Fifth Third Bank | All Rights Reserved Lehman Brothers Global Financial Services Conference Kevin Kabat, Chairman, President & CEO September 9, 2008 Exhibit 99.1 |

2 Fifth Third Bank | All Rights Reserved Naples Raleigh Agenda Overview 2Q08 results Operating trends Credit trends Capital position Summary and priorities Appendix Cincinnati Florence Louisville Lexington Nashville Atlanta Augusta Orlando Tampa Naples Raleigh Charlotte Huntington Pittsburgh Cleveland Columbus Toledo Detroit Grand Rapids Traverse City Chicago Evansville Jacksonville Indianapolis St. Louis |

3 Fifth Third Bank | All Rights Reserved Naples Fifth Third overview ^ As of 6/30/2008 * As of 9/05/2008 ** Nilson, March 2008 $115 billion assets #14 ^ $9 billion market cap #12 * Over 1,300 banking centers Over 2,300 ATMs 18 affiliates in 12 states World’s 5 th largest merchant acquirer ** Cincinnati Florence Louisville Lexington Nashville Atlanta Augusta Orlando Tampa Naples Raleigh Charlotte Huntington Pittsburgh Cleveland Columbus Toledo Detroit Grand Rapids Traverse City Chicago Evansville Jacksonville Indianapolis St. Louis |

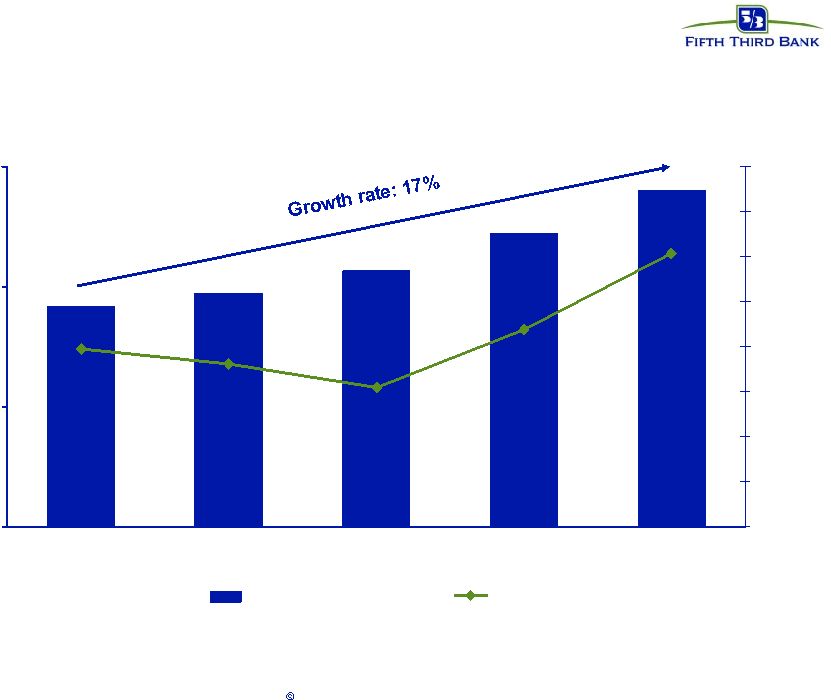

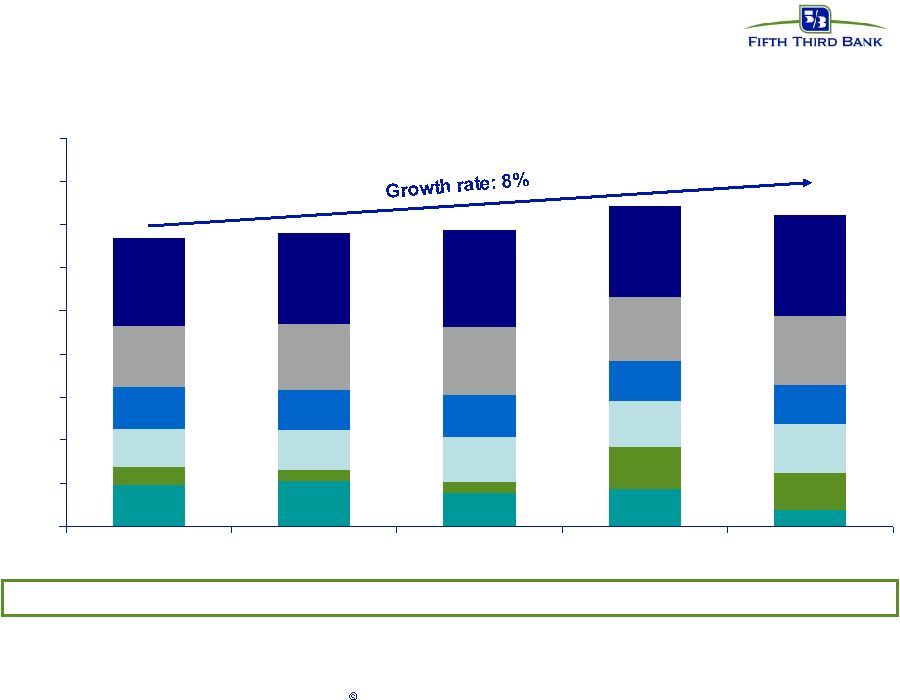

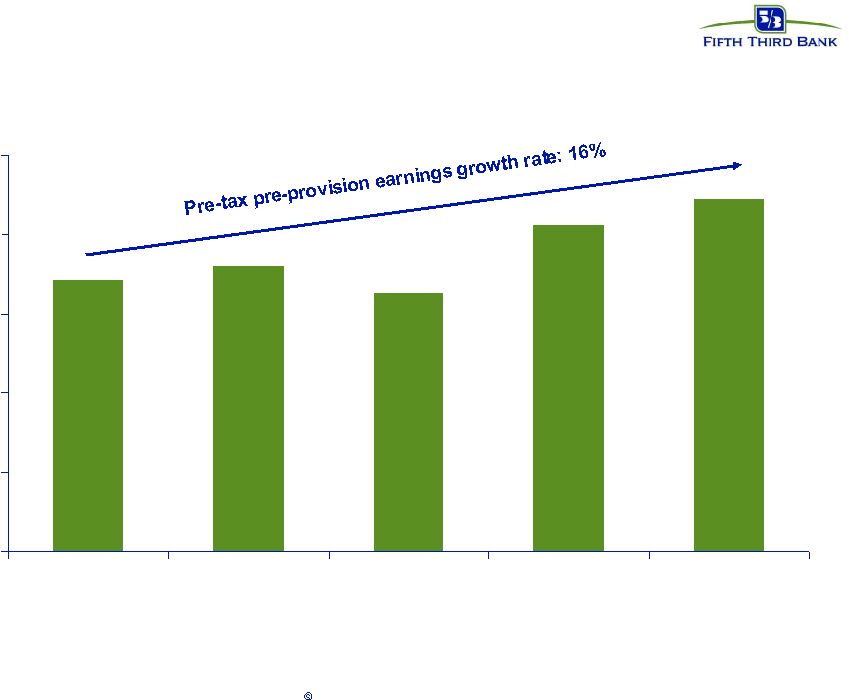

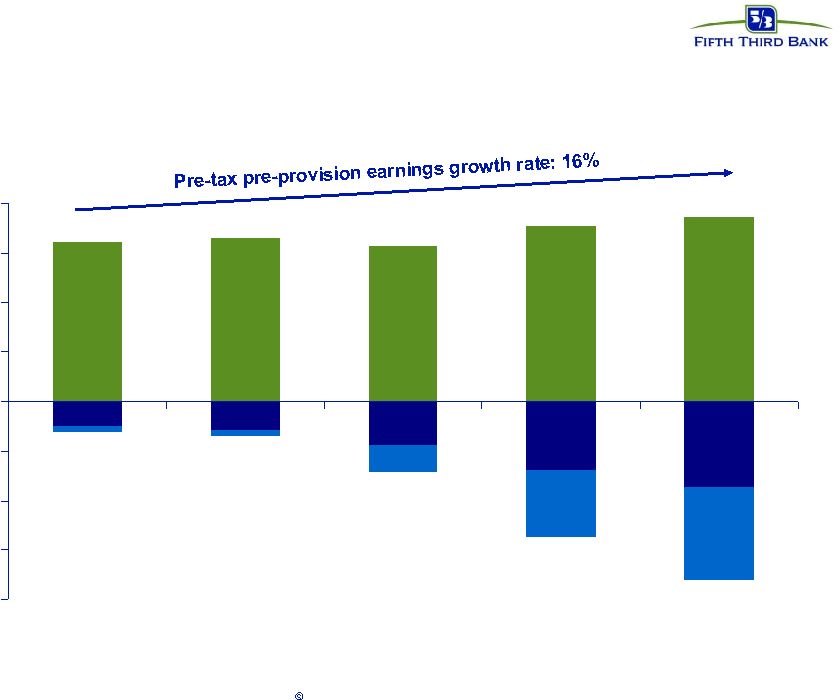

4 © Fifth Third Bank | All Rights Reserved 2Q08 in review Difficult quarter due to economic environment — Significant increase in net charge-offs and provision expense – Net charge-offs of $344 million, provision expense of $719 million — Charges related to the tax treatment of leveraged leases Core business momentum remains strong – core pre-tax pre-provision income up 16% from 2Q07* — Net interest income growth flat, but up 17% excluding $130 million leveraged lease litigation charge — Fee income growth of 8% on double digit growth in payments processing revenue, deposit service revenue, corporate banking revenue, and mortgage banking revenue — Average loan growth of 11% and transaction deposit growth of 6% ^ Issued $1.1 billion in convertible preferred securities, reduced dividend to $0.15 per quarter — Tier 1 capital ratio of 8.51% — Tangible equity ratio of 6.37% — Anticipated sale of non-core businesses expected to generate more than $1 billion after tax in tangible equity capital * Reported pre-tax pre-provision income of $602 million; excluding $130 million in leveraged lease charge to net interest income and $13 million in acquisition related expenses, core results $745 million ^ Loans include held for investment; transaction deposits represent core deposits excluding CDs |

5 Fifth Third Bank | All Rights Reserved 3.00% 3.25% 3.50% 3.75% 2Q07 3Q07 4Q07 1Q08 2Q08* $500 $550 $600 $650 $700 $750 $800 $850 $900 Net interest income NIM Increasing net interest income *Reported net interest income of $744 and net interest margin of 3.04%. 2Q08 results above exclude $130 million charge related to leveraged lease litigation |

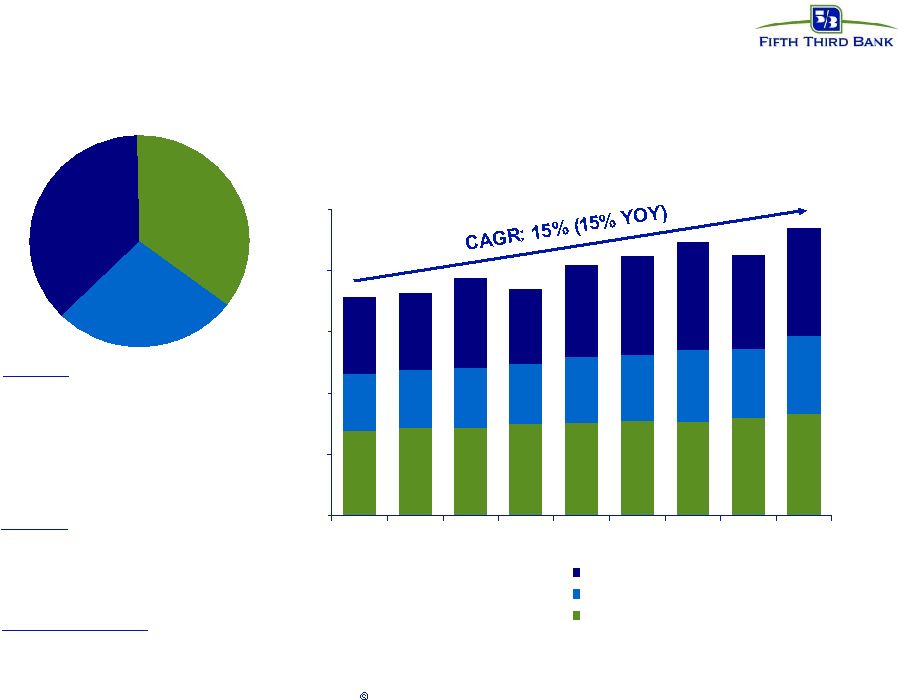

6 Fifth Third Bank | All Rights Reserved Fee income growth and diversification $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2Q07 3Q07 4Q07 1Q08 2Q08 Payment processing Deposit service charges Investment advisory Corporate banking Mortgage Secs/other Excludes $152 million BOLI charge and $273 million Visa IPO gain in 1Q08; excludes $177 million BOLI charge in 4Q07. YOY growth +15% +12% -5% +26% +108% -59% Continued strong growth in processing, deposit fees and corporate banking fees |

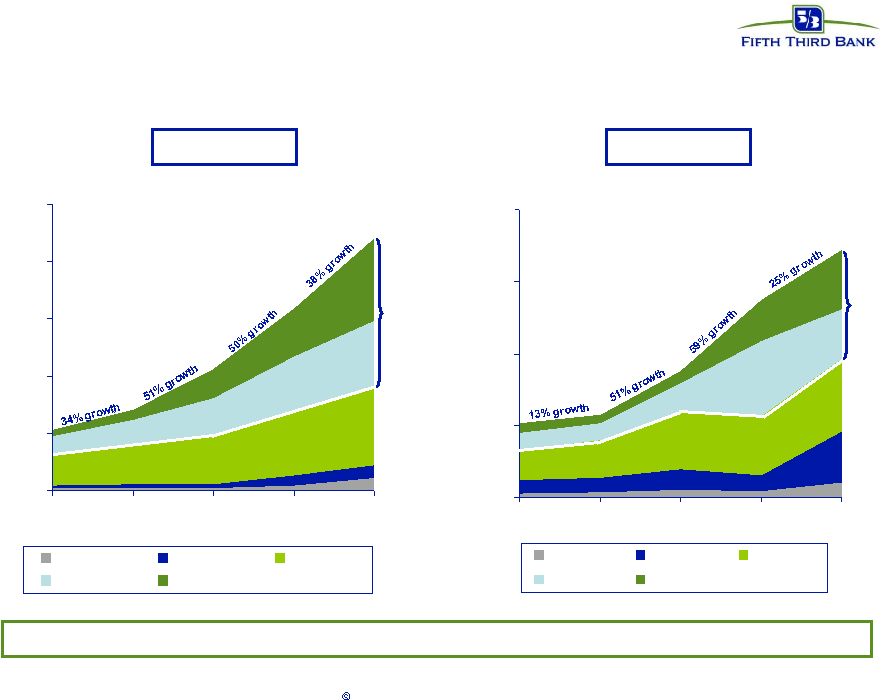

7 Fifth Third Bank | All Rights Reserved FTPS: key growth engine 2Q08 revenue 37% 36% 27% Merchant Services Financial Institutions Bankcard $0 $50 $100 $150 $200 $250 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 Merchant Bankcard FI/EFT +19% 2-Yr CAGR Merchant • 4 Largest U.S. Acquirer • Over 37,500 merchants • $26.7B in credit/debit processing volume • Over 5.6B acquired transactions • e.g. Nordstrom, Saks, Walgreen's, Office Max, Barnes and Noble, U.S. Treasury Financial Institutions • 2,700 FI relationships • 877mm POS/ATM transactions Bankcard • $2.0B in outstanding balances • 1.6MM cardholders • Top three Debit MasterCard Issuer • 23rd largest U.S. bankcard issuer YOY growth +16% +10% +16% +20% +10% th |

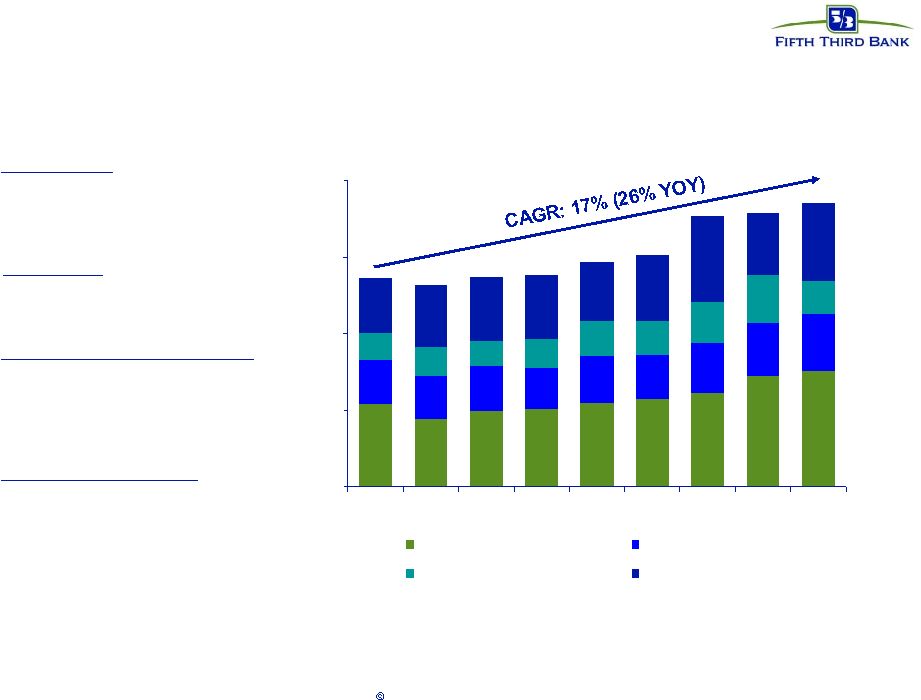

8 Fifth Third Bank | All Rights Reserved Corporate banking $0 $30 $60 $90 $120 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 International Business lending Derivatives Capital markets lending fees 2-Yr CAGR YOY growth +19% +10% +14% +18% +29% -6% +23% +38% International • Letters of credit • Foreign exchange Capital markets lending fees • Institutional Sales • Asset securitization/conduit fees • Loan/lease syndication fees Derivatives • Customer interest rate derivatives Business lending fees • Commitment and other loan fees |

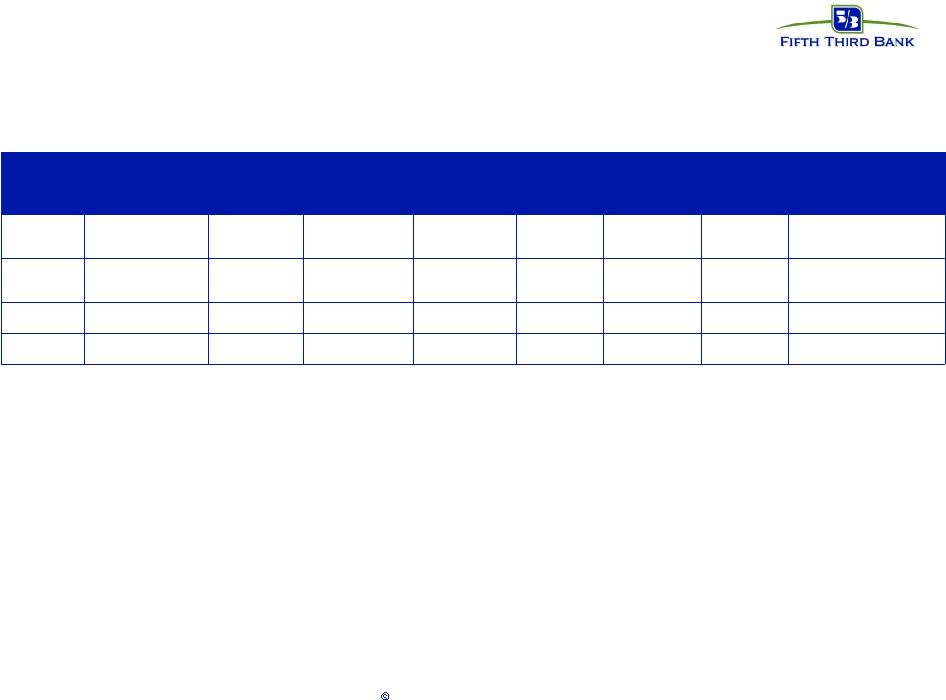

9 Fifth Third Bank | All Rights Reserved Outperformed 10% 4% 16% Pre-tax pre-provision earnings growth* FITB 2Q08 Large bank peers (1) 2Q08 Midwest peers (2) 2Q08 YOY performance vs. peers Average loan growth 11% 8% 9% Outperformed Average transaction deposit growth NII growth* 6% 17% 5% 8% 5% 4% Outperformed Outperformed Operating fee growth* 9% 1% 8% Outperformed Operating efficiency ratio* 53% 57% 57% Outperformed NPA growth 316% 236% 211% Underperformed Net charge-off ratio 1.66% 1.58% 1.84% In line * NII for all banks adjusted for leveraged lease charges. Operating fees for all banks per SNL and excludes securities gains/losses and other nonrecurring revenue. Operating expenses for all banks exclude merger-related charges, goodwill impairments, and other nonrecurring expenses. Fifth Third reported NII declined $1mm (0%) and reported fees grew 8% vs. 2Q08. Fifth Third’s reported efficiency ratio was 59%. (1) Large bank peer average consists of BBT, COF, CMA, HBAN, KEY, MTB, MI, NCC, PNC, RF, STI, USB, WB, WM, WFC and ZION; for peer deposit, loan, NII, fee growth, and pre-tax pre-provision earnings growth comparisons, excludes HBAN due to significant impact of acquisition; Operating fee growth, pre-tax pre-provision earnings growth, and operating efficiency ratio comparisons exclude NCC, WB, and WM due to significant negative items in 2Q08. (2) Midwest peer average consists of HBAN, KEY, MI, CMA, NCC and USB, except where outlined above. Source: SNL and company reports. Loans include held for investment and held for sale. Transaction deposits are core deposits excluding CDs. Peer performance summary Continue to outperform on key value drivers; credit remains challenging |

10 Fifth Third Bank | All Rights Reserved Strong operating performance… $300 $400 $500 $600 $700 $800 2Q07 3Q07 4Q07 1Q08 2Q08 Reported pre-tax pre-provision earnings growth -6% due primarily to 2Q08 leveraged lease charges. Data above excludes $130 million charge related to impact of leasing litigation and $13 million in acquisition related expenses in 2Q08; prior quarters exclude $152 BOLI charge, $273 Visa IPO gain, $152 million reversal of Visa litigation expenses and $16 million in merger-related and severance charges in 1Q08; excludes $177 million BOLI charge, $94 million in Visa litigation expense, and $8 million in merger-related expenses in 4Q07; excludes $78 million in Visa litigation expense in 3Q07. |

11 Fifth Third Bank | All Rights Reserved -$800 -$600 -$400 -$200 $0 $200 $400 $600 $800 2Q07 3Q07 4Q07 1Q08 2Q08 …offset by credit costs See note on p. 9 for adjustments. Net charge- offs Additional provision |

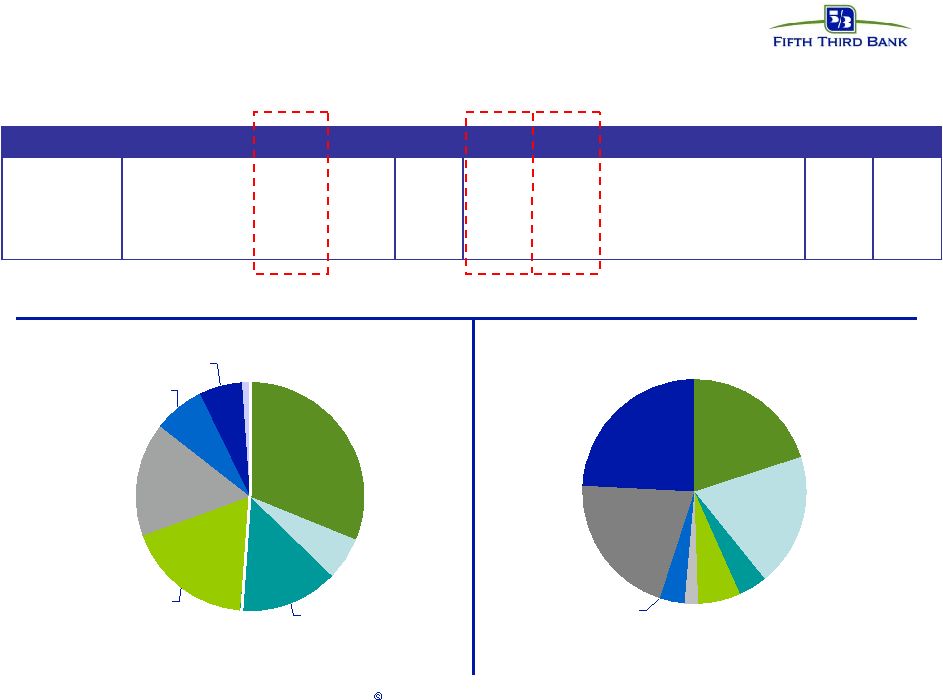

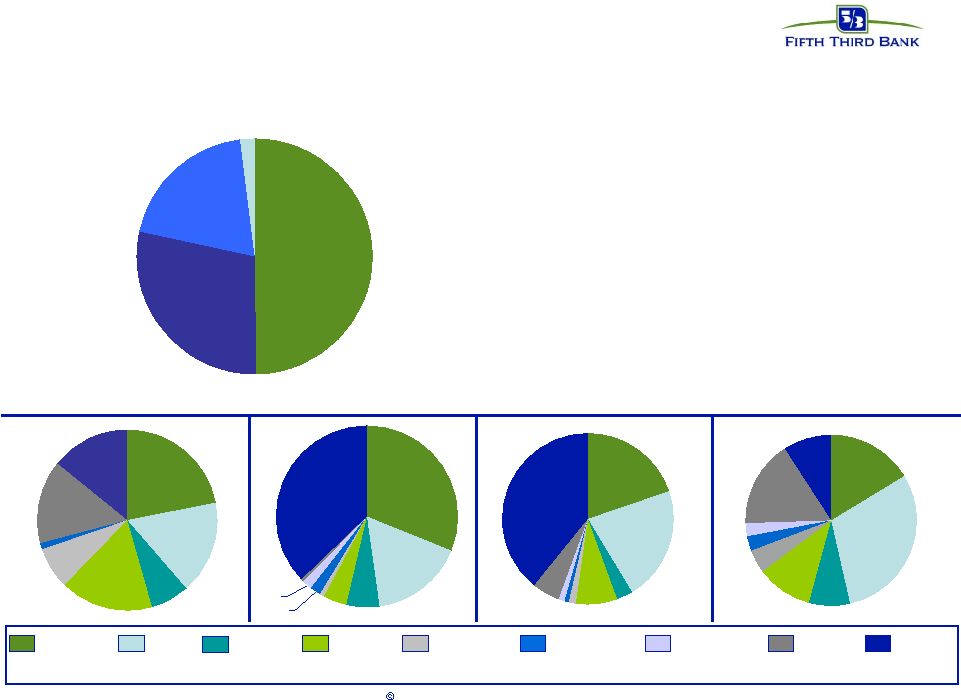

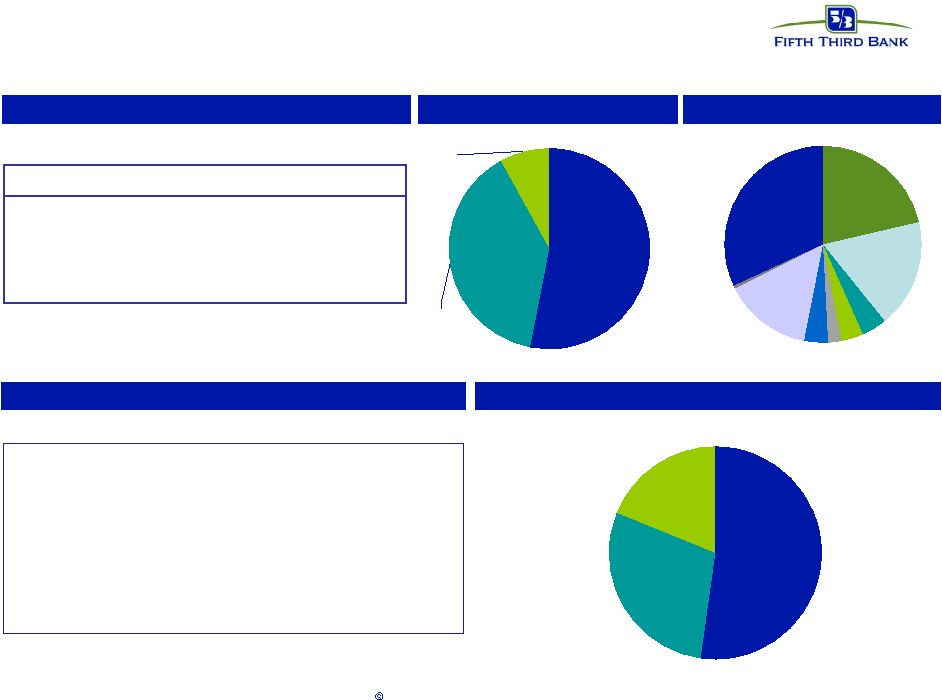

12 Fifth Third Bank | All Rights Reserved ($ in millions) C&I Commercial mortgage Commercial construction Commercial lease Total commercial Residential mortgage Home equity Auto Credit card Other consumer Total consumer Total loans & leases Loan balances $28,958 $13,394 $6,007 $3,647 $52,006 $9,866 $12,421 $8,362 $1,717 $1,152 $33,518 $85,524 % of total 34% 16% 7% 4% 61% 12% 15% 10% 2% 1% 39% Non-performing assets $414 $540 $552 $18 $1,524 $448 $183 $28 $15 $1 $674 $2,198 NPA ratio 1.43% 4.03% 9.19% 0.49% 2.93% 4.54% 1.47% 0.33% 0.88% 0.08% 2.00% 2.56% Net charge-offs $107 $21 $49 $0 $177 $63 $54 $26 $21 $3 $167 $344 Net charge-off ratio 1.52% 0.66% 3.46% -0.01% 1.41% 2.57% 1.83% 1.21% 4.93% 1.31% 2.04% 1.66% Credit by portfolio C&I 32% Home equity 16% Other consumer 1% Auto 7% Residential mortgage 18% Commercial mortgage 6% Commercial construction 14% Card 6% MI 20% Other / National 21% FL 24% KY 2% TN 4% IL 6% OH 19% IN 4% NC/GA 0% Net charge-offs by loan type Net charge-offs by geography |

13 Fifth Third Bank | All Rights Reserved 0 100,000 200,000 300,000 400,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 C&I/Lease Auto Credit Card Other CRE Res RE Total NCOs Total NPAs 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 C&I/Lease Auto/Other CRE Res RE Res RE CRE NPA, charge-off growth driven by residential, commercial real estate Res RE CRE Real estate driving credit deterioration |

14 Fifth Third Bank | All Rights Reserved - 100,000 200,000 300,000 400,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Other SE National Other MW Michigan Florida 421 - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Other SE National Other MW Michigan Florida Highest stress markets Highest stress markets Michigan and Florida: most stressed markets NPA, charge-off growth driven by Florida and Michigan Total NCOs Total NPAs |

15 Fifth Third Bank | All Rights Reserved Credit containment Eliminated all brokered home equity production Suspended all new developer lending Significantly tightened underwriting limits and exception authorities Major expansion of commercial and consumer workout teams Aggressive write downs in stressed geographies Significant addition to reserve levels Direct executive management oversight of every major credit decision Continue to move aggressively to stay ahead of emerging credit issues |

16 Fifth Third Bank | All Rights Reserved • Capital plan and targets designed to help ensure strong regulatory capital and tangible equity levels, positioning Fifth Third to absorb losses and provisions significantly in excess of current levels and environmental conditions through 2009 Revised Tier 1 capital targets to provide greater cushion • Strengthened Fifth Third’s capital position through several capital actions: – Capital issuance – Issued $1.1 billion of Tier 1 capital in the form of convertible preferred securities - achieved new Tier 1 target immediately – Dividend reduction – Reducing quarterly common dividend to $0.15 per share, conserves $1.2 billion in common equity through the end of 2009 relative to previous $0.44 level per share – Asset sales/dispositions – Anticipated sale of non-core businesses expected to generate $1 billion or more after-tax in additional common equity capital Capital actions intended to maintain a Tier 1 ratio within target range if credit cycle significantly deteriorates without further capital issuance Capital actions 6-7% 11.5-12.5% 8-9% Target N/A 10% 6% Regulatory “well- capitalized” minimum 6.37% TE/TA 12.15% Total Capital 8.51% 2Q08 Tier 1 Capital Ratio |

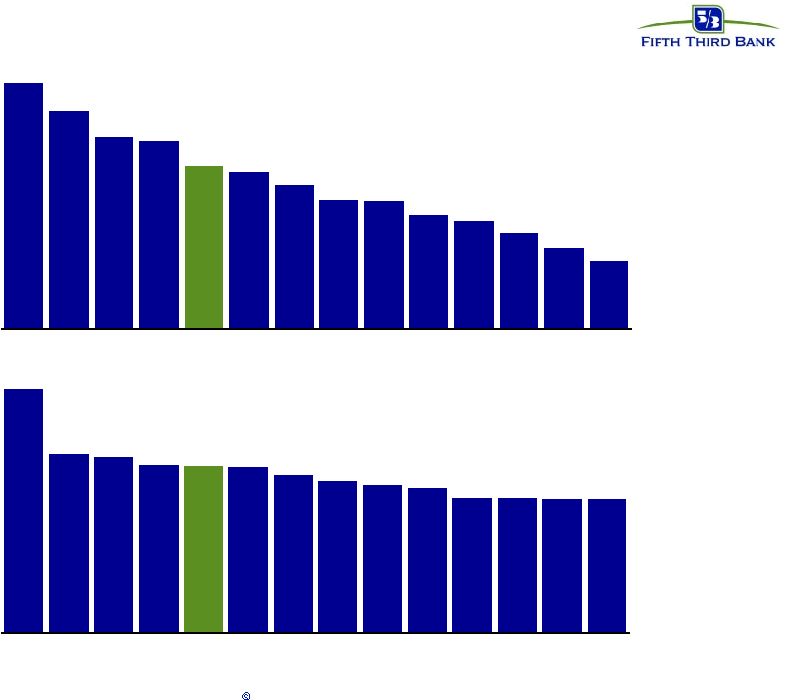

17 Fifth Third Bank | All Rights Reserved Strong capital position Tangible Equity / Tangible Assets Tier 1 Capital As of 6/30/08 Peer group: U.S. banks sharing similar geography or debt ratings. Source: SNL and company reports 11.06 8.92 8.82 8.53 8.51 8.47 8.20 8.00 7.87 7.76 7.48 7.47 7.45 7.45 NCC BBT HBAN KEY FITB USB PNC WB MI MTB RF STI ZION CMA 8.94 7.49 6.98 6.89 6.37 6.24 5.97 5.67 5.65 5.35 5.23 4.98 4.68 4.40 NCC CMA KEY MI FITB STI ZION RF HBAN BBT USB MTB WB PNC |

18 Fifth Third Bank | All Rights Reserved Fifth Third debt ratings # Date of most recent change in rating or outlook Sub Senior AA A+ AA- Aa2 Fifth Third Bank (MI) AA (low) A A+ Aa3 Stable 6/18/08 A A+ A A+ Fitch AA AA- Aa2 Senior Fifth Third Bank (OH) AA (low) A+ Aa3 Sub 3/18/08 8/3/08 6/18/08 Rating Date # Current Outlook Fifth Third Bancorp Negative CreditWatch negative Review for possible downgrade A (high) A A1 Sub AA (low) DBRS A+ S&P Aa3 Moody’s Senior |

19 Fifth Third Bank | All Rights Reserved Fifth Third debt ratings Moody's S&P Fitch DBRS Well Fargo (Well Fargo Bank NA) Aaa AAA AA AAH Bank of America (Bank America America NA) Aaa AA+ AA- AA JPMorgan Chase (JPMorgan Chase Bank NA) Aaa AA AA- AAL US Bank (US Bank NA North Dakota) Aa1 AA+ AA- NR BB&T (BB&T Co/WI) Aa2 AA- AA- AA Fifth Third Bancorp (Fifth Third Bank) Aa2 AA- A+ AA SunTrust (SunTrust Bank) Aa2 AA- A+ AAL PNC (PNC Bank NA) Aa3 AA- A+ AAL Wachovia (Wachovia Bank NA) Aa3 AA- A+ AA M&I (M&I Bank) Aa3 A A+ AH Comerica (Comerica Bank) A1 A+ A+ AH Regions (Regions Bank) A1 A+ A+ AAL Key (Key Bank NA) A1 A A NR M&T (Manufacturers & Traders Trust Co.) A2 A A- A National City (National City Bank) A2 A A AAL Huntington (Huntington National Bank) A2 A- A- A Zions (Zions First National Bank, Utah) A2 A- A- A NR: not rated Lead Bank Source: Bloomberg LLP as of 09/03/2008 The ratings listed in this document are generated from information provided to Fifth Third through Bloomberg LP. These ratings are subject to change based upon criteria developed by the applicable rating agency; Fifth Third does not necessarily agree with any of these ratings and has not independently verified or reviewed any of these companies to determine whether they would meet any ratings, underwriting or other credit criteria developed independently by Fifth Third. Neither you nor any customer should use these ratings as determinative in purchasing credit or other services from Fifth Third. Fifth Third does not provide legal, accounting, financial, tax or other expert advice. Consult your own legal, accounting, financial and tax advisors before making any decision to invest with or request credit from Fifth Third. |

20 Fifth Third Bank | All Rights Reserved Fifth Third differentiators Integrated affiliate delivery model Strong sales culture Operational efficiency Streamlined decision making Integrated payments platform (FTPS) Acquisition integration Customer satisfaction |

21 Fifth Third Bank | All Rights Reserved Summary and priorities Fifth Third has taken steps to ensure it is well-positioned to weather potential further deterioration in the credit environment Delivery of strong operating results remains a hallmark of Fifth Third despite sluggish economy Capital plan designed to maintain Tier 1 capital in excess of 8% under significant additional stress in credit trends |

22 Fifth Third Bank | All Rights Reserved Fifth Third: building a better tomorrow Consistently outperform the U.S. banking industry Deliver growth in excess of industry Enhance the customer experience Increase employee engagement Institutionalize enterprise operational excellence |

23 Fifth Third Bank | All Rights Reserved Appendix |

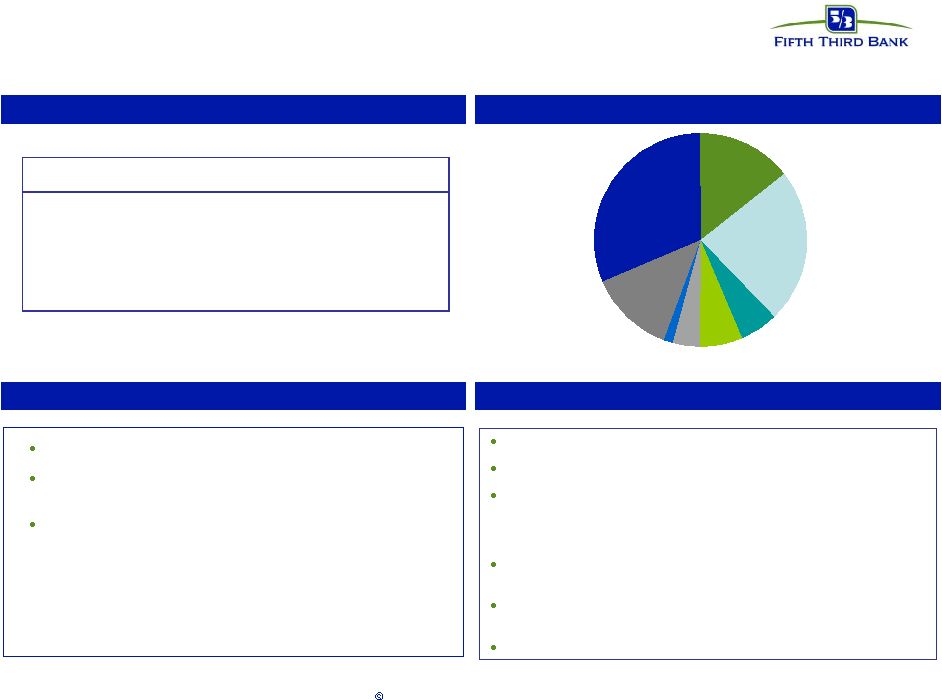

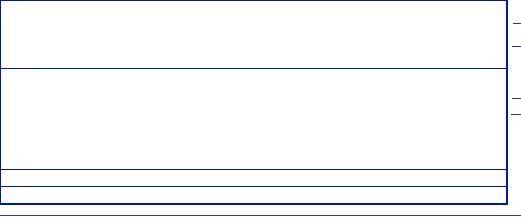

24 Fifth Third Bank | All Rights Reserved Nonperforming assets • Total NPAs of $2.2B, or 256 bps • Commercial NPAs of $1.5B; recent growth driven by commercial construction and real estate, particularly in Michigan and Florida • Consumer NPAs of $674M; recent growth driven by residential real estate, particularly in Michigan and Florida 22% 17% 7% 17% 7% 1% 15% 14% 3% 8% 39% 20% 5% 1% 1% 1% 22% 30% 8% 4% 3% 16% 9% 3% 16% 11% 31% 6% 37% 0% 4% 1% 2% 2% 17% C&I* (20%) CRE (49%) Residential (29%) Other Consumer (2%) ILLINOIS INDIANA FLORIDA TENNESSEE KENTUCKY OHIO MICHIGAN Residential $630M 29% C&I* $431M 20% Other $44M 2% CRE $1.1B 49% *C&I includes commercial lease NORTH CAROLINA / GEORGIA OTHER / NATIONAL |

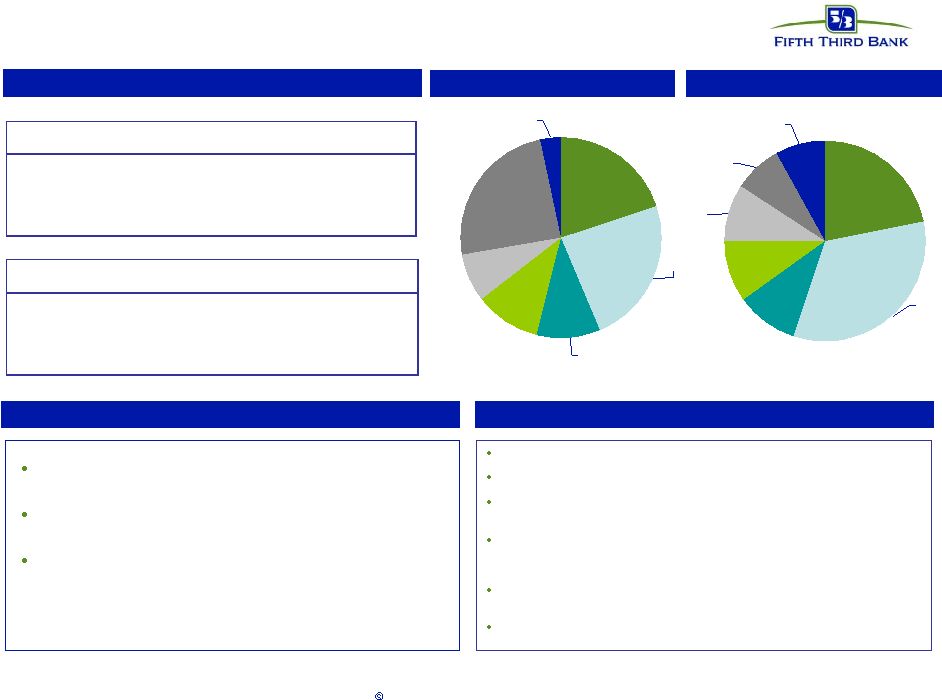

25 Fifth Third Bank | All Rights Reserved Commercial construction Accomodation 1% Auto Retailers 1% Finance & insurance 1% Construction 37% Manufacturing 1% Real estate 44% Retail Trade 1% Other 8% Wholesale Trade 6% Loans by geography Credit trends Loans by industry Comments • Declining valuations in residential and land developments • Higher concentrations in now stressed markets (Florida and Michigan) • Continued stress expected through 2008 ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $5,469 $5,463 $5,561 $5,592 $6,007 90+ days delinquent $33 $54 $67 $49 $53 90+ days ratio 0.60% 0.99% 1.21% 0.87% 0.88% NPAs $66 $106 $257 $418 $552 as % of loans 1.21% 1.94% 4.61% 7.48% 9.19% Net charge-offs $7 $5 $12 $72 $49 as % of loans 0.48% 0.35% 0.83% 5.20% 3.46% Commercial construction OH 26% IN 8% KY 5% NC/GA 5% Other 1% FL 21% TN 7% MI 19% IL 8% |

26 Fifth Third Bank | All Rights Reserved Homebuilder/developer Credit trends Loans by property type Comments Raw & developed land 52% Other including acquired portfolio 29% Residential vertical 19% *Current definition not in use prior to 3Q07 • Making no new loans to builder/developer sector • Residential & land valuations under continued stress • 6% of commercial loans; < 4% of total gross loans • Balance by product approximately 53% Construction, 39% Mortgage, 8% C&I • 12% of loans are speculative loans Commercial construction 53% Commercial mortgage 39% C&I 8% Portfolio split Loans by geography ($ in millions) 3Q07 4Q07 1Q08 2Q08 Balance $2,594 $2,868 $2,705 $3,295 90+ days delinquent $50 $57 $60 $123 90+ days ratio 1.94% 1.99% 2.21% 3.73% NPAs $78 $176 $309 $547 as % of loans 3.01% 6.14% 11.42% 16.62% Net charge-offs $4 $8 $43 $34 as % of loans 0.54% 1.11% 6.14% 4.63% Homebuilders/developers* OH 18% IN 4% KY 2% NC/GA 14% Other 0% FL 32% TN 4% MI 22% IL 4% |

27 Fifth Third Bank | All Rights Reserved Residential mortgage 1 liens: 100% ; weighted average LTV: 77% Weighted average origination FICO: 728 Origination FICO distribution: <659 13%; 660-689 11%; 690-719 17%; 720-749 18%; 750+ 41% (note: loans <659 includes CRA loans and FHA/VA loans) Origination LTV distribution: <70 26%; 70.1-80 42%; 80.1-90 11%; 90.1-95 5%; >95% 16% Vintage distribution: 2008 8%; 2007 18%; 2006 17%; 2005 28%; 2004 14%; prior to 2004 15% % through broker: 12%; performance similar to direct Loans by geography Credit trends Portfolio details Comments 31% FL concentration driving 63% total loss FL lots ($454 mm) running at 15% annualized loss rate (YTD) Mortgage company originations targeting 95% salability ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $8,477 $9,057 $10,540 $9,873 $9,866 90+ days delinquent $98 $116 $186 $192 $229 90+ days ratio 1.15% 1.28% 1.76% 1.95% 2.32% NPAs $112 $150 $216 $333 $448 as % of loans 1.32% 1.65% 2.04% 3.37% 4.54% Net charge-offs $9 $9 $18 $34 $63 as % of loans 0.43% 0.41% 0.72% 1.33% 2.57% Residential mortgage OH 23% IN 6% KY 4% Other* 13% FL 31% TN 2% MI 15% IL 6% *Other includes North Carolina and Georgia st |

28 Fifth Third Bank | All Rights Reserved Home equity 1 liens: 24%; 2 liens: 76% (18% of 2 liens behind FITB 1 s) Weighted average origination FICO: 755 Origination FICO distribution: <659 5%; 660-689 9%; 690-719 16%; 720- 749 19%; 750+ 51% Weighted average CLTV: 77% (1 liens 65%; 2nd liens 82%)Origination CLTV distribution: <70 28%; 70.1-80 22%; 80.1-90 21%; 90.1-95 10; >95 20% Vintage distribution: 2008 7%; 2007 13%; 2006 19%; 2005 17%; 2004 13%; prior to 2004 31% % through broker channels: 20% WA FICO: 740 brokered, 758 direct; WA CLTV: 89% brokered; 74% direct Portfolio details Comments MI 20% Other* 24% IL 11% KY 8% OH 25% IN 10% FL 3% MI 22% Other* 8% IL 10% KY 9% OH 33% IN 10% FL 8% Brokered loans by geography Direct loans by geography Credit trends Approximately 20% of portfolio concentration in broker product driving approximately 51% total loss Portfolio experiencing increased loss severity (losses on 2 liens approximately 100%) Aggressive home equity line management strategies in place ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $2,810 $2,746 $2,713 $2,651 $2,433 90+ days delinquent $24 $30 $34 $33 $34 90+ days ratio 0.86% 1.08% 1.25% 1.26% 1.40% Net charge-offs $9 $14 $17 $23 $28 as % of loans 1.19% 1.94% 2.52% 3.29% 4.64% Home equity - brokered ($ in millions) 2Q07 3Q07 4Q07 1Q08 2Q08 Balance $8,970 $8,991 $9,161 $9,152 $9,988 90+ days delinquent $37 $34 $38 $43 $42 90+ days ratio 0.41% 0.38% 0.41% 0.47% 0.42% Net charge-offs $11 $14 $15 $18 $27 as % of loans 0.48% 0.59% 0.66% 0.78% 1.07% Home equity - direct Note: Brokered and direct home equity net charge-off ratios are calculated based on end of period loan balances *Other includes North Carolina, Georgia, and Tennessee st nd nd st nd st |

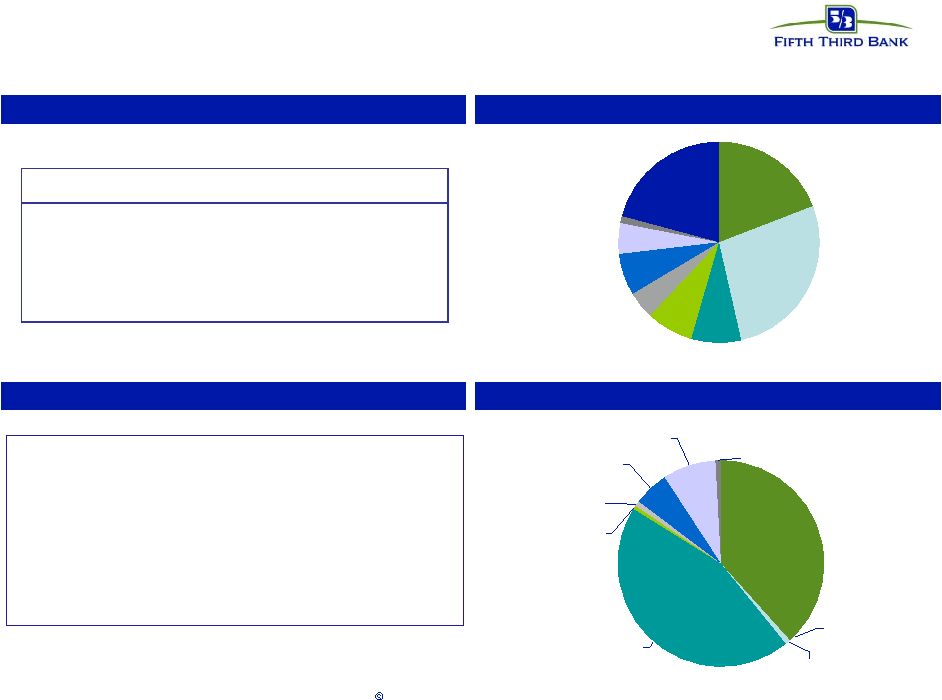

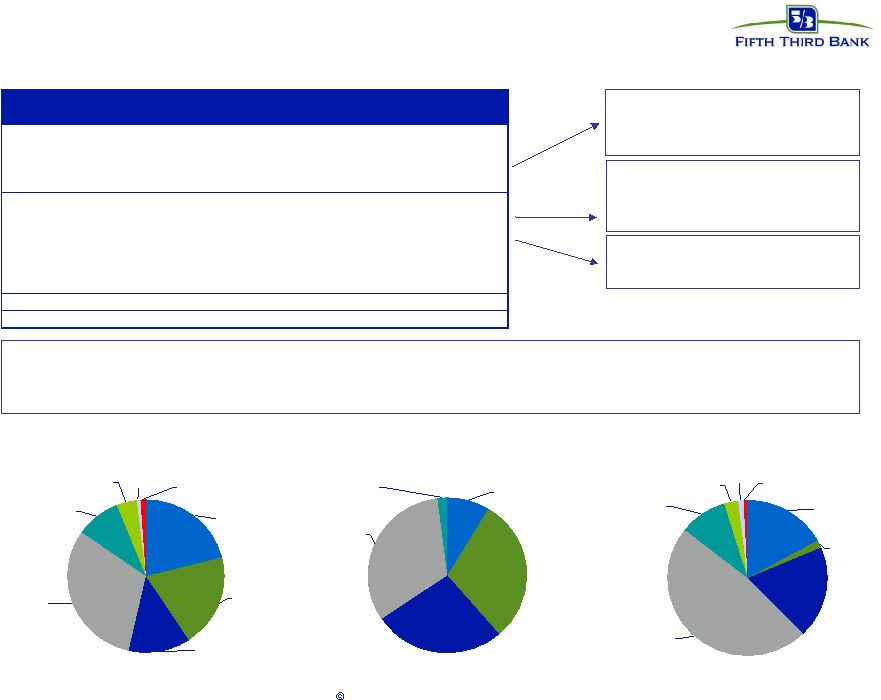

29 Fifth Third Bank | All Rights Reserved Michigan market Total Loans Home Equity 17% Credit Card 2% Auto 7% Resi Mortgage 9% Coml Lease 1% C&I 32% Commercial Mortgage 24% Coml Const 7% Other Cons 1% NPAs Home Equity 10% Credit Card 1% Auto 1% Resi Mortgage 12% Coml Lease 1% C&I 15% Commercial Mortgage 27% Coml Const 33% Net charge-offs Auto 5% Other Cons 1% Credit Card 6% Home Equity 21% Resi Mortgage 8% C&I 24% Commercial Mortgage 15% Coml Const 20% Summary: Deterioration in home price values coupled with weak economy (unemployment rate of 7.4%) impacting credit trends due to frequency of defaults and severity Issues: homebuilders, developers tied to weak real estate market Issues: valuations, economy, unemployment Economic weakness impacts commercial real estate market ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 5.01 17% 87 21% 16 15% Commercial mortgage 3.86 29% 152 28% 10 50% Commercial construction 1.16 19% 187 34% 14 29% Commercial lease 0.22 6% 7 42% (0) 3% Commercial 10.24 20% $434 28% 41 23% Mortgage 1.43 15% 70 16% 6 9% Home equity 2.68 22% 55 30% 15 27% Auto 1.14 14% 4 15% 4 14% Credit card 0.30 18% 3 20% 4 19% Other consumer 0.12 10% 0 6% 0 12% Consumer 5.67 17% $132 20% 29 17% Total 15.91 19% $566 26% 69 20% |

30 Fifth Third Bank | All Rights Reserved Florida market NPAs Home Equity 2% Resi Mortgage 32% C&I 9% Commercial Mortgage 30% Coml Const 27% Net charge-offs Auto 3% Other Cons 1% Credit Card 1% Home Equity 10% Resi Mortgage 47% C&I 17% Commercial Mortgage 2% Coml Const 19% Summary: Deterioration in real estate values having effect on credit trends as evidenced by increasing NPA/NCOs in real estate related products Issues: homebuilders, developers tied to weakening real estate market Issues: increasing severity of loss due to significant declines in valuations Issues: valuations; relatively small home equity portfolio Total Loans Home Equity 9% Credit Card 1% Auto 4% Resi Mortgage 31% C&I 21% Commercial Mortgage 20% Coml Const 13% Other Cons 1% ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 2.11 7% 61 15% 14 13% Commercial mortgage 1.95 15% 215 40% 2 8% Commercial construction 1.26 21% 193 35% 16 33% Commercial lease 0.00 0% - 0% - 0% Commercial 5.31 10% $469 31% 32 18% Mortgage 3.09 31% 233 52% 40 63% Home equity 0.91 7% 14 8% 8 15% Auto 0.42 5% 3 12% 2 9% Credit card 0.08 5% 1 4% 1 5% Other consumer 0.12 10% 0 14% 1 15% Consumer 4.61 14% $251 37% 52 31% Total 9.92 12% $720 33% 84 24% |

31 Fifth Third Bank | All Rights Reserved Cautionary statement This report may contain forward-looking statements about Fifth Third Bancorp and/or the company as combined acquired entities within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. This report may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Fifth Third Bancorp and/or the combined company including statements preceded by, followed by or that include the words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trend,” “objective,” “continue,” “remain” or similar expressions or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and weakening in the economy, specifically the real estate market, either national or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) changes and trends in capital markets; (8) competitive pressures among depository institutions increase significantly; (9) effects of critical accounting policies and judgments; (10) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies; (11) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged; (12) ability to maintain favorable ratings from rating agencies; (13) fluctuation of Fifth Third’s stock price; (14) ability to attract and retain key personnel; (15) ability to receive dividends from its subsidiaries; (16) potentially dilutive effect of future acquisitions on current shareholders' ownership of Fifth Third; (17) effects of accounting or financial results of one or more acquired entities; (18) difficulties in combining the operations of acquired entities; (19) inability to generate the gains on sale and related increase in shareholders’ equity that it anticipates from the sale of certain non-core businesses, (20) loss of income from the sale of certain non-core businesses could have an adverse effect on Fifth Third’s earnings and future growth (21) ability to secure confidential information through the use of computer systems and telecommunications networks; and (22) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. Additional information concerning factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements is available in the Bancorp's Annual Report on Form 10-K for the year ended December 31, 2007, filed with the United States Securities and Exchange Commission (SEC). Copies of this filing are available at no cost on the SEC's Web site at www.sec.gov or on the Fifth Third’s Web site at . Fifth Third undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this report. www.53.com |