Fifth Third Bank | All Rights Reserved Exhibit 99.1 Investor Update September 15, 2010 Please refer to earnings release dated July 22, 2010 and 10-Q dated August 9, 2010 for further information, including full results reported on a U.S. GAAP basis |

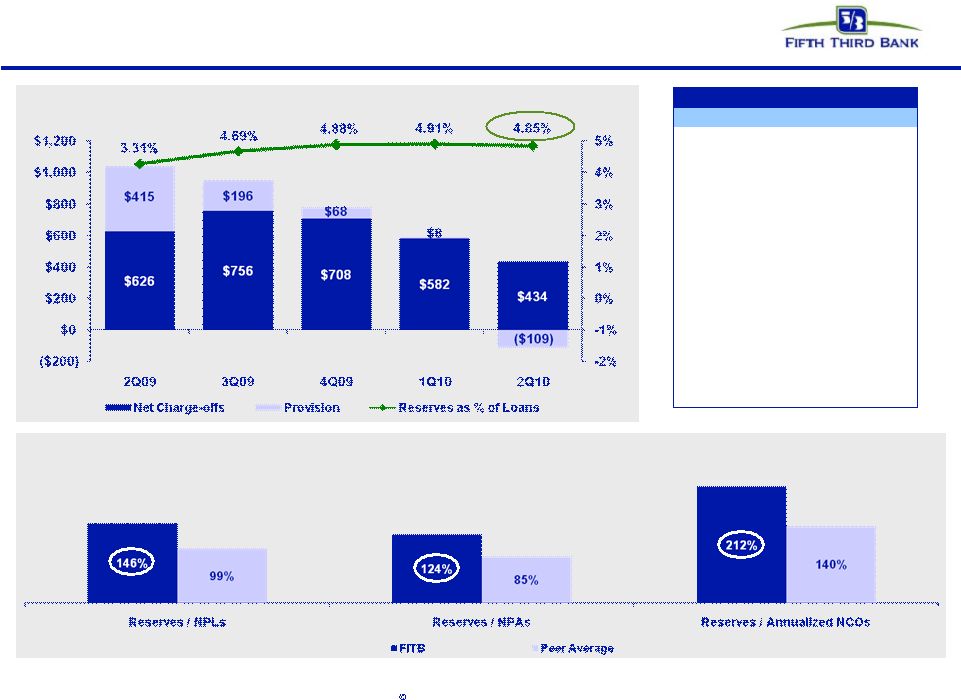

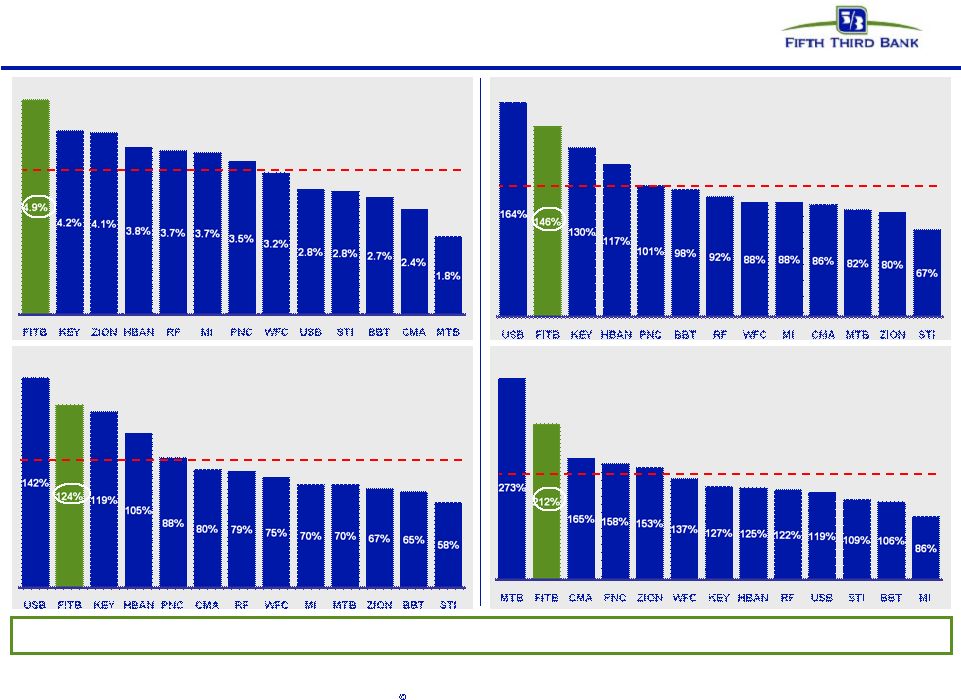

2 Fifth Third Bank | All Rights Reserved 2Q10 in review Significant improvement in credit trends • Net charge-offs declined 25% sequentially (lowest level since 2Q08) – At $434M, down 43% from $756M peak • Nonperforming assets declined 5% and nonperforming loans declined 8% sequentially (lowest levels since the first half of 2009) – Total delinquencies declined 17% sequentially (lowest level since 2Q07) • Loan loss allowance of 4.85%, 146% of nonperforming loans and leases and more than two times annualized 2Q10 net charge-offs • Realized credit losses have been significantly below SCAP scenarios Actions driving progress • Focusing on credit quality, portfolio management and loss mitigation strategies • Executing on customer satisfaction initiatives and improving customer loyalty • Enhancing breadth and profitability of offerings and relationships • Becoming an employer of choice in the industry by continuing to enhance employee engagement Continued strong operating results • Net income of $192 million versus 1Q10 net loss of $10 million • Pre-provision net revenue of $567 million consistent with 1Q10 • Average core deposits up $582 million, or 1% sequentially; Average transaction deposits up $1.3 billion, or 2% sequentially • Strong capital ratios: Tier 1 common 7.2%, Leverage ratio 12.2%, Tier 1 ratio 13.7%, Total capital ratio 18.0% • Extended $20 billion of new and renewed credit |

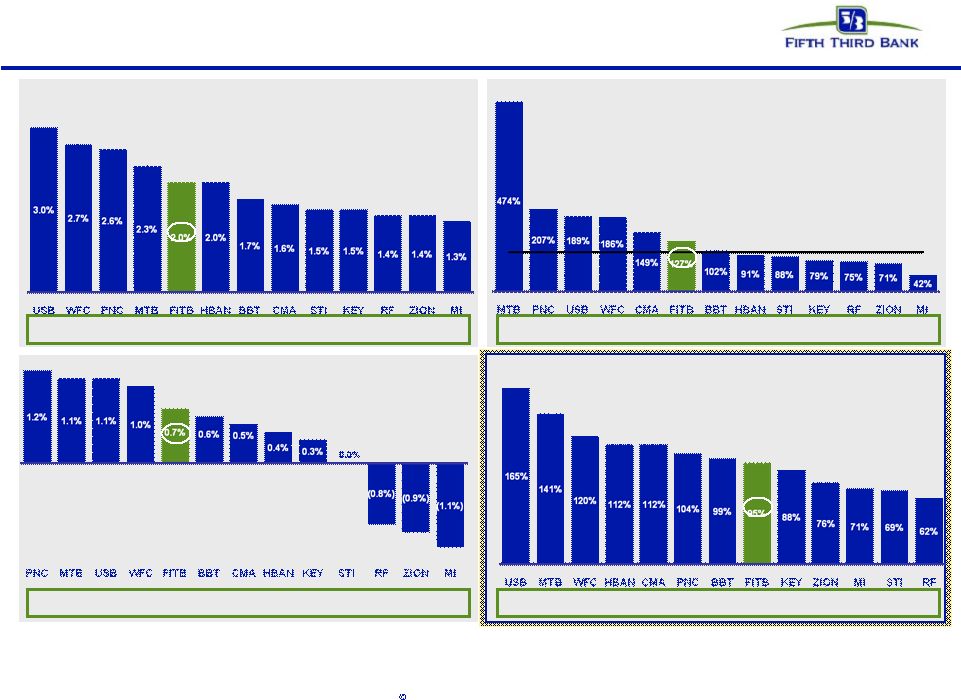

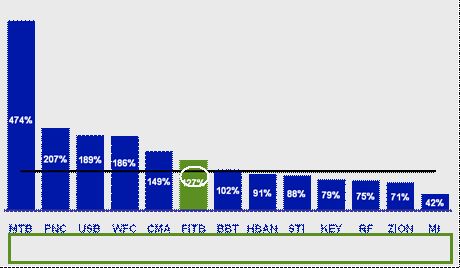

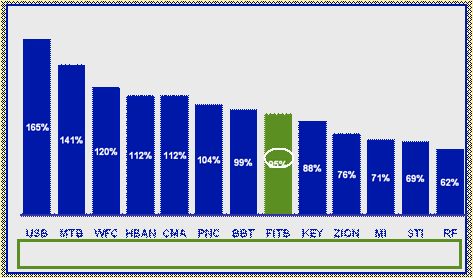

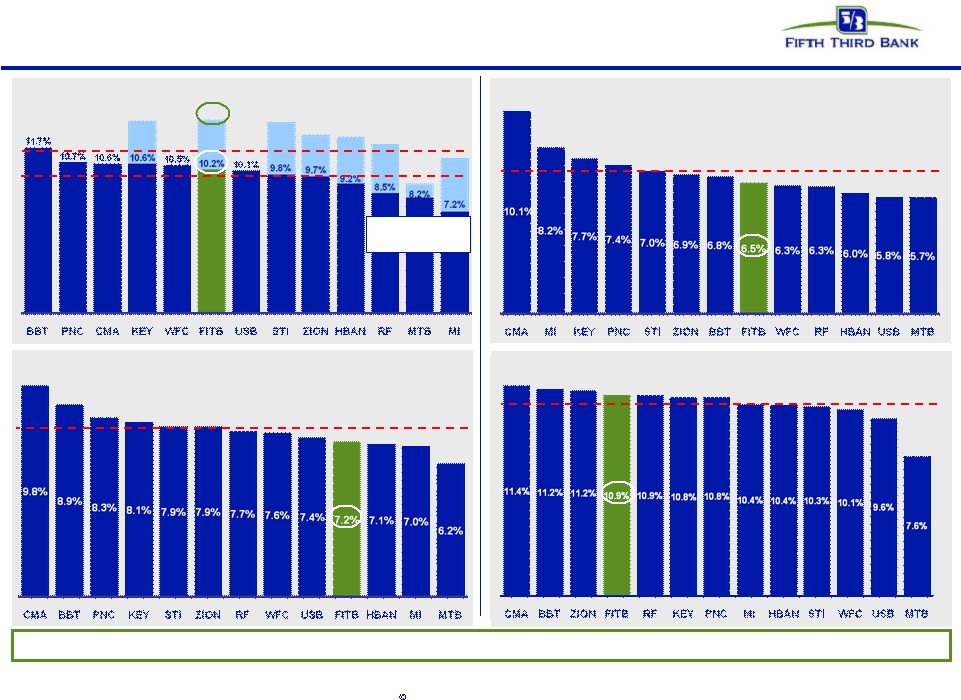

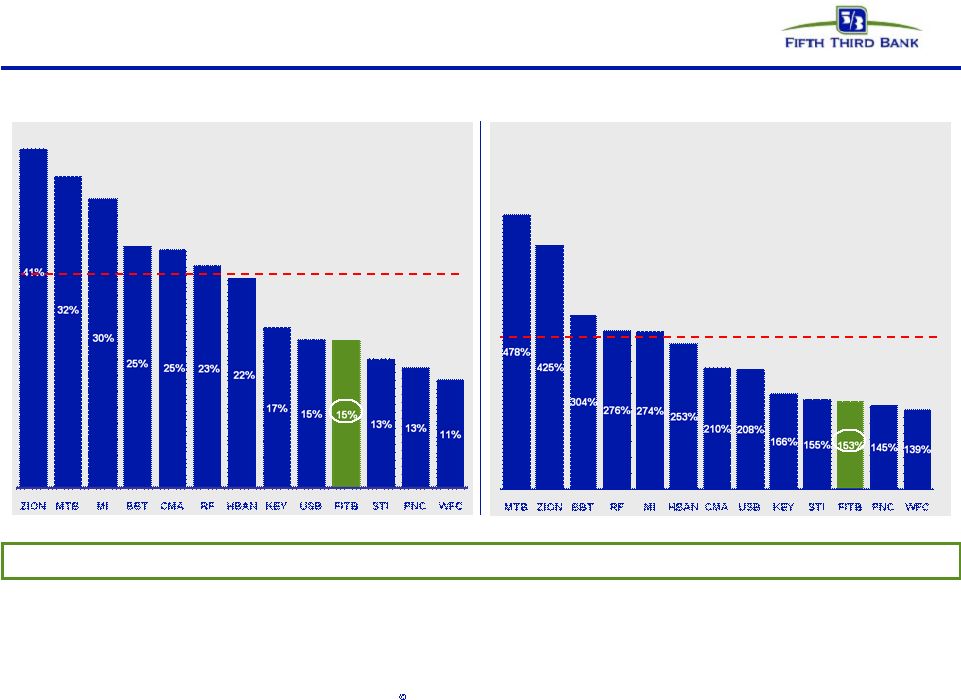

3 Fifth Third Bank | All Rights Reserved Strong profitability results Strong profitability results Core PPNR / Average assets (Annualized) Core PPNR / NCOs Price to Book Value Strong relative profitability not yet reflected in valuation. Source: SNL Financial and company reports. Data as of 2Q10. Price to Book as of 9/9/10. * Core pre-tax pre-provision earnings excludes the following items: securities gains/losses, gains/losses from debt extinguishments, leveraged lease gains/losses, gains from asset sales, and other non-recurring items. ROAA …driving above average profitability. …more than sufficient to absorb credit losses… Strong pre-provision profitability… |

4 Fifth Third Bank | All Rights Reserved Net interest income NII and NIM (FTE) • Sequential trends in net interest income and net interest margin reflect weak loan demand and impact of excess liquidity held in cash equivalents – NII down $14M and NIM down 6 bps in 2Q10 over prior quarter • Expect improved NII and NIM in 3Q10 from CD maturities, stable loan spreads, and public funds deposit runoff (bps) Reported NIM and YOY growth versus peers Peers include: BBT, CMA, HBAN, KEY, MI, MTB, PNC, RF, STI, USB, WFC, ZION Source: SNL Financial and company reports * Reflects purchase accounting adjustments from the First Charter acquisition of $37M, $29M, $25M, $21M, and $17M in 2Q09, 3Q09, 4Q09, 1Q10, and 2Q10, respectively. ** Excludes purchase accounting adjustments Yields and rates** ($Ms) |

5 Fifth Third Bank | All Rights Reserved Balance sheet: Continued growth in core funding • CRE loans down 4% sequentially and 14% from the previous year • C&I loans were flat sequentially and down 7% from the previous year largely due to customer pay-downs and deleveraging despite strong originations – C&I balance trends more positive thus far in 3Q10 • Consumer loans down 2% sequentially and 1% from the previous year – 3Q10 balances likely to increase due to retention of higher quality, shorter term mortgages • Currently expect period end loans to be flat to up modestly in 3Q10 • Loan to core deposit ratio of 100%, down from 119% in 2Q09 • Everyday Great Rates strategy continues to drive core deposit growth – DDAs up 3% sequentially and 16% year-over-year – Retail transaction deposits up 5% sequentially and 12% from 2Q09 – Commercial transaction deposits down 2% from 1Q10, up 41% from 2Q09 • Expect modest period end core deposit growth in 3Q10, despite public funds and CD runoff Average loan growth ($B)^ Average core deposit growth ($B) 82 80 78 78 69 70 72 76 Average wholesale funding ($B) 31 26 20 22 • Reduced wholesale funding by $1.2 billion sequentially and $12.4 billion from the previous year – Non-core deposits down 10% sequentially and 45% from the previous year – Short term borrowings up 4% sequentially and down 80% from the previous year – Long-term debt down 5% sequentially and 2% from the previous year ^ Excludes loans held-for-sale Note: Numbers may not sum due to rounding 77 77 19 |

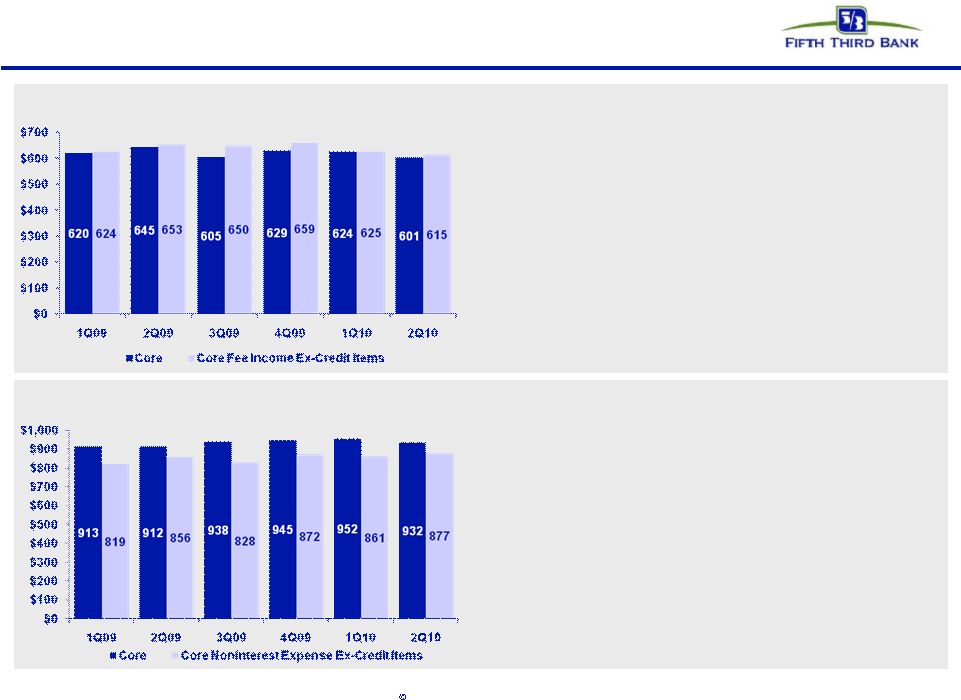

6 Fifth Third Bank | All Rights Reserved Stable income and expense in difficult environment Core fee income ($M) Core expenses ($M) • Core noninterest income of $601M declined $23M, or 4%, compared with prior quarter, impacted by lower mortgage banking net revenue • Sequential strength in card and processing revenue (+15%), corporate banking revenue (+14%), and deposit service charges (+5%) • Credit-related costs affected fee income by $14M in 2Q10 compared with $1M in 1Q10 and $8M in 2Q09 • 3Q mortgage revenue results likely to be stronger than originally expected, reflecting continued strong originations and current MSR hedge gain positions • Reg E impact tracking to be in-line or modestly better than initial $80 million annualized estimate (unmitigated) • 3Q10 pretax gain on BOLI settlement of $125 million (net of expenses) • Expense trends reflect elevated credit costs, higher compensation due to increased production levels, and investment in sales force expansion • Core efficiency ratio of 62.6% in 2Q10, compared with 62.4% in 1Q10 and 61.6% in 2Q09 • Credit-related costs affected noninterest expenses by $55M in 2Q10 ($91M in 1Q10 and $57M in 2Q09) • Total expense related to mortgage repurchases ~$18M in 2Q10 compared with $39M in 1Q10 and $10M in 2Q09 – Mortgage repurchase expense expected to increase in 3Q10; increased claims, file requests and losses likely to result in higher modeled 3Q mortgage repurchase reserves * Refer to slide 20 for itemized effects of non-core fees and expenses |

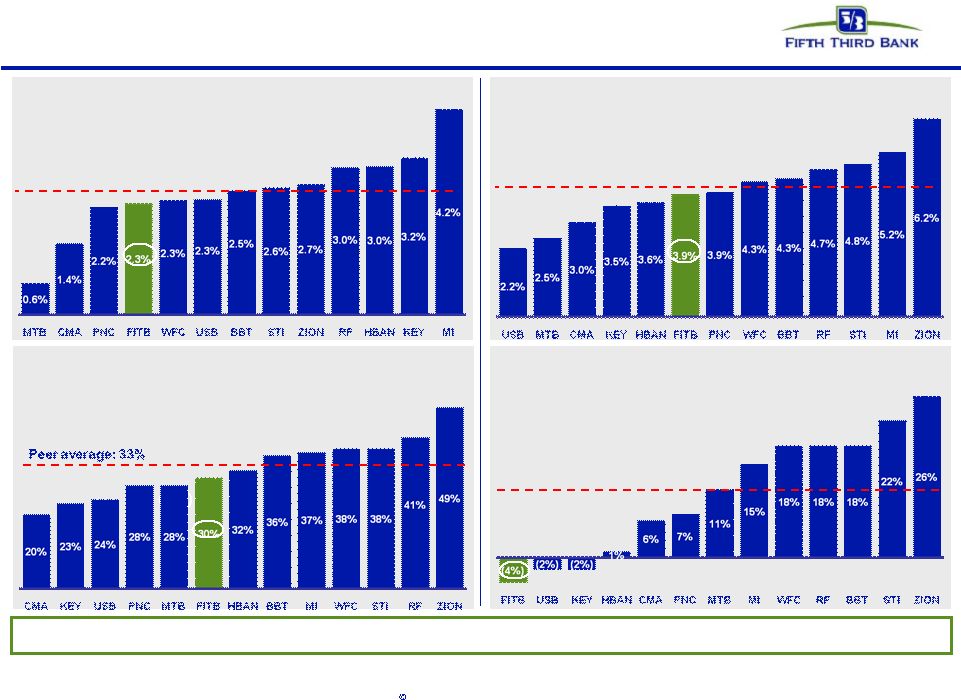

7 Fifth Third Bank | All Rights Reserved Strong credit metrics compared with peers Source: SNL Financial and company reports. Data as of 2Q10. HFI NPA Ratio Peer average: 2.5% Peer average: 4.0% Net Charge-off Ratio (Annualized) “Texas Ratio” (HFI NPAs + Over 90s) / (Reserves + TCE) HFI NPAs + Over 90s - Reserves / TCE Peer average: 11% FITB credit metrics lower than peer average and represent position of relative strength |

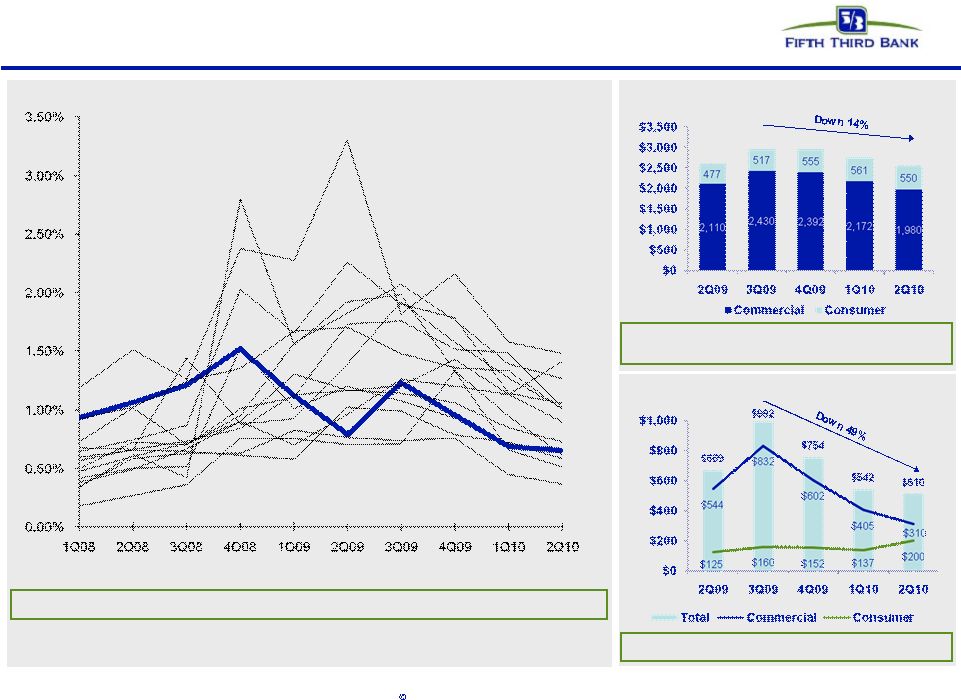

8 Fifth Third Bank | All Rights Reserved Recent credit trends better than peers Source: SNL and company reports. NPA and NCO ratios exclude loans held-for-sale and covered assets for peers where appropriate. * 4Q08 net charge-offs included $800M in NCOs related to commercial losses moved to held-for-sale FITB credit metrics were higher than peers but are now generally better than peers NPA ratio vs. peers Net charge-off ratio vs. peers* Loans over 90 days delinquent % vs. peers Loans 30-89 days delinquent % vs. peers (7.5%) (HFS transfer) |

9 Fifth Third Bank | All Rights Reserved Non-performing loans Non-performing loans ($M) $2.6B $2.9B $2.9B $2.7B Non-performing loans improving with lower severity mix $2.5B Non-performing loan inflows have been lower than peers since early 2009. FITB NPL inflows (relative to loans) vs. Peers FITB Source: SNL Financial Peers include: BAC, BBT, C, CMA, HBAN, JPM, KEY, MI, MTB, PNC, RF, STI, USB, and WFC New non-performing loan flows ($M) NPL flows have declined significantly |

10 Fifth Third Bank | All Rights Reserved Strong reserve position Source: SNL Financial and company reports. NPAs/NPLs exclude held-for-sale portion for all banks and covered assets for BBT, USB, and ZION. Coverage ratios are strong relative to peers Industry leading reserve level 1. FITB 4.85% 2. KEY 4.16% 3. ZION 4.11% 4. HBAN 3.79% 5. RF 3.71% 6. MI 3.69% 7. PNC 3.46% 8. WFC 3.21% 9. USB 2.83% 10. STI 2.79% 11. BBT 2.66% 12. CMA 2.38% 13. MTB 1.77% Peer Average 3.21% Reserves / Loans |

11 Fifth Third Bank | All Rights Reserved Robust capital position Source: SNL Financial and company reports. Strong capital ratios relative to peers, particularly considering reserve levels Peer average w/ TARP: 11.5% Peer average w/o TARP: 9.7% Tier 1 capital ratio (with and without TARP) 9.2% 11.0% 13.5% 12.6% 12.5% 13.6% 13.7% 12.0% Tangible common equity ratio Peer average: 7.0% Tier 1 common ratio Peer average: 7.8% (Tier 1 common + reserves) / RWA Peer average: 10.4% |

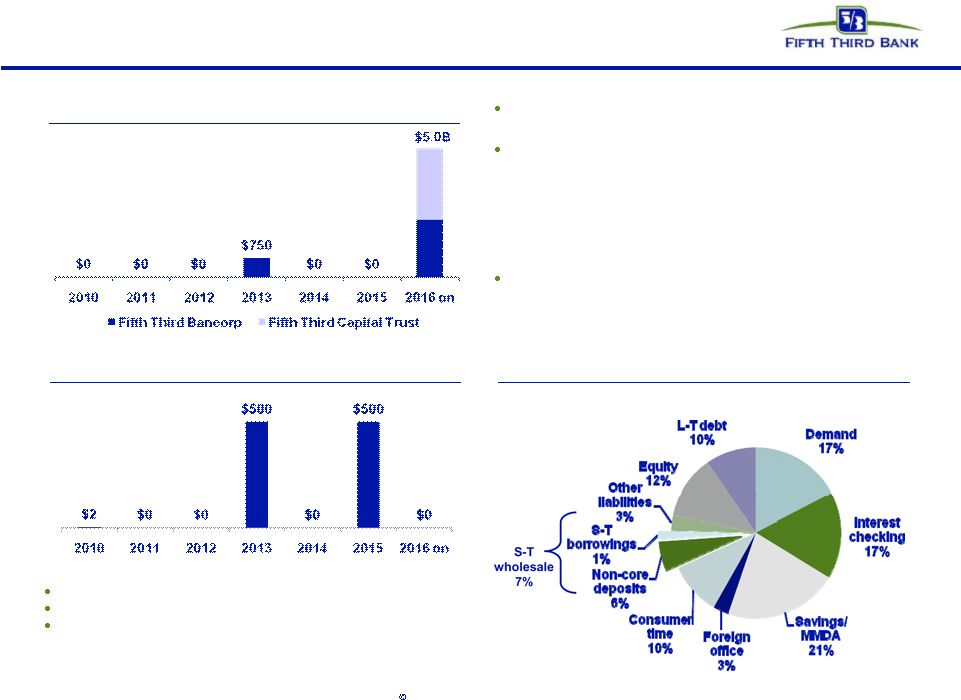

12 Fifth Third Bank | All Rights Reserved Strong liquidity profile Retail Brokered CD maturities: $328M in 2010; $31M in 2011 FHLB borrowings $2.6B 6/30 unused avail. capacity $22B ($18.1B in Fed and $3.6B in FHLB) Holding Company cash at 6/30/10: $1.4B — Total Fed deposits ~$4.0B Expected cash obligations over the next 12 months (assuming no TARP repayment) — $0 debt maturities — ~$39M common dividends — ~$205M preferred dividends (~$35M Series G, ~$170M TARP) — ~$281M interest and other expenses Cash currently sufficient to more than satisfy all fixed obligations* over the next 24 months without accessing capital markets/subsidiary dividends Bank unsecured debt maturities ($M – excl. Brokered CDs) Heavily core funded Holding company unsecured debt maturities ($M) * Debt maturities, common and preferred dividends, interest and other expenses |

13 Fifth Third Bank | All Rights Reserved Liquidity management Over the past two years, Fifth Third has taken a number of steps to strengthen the overall liquidity position of the bank and to strengthen overall liquidity risk management. These items include: — A shift to a more core-funded balance sheet, with a focus on relationship deposits — Decreased reliance on unsecured short-term funding and less stable funding sources — Increased efficiency in mobilizing assets for funding and contingent liquidity purposes – Better recognition of the liquidity value of various assets, and the ease with which those assets can be utilized for funding — The implementation of additional liquidity metrics to enhance liquidity and funding management Liquidity measures are significantly improved relative to pre-crisis levels: Liquidity Comparison June 30th, 2008 June 30th, 2010 Total Wholesale Funding Portfolio $28 Billion $11 Billion % Maturing within 1 Year 61% 3% Total FHLB Borrowings $6 Billion $3 Billion Brokered CDs $6 Billion $358 Million Overnight Borrowings $3 Billion $0 Total Secured Borrowing Capacity $13 Billion $24 Billion Non-Core Funding / Total Assets 32% 17% Net Loans & Leases / Core Deposits 133% 102% Core Deposits $64 Billion $76 Billion Fifth Third will continue to focus on core funding, asset liquidity, and contingent funding sources, while maintaining a low reliance on unsecured short-term funding and more volatile funding sources. |

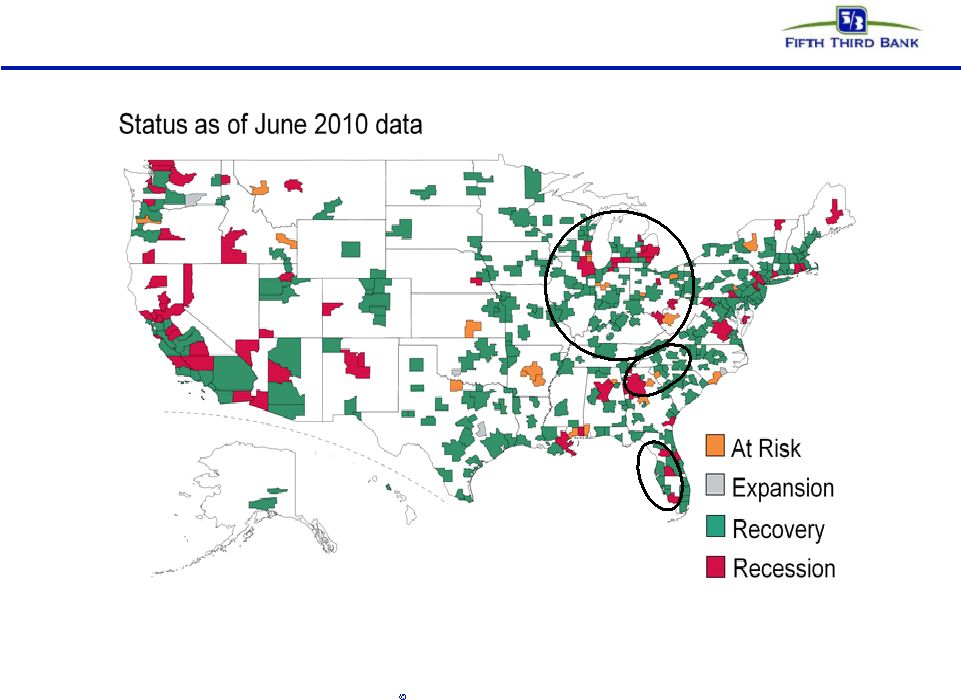

14 Fifth Third Bank | All Rights Reserved Majority of footprint beginning to recover (Early cycle impact; strong industrial base) Source: Map from Moody’s Analytics, deposit market share data from SNL Financial and FDIC Categories based on Moody’s Analytics’ Adversity Index, which is a composite index of unemployment, industrial production, home prices and housing starts. Declining values lead to labeling as Recession, rising indicators are labeled as Recovery, rising indicators past previous growth peaks are labeled as Expansion, and mixed indicators are labeled as At Risk |

15 Fifth Third Bank | All Rights Reserved Continuing to invest for the future |

16 Fifth Third Bank | All Rights Reserved Well-positioned for changed financial landscape Fifth Third’s business model is driven by traditional banking activities — Making loans, taking deposits, treasury management — Largest bank headquartered within core Midwest footprint No significant business at Fifth Third impaired during crisis; core business activities not generally limited by financial reform — Didn’t/don’t originate/sell CDOs — Didn’t/don’t originate/sell subprime mortgages or Option ARMs — De minimis market making in derivatives — De minimis proprietary trading — Small private equity portfolio <$100M (holding company subsidiary) — Low level of financial system “interconnectedness” (e.g., Fifth Third loss in Lehman bankruptcy should be less than $2 million) — Daily VaR less than $500 thousand While financial reform will be costly, expect financial reform to create new opportunities for banking industry through re-intermediation Expect to continue capitalizing on strong competitive position as the landscape evolves further toward Fifth Third’s traditional strengths |

17 Fifth Third Bank | All Rights Reserved Peer performance summary – YoY Comparison Continued relative outperformance on key value drivers FITB 2Q10 Regional bank peer average (1) 2Q10 Performance vs. peers Core pre-tax pre-provision earnings* / average assets (annualized) 2.0% 1.9% Better Average core deposits growth +12% +7% Better Net charge-off ratio / (bps) 2.26% (-82) 2.50% (-3) Better NPA ratio* / (bps) 3.87% (+39) 4.01% (+50) Better Operating efficiency ratio* 63% 64% Better Average loan growth* -6% -7% Better Net interest margin / (bps) 3.57% (+31) 3.62% (+33) In-line Source: SNL Financial and company reports. (1) Regional bank peer average consists of BBT, CMA, HBAN, KEY, MTB, MI, PNC, RF, STI, USB, WFC, and ZION. * Operating fee growth, core pre-tax pre-provision earnings, and operating efficiency ratio exclude the following items: securities gains/losses, gains/losses from debt extinguishments, leveraged lease gains/losses, gains from asset sales, goodwill impairment charges, FDIC special assessment, the pro forma effect of the 2Q09 processing business sale, and other non-recurring items. Average loans include only loans held-for-investment. NPAs exclude loans held-for-sale and covered assets. |

18 Fifth Third Bank | All Rights Reserved Cautionary statement This report may contain statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K and our most recent quarterly report on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements we may make. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. There are a number of important factors that could cause future results to differ materially from historical performance and these forward- looking statements. Factors that might cause such a difference include, but are not limited to: (1) general economic conditions and weakening in the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired entities and/or the combined company do business, are less favorable than expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems encountered by larger or similar financial institutions may adversely affect the banking industry and/or Fifth Third (10) competitive pressures among depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12) changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged; (14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third; (19) effects of accounting or financial results of one or more acquired entities; (20) difficulties in separating Fifth Third Processing Solutions from Fifth Third; (21) loss of income from any sale or potential sale of businesses that could have an adverse effect on Fifth Third’s earnings and future growth; (22) ability to secure confidential information through the use of computer systems and telecommunications networks; and (23) the impact of reputational risk created by these developments on such matters as business generation and retention, funding and liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. |

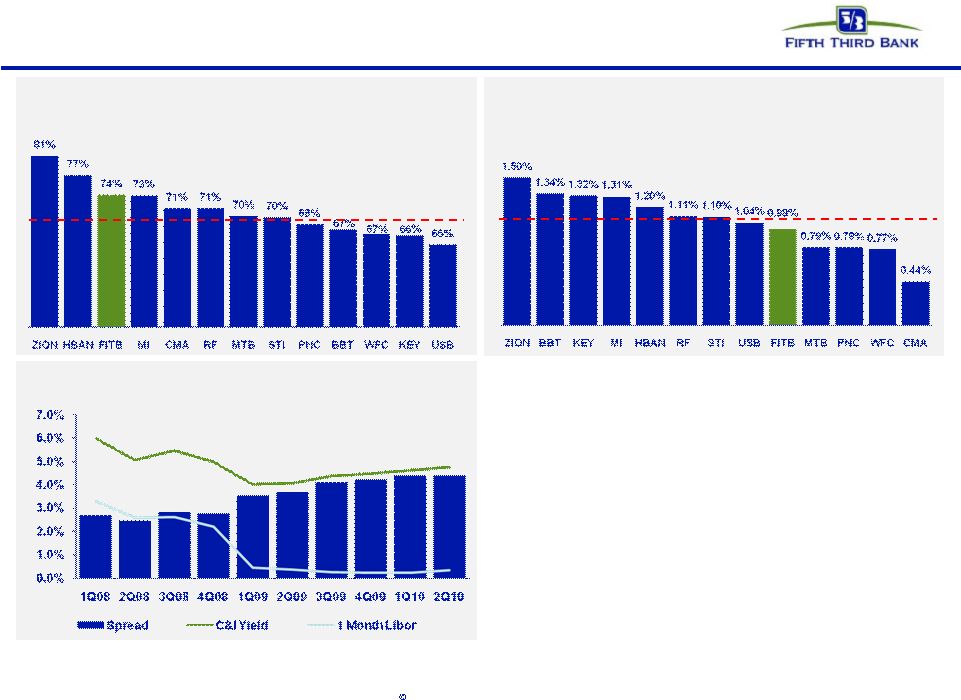

19 Fifth Third Bank | All Rights Reserved Liability mix and pricing discipline drive strong net interest income/NIM results • Strong, deposit rich core funding mix supports relatively low cost of funds – Low reliance on wholesale funding • Continued pricing discipline on commercial loans, consistent with market trends toward better risk-adjusted spreads – C&I spreads over 1-month LIBOR have increased more than 150 bps in the past two years Source: SNL Financial and company reports. Deposits / Assets C&I Spread to 1-month LIBOR 2Q10 Cost of Funds Peer Comparison Peer average 1.06% Peer average 69% |

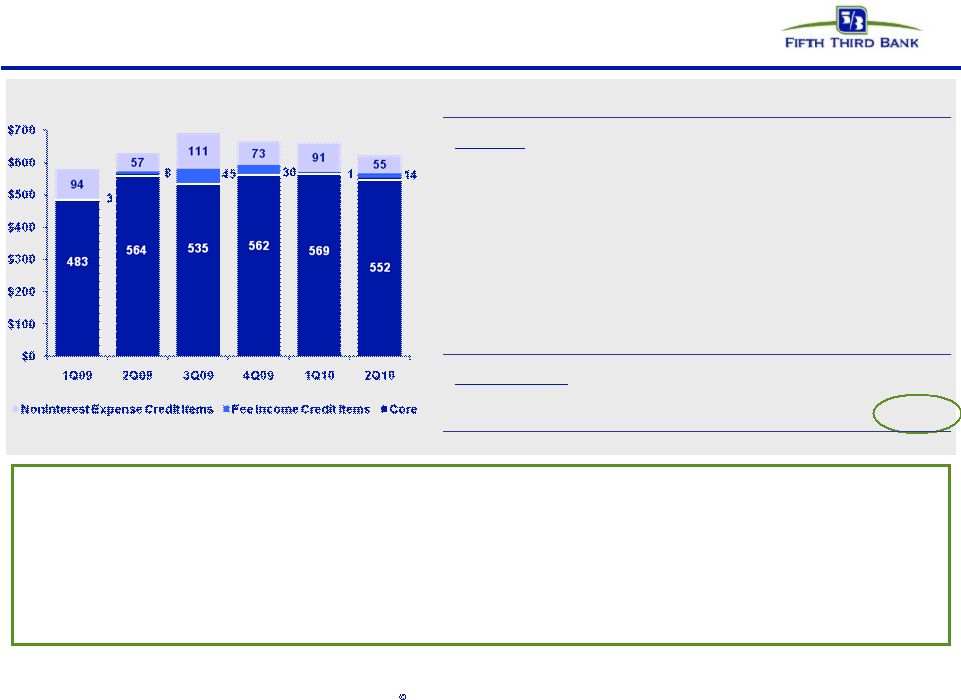

20 Fifth Third Bank | All Rights Reserved Pre-tax pre-provision earnings • Reported PPNR of $567M consistent with strong 1Q10 levels, reflecting fee income results and lower expenses, partially offset by lower net interest income • Core PPNR of $552M, due to negative adjustments totaling $15M, resulting in sequential and year-over-year declines of 3% and 2%, respectively • Excluding the impact of credit-related adjustments ($69M in 2Q10), PPNR down 6% versus 1Q10; down 2% versus 2Q09 Core PPNR Core PPNR reconciliation * Pre-provision net revenue (PPNR): net interest income plus noninterest income minus noninterest expense 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 Reported PPNR $511 $2,393 $844 $562 $568 $567 Adjustments: Gain on sale of Visa shares - - (244) - - - BOLI charge 54 - - - - - Gain from sale of processing interest - (1,764) 6 - - - Divested merchant and EFT revenue (155) (169) - - - - Class B Visa swap fair value adjustment - - - - 9 - Securities gains/losses 24 (5) (8) (2) (14) (8) Visa litigation reserve expense - - (73) - - - Other litigation reserve expense - - - 22 4 3 FTPS warrants and puts - - - (20) 2 (10) Seasonal pension expense - - 10 - - - FDIC special assessment - 55 - - - - Divested merchant & EFT expense (est.) 49 54 - - - - Core PPNR $483 $564 $535 $562 $569 $552 Credit Related Items: OREO write-downs, FV adjs, & G/L on loan sales 3 8 45 30 1 14 Problem asset work-out expenses 94 57 111 73 91 55 Credit adjusted PPNR $580 $630 $690 $665 $661 $621 |

21 Fifth Third Bank | All Rights Reserved Manageable commercial real estate exposure CRE / Assets Source: SNL Financial and company reports. CRE / (TCE + Reserves) Peer average: 256% Peer average: 22% CRE exposure lower than peer average; problems relatively more manageable given capital and reserves |

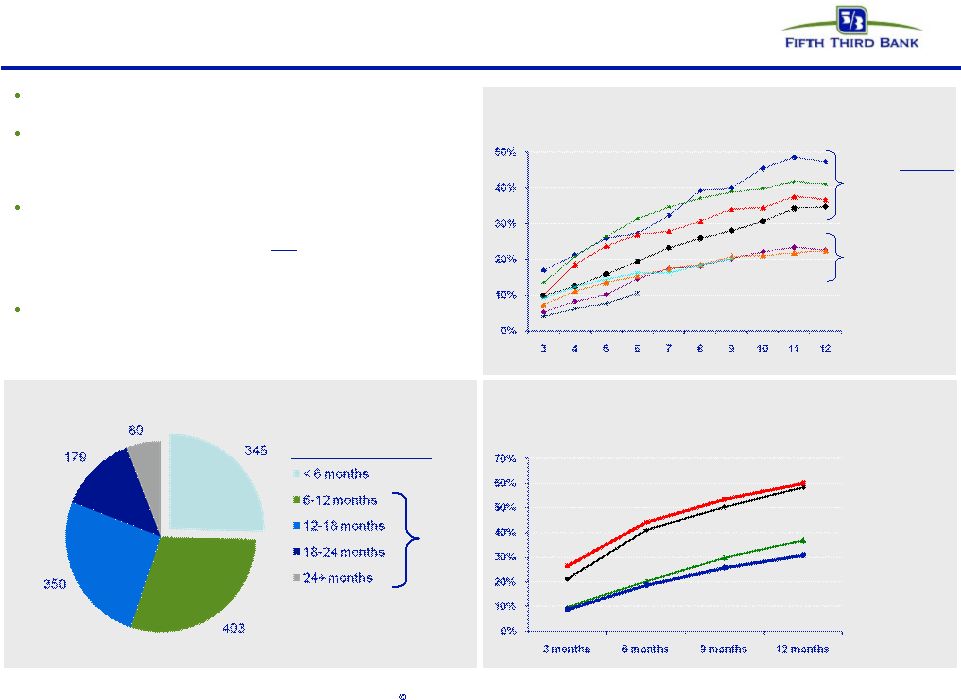

22 Fifth Third Bank | All Rights Reserved Troubled debt restructurings (TDR) overview Successive improvement in vintage performance during 2008 and 2009, even as volume of modification increased Fifth Third’s mortgage portfolio TDRs have redefaulted at a lower rate than other bank held portfolio modifications — Fifth Third’s TDRs are about a third less likely to redefault than modifications on GSE mortgages Of $1.8B in consumer TDRs, over $1.6B were on accrual status and $246M were nonaccruals — $1.0B of TDRs are current and have been on the books 6 or more months; within that, $600M of TDRs are current and have been on the books for more than a year TDR default propensity declines significantly with seasonality — We do not typically see significant defaults on current loans once a vintage approaches 12 months since modification TDR performance has improved in newer vintages Outperforming redefault benchmarks Source: Fifth Third and OCC/OTS data; data through 4Q09; industry data cumulative through 4Q09 Mortgage TDR 60+ redefault trend by vintage 1Q08 $69M 2Q08 $135M 3Q08 $146M 4Q08 $176M 1Q09 $221M 2Q09 $257M Months since modification Mortgage TDR 60+ redefault rate: Fifth Third comparison (through December 2009) Fannie Mae Industry portfolio loans Fifth Third Volume by vintage Freddie Mac 3Q09 $386M Current consumer TDRs ($Ms) 4Q09 $153M $1.0 billion 2008 2009 Time since restructuring |

23 Fifth Third Bank | All Rights Reserved Industry leading reserve levels Reserves / NPAs Reserves / Loans Source: SNL Financial and company reports. Data as of 2Q10. NPLs and NPAs exclude loans held-for-sale. Reserves / Net Charge-offs (Annualized) Reserves / NPLs Peer average: 3.2% Peer average: 140% Fifth Third is the only bank with both Reserve/NPAs above 1 and Reserves/NCOs >150% Peer average: 85% Peer average: 99% |

24 Fifth Third Bank | All Rights Reserved Potential impact of key elements of Dodd-Frank Act and other recent financial legislation* Scope of activity Potential impact** Volcker Rule / Derivatives • Vast majority of derivatives activities are exempted (FITB generally not a market maker) • Any proprietary trading de minimis • “P/E” fund investments <$100M (<1% of Tier 1 capital) • Expect minimal financial impact from loss of existing revenue • Potentially higher compliance costs despite small levels of non-exempt activities Debit Interchange (Durbin Amendment) • LTM^ debit interchange revenue $190M – Signature $171M, PIN $19M • LTM debit interchange $ volume: $15B – Signature $11.6B, PIN $3.4B • LTM debit interchange transaction volume: 412M – Signature 328M, PIN 84M • Will not know what “reasonable” and “proportional” mean until after Fed study • Each 10 bps reduction in overall interchange rates would represent ~$15M revenue impact annually, before effect of mitigation • Additional follow-on effects on industry debit card payments business could result from changes Deposit Insurance • Current assessed base (Deposits): $80B • Proposed assessed base (Assets-TE): $97B • FITB percentage share of new industry assessment base lower than its percentage share of old base (due to lower reliance on wholesale funding) • Don’t know assessment rates on new base • DIF reserve target increase to 1.35% from 1.15% – May be achieved from banks >$50B through higher annual assessments or longer period of elevated assessments Reg. E • Requires customers to “opt-in” to allow non-recurring electronic overdrafts (e.g. debit, ATM) from accounts • Estimated ~$20M per quarter ($80M annualized) reduction to deposit service charges, before effect of mitigation Potential impact of these and other elements of financial regulatory reform, such as CFPA activities and many other aspects, are unknown at this time TRUPs exclusion (Collins Amendment) • 280 bps of non-common Tier 1 capital in capital structure • >300 bps of non-common Tier 1 currently – Potentially more than may be needed post-Basel III • 3-year transition period begins 2013 • Will manage capital structure to desired composition * Based on current understanding of legislation. ** Potential impact, as noted above, is not intended to be inclusive of all potential impacts that may result from implementation of legislation. Please refer also to cautionary statement. ^ LTM = last twelve months |

25 Fifth Third Bank | All Rights Reserved Fifth Third Debt Ratings As of 9/13/10 Fifth Third Bancorp Moody's Standard & Poor's Fitch DBRS Short Term Debt P-2 Short Term Issuer A-2 Short Term Issuer F1 Short Term R-1L Senior Unsecured Baa1 Long Term Issuer BBB Long Term Issuer A- Long Term Issuer AL Outlook Negative Outlook Stable Individual Rating C *+ Outlook Stable Outlook Date 4/14/2009 Outlook Date 7/23/2010 Outlook Stable Outlook Date 11/24/2009 Outlook Date 5/24/2010 Fifth Third Bank (OH) Moody's Standard & Poor's Fitch DBRS Short Term Debt P-1 *- Short Term Issuer A-2 ST Issuer Default F1 Short Term R-1L Long Term Issuer A2 *- Long Term Issuer BBB+ Long Term Issuer A- Long Term Deposit A Long Term Deposit A2 *- Long Term Deposit A Senior Unsecured A *- Indicates Negative Watch *+ Indicates Positive Watch |