© Fifth Third Bancorp | All Rights Reserved © Fifth Third Bancorp | All Rights Reserved Barclays Global Financial Services Conference Tim Spence Chairman, Chief Executive Officer and President September 11, 2024

© Fifth Third Bancorp | All Rights Reserved Fifth Third Bancorp | All Rights Reserved This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements; (13) failure of internal controls and other risk management programs; (14) losses related to fraud, theft, misappropriation or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) weakness in the national or local economies; (24) global political and economic uncertainty or negative actions; (25) changes in interest rates and the effects of inflation; (26) changes and trends in capital markets; (27) fluctuation of Fifth Third’s stock price; (28) volatility in mortgage banking revenue; (29) litigation, investigations, and enforcement proceedings by governmental authorities; (30) breaches of contractual covenants, representations and warranties; (31) competition and changes in the financial services industry; (32) potential impacts of the adoption of real-time payment networks; (33) changing retail distribution strategies, customer preferences and behavior; (34) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (35) potential dilution from future acquisitions; (36) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (37) results of investments or acquired entities; (38) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (39) inaccuracies or other failures from the use of models; (40) effects of critical accounting policies and judgments or the use of inaccurate estimates; (41) weather-related events, other natural disasters, or health emergencies (including pandemics); (42) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; (43) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases; and (44) Fifth Third's ability to meet its environmental and/or social targets, goals and commitments. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein. Copies of those filings are available at no cost on the SEC’s website at www.sec.gov or on our website at www.53.com. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 27 through 29 of our 2Q24 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. This presentation incorporates the following peers: CFG, CMA, FCNCA, FHN, HBAN, KEY, MTB, PNC, RF, TFC, USB, & ZION. Cautionary statement 2

© Fifth Third Bancorp | All Rights Reserved Disciplined execution guided by core principles Stability Profitability Growth Consistent and disciplined management, with a long-term focus throughout the company 3 • Defensive balance sheet positioning • Strong credit profile • Diverse fee mix with high total revenue contribution • Expense discipline • Drive NIM expansion • Southeast demographics • Midwest & renewables infrastructure investments • Tech-enabled product innovation #2 #3#1

© Fifth Third Bancorp | All Rights Reserved Midwest footprint (branch count in white) Major FITB markets 2 with a top 5 deposit share London office Leading position in the markets we compete in 3 Key Southeast MSAs of focus Toronto office Top performing regional bank with local scale and national reach 4 Fifth Third Corporate Headquarters Cincinnati, Ohio 249 161 100 157 66 5 41 77 10 29 175 Assets $213 billion Ranked 10 th in the U.S. 1 Deposits $167 billion Ranked 9 th in the U.S. 1 U.S. branches 1,070 Ranked 8 th in the U.S. 1 Commercial Payments Top 5 market share across several product categories 5 Southeast footprint (branch count in white) #2 #6Midwest Southeast unchanged YoY improved 2 spots YoY Deposit share rankings 4 #3 Fifth Third footprint improved 1 spot YoY Significant locational share in notable MSAs Nashville, TN Charlotte, NC #3 #4 Cincinnati, OH #1 Chicago, IL #3 Top 10 deposit share in ~90% of retail footprint Columbus, OH Indianapolis, IN #3 #3 Tampa, FL #6 Grand Rapids, MI #1 Assets, deposits, and branches as of 6/30/24; 1 Rankings consist of US commercial banks and exclude foreign, trust, & traditional investment banks; 2 Includes MSAs with $5BN+ in deposits on a capped basis (deposits per branch capped at $250MM per June 2023 FDIC data); 3 Data sourced from S&P Global Market Intelligence; 4 Deposits per branch capped at $250MM per June 2023 FDIC data; Midwest and Southeast rankings represent in footprint deposit market share; 5 Source: 2023 Cash Management Services Survey administered by EY

© Fifth Third Bancorp | All Rights Reserved Commercial Banking Lending / Deposits / Capital Markets / Treasury Management & Payments $67B loans $63B deposits Consumer & Small Business Banking Wealth & Asset Management Business Offerings Loans / Deposits $4B loans $11B deposits $46B loans $88B deposits Select Awards & accolades A simple, diversified business portfolio 5 NII contribution 1 Fee contribution 1 39% 58% 3% 47% 39% 14% 2Q24 avg. Lending / Deposits / Payments Wealth Management / Trust / Custody 1 As a percent of LTM 2Q24 segment revenue, which excludes Other Corporate

© Fifth Third Bancorp | All Rights Reserved 1.22% Peer 7 FITB Peer 2 Peer 8 Peer 5 Peer 4 Peer 1 Peer 9 Peer 10 Peer 11 Peer 3 Peer 6 15.1%FITB Peer 2 Peer 1 Peer 7 Peer 8 Peer 4 Peer 10 Peer 5 Peer 9 Peer 3 Peer 11 Peer 6 60.5% Peer 9 Peer 6 x Peer 10 Peer 8 Peer 7 Peer 3 Peer 4 Peer 11 Peer 1 Peer 2 Peer 5 14.0% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 x Peer 10 Peer 11 1.29% Peer 5 Peer 2 Peer 1 Peer 3 Peer 8 Peer 6 Peer 7 Peer 4 Peer 10 x Peer 9 Peer 11 Driving to consistently generate top quartile results 6 Return on tangible common equity 1,2 FY18 LTM 2Q24 FY18 FY18 Return on assets 1 Efficiency ratio 1 Adjusted basis Adjusted basis Adjusted basis Remain focused on long-term horizon Expect to continue generating top-tier financial results 3 56.9% Peer 2 FITB Peer 7 Peer 3 Peer 9 Peer 4 Peer 8 Peer 1 Peer 10 Peer 11 Peer 5 Peer 6 LTM 2Q24 LTM 2Q24 1 Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release; 2 Return on tangible common equity excludes AOCI; Certain peers excluded due to limited data; 3 See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release

© Fifth Third Bancorp | All Rights Reserved Leading to top returns for our shareholders 7 Total shareholder return Source: Bloomberg; Note: Results exclude FCNCA as they participated in an FDIC assisted acquisition. Top quartile performer in both a low-rate and rising rate environment Trailing TSR as of 8/31/2024; Excludes FCNCA

© Fifth Third Bancorp | All Rights Reserved Intentionally diversifying fee revenue to perform well in any environment • Total adjusted fee revenue accounted for ~34% of total adjusted revenue for the last twelve months ending 6/30/24 • Focused on diversified revenue to lessen cyclical impacts, with success in Wealth & Asset Management, Capital Markets, and Commercial Payments 8 20% 19% 14% 14% 8% 7% 7% 5% 6% Fee revenue mix is well-diversified LTM 2Q24 adjusted noninterest income mix 2,3 Wealth & Asset Management Card and processing revenue Mortgage banking revenue Leasing business revenue Other noninterest income LTM 2Q24 Adjusted Noninterest Income $2.9B Capital Markets Other Commercial banking revenue Commercial Payments 1 Consumer deposit fees 34% 28% x Peer Median Fee contribution as a percent of revenue stands out favorably relative to peers LTM 2Q24; Adjusted noninterest income as a percent of adjusted revenue 3 Totals may not foot due to rounding; 1 Gross Treasury management fees; 2 Excluding securities gains/losses; 3 Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release

© Fifth Third Bancorp | All Rights Reserved Rich history of payments innovation 9 1970s 1980s 1990s 2000s 2010s 2020 2024 Fifth Third takes leadership position with Check 21. Embedded Payments business unit formed. Among first banks to join Zelle network. Acquired Big Data Healthcare to accelerate TM solutions within Healthcare vertical. Completed Rize Money acquisition and integration which supported the launch of Newline by Fifth Third. Began offering Managed Services solutions including currency solutions and dynamic discounting. Launched a debit card program, the Master Money card for processing online debit card sales Expanded Managed services offerings to include Managed payables and receivables solutions. Newline continues to expand offerings and add partnerships. Introduced JEANIE® – the first shared ATM network in the United States. Joint venture retaining 49% of Vantiv (now Worldpay), 2nd largest nonbank merchant acquirer. Established 3rd party payment process program (BIN sponsorship acquiring capabilities). Joins National Bank Americard (Visa) network. Midwest Payments Solutions formed (later known as Vantiv).

© Fifth Third Bancorp | All Rights Reserved 0.05% 0.06% 0.06% 0.08% 0.08% 0.10% 0.10% 0.10% 0.11% 0.13% 0.15% 0.19% 0.41% Peer 12 Peer 11 Peer 10 Peer 9 Peer 8 Peer 7 Peer 6 Peer 5 Peer 4 Peer 3 Peer 2 Peer 1 x Well established commercial payments organization with significant scale 10 ACH Credit send / Commercial Deposits 1 Significant scale with national recognition #2 of 37 in Coin and currency revenue #2 of 32 in Retail lockbox remittances #3 of 42 in Total ACH originations #3 of 39 in Wholesale lockbox remittances #4 of 37 in Total check clearing #5 of 35 in Account reconciliations Top 5 market share in several product categories 3 0.16% 0.17% 0.18% 0.18% 0.20% 0.20% 0.21% 0.22% 0.30% 0.37% 0.48% 0.49% 0.49% Peer 12 Peer 3 Peer 9 Peer 11 Peer 8 Peer 2 Peer 10 Peer 6 Peer 5 Peer 4 Peer 7 Peer 1 x Non-consumer deposit fees / Commercial Deposits 2 1 2023 ACH data from NACHA; deposit balances as of 4Q23; 2 Total deposit fees less consumer (OD, maintenance, and ATM fees) relative to commercial deposits (defined as total deposits less individual deposits per the call report) as of 2Q24; 3 Source: 2023 Cash Management Services Survey administered by EY Legacy TM Commercial payments product lines trillion ~1,300 People in the commercial payments organization $5 $10 $15 $17 2007 2019 2023 2024 Annualized Traditional treasury mgmt. Managed Services Newline Embedded payments HighlightsPayments processed ~14K Commercial payments related clients >1/3 Of new Commercial relationships are payments-led with no credit extended #6 Fee equivalent revenue 3 (up from #8 in 2022) Commercial payments innovation was key differentiator for 2023 “Bank of the Year” award by The Banker • Platform • Interaction channels • Financial products • Risk solutions • A/R automation • A/P automation • Cash logistics • Healthcare (Big Data HC) • Liquidity manager • Escrow manager • Commercial card • Lockbox & check trillion trillion trillion

© Fifth Third Bancorp | All Rights Reserved Significant opportunity within B2B payments 11 Significant growth off a sizable base Significant opportunity to automate back-office processes related to cash conversion cycle $29.2 trillion ~12% B2B payment market in the United States Expected annual growth through 2030 1 35% 32% 25% 8% Currently automating Very interested Interested Not interested / NA Interest level in automating the cash conversion cycle 2 33% Of all B2B payments still being done via check 6 68% Deal with late payments impacting cashflows 8 ~50% of invoices received still require manual intervention 3 80% Experience fraud attacks/attempts 7 Automating workflows and digitizing the cash conversion cycle generates significant value Invoice processing cost Paper vs. electronic payment Cost of collecting late payments Baseline Best-in-class Improvement $9.87 Average cost per invoice received and processed 3 $2.81 Cost per invoice received and processed 3 +$4.00 Average cost of issuing a paper check 4 $0.50 Average cost to issue an electronic payment 4 +$5.00 Cost per $1,000 in revenue to collect a payment greater than 30 days past due 5 $1.00 Cost per $1,000 in revenue to collection a payment less than 30 days past due 5 +72% +88% +80% 1 Fortune Business Insight: B2B Market]; See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release 2 Datos: Best Practices in Receivables management 2023; 3 Ardent partners: Accounts payable Metrics that Matter 2024; 4 NACHA: “ACH costs are a Fraction of Check Costs for Business”; 5 High Radius: “What is the cost of collecting”; 6 AFP 2022 Digital Payments Survey Report; 7 AFP 2024 Payment Fraud and Control Report ; 8 PYMTS.com “Accounts Receivable Automaton Smooths O2C Continuum”

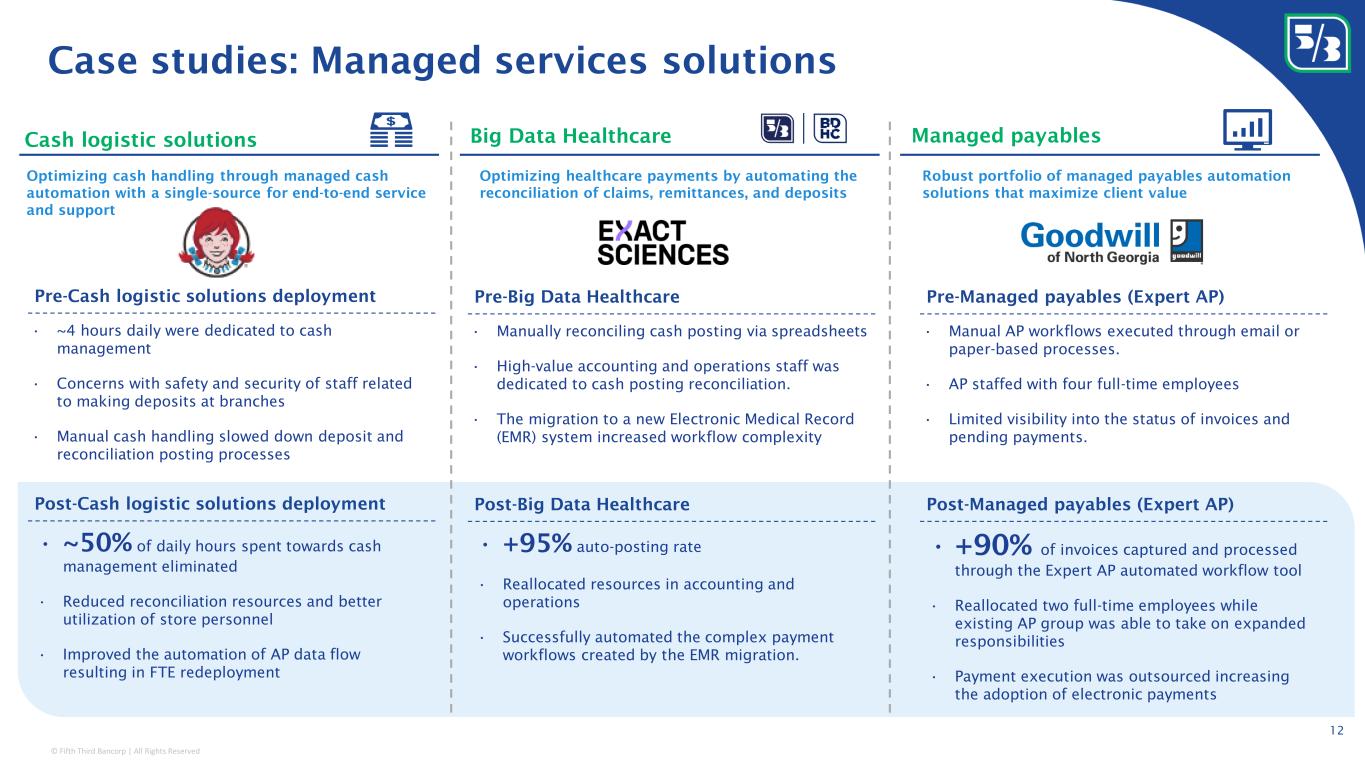

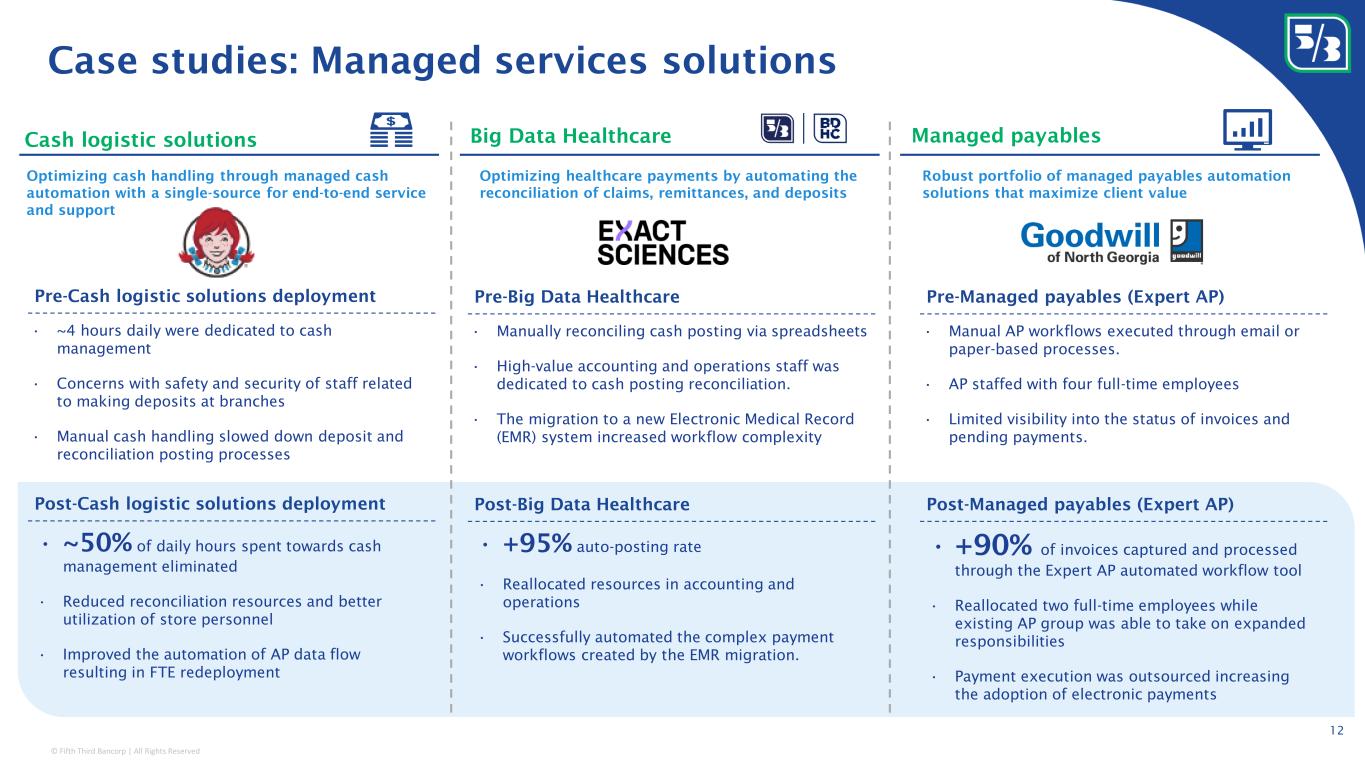

© Fifth Third Bancorp | All Rights Reserved Case studies: Managed services solutions 12 Big Data HealthcareCash logistic solutions Managed payables Robust portfolio of managed payables automation solutions that maximize client value Optimizing healthcare payments by automating the reconciliation of claims, remittances, and deposits Optimizing cash handling through managed cash automation with a single-source for end-to-end service and support Pre-Big Data Healthcare Post-Big Data Healthcare • Manually reconciling cash posting via spreadsheets • High-value accounting and operations staff was dedicated to cash posting reconciliation. • The migration to a new Electronic Medical Record (EMR) system increased workflow complexity • +95% auto-posting rate • Reallocated resources in accounting and operations • Successfully automated the complex payment workflows created by the EMR migration. Pre-Managed payables (Expert AP) Post-Managed payables (Expert AP) • Manual AP workflows executed through email or paper-based processes. • AP staffed with four full-time employees • Limited visibility into the status of invoices and pending payments. • +90% of invoices captured and processed through the Expert AP automated workflow tool • Reallocated two full-time employees while existing AP group was able to take on expanded responsibilities • Payment execution was outsourced increasing the adoption of electronic payments Pre-Cash logistic solutions deployment Post-Cash logistic solutions deployment • ~4 hours daily were dedicated to cash management • Concerns with safety and security of staff related to making deposits at branches • Manual cash handling slowed down deposit and reconciliation posting processes • ~50% of daily hours spent towards cash management eliminated • Reduced reconciliation resources and better utilization of store personnel • Improved the automation of AP data flow resulting in FTE redeployment

© Fifth Third Bancorp | All Rights Reserved • Newline is vertically integrated API platform that enables enterprises to launch payment, card, and deposit solutions directly with Fifth Third Bank. 13 Client Payment & Deposit Solutions Client list includes a broad range of category leaders Newline offers the risk management of a large bank combined with the quality, sophistication, and product velocity of a software company Select clients Newline powers Blackbaud, a leading software platform for nonprofits, education, and CSRs Newline highlights • 150+ clients • Top 3 Merchant Acquiring Bank • Top 5 Card issuing sponsor bank • Top 10 ACH Originator • 35% YoY deposit growth • $2BN+ in deposits Embedded payment and deposit solutions Payment solutions and money movement Bank Accounts Card programs and sponsorship • Full suite of batch and API payment offerings including wire, ACH, RTP, and FedNow (coming soon) • Funds storage • Issue consumer/commercial cards through utilization of BIN sponsorship Embedded financial solutions driven by Newline Blackbaud’s software platform Payment services Blackbaud’s End Customers Non-profits and companies Payments powered by Newline

© Fifth Third Bancorp | All Rights Reserved Expect strong commercial payments growth 14 FY17 2Q24 LTM Future state Embedded payments/ Newline Managed Services Traditional treasury management 16% CAGR 4% CAGR 20+% ~10% ~5% >2x growth 1 See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release Expected 5-year CAGR Expect commercial payments to be a $1 billion business in ~5 years 1

© Fifth Third Bancorp | All Rights Reserved Fifth Third Bancorp | All Rights Reserved up ~2% Noninterest expense 1 up ~1% (2Q24 baseline: $1.204 billion) Net charge-off ratio 40 – 45 bps Effective tax rate 22 – 23% 1 Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 2Q24 earnings release As of September 10, 2024; please see cautionary statements on page 2 Total revenue 1 up 1 – 2% (2Q24 baseline: $2.118 billion; Includes securities g/l) (including HFS) Avg. loans & leases stable to up ~1% Current expectations 3Q24 compared to 2Q24 15 Net interest income 1 Noninterest income 1 up 1 – 2% (2Q24 baseline: $1.398 billion) (2Q24 baseline: $717 million) up ~2% up ~1% ~50 bps ~22% up 2 – 3% stable up 3 – 4% As of September 10, 2024As of July 19, 2024 Allowance for credit losses expect ~$25MM build due to loan growth/mix and assumes no change to macroeconomic outlook and risk profile as of 2Q24 expect $10 – $25MM build Based on August 2024 macroeconomic outlook

© Fifth Third Bancorp | All Rights Reserved ✓ Well-diversified and resilient balance sheet to provide stability and profitability ✓ Consistent investments to generate balanced and growing revenue streams while maintaining peer-leading expense discipline ✓ Multi-year track record of making appropriate and preemptive changes to the business ✓ Transparent management team Positioned to generate long-term sustainable value to shareholders despite the environment Why Fifth Third 16