Fifth Third Bancorp (FITB) 8-KFifth Third Bancorp Announces First Quarter 2010 Results

Filed: 22 Apr 10, 12:00am

Fifth Third Bank | All Rights Reserved 1Q10 Credit Trends April 22, 2010 Please refer to earnings release dated April 22, 2010 for full results including those reported on a U.S. GAAP basis Exhibit 99.3 |

2 Fifth Third Bank | All Rights Reserved Updated stress testing - process overview Similar process to that used in 2008 and SCAP processes; updated for actual performance and current economic expectations Moody’s “Base” and “Longer Recession and Weaker Recovery” case scenarios key economic assumptions Commercial — 33 geographic/industry sectors analyzed and regressed against economic and performance drivers — Migration trends from criticized to nonaccrual and charge-off evaluated by region and industry Consumer — Portfolios subdivided into appropriate categories (i.e. liquidating vs. non- liquidating home equity) — Results derived using combination of regression models, loss curves and roll rates, and applied economic factors – Mortgage and home equity key correlation: HPI – Credit card key correlation: unemployment – Other consumer key correlations: unemployment and GDP Base Adverse Economic Assumptions* 2010 2010 Peak Unemployment 10.3% 11.4% GDP 2.4% 0.3% Avg. change in quarterly HPI (1.8%) (2.7%) * Moody’s Economy.com; as of March 2010 |

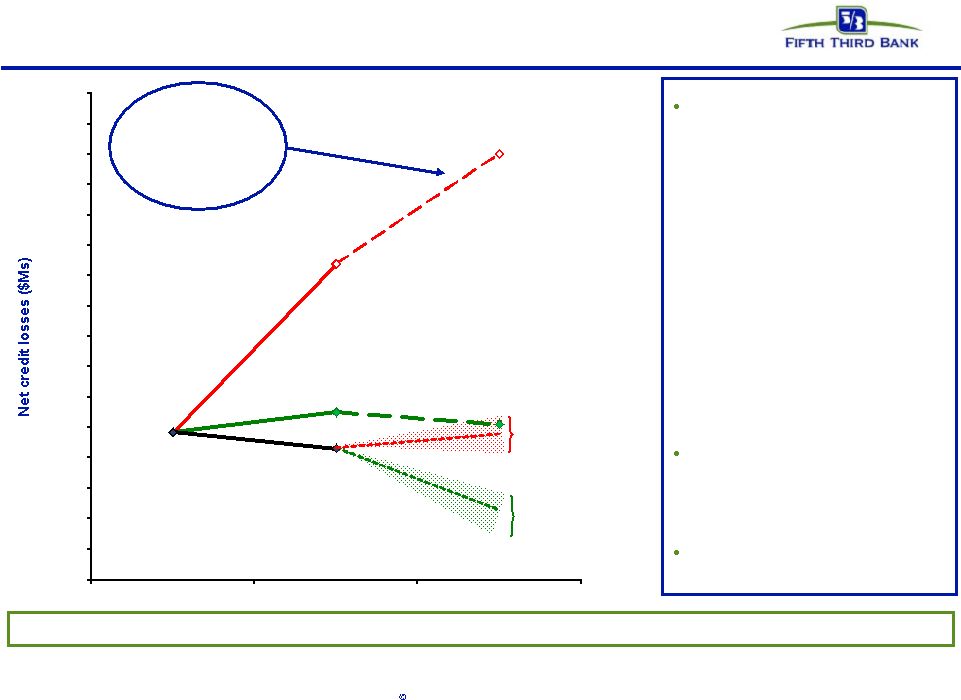

3 Fifth Third Bank | All Rights Reserved Updated credit loss expectations vs. SCAP scenarios $4.1B $5.0B $2.8B Moody’s Weaker Recovery / Mild Second Recession Case** Assumptions (Mar. 2010) Moody’s Base Case** Assumptions (Mar. 2010) Realized credit losses have been significantly below SCAP submissions; expected to continue SCAP Baseline Scenario (Submitted; Mar 2009) SCAP Adverse Scenario (Supervisory; Mar 2009) * Red SCAP line represents more adverse scenario as adjusted by supervisors for additional assumed two-year losses. Supervisory estimates of total two-year losses under more adverse scenario were not allocated by period. Estimate allocates total two-year supervisory losses using the allocation under Fifth Third’s submission. ** Source for macroeconomic assumptions: Moody’s Economy.com. Assumptions as of March 2010. Actual $2.6B Actual $2.7B Fifth Third capitalized for this level of credit losses under SCAP (plus surplus raised vs. buffer) Fifth Third’s realized credit losses have been significantly below its SCAP submitted baseline and more adverse scenarios – In SCAP submissions, we incorporated significant conservatism, given then- prevailing negative economic and industry trends and extreme uncertainty in potential loss outcomes at the time – Economic and credit market conditions have been much better than potential downside expectations in Spring 2009, benefiting results vs. SCAP scenarios Base and stress scenarios reflect Moody’s Base Case and Moody’s Weaker Recover / Mild Second Recession Case (as of March 2010)** Our current expectation is for 2010 losses to be lower than 2009 $2.9B $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 $3,250 $3,500 $3,750 $4,000 $4,250 $4,500 $4,750 $5,000 $5,250 $5,500 2008 2009 2010 |

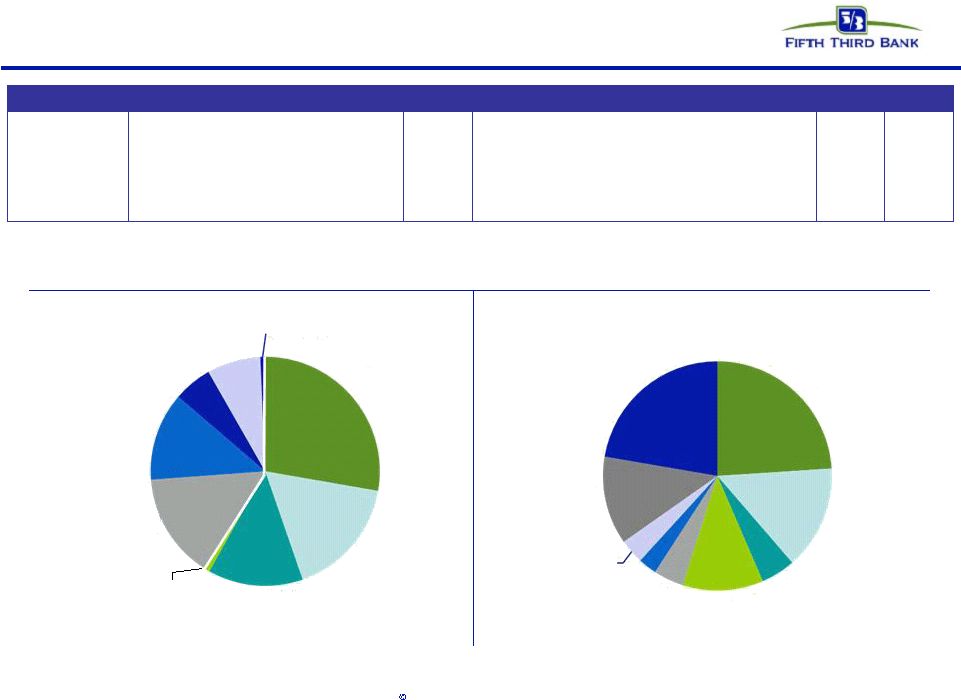

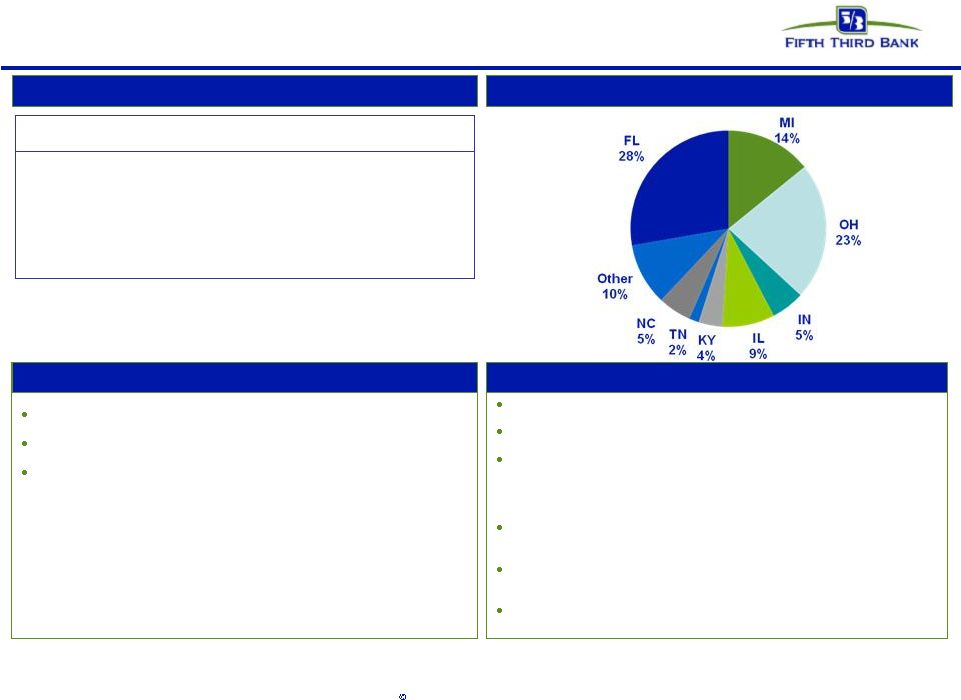

4 Fifth Third Bank | All Rights Reserved Credit by portfolio* Net charge-offs by loan type Net charge-offs by geography *NPAs exclude loans held-for-sale. Ratios in above tables are subject to rounding. ($ in millions) C&I Commercial mortgage Commercial construction Commercial lease Total commercial Residential mortgage Home equity Auto Credit card Other consumer Total consumer Total loans & leases Loan balances $26,131 $11,744 $3,277 $3,388 $44,541 $7,918 $12,186 $10,180 $1,863 $736 $32,882 $77,423 % of total 34% 15% 4% 4% 58% 10% 16% 13% 2% 1% 42% NPAs $788 $1,002 $569 $55 $2,414 $521 $70 $22 $101 $1 $715 $3,129 NPA / Loans + OREO 3.01% 8.43% 16.95% 1.62% 5.39% 6.48% 0.57% 0.22% 5.45% 0.12% 2.16% 4.02% Net charge-offs $161 $99 $78 $4 $342 $88 $73 $31 $44 $4 $240 $582 Net charge-off ratio 2.49% 3.42% 8.57% 0.44% 3.07% 4.46% 2.38% 1.27% 9.23% 2.07% 2.93% 3.01% C&I 28% Commercial mortgage 17% Commercial construction 13% Coml Lease 1% Residential mortgage 15% Home equity 12% Auto 5% Card 8% Other consumer 1% MI 25% OH 15% IN 5% IL 11% TN 3% Other / National 12% FL 22% KY 4% NC 4% |

5 Fifth Third Bank | All Rights Reserved Portfolio performance drivers Performance Largely Driven By No Participation In Discontinued or Suspended Lending * Residential construction-related consumer mortgages intended to be held in portfolio until permanent financing complete. Jumbo mortgage originations currently being held due to market conditions. Geography • Florida and Michigan most stressed • Remaining Midwest and Southeast performance reflect economic trends Products • Homebuilder/developer charge-offs $81 million in 1Q10 – Total charge-off ratio 3.0% (2.4% ex-HBs) – Commercial charge-off ratio 3.1% (2.6% ex- HBs) • Brokered home equity charge-offs 6.2% in 1Q10 – Direct home equity portfolio 1.6% 1Q10 NCO Ratios Coml Cons Total FL/MI 5.5% 5.2% 5.3% Other 2.3% 2.1% 2.2% • Subprime • Option ARMs Discontinued in 2007 • Brokered home equity ($1.9B) Suspended in 2008 • Homebuilder/residential development ($1.3B) • Other non-owner occupied commercial RE excluding homebuilder/developer ($8.0B) Saleability • All mortgages originated for intended sale* Total 3.1% 2.9% 3.0% |

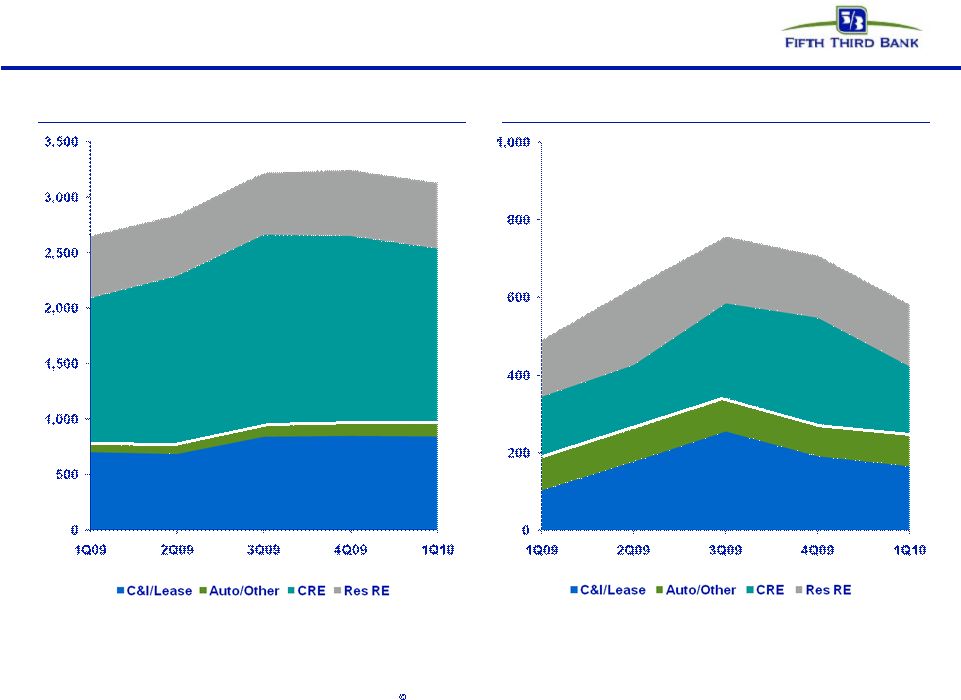

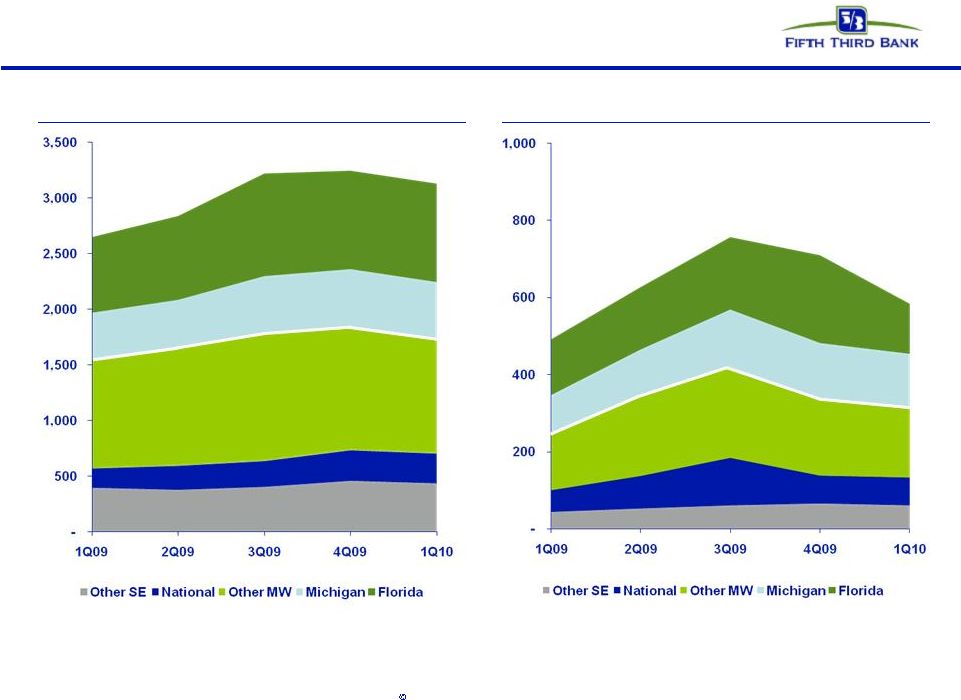

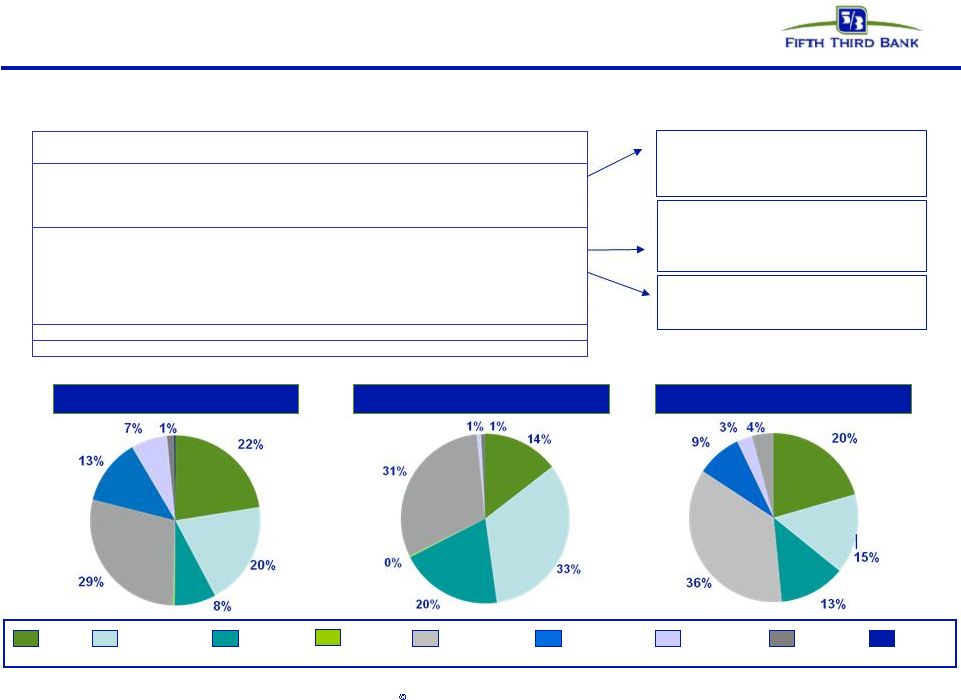

6 Fifth Third Bank | All Rights Reserved Non-performing assets and net charge-offs: Product view* * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. During 1Q09 the Bancorp modified its nonaccrual policy to exclude TDR loans less than 90 days past due because they were performing in accordance with restructured terms. For comparability purposes, prior periods were adjusted to reflect this reclassification. Total NPAs Total NCOs |

7 Fifth Third Bank | All Rights Reserved Total NPAs Total NCOs * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. During 1Q09 the Bancorp modified its nonaccrual policy to exclude TDR loans less than 90 days past due because they were performing in accordance with restructured terms. For comparability purposes, prior periods were adjusted to reflect this reclassification. Non-performing assets and net charge-offs: Geographic view* |

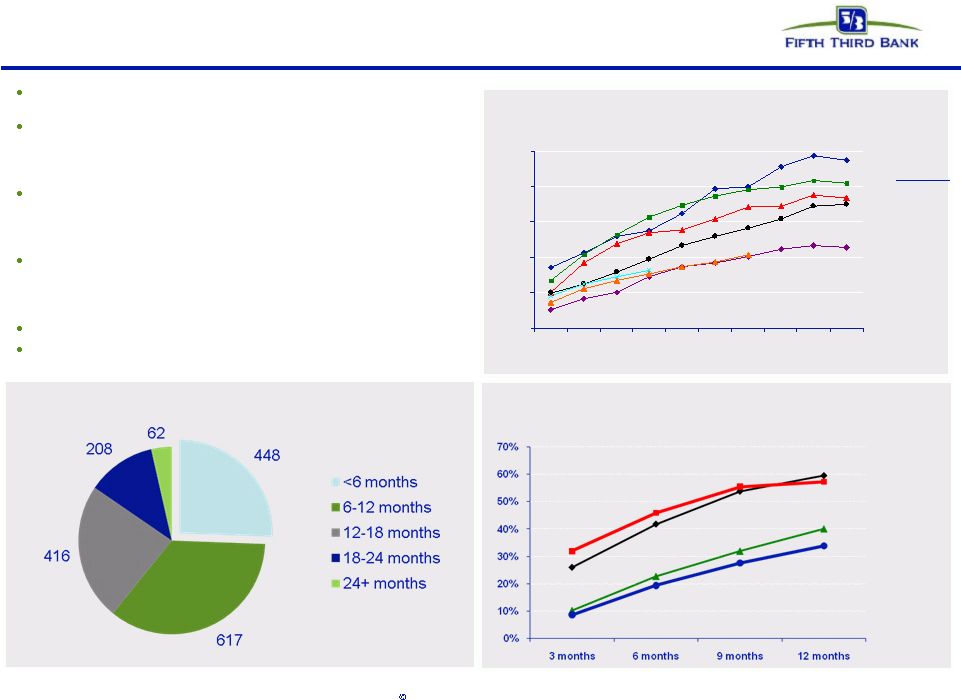

8 Fifth Third Bank | All Rights Reserved Troubled debt restructurings (TDR) overview Successive improvement in vintage performance during 2008 and 2009, even as volume of modification increased Fifth Third’s mortgage portfolio TDRs have redefaulted at a lower rate than other bank held portfolio modifications — Fifth Third’s TDRs are about a third less likely to redefault than modifications on GSE mortgages Of $1.8B in consumer TDRs, over $1.3B (76%) are current — $940M of those have been current more than 6 months, approximately half of which have been current more than a year As current TDRs season, their default propensity declines significantly — We do not typically see significant defaults on current loans once a vintage approaches 12 months since modification Delinquent TDRs total $415M (24%) Of $1.8B in consumer TDRs, $1.5B are on accrual status and $271M are nonaccruals 0% 10% 20% 30% 40% 50% 3 4 5 6 7 8 9 10 11 12 TDR performance has improved in newer vintages Source: Fifth Third and OCC/OTS data; data through 3Q09; industry data cumulative through 3Q09 Mortgage TDR 60+ redefault trend by vintage 1Q08 $69M 2Q08 $135M 3Q08 $146M 4Q08 $176M 1Q09 $221M 2Q09 $257M Months since modification Volume by vintage 3Q09 $386M Current consumer TDRs ($MMs) Outperforming redefault benchmarks Mortgage TDR 60+ redefault rate: Fifth Third comparison (through Sept. 2009) Fannie Mae Industry portfolio loans Fifth Third Freddie Mac |

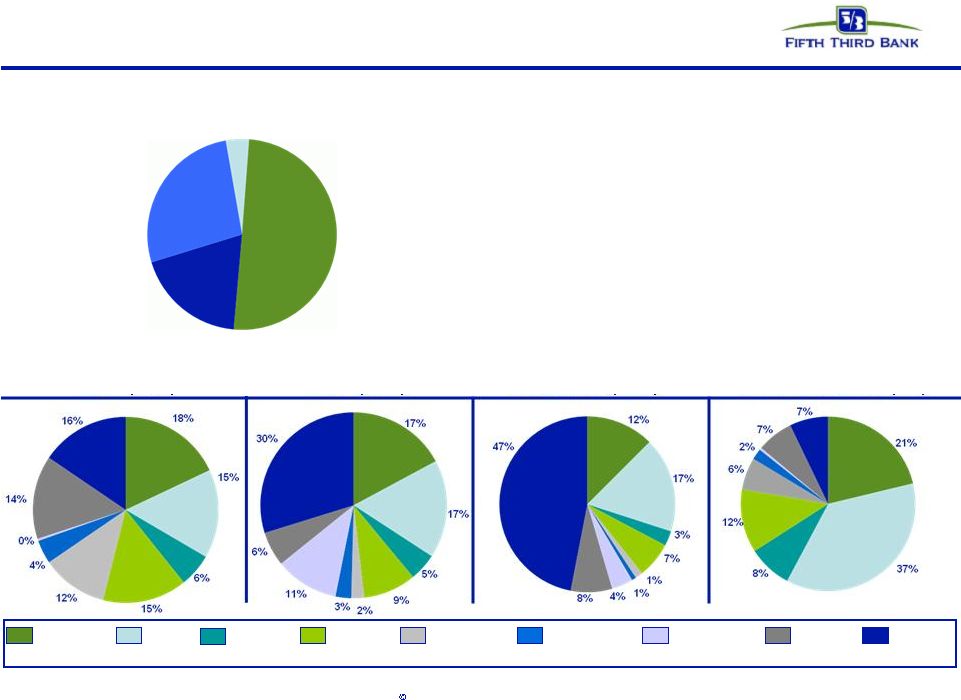

9 Fifth Third Bank | All Rights Reserved Nonperforming assets* • Total NPAs of $3.1B • Homebuilder/developer NPAs of $520M; represent 17% of total NPAs • Commercial NPAs of $2.4B; down 5% from the previous quarter • Consumer NPAs of $715M; up 1% from the previous quarter C&I^ (27%) CRE (50%) Residential (19%) Other Consumer (4%) ^ C&I includes commercial lease ILLINOIS INDIANA FLORIDA TENNESSEE KENTUCKY OHIO MICHIGAN NORTH CAROLINA OTHER / NATIONAL * NPAs exclude loans held-for-sale. Residential $590M 19% C&I^ $843M 27% Other $96M 4% CRE $1.6B 50% |

10 Fifth Third Bank | All Rights Reserved Nonperforming loan rollforward Commercial Consumer Total 1Q09 2Q09 3Q09 4Q09 1Q10 Beginning NPL amount 457 459 477 517 555 New nonaccrual loans 157 125 160 152 137 Net other activity (155) (107) (120) (114) (131) Ending Consumer NPL 459 477 517 555 561 Total NPL 2,396 2,587 2,947 2,947 2,733 Total new nonaccrual loans 956 669 992 754 542 1Q09 2Q09 3Q09 4Q09 1Q10 Beginning NPL amount 1,406 1,937 2,110 2,430 2,392 New nonaccrual loans 799 544 832 602 405 Paydowns, transfers and sales (157) (190) (246) (332) (425) Charge-offs (111) (181) (266) (308) (200) Ending Commercial NPL 1,937 2,110 2,430 2,392 2,172 |

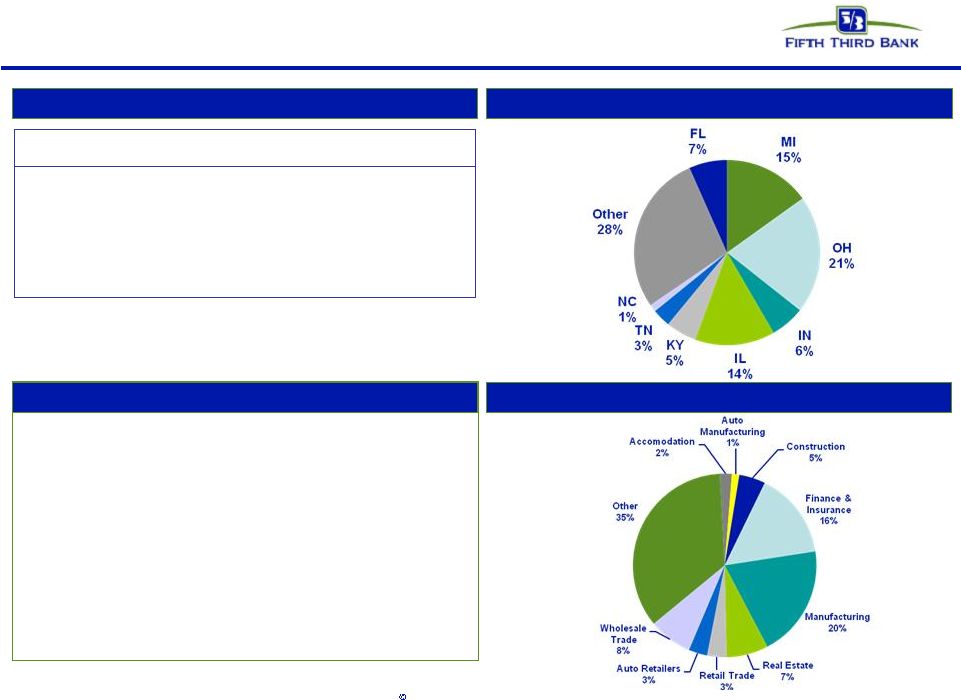

11 Fifth Third Bank | All Rights Reserved Commercial & industrial* Loans by geography Credit trends Loans by industry Comments • 32% of 1Q10 losses on loans to companies in real estate related industries – Loans to real estate related industries of $3.2B; 1Q10 NCO ratio of 6.6% – 1Q10 C&I loss rate of 2.5%, excluding loans to real estate related industries, 1.9% • FL represented 16% of 1Q10 losses, 7% of loans; MI represented 27% of losses, 15% of loans * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $28,617 $28,409 $26,175 $25,683 $26,131 90+ days delinquent $131 $142 $256 $118 $63 as % of loans 0.46% 0.50% 0.98% 0.46% 0.24% NPAs $675 $634 $790 $781 $788 as % of loans 2.36% 2.23% 3.02% 3.04% 3.02% Net charge-offs $103 $177 $256 $183 $162 as % of loans 1.45% 2.53% 3.70% 2.81% 2.49% C&I |

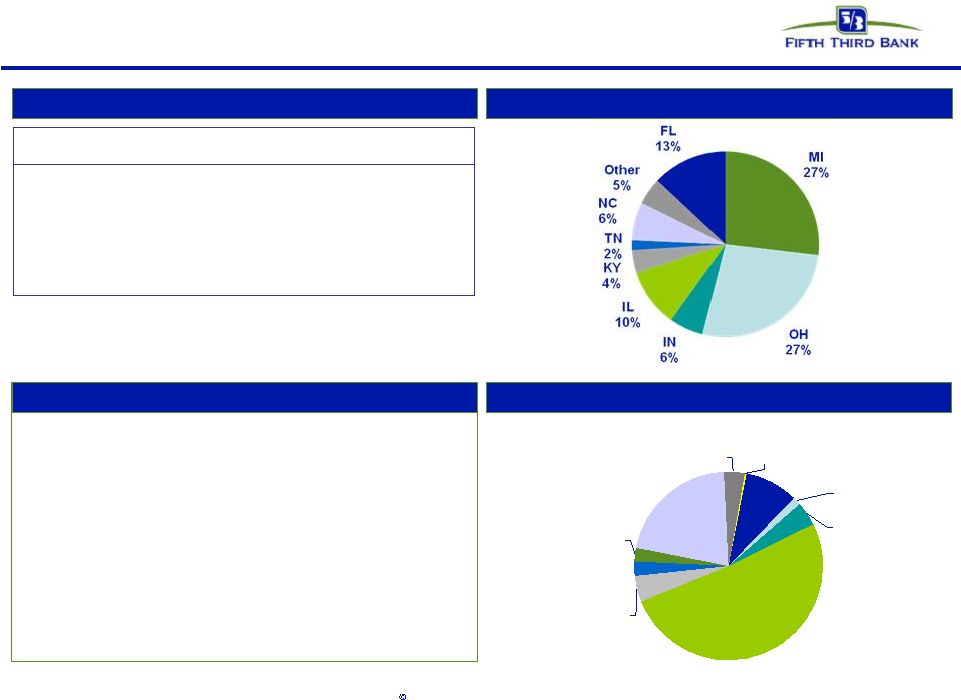

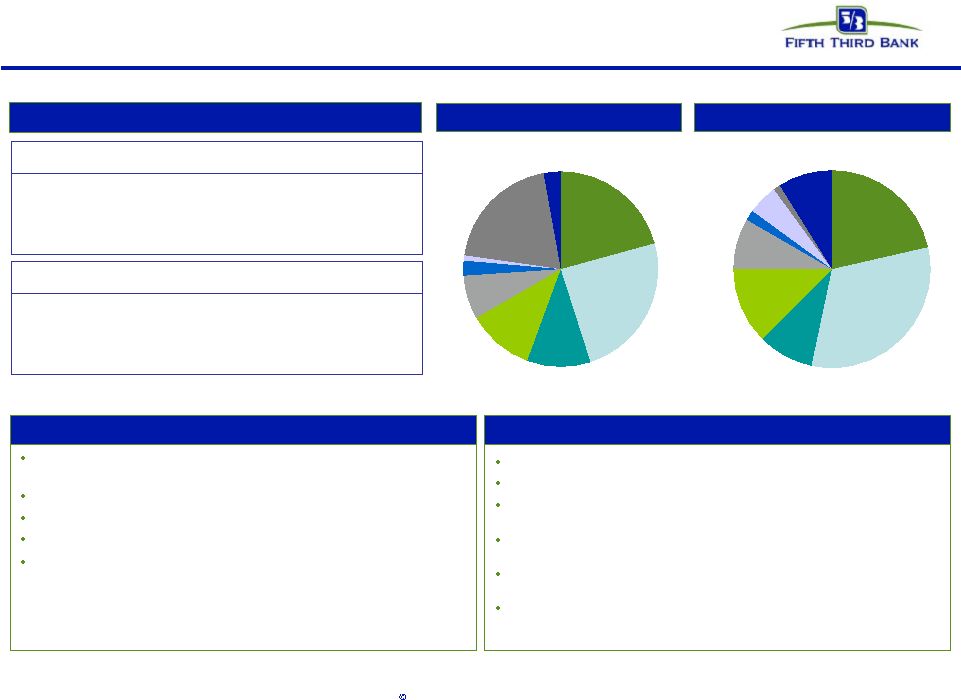

12 Fifth Third Bank | All Rights Reserved Commercial mortgage* Accomodation 4% Retail Trade 4% Construction 9% Auto Manufacturing 0% Finance & Insurance 1% Manufacturing 4% Real Estate 52% Other 21% Wholesale Trade 2% Auto Retailers 3% Loans by geography Credit trends Loans by industry Comments • Owner occupied 1Q10 NCO ratio of 2.1%, other non-owner occupied 1Q10 NCO ratio of 4.5% • In 4Q08 reduced problem assets in most stressed markets (FL and MI) through portfolio actions • Loans from FL/MI represented 40% of total loans, 53% of total losses in 1Q10 * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $12,560 $12,407 $12,105 $11,803 $11,744 90+ days delinquent $124 $131 $184 $59 $44 as % of loans 0.99% 1.06% 1.52% 0.50% 0.38% NPAs $718 $791 $968 $985 $1,002 as % of loans 5.72% 6.37% 8.00% 8.34% 8.53% Net charge-offs $77 $85 $118 $142 $99 as % of loans 2.50% 2.73% 3.82% 4.69% 3.42% Commercial mortgage |

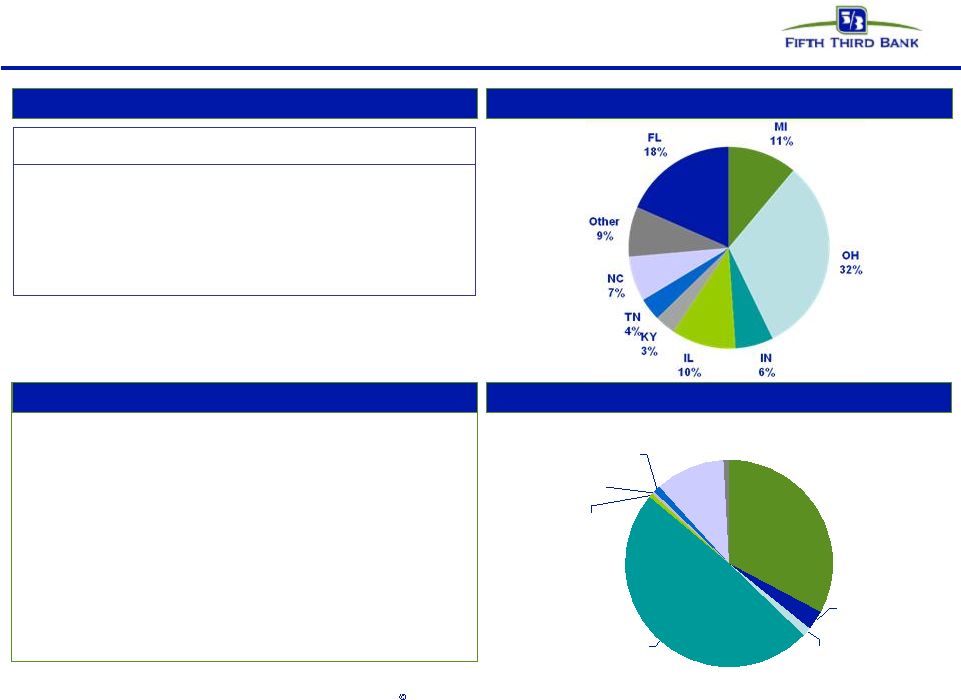

13 Fifth Third Bank | All Rights Reserved Commercial construction* Accomodation 1% Auto Retailers 0% Finance & insurance 3% Construction 33% Manufacturing 1% Real estate 49% Retail Trade 1% Other 11% Wholesale Trade 1% Loans by geography Credit trends Loans by industry Comments * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. • Owner occupied 1Q10 NCO ratio of 4.6%, other non-owner occupied 1Q10 NCO ratio of 9.7% • In 4Q08 reduced problem assets in most stressed markets (FL and MI) through portfolio actions • Loans from FL/MI represented 29% of total loans, 40% of total losses in 1Q10 ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $4,745 $4,491 $4,147 $3,784 $3,277 90+ days delinquent $49 $60 $168 $16 $9 as % of loans 1.02% 1.34% 4.04% 0.44% 0.28% NPAs $597 $735 $751 $707 $569 as % of loans 12.59% 16.36% 18.11% 18.68% 17.36% Net charge-offs $76 $79 $126 $135 $78 as % of loans 6.21% 6.76% 11.56% 13.28% 8.57% Commercial construction |

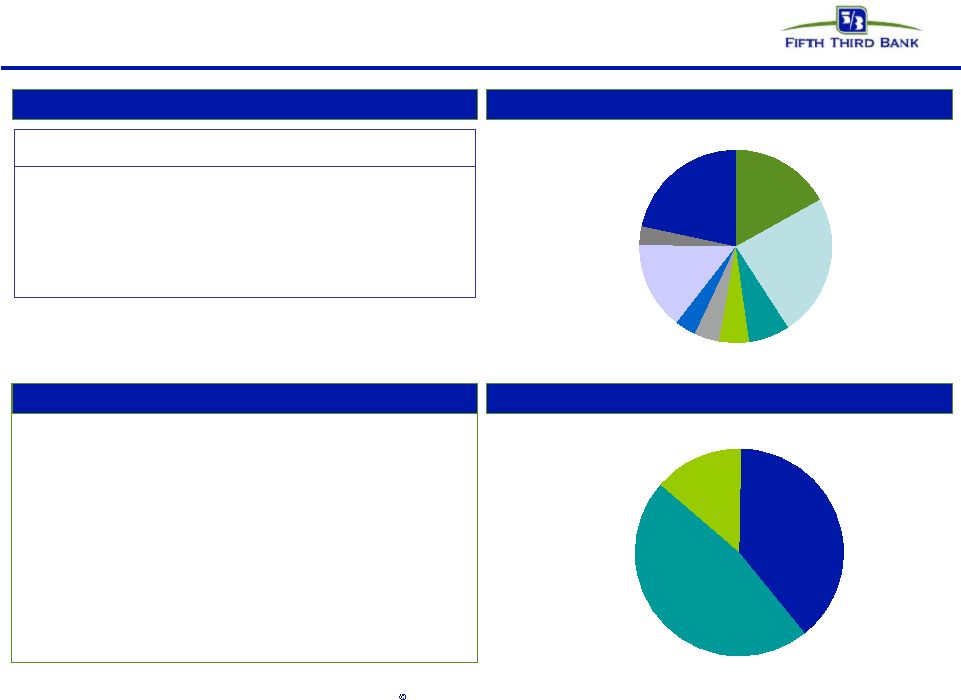

14 Fifth Third Bank | All Rights Reserved Homebuilders/developers* Loans by geography Credit trends Loans by industry Comments • Currently making no new loans to builder/developer sector • Residential & land valuations under continued stress • 3% of commercial loans; 2% of total loans • Balance by product approximately 39% Construction, 47% Mortgage, 14% C&I MI 17% OH 23% IN 7% IL 5% KY 4% TN 4% NC 15% Other 3% FL 22% C&I 14% Commercial construction 39% Commercial mortgage 47% * NPAs exclude loans held-for-sale. Net charge-offs exclude losses on loans sold or transferred to held-for-sale in 4Q08. ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $2,322 $2,102 $1,846 $1,563 $1,324 90+ days delinquent $37 $53 $79 $19 $6 as % of loans 1.59% 2.51% 4.29% 1.19% 0.43% NPAs $554 $613 $600 $548 $520 as % of loans 23.87% 29.14% 32.51% 35.09% 39.28% Net charge-offs $64 $76 $108 $110 $81 as % of loans 10.73% 14.06% 21.92% 26.25% 22.89% Homebuilders/developers |

15 Fifth Third Bank | All Rights Reserved Residential mortgage 1 liens: 100% ; weighted average LTV: 78% Weighted average origination FICO: 724 Origination FICO distribution: <660 11%; 660-689 8%; 690-719 12%; 720-749 14%; 750+ 31%; Other ^ 24% (note: loans <660 includes CRA loans and FHA/VA loans) Origination LTV distribution: <=70 26%; 70.1-80 41%; 80.1-90 11%; 90.1-95 6%; >95% 16% Vintage distribution: 2010 2%; 2009 6%; 2008 13%; 2007 16%; 2006 15%; 2005 24%; 2004 and prior 24% % through broker: 13%; performance similar to direct Loans by geography Credit trends Portfolio details Comments FL portfolio 28% of loans driving 53% of total losses FL lots ($260M) running at 29% annualized loss rate (YTD) Mortgage company originations targeting 95% salability ^ Includes acquired loans where FICO at origination is not available During 1Q09 the Bancorp modified its nonaccrual policy to exclude TDR loans less than 90 days past due because they were performing in accordance with restructured terms. For comparability purposes, prior periods were adjusted to reflect this reclassification. ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $8,875 $8,489 $8,229 $8,035 $7,918 90+ days delinquent $231 $242 $198 $189 $157 as % of loans 2.60% 2.85% 2.41% 2.35% 1.98% NPAs $475 $475 $484 $523 $521 as % of loans 5.35% 5.59% 5.89% 6.51% 6.57% Net charge-offs $75 $112 $92 $78 $88 as % of loans 3.27% 5.17% 4.38% 3.82% 4.46% Residential mortgage st |

16 Fifth Third Bank | All Rights Reserved Home equity 1 liens: 29%; 2 liens: 71% Weighted average origination FICO: 757 Origination FICO distribution: <660 4%; 660-689 8%; 690-719 13%; 720-749 17%; 750+ 49%; Other 10% Average CLTV: 75% Origination CLTV distribution: <=70 43%; 70.1-80 23%; 80.1-90 17%; 90.1-95 6%; >95 10% Vintage distribution: 2010 1%; 2009 5%; 2008 11%; 2007 12%; 2006 16%; 2005 15%; 2004 and prior 41% % through broker channels: 16% WA FICO: 739 brokered, 760 direct; WA CLTV: 90% brokered; 73% direct Portfolio details Comments Brokered loans by geography Direct loans by geography Credit trends Approximately 16% of portfolio in broker product driving approximately 40% total loss Approximately one third of Fifth Third 2 liens are behind Fifth Third 1 liens Sequential improvement generally due to lower losses in FL 2005/2006 vintages represent 31% of portfolio; account for 56% of losses Aggressive home equity line management strategies in place Note: Brokered and direct home equity net charge-off ratios are calculated based on end of period loan balances ^ Includes acquired loans where FICO at origination is not available MI 21% OH 33% IN 9% IL 13% KY 8% Other 1% FL 9% NC 5% TN 1% MI 21% OH 25% IN 10% IL 11% KY 7% Other 20% FL 3% NC 1% TN 2% ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $2,225 $2,125 $2,028 $1,948 $1,906 90+ days delinquent $42 $34 $38 $33 $29 as % of loans 1.91% 1.58% 1.87% 1.72% 1.53% Net charge-offs $30 $39 $30 $34 $30 as % of loans 5.46% 7.41% 5.96% 7.02% 6.31% Home equity - brokered ($ in millions) 1Q09 2Q09 3Q09 4Q09 1Q10 Balance $10,486 $10,386 $10,349 $10,226 $10,280 90+ days delinquent $61 $63 $66 $65 $60 as % of loans 0.59% 0.61% 0.64% 0.64% 0.58% Net charge-offs $42 $49 $49 $48 $43 as % of loans 1.62% 1.91% 1.89% 1.85% 1.65% Home equity - direct nd st nd st |

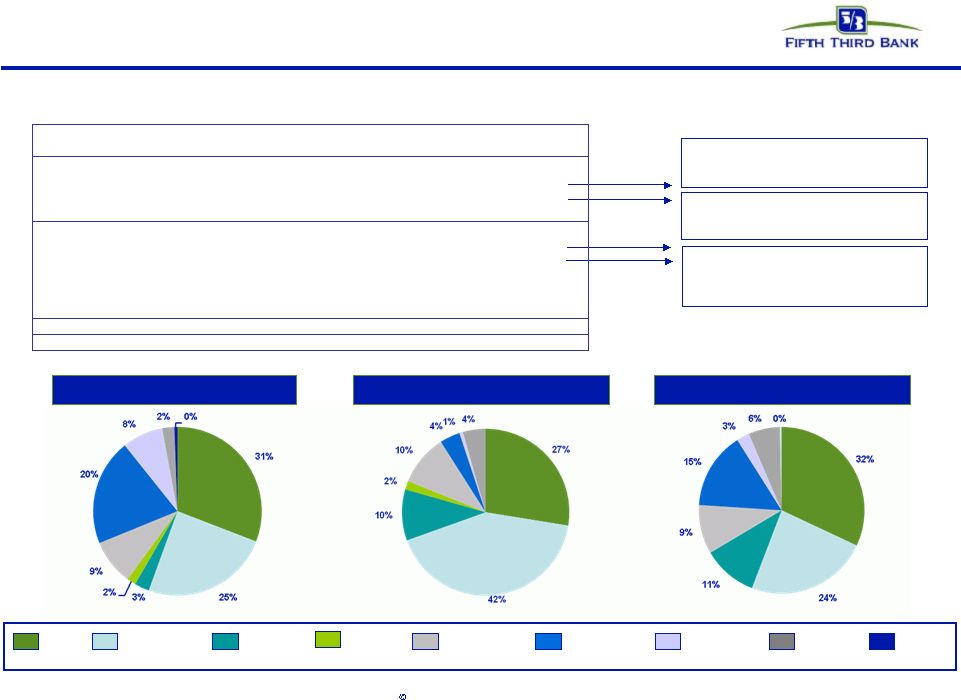

17 Fifth Third Bank | All Rights Reserved Florida market* Deterioration in real estate values having effect on credit trends as evidenced by increasing NPA/NCOs in real estate related products Homebuilders, developers tied to weakening real estate market Losses due to significant declines in valuations Valuations; relatively small home equity portfolio COML MORTGAGE C&I RESI MORTGAGE OTHER CONS COML CONST COML LEASE HOME EQUITY AUTO CREDIT CARD Total Loans NPAs NCOs * NPAs exclude loans held-for-sale. ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 1.7 7% 128 16% 27 16% Commercial mortgage 1.5 13% 295 29% 20 20% Commercial construction 0.6 18% 174 31% 16 21% Commercial lease 0.0 1% 2 4% - 0% Commercial 3.9 9% 599 25% 63 18% Mortgage 2.2 28% 271 52% 46 53% Home equity 1.0 8% 6 9% 11 15% Auto 0.5 5% 2 8% 4 12% Credit card 0.1 6% 7 7% 5 12% Other consumer 0.0 2% 0 22% 0 9% Consumer 3.8 12% 286 40% 67 28% Total 7.7 10% 885 28% 130 22% |

18 Fifth Third Bank | All Rights Reserved Michigan market* Deterioration in home price values coupled with weak economy impacting credit trends due to frequency of defaults and severity Homebuilders, developers tied to weak real estate market Negative impact from housing valuations, economy, unemployment Economic weakness impacts commercial real estate market COML MORTGAGE C&I RESI MORTGAGE OTHER CONS COML CONST COML LEASE HOME EQUITY AUTO CREDIT CARD Total Loans NPAs NCOs * NPAs exclude loans held-for-sale. ($ in millions) Loans (bn) % of FITB NPAs (mm) % of FITB NCOs (mm) % of FITB Commercial loans 3.9 15% 143 18% 44 27% Commercial mortgage 3.2 27% 218 22% 33 33% Commercial construction 0.4 11% 51 9% 15 19% Commercial lease 0.2 6% 9 16% 2 0% Commercial 7.7 17% 421 17% 94 27% Mortgage 1.1 14% 51 10% 13 15% Home equity 2.6 21% 22 32% 21 28% Auto 1.0 10% 4 16% 3 11% Credit card 0.3 16% 23 22% 8 19% Other consumer 0.1 10% 0 11% 1 13% Consumer 5.1 16% 100 14% 46 19% Total 12.8 16% 521 17% 140 24% |

19 Fifth Third Bank | All Rights Reserved Cautionary statement This report may contain statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and weakening in the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third (10) competitive pressures among depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged; (14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (19) effects of accounting or financial results of one or more acquired entities; (20) difficulties in separating Fifth Third Processing Solutions from Fifth Third; (21) loss of income from any sale or potential sale of businesses that could have an adverse effect on Fifth Third’s earnings and future growth;(22) ability to secure confidential information through the use of computer systems and telecommunications networks; and (23) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. |