| | |

|

OMB APPROVAL |

|

OMB Number: | | 3235-0570 |

| |

Expires: | | Nov. 30, 2005 |

|

Estimated average burden |

hours per response: | | 5.0 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-3254

Strong Large Cap Growth Fund, Inc.,

on behalf of Strong Large Cap Growth Fund

(Exact name of registrant as specified in charter)

| | |

| P.O. Box 2936 Milwaukee, WI | | 53201 |

| (Address of principal executive offices) | | (Zip code) |

Richard Smirl, Strong Capital Management, Inc.

P.O. Box 2936 Milwaukee, WI 53201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 359-3400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (S) 3507.

Item 1. Reports to Shareholders

ANNUAL REPORT | December 31, 2003

Strong

Growth

Funds

| | |

| Strong Blue Chip Fund | | |

| |

| Strong Discovery Fund | | |

| |

| Strong Endeavor Fund | | |

| |

| Strong Large Cap Growth Fund | | |

| |

| Strong U.S. Emerging Growth Fund | | |

| |

| Strong Enterprise Fund | | |

| |

| Strong Growth 20 Fund | | |

| |

| Strong Growth Fund | | |

| |

| Strong Large Company Growth Fund | | |

| |

| | |  |

ANNUAL REPORT | December 31, 2003

Strong

Growth

Funds

Table of Contents

A Few Words From Dick Weiss

Market Update — January 1, 2003, to December 31, 2003

One of the great strengths of Strong Capital Management, Inc. (“Strong”), is the autonomy of its different investment teams. Unlike so many institutions where a single investment philosophy predominates and stock selection is done by committee, Strong is comprised of highly independent investment teams with individual philosophies and practices.

This independence notwithstanding, the investment teams share a common objective — adding value for shareholders.

Despite the turmoil surrounding the mutual fund industry and our firm during the last quarter of 2003, Strong’s investment teams performed admirably. According to Lipper, 74 percent of the Strong Funds beat their respective peer indices since their inception.*

Indeed, 2003 turned out to be a better year than anticipated by the investment world. In October of 2002, the market bottomed, and then began a steady advance upward into 2003. Troubled by the prospect of military conflict with Iraq, the market turned down in January and bottomed again in March. Once the outcome in Iraq

Economic Growth Rebounded in 2003

| * | Results are based on total returns. 110 of 149 funds, including separate share classes, outperformed their Lipper Peer Indices since the funds’ inception through 12-31-03. Investment values fluctuate. Results will vary for other time periods. Does not include effect of any loads (as applicable). |

(Continued on next page)

became clear, the market anticipated the major business recovery that materialized in the third and fourth quarters, and resumed its forward march. The S&P 500 Index, Dow Jones Industrial Average, and Nasdaq moved up smartly for the remainder of the year.

It was, in effect, a rising tide that lifted many boats. Stocks that had been especially battered by the three-year bear market — either because the market assumed their business models were broken or because they had been pushed to the edge of bankruptcy — enjoyed dramatic recoveries. Once it became clear that the economy had bottomed, many of the most downtrodden stocks rebounded like coiled springs and rose appreciably in the second half of 2003. This is a phenomenon that has typically occurred after tough bear markets and has generally lasted around 6-8 months. I believe we are approaching the end of this phase.

In some instances, I believe going against conventional wisdom in 2004 will spell the difference between average and exceptional performance. For example:

| | • | Popular opinion has it that manufacturing — a sector which has suffered for roughly 30 years — will continue to falter in 2004. I disagree. It appears that 2004 may shape up to be the first synchronized global economic recovery in years. That, combined with a weak dollar, should make U.S. manufacturing goods increasingly competitive around the world and bolster the sector’s overall results. |

| | • | The energy sector, which significantly underperformed in 2003, looks promising as well. While it participated in the fourth quarter rally, it lagged for the year and was nearing an all-time low, as a percentage of the S&P 500 Index. Energy prices were stronger than most observers expected in 2003. Given the likely increase in demand as the global economy expands, energy prices should remain at the upper end of their normal trading range. This scenario would allow individual energy stocks to play catch-up. |

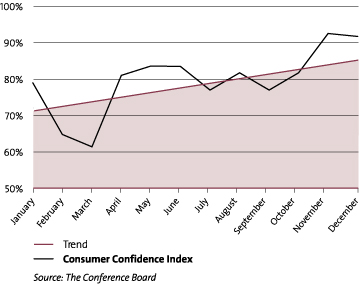

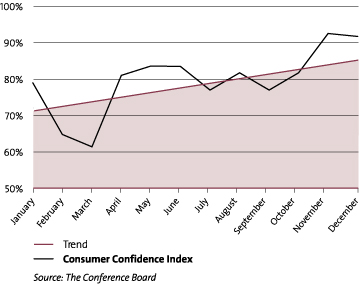

Here at home, the U.S. economy shows unmistakable signs of strengthening. Job growth is gaining momentum. Consumer confidence quite clearly is on the rise. All in all, it’s an encouraging combination.

If you accept the premise that there will be a wider divergence of performance this year, diversification becomes essential. It’s going to be harder to make money in 2004 than it was in 2003. But in a market environment where a rising tide will not lift all issues indiscriminately, diversified mutual funds can be a sound and sensible investment option.

Consumer Confidence Increased in 2003

Thank you for investing with Strong.

Richard T. Weiss

Vice Chairman

Strong Financial Corporation

Strong Blue Chip Fund

The year 2003 proved to be a very strong year for equities, providing welcome relief from the three-year bear market. In this environment, the Strong Blue Chip Fund posted a return of 29.00% for the one-year period. This placed it slightly ahead of its broad-based benchmark, the S&P 500, which returned 28.67%.

Over the year, the Fund’s performance generally followed the same direction as the broader market. The Fund posted mild losses in the first quarter, when the markets and the economy were stalled by concerns about the war with Iraq. Over the remainder of the year, however, the Fund posted strong returns as the war’s quick resolution boosted investor and consumer confidence. Economic stimulus, in the form of tax cuts from the President and Congress, and continued low interest rates from the Federal Reserve helped to drive an economic rebound that supported strong equity performance across virtually every sector of the market.

Small caps led the market

In keeping with our “blue chip” mandate, this Fund focused on the stocks of high-quality, large-cap companies that we believed offer solid prospects for future growth and were available at reasonable prices. In the early stages of the year’s recovery, investors were still cautious, and thus favored larger-company stocks, which can offer a greater degree of stability than small-cap stocks. The Fund benefited strongly from this trend in the second quarter of the year.

As the economy showed signs of an accelerating recovery, though, investors gained more confidence and were willing to take on higher degrees of risk. This led to renewed interest in smaller-company stocks, driving their returns strongly forward in the second half of the year. Our portfolio was strongly skewed toward larger companies, so this shift in market direction was not entirely favorable to our relative returns. Less risk-wary investors also drove technology stocks higher, which did have a positive impact on a number of the Fund’s holdings.

While we retained a large-cap focus, in spring we expanded the universe of stocks eligible for inclusion in the portfolio. This roughly doubled the number of eligible stocks, giving us the ability to be both more flexible and more selective in our investments. This change contributed to the Fund’s improved performance in the late spring and the second half of the year. This does not mean that we are adding small caps to the Fund; it simply indicates that we have been able to make good use of our new ability to range outside of the very largest companies in the U.S.

Technology had strong returns

The return to favor of many technology and telecommunication stocks had a positive impact on the Fund’s performance. Among our successful holdings in these areas were eBay, Yahoo!, and Nextel Communications. We consider eBay and Yahoo! to be representatives of not only the technology sector but also a representative of consumer stocks. This characteristic was strongly evident in 2003, as the two appeared to benefit from strong consumer trends as well as renewed interest in the tech sector. The single most beneficial holding in the portfolio was also a technology stock: networking giant Cisco Systems. Because technology stocks have already experienced a strong run-up, we do not anticipate carrying a large overweighting in the sector (relative to our benchmark) in 2004.

In the second half of the year, we reduced the Fund’s exposure to healthcare stocks. As many stocks in the sector underperformed the market — particularly major pharmaceutical companies — this move benefited our returns. We believe we now can identify companies in the sector that offer good opportunities for growth, given their now much more reasonable valuations.

Recovery appears likely to continue

The consumer has led the economic recovery so far, with heavy spending in housing and cars. We believe consumer spending will continue to play a large role in economic growth in 2004. There are hopes for an improving employment picture, and that, along with continued benefits from 2003’s tax-cut legislation, should help to further the outlook for consumer spending. For this reason, we expect to emphasize consumer-oriented stocks in the portfolio.

Business spending may, however, now be moving into a leadership role, as evidenced by a resurgence in production and rising orders for capital goods. Considering all these factors, we have positioned the Fund to benefit from the global economic expansion that we anticipate will continue in 2004.

Thank you for your investment in the Strong Blue Chip Fund.

Karen E. McGrath

Portfolio Manager

2

Fund Highlights

Your Fund’s Approach

The Fund invests, under normal conditions, at least 80% of its net assets in blue chip companies. The Fund considers blue chip companies to be companies whose stock is included in the Russell Top 200 Growth Index or companies with a similar capitalization at the time of the Fund’s investment. The Fund invests in blue chip companies and focuses on companies its manager believes offers the potential for capital growth.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 29.00 | % |

3-year | | -12.43 | % |

5-year | | -5.36 | % |

Since Fund Inception (6-30-97) | | 2.69 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

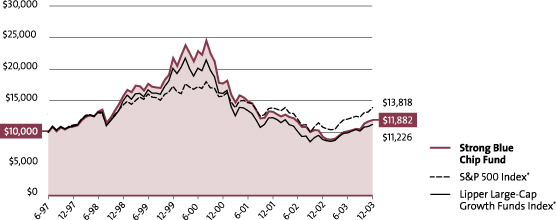

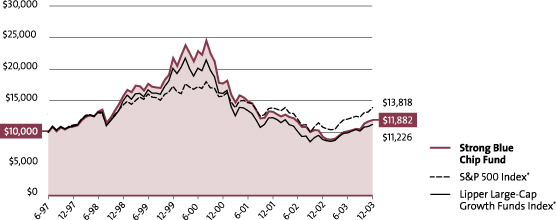

Growth of an Assumed $10,000 Investment†

From 6-30-97 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

3

Strong Discovery Fund

The Strong Discovery Fund delivered its best annual return to shareholders in more than a decade, gaining 38.34%. Nonetheless, the Fund’s positioning during the second quarter negatively affected the overall performance, resulting in the Fund trailing its broad-based benchmark, the Russell 2000 Index, which returned 47.25% for the year.

The return of the Russell 2000 was heavily influenced by the smallest companies in the index. In fact, micro-cap companies — those with market capitalizations of less than $500 million — produced a good deal of the index’s return. This Fund strives to keep a balance of both small- and mid-cap stocks to help manage risk. We believe this is a prudent long-term strategy, though it hindered our performance relative to our benchmark this past year.

Improvement in the economy and markets

The stock market improved considerably during the middle of 2003, as concerns about the conflict in Iraq eased, and the outlook for economic growth improved. Investor confidence improved significantly, and consumer spending remained robust. By the end of the year, signs of an impressive economic recovery became undeniable.

While we were not surprised by the fundamental strength of the economy or corporate earnings, we were surprised that high-volatility stocks experienced the strongest performance over the past year. This is evidenced by data indicating that the strongest performance in 2003 came from those companies that had the poorest returns on equity in addition to having the most volatile stock prices. Our focus on exhaustive, fundamental research tends to steer us away from such companies, which accounts for much of our underperformance this past year.

Intensive research drives the process

Our team of portfolio managers and analysts worked diligently in 2003 to research each individual holding for the Discovery Fund. Our research process is based on the idea of surrounding a company. This can be likened to the work of investigative journalists. We begin by thoroughly analyzing its financial statements, looking for strong earnings growth relative to the investment required to grow their businesses.

This year our research led us to a number of consumer discretionary holdings, including Urban Outfitters, which contributed significantly to performance. This lifestyle merchandising company operates specialty retail stores under the Urban Outfitters, Anthropologie, and Free People brands. Many elements of our research process helped us to identify the opportunity we believe this company represents. We hold extensive conversations with senior management, but also interview middle managers, sales personnel, and product or channel managers who can provide valuable insights into sales trends, customer interests, and the competitive landscape. These relationships help us to gain an understanding of the effectiveness of new product and customer initiatives. Information from competitors, suppliers, and customers helps to round out our understanding of a company.

Companies with distinct qualities

With our investigative research, we were able to determine that Urban Outfitters, which targets fashion-conscious young adults, offered unique merchandise that indicated a keen understanding of customer buying trends. We believed this company had an exciting growth opportunity in each of its store concepts, as the company grows from a relatively small base. We also believed the company would be able to grow smart, as it began to open more mall-based locations, which have a lower cost to operate.

Our research also led us to pay close attention to the healthcare sector, which was a robust contributor to portfolio performance in 2003. Fund holding Digene Corporation, a developer of gene-based testing systems for the screening of human diseases, performed especially well. Digene’s primary focus is on screening for women’s cancers and infectious diseases. During the year, Digene’s stock performed well as its testing products gained further acceptance and as the company continued its expansion in Europe.

When investing in small- and mid-cap companies, we believe that our research into companies of all sizes is a key advantage. Many small- and mid-cap companies compete, form partnerships, or do business with larger companies. With research that spans the market capitalization spectrum, we get unusual insights that enhance our ability to build a differentiated portfolio of growth stocks.

Our outlook for 2004

Investors enter 2004 with more optimism about the future for equities, supported by an improving economy and low interest rates and inflation. After the broad rally of the past year, however, we believe investors will be much more

4

Fund Highlights

Your Fund’s Approach

The Fund invests in securities that its managers believe offer attractive opportunities for growth. The Fund usually invests in a diversified portfolio of common stocks from small- and medium-capitalization companies. These are chosen through a combination of in-depth fundamental analysis of a company’s financial reports and direct, on-site research during company visits.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 38.34 | % |

5-year | | 6.75 | % |

10-year | | 7.82 | % |

Since Fund Inception (12-31-87) | | 12.57 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

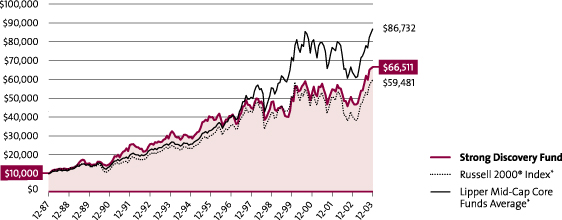

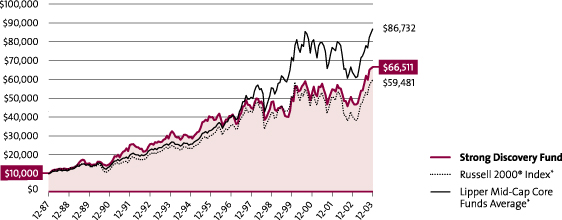

Growth of an Assumed $10,000 Investment†

From 12-31-87 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Mid-Cap Core Funds Average. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Because smaller companies often have narrower markets and limited financial resources, investments in theses stocks present more risk than investments in those of larger, more established companies.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| * | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. The Lipper Mid-Cap Core Funds Average is the average of all funds in the Lipper Mid-Cap Core Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

discriminating going forward. They are likely to reward companies with sustainable or improving growth, and punish those whose projections prove too optimistic — a situation that could particularly affect companies with the loftiest stock prices.

Thank you for your investment in the Strong Discovery Fund. We appreciate the trust you’ve placed in us.

Thomas J. Pence

Portfolio Co-Manager

James M. Leach

Portfolio Co-Manager

5

Strong Endeavor Fund

For the year ended December 31, 2003, the Strong Endeavor Fund delivered very solid returns, advancing 32.57%. It outperformed its broad-based index, the S&P 500, which returned 28.67% over the same period.

We had positioned the Fund to benefit from overall improvement in economic conditions and investor confidence. As that improvement took shape over the course of the year, the Fund posted solid performance. The Fund’s returns were largely driven by solid stock picking among the consumer discretionary, technology, and healthcare sectors of the market.

An investigative approach

Our team of portfolio managers and analysts worked diligently in 2003 to research each individual holding for the Fund. Our research process is based on the idea of surrounding a company. This can be likened to the work of investigative journalists, tapping into an extensive network of sources to develop an original investment opinion. We begin surrounding a company by thoroughly analyzing its financial statements, looking for companies that can produce strong earnings growth relative to the investment required to grow their businesses.

One of the companies this research led us toward in 2003 was Cisco Systems, the manufacturer of a broad array of networking and communications products. We seek to gain perspectives from many key individuals who directly affect the particular company or industry that is the subject of our research. We hold extensive conversations with senior management, but also interview middle managers, sales personnel, and product or channel managers who can provide valuable insights into sales trends, customer interests, and the competitive landscape. These relationships help us to gain an understanding of the effectiveness of new product and customer initiatives. Information from competitors, suppliers, and customers helps to round out our understanding.

In Cisco’s case, our research among component suppliers indicated that business trends were improving across most of the company’s customer base. Indeed, Cisco was able to announce an important new contract with the U.S. Defense Department to build a high-speed data network. Cisco’s solid operating leverage, improving business trends, and reduced product backlog and lead times were all positive for the company’s stock.

Healthy performers for the fund

Semiconductor manufacturer Intel Corporation was also a solid holding during the period. The semiconductor industry fared well this year, and Intel rose on the strength in demand as it witnessed a solid push in the markets for servers, desktop computers, and mobile devices. Also, the company continued to benefit from high expectations that its Centrino chipset will allow it to build considerable market share in the growing laptop market.

Finally, as demand for leisure travel improved this year, our carefully researched holdings in the travel sector contributed positively to returns. For example, Royal Caribbean, one of the world’s largest cruise lines, benefited from improved bookings and its strong position among its competitors. As the economy strengthened, we detected improving leisure travel as trends returned to normal after three years of below-average results.

We believe that our research of companies of all sizes is a key advantage even when investing in larger-cap companies. Many large companies compete, form partnerships, or do business with smaller and midsize companies. With research that spans the market-capitalization spectrum, we get unusual insights that enhance our ability to build a differentiated portfolio of growth stocks.

A positive outlook overall

We expect economic and corporate earnings growth to continue at a moderate pace in the coming year. Inflation appears to be at a sustainably low level, with strong productivity gains and job growth finally picking up. These factors should provide a solid foundation for the equity markets next year.

There is, however, potential for rising interest rates due to a weaker dollar and improving economy, which could hamper stock returns somewhat. In this environment, we intend to continue to maintain a balance of core growth holdings and develop growth stocks in the portfolio. Our aim is to take advantage of the opportunities that may present themselves in 2004, while prudently managing risk.

Thank you for your investment in the Strong Endeavor Fund. We appreciate the trust you’ve placed in us.

Thomas J. Pence

Portfolio Co-Manager

D. Paul Berg

Portfolio Co-Manager

6

Fund Highlights

Your Fund’s Approach

The Fund focuses on companies that its managers believe have above-average earnings growth prospects. The Fund invests primarily in large-capitalization companies but also invests in small- and medium-capitalization companies. The Fund’s managers select companies that have attractive growth prospects, accelerating sales and earnings, and positive fundamentals.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 32.57 | % |

Since Fund Inception (4-6-01) | | -2.54 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

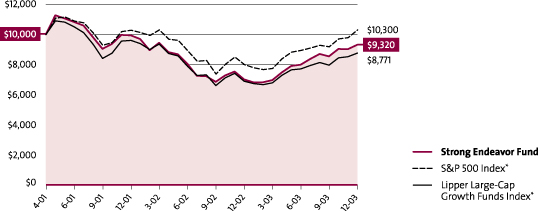

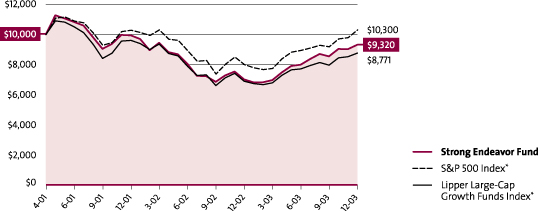

Growth of an Assumed $10,000 Investment†

From 4-6-01 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with a similar investment in the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or a loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

7

Strong Large Cap Growth Fund

The year 2003 offered extraordinary returns for equity investors, as double-digit returns surpassed the common expectations after a three-year bear market. The Strong Large Cap Growth Fund was up a solid 26.83% for the year, performance that placed it just behind its broad-based S&P 500 Index, which returned 28.67% for the same period.

Economic stimulus efforts worked

Stock markets surged upward around the world as central banks, including the U.S. Federal Reserve, took active steps to ignite languishing global economies. In the U.S., the Fed’s efforts received an extra boost from the tax cuts provided by the President and Congress.

The economic stimulus had its desired impact, and as economic activity increased, corporate earnings improved, and investors gained some much-needed confidence to buy stocks. The change was dramatic, with the equity markets rallying by more than 35% off the lows they hit in March.

While many positive fundamental trends provided welcome support for this year’s rally, the equity market included a speculative element as well. This is evidenced by data indicating that the strongest performance in 2003 came from those companies that had the poorest returns on equity in addition to having the most volatile stock prices. Our process tends to steer us away from such companies, which accounts for much of our underperformance this past year.

A hands-on research process

Our investment process to discover long-term winners was very fundamental in nature. First, we did our financial homework and kicked the tires, meeting directly with company management — and researching competitors as well, to gain a broader understanding of the opportunities and pressures within an industry. We then considered this company-specific research in light of our overall outlook on the direction of the economy, as well as any broad investment themes that we believed could provide a favorable tailwind for specific sectors and industries. Among the themes we considered were the impact of the aging of the baby boomer generation, the emergence of China as an economic power, and the rising demand for healthcare products and services.

Managing risk is essential, given that growth stocks tend to be more volatile than value-oriented stocks. We sought to diversify the Fund by owning 80 to 100 stocks in the portfolio, spanning many industries. Our discipline for selling stocks was also driven by our eye toward risk management. We set target prices for the stocks the Fund owns, and we continuously monitored the relevant valuation measures for our holdings. We also watched for changes in fundamental conditions that could hurt the prospects for one or more of the Fund’s holdings.

Two examples from the portfolio

Intel is an example of one of the Fund’s largest holdings, and one of its biggest gainers in 2003. As the world’s largest manufacturer of microprocessors for personal computers and other uses through the technology and telecommunications industries, Intel has emerged from the post-Y2K technology recession as an even stronger and more dominant competitor. Intel managed to remain profitable throughout the recession while awaiting an economic recovery by offering a host of new products, including the Centrino processor for mobile computers.

Another large Fund holding that performed during the year was Home Depot. In early 2003, Home Depot was commonly viewed as a broken, one-time growth stock with a new management team that didn’t understand the retail business and had carelessly destroyed the company’s famous culture of customer service. We didn’t accept the conventional wisdom at face value and instead looked more closely at the company’s CEO, Bob Nardelli. After carefully researching his reputation and previous track record, and by listening to his plans for turning around the troubled retailer, we formed a much more positive opinion and invested in the stock. In 2003, Nardelli’s initiatives, supported by a buoyant housing market, enabled Home Depot to exceed consensus earnings expectations and caused its stock to outperform for the year.

Economy could remain strong

Our outlook for the coming months is continued economic strength with the Federal Reserve keeping interest rates low through the first half of the year. These factors, combined with the tendency for Presidential election years to be friendly to the equity markets, should provide a good backdrop for stocks in early 2004. We therefore believe the companies that can benefit from a stronger economic environment should do well in the coming year.

8

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of large-capitalization companies that its manager believes offer the potential for capital growth. The Fund’s manager seeks to identify companies that have superior sales and earnings, enjoy a competitive advantage, and have effective management. Although the Fund can invest in stocks of any economic sector, at times it may emphasize one or more particular sectors.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 26.83 | % |

5-year | | -3.59 | % |

10-year | | 6.92 | % |

Since Fund Inception (12-30-81) | | 11.82 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

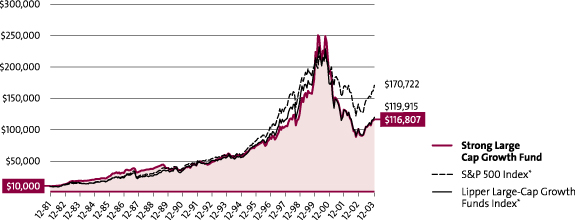

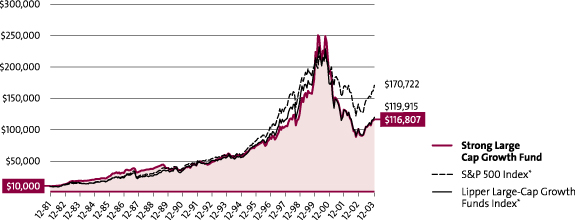

Growth of an Assumed $10,000 Investment†

From 12-30-81 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

Thank you for your continued investment in the Strong Large Cap Growth Fund. We appreciate the confidence you’ve placed in us.

Bruce C. Olson

Portfolio Manager

9

Strong U.S. Emerging Growth Fund

For the year ended December 31, 2003, the Strong U.S. Emerging Growth Fund returned 48.70%, placing it ahead of its broad-based benchmark, the Russell 2000 Index, which returned 47.25% for the same period.

The economic climate improved as the year progressed, as did the Fund’s performance. We believed that the Federal Reserve would maintain its accommodative stance on interest rates and also anticipated that the fiscal stimulus measures — particularly tax cuts — pursued by President Bush in advance of the election year would provide further support for economic recovery.

Based on our economic outlook, we decided to emphasize in the portfolio those companies and sectors that were positioned to benefit from a recovering economy. This move played a large part in the Fund’s strong relative and absolute performance.

There was also a change in market leadership; where value stocks had prevailed in less certain times, growth stocks came to the fore as the economic recovery took firm hold.

Prepared for recovery

The most notable event in the first half of 2003 was the war in Iraq. Uncertainty leading up to the war caused consumer and business confidence to plummet, making it very difficult to manage growth stock portfolios. In November 2002, we repositioned the Fund in anticipation of improving business conditions and increasing consumer confidence, positioning that hurt performance in the year’s first quarter.

As the major portion of the war came to a quick resolution, however, confidence returned to the economy and the markets. Improvement began in the second quarter, and in the third and fourth quarters the signs of economic recovery became much clearer. The resumption of economic growth coupled with low interest rates and inflation provided a very positive backdrop for small- and mid-cap growth stocks. We expect these positive conditions to continue into the future.

Favored sectors for the fund

We added to our holdings in those groups that have traditionally done well coming out of slow economic periods. These include trucking companies, freight forwarders, retailers, restaurants, and technology companies. For different reasons, we also began to add to our position in the energy sector. After three years of almost no drilling among these companies, we began to see an upturn in such activity. This suggested that a new natural-gas production cycle was beginning, which would be a positive development given the very constrained supply situation that existed.

To accommodate these additions to the portfolio, we reduced our holdings among some of the more defensive stocks in our portfolio. While these companies retained appealing characteristics, they historically have underperformed faster-growing sectors during an economic recovery.

Our outlook is positive

The shift in market leadership from value to growth stocks helped drive our performance in 2003. Typically, such cycles of outperformance for an investment style have lasted from three to five years. While we will carefully monitor the market and economic climate for changing conditions, we find this historical pattern to be encouraging as we look to the months and years ahead.

We anticipate that the positive environment for small- and mid-cap growth stocks should persist for some time to come. Based on our research, we believe that corporate profits may exceed expectations in 2004. Continued low interest rates and inflation, along with the still significant amounts of investable cash that remains on the sidelines, could help fuel the next move upward in the broader market in general, and smaller-cap growth stocks specifically.

Thank you for your investment in the Strong U.S. Emerging Growth Fund.

Thomas L. Press

Portfolio Co-Manager

Donald M. Longlet

Portfolio Co-Manager

Robert E. Scott

Portfolio Co-Manager

10

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of U.S. companies that appear to have relatively strong long-term growth potential in revenues and profitability. To identify these companies, the managers look for several characteristics, including strong revenue growth, high return on invested capital, overall financial strength, competitive advantages, reasonable current stock price, effective management, and competence in research, development, and marketing.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 48.70 | % |

3-year | | -8.06 | % |

5-year | | 9.16 | % |

Since Fund Inception (12-31-98) | | 9.16 | % |

The Fund’s return since inception was significantly enhanced through investments in initial public offerings. You should not expect that such favorable returns can be consistently achieved. Please consider this before investing. Equity funds are volatile investments and should only be considered for long-term goals.

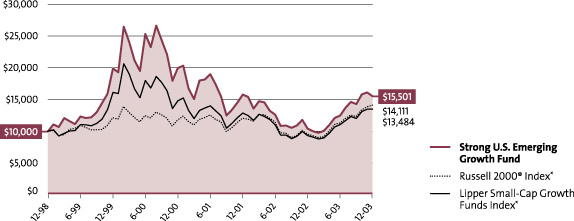

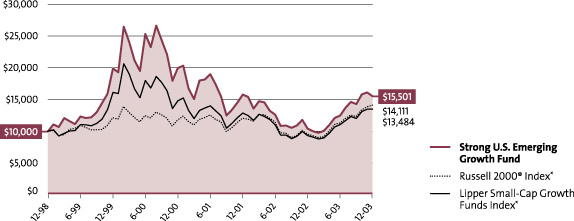

Growth of an Assumed $10,000 Investment†

From 12-31-98 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Small-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

| * | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index. The Lipper Small-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Growth Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

11

Strong Enterprise Fund

During the year, the Strong Enterprise Fund delivered solid gains to shareholders, advancing by 36.98% for the year ended December 31, 2003. The Fund’s returns lagged those of its broad-based benchmark, the Russell Midcap Index, which returned 40.06% for the same period.

While many positive fundamental trends provided welcome support for this year’s rally, the equity market included a speculative element as well. This is evidenced by data indicating that the strongest performance in 2003 came from those companies that had the poorest returns on equity in addition to having the most volatile stock prices. Our focus on exhaustive, fundamental research tends to steer us away from such companies, which accounts for much of our underperformance this past year.

An investigative investment process

Our team of portfolio managers and analysts worked diligently in 2003 to research each individual holding for the Enterprise Fund. Our research process is based on the idea of surrounding a company. This can be likened to the work of investigative journalists. We begin surrounding a company by thoroughly analyzing its financial statements, looking for companies that can produce strong earnings growth relative to the investment required to grow their businesses.

This year, our research led us to a number of consumer discretionary holdings, including Harman International Industries, that were strong performers during the year. Harman markets high-fidelity audio products and electronic systems for the consumer and professional markets. Many elements of our research process helped us to identify the opportunity we believed this company represented.

We hold extensive conversations with senior management, but we also interview middle managers, sales personnel, and product or channel managers who can provide valuable insights into sales trends, customer interests, and the competitive landscape. These relationships help us to gain an understanding of the effectiveness of new product and customer initiatives. Information from competitors, suppliers, and customers helps to round out our understanding of a company.

With our investigative research, we were able to determine that Harman was continuing to benefit from rolling out its Harman Infotainment system to higher-end auto manufacturers. The Harman system also helps auto manufacturers decrease costs by simplifying the assembly process. We believed Harman’s customer base should allow it to generate solid long-term revenue and earnings growth.

Ideas in many parts of the market

Another consumer holding our research drew us toward was Marvel Enterprises, the character-based entertainment company. Over the past couple of years, Marvel has transformed its business to focus on licensing its characters, which has decreased the level of capital invested and increased profit margins. We expected the company’s international licensing to expand dramatically over the next few years, and we believed Marvel’s deep pipeline of movie and toy licensing opportunities would continue to support strong profit growth.

We also were able to identify opportunities in other sectors of the market. For example, Millennium Pharmaceuticals was a solid performer during the year. Millennium focuses on developing products for cardiovascular diseases as well as cancer. The company also has potential products in earlier stages of development in each of those areas, as well as in the inflammatory disease and metabolic disease fields. Our research among physicians and other healthcare industry participants indicated that Millennium had products poised to experience strong growth and be well received by the medical community.

When investing in mid-cap companies, we believe that our research into companies of all sizes is a key advantage. Many mid-size companies compete, form partnerships, or do business with both small and large companies. With research that spans the market capitalization spectrum, we get unusual insights that enhance our ability to build a differentiated portfolio of growth stocks.

Our outlook for the year ahead

Investors enter 2004 with more optimism about the future for equities; supported by an improving economy and low interest rates and inflation. After the broad rally of the past year, however, we believe investors will be much more discriminating going forward. They are likely to reward companies with sustainable or improving growth, and punish those whose projections prove too optimistic — a situation that could particularly affect companies with the loftiest stock prices.

Thank you for your investment in the Strong Enterprise Fund. We appreciate the trust you’ve placed in us.

Thomas J. Pence

Portfolio Manager

12

Fund Highlights

Your Fund’s Approach

The Fund typically invests in stocks of small- and medium-capitalization companies, though it may invest in companies of any size. It focuses on companies that the manager believes are positioned for rapid growth of revenue and earnings. The Fund’s manager strives to find leading companies in rapidly growing industries such as business services, computer and digital products, financial services, healthcare services, Internet-related companies, medical technology, retail, and telecommunication.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 36.98 | % |

3-year | | -8.43 | % |

5-year | | 9.19 | % |

Since Fund Inception (9-30-98) | | 17.07 | % |

| |

Institutional Class1

| | | |

1-year | | 37.55 | % |

3-year | | -8.31 | % |

5-year | | 9.28 | % |

Since Fund Inception (9-30-98) | | 17.16 | % |

| |

Advisor Class2

| | | |

1-year | | 37.39 | % |

3-year | | -8.36 | % |

5-year | | 9.12 | % |

Since Fund Inception (9-30-98) | | 16.98 | % |

| |

Class K3

| | | |

1-year | | 37.89 | % |

3-year | | -8.15 | % |

5-year | | 9.39 | % |

Since Fund Inception (9-30-98) | | 17.27 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

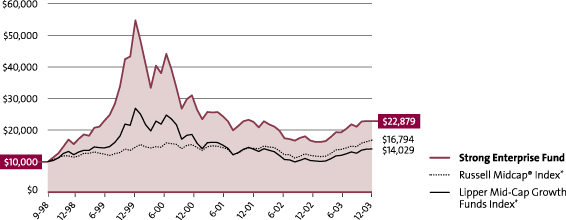

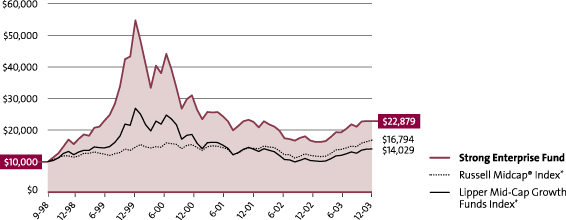

Growth of an Assumed $10,000 Investment †

From 9-30-98 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary, due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | The performance of the Institutional Class shares prior to 6-30-03 is based on the Fund’s Investor Class shares’ performance. Please consult a prospectus for information about all share classes. |

| 2 | The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares. Please consult a prospectus for information about all share classes. |

| 3 | The performance of Class K shares prior to 8-30-02 is based on the Fund’s Investor Class shares’ performance. Please consult a prospectus for information about all share classes. |

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

| * | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index, which represent approximately 26% of the total market capitalization of the Russell 1000® Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

13

Strong Growth 20 Fund

After enduring three consecutive years of negative returns in the equity markets, investors had something to smile about in 2003. For the year ended December 31, 2003, the Strong Growth 20 Fund posted a solid return of 27.18%, roughly in line with the broad-based S&P 500 Index return of 28.67%.

Many factors drove performance

During the year, several factors combined to create a very favorable investing climate. Among these factors were economic stimulus from new tax cuts, reduction of geopolitical uncertainties, and continued low interest rates and inflation. The positive impact was felt in both growth and value stocks, and across nearly all sectors of the economy.

The stocks that were the top contributors to the Fund’s performance over the year were in the consumer sector. This segment of the market experienced above-average growth as the economy strengthened over the course of the year. The Fund’s weaker holdings were confined mainly to the technology and energy sectors and hurt the performance of the Fund relative to the S&P 500 Index.

Our investment process

Research drives our process of selecting stocks for the Strong Growth 20 Fund. For a stock to be chosen for inclusion in the Fund, it must display — or have solid prospects for displaying — above-average growth trends in revenue, earnings, or both. Identifying stocks that are experiencing this growth is important. But what matters the most in our investment process is seeking to discern growth trends that are sustainable, as opposed to those that are likely to be short-lived.

In order for a company to make the most of its growth opportunities, it must also have a solid management team in place. For that reason, we analyze management’s track record of execution and often take time to get to know a company’s managers before buying its stock. Through our thorough, hands-on research, we also seek to determine whether their business plan is sensible and offers opportunities for future expansion. Finally, before we add a stock to the portfolio, we consider whether it fits in with our overall economic view, as well as one or more of the important investment themes that guide our market outlook. These trends include the aging of the overall population and the changes technological innovation can bring to virtually every part of the economy.

Harman International Industries is a company that met the above criteria — and it proved to be an excellent holding for the Fund during the year. Harman makes information, entertainment, and navigation systems used in a variety of automobiles. We were attracted to Harman because we recognized its element of sustainable, above-average growth, driven by their systems’ increasing popularity and management’s ability to take advantage of their opportunities. Harman was able to increase both the number of automobile makers to which it sells and its sales per vehicle. The result was outstanding revenue and earnings growth.

Our decision to sell a stock is generally based on criteria that are essentially the opposite of our buying criteria. We may sell a stock when we see a deterioration in fundamentals that threatens the sustainability of a company’s existing or prospective growth. Conditions that could cause this may include, but are not limited to, changes we see in the economy, a new competitive threat, or a change in management personnel or direction.

Maintaining a positive outlook

Our outlook for the next few months remains positive, as we expect the economy to benefit from continued low interest rates and inflation. This environment should allow for solid growth in corporate profits, which of course is beneficial to stock prices.

As has been our practice, we expect to continue to seek out the fastest-growing companies we can identify that we believe fit within the framework of our time-tested investment process.

We thank you for your continued investment in the Strong Growth 20 Fund.

Brandon M. Nelson

Portfolio Manager

14

Fund Highlights

Your Fund’s Approach

The Fund focuses on the stocks of 20 to 30 companies that its manager believes have favorable prospects for superior growth of earnings but are selling at reasonable valuations based on their earnings, cash flow, or asset value. Although the Fund can invest in stocks of any economic sector, at times it may emphasize one or more particular sectors.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 27.18 | % |

3-year | | -19.81 | % |

5-year | | -0.63 | % |

Since Fund Inception (6-30-97) | | 6.50 | % |

| |

Advisor Class1

| | | |

1-year | | 27.48 | % |

3-year | | -19.67 | % |

5-year | | -0.64 | % |

Since Fund Inception (6-30-97) | | 6.43 | % |

The Fund’s return since inception was significantly enhanced through investments in initial public offerings. You should not expect that such favorable returns can be consistently achieved. Please consider this before investing. Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 6-30-97 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary, due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares. Please consult a prospectus for information about all share classes. |

The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility and market pressure than a fully diversified fund.

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

15

Strong Growth Fund

In a strong year for equities across the board, the Strong Growth Fund outperformed its broad-based benchmark, the S&P 500 Index. The Fund posted a return of 30.13% for the year ended December 31, 2003, while the S&P 500 returned 28.67%.

The stock market in 2003 was driven by three major trends. First, the newly enacted tax cuts offered the potential for stimulus to the economy and also provided a boost to investors’ anticipated after-tax returns. Second, the economy displayed solid improvement through the year, accelerating in the second half. Third, the credit and capital markets opened up dramatically, giving companies the opportunity to repair troubled balance sheets.

Overall, this environment favored the lowest-quality stocks the most, as the market found it had less reason to worry about these companies’ long-term viability. For most of the year, we positioned the Fund in stocks and sectors that we believed were likely to benefit strongly from the improving economy.

Seeking out fast-growing companies

Our process for selecting individual stocks has proprietary research at its core. The underlying theme to our process is the continual search for companies with superior business models that can achieve earnings growth by increasing their revenues and gaining market share.

Apollo Group is a good example to demonstrate our investment process. The company offers higher education both on campuses and via the Internet through its University of Phoenix operations. The company fit into an important investment theme that we follow, the dramatic economic growth associated with the very large echo boomer generation (that is, the children of the original baby boomers). This generation is now moving into its post-secondary education years, providing a generous tailwind for the University of Phoenix’s growth.

The company gained market share, strongly outpacing most of the post-secondary education market. Furthermore, it met our criteria for revenue growth, positive earnings surprises, return on invested capital, and consistency of performance. We supplemented our quantitative research with regular visits to the company to evaluate whether our growth expectations remained reasonable or needed to be revised upward or downward.

Choosing when to sell a stock

With Apollo Group, we observed times where the price of the stock was near our valuation targets — that is, the price we believed fully reflected its intrinsic value. As we do with other stocks in the portfolio, we took the opportunity to reduce our position in the stock. Because we invest in fast-growing companies, this sell discipline — that is, devising and employing the criteria we use to determine when a stock is no longer appropriate for the Fund — is a vital part of our management process.

Performance ultimately is driven not only by how well we buy a stock, but also by how well we sell it. Our decisions to sell stocks are driven by signs that the stock’s price has risen too high relative to its earnings and growth prospects and by indications that the growth rates we sought when we bought the stock may not come to fruition. (Similarly, we may choose to increase our position in a company if |its stock price dips while its prospects remain good.) Our consistent process has served us well with respect to Apollo Group, and we believe it is a good formula for evaluating, selecting, and eventually selling a wide range of growth stocks over the long term.

The outlook for 2004

For the near future, we anticipate continued economic strength, with the Federal Reserve taking a benign stance on interest rates through the first half of 2004. We believe that corporate profitability will continue to experience an above-average rate of growth, driven by rebounding domestic and international economies. We believe this should present a reasonable environment for growth stock investing.

The stock market is dynamic. Among the factors to which we expect to pay close attention in the coming months will be the direction of long bond rates, the recent weakness in the U.S. dollar relative to major foreign currencies, the environment for corporate credit, and the evolving demand for healthcare services.

We thank you for your investment in the Strong Growth Fund and appreciate the confidence you’ve continued to place in us.

Thomas C. Ognar

Portfolio Manager

16

Fund Highlights

Your Fund’s Approach

The Fund focuses on stocks of companies that its manager believes have favorable prospects for superior growth of earnings but are selling at reasonable valuations based on earnings, cash flow, or asset value. Although the Fund can invest in stocks of any economic sector, at times it may emphasize one or more particular sectors.

Average Annual Total Returns

As of 12-31-03

| | | |

Investor Class

| | | |

1-year | | 30.13 | % |

5-year | | 0.27 | % |

10-year | | 11.72 | % |

Since Fund Inception (12-31-93) | | 11.72 | % |

| |

Institutional Class1

| | | |

1-year | | 30.93 | % |

5-year | | 0.79 | % |

10-year | | 12.01 | % |

Since Fund Inception (12-31-93) | | 12.01 | % |

| |

Advisor Class2

| | | |

1-year | | 30.06 | % |

5-year | | 0.10 | % |

10-year | | 11.45 | % |

Since Fund Inception (12-31-93) | | 11.45 | % |

| |

Class C3

| | | |

1-year | | 27.92 | % |

5-year | | -0.80 | % |

10-year | | 10.45 | % |

Since Fund Inception (12-31-93) | | 10.45 | % |

| |

Class K4

| | | |

1-year | | 30.78 | % |

5-year | | 0.49 | % |

10-year | | 11.84 | % |

Since Fund Inception (12-31-93) | | 11.84 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

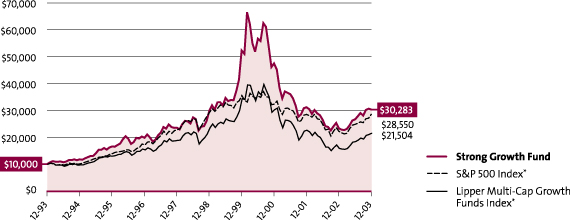

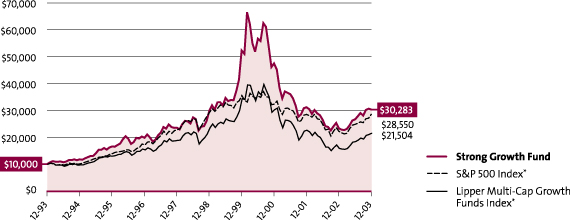

Growth of an Assumed $10,000 Investment†

From 12-31-93 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Investor Class shares only; performance for other classes will vary due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | The performance of the Institutional Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance. Please consult a prospectus for information about all share classes. |

| 2 | The performance of the Advisor Class shares prior to 2-24-00 is based on the Fund’s Investor Class shares’ performance, restated for the higher expense ratio of the Advisor Class shares. Please consult a prospectus for information about all share classes. |

| 3 | The performance of Class C shares prior to 12-26-02 is based on the Fund’s Investor Class shares’ performance restated for the higher expense ratio of the Class C shares. Please consult a prospectus for information about all share classes. Average annual total returns include a 1.00% contingent deferred sales charge imposed on redemptions made within 12 months of purchase. |

| 4 | The performance of Class K shares prior to 8-30-02 is based on the Fund’s Investor Class shares’ performance. Please consult a prospectus for information about all share classes. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

17

Strong Large Company Growth Fund

After three tough years for equity investors, 2003 ended up to be a great year. The Strong Large Company Growth Fund returned 24.16% for the year ended December 31, 2003. Although that was a strong positive return, it was not good enough to top the broad-based benchmark, the S&P 500 Index, which posted a return of 28.67% over the same period.

Lower quality prevailed

In 2003, the market rode the dual currents of emotions and liquidity. For their part, emotions began the year at a fairly low level. Over time, a well-fought war in Iraq, an improving economy, and the capture of Saddam Hussein led to an ever-growing level of confidence. Liquidity, on the other hand, stayed at very high levels during the entire year. Record-low interest rates, massive fiscal stimulus to the economy in the form of tax cuts, and the decline of the dollar relative to major foreign currencies have all given overextended consumers and corporations alike a chance to repair badly damaged balance sheets.

As is often the case in an environment of easy money, those companies in the greatest financial distress were the biggest beneficiaries of these trends, while those with the strongest balance sheets had the least to gain. According to Merrill Lynch research, S&P 500 companies rated A or better by Standard & Poor’s were up 27.4% for the year, while those companies rated C or D returned a dramatic 80.9%. This is easily one of the best one-year performances for junk-rated companies in history.

While lower-rated companies outperformed in 2003, over the longer term, we believe that the strongest returns will accrue to those companies that have the strongest finances, business models, and management teams. We therefore use an investment approach designed to identify such companies for the Fund.

Portfolio emphasizes higher quality

Our investment process starts with fundamentals — we analyze a company’s management, business model, and its stock price relative to its earnings. Second, we look at technicals — the trend in a stock’s price and in the company’s earnings. Last, but not least, we look at expectations — the current market sentiment toward the stock, indicating how much of the stock’s fundamentals and technicals are already factored into the share price.

The ideal candidate for addition to our portfolio would have strong fundamentals, strong technicals, and low expectations. We do not always make perfect decisions, but our disciplined process is designed to help us outperform our benchmark over time, while keeping risk levels modest. We believe that over long periods of time, the large-cap equity markets are very efficient. An efficient market is similar to games like tennis or golf, in that the goal is to make few mistakes and exploit those rare opportunities when the odds are in your favor.

Because our stock-selection process is designed to select higher-quality companies, we were significantly underweighted in low-quality companies relative to their representation in the index over the past year. This posture largely accounted for the Fund’s underperformance. Somewhat alarmingly (in our view), the market in 2003 appeared very similar to that in 1999 — another year that saw the returns of lower-quality, higher-risk stocks trounce those of higher-quality companies. This kind of short-run aberration poses a clear challenge to managers who remain committed to a higher-quality approach, as we do, but who attempt to outperform on an annual basis.

After a tough relative performance year like 2003, we have analyzed our process — and have found very little to change. This is supported by the Fund’s long-term performance versus the S&P 500 Index. We expect to continue to keep the Fund invested in stocks that are appealing on the basis of fundamentals, technicals, and expectations. To help manage risk, we expect to carefully monitor our allocations to market sectors and industries.

Keeping an eye on the consensus

We are hesitant to do anything that resembles market forecasting, but we do believe it is very important to monitor and understand the consensus view and see if we have a different perception.

Time and again, the market has shown a great ability to prove the consensus wrong, and nobody actually knows what the future holds. We therefore believe it’s prudent to remain flexible and be prepared to move against the consensus when it appears warranted.

Thank you for your investment in the Strong Large Company Growth Fund.

Christopher H. Wiles

Portfolio Co-Manager

Lawrence E. Eakin Jr.

Portfolio Co-Manager

18

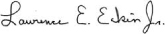

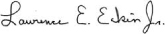

Fund Highlights

Your Fund’s Approach