Exhibit 99.2

Draft

5/03/2009

Supplemental Schedules

First Quarter 2009

Draft

5/03/2009

Quarterly Financial Highlights

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

Pre-tax Operating Income * | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Life Marketing | | $ | 46,449 | | $ | 38,127 | | $ | 52,222 | | $ | 51,737 | | $ | 42,510 | | $ | 46,449 | | $ | 42,510 | |

Acquisitions | | 33,576 | | 34,514 | | 33,021 | | 35,368 | | 33,621 | | 33,576 | | 33,621 | |

Annuities | | 2,489 | | 9,487 | | 556 | | 6,175 | | (575 | ) | 2,489 | | (575 | ) |

Stable Value Products | | 16,216 | | 17,545 | | 28,184 | | 27,866 | | 20,207 | | 16,216 | | 20,207 | |

Asset Protection | | 9,852 | | 6,664 | | 8,186 | | 6,087 | | 6,280 | | 9,852 | | 6,280 | |

Corporate & Other | | (29,973 | ) | (2,093 | ) | (32,173 | ) | (41,747 | ) | (9,247 | ) | (29,973 | ) | (9,247 | ) |

Total Pre-tax Operating Income | | $ | 78,609 | | $ | 104,244 | | $ | 89,996 | | $ | 85,486 | | $ | 92,796 | | $ | 78,609 | | $ | 92,796 | |

| | | | | | | | | | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Total GAAP Assets | | $ | 41,749,006 | | $ | 42,636,077 | | $ | 41,152,791 | | $ | 39,572,449 | | $ | 38,760,243 | | | | | |

Shareowners’ Equity | | $ | 2,163,860 | | $ | 2,081,742 | | $ | 1,524,655 | | $ | 761,095 | | $ | 783,178 | | | | | |

Shareowners’ Equity (excluding accumulated other comprehensive income (loss)) ** | | $ | 2,543,808 | | $ | 2,567,964 | | $ | 2,452,860 | | $ | 2,428,151 | | $ | 2,443,382 | | | | | |

| | | | | | | | | | | | | | | |

Stock Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Closing Price | | $ | 40.56 | | $ | 38.05 | | $ | 28.51 | | $ | 14.35 | | $ | 5.25 | | $ | 40.56 | | $ | 5.25 | |

Average Shares Outstanding | | | | | | | | | | | | | | | |

Basic | | 71,080,703 | | 71,116,961 | | 71,115,365 | | 71,122,593 | | 70,850,571 | | 71,080,703 | | 70,850,571 | |

Diluted | | 71,453,824 | | 71,442,599 | | 71,380,898 | | 71,122,593 | | 71,392,134 | | 71,453,824 | | 71,392,134 | |

* “Pre-tax Operating Income” is a non-GAAP financial measure. “Income (loss) Before Income Tax” is a GAAP financial measure to which “Pre-tax Operating Income” may be compared.

See Page 5 for a reconciliation of “Pre-tax Operating Income” to “Income (loss) Before Income Tax”.

** “Shareowners’ equity excluding accumulated other comprehensive income (loss)” is a non-GAAP financial measure. “Shareowners’ equity” is a GAAP financial measure to which “Shareowners’ equity excluding accumulated other comprehensive income (loss)” may be compared.

See Page 4 for a reconciliation of “Shareowners’ equity excluding accumulated other comprehensive income (loss)” to “Shareowners’ equity”.

1

Draft

5/03/2009

Financial Strength Ratings as of March 31, 2009

Legal Entity | | A.M. Best | | Fitch | | Standard & Poor’s | | Moody’s | |

| | | | | | | | | |

Insurance companies: | | | | | | | | | |

Protective Life Insurance Company | | A+ | | A+ | | AA- | | A2 | |

West Coast Life Insurance Company | | A+ | | A+ | | AA- | | A2 | |

Protective Life and Annuity Insurance Company | | A+ | | A+ | | AA- | | — | |

Lyndon Property Insurance Company | | A- | | — | | — | | — | |

Credit Ratings as of March 31, 2009

Legal Entity | | A.M. Best | | Fitch | | Standard & Poor’s | | Moody’s | |

| | | | | | | | | |

Protective Life Corporation | | a- | | A-/BBB+ (1) | | A- | | Baa2 | |

Protective Life Insurance Company | | aa- | | — | | AA- | | — | |

(1) The default rating is A-. The BBB+ rating is related to our senior notes due at 2013, 2014, and 2018.

2

Draft

5/03/2009

GAAP Consolidated Statements of Income (Loss)

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 662,404 | | $ | 678,873 | | $ | 664,464 | | $ | 686,812 | | $ | 697,271 | | $ | 662,404 | | $ | 697,271 | |

Reinsurance Ceded | | (371,072 | ) | (423,774 | ) | (366,734 | ) | (421,230 | ) | (355,302 | ) | (371,072 | ) | (355,302 | ) |

Net Premiums and Policy Fees | | 291,332 | | 255,099 | | 297,730 | | 265,582 | | 341,969 | | 291,332 | | 341,969 | |

Net investment income | | 408,465 | | 438,941 | | 423,522 | | 404,236 | | 421,685 | | 408,465 | | 421,685 | |

RIGL - Derivatives | | (1,657 | ) | 65,087 | | 91,991 | | (38,764 | ) | 92,433 | | (1,657 | ) | 92,433 | |

RIGL - All Other Investments | | (28,045 | ) | (32,425 | ) | (148,458 | ) | (63,766 | ) | (41,843 | ) | (28,045 | ) | (41,843 | ) |

| | | | | | | | | | | | | | | |

OTTI losses | | — | | (79,986 | ) | (202,644 | ) | (29,168 | ) | (117,314 | ) | — | | (117,314 | ) |

OTTI losses recognized in OCI (before taxes) | | — | | — | | — | | — | | 27,488 | | — | | 27,488 | |

Net OTTI losses recognized in earnings | | — | | (79,986 | ) | (202,644 | ) | (29,168 | ) | (89,826 | ) | — | | (89,826 | ) |

| | | | | | | | | | | | | | | |

Other income | | 45,509 | | 47,983 | | 47,943 | | 47,057 | | 38,663 | | 45,509 | | 38,663 | |

Total Revenues | | 715,604 | | 694,699 | | 510,084 | | 585,177 | | 763,081 | | 715,604 | | 763,081 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 494,676 | | 470,344 | | 535,839 | | 475,682 | | 545,475 | | 494,676 | | 545,475 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 68,370 | | 71,450 | | 39,331 | | 54,591 | | 113,648 | | 68,370 | | 113,648 | |

Other operating expenses | | 65,068 | | 60,204 | | 60,788 | | 47,120 | | 46,671 | | 65,068 | | 46,671 | |

Interest on indebtedness - subsidiaries | | 17,233 | | 18,554 | | 16,990 | | 14,698 | | 7,991 | | 17,233 | | 7,991 | |

Interest on indebtedness - holding company - other debt | | 7,267 | | 7,267 | | 7,677 | | 9,942 | | 7,740 | | 7,267 | | 7,740 | |

Interest on indebtedness - holding company - hybrid securities | | 9,401 | | 9,401 | | 9,401 | | 9,401 | | 9,400 | | 9,401 | | 9,400 | |

Total Benefits and Expenses | | 662,015 | | 637,220 | | 670,026 | | 611,434 | | 730,925 | | 662,015 | | 730,925 | |

| | | | | | | | | | | | | | | |

INCOME (LOSS) BEFORE INCOME TAX | | 53,589 | | 57,479 | | (159,942 | ) | (26,257 | ) | 32,156 | | 53,589 | | 32,156 | |

Income tax expense (benefit) | | 17,707 | | 19,295 | | (59,934 | ) | (10,344 | ) | 10,021 | | 17,707 | | 10,021 | |

NET INCOME (LOSS) | | $ | 35,882 | | $ | 38,184 | | $ | (100,008 | ) | $ | (15,913 | ) | $ | 22,135 | | $ | 35,882 | | $ | 22,135 | |

| | | | | | | | | | | | | | | |

PER SHARE DATA FOR QUARTER | | | | | | | | | | | | | | | |

Operating income-diluted * | | $ | 0.73 | | $ | 0.96 | | $ | 0.88 | | $ | 0.80 | | $ | 0.86 | | | | | |

RIGL - Derivatives net of gains related to corp debt, investments and annuities | | 0.04 | | 0.59 | | 0.91 | | (0.15 | ) | 0.65 | | | | | |

RIGL - All Other Investments, net of participating income | | (0.27 | ) | (1.02 | ) | (3.19 | ) | (0.87 | ) | (1.20 | ) | | | | |

Net income (loss)-diluted | | $ | 0.50 | | $ | 0.53 | | $ | (1.40 | ) | $ | (0.22 | ) | $ | 0.31 | | | | | |

Average shares outstanding-diluted | | 71,453,824 | | 71,442,599 | | 71,380,898 | | 71,122,593 | | 71,392,134 | | | | | |

Dividends paid | | $ | 0.225 | | $ | 0.235 | | $ | 0.235 | | $ | 0.12 | | $ | 0.12 | | | | | |

PER SHARE DATA FOR YTD | | | | | | | | | | | | | | | |

Operating income-diluted * | | $ | 0.73 | | $ | 1.69 | | $ | 2.57 | | $ | 3.37 | | $ | 0.86 | | | | | |

RIGL - Derivatives net of gains related to corp debt, investments and annuities | | 0.04 | | 0.63 | | 1.54 | | 1.39 | | 0.65 | | | | | |

RIGL - All Other Investments, net of participating income | | (0.27 | ) | (1.28 | ) | (4.47 | ) | (5.35 | ) | (1.20 | ) | | | | |

Net income (loss)-diluted | | $ | 0.50 | | $ | 1.04 | | $ | (0.36 | ) | $ | (0.59 | ) | $ | 0.31 | | | | | |

Average shares outstanding-diluted | | 71,453,824 | | 71,448,211 | | 71,425,610 | | 71,108,961 | | 71,392,134 | | | | | |

Dividends paid | | $ | 0.225 | | $ | 0.460 | | $ | 0.695 | | $ | 0.815 | | $ | 0.12 | | | | | |

* “Operating Income” is a non-GAAP financial measure. “Net Income (loss)” is a GAAP financial measure to which “Operating Income” may be compared.

3

Draft

5/03/2009

GAAP Consolidated Balance Sheets

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

ASSETS | | | | | | | | | | | |

| | | | | | | | | | | |

Fixed maturities | | $ | 23,167,901 | | $ | 24,097,693 | | $ | 22,084,909 | | $ | 20,098,980 | | $ | 19,571,798 | |

Equity securities | | 289,307 | | 357,672 | | 312,389 | | 302,132 | | 268,211 | |

Mortgage loans | | 3,377,397 | | 3,523,121 | | 3,653,919 | | 3,848,288 | | 3,858,573 | |

Investment real estate | | 7,975 | | 7,834 | | 7,793 | | 14,810 | | 14,769 | |

Policy loans | | 813,107 | | 805,105 | | 811,846 | | 810,933 | | 800,617 | |

Other long-term investments | | 193,364 | | 222,770 | | 329,259 | | 432,137 | | 451,847 | |

Long-term investments | | 27,849,051 | | 29,014,195 | | 27,200,115 | | 25,507,280 | | 24,965,815 | |

Short-term investments | | 1,121,138 | | 839,973 | | 987,604 | | 1,059,506 | | 845,558 | |

Total investments | | 28,970,189 | | 29,854,168 | | 28,187,719 | | 26,566,786 | | 25,811,373 | |

Cash | | 117,933 | | 107,367 | | 86,587 | | 149,358 | | 180,648 | |

Accrued investment income | | 281,396 | | 294,908 | | 308,144 | | 287,543 | | 286,363 | |

Accounts and premiums receivable | | 118,533 | | 139,123 | | 163,258 | | 55,017 | | 59,867 | |

Reinsurance receivable | | 5,287,241 | | 5,203,089 | | 5,227,020 | | 5,254,788 | | 5,273,817 | |

Deferred policy acquisition costs and value of businesses acquired | | 3,499,271 | | 3,629,243 | | 3,965,955 | | 4,200,321 | | 4,243,218 | |

Goodwill | | 116,481 | | 116,307 | | 122,128 | | 120,954 | | 120,179 | |

Property and equipment, net | | 42,027 | | 40,924 | | 40,274 | | 39,707 | | 37,795 | |

Other assets | | 156,486 | | 163,752 | | 172,759 | | 174,035 | | 174,777 | |

Current/Deferred income tax | | 148,342 | | 120,248 | | 154,454 | | 453,526 | | 440,110 | |

Assets related to separate accounts | | | | | | | | | | | |

Variable annuity | | 2,686,752 | | 2,641,203 | | 2,426,806 | | 2,027,470 | | 1,907,272 | |

Variable universal life | | 324,355 | | 325,745 | | 297,687 | | 242,944 | | 224,824 | |

| | | | | | | | | | | |

TOTAL ASSETS | | $ | 41,749,006 | | $ | 42,636,077 | | $ | 41,152,791 | | $ | 39,572,449 | | $ | 38,760,243 | |

4

Draft

5/03/2009

GAAP Consolidated Balance Sheets - Continued

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | |

Policy liabilities and accruals | | | | | | | | | | | |

Future policy benefits and claims | | $ | 16,728,276 | | $ | 16,772,722 | | $ | 16,882,724 | | $ | 17,008,524 | | $ | 17,118,094 | |

Unearned premiums | | 1,188,886 | | 1,222,142 | | 1,248,942 | | 1,251,855 | | 1,230,108 | |

Stable value product deposits | | 5,207,936 | | 5,442,022 | | 6,021,834 | | 4,960,405 | | 4,360,658 | |

Annuity deposits | | 8,726,137 | | 8,886,520 | | 8,976,496 | | 9,357,427 | | 9,316,791 | |

Other policyholders’ funds | | 350,779 | | 405,653 | | 424,185 | | 421,313 | | 443,173 | |

Securities sold under repurchase agreements | | — | | 360,000 | | — | | — | | — | |

Other liabilities | | 1,116,630 | | 1,306,493 | | 741,120 | | 926,821 | | 719,550 | |

Accrued income taxes | | — | | — | | — | | — | | — | |

Deferred income taxes | | 361,038 | | 317,531 | | 58,747 | | — | | — | |

Non-recourse funding obligations | | 1,375,000 | | 1,375,000 | | 1,375,000 | | 1,375,000 | | 1,375,000 | |

Debt | | 579,852 | | 559,852 | | 649,852 | | 714,852 | | 756,852 | |

Liabilities related to variable interest entities | | 400,000 | | 400,000 | | — | | — | | — | |

Subordinated Debt Securities | | 524,743 | | 524,743 | | 524,743 | | 524,743 | | 524,743 | |

Minority interest - subsidiaries | | 14,762 | | 14,709 | | — | | — | | — | |

Liabilities related to separate accounts | | | | | | | | | | | |

Variable annuity | | 2,686,752 | | 2,641,203 | | 2,426,806 | | 2,027,470 | | 1,907,272 | |

Variable universal life | | 324,355 | | 325,745 | | 297,687 | | 242,944 | | 224,824 | |

TOTAL LIABILITIES | | 39,585,146 | | 40,554,335 | | 39,628,136 | | 38,811,354 | | 37,977,065 | |

| | | | | | | | | | | |

SHAREOWNERS’ EQUITY | | | | | | | | | | | |

Common stock | | 36,626 | | 36,626 | | 36,626 | | 36,626 | | 36,626 | |

Additional paid-in-capital | | 446,191 | | 447,914 | | 448,887 | | 448,481 | | 449,009 | |

Treasury stock | | (27,998 | ) | (27,334 | ) | (26,978 | ) | (26,978 | ) | (26,490 | ) |

Cumulative Effect Adjustments | | 3,616 | | 3,616 | | 3,616 | | 3,616 | | 3,616 | |

Unallocated ESOP shares | | (474 | ) | (474 | ) | (474 | ) | (474 | ) | — | |

Retained earnings | | 2,085,847 | | 2,107,616 | | 1,991,183 | | 1,966,880 | | 1,980,621 | |

Accumulated other comprehensive income (loss) | | (379,948 | ) | (486,222 | ) | (928,205 | ) | (1,667,056 | ) | (1,660,204 | ) |

TOTAL SHAREOWNERS’ EQUITY | | 2,163,860 | | 2,081,742 | | 1,524,655 | | 761,095 | | 783,178 | |

TOTAL LIABILITIES AND SHAREOWNERS’ EQUITY | | $ | 41,749,006 | | $ | 42,636,077 | | $ | 41,152,791 | | $ | 39,572,449 | | $ | 38,760,243 | |

| | | | | | | | | | | |

SHAREOWNERS’ EQUITY PER SHARE | | | | | | | | | | | |

Total Shareowners’ Equity | | $ | 30.99 | | $ | 29.80 | | $ | 21.81 | | $ | 10.89 | | $ | 11.19 | |

Less: Accumulated other comprehensive income (loss) | | (5.44 | ) | (6.96 | ) | (13.28 | ) | (23.85 | ) | (23.72 | ) |

Excluding accumulated other comprehensive income (loss)* | | $ | 36.43 | | $ | 36.76 | | $ | 35.09 | | $ | 34.74 | | $ | 34.91 | |

| | | | | | | | | | | |

Total Shareowners’ Equity | | $ | 2,163,860 | | $ | 2,081,742 | | $ | 1,524,655 | | $ | 761,095 | | $ | 783,178 | |

Less: Accumulated other comprehensive income (loss) | | (379,948 | ) | (486,222 | ) | (928,205 | ) | (1,667,056 | ) | (1,660,204 | ) |

Shareowners’ Equity (excluding accumulated other comprehensive income (loss)) * | | $ | 2,543,808 | | $ | 2,567,964 | | $ | 2,452,860 | | $ | 2,428,151 | | $ | 2,443,382 | |

| | | | | | | | | | | |

Common shares outstanding | | 69,829,037 | | 69,864,518 | | 69,903,431 | | 69,905,807 | | 69,986,429 | |

Treasury Stock shares | | 3,422,923 | | 3,387,442 | | 3,348,529 | | 3,346,153 | | 3,265,531 | |

* “Shareowners’ equity excluding accumulated other comprehensive income (loss)” is a non-GAAP financial measure. “Shareowners’ equity” is a GAAP financial measure to which “Shareowners’ equity excluding accumulated other comprehensive income (loss)” may be compared.

5

Draft

5/03/2009

Calculation of Operating Earnings (Loss) Per Share

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

CALCULATION OF NET INCOME (LOSS) PER SHARE | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) | | $ | 35,882 | | $ | 38,184 | | $ | (100,008 | ) | $ | (15,913 | ) | $ | 22,135 | | $ | 35,882 | | $ | 22,135 | |

| | | | | | | | | | | | | | | |

Average shares outstanding-basic | | 71,080,703 | | 71,116,961 | | 71,115,365 | | 71,122,593 | | 70,850,571 | | 71,080,703 | | 70,850,571 | |

Average shares outstanding-diluted | | 71,453,824 | | 71,442,599 | | 71,380,898 | | 71,122,593 | | 71,392,134 | | 71,453,824 | | 71,392,134 | |

| | | | | | | | | | | | | | | |

Net income (loss) per share-basic | | $ | 0.50 | | $ | 0.54 | | $ | (1.41 | ) | $ | (0.22 | ) | $ | 0.31 | | $ | 0.50 | | $ | 0.31 | |

Net income (loss) per share-diluted | | $ | 0.50 | | $ | 0.53 | | $ | (1.40 | ) | $ | (0.22 | ) | $ | 0.31 | | $ | 0.50 | | $ | 0.31 | |

| | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | $ | 35,882 | | $ | 38,184 | | $ | (100,008 | ) | $ | (15,913 | ) | $ | 22,135 | | $ | 35,882 | | $ | 22,135 | |

EPS (basic) | | $ | 0.50 | | $ | 0.54 | | $ | (1.41 | ) | $ | (0.22 | ) | $ | 0.31 | | $ | 0.50 | | $ | 0.31 | |

EPS (diluted) | | $ | 0.50 | | $ | 0.53 | | $ | (1.40 | ) | $ | (0.22 | ) | $ | 0.31 | | $ | 0.50 | | $ | 0.31 | |

| | | | | | | | | | | | | | | |

CALCULATION OF REALIZED INVESTMENT GAINS (LOSSES) PER SHARE | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

RIGL - Derivatives | | $ | (1,657 | ) | $ | 65,087 | | $ | 91,991 | | $ | (38,764 | ) | $ | 92,433 | | $ | (1,657 | ) | $ | 92,433 | |

Derivative Gains related to Corporate Debt and Investments | | (484 | ) | (1,786 | ) | (1,915 | ) | (1,569 | ) | (2,238 | ) | (484 | ) | (2,238 | ) |

Derivative Gains related to Annuities | | 6,240 | | 1,850 | | 10,385 | | 22,496 | | (19,088 | ) | 6,240 | | (19,088 | ) |

RIGL - All Other Investments, net of participating income | | (28,045 | ) | (112,411 | ) | (351,102 | ) | (92,934 | ) | (131,669 | ) | (28,045 | ) | (131,669 | ) |

Related amortization of DAC & VOBA | | (1,074 | ) | 495 | | 703 | | (972 | ) | (78 | ) | (1,074 | ) | (78 | ) |

| | (25,020 | ) | (46,765 | ) | (249,938 | ) | (111,743 | ) | (60,640 | ) | (25,020 | ) | (60,640 | ) |

Tax effect | | 8,757 | | 16,368 | | 87,478 | | 39,110 | | 21,224 | | 8,757 | | 21,224 | |

| | $ | (16,263 | ) | $ | (30,397 | ) | $ | (162,460 | ) | $ | (72,633 | ) | $ | (39,416 | ) | $ | (16,263 | ) | $ | (39,416 | ) |

| | | | | | | | | | | | | | | |

RIGL - Derivatives per share-diluted | | $ | 0.04 | | $ | 0.59 | | $ | 0.91 | | $ | (0.15 | ) | $ | 0.65 | | $ | 0.04 | | $ | 0.65 | |

RIGL - All Other Investments per share-diluted | | $ | (0.27 | ) | $ | (1.02 | ) | $ | (3.19 | ) | $ | (0.87 | ) | $ | (1.20 | ) | $ | (0.27 | ) | $ | (1.20 | ) |

| | | | | | | | | | | | | | | |

OPERATING INCOME PER SHARE * | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) per share-diluted | | $ | 0.50 | | $ | 0.53 | | $ | (1.40 | ) | $ | (0.22 | ) | $ | 0.31 | | $ | 0.50 | | $ | 0.31 | |

RIGL - Derivatives per share-diluted | | 0.04 | | 0.59 | | 0.91 | | (0.15 | ) | 0.65 | | 0.04 | | 0.65 | |

RIGL - All Other Investments, net of participating income per share-diluted | | (0.27 | ) | (1.02 | ) | (3.19 | ) | (0.87 | ) | (1.20 | ) | (0.27 | ) | (1.20 | ) |

Operating income per share-diluted | | $ | 0.73 | | $ | 0.96 | | $ | 0.88 | | $ | 0.80 | | $ | 0.86 | | $ | 0.73 | | $ | 0.86 | |

| | | | | | | | | | | | | | | |

NET OPERATING INCOME * | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) | | $ | 35,882 | | $ | 38,184 | | $ | (100,008 | ) | $ | (15,913 | ) | $ | 22,135 | | $ | 35,882 | | $ | 22,135 | |

Less: RIGL - Derivatives net of tax & gains related to corp debt, investments & annuities | | 2,664 | | 42,349 | | 65,299 | | (11,594 | ) | 46,220 | | 2,664 | | 46,220 | |

Less: RIGL - All Other Investments net of tax, amortization, and participating income | | (18,927 | ) | (72,746 | ) | (227,759 | ) | (61,039 | ) | (85,636 | ) | (18,927 | ) | (85,636 | ) |

Net operating income | | $ | 52,145 | | $ | 68,581 | | $ | 62,452 | | $ | 56,720 | | $ | 61,551 | | $ | 52,145 | | $ | 61,551 | |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME ** | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Income (loss) before income tax and discontinued operations | | $ | 53,589 | | $ | 57,479 | | $ | (159,942 | ) | $ | (26,257 | ) | $ | 32,156 | | $ | 53,589 | | $ | 32,156 | |

Less: RIGL - Derivatives | | (1,657 | ) | 65,087 | | 91,991 | | (38,764 | ) | 92,433 | | (1,657 | ) | 92,433 | |

Less: Derivative gains related to corporate debt, investments & annuities | | 5,756 | | 64 | | 8,470 | | 20,927 | | (21,326 | ) | 5,756 | | (21,326 | ) |

Less: RIGL - All Other Investments, net of participating income | | (28,045 | ) | (112,411 | ) | (351,102 | ) | (92,934 | ) | (131,669 | ) | (28,045 | ) | (131,669 | ) |

Less: Related amortization of DAC & VOBA | | (1,074 | ) | 495 | | 703 | | (972 | ) | (78 | ) | (1,074 | ) | (78 | ) |

Pre-tax operating income | | $ | 78,609 | | $ | 104,244 | | $ | 89,996 | | $ | 85,486 | | $ | 92,796 | | $ | 78,609 | | $ | 92,796 | |

* “Net Operating Income” and “Operating Income Per Share” are non-GAAP financial measures. “Net Income (Loss)” and “Net Income (Loss) Per Share” are GAAP financial measures to which “Net Operating Income” and “Operating Income Per Share” may be compared.

** “Pre-tax Operating Income” is a non-GAAP financial measure. “Income (Loss) Before Income Tax” is a GAAP financial measure to which “Pre-tax Operating Income” may be compared.

6

Draft

5/03/2009

Invested Asset Summary

(Dollars In Millions) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

Total Portfolio | | | | | | | | | | | |

| | | | | | | | | | | |

Fixed Income | | $ | 23,167.9 | | $ | 24,097.7 | | $ | 22,084.9 | | $ | 20,099.0 | | $ | 19,571.8 | |

Mortgage Loans | | 3,377.4 | | 3,523.1 | | 3,653.9 | | 3,848.3 | | 3,858.6 | |

Real Estate | | 8.0 | | 7.8 | | 7.8 | | 14.8 | | 14.8 | |

Equities | | 289.3 | | 357.7 | | 312.4 | | 302.1 | | 268.2 | |

Policy Loans | | 813.1 | | 805.1 | | 811.8 | | 810.9 | | 800.6 | |

Short-Term Investments | | 1,121.1 | | 840.0 | | 987.6 | | 1,059.5 | | 845.6 | |

Other Long-Term Investments | | 193.4 | | 222.8 | | 329.3 | | 432.1 | | 451.8 | |

Total Invested Assets | | $ | 28,970.2 | | $ | 29,854.2 | | $ | 28,187.7 | | $ | 26,566.7 | | $ | 25,811.4 | |

7

Draft

5/03/2009

Invested Asset Summary - Fixed Income

(Dollars In Millions) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

Fixed Income | | | | | | | | | | | |

| | | | | | | | | | | |

Corporate Bonds | | $ | 13,852.4 | | $ | 14,642.9 | | $ | 13,552.4 | | $ | 12,306.3 | | $ | 12,042.8 | |

Residential Mortgage-Backed Securities | | 6,216.0 | | 6,587.1 | | 5,652.5 | | 4,960.2 | | 4,731.9 | |

Commercial Mortgage-Backed Securities | | 1,232.7 | | 1,206.3 | | 1,249.5 | | 1,184.9 | | 1,164.2 | |

Asset-Backed Securities | | 1,486.1 | | 1,316.5 | | 1,209.0 | | 1,132.7 | | 1,175.2 | |

US Govt Bonds | | 317.7 | | 313.3 | | 390.2 | | 484.9 | | 427.5 | |

States, Municipals and Political Subdivisions | | 62.9 | | 31.5 | | 31.3 | | 30.0 | | 30.2 | |

Preferred Securities | | 0.1 | | 0.1 | | — | | — | | — | |

Convertibles and Bonds with Warrants | | — | | — | | — | | — | | — | |

Total Fixed Income Portfolio | | $ | 23,167.9 | | $ | 24,097.7 | | $ | 22,084.9 | | $ | 20,099.0 | | $ | 19,571.8 | |

| | | | | | | | | | | |

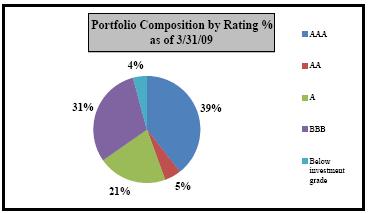

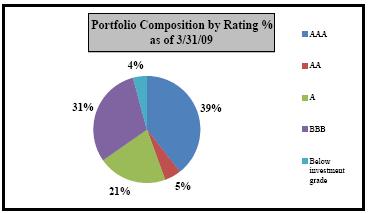

Fixed Income - Quality | | | | | | | | | | | |

| | | | | | | | | | | |

AAA | | 42.2 | % | 40.9 | % | 38.6 | % | 35.2 | % | 33.7 | % |

AA | | 8.2 | % | 7.3 | % | 7.1 | % | 6.6 | % | 6.1 | % |

A | | 17.8 | % | 18.1 | % | 18.8 | % | 19.8 | % | 19.0 | % |

BBB | | 27.0 | % | 28.4 | % | 30.3 | % | 33.0 | % | 33.6 | % |

Below investment grade | | 4.8 | % | 5.3 | % | 5.2 | % | 5.4 | % | 7.6 | % |

| | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Note: Prior quarter public utilities securities have been reclassed to Corporate Bonds

8

Draft

5/03/2009

Invested Asset Summary - Mortgages

(Dollars In Millions) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

Mortgage Loans - Type | | | | | | | | | | | |

| | | | | | | | | | | |

Retail | | 64.5 | % | 64.4 | % | 64.9 | % | 65.2 | % | 64.8 | % |

Apartments | | 10.8 | % | 10.6 | % | 10.4 | % | 10.1 | % | 10.7 | % |

Office Buildings | | 13.8 | % | 13.8 | % | 14.0 | % | 14.3 | % | 14.4 | % |

Warehouses | | 8.0 | % | 8.3 | % | 8.1 | % | 7.9 | % | 7.7 | % |

Miscellaneous | | 2.9 | % | 2.9 | % | 2.6 | % | 2.5 | % | 2.4 | % |

| | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

| | | | | | | | | | | |

Problem Mortgage Loans | | | | | | | | | | | |

| | | | | | | | | | | |

60 Days Past Due | | $ | 7.4 | | $ | — | | $ | 7.8 | | $ | — | | $ | 0.7 | |

90 Days Past Due | | — | | 7.4 | | 7.4 | | 7.4 | | 10.7 | |

Renegotiated Loans | | — | | — | | — | | — | | — | |

Foreclosed Real Estate | | — | | — | | — | | 7.8 | | — | |

| | $ | 7.4 | | $ | 7.4 | | $ | 15.2 | | $ | 15.2 | | $ | 11.4 | |

9

Draft

5/03/2009

Invested Asset Summary - Trading Portfolios

(Dollars In Millions) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | |

| | | | | | | | | | | |

Trading Portfolio Composition (excl. Modco Trading Portfolio) | | | | | | | | | | | |

| | | | | | | | | | | |

Asset Class | | | | | | | | | | | |

AAA | | $ | 182.3 | | $ | 192.4 | | $ | 183.4 | | $ | 148.6 | | $ | 138.7 | |

AA | | 16.6 | | 17.1 | | 19.2 | | — | | 3.6 | |

A | | 62.4 | | 58.1 | | 81.9 | | 55.3 | | 48.6 | |

BBB | | 153.7 | | 153.9 | | 103.0 | | 137.5 | | 134.5 | |

Below investment grade | | — | | — | | — | | — | | 5.8 | |

Short-term investments | | 17.6 | | 2.0 | | — | | — | | — | |

Swaps | | (13.9 | ) | (5.7 | ) | — | | — | | — | |

Total | | $ | 418.7 | | $ | 417.8 | | $ | 387.5 | | $ | 341.4 | | $ | 331.2 | |

| | | | | | | | | | | |

Modco Trading Portfolio | | | | | | | | | | | |

| | | | | | | | | | | |

Asset Class | | | | | | | | | | | |

AAA | | $ | 1,527.2 | | $ | 1,477.5 | | $ | 1,330.5 | | $ | 1,357.1 | | $ | 1,079.0 | |

AA | | 263.8 | | 249.6 | | 200.2 | | 147.3 | | 134.1 | |

A | | 754.0 | | 713.3 | | 654.9 | | 591.5 | | 563.6 | |

BBB | | 806.5 | | 837.3 | | 792.5 | | 743.5 | | 837.2 | |

Below investment grade | | 29.9 | | 46.7 | | 53.2 | | 55.6 | | 112.1 | |

Total | | $ | 3,381.4 | | $ | 3,324.4 | | $ | 3,031.3 | | $ | 2,895.0 | | $ | 2,726.0 | |

10

Draft

5/03/2009

Invested Asset Summary - MBS - Alt-A

Mortgage-backed Securities Collateralized by Alt-A Mortgage Loans as of March 31, 2009:

(Dollars In Millions) | | 2005 and | | | | | | | | | | | |

(Unaudited) | | Prior | | 2006 | | 2007 | | 2008 | | 2009 | | Total | |

| | | | | | | | | | | | | |

Estimated Fair Value of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | 26.7 | | $ | 70.6 | | $ | 70.6 | | $ | — | | $ | — | | $ | 167.9 | |

AA | | — | | — | | — | | — | | — | | — | |

A | | 10.8 | | — | | — | | — | | — | | 10.8 | |

BBB | | 34.6 | | — | | — | | — | | — | | 34.6 | |

Below investment grade | | 5.7 | | 162.5 | | 114.9 | | — | | — | | 283.1 | |

Total mortgage-backed securities collateralized by Alt-A mortgage loans | | $ | 77.8 | | $ | 233.1 | | $ | 185.5 | | $ | — | | $ | — | | $ | 496.4 | |

| | | | | | | | | | | | | |

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | (4.4 | ) | $ | (11.0 | ) | $ | (11.0 | ) | $ | — | | $ | — | | $ | (26.4 | ) |

AA | | — | | | | | | | | — | | — | |

A | | (3.5 | ) | — | | — | | — | | — | | (3.5 | ) |

BBB | | (7.3 | ) | — | | — | | — | | — | | (7.3 | ) |

Below investment grade | | (4.4 | ) | (88.1 | ) | (59.4 | ) | — | | — | | (151.9 | ) |

Total mortgage-backed securities collateralized by Alt-A mortgage loans | | $ | (19.6 | ) | $ | (99.1 | ) | $ | (70.4 | ) | $ | — | | $ | — | | $ | (189.1 | ) |

11

Draft

5/03/2009

Invested Asset Summary - MBS - Subprime

Mortgage-backed Securities Collateralized by Subprime Loans as of March 31, 2009:

(Dollars In Millions) | | 2005 and | | | | | | | | | | | |

(Unaudited) | | Prior | | 2006 | | 2007 | | 2008 | | 2009 | | Total | |

| | | | | | | | | | | | | |

Estimated Fair Value of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | 3.4 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 3.4 | |

AA | | 0.9 | | 1.5 | | 3.3 | | — | | — | | 5.7 | |

A | | — | | 6.1 | | — | | — | | — | | 6.1 | |

BBB | | 0.1 | | 5.2 | | 3.0 | | — | | — | | 8.3 | |

Below investment grade | | 1.2 | | 8.8 | | 6.4 | | — | | — | | 16.4 | |

Total mortgage-backed securities collateralized by sub-prime mortgage loans | | $ | 5.6 | | $ | 21.6 | | $ | 12.7 | | $ | — | | $ | — | | $ | 39.9 | |

| | | | | | | | | | | | | |

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | (1.1 | ) | $ | — | | $ | — | | $ | — | | $ | — | | $ | (1.1 | ) |

AA | | (0.7 | ) | (0.4 | ) | (6.8 | ) | — | | — | | (7.9 | ) |

A | | — | | (1.2 | ) | — | | — | | — | | (1.2 | ) |

BBB | | (0.1 | ) | (2.0 | ) | (8.0 | ) | — | | — | | (10.1 | ) |

Below investment grade | | (1.4 | ) | (5.3 | ) | (7.0 | ) | — | | — | | (13.7 | ) |

Total mortgage-backed securities collateralized by sub-prime mortgage loans | | $ | (3.3 | ) | $ | (8.9 | ) | $ | (21.8 | ) | $ | — | | $ | — | | $ | (34.0 | ) |

12

Draft

5/03/2009

Invested Asset Summary - MBS - Prime

Mortgage-backed Securities Collateralized by Prime Loans as of March 31, 2009:

(Dollars In Millions) | | 2005 and | | | | | | | | | | | |

(Unaudited) | | Prior | | 2006 | | 2007 | | 2008 | | 2009 | | Total | |

| | | | | | | | | | | | | |

Estimated Fair Value of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | 2,673.8 | | $ | 594.8 | | $ | 213.6 | | $ | 3.8 | | $ | — | | $ | 3,486.0 | |

AA | | 5.8 | | 68.0 | | — | | — | | — | | 73.8 | |

A | | 1.6 | | 120.8 | | 6.7 | | — | | — | | 129.1 | |

BBB | | 1.4 | | 178.8 | | 77.2 | | — | | — | | 257.4 | |

Below investment grade | | 19.4 | | 140.6 | | 89.3 | | — | | — | | 249.3 | |

Total mortgage-backed securities collateralized by prime loans | | $ | 2,702.0 | | $ | 1,103.0 | | $ | 386.8 | | $ | 3.8 | | $ | — | | $ | 4,195.6 | |

| | | | | | | | | | | | | |

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | (144.6 | ) | $ | (75.7 | ) | $ | (40.6 | ) | $ | 0.2 | | $ | — | | $ | (260.7 | ) |

AA | | (11.8 | ) | (28.5 | ) | — | | — | | — | | (40.3 | ) |

A | | (0.3 | ) | (29.1 | ) | (1.7 | ) | — | | — | | (31.1 | ) |

BBB | | 0.2 | | (39.8 | ) | (25.9 | ) | — | | — | | (65.5 | ) |

Below investment grade | | (3.1 | ) | (34.8 | ) | (41.7 | ) | — | | — | | (79.6 | ) |

Total mortgage-backed securities collateralized by prime loans | | $ | (159.6 | ) | $ | (207.9 | ) | $ | (109.9 | ) | $ | 0.2 | | $ | — | | $ | (477.2 | ) |

13

Draft

5/03/2009

Invested Asset Summary - External CMBS

External Commercial Mortgage-backed Securities as of March 31, 2009:

(Dollars In Millions) | | 2005 and | | | | | | | | | | | |

(Unaudited) | | Prior | | 2006 | | 2007 | | 2008 | | 2009 | | Total | |

| | | | | | | | | | | | | |

Estimated Fair Value of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | 258.6 | | $ | 12.1 | | $ | — | | $ | 37.0 | | $ | — | | $ | 307.7 | |

BBB | | 4.8 | | — | | — | | — | | — | | 4.8 | |

Total external commercial mortgage-backed securities | | $ | 263.4 | | $ | 12.1 | | $ | — | | $ | 37.0 | | $ | — | | $ | 312.5 | |

| | | | | | | | | | | | | |

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | (4.8 | ) | $ | (1.6 | ) | $ | — | | $ | (7.2 | ) | $ | — | | $ | (13.6 | ) |

BBB | | (2.2 | ) | — | | — | | — | | — | | (2.2 | ) |

Total external commercial mortgage-backed securities | | $ | (7.0 | ) | $ | (1.6 | ) | $ | — | | $ | (7.2 | ) | $ | — | | $ | (15.8 | ) |

14

Draft

5/03/2009

Invested Asset Summary - ABS*

Asset-backed Securities* as of March 31, 2009:

(Dollars In Millions) | | 2005 and | | | | | | | | | | | |

(Unaudited) | | Prior | | 2006 | | 2007 | | 2008 | | 2009 | | Total | |

| | | | | | | | | | | | | |

Estimated Fair Value of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | 634.4 | | $ | 40.8 | | $ | 373.1 | | $ | 47.7 | | $ | — | | $ | 1,096.0 | |

AA | | 6.6 | | — | | — | | — | | — | | 6.6 | |

A | | 1.8 | | — | | — | | — | | — | | 1.8 | |

BBB | | 3.1 | | 5.8 | | 24.3 | | — | | — | | 33.2 | |

Below investment grade | | — | | 25.8 | | 11.8 | | — | | — | | 37.6 | |

Total asset-backed securities | | $ | 645.9 | | $ | 72.4 | | $ | 409.2 | | $ | 47.7 | | $ | — | | $ | 1,175.2 | |

| | | | | | | | | | | | | |

Estimated Unrealized Gain (Loss) of Security by Year of Security Origination | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Rating | | | | | | | | | | | | | |

AAA | | $ | (29.2 | ) | $ | (1.9 | ) | $ | (36.5 | ) | $ | (2.3 | ) | $ | — | | $ | (69.9 | ) |

AA | | (0.7 | ) | — | | — | | — | | — | | (0.7 | ) |

A | | (0.2 | ) | — | | — | | — | | — | | (0.2 | ) |

BBB | | (1.2 | ) | (2.0 | ) | (2.8 | ) | — | | — | | (6.0 | ) |

Below investment grade | | — | | (37.2 | ) | (3.6 | ) | — | | — | | (40.8 | ) |

Total asset-backed securities | | $ | (31.3 | ) | $ | (41.1 | ) | $ | (42.9 | ) | $ | (2.3 | ) | $ | — | | $ | (117.6 | ) |

* Excludes Residential and Commercial mortgage-backed securities

15

Draft

5/03/02009

Invested Asset Summary - Other

(Dollars In Millions)

(Unaudited) | | GAAP

Amortized

Cost | | Market

Value | | Unrealized

Gain / (Loss) | |

Hybrid / Preferred Securities | | | | | | | |

Domestic Exposure | | | | | | | |

Upper Tier 2 | | $ | — | | $ | — | | $ | — | |

Tier 1 | | 987.6 | | 491.2 | | (496.4 | ) |

Preferred Stock | | 178.7 | | 122.2 | | (56.5 | ) |

Total Domestic Exposure | | $ | 1,166.3 | | $ | 613.4 | | $ | (552.9 | ) |

| | | | | | | |

European Exposure | | | | | | | |

Upper Tier 2 | | $ | 8.3 | | $ | 4.9 | | $ | (3.4 | ) |

Tier 1 | | 282.3 | | 88.2 | | (194.1 | ) |

Preferred Stock | | 64.5 | | 43.0 | | (21.5 | ) |

Total European Exposure | | $ | 355.1 | | $ | 136.1 | | $ | (219.0 | ) |

| | | | | | | |

Other Foreign Exposure | | | | | | | |

Upper Tier 2 | | $ | — | | $ | — | | $ | — | |

Tier 1 | | 66.2 | | 35.0 | | (31.2 | ) |

Preferred Stock | | 0.1 | | — | | (0.1 | ) |

Total Other Foreign Exposure | | $ | 66.3 | | $ | 35.0 | | $ | (31.3 | ) |

| | | | | | | |

Total Domestic, European and Other Exposure | | | | | | | |

Upper Tier 2 | | $ | 8.3 | | $ | 4.9 | | $ | (3.4 | ) |

Tier 1 | | 1,336.1 | | 614.4 | | (721.7 | ) |

Preferred Stock | | 243.3 | | 165.2 | | (78.1 | ) |

Total Domestic, European and Other Exposure | | $ | 1,587.7 | | $ | 784.5 | | $ | (803.2 | ) |

16

Draft

5/03/2009

Life Marketing Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 358,783 | | $ | 377,807 | | $ | 372,674 | | $ | 391,302 | | $ | 413,777 | | $ | 358,783 | | $ | 413,777 | |

Reinsurance Ceded | | (207,865 | ) | (255,739 | ) | (205,699 | ) | (254,723 | ) | (204,167 | ) | (207,865 | ) | (204,167 | ) |

Net Premiums and Policy Fees | | 150,918 | | 122,068 | | 166,975 | | 136,579 | | 209,610 | | 150,918 | | 209,610 | |

Net investment income | | 84,956 | | 86,989 | | 88,825 | | 89,283 | | 93,527 | | 84,956 | | 93,527 | |

Realized investment gains (losses) | | — | | — | | — | | — | | — | | — | | — | |

Other income | | 25,045 | | 26,010 | | 23,507 | | 22,184 | | 19,830 | | 25,045 | | 19,830 | |

Total Revenues | | 260,919 | | 235,067 | | 279,307 | | 248,046 | | 322,967 | | 260,919 | | 322,967 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 177,778 | | 161,861 | | 212,201 | | 153,115 | | 236,526 | | 177,778 | | 236,526 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 26,923 | | 27,234 | | 5,009 | | 35,256 | | 35,728 | | 26,923 | | 35,728 | |

Other operating expenses | | 9,769 | | 7,845 | | 9,875 | | 7,938 | | 8,203 | | 9,769 | | 8,203 | |

Total Benefits and Expenses | | 214,470 | | 196,940 | | 227,085 | | 196,309 | | 280,457 | | 214,470 | | 280,457 | |

| | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAX | | $ | 46,449 | | $ | 38,127 | | $ | 52,222 | | $ | 51,737 | | $ | 42,510 | | $ | 46,449 | | $ | 42,510 | |

Life Marketing Key Data

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

SALES BY PRODUCT | | | | | | | | | | | | | | | |

Traditional | | $ | 27,008 | | $ | 26,881 | | $ | 23,039 | | $ | 22,274 | | $ | 23,151 | | $ | 27,008 | | $ | 23,151 | |

Universal life | | 14,663 | | 12,581 | | 11,092 | | 14,496 | | 12,819 | | 14,663 | | 12,819 | |

Variable universal life | | 1,604 | | 1,679 | | 1,222 | | 1,162 | | 642 | | 1,604 | | 642 | |

Total | | $ | 43,275 | | $ | 41,141 | | $ | 35,353 | | $ | 37,932 | | $ | 36,612 | | $ | 43,275 | | $ | 36,612 | |

| | | | | | | | | | | | | | | |

SALES BY DISTRIBUTION | | | | | | | | | | | | | | | |

Brokerage general agents | | $ | 24,396 | | $ | 23,545 | | $ | 20,805 | | $ | 20,549 | | $ | 21,464 | | $ | 24,396 | | $ | 21,464 | |

Independent agents | | 8,852 | | 9,331 | | 7,403 | | 7,515 | | 7,280 | | 8,852 | | 7,280 | |

Stockbrokers/banks | | 8,447 | | 7,307 | | 6,587 | | 8,205 | | 7,173 | | 8,447 | | 7,173 | |

BOLI/other | | 1,580 | | 958 | | 558 | | 1,663 | | 695 | | 1,580 | | 695 | |

Total | | $ | 43,275 | | $ | 41,141 | | $ | 35,353 | | $ | 37,932 | | $ | 36,612 | | $ | 43,275 | | $ | 36,612 | |

17

Draft

5/03/2009

Annuities Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 8,191 | | $ | 8,449 | | $ | 7,885 | | $ | 10,013 | | $ | 10,985 | | $ | 8,191 | | $ | 10,985 | |

Reinsurance Ceded | | — | | — | | — | | (206 | ) | (42 | ) | — | | (42 | ) |

Net Premiums and Policy Fees | | 8,191 | | 8,449 | | 7,885 | | 9,807 | | 10,943 | | 8,191 | | 10,943 | |

Net investment income | | 77,286 | | 85,007 | | 89,742 | | 95,516 | | 102,982 | | 77,286 | | 102,982 | |

RIGL - Derivatives | | (6,240 | ) | (1,850 | ) | (10,385 | ) | (22,496 | ) | 19,088 | | (6,240 | ) | 19,088 | |

RIGL - All Other Investments | | 20 | | 1,095 | | (14,419 | ) | 387 | | (6,448 | ) | 20 | | (6,448 | ) |

Other income | | 3,003 | | 3,255 | | 3,366 | | 3,137 | | 3,380 | | 3,003 | | 3,380 | |

Total Revenues | | 82,260 | | 95,956 | | 76,189 | | 86,351 | | 129,945 | | 82,260 | | 129,945 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 67,416 | | 71,842 | | 81,441 | | 90,101 | | 85,808 | | 67,416 | | 85,808 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 5,901 | | 7,239 | | 3,034 | | (15,558 | ) | 45,085 | | 5,901 | | 45,085 | |

Other operating expenses | | 6,414 | | 6,333 | | 6,650 | | 6,225 | | 5,975 | | 6,414 | | 5,975 | |

Total Benefits and Expenses | | 79,731 | | 85,414 | | 91,125 | | 80,768 | | 136,868 | | 79,731 | | 136,868 | |

| | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAX | | 2,529 | | 10,542 | | (14,936 | ) | 5,583 | | (6,923 | ) | 2,529 | | (6,923 | ) |

| | | | | | | | | | | | | | | |

Adjustments to Reconcile to Operating Income: | | | | | | | | | | | | | | | |

Less: RIGL - Derivatives | | (6,240 | ) | (1,850 | ) | (10,385 | ) | (22,496 | ) | 19,088 | | (6,240 | ) | 19,088 | |

Add back: Derivative gains related to annuities | | (6,240 | ) | (1,850 | ) | (10,385 | ) | (22,496 | ) | 19,088 | | (6,240 | ) | 19,088 | |

Less: RIGL - All Other Investments | | 20 | | 1,095 | | (14,419 | ) | 387 | | (6,448 | ) | 20 | | (6,448 | ) |

Add back: Related amortization of deferred acquisition costs | | (20 | ) | 40 | | 1,073 | | 979 | | (100 | ) | (20 | ) | (100 | ) |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME | | $ | 2,489 | | $ | 9,487 | | $ | 556 | | $ | 6,175 | | $ | (575 | ) | $ | 2,489 | | $ | (575 | ) |

Annuities Key Data

| | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

| | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

SALES | | | | | | | | | | | | | | | |

Variable Annuity | | $ | 92,792 | | $ | 115,448 | | $ | 132,374 | | $ | 111,794 | | $ | 139,056 | | $ | 92,792 | | $ | 139,056 | |

Immediate Annuity | | 225,759 | | 41,731 | | 34,727 | | 47,642 | | 26,043 | | 225,759 | | 26,043 | |

Single Premium Deferred Annuity | | 81,891 | | 185,468 | | 58,854 | | 400,638 | | 151,016 | | 81,891 | | 151,016 | |

Market Value Adjusted Annuity | | 208,423 | | 205,866 | | 240,639 | | 411,145 | | 117,305 | | 208,423 | | 117,305 | |

Equity Indexed Annuity | | 3,175 | | 3,723 | | 5,565 | | 4,911 | | 3,316 | | 3,175 | | 3,316 | |

Total | | $ | 612,040 | | $ | 552,236 | | $ | 472,159 | | $ | 976,130 | | $ | 436,736 | | $ | 612,040 | | $ | 436,736 | |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME | | | | | | | | | | | | | | | |

Variable Annuity | | $ | 4,068 | | $ | 5,436 | | $ | (5,737 | ) | $ | (7,056 | ) | $ | (5,841 | ) | $ | 4,068 | | $ | (5,841 | ) |

Fixed Annuity | | (1,579 | ) | 4,051 | | 6,293 | | 13,231 | | 5,266 | | (1,579 | ) | 5,266 | |

Total | | $ | 2,489 | | $ | 9,487 | | $ | 556 | | $ | 6,175 | | $ | (575 | ) | $ | 2,489 | | $ | (575 | ) |

| | | | | | | | | | | | | | | |

DEPOSIT BALANCE | | | | | | | | | | | | | | | |

VA Fixed Annuity | | $ | 190,968 | | $ | 201,171 | | $ | 212,011 | | $ | 202,395 | | $ | 226,707 | | | | | |

VA Separate Account Annuity | | 2,501,975 | | 2,464,467 | | 2,265,765 | | 2,098,203 | | 1,786,993 | | | | | |

Sub-total | | 2,692,943 | | 2,665,638 | | 2,477,776 | | 2,300,598 | | 2,013,700 | | | | | |

Fixed Annuity | | 5,114,313 | | 5,443,137 | | 5,703,702 | | 6,195,293 | | 6,530,391 | | | | | |

Total | | $ | 7,807,256 | | $ | 8,108,775 | | $ | 8,181,478 | | $ | 8,495,891 | | $ | 8,544,091 | | | | | |

18

Draft

5/03/2009

Stable Value Products Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Net investment income | | $ | 78,361 | | $ | 77,747 | | $ | 88,254 | | $ | 83,991 | | $ | 63,176 | | $ | 78,361 | | $ | 63,176 | |

RIGL - Derivatives | | 220 | | 354 | | (3,196 | ) | (1,451 | ) | 707 | | 220 | | 707 | |

RIGL - All Other Investments | | 5,213 | | 1,469 | | 8,180 | | (17,216 | ) | 1,155 | | 5,213 | | 1,155 | |

Other income | | — | | — | | 3,000 | | 6,360 | | 1,526 | | — | | 1,526 | |

Total Revenues | | 83,794 | | 79,570 | | 96,238 | | 71,684 | | 66,564 | | 83,794 | | 66,564 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 59,929 | | 57,485 | | 60,128 | | 60,066 | | 42,585 | | 59,929 | | 42,585 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 1,067 | | 1,095 | | 1,211 | | 1,094 | | 927 | | 1,067 | | 927 | |

Other operating expenses | | 1,149 | | 1,622 | | 1,731 | | 1,325 | | 983 | | 1,149 | | 983 | |

Total Benefits and Expenses | | 62,145 | | 60,202 | | 63,070 | | 62,485 | | 44,495 | | 62,145 | | 44,495 | |

| | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAX | | 21,649 | | 19,368 | | 33,168 | | 9,199 | | 22,069 | | 21,649 | | 22,069 | |

| | | | | | | | | | | | | | | |

Adjustments to Reconcile to Operating Income: | | | | | | | | | | | | | | | |

Less: RIGL-Derivatives | | 220 | | 354 | | (3,196 | ) | (1,451 | ) | 707 | | 220 | | 707 | |

Less: RIGL-All Other Investments | | 5,213 | | 1,469 | | 8,180 | | (17,216 | ) | 1,155 | | 5,213 | | 1,155 | |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME | | $ | 16,216 | | $ | 17,545 | | $ | 28,184 | | $ | 27,866 | | $ | 20,207 | | $ | 16,216 | | $ | 20,207 | |

Stable Value Products Key Data

| | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

| | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

SALES | | | | | | | | | | | | | | | |

GIC | | $ | 74,232 | | $ | 11,113 | | $ | 22,600 | | $ | 58,339 | | $ | — | | $ | 74,232 | | $ | — | |

GFA - Direct Institutional | | — | | 425,000 | | 636,651 | | — | | — | | — | | — | |

GFA - Registered - Institutional | | 450,000 | | — | | — | | — | | — | | 450,000 | | — | |

GFA - Registered - Retail | | 113,404 | | 151,725 | | 25,719 | | — | | — | | 113,404 | | — | |

Total | | $ | 637,636 | | $ | 587,838 | | $ | 684,970 | | $ | 58,339 | | $ | — | | $ | 637,636 | | $ | — | |

| | | | | | | | | | | | | | | |

DEPOSIT BALANCE | | | | | | | | | | | | | | | |

Quarter End Balance | | $ | 5,207,936 | | $ | 5,442,022 | | $ | 6,021,834 | | $ | 4,960,405 | | $ | 4,360,658 | | | | | |

Average Daily Balance | | $ | 5,140,310 | | $ | 5,139,017 | | $ | 5,824,533 | | $ | 5,666,809 | | $ | 4,523,563 | | | | | |

| | | | | | | | | | | | | | | |

OPERATING SPREAD | | 1.26 | % | 1.34 | % | 1.70 | %(1) | 1.52 | %(1) | 1.65 | %(1) | | | | |

(1) Excludes one-time funding agreement retirement gains

19

Draft

5/03/2009

Asset Protection Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 95,335 | | $ | 91,110 | | $ | 88,763 | | $ | 87,961 | | $ | 86,935 | | $ | 95,335 | | $ | 86,935 | |

Reinsurance Ceded | | (47,443 | ) | (42,954 | ) | (40,249 | ) | (40,229 | ) | (41,485 | ) | (47,443 | ) | (41,485 | ) |

Net Premiums and Policy Fees | | 47,892 | | 48,156 | | 48,514 | | 47,732 | | 45,450 | | 47,892 | | 45,450 | |

Net investment income | | 9,905 | | 9,808 | | 9,595 | | 9,348 | | 8,932 | | 9,905 | | 8,932 | |

Realized investment gains (losses) | | — | | — | | — | | — | | — | | — | | — | |

Other income | | 15,136 | | 17,379 | | 16,445 | | 13,311 | | 12,473 | | 15,136 | | 12,473 | |

Total Revenues | | 72,933 | | 75,343 | | 74,554 | | 70,391 | | 66,855 | | 72,933 | | 66,855 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 24,766 | | 27,662 | | 28,021 | | 26,288 | | 34,110 | | 24,766 | | 34,110 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 14,332 | | 15,341 | | 14,154 | | 13,877 | | 13,683 | | 14,332 | | 13,683 | |

Other operating expenses | | 23,983 | | 25,676 | | 24,193 | | 24,139 | | 12,782 | | 23,983 | | 12,782 | |

Total Benefits and Expenses | | 63,081 | | 68,679 | | 66,368 | | 64,304 | | 60,575 | | 63,081 | | 60,575 | |

| | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAX | | $ | 9,852 | | $ | 6,664 | | $ | 8,186 | | $ | 6,087 | | $ | 6,280 | | $ | 9,852 | | $ | 6,280 | |

Asset Protection Key Data

| | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

| | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

SALES | | | | | | | | | | | | | | | |

Credit insurance | | $ | 22,790 | | $ | 18,381 | | $ | 15,628 | | $ | 10,518 | | $ | 8,483 | | $ | 22,790 | | $ | 8,483 | |

Service contracts | | 71,663 | | 82,199 | | 72,483 | | 53,517 | | 48,076 | | 71,663 | | 48,076 | |

Other products | | 16,262 | | 19,055 | | 16,126 | | 12,025 | | 11,781 | | 16,262 | | 11,781 | |

Total | | $ | 110,715 | | $ | 119,635 | | $ | 104,237 | | $ | 76,060 | | $ | 68,340 | | $ | 110,715 | | $ | 68,340 | |

20

Draft

5/03/2009

Acquisitions Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 191,492 | | $ | 193,516 | | $ | 188,377 | | $ | 191,053 | | $ | 178,676 | | $ | 191,492 | | $ | 178,676 | |

Reinsurance Ceded | | (115,763 | ) | (125,079 | ) | (120,785 | ) | (126,071 | ) | (109,607 | ) | (115,763 | ) | (109,607 | ) |

Net Premiums and Policy Fees | | 75,729 | | 68,437 | | 67,592 | | 64,982 | | 69,069 | | 75,729 | | 69,069 | |

Net investment income | | 136,213 | | 134,482 | | 132,177 | | 127,156 | | 123,541 | | 136,213 | | 123,541 | |

RIGL - Derivatives | | 28,590 | | 46,499 | | 106,974 | | 27,737 | | 57,684 | | 28,590 | | 57,684 | |

RIGL - All Other Investments | | (36,318 | ) | (50,323 | ) | (146,976 | ) | (72,964 | ) | (52,463 | ) | (36,318 | ) | (52,463 | ) |

Other income | | 1,421 | | 1,847 | | 1,605 | | 1,862 | | 1,403 | | 1,421 | | 1,403 | |

Total Revenues | | 205,635 | | 200,942 | | 161,372 | | 148,773 | | 199,234 | | 205,635 | | 199,234 | |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 154,420 | | 142,801 | | 145,153 | | 137,897 | | 138,731 | | 154,420 | | 138,731 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 19,596 | | 19,977 | | 15,405 | | 19,406 | | 17,741 | | 19,596 | | 17,741 | |

Other operating expenses | | 6,865 | | 6,939 | | 6,019 | | 1,322 | | 4,098 | | 6,865 | | 4,098 | |

Total Benefits and Expenses | | 180,881 | | 169,717 | | 166,577 | | 158,625 | | 160,570 | | 180,881 | | 160,570 | |

| | | | | | | | | | | | | | | |

INCOME (LOSS) BEFORE INCOME TAX | | 24,754 | | 31,225 | | (5,205 | ) | (9,852 | ) | 38,664 | | 24,754 | | 38,664 | |

| | | | | | | | | | | | | | | |

Adjustments to Reconcile to Operating Income: | | | | | | | | | | | | | | | |

Less: RIGL - Derivatives | | 28,590 | | 46,499 | | 106,974 | | 27,737 | | 57,684 | | 28,590 | | 57,684 | |

Less: RIGL - All Other Investments | | (36,318 | ) | (50,323 | ) | (146,976 | ) | (72,964 | ) | (52,463 | ) | (36,318 | ) | (52,463 | ) |

Add back: Related amortization of deferred policy acquisition costs and value of businesses acquired | | 1,094 | | (535 | ) | (1,776 | ) | (7 | ) | 178 | | 1,094 | | 178 | |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME | | $ | 33,576 | | $ | 34,514 | | $ | 33,021 | | $ | 35,368 | | $ | 33,621 | | $ | 33,576 | | $ | 33,621 | |

21

Draft

5/03/2009

Corporate & Other Quarterly Trends

(Dollars In Thousands) | | 1ST QTR | | 2ND QTR | | 3RD QTR | | 4TH QTR | | 1ST QTR | | 3 MOS | |

(Unaudited) | | 2008 | | 2008 | | 2008 | | 2008 | | 2009 | | 2008 | | 2009 | |

| | | | | | | | | | | | | | | |

REVENUES | | | | | | | | | | | | | | | |

Gross Premiums and Policy Fees | | $ | 8,603 | | $ | 7,991 | | $ | 6,765 | | $ | 6,483 | | $ | 6,898 | | $ | 8,603 | | $ | 6,898 | |

Reinsurance Ceded | | (1 | ) | (2 | ) | (1 | ) | (1 | ) | (1 | ) | (1 | ) | (1 | ) |

Net Premiums and Policy Fees | | 8,602 | | 7,989 | | 6,764 | | 6,482 | | 6,897 | | 8,602 | | 6,897 | |

Net investment income | | 21,744 | | 44,908 | | 14,929 | | (1,058 | ) | 29,527 | | 21,744 | | 29,527 | |

RIGL - Derivatives | | (24,227 | ) | 20,084 | | (1,402 | ) | (42,554 | ) | 14,954 | | (24,227 | ) | 14,954 | |

RIGL - All Other Investments | | 3,040 | | (64,652 | ) | (197,887 | ) | (3,141 | ) | (73,913 | ) | 3,040 | | (73,913 | ) |

Other income | | 904 | | (508 | ) | 20 | | 203 | | 51 | | 904 | | 51 | |

Total Revenues | | 10,063 | | 7,821 | | (177,576 | ) | (40,068 | ) | (22,484 | ) | 10,063 | | (22,484 | ) |

| | | | | | | | | | | | | | | |

BENEFITS & EXPENSES | | | | | | | | | | | | | | | |

Benefits and settlement expenses | | 10,367 | | 8,693 | | 8,895 | | 8,215 | | 7,715 | | 10,367 | | 7,715 | |

Amortization of deferred policy acquisition costs and value of businesses acquired | | 551 | | 564 | | 518 | | 516 | | 484 | | 551 | | 484 | |

Other operating expenses | | 50,789 | | 47,011 | | 46,388 | | 40,212 | | 39,761 | | 50,789 | | 39,761 | |

Total Benefits and Expenses | | 61,707 | | 56,268 | | 55,801 | | 48,943 | | 47,960 | | 61,707 | | 47,960 | |

| | | | | | | | | | | | | | | |

INCOME (LOSS) BEFORE INCOME TAX | | (51,644 | ) | (48,447 | ) | (233,377 | ) | (89,011 | ) | (70,444 | ) | (51,644 | ) | (70,444 | ) |

| | | | | | | | | | | | | | | |

Adjustments to Reconcile to Operating Income: | | | | | | | | | | | | | | | |

Less: RIGL-Derivatives | | (24,227 | ) | 20,084 | | (1,402 | ) | (42,554 | ) | 14,954 | | (24,227 | ) | 14,954 | |

Less: RIGL-All Other Investments, net of participating income | | 3,040 | | (64,652 | ) | (197,887 | ) | (3,141 | ) | (73,913 | ) | 3,040 | | (73,913 | ) |

Add back: Derivative gains related to corporate debt and investments | | 484 | | 1,786 | | 1,915 | | 1,569 | | 2,238 | | 484 | | 2,238 | |

| | | | | | | | | | | | | | | |

PRE-TAX OPERATING INCOME (LOSS) | | $ | (29,973 | ) | $ | (2,093 | ) | $ | (32,173 | ) | $ | (41,747 | ) | $ | (9,247 | ) | $ | (29,973 | ) | $ | (9,247 | ) |

22