Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Lehman Brothers Financial Services Conference Kevin Kabat, President and CEO September 11, 2007 Exhibit 99.1 |

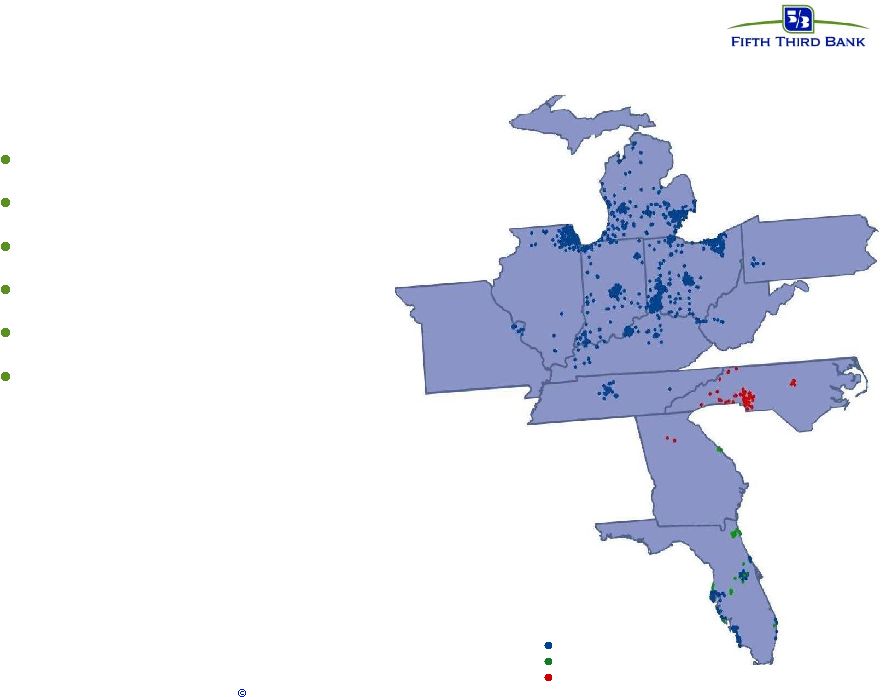

2 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Fifth Third profile $101 billion assets (#13) $20 billion market cap* (#12) 1,167 banking centers 2,132 ATMs 18 affiliates in 10 states $1.5 billion operating income # * as of 8/24/07. # 2Q07 annualized. Cincinnati Florence Louisville Lexington Nashville Atlanta Augusta Orlando Tampa Naples Raleigh Charlotte Huntington Pittsburgh Cleveland Columbus Toledo Detroit Grand Rapids Traverse City Chicago Evansville St. Louis Jacksonville Indianapolis Fifth Third’s current footprint R-G Crown First Charter |

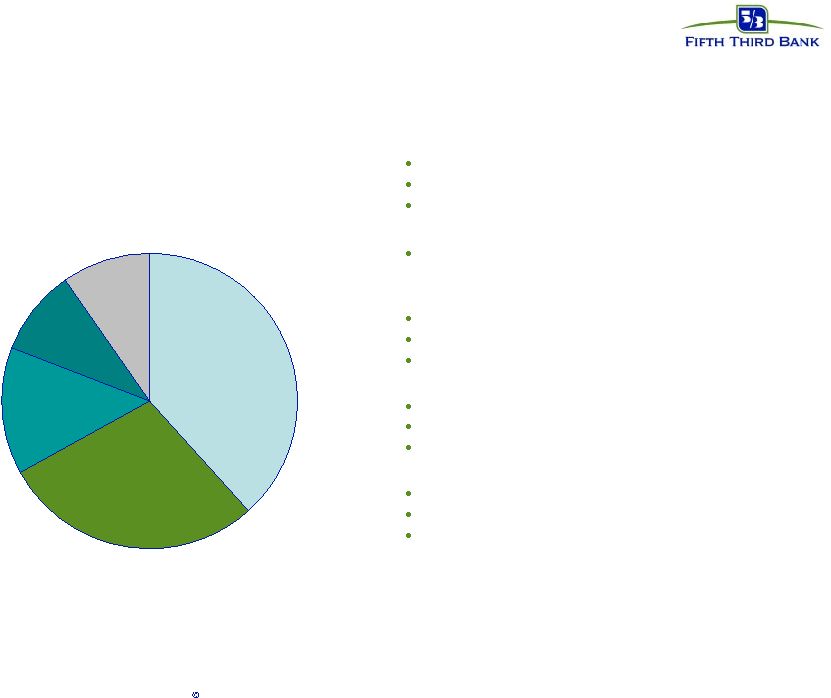

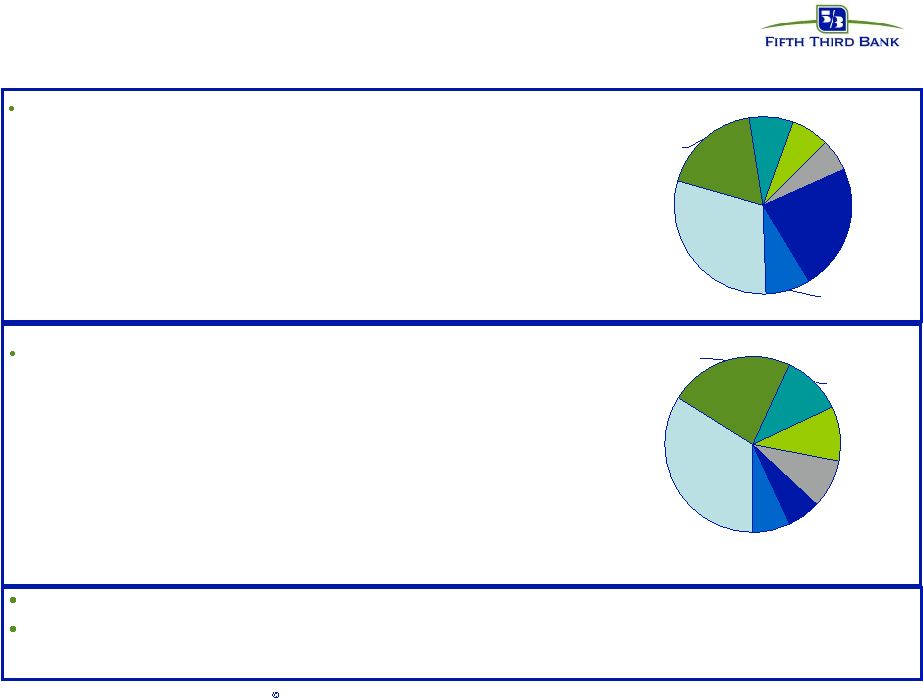

3 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Diversified franchise 38% 14% 29% 9% 10% 2007 Revenue - $6 billion* Branch Banking $2.3B FTPS $835M Investment Advisors $563M Commercial Banking $1.7B Consumer Lending $581M Branch Banking (38% of earnings) Retail & Business banking 2.7 million households 1,167 branches, 2,132 ATMs Commercial Banking (29%) Corporate & Middle Market Lending, Treasury Services, International Trade Finance, Commercial leasing and syndicated finance Processing Solutions (FTPS) (14%) Over 145,000 merchant locations Processes transactions for over 2,400 Financial Institutions 3 leading issuer of MasterCard Branded debit cards Consumer Lending (10%) 8,700 dealer indirect auto lending network $40.9 billion mortgage servicing portfolio Federal and private student education loans Investment Advisors (9%) 2,000 Registered Representatives 423 Private Bank Relationship Managers Over 80,000 Private Bank Relationships *Represents tax-equivalent revenue. Excludes $(256)MM general corporate and other; data YTD annualized. 1 Source Media 2007 edition rd 1 |

4 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Historical context Strong sales culture — Loan, deposit growth > industry — Affiliate/entrepreneurial drive Strong expense management — Low 50s efficiency ratio Average service/customer satisfaction — “Sold through” attrition (e.g., DDA high-teens) Internal orientation Retain and leverage historical strengths while capturing incremental growth opportunities |

5 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference (CAGR: YTD 2007 vs. YTD 2003: per share) Source: SNL Financial; data shown per share to adjust for effect of acquisitions. 1 ROE for peers uses First Call actual operating earnings to compute ROE. 2 Median of top 20 banks (excluding trust banks, C, JPM); median revenue growth of five processing companies (FDC, ADS, FISV, GPN, TSS); 3 Average of large Midwest peers (NCC, PNC, HBAN, MI, KEY, CMA, USB). Strong underlying performance 14.9% 13.6% 15.2% ROE 1 58.5% 58.6% 56.1% Efficiency ratio 17% 13% 23% Credit card loan growth N/A 14% 16% Processing fee growth 3% 5% 7% Core deposit growth 7% 9% 14% Loan growth Midwest Peers 3 Peer Group 2 Fifth Third |

6 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Strategic focus: 2007–2009 Strategic focus: 2007–2009 Deliver growth in excess of industry Enhance the customer experience Increase employee engagement Institutionalize enterprise operational excellence Banking Banking Processing Processing Investments Investments Employee Engagement Customer Experience Operational Excellence Fifth Third Bank |

7 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Growth opportunities Areas of evident success — De novo – accelerate new branch openings — Healthcare – enhance product offerings, specialized channel — Credit card – increase cardholder acquisition Works in progress — Middle market expansion – expand products, services, and sales — Small business banking – leverage existing distribution channels — Commercial underserved markets – targeted markets for deployment of additional bankers and teams Deferred — Commercial new markets (LPOs) – targeted markets for deployment of additional bankers and teams |

8 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference De novo activities • Opened 55 total new branches in the past 12 months • Continue to invest in high opportunity markets • Site selection focuses on market potential, predictive modeling and IRR optimization • De novo activity has been, and will continue to be, of significant economic value to Fifth Third 2007- 2009 planned builds 47% 28% 7% 18% Florida Chicago Other Tennessee * Six years De novo statistics • Mature* deposits $40MM • Mature* loans $13MM • Expected IRR 20%+ • Breakeven 20 months • Cumulative breakeven 36 months |

9 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Credit cards: capturing our fair share 13th largest bank, 24th largest credit card issuer We’ve underinvested in the credit card business relative to competitors Significant opportunity in high risk-adjusted return business — Improve retail production by deploying sales technologies to enhance ease of sale — Move from “ultra” conservative underwriting to “conservative” underwriting (weighted average FICO from >740 to >720) — Optimize profitability of existing portfolio through modest investments in marketing, analytics, and human capital Goal: double assets, accounts, net income by 2009 Assets Accounts Net income 2006 2009 1,100 2,400 1.0 2.0 41 83 ($ MMs) |

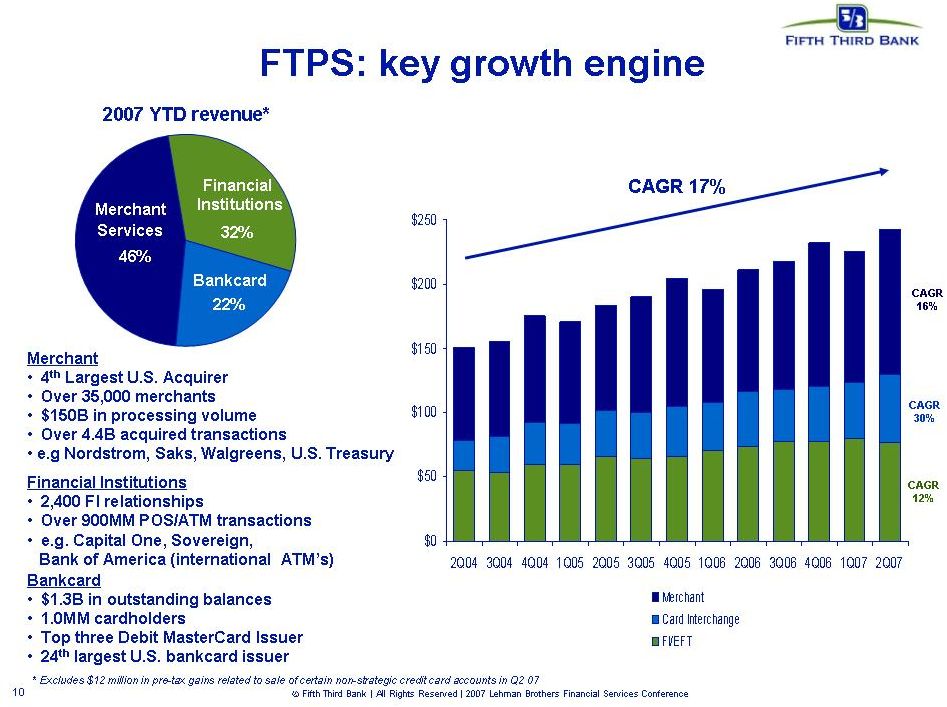

10 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference |

11 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Fifth Third healthcare strategy Relationships • less than 50 hospitals/health systems (<10 for-profit) • less than 2,000 physicians/medical practice groups • Over 600 healthcare entities in-footprint with revenues > $100 Million • Approximately 150,000 healthcare entities in-footprint; < 5,000 existing relationships Relationships • Primary Bank for fewer than 50 hospitals / health systems • Over 600 healthcare entities in-footprint with revenues > $100 Million • Current market share of 2.3% (12.7% gap to total commercial business market share) Significant opportunity to gain share within footprint and in selected national markets Promote a comprehensive healthcare strategy for the Bancorp • Establish healthcare as a core competency of Fifth Third - Hired senior executive to lead initiative - Established national team to target relationships in excess of $100M - Coordinate all healthcare strategies and offerings across all LOBs • Define healthcare market, targeted opportunities, and pursuit strategy - EOB image capture, denial management and secondary billing capabilities - Pharma, disease management, dialysis, hospice, OT/PT, imaging - Managed care, home health, insurance, specialty hospitals, behavioral health • Double current market share of 2.3% -> 5% by 2011 |

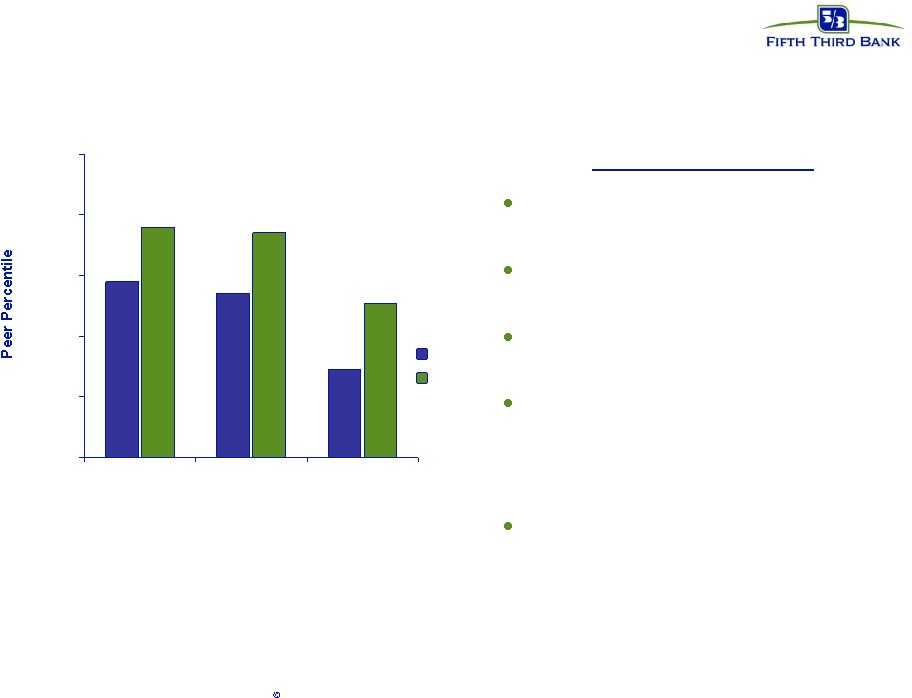

12 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Fifth Third: relative service performance 54% 29% 76% 74% 51% 58% 0% 20% 40% 60% 80% 100% Overall Satisfaction Loyalty Problem Incidence 3Q05 2Q07 45% 55% 36% 46% 27% 21% 2007 Key Actions Financial Center service optimization initiative launched Add KDI component to new incentive compensation plan Financial Center action planning in place Implementing a consistent process and support tools for handling customers problems at the Financial Centers and Call Center Creating a central escalation team to manage problems that cannot be resolved immediately Source : Gallup Customer Surveys: 3Q05/2Q07 Percentages within bars = % of surveyed customers rating metric at target level or experiencing a problem Goal: 75 th percentile |

13 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Copyright © 2007 The Gallup Organization, Princeton, NJ. All rights reserved. 14 59 54 24 32 17 0% 20% 40% 60% 80% 100% Fifth Third Bank Overall 2005 Fifth Third Bank Overall 2007 Engaged – Loyal and psychologically committed Not Engaged – Productive but not psychologically connected Disengaged 1.41:1 2.29:1 Ratio of Engaged to Actively Disengaged * Source: Gallup Poll data of U.S. working population 18 years and older, accumulated during 2006 2.67:1 2007 Gallup Overall Database 2.00:1 U.S. Working Population* Employee Engagement update +33% - 8% -18% |

14 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Enterprise Operational Excellence Improve operational efficiencies — Standardize, digitize and optimize core processes — Deploy technology to eliminate manual processes and improve quality — Reducing cycle times and errors is increasing customer satisfaction Modernize servicing platforms and capabilities — Understand our customers, know our customer & know their issues — Call Center transformation to improve customer experiences — Provide seamless & consistent support between web, voice, ATM, etc. Integrated product suites to help our customers be more effective — Remote Capture product suite — Virtual vault — National Lockbox — Healthcare EOB 835 suite |

15 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Capital plan Current tangible capital levels very strong — Tangible common equity/tangible assets ratio of 6.92% at 6/30/2007 — Post acquisition TCE/TA target: 6.5% (Crown = 45 bps, First Charter = 35 bps) 2007 plans — Improve efficiency of capital structure through limited substitution of hybrids for common stock — Remaining share repurchase authorization of approximately 22 million shares (as of 6/30/2007) Future considerations — Evaluate future capital position in context of performance, operating environment, and acquisition plans — Maintain strong regulatory capital levels in conjunction with management of tangible equity ratio — Maintain strong capital levels relative to peers and commensurate with business profile |

16 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Residential real estate - topical areas* Mortgage: $8.5B outstanding — 1 st liens: 100% — Weighted average LTV: 80%; weighted average FICO: 720 – Origination FICO bands: <659 13%; 660-689 11%; 690-719 17%; 720-749 18%; 750+ 39% (note: loans <659 includes CRA loans and FHA/VA loans) — % through broker: 10% — NPAs: $112MM (1.30%); over 90s: $98MM (1.15%) — Charge-offs: $16MM YTD (0.38%) OH 34% IL 10% KY 9% FL 6% MI 23% IN 11% Other 7% OH 30% FL 23% IL 7% KY 6% MI 18% IN 8% Other 8% * All data as of 6/30/07 Home equity: $11.8B outstanding — 1 st liens: 30%; 2 nd liens: 70% (25% of 2 nd liens behind FITB 1 st s) — Weighted average CLTV: 78% (1 st liens 62%; 2 nd liens 83%) — Weighted average FICO: 742 (1 st liens 750; 2 nd liens 740) – Origination FICO bands: <659 5%; 660-689 10%; 690-719 16%; 720-749 20%; 750+ 48% — % through broker: 23% (broker WA FICO 735; direct WA FICO 745) — NPAs: $68MM (0.58%); over 90s: $61MM (0.52%) — Charge-offs: $36 million YTD (0.61%) No subprime Alt A originations: 2Q07 $192MM; $123MM warehouse, WA FICO 702, WA LTV 73% — $38MM in loan portfolio (viewed as unsaleable in current market environment), WA FICO 698 |

17 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Commercial portfolio - topical areas* Commercial real estate (CRE) Total outstandings $16.5B — Commercial mort $11.0B (50% owner occ’d) — Construction 5.5B (20% owner occ’d) Total CRE 16.5B (40% owner occ’d) Total CRE exp $20.2B — Average size $1MM (relationship) — 39% of commercial loans, 22% of total loans Problem assets — NPAs $183MM (1.11%) — > 90 days past due 70MM (0.42%) — YTD charge-offs 35MM (0.41%) Syndicated lending Total loans ~$4B outstandings — PD rating # 5.5 vs. 6.5 for commercial portfolio — Ave size ~$8 million — Relationships ~550 < 10% of commercial loans, < 5% total loans Leveraged^ < $200MM outstandings — Ave size ~$6MM — Relationships ~20 — Syndication warehouse $100 million – No “hung” deals Problem assets – NPAs $12MM – >90 days past due 0MM Commercial paper conduit $3.3B facility — High quality, short-term commercial loans, commercial receivables, commercial securities — No subprime, mortgage assets in conduit Fully backed and enhanced by Fifth Third Bank — Liquidity facility not utilized to date (9/7/07) # Weighted average probability of default rating ^Regulatory HLT definition, i.e., priced at L+250 bps or greater Office 23% Other 11% Raw land 5% Land under devel't 7% Indu 14% Apts 18% Retail 18% Devel'd land 4% CRE collateral type * All data as of 6/30/07 |

18 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference M&A – what matters to Fifth Third Markets — Expansion into demographically attractive geographies — Creation of deeper shares in existing markets Attractive business lines — Supplement existing business, addition of complementary businesses or capabilities Favorable economics — Conservative assumptions — Pricing metrics in line or better than comparable transactions — Accretion within a reasonable timeframe — Deal IRR hurdle of mid-teens Protection of debt ratings |

19 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Fifth Third: building a better tomorrow Balancing growth and profitability Capitalizing on strengths and developing plans to address areas of weakness Communicating clearly with investors Delivering on promises Returning to above-par performance and shareholder returns |

20 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Appendix |

21 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference First Charter Acquisition Manageable risks $4.9 billion in assets, $3.2 billion in deposits, 59 branches – Immediate presence in Charlotte, ranking 4th in deposit market share – Entry into the Charlotte, Raleigh-Durham and Atlanta markets – 5 branches in Raleigh serve as a base for future growth Opportunity to develop Georgia presence Helps connect Fifth Third’s Midwest and Florida operations Cash EPS accretion, operating EPS neutrality achieved within two years of closing*, excluding revenue synergies IRR of 14%, excluding revenue synergies Achievable cost savings, earnings growth assumptions; Significant revenue enhancement opportunities present but not modeled Price/earnings ratio, price/book ratio, price/tangible book ratio considerably lower than comparable deals Maintaining target TCE/TA ratio of 6.5% Strong credit history – Recent Penland situation an isolated situation, reserves adequate – Remaining portfolio continues to perform relatively well Previous financial reporting issues solved and behind the company Transaction highlights Financial discipline * Assumes 1Q08 closing, 1Q09 measurement date. |

22 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference |

23 Fifth Third Bank | All Rights Reserved | 2007 Lehman Brothers Financial Services Conference Additional information Where You Can Find Additional Information About The Merger The proposed Merger will be submitted to First Charter’s shareholders for consideration. Fifth Third will file a Form S-4 Registration Statement, First Charter will file a Proxy Statement and both companies will file other relevant documents regarding the Merger with the Securities and Exchange Commission (the “SEC”). First Charter will mail the Proxy Statement/Prospectus to its shareholders. These documents, and any applicable amendments or supplements, will contain important information about the Merger, and Fifth Third and First Charter urge you to read these documents when they become available. You may obtain copies of all documents filed with the SEC regarding the Merger, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents free of charge from Fifth Third’s website (www.53.com) under the heading “About Fifth Third” and then under the heading “Media and Investors-Investor Relations” and then under the item “SEC Filings.” You may also obtain these documents, free of charge, from First Charter’s website (www.FirstCharter.com) under the section “About First Charter” and then under the heading “Investor Relations” and then under the item “Financial Reports / SEC Filings.” Participants in The Merger Fifth Third and First Charter and their respective directors and executive officers may be deemed participants in the solicitation of proxies from First Charter’s shareholders in connection with the Merger. Information about the directors and executive officers of Fifth Third and First Charter and information about other persons who may be deemed participants in the Merger will be included in the Proxy Statement/Prospectus. You can find information about Fifth Third’s executive officers and directors in its definitive proxy statement filed with the SEC on March 9, 2007. You can find information about First Charter’s executive officers and directors in its definitive proxy statement filed with the SEC on March 25, 2007. You can obtain free copies of these documents from the websites of Fifth Third, First Charter or the SEC. |