In 2020, our Board fully integrated material ESG factors into the company’s governance structures and oversight of management activities. We expanded the responsibilities of the Nominating & Corporate Governance Committee to include overseeing human capital management and ensuring all material ESG areas have appropriate board oversight.

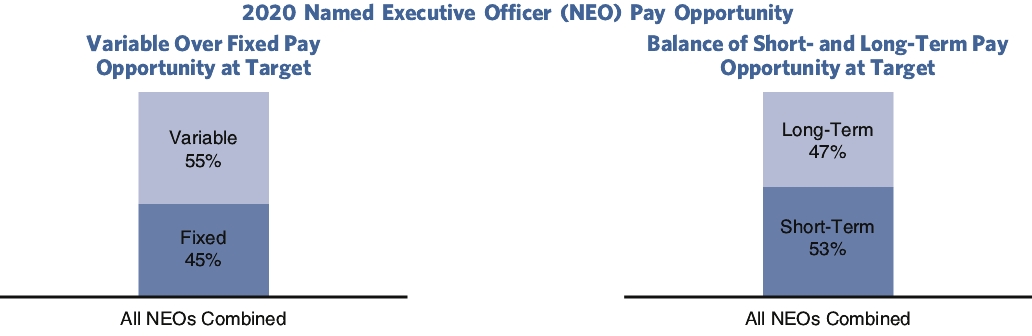

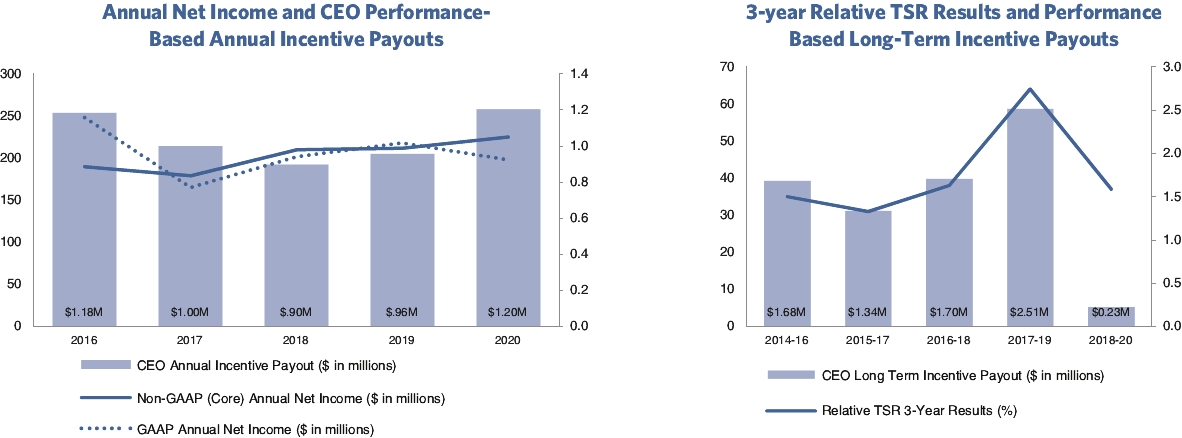

The Compensation Committee also expanded the ESG component of executive incentive compensation for HEI and utility executives to further align management incentives with our strategic goals. In addition to existing goals related to the renewable transition, safety, reliability and customer satisfaction, beginning in 2020 the Compensation Committee added renewable portfolio standard (RPS) achievement goals to HEI and utility executives’ long-term incentive metrics. We’re expanding on this for HEI and utility executives in 2021 with the addition of diversity, equity and inclusion and electrification goals.

The new performance-based regulation (PBR) framework, developed with our regulators and stakeholders, further incentivizes the utility to achieve ESG outcomes relating to increasing renewable energy, facilitating customer participation in the clean energy transition, modernizing our grid and advancing affordability and customer equity. In doing so, PBR offers the utility the opportunity to earn additional revenue if it achieves performance targets – directly linking our financial performance with stakeholder outcomes.

Enhanced ESG Reporting

In 2020 the Board prioritized enhancing the transparency of our ESG disclosures to allow investors and other stakeholders to see the value of our efforts and gauge our progress.

In September, HEI released its first consolidated ESG report, providing new data, insights and updates regarding the Company’s commitment to sustainable operations, addressing climate change and promoting diversity, equity and inclusion. The new report is aligned with Sustainability Accounting Standards Board (SASB) disclosure standards relevant to HEI’s utility and bank subsidiaries. Future reports will also incorporate disclosures aligned with Task Force on Climate-related Financial Disclosures (TCFD) guidance.

Commitment to Diversity

Our Board remains deeply committed to maintaining diverse perspectives across our Board and our workforce, and reflecting the unique diversity of our state. Today 50% of our directors are women, 10% are Asian and 10% are Native Hawaiian. At our utility, 90% of all employees and 65% of executives are racially diverse, and 29% of employees and 47% of executives are female. At our bank, 88% of our employees and 70% of executives are racially diverse, and 67% of employees and 40% of executives are female.

The Board is committed to continuing to strengthen HEI’s practices, including hiring and promoting individuals from diverse backgrounds, to ensure a diverse and inclusive culture throughout the HEI family of companies.

Ongoing Board and Management Succession Planning

We have a robust succession planning process for both the Board and management. In 2020 we continued to refresh Board and committee leadership. I was appointed Board Chair following the retirement of Jeff Watanabe. In addition, Richard Dahl was appointed Chair of the Compensation Committee.

The Board continues to oversee our management succession planning processes throughout our enterprise. The Nominating and Governance Committee evaluates internal and external succession candidates regularly, and the full Board discusses these candidates at least annually. In addition, potential leaders are given frequent exposure to the Board to further familiarize directors with our talent pool.

Shareholder and Stakeholder Engagement

We believe strong corporate governance includes engaging with our shareholders and considering their views. Over the past year, our company reached out to or engaged with shareholders representing more than 50% of our institutional shareholder base. These meetings covered our financial and operational performance, our progress toward renewable energy goals, our ESG reporting and Board oversight of ESG matters, executive compensation and Board and management succession planning, and involved our independent directors as appropriate.

Partly as a result of shareholder feedback, and following shareholder approval at our 2020 annual meeting, the Company amended its Articles of Incorporation with corporate governance enhancements to declassify the Board and adopt a majority voting standard in uncontested director elections.