This prospectus supplement relates to an effective registration statement, but the information in this prospectus supplement is not complete and may be changed. This prospectus supplement and the accompanying prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-230568

Subject to completion, dated October 28, 2021

Prospectus supplement

(To prospectus dated March 28, 2019)

$

% Fixed Rate/Floating Rate Senior Notes due 2027

Issue Price for the Notes: %

Fifth Third Bancorp is offering $ in an aggregate principal amount of % Fixed Rate/Floating Rate Senior Notes due 2027 (the “notes”).

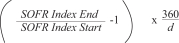

The notes will initially bear interest at the rate of % per annum, payable semi-annually in arrears on and on of each year, commencing on the issue date, and ending on , 2026. Commencing on , 2026 the notes will bear interest at a floating rate per annum equal to Compounded SOFR (determined with respect to each quarterly interest period using the SOFR Index as described herein) plus %, payable quarterly in arrears on , , and at the maturity date. The notes will mature on , 2027.

As described under “Use of Proceeds,” we expect to use an amount equal to the net proceeds from the sale of the notes to finance or refinance, in whole or in part, Eligible Green Projects (as defined below).

The notes will be unsecured senior obligations of Fifth Third Bancorp. The notes will be redeemable, in whole, but not in part, by us on , 2026, the date that is one year prior to the maturity date, at 100% of the principal amount of the notes, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date. In addition, the notes will be redeemable, in whole or in part, by us on or after the 30th day prior to the maturity date, at 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date. See “Description of the Notes—Optional redemption.”

There will be no sinking fund for the notes. The notes will be issued only in minimum denominations of $2,000 or any integral multiples of $1,000 in excess thereof.

See “Risk Factors” beginning on page S-5 of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of certain risks that you should consider in connection with an investment in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined that this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Price to public | | | Underwriting discount | | | Proceeds to us | |

Per note | | | | % | | | | % | | | | % |

Total for the notes | | $ | | | | $ | | | | $ | | |

The price to the public set forth above does not include accrued interest, if any. Interest on the notes will accrue from , 2021.

The notes are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The notes will not be listed on any securities exchange or interdealer market quotation system. Currently, there is no public market for the notes.

We expect that the notes will be ready for delivery through the book-entry facilities of The Depository Trust Company, Clearstream Banking, Société Anonyme or Euroclear Bank S.A./N.V., as operator of the Euroclear System, as applicable, against payment in New York, New York on or about , 2021.

Joint Book-Running Managers

| | | | |

| J.P. Morgan | | Fifth Third Securities | | Citigroup |

The date of this prospectus supplement is , 2021.