SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

FLIR SYSTEMS, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

16505 S.W. 72nd Avenue

Portland, Oregon 97224

(503) 684-3731

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 24, 2002

To the Shareholders of FLIR Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of FLIR Systems, Inc. (the “Company”) will be held on Wednesday, April 24, 2002, at 2:00 p.m., at the Hilton Portland & Executive Tower, 921 S.W. Sixth Avenue, Portland, Oregon 97204-1296 for the following purposes:

| 1. | Election of Directors. To elect two Directors, each for a three-year term. |

| 2. | Approval of the Company’s 2002 Stock Incentive Plan. To approve the Company’s 2002 Stock Incentive Plan; and |

| 3. | Other Business. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on March 1, 2002 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

| By | Order of the Board, |

|

| Ea | rl R. Lewis |

| Ch | airman of the Board of Directors, President |

| and | Chief Executive Officer |

Portland, Oregon

March 15, 2002

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, WHETHER OR NOT YOU PLAN TO BE PRESENT IN PERSON AT THE ANNUAL MEETING, PLEASE DATE, SIGN AND COMPLETE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

FLIR SYSTEMS, INC.

16505 S.W. 72nd Avenue

Portland, OR 97224

(503) 684-3731

PROXY STATEMENT

for the

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 24, 2002

INTRODUCTION

General

This Proxy Statement is being furnished to the shareholders of FLIR Systems, Inc., an Oregon corporation (“FLIR” or the “Company”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors” or the “Board”) from holders of the outstanding shares of FLIR common stock, par value $0.01 per share (the “Common Stock”), for use at the Company’s Annual Meeting of Shareholders to be held on April 24, 2002, and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, shareholders will be asked to elect two members of the Board of Directors, approve the Company’s 2002 Stock Incentive Plan and transact such other business as may properly come before the meeting or any adjournments thereof. This Proxy Statement, together with the enclosed proxy card, is first being mailed to shareholders of FLIR on or about March 25, 2002.

Solicitation, Voting and Revocability of Proxies

The Board of Directors has fixed the close of business on March 1, 2002 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were approximately 7,000 beneficial holders of the 16,716,934 shares of Common Stock then outstanding. The presence, in person or by proxy, of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If the enclosed form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.Executed but unmarked proxies will be voted FOR the election of the two nominees for election to the Board of Directors and FOR the approval of the Company’s 2002 Stock Incentive Plan. The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the proxy will vote the shares represented by such proxy upon such matters as determined by a majority of the Board of Directors.

The presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s proxy. A shareholder may, however, revoke a proxy at any time prior to its exercise by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to, Corporate Secretary, FLIR Systems, Inc., 16505 S.W. 72nd Avenue, Portland, Oregon 97224, or by attending the Annual Meeting and

1

voting in person. However, a shareholder who attends the Annual Meeting need not revoke a previously executed proxy and vote in person unless such shareholder wishes to do so. All valid, unrevoked proxies will be voted at the Annual Meeting.

ELECTION OF DIRECTORS

At the Annual Meeting two Directors will be elected, each for a three-year term. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election as Directors of the persons named below as nominees. The Board of Directors believes that the nominees will stand for election and will serve if elected as Directors. However, if any of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the number of Directors constituting the Board of Directors may be reduced prior to the Annual Meeting or the proxies may be voted for the election of such other person as the Board of Directors may recommend.

Under the Company’s articles of incorporation and bylaws, the Directors are divided into three classes. The term of office of only one class of Directors expires in each year, and their successors are elected for terms of three years and until their successors are elected and qualified. There is no cumulative voting for election of Directors.

Information as to Nominees and Continuing Directors. The following table sets forth the names of the Board of Directors’ nominees for election as a Director and those Directors who will continue to serve after the Annual Meeting. Also set forth is certain other information with respect to each such person’s age, principal occupation or employment during the past five years, the periods during which he has served as a Director of FLIR, the expiration of his term as a Director and the positions currently held with FLIR.

Nominees: | Age | Director Since | Expiration of Current Term | Position Held with FLIR | ||||

| John C. Hart | 68 | 1987 | 2002 | Director | ||||

| Angus L. Macdonald | 47 | 2001 | 2002 | Director | ||||

Continuing Directors: | ||||||||

| Earl R. Lewis | 58 | 1999 | 2003 | President, Chief Executive Officer and Chairman of the Board of Directors | ||||

| Ronald L. Turner | 55 | 1993 | 2003 | Director | ||||

| Steven E. Wynne | 50 | 2000 | 2003 | Director | ||||

| W. Allen Reed | 55 | 1992 | 2004 | Director |

JOHN C. HART. Mr. Hart has served as a Director of the Company since February 1987 and his current term expires at the Company’s 2002 Annual Meeting of Shareholders, at which time his election to the Board for a three-year term will be voted upon. He served as Chairman of the Board of Directors from 1987 to April 1993. From 1982 until his retirement in 1993, Mr. Hart served as Vice President of Finance, Treasurer, Chief Financial Officer and a member of the Board of Directors of Louisiana-Pacific Corporation. Mr. Hart also served as interim President and Chief Executive Officer of the Company from May through November 2000.

ANGUS L. MACDONALD. Mr. Macdonald was elected to the Board of Directors in 2001 for a term to expire at the Company’s 2002 Annual Meeting of Shareholders, at which time his election to the Board for a three-year term will be voted upon. Mr. Macdonald is currently President of Life Sciences Consultants, Inc., an advisory firm to growth companies regarding capital formation, corporate development and strategy. From 1996 to 2000, he was Senior Vice President and headed Special Situations in the health care equities research group at Lehman Brothers, Inc. Prior to joining Lehman Brothers, Mr. Macdonald was a senior securities analyst at Fahnestock, Inc. He holds a B.A. from the University of Pennsylvania and an MBA from Cranfield University, UK.

2

EARL R. LEWIS. Mr. Lewis has served as Chairman, President and Chief Executive Officer of the Company since November 1, 2000. He was initially elected to the Board in June 1999 in connection with the acquisition of Spectra Physics AB by Thermo Instrument Systems Inc. Mr. Lewis was formerly President and Chief Executive Officer of Thermo Instrument Systems, Inc. and Chief Operating Officer, Measurement and Detection, of Thermo Electron Corporation, the parent company of Thermo Instrument Systems. Mr. Lewis is also a Director of SpectRx Inc., IGI, Harvard BioScience, Inc. and a trustee of Dean College. Mr. Lewis holds a B.S. from Clarkson College of Technology and has attended post-graduate programs at the University of Buffalo, Northeastern University and Harvard University.

RONALD L. TURNER. Mr. Turner was elected to the Board of Directors in 1993. Mr. Turner was appointed Chairman, President and Chief Executive Officer of Ceridian Corporation in May 2000, after serving Ceridian Corporation as President and Chief Executive Officer since January 2000, President and Chief Operating Officer since 1998 and Executive Vice President, Operations since 1997. From 1993 to 1997, Mr. Turner served as President and Chief Executive Officer of Computing Devices International, an aerospace company, which was a division of Ceridian Corporation. From 1987 to 1993, Mr. Turner was President and Chief Executive Officer of GEC-Marconi Electronic Systems Corporation, a defense electronics company. Prior to 1987, Mr. Turner worked for Martin Marietta Corporation for 14 years in a variety of executive positions. Mr. Turner serves on the Board of Directors of Ceridian Corporation and is a member of The Business Roundtable. He is also Vice Chairman of the Electronics Industries Alliance, serves on its Executive Committee and Board of Governors and is on the board of the Government Electronics and Information Technology Association. He is also a past President and a member of the Board of Governors of the Massachusetts Institute of Technology Society of Sloan Fellows.

STEVEN E. WYNNE. Mr. Wynne was elected to the Board of Directors in November 1999. Mr. Wynne is currently a partner in the Portland, Oregon law firm of Ater Wynne LLP. Mr. Wynne was formerly Chairman and Chief Executive Officer of eteamz.com, an on-line community serving amateur athletics from June 2000 until its sale to Active.com in January 2001. From February 1995 to March 2000, Mr. Wynne served as President and Chief Executive Officer of adidas America, Inc. Prior to that time, he was a partner in the law firm of Ater Wynne LLP. Mr. Wynne received an undergraduate degree and a J.D. from Willamette University. Mr. Wynne also serves on the Board of Directors of Planar Systems, Inc.

W. ALLEN REED. Mr. Reed has served as a Director of the Company since April 1992. Mr. Reed is President and Chief Executive Officer of General Motors Investment Management Corporation. From 1991 to 1994, Mr. Reed was Vice President and Treasurer of GM Hughes Electronics Corporation and Hughes Aircraft Company (“Hughes”). From 1984 to 1991, Mr. Reed was President of the Hughes Investment Management Company, a wholly owned subsidiary of Hughes. Prior to joining Hughes, Mr. Reed was Vice President and Portfolio Manager for Allen & Associates Investment Management Company. Mr. Reed serves on the Boards of Directors of iShares, Inc., Temple-Inland Industries, General Motors Acceptance Corporation and GMAC Insurance Holdings. Mr. Reed also serves as Chairman of the Investment Advisory Committee for the Howard Hughes Medical Institute.

Board of Directors Committees and Nominations by Shareholders. The Board of Directors acts as a nominating committee for selecting nominees for election as Directors. The Company’s bylaws also permit shareholders to make nominations for the election of Directors, if such nominations are made pursuant to timely notice in writing to the Company’s Secretary. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the date of the meeting, provided that at least 60 days notice or prior public disclosure of the date of the meeting is given or made to shareholders. If less than 60 days notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received by the Company not later than the close of business on the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made. A shareholder’s notice of nomination must also set forth certain information specified in the Company’s bylaws concerning each person the shareholder proposes to nominate for election and the nominating shareholder.

3

The Board of Directors has appointed a standing Audit Committee. The members of the Audit Committee currently are Messrs. Macdonald, Reed and Wynne. The Audit Committee reviews the scope of the independent annual audit, the independent public accountants’ letter to the Board of Directors concerning the effectiveness of the Company’s internal financial and accounting controls and management’s response to that letter, if deemed necessary. The Audit Committee met five times during the fiscal year ended December 31, 2001. The Board of Directors also has appointed a Compensation Committee that reviews executive compensation and makes recommendations to the full Board regarding changes in compensation, and also administers the Company’s stock option plans. During the fiscal year ended December 31, 2001, the Compensation Committee held five meetings. The members of the Compensation Committee currently are Messrs. Hart, Macdonald and Turner.

During 2001 the Company’s Board of Directors held four meetings. Each incumbent Director attended more than 75% of the aggregate of the total number of meetings held by the Board of Directors and the total number of meetings held by all committees of the Board on which he served during the period that he served.

See “Management—Executive Compensation” for certain information regarding compensation of Directors.

The Board of Directors unanimously recommends that shareholders vote FOR the election of its nominees for Director.If a quorum is present, the Company’s bylaws provide that Directors are elected by a plurality of the votes cast by the shares entitled to vote. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality exists with respect to a given nominee.

MANAGEMENT

Executive Officers

The executive officers of the Company are as follows:

Name | Age | Position | ||

| Earl R. Lewis | 58 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

| Arne Almerfors | 56 | Executive Vice President and President, Thermography Division | ||

| Stephen M. Bailey | 54 | Senior Vice President, Finance and Chief Financial Officer | ||

| James A. Fitzhenry | 46 | Senior Vice President, General Counsel and Secretary | ||

| Daniel L. Manitakos | 44 | Senior Vice President and General Manager, Boston Operations | ||

| Detlev H. Suderow | 55 | Senior Vice President, Human Resources | ||

| William A. Sundermeier | 38 | Senior Vice President and General Manager, Portland Operations | ||

| Andrew C. Teich | 41 | Senior Vice President, Sales and Marketing |

Information concerning the principal occupation of Mr. Lewis is set forth under “Election of Directors.” Information concerning the principal occupation during the last five years of the executive officers of the Company who are not also Directors of the Company is set forth below.

ARNE ALMERFORS. Mr. Almerfors joined FLIR in December 1997 in connection with FLIR’s acquisition of AGEMA Infrared Systems AB, and currently serves as Executive Vice President and President of the Thermography division. From 1995 to 1997, Mr. Almerfors was President and Chief Executive Officer of AGEMA Infrared Systems AB. He also served as President and Chief Executive Officer of CE Johansson AB, a manufacturer of coordinate measuring devices, from 1989 to 1995. Mr. Almerfors received his B.S., MBA, Masters in Political Science and certification for post-graduate courses in corporate finance and accounting from the University of Stockholm.

STEPHEN M. BAILEY. Mr. Bailey joined FLIR in April 2000 as Senior Vice President, Finance and Chief Financial Officer. Prior to joining FLIR, Mr. Bailey served as Vice President and Chief Financial Officer

4

of Bauce Communications, Inc., President of Pro Golf of Portland, Inc., and Chief Financial Officer and Chief Operating Officer of Desk2Web Technologies, Inc. From 1975 to 1988, Mr. Bailey served in various senior executive positions with Amfac, Inc., including Senior Vice President and Controller of Amfac Foods, Inc., President of Amfac Supply Company and as Senior Vice President and Controller of Amfac, Inc. A CPA, Mr. Bailey also worked at Touche Ross & Company (which subsequently became Deloitte & Touche) from 1970 to 1975. Mr. Bailey received his B.S. from Oregon State University.

JAMES A. FITZHENRY. Mr. Fitzhenry joined FLIR in 1993 as Corporate Counsel and Director of Administration, and was appointed Senior Vice President, General Counsel and Secretary in 1995. From 1990 to 1993, Mr. Fitzhenry served in the White House under President George W. Bush as Assistant Director of the Office of Policy Development and Associate Director of the Office of Cabinet Affairs. Previously, he served as legal counsel and legislative director to U.S. Senator Mark O. Hatfield (R-Ore.), Deputy State Treasurer for the State of Oregon and practiced law in Portland, Oregon. Mr. Fitzhenry received his B.A. from the University of Oregon and his J.D. and MBA degrees from Willamette University.

DANIEL L. MANITAKOS. Mr. Manitakos joined FLIR in March 1999 as Vice President, Boston Operations and was appointed Senior Vice President and General Manager, Boston Operations in September 2000. Mr. Manitakos served as Vice President, Operations at Inframetrics, Inc. prior to its acquisition by FLIR in March 1999. Mr. Manitakos served in various engineering and operations capacities since joining Inframetrics in 1989. He received his B.S. in Mechanical Engineering from the University of Massachusetts, an M.S. in Mechanical Engineering from Northeastern University and an MBA from Suffolk University. Mr. Manitakos is also a Registered Professional Engineer in Massachusetts.

DETLEV H. SUDEROW. Mr. Suderow joined FLIR in March 1999 as Director of Human Resources and was appointed Vice President in July of 1999 and Senior Vice President in September 2001. Prior to joining FLIR, he served as Vice President of Human Resources for Inframetrics, Inc. from 1996 to 1999. Mr. Suderow previously held senior human resource management positions at Data General Corporation and Digital Equipment Corporation. He received his B.A. from Brandeis University, a M.Ed. degree in Counseling Psychology from Tufts University and has completed advanced graduate studies in psychology at the University of Zurich in Switzerland.

WILLIAM A. SUNDERMEIER. Mr. Sundermeier joined FLIR in 1994 as Product Marketing Manager and was appointed Director of Product Marketing in 1995. In 1999, Mr. Sundermeier was appointed Senior Vice President for Product Strategy. In September 2000, Mr. Sundermeier was appointed Senior Vice President and General Manager, Portland Operations. Prior to joining FLIR, Mr. Sundermeier was a founder of Quality Check Software, Inc. (QCS) in 1993. From 1985 to 1993, Mr. Sundermeier served as Product Line Manager at Cadre Technologies, Inc. Mr. Sundermeier also served as Software/Hardware Engineer at Tektronix, Inc. from 1980 to 1985. Mr. Sundermeier received his B.S. in Computer Science from Oregon State University and has attended post-graduate programs at the Oregon Graduate Institute and the Wharton School of the University of Pennsylvania. Mr. Sundermeier is also a director of Max-Viz, Inc.

ANDREW C. TEICH. Mr. Teich joined FLIR in March 1999 as Senior Vice President of Marketing. Mr. Teich was appointed Senior Vice President, Sales and Marketing in 2000. From 1996, Mr. Teich served as Vice President of Sales and Marketing at Inframetrics, Inc. prior to its acquisition by FLIR in March 1999. From 1984 to 1996, Mr. Teich served in the capacities of Sales Engineer, Western Regional Sales Manager, International Sales Manager and Vice President of Sales at Inframetrics. He holds an A.S. degree in Industrial Design from the University of Bridgeport and received his B.S. in Marketing from Arizona State University.

5

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table provides information concerning the compensation of the Company’s Chief Executive Officer during the fiscal year ending December 31, 2001 and each of the four other most highly compensated executive officers of the Company (the “named executive officers”) for the fiscal years ending December 31, 2001, 2000 and 1999 or such periods as the named executive officer was an officer of the Company.

Name and Principal Position | Annual Compensation | Long-Term Compensation | All Other(2) | |||||||||||||

Restricted Stock | Stock Options | |||||||||||||||

Year | Salary | Bonus | Awards(1) | Granted | ||||||||||||

| Earl R. Lewis(3) | 2001 | $ | 300,042 | $ | 300,000 | $ | — | 346,000 | $ | 5,250 | ||||||

| Chairman of the Board of Directors, | 2000 | 50,000 | — | 139,262 | 256,000 | — | ||||||||||

| President and Chief Executive Officer | ||||||||||||||||

| Arne Almerfors | 2001 | 204,523 | 140,000 | — | — | 35,682 | ||||||||||

| Executive Vice President and | 2000 | 148,622 | 26,748 | — | 36,000 | 40,334 | ||||||||||

| President, Thermography Division | 1999 | 144,305 | — | — | 12,000 | 45,122 | ||||||||||

| Stephen M. Bailey(4) | 2001 | 231,360 | 110,000 | — | 83,500 | 5,250 | ||||||||||

| Sr. Vice President, Finance and | 2000 | 160,828 | 22,000 | — | 39,000 | 5,250 | ||||||||||

| Chief Financial Officer | ||||||||||||||||

| Andrew C. Teich | 2001 | 220,965 | 120,000 | — | 84,000 | 5,250 | ||||||||||

| Sr. Vice President, Sales and | 2000 | 213,642 | 22,000 | — | 31,000 | 9,005 | ||||||||||

| Marketing | 1999 | 182,144 | — | — | — | 8,000 | ||||||||||

| William A. Sundermeier | 2001 | 209,199 | 120,000 | — | 84,000 | 5,250 | ||||||||||

| Sr. Vice President and General | 2000 | 194,850 | 22,000 | — | 31,000 | 5,250 | ||||||||||

| Manager, Portland Operations | 1999 | 149,092 | — | — | 15,000 | 5,000 | ||||||||||

| (1) | This amount represents the value of shares of restricted stock awarded to Mr. Lewis based on the market price of the Company’s common stock on the date of award, including 8,332 shares of restricted stock awarded to Mr. Lewis as compensation for consulting services for the period August 15, 2000 through October 31, 2000, and 13,333 shares of restricted stock awarded to Mr. Lewis in lieu of a cash bonus for 2000. All such shares of restricted stock vest upon the earlier to occur of the date (i) that the Company’s total debt is less than $60 million, or (ii) Mr. Lewis ceases to be an employee of the Company. These shares vested in August 2001. |

| (2) | The amounts set forth under All Other Compensation represent amounts contributed on behalf of the named executive officers to retirement plans. |

| (3) | Mr. Lewis has served as President and Chief Executive Officer since November 2000. |

| (4) | Mr. Bailey joined the Company in April 2000. |

Supplemental Executive Pension Plan

In 2001, the Company adopted a Supplemental Executive Retirement Plan (SERP or the “Plan”) that provides retirement benefits to its executive officers in the US. Under the SERP, separate unfunded retirement accounts are established for each eligible officer and such accounts are credited with an amount to equal 10% of such officer’s compensation during each Plan year. The retirement accounts earn interest at the prime interest rate plus 2%. Vesting in the retirement accounts is based upon the age of the officer and increases annually with full vesting provided at the earlier of age 60 or after 10 years of service. Upon normal retirement, the officer is entitled to receive the amount in their respective retirement account in equal annual installments, including principal and interest, over 20 years. The Plan also provides for a minimum retirement benefit that is equal to

6

15% of the officer’s compensation during that officer’s last 12 months of employment. The Plan defines normal retirement as termination of employment with the Company at or after age 60. There are early retirement provisions in the Plan established based upon termination of employment at or after age 55 with at least five full years of service. Under these early retirement provisions, the minimum annual retirement benefit is reduced by 6% for each year prior to age 60 in which the termination occurs. At December 31, 2001, the estimated minimum annual benefits for each of the named executive officers is as follows: Mr. Lewis—$95,488; Mr. Bailey—$66,810; Mr. Teich—$92,373; and Mr. Sundermeier—$94,617. Mr. Almerfors is not eligible to participate in the Plan.

Stock Options

The following table sets forth information concerning options granted to the named executive officers during the year ended December 31, 2001 under the Company’s stock options plans:

Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees In 2001 | Exercise Price Per Share | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | ||||||||||||

Name | 5% | 10% | ||||||||||||||

| Earl R. Lewis | 50,000(2) | 5.7 | % | $ | 6.75 | 2/20/11 | $ | 212,252 | $ | 537,888 | ||||||

| 36,000(3) | 4.1 | % | 28.90 | 9/10/11 | 654,302 | 1,658,130 | ||||||||||

| 260,000(4) | 29.6 | % | 37.00 | 12/27/11 | 6,049,966 | 15,331,802 | ||||||||||

| Arne Almerfors | — | — | — | — | — | — | ||||||||||

| Stephen M. Bailey | 24,000(3) | 2.7 | % | 28.90 | 9/10/11 | 436,201 | 1,105,420 | |||||||||

| 59,500(4) | 6.8 | % | 37.00 | 12/27/11 | 1,384,512 | 3,508,624 | ||||||||||

| Andrew C. Teich | 24,000(3) | 2.7 | % | 28.90 | 9/10/11 | 436,201 | 1,105,420 | |||||||||

| 60,000(4) | 6.8 | % | 37.00 | 12/27/11 | 1,396,146 | 3,538,108 | ||||||||||

| William A. Sundermeier | 24,000(3) | 2.7 | % | 28.90 | 9/10/11 | 436,201 | 1,105,420 | |||||||||

| 60,000(4) | 6.8 | % | 37.00 | 12/27/11 | 1,396,146 | 3,538,108 | ||||||||||

| (1) | The amounts shown are hypothetical gains based on the indicated assumed rates of appreciation of the Common Stock compounded annually for a ten-year period. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock and overall stock market conditions. There can be no assurance that the Common Stock will appreciate at any particular rate or at all in future years. |

| (2) | These options became exercisable beginning on August 14, 2001, with one-half of the options becoming exercisable on that date and the other one-half becoming exercisable on the first anniversary of that date. |

| (3) | These options became fully exercisable on the date of grant. |

| (4) | These options become exercisable beginning on the first anniversary of the date of grant, with one-half of the options becoming exercisable on that date and the other one-half becoming exercisable on the second anniversary of the date of grant. |

7

Options Exercised in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth, for each of the named executive officers, the shares acquired upon option exercises during 2001 and the related value realized, and the number and value of unexercised options as of December 31, 2001.

Options Exercised in Last Fiscal Year(1) | Number of Securities Underlying Unexercised Options at December 31, 2001 | Value of Unexercised In-the-Money Options At December 31, 2001(2) | |||||||||||||

Number of Shares | Value Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

| Earl R. Lewis | 20,814 | $ | 419,183 | 171,186 | 410,000 | $ | 5,207,478 | $ | 12,481,326 | ||||||

| Arne Almerfors | — | — | 47,000 | 16,000 | 1,429,740 | 486,720 | |||||||||

| Stephen M. Bailey | — | — | 50,000 | 72,500 | 1,521,000 | 2,205,450 | |||||||||

| Andrew C. Teich | — | — | 55,000 | 75,000 | 1,673,100 | 2,281,500 | |||||||||

| William A. Sundermeier | 22,200 | 800,947 | 43,801 | 74,999 | 1,332,426 | 2,281,470 | |||||||||

| (1) | The value realized is based on the difference between the market price at the time of exercise of the options and the applicable exercise price. |

| (2) | The value of unexercised in-the-money options is based on the difference between $37.92, which was the closing price of the Common Stock on December 31, 2001, and the applicable exercise price. |

Change of Control and Employment Agreements

CHANGEOF CONTROL AGREEMENTS. The Company has entered into change of control agreements (the “Change of Control Agreements”) with each of the named executive officers. Each of the Change of Control Agreements is for a term ending December 31, 2003, provided that if a Change of Control (as defined) occurs before December 31, 2003, the Change of Control Agreements will continue in effect for a period of 90 days beyond the stated term. If a Change of Control occurs during the term of the Change of Control Agreements and an executive officer’s employment terminates within 60 days before or 90 days after the Change of Control for any reason other than the executive officer’s death or disability or termination by the Company for “Cause,” such executive officer would be entitled to receive a lump sum payment in an amount equal to two times the executive officer’s average annualized compensation for the two most recent tax years ending before the Change of Control. In addition, such executive officer would be entitled to the continuation of health and insurance benefits for up to 24 months following the termination of employment and all unvested stock options and rights under Company retirement and pension plans would become immediately and fully vested. For purposes of the Change of Control Agreements, a “Change of Control” means any merger or consolidation transaction that results in the shareholders of the Company immediately before such transaction owning less than 50 percent of the total combined voting power of the surviving corporation in the transaction. For purposes of the Change of Control Agreements, “Cause” includes the commission of certain illegal or wrongful acts, a breach of any material term of the Change of Control Agreement or a breach of fiduciary duty to the Company.

EMPLOYMENT AGREEMENT. The Company entered into an Employment Agreement (the “Agreement”) with Mr. Lewis effective January 1, 2002 pursuant to which Mr. Lewis is employed by the Company as President and Chief Executive Officer. The Agreement is for a term ending January 1, 2004, and provides for a minimum annual base salary of $400,000 for 2002 and $500,000 for 2003 and annual bonus eligibility of up to 100 percent of base salary. Pursuant to the Agreement, Mr. Lewis will also be granted stock options at the discretion of the Compensation Committee of the Company’s Board of Directors. If Mr. Lewis terminates the Agreement or the Company terminates the Agreement for “Cause” (as defined in the Agreement), Mr. Lewis would be paid through the date of termination. If the Company terminates the Agreement without Cause, the Company would be required to continue to pay Mr. Lewis an amount equal to his base salary in effect at the time of termination for a period equal to the greater of 18 months or the remaining term of the Agreement plus certain bonus payments. In addition, if the Company terminates the Agreement without Cause, all options granted to Mr. Lewis

8

shall immediately vest. In the event that the Agreement terminates as a result of the death of Mr. Lewis, the Company would be required to pay an amount equal to one year’s base salary to Mr. Lewis’ estate or designated beneficiary. The Agreement also provides that Mr. Lewis will be entitled to all benefits made available to other executive officers and provides for the payment of certain housing, relocation, and automobile and travel expenses incurred by Mr. Lewis.

Director Compensation

Under the Company’s 1993 Stock Option Plan for Non-employee Directors, as amended, an option to purchase 6,000 shares of Common Stock is automatically granted to each non-employee Director each year on the day of the Annual Meeting. Further, in addition to the granting of stock options described above and the reimbursement for out-of-pocket and travel expenses incurred in attending Board meetings, non-employee Directors of the Board are paid a $3,000 quarterly retainer, a $1,000 quarterly retainer for non-employee Directors who serve as Chairman of the Audit or Compensation Committees of the Board, an attendance fee of $1,000 for personal attendance ($500 for participation by phone) at each regularly scheduled meeting of the full Board and an attendance fee of $500 for personal attendance ($200 for participation by phone) of each meeting of the Audit or Compensation Committees.

COMPENSATION COMMITTEE REPORT

Under rules established by the Securities and Exchange Commission (the “SEC”), the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company’s Chairman of the Board of Directors and Chief Executive Officer and the four other most highly compensated executive officers. In fulfillment of this requirement, the Compensation Committee, at the direction of the Board of Directors, has prepared the following report for inclusion in this Proxy Statement.

Executive Compensation Philosophy. The Compensation Committee of the Board of Directors is composed entirely of outside Directors. The Compensation Committee is responsible for setting and administering the policies and programs that govern both annual compensation and stock ownership programs for the executive officers of the Company. The Company’s executive compensation policy is based on principles designed to ensure that an appropriate relationship exists between executive pay and corporate performance, while at the same time motivating and retaining executive officers.

Executive Compensation Components. The key components of the Company’s compensation program are base salary, an annual incentive award, and equity participation. These components are administered with the goal of providing total compensation that is competitive in the marketplace, rewards successful financial performance and aligns executive officers’ interests with those of stockholders. The Compensation Committee reviews each component of executive compensation on an annual basis.

Base Salary. Base salaries for executive officers are set at levels believed by the Compensation Committee to be sufficient to attract and retain qualified executive officers. Base pay increases are provided to executive officers based on an evaluation of each executive’s performance, as well as the performance of the Company as a whole. In establishing base salaries, the Compensation Committee not only considers the financial performance of the Company, but also the success of the executive officers in developing and executing the Company’s strategic plans, developing management employees and exercising leadership. The Compensation Committee believes that executive officer base salaries for 2001 were reasonable as compared to amounts paid by companies of similar size.

Annual Incentive. The Compensation Committee believes that a significant proportion of total cash compensation for executive officers should be subject to attainment of specific Company earnings criteria. This approach creates a direct incentive for executive officers to achieve desired performance goals and places a

9

significant percentage of each executive officer’s compensation at risk. Consequently, each year the Compensation Committee establishes potential bonuses for executive officers based on the Company’s achievement of certain earnings criteria. The Compensation Committee believes that executive officer annual bonuses for 2001 were reasonable as compared to amounts paid by companies of similar size.

Stock Options. The Compensation Committee believes that equity participation is a key component of its executive compensation program. Stock options are granted to executive officers primarily based on the officer’s actual and potential contribution to the Company’s growth and profitability and competitive marketplace practices. Option grants are designed to retain executive officers and motivate them to enhance stockholder value by aligning the financial interests of executive officers with those of stockholders. Stock options also provide an effective incentive for management to create shareholder value over the long term since the full benefit of the compensation package cannot be realized unless an appreciation in the price of the Company’s Common Stock occurs over a number of years.

Compensation of Chief Executive Officer. Consistent with the executive compensation policy and components described above, the Compensation Committee determined the salary, bonus and stock options received by Earl R. Lewis, the President and Chief Executive Officer of the Company, for services rendered in 2001. Mr. Lewis received a base salary of $300,000 for 2001. He also received an annual bonus of $300,000 and stock options to purchase 346,000 shares of the Company’s common stock.

| CO | MPENSATION COMMITTEE |

| Joh | n C. Hart |

| An | gus Macdonald |

| Ro | nald L. Turner |

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during the fiscal year ended December 31, 2001, were Messrs. Hart, Macdonald and Turner.

Section 16 Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) requires the Company’s Directors and officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons also are required to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on the Company’s review of the copies of such reports received by it with respect to fiscal 2001, or written representations from certain reporting persons, the Company believes that all filing requirements applicable to its Directors, officers and persons who own more than 10% of a registered class of the Company’s equity securities have been complied with for fiscal 2001.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

From time to time, the Company may provide loans to certain officers of the Company in connection with their employment. On November 29, 2001, the Company loaned James A. Fitzhenry, Senior Vice President and General Counsel, an amount of $75,000, bringing the total outstanding loans to Mr. Fitzhenry to an amount of $89,484 at that date. The total loan amount is a full recourse obligation of Mr. Fitzhenry and is represented by an unsecured promissory note in the face amount of $89,484 that bears interest at the rate of 6% per year, compounded annually.

10

STOCK OWNED BY MANAGEMENT AND PRINCIPAL SHAREHOLDERS

The following table sets forth certain information known to the Company with respect to the beneficial ownership of the Company’s Common Stock as of January 31, 2002 by: (i) each person known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) each of the Company’s Directors, (iii) each of the Company’s named executive officers, and (iv) all Directors and executive officers as a group. Except as otherwise indicated, the Company believes that each of the following shareholders has sole voting and investment power with respect to the shares beneficially owned by such shareholder.

Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned(1) | Percent Common Stock Outstanding | ||

Thermo Electron Corporation(2) 81 Wyman Street Waltham, MA 02454 | 1,762,000 | 10.6% | ||

FMR Corp(3) 82 Devonshire Street Boston, MA 02109 | 1,336,260 | 8.0% | ||

| Earl R. Lewis | 298,296 | 1.8% | ||

| John C. Hart | 35,500 | * | ||

| Angus L. Macdonald | 33,000 | * | ||

| W. Allen Reed | 24,000 | * | ||

| Ronald L. Turner | 30,000 | * | ||

| Steven E. Wynne | 12,000 | * | ||

| Arne Almerfors | 60,120 | * | ||

| Stephen M. Bailey | 59,579 | * | ||

| Andrew C. Teich | 97,208 | * | ||

| William A. Sundermeier | 58,720 | * | ||

| Directors and Executive Officers as a group (13 persons) | 920,337 | 5.5% |

| * | Less than one percent (1%). |

| (1) | Applicable percentage of ownership is based on 16,604,091 shares of FLIR Common Stock outstanding as of January 31, 2002. Beneficial ownership is determined in accordance with rules of the SEC, and includes voting power and investment power with respect to shares. Shares issuable upon the exercise of outstanding stock options that are currently exercisable or become exercisable within 60 days from January 31, 2002 are considered outstanding for the purpose of calculating the percentage of Common Stock owned by such person, but not for the purpose of calculating the percentage of Common Stock owned by any other person. The number of shares that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of January 31, 2002 is as follows: Mr. Lewis—196,186; Mr. Hart—34,000; Mr. Macdonald—6,000; Mr. Reed—24,000; Mr. Turner—30,000; Mr. Wynne—12,000; Mr. Almerfors—51,000; Mr. Bailey—50,000; Mr. Teich—60,000; Mr. Sundermeier—48,800; and all Directors and executive officers as a group—671,819. |

| (2) | This information as to beneficial ownership is based on correspondence received from Thermo Electron Corporation on March 12, 2002 stating that Thermo Electron Corporation is the beneficial owner of 1,762,000 shares of Common Stock as to which it has sole voting and dispositive power. |

| (3) | This information as to beneficial ownership is based on a Schedule 13G filed by FMR Corp with the Securities and Exchange Commission on February 14, 2002. The Schedule 13G states that FMR Corp and its affiliates are the beneficial owners of 1,336,260 shares of Common Stock as to which certain affiliates of FMR Corp have sole voting and dispositive power. |

11

STOCK PERFORMANCE GRAPH

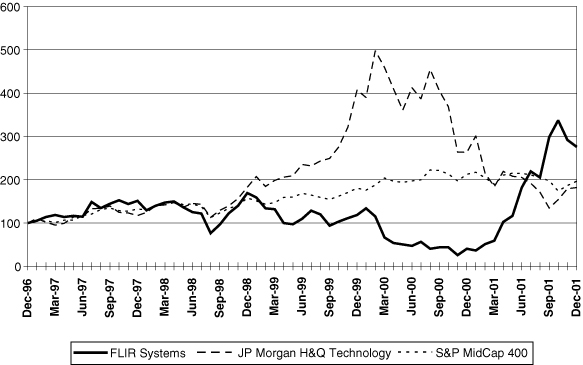

The following graph compares the monthly return for the Company, the Standard & Poor’s MidCap 400 Index and the JP Morgan H&Q Technology Index.

COMPARISON OF MONTHLY RETURN*

AMONG FLIR SYSTEMS, INC., THE S&P MIDCAP 400 INDEX

AND THE JP MORGAN H&Q TECHNOLOGY INDEX

| * | The monthly return on investment (change in stock price plus reinvested dividends) for each of the periods for the Company, the Standard & Poor’s MidCap 400 Index and the JP Morgan H&Q Technology Index is based on the stock price on June 22, 1993, the date of the Company’s initial public offering. |

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is comprised of three Directors who are considered independent under applicable Nasdaq Stock Market rules. The Committee operates under a written charter adopted by the Board.

The primary purpose of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board and report the results of their activities to the Board. The Audit Committee annually reviews and recommends to the Board the selection of the Company’s independent accountants.

Management is responsible for preparing the Company’s financial statements. The independent accountants are responsible for performing an independent audit of the Company’s audited financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Committee’s responsibility is to monitor and oversee these processes.

12

In this context, the Committee has reviewed and discussed the audited financial statements with management and the independent accountants. The Committee also has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company’s independent accountants also provided to the Committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Committee discussed with the independent accountants that firm’s independence.

Based on the above discussions and review with management and the independent accountants, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Commission.

| AU | DIT COMMITTEE |

| An | gus L. Macdonald |

| W. | Allen Reed |

| Ste | ven E. Wynne |

APPROVAL OF THE COMPANY’S 2002 STOCK INCENTIVE PLAN

The Board of Directors is requesting that the Company’s shareholders approve the Company’s 2002 Stock Incentive Plan (the “2002 Plan”), which was adopted by the Board of Directors on February 12, 2002. The purposes of the 2002 Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentives to the employees and consultants of the Company and to promote the success of the Company’s business. The 2002 Plan replaces the Company’s 1992 Stock Incentive Plan, which expires this year and under which only 5,930 shares of Common Stock remained available for option grants as of December 31, 2001. The following discussion is intended only as a summary of the material provisions of the 2002 Plan. Shareholders are encouraged to review the 2002 Plan, included herein as Exhibit A, in its entirety before voting on this proposal.

The 2002 Plan provides for grants of both “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”) and “non-qualified stock options” which are not qualified for treatment under Section 422 of the Code, and for direct stock grants and sales to employees or consultants of the Company. A total of 1,500,000 shares of Common Stock have been reserved for issuance under the 2002 Plan upon the exercise of stock options which may be granted to employees, officers and consultants of the Company. As of December 31, 2001, approximately 800 persons were eligible to participate in the 2002 Plan. Because the officers and employees of the Company who may participate in the 2002 Plan and the amount of their options will be determined by the Compensation Committee in its discretion, it is not possible to state the names or positions of, or the number of options that may be granted to, the Company’s officers and employees. No employee may receive options under the 2002 Plan for more than 300,000 shares in any one fiscal year, except that options for up to an additional 200,000 shares may be granted in connection with a person’s initial employment with the Company.

The administration of the 2002 Plan has been delegated to the Compensation Committee of the Board of Directors (the “Committee”). In addition to determining who will be granted options, the Committee has the authority and discretion to determine when options will be granted and the number of options to be granted and whether the options will be incentive stock options or non-qualified stock options. Only “employees” of the Company as that term is defined in the Code will be entitled to receive Incentive Stock Options. See “Federal Income Tax Consequences” below. The Committee also may determine the time or times when each option becomes exercisable, the duration of the exercise period for options and the form or forms of the instruments evidencing options granted under the 2002 Plan. The Committee also may construe the 2002 Plan and the provisions in the instruments evidencing options granted under the 2002 Plan to employee and officer

13

participants and is empowered to make all other determinations deemed necessary or advisable for the administration of the 2002 Plan.

The term of each option granted under the 2002 Plan will be ten years from the date of grant, or such shorter period as may be established at the time of the grant. An option granted under the 2002 Plan may be exercised at such times and under such conditions as determined by the Compensation Committee. If a person who has been granted an option ceases to be an employee or consultant of the Company, such person may exercise that option only during the three month period after the date of termination, and only to the extent that the option was exercisable on the date of termination. If a person who has been granted an option ceases to be an employee or consultant as a result of such person’s total and permanent disability, such person may exercise that option at any time within twelve months after the date of termination, but only to the extent that the option was exercisable on the date of termination. Except as otherwise provided by the Compensation Committee at the time an option is granted, no option granted under the 2002 Plan is transferable other than at death, and each option is exercisable during the life of the optionee only by the optionee. In the event of the death of a person who has received an option, the option generally may be exercised by a person who acquired the option by bequest or inheritance during the twelve month period after the date of death to the extent that such option was exercisable at the date of death.

The exercise price of incentive stock options granted under the 2002 Plan may not be less than the fair market value of a share of Common Stock on the date of grant of the option. For non-qualified stock options, the exercise price may be less than, equal to, or greater than the fair market value of the Common Stock on the date of grant, provided that the Compensation Committee must specifically determine that any option grant at an exercise price less than fair market value is in the best interests of the Company. The consideration to be paid upon exercise of an option, including the method of payment, will be determined by the Compensation Committee and may consist entirely of cash, check, shares of Common Stock, such other consideration and method of payment permitted by applicable law or any combination of such methods of payment as permitted by the Compensation Committee. The Compensation Committee has the authority to reset the price of any stock option after the original grant and before exercise. In the event of stock dividends, splits, and similar capital changes, the 2002 Plan provides for appropriate adjustments in the number of shares available for option and the number and option prices of shares subject to outstanding options.

In the event of a proposed sale of all or substantially all of the assets of the Company, or a merger of the Company with and into another corporation, outstanding options shall be assumed or equivalent options shall be substituted by such successor corporation, unless the Committee provides all option holders with the right to immediately exercise all of their options, whether vested or unvested. In the event of a proposed dissolution or liquidation of the Company, outstanding options will terminate immediately prior to the consummation of such proposed action, unless otherwise provided by the Committee. In such a situation, the Committee is authorized to give option holders the right to immediately exercise all of their options, whether vested or unvested.

The 2002 Plan will continue in effect until November 2012, unless earlier terminated by the Board of Directors, but such termination will not affect the terms of any options outstanding at that time. The Board of Directors may amend, terminate or suspend the 2002 Plan at any time. Amendments to the 2002 Plan must be approved by shareholders if required by applicable tax, securities or other law or regulation.

The issuance of shares of Common Stock upon the exercise of options is subject to registration with the Securities and Exchange Commission of the shares reserved by the Company under the 2002 Plan.

Federal Income Tax Consequences

The federal income tax discussion set forth below is included for general information only. Optionees are urged to consult their tax advisors to determine the particular tax consequences applicable to them, including the application and effect of foreign, state and local income and other tax laws.

14

Incentive Stock Options. Certain options authorized to be granted under the 2002 Plan are intended to qualify as incentive stock options for federal income tax purposes. Under federal income tax law currently in effect, the optionee will recognize no income upon grant or upon a proper exercise of an incentive stock option. If an employee exercises an incentive stock option and does not dispose of any of the option shares within two years following the date of grant and within one year following the date of exercise, then any gain realized upon subsequent disposition of the shares will be treated as income from the sale or exchange of a capital asset. If an employee disposes of shares acquired upon exercise of an incentive stock option before the expiration or either the one-year holding period or the two-year waiting period, any amount realized will be taxable as ordinary compensation income in the year of such disqualifying disposition to the extent that the lesser of the fair market value of the shares on the exercise date or the proceeds of the sale of the shares exceeds the exercise price.

Non-qualified Stock Options. Certain options authorized to be granted under the 2002 Plan will be treated as non-qualified stock options for federal income tax purposes. Under federal income tax law presently in effect, no income is realized by the grantee of a non-qualified stock option pursuant to the 2002 Plan until the option is exercised. At the time of exercise of a non-qualified stock option, the optionee will realize ordinary compensation income in the amount by which the market value of the shares subject to the option at the time of exercise exceeds the exercise price. Upon the sale of shares acquired upon exercise of a non-qualified stock option, the excess of the amount realized from the sale over the market value of the shares on the date of exercise will be taxable as a capital gain.

Consequences to the Company. The Company recognizes no deduction at the time of grant or exercise of an incentive stock option. The Company will recognize a deduction at the time of exercise of a non-qualified stock option on the difference between the option price and the fair market value of the shares on the date of grant. The Company also will recognize a deduction to the extent the optionee recognizes income upon a disqualifying disposition of shares underlying an incentive stock option.

Board Recommendation

The Board of Directors unanimously recommends a vote FOR approval of the Company’s 2002 Stock Incentive Plan. If a quorum is present, this proposal will be approved if a majority of the votes cast on the proposal are voted in favor of approval and no options may be granted under the 2002 Stock Incentive Plan if this proposal is not approved. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting but will not be counted and will have no effect in determining whether the proposal is approved. Proxies solicited by the Board will be voted for approval of the 2002 Stock Incentive Plan unless a vote against the proposal or abstention is specifically indicated.

INDEPENDENT AUDITORS

Appointment of Independent Auditors

The Board of Directors has appointed Arthur Andersen LLP to act as independent auditors for the Company for the fiscal year ending December 31, 2002. Arthur Andersen LLP served as the Company’s independent auditors for the year ended December 31, 2001. A representative of Arthur Andersen LLP is expected to be present at the Annual Meeting, will be given the opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

15

Fees Billed to the Company by Arthur Andersen LLP

The aggregate fees billed by Arthur Andersen LLP for professional services rendered for the fiscal year ending December 31, 2001 were as follows:

| Audit Fees | $ | 595,000 | |

| Financial Information Systems Design and Implementation | — | ||

| Other: | |||

| Audit Related | 134,000 | ||

| Other (1) | 345,000 | ||

| Total Other | 479,000 | ||

| Total Fees | $ | 1,074,000 | |

(1) Principally represents various forms of tax compliance assistance, both foreign and domestic.

Change of Independent Auditors

On May 2, 2000, the Company dismissed PricewaterhouseCoopers, LLP (“PricewaterhouseCoopers”) as its independent auditors. The action was approved by the Board of Directors and the Audit Committee of the Board of Directors. The audit reports of PricewaterhouseCoopers on the consolidated financial statements of the Company and its subsidiaries as of and for the years ended December 31, 1998 and 1999, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles, except that the report on the financial statements for the year ended December 31, 1999 included an emphasis of a matter paragraph referring to the restatement of the 1998 financial statements, as described in the notes thereto.

In connection with the audits for the two years ended December 31, 1999 and 1998, and the subsequent interim period through May 2, 2000, there were no disagreements with PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which if not resolved to the satisfaction of PricewaterhouseCoopers, would have caused it to make a reference to the subject matter of the disagreement in connection with its report.

In connection with the audit of the Company’s consolidated financial statements for the year ended December 31, 1999, PricewaterhouseCoopers delivered to the Company its Report to the Audit Committee - Results of 1999 Audit (the “Report”). The Report stated that, in the course of PricewaterhouseCoopers’ audit of the Company’s consolidated financial statements for the year ended December 31, 1999, PricewaterhouseCoopers noted certain matters involving the internal control structure or its operations that it considered to be material weaknesses. The Report identified material weaknesses in internal controls in three areas: (i) lack of follow-up by personnel independent from the inventory costing system (ii) the use of manual entries to general ledger account balances for sales, cost of sales, accounts receivable, inventory and intercompany receivables and payables and the lack of regular and timely follow-up of the related accounts, and (iii) the lack of regular and timely reconciliation of inter-company receivable and payable accounts and follow-up of the related accounts. The Report also stated that, as a result of the material weaknesses in internal controls identified in the Report, PricewaterhouseCoopers had determined that it would be unable to perform a review of the Company’s March 31, 2000 interim financial statements (the “First Quarter SAS 71 Review”) and that PricewaterhouseCoopers believed that the material weaknesses raised questions about the Company’s ability to prepare interim consolidated financial information that was both timely and accurate. The Company authorized PricewaterhouseCoopers to respond fully to questions from any successor auditors regarding this matter. The Company believes that it has corrected the deficiencies identified by PricewaterhouseCoopers.

The Company requested that PricewaterhouseCoopers furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the statements contained herein. A copy of such letter dated May 9, 2000 was filed as Exhibit 16.1 to the Current Report on Form 8-K dated May 9, 2000.

16

On July 13, 2000, the Company engaged Arthur Andersen LLP (“Arthur Andersen”) as its independent auditors for the fiscal year ended December 31, 2000. The engagement of Arthur Andersen was approved by the Company’s Board of Directors.

During the then two most recent fiscal years and the interim period through May 2, 2000, the date Arthur Andersen was retained to conduct the First Quarter SAS 7 1 Review, neither the Company nor any person on its behalf consulted Arthur Andersen regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, (ii) the type of audit opinion that might be rendered on the Company's financial statements, or (iii) any matter that was either the subject of a disagreement (as defined in paragraph 304(a)(l)(iv) of the Regulation S-K) or a reportable event (as described in paragraph 304(a)(l)(v) of Regulation S-K).

In the ordinary course of the First Quarter SAS 7 1 Review, the Company discussed various accounting and financial reporting matters with Arthur Andersen. The Company also provided Arthur Andersen with a copy of the Report issued by PricewaterhouseCoopers and discussed such Report with Arthur Andersen. Arthur Andersen discussed the Report with PricewaterhouseCoopers and has advised the Company that it considered the Report and these discussions in conducting the First Quarter SAS 71 Review. The Company also informed PricewaterhouseCoopers of its discussions with Arthur Andersen of these matters.

DATE FOR SUBMISSION OF SHAREHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, some shareholder proposals may be eligible for inclusion in the Company’s 2003 proxy statement. Any such proposal must be received by the Company not later than November 15, 2002. Shareholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities law. The submission of a shareholder proposal does not guarantee that it will be included in the Company’s proxy statement. Alternatively, under the Company’s bylaws, a proposal or nomination that a shareholder does not seek to include in the Company’s proxy statement pursuant to Rule 14a-8 may be delivered to the Secretary of the Company not less than 60 days nor more than 90 days prior to the date of an Annual Meeting, unless notice or public disclosure of the date of the meeting occurs less than 60 days prior to the date of such meeting, in which event, shareholders may deliver such notice not later than the 10th day following the day on which notice of the date of the meeting was mailed or public disclosure thereof was made. A shareholder’s submission must include certain specified information concerning the proposal or nominee, as the case may be, and information as to the shareholder’s ownership of common stock of the Company. Proposals or nominations not meeting these requirements will not be entertained at the Annual Meeting. If the shareholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Securities Exchange Act of 1934, the Company may exercise discretionary voting authority under proxies it solicits to vote in accordance with its best judgment on any such proposal or nomination submitted by a shareholder.

17

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not know of any other matters to be presented for action by the shareholders at the 2002 Annual Meeting. If, however, any other matters not now known are properly brought before the meeting, the persons named in the accompanying proxy will vote such proxy in accordance with the determination of a majority of the Board of Directors.

COST OF SOLICITATION

The cost of soliciting proxies will be borne by the Company. In addition to use of the mails, proxies may be solicited personally or by telephone by Directors, officers and employees of the Company, who will not be specially compensated for such activities. Also, W.F. Doring & Co. may solicit proxies at an approximate cost of $2,500 plus reasonable expenses. Such solicitations may be made personally, or by mail, facsimile, telephone, telegraph or messenger. The Company will also request persons, firms and companies holding shares in their names or in the name of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from such beneficial owners. The Company will reimburse such persons for their reasonable expenses incurred in that connection.

ADDITIONAL INFORMATION

A copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2001 accompanies this Proxy Statement. The Company is required to file an Annual Report on Form 10-K for its fiscal year ended December 31, 2001 with the Securities and Exchange Commission. Shareholders may obtain, free of charge, a copy of the Form 10-K (without exhibits) by writing to Investor Relations, FLIR Systems, Inc., 16505 S.W. 72nd Avenue, Portland, Oregon 97224.

| By | Order of the Board of Directors |

|

| Ea | rl R. Lewis |

Chairman of the Board of Directors, President and |

Chief Executive Officer |

Portland, Oregon

March 15, 2002

18

Appendix A

FLIR SYSTEMS, INC.

2002 STOCK INCENTIVE PLAN

| 1. | Purposes of the Plan. The purposes of this Stock Incentive Plan are to attract, retain and reward individuals who can and do contribute to the Company’s success by providing Employees and Consultants an opportunity to share in the equity of the Company and to more closely align their interests with the Company and its shareholders. |

Options granted hereunder may be either “incentive stock options,” as defined in Section 422 of the Internal Revenue Code of 1986, as amended, or “nonqualified stock options,” at the discretion of the Board and as reflected in the terms of the written option agreement. In addition, shares of the Company’s Common Stock may be sold hereunder independent of any Option grant.

2.Definitions. As used herein, the following definitions shall apply:

| 2.1 | “Administrator” shall mean the Board or any of its Committees as shall be administering the Plan, in accordance with Section 4.1 of the Plan. |

| 2.2 | “Board” shall mean the Board of Directors of the Company. |

| 2.3 | “Code” shall mean the Internal Revenue Code of 1986, as amended. |

| 2.4 | “Committee” shall mean a committee appointed by the Board in accordance with Section 4.1 of the Plan. |

| 2.5 | “Common Stock” shall mean the Common Stock of the Company. |

| 2.6 | “Company” shall mean FLIR Systems, Inc., an Oregon corporation. |

| 2.7 | “Consultant” shall mean any person who is engaged by the Company or any Parent or Subsidiary to render consulting services and is compensated for such consulting services and any Director of the Company whether compensated for such services or not. |

| 2.8 | “Continuous Status as an Employee or Consultant” shall mean the absence of any interruption or termination of service as an Employee or Consultant. Continuous Status as an Employee or Consultant shall not be considered interrupted in the case of: (i) any sick leave, military leave, or any other leave of absence approved by the Company; provided, however, that for purposes of Incentive Stock Options, any such leave is for a period of not more than ninety days or reemployment upon the expiration of such leave is guaranteed by contract or statute, provided, further, that on the ninety-first day of such leave (where reemployment is not guaranteed by contract or statute) the Optionee’s Incentive Stock Option shall automatically convert to a Nonqualified Stock Option; or (ii) transfers between locations of the Company or between the Company, its Parent, its Subsidiaries or its successor. |

| 2.9 | “Director” shall mean a member of the Board. |

| 2.10 | “Disability” shall mean total and permanent disability as defined in Section 22(e)(3) of the Code. |

| 2.11 | “Employee” shall mean any person, including Officers and Directors, employed by the Company or any Parent or Subsidiary. Neither the payment of a director’s fee by the Company nor service as a Director shall be sufficient to constitute “employment” by the Company. |

A-1

| 2.12 | “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended. |

| 2.13 | “Fair Market Value” shall mean, as of any date, the value of Common Stock determined as follows: |

| 2.13.1 | If the Common Stock is listed on any established stock exchange or a national market system, including without limitation the Nasdaq National Market or the Nasdaq SmallCap Market of the Nasdaq Stock Market, its Fair Market Value shall be the closing sales price for the Common Stock (or the closing bid, if no sales were reported) as quoted on such exchange or system on the date of determination, as reported inThe Wall Street Journal or such other source as the Administrator deems reliable; provided, if the date of determination does not fall on a day on which the Common Stock has traded on such securities exchange or market system, the date on which the Fair Market Value shall be established shall be the last day on which the Common Stock was so traded prior to the date of determination, or such other appropriate day as shall be determined by the Administrator, in its sole discretion; |

| 2.13.2 | If the Common Stock is regularly quoted by a recognized securities dealer but selling prices are not reported, its Fair Market Value shall be the mean between the high bid and low asked prices for the Common Stock on the date of determination, as reported inThe Wall Street Journal or such other source as the Administrator deems reliable; provided, if the date of determination does not fall on a day on which the Common Stock has been so quoted, the date on which the Fair Market Value shall be established shall be the last day on which the Common Stock was so quoted prior to the date of determination, or such other appropriate day as shall be determined by the Administrator, in its sole discretion; |

| 2.13.3 | In the absence of an established market for the Common Stock, the Fair Market Value shall be determined in good faith by the Administrator. |

| 2.14 | “Incentive Stock Option” shall mean an Option intended to qualify as an incentive stock option within the meaning of Section 422 of the Code. |

| 2.15 | “Nonqualified Stock Option” shall mean an Option not intended to qualify as an incentive stock option within the meaning of Section 422 of the Code. |

| 2.16 | “Notice of Grant” shall mean a written notice evidencing certain terms and conditions of an individual Option grant. The Notice of Grant is part of the Option Agreement. |

| 2.17 | “Officer” shall mean a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder. |

| 2.18 | “Option” shall mean a stock option granted pursuant to the Plan. |

| 2.19 | “Option Agreement” shall mean a written agreement between the Company and an Optionee evidencing the terms and conditions of an individual Option grant. The Option Agreement is subject to the terms and conditions of the Plan. |

| 2.20 | “Optioned Stock” shall mean the Common Stock subject to an Option. |

| 2.21 | “Optionee” shall mean an Employee or Consultant who holds an Option. |

| 2.22 | “Parent” shall mean a “parent corporation,” whether now or hereafter existing, as defined in Section 424(e) of the Code. |

A-2

| 2.23 | “Plan” shall mean this 2002 Stock Incentive Plan. |

| 2.24 | “Rule 16b-3” shall mean Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised with respect to the Plan. |

| 2.25 | “Sale” or“Sold” shall include, with respect to the sale of Shares under the Plan, the sale of Shares for any form of consideration specified in Section 8.2, as well as a grant of Shares for consideration in the form of past or future services. |

| 2.26 | “Share” shall mean a share of the Common Stock, as adjusted in accordance with Section 11 of the Plan. |

| 2.27 | “Subsidiary” shall mean a “subsidiary corporation,” whether now or hereafter existing, as defined in Section 424(f) of the Code. |

3. Stock Subject to the Plan.

| 3.1 | Subject to the provisions of Section 3.2 below and the provisions of Section 11 of the Plan, the maximum aggregate number of Shares that may be optioned and/or Sold under the Plan is 1,500,000 shares of Common Stock. The Shares may be authorized, but unissued, or reacquired Common Stock. |

| 3.2 | If an Option should expire or become unexercisable for any reason, or is otherwise terminated or forfeited, without having been exercised in full, the unpurchased Shares which were subject thereto shall, unless the Plan shall have been terminated, become available for future Option grants and/or Sales under the Plan. If any Shares issued pursuant to a Sale or exercise of an Option shall be reacquired, canceled or forfeited for any reason, such Shares shall become available for future Option grants and/or Sales under the Plan, unless the Plan shall have been terminated. If any reacquired, canceled or forfeited Shares were originally issued upon exercise of an Incentive Stock Option, then once so reacquired, canceled or forfeited, such Shares shall not be considered to have been issued for purposes of applying the limitation set forth in Section 3.3 below. If the exercise price of any Option granted under the Plan is satisfied by tendering shares of Common Stock to the Company (by either actual delivery or by attestation), only the number of shares of Common Stock issued net of the Shares of Common Stock tendered shall be deemed delivered for purposes of determining the maximum number of Shares available for delivery under the Plan. |

| 3.3 | Notwithstanding any other provision of this Section 3, the maximum number of Shares that may be issued upon the exercise of Incentive Stock Options shall be 1,500,000. |

4.Administration of the Plan.

| 4.1 | Procedure. |

| 4.1.1 | Multiple Administrative Bodies. If permitted by Rule 16b-3, the Plan may be administered by different bodies with respect to Directors, Officers who are not Directors, and Employees who are neither Directors nor Officers. |

| 4.1.2 | Administration With Respect to Directors and Officers Subject to Section 16(b). With respect to Option grants made to Employees who are also Officers or Directors subject to Section 16(b) of the Exchange Act, the Plan shall be administered by (A) the Board, if the Board may administer the Plan in compliance with the rules governing a plan intended to qualify as a discretionary plan under Rule 16b-3, or (B) a Committee designated by the Board to administer the Plan, which Committee shall be constituted to comply with the rules, |

A-3