Safe Harbor Statement

This presentation includes “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our business strategy, our prospects and our

financial position. These statements can be identified by the use of forward-looking

terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” ��will,”

“should,” “could,” or “anticipates” or the negative or other variation of these similar

words, or by discussions of strategy or risks and uncertainties. These statements are

based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary

materially from the Company’s expectations and projections. Important factors that

could cause actual results to differ materially from such forward-looking statements

include, without limitation, risks related to the following:

Increasing competition in the communications industry; and

A complex and uncertain regulatory environment.

A further list and description of these risks, uncertainties and other factors can be found

in the Company’s SEC filings which are available online at www.sec.gov,

www.shentel.com or on request from the Company. The Company does not undertake

to update any forward-looking statements as a result of new information or future

events or developments.

Use of Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures that are not

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating

activities and exclude the effects of certain operating, capital and financing costs and

may differ from comparable information provided by other companies, and they should

not be considered in isolation, as an alternative to, or more meaningful than measures

of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the

industry and are presented because Shentel believes they provide relevant and useful

information to investors. Shentel utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, return investment to shareholders and to fund

continued growth. Shentel also uses these financial performance measures to evaluate

the performance of its businesses and for budget planning purposes.

1Q ‘09 Highlights

Net Income - 1Q09 net loss of $4.1

million due to impairment charge

Discontinued Operations -

Converged Services impairment charge

$10.7 million after tax; several

interested buyers

Strong operating results - Net

income from continuing operations of

$6.2 million up 14.2%

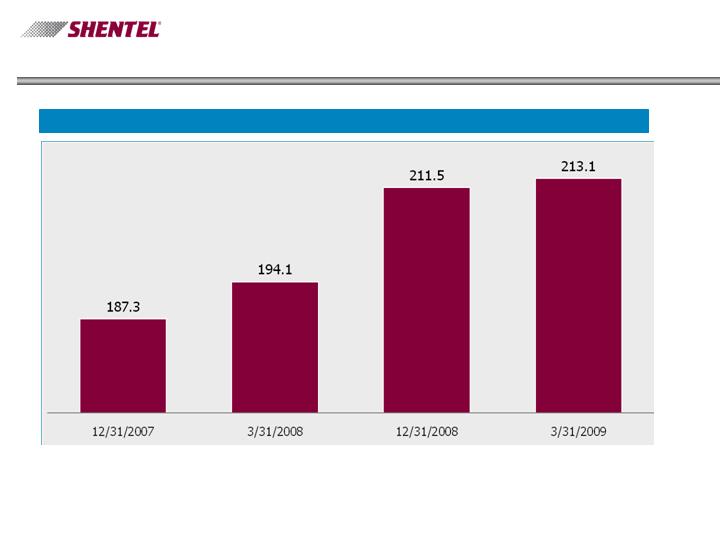

Net Income (in millions)

Net Income from Continuing Operations

(in millions)

1Q ‘09 Highlights

Cable Triple Play - Upgrade of cable

and acquisition integration in progress

Investment in wireless for

sustained growth – 26 additional

EVDO sites and 8 additional cell sites

Acquisition of Rural Access Lines

– Acquiring approximately 1,000 rural

access lines for $600k, upgrading to

DSL for $1.7 m

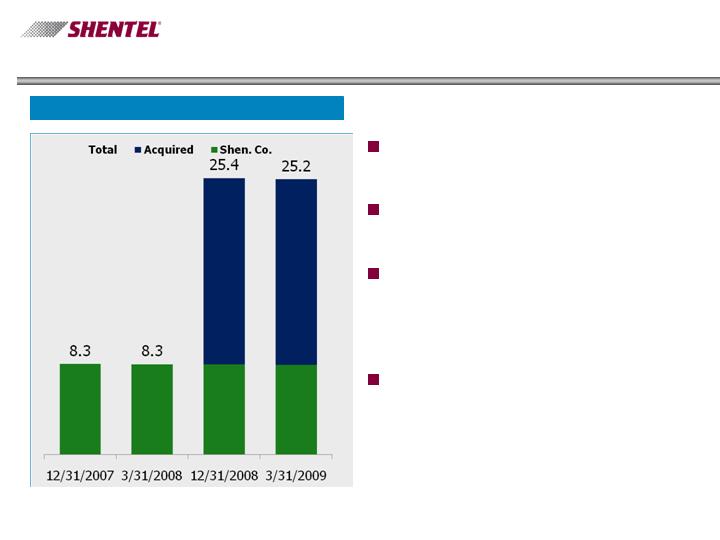

Number of Cell Sites

Operational Issues

Capital Spending Rationale – Will delay some capital projects based

on payback should the economic conditions warrant it

Broadband Stimulus – We are continuing to monitor the evolving

rules for public support of rural broadband development

Being Opportunistic – Our balance sheet enables us to take

advantage of opportunities which fit our business model

Delivering value for

Shareholders – EPS from

continuing operations up 13% in

1Q’09 over 1Q’08

EPS - EPS loss of $.18 for 1Q ‘09

as a result of $.45/per share

impairment loss

EPS

Earnings Per Share

Earnings per Share from Continuing

Operations

– Quarter over Quarter

Profitability

OIBDA ($ millions)

Maintaining profitability while investing in growth –

OIBDA up 25% for 1Q’09 over 1Q’08

3%

50%

47%

OIBDA Margin

$4.0

$19.9

$15.9

OIBDA

$1.5

7.8

6.3

Depreciation and Amortization

$2.5

$12.1

$9.6

Operating Income

Change

March

31, 2009

March

31, 2008

Quarter Ended

Cash Flows

Cash Flows ($ millions)

Strong operating cash flow –

48% growth in cash generated by

operations

Capex Well Supported–

Increased capital expenditures

supported more than adequately

by operating cash flow and debt

facility

Future Cash Flows – New debt

facility has equal amortization over

six years beginning in 2010, when

CAPEX spending is expected to

drop

Positioned to deliver for

shareholders – Ability to be

opportunistic or return value to

shareholders

$7.60

$13.40

$5.80

Free Cash Flow

$0.10

$0.40

$0.30

Other

-$0.10

-$1.10

-$1.00

Debt Repayments

$2.00

$2.00

$0.00

Borrowings

-$1.30

-$9.10

-$7.80

Capital Expenditures

$6.90

$21.20

$14.30

Net Cash from

Operations

Change

1Q ‘09

1Q ‘08

Key Operational Results – PCS

Decrease in store traffic

Modest increase in churn

from 1.98% in Q1 ‘08 to

2.15% in Q2 ‘09

Lower bad debt in Q1 ‘09

compared to Q1 ’08 (from

$2.5m to $1.7m)

Net Additions

Gross Additions

Gross Billed revenue per subscriber

continues to grow – Data revenues

growth continues

1 – Before Service credits, bad debt, Sprint Nextel fees. See reconciliation of Non-GAAP financial measures

on slide 23

Key Operational Results – PCS

Gross Billed Revenue per User – Data &

Voice 1

PCS Customers Top Picks Q1 2009

Top Service Plans

Everything Messaging

Family 1500

Everything Data Family

1500

Simply Everything

48% of Gross Adds

Top Devices

LG Rumor 17%

LG Lotus 16%

Samsung Rant 9%

Mobile Data Cards 8%

Samsung Instinct 3%

Equipment Sales Shentel

Controlled Channels

Meeting PCS Customer Needs

On track to complete 2009

construction plans

Expanded data offering

Over 90% POP’s will have

EVDO coverage by year

end 2009

PA coverage improved

Capacity increased

Number of Cell Sites

Key Operational Results - Telco

Modest access line

loss

43% data penetration

2009 Capex to

increase broadband

speeds to 10Mbps

1 DSL only available within LEC area

2 Dial-up offered inside and outside the LEC area

Internet Customers (000s)

Access lines (000s)

Key Operational Results - Cable

Integrating acquisition of

17,000 new customers

Converting acquired systems

to our billing platform

Upgrade underway to enable

us to offer triple play to 85%

of acquired homes passed by

year end 2009

Re-launch of the first acquired

market in late Q2

Number of Customers (000’s)

Non-GAAP Financial Measure – Billed Revenue per Subscriber

Dollars in thousands (except subscribers and revenue per subscriber)

1Q ‘09

1Q ‘08

Gross billed revenue

Wireless segment total operating revenues

$28,804

$ 24,407

Equipment revenue

(1,270)

(1,300)

Other revenue

(2,174)

(2,055)

Wireless service revenue

25,360

21,052

Service credits

3,764

3,498

Write-offs

1,705

2,496

Management fee

2,482

2,091

Service fee

2,730

2,300

Gross billed revenue

36,041

31,437

Average subscribers

212,196

190,870

Billed revenue per subscriber

$ 56.62

$ 54.90