- FITB Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Fifth Third Bancorp (FITB) DEF 14ADefinitive proxy

Filed: 4 Mar 25, 4:36pm

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

| Lead Independent Director Letter to our Shareholders |

To my Fellow Shareholders,

It is with great pride that I invite you to join us at the Fifth Third Bancorp 2025 Annual Shareholders Meeting, which will be held virtually on Tuesday, April 15, 2025. I’m pleased to have served the Board once again this year as Lead Independent Director.

In 2024, our Board maintained a focus on ensuring that Fifth Third delivers consistently strong results for our shareholders. The Board remained committed to the core principals of stability, profitability, and growth. Our balance sheet reflects stability through a diversified loan portfolio that is resilient to changes in the interest rate environment. We’ve achieved top-quartile profitability through well-diversified revenue streams and expense discipline. We continue to execute on our growth strategies, as evident in our Southeast expansion, middle market expansion, Commercial payments investment, increase in Wealth and Asset Management sales force, and technology modernization initiatives. With a strong and collaborative management team in place, the Board will continue to focus on a strategy that yields long-term growth and shareholder value.

This year, three of our esteemed and long-serving directors will retire. Marsha Williams joined our Board in 2008. Her contributions to our Board and our Company are innumerable. Having served as Lead Independent Director, she leaves the Board with a legacy of collegiality, consensus-building, and reasoned decision-making. Emerson Brumback joined our Board in 2009 after a successful career in the banking industry. Throughout his tenure as Audit Committee Chair and later as Risk and Compliance Committee Chair, Mr. Brumback demonstrated invaluable risk and operational expertise through varying economic cycles. Mike McCallister joined our Board in 2011 after a successful career at Humana, serving as its Chair, CEO, and President. Drawing on his experience as a public company CEO, he has provided a unique perspective on corporate transactions and chaired our Human Capital and Compensation Committee for several years with steady and thoughtful leadership. We wish Marsha, Emerson, and Mike the best in their retirements and remain most grateful for their extraordinary contributions to our Board and our Company. We believe our recent and continuing succession planning efforts have positioned the Board to maintain the appropriate expertise and experience to ensure our continued high level of effectiveness. We will continue to engage in succession planning initiatives into 2025 and beyond. Following the retirements of Ms. Williams and Messrs. Brumback and Heminger, our Board has voted to reduce its size to 13 members.

We look forward to the opportunities 2025 offers. Indeed, it is an exciting time for Fifth Third, and we look forward to continuing to serve you, our shareholders.

Regards,

| ||||||

Nicholas K. Akins Lead Independent Director |

Notice of 2025 Annual Meeting of Shareholders

To: Holders of Outstanding Common Stock and 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A

Date and Time |

Location |

Vote | ||||||

Tuesday, April 15, 2025, 11:30 a.m., Eastern Time

|

Virtual www.virtualshareholdermeeting.com/FITB2025

|

Shareholders of record at close of business on Friday, February 21, 2025 are entitled to vote

|

Items of Business:

1 | Election 13 members of the Board of Directors to serve until the Annual Meeting of Shareholders in 2026. | |

2 | Ratification of the appointment of Deloitte & Touche LLP to serve as the independent external audit firm for the Company for the year 2025. | |

3 | An advisory approval of the Company’s compensation of its named executive officers. | |

4 | Transaction of such other business that may properly come before the Annual Meeting or any adjournment thereof. | |

Even if you plan to attend the virtual meeting, please vote at your earliest convenience by signing and returning the proxy card you receive or by voting over the internet or by telephone.

If you plan to attend the virtual Annual Meeting:

Please note that any member of the public will be able to attend and listen to the Annual Meeting, though the submission of questions will be limited only to holders of Common Stock and of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A (and depository shares representing those shares) (collectively, “Series A, Class B Preferred Stock”) of the Company and the holders of shareholder proxies. Shareholders and others may access the Annual Meeting website beginning at approximately 11:15 a.m., Eastern Time on April 15, 2025. To vote at the meeting, Common Stock shareholders must use their 16-digit control number. For more information on attending the virtual Annual Meeting, please see page 2.

|

If you have any questions or need assistance voting your shares, please call D.F. King & Co., Inc., which is assisting us, toll-free at 1-800-870-0653.

| By Order of the Board of Directors, |

|

| Michael L. Powell, Corporate Secretary |

| Table of Contents |

|

Proxy Statement Highlights

This highlights section does not contain all the information that you should consider before voting. Please read this entire Proxy Statement carefully. For more information on our 2024 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2024, a copy of which is available at ir.53.com.

Voting matters and Board recommendations:

Proposal | Board Recommendation | |

| Election of 13 directors to serve until the Annual Meeting of Shareholders in 2026. | ✓ “FOR” all nominees | |

| Ratification of the appointment of Deloitte & Touche LLP to serve as the independent external audit firm for Fifth Third Bancorp for the year 2025. | ✓ “FOR” | |

| Advisory approval of Fifth Third Bancorp’s compensation of its named executive officers. | ✓ “FOR” | |

Casting your vote:

| • | Our Board of Directors is soliciting proxies and voting instructions for the Annual Meeting of Shareholders to be held virtually on Tuesday, April 15, 2025 at 11:30 a.m. Eastern Time. The proxy materials were first made available to shareholders on or about March 4, 2025. |

| • | Your vote is important! Please cast your vote as soon as possible. If you vote by Internet or phone, you must vote no later than 11:59 p.m. Eastern Time on April 14, 2025 for Common Stock held directly and by 11:59 p.m. Eastern Time on April 10, 2025 for Common Stock held in a Plan and for Series A, Class B Preferred Stock. |

Internet:

www.proxyvote.com | Telephone:

1.800.690.6903 | Mail:

Sign, date, and mail the enclosed Proxy card.

|

| For more information on how to cast your vote, please see pages 94-95. |

| Fifth Third 2025 Proxy Statement | 1 |

PROXY STATEMENT HIGHLIGHTS

Attending the Annual Meeting:

The 2025 Annual Meeting of Shareholders (“Annual Meeting”) of Fifth Third Bancorp (the “Company,” the “Bancorp,” or “Fifth Third”) will be held in a virtual format only, via the internet. We have held virtual meetings in each year since 2020 and will continue to consider the benefits of future virtual meetings. We have carefully and thoughtfully structured our virtual meeting to include opportunities for participation which are consistent with previous in-person meetings. We believe that holding our Annual Meeting virtually facilitates greater shareholder attendance and participation by allowing all shareholders to participate equally, through any internet-connected device from any location, free of cost. In practice, we have experienced increased engagement and shareholder participation at our virtual Annual Meeting than occurred at meetings prior to our adopting a virtual format. As described below, we observe best practices for virtual shareholder meetings, including by providing a support line for technical and other assistance and addressing as many relevant shareholder questions as time allows.

The Annual Meeting will start at 11:30 a.m. Eastern Time on April 15, 2025. Shareholders and guests may join the virtual meeting beginning at 11:15 a.m. Eastern Time. Any member of the public is invited to attend as a guest and listen to the Annual Meeting by visiting www.virtualshareholdermeeting.com/FITB2025 and logging in as a guest. Shareholders of record of Fifth Third Common Stock or of Series A, Class B Preferred Stock, beneficial holders of Fifth Third Common Stock or of Series A, Class B Preferred Stock, or authorized representatives of a beneficial holder of Fifth Third Common Stock or of Series A, Class B Preferred Stock, or their legal proxy holders, as of the close of business on February 21, 2025, the record date, are entitled to submit questions at the virtual Annual Meeting. Shareholders may participate by visiting www.virtualshareholdermeeting.com/FITB2025 and choosing the shareholder log-in and entering their 16-digit control number that is printed in the box marked by the arrow on the Notice of Internet Availability of Proxy Materials or your Proxy Card. We encourage shareholders and guests wishing to attend the Annual Meeting to visit www.virtualshareholdermeeting.com/FITB2025 in advance of the meeting to verify their internet

connection, familiarize themselves with the online access process, and update their devices and/or browsers, as appropriate. The virtual Annual Meeting platform is fully supported across browsers and devices equipped with the most updated version of applicable software and plugins. Additionally, shareholders should allow sufficient time after logging in to ensure that they can hear streaming audio prior to the start of the meeting.

Anyone wishing to attend the meeting and encountering difficulty with the Annual Meeting virtual platform during the sign-in process or at any time during the meeting may utilize technical support provided by the Company through Broadridge Financial Solutions, Inc. Technical support information is provided on the sign-in page.

Shareholders will have substantially the same opportunities to participate in our virtual Annual Meeting as they would have at an in-person meeting. Shareholders will be able to attend, vote (in the case of holders of Common Stock), examine the shareholder list, and submit questions before and during a portion of the meeting via the online platform. Shareholders may submit questions by signing into the virtual meeting platform at www.virtualshareholdermeeting.com/FITB2025, and by typing a question into the “Ask a Question” field and clicking submit. Shareholders may submit questions beginning on April 8, 2025 by logging onto proxyvote.com with their 16-digit control number. Questions that are germane to the purpose of the Annual Meeting will be answered during the meeting, subject to time constraints. Questions regarding personal matters or matters not relevant to the Annual Meeting will not be answered. Substantially similar questions may be combined.

Shareholders of Common Stock may vote during the Annual Meeting. Shareholders may also vote before the date of the Annual Meeting using one of the methods provided on the proxy card. Holders of depositary shares representing Preferred Stock may only submit voting instructions prior to the Annual Meeting using one of the methods provided on the proxy card. We recommend that shareholders vote by mail, internet, or telephone prior to the Annual Meeting, even if they plan to attend the Annual Meeting virtually.

| 2 |

PROXY STATEMENT HIGHLIGHTS

About Our Company

| Fifth Third is a diversified financial services company headquartered in Cincinnati, Ohio and is the indirect holding company of Fifth Third Bank, National Association. The Bancorp operates three main businesses: Commercial Banking, Consumer and Small Business Banking, and Wealth & Asset Management. Fifth Third has approximately 19,000 employees, banking centers across 11 states, and commercial and consumer lending presence across the United States. | Key Strategic Priorities

Stability • Resilient balance sheet

• Strong credit profile

Profitability • Diverse fee mix with high total revenue contribution

• Expense discipline

• NII growth and NIM expansion

Growth • Southeast demographics

• Midwest and renewables infrastructure investments

• Technology-enabled product innovation |

Fifth Third Bank Footprint Map

|

| Fifth Third 2025 Proxy Statement | 3 |

PROXY STATEMENT HIGHLIGHTS

Corporate Performance Highlights

Strong financial performance, reflecting solid operating results

| • | Our adjusted full-year return on assets, return on tangible common equity excluding AOCI, and efficiency ratio all finished among the top in our peer group |

| • | Prudently managed expenses throughout the year while continuing to invest in the business |

| • | Generated consumer household growth of 2.3% year-over-year, including six percent growth in our Southeast markets |

Sustainability

| • | Named one of the World’s Most Ethical Companies® by Ethisphere for the fifth time |

| • | Named among America’s top-performing companies on the issues most important to consumers as measured by JUST Capital and CNBC |

| • | Exceeded our $180 million commitment to prioritize financial access and neighborhood revitalization through our Neighborhood Program |

| • | Achieved over $42 billion towards our $100 billion environmental and social finance target through 2030 |

| • | Operational sustainability targets to be achieved by 2030: |

| • | Purchase 100% renewable power (Achieved) |

| • | Reduce energy use by 40% (Achieved) |

| • | Reduce location-based greenhouse gas (“GHG emissions”) (Fifth Third’s scope 1 and 2 emissions) by 75% (currently at 54%) |

| • | Reduce potable water use by 50% (currently at 35%) |

| • | Divert 75% of waste from going to landfills (currently at 66%) |

| • | Reduce paper use by 75% and purchase remaining paper from certified sources (currently at 65%) |

Robust capital & liquidity

| • | Grew our Common Equity Tier 1 ratio 30 bps in 2024 to 10.6% |

| • | Maintained full Category 1 liquidity coverage ratio (“LCR”) compliance ending the year at 125% |

| • | Remained heavily core-funded, with loan-to-core deposit ratio ending the year at 73% |

Strong shareholder returns

| • | Increased quarterly cash dividend on common shares two cents, or six percent |

| • | Returned $1.6 billion of capital to our shareholders |

Balance sheet management

| • | Highest year-over-year retail deposit growth on a capped branch deposit basis |

| • | Maintained or improved market share rank in every market where we compete |

| • | Resilient balance sheet delivers positive momentum throughout 2024 in net interest income due to deposit rate management and fixed rate asset re-pricing |

Disciplined risk management

| • | Credit results continue to demonstrate our disciplined client selection, conservative underwriting, and granular, high-quality relationships |

| • | Asset quality trends remain strong and near historical averages and had $0 of net charge-offs in commercial real estate for the second straight year |

| 4 |

PROXY STATEMENT HIGHLIGHTS

Item 1: Election of Directors

The Board of Directors proposes the election of 13 directors to serve until the 2026 Annual Meeting of Shareholders. Our directors provide robust and effective governance and oversight. The nominees for director, collectively, represent varying perspectives and provide a broad range of skills, expertise, and experience to guide the Company.

Our Board of Directors recommends a vote “For” each nominee. For more information on our nominees, please see page 15.

Board of Directors Highlights

2025 Director Nominee Overview

| Name | Age | Director Since | Other Public Company Boards* | |||||||||||||||

Nicholas K. Akins | 64 | 2013 | DTE Energy GE Vernova American Electric Power (2023) | |||||||||||||||

B. Evan Bayh, III | 69 | 2011 | Marathon Petroleum Company Berry Global Group, Inc. RLJ Lodging Trust | |||||||||||||||

Jorge L. Benitez | 65 | 2015 | World Fuel Services Interpublic Group | |||||||||||||||

Katherine B. Blackburn | 59 | 2014 | None | |||||||||||||||

Linda W. Clement-Holmes | 62 | 2020 | Cincinnati Financial Corporation | |||||||||||||||

C. Bryan Daniels | 66 | 2019 | None | |||||||||||||||

Laurent Desmangles | 57 | 2023 | None | |||||||||||||||

Mitchell S. Feiger | 66 | 2020 | None | |||||||||||||||

Thomas H. Harvey | 64 | 2019 | None | |||||||||||||||

Gary R. Heminger | 71 | 2006 | PPG Industries, Inc. Marathon Petroleum Company (2020) MPLX GP LLC (2020) | |||||||||||||||

Eileen A. Mallesch | 69 | 2016 | Arch Capital Group, Ltd. Brighthouse Financial State Auto Financial Corp. (2021) Libbey, Inc. (2020) | |||||||||||||||

Kathleen A. Rogers | 59 | 2023 | Federal Home Loan Bank of Cincinnati | |||||||||||||||

Timothy N. Spence | 46 | 2022 | None | |||||||||||||||

| * | The year in which a public company directorship previously ended is indicated by the parenthetical year following the company name. |

| Fifth Third 2025 Proxy Statement | 5 |

PROXY STATEMENT HIGHLIGHTS

Skills and Attributes Among Board Nominees

| Accounting/ Financial Reporting |  | Financial Services Industry | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 8/13 | 8/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and Benefits |  | Human Capital Management | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/13 | 10/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Governance |  | Legal and Regulatory | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 13/13 | 7/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cybersecurity |  | Risk Management | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 8/13 | 11/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Digital Innovation and FinTech |  | Strategic Planning | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 8/13 | 13/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive Management |  | Sustainability | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 13/13 | 10/13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

∎ represents each director who possesses the skill or attribute

| 6 |

PROXY STATEMENT HIGHLIGHTS

Board Governance Overview

Fifth Third’s Board of Directors is committed to strong and effective governance and oversight. Annually, the Board reviews and enhances, as necessary, its practices related to Board independence, Board accountability, and Board effectiveness. Below are some highlights of our Board governance program.

Board Independence

| • | Strong Lead Independent Director: Mr. Akins, our Lead Independent Director, provides strong leadership of the independent directors through responsibilities expressly defined in Fifth Third’s Corporate Governance Guidelines. The Lead Independent Director is annually elected by all independent directors. |

| • | Substantial Majority of Independent Directors: The Board of Directors is comprised of a substantial majority of independent directors. The Board has affirmatively determined that all director nominees are considered independent under applicable Nasdaq standards except Mr. Spence, our President and CEO. |

| • | Independent Director-Led Committees: All standing Committees of the Board of Directors are led by and entirely comprised of independent directors. |

| • | Executive Sessions: Independent directors regularly meet in executive session throughout the year. |

| • | Engagement with Regulators: Fifth Third’s regulators are invited to meet with independent directors outside the presence of management. |

Board Accountability

| • | Ethics Training and Certification: Directors receive annual ethics training and must review and acknowledge the Code of Business Conduct and Ethics on an annual basis. |

| • | Attendance: The Board of Directors and its Committees had a 97% aggregate attendance rate in 2024. |

| • | Majority Voting Standards: Fifth Third utilizes majority voting requirements for uncontested director elections, and all directors must be elected annually with no staggered or multi-year terms. In addition, in 2021, Fifth Third eliminated supermajority voting requirements for shareholder approval of amendments to the Articles of Incorporation and for certain business mergers and combinations. |

| • | Retirement Age: Our Code of Regulations provides that a director should not stand for re-election at the Annual Meeting following his or her 72nd birthday; provided that the Nominating and Corporate Governance Committee may waive this requirement upon consideration of relevant factors listed in our Corporate Governance Guidelines. |

| • | Annually Reviewed Director Pay Program: The Director Pay Program, for non-employee directors, is reviewed and approved annually by the Human Capital and Compensation Committee. |

| • | Oversight of Strategy: The Board of Directors actively oversees the development of strategic objectives during a dedicated board meeting and receives updates on the implementation of the strategic plan throughout the year at regularly scheduled Board meetings. The Board also reviews the risk assessment of the strategic plan. |

| • | Proxy Access: The Board amended the Bancorp’s Regulations in 2020 to allow proxy access. |

| • | Stock Ownership Requirements: Directors are required to own Fifth Third stock equal in value to six times their annual director salary (not including fees for Committee service) within five years of their Board appointment. |

| • | Oversight of Executive Management Succession Planning: The Board engages in an annual executive management succession planning review meeting, in addition to regular succession planning discussions at the Committee level. |

| Fifth Third 2025 Proxy Statement | 7 |

PROXY STATEMENT HIGHLIGHTS

Board Effectiveness

| • | Robust Self-Assessments, Including Lead Independent Director Interviews: The Board of Directors and the Nominating and Corporate Governance Committee oversee the annual self-evaluation process, which includes both written assessments of the Board and each Committee and interviews between the Lead Independent Director and each independent director. Management implements action plans based on directors’ feedback and reports to the Board on the implementation of those plans to ensure continuous improvement. |

| • | Director Skills and Expertise: The Board annually evaluates Board effectiveness and reviews directors’ skills and expertise to ensure the Board represents a broad skill set oriented to the historical and emerging needs of the business. |

| • | Strong Director Education Program: Fifth Third has instituted a robust director education program, approved annually by the Board, to enhance directors’ knowledge on topics relevant to oversight of a large financial institution. Director education sessions typically occur at every regularly scheduled Board meeting and several times a year in Committee meetings. In 2024, the Board and its Committees had a total of 30 education sessions. |

| • | Broad Director Onboarding Program: Our Board-approved, comprehensive Director Onboarding Program seeks to quickly integrate new directors in our business and culture and features one-on-one sessions with senior executives and functional area representatives, facility tours, and training on company policies and industry trends. |

| • | Board Succession Planning: The Board, and its relevant Committees, regularly discuss director succession planning, focusing on business needs, industry trends, diverse perspectives, and shareholder expectations. |

| • | Committee Refreshment: The Nominating and Corporate Governance Committee annually reviews the leadership and membership of each Committee and recommends adjustments, as necessary. Additionally, approximately every two to three years, the Committee undertakes a thorough recalibration analysis to address Committee leadership and membership in light of new and anticipated business programs and regulatory requirements, succession planning initiatives, and director development, while ensuring ongoing consistency and continuity. |

| • | Over-boarding Restrictions: Directors are subject to over-boarding restrictions, updated in 2021, to improve Board effectiveness, to ensure that directors have sufficient time and attention to devote to their duties at Fifth Third, and to more closely align with shareholder expectations. Directors may serve on four total public company boards, and directors who are active CEOs may serve on two total public company boards. |

| • | Strong Corporate Governance Guidelines: The Corporate Governance Guidelines and Board Committee Charters are reviewed annually to maintain strong and sound governance practices. |

Voting Power

There are currently 668,098,917 outstanding shares of Fifth Third Common Stock and each share is entitled to one vote on all proposals at the meeting. In addition, there are 200,000 outstanding shares of Series A, Class B Preferred Stock (represented by approximately 8,000,000 depositary shares). Each share of Series A, Class B Preferred Stock has 24 votes per share on all proposals at the meeting. The total voting power of all outstanding shares of Series A, Class B Preferred Stock is equal to 4,800,000 votes of our Common Stock, or less than one percent of the total voting power of our outstanding Common Stock.

| 8 |

PROXY STATEMENT HIGHLIGHTS

Item 2: Ratification of the Appointment of Deloitte & Touche LLP to Serve as Independent Auditor

The Board of Directors proposes to ratify the appointment of Deloitte & Touche LLP to serve as the independent external audit firm for Fifth Third Bancorp for the year 2025. The Audit Committee and the Board of Directors believe Deloitte & Touche’s continued service as Fifth Third’s independent external audit firm is in the best interests of the Company and our shareholders. The Audit Committee will further evaluate the appointment of Deloitte & Touche LLP as independent external audit firm if the appointment is not ratified by a majority of shareholders.

Our Audit Committee and our Board of Directors recommend a vote “For” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent external audit firm for 2025. For more information on this item, please see page 85. This item appears as Item 2 on your proxy card.

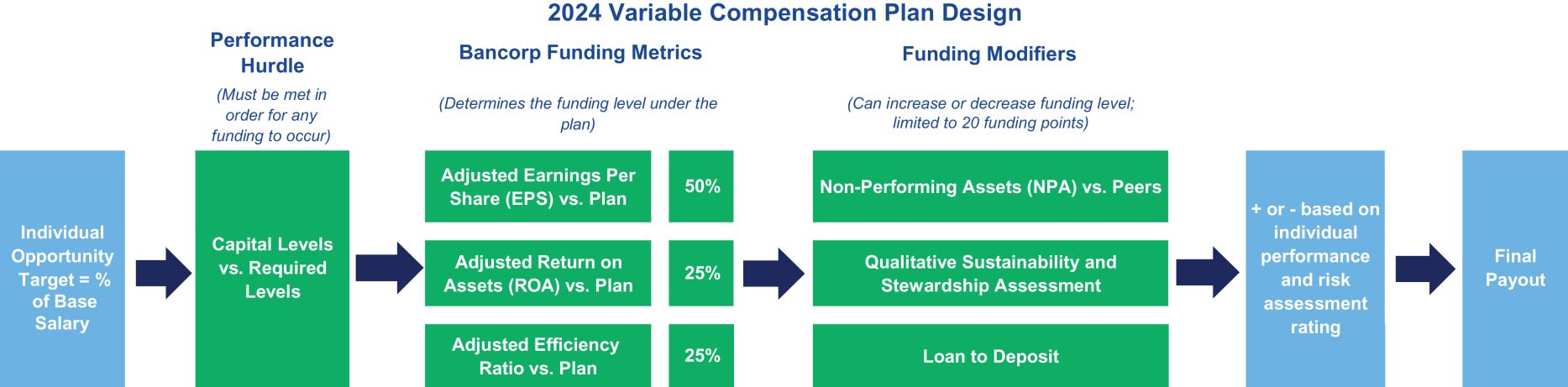

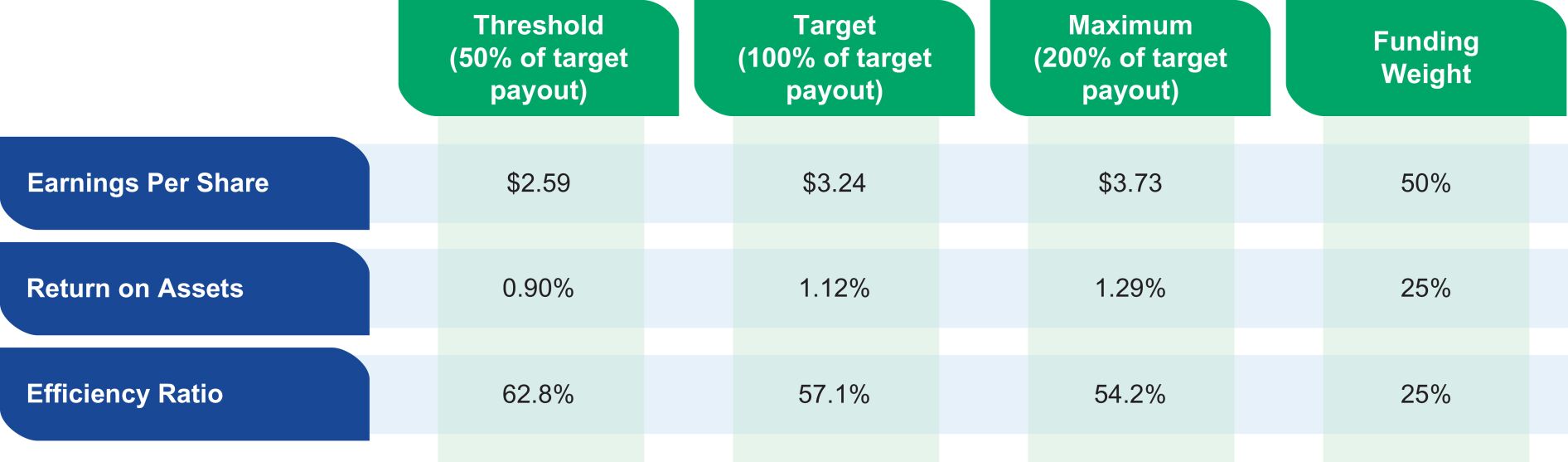

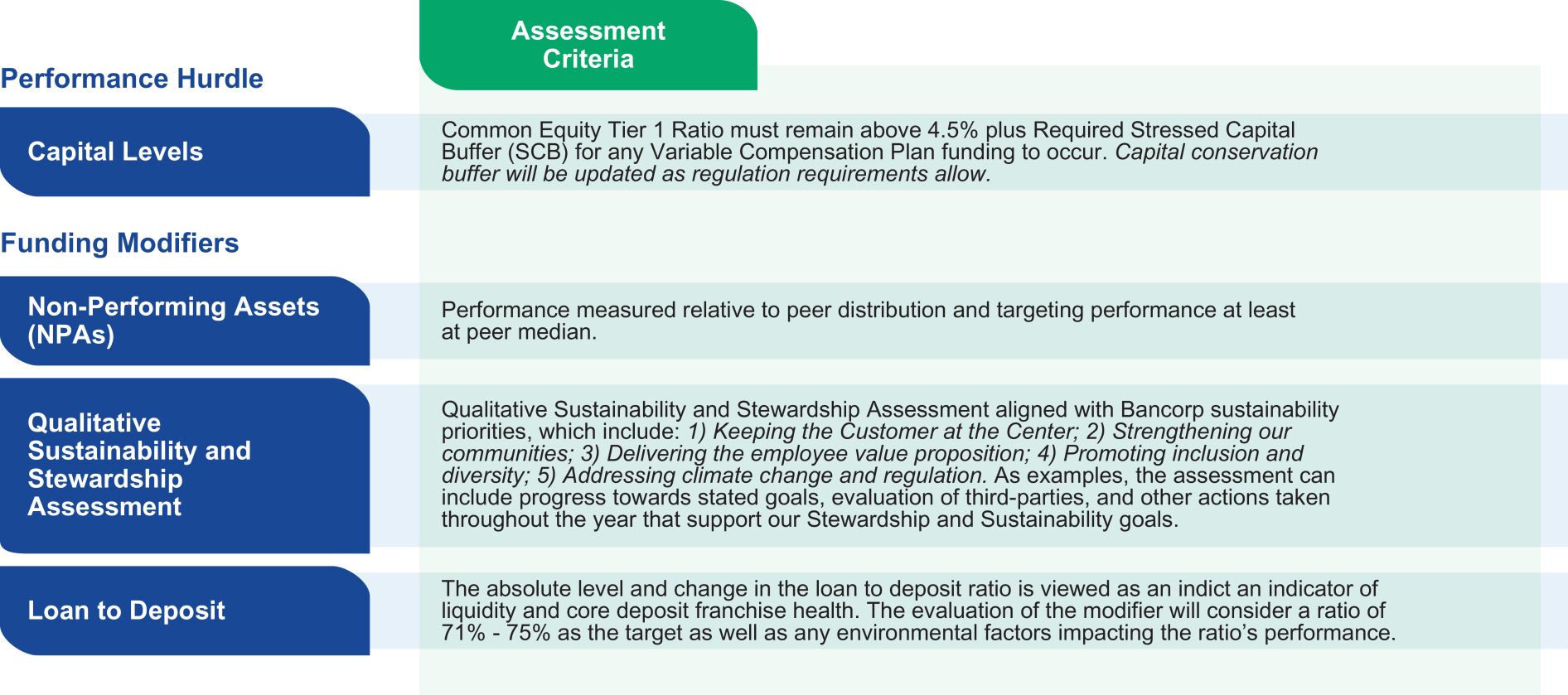

Item 3: Advisory Approval of the Company’s Compensation of its Named Executive Officers

The Board of Directors seeks advisory approval of the compensation for Fifth Third’s Named Executive Officers. The Human Capital and Compensation Committee and our Board of Directors have established a compensation philosophy and a compensation program that rewards employees for delivering the right products to the right customers. Our compensation program considers our shareholders’ long-term interests and alignment with Fifth Third’s values, while also staying within our risk tolerance.

Our Human Capital and Compensation Committee and our Board of Directors recommend a vote “For” the advisory approval of the compensation of our Named Executive Officers. For more information on this item, please see page 86. This item appears as Item 3 on your proxy card.

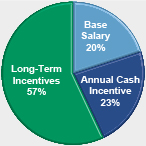

Executive Compensation Highlights

Our Named Executive Officers have more than 50% or more of their target total compensation delivered in the form of long-term, equity-based compensation.

2024 Total Compensation Pay Mix(1)

Chief Executive Officer

| Average of Other NEOs | |||||

|  |

| (1) | The percentages reflect the Named Executive Officer’s base salary as of December 31, 2024, target annual cash incentive award for 2024, and target long-term, equity-based incentive award for 2024. |

| Fifth Third 2025 Proxy Statement | 9 |

PROXY STATEMENT HIGHLIGHTS

Our compensation program incorporates best practices in governance and executive compensation, including the following:

| Compensation matter | Fifth Third’s practice | |

Frequency of pay practices review | Annual | |

Frequency of say-on-pay advisory vote | Annual | |

Robust code of business conduct and ethics | ✓ | |

Pay for performance | ✓ | |

Employment agreements for executive officers | ✘ | |

Excessive perks | ✘ | |

Sustainability Performance

Fifth Third had five 2024 sustainability priorities: strengthening our communities, promoting inclusion and diversity, addressing climate change, delivering our commitment to employees, and keeping the customer at the center. These priorities have been incorporated in senior executive goal-planning as well as the 2024 variable compensation plan for executives and employees. We continue to see progress in the initiatives aligned to each priority. In 2024, Fifth Third continued lending, investment, and philanthropy initiatives as part of the Neighborhood Investment Program and supported additional community development through lending and investment. Our employees committed 110,000 hours to community service in 2024. We continued progress on our sustainability finance goals and our sustainability performance remained in the top quartile among peers. We maintained our focus on our values and enhanced the alignment of our work culture and future success. We continued our focus on the customer, making more than 13 million customer outreach calls in 2024 and have increased consumer checking customers. Our customers are utilizing our consumer-driven products, including Extra Time and Early Pay products.

| 10 |

Election of Directors (Item 1 on Proxy Card)

In accordance with our Regulations, directors are each elected annually to a one-year term expiring at the next Annual Meeting of Shareholders. The terms of our current directors expire at the Annual Meeting on April 15, 2025. Thirteen of our current directors have been nominated to be elected to serve until the Annual Meeting of Shareholders in 2026.

Process for Director Nominations

Director candidates are nominated by the Nominating and Corporate Governance Committee. Pursuant to its Charter, the Nominating and Corporate Governance Committee annually reviews the current composition of the Board, taking into consideration director skills, expertise, background, and experience, the current and emerging needs of our business, and feedback from directors in the Board’s robust self-evaluation process. In addition, the Nominating and Corporate Governance Committee reviews the background and skills of director candidates based on the needs of the Company and the Board. Candidates are reviewed by the Nominating and Corporate Governance Committee and the Board of Directors prior to nomination or appointment to the Board.

Our Corporate Governance Guidelines provide that shareholders may propose nominees to the Nominating and Corporate Governance Committee by submitting the names and qualifications of such persons to the Nominating and Corporate Governance Committee no later than December 31 of each year. Submissions are to be addressed to the Nominating and Corporate Governance Committee at our executive offices and will be forwarded to the Committee. The Nominating and Corporate Governance Committee will then evaluate the possible nominee using the criteria provided in our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee Charter, and other relevant corporate governance disclosures and will consider such person in comparison to all other candidates. The Nominating and Corporate Governance Committee is not obligated to nominate any such individual for election. No such shareholder nominations have been received by Fifth Third for this Annual Meeting. Shareholders may also nominate candidates directly for election by following the procedures in our Code of Regulations. These are summarized in the “2026 Shareholder Proposals” section of this Proxy Statement.

Pursuant to applicable law and our Regulations, any vacancies that occur after the directors are elected may be filled by the Board of Directors for the remainder of the full term of the vacant directorship or the Board may elect not to fill the vacancy and to reduce the size of the Board. There is no family relationship between and among any of our executive officers or directors. There are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any directors are elected or officers are appointed.

| Fifth Third 2025 Proxy Statement | 11 |

ELECTION OF DIRECTORS

Criteria for Director Nominations

Our Corporate Governance Guidelines set forth the following non-exclusive criteria for directors:

| • | independence (to compose a Board of Directors that has a majority of its members who are independent) |

| • | highest personal and professional ethics and integrity |

| • | willingness to devote sufficient time to fulfilling duties as a director |

| • | impact on the mix of the Board’s overall experience in business, government, education, technology, and other areas relevant to our business |

| • | impact on the Board’s composition in terms of skills, background, geography, and other factors relevant to our business |

| • | the number of other public company boards on which the candidate may serve (e.g., a non-CEO director may not serve on more than three public company boards in addition to Fifth Third) |

The Board of Directors and Nominating and Corporate Governance Committee believe that a variety of backgrounds, skills, and characteristics is a critical component to an effective and high-performing board and prioritize candidates accordingly.

The Nominating and Corporate Governance Committee reviewed the qualifications of each nominee for election as director and found that each possesses strong personal and professional ethics and integrity and each is committed to representing the interests of Fifth Third and our shareholders. In addition, as a group, the skills, expertise, and experience of our nominees are well-suited to address the current and emerging needs of our business and to achieve our strategic goals. Our Board of Directors believes that each of our director nominees has demonstrated the ability to devote sufficient time and attention to board duties and to otherwise fulfill the responsibilities required of directors. Therefore, the Nominating and Corporate Governance Committee has nominated the following thirteen (13) persons for election as directors: Nicholas K. Akins, B. Evan Bayh, III, Jorge L. Benitez, Katherine B. Blackburn, Linda W. Clement-Holmes, C. Bryan Daniels, Laurent Desmangles, Mitchell S. Feiger, Thomas H. Harvey, Gary R. Heminger, Eileen A. Mallesch, Kathleen A. Rogers, and Timothy N. Spence. All nominees are current directors of Fifth Third Bancorp. Our Board of Directors has determined that all nominees are considered independent under applicable Nasdaq Global Select Market (“Nasdaq”) standards, except for Mr. Spence.

| 12 |

ELECTION OF DIRECTORS

Director Nominee Overview

| Name | Age | Director Since | Other Public Company Boards* | |||||||||||||||

Nicholas K. Akins | 64 | 2013 | DTE Energy GE Vernova American Electric Power (2023) | |||||||||||||||

B. Evan Bayh, III | 69 | 2011 | Berry Global Group, Inc. Marathon Petroleum Company RLJ Lodging Trust | |||||||||||||||

Jorge L. Benitez | 65 | 2015 | Interpublic Group World Fuel Services | |||||||||||||||

Katherine B. Blackburn | 59 | 2014 | None | |||||||||||||||

Linda W. Clement-Holmes | 62 | 2020 | Cincinnati Financial Corporation | |||||||||||||||

C. Bryan Daniels | 66 | 2019 | None | |||||||||||||||

Laurent Desmangles | 57 | 2023 | None | |||||||||||||||

Mitchell S. Feiger | 66 | 2020 | None | |||||||||||||||

Thomas H. Harvey | 64 | 2019 | None | |||||||||||||||

Gary R. Heminger | 71 | 2006 | PPG Industries, Inc. Marathon Petroleum Company (2020) MPLX GP LLC (2020) | |||||||||||||||

Eileen A. Mallesch | 69 | 2016 | Arch Capital Group, Ltd. Brighthouse Financial Libbey, Inc. (2020) State Auto Financial Corp. (2021) | |||||||||||||||

Kathleen A. Rogers | 59 | 2023 | Federal Home Loan Bank of Cincinnati | |||||||||||||||

Timothy N. Spence | 46 | 2022 | None | |||||||||||||||

| * | The year in which a public company directorship previously ended is indicated by the parenthetical year following the company name. |

| Fifth Third 2025 Proxy Statement | 13 |

ELECTION OF DIRECTORS

Director Retirement Age Provision

Fifth Third’s Corporate Governance Guidelines provide that a director should retire from the Board at the next annual meeting of shareholders at which the director’s term expires that follows his or her 72nd birthday. Upon recommendation from the Nominating and Corporate Governance Committee, the Board may waive this retirement age provision a maximum of three times per director after consideration of the following, among other factors: whether Fifth Third is undergoing significant transition periods in executive leadership, whether there has been an unexpected loss of directors, or whether such a director possesses a specific expertise relevant to the current or emerging business needs of Fifth Third, has unique and valuable industry-specific knowledge, or possesses some other attributes deemed essential by the Board or Nominating and Corporate Governance Committee.

Pursuant to our Corporate Governance Guidelines, Ms. Williams and Messrs. Brumback and McCallister will have met our retirement age prior to the 2025 Annual Meeting and, therefore, our Nominating and Corporate Governance Committee has not nominated Ms. Williams, Mr. Brumback, or Mr. McCallister for election to the Board in 2025. Ms. Williams joined the Board in 2008. She has served as both Board Chair and Lead Independent Director and has chaired several committees of the Board. Her significant experience in the financial services industry, extensive corporate governance expertise, and deep institutional knowledge have been an asset to the Board. Mr. Brumback joined the Board in 2009. His expertise in the financial services sector, highlighted by his risk and operational management skills, have been valuable to the Board throughout his tenure, highlighted by his leadership of the Audit Committee and later the Risk and Compliance Committee. Mr. McCallister joined our Board in 2011 and, drawing on his experience as a public company CEO, has provided a unique perspective on corporate transactions. He has led our Human Capital and Compensation Committee for several years through steady and thoughtful leadership. The Board of Directors extends its sincere appreciation for the many years of dedicated service of Ms. Williams and Messrs. Brumback and McCallister. Our recent and continuing succession planning efforts have positioned the Board well to address our current and anticipated business needs and ensure that the Board will continue to have sufficient experience, expertise, institutional knowledge, and skill sets to continue to maintain a high level of effectiveness. Accordingly, the Board has voted to reduce its size from 16 members to 13 members at the conclusion of the Annual Shareholders Meeting.

| 14 |

ELECTION OF DIRECTORS

Nominees for Election as Directors

| Nicholas K. Akins Retired Chair, Chief Executive Officer, and President of American Electric Power Company

Career Highlights: • Retired Chair, CEO, and President of American Electric Power Company • 40-year career of increasing leadership responsibility with American Electric Power Company (initially with the former Central and South West Corporation that merged with AEP in 2000), including roles as Executive Chair (2023), Chief Executive Officer (2011), President (2011), and Executive Vice President (2006)

Key Qualifications and Experience • Business expertise as chief executive officer of multi-state utility • Oversight of operational, financial, and compliance-related management in heavily regulated industry • Significant experience leading corporate and employee culture initiatives • Oversight of cyber-related activities in business systems and critical infrastructure

Skills and Attributes: Accounting/Financial Reporting, Compensation and Benefits, Corporate Governance, Cybersecurity, Executive Management, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning, Sustainability | |

| B. Evan Bayh, III Senior Advisor of Apollo Global Management

| |

| Career Highlights: | ||

• Non-executive Senior Advisor, Apollo Global Management | ||

• Served as United States Senator for the State of Indiana | ||

• Served as Governor of the State of Indiana | ||

• Former Partner, McGuire Woods | ||

• Former Partner, Cozen O’Connor | ||

Key Qualifications and Experience • Oversight of a broad array of financial, economic, and policy issues impacting a wide variety of businesses as Governor and Senator • Service as a member of the Senate Banking Committee and the Chair of the International Trade and Finance Subcommittee • Extensive knowledge of cybersecurity issues as a result of membership on the Senate Intelligence Committee and the Central Intelligence Agency External Advisory Board

Skills and Attributes: Compensation and Benefits, Corporate Governance, Cybersecurity, Digital Innovation and FinTech, Executive Management, Financial Services Industry, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning, Sustainability | ||

| Fifth Third 2025 Proxy Statement | 15 |

ELECTION OF DIRECTORS

| Jorge L. Benitez Retired Chief Executive Officer of North America, Accenture

Career Highlights: • Retired Chief Executive Officer of North America, Accenture • Former Chief Operating Officer, Accenture Products Operating Group

Key Qualifications and Experience • Extensive experience developing and executing business strategies across a range of industries • Significant experience implementing large-scale systems integration services • Oversight of operating units within a large, multinational, publicly-traded company

Skills and Attributes: Accounting/Financial Reporting, Compensation and Benefits, Corporate Governance, Cybersecurity, Digital Innovation and Fintech, Executive Management, Human Capital Management, Risk Management, Strategic Planning, Sustainability | |

| Katherine B. Blackburn Executive Vice President of Cincinnati Bengals, Inc.

Career Highlights: • Executive Vice President, Cincinnati Bengals, Inc.

Key Qualifications and Experience • Extensive experience managing Cincinnati Bengals professional football franchise, including human resource management, cost and efficiency management, marketing, and business negotiations • Extensive experience with inclusion and diversity initiatives, including with the National Football League’s Diversity Committee • Knowledge and familiarity of Fifth Third Bank and the Cincinnati, Ohio regional market

Skills and Attributes: Compensation and Benefits, Corporate Governance, Cybersecurity, Digital Innovation and Fintech, Executive Management, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning, Sustainability | |

| 16 |

ELECTION OF DIRECTORS

| Linda W. Clement-Holmes Retired Chief Information Officer of The Procter & Gamble Company

Career Highlights: • Retired Chief Information Officer, Global Information and Decision Solutions Officer, Senior Vice President of Global Business Services, and Chief Diversity Officer of The Procter and Gamble Company

Key Qualifications and Experience • 35-year career at Procter and Gamble, culminating in service as Chief Information Officer • Extensive technology, cybersecurity, and digital innovation expertise, including leadership of global Procter and Gamble technology team and responsibility for digital and IT architecture and governance, including information security • Experience in corporate strategy, including use of emerging business technologies to support speed and innovation • Knowledge of Cincinnati, Ohio regional market and leadership in inclusion and diversity efforts

Skills and Attributes: Compensation and Benefits, Corporate Governance, Cybersecurity, Digital Innovation and FinTech, Executive Management, Human Capital Management, Risk Management, Strategic Planning, Sustainability | |

| C. Bryan Daniels Co-Founder and Principal of Prairie Capital, a Chicago-based private equity firm

Career Highlights: • Co-Founder and Principal of Prairie Capital, a Chicago-based private equity firm • Former Senior Vice President of Commercial Banking at American National Bank and Trust Company

Key Qualifications and Experience • Extensive and varied experiences as an executive, director, and investor in the financial services industry • Possesses a rich and multi-faceted understanding of many different industries, companies, and business practices from his role at Prairie Capital • Substantial experience in technology in several industries, including financial services

Skills and Attributes: Corporate Governance, Cybersecurity, Digital Innovation and FinTech, Executive Management, Financial Services Industry, Risk Management, Strategic Planning | |

| Fifth Third 2025 Proxy Statement | 17 |

ELECTION OF DIRECTORS

| Laurent Desmangles Retired Senior Partner and Managing Director of Boston Consulting Group

Career Highlights: • Retired Senior Partner and Managing Director, Boston Consulting Group • Advisor, Nyca Partners • Advisor, Demopolis Equity Partners • Former Director of Financial Institutions Practice, Oliver Wyman

Key Qualifications and Experience • 30 years of experience advising large financial services organizations on corporate strategy, large scale transformation, digital and analytics innovation, and change management • Significant knowledge of the financial services industry, including retail and commercial banking, market dynamics, and operational opportunities • Expertise in FinTech sector

Skills and Attributes: Corporate Governance, Digital Innovation and FinTech, Executive Management, Financial Services Industry, Strategic Planning, Sustainability | |

| Mitchell S. Feiger Retired Chair and Chief Executive Officer of Fifth Third Bank (Chicago)

Career Highlights: • Former Chief Executive Officer and President of MB Financial, Inc. • Former Chief Executive Officer and President of MB Financial Bank, National Association • Former Chief Executive Officer, President, and director of Coal City Corporation (merged with Avondale Financial Corp and was renamed MB Financial, Inc.)

Key Qualifications and Experience • 35 years of experience in the financial services industry, including 27 years as the president or chief executive officer of a bank holding company or commercial bank; President and Chief Executive Officer of MB Financial, Inc. immediately prior to its merger with Fifth Third Bancorp • Extensive knowledge of the financial services industry and banking business and operations in Chicago region • Significant experience in leadership of public companies • Substantial bank regulatory experience

Skills and Attributes: Accounting and Reporting, Compensation and Benefits, Corporate Governance, Digital Innovation and Fintech, Executive Management, Financial Services Industry, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning | |

| 18 |

ELECTION OF DIRECTORS

| Thomas H. Harvey Chief Executive Officer of Energy Innovation: Policy and Technology, LLC

Career Highlights: • Chief Executive Officer of Energy Innovation: Policy and Technology, LLC • Former Chair of the Board of MB Financial, Inc. • Former Chief Executive Officer of ClimateWorks Foundation • Former Environmental Program Director of the William and Flora Hewlett Foundation • Former President of Energy Foundation

Key Qualifications and Experience • 25 years of service in the financial services industry • Strong organizational and leadership skills and extensive investment experience derived from his executive positions with multiple foundations and organizations • Unique and diverse knowledge and experience with the emergence and growth of technology in the banking industry • Extensive knowledge and experience with renewable energy, sustainability, and climate matters

Skills and Attributes: Accounting/Financial Reporting, Corporate Governance, Executive Management, Financial Services Industry, Human Capital Management, Strategic Planning, Sustainability | |

| Gary R. Heminger Retired Chair and Chief Executive Officer of Marathon Petroleum Corporation

Career Highlights: • Retired Chair and Chief Executive Officer of Marathon Petroleum Corporation • Former Chief Executive Officer of MPLX GP LLC

Key Qualifications and Experience • Over 40 years of experience with Marathon Petroleum Corporation in a variety of groups and functions • Extensive valuable business knowledge from overseeing all operations, performance, reporting, and financial metrics for Marathon’s refining, marketing, transportation, and Speedway businesses • Substantial financial experience through oversight of all financial data, working capital, and merger and acquisition activity at Marathon

Skills and Attributes: Accounting/Financial Reporting, Compensation and Benefits, Corporate Governance, Executive Management, Human Capital Management, Risk Management, Strategic Planning, Sustainability | |

| Fifth Third 2025 Proxy Statement | 19 |

ELECTION OF DIRECTORS

| Eileen A. Mallesch Certified Public Accountant (inactive) and Retired Senior Vice President & Chief Financial Officer of Nationwide Property and Casualty Segment, Nationwide Mutual Insurance Company

Career Highlights: • Certified Public Accountant • Retired Senior Vice President & Chief Financial Officer of Nationwide Property and Casualty Segment, Nationwide Mutual Insurance Company • Former Senior Vice President and Chief Financial Officer of Genworth Financial Life Insurance/Service Company

Key Qualifications and Experience • More than 25 years of broad financial and strategy experience in a variety of industries, including insurance, telecommunications, consumer products, and manufacturing • Extensive financial management experience from tenure with Nationwide and Genworth • Vast knowledge of enterprise resource planning and large-scale technology integrations, strategic planning, managing acquisitions and divestitures, and risk and compliance management • Substantial experience as a public company director

Skills and Attributes: Accounting/Financial Reporting, Compensation and Benefits, Corporate Governance, Cybersecurity, Executive Management, Financial Services Industry, Legal and Regulatory, Risk Management, Strategic Planning, Sustainability | |

| Kathleen A. Rogers Retired Executive Vice President of U.S. Bank

Career Highlights: • Retired Executive Vice President, Chief Financial Officer, and Chief Finance Administration Officer of U.S. Bank

Key Qualifications and Experience • Business expertise from 35-year career in the financial services industry • Significant knowledge of public company financial management, including financial risk management, treasury actions, accounting policy and reporting, corporate development activities (including mergers and acquisitions), and strategic investments • Extensive experience in regulatory activities and investor relations • Substantial experience in technology in several industries, including financial services

Skills and Attributes: Accounting and Financial Reporting, Compensation and Benefits, Corporate Governance, Executive Management, Financial Services Industry, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning | |

| 20 |

ELECTION OF DIRECTORS

| Timothy N. Spence Chair, Chief Executive Officer, and President of Fifth Third Bancorp

Career Highlights: • Chair and Chief Executive Officer of Fifth Third Bancorp; President (2020-present); Executive Vice President and Head of Consumer Bank, Payments and Strategy (2018-2020); Head of Payments, Strategy and Digital Solutions (2017-2018); and Chief Strategy Officer (2015-2020) • Prior to joining Fifth Third, Mr. Spence was a Senior Partner with Oliver Wyman

Key Qualifications and Experience • Broad knowledge of the Company and the financial services sector from expansive experience heading multiple Fifth Third businesses • Unique and valuable experience from leading Fifth Third’s digital transformation efforts, including completion of significant acquisitions and investments • Substantial experience leading strategic plan development and implementation

Skills and Attributes: Accounting/Financial Reporting, Compensation and Benefits, Corporate Governance, Cybersecurity, Digital Innovation/FinTech, Executive Management, Financial Services Industry, Human Capital Management, Legal and Regulatory, Risk Management, Strategic Planning, Sustainability | |

| Fifth Third 2025 Proxy Statement | 21 |

ELECTION OF DIRECTORS

Shares of Company Common Stock Beneficially Owned as of December 31, 2024(1) | Percent of Class | |||||||||

Nicholas K. Akins |

| 72,164 |

| .0108 | % | |||||

B. Evan Bayh, III |

| 33,663 |

| .0050 | % | |||||

Jorge L. Benitez |

| 40,111 |

| .0060 | % | |||||

Katherine B. Blackburn |

| 136,637 |

| .0204 | % | |||||

Emerson L. Brumback |

| 82,539 |

| .0123 | % | |||||

Linda W. Clement-Holmes |

| 18,293 |

| .0027 | % | |||||

C. Bryan Daniels(2) |

| 369,221 |

| .0551 | % | |||||

Laurent Demangles |

| 7,997 |

| .0012 | % | |||||

Mitchell S. Feiger(3) |

| 506,383 |

| .0756 | % | |||||

Thomas H. Harvey(4) |

| 159,302 |

| .0238 | % | |||||

Gary R. Heminger(5) |

| 137,339 |

| .0205 | % | |||||

Eileen A. Mallesch |

| 46,090 |

| .0069 | % | |||||

Michael B. McCallister(6) |

| 85,144 |

| .0127 | % | |||||

Kathleen A. Rogers |

| 8,807 |

| .0013 | % | |||||

Timothy N. Spence |

| 590,458 |

| .0881 | % | |||||

Marsha C. Williams | 47,729 | .0071 | % | |||||||

All Directors and Executive Officers (27 persons) | 3,522,215 | .5247 | % | |||||||

| (1) | As reported to Fifth Third Bancorp by the directors as of the date stated. Includes shares held in the name of spouses, minor children, certain relatives, trusts, estates, and certain affiliated companies as to which beneficial ownership may be disclaimed. Unless otherwise noted, all shares of our Common Stock are subject to the sole voting power and investment power of the directors and executive officers. As of December 31, 2024, none of the Company’s current executive officers or directors owned any Series H Preferred Stock, Series I Preferred Stock, Series J Preferred Stock, Series K Preferred Stock, Series A, Class B Preferred Stock, or any Depositary Shares representing interests in Series H Preferred Stock, Series I Preferred Stock, Series J Preferred Stock, Series K Preferred Stock, or Series A, Class B Preferred Stock. |

The amounts shown represent the total shares owned outright by such individuals together with stock appreciation rights exercisable as of (or exercisable within 60 days of) December 31, 2024 but unexercised and shares of common stock underlying outstanding restricted stock units. Specifically, Mr. Spence owned 293,229 stock appreciation rights exercisable as of (or exercisable within 60 days of) December 31, 2024. The amounts listed for stock appreciation rights represent the number of rights that may be exercised; the actual number of shares delivered will vary based on the stock’s appreciation over the grant price at the time of exercise. The aggregate number of stock appreciation rights exercisable as of (or exercisable within 60 days of) December 31, 2024 but unexercised held by the executive officers who are not also directors or nominees is 567,989. Directors owned the following number of restricted stock units as of December 31, 2024 Nicholas K. Akins, 72,164; B. Evan Bayh III, 52,807; Jorge L. Benitez, 48,167; Katherine B. Blackburn, 58,337; Emerson L. Brumback, 52,807; Linda W. Clement-Holmes, 22,072; C. Bryan Daniels, 32,144; Laurent Demangles, 7,997; Mitchell S. Feiger, 22,167; Thomas H. Harvey, 31,563; Gary R. Heminger, 52,807; Eileen A. Mallesch, 46,090; Michael B. McCallister, 64,601; Kathleen A. Rogers, 7,997; Timothy N. Spence, 123,607; and Marsha C. Williams, 74,291. Some directors have deferred receipt of the common stock underlying certain of their restricted stock units: B. Evan Bayh III, 41,144; Jorge L. Benitez, 8,056; Linda W. Clement-Holmes, 3,779; C. Bryan Daniels, 17,327; Mitchell S. Feiger, 18,411; Thomas H. Harvey, 13,149; Gary R. Heminger, 32,828; Michael B. McCallister, 5,580; and Marsha C. Williams, 58,357. All directors and executive officers as a group own 1,337,553 restricted stock units. 613,460 of these restricted stock units are subject to vesting within 60 days of December 31, 2024.

| (2) | Includes 8,963 shares of Common Stock held in an IRA owned by Mr. Daniels or an immediate family member. |

| (3) | Includes 502,627 shares of Common Stock owned by a trust of Mr. Feiger or an immediate family member. |

| (4) | Includes 62,763 shares of Common Stock owned by a trust of Mr. Harvey or an immediate family member. |

| (5) | Includes 14,786 shares of Common Stock held in an IRA owned by Mr. Heminger or an immediate family member. |

| (6) | Includes 16,143 shares of Common Stock owned by a trust of Mr. McCallister or an immediate family member. |

| 22 |

ELECTION OF DIRECTORS

Director Skills Matrix

We believe each of our directors makes unique, valuable, and substantial contributions to the Board, both individually and as a collective group. The following matrix provides information regarding the director nominees, including certain types of knowledge, skills, and experience that the Board believes are relevant to our business and the achievement of our strategy. The type and degree of knowledge, skill, or experience below may vary among our directors. The matrix does not include all knowledge, skills, experience, or other attributes of our directors that may be relevant and valuable to their service on our Board; a director may possess other knowledge, skills, and experience not indicated in the matrix. The mix of knowledge, skill, experience, and attributes of our directors, collectively, lends itself to a highly collaborative and effective Board.

|  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||

|

Accounting/Financial Reporting Experience as an accountant or auditor at large accounting firm, Chief Financial Officer, or other relevant experience in accounting and financial reporting |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Compensation and Benefits Experience in management and development of human capital, compensation, or benefits programs |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Corporate Governance Experience in governance matters, principles, and administration |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Cybersecurity Experience in information security, data privacy, and cybersecurity |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Digital Innovation and FinTech Experience in use of technology to facilitate business operations and customer service |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Executive Management Business and strategic management experience from service in a significant leadership position, such as a chief executive officer, chief financial officer, or other senior leadership role |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Financial Services Industry Experience in one or more of the Company’s specific financial services areas, including retail banking, wholesale banking, wealth and investment management, or global payments |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Human Capital Management Experience in managing and developing a large workforce, managing compensation, directing strategies leveraging human capital, managing inclusion efforts, establishing culture, implementing succession planning and talent management, and/or managing other human capital initiatives |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Legal and Regulatory Experience acquired through a law degree and as a practicing attorney in understanding legal risks and obligations; experience in governmental and regulatory affairs, including as part of a business and/or through positions with government organizations and regulatory bodies |

|

|

|

|

|

|

|

|

| ||||||||||||||||||

| Risk Management Experience with reviewing or managing risk in a large organization, including specific types of risk (e.g., physical security, financial risk, or risks facing large financial institutions) |

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| Strategic Planning Experience defining and driving strategic direction and growth and managing the operations of a business or large organization |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Sustainability Experience in environmental issues, such as climate matters, or social criteria and community affairs matters, including as part of a business and managing corporate social responsibility issues as strategic and business imperatives |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Fifth Third 2025 Proxy Statement | 23 |

ELECTION OF DIRECTORS

Vote Required

(of our outstanding Common Stock and Series A, Class B Preferred Stock, voting together as a single class)

Our directors are elected by the holders of our outstanding Common Stock and Series A, Class B Preferred Stock, voting together as a single class. The holders of the Common Stock have one vote per share, and the holders of Preferred Stock have 24 votes per share. Under Ohio law, our Articles of Incorporation, and our Regulations, in an uncontested election of directors (i.e., an election where the number of candidates nominated for election to the Board of Directors equals the number of directors to be elected), each person receiving a greater number of votes “for” his or her election than votes “against” his or her election will be elected as a director.

We have also adopted provisions of our Corporate Governance Guidelines stating that in an uncontested election of directors, any nominee for director who receives a greater number of votes “against” his or her election than votes “for” his or her election will promptly tender his or her resignation to the Chair of the Board following certification of the shareholder vote. The Nominating and Corporate Governance Committee will promptly consider the tendered resignation and will recommend to the Board whether to accept or reject the tendered resignation no later than 60 days following the date of the shareholders’ meeting at which the election occurred. In considering whether to accept or reject the tendered resignation, the Nominating and Corporate Governance Committee will consider factors deemed relevant by the Committee members including, without limitation, the director’s length of service, the director’s particular qualifications and contributions to Fifth Third, the reasons underlying the majority “against” vote (if known) and whether these reasons can be cured, and compliance with stock exchange listing standards and the Corporate Governance Guidelines. The Board will act on the Nominating and Corporate Governance Committee’s recommendation no later than 90 days following the date of the shareholders’ meeting at which the election occurred. In considering the Nominating and Corporate Governance Committee’s recommendation, the Board will evaluate the factors considered by the Nominating and Corporate Governance Committee and such additional information and factors the Board believes to be relevant.

If any nominee(s) shall be unable to serve, which is not now contemplated, the proxies will be voted for such substitute nominee(s) as the Nominating and Corporate Governance Committee of the Board of Directors recommends.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH

OF THE CANDIDATES FOR DIRECTOR NAMED ABOVE.

| 24 |

Board of Directors, Committees, Meetings, and Functions

Our Board of Directors met 10 times during 2024. Our Board of Directors also holds executive sessions of those members of the Board of Directors who meet the then-current standards of independence. In 2024, these sessions were led by Mr. Akins, who served as our Lead Independent Director.

No current member of our Board of Directors attended less than 75% of the aggregate number of meetings of the Board of Directors and all Committees on which such director served during 2024.

Neither the Board nor the Nominating and Corporate Governance Committee has implemented a formal policy regarding director attendance at the Annual Meeting; however, each director is expected to attend the Annual Meeting and the Board typically holds a Board meeting directly following the Annual Meeting. In 2024, all directors attended the Annual Meeting.

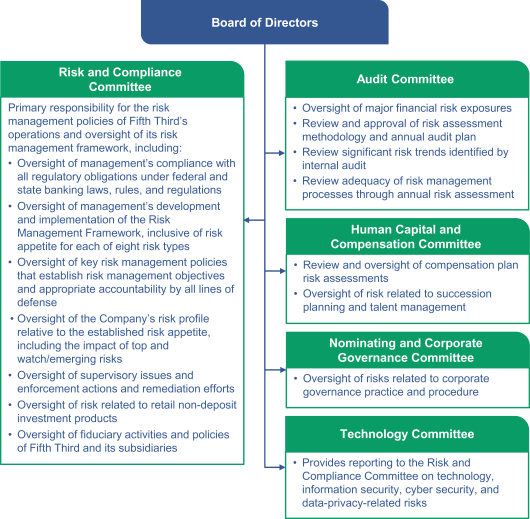

During 2024, there were six Committees of the Board of Directors, which assisted the Board in carrying out its responsibilities: Audit, Finance, Human Capital and Compensation, Nominating and Corporate Governance, Risk and Compliance, and Technology. Each Committee operates under a charter approved by the Board of Directors and reviewed annually by the respective Committee and the Board of Directors. The Board’s Committees meet on a regular basis according to the requirements of their charters. Each Committee reports its activities, discussions, recommendations, and approvals to the Board at each regularly scheduled Board meeting. Committee leadership and membership is reviewed annually by the Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee. Each Committee is comprised of only independent directors.

Committee Composition

Directors: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

| Audit |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

| |||||||||||||||||||

| Finance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| Human Capital and Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| Nominating and Corporate Governance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

| Risk and Compliance |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

| Technology |

* |

|

|

| Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

= member

= member

* = Serves as an ex-officio, non-voting member

| Fifth Third 2025 Proxy Statement | 25 |

BOARD OF DIRECTORS, ITS COMMITTEES, MEETINGS, AND FUNCTIONS

10

Audit Committee meetings in 2024

|

Audit Committee

Our Audit Committee serves in a dual capacity as the Audit Committee of Fifth Third Bancorp and Fifth Third Bank, National Association and is comprised entirely of independent directors.

The Audit Committee’s functions include:

| • | Engagement of Fifth Third’s independent external audit firm and review of its independence |

| • | Review and approval of the independent external audit firm’s annual plan and review of audit results |

| • | Approval of all auditing and non-auditing services performed by our independent external audit firm |

| • | Approval of annual internal audit plan and review of the results of the procedures for internal auditing |

| • | Review and oversight of appointment and performance of senior internal audit executive |

| • | Review of Fifth Third’s financial results and periodic SEC and other regulatory filings |

| • | Review of the design and effectiveness of internal controls |

| • | Oversight of the administration of Fifth Third’s Code of Business Conduct and Ethics |

| • | Review of reporting regarding calls to Fifth Third’s EthicsLine |

| • | Fulfillment of the statutory requirements of a bank audit committee, as prescribed under applicable law |

Audit Committee members in 2024 were Eileen A. Mallesch (Chair), B. Evan Bayh, III, Jorge L. Benitez, Linda W. Clement-Holmes, C. Bryan Daniels, Gary R. Heminger, and Kathleen A. Rogers. Katherine B. Blackburn and Thomas H. Harvey also served on the Audit Committee in 2024.

All members of the Audit Committee met the independence standards of Rule 5605(a)(2) and the audit committee qualifications of Rule 5605(c)(2) of the Nasdaq listing standards. The Board of Directors has determined that Messes. Mallesch and Rogers and Mr. Heminger are audit committee financial experts and are independent as described in the preceding sentence. As Lead Independent Director, Mr. Akins serves as an ex-officio, non-voting member of the Audit Committee. The Board of Directors has adopted a written charter for the Audit Committee, which may be found in the Corporate Governance section of our website at www.53.com. The formal report of the Audit Committee with respect to the year 2024 is on page 83 herein.

2

Finance Committee meetings in 2024

|

Finance Committee

The Finance Committee serves in a dual capacity as the Finance Committee of Fifth Third Bancorp and Fifth Third Bank, National Association and is comprised entirely of independent directors.

The Finance Committee’s functions include:

| • | Exercise of the powers of the Board of Directors of Fifth Third Bancorp and Fifth Third Bank during the intervals between meetings |

| • | Exercise of management of the business, properties, and affairs of both Fifth Third Bancorp and Fifth Third Bank to the extent permissible |

Finance Committee members for 2024 were Gary R. Heminger (Chair), Nicholas K. Akins, Jorge L. Benitez, Mitchell S. Feiger, Thomas H. Harvey, Michael B. McCallister, and Eileen A. Mallesch. Emerson L. Brumback also served on the Finance Committee in 2024.

The Board of Directors has adopted a Finance Committee charter which may be found in the Corporate Governance section of our website at www.53.com.

| 26 |

BOARD OF DIRECTORS, ITS COMMITTEES, MEETINGS, AND FUNCTIONS

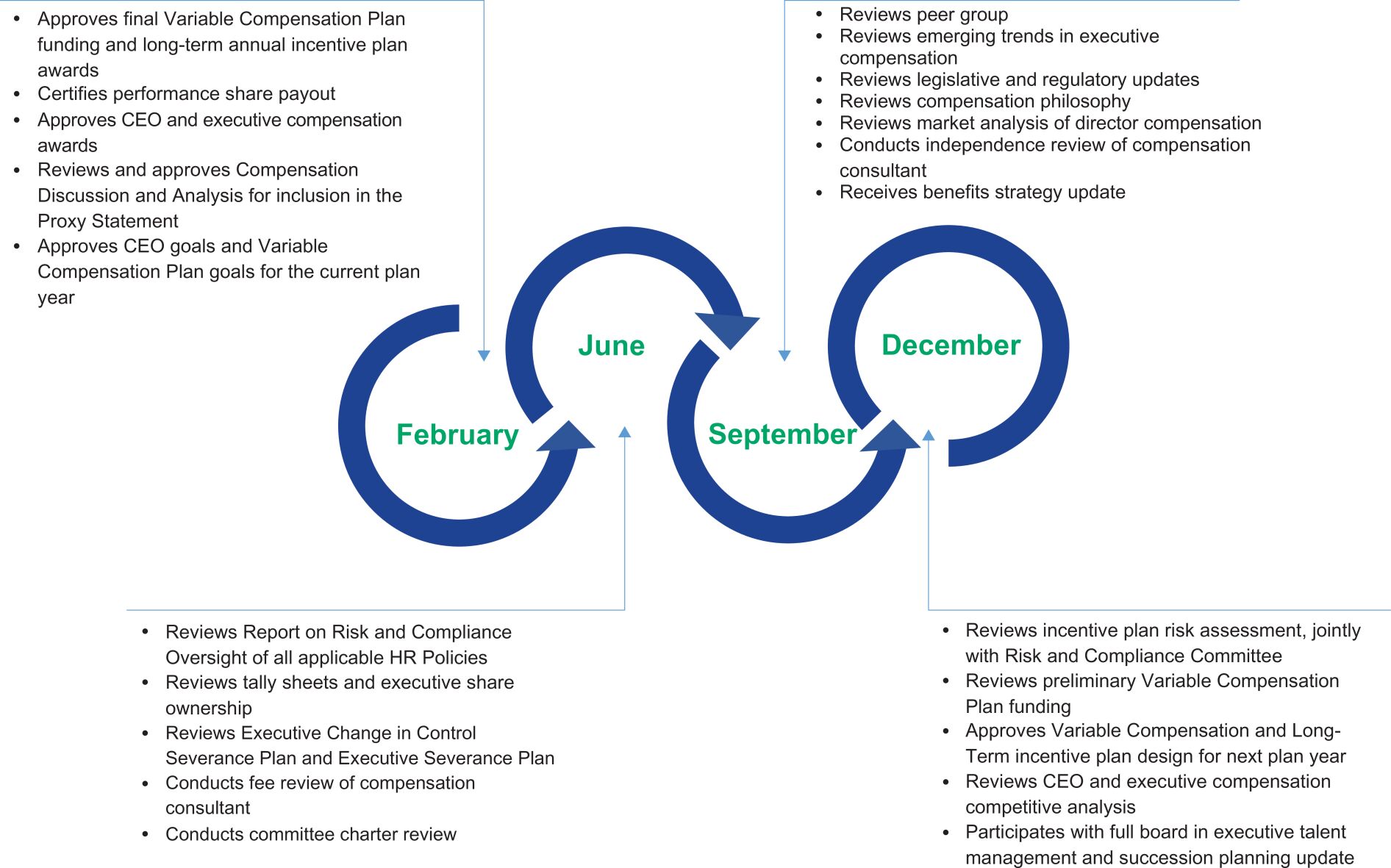

6

Human Capital and Compensation Committee meetings in 2024

|

Human Capital and Compensation Committee

Our Human Capital and Compensation Committee serves in a dual capacity as the Human Capital and Compensation Committee of Fifth Third Bancorp and Fifth Third Bank, National Association and is comprised entirely of independent directors.

The Human Capital and Compensation Committee’s functions include:

| • | Oversight of benefit, bonus, incentive compensation, severance, equity-based and other compensation plans, policies, and programs |

| • | Review and approval of executive compensation and equity plan allocation |

| • | Oversight of the development and administration of incentive compensation plans, policies, and programs |

| • | Oversight of Talent Management and Succession Planning Programs, including succession planning for the CEO and other executive officers |

| • | Review and recommendation of director compensation |

| • | Oversight of establishment and administration of an effective incentive compensation strategy which provides balanced risk-taking incentives in alignment with risk appetite |

Human Capital and Compensation Committee members for 2024 were Michael B. McCallister (Chair), Nicholas K. Akins, Jorge L. Benitez, Linda W. Clement-Holmes, Gary R. Heminger, and Marsha C. Williams. Emerson L. Brumback and Kathleen A. Rogers also served on the Human Capital and Compensation Committee in 2024.

The Board of Directors has adopted a Human Capital and Compensation Committee charter which may be found in the Corporate Governance section of our website at www.53.com. The formal report of the Human Capital and Compensation Committee with respect to 2024 compensation is on page 63 herein.

3

Nominating and Corporate Governance Committee meetings in 2024

|

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee serves in a dual capacity as the Nominating and Corporate Governance Committee of Fifth Third Bancorp and Fifth Third Bank, National Association and is comprised entirely of independent directors.

The Nominating and Corporate Governance Committee’s functions include:

| • | Recommendation of corporate governance policies and guidelines to enhance effectiveness, including those related to Board size and composition; Board function; meeting frequency and structure; the frequency, structure, and guidelines for calling executive sessions; meeting procedures; and the formation of new committees |

| • | Review of Fifth Third’s governance structure, including committee structure |

| • | Identification and assessment of independence, backgrounds, and skills required for members of the Board |

| • | Identification and nomination of director candidates and committee chairs and member candidates |

| • | Review of and oversight of compliance with Corporate Governance Guidelines |

| • | Review of potential conflicts of interest involving directors |

| • | Creation and oversight of director education and onboarding programs |

| • | Oversight of corporate social responsibility |

| • | Creation and review of the Code of Business Conduct and Ethics |

| • | Oversight of the Company’s commitment to sustainability issues and the Company’s sustainability business strategy |

| • | Annual review of Board and Committee performance |

Nominating and Corporate Governance Committee members for 2024 were Thomas H. Harvey (Chair), Nicholas K. Akins, Katherine B. Blackburn, Laurent Desmangles, and Marsha C. Williams. B. Evan Bayh, III and Jorge L. Benitez also served on the Nominating and Corporate Governance Committee in 2024.

| Fifth Third 2025 Proxy Statement | 27 |

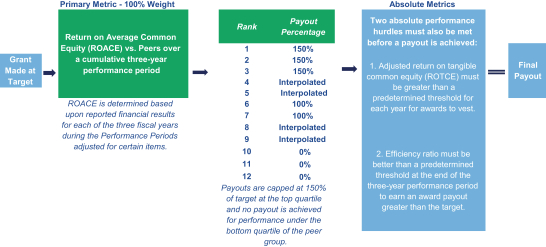

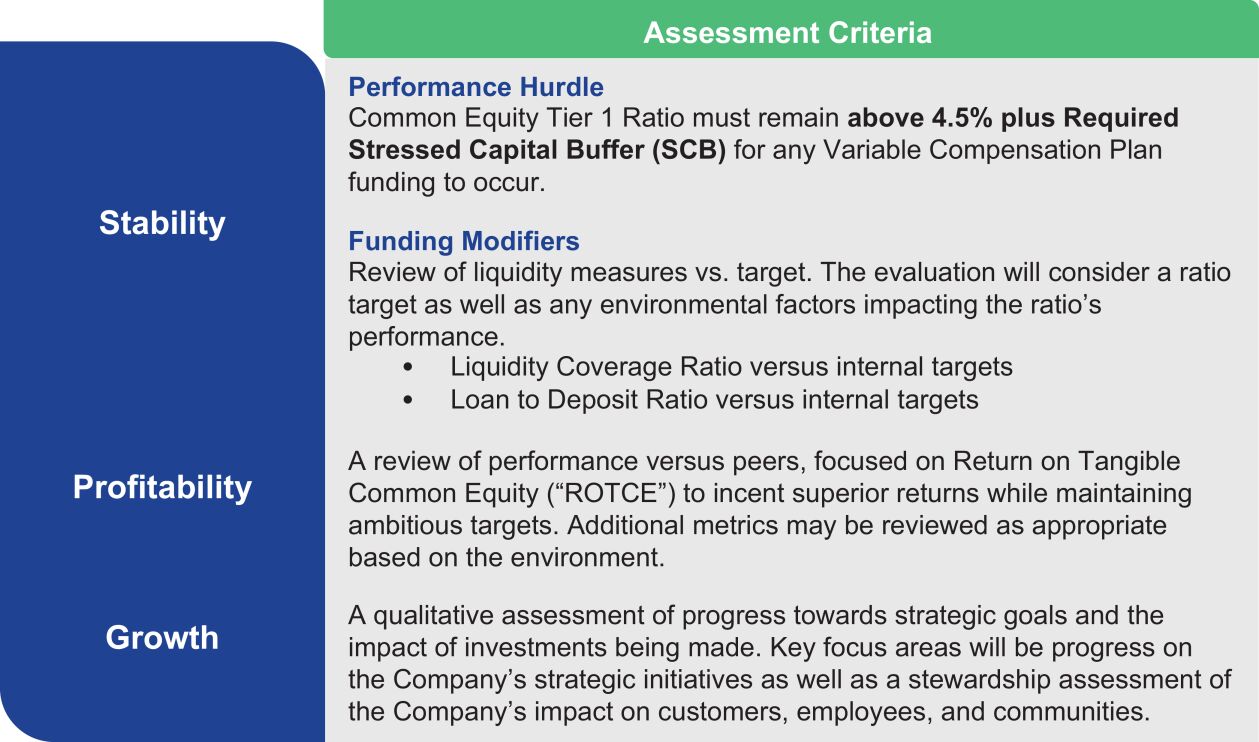

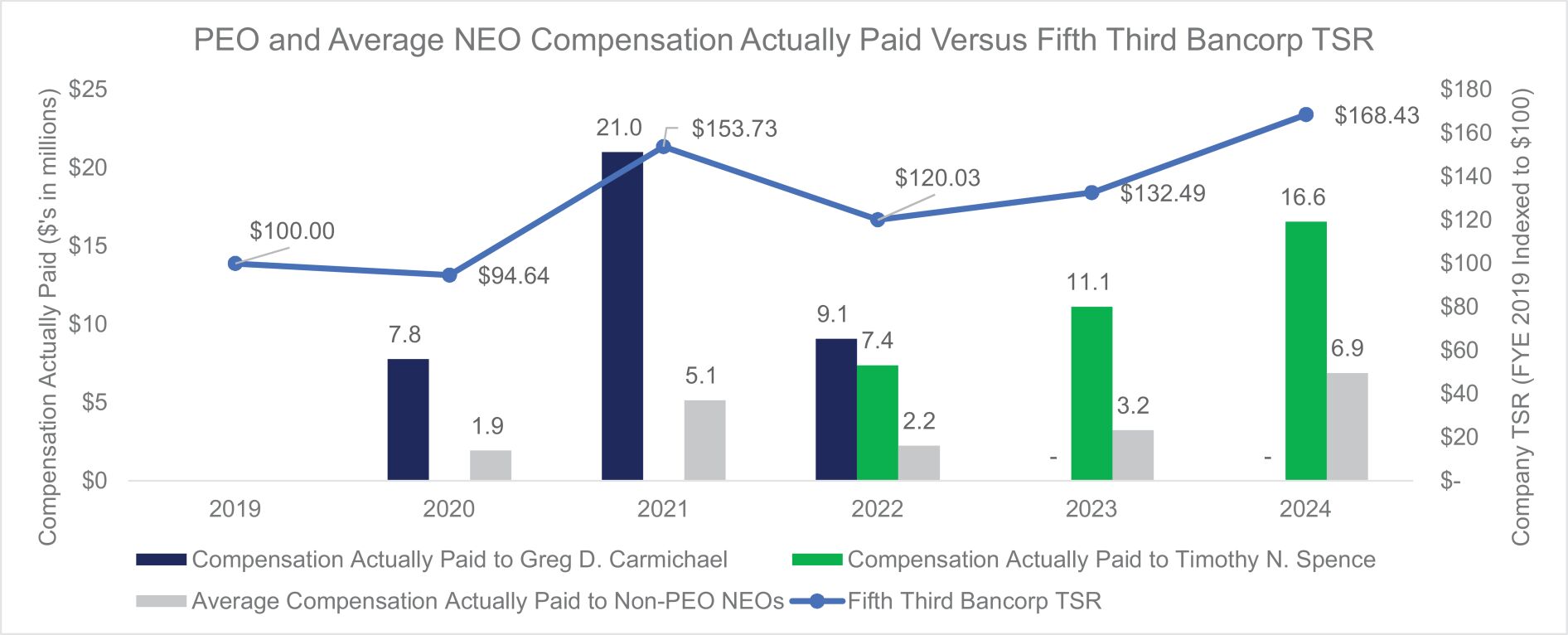

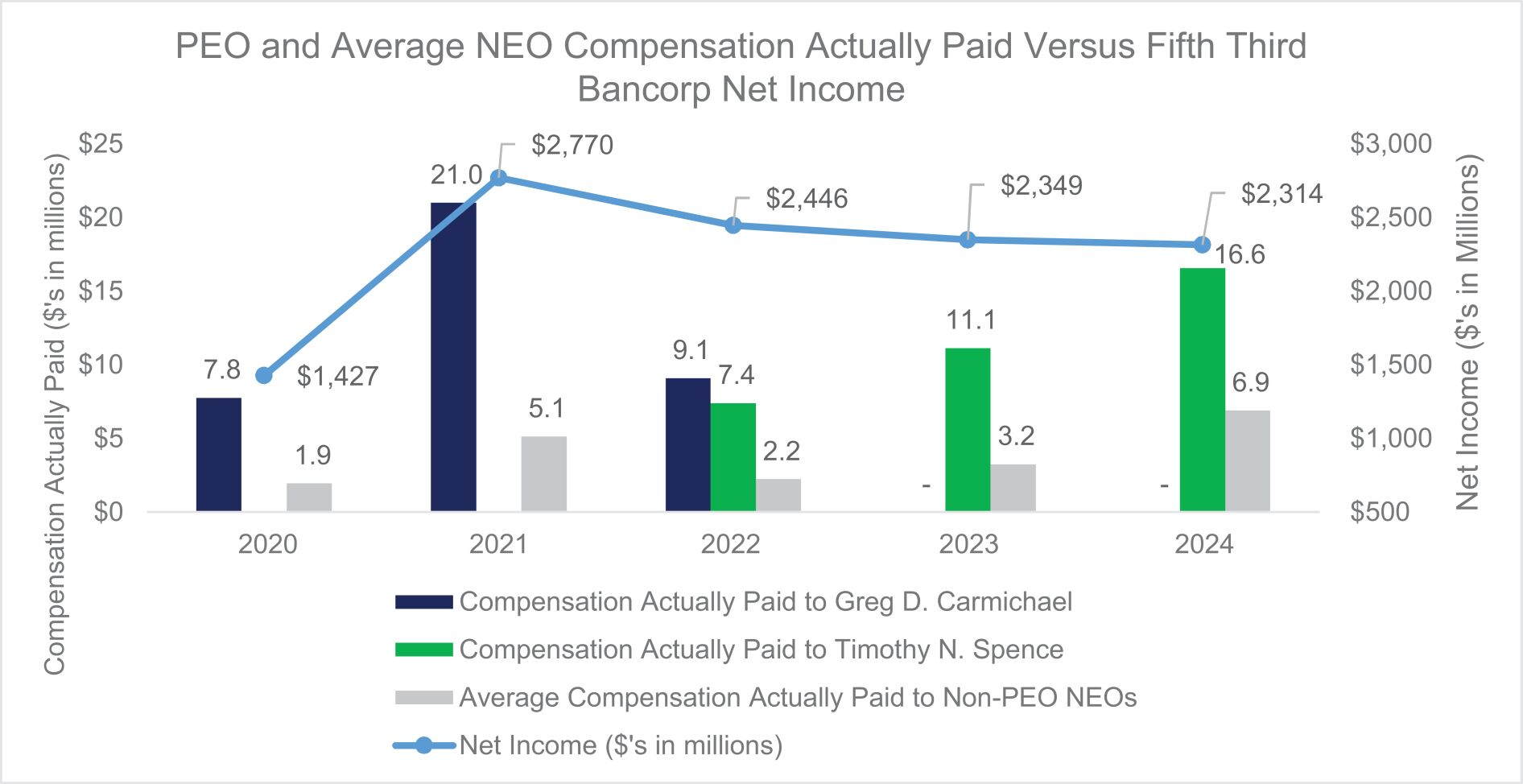

BOARD OF DIRECTORS, ITS COMMITTEES, MEETINGS, AND FUNCTIONS