Fifth Third Bank | All Rights Reserved Acquisition of Crown Bank May 21, 2007 Exhibit 99.2 |

1 Fifth Third Bank | All Rights Reserved Transaction summary Consideration/ $288 million in cash to R-G Financial, Crown Bank assumption of $50 million in TRUPs Expected divestitures None Timing Expected closing 4Q07 Required approvals Standard regulatory approvals Approved by Fifth Third, R-G Financial boards Due diligence Conducted March through May 2007 Conditions of close Lifting of cease and desist (“C&D”) order Delivery of financial statements in accordance with GAAP Minimum closing adjusted tangible equity Other $17.5 million break-up fee Consideration/ $16 million in cash (appraised value) to an R-G leased land Financial affiliate for land currently leased by Crown for 15 branches |

2 Fifth Third Bank | All Rights Reserved Significant enhancement to Florida franchise Manageable risks Expands presence in Orlando and Tampa; creates position in attractive Jacksonville and Georgia markets – Moves Fifth Third from 10 th to 7 th in Orlando deposit market share and from 9 th to 5 th in Tampa – 9 branches (9 th share) in Jacksonville serve as a base for future growth – Accelerates long-term plans in Florida, displaces $4MM+/branch de novo investment for similar locations Opportunity to expand our footprint in Georgia Paying 0.87x book value for Florida franchise (1.56x tangible book value) Accretive to cash basis EPS in first year Generates 19% IRR Significant cost savings achievable from leveraging existing Florida infrastructure Improved profitability readily achievable based on Florida franchise results Existing Florida platform provides for efficient conversion Satisfactory resolution of Crown’s cease and desist order and delivery of financial statements in accordance with GAAP are conditions of closing Transaction highlights Financial discipline |

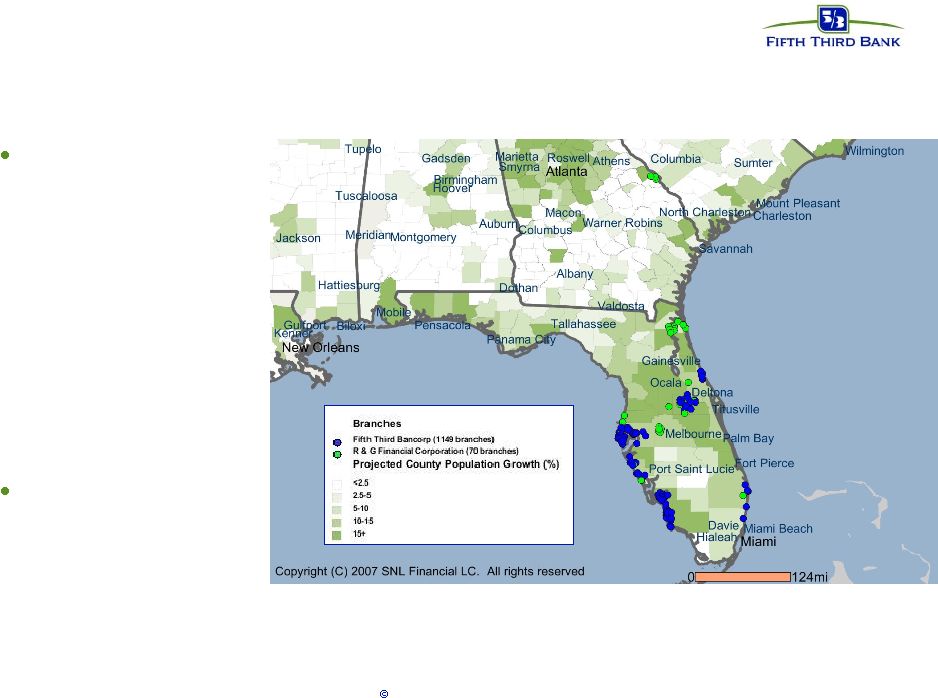

3 Fifth Third Bank | All Rights Reserved Crown Bank R-G Crown established with R-G Financial purchase of Crown Bank in 2002 Subsequent purchase of 18 branches divested in Wachovia/SouthTrust merger Very attractive demographics — 33 branch network (30 in Florida, 3 in Augusta, GA) — Generates high scores in FITB de novo model — Weighted average projected population growth of 14.2% in footprint — Weighted average projected household income growth of 16.0% Crown Bank transitioning from traditional thrift toward full-service banking Earnings have come under pressure given regulatory and accounting issues: 2002 2003 2004 2005 2006 1Q07 Reported to OTS 1 ($4.6MM) $3.1MM $14.7MM $7.5MM $0.8MM ($1.8MM) Estimated post-restatement 2 ($22.5MM) $2.1MM $12.7MM $15.0MM 1 Excluding $2.4 million in acquisition-related expenses in 2005; $3.3 million in restatement-related costs in 2006; and $0.5 million of restatement-related costs in 1Q07. 2 Crown estimates. Subject to revision. Unaudited. |

4 Fifth Third Bank | All Rights Reserved Snapshot of Florida retail franchise Market Demographics Crown Franchise Crown Bank MSA Population Growth Projected Population Growth Household Income Growth Projected Household Income Growth Crown Bank MSA Branches Deposits ($ in Millions) Market Share (%) Share Rank Percent of Total (%) Orlando 23.6% 19.5% 20.7% 14.9% Orlando 7 603 1.9% 11 29.5% Tampa 13.4% 11.9% 20.0% 16.6% Tampa 5 523 1.2% 14 25.6% Jacksonville 17.4% 14.8% 21.1% 17.1% Jacksonville 9 382 1.4% 9 18.7% Augusta (GA) 8.0% 7.0% 22.8% 17.6% Augusta (GA) 3 139 2.4% 10 6.8% Lakeland 14.9% 11.9% 17.5% 13.1% Lakeland 5 125 2.2% 9 6.1% Sarasota 18.0% 15.1% 21.2% 15.9% Sarasota 1 80 0.5% 32 3.9% Punta Gorda 12.4% 8.6% 19.4% 16.2% Punta Gorda 1 74 2.2% 11 3.6% Daytona Beach 14.9% 11.5% 20.1% 16.0% Daytona Beach 1 61 0.8% 17 3.0% Miami/FtL/PB 11.3% 8.5% 21.8% 16.6% FtL/Boca/PB 1 58 0.1% nm 2.8% Weighted Avg 17.0% 14.2% 20.5% 16.0% Total 33 2,045 100.0% National Avg 7.9% 6.7% 22.3% 17.8% Combined Florida MSA Branches Deposits ($ in Millions) Market Share (%) Share Rank Percent of Total (%) Naples 19 1,869 17.5% 1 25.6% Tampa 35 1,592 3.5% 5 21.8% Orlando 23 1,226 3.9% 7 16.8% Fort Myers 16 997 9.1% 4 13.7% Sarasota 11 584 3.5% 4 8.0% Jacksonville 9 382 1.4% 9 5.2% Daytona Beach 6 235 2.9% 8 3.2% FtL/Boca/PB 6 208 0.3% 31 2.9% Lakeland 5 125 2.2% 9 1.7% Punta Gorda 1 74 2.2% 11 1.0% Total 131 7,293 2.0% 7 100.0% 1 Assuming realization of expected net income for Crown in 2010, as proportion of 1Q07 FITB annualized net income SNL Financial Combined Florida Franchise Transaction would raise Florida contribution to 5/3 rd earnings from 6.5% to 9% 1 |

5 Fifth Third Bank | All Rights Reserved Branch locations enhance Fifth Third’s existing Florida franchise — Footprint centered in key Florida demographic areas — Strong fit with existing network (only two consolidations currently expected, one relocation replaced) Three branches in Georgia create regulatory capability for de novo expansion Accelerates momentum in high-growth Florida market |

6 Fifth Third Bank | All Rights Reserved Transaction Comparables Buyer Name Seller Name Bank/ Thrift Deal Value Price/ Branch $MM Price/ Book % Price/ Tangible Book % Price/ Assets % Core Dep. Prem. % Transaction Date Banco de Sabadell TransAtlantic Bank B 175 $ 25 $ 349 349 30 43 1/24/2007 Colonial BancGroup Commercial Bankshares B 317 $ 23 331 332 31 41 1/23/2007 Marshall and Ilsley United Heritage Bankshares B 218 $ 18 306 312 30 38 12/1/2006 Park National Vision Bancshares B 170 $ 11 298 322 24 28 9/14/2006 National City Fidelity Bankshares T 1,038 $ 21 342 368 25 25 7/26/2006 National City Harbor Florida Bancshares T 1,104 $ 27 321 324 34 42 7/10/2006 Boston Private Gibralter Financial Corp. T 242 $ 48 367 370 27 NM 4/18/2005 Colonial BancGroup FFLC Bancorp T 225 $ 14 260 260 21 23 1/14/2005 Whitney Holding Corp First National Bancshares B 120 $ 15 417 436 36 37 7/27/2005 Commerce Bancorp Palm Beach County Bank B 113 $ 16 448 448 32 39 7/25/2005 Alabama National Florida Choice Bankshares B 109 $ 18 260 260 37 40 10/27/2005 Average 22 $ 336 344 30 36 Median 18 331 332 30 39 Fifth Third¹ Crown² 338 $ 10 $ 87 156 11 25 4Q07 1 Purchase price of $338 million for Crown Bank. 2 As of 3/31/07, including Crown expected restatements related to 2002-2005 financial results. Reported equity $389 million, reported tangible equity $225 million; estimated restated equity $390 million, estimated restated tangible equity $216 million. |

7 Fifth Third Bank | All Rights Reserved Financial assumptions Earnings assumptions Profitability Business plan produces ROA equal to 60% of 5/3 rd Florida operations 1 in 2008, 85% in 2009, and 100% in 2010. Earnings growth after 2010 at 5/3rd consensus growth rate of 10%. Asset growth None in 2008 and 2009 (commercial and consumer loan growth offset by run off in mortgage book), 8.5% thereafter Charge-offs 2 25 bps Expense efficiencies $24 million pre-tax 3 (37% of 1Q07 annualized cash expense); 75% realized in 2008, 100% in 2009 Cash one-time costs $48 million pre-tax 3 (2x cost savings) Excess capital $51 million (vs. 6.5% against $2.5 billion in tangible assets) 4 FMV marks Credit marks, less existing allowance of $15 million, equal or less than excess capital Fair market value marks determined at closing Target TCE ratio 6.5% for both Crown and Fifth Third post-transaction No change to Fifth Third share repurchase plans New 30 million share repurchase authorization 1 FITB Florida 1Q07 ROA 1.23%. 2 Crown charge-off ratio range from 7-13 bps from 2004-2006. Charge-off assumption after effect of loan credit-related fair market value purchase accounting adjustments (PAAs). 3 Expense efficiencies after-tax $15 million; one-time costs $30 million after tax. Assumed tax rate 38%. 4 Assumes sale of $300 million investment securities portfolio at closing. 5 Crown tangible equity in excess of 6.5% of $51 million. Assumed marginal tax rate of 38%. |

8 Fifth Third Bank | All Rights Reserved Crown projected cash earnings¹ 20 29 36 Funding of purchase price/one-time costs² ( 15) ( 15) ( 15) Crown cash basis earnings contribution¹ $ 5 $ 14 $ 21 New CDI amortization³ ( 5) ( 4) ( 4) Crown earnings contribution 4 $ 0 $ 10 $ 17 EPS Accretion/(Dilution) 5 Cash basis EPS $ 0.01 $ 0.03 $ 0.04 EPS $ 0.00 $ 0.02 $ 0.03 EPS accretive transaction 1 See assumptions on page 7. Earnings before amortization of intangibles. Crown assumed tax rate of 38%. Includes no benefit from accretion of fair value purchase accounting marks into earnings. 2 Assumes 6.5% cost of cash related to purchase price and funding of cash one-time costs. 3 Assumes CDI and other intangibles created equal to 3% of $1.3 billion total core deposit base amortized over 10 years sum-of-years’ digits. 4 Illustrates net income applicable to common shareholders. Assumes all one-time costs are purchase accounting adjustments (a small amount may be restructuring expenses through P&L). 5 Assumes FITB 1Q07 average fully diluted share count of 554 million. Not a projection for future periods. ($ in millions after-tax) 2008E 2009E 2010E Crown Bank earnings contribution Expect EPS dilution of approximately $0.01 in 4Q07 |

9 Fifth Third Bank | All Rights Reserved Cash purchase price ( $288) Assumption of TRUPs ( $50) After-tax cash one-times ( 30) Excess capital less loan marks¹ 0 Capital to fund asset growth² 0 0 (15) (16) (18) Crown cash income³ 20 29 36 40 44 Net funding impact 4 0 0 0 0 0 Term. value-2013 income (14.7x) 5 711 Incremental Cash Flow ( $368) 20 29 21 24 737 19% $127MM Strong transaction economics ($ in millions) IRR/ 2007 2008 2009 2010 2011 2012 NPV 6 IRR on Crown Bank purchase 1 Crown tangible equity in excess of 6.5% of $51 million, less assumed credit marks to loan portfolio (net of $15 million existing loan loss allowance). Assume marginal tax rate of 38%. 2 Assumes asset growth of 0% in 2008 and 2009 and 8.5% thereafter. 3 Based on assumptions outlined on pages 7 and 8, grown at FITB consensus EPS growth rate of 10% after 2010. 4 Cost of funding restructuring charge offset by interest savings from calling/refinancing trust preferred securities. 5 Terminal value based on Fifth Third’s 5/18/07 forward twelve months P/E ratio of 14.7x. 6 at assumed 11% cost of equity. |

10 Fifth Third Bank | All Rights Reserved Expect total one-time cash costs of $48 million pre-tax or $30 million after-tax¹ Estimated recognition of cash costs — All assumed to be realized in 2007 through purchase accounting adjustments, although some portion will be realized in 2008 and a small portion may be realized through P&L Fair market value adjustments and standard purchase accounting adjustments — Determined as of closing date — Assumed credit-related marks 1 equal to or less than Crown excess capital (tangible equity in excess of 6.5% or $51 million) One-time merger-related costs 1 Net of existing allowance for loan losses of $15 million; assumes marginal tax rate of 38%. |

11 Fifth Third Bank | All Rights Reserved Expect annual expense efficiencies of $24 million pre-tax ($15 million after-tax) — 37% of R-G Crown 1Q07 annualized expense base — Expect to realize 75% in 2008; 100% in 2009 Reductions primarily in headquarters, back-office and redundant systems — Branch network folding into existing affiliates — Back office technology on platform similar to 5/3 rd — Customer facing sales positions expected to be largely unaffected Achievable expense efficiencies 1 Assumes 38% marginal tax rate. |

12 Fifth Third Bank | All Rights Reserved Re-mix of Crown core deposit base — Transaction deposits represent 43% of Crown’s core deposits, 79% of Fifth Third Florida — Fifth Third Bank AA debt ratings vs. Crown Bank’s BB ratings Re-mix of Crown loan book — 70% of Crown loan book residential mortgages vs. 23% of 5/3rd Florida — Additional business banking, middle market penetration Better fee penetration — Approximately 10% of Crown revenue from fees, vs. 20%+ historically 1 and 25-30% for Fifth Third Florida — Key drivers: transaction deposit fees, merchant sales, mortgage banking 1 Much stronger starting position than with de novo alternative Significant revenue opportunity 1 C&D order currently limiting mortgage sales |

13 Fifth Third Bank | All Rights Reserved Financial highlights - combined Combined Crown Fifth Third 537 43 494 Nonperforming assets 38 bps 10 bps 39 bps Net charge-offs/avg loans Estimated pro forma capital ratios² 7.2% 7.6% 7.6% TCE/TA ratio 102,842 3,018 99,824 Assets 9.2% 7.7% 9.4% Leverage ratio 7,271 225 7,454 Tangible common equity 1 11.2% 12.1% 11.2% Total capital ratio 8.7% 11.4% 8.7% Tier 1 capital ratio 9,804 389 9,804 Shareholders equity 1 62,061 1,335 60,726 Core deposits 77,264 2,443 74,821 Loans and leases As of March 31, 2007 1 As reported to OTS; excluding Crown expected restatements related to 2002-2005 financial results; does not include purchase accounting adjustments, including fair market value PAAs at closing. 2 Combined columns include estimated exit-cost purchase accounting adjustments; assumes credit-related fair market value PAAs to loans on an after-tax basis equal to current Crown TCE > 6.5% of $51 million; additional fair value purchase accounting adjustments determined as of closing. |

14 Fifth Third Bank | All Rights Reserved Unique opportunity to expand Florida franchise — Accelerates plans for Orlando and Tampa — Adds Jacksonville platform — Ability to build de novo branches in Georgia Very attractive pricing relative to recent Florida transactions — Meaningful contribution to 5/3 rd EPS and Florida presence for small financial investment at strong IRR — Attractive earnings/economic characteristics relative to de novo alternative - $127 million NPV from $338 million investment — Pricing reflects Crown difficulties as well as discount for expected credit deterioration in Florida Significant opportunities for profitability enhancement — Crown currently under-earning relative to potential — Cost savings readily achievable in integration — Offer full-service product set/deeper distribution network Summary |

15 Fifth Third Bank | All Rights Reserved Cautionary statement This report may contain forward-looking statements about Fifth Third Bancorp and/or the company as combined acquired entities within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. This report may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Fifth Third Bancorp and/or the combined company including statements preceded by, followed by or that include the words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trend,” “objective,” “continue,” “remain” or similar expressions or future or conditional verbs such as “will,” “would,” should,” “could,” “might,” “can,” “may” or similar expressions. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions, either national or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, are less favorable than expected; (2) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (3) changes in the interest rate environment reduce interest margins; (4) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (5) changes and trends in capital markets; (6) competitive pressures among depository institutions increase significantly; (7) effects of critical accounting policies and judgments; (8) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies; (9) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged; (10) ability to maintain favorable ratings from rating agencies; (11) fluctuation of Fifth Third’s stock price; (12) ability to attract and retain key personnel; (13) ability to receive dividends from its subsidiaries; (14) potentially dilutive effect of future acquisitions on current shareholders' ownership of Fifth Third; (15) difficulties in combining the operations of acquired entities; (16) effects of accounting or financial results of one or more acquired entity; (17) ability to secure confidential information through the use of computer systems and telecommunications network; and (18) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. Additional information concerning factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements is available in the Bancorp's Annual Report on Form 10-K for the year ended December 31, 2006, as amended, filed with the United States Securities and Exchange Commission (SEC). Copies of this filing are available at no cost on the SEC's Web site at www.sec.gov or on the Fifth Third’s Web site at www.53.com. Fifth Third undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this report. |