UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006 transition period from to

Commission File Number 1-11152

INTERDIGITAL COMMUNICATIONS CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 23-1882087 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

781 Third Avenue King of Prussia, Pennsylvania | | 19406-1409 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number including area code: (610) 878-7800

Securities registered pursuant to Section 12(b) of the Act:

| | |

Common Stock (par value $.01 per share) | | The NASDAQ Stock Market LLC |

| (title of class) | | (name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

Series B Junior Participating Preferred Stock Rights

(title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not herein contained, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filed ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,789,049,417.79 as of June 30, 2006.

The number of shares outstanding of the registrant’s common stock was 49,748,014 as of February 23, 2007.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2007 Annual Meeting of Shareholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Annual Report. Such Definitive Proxy Statement will be filed not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2006.

TABLE OF CONTENTS

InterDigital® is a registered trademark of InterDigital Communications Corporation. All other trademarks, service marks and/or trade names appearing in this Form 10-K are the property of their respective holders.

GLOSSARY OF TERMS

1xEV-DO

“First Evolution Data Optimized.” An evolution of cdma2000.

2G

“Second Generation.” A generic term usually used in reference to voice-oriented digital wireless products, primarily mobile handsets that provide basic voice services.

2.5G

A generic term usually used in reference to fully integrated voice and data digital wireless devices offering higher data rate services and features compared to 2G.

3G

“Third Generation.” A generic term usually used in reference to the generation of digital mobile devices and networks after 2G and 2.5G, which provide high speed data communications capability along with voice services.

3GPP

“3G Partnership Project.” A partnership of worldwide accredited Standards organizations the purpose of which is to draft specifications for Third Generation mobile telephony.

802.11

An IEEE Standard for wireless LAN interoperability. Letter appendages (i.e., 802.11 a/b/g) identify various amendments to the Standards which denote different features and capabilities.

Air Interface

The wireless interface between a terminal unit and the base station or between wireless devices in a communication system.

ANSI

“American National Standards Institute.” The United States national standards accreditation and policy agency. ANSI monitors and provides oversight of all accredited U.S. Standards Development Organizations to insure they follow an open public process.

ASIC

“Application Specific Integrated Circuit.” A computer chip developed for a specific purpose, and frequently designed using a microprocessor core and integrating other functions unique to the application in which the chip will be used. Many SOC designs are ASICs.

ATIS

“Alliance for Telecommunications Industry Solutions.” An ANSI-accredited U.S.-based Standards association which concentrates on developing and promoting technical/operational standards for the communications and information technology industries worldwide.

Bandwidth

A range of frequencies that can carry a signal on a transmission medium, measured in Hertz and computed by subtracting the lower frequency limit from the upper frequency limit.

Base Station

The central radio transmitter/receiver, or group of central radio transmitters/receivers, that maintains communications with subscriber equipment sets within a given range (typically, a cell site).

Category 10

The HSDPA Standard contains different “categories,” ranging from category 1 through category 10, to define specific configurations and performances. Category 10 is the fastest mode of HSDPA capable of achieving 14Mbps.

i

CDMA

“Code Division Multiple Access.” A method of digital spread spectrum technology wireless transmission that allows a large number of users to share access to a single radio channel by assigning unique code sequences to each user.

cdmaOne

A wireless cellular system application based on 2G narrowband CDMA technologies (e.g., TIA/EIA-95).

cdma2000®

A Standard which evolved from narrowband CDMA technologies (i.e., TIA/EIA-95 and cdmaOne). The CDMA family includes, without limitation, CDMA2000 1x, CDMA 1xEV-DO, CDMA2000 1xEV-DV and CDMA2000 3x. Although CDMA2000 1x is included under the IMT-2000 family of 3G Standards, its functionality is similar to 2.5G technologies. CDMA2000® and cdma2000® are registered trademarks of the Telecommunications Industry Association (TIA – USA).

Chip

An electronic circuit that consists of many individual circuit elements integrated onto a single substrate.

Chip Rate

The rate at which information signal bits are transmitted as a sequence of chips. The chip rate is usually several times the information bit rate.

Circuit

The connection of channels, conductors and equipment between two given points through which an electric current may be established.

Digital

Information transmission where the data is represented in discrete numerical form.

Digital Cellular

A cellular communications system that uses over-the-air digital transmission.

Duplex

A characteristic of data transmission; either full duplex or half duplex. Full duplex permits simultaneous transmission in both directions of a communications channel. Half duplex means only one transmission at a time.

EDGE

“Enhanced Data rates for GSM Evolution.” Technology designed to deliver data at rates up to 473.6 Kbps, triple the data rate of GSM wireless services, and built on the existing GSM Standard and core network infrastructure. EDGE systems built in Europe are considered a 2.5G technology.

ETSI

“European Telecommunications Standards Institute.” The Standards organization which drafts Standards for Europe.

FABLESS

“Fabless” means fabrication carried out by another party under a contract.

FDD

“Frequency Division Duplex.” A duplex operation using a pair of frequencies, one for transmission and one for reception.

FDMA

“Frequency Division Multiple Access.” A technique in which the available transmission of bandwidth of a channel is divided by frequencies into narrower bands over fixed time intervals resulting in more efficient voice or data transmissions over a single channel.

Frequency

The rate at which an electrical current or signal alternates, usually measured in Hertz.

ii

GHz

“Gigahertz.” One gigahertz is equal to one billion cycles per second.

GPRS

“General Packet Radio Systems.” A packet-based wireless communications service that enables high-speed wireless Internet and other data communications via GSM networks.

GSM

“Global System for Mobile Communications.” A digital cellular Standard, based on TDMA technology, specifically developed to provide system compatibility across country boundaries.

Hertz

The unit of measuring radio frequency (one cycle per second).

HSDPA

“High Speed Downlink Packet Access.” An enhancement to WCDMA/UMTS technology optimized for high speed packet-switched data and high-capacity circuit switched capabilities. A 3G technology enhancement.

HSUPA

“High Speed Uplink Packet Access.” An enhancement to WCDMA technology that improves the performance of the radio uplink to increase capacity and throughput, and to reduce delay.

iDEN®

“Integrated Dispatch Enhanced Network.” A proprietary TDMA Standards-based technology which allows access to phone calls, paging and data from a single device. iDEN is a registered trademark of Motorola, Inc.

IEEE

“Institute of Electrical and Electronic Engineers.” A membership organization of engineers that among its activities produces data communications standards.

IEEE 802

A Standards body within the IEEE that specifies communications protocols for both wired and wireless local area and wide area networks (LAN/WAN).

IC

“Integrated Circuit.” A multifunction circuit formed in or around a semiconductor base.

Internet

A network comprised of numerous interconnected commercial, academic and governmental networks in over 100 countries.

IPR

“Intellectual Property Right.”

ISO

“International Standards Organization.” An international organization, which sets international electrical and electronics standards. The U.S. member body is ANSI.

iii

ITU

“International Telecommunication Union.” An international organization established by the United Nations with membership from virtually every government in the world. Publishes recommendations for engineers, designers, OEMs, and service providers through its three main activities: defining and adoption of telecommunications standards; regulating the use of the radio frequency spectrum; and furthering telecommunications development globally.

ITC

“InterDigital Technology Corporation,” one of our wholly-owned Delaware subsidiaries.

Kbps

“Kilobits per Second.” A measure of information-carrying capacity (i.e., the data transfer rate) of a circuit, in thousands of bits.

Km

“Kilometer.”

Know-How

Technical information, technical data and trade secrets that derive value from the fact that they are not generally known in the industry. Know-how can include, but is not limited to, designs, drawings, prints, specifications, semiconductor masks, technical data, software, net lists, documentation and manufacturing information.

LAN

“Local Area Network.” A private data communications network linking a variety of data devices located in the same geographical area and which share files, programs and various devices.

LTE

“Long Term Evolution.” Generic name for the 3GPP project addressing future improvements to the 3G Universal Terrestrial Radio Access Network (UTRAN).

MAC

“Media Access Control.” Part of the 802.3 (Ethernet LAN) standard which contains specifications and rules for accessing the physical portions of the network.

MAN

“Metropolitan Area Network.” A communication network which covers a geographic area such as a city or suburb.

Mbps

“Megabits per Second.” A measure of information – carrying capacity of a circuit; millions of bits per second.

MIMO

“Multiple Input Multiple Output.” A method of digital wireless transmission where the transmitter and/or receiver uses multiple antennas to increase the achievable data rate or improve the reliability of a communication link.

Modem

A combination of the words modulator and demodulator, referring to a device that modifies a signal (such as sound or digital data) to allow it to be carried over a medium such as wire or radio.

Multiple Access

A methodology (e.g., FDMA, TDMA, CDMA) by which multiple users share access to a transmission channel. Most modern systems accomplish this through “demand assignment” where the specific parameter (frequency, time slot, or code) is automatically assigned when a subscriber requires it.

iv

ODM

“Original Design Manufacturer.” Independent contractors that develop and manufacture equipment on behalf of another company using another company’s brand name on the product.

OEM

“Original Equipment Manufacturer.” A manufacturer of equipment (e.g., base stations, terminals) that sells to operators.

OFDM

“Orthogonal Frequency Division Multiplexing.” A method of digital wireless transmission that distributes a signal across a large number of closely spaced carrier frequencies.

OFDMA

“Orthogonal Frequency Division Multiple Access.” A method of digital wireless transmission that allows a multiplicity of users to share access by assigning sets of narrowband carrier frequencies. It is an extension of OFDM to multiple users.

OSI Reference Model

A seven layer network architecture model developed by ISO and ITU. Each layer specifies particular network functions.

PCMCIA

“Personal Computer Memory Card International Association.” An international industry group that promotes standards for credit card-sized memory card hardware that fits into computing devices such as laptops.

PDC

“Personal Digital Cellular.” The Standard developed in Japan for TDMA digital cellular mobile radio communications systems.

PHS

“Personal Handyphone System.” A digital cordless telephone system and digital network based on TDMA. This low-mobility microcell Standard was developed in Japan. Commonly known as PAS in China.

PHY

“Physical Layer.” The wires, cables, and interface hardware that connect devices on a wired or wireless network. It is the lowest layer of network processing that connects a device to a transmission medium.

Platform

A combination of hardware and software blocks implementing a complete set of functionalities that can be optimized to create an end product.

Protocol

A formal set of conventions governing the format and control of interaction among communicating functional units.

RF

“Radio Frequency.” The range of electromagnetic frequencies above the audio range and below visible light.

Smart Antenna

Antennas utilizing multiple elements with signal processing capabilities which enhance desired, or reduce undesired, transmission to or from wireless products.

SOC

“System-on-a-chip.” The embodiment on a single silicon chip of the essential components that comprise the operational core of a digital system.

v

Standards

Specifications that reflect agreements on products, practices, or operations by nationally or internationally accredited industrial and professional associations or governmental bodies in order to allow for interoperability.

TDD

“Time Division Duplexing.” A duplex operation using a single frequency, divided by time, for transmission and reception.

TD/FDMA

“Time Division/Frequency Division Multiple Access.” A technique that combines TDMA and FDMA.

TDMA

“Time Division Multiple Access.” A method of digital wireless transmission that allows a multiplicity of users to share access (in a time ordered sequence) to a single channel without interference by assigning unique time segments to each user within the channel.

TD-SCDMA

“Time Division Synchronous CDMA.” A form of TDD utilizing a low Chip Rate.

Terminal/Terminal Unit

Equipment at the end of a communications path. Often referred to as an end-user device or handset. Terminal units include mobile phone handsets, personal digital assistants, computer laptops and telephones.

TIA/EIA-54

The original TDMA digital cellular Standard in the United States. Implemented in 1992 and then upgraded to the TIA/EIA-136 digital Standard in 1996.

TIA/EIA-95

A 2G CDMA Standard.

TIA/EIA-136

A United States Standard for digital TDMA technology.

TIA (USA)

The Telecommunications Industry Association.

WAN

“Wide Area Network.” A data network that extends a LAN outside of its coverage area, via telephone common carrier lines, to link to other LANs.

WCDMA

“Wideband Code Division Multiple Access” or “Wideband CDMA.” The next generation of CDMA technology optimized for high speed packet-switched data and high-capacity circuit switched capabilities. A 3G technology.

Wideband

A communications channel with a user data rate higher than a voice-grade channel; usually 64Kbps to 2Mbps.

WiMAX

A commercial brand associated with products and services using IEEE 802.16 Standard technologies for wide area networks broadband wireless.

Wireless

Radio-based systems that allow transmission of information without a physical connection, such as copper wire or optical fiber.

vi

Wireless LAN (WLAN)

“Wireless Local Area Network.” A collection of devices (computers, networks, portables, mobile equipment, etc.) linked wirelessly over a limited local area.

WTDD

“Wideband TDD” or “Wideband Time Division Duplex.” A form of TDD utilizing a high Chip Rate.

vii

PART I

General

We design and develop advanced digital wireless technologies for use principally in digital cellular and IEEE 802 related products. We actively participate in and contribute our technology solutions to worldwide organizations responsible for the development and approval of Standards to which digital cellular and IEEE 802 compliant products are built, and our contributions are regularly incorporated into such Standards. We license our technology (e.g., terminal unit protocol software and physical layer designs) and patents to mobile device manufacturers, semiconductor companies and other equipment producers that manufacture, use and sell digital cellular and IEEE 802 related products. We have also designed and are developing, using third-party fabrication, a complete 2G/3G dual-mode modem ASIC for use in advanced modem platforms. We intend to offer both the ASIC and the platforms for sale to customers in the digital cellular terminal unit market. We have built our suite of technology and patent offerings through independent development, joint development with other companies, and selected acquisitions.

Currently, we generate revenues and cash flow primarily from royalties received under our patent license agreements. We also generate revenues and cash flow by licensing our technology and providing related technology solutions. We plan to increase our revenues by creating synergies between our patent licensing and technology licensing businesses through the sale of our 2G/3G modem ASIC and platforms.

As an early participant in the digital wireless market, we developed pioneering solutions for the two primary cellular air interface technologies in use today: TDMA and CDMA. That early involvement, as well as our continued development of advanced digital wireless technologies, has enabled us to create our significant worldwide portfolio of patents and patent applications. Included in that portfolio are a number of patents and patent applications which we believe are or may become essential to 2G and 3G cellular Standards, and other wireless Standards such as IEEE 802. Accordingly, we believe that companies making, using or selling products compliant with these Standards require a license under our essential patents, and will require licenses under essential patents that may issue from our pending patent applications. In conjunction with our participation in certain Standards bodies, we have filed declarations stating that we believe we have essential patents and that we agree to make our essential patents available for use and license on fair, reasonable and non-discriminatory terms or similar terms consistent with the requirements of the respective Standards organizations.

Third party products incorporating our patented inventions include:

| | • | | Mobile devices, including cellular phones, wireless personal digital assistants and notebook computers, PCMCIA cards, and similar products |

| | • | | Base stations and other wireless infrastructure equipment |

| | • | | Components for wireless devices |

We also incorporate our patented inventions into our own technology solutions, including our 2G/3G modem ASIC. In addition to conforming to applicable Standards, our solutions also include proprietary implementations for which we seek patent protection. We believe that our technology solutions provide time-to-market, performance and cost advantages to our customers.

Our investments in the development of advanced digital wireless technologies and related products and solutions include sustaining a highly specialized engineering team and providing that team with the equipment and advanced software platforms necessary to support the development of technologies. Over each of the last three years, our cost of development has ranged between 43% and 47% of our total operating expenses. The largest portion of this cost has been personnel costs. As of December 31, 2006, we employed 243 engineers, 69% of whom hold advanced degrees, 33 of whom hold PhDs.

We incorporated in 1972 under the laws of the Commonwealth of Pennsylvania, and we conducted our initial public offering in November 1981. Our corporate headquarters and administrative offices are located in King of Prussia, Pennsylvania, USA. Our research and technology and product development teams are located in the following locations: King of Prussia, Pennsylvania, USA; Melville, New York, USA; and Montreal, Quebec, Canada.

Our Internet address iswww.interdigital.comwhere, in the “Investing” section,we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, certain other reports required to be filed under the Securities Exchange Act of 1934, and all amendments to those reports as soon as reasonably practicable after such material is filed with the United States Securities and Exchange Commission (SEC). The information contained on or connected to our website is not incorporated by reference into this Form 10-K.

1

Wireless Communications Industry Overview

Participants in the wireless communications industry include original equipment manufacturers (OEMs), semiconductor manufacturers, original design manufacturers (ODMs), a variety of technology suppliers, applications developers, and operators that offer communications services and products to consumers and businesses. To achieve economies of scale and allow for interoperability, products for the wireless industry have typically been built to wireless Standards. These Standards have evolved in response to large demand for services and expanded capabilities. Although the cellular market initially focused on delivering voice-oriented services, over the past five years the industry transitioned from providing digital voice-oriented wireless products and basic data services (commonly referred to as Second Generation or 2G), to providing voice and higher speed data services (commonly referred to as Third Generation or 3G technologies). Concurrently, non-cellular wireless technologies, such as IEEE 802.11, have emerged as a means to provide wireless Internet access for fixed and nomadic use. Industry participants anticipate a proliferation of converged devices that incorporate multiple air interface technologies and functionalities, and provide seamless operation. As an example, such converged devices may provide seamless operation between a 3G network and a WLAN network.

Over the course of the last ten years, the cellular communications industry has experienced rapid growth worldwide. Total worldwide cellular wireless communications subscribers rose from slightly more than 200 million at the end of 1997 to approximately 2.6 billion at the end of 2006. In several countries, mobile telephones now outnumber fixed-line telephones. Market analysts expect that the aggregate number of global wireless subscribers could approach 4 billion in 2011.

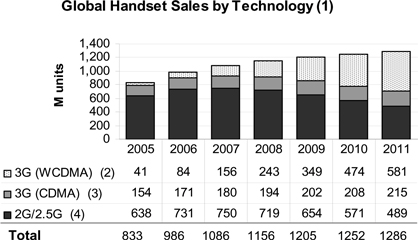

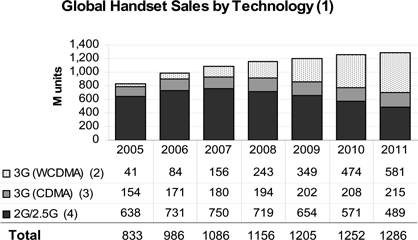

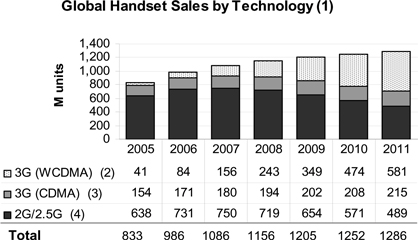

| (1) | Source: Strategy Analytics, Inc. October 2006. Data for 2006 through 2011 represents estimates of handset sales. |

| (2) | Includes: WCDMA/HSDPA and TD-SCDMA. |

| (3) | Includes: cdma2000 and its evolutions, such as EV-DO. |

| (4) | Includes: GSM/GPRS/EDGE and Analog, iDEN, TDMA, PHS and PDC. |

The growth in new cellular subscribers, combined with existing customers choosing to replace their mobile phones, helped fuel the growth of mobile phone sales from approximately 115 million units in 1997 to approximately one billion units in 2006. We believe the combination of a broad subscriber base, continued technological change, and the growing dependence on the Internet, e-mail and other digital media sets the stage for continued growth in the sales of wireless products and services through the balance of this decade. For those reasons, shipments of 3G-enabled phones, which represented approximately 25% of the market in 2006, are predicted to increase to approximately 60% of the market by 2011.

In addition to the advances in digital cellular technologies, the industry has also made significant advances in non-cellular wireless technologies. In particular, IEEE 802.11 WLAN has gained momentum in recent years as a wireless broadband solution in the home, office and in public areas. IEEE 802.11 technology offers high-speed data connectivity through unlicensed spectrum within a relatively modest operating range. Since its introduction in 1998, semiconductor shipments of products built to the IEEE

2

802.11 Standard have nearly doubled every year. While relatively small compared to the cellular market (approximately 200 million IEEE 802.11 wireless ICs shipped in 2006), the affordability and attractiveness of the technology has helped fuel rapid market growth.In addition, the IEEE wireless Standards bodies are creating sets of Standards to enable higher data rates, provide coverage over longer distances, and enable roaming. These Standards are establishing technical specifications for high data rates, such as IEEE 802.16 (WiMAX) as well as technology specifications to enable seamless handoff between different air interfaces (IEEE 802.21).

Evolution of Wireless Standards

Wireless communications Standards are formal guidelines for engineers, designers, manufacturers and service providers that regulate and define the use of the licensed radio frequency spectrum in conjunction with providing specifications for wireless communications products. A primary goal of the Standards is to assure interoperability of products, marketed by multiple companies, built to a common Standard. A number of international and regional wireless Standards Development Organizations (SDOs), including the International Telecommunications Union (ITU), the European Telecommunications Standards Institute (ETSI), the Telecommunications Industry Association (TIA), the Alliance for Telecommunications Industry Solutions (ATIS), and the American National Standards Institute (ANSI), have responsibility for the development and administration of wireless communications Standards. New Standards are typically adopted with each new generation of products, are often compatible with previous generations of the Standards, and are defined to ensure interoperability.

SDOs typically ask participating companies to declare formally whether they believe they hold patents or patent applications essential to a particular Standard and whether they are willing to license those patents on either a royalty-bearing basis on fair, reasonable and nondiscriminatory terms or on a royalty-free basis. To manufacture, have made, sell, offer to sell, or use such products on a non-infringing basis, a manufacturer or other entity doing so must first obtain a license from the holder of those essential patent rights. The SDOs do not have enforcement authority against entities that fail to obtain required licenses, nor do they have the ability to protect the intellectual property rights of holders of essential patents.

Digital Cellular Standards

The principal Standardized digital cellular wireless products in use today are based on TDMA and CDMA technologies. The Standardized TDMA technologies include GSM, TIA/EIA 54/136 (commonly known as AMPS-D, United States-based TDMA), PDC, PHS, DECT and TETRA. Of the TDMA technologies, GSM is the most prevalent, having been deployed in Europe, Asia, Africa, the Middle East, the Americas and other regions. Approximately 74% of worldwide handset sales for 2006 conform to GSM Standards. TIA/EIA 54/136 technology has been deployed primarily in North, Central and South America and is slowly being replaced by other technologies. PDC technology has been deployed in Japan, while PHS technologies are deployed primarily in Japan, the People’s Republic of China (under the name PAS) and Taiwan. DECT is a digital cordless telephone Standard that operates primarily in Europe. TETRA is an open digital trunked radio Standard widely deployed in Europe to meet the needs of professional mobile radio users such as railways and utilities.

Standardized TDMA-based 2.5G systems were dominant in 2006, with GPRS/EDGE comprising over 80% of global GSM shipments. 2.5G systems provide higher data rate services based on packet-data technology and, depending upon the generation of installed infrastructure, can be implemented without substantial additional infrastructure investment.

Narrowband CDMA-based technologies include TIA/EIA-95 (more commonly known as cdmaOne) and cdma2000 technologies and serve parts of the United States, Japan, South Korea and several other countries. In 2006, nearly 20% of worldwide handset sales were based on these CDMA technologies. CdmaOne is being replaced by cdma2000 and its variants.

Deployment of 3G services allows operators to take advantage of additional radio spectrum allocations and, through the use of higher speeds than 2.5G, deliver additional applications to their customers. The five specifications under the 3G standard include the following forms of CDMA technology: FDD, TDD, and Multichannel CDMA (cdma2000 technology). FDD and TDD collectively are referred to in the industry as WCDMA. In addition, TD-SCDMA, a variant of TDD technology, has been included in the Standard’s specifications.

The defined capabilities of the various 3G technologies have continued to evolve within the SDOs. In particular, the development of faster and more efficient methods to carry packet data over the air has resulted in the ability to provide data rates substantially higher than were envisioned in the original 3G specifications. Chief among these emerging technologies are High Speed Downlink Packet Access and High Speed Uplink Packet Access (HSDPA/HSUPA), an evolution of WCDMA, and First Evolution Data Optimized (1xEV-DO), an evolution of cdma2000. Nearly 100 operators had launched HSDPA networks by year end 2006. Despite the increased data rates and other capabilities provided by the HSDPA/HSUPA and 1xEV-DO evolutions of their respective technologies, which are beginning to be deployed, the Standards groups continue to advance the performance and capabilities of their respective air interfaces. The advances to the WCDMA air interface are being made under a program within 3GPP entitled “Long Term Evolution” (LTE). There is a similar long term evolution program underway within 3GPP2 for cdma 2000.

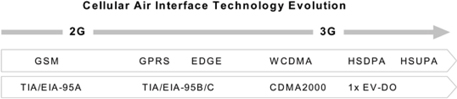

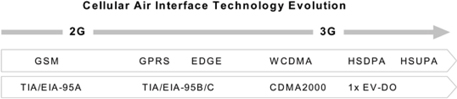

3

Most operators with existing GSM systems are deploying either GPRS-EDGE or WCDMA systems, and industry analysts expect that the vast majority of GSM operators will migrate to WCDMA. WCDMA-enabled devices accounted for nearly 10 percent of total shipments in 2006. Operators that originally deployed TIA/EIA-95-based systems have generally deployed cdma2000 systems. Operators that originally deployed TIA/EIA-136 systems are generally deploying WCDMA systems. TD-SCDMA is being developed for potential deployment in the People’s Republic of China and for possible export outside of China. The chart below shows the anticipated technology evolution for the predominant cellular technologies in use today.

IEEE 802-Based Standards

The IEEE began to address the need for an interoperability Standard among WLANs in 1990. The final Standard, IEEE 802.11, was ratified in 1997. Since that time, the IEEE 802.11 Working Group has continued to update and expand the basic IEEE 802.11 Standard to achieve higher data rates, accommodate additional operating frequencies and provide additional features. Equipment conforming to these Standards (i.e., IEEE 802.11a/b/g) is in the marketplace today. Intended for short range applications, operating in unlicensed frequency bands and requiring a modest amount of infrastructure, IEEE 802.11 Standards-based equipment has seen substantial market growth, especially in consumer home networking applications. Similar to 3G, this Standard also continues to evolve toward higher data rates and improved service capabilities.

The wide area network community has also established the IEEE 802.16 Working Group to define air interface Standards for longer distance (2 to 50 km) Metropolitan Area and Wide Area Networks (MAN/WAN). The first 802.16 Standard was published in 2002. Specifying operating frequencies from 10 to 66 GHz, it is primarily aimed toward very high speed wide area point to multipoint fixed applications. In 2003, an amendment to the 802.16 Standard was published which added operation in the 2 to 11 GHz frequency bands. This addition made the Standard much more suitable for providing wireless broadband high-speed Internet access for residential and small office applications. Equipment conforming to the 802.16-2004 fixed Standard was initially introduced in 2006. Concurrent with this revision of the fixed Standard, the 802.16 Working Group embarked on defining a mobile version of the Standard (referred to as 802.16e). The mobile version of the Standard was completed and published in February 2006 and initial equipment shipments are expected to commence in late 2007. More recently, the IEEE 802 community has begun to address the question of handover between the different IEEE 802 technologies, both wired and wireline, as well as handover to external non-802 networks, such as 3G. This new group, IEEE 802.21, entitled Media Independent Handover Services HS, anticipates that their initial Standard will be available in mid to late 2007. The IEEE 802.21 technology is specifically oriented towards the future all-IP Next Generation Network that merges existing fixed and mobile networks into a single homogeneous integrated network capable of supporting all envisioned advanced fixed and mobile services including voice, data, and video. InterDigital is an active contributor in this arena.

InterDigital’s Strategy

Core to our strategy is our ability to develop advanced digital wireless technologies for the digital cellular and IEEE 802 markets. We intend to continue to develop those technologies, contribute our ideas into the Standards bodies and bring those technologies to market generating revenues from patent and technology licensing as well as product sales. Our goal is to derive revenue on every 3G mobile terminal unit sold, either in the form of patent licensing revenues, technology and product related revenues, or a combination of two or more of these elements. In recent years, our patent license agreements have contributed the majority of our cash flow and revenues. As of December 2006, we recorded patent royalties on approximately 35-40% of all 3G mobile devices sold worldwide. In addition, our technology and product solutions offer an additional means to generate revenue from 3G mobile devices.

Our strategy for achieving our goal is as follows:

| | • | | Continue to fund substantial technology development |

4

| | • | | Maintain substantial involvement in key worldwide Standards bodies, contributing to the ongoing definition of wireless Standards and incorporating our inventions into those Standards |

| | • | | License our patented technology to wireless equipment producers worldwide, maximizing realizable value in our 3G licenses by investing the time necessary to negotiate appropriate economic terms for 3G products |

| | • | | Vigorously defend our intellectual property and related contractual rights |

| | • | | Offer technology blocks, as well as a complete 2G/3G dual-mode modem ASIC using third party fabrication, and platforms to terminal unit manufacturers |

| | • | | Establish key strategic relationships to facilitate time-to-market advantages and gain competitive access to both complimentary technologies and production capabilities |

| | • | | Offer our intellectual property rights and technology products on both a complimentary and stand-alone basis |

InterDigital’s Technology Position

Cellular Technologies

We have a long history of developing cellular technologies including those related to CDMA and TDMA and, more recently, OFDMA and MIMO.

A number of our TDMA-based and CDMA-based inventions are being used in all 2G, 2.5G and 3G wireless networks and mobile terminal devices. We led the industry in establishing TDMA-based TIA/EIA-54 as a digital wireless U.S. Standard in the 1980s, and created a substantial portfolio of TDMA-based patented inventions. These inventions include or relate to fundamental elements of TDMA-based systems in use around the world. Some of our more central inventions are:

| | • | | The fundamental architecture of commercial Time Division/Frequency Division Multiple Access (TD/FDMA) systems |

| | • | | Methods of synchronizing TD/FDMA systems |

| | • | | A flexible approach to managing system capacity through the reassignment of online subscriber units to different time slots and/or frequencies in response to system conditions |

| | • | | The design of a multi-component base station, utilizing distributed intelligence, that allows for more robust performance |

| | • | | Initializing procedures that enable roaming |

A number of our TDMA-based inventions are being used in all 2G and 2.5G wireless networks and mobile terminal devices.

We also have developed and patented innovative CDMA technology solutions. Today, we hold a significant worldwide portfolio of CDMA patents and patent applications. Similar to our TDMA inventions, we believe that a number of our CDMA inventions are essential to the implementation of CDMA systems in use today. Some of our more important CDMA inventions include or relate to:

| | • | | Global pilot: The use of a common pilot channel to synchronize sub-channels in a multiple access environment |

| | • | | Bandwidth allocation: Techniques including multi-channel and multi-code mechanisms |

| | • | | Power control: Highly efficient schemes for controlling the transmission output power of terminal and base station devices, a vital feature in a CDMA system |

| | • | | Joint detection and interference cancellation techniques for reducing interference |

| | • | | Soft handover enhancement techniques between designated cells |

| | • | | Various sub-channel access and coding techniques |

| | • | | Geo-location for calculating the position of terminal users |

| | • | | Multi-user detection (MUD) |

| | • | | High speed packet data channel coding |

| | • | | High speed packet data delivery in a mobile environment |

The cellular industry has ongoing initiatives aimed at technology improvements. We have engineering development projects to build and enhance our technology portfolio in many of these areas, including the Long Term Evolution (LTE) project for 3GPP radio technology, further evolution of the 3GPP WCDMA Standard, and continuing improvements to the legacy GSM-EDGE

5

Radio Access Network (GERAN). The common goal is to improve the user experience and reduce the cost to operators via increased capacity, reduced cost per bit, increased data rates and reduced latency generally, to provide cost-effective mobile data services that approach the quality of wired connections. Of the above activities, LTE is the most advanced in that it uses the newer OFDMA/MIMO technologies.

IEEE 802-based Wireless Technologies

With our strong wireless background, we have expanded our engineering and corporate development activities to focus on solutions that apply to other wireless market segments. These segments primarily fall within the continually expanding scope of the IEEE 802 family of Standards. We are building a portfolio of technology related to the WLAN and digital cellular area that includes, for example, improvements to the IEEE 802.11 PHY and MAC to increase peak data rates (i.e., IEEE 802.11n), handover among radio access technologies (IEEE 802.21), mesh networks (IEEE 802.11s), wireless network management (IEEE 802.11v), and wireless network security.

6

Business Activities

Patent Licensing

Our Patent Portfolio

As of December 31, 2006, our patent portfolio consisted of 767 U.S. patents (217 of which issued in 2006), and 2,386 non-U.S. patents (826 of which issued in 2006). We also have numerous patent applications pending worldwide. As of December 31, 2006 we had 1,163 pending applications in the U.S. and 7,660 pending non-U.S. patent applications. The patents and applications comprising our portfolio relate specifically to digital wireless radiotelephony technology (including, without limitation, TDMA and/or CDMA) and expire at differing times ranging from 2007 through 2026. A significant part of our TDMA patent portfolio, representing some of the Company’s “pioneering” TDMA patents, expired during 2006. (See, “Item 1A-Risk Factors-Our Future Financial Condition and Operating Results Could Fluctuate Significantly.”).

The United States Patent and Trademark Office (USPTO) permits the filing of “provisional” applications for, among other reasons, protecting rights on an expedited basis. Typically, the filing of a provisional application is followed with the filing of a “non-provisional” application, a formal filing which may add content, such as claim language, to the provisional application, or may combine multiple provisional applications. The USPTO, along with other international patent offices, also permits the filing of “continuation” or “divisional” applications, which are based, in whole or in part, on a previously filed non-provisional patent application. Most of our foreign patent applications are single treaty application filings, which can produce patents in all of the countries that are parties to a particular treaty. During 2006, we filed 516 U.S. patent applications consisting of 125 first filed, U.S. non-provisional, non-continuation patent applications, 275 U.S. provisional applications, and 116 U.S. continuation, continuation-in-part or divisional applications. Typically, each new U.S. non-provisional application is used as the basis for the later filing of one or more foreign applications.

Patent Licenses

Currently, numerous manufacturers supply digital cellular equipment conforming to 2G and 3G Standards. Accordingly, we believe that those companies require licenses under our essential patents and will require licenses under essential patents that may issue from our pending patent applications. While some companies seek licenses before they commence manufacturing and/or selling devices that use our patented inventions, most do not. Consequently, we approach companies and seek to establish license agreements. We expend significant effort identifying potential users of our inventions and negotiating patent license agreements with companies that may be reluctant to take licenses. We are in active discussions with a number of companies regarding the licensing of our 2G and 3G-related patents on a worldwide basis. During negotiations, unlicensed companies may raise different defenses and arguments as to their need to enter into a patent license with us, to which we respond. In the past year, these defenses and arguments have included positions by companies: (i) as to the essential nature of our patents, (ii) that their products do not infringe our patents and/or that our patents are invalid and/or unenforceable, and (iii) concerning the impact of litigation between us and other third parties. If we believe that a third party is required to take a license to our patents in order to manufacture and sell products, we might commence legal action against the third party if they refuse to enter into a patent license agreement.

We offer non-exclusive, royalty-bearing patent licenses to companies that manufacture, use or sell, or intend to manufacture, use or sell, equipment that implements the inventions covered by our portfolio of patents. We have entered into numerous non-exclusive, non-transferable (with limited exceptions) patent license agreements with companies around the world. When we enter into a new patent license agreement, the licensee typically agrees to pay consideration for sales made prior to the effective date of the license agreement and also agrees to pay royalties or license fees on covered products that it will sell or anticipates selling during the term of the agreement. We expect that, for the most part, new license agreements will follow this model. Our patent license agreements are structured on a royalty-bearing basis, paid-up basis or combination thereof. Most of our patent license agreements are royalty bearing. Most of these agreements provide for the payment of royalties on an ongoing basis, based on sales of covered products built to a particular Standard (convenience based licenses). Others provide for the payment of royalties on an ongoing basis if the manufacture, sale or use of the licensed product infringes one of our patents (infringement based licenses).

Our license agreements typically contain provisions which give us the right to audit our licensees’ books and records to ensure compliance with the licensees’ reporting and payment obligations under those agreements. From time to time, these audits reveal underreporting or underpayments under the applicable agreements. In such cases, we might enter into negotiations to resolve the discrepancy or dispute resolution proceedings with the licensee, either of which might lead to payment of all or a portion of the amount claimed due under the audit, or we might terminate the license.

We recognize the revenue from per-unit royalties in the period when we receive royalty reports from licensees. In circumstances where we receive consideration for sales made prior to the effective date of a patent license, we typically recognize such payments as revenue in the quarter in which the patent license agreement is signed. However, if the patent license agreement is reached as part of the settlement of patent infringement litigation, we recognize consideration for past sales as other income. Some of these patent license agreements provide for the non-refundable prepayment of royalties which are usually made in exchange for prepayment discounts. As the licensee reports sales of covered products, the royalties due are calculated and either applied against

7

any prepayment, or paid in cash. Additionally, royalties on sales of covered products under the license agreement are payable or exhausted against prepayments based on the royalty formula applicable to the particular license agreement. These formulas include flat dollar rates per-unit, a percentage of sales, percentage of sales with a per-unit cap, and other similar measures. The formulas can also vary by other factors including territory, covered Standards, quantity and dates sold.

Some of our patent licenses are paid-up, requiring no additional payments relating to designated sales under agreed upon conditions. Those conditions generally can include paid-up licenses for a period of time, for a class of products, under certain patents, or for sales in certain countries or a combination thereof. Licenses can become paid-up based on the payment of fixed amounts or after the payment of royalties for a term. We recognize revenues related to fixed amounts on a straight-line basis.

From time to time, some of our patent licenses may contain “most favored licensee” (MFL) clauses which permit the licensee to elect to apply the terms of a subsequently executed license agreement with another party that are more favorable than those of the licensee’s original agreement. The application of the MFL clause may affect, and generally acts to reduce, the amount of royalties payable by the licensee. The application of an MFL clause can be complex, given the varying terms among patent license agreements. Currently our key license agreements that contain MFL clauses include those with NEC Corporation of Japan (NEC) and our 1996 patent license agreement (Samsung Agreement) with Samsung Electronics Co. Ltd. (Samsung) to the extent that latter MFL clause has survived. (See “Item 3 – Legal Proceedings, Samsung”). In first quarter 2007, NEC gave notice of its intent to enforce the MFL provision under its worldwide, non-exclusive, generally non-transferable, royalty-bearing, narrowband CDMA and 3G patent license agreement with ITC. The outcome of discussions with NEC over the application of its intent to enforce this MFL provision could result in a delay in our receipt of or inability to collect royalties from NEC, commencement of dispute resolution proceedings, a decrease in royalties payable by NEC, or a combination of these events. While we believe NEC has waived any applicable MFL rights, NEC may advance an alternative position and could seek to litigate the matter and, while not permissible under the agreement, suspend payments.

Expenditures relating to maintaining our current licenses (other than enforcement and arbitration proceedings) are not material, and are predominantly administrative in nature. Cash flows from patent license agreements have been used for general corporate purposes, including substantial reinvestment in Standards contributions, technology development and productization. Revenues generated from royalties are subject to quarterly and annual fluctuations. (See,“Item 1A-Risk Factors, Our Future Financial Condition and Operating Results Could Fluctuate Significantly.”).

During 2006, 2005, and 2004, revenue from our Asian-based licensees comprised 39%, 71%, and 78% of total revenues, respectively. For the same years, revenue from our European-based licensees comprised 58%, 14%, and 18% of total revenues, respectively.

In addition to patent licensing, we actively seek to license know-how both to companies with whom we have had strategic relationships (including alliance partners) and to other companies. (See,“-Business Activities, Technology and Product Development.”).

The achievement of our long term strategic objectives is based on securing 3G patent license agreements with a substantial portion, if not all, of the mobile phone industry. Because the vast majority of 3G terminal unit sales are expected to occur in the future, we believe the Company is best served by entering into patent license agreements on appropriate economic terms, even if securing such terms results in completing the negotiation of any particular license later than it otherwise could have been completed on less favorable terms.

2006 Patent License Activity

In first quarter 2006, we entered into a worldwide, non-exclusive, royalty-bearing, convenience-based patent license agreement with LG Electronics, Inc. (LG) covering the sale of (i) terminal units compliant with 2G and 2.5G TDMA-based and 3G Standards, and (ii) infrastructure compliant with cdma2000 technology and its extensions up to a limited threshold amount. Under the terms of the patent license agreement, LG paid us $95 million in first quarter 2006, and is obligated to pay us two additional installments of $95 million each in the first quarters of 2007 and 2008. The agreement expires at the end of 2010 upon which LG will receive a paid-up license to sell single-mode GSM/GPRS/EDGE terminal units under the patents included under the license, and become unlicensed as to all other products covered under the agreement. We are recognizing revenue associated with this agreement on a straight-line basis from the inception of the agreement until December 31, 2010.

In second quarter 2006, ITC and Panasonic Mobile Communications Co., Ltd. (formerly known as Matsushita Communications Industrial Co, Ltd.) (Panasonic), resolved the issue of the amount of royalties to be applied against Panasonic’s advance payment under its 2001 CDMA (including 3G) patent license agreement with ITC. ITC and Panasonic agreed to apply $12.0 million out of Panasonic’s $19.5 million advance payment in satisfaction of Panasonic’s royalty obligations. Subsequent to this resolution, Panasonic exhausted the balance of its advance payment and now is obligated to make additional royalty payments as covered products are sold.

In second quarter 2006, InterDigital and ITC entered into two principal agreements with Nokia Corporation (Nokia) which resolved certain legal proceedings between them. Specifically, in the first agreement, an Arbitration Settlement Agreement (Arbitration Settlement Agreement), the parties resolved their disputes arising out of a June 2005 Arbitral Award (Final Award). The Final Award, among

8

other things, had established royalty rates applicable to Nokia’s sales of covered 2G and 2.5G terminal units and infrastructure in the period from January 1, 2002 through December 31, 2006 under the Patent License Agreement entered into between them in 1999 (Nokia Agreement). Pursuant to the Arbitration Settlement Agreement, in April 2006 Nokia paid InterDigital $253 million. Nokia is deemed to have a fully paid-up license covering worldwide sales of 2G TDMA-based products, consisting primarily of GSM/GPRS/EDGE terminal units and infrastructure. Nokia is also released from infringement liability for worldwide sales of 3G terminal units and infrastructure through April 26, 2006. Nokia and InterDigital also agreed to terminate the Nokia Agreement, including the application of an MFL provision under the Nokia Agreement. As a result of the termination of the Nokia Agreement, Nokia’s MFL status ceases and Nokia’s sales of 3G products after April 26, 2006 are not licensed by InterDigital. Pursuant to a second agreement, Nokia dismissed its claims in an outstanding action against ITC in the English High Court of Justice, Chancery Division, Patents Court relating to the validity and infringement of three of ITC’s UK patents. (See, “Item 3 –Legal Proceedings, Other”.)

In fourth quarter 2006, ITC and Sharp entered into an Amendment which extended the term of the PHS/PDC patent license agreement from April 2008 to April 2011. ITC’s PHS/PDC patent license agreement with Sharp is worldwide, non-exclusive, generally nontransferable, royalty-bearing, and convenience-based, covering sales of terminal devices compliant with TDMA-based PHS and PDC Standards.

In fourth quarter 2006, we entered into non-exclusive, worldwide, royalty-bearing, convenience-based, patent license agreements with Inventec Appliances Corp. (Inventec) covering the sale of terminal units and infrastructure compliant with 2G, 2.5G, and 3G Standards by Inventec and all of its Taiwanese subsidiaries.

Patent Licensees Generating 2006 Revenues Exceeding 10% of Total Revenues

In 2006, patent license revenue from our license agreements with Nokia and LG comprised 53% and 11% of our total revenue of $480.5 million, respectively. Excluding $267.4 million of non-recurring patent license revenue, $253 million of which was attributable to payment to us by Nokia under an April 28, 2006 Arbitration Settlement Agreement, LG, NEC and Sharp Corporation of Japan (Sharp) were approximately 26%, 19% and 17% of our total 2006 recurring revenues, respectively.

Patent Licensees Generating Revenues Exceeding 10% of Recurring Revenues

The loss of revenues and cash payments from LG (referred to above) or any of the licensees discussed below (with the exception of the NEC 2G Agreement, for which all present and anticipated cash has been received) would adversely affect either our cash flow or results of operations and could affect our ability to achieve or sustain acceptable levels of profitability.

ITC is a party to a worldwide, non-exclusive, generally nontransferable, royalty-bearing, narrowband CDMA and 3G patent license agreement with NEC. Pursuant to its patent license agreement with ITC, NEC is obligated to pay royalties on a convenience basis on all sales of products covered under the license. We recognize revenue associated with this agreement in the periods we receive the related royalty reports. This patent license agreement expires upon the last to expire of the patents licensed under the agreement. NEC and ITC are also parties to a separate non-exclusive, worldwide, convenience-based, generally nontransferable, royalty-bearing TDMA patent license agreement (2G), which expires upon the last to expire of the patents licensed under the agreement. In 2002, the parties amended that agreement to provide for the payment by NEC to ITC of $53.0 million, in exchange for which royalty obligations for PHS and PDC products are considered paid-up. We recognized revenue associated with this $53.0 million payment on a straight-line basis from the January 2002 agreement date through February 2006, which was the expected period of use by NEC. It is unlikely that NEC would have any further royalty payment obligations under that agreement based on existing paid-up and other unique provisions. In 2006, we recorded revenues of $40.0 million from NEC of which approximately $2.0 million is attributable to our 2G patent license agreement and approximately $38 million is attributable to our narrowband CDMA and 3G patent license agreement.

ITC is a party to a worldwide, non-exclusive, generally nontransferable, royalty-bearing, convenience-based patent license agreement with Sharp (Sharp PHS/PDC Agreement) covering sales of terminal devices compliant with TDMA-based PHS and PDC Standards. In fourth quarter 2006, ITC and Sharp entered into an Amendment which extended the term of the Sharp PHS/PDC Agreement from April 2008 to April 2011. Sharp is obligated to make royalty payments on sales of licensed products as covered products are sold. We recognize revenue associated with this agreement in the periods we receive the related royalty reports.

ITC and Sharp are also parties to a separate worldwide, non-exclusive, convenience-based, generally nontransferable, royalty-bearing patent license agreement (Sharp NCDMA/GSM/3G Agreement) covering sales of GSM, narrowband CDMA and 3G products that expires upon the last to expire of the patents licensed under the agreement. Under an amendment to that agreement executed in first quarter 2004, which affects certain payment terms and other obligations of the parties, Sharp made a

9

royalty pre-payment of approximately $17.8 million in second quarter 2004, which was exhausted in the fourth quarter of 2004. Sharp is obligated to make royalty payments on sales of licensed products, to the extent it does not have a royalty credit, as covered products are sold. As part of the 2006 Amendment referred to in the preceding paragraph, Sharp made additional lump-sum payments and agreed to prepay estimated 2007 royalties on designated sales. We recognize revenue associated with this agreement in the period that royalty reports are received. This license agreement expires upon the last to expire of the patents licensed under this agreement. In 2006, we recorded revenues of $35.8 million from Sharp of which approximately $4.7 million is attributable to the Sharp PHS/PDC Agreement and approximately $31.1 million is attributable to the Sharp NCDMA/GSM/3G Agreement.

Legal Proceedings

Patent Oppositions

In high technology fields characterized by rapid change and engineering distinctions, the validity and value of patents are sometimes subject to complex legal and factual challenges and other uncertainties. Accordingly, our patents are subject to uncertainties typical of patent enforcement generally. The validity of some of our key patents has been and continues to be challenged in patent opposition and revocation proceedings in a number of jurisdictions. While in a few cases, our patents have been invalidated or substantially narrowed, this has not impaired our patent license program because we generally license a broad portfolio of patents held worldwide, not a single patent or invention in a single jurisdiction. If a party successfully asserts that some of our patents are not valid, are unenforceable, should be revoked or do not cover their products, or if products are implemented in a manner such that patents we believe to be commercially important are not infringed, we do not believe there would be a material adverse impact on our ongoing revenues from existing patent license agreements, although there could be an adverse impact on our ability to generate new royalty streams. The cost of enforcing and protecting our patent portfolio is significant. (See,“Item 1A-Risk Factors, Our Revenue and Cash Flow Could Decline Depending Upon the Success of Our Licensing Program.”).

Patent Infringement and Declaratory Action Lawsuits

From time to time, if we believe any party is required to license our patents in order to manufacture and sell certain digital cellular products and such party has not done so, we may institute legal action against them. These legal actions typically take the form of a patent infringement lawsuit. In a patent infringement lawsuit, we would typically seek damages for past infringement and an injunction against future infringement. The response from the subject party can come in the form of challenges to the validity, enforceability, essentiality and/or applicability of our patents to their products. In addition, a party might file a Declaratory Judgment action to seek a court’s declaration that our patents are invalid, unenforceable, not infringed by the other party’s products, or are not essential. Our response may include claims of infringement. (See,“Item 3 –Legal Proceedings”). When we include claims of infringement, a favorable ruling for the Company can result in the payment of damages for past sales, the setting of a royalty for future sales, or issuance by the court of an injunction enjoining the manufacturer from manufacturing and/or selling the infringing product. An adverse ruling, in terms of having patents declared invalid, non-infringed or unenforceable, could result in difficulty securing new licenses to the extent such a ruling affects a significant portion of our patent portfolio related to any particular wireless Standard. Regardless of the actual outcome of the litigation, the cost of such litigation can be significant. As part of a settlement of a patent infringement lawsuit against a third party, we could recover consideration for past infringement, and grant a license under the patent(s) in suit (as well as other patents) for future sales. Such a license could take any of the forms discussed above.

Contractual Arbitration Proceedings

We and our licensees, in the normal course of business, may have disagreements as to the rights and obligations of the parties under the applicable license agreement. For example, we could have a disagreement with a licensee as to the amount of reported sales and royalties. Our license agreements typically provide for audit rights as well as private arbitration as the mechanism for resolving disputes. Arbitration proceedings can be resolved through an award rendered by the arbitrators or by settlement between the parties. Parties to an arbitration might have the right to have the Award reviewed in a court of competent jurisdiction; however, based on public policy favoring the use of arbitration, it is difficult to have arbitration awards vacated or modified. The party securing an arbitration award may seek to have that award converted into a judgment through an enforcement proceeding. The purpose of such a proceeding is to secure a judgment that can be used for, if need be, seizing assets of the other party. (See,“Item 3-Legal Proceedings”).

We are currently involved in legal proceedings with Samsung relating to its patent license agreement with us and an Arbitral Award rendered in connection therewith. (See,“Item 3 –Legal Proceedings, Samsung” for further discussion of proceedings relating to our patents).

10

Technology and Product Development

We have designed, developed and placed into operation a variety of advanced digital wireless technologies, systems and products since our inception in the early 1970s. Historically, our strength has been our ability to explore emerging technologies, identifying needs created by the development of advanced wireless systems, and building technologies for those new requirements.

Today, we are focusing our product development efforts principally on the advanced cellular technologies. This includes 3G WCDMA technologies, in particular HSDPA/HSUPA implementations, and the 3GPP Long Term Evolution (LTE) project based on OFDMA/MIMO. We are integrating licensed 2G GSM/GPRS/EDGE solutions with our advanced 3G technology (WCDMA/HSDPA/HSUPA) in order to offer technology licenses as well as a fully-integrated 2G/3G complete dual-mode modem ASIC solution to semiconductor and mobile device manufacturers, respectively. We will initially market our 2G/3G dual-mode modem ASIC and platforms to data card manufacturers.

We also develop advanced IEEE 802 wireless technologies, in particular technology related to WLAN and digital cellular applications that includes improvements to IEEE 802.11 PHY and MAC to increase peak data rates (i.e., IEEE 802.11n), handover among radio access technologies (IEEE 802.21), mesh networks (IEEE 802.11s), wireless network management (IEEE 802.11v), and wireless network security.

We recorded expenses of $65.4 million, $63.1 million and $51.2 million during 2006, 2005, and 2004, respectively, related to our research and development efforts. These efforts foster inventions which are the basis of many of our patents. As a result of such patents and related patent license agreements, in 2006, 2005 and 2004, we recognized $473.6 million, $144.1 million and $103.4 million of patent licensing revenue, respectively. In addition, in 2006, 2005, and 2004, we recognized technology solutions revenues totaling $6.9 million, $19.0 million and $0.3 million, respectively.

3G WCDMA/FDD Technology and Product Development

We are developing a fully integrated 2G/3G dual-mode modem ASIC utilizing third-party fabrication. Our initial product launch consists of an advanced offering incorporating HSDPA/HSUPA technologies in a platform customized for the data card market.

We have developed various technology blocks, upgrades and platforms compliant with the 3GPP WCDMA/FDD Standards. The Standard for initial system deployment was identified as Release 99 or Release 4. Subsequent releases, identified as Release 5, Release 6, etc., add various advanced features and functions. For example, Release 5 HSDPA, an upgrade to WCDMA, provides high speed data capabilities, theoretically up to 14 Mbps, from the network to mobile handsets (i.e., the downlink). We have developed technology blocks that can upgrade an existing FDD modem to HSDPA capabilities. Our Release 5 development effort includes a complete 3G modem comprising a physical layer and protocol stack with HSDPA and non-HSDPA channels. This allows us to offer customers a complete Release 5 FDD modem solution, as well as smaller blocks that augment their existing technology. These blocks include advanced receiver technology that can support the highest rate HSDPA mode, Category 10, and can be scaled to lower categories and data rates depending on customer requirements. In first quarter 2006, we successfully demonstrated Category 10 performance, the highest HSDPA mode, with throughput in excess of 10Mbps in our coprocessor at 3GSM World Congress in Barcelona, Spain. Release 6 of the WCDMA Standard introduces HSUPA, which increases the uplink rate to a theoretical maximum of 5.8 Mbps, includes both HSDPA and HSUPA, is poised to support high speed data in both the uplink and downlink, reduce the latency in data transmission and increase overall network capacity.

Recognizing the need continually to improve data rates, coverage and capacity, work is underway within 3GPP on further evolution of the Standards. Release 7 is expected to address incremental performance improvements. In addition, work continues on a longer term initiative known as Evolved UTRA/UTRAN (UMTS Terrestrial Radio Access/ UMTS Terrestrial Radio Access Network). The objectives of this initiative are more ambitious, targeting peak data rates of 100 Mbps in the downlink and 50 Mbps in the uplink, improved spectrum efficiency, significantly reduced data latency, and scaleable bandwidths from as low as 1.25 MHz to as high as 15 MHz. We are participating in Release 7 and evolved UTRA/UTRAN Standards activities and have launched internal projects to develop the technology necessary for the new performance requirements. In addition to supplying technology blocks to partners, we are developing our complete 2G/3G dual-mode modem ASIC, using “fabless” production.

WCDMA/TDD Technology Product Development

During the period 1999 through 2003, the Company was actively engaged in the development and standardization of technology related to one of the modes of the 3G standard, namely TDD. Our TDD technology development effort resulted in the Company developing a validated and fully Standards compliant WTDD technology solution. We delivered TDD technology building blocks to Nokia for use in 3G wireless products for which they paid an aggregate amount of approximately $58.0 million.

As a result of this and prior technology development efforts, the Company established a significant patent portfolio related to TDD-based wireless systems, including without limitation the TDD mode of WCDMA and the TD-SCDMA systems being deployed in the People’s Republic of China. As part of its license agreements, the Company typically includes TDD-based Standards (like TD-SCDMA) as a covered Standard. In addition, the Company has expended and continues to expend appropriate resources targeted to generate revenue from the roll-out of TD-SCDMA products in the People’s Republic of China.

11

Wireless LAN and Mobility

As part of our broader technology development activities, we are developing solutions addressing WLAN technology and mobility between WLAN and cellular networks. These projects support activities within the IEEE 802 and 3GPP network architecture working groups. These technology areas include improvements to the 802.11 PHY and MAC to increase peak data rates (i.e., IEEE 802.11n), handover between radio access technologies (i.e., IEEE 802.21), mesh networks, wireless network management, and wireless network security.

12

3G FDD / WCDMA Technology Product Customers and Partners

Infineon Technologies AG

We jointly developed and continue to support a 3G protocol stack for use in terminal units under our 2001 cooperative development, sales and alliance agreement with Infineon Technologies AG (Infineon). This 3G protocol stack interfaces with existing GSM/GPRS/EDGE protocol stack software to provide dual-mode (2G/3G) protocol stack functionality, supports Infineon’s 3G baseband processor, and is portable to other baseband processors. Together with Infineon, we completed the full dual-mode WCDMA/FDD release 99 protocol stack in 2003. This protocol stack solution has been commercially deployed and continues to be offered to 3G mobile phone and semiconductor producers. The technology is operating in commercial production in Japan. We have supported Infineon with interoperability testing and continue to support product launch and certification with field support, software support and lab testing. In fourth quarter 2005, we extended our 3G protocol stack relationship with Infineon to include the joint development and commercialization of upgraded, Standards-compliant Release 5 protocol stacks with HSDPA functionality. In the first quarter of 2006, we further extended our 3G protocol stack relationship with Infineon to include joint development and commercialization of an upgraded, Standards-compliant Release 6 protocol stack to include HSUPA functionality.

Also in fourth quarter 2005, we entered into a new agreement with Infineon permitting us independently to offer a complete dual-mode GSM/GPRS/EDGE and WCDMA/HSDPA integrated protocol stack to the market. Under the agreement, we have licensed Infineon’s legacy GCF-certified GSM/GPRS/EDGE protocol stack, which we are now able to license to customers in combination with our evolving 3G protocol stack and baseband offering. This provides us the ability to offer a comprehensive Standards-compliant WCDMA Release 5 dual-mode protocol stack, as well as a complete 3G physical to application layer modem solution. In addition to GCF certification, the GSM/GPRS/EGDE protocol stack has 75 type approvals and has completed interoperability testing with more than 80 operators in 40 countries worldwide.

In fourth quarter 2006, we announced an additional expansion of our relationship with Infineon, whereby we have licensed Infineon’s field-proven GSM/GPRS/EDGE baseband modem, the S-GOLD(R) 3, and have also licensed the layer one control software (in addition to the protocol stack software which had previously been licensed). This provides us for the first time with the ability to offer a comprehensive Standards-compliant 2G/3G modem solution. Under the terms of the extended agreement with Infineon, we have the right to use the Infineon 2G technology in our own modem offering or to sublicense the technology to third parties developing their own 2G/3G modem offerings. We also gain access to all of the applicable design specifications, source code and other design data for Infineon’s integrated GSM/GPRS/EDGE baseband and protocol stack technology, including the S-GOLD(R) 3 baseband processor ASIC design with support for Infineon’s RF, Power Management and Connectivity modules as well as related components.

We and Infineon also have cross-licensed to each other a limited set of patents for specified purposes. We also have agreed to a framework for determining royalties applicable to other 2G and 3G products.

General Dynamics C4 Systems

In December 2004, we entered into an agreement with General Dynamics C4 Systems (formerly known as General Dynamics Decision Systems, Inc.) (General Dynamics) to serve as a subcontractor on the Mobile User Objective System (MUOS) program for the U.S. military. MUOS is an advanced tactical terrestrial and satellite communications system utilizing 3G commercial cellular technology to provide significantly improved high data rate and assured communications for U.S. war fighters.

Under the Software License Agreement (SLA), we delivered to General Dynamics Standards-compliant WCDMA modem technology, originating from the technology we developed under our original agreement with Infineon, for incorporation into handheld terminals. The SLA provided for the payment of $18.5 million in exchange for delivery of, and a limited license to, our commercial technology solution for use within the U.S. Government’s MUOS and Joint Tactical Radio System programs. Maintenance and product training were also covered by this amount. A majority of our MUOS program deliverables and related payments occurred during 2005. We completed delivery of our technology solution in 2006. In addition to the deliverables specifically identified in the SLA, we originally agreed to provide software maintenance services for a period of three years and additional future services as requested by General Dynamics. In fourth quarter 2006, General Dynamics agreed to amend the SLA to release us from our maintenance obligations over the final two years of the SLA, in exchange for a $0.5 million reduction to their remaining payments and provision of limited engineering support services. We recognized approximately $0.9 million in fourth quarter 2006 as a result of this amendment.

NXP Semiconductors B.V. (formerly Philips Semiconductors)

In August 2005, we entered into an agreement with NXP (formerly Philips Semiconductors B.V.) to deliver our physical layer HSDPA technology solution to NXP for integration into its family of Nexperia™ cellular system chipsets. Under the

13