid.

Stock or cash awards. Customarily, stock grants are made annually to nonemployee directors under HEI’s 2011 Nonemployee Director Stock Plan (2011 Director Plan) on the last business day in June and vest immediately. For 2024, considering the extreme volatility of HEI’s Common Stock, the nonemployee directors were paid a cash award instead of the customary annual stock grant. Consequently, on June 30, 2024, each nonemployee director at that time received a cash award of $66,000.

Deferred compensation. Nonemployee directors may participate in the HEI Deferred Compensation Plan implemented in 2011 (2011 Deferred Compensation Plan). Under the plan, deferred amounts are credited with gains/losses of deemed investments chosen by the participant from a list of publicly traded mutual funds and other investment offerings. Earnings are not above-market or preferential. Participants may elect the timing upon which distributions are to begin following separation from service (including retirement) and may choose to receive such distributions in a lump sum or in installments over a period of up to 15 years. Lump sum benefits are payable in the event of disability or death. In 2024, no Hawaiian Electric director participated in the 2011 Deferred Compensation Plan.

Health benefits. Directors may participate, at their election and at their cost, in the group employee medical, vision and dental plans generally made available to Hawaiian Electric employees. No Hawaiian Electric director currently participates in such plans.

2024 DIRECTOR COMPENSATION TABLE

The table below shows the compensation paid to Hawaiian Electric nonemployee directors in 2024. | | | | | | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash

($) (1) | | | | Total

($) |

| James A. Ajello | 147,500 | | | | | 147,500 | |

| Timothy E. Johns, Chairman | 222,750 | | | | | 222,750 | |

| Mary E. Kipp | 142,500 | | | | | 142,500 | |

| Alana K. Pakkala | 127,500 | | | | | 127,500 | |

| Toby B. Taniguchi | 145,500 | | | | | 145,500 | |

1.Represents cash retainers and extra meeting fees for board and committee service (as detailed below) and includes an additional cash award in the amount of $66,000, as described above under “Stock or Cash Awards.”

The table below shows the total fees paid in cash to Hawaiian Electric nonemployee directors for Hawaiian Electric board and committee service and service on the Cybersecurity Working Group in 2024. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Hawaiian Electric Board ($) (1) | | Hawaiian Electric Chairman ($) | | Hawaiian Electric

Audit & Risk

Committee ($) | | Cyber- security Working Group ($) | | Hawaiian Electric Nonvoting Representative to HEI Committees ($) | | Extra Meeting Fees

($) (2) | | Total ($) |

| James A. Ajello | 51,000 | | | — | | | 7,500 | | | 5,000 | | | — | | | 18,000 | | | 81,500 | |

| Timothy E. Johns | 51,000 | | | 45,000 | | | 18,750 | | | — | | | 20,000 | | | 22,000 | | | 156,750 | |

| Mary E. Kipp | 51,000 | | | — | | | 7,500 | | | — | | | — | | | 18,000 | | | 76,500 | |

| Alana K. Pakkala | 41,129 | | | — | | | 371 | | | — | | | — | | | 20,000 | | | 61,500 | |

| Toby B. Taniguchi | 51,000 | | | — | | | 7,500 | | | — | | | — | | | 21,000 | | | 79,500 | |

1. Represents $51,000 annual cash retainer for board service.

2. Represents extra meeting fees earned for attending Board and committee meetings in excess of the number of meetings specified in “Director Compensation - Extra meeting fees.”

Compensation Discussion and Analysis

This section describes Hawaiian Electric’s executive compensation program and the compensation decisions made for Hawaiian Electric’s 2024 named executive officers, who are listed below. | | | | | |

| Name | Title |

| Shelee M. T. Kimura | Hawaiian Electric President and Chief Executive Officer (CEO) |

| Paul K. Ito | Hawaiian Electric Senior Vice President, Chief Financial Officer and Treasurer |

| Jimmy D. Alberts | Hawaiian Electric Senior Vice President and Chief Operations Officer |

| Jason E. Benn | Hawaiian Electric Senior Vice President & Chief Transformation and Administrative Officer |

| Colton K. Ching | Hawaiian Electric Senior Vice President, Planning & Technology |

2024 Executive summary

Following the 2023 Maui windstorm and wildfires, the Company has faced unprecedented operational and financial challenges, while also making considerable progress towards overcoming them. In meeting these challenges, the Company's executive officers have experienced material increases in workload and performance pressure, against the backdrop of significant uncertainty regarding the Company's financial health and future. This has been accompanied by significant declines in the value of HEI Common Stock, which negatively impacted the value of in-flight equity awards, as well as the net worth of the Company’s executive officers, as the majority of their total compensation has historically been paid in the form of equity. These factors, among others, created heightened and novel retention and recruiting challenges to which the Company's compensation practices needed to adapt. In addition, the Compensation and Human Capital Management Committee and Board recognized the executive team's leadership in enabling the Company to reach the critical milestones that were reached in the past year in advancing the Company's return to operational and financial stability.

In consideration of these elements, as described in more detail below, the Company's 2024 compensation program applied a balanced approach to incentives and retention, with an emphasis on alignment with peer median compensation and a temporary and partial shift from equity to cash-based compensation. The use of cash instead of equity also helped ensure such compensation continued to serve as an incentive at a time when the company’s stock was experiencing significant volatility.

Guiding principles

In designing Hawaiian Electric’s 2024 executive compensation program and making pay decisions, the HEI Compensation & Human Capital Management Committee and Hawaiian Electric Board followed these guiding principles:

•Pay should reflect Company performance, particularly over the long-term.

•Compensation programs should align executives’ interests with those of our shareholders, customers and employees.

•Programs should be designed to attract, motivate and retain talented executives who can drive the Company’s success.

•The cost of programs should be reasonable while maintaining their purpose and benefit.

Key design features

The 2024 compensation program for Hawaiian Electric’s named executive officers is comprised of four primary elements – base salary, performance-based annual incentives, performance-based long-term incentives earned over three years and time-based long-term incentives including restricted stock units (RSUs) and restricted cash awards (RCAs) that vest over three years. With these elements, named executive officers’ total compensation opportunity is designed to provide a balance between fixed and variable (performance-based) pay, and between short-term and long-term incentives. Other named executive officer benefits include eligibility to participate in retirement and nonqualified deferred compensation plans, and minimal perquisites.

Pay for performance

The compensation of our named executive officers earned for 2024 reflects Hawaiian Electric’s 2024 performance, as well as its performance over the three-year period that ended December 31, 2024:

•For 2024 annual incentive performance, the following metrics applied to all Hawaiian Electric named executive officers for the one-year period ending December 31, 2024: (a) safety and resilience, which includes wildfire mitigation, employee safety and energy security, (b) financial health, which includes Hawaiian Electric net income and liquidity, (c) trust & reputation, and (d) healthy & engaged workforce, each on a consolidated basis.

•Long-term incentives comprise a significant portion of each Hawaiian Electric named executive officer’s pay opportunity. For the three-year period that ended December 31, 2024, the Hawaiian Electric named executive officer performance metrics were: (a) Hawaiian Electric 3-year average annual net income growth, (b) Hawaiian Electric 3-year return on average common equity (ROACE), (c) carbon emissions (CO2e) reduction, and (d) HEI total shareholder return compared to the companies in the Edison Electric Institute (EEI) Index.

The Hawaiian Electric Board and HEI Compensation & Human Capital Management Committee believe that Hawaiian Electric’s executive compensation program serves the Company’s pay-for-performance objective and is structured to encourage participants to build long-term value for the benefit of all stakeholders, including shareholders, customers and employees.

Compensation process

Roles in determining compensation

Roles of the Hawaiian Electric Board and HEI Compensation & Human Capital Management Committee. The Hawaiian Electric Board does not have a separate compensation committee. Rather, the entire Hawaiian Electric Board performs the function of a compensation committee and oversees the design and implementation of Hawaiian Electric’s executive compensation programs. In addition, as part of its responsibility to oversee compensation programs at HEI and its subsidiaries, the HEI Compensation & Human Capital Management Committee assists the Hawaiian Electric Board by approving performance- and equity-based compensation for ratification by the Hawaiian Electric Board and making recommendations to the Hawaiian Electric Board regarding other executive compensation matters.

The HEI Compensation & Human Capital Management Committee fulfills its responsibilities to assist the Hawaiian Electric Board regarding executive compensation matters by engaging annually in a rigorous process to arrive at compensation decisions regarding the named executive officers. In the course of this process, the HEI Compensation & Human Capital Management Committee:

•Engages in extensive deliberations in meetings held over several months;

•Consults with its independent compensation consultant during and outside of meetings;

•Focuses on Hawaiian Electric’s long-term strategy, and near-term goals to implement such strategy, in setting performance metrics and goals;

•Reviews tally sheets for each named executive officer to understand how the elements of compensation relate to each other and to the compensation package as a whole (the tally sheets include fixed and variable (performance-based) compensation, minimal perquisites and change in pension value for past periods);

•Examines data and analyses prepared by its independent compensation consultant concerning peer group selection, comparative compensation data and evolving best practices;

•Reviews Hawaiian Electric’s performance and discusses assessments of the individual performance of senior members of management;

•Analyzes the reasonableness of incentive payouts in light of the long-term benefits to all stakeholders;

•Considers trends in compensation to determine whether incentive programs are working effectively; and

•Reviews risk assessments conducted by the HEI and Hawaiian Electric Enterprise Risk Management functions to determine whether compensation programs and practices carry undue risk.

Early each year, the HEI Compensation & Human Capital Management Committee determines compensation earned under incentive plans with respect to performance periods ending in the prior year, establishes performance metrics and goals for incentive plans beginning in the current year and recommends to the Hawaiian Electric Board the level of compensation and mix of pay elements for each named executive officer.

The Hawaiian Electric Board discusses evaluations of the Hawaiian Electric CEO’s performance, considers HEI Compensation & Human Capital Management Committee recommendations concerning the CEO’s pay and determines the CEO’s compensation. The Hawaiian Electric Board also reviews HEI Compensation & Human Capital Management Committee recommendations concerning the other Hawaiian Electric named executive officers and approves their compensation.

Role of executive officers. The Hawaiian Electric CEO, who is also a member of the Hawaiian Electric board of directors, assesses and reports on the performance of the other Hawaiian Electric named executive officers and makes recommendations to the HEI Compensation & Human Capital Management Committee with respect to their levels of compensation and mix of pay elements. The CEO also participates in deliberations of the Hawaiian Electric Board in acting on the HEI Compensation & Human Capital Management Committee’s recommendations on the other Hawaiian Electric named

executive officers. The CEO does not participate in the deliberations of the HEI Compensation & Human Capital Management Committee to recommend, or of the Hawaiian Electric Board to determine, the CEO’s own compensation.

Hawaiian Electric management supports the HEI Compensation & Human Capital Management Committee in executing its responsibilities by providing data and other materials for HEI Compensation & Human Capital Management Committee meetings (including tally sheets and recommendations regarding performance metrics, goals and pay mix); by attending portions of HEI Compensation & Human Capital Management Committee meetings as appropriate to provide perspective and expertise relevant to agenda items; and by supplying such other data and information as may be requested by the HEI Compensation & Human Capital Management Committee and/or its independent compensation consultant.

Compensation consultant & consultant independence. The Compensation & Human Capital Management Committee’s independent compensation consultant, Frederic W. Cook & Co., Inc. (FW Cook), is retained by, and reports directly to, the HEI Compensation & Human Capital Management Committee. FW Cook provides the HEI Compensation & Human Capital Management Committee with independent expertise on market practices and developments in executive compensation, compensation program design, peer group composition and competitive pay levels, and provides related research, data and analyses. FW Cook also advises the HEI Compensation & Human Capital Management Committee regarding analyses and proposals presented by management related to executive compensation. A representative of FW Cook attends HEI Compensation & Human Capital Management Committee meetings, participates in Committee executive sessions and communicates directly with the Compensation & Human Capital Management Committee.

In early 2025, as in prior years, the HEI Compensation & Human Capital Management Committee evaluated FW Cook’s independence, taking into account all factors it considered relevant, including the factors specified in the NYSE listing standards and the absence of other relationships between FW Cook and HEI, Hawaiian Electric and their directors or executive officers. Based on its review of such factors, and based on FW Cook’s independence policy, which was shared with the HEI Compensation & Human Capital Management Committee, the Committee concluded that FW Cook is independent and that the work of FW Cook has not raised any conflict of interest.

Use of comparative market data

Compensation benchmarking. The HEI Compensation & Human Capital Management Committee considers market data from peer group companies as a reference point in determining the named executive officers’ pay components and target compensation opportunity (composed of base salary, performance‑based annual incentive, performance‑based long‑term incentive and time‑based long-term incentive). The HEI Compensation & Human Capital Management Committee may decide that an executive’s compensation opportunity should be higher or lower in relation to peers based on considerations including internal equity, the executive’s level of responsibility, experience, expertise and past performance, as well as retention and succession objectives.

Comparative market data used in setting 2024 executive pay consisted of information from public company proxy statements for peer group companies and the Willis Towers Watson Energy Services Survey.

Peer groups. The HEI Compensation & Human Capital Management Committee annually reviews the peer groups used in benchmarking for Hawaiian Electric executive compensation, with analysis and recommendations provided by FW Cook. For 2024 compensation, the Committee determined, with input from FW Cook, that no changes to Hawaiian Electric’s 2024 peer group were necessary or appropriate. The selection criteria and 2024 Hawaiian Electric peer group is set forth below.

| | | | | | | | |

| Hawaiian Electric 2024 Peer Group (applies to all Hawaiian Electric named executive officers) |

| Selection Criteria | · Electric utilities with primarily regulated operations · Revenue balanced in a range of approximately 0.4x to 2.5x Hawaiian Electric’s revenue · Market cap as a secondary consideration |

| Peer Group for 2024 Compensation | ALLETE, Inc. Alliant Energy Corp. AVANGRID, Inc. Avista Corp. Black Hills Corp. Evergy, Inc. IDACORP, Inc.

| MDU Resources Group Inc. NiSource Inc.

Northwestern Corp

OGE Energy Corp.

Pinnacle West Capital Corp.

Portland General Electric

TXNM Energy, Inc. |

| |

Relationship between compensation programs and risk management

Hawaiian Electric’s compensation policies and practices are designed to encourage executives to build value for all stakeholders, including shareholders, customers and employees, and to discourage decisions that introduce inappropriate risks.

Hawaiian Electric’s Enterprise Risk Management (ERM) function is principally responsible for identifying and monitoring risk at Hawaiian Electric and its subsidiaries, and for reporting on high risk areas to the Hawaiian Electric Board and Hawaiian Electric Audit & Risk Committee. As a result, all Hawaiian Electric and HEI directors, including those who serve on or are representatives to the HEI Compensation & Human Capital Management Committee, are apprised of risks that could reasonably be expected to have a material adverse effect on Hawaiian Electric.

Risk assessment. On an annual basis, the HEI Compensation & Human Capital Management Committee and its independent compensation consultant review a risk assessment of compensation programs in place at Hawaiian Electric and its subsidiaries, which is updated annually by the Hawaiian Electric and HEI ERM function. Based on its review of the risk assessment of compensation programs in place in 2024 and consultation with FW Cook, the HEI Compensation & Human Capital Management Committee believes that Hawaiian Electric's compensation plans do not encourage risk taking that is reasonably likely to have a material adverse effect on Hawaiian Electric.

Risk mitigation features of compensation programs. Hawaiian Electric’s compensation programs incorporate the following features to promote prudent decision-making and guard against excessive risk:

•Financial performance objectives for the annual incentive program are linked to Board-approved budget guidelines, and nonfinancial measures (such as resilience and safety) are designed to be aligned with the interests of all Hawaiian Electric stakeholders.

•Annual and long-term incentive awards are capped at maximum performance levels.

•Financial opportunities under long-term incentives are greater than those under annual incentives, emphasizing the importance of long-term outcomes.

•Share ownership and retention guidelines, requiring named executive officers to hold significant amounts of HEI Common Stock ensure that Hawaiian Electric’s named executive officers have a substantial personal stake in the long-term performance of Hawaiian Electric and HEI. The guidelines specific to the named executive officers are discussed below under “Share ownership and retention are required throughout employment with the Company.”

•Long-term incentive payouts are 50-100% equity-based, so executives share in the same upside potential and downside risk as all HEI shareholders.

•Annual grants of long-term performance-based and long-term time-based incentives vest over a period of three years to encourage sustained performance and executive retention.

•Performance-based plans use a variety of financial metrics (e.g., net income) and nonfinancial performance metrics (e.g., customer satisfaction, reliability and safety) that correlate with long-term value creation for all stakeholders and are impacted by management decisions.

•The Hawaiian Electric Board and HEI Compensation & Human Capital Management Committee continuously monitor risks faced by the enterprise, including through management presentations at quarterly meetings and through periodic written reports from management.

Share ownership and retention are required throughout employment with the Company

Hawaiian Electric named executive officers are required to own and retain HEI Common Stock throughout their employment with the Company. Each officer subject to the requirements has until January 1 of the year following the fifth anniversary of the later of (i) any amendment to his or her required level of stock ownership or (ii) first becoming subject to the requirements (Compliance Date), to reach the following ownership levels: | | | | | |

| Position | Value of Stock to be Owned |

| Hawaiian Electric President and CEO | 2x base salary |

| Other Named Executive Officers | 1x base salary |

Until reaching the applicable stock ownership target, officers subject to the requirements must retain 50% of shares received in payout under the LTIP (net of any shares withheld for taxes) and 50% of shares received through the vesting of RSUs (net of any shares withheld for taxes). Each of the named executive officers has either complied with the ownership requirement or has not yet reached his or her respective Compliance Date.

2024 compensation elements and pay decisions

Elements and objectives

The total compensation program for named executive officers is made up of the five standard components summarized below. Each component fulfills important objectives that reflect our focus on pay for performance, competitive programs to attract and retain talented executives and aligning executive decisions with the interests of all stakeholders. These elements are described in further detail in the pages that follow.

| | | | | | | | |

Compensation element1 | Summary | Objectives |

| Base Salary | Fixed level of cash compensation set in reference to peer group median (may vary based on performance, experience, responsibilities, expertise and other factors). | Attract and retain talented executives by providing competitive fixed cash compensation.

|

| Annual Performance-Based Incentives | Variable cash award based on achievement of pre-set performance goals for the year. Award opportunity is determined as a percentage of base salary. Performance below threshold levels yields no incentive payment. | Drive achievement of key business results linked to short-term and long-term strategy and reward executives for their contributions to such results. Balance compensation cost and return by paying awards based on performance. |

| Long-Term Performance-Based Incentives | Variable equity award based on meeting pre-set performance objectives over a 3-year period. Award opportunity is determined as a percentage of base salary. Performance below threshold levels yields no incentive payment. | Motivate executives and align their interests with those of all stakeholders by promoting long-term value growth and by paying awards in the form of equity.

Balance compensation cost and return by paying awards based on performance. |

| Long-Term Time-Based Incentives | Annual grants in the form of RSUs or RCAs that vest over 3 years. Amount of grant is determined as a percentage of base salary.

| Promote retention of talented leaders through multi-year vesting and alignment of executive and shareholder interests through shared ownership of HEI Common Stock. |

| Benefits | Includes defined benefit pension plans and defined contribution plan, deferred compensation plans, double-trigger change-in-control agreements; minimal perquisites and an executive death benefit plan (frozen since 2009). | Enhance total compensation with meaningful and competitive benefits that promote retention and peace of mind and contribute to financial security. Double-trigger change-in-control agreements encourage focused attention of executives during major corporate transitions. |

1 The Company's current executive compensation program does not include stock options. Except for atypical off-cycle RSU grants most commonly made as part of a new compensation arrangement (typically in connection with a new hire or promotion), all equity grants are made annually in February following HEI Compensation & Human Capital Management Committee approval.

Changes to compensation elements in 2024

On an annual basis, the HEI Compensation & Human Capital Management Committee reviews and recommends for Hawaiian Electric Board approval, each named executive officer’s target compensation opportunity, which is composed of base salary, target annual cash and target long-term equity opportunities. Target annual cash and target long-term incentive opportunities are established, in each case, as a percentage of the named executive officer’s base salary.

The HEI Compensation & Human Capital Management Committee recommended, and the Hawaiian Electric Board approved, changes to compensation for 2024, as shown in the table below. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Base Salary1 ($) | | Performance-Based Annual Incentive (Target Opportunity2 as % of Base Salary) | | Performance-Based Long-Term Incentive (Target Opportunity2 as % of Base Salary) | | Time-Based Long-Term Incentive (Value as % of Base Salary) |

| Name | 2023 | 2024 | | 2023 | 2024 | | 2023-25 | 2024-26 | | 2023 | 2024 |

| Shelee M. T. Kimura | 575,000 | 650,000 | | 75 | same | | 90 | 105 | | 60 | 105 |

| Paul K. Ito | 475,000 | 485,917 | | 70 | 75 | | 80 | 95 | | 1003 | 95 |

| Jimmy D. Alberts | 364,583 | 376,000 | | 55 | 60 | | 50 | 80 | | 35 | 80 |

| Jason E. Benn | 322,333 | 349,750 | | 50 | 60 | | 45 | 80 | | 35 | 80 |

| Colton K. Ching | 331,667 | 342,750 | | 50 | 60 | | 45 | 80 | | 35 | 80 |

1Base salary increases for 2023 for Ms. Kimura and Messrs. Alberts, Benn and Ching became effective as of March 1, 2023. Base salary increases for 2024 for Ms. Kimura and Messrs. Ito, Alberts and Ching became effective as of March 1, 2024. Base salaries that became effective March 1, 2023 and 2024 are prorated amounts to include two months of 2022 and 2023 base salary, respectively, and ten months of 2023 and 2024 base salary, respectively. Mr. Benn received a base salary increase for 2024 effective as of March 1, 2024, and received an additional base salary increase upon his promotion to Senior Vice President & Chief Transformation and Administrative Officer on August 15, 2024. Accordingly, his 2024 base salary is prorated.

2The threshold and maximum opportunities are 0.5 times target and 2 times target, respectively.

3Includes special grant of 50% of base salary in 2023 in connection with Mr. Ito’s promotion to HEI Executive Vice President, Chief Financial Officer and Treasurer.

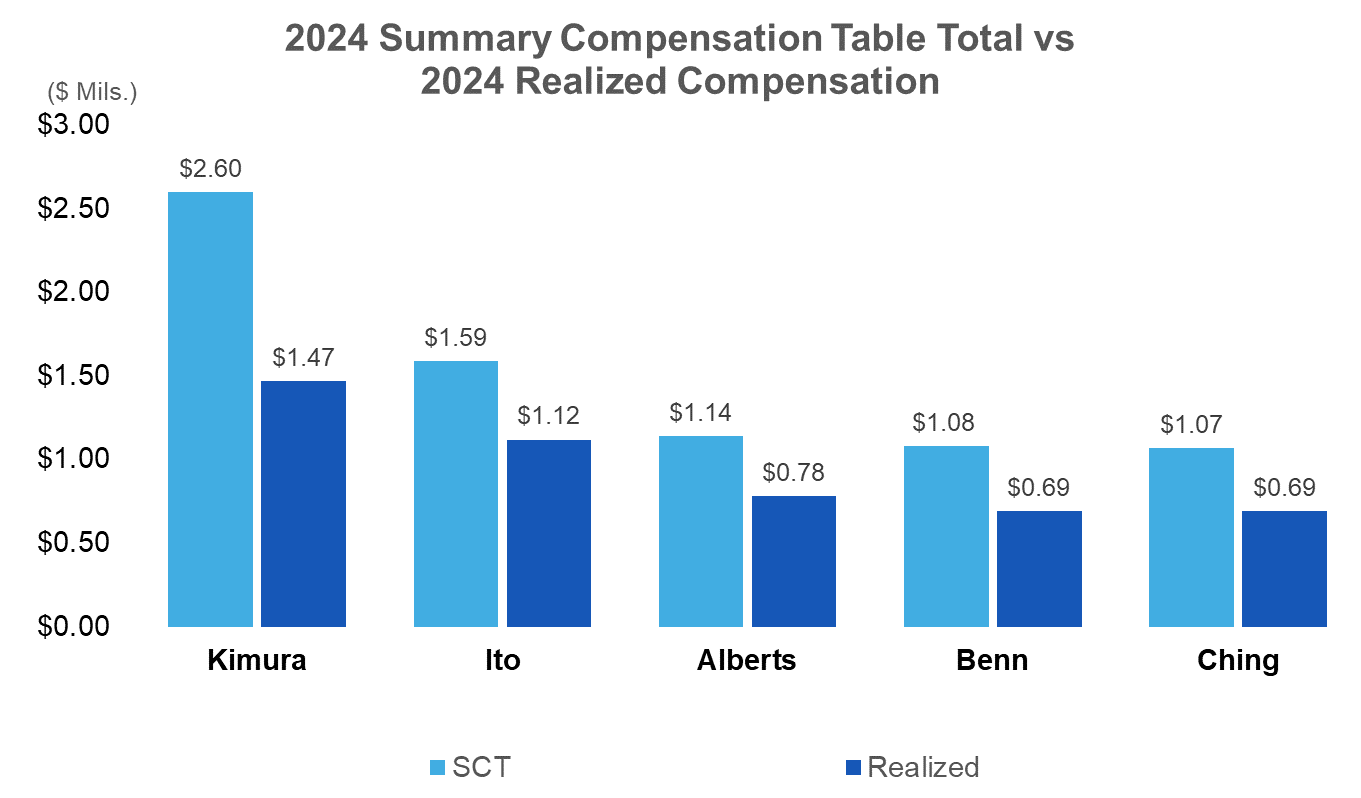

Realized Compensation for 2024

The table below and graph that follows provide a supplemental disclosure representing the total direct compensation realized (Realized Compensation) by each NEO for 2022-2024. As an example, 2024 Realized Compensation includes the salary paid in 2024, EICP payouts for the 2024 performance period that was paid in 2025, RCAs that vested and were paid in 2024, the LTIP award for the 2022-2024 performance period that vested and was settled in shares of HEI Common Stock in 2025 (0 shares in 2025), and the value of RSUs that vested and were settled in shares of HEI Common Stock in 2024. The table and graph below differ substantially from the Summary Compensation Table and are not a substitute for that table. For example, SEC rules require that the full grant date fair value of equity awards be reported in the Summary Compensation Table for the year in which they were granted; however, this supplemental disclosure includes the value of compensation actually received from equity awards in the year in which the awards vested and were settled. Consequently, Realized Compensation for a NEO for any given year may differ significantly from the total compensation reported in the Summary Compensation Table for that year.

| | | | | | | | | | | | | | | | | | | | |

Name and 2024

Principal Positions | Year | Summary Compensation Table Total ($) | Change in Pension Value ($) | Stock

Awards

($) | Value Realized

on Vesting of Stock

Awards

($) | Realized Compensation ($) |

| Shelee M. T. Kimura | 2024 | 2,596,499 | | (521,723) | | (704,346) | | 103,411 | | 1,473,841 | |

| President and Chief Executive Officer | 2023 | 2,077,532 | | (606,930) | | (895,602) | | 284,167 | | 859,167 | |

| 2022 | 1,514,176 | | — | | (814,267) | | 225,344 | | 925,253 | |

| Paul K. Ito | 2024 | 1,585,693 | | (73,426) | | (476,397) | | 82,085 | | 1,117,955 | |

| Senior Vice President, Chief Financial Officer & Treasurer | 2023 | 880,983 | | (87,000) | | (672,667) | | 4,810 | | 126,126 | |

| | | | | |

| Jimmy D. Alberts | 2024 | 1,144,141 | | (109,216) | | (310,423) | | 51,431 | | 775,933 | |

| Senior Vice President & Chief Operations Officer | 2023 | 853,397 | | (143,044) | | (321,561) | | 200,910 | | 589,702 | |

| 2022 | 792,931 | | — | | (290,387) | | 253,631 | | 756,175 | |

| Jason E. Benn | 2024 | 1,083,659 | | (155,335) | | (274,516) | | 38,933 | | 692,741 | |

| Senior Vice President & Chief Transformation and Administrative Officer | 2023 | 909,884 | | (320,416) | | (267,135) | | 124,124 | | 446,457 | |

| 2022 | 676,474 | | — | | (255,137) | | 91,353 | | 512,690 | |

| Colton K. Ching | 2024 | 1,067,448 | | (140,092) | | (282,975) | | 47,632 | | 692,013 | |

| Senior Vice President, Planning & Technology | 2023 | 1,016,944 | | (410,407) | | (274,870) | | 188,736 | | 520,403 | |

| 2022 | 692,969 | | — | | (261,356) | | 229,478 | | 661,091 | |

The amount of “Realized Compensation” shown in the table above and graph below is calculated by taking the amount of total compensation as set forth in the Summary Compensation Table, subtracting the amount of “Change in Pension Value” and “Stock Awards” (in each case, as described in more detail in the Summary Compensation Table and accompanying footnotes), and adding the amount of “Value Realized on Vesting” from the “2024 Option Exercises and Stock Vested” table, and described in more detail in footnote 1 thereto.

Base salary

Base salaries for Hawaiian Electric named executive officers are reviewed and determined annually. In establishing its base salaries for the year, the HEI Compensation & Human Capital Management Committee considers competitive market data, internal equity and each executive’s level of responsibility, experience, expertise and performance, as well as retention and succession considerations. The Committee considers the competitive median as a reference point in setting base salaries, but may determine that the foregoing factors justify a higher or lower salary. The resulting 2024 base salaries are shown in the table above.

For 2024, Ms. Kimura received a base salary increase in connection with her promotion to President and CEO in 2022 and as part of a plan to incrementally increase Ms. Kimura’s base salary over time to an amount that more closely aligns with the peer median. Mr. Benn received a base salary increase for 2024 effective as of March 1, 2024, and received an additional base salary increase upon his promotion to Senior Vice President & Chief Transformation and Administrative Officer on August 15, 2024. Other executive officers received ordinary aging and/or merit increases in the amounts shown in the table above.

Annual incentives

Hawaiian Electric named executive officers and other executives are eligible to earn an annual cash incentive award under the HEI Executive Incentive Compensation Plan (EICP) based on the achievement of performance goals for the year. Each year, the HEI Compensation & Human Capital Management Committee determines or recommends, and the Hawaiian Electric Board ratifies or approves, as applicable, the target annual incentive opportunity for each named executive officer, performance metrics and the applicable goals.

2024 target annual incentive opportunity. The target annual incentive opportunity is determined as a percentage of base salary, with the threshold and maximum opportunities equal to 0.5 times and 2 times the target opportunity, respectively. In establishing the target percentage for each executive, the HEI Compensation & Human Capital Management Committee takes into account the mix of pay elements, competitive market data, internal equity, prior performance and other factors described above under “Base salary.”

The 2024 target annual incentive opportunities for the named executive officers are shown in the table above. For 2024, the HEI Compensation & Human Capital Management Committee recommended, and the Hawaiian Electric Board approved, increasing Messrs. Ito’s, Alberts’s, Benn’s, and Ching’s 2024 target opportunity to more closely align with the peer median for their positions.

2024 performance metrics, goals and results. The performance metrics for annual incentives are chosen because they connect directly to Hawaiian Electric’s strategic priorities and correlate with creating long-term value for all stakeholders, including shareholders, customers and employees. The 2024 metrics promote resilience and safety, including wildfire mitigation and generation reliability.

In addition to selecting performance metrics, the HEI Compensation & Human Capital Management Committee determines, and the Hawaiian Electric Board ratifies, the level of performance required to attain the threshold, target and maximum goal for each metric. The level of difficulty of the goals reflects the Committee’s and the Board’s belief that incentive pay should be motivational – that is, the goals should be challenging but achievable – and that such pay should be balanced with reinvestment in the Company and return to shareholders. Consistent with this approach, the HEI Compensation & Human Capital Management Committee and Hawaiian Electric Board believe the threshold should represent solid performance with positive financial/operating results, target should denote challenging but achievable goals and maximum should signify exceptional performance.

The target level for financial goals, such as net income, is generally set at the level of the Board-approved budget, which represents the level of performance Hawaiian Electric seeks to achieve for the year. In setting the threshold and maximum levels, the Committee and Board consider whether the risks to accomplishing the budget weigh more heavily toward the downside and how challenging it would be to achieve incremental improvements over the target level.

The table below identifies the 2024 annual incentive metrics, the objective each measure serves, the level of achievement required to attain the threshold, target and maximum levels for each metric and the results for 2024. | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 Annual Incentive Performance Metrics & Why We Use Them | Weight-

ing | Goals | |

| Threshold | Target | Maximum | Result |

Safety and Resilience1 rewards successful implementation of wildfire mitigation and prevention measures designed to reduce wildfire risk, improve employee safety by reducing serious injuries and lost workdays and generation reliability which promotes customer satisfaction and confidence | 55% | | See Appendix B | | See Appendix B |

Financial Health2 focuses on net income and liquidity which promotes long-term financial stability and increases shareholder value | 25% | | See Appendix B | | See Appendix B |

Trust & Reputation3 promotes customer satisfaction and community trust and supports sustained long-term shareholder value | 10% | | See Appendix B | | See Appendix B |

Healthy & Engaged Workforce4 measures employee engagement, belonging and well-being which promote retention and commitment | 10% | | See Appendix B | | See Appendix B |

1 Safety and Resilience includes goals related to (i) implementation of the wildfire mitigation plan, (ii) employee safety measured by improvement in recordable incidents and lost workdays, and (iii) energy security measured by outage percentage and reportable cyber events.

2 Financial Health includes goals related to (i) Hawaiian Electric’s consolidated adjusted net income for 2024, and (ii) liquidity measured as the actual book cash balance plus committed liquidity sources.

3 Trust & Reputation includes goals related to consolidated customer satisfaction and Company image based on quarterly results of customer surveys conducted by an outside vendor.

4 Healthy & Engaged Workforce: Employee Engagement Score is based on the results of the annual employee engagement survey.

Based on the level of performance achieved and shown in the table above, in early 2025, the HEI Compensation & Human Capital Management Committee approved, and the Hawaiian Electric Board ratified, the following 2024 annual incentive payouts. The payout amounts are included in the 2024 Summary Compensation Table below in the “Nonequity Incentive Plan Compensation” column. The range of possible annual incentive payouts for 2024 is shown below in the 2024 Grants of Plan-Based Awards table.

| | | | | |

| Name | 2024 Annual Incentive Payout |

| Shelee M. T. Kimura | $ | 606,680 | |

| Paul K. Ito | 453,531 | |

| Jimmy D. Alberts | 280,756 | |

| Jason E. Benn | 259,725 | |

| Colton K. Ching | 255,931 | |

Non‑GAAP Net Income Metrics — 2024 Annual Incentive. Hawaiian Electric Consolidated Adjusted Net Income for purposes of 2024 annual incentive compensation were calculated on a non‑GAAP basis, consistent with prior years. Pursuant to the EICP, the Compensation & Human Capital Management Committee may exclude items from the calculation of net income to the extent they arose from extraordinary or nonrecurring events or from changes to applicable accounting rules or practices. In 2024, the Company experienced extraordinary and nonrecurring events that impacted the Company's operations and financial performance in a variety of ways, some of which the Compensation & Human Capital Management Committee deemed appropriate to take into consideration in determining EICP performance. Specifically, the Compensation & Human Capital Management Committee determined it to be appropriate to exclude the items of expense/(gain) set forth in the table in Appendix A (and explained further in the accompanying footnotes). Excluded items include a portion of the wildfire-related expenses and wildfire settlement expense.

Long-term incentives

Long-term incentives include performance-based opportunities under the Long-Term Incentive Plan (LTIP), which are based on achievement of performance goals over rolling three-year periods, and time-based opportunities that include RSUs and RCAs, which are time-based and vest over a three-year period. These incentives are designed to reward executives for creating long-term value that benefits all stakeholders, including customers and shareholders.

Long-term performance-based incentives

The three-year performance periods for long-term performance-based incentives foster a long-term perspective and provide balance with the shorter-term focus of the annual incentive program. In addition, the overlapping three-year performance periods encourage sustained high levels of performance because at any one time, three separate potential awards are at risk.

Similar to the annual incentives, in developing long-term incentives, the HEI Compensation & Human Capital Management Committee approves, and the Hawaiian Electric Board ratifies, the target incentive opportunity for each named executive officer and performance metrics and goals for the three-year period.

2024-26 long-term incentive plan

2024-26 target long-term incentive opportunity. As with the annual incentives, the target long-term incentive opportunity is established as a percentage of base salary, with the threshold and maximum opportunities equal to 0.5 times and 2 times the target opportunity, respectively. In establishing the target percentage for each executive, the HEI Compensation & Human Capital Management Committee considers the mix of pay elements, competitive market data, internal equity, performance and the other factors described above under “Base salary.”

For the 2024-26 long-term incentive opportunity, in consideration of its review of the market data for each position and the retention and incentive value of the overall long-term incentive program, the HEI Compensation & Human Capital Management Committee recommended, and the Hawaiian Electric Board approved, increases to the 2024-26 LTIP target opportunities for Messrs. Alberts and Ito to more closely align with the peer median for their positions, as described in the preceding section (Annual Incentives). See the table above under the heading “Changes to elements in 2024” for the resulting 2024-26 target opportunities.

2024-26 performance metrics and goals. The performance metrics for long-term incentives are chosen for their relationship to the creation of long-term value and alignment with Hawaiian Electric’s multi-year strategic plans.

In addition to selecting performance metrics, the HEI Compensation & Human Capital Management Committee establishes, and the Hawaiian Electric Board ratifies, the level of achievement required to attain threshold, target and maximum performance for each metric. The same principles that the HEI Compensation & Human Capital Management Committee applies to annual incentive goals apply to long-term incentive goals. As such, the level of difficulty of the goals reflects the Committee’s and the Board’s belief that incentive pay should be motivational – that is, the goals should be challenging but achievable – and that such pay should be balanced with reinvestment in the Company and return to shareholders. Consistent with this approach, the Committee and Board believe threshold should represent solid performance with positive financial/operating results, target should denote challenging but achievable goals and maximum should signify exceptional performance.

The target level reflects objectives Hawaiian Electric seeks to achieve over the performance period. In setting the threshold and maximum levels, the Committee and Board consider whether the risks to accomplishing those levels weigh more heavily toward the downside and how challenging it would be to achieve incremental improvements over the target result. For the 2024-26 period, the Committee established, and the Hawaiian Electric Board ratified, the metrics and weightings in the following table. For the 2024-26 performance period, Hawaiian Electric prioritized goals related to safety and system hardening and growth in long-term shareholder value in the wake of the Maui windstorm and wildfires.

| | | | | | | | |

| 2024-26 Long-Term Incentive | | |

| Performance Metrics & Why We Use Them | Weighting | | | |

Hawaiian Electric long term issuer credit rating1 rewards improved access to and cost of capital thereby improving liquidity and long-term shareholder value | 40% | | | |

Hawaiian Electric public safety: system hardening to new standards2 public safety by hardening the company’s system and mitigating wildfire risk | 50% | | | |

HEI Relative TSR3 compares the value created for HEI shareholders to that created by the HEI Compensation Peers. | 10% | | | |

1 Hawaiian Electric long term issuer credit rating measures improvement in credit rating by at least two credit rating agencies.

2 Hawaiian Electric public safety: system hardening to new standards measures progress towards upgrading prescribed equipment to achieve enhanced safety standards.

3 HEI Relative TSR compares HEI’s TSR to that of the HEI Compensation Peers (see above). For LTIP purposes, TSR is the sum of the growth in price per share of HEI Common Stock as measured at the beginning of the performance period to the end, calculated using the average closing share price for the trading days in December at the end of the performance period, plus dividends paid during the

period, assuming reinvestment, divided by the average closing share price for the trading days in January at the beginning of the performance period.

The Company believes that all Hawaiian Electric stakeholders benefit when the above goals are met. Achievement of these goals makes Hawaiian Electric and HEI stronger financially, enabling Hawaiian Electric and HEI to raise capital at favorable rates for reinvestment in the Utilities and supporting shareholder dividends. From a historical perspective, long-term incentive payouts are not easy to achieve, nor are they guaranteed. Strong leadership on the part of the named executive officers will be needed to achieve the long-term objectives required for them to earn the incentive payouts.

2022-24 long-term incentive plan. The Hawaiian Electric Board and HEI Compensation & Human Capital Management Committee established the 2022-24 long-term incentive opportunities, performance metrics and goals in February 2022. Those decisions were described in the Hawaiian Electric Annual Report on Form 10-K for the year ended December 31, 2022 and are summarized again below to provide context for the results and payouts for the 2022-24 period.

2022-24 target long-term incentive opportunity. In February 2022, the HEI Compensation & Human Capital Management Committee established, and the Hawaiian Electric Board ratified, the following 2022-24 target incentive opportunities as a percentage of named executive officer base salary.

| | | | | |

| Name | 2022-24 Target Opportunity* (as % of Base Salary) |

| Shelee M. T. Kimura | 90% |

| Paul K. Ito | 45% |

| Jimmy D. Alberts | 45% |

| Jason E. Benn | 45% |

| Colton K. Ching | 45% |

*The threshold and maximum opportunities were 0.5 times the target opportunity and 2 times the target opportunity, respectively.

2022-24 performance metrics, goals and results. The HEI Compensation & Human Capital Management Committee established, and the Hawaiian Electric Board approved, the 2022-24 performance metrics and goals below in February 2022. The performance metrics were selected for their correlation with sustained growth and value and alignment with Hawaiian Electric’s multi-year strategic plans. The table below identifies the 2022-24 LTIP metrics, the objective each metric serves, the level of achievement required to attain the threshold, target and maximum levels for each metric and the results for 2022-24. The 2022-24 LTIP targets were determined based on a significantly different budget and forecast that existed before the Maui windstorm and wildfires. The material increase in expenses and decrease in HEI stock price, among other material changes that followed the Maui windstorm and wildfires, created significant challenges to meeting many 2022-24 LTIP targets.

Based on achieving below threshold performance, as described in the table below, in early 2025 the HEI Compensation & Human Capital Management Committee approved and the Hawaiian Electric Board ratified no payout (0 shares) under the 2022-24 long-term incentive plan.

The results shown in the table below may exclude the impact of unusual events that affected Hawaiian Electric during the 2022-24 period that, pursuant to the terms of the plans, the HEI Compensation & Human Capital Management Committee determined it appropriate to exclude. Any such adjustments are described below under “Non-GAAP Net Income Metrics - 2022-24 LTIP.”

| | | | | | | | | | | | | | | | | |

| 2022-24 Long-Term Incentive | | Goals | |

| Performance Metrics & Why We Use Them | Weighting | Threshold | Target | Maximum | Result |

| Kimura, Alberts, Benn and Ching* | | | | | |

Hawaiian Electric 3-year Average Annual Net Income Growth1 promotes shareholder value by focusing on net income growth based on the years included in the plan. | 30% | 4.0% | 6.0% | 8.0% | 0.7% |

Hawaiian Electric 3-year Average ROACE2 promotes profitability based on net income as a % of average common equity. | 30% | 8.3% | 8.5% | 8.7% | 7.9% |

Hawaiian Electric Carbon Emissions (CO2e) Reduction3 promotes reduction of carbon dioxide equivalent emissions from power generation. | 20% | 28% | 32% | 36% | 27% |

HEI Relative TSR4 compares the value created for HEI shareholders to that created by other investor-owned electric companies (EEI Index). | 20% | 30th percentile | 50th percentile | 70th percentile | 0 percentile |

| | | | | |