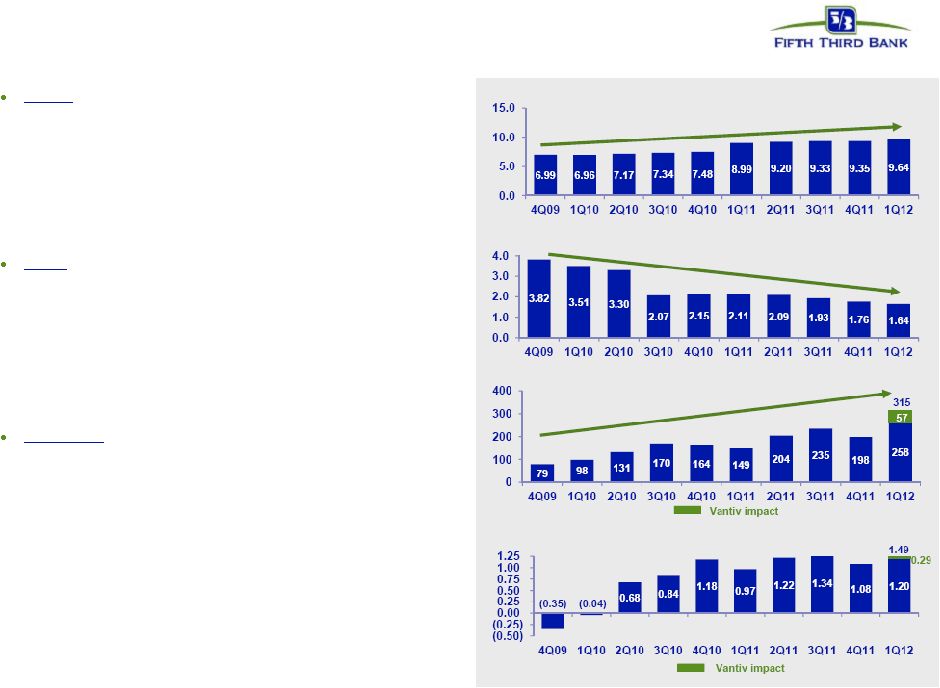

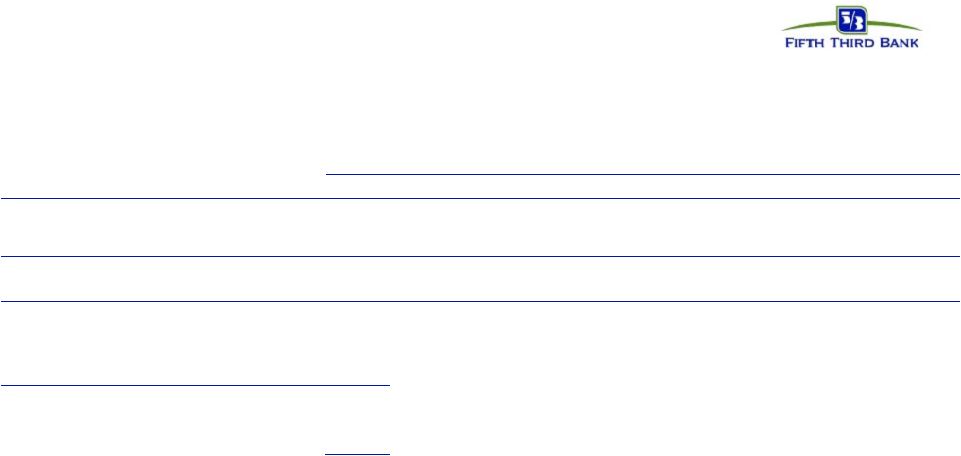

29 © Fifth Third Bank | All Rights Reserved Regulation G Non-GAAP reconciliation Fifth Third Bancorp and Subsidiaries Regulation G Non-GAAP Reconcilation $ and shares in millions (unaudited) March December September June March December September June March December 2012 2011 2011 2011 2011 2010 2010 2010 2010 2009 Total Bancorp shareholders' equity (U.S. GAAP) $13,560 $13,201 $13,029 $12,572 $12,163 $14,051 $13,884 $13,701 $13,408 $13,497 Goodwill and certain other intangibles (2,518) (2,514) (2,514) (2,536) (2,546) (2,546) (2,525) (2,537) (2,556) (2,565) Unrealized gains (468) (470) (542) (396) (263) (314) (432) (440) (288) (240) Qualifying trust preferred securities 2,248 2,248 2,273 2,312 2,763 2,763 2,763 2,763 2,763 2,763 Other 38 38 20 20 12 11 8 (25) (30) (27) Tier I capital 12,860 12,503 12,266 11,972 12,129 13,965 13,698 13,462 13,297 13,428 Less: Preferred stock (398) (398) (398) (398) (398) (3,654) (3,642) (3,631) (3,620) (3,609) Qualifying trust preferred securities (2,248) (2,248) (2,273) (2,312) (2,763) (2,763) (2,763) (2,763) (2,763) (2,763) Qualifying noncontrolling interest in consolidated subsidiaries (50) (50) (30) (30) (30) (30) (30) - - - Tier I common equity (a) 10,164 9,807 9,565 9,232 8,938 7,518 7,263 7,068 6,914 7,056 Unrealized gains 468 Disallowed deferred tax assets - Disallowed MSRs 78 Other 11 Less: 10% of individual deferred tax assets, MSRs, investment in financial entitie - 15% of aggregate deferred tax assets, MSRs, investment in financial entiti - Tier 1 common equity, Basel III proforma (b) 10,721 Risk-weighted assets, determined in accordance with prescribed regulatory requirements (c) 105,412 104,945 102,562 100,320 99,392 100,561 98,904 98,604 99,281 100,933 Regulatory deductions not deducted from Tier 1 common equity, risk-weighted at 250% 1,582 Risk-weighted assets, Basel III proforma (d) 106,994 Ratios: Tier I common equity (a) / (c) 9.64% 9.35% 9.33% 9.20% 8.99% 7.48% 7.34% 7.17% 6.96% 6.99% Tier I common equity, Basel III proforma (b) / (d) 10.02% For the Three Months Ended Add: |