QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 28, 2007 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-8207

THE HOME DEPOT, INC.

(Exact Name of Registrant as Specified in its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation or Organization)

95-3261426

(I.R.S. Employer Identification No.)

2455 PACES FERRY ROAD, N.W., ATLANTA, GEORGIA 30339

(Address of Principal Executive Offices) (Zip Code)

Registrant's Telephone Number, Including Area Code:(770) 433-8211

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

TITLE OF EACH CLASS

| | NAME OF EACH EXCHANGE

ON WHICH REGISTERED

|

|---|

| Common Stock, $0.05 Par Value Per Share | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer o Non-accelerated filer o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Common Stock of the Registrant held by non-affiliates of the Registrant on July 30, 2006 was $70.6 billion.

The number of shares outstanding of the Registrant's Common Stock as of March 26, 2007 was 1,969,535,236 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's proxy statement for the 2007 Annual Meeting of Shareholders are incorporated by reference in Part III of this Form 10-K to the extent described herein.

THE HOME DEPOT, INC.

FISCAL YEAR 2006 FORM 10-K

TABLE OF CONTENTS

| PART I | | |

Item 1. |

|

Business |

|

1 |

Item 1A. |

|

Risk Factors |

|

7 |

Item 1B. |

|

Unresolved Staff Comments |

|

11 |

Item 2. |

|

Properties |

|

11 |

Item 3. |

|

Legal Proceedings |

|

13 |

Item 4. |

|

Submission of Matters to a Vote of Security Holders |

|

15 |

Item 4A. |

|

Executive Officers of the Company |

|

15 |

PART II |

|

|

Item 5. |

|

Market for the Registrant's Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities |

|

17 |

Item 6. |

|

Selected Financial Data |

|

19 |

Item 7. |

|

Management's Discussion and Analysis of Financial Condition and Results of

Operations |

|

20 |

Item 7A. |

|

Quantitative and Qualitative Disclosures About Market Risk |

|

30 |

Item 8. |

|

Financial Statements and Supplementary Data |

|

31 |

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial

Disclosure |

|

60 |

Item 9A. |

|

Controls and Procedures |

|

60 |

Item 9B. |

|

Other Information |

|

60 |

PART III |

|

|

Item 10. |

|

Directors, Executive Officers and Corporate Governance |

|

61 |

Item 11. |

|

Executive Compensation |

|

61 |

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters |

|

61 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

61 |

Item 14. |

|

Principal Accounting Fees and Services |

|

61 |

PART IV |

|

|

Item 15. |

|

Exhibits, Financial Statement Schedules |

|

62 |

|

|

Signatures |

|

68 |

|

|

Index of Exhibits |

|

69 |

CAUTIONARY STATEMENT PURSUANT TO THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements regarding our future performance made in this report are forward-looking statements. Forward-looking statements may relate to such matters as Net Sales growth, comparable store sales, impact of cannibalization, state of the residential construction and housing markets, commodity price inflation and deflation, implementation of store initiatives, protection of intellectual property rights, Net Earnings performance, including Depreciation and Amortization expense, earnings per share, stock-based compensation expense, store openings and closures, capital allocation and expenditures, the effect of adopting certain accounting standards, return on invested capital, management of our purchasing or customer credit policies, strategic direction, including whether or not a sale or initial public offering of HD Supply will occur or, if a transaction is undertaken, its terms or timing, and the demand for our products and services.

These statements are based on currently available information and our current assumptions, expectations and projections about future events. While we believe that our assumptions, expectations and projections are reasonable in view of the currently available information, you are cautioned not to place undue reliance on our forward-looking statements. These statements are not guarantees of future performance. They are subject to future events, risks and uncertainties – many of which are beyond our control – as well as potentially inaccurate assumptions, that could cause actual results to differ materially from our expectations and projections. Some of the material risks and uncertainties that could cause actual results to differ materially from our expectations and projections are described in Item 1A. "Risk Factors." You should read that information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and our Consolidated Financial Statements and related notes in Item 8 of this report. We note such information for investors as permitted by the Private Securities Litigation Reform Act of 1995. There also may be other factors that we cannot anticipate or that are not described in this report, generally because we do not perceive them to be material, that could cause results to differ materially from our expectations.

Forward-looking statements speak only as of the date they are made, and we do not undertake to update these forward-looking statements. You are advised, however, to review any further disclosures we make on related subjects in our periodic filings with the Securities and Exchange Commission ("SEC").

PART I

Item 1. Business.

Introduction

The Home Depot, Inc. is the world's largest home improvement retailer and the second largest retailer in the United States ("U.S."), based on Net Sales for the fiscal year ended January 28, 2007 ("fiscal 2006"). As of the end of fiscal 2006, we were operating 2,147 stores, most of which are The Home Depot stores.

The Home Depot stores sell a wide assortment of building materials, home improvement and lawn and garden products and provide a number of services. The Home Depot stores average approximately 105,000 square feet of enclosed space, with approximately 23,000 additional square feet of outside garden area. As of the end of fiscal 2006, we had 2,100 The Home Depot stores located throughout the U.S. (including the territories of Puerto Rico and the Virgin Islands), Canada, China and Mexico. In addition, at the end of fiscal 2006, the Company operated 34 EXPO Design Center stores, 11 The Home Depot Landscape Supply stores and two The Home Depot Floor stores.

1

In addition to our retail stores, our business includes HD Supply, which distributes products and sells installation services primarily to business-to-business customers, including home builders, professional contractors, municipalities and maintenance professionals. HD Supply consists of four major platforms: 1) infrastructure, including waterworks and utilities; 2) construction, including construction supply, lumber and building materials, electrical, plumbing/HVAC and interiors; 3) maintenance, including facilities maintenance and industrial PVF; and 4) repair and remodel.

In February 2007, the Company announced its decision to evaluate strategic alternatives for HD Supply, including a possible sale or initial public offering of the business. There can be no assurance that any transaction will occur or, if one is undertaken, its terms or timing.

The Home Depot, Inc. is a Delaware corporation that was incorporated in 1978. Our Store Support Center (corporate office) is located at 2455 Paces Ferry Road, N.W., Atlanta, Georgia 30339. Our telephone number is (770) 433-8211.

We maintain an Internet website at www.homedepot.com. We make available on our website, free of charge, our Annual Reports to shareholders, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and Forms 3, 4 and 5 as soon as reasonably practicable after filing such documents with, or furnishing such documents to, the SEC.

We include our website addresses throughout this filing only as textual references. The information contained on our websites is not incorporated by reference into this Form 10-K.

Our Business

We operate in two reportable segments, Retail and HD Supply. You will find information concerning the financial results and the total assets of each segment in Note 12 to the Consolidated Financial Statements. Financial information about our operations outside the United States is also reported in Note 12 to the Consolidated Financial Statements.

Retail Segment

Operating Strategy. Our operating strategy is to offer a broad assortment of high-quality merchandise and services at competitive prices using knowledgeable, service-oriented personnel and strong marketing and credit promotions. We believe that our associates' knowledge of products and home improvement techniques and applications is very important to our marketing approach and our ability to maintain and enhance customer satisfaction.

Customers. The Home Depot stores serve three primary customer groups:

- •

- Do-It-Yourself ("D-I-Y") Customers:These customers are typically home owners who purchase products and complete their own projects and installations. To complement the expertise of our associates, The Home Depot stores offer "how-to" clinics taught by associates and merchandise vendors.

- •

- Do-It-For-Me ("D-I-F-M") Customers: These customers are typically home owners who purchase materials themselves and hire third parties to complete the project and/or installation. We arrange for the installation of a variety of The Home Depot products through qualified independent contractors.

- •

- Professional Customers: These customers are professional remodelers, general contractors, repairmen and tradesmen. In many stores, we offer a variety of programs to these customers, including additional delivery and will-call services, dedicated staff, extensive merchandise selections and expanded credit programs, all of which we believe increase sales to these customers.

2

Products. A typical The Home Depot store stocks 35,000 to 45,000 products during the year, including both national brand name and proprietary items. The following table shows the percentage of Net Sales of each major product group (and related services) for each of the last three fiscal years:

| | Percentage of Net Sales for

Fiscal Year Ended

| |

|---|

Product Group

| | January 28,

2007

| | January 29,

2006

| | January 30,

2005

| |

|---|

| Building materials, lumber and millwork | | 23.6 | % | 24.2 | % | 24.4 | % |

| Plumbing, electrical and kitchen | | 30.8 | | 29.4 | | 29.0 | |

| Hardware and seasonal | | 27.0 | | 27.1 | | 26.9 | |

| Paint, flooring and wall covering | | 18.6 | | 19.3 | | 19.7 | |

| | |

| |

| |

| |

| Total | | 100.0 | % | 100.0 | % | 100.0 | % |

| | |

| |

| |

| |

To complement and enhance our product selection, we have formed strategic alliances and exclusive relationships with selected suppliers to market products under a variety of well-recognized brand names. During fiscal 2006, we offered a number of proprietary and exclusive brands across a wide range of departments including, but not limited to, Behr Premium Plus® paint, Charmglow® gas grills, Hampton Bay® lighting, Mills Pride® cabinets, Vigoro® lawn care products, Husky® hand tools, RIDGID® and Ryobi® power tools, Pegasus® faucets, Traffic Master® carpet, Glacier Bay® bath fixtures and Veranda® decking products. We may consider additional strategic alliances and relationships with other suppliers and will continue to assess opportunities to expand the range of products available under brand names that are exclusive to The Home Depot.

In fiscal 2006, innovative and distinctive products continued to be a growth driver supporting our merchandising strategy. The following successes helped differentiate The Home Depot in the marketplace:

- •

- Introduced the most comprehensive lineup of top brand lawn tractors and mowers available nationwide, including Cub Cadet®, Toro®, John Deere® and Honda®;

- •

- Launched an expanded outdoor living assortment, including Hampton Bay patio and Charmglow grills;

- •

- Launched an exclusive line-up of lithium-ion power tools from Milwaukee®, RIDGID and Makita®; and

- •

- Launched the LG® SteamWasher™ and the Maytag® Epic™ washer and dryer.

We maintain a global sourcing merchandise program to source high-quality products directly from manufacturers. Our product development merchants travel internationally to identify opportunities to purchase items directly for our stores. Additionally, we have four sourcing offices located in Shanghai, Shenzhen, Dalian, and Chengdu, China, as well as one office in Gurgaon, India. We also have a quality assurance engineer located in Milan, Italy and we have product development merchants, as well as a sourcing office, in Monterrey, Mexico. We currently source products from more than 800 factories in approximately 35 countries.

Services. The Home Depot and EXPO Design Center stores offer a variety of installation services. These services target D-I-F-M customers who select and purchase products and installation of those products from us. These installation programs include products such as carpeting, flooring, cabinets, countertops and water heaters. In addition, we provide professional installation of a number of products sold through our in-home sales programs, such as generators and furnace and central air systems.

3

Store Growth

United States. At the end of fiscal 2006, we were operating 1,872 The Home Depot stores in the U.S., including the territories of Puerto Rico and the Virgin Islands. During fiscal 2006, we opened 86 new The Home Depot stores, including eight relocations, in the U.S.

Canada. At the end of fiscal 2006, we were operating 155 The Home Depot stores in ten Canadian provinces. Of these stores, 20 were opened during fiscal 2006, including two relocations.

Mexico. At the end of fiscal 2006, we were operating 61 The Home Depot stores in Mexico. Of these stores, seven were opened during fiscal 2006.

China. In fiscal 2006, we acquired The Home Way, a Chinese home improvement retailer, including 12 stores in six cities.

Credit Services. We offer credit purchase programs through third-party credit providers to professional, D-I-Y and D-I-F-M customers. In fiscal 2006, approximately 4.5 million new The Home Depot credit accounts were opened, bringing the total number of The Home Depot account holders to approximately 17 million. Proprietary credit card sales accounted for approximately 28% of store sales in fiscal 2006. We also offer an unsecured Home Improvement Loan program through third-party credit providers that gives our customers the opportunity to finance the purchase of products and services in our stores. We believe this loan program not only supports large sales, such as kitchen and bath remodels, but also generates incremental sales from our customers.

Logistics. Our logistics programs are designed to ensure excellent product availability for customers, effective use of our investment in inventory and low total supply chain costs. At the end of fiscal 2006, we operated 18 import distribution centers located in the U.S. and Canada. At the end of fiscal 2006, we also operated 30 lumber distribution centers in the U.S. and Canada to support the lumber demands of our stores and 10 transit facilities to receive merchandise from manufacturers for immediate delivery to our stores. At the end of fiscal 2006, approximately 40% of the merchandise shipped to our stores flowed through our network of distribution centers and transit facilities. As our networks evolve, we expect to increase our flow-through. The remaining merchandise will be shipped directly from our suppliers to our stores. In addition to replenishing merchandise supplies at our stores, we also provide delivery services directly to our customers.

Seasonality. Our business is seasonal to a certain extent. Generally, our highest volume of sales occurs in our second fiscal quarter and the lowest volume occurs during our fourth fiscal quarter.

Competition. Our business is highly competitive, based in part on price, store location, customer service and depth of merchandise. In each of the markets we serve, there are a number of other home improvement stores, electrical, plumbing and building materials supply houses and lumber yards. With respect to some products, we also compete with discount stores, local, regional and national hardware stores, mail order firms, warehouse clubs, independent building supply stores and, to a lesser extent, other retailers. In addition to these entities, our EXPO Design Center stores compete with specialty design stores or showrooms, some of which are only open to interior design professionals. Due to the variety of competition we face, we are unable to precisely measure the impact on our sales by our competitors.

HD Supply Segment

Operating Strategy. Our operating strategy is to provide a total solution for every phase of a building project, from infrastructure to construction to lifetime maintenance and repair and remodel. We believe that our broad product and service offering, our highly knowledgeable sales force and our reputation for superior customer service enable us to be a single-source supplier to our customers for the entire project lifecycle.

4

Customers. We distribute products and offer services primarily to builders, contractors, government entities, industrial businesses and maintenance professionals. Our customers typically select their vendors primarily on the basis of product availability, relationships with and expertise of sales personnel, price and the quality and scope of services offered. Additionally, professional customers generally purchase large volumes, are repeat buyers because of their involvement in longer-term projects and require specialized services. We complement our product offering with customer-driven, value-added services, such as integrated supply, design assistance, kitting, assembly and fabrication services.

Products and Services. Our products and services are focused around the following four major categories that are related to different phases of a building project:

- •

- Infrastructure: This category covers the products and services to construct and support the public works systems for residential and commercial projects.

- •

- Construction: This category covers the interior and exterior structural building components for residential and commercial projects.

- •

- Maintenance: This category covers products and services for the routine maintenance, repair and operations needs of multifamily housing, hospitality, healthcare, government and industrial facilities.

- •

- Repair and Remodel: This category covers home improvement products and building materials, serving the consumer, professional handyman and light remodeler markets.

Inventories. We maintain extensive inventories to meet the rapid delivery requirements of our customers. Our inventories are based on the needs, delivery schedules and lead times of our customers. We focus on distributing products that leverage our strengths in inventory management, purchasing, specialized sales force, distribution and logistics, credit management and information technology.

Credit Services. Over 90% of our sales volume is facilitated through the extension of credit to our customers. Our businesses offer credit to customers, either through unsecured credit that is based solely upon the creditworthiness of the customer, or secured credit for materials sold for a specific job where the security lies in lien rights associated with the material going into the job. The type of credit offered depends both on the financial strength of the customer and the nature of the business in which the customer is involved. End users, resellers and other non-contractor customers generally purchase more on unsecured credit than secured credit. These lines of credit are granted only after a sufficient review of the creditworthiness of the customer. In addition, on a regular basis, large unsecured credit lines are reviewed to ensure they are still financially sound.

Logistics. Our distribution network consists of over 1,000 combined branches and central distribution centers in the United States. The efficient operation of our distribution network is critical in providing quality service to our customer base. Our central distribution centers and branches use warehouse management technology to optimize receiving, inventory control and picking, packing and shipping functions. In addition, we leverage several of our larger branches as distribution points for certain product lines.

The majority of customer orders are shipped from inventory at our branches. In order to maintain complete control of the delivery process, we use over 4,000 vehicles from our total vehicle fleet to deliver products to our customers. We also accommodate special orders from our customers and facilitate the shipment of certain large volume orders directly from the manufacturer to the customer. Orders for larger construction projects normally require long-term delivery schedules throughout the period of construction, which in some cases may continue for several years.

5

Seasonality. Our business is seasonal to a certain extent. Generally, our highest volume of sales occurs in our second fiscal quarter and the lowest volume occurs during our fourth fiscal quarter.

Competition. We are one of the largest wholesale distributors of our range of products in the United States, and we believe that no other company competes against us across all of our product lines. However, there is significant competition in each of our individual product lines. Our competition includes other wholesalers, manufacturers that sell products directly to their respective customer base and some of our customers that resell our products. To a limited extent, retailers of plumbing, electrical fixtures and supplies, building materials, maintenance repair and operations supplies and contractors' tools also compete with us. Competition varies depending on product line, customer classification and geographic area. The principal competitive factors in our business include, but are not limited to, availability of materials and supplies; technical product knowledge and expertise as to application and usage; advisory or other service capabilities; ability to build and maintain customer relationships; same-day delivery capabilities in certain product lines; pricing of products and provision of credit.

Support Services

Information Technologies. During fiscal 2006, we continued to make significant information technology investments to support better customer service and provide an improved shopping environment in our stores. We completed the deployment of self-checkout registers to all our U.S. stores and the majority of our stores in Canada and enhanced our coupon processing at all check-outs. We also began implementing in-store call boxes and installed voice over internet phone systems in order to provide customers faster assistance from our associates. To support the continued growth of our appliance business, we upgraded our proprietary Depot Direct appliance fulfillment system.

In addition to significant investments in store technology, we upgraded our order management system, which improves the speed and accuracy of online order processing and provides customers the ability to check special order status on the internet. We also defined a set of common enterprise system platforms for our HD Supply wholesale businesses and began migrating the HD Supply businesses to these platforms, beginning with the payroll and financial functions.

We also began work on the strategic effort to implement a new Retail Systems platform to further improve the performance of our merchandising functions and store operations. We also commenced the effort to add new automation into our supply chain functions focusing on new systems for warehouse distribution, transportation management and enhancements to support greater order penetration through our centralized replenishment systems.

Associates. At the end of fiscal 2006, we employed approximately 364,000 associates, of whom approximately 26,000 were salaried, with the remainder compensated on an hourly or temporary basis. Approximately 68% of our associates are employed on a full-time basis. We believe that our employee relations are very good. To attract and retain qualified personnel, we seek to maintain competitive salary and wage levels in each market we serve.

Intellectual Property. Through our wholly-owned subsidiary, Homer TLC, Inc., we have registered or applied for registration, in a number of countries, for a variety of internet domain names, service marks and trademarks for use in our businesses, including The Home Depot®; HD Supply; Hampton Bay® fans, lighting and accessories; Glacier Bay® toilets, sinks and faucets; Pegasus® faucets and bath accessories; Commercial Electric® lighting fixtures; Workforce® tools, tool boxes and shelving; www.hdsupply.com and www.doitherself.com. Furthermore, we have also obtained and now maintain patent portfolios relating to certain products and services provided by The Home Depot, and continually seek to patent or otherwise protect selected innovations we incorporate into our products and business operations. We regard our intellectual property as having significant value to each business segment and as being an important factor in the marketing of our brand, e-commerce, stores

6

and new areas of business. We are not aware of any facts that could be expected to have a material adverse affect on our intellectual property.

Quality Assurance Program. We have a quality assurance program for our directly imported globally-sourced products. Through this program, we have established criteria for supplier and product performance, which measures factors such as product quality and timeliness of shipments. The performance record is made available to the factories to allow them to strive for improvement. The program addresses quality assurance at the factory, product and packaging levels.

Environmental, Health & Safety ("EH&S"). We are committed to maintaining a safe environment for our customers and associates, and protecting the environment of the communities in which we do business. Our EH&S function in the field is directed by trained associates focused primarily on execution of the EH&S programs. Additionally, we have an Atlanta-based team of dedicated EH&S professionals who evaluate, develop, implement and enforce policies, processes and programs on a Company-wide basis.

Item 1A. Risk Factors.

The risks and uncertainties described below could materially and adversely affect our business, financial condition and results of operations and could cause actual results to differ materially from our expectations and projections. While we believe that our assumptions, expectations and projections are reasonable in view of the currently available information, you are cautioned not to place undue reliance on our forward-looking statements. These statements are not guarantees of future performance. They are subject to future events, risks and uncertainties – many of which are beyond our control – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our expectations and projections. Forward-looking statements may relate to such matters as Net Sales growth, comparable store sales, impact of cannibalization, state of the residential construction and housing markets, commodity price inflation and deflation, implementation of store initiatives, protection of intellectual property rights, Net Earnings performance, including Depreciation and Amortization expense, earnings per share, stock-based compensation expense, store openings and closures, capital allocation and expenditures, the effect of adopting certain accounting standards, return on invested capital, management of our purchasing or customer credit policies, strategic direction, including whether or not a sale or initial public offering of HD Supply will occur or, if a transaction is undertaken, its terms or timing, and the demand for our products and services. You should read these Risk Factors in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and our Consolidated Financial Statements and related notes in Item 8 of this report. There also may be other factors that we cannot anticipate or that are not described in this report, generally because we do not perceive them to be material, that could cause results to differ materially from our expectations. Forward-looking statements speak only as of the date they are made, and we do not undertake to update these forward-looking statements. You are advised, however, to review any further disclosures we make on related subjects in our periodic filings with the SEC.

Rising costs, a reduction in the availability of financing, weather and other conditions in North America could adversely affect our costs of doing business, demand for our products and services and our average ticket price.

Interest rates, fuel and other energy costs, labor and healthcare costs, availability of financing, employment, state of the residential construction and housing markets, consumer confidence and general economic outlook, weather, natural disasters, terrorism and other conditions that adversely

7

affect consumer demand for our products and services could adversely affect our financial performance. These and other similar factors could:

- •

- increase our costs,

- •

- cause our customers to delay undertaking or determine not to undertake new home improvement projects,

- •

- cause our customers to delay purchasing or determine not to purchase home improvement products and services,

- •

- cause our customers to delay or determine not to undertake new spending in the commercial, residential, industrial and public infrastructure markets, and

- •

- lead to a decline in customer transactions and in average ticket price.

We rely on third party suppliers, and if we fail to identify and develop relationships with a sufficient number of qualified suppliers, our ability to timely and efficiently access products that meet our high standards for quality could be adversely affected.

We buy our products and supplies from suppliers located throughout the world. Our ability to continue to identify and develop relationships with qualified suppliers who can satisfy our high standards for quality and our need to access products and supplies in a timely and efficient manner is a significant challenge. Our ability to access products and supplies also can be adversely affected by political instability, the financial instability of suppliers, suppliers' noncompliance with applicable laws, trade restrictions, tariffs, currency exchange rates, transport capacity and cost and other factors beyond our control.

If we are unable to effectively manage and expand our alliances and relationships with selected suppliers of brand name products, we may be unable to effectively execute our strategy to differentiate us from our competitors.

As part of our strategy of differentiation, we have formed strategic alliances and exclusive relationships with selected suppliers to market products under a variety of well-recognized brand names. If we are unable to manage and expand these alliances and relationships or identify alternative sources for comparable products, we may not be able to effectively execute our strategy of differentiation.

Any inability to open new stores on schedule will delay the contribution of these new stores to our financial performance.

We expect to increase our presence in existing markets and enter new markets. Our ability to open new stores will depend primarily on our ability to:

- •

- identify attractive locations,

- •

- negotiate leases or real estate purchase agreements on acceptable terms,

- •

- attract and train qualified employees, and

- •

- manage pre-opening expenses, including construction costs.

Our ability to open new stores also will be affected by environmental regulations, local zoning issues and other laws related to land use. Failure to effectively manage these and other similar factors will affect our ability to open stores on schedule, which will delay the impact of these new stores on our financial performance.

8

The implementation of our technology initiatives could disrupt our operations in the near term, and our technology initiatives might not provide the anticipated benefits or might fail.

We have made, and will continue to make, significant technology investments both in our stores and branches and in our administrative functions. Our technology initiatives are designed to streamline our operations to allow our associates to continue to provide high quality service to our customers and to provide our customers a better experience. The cost and potential problems and interruptions associated with the implementation of our technology initiatives could disrupt or reduce the efficiency of our operations in the near term. In addition, our new or upgraded technology might not provide the anticipated benefits, it might take longer than expected to realize the anticipated benefits or the technology might fail altogether.

We may not timely identify or effectively respond to consumer trends, which could adversely affect our relationship with our customers, the demand for our products and services and our market share.

It is difficult to successfully predict the products and services our customers will demand. The success of our business depends in part on our ability to identify and respond to evolving trends in demographics and consumer preferences. Failure to design attractive stores and to timely identify or effectively respond to changing consumer tastes, preferences, spending patterns and home improvement needs could adversely affect our relationship with our customers, the demand for our products and services and our market share.

The inflation or deflation of commodity prices could affect our prices, demand for our products, sales and profit margins.

Prices of certain commodity products, including lumber and other raw materials, are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, market speculation, government regulations and periodic delays in delivery. Rapid and significant changes in commodity prices may affect our sales and profit margins.

If we cannot successfully manage the unique challenges presented by international markets, we may not be successful in expanding our international operations.

Our strategy includes expansion of our operations in existing and new international markets by selective acquisitions, strategic alliances and the opening of new stores and branches. Our ability to successfully execute our strategy in international markets is affected by many of the same operational risks we face in expanding our U.S. operations. In addition, our international expansion may be adversely affected by our ability to identify and gain access to local suppliers as well as by local laws and customs, legal and regulatory constraints, political and economic conditions and currency regulations of the countries or regions in which we currently operate or intend to operate in the future. Risks inherent in our international operations also include, among others, the costs and difficulties of managing international operations, adverse tax consequences and greater difficulty in enforcing intellectual property rights. Additionally, foreign currency exchange rates and fluctuations may have an impact on our future costs or on future cash flows from our international operations.

Our success depends upon our ability to attract, train and retain highly qualified associates.

To be successful, we must attract, train and retain a large and growing number of highly qualified associates while controlling related labor costs. Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates and health and other insurance costs. In addition, many of our associates are in hourly positions with historically high turnover rates. We compete with other retail and non-retail businesses for these associates and invest significant resources in training and

9

motivating them. We also depend on our executives and other key associates for our success. There is no assurance that we will be able to attract or retain highly qualified associates in the future.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, such as revenue recognition, asset impairment, inventories, self-insurance, tax matters and litigation, are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes in these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported or expected financial performance.

Increased competition could adversely affect prices and demand for our products and services and could decrease our market share.

We operate in markets in industries that are highly competitive. Our retail business competes principally based on price, store location, customer service and depth of merchandise. Our HD Supply business competes principally based on ability to provide and deliver supplies, product knowledge and expertise, advisory services and availability of credit. In each market we serve, there are a number of other home improvement stores, electrical, plumbing and building materials supply houses and lumber yards. With respect to some products, we also compete with discount stores, local, regional and national hardware stores, mail order firms, warehouse clubs, independent building supply stores and other retailers. In addition, we compete with specialty design stores or showrooms, some of which are only open to interior design professionals, local and regional distributors, and wholesalers and manufacturers that sell products directly to their customer bases. Intense competitive pressures from one or more of our competitors could affect prices or demand for our products and services. If we are unable to timely and appropriately respond to these pressures, our financial performance and our market share could be adversely affected.

We are involved in a number of legal proceedings, and while we cannot predict the outcomes of such proceedings and other contingencies with certainty, some of these outcomes may adversely affect our operations or increase our costs.

We are involved in a number of legal proceedings, including government inquiries and investigations, and consumer, employment, tort and other litigation. We cannot predict the outcomes of these legal proceedings and other contingencies, including environmental remediation and other proceedings commenced by government authorities, with certainty. The outcome of some of these legal proceedings and other contingencies could require us to take or refrain from taking actions which could adversely affect our operations or could require us to pay substantial amounts of money. Additionally, defending against these lawsuits and proceedings may involve significant expense and diversion of management's attention and resources from other matters.

Our costs of doing business could increase as a result of changes in federal, state or local regulations.

Changes in the federal, state or local minimum wage or living wage requirements or changes in other wage or workplace regulations could increase our costs of doing business. Changes in federal, state or local regulations governing the sale of some of our products could increase our costs of doing business. In addition, changes to federal, state and local tax regulations could increase our costs of doing business.

10

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

The following tables show locations of the 1,872 The Home Depot stores and the 830 HD Supply locations in the U.S. and its territories and the 228 The Home Depot stores and the 63 HD Supply locations outside of the U.S. at the end of fiscal 2006:

| | Number of Locations

|

|---|

U.S. Locations

| | Retail

| | HD Supply

|

|---|

| Alabama | | 26 | | 8 |

| Alaska | | 6 | | 1 |

| Arizona | | 52 | | 51 |

| Arkansas | | 14 | | 8 |

| California | | 214 | | 99 |

| Colorado | | 44 | | 23 |

| Connecticut | | 26 | | — |

| Delaware | | 7 | | 6 |

| District of Columbia | | 1 | | — |

| Florida | | 140 | | 123 |

| Georgia | | 81 | | 81 |

| Hawaii | | 7 | | 3 |

| Idaho | | 11 | | 3 |

| Illinois | | 70 | | 15 |

| Indiana | | 26 | | 13 |

| Iowa | | 9 | | 5 |

| Kansas | | 16 | | 4 |

| Kentucky | | 15 | | 7 |

| Louisiana | | 25 | | 11 |

| Maine | | 11 | | — |

| Maryland | | 40 | | 19 |

| Massachusetts | | 42 | | 2 |

| Michigan | | 70 | | 6 |

| Minnesota | | 31 | | 3 |

| Mississippi | | 14 | | 12 |

| Missouri | | 33 | | 11 |

| Montana | | 6 | | 5 |

| Nebraska | | 8 | | 4 |

| Nevada | | 17 | | 12 |

| New Hampshire | | 19 | | — |

| New Jersey | | 64 | | 7 |

| New Mexico | | 13 | | 8 |

| New York | | 97 | | 1 |

| North Carolina | | 41 | | 46 |

| North Dakota | | 2 | | — |

| Ohio | | 70 | | 31 |

| Oklahoma | | 16 | | 2 |

| Oregon | | 22 | | 8 |

| Pennsylvania | | 66 | | 7 |

| Puerto Rico | | 8 | | — |

| Rhode Island | | 8 | | 1 |

| South Carolina | | 25 | | 30 |

| South Dakota | | 1 | | — |

| Tennessee | | 34 | | 24 |

| Texas | | 172 | | 71 |

| Utah | | 19 | | 8 |

| Vermont | | 4 | | — |

| Virgin Islands | | 1 | | — |

| Virginia | | 45 | | 20 |

| Washington | | 42 | | 20 |

| West Virginia | | 6 | | 4 |

| Wisconsin | | 30 | | 3 |

| Wyoming | | 5 | | 4 |

| |

| |

|

| Total U.S. | | 1,872 | | 830 |

11

| | Number of Locations

|

|---|

International Locations

| | Retail

| | HD Supply

|

|---|

| Canada: | | | | |

| | Alberta | | 21 | | 3 |

| | British Columbia | | 22 | | 5 |

| | Manitoba | | 6 | | 2 |

| | New Brunswick | | 3 | | 1 |

| | Newfoundland | | 1 | | — |

| | Nova Scotia | | 3 | | 2 |

| | Ontario | | 75 | | 46 |

| | Prince Edward Island | | 1 | | 1 |

| | Quebec | | 20 | | 2 |

| | Saskatchewan | | 3 | | 1 |

| |

| |

|

| Total Canada | | 155 | | 63 |

Mexico: |

|

|

|

|

| | Aguascalientes | | 1 | | |

| | Baja California | | 3 | | |

| | Baja California Sur | | 1 | | |

| | Chihuahua | | 5 | | |

| | Coahuila | | 2 | | |

| | Distrito Federal | | 7 | | |

| | Durango | | 1 | | |

| | Guanajuato | | 4 | | |

| | Guerrero | | 1 | | |

| | Hidalgo | | 1 | | |

| | Jalisco | | 3 | | |

| | Michoacán | | 1 | | |

| | Morelos | | 1 | | |

| | Nuevo León | | 6 | | |

| | Puebla | | 2 | | |

| | Queretaro | | 1 | | |

| | Quintana Roo | | 1 | | |

| | San Luis Potosi | | 1 | | |

| | Sinaloa | | 3 | | |

| | Sonora | | 2 | | |

| | State of Mexico | | 8 | | |

| | Tabasco | | 1 | | |

| | Tamaulipas | | 2 | | |

| | Veracruz | | 2 | | |

| | Yucatan | | 1 | | |

| |

| | |

| Total Mexico | | 61 | | |

China: |

|

|

|

|

| | Beijing | | 2 | | |

| | Henan | | 1 | | |

| | Liaoning | | 1 | | |

| | Shaanxi | | 2 | | |

| | Shandong | | 1 | | |

| | Tianjin | | 5 | | |

| |

| | |

| Total China | | 12 | | |

Additionally, at the end of fiscal 2006, we had 47 other retail store locations, which included 34 EXPO Design Center stores located in Arizona, California, Florida, Georgia, Illinois, Maryland, Massachusetts, Missouri, New Jersey, New York, Tennessee, Texas and Virginia; 11 The Home Depot Landscape Supply stores located in Georgia and Texas; and two The Home Depot Floor Stores located in Florida and Texas. We also operated seven Home Decorators Collection locations in Illinois, Kansas, Missouri and Oklahoma.

Of our 2,147 retail stores at the end of fiscal 2006, approximately 87% were owned (including those owned subject to a ground lease) consisting of approximately 196.0 million square feet, and approximately 13% of such stores were leased consisting of approximately 29.3 million square feet. In recent years, we have increased the relative percentage of new stores that are owned. We generally prefer to own retail stores because of greater operating control and flexibility, generally lower occupancy costs and certain other economic advantages.

At the end of fiscal 2006, our Retail segment utilized 195 warehouses and distribution centers located in 42 states, consisting of approximately 28.2 million square feet, of which approximately 2.0 million is owned and approximately 26.2 million is leased.

HD Supply consists of four major platforms: infrastructure, construction, maintenance and repair and remodel. The infrastructure platform consists of 325 U.S. branches in 41 states and four branches in Canada. The construction platform consists of 527 U.S. branches in 35 states and 56 branches in Canada. The maintenance platform consists of 90 U.S. branches in 25 states and five branches in Canada. Finally, the repair and remodel platform consists of 13 U.S. branches in two states. One or more platforms may operate multiple branches at one HD Supply location.

12

Of our 893 HD Supply locations at the end of fiscal 2006, approximately 13% were owned (including those owned subject to a ground lease) and approximately 87% of such stores were leased. We generally prefer to lease HD Supply locations as it provides flexibility to relocate or expand with our HD Supply customer base. Additionally, HD Supply had 66 U.S. warehouses and distribution centers located in 19 states and two in Canada to support other HD Supply locations. The HD Supply locations, warehouses and distribution centers utilized approximately 23.7 million square feet, of which approximately 2.8 million is owned and approximately 20.9 million is leased at the end of fiscal 2006.

Our executive, corporate staff, divisional staff and financial offices occupy approximately 2.0 million square feet of leased and owned space in Atlanta, Georgia. At the end of fiscal 2006, we occupied an aggregate of approximately 4.4 million square feet, of which approximately 2.5 million square feet is owned and approximately 1.9 million square feet is leased, for store support centers and customer support centers.

We believe that at the end of existing lease terms, our current leased space can be either relet or replaced by alternate space for lease or purchase that is readily available.

Item 3. Legal Proceedings.

In August 2005, the Company received an informal request from the staff of the SEC for information related to the Company's return-to-vendor policies and procedures. The Company has responded to this and subsequent requests and continues to fully cooperate with the SEC staff. The SEC has informed the Company that the informal inquiry is not an indication that any violations of law have occurred. Although the Company cannot predict the outcome of this matter, it does not expect that this informal inquiry will have a material adverse effect on its consolidated financial condition or results of operations.

In June 2006, the SEC commenced an informal inquiry into the Company's stock option granting practices, and the Office of the U.S. Attorney for the Southern District of New York has also requested information on this subject. In addition, a subcommittee of the Audit Committee reviewed the Company's historical stock option practices and engaged independent outside counsel to assist in this matter. On December 6, 2006, the Company announced the results of this investigation. The Company determined that the unrecorded expense from 1981 through the present is approximately $227 million in the aggregate, including related tax items. In accordance with the provisions of Staff Accounting Bulletin No. 108, "Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements," the Company corrected these errors by decreasing beginning Retained Earnings for fiscal 2006 by $227 million, with offsetting entries to Paid-In Capital, Other Accrued Expenses and Deferred Income Taxes, within its Consolidated Financial Statements. The Company and the subcommittee are continuing to cooperate with the SEC and the Office of U.S. Attorney. Although the Company cannot predict the outcome of these matters, it does not believe they will have a material adverse effect on its consolidated financial condition or results of operations.

The following actions have been filed against the Company and, in some cases, against certain of its current and former officers and directors as described below. Although the Company cannot predict their outcome, it does not expect these actions, individually or together, will have a material adverse effect on its consolidated financial condition or results of operations.

In the second quarter of fiscal 2006, six purported, but as yet uncertified, class actions were filed against the Company and certain of its current and former officers and directors in the U.S. District Court for the Northern District of Georgia in Atlanta, alleging certain misrepresentations in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder in connection with the Company's return-to-vendor practices. These actions were filed by certain current and former shareholders of the Company. In the third quarter of fiscal 2006, one of the shareholders

13

dismissed his complaint. The Court has preliminarily appointed a lead plaintiff, and the lead plaintiff has filed an amended complaint in each of the remaining five actions. Relief sought in the amended complaint includes unspecified damages and costs and attorney's fees. The defendants have filed a motion to dismiss the amended complaint. The Company believes these actions are without merit and intends to defend them vigorously.

In the second and third quarters of fiscal 2006, three purported, but as yet uncertified, class actions were filed against the Company, The Home Depot FutureBuilder Administrative Committee and certain of the Company's current and former directors and employees in federal court in Brooklyn, New York alleging breach of fiduciary duty in violation of the Employee Retirement Income Security Act of 1974 in connection with the Company's return-to-vendor and stock option practices. These actions were transferred to the U.S. District Court for the Northern District of Georgia in Atlanta. These actions were brought by certain former employees of the Company and seek unspecified damages, costs, attorneys' fees and equitable and injunctive relief. The Company believes these actions are without merit and intends to defend them vigorously.

In the second and third quarters of fiscal 2006, six shareholder derivative actions were filed nominally on behalf of the Company against certain current and former officers and directors in the Superior Court of Fulton County, Georgia, alleging breach of fiduciary duty, abuse of control, gross mismanagement, waste of corporate assets, and unjust enrichment in connection with the Company's return-to-vendor, stock option, and compensation practices. Such actions were filed by alleged shareholders of the Company. Relief sought in each action includes unspecified damages, injunctive relief, disgorgement of profits, benefits and compensation obtained by the defendants, costs, and attorney's fees. Subsequently, one joint amended complaint was filed on behalf of all plaintiffs encompassing all the various claims and seeking the same relief. The defendants have moved to dismiss or alternatively stay the litigation.

In the first quarter of fiscal 2007, one additional shareholder derivative action was filed nominally on behalf of the Company against certain of the Company's current directors and its former chief executive officer in the U.S. District Court for the Northern District of Georgia in Atlanta, alleging breach of fiduciary duty, abuse of control, gross mismanagement, waste of corporate assets and unjust enrichment in connection with the Company's stock option and compensation practices. The action was filed by alleged shareholders of the Company. Relief sought in the action includes unspecified damages, injunctive relief, punitive damages, and costs and attorneys' fees.

In compliance with SEC disclosure requirements, the environmental proceedings set forth below involve potential monetary sanctions of $100,000 or more. Although the Company cannot predict the outcome of these proceedings, it does not expect any such outcome to have a material adverse effect on its consolidated financial condition or results of operations.

In January 2003, Home Depot U.S.A., Inc., a wholly-owned subsidiary of the Company, received a request for information from the U.S. Environmental Protection Agency ("EPA") regarding alleged pollutant discharges during construction activities at certain The Home Depot stores. The EPA subsequently referred this matter to the U.S. Department of Justice ("DOJ"). The DOJ and the Company are currently discussing the potential settlement of this matter.

In April 2005, the Company received subpoenas from the State of New York's Office of Attorney General seeking documents and testimony related to the sale and handling of pesticides. The Company is cooperating fully with the Office of Attorney General and believes it is indemnified if monetary sanctions are imposed.

In July 2005, the Company received a grand jury subpoena from the United States Attorney's Office in Los Angeles, California, seeking documents and information relating to the Company's handling, storage and disposal of hazardous waste. California state and local government authorities are also

14

investigating this matter. In January 2006, the Company received an administrative subpoena from the District Attorney of Riverside County, California seeking records and documents in connection with such investigation. The Company is cooperating fully with the respective authorities. The California state and local authorities and the Company are currently discussing the potential settlement of this matter.

Item 4. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 4A. Executive Officers of the Company.

Executive officers of the Company are appointed by, and serve at the pleasure of, the Board of Directors. The current executive officers of the Company are as follows:

ROGER W. ADAMS, age 50, has been Senior Vice President and Chief Marketing Officer since October 2006. From February 2005 through October 2006, he served as the Company's Senior Vice President – Marketing. Mr. Adams previously served as Executive Director of Corporate Advertising, Marketing and CRM of General Motors Corporation from June 2004 to January 2005. From March 1996 to June 2004, he served as general manager of General Motor's Buick, Pontiac and GMC Division.

FRANCIS S. BLAKE, age 57, has been Chairman and Chief Executive Officer since January 2007. From March 2002 through January 2007, he served as the Company's Executive Vice President – Business Development and Corporate Operations. He was formerly the Deputy Secretary of Energy from June 2001 until March 2002. From June 2000 until May 2001, he was a Senior Vice President at General Electric Company and was Vice President of GE Power Systems from February 1996 until July 2000. Mr. Blake serves as a director of The Southern Company.

TIMOTHY M. CROW, age 51, has been Executive Vice President – Human Resources since February 2007. From May 2002 to February 2007, he served as Senior Vice President, Organization, Talent and Performance Systems. Mr. Crow previously served as Senior Vice President – Human Resources of K-Mart Corporation, a mass merchandising company, from 1999 through May 2002.

JOSEPH J. DeANGELO, age 45, has been Executive Vice President and Chief Operating Officer since January 2007. From August 2005 through December 2006, he served as the Company's Executive Vice President – Home Depot Supply. From January 2005 through August 2005, he served as Senior Vice President – Home Depot Supply, Pro Business and Tool Rental, and from April 2004 through January 2005, he served as Senior Vice President – Pro Business and Tool Rental. Mr. DeAngelo previously served as Executive Vice President of The Stanley Works, a tool manufacturing company, from April 2003 through April 2004. From 1986 until April 2003, Mr. DeAngelo held various positions with General Electric Company. His final position with GE was as President and Chief Executive Officer of GE TIP/Modular Space, a division of GE Capital.

ROBERT P. DeRODES, age 56, has been Executive Vice President – Chief Information Officer since February 2002. He previously served as President and Chief Executive Officer of Delta Technology, Inc. and Chief Information Officer for Delta Air Lines, Inc. from September 1999 until February 2002. From February 1995 to September 1999, he served as Senior Technology Officer at Citibank for the Card Products Group. From February 1993 to February 1995, he was President of Sabre Development Services for the Sabre Group Holdings, Inc., a subsidiary of American Airlines, Inc.

MARVIN R. ELLISON, age 42, has been President – Northern Division since January 2006. From August 2005 through January 2006, he served as Senior Vice President – Logistics and from October 2004 through August 2005 he served as Vice President – Logistics. From June 2002 through October 2004, he served as Vice President – Loss Prevention. From 1987 until June 2002, Mr. Ellison

15

held various management and executive level positions with Target Corporation, a general merchandise retailer. His final position with Target was Director, Assets Protection.

CRAIG A. MENEAR, age 49, has been Senior Vice President – Merchandising since October 2006. From August 2003 through October 2006, he has served as Senior Vice President – Merchandising, Hardlines. From 1997 through August 2003, Mr. Menear served in various management and vice president level positions in the Company's Merchandising department, including Merchandising Vice President of Hardware, Merchandising Vice President of the Southwest Division, and Divisional Merchandise Manager of the Southwest Division.

BRUCE A. MERINO, age 53, has been President – Western Division since May 2000 and President, EXPO Design Center since October 2005. From October 1996 through May 2000, he served as Merchandising Vice President.

PAUL RAINES, age 42, has been President – Southern Division since February 2005. Prior thereto he served as Regional Vice President – Florida from April 2003 through January 2005. From January 2002 through April 2003, Mr. Raines served as Vice President – Store Operations, and from January 2000 through January 2002, Mr. Raines served as Director of Labor Management.

RICARDO SALVIDAR, age 54, has been President – Mexico since 2001. From 1980 to 2001, Mr. Salvidar held various management and executive level positions with Grupo Alfa, a Mexican conglomerate. His final position with Grupo Alfa was President and Chief Executive Officer of Total Home.

JAMES C. SNYDER, JR., age 43, has been Vice President – Secretary and Acting General Counsel since February 2007. From March 2006 to February 2007, Mr. Snyder served as Vice President – Legal, Risk Management. From March 2004 to March 2006 Mr. Snyder served as Vice President – Legal. Prior thereto Mr. Snyder served as Director, Legal from November 2002 to March 2004. Mr. Snyder joined the Company in March 2001 as Corporate Counsel.

CAROL B. TOMÉ, age 50, has been Chief Financial Officer since May 2001 and Executive Vice President – Corporate Services since January 2007. Prior thereto Ms. Tomé served as Senior Vice President – Finance and Accounting/Treasurer from February 2000 through May 2001 and as Vice President and Treasurer from 1995 through February 2000. From 1992 until 1995, when she joined the Company, Ms. Tomé was Vice President and Treasurer of Riverwood International Corporation, a provider of paperboard packaging. Ms. Tomé serves as a director of United Parcel Service, Inc.

ANNETTE M. VERSCHUREN, age 50, has been President, The Home Depot Canada since March 1996 and President, The Home Depot Asia since September 2006. From February 2003 through October 2005, she also served as President, EXPO Design Center.

16

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Since April 19, 1984, our common stock has been listed on the New York Stock Exchange, trading under the symbol "HD." The Company paid its first cash dividend on June 22, 1987, and has paid cash dividends during each subsequent quarter. Future dividend payments will depend on the Company's earnings, capital requirements, financial condition and other factors considered relevant by the Board of Directors.

The table below sets forth the high and low sales prices of our common stock on the New York Stock Exchange and the quarterly cash dividends declared per share of common stock during the periods indicated.

| | Price Range

| |

|

|---|

| | Cash Dividends

Declared

|

|---|

| | High

| | Low

|

|---|

| Fiscal Year 2006 | | | | | | | | | |

| | First Quarter Ended April 30, 2006 | | $ | 43.95 | | $ | 38.50 | | $ | 0.150 |

| | Second Quarter Ended July 30, 2006 | | $ | 41.61 | | $ | 32.85 | | $ | 0.150 |

| | Third Quarter Ended October 29, 2006 | | $ | 38.24 | | $ | 33.07 | | $ | 0.225 |

| | Fourth Quarter Ended January 28, 2007 | | $ | 41.84 | | $ | 35.77 | | $ | 0.225 |

Fiscal Year 2005 |

|

|

|

|

|

|

|

|

|

| | First Quarter Ended May 1, 2005 | | $ | 42.99 | | $ | 34.56 | | $ | 0.100 |

| | Second Quarter Ended July 31, 2005 | | $ | 43.98 | | $ | 35.54 | | $ | 0.100 |

| | Third Quarter Ended October 30, 2005 | | $ | 43.39 | | $ | 37.14 | | $ | 0.100 |

| | Fourth Quarter Ended January 29, 2006 | | $ | 43.27 | | $ | 39.65 | | $ | 0.150 |

As of March 26, 2007, there were approximately 180,000 shareholders of record and approximately 1,700,000 additional shareholders holding stock under nominee security position listings.

17

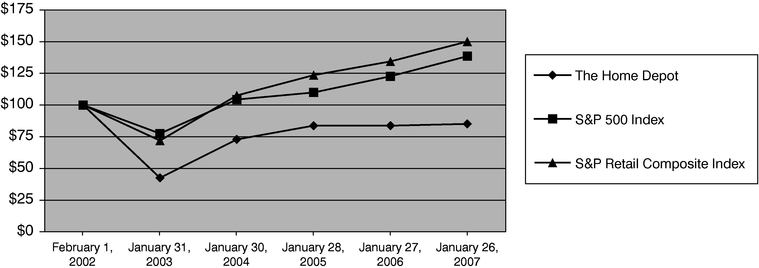

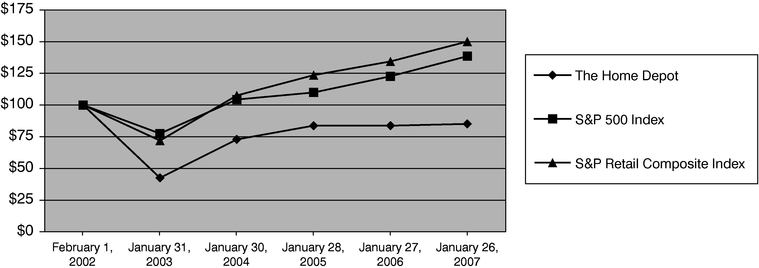

Stock Performance Graph

This graph depicts the Company's cumulative total shareholder returns relative to the performance of the Standard & Poor's 500 Composite Stock Index and the Standard & Poor's Retail Composite Index for the five-year period commencing February 4, 2002, the first trading day of Fiscal 2002, and ending on January 26, 2007, the last trading day of Fiscal 2006. The graph assumes $100 invested at the closing price of the Company's common stock on the New York Stock Exchange and each index on February 1, 2002 and assumes that all dividends were reinvested on the date paid. The points on the graph represent fiscal year-end amounts based on the last trading day in each fiscal year.

| | Fiscal 2001

| | Fiscal 2002

| | Fiscal 2003

| | Fiscal 2004

| | Fiscal 2005

| | Fiscal 2006

|

|---|

| The Home Depot | | $ | 100.00 | | $ | 42.57 | | $ | 72.88 | | $ | 83.75 | | $ | 83.72 | | $ | 85.12 |

| S&P 500 Index | | $ | 100.00 | | $ | 77.53 | | $ | 104.34 | | $ | 109.90 | | $ | 122.67 | | $ | 138.49 |

| S&P Retail Composite Index | | $ | 100.00 | | $ | 71.95 | | $ | 107.54 | | $ | 123.56 | | $ | 134.39 | | $ | 150.06 |

18

Issuer Purchases of Equity Securities

Since fiscal 2002, the Company has repurchased shares of its common stock having a value of approximately $16.4 billion. The number and average price of shares purchased in each fiscal month of the fourth quarter of fiscal 2006 are set forth in the table below:

Period

| | Total Number of

Shares Purchased(1)

| | Average

Price Paid

per Share

| | Total Number of

Shares Purchased as

Part of Publicly

Announced Program(2)

| | Approximate Dollar

Value of Shares

that May Yet Be

Purchased Under

the Program

|

|---|

| Oct. 30, 2006 – Nov. 26, 2006 | | 3,331,219 | | $ | 36.93 | | 3,294,598 | | $ | 4,116,600,751 |

| Nov. 27, 2006 – Dec. 24, 2006 | | 75,065,717 | | $ | 39.97 | | 75,056,293 | | $ | 1,116,575,324 |

| Dec. 25, 2006 – Jan. 28, 2007 | | 295,277 | | $ | 40.39 | | — | | $ | 1,116,575,324 |

- (1)

- These amounts include repurchases pursuant to the Company's 1997 and 2005 Omnibus Stock Incentive Plans (the "Plans"). Under the Plans, participants may exercise stock options by surrendering shares of common stock that the participants already own as payment of the exercise price. Participants in the Plans may also surrender shares as payment of applicable tax withholding on the vesting of restricted stock and deferred share awards. Shares so surrendered by participants in the Plans are repurchased pursuant to the terms of the Plans and applicable award agreement and not pursuant to publicly announced share repurchase programs. For the quarter ended January 28, 2007, the following shares of The Home Depot common stock were surrendered by participants in the Plans and included in the total number of shares purchased: Oct. 30, 2006 – Nov. 26, 2006 – 36,621 shares at an average price per share of $37.82; Nov. 27, 2006 – Dec. 24, 2006 – 9,424 shares at an average price per share of $39.35; Dec. 25, 2006 – Jan. 28, 2007 – 295,277 shares at an average price per share of $40.39.

- (2)

- The Company's common stock repurchase program was initially announced on July 15, 2002. As of the end of the fourth quarter of fiscal 2006, the Board had approved purchases up to $17.5 billion. The program does not have a prescribed expiration date.

Sales of Unregistered Securities

During the fourth quarter of fiscal 2006, the Company issued 5,805 deferred stock units under The Home Depot, Inc. NonEmployee Directors' Deferred Stock Compensation Plan pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933, as amended. The deferred stock units were credited to the accounts of such nonemployee directors who elected to receive board and committee fees in the form of deferred stock units instead of receiving such fees in cash as payment for board and committee meetings held during the fourth quarter of fiscal 2006. The deferred stock units convert to shares of common stock on a one-for-one basis following a termination of service as described in this plan.

During the fourth quarter of fiscal 2006, the Company credited 884 deferred stock units to participant accounts under The Home Depot FutureBuilder Restoration Plan pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended, for involuntary, non-contributory plans. The deferred stock units convert to shares of common stock on a one-for-one basis following the termination of services as described in this plan.

Item 6. Selected Financial Data.

The information required by this item is incorporated by reference to pages F-1 and F-2 of this report.

19

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Executive Summary and Selected Consolidated Statements of Earnings Data

For fiscal year ended January 28, 2007 ("fiscal 2006"), we reported Net Earnings of $5.8 billion and Diluted Earnings per Share of $2.79 compared to Net Earnings of $5.8 billion and Diluted Earnings per Share of $2.72 for fiscal year ended January 29, 2006 ("fiscal 2005"). Net Sales increased 11.4% to $90.8 billion for fiscal 2006 from $81.5 billion for fiscal 2005. Our gross profit margin was 32.8% and our operating margin was 10.7% for fiscal 2006.

In the face of a slowdown in the housing market, our retail comparable store sales declined 2.8% in fiscal 2006 driven by a decline in comparable store customer transactions. This was partially offset by an increase in our average ticket of 1.6% in fiscal 2006 to $58.90, including increases in 8 of 10 selling departments.

We grew our numerous installation and home maintenance programs serving our do-it-for-me customers through our stores. Our retail services revenue increased 8.3% to $3.8 billion for fiscal 2006. We experienced sustained growth in categories such as countertops, exterior patios, solar, windows and HVAC.

We continued to introduce innovative and distinctive merchandise that reflects emerging consumer trends, supported by continued investments in store modernization and technology. We invested $3.5 billion in capital expenditures during fiscal 2006 primarily for new store construction, store modernization and technology. We began an accelerated store reinvestment program whereby we increased our investment in existing stores by $350 million more than our plan in the second half of fiscal 2006 to enhance the customer experience. This investment included capital and expense dollars to reset 100 merchandise bays in 540 stores, incorporate a richer staffing model and support our "Orange Juiced" program, a customer service incentive program for our store associates.

We added 125 new stores in fiscal 2006, including 12 stores through our acquisition of The Home Way, a Chinese home improvement retailer, and 10 relocations, bringing our total store count at the end of fiscal 2006 to 2,147. As of the end of fiscal 2006, 228, or approximately 11%, of our stores were located in Canada, Mexico or China compared to 191, or approximately 9%, at the end of fiscal 2005.

We have expanded our business by capturing a growing share of the professional residential, commercial and heavy construction markets through the growth of HD Supply. HD Supply experienced 162% Net Sales growth in fiscal 2006 and accounted for approximately 13% of our total Net Sales in fiscal 2006. We completed 12 acquisitions in fiscal 2006 that were integrated into HD Supply, including Hughes Supply, Inc., a leading distributor of construction and repair products. Organic Net Sales growth for the HD Supply segment was 5.6% in fiscal 2006.

In February 2007, we announced our decision to evaluate strategic alternatives for HD Supply. In order to maximize the value of HD Supply, we would need to further integrate it with our Retail business. We are currently evaluating whether this integration or other strategic alternatives, such as a sale or initial public offering of the business, would create the most shareholder value.

We generated $7.7 billion of cash flow from operations in fiscal 2006. We used this cash flow, along with the net proceeds of additional borrowings of $7.6 billion, to fund $8.1 billion of share repurchases and dividends, $4.3 billion in acquisitions and $3.5 billion in capital expenditures. At the end of fiscal 2006, our long-term debt-to-equity ratio was 47%. Our return on invested capital (computed on beginning long-term debt and equity for the trailing four quarters) was 20.5% at the end of fiscal 2006 compared to 22.4% for fiscal 2005.

20

We believe the selected sales data, the percentage relationship between Net Sales and major categories in the Consolidated Statements of Earnings and the percentage change in the dollar amounts of each of the items presented as follows is important in evaluating the performance of our business operations.

| | % of Net Sales

| | % Increase

(Decrease)

In Dollar Amounts

| |

|---|

| | Fiscal Year(1)

| |

|---|

| | 2006

| | 2005

| | 2004

| | 2006

vs. 2005

| | 2005

vs. 2004

| |

|---|

| NET SALES | | | 100.0 | % | | 100.0 | % | | 100.0 | % | 11.4 | % | 11.5 | % |

| Gross Profit | | | 32.8 | | | 33.5 | | | 33.4 | | 9.0 | | 11.8 | |

| Operating Expenses: | | | | | | | | | | | | | | |

| | Selling, General and Administrative | | | 20.2 | | | 20.2 | | | 20.9 | | 11.3 | | 8.1 | |

| | Depreciation and Amortization | | | 1.9 | | | 1.8 | | | 1.7 | | 19.7 | | 17.9 | |

| | |

| |

| |

| |

| |

| |

| | | Total Operating Expenses | | | 22.1 | | | 22.0 | | | 22.6 | | 12.0 | | 8.8 | |

| | |

| |

| |

| |

| |

| |

| OPERATING INCOME | | | 10.7 | | | 11.5 | | | 10.8 | | 3.3 | | 18.1 | |

| Interest Income (Expense): | | | | | | | | | | | | | | |

| | Interest and Investment Income | | | — | | | 0.1 | | | 0.1 | | (56.5 | ) | 10.7 | |

| | Interest Expense | | | (0.4 | ) | | (0.2 | ) | | (0.1 | ) | 174.1 | | 104.3 | |

| | |

| |

| |

| |

| |

| |

| | | Interest, net | | | (0.4 | ) | | (0.1 | ) | | — | | 350.6 | | 478.6 | |

| | |

| |

| |

| |

| |

| |

EARNINGS BEFORE PROVISION FOR

INCOME TAXES | | | 10.3 | | | 11.4 | | | 10.8 | | 0.3 | | 17.3 | |

| Provision for Income Taxes | | | 4.0 | | | 4.2 | | | 4.0 | | 3.0 | | 18.3 | |

| | |

| |

| |

| |

| |

| |

| NET EARNINGS | | | 6.3 | % | | 7.2 | % | | 6.8 | % | (1.3 | )% | 16.7 | % |

| | |

| |

| |

| |

| |

| |

| SELECTED SALES DATA(2) | | | | | | | | | | | | | | |

| Number of Retail Customer Transactions (millions) | | | 1,330 | | | 1,330 | | | 1,295 | | 0.0 | % | 2.7 | % |

| Average Ticket | | $ | 58.90 | | $ | 57.98 | | $ | 54.89 | | 1.6 | | 5.6 | |

Weighted Average Weekly Sales per

Operating Store (000s) | | $ | 723 | | $ | 763 | | $ | 766 | | (5.2 | ) | (0.4 | ) |

| Weighted Average Sales per Square Foot | | $ | 357.83 | | $ | 377.01 | | $ | 375.26 | | (5.1 | ) | 0.5 | |

Retail Comparable Store Sales (Decrease)

Increase (%)(3) | | | (2.8 | )% | | 3.1 | % | | 5.1 | % | N/A | | N/A | |

- (1)

- Fiscal years 2006, 2005 and 2004 refer to the fiscal years ended January 28, 2007, January 29, 2006 and January 30, 2005, respectively. Fiscal years 2006, 2005 and 2004 include 52 weeks.

- (2)

- Includes Retail segment only.

- (3)

- Includes Net Sales at locations open greater than 12 months, including relocated and remodeled stores. Retail stores become comparable on the Monday following their 365th day of operation. Retail comparable store sales is intended only as supplemental information and is not a substitute for Net Sales or Net Earnings presented in accordance with generally accepted accounting principles.

21