© Fifth Third Bancorp | All Rights Reserved © Fifth Third Bancorp | All Rights Reserved RBC Capital Markets Financial Institutions Conference Bryan Preston Chief Financial Officer March 5, 2025

© Fifth Third Bancorp | All Rights Reserved This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements, including the use of artificial intelligence; (13) failure of internal controls and other risk management programs; (14) losses related to fraud, theft, misappropriation or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) weakness in the national or local economies; (24) global political and economic uncertainty or negative actions; (25) changes in interest rates and the effects of inflation; (26) changes and trends in capital markets; (27) fluctuation of Fifth Third’s stock price; (28) volatility in mortgage banking revenue; (29) litigation, investigations, and enforcement proceedings; (30) breaches of contractual covenants, representations and warranties; (31) competition and changes in the financial services industry; (32) potential impacts of the adoption of real-time payment networks; (33) changing retail distribution strategies, customer preferences and behavior; (34) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (35) potential dilution from future acquisitions; (36) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (37) results of investments or acquired entities; (38) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (39) inaccuracies or other failures from the use of models; (40) effects of critical accounting policies and judgments or the use of inaccurate estimates; (41) weather-related events, other natural disasters, or health emergencies (including pandemics); (42) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; (43) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases; and (44) Fifth Third's ability to meet its environmental and/or social targets, goals and commitments. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein. Copies of those filings are available at no cost on the SEC’s website at www.sec.gov or on our website at www.53.com. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures in later slides in this presentation, as well as on pages 27 through 29 of our 4Q24 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. This presentation incorporates the following peers: CFG, CMA, FCNCA, FHN, HBAN, KEY, MTB, PNC, RF, TFC, USB, & ZION. Cautionary statement 2

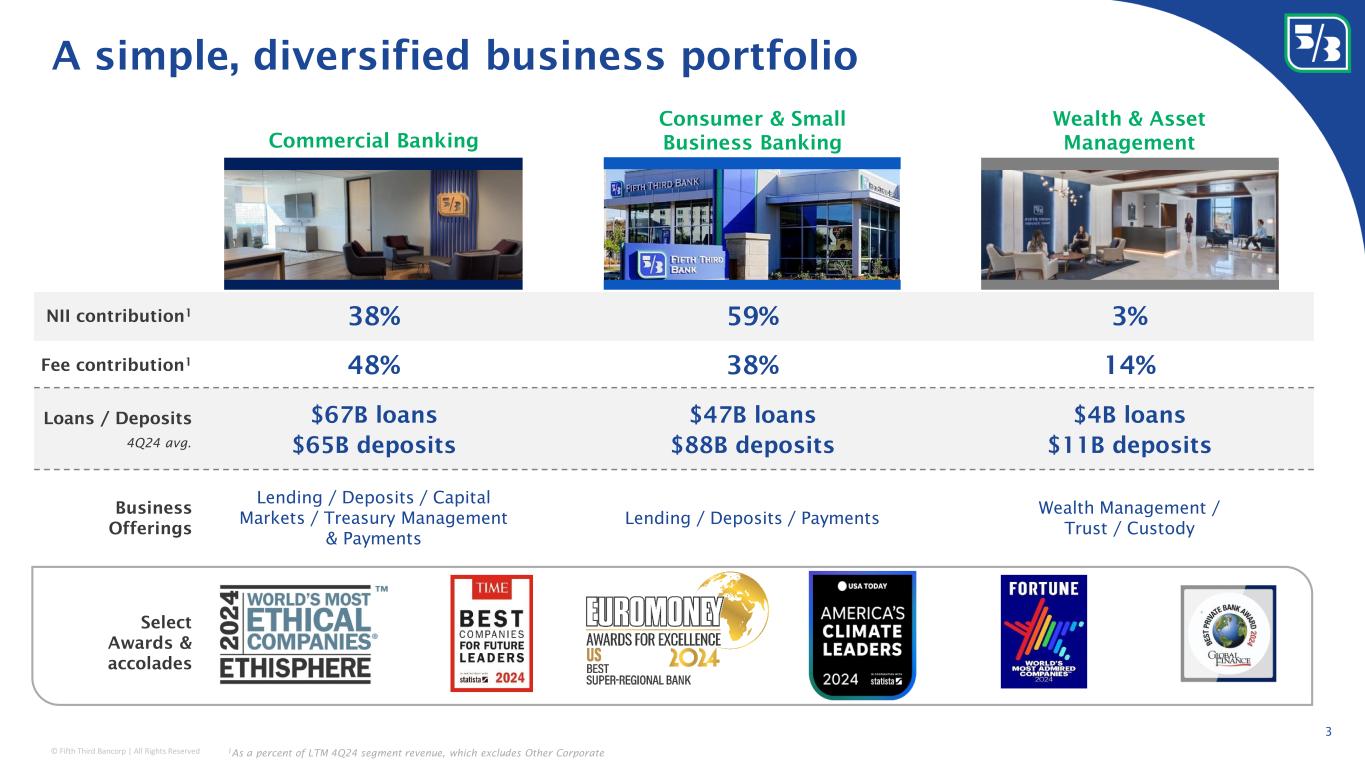

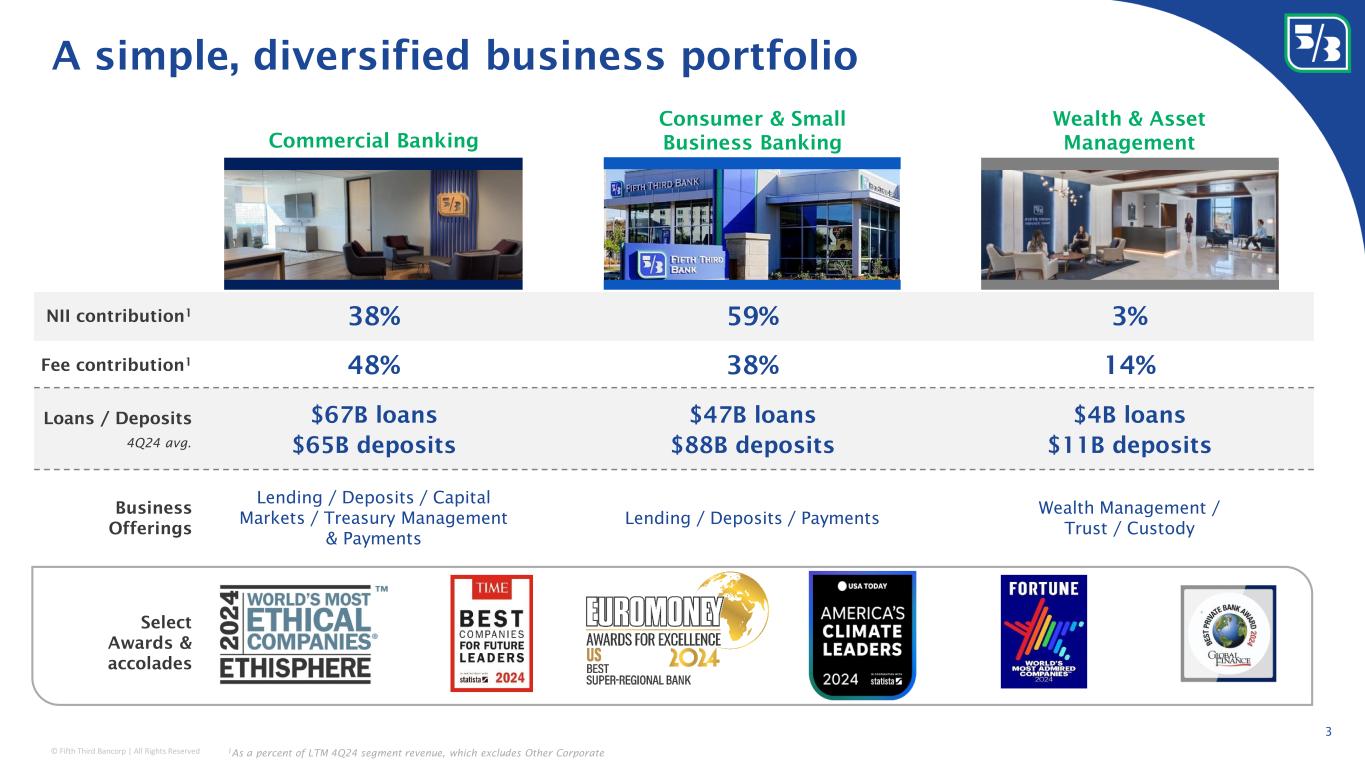

© Fifth Third Bancorp | All Rights Reserved Commercial Banking Lending / Deposits / Capital Markets / Treasury Management & Payments $67B loans $65B deposits Consumer & Small Business Banking Wealth & Asset Management Business Offerings Loans / Deposits $4B loans $11B deposits $47B loans $88B deposits Select Awards & accolades A simple, diversified business portfolio NII contribution 1 Fee contribution 1 38% 59% 3% 48% 38% 14% 4Q24 avg. Lending / Deposits / Payments Wealth Management / Trust / Custody 1 As a percent of LTM 4Q24 segment revenue, which excludes Other Corporate 3

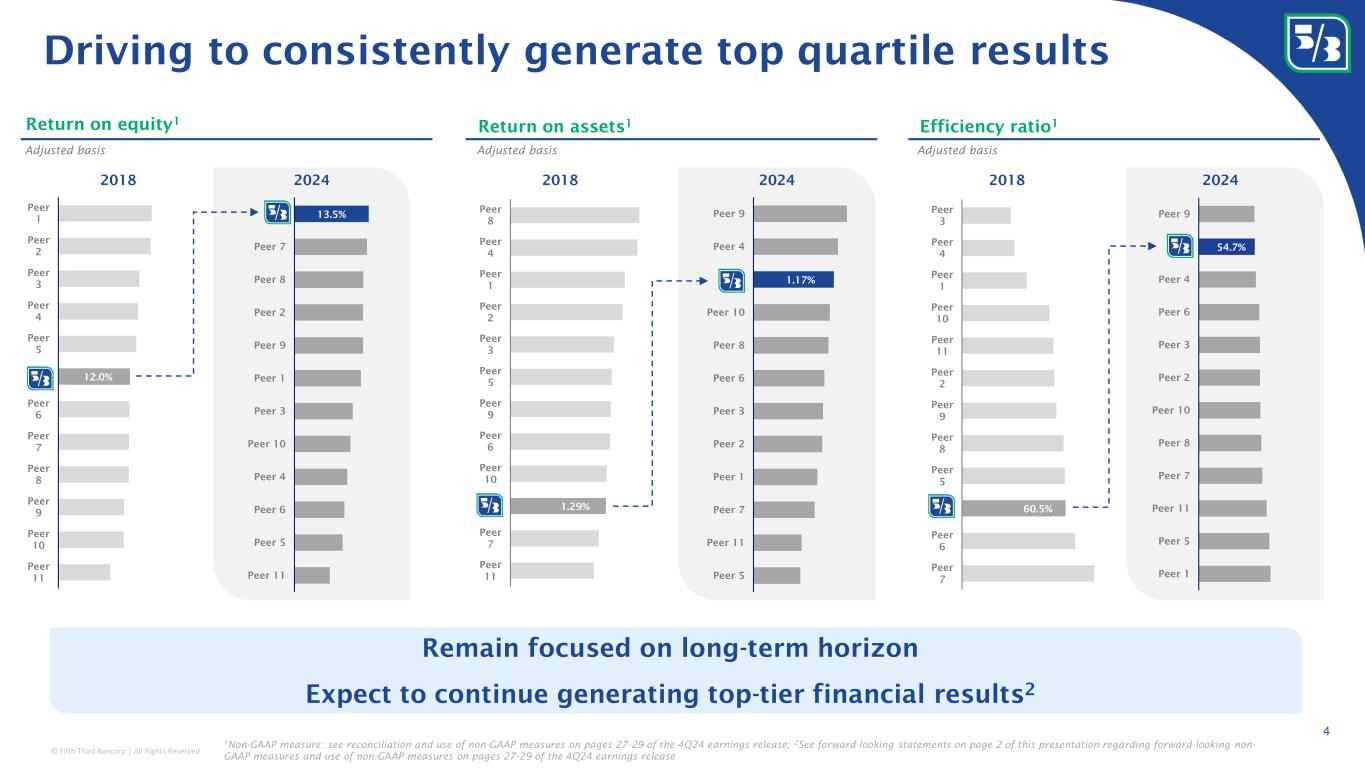

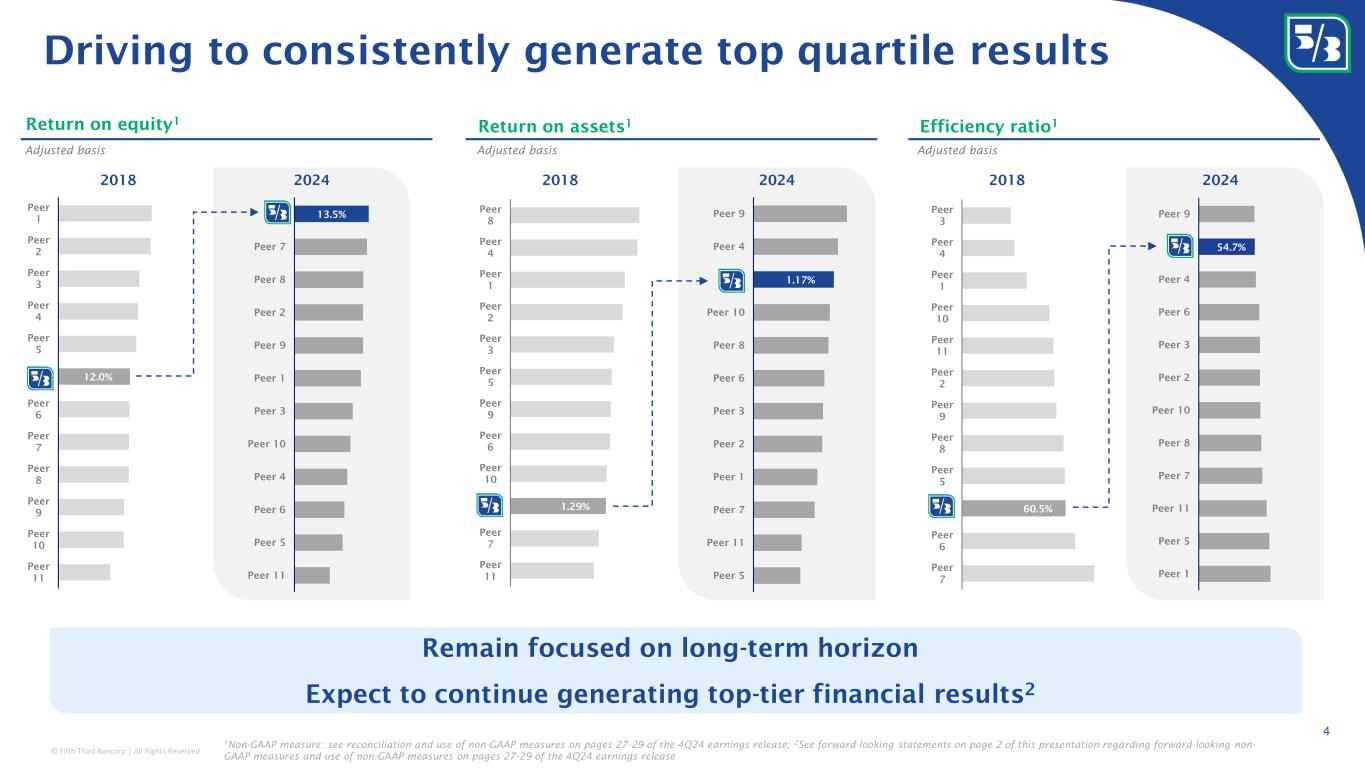

© Fifth Third Bancorp | All Rights Reserved 1.17% Peer 9 Peer 4 x Peer 10 Peer 8 Peer 6 Peer 3 Peer 2 Peer 1 Peer 7 Peer 11 Peer 5 54.7% Peer 9 x Peer 4 Peer 6 Peer 3 Peer 2 Peer 10 Peer 8 Peer 7 Peer 11 Peer 5 Peer 1 12.0% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 X Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 13.5%x Peer 7 Peer 8 Peer 2 Peer 9 Peer 1 Peer 3 Peer 10 Peer 4 Peer 6 Peer 5 Peer 11 60.5% Peer 7 Peer 6 x Peer 5 Peer 8 Peer 9 Peer 2 Peer 11 Peer 10 Peer 1 Peer 4 Peer 3 1.29% Peer 8 Peer 4 Peer 1 Peer 2 Peer 3 Peer 5 Peer 9 Peer 6 Peer 10 x Peer 7 Peer 11 Driving to consistently generate top quartile results 4 Return on equity 1 2018 2024 2018 2018 Return on assets 1 Efficiency ratio 1 Adjusted basis Adjusted basis Adjusted basis Remain focused on long-term horizon Expect to continue generating top-tier financial results 2 2024 2024 1 Non-GAAP measure: see reconciliation and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release; 2 See forward-looking statements on page 2 of this presentation regarding forward-looking non- GAAP measures and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release

© Fifth Third Bancorp | All Rights Reserved Disciplined execution guided by core principles Stability Profitability Growth Consistent and disciplined management, with a long-term focus throughout the company 5 • Resilient balance sheet • Strong credit profile • Diverse fee mix with high total revenue contribution • Expense discipline • NII growth and NIM expansion • Southeast demographics • Middle market and wealth sales force expansion • Tech-enabled product innovation #2 #3#1

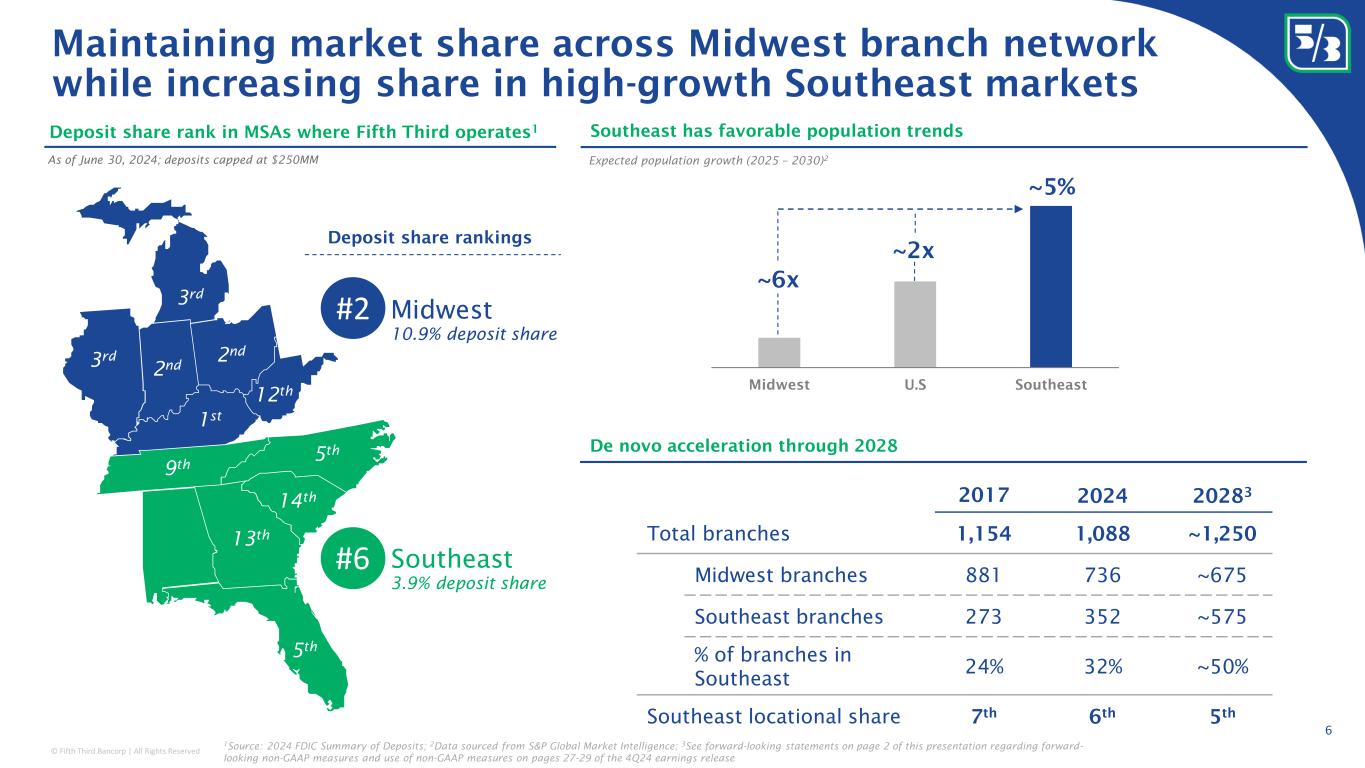

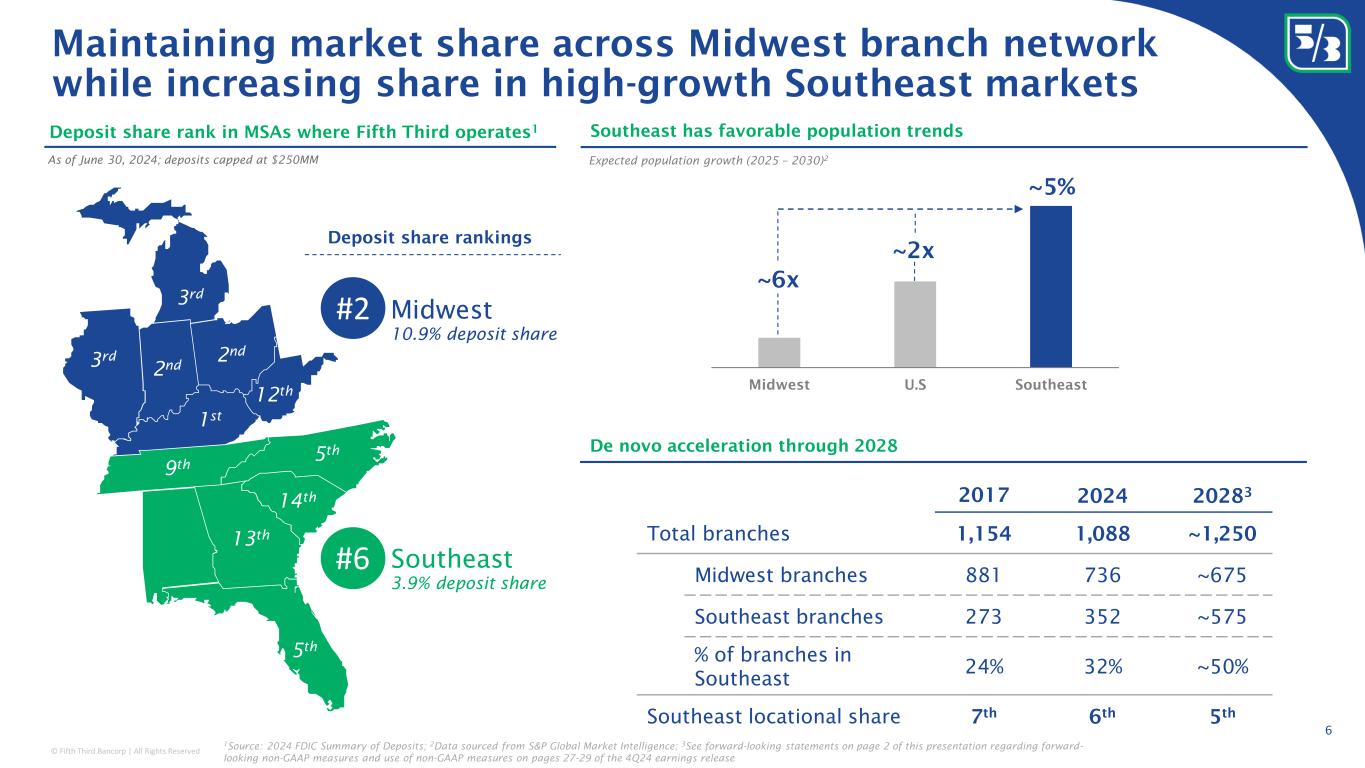

© Fifth Third Bancorp | All Rights Reserved Deposit share rank in MSAs where Fifth Third operates 1 As of June 30, 2024; deposits capped at $250MM Maintaining market share across Midwest branch network while increasing share in high-growth Southeast markets 9 th 12 th 5 th 13 th 14 th 3 rd 2 nd 1 st 5 th 2 nd 3 rd 6 Southeast has favorable population trends Expected population growth (2025 – 2030) 2 Midwest#2 Southeast#6 10.9% deposit share 3.9% deposit share 1 Source: 2024 FDIC Summary of Deposits; 2 Data sourced from S&P Global Market Intelligence; 3 See forward-looking statements on page 2 of this presentation regarding forward- looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release Midwest U.S Southeast ~2x ~6x ~5% Deposit share rankings 2017 2024 2028 3 Total branches 1,154 1,088 ~1,250 Midwest branches 881 736 ~675 Southeast branches 273 352 ~575 % of branches in Southeast 24% 32% ~50% Southeast locational share 7 th 6 th 5 th De novo acceleration through 2028

© Fifth Third Bancorp | All Rights Reserved 6.0% 3.9% 2.3% 2.1% 2.1% 1.6% 1.5% 1.2% 1.1% 1.1% 0.4% 0.4% Peer 6 Peer 10 Peer 9 Peer 7 Peer 8 Peer 1 Peer 5 Peer 4 Peer 2 Peer 3 Peer 11 Southeast investments with proven performance and growth potential Illustrative deposit growth potential from branches aged <5y achieving levels of branches aged >5y 2 Share of total branches <5y 1.5%3.3%4.3% 2.2% 2.7% 1.8% 2.0% 0.4%8.5% 1.5% 1.2% 0.5% Median of 1.5% Source: 2024 FDIC Summary of Deposits & S&P Global Market Intelligence; 1 Filtered for de novos and based on 2024 FDIC data. Not all de novos have been open for 5 years; 2 Reflects the growth potential for total deposits if all branches aged <5y achieved the average deposit per branch productivity of all branches aged >5y for each bank, respectively. Based on SNL deposit per MSA market share data, individual deposits per branch considered are capped at $1bn Deposit growth opportunity due to seasoning of existing network ($B) $1.4$2.7$10.4 $2.3 $2.4 $0.7 $0.9 $0.3$8.1 $3.0 $3.0 $0.2 7 207 138 43 39 26 22 23 Trillionaire 1 X Peer 9 Peer 6 Trillionaire 2 Peer 8 Trillionaire 3 Southeast de novo branch builds In Southeast states from 2018 – December 2024 Average de novo deposits per branch by vintage 1 $0 $20 $40 Year 1 Year 2 Year 3 Year 4 Year 5 Fifth Third Peer Avg $ in millions

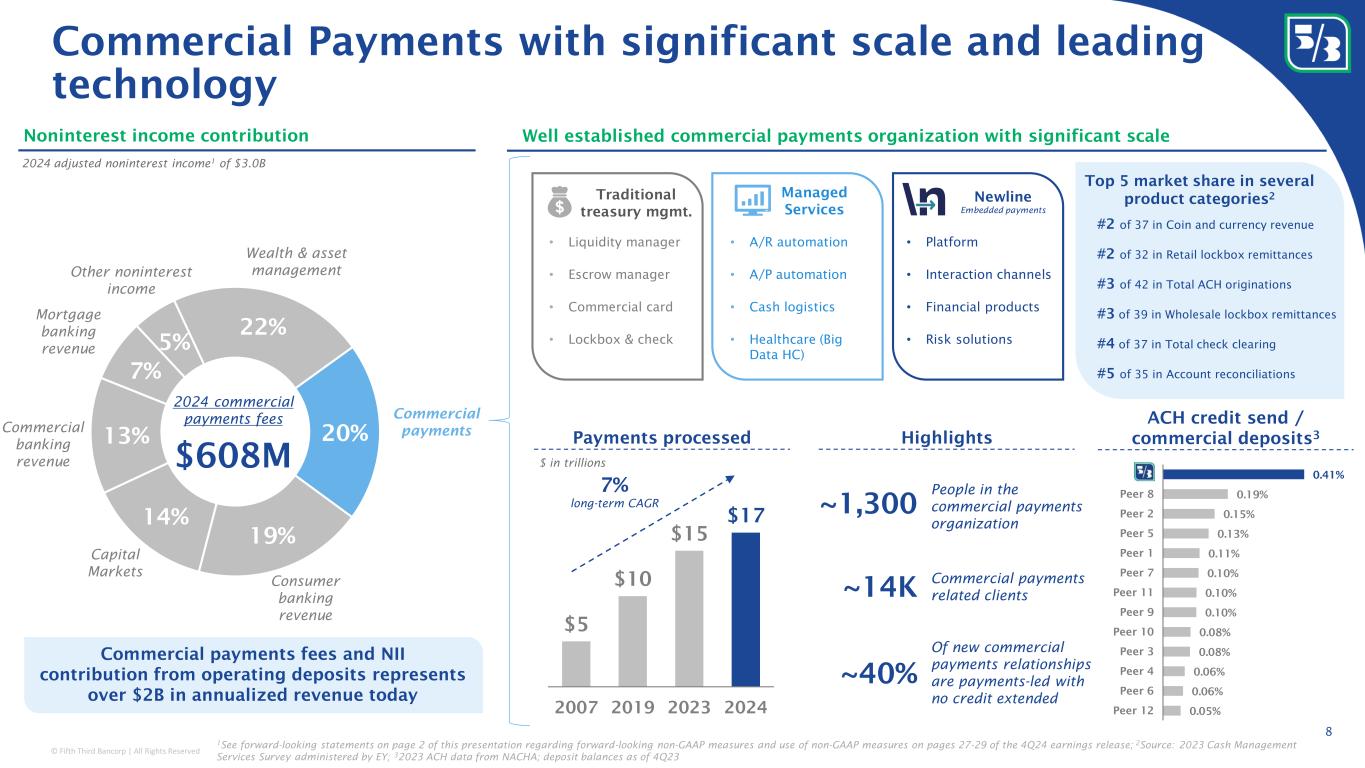

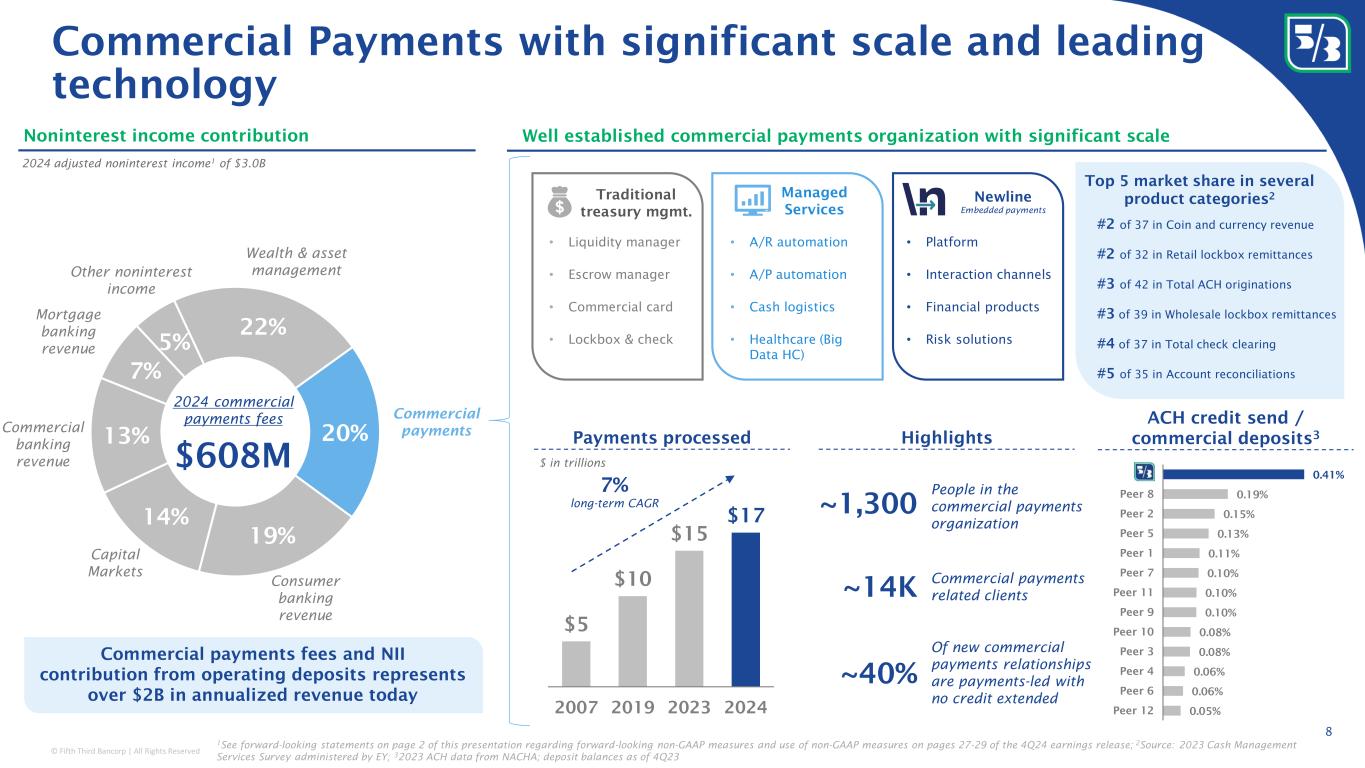

© Fifth Third Bancorp | All Rights Reserved Commercial Payments with significant scale and leading technology 8 Well established commercial payments organization with significant scale 1 See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release; 2 Source: 2023 Cash Management Services Survey administered by EY; 3 2023 ACH data from NACHA; deposit balances as of 4Q23 #2 of 37 in Coin and currency revenue #2 of 32 in Retail lockbox remittances #3 of 42 in Total ACH originations #3 of 39 in Wholesale lockbox remittances #4 of 37 in Total check clearing #5 of 35 in Account reconciliations Top 5 market share in several product categories 2 22% 20% 19% 14% 13% 7% 5% Wealth & asset management Mortgage banking revenue Other noninterest income Capital Markets Commercial banking revenue Commercial payments Consumer banking revenue Traditional treasury mgmt. Managed Services Newline Embedded payments • Platform • Interaction channels • Financial products • Risk solutions • A/R automation • A/P automation • Cash logistics • Healthcare (Big Data HC) • Liquidity manager • Escrow manager • Commercial card • Lockbox & check 0.05% 0.06% 0.06% 0.08% 0.08% 0.10% 0.10% 0.10% 0.11% 0.13% 0.15% 0.19% 0.41% Peer 12 Peer 6 Peer 4 Peer 3 Peer 10 Peer 9 Peer 11 Peer 7 Peer 1 Peer 5 Peer 2 Peer 8 x HighlightsPayments processed ACH credit send / commercial deposits 3 ~1,300 People in the commercial payments organization ~14K Commercial payments related clients ~40% Of new commercial payments relationships are payments-led with no credit extended $5 $10 $15 $17 2007 2019 2023 2024 $ in trillions 2024 commercial payments fees $608M Commercial payments fees and NII contribution from operating deposits represents over $2B in annualized revenue today Noninterest income contribution 2024 adjusted noninterest income 1 of $3.0B 7% long-term CAGR

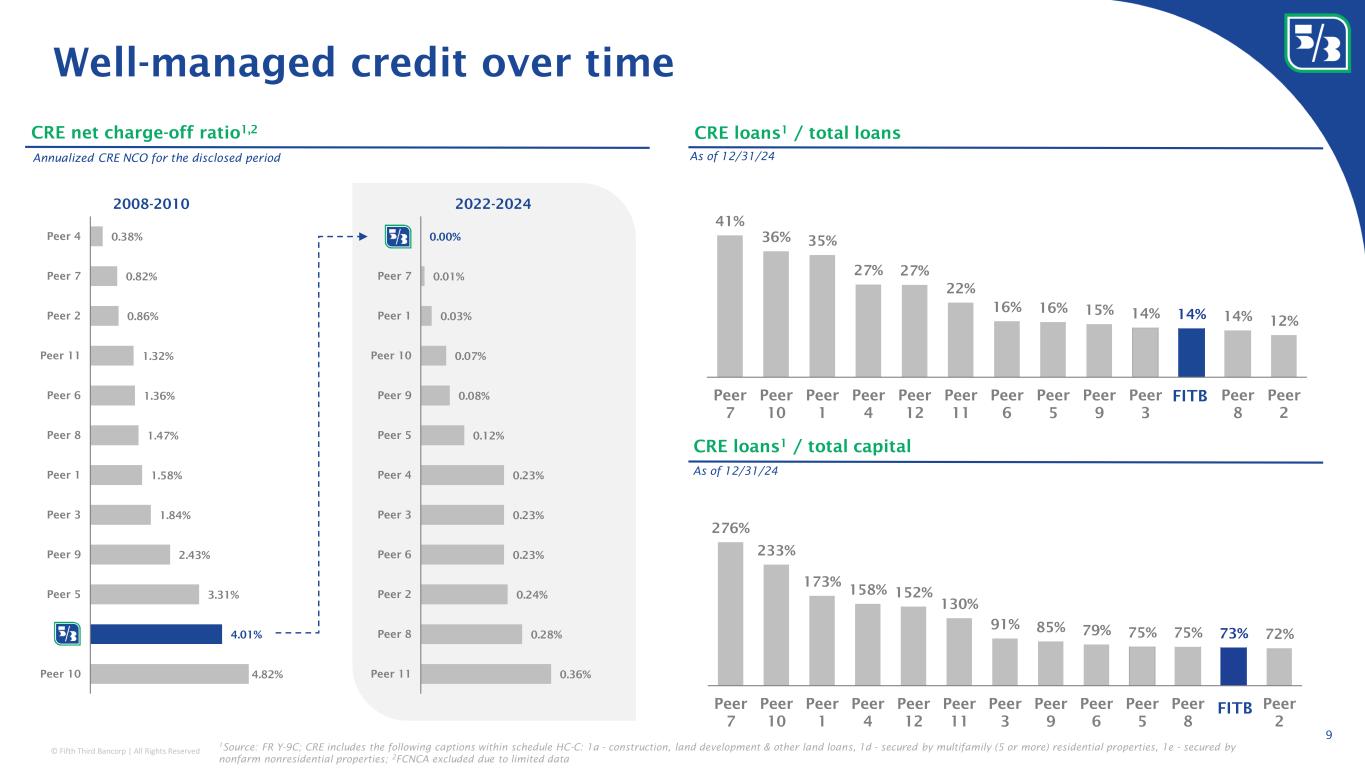

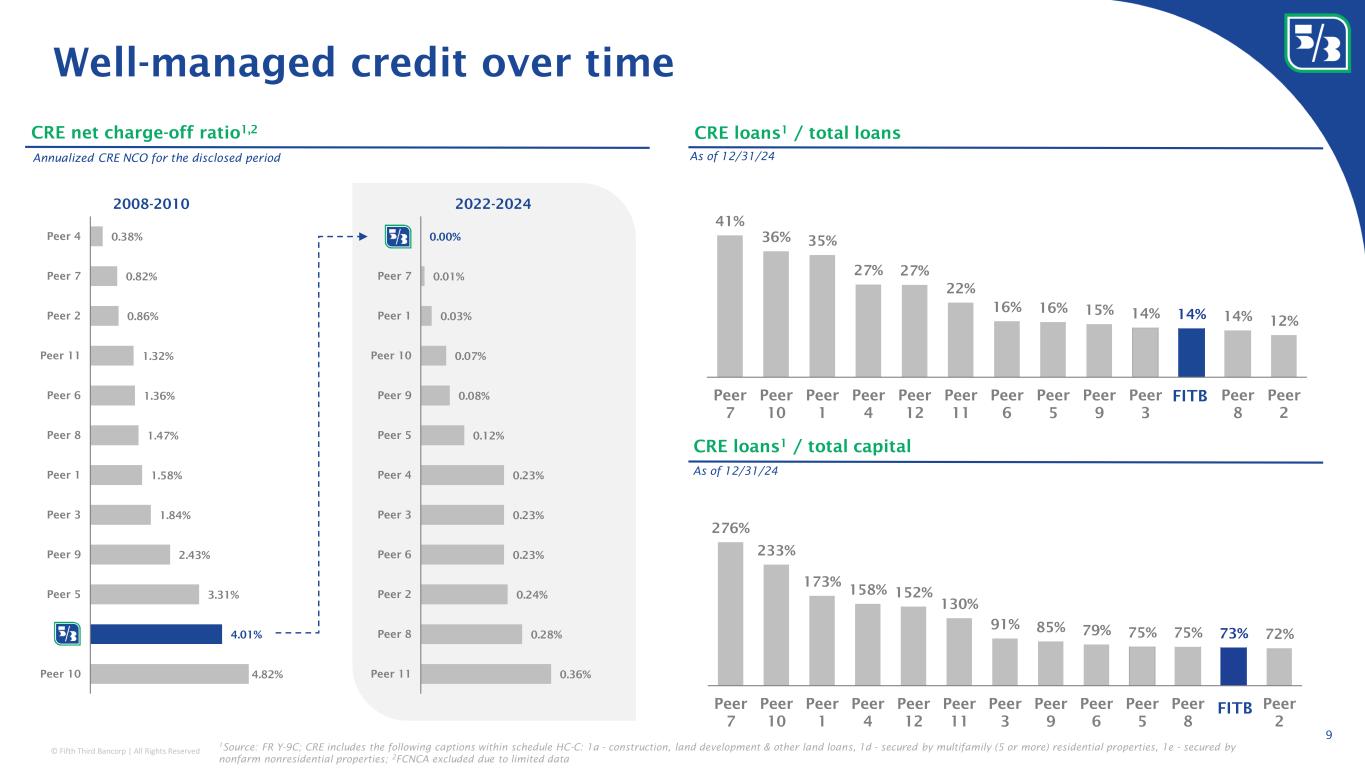

© Fifth Third Bancorp | All Rights Reserved 4.82% 4.01% 3.31% 2.43% 1.84% 1.58% 1.47% 1.36% 1.32% 0.86% 0.82% 0.38% Peer 10 x Peer 5 Peer 9 Peer 3 Peer 1 Peer 8 Peer 6 Peer 11 Peer 2 Peer 7 Peer 4 1 Source: FR Y-9C; CRE includes the following captions within schedule HC-C: 1a - construction, land development & other land loans, 1d - secured by multifamily (5 or more) residential properties, 1e - secured by nonfarm nonresidential properties; 2 FCNCA excluded due to limited data Well-managed credit over time CRE net charge-off ratio 1,2 CRE loans 1 / total loans CRE loans 1 / total capital 9 As of 12/31/24 41% 36% 35% 27% 27% 22% 16% 16% 15% 14% 14% 14% 12% Peer 7 Peer 10 Peer 1 Peer 4 Peer 12 Peer 11 Peer 6 Peer 5 Peer 9 Peer 3 Peer 8 Peer 2 276% 233% 173% 158% 152% 130% 91% 85% 79% 75% 75% 73% 72% Peer 7 Peer 10 Peer 1 Peer 4 Peer 12 Peer 11 Peer 3 Peer 9 Peer 6 Peer 5 Peer 8 Peer 2 FITB FITB 2008-2010 2022-2024 0.36% 0.28% 0.24% 0.23% 0.23% 0.23% 0.12% 0.08% 0.07% 0.03% 0.01% 0.00% Peer 11 Peer 8 Peer 2 Peer 6 Peer 3 Peer 4 Peer 5 Peer 9 Peer 10 Peer 1 Peer 7 x Annualized CRE NCO for the disclosed period As of 12/31/24

© Fifth Third Bancorp | All Rights Reserved $14.83 $17.64 $18.69 $19.61 $20.40 $21.18 $21.93 3.88% 3.88% 4.58% 4.7% 4.8% 4.9% 4.9% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 10 12 14 16 18 20 22 24 12/31/22 12/31/23 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 +19% +6% Forecast Balance sheet positioned to grow tangible book value per share 10 TBV/S Incl. AOCI AOCI accretion +5% +4% TBV/share will improve due to AOCI accretion alone 1,2 1 See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release; 2 Analysis based on 12/31/2024 portfolio utilizing the implied forward curve as of 12/31/2024 +4% +4% Projected growth from AOCI burndown alone 10-year treasury yield Projected TBV/share growth includes no future earnings contribution Actuals

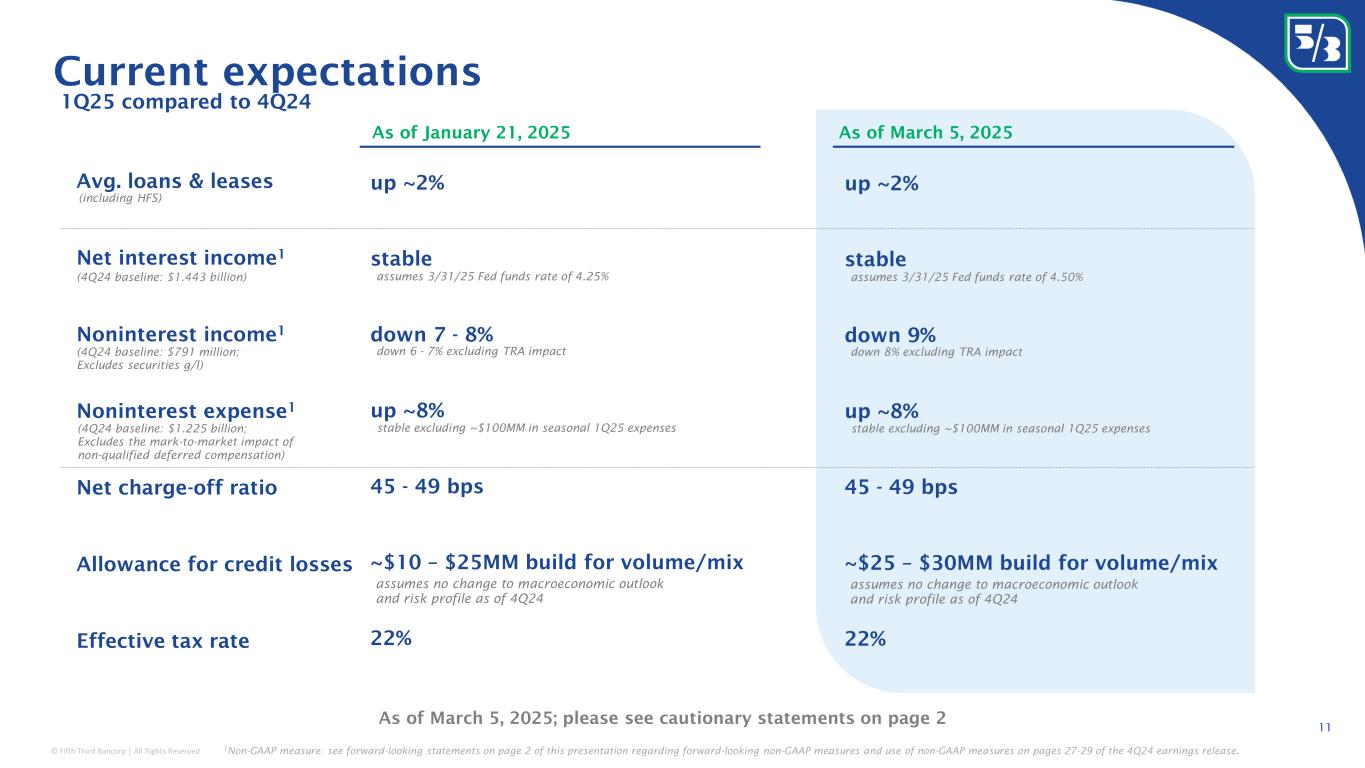

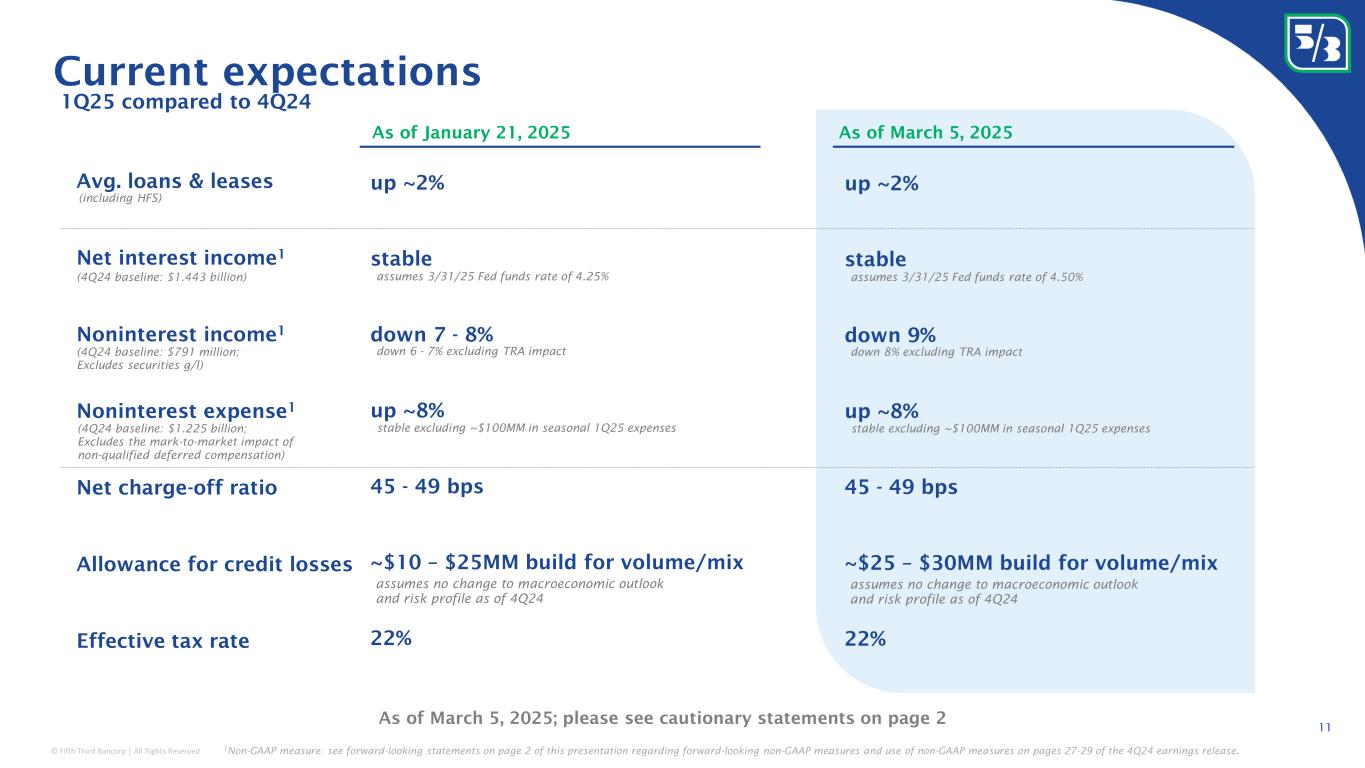

© Fifth Third Bancorp | All Rights Reserved stable Noninterest expense 1 up ~8% (4Q24 baseline: $1.225 billion; Excludes the mark-to-market impact of non-qualified deferred compensation) Net charge-off ratio 45 - 49 bps (including HFS) Avg. loans & leases up ~2% Current expectations 11 Net interest income 1 Noninterest income 1 down 9% (4Q24 baseline: $1.443 billion) (4Q24 baseline: $791 million; Excludes securities g/l) stable excluding ~$100MM in seasonal 1Q25 expenses assumes 3/31/25 Fed funds rate of 4.50% down 8% excluding TRA impact Effective tax rate 22% Allowance for credit losses ~$25 – $30MM build for volume/mix assumes no change to macroeconomic outlook and risk profile as of 4Q24 1Q25 compared to 4Q24 As of March 5, 2025; please see cautionary statements on page 2 1 Non-GAAP measure: see forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the 4Q24 earnings release. As of March 5, 2025As of January 21, 2025 stable up ~8% 45 - 49 bps up ~2% down 7 - 8% stable excluding ~$100MM in seasonal 1Q25 expenses assumes 3/31/25 Fed funds rate of 4.25% down 6 - 7% excluding TRA impact 22% ~$10 – $25MM build for volume/mix assumes no change to macroeconomic outlook and risk profile as of 4Q24

© Fifth Third Bancorp | All Rights Reserved ✓ Well-diversified and resilient balance sheet to provide stability and profitability ✓ Consistent investments to generate balanced and growing revenue streams while maintaining peer-leading expense discipline ✓ Multi-year track record of making appropriate and preemptive changes to the business ✓ Transparent management team Positioned to generate long-term sustainable value to shareholders despite the environment Why Fifth Third 12

© Fifth Third Bancorp | All Rights Reserved Appendix 13

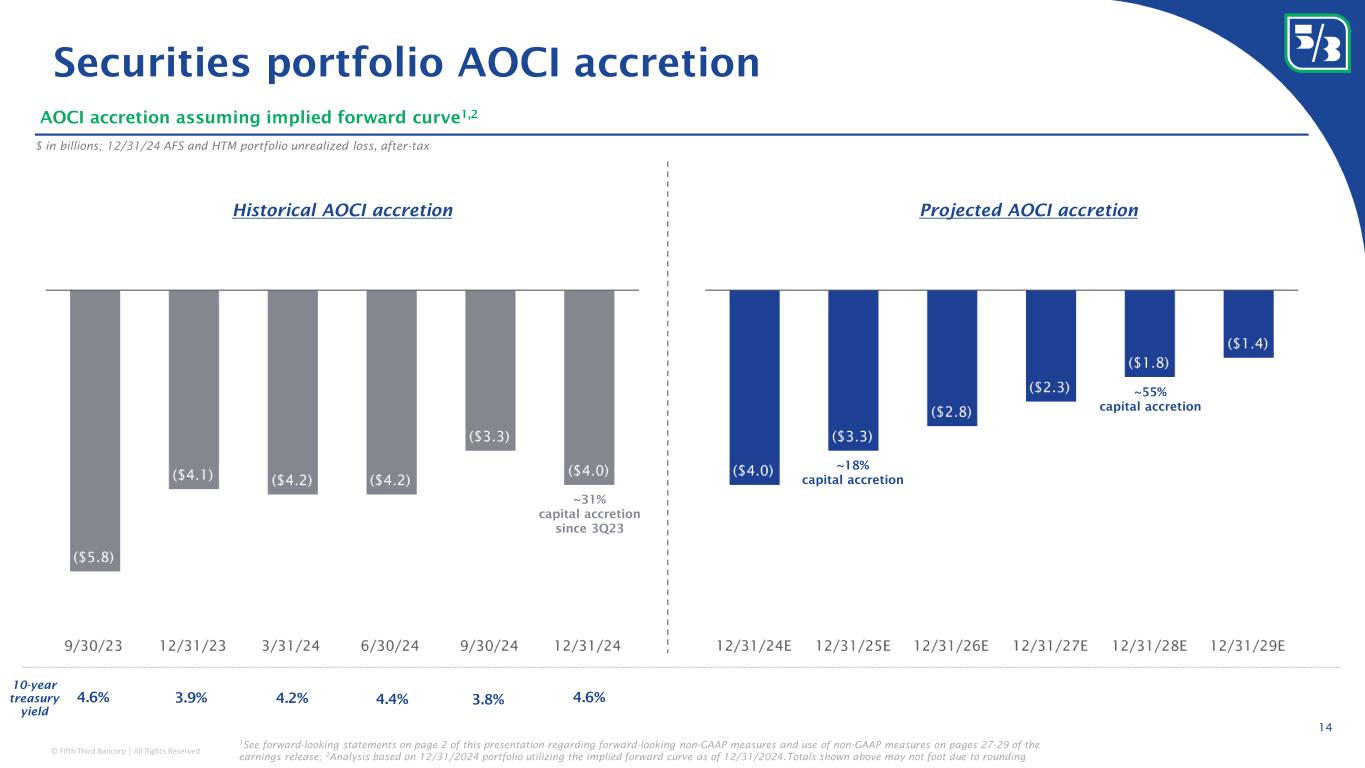

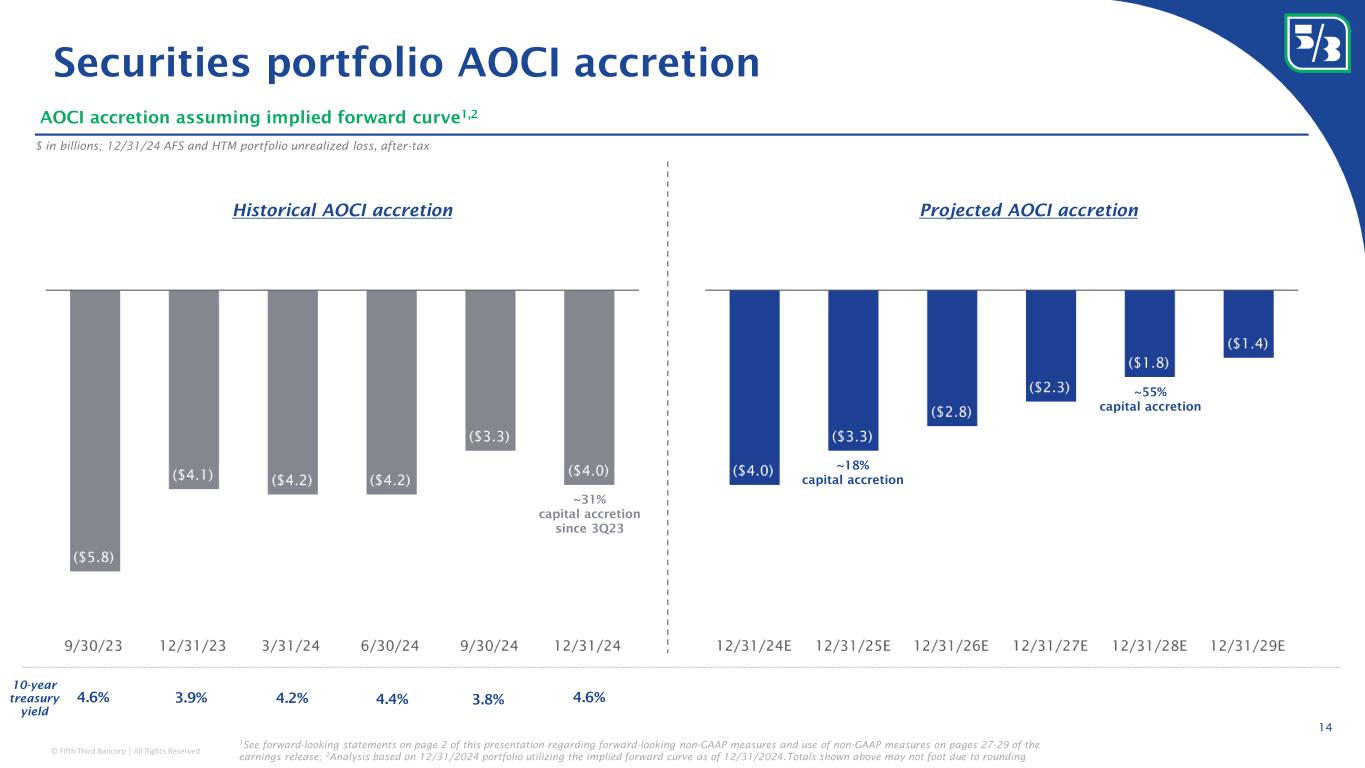

© Fifth Third Bancorp | All Rights Reserved Classification: Internal Use 10-year treasury yield Projected AOCI accretion Securities portfolio AOCI accretion 14 $ in billions; 12/31/24 AFS and HTM portfolio unrealized loss, after-tax ~55% capital accretion ~18% capital accretion Historical AOCI accretion ~31% capital accretion since 3Q23 AOCI accretion assuming implied forward curve 1,2 4.6% 4.2%3.9% 4.4% 3.8% 4.6% 1 See forward-looking statements on page 2 of this presentation regarding forward-looking non-GAAP measures and use of non-GAAP measures on pages 27-29 of the earnings release; 2 Analysis based on 12/31/2024 portfolio utilizing the implied forward curve as of 12/31/2024.Totals shown above may not foot due to rounding

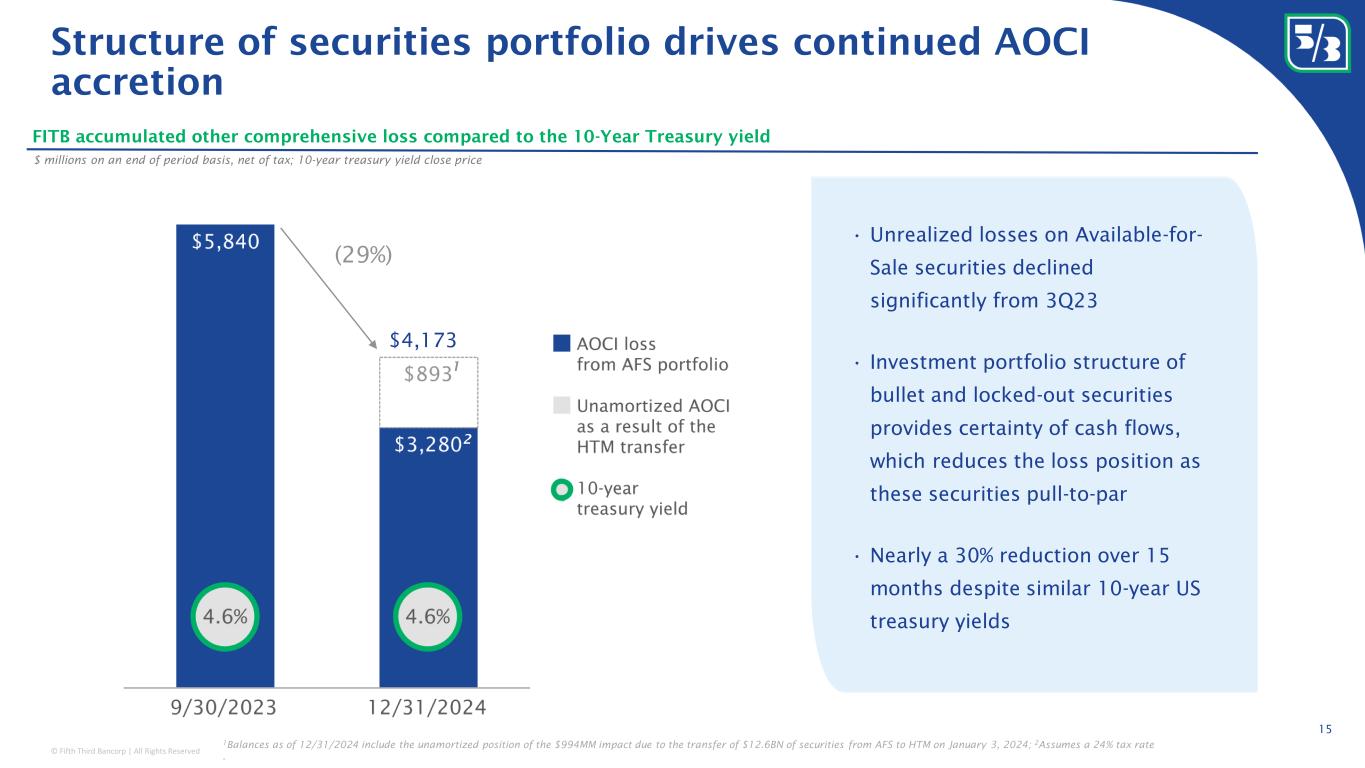

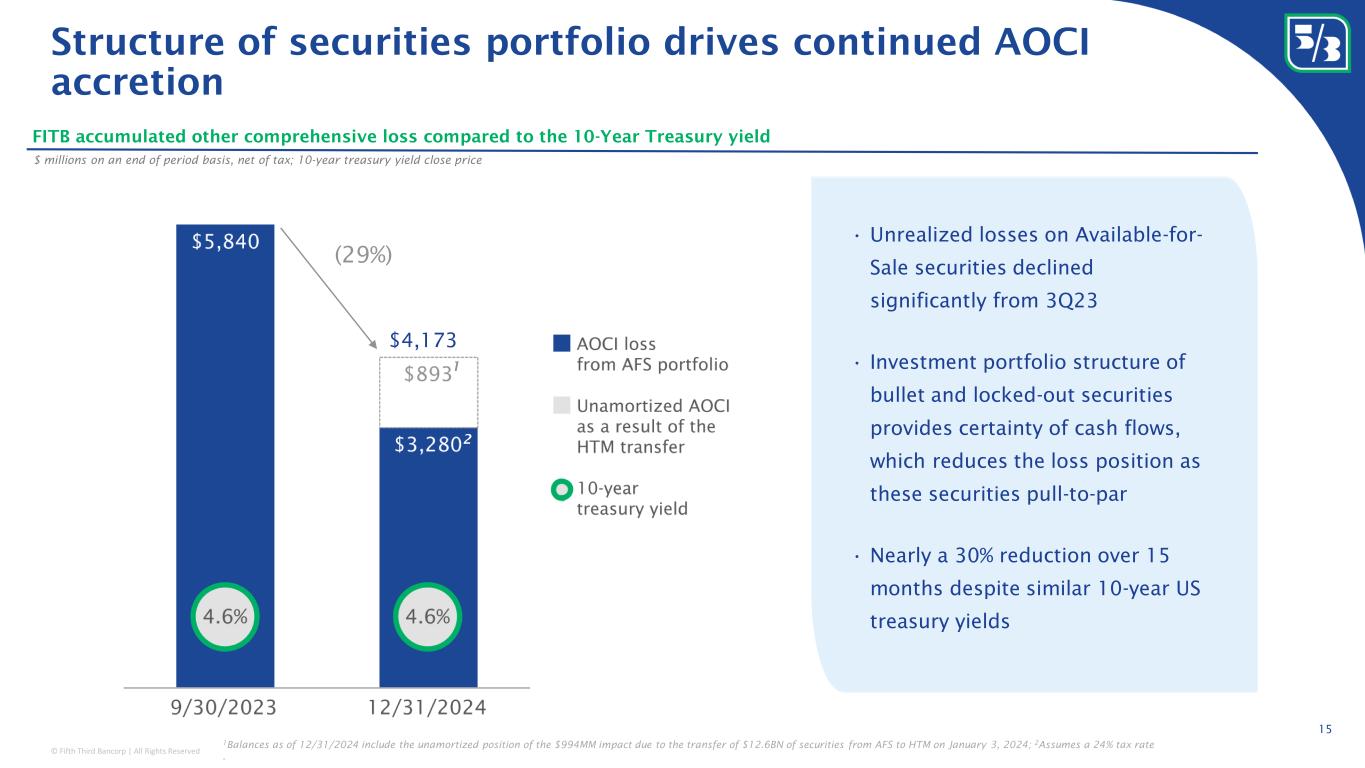

© Fifth Third Bancorp | All Rights Reserved Structure of securities portfolio drives continued AOCI accretion 15 • Unrealized losses on Available-for- Sale securities declined significantly from 3Q23 • Investment portfolio structure of bullet and locked-out securities provides certainty of cash flows, which reduces the loss position as these securities pull-to-par • Nearly a 30% reduction over 15 months despite similar 10-year US treasury yields FITB accumulated other comprehensive loss compared to the 10-Year Treasury yield $ millions on an end of period basis, net of tax; 10-year treasury yield close price 1 $4,173 (29%) 2 1 Balances as of 12/31/2024 include the unamortized position of the $994MM impact due to the transfer of $12.6BN of securities from AFS to HTM on January 3, 2024; 2 Assumes a 24% tax rate .