Fifth Third Bank | All Rights Reserved Fifth Third / Advent Processing Transaction Supplemental Information March 30, 2009 Exhibit 99.2 |

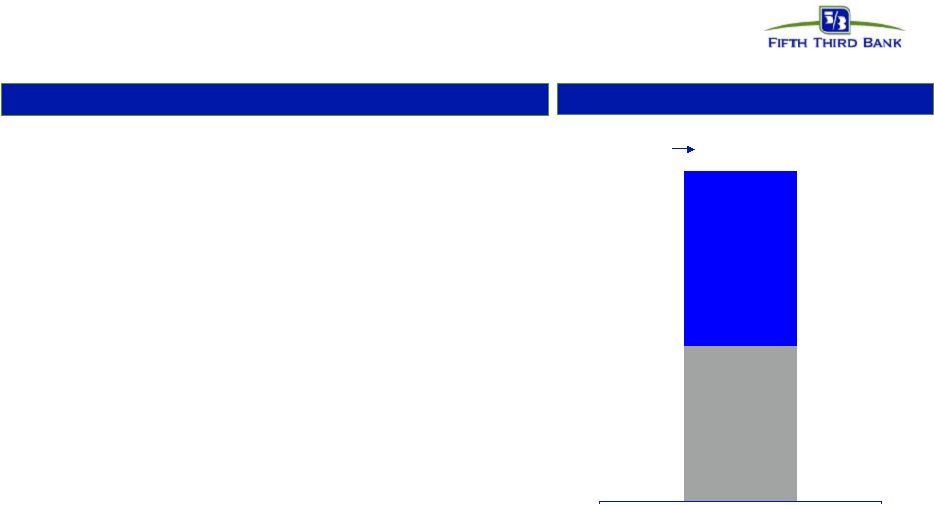

2 © Fifth Third Bank | All Rights Reserved Joint venture valuation Key transaction attributes • $2.35 billion enterprise value made up of $1.1 billion of equity value* and $1.25 billion senior secured note – Equity valuation of $1.1 billion* – $561 million cash payment related to Advent’s 51% stake in Fifth Third Processing Solutions, LLC and put rights – Fifth Third Bank (OH) retains 49% ownership in Fifth Third Processing Solutions, LLC with warrants to acquire incremental economic interest in LLC – Fifth Third Processing Solutions, LLC will have $1.25 billion seven- year, senior secured note payable to Fifth Third subsidiaries bearing 9.5% interest – The agreement is subject to certain potential purchase price adjustments • Expected costs related to build out of infrastructure for LLC included as additional book basis in business • Agreement related to transition services will generate revenue that is expected to offset expenses retained by Fifth Third currently allocated to the processing business • Buyer will have right to sell its interest in the processing business to Fifth Third under certain conditions • This joint venture transaction would increase Fifth Third Bancorp’s 12/31/2008 tangible common equity and Tier 1 capital by approximately $1.2B, and its common equity by approximately $950 million on a pro forma basis Enterprise value components $1.10 $1.25 $144.0 mm (13%) $210.4 mm (19%) Equity value* Enterprise Value Note payable to Fifth Third Bank subsidiaries $2.35* billion * Before Fifth Third’s valuation of warrants, put rights, and minority interest discounts expected to reduce its implied valuation of the business by an estimated $50 million. |

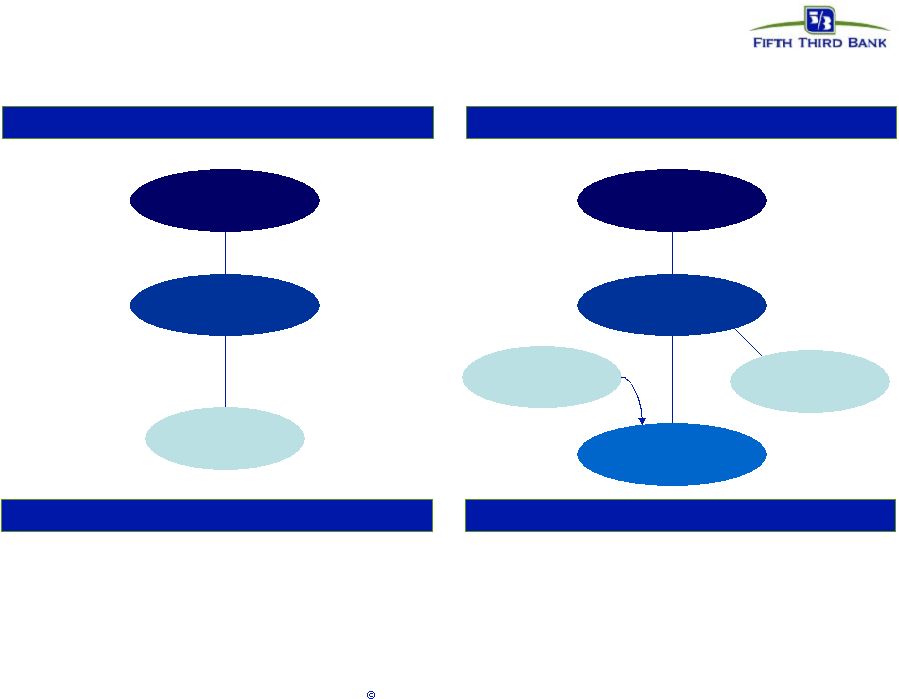

3 Fifth Third Bank | All Rights Reserved Formation of Fifth Third Processing Solutions, LLC Creation of Processing Business LLC Pre-transaction structure Fifth Third Bancorp Fifth Third Bank (OH) Fifth Third processing and credit card business Fifth Third Bancorp Fifth Third Processing Solutions, LLC Fifth Third processing business Fifth Third Bank (OH) Overview / actions Overview / actions • At formation, Fifth Third Processing Solutions, LLC will be an indirect wholly-owned subsidiary of Fifth Third Bank (OH) • Fifth Third Bank (OH) will contribute the net assets of the processing business to subsidiary of the LLC • The processing business is currently part of Fifth Third Bank (OH) and contains merchant processing and financial institutions activities • Part of SEC reporting segment, “Fifth Third Processing Solutions,” which includes other activities primarily related to credit card issuance Credit card business Note: Transaction diagrams exclude certain pass-through and other non-operating entities that may be part of final legal structure. |

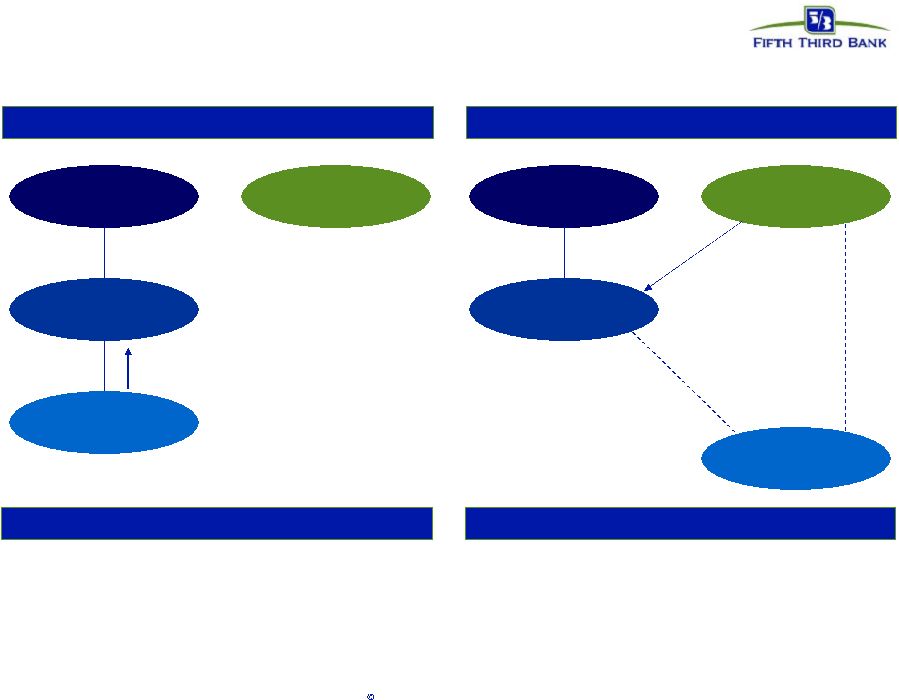

4 Fifth Third Bank | All Rights Reserved Transaction structure Transaction Capitalization of Fifth Third Processing Solutions, LLC Overview / actions Overview / actions • Fifth Third Bank sells 51 percent of Fifth Third Processing Solutions, LLC to Advent, with Advent paying cash for their interest and put rights • Fifth Third Processing Solutions, LLC is deconsolidated • Post-transaction, Fifth Third and Advent own a 49% and 51% stake in Fifth Third Processing Solutions, LLC, respectively • Assets are contributed to Fifth Third Processing Solutions, LLC, subject to a senior note payable to subsidiary of Fifth Third in the amount of $1.25 billion to create appropriate and sustainable leverage; secured by assets of LLC Fifth Third Bancorp Fifth Third Bank (OH) Advent Fifth Third Processing Solutions, LLC $1.25B note payable to Fifth Third subsidiary $561MM cash Fifth Third Bancorp Fifth Third Bank (OH) Advent Fifth Third Processing Solutions, LLC 49% Ownership 51% Ownership Note: Transaction diagrams exclude certain pass-through and other non-operating entities that may be part of final legal structure. |

5 © Fifth Third Bank | All Rights Reserved Selected comparable companies Note: Sources: FactSet Research, Bloomberg, Wall Street Research, company filings, and other publicly available information. Data as of March 25, 2009. 2008 numbers based on company filings for companies that have reported earnings. Financials exclude one-time charges. (1) 2008A EBITDA of $282 million and 2008A net revenue of $694 million. Enterprise value based on $2.35 billion less Fifth Third’s estimated valuation adjustments of $50 million. • Transaction multiples represent a premium to current market multiples • Retention of 49% ownership allows further sharing in upside potential of the joint venture 2008 EBITDA Net revenue Payment processing and bank outsourcing comparable companies Mean 6.8x 1.8x Median 7.1x 1.8x Fifth Third processing business transaction 8.2x 3.3x |

6 © Fifth Third Bank | All Rights Reserved Estimated impact of transaction - capital Note: Estimates subject to change. Assumes 37% marginal tax rate. Assumes book deconsolidation for 51% sale. Write-up of remaining stake in Fifth Third Processing Solutions, LLC based on sale price. (1) Current ratios as of 4Q08. Tangible common equity ratio of 4.23% at 12/31/2008 excluded unrealized gains on securities of $98 million (TCE ratio including gains 4.31%). Tier 1 capital was $11.9 billion on 12/31/08. Tangible assets and risk-weighted assets at 12/31/2008 were $116.9 billion and $112.6 billion, respectively. (2) Basis point changes shown relative to 4Q08 ratios. (3) Enterprise value based on $2.35 billion less Fifth Third’s estimated valuation adjustments of $50 million. (4) Estimated $600 million book basis (including $210 million in goodwill) and estimated $390 million tax basis for Fifth Third Processing Solutions, LLC. (5) Total enterprise value less book basis. (6) Includes one-time costs of estimated $45 million. 12/31/08 Capital Pro forma Capital Ratios TCE / TA 4.23% 94 bps 5.17% TE / TA 7.86% 90 bps 8.76% Tier 1 risk-based 10.59% 90 bps 11.49% Tier 1 leverage 10.27% 88 bps 11.15% Total RBC 14.78% 85 bps 15.63% Components of estimated gain calculation ($ in millions) Enterprise value $2,300 Book basis 600 Pre-tax gain 1,700 After-tax gain / increase in common equity $7,836 950 $8,786 Increase in tangible common equity 5,043 1,160 6,203 Increase in Tier 1 capital 11,924 1,160 13,084 Estimates (1) (2) (1) (2) (3) (5) (4) (6) (6) (6) |

7 © Fifth Third Bank | All Rights Reserved Estimated impact of transaction - earnings Notes: Assumes 37% effective tax rate. (1) 2008 net income of business being sold. (2) Amortizable embedded basis difference assumed to be $1.3 billion, amortized straight-line over 7 years. (3) Interest on note payable to a subsidiary of Fifth Third at yield of 9.5%. (4) Net cash proceeds after tax used to repay debt at assumed 0.25% rate for illustrative purposes. (5) Dilution to earnings per share excluding amortization of intangibles of $57 million. Historical 2008 ($ in millions) Net income of processing business (1) ($162) After-tax pro forma adjustments Income from 49% retained interest in LLC $43 Amortization of embedded basis difference (2) (57) Interest income on note to Fifth Third (3) 75 Earnings on cash proceeds (4) 1 Total after-tax adjustments $62 Pro forma earnings dilution ($100) 2008 period end shares 577,387 Pro forma EPS dilution ($ / Share) ($0.17) Pro forma EPS dilution excluding intangibles amortization (5) ($0.07) Memoranda Net income of processing business $162 Interest expense on note to Fifth Third 75 Total pro forma net income of LLC $87 Net income allocated to Fifth Third (49%) 43 |

8 © Fifth Third Bank | All Rights Reserved Reconciliation to segment reporting Notes: (1) Primarily related to elimination of inter-company communications expense (2) Fifth Third Bancorp segment reporting methodology and Fifth Third Processing Solutions, LLC reporting methodology may differ in certain items between revenue and expenses (3) Primarily related to credit card business • Note: segment results related to retained businesses (primarily credit cards) do not include revenue and earnings recognized in other segments, primarily the Retail segment Segment results 2008 10-K Adjustments (1) Pro forma processing business Processing LLC (2) Retained businesses (3) Total Noninterest Income 842,722 (18,994) 823,728 693,728 130,000 Total Operating Expenses 553,622 (26,407) 527,215 432,252 94,963 Income from Operations 289,100 7,414 296,514 261,476 35,037 NII After Provision (8,785) 4,978 (3,807) (6,513) 2,706 Income before Tax 280,315 12,392 292,707 254,963 37,743 |

9 © Fifth Third Bank | All Rights Reserved Advent – Significant financial services experience One of the world’s leading global buyout firms • Since inception in 1984, Advent has raised $24 billion (€18 billion) in private equity capital and, through its buyout programs, has completed more than 250 transactions valued at over $40 billion (€27 billion) in 40 countries • 115 investment professionals across western and central Europe, North America, Latin America and Asia • Focus on international buyouts, strategic restructuring opportunities and growth buyouts in core sectors, including global payments and transaction processing (9 recent investments) • Brokerage & trading • Risk management • Asset management • Depository institutions • Debt collections • Core processing • Insurance brokerage • Policy origination & processing • Warranty services • Money transfer • Merchant acquiring • Credit card processing • Claims processing • Document mgmt • Legal support services • Subscription-based consulting services • Data analytics • Database services Securities & Inv. Mgmt. Banking / Financial Svcs Insurance Services Payments Information Services BPO MONEXT |

10 © Fifth Third Bank | All Rights Reserved Cautionary statement This report may contain forward-looking statements about Fifth Third Bancorp and/or the LLC within the meaning of Sections 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. This report may contain certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Fifth Third Bancorp and/or the LLC including statements preceded by, followed by or that include the words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trend,” “objective,” “continue,” “remain” or similar expressions or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and weakening in the economy, specifically the real estate market, either national or in the states in which Fifth Third, and/or the LLC do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third (10) competitive pressures among depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, and/or the LLC or the businesses in which these entities are engaged; (14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders' ownership of Fifth Third; (19) effects of accounting or financial results of one or more acquired entities; (20) difficulties in separating the operations of the LLC; (21) lower than expected gains related to sale of businesses; (22) loss of income from the sale of businesses that could have an adverse effect on Fifth Third’s earnings and future growth; (23) failure to consummate the transaction described herein; (24) ability to secure confidential information through the use of computer systems and telecommunications networks; and (25) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. Fifth Third undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this report. |