As filed with the U.S. Securities and Exchange Commission on November 19, 2024

File No. 333-

WASHINGTON, D.C. 20549

Catherine L. Newell, Esquire, President and General Counsel

Jana L. Cresswell, Esquire

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

DIMENSIONAL FUND ADVISORS LP

DFA Investment Dimensions Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

[ ], 2024

Dear Shareholder:

We are contacting you with some important information concerning your investment in the Dimensional 2010 Target Date Retirement Income Fund.

The Board of Directors of DFA Investment Dimensions Group Inc. has approved the reorganization (the “Reorganization”) of the Dimensional 2010 Target Date Retirement Income Fund (the “Target Portfolio”) into the Dimensional Retirement Income Fund (the “Acquiring Portfolio” and with the Target Portfolio, the “Portfolios”).

The Portfolios are part of Dimensional Fund Advisors LP’s (“Dimensional”) suite of target date retirement income funds that seek to achieve an asset allocation consistent with the fund’s position on the evolving asset allocation “glide path” disclosed in its prospectus. Based on the design of the glide path, each such fund generally becomes more conservative (e.g., by reducing its allocation to equity underlying funds and increasing its allocation to fixed income underlying funds) until reaching a final static asset allocation or “landing point” fifteen years after its target date, at which time the fund will have approximately the same asset allocation as the Acquiring Portfolio. Accordingly, as disclosed in the Target Portfolio’s prospectus, the Target Portfolio will have approximately the same asset allocation as the Acquiring Portfolio as of 2025, which is fifteen years past the Target Portfolio’s targeted retirement date.

The Reorganization is expected to occur on or about February 7, 2025. Upon completion of the Reorganization, shareholders of the Target Portfolio will become shareholders of the Acquiring Portfolio, and will receive shares of the Acquiring Portfolio equal in value to their shares in the Target Portfolio. The Reorganization is expected to be tax-free for federal income tax purposes, and no sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee will be charged by the Portfolios as a result of the Reorganization.

The Reorganization does not require shareholder approval, and you are not being asked to vote.

However, we do ask that you review the enclosed combined Information Statement/Prospectus, which contains information about the Acquiring Portfolio, including fees and expenses.

The Board of Directors of DFA Investment Dimensions Group Inc., including a majority of the independent directors of the Board, on behalf of each Portfolio, have unanimously approved the Reorganization and believes the Reorganization is in the best interests of the Portfolios and their shareholders.

If you have questions, please call Dimensional collect at 512-306-7400.

Thank you for investing with Dimensional.

Sincerely,

Gerard K. O’Reilly

Chairman

INFORMATION STATEMENT/PROSPECTUS

Dated [ , 2024]

DFA Investment Dimensions Group Inc.

6300 Bee Cave Road, Building One

Austin, TX 78746

(512) 306-7400

This Information Statement/Prospectus is being furnished to shareholders of the Dimensional 2010 Target Date Retirement Income Fund (the “Target Portfolio”) in connection with the reorganization of the Target Portfolio into the Dimensional Retirement Income Fund (the “Acquiring Portfolio”), another portfolio in the Dimensional Fund Complex as described below.

The Board of Directors (the “Board”) of DFA Investment Dimensions Group, Inc. (“DFAIDG”) approved a Plan of Reorganization (the “Plan”) under which:

| (i) | the Acquiring Portfolio, a series of DFAIDG, will acquire substantially all of the assets of the Target Portfolio, also a series of DFAIDG, in exchange solely for shares of common stock of the Acquiring Portfolio; |

| (ii) | the shares of the Acquiring Portfolio will be distributed to the shareholders of the Target Portfolio according to their respective interests in such Target Portfolio; and |

| (iii) | the Target Portfolio will be liquidated and dissolved (the “Reorganization”). |

A copy of the Plan is provided in Exhibit A hereto.

The shares of the Acquiring Portfolio received by the shareholders of the Target Portfolio in the exchange will be equal in aggregate net asset value to the aggregate net asset value of their shares of the Target Portfolio as of the closing date of the Reorganization. The Reorganization is expected to be effective on or about February 7, 2025.

The Board of Directors of DFAIDG (the “Board”), including a majority of the directors who are not “interested persons” (the “Independent Directors”) as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), believes that the Reorganization is in the best interests of the Target Portfolio and that the interests of the Target Portfolio’s shareholders will not be diluted as a result of the Reorganization. Similarly, the Board, including a majority of the Independent Directors, believes that the Reorganization is in the best interests of the Acquiring Portfolio, and that the interests of the Acquiring Portfolio’s shareholders will not be diluted as a result of the Reorganization. For federal income tax purposes, the Reorganization is intended to be structured as a tax-free transaction for the Target Portfolio, the Acquiring Portfolio, and their shareholders.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATION PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Each of the Target Portfolio and the Acquiring Portfolio is a diversified portfolio of DFAIDG, a corporation created under the laws of Maryland, which is registered with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”) as an open-end management investment company. The investment objectives of the Target Portfolio and the Acquiring Portfolio (together, the “Portfolios”) are identical—to provide total return consistent with the Portfolio's asset allocation. Total return is composed of income and capital appreciation. The principal offices of DFAIDG are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746. The Portfolios are sponsored by Dimensional Fund Advisors LP (“Dimensional”). The principal offices of Dimensional are located at 6300 Bee Cave Road, Building One, Austin, Texas 78746.

This Information Statement/Prospectus, which you should read carefully and retain for future reference, sets forth concisely the information that you should know before investing. A statement of additional information, dated [

__, 2024], relating to this Information Statement/Prospectus and the proposed Reorganization, is available upon request and without charge by calling collect or writing to Dimensional at the phone number and address listed above. The

prospectus of the Acquiring Portfolio, dated February 28, 2024 (as it may be supplemented through the date hereof) (the “Acquiring Portfolio’s Prospectus”), accompanies this Information Statement/Prospectus and is incorporated herein by reference, which means that the Acquiring Portfolio’s Prospectus is legally considered to be a part of this Information Statement/Prospectus.

Additional information about the Acquiring Portfolio, the Target Portfolio, and the proposed Reorganization, including the prospectuses, statements of additional information, and the most recent annual and semi-annual shareholder reports and other information such as Portfolio Financial Statements for the Acquiring Portfolio and the Target Portfolio, has been filed with the SEC and is available, free of charge, by (i) calling Dimensional collect at 512-306-7400, (ii) accessing the documents at the Portfolios’ website at https://us.dimensional.com/fund-documents, or (iii) writing to the Portfolios at the address listed on the cover of this Information Statement/Prospectus. In addition, these documents may be obtained from the EDGAR database on the Commission’s Internet site at http://www.sec.gov. You also may obtain this information upon payment of a duplicating fee, by e-mailing the Commission at the following address: publicinfo@sec.gov.

This Information Statement/Prospectus, dated [ ], 2024, and the Exhibit are expected to be mailed to shareholders of the Target Portfolio on or about [January __], 2025.

AN INVESTMENT IN THE PORTFOLIOS IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR

ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN THE PORTFOLIOS INVOLVES INVESTMENT RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

LIKE ALL MUTUAL FUNDS, THE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

SUMMARY

| | 1 |

| How will the Reorganization work?

| 1 |

| Why did the Board approve the Reorganization?

| 1 |

| | How will the Reorganization affect me?

| 2 |

| | Who will bear the costs associated with the Reorganization?

| 2 |

| | What are the federal income tax consequences of the Reorganization?

| 3 |

| | How do the Portfolios’ investment objectives, investment strategies, and investment policies compare?

| 3 |

| | What are the principal risks of an investment in the Portfolios?

| 4 |

| | How will the Reorganization affect my fees and expenses?

| 5 |

| | What are the distribution arrangements for the Portfolios?

| 5 |

| | What are the Portfolios’ arrangements for purchases, exchanges, and redemptions?

| 5 |

COMPARISON OF SOME IMPORTANT FEATURES OF THE PORTFOLIOS

| 7 |

| | How do the performance records of the Portfolios compare?

| 7 |

| | What are the fees and expenses of the Portfolios and what might they be after the Reorganization?

| 10 |

| | Expense Example

| 11

|

| | What are the Portfolios’ dividend payment policies and pricing arrangements?

| 11 |

| | Who manages the Portfolios?

| 12 |

INFORMATION ABOUT THE REORGANIZATION

| 14 |

| | Reasons for the Reorganization

| 14 |

INFORMATION ABOUT THE PLAN

| 17 |

| | How will the Reorganization be carried out?

| 17 |

| | Who will pay the expenses of the Reorganization?

| 18 |

| | What are the tax consequences of the Reorganization?

| 18 |

CAPITAL STRUCTURE AND SHAREHOLDER RIGHTS

| 20 |

| | Capital Structure

| 20 |

| | Rights of Target Portfolio and Acquiring Portfolio Shareholders

| 21 |

| | What is the capitalization of the Portfolios?

| 22 |

ADDITIONAL INFORMATION ABOUT THE ACQUIRING PORTFOLIO AND THE TARGET PORTFOLIO

| 23 |

| | Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks

| 23 |

| | How do the fundamental investment policies of the Portfolios compare?

| 29 |

| | Where can I find more financial and performance information about the Portfolios?

| 29 |

PRINCIPAL SHAREHOLDERS

| 30 |

ADDITIONAL INFORMATION

| 31 |

FINANCIAL HIGHLIGHTS

| 32 |

SUMMARY

This is only a summary of certain information contained in this Information Statement/Prospectus. Shareholders should carefully read the more complete information in the rest of this Information Statement/Prospectus, including the Plan relating to the Reorganization, a form of which is attached to this Information Statement/Prospectus in Exhibit A, and the Acquiring Portfolio’s Prospectus, which accompanies this Information Statement/Prospectus.

How will the Reorganization work?

Under the Plan, substantially all of the Target Portfolio’s assets will be transferred to the Acquiring Portfolio, in exchange for shares of the Acquiring Portfolio of equivalent aggregate net asset value (“NAV”). Your shares of the Target Portfolio will be exchanged for shares of equivalent aggregate NAV of the Acquiring Portfolio. Because each Portfolio has a different NAV per share, the number of Acquiring Portfolio shares that you receive likely will be different than the number of Target Portfolio shares that you own, even though the total value of your investment will be the same immediately before and after the exchange. After shares of the Acquiring Portfolio are distributed to the Target Portfolio’s shareholders, the Target Portfolio will be completely liquidated and dissolved. (The transaction is referred to in this Information Statement/Prospectus as the “Reorganization.”) As a result of the Reorganization, you will cease to be a shareholder of the Target Portfolio and will become a shareholder of the Acquiring Portfolio. This exchange will occur on the closing date of the Reorganization, which is the specific date on which the Reorganization takes place. The closing date of the Reorganization is expected to occur on or about February 7, 2025.

Why did the Board approve the Reorganization?

The Portfolios are part of Dimensional’s suite of target date retirement income funds. Over time, the Target Portfolio’s asset allocation strategy has become generally more conservative (e.g., by reducing its allocation to equity Underlying Funds (defined below) and increasing its allocation to fixed income Underlying Funds) until it reaches the final “landing point,” which is 15 years after its target date (i.e., 2025 in the case of the Target Portfolio). At such time, the Target Portfolio will reach its final static asset allocation, which is expected to be approximately the same asset allocation as the Acquiring Portfolio. The Target Portfolio will have an identical investment objective, investment restrictions and risks, and substantially identical investment strategies as the Acquiring Portfolio.

It is expected that the Reorganization will enable the combined Portfolio to operate more efficiently in the future. Dimensional will continue as the investment adviser of the combined Portfolio after the Reorganization and no change in portfolio managers will result from the Reorganization. In addition, no increase in management, administration or other fee rates will result from the Reorganization. The Target Portfolio and the Acquiring Portfolio have the same expense structure, the same types of fees and the same fee rates.

The portfolio managers of the Acquiring Portfolio have reviewed the portfolio holdings of the Target Portfolio and, as of October 31, 2024, all the securities held by the Target Portfolio comply with the compliance guidelines and/or investment restrictions of the Acquiring Portfolio. It is not anticipated that the Acquiring Portfolio will sell any securities of the Target Portfolio acquired in the Reorganization in preparation for, or as a result of, the Reorganization, other than in the ordinary course of business. Consequently, minimal transaction costs are anticipated to be incurred in restructuring the portfolio holdings of the Target Portfolio in connection with the Reorganization.

The Board, including all of the Board’s Directors who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (together, the “Independent Directors”), after careful consideration, have determined that the Reorganization is in the best interests of the Target Portfolio and will not dilute the interests of the existing shareholders of the Target Portfolio. The Board made this determination based on various factors, including economies of scale and operational efficiencies, in addition to those that are discussed in this Information Statement/Prospectus, under the discussion of the Reorganization in the section entitled “Reasons for the Reorganization.”

Similarly, the Board, including all of the Independent Directors, has approved the Reorganization with respect to the Acquiring Portfolio. The Board has determined that the Reorganization is in the best interests of the Acquiring Portfolio and that the interests of the Acquiring Portfolio’s shareholders will not be diluted as a result of the Reorganization.

How will the Reorganization affect me?

If your Reorganization is consummated, you will cease to be a shareholder of the Target Portfolio and will become a shareholder of the Acquiring Portfolio. Upon completion of the Reorganization, it is anticipated that the Reorganization will benefit you because the Target Portfolio’s shareholders will become shareholders of a larger fund that may be able to achieve greater operating efficiencies from economies of scale. For a more detailed comparison of the Portfolios’ fees and expenses, see the section below “What are the fees and expenses of the Portfolios and what might they be after the Reorganization?”

Who will bear the costs associated with the Reorganization?

It is anticipated that the total costs of the Reorganization, including the expenses of preparing, printing, and mailing this Information Statement/Prospectus, will be approximately $95,000. The expenses of the Reorganization will be paid by the Target Portfolio. However, in light of the Target Portfolio’s current expense assumption agreement that does not expire until after the anticipated closing date of the Reorganization, Dimensional will pay the Portfolio’s allocation of the reorganization expenses.

What are the federal income tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Target Portfolio and the Acquiring Portfolio must receive an opinion of Stradley Ronon Stevens & Young LLP (“Stradley Ronon”) to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor, in general, the Target Portfolio will recognize gain or loss as a direct result of the Reorganization of the Target Portfolio, and the holding period and aggregate tax basis for the Acquiring Portfolio shares that you receive will be the same as the holding period and aggregate tax basis of the Target Portfolio shares that you surrender in the Reorganization. At any time prior to the consummation of the Reorganization, you may redeem your Target Portfolio shares, generally resulting in the recognition of gain or loss for U.S. federal income tax purposes.

You should, however, consult your tax advisor regarding the effect, if any, of the Reorganization, in light of your individual circumstances. You should also consult your tax advisor about state and local tax consequences. For more information about the tax consequences of the Reorganization, please see the section “Information About the Reorganization—What are the tax consequences of the Reorganization?”

How do the Portfolios’ investment objectives, investment strategies, and investment policies compare?

The Target Portfolio and Acquiring Portfolio have identical investment objectives. Each Portfolio’s investment objective is fundamental and cannot be changed without shareholder approval. The Target Portfolio and Acquiring Portfolio employ substantially identical principal investment strategies in seeking to achieve their respective objectives, although there are certain differences.

Each Portfolio, as a fund of funds, allocates and reallocates its assets among a combination of equity and fixed income mutual funds managed by Dimensional (the “Underlying Funds”), which includes exposure through those fixed income Underlying Funds to long-term and intermediate-term U.S. Treasury inflation-protected securities. The Target Portfolio’s allocation to the Underlying Funds changes based on an asset allocation strategy that becomes generally more conservative, by reducing its allocation to equity Underlying Funds and increasing its allocation to fixed income Underlying Funds, until reaching the final “landing point,” which is 15 years after the target date (i.e., 2025 in the case of the Target Portfolio), at which time the Portfolio reaches its final static asset allocation. In contrast,

the Acquiring Portfolio allocates its assets according to an asset allocation strategy designed for investors who have retired and are planning to withdraw the value of the investment in the Portfolio over many years. The asset allocation strategy for both Portfolios reflects the need for reduced equity risk and lower volatility of the inflation-adjusted income the Portfolio may be able to support during an investor’s retirement.

As noted above, each Portfolio’s allocation to its Underlying Funds is based on the Portfolio’s position on the glide path utilized for Dimensional’s suite of target date retirement income funds, which results in different acquired fund fees and expenses for each Portfolio (e.g., as noted below, the fees and expenses of the Acquiring Portfolio were 0.01% (one basis point) higher than the fees and expenses of the Target Portfolio as reflected in each Portfolio’s currently effective prospectus). When the Target Portfolio reaches the landing point in 2025, however, it is expected to have approximately the same asset allocation as the Acquiring Portfolio. For further information about the Portfolios’ investment objectives and investment strategies, see “Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks,” below.

The Portfolios have adopted identical fundamental investment restrictions, which may not be changed without prior shareholder approval. The Acquiring Portfolio’s fundamental investment restrictions are listed in the Acquiring Portfolio’s

statement of additional information, dated February 28, 2024 (as supplemented through the date hereof), which is incorporated by reference into the

statement of additional information relating to this Information Statement/Prospectus, and is available upon request. The Target Portfolio’s fundamental investment restrictions are listed in its statement of additional information, dated February 28, 2024 (as supplemented through the date hereof), which is incorporated by reference into the statement of additional information relating to this Information Statement/Prospectus, and is available upon request.

What are the principal risks of an investment in the Portfolios?

An investment in each Portfolio involves risks common to most mutual funds. There is no guarantee against losses resulting from investments in the Portfolios, nor that the Portfolios will achieve their investment objectives. The risks associated with an investment in the Target

Portfolio and the Acquiring Portfolio are identical. You may lose money if you invest in the Portfolios.

For further information about the risks of investments in the Portfolios, see “Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks,” below.

How will the Reorganization affect my fees and expenses?

The fees and expenses of the Acquiring Portfolio are 0.01% (one basis point) higher than the fees and expenses of the Target Portfolio as reflected in each Portfolio’s currently effective prospectus due to the Acquiring Portfolio’s acquired fund fees and expenses, which are excluded from each Portfolio’s expense assumption agreement. The difference between the acquired fund fees and expenses incurred by the Portfolios during the most recent fiscal year is a result of each Portfolio’s allocation to its Underlying Funds based on the Portfolio’s position on the glide path utilized for Dimensional’s suite of target date retirement income funds; however, as described in additional detail below, prior to the Reorganization, it is anticipated that the Portfolios’ Underlying Fund allocations and position on the glidepath will be substantially identical. In addition, Dimensional has agreed to extend the Acquiring Portfolio’s expense assumption agreement through February 28, 2026 in order to limit the Acquiring Portfolio’s expenses until at least such date. However, because the Acquiring Portfolio’s acquired fund fees and expenses are excluded from its expense assumption agreement, the Acquiring Portfolio’s fees and expenses will be higher than the Target Portfolio’s current fees and expenses.

What are the distribution arrangements for the Portfolios?

The Portfolios are distributed by DFA Securities LLC (“DFAS”), which serves as the principal underwriter for the shares of the Portfolios. DFAS is a wholly-owned subsidiary of Dimensional. The principal business address of DFAS is 6300 Bee Cave Road, Building One, Austin, Texas 78746. Pursuant to the Amended and Restated Distribution Agreement (the “Distribution Agreement”) between DFAS and DFAIDG on behalf of each Portfolio, DFAS uses its best efforts to arrange for the sale of the Portfolios’ shares, which are continuously offered. No sales charges are paid by investors or the Portfolios. No compensation is paid by the Portfolios to DFAS under the Distribution Agreement.

Each Portfolio currently offers one class of shares, which does not charge a front-end sales load at the time of purchase or a contingent-deferred sales load at the time of redemption.

What are the Portfolios’ arrangements for purchases, exchanges, and redemptions?

The Target Portfolio and the Acquiring Portfolio have identical procedures for purchasing, exchanging and redeeming shares. You may refer to the Acquiring Portfolio’s Prospectus, which accompanies this Information Statement/Prospectus, under the sections

titled “Purchase of Shares,” “Exchange of Shares” and “Redemption of Shares” for the procedures applicable to purchases, exchanges, and redemptions of the shares of each Portfolio, which are also summarized below. In addition, the Target Portfolio and the Acquiring Portfolio have identical policies regarding excessive or short-term trading.

Shares of each Portfolio generally are available to defined contribution plans and other similar group benefit plans that are exempt from taxation under the Code and employer sponsored non-qualified deferred compensation plans (“Retirement Plans”). In addition to Retirement Plans, the Portfolios are available for investment only by institutional clients, clients of registered investment advisors, clients of financial institutions, and a limited number of certain other investors, each as approved from time to time by Dimensional. There is currently no minimum initial or subsequent investment requirement for any of the Portfolios. All investments are subject to the approval of Dimensional. Shares may be purchased by shareholders of each Portfolio by contacting the shareholder’s financial adviser or other financial intermediary. Shareholders of the Target Portfolio will be eligible to purchase shares of the Acquiring Portfolio following the Reorganization.

The purchase price of a share of each Portfolio is its NAV per share. The NAV per share of each Portfolio is calculated after the close of the New York Stock Exchange (the “NYSE”) (normally, 4:00 p.m. Eastern Time) on each day the NYSE is open. Provided that a Portfolio’s transfer agent or a transfer agent sub-designee has received the investor’s Account Registration Form in good order, shares of the Portfolio will be priced at the public offering price, which is the NAV of the shares next determined after receipt of the investor’s order. Each Portfolio reserves the right to reject any initial or subsequent investment request.

Each of the Target Portfolio and the Acquiring Portfolio permits its shareholders to exchange shares of the Portfolio, respectively, for shares of certain other portfolios of DFAIDG and Dimensional Investment Group Inc. (“DIG”). An exchange involves the simultaneous redemption of shares of one portfolio and the purchase of shares of another portfolio at each portfolio’s respective closing NAV next determined after the request for exchange has been received, and is a taxable transaction.

Each Portfolio redeems its shares at the NAV of such shares next determined after receipt of a written request for redemption in good order by the Portfolio’s transfer agent (or by a financial intermediary or sub-designee, if applicable).

Each Portfolio is intended for long-term investors and is not intended for investors that engage in excessive short-term trading activity that may be harmful to the Portfolios, including but not limited to market timing. The Board has adopted a policy (the “Trading Policy”) that is designed to discourage and prevent market timing or excessive short-term trading in the Portfolios. Under purchase blocking procedures implemented by Dimensional, DFAS, and their agents, subject to certain exemptions, an investor who has engaged in any two purchases and two redemptions (including redemptions that are part of an exchange transaction) in a Portfolio in any rolling 30 calendar day monitoring period (i.e., two “round trips”) will be blocked from making any additional purchases in the Portfolio for 90 calendar days (a “purchase block”). You

may refer to the Acquiring Portfolio’s Prospectus, which accompanies this Information Statement/Prospectus, under the section titled “Policy Regarding Excessive Short-Term Trading,” for further information relating to the Trading Policy and the procedures applicable to purchase blocks.

COMPARISON OF SOME IMPORTANT FEATURES OF THE PORTFOLIOS

How do the performance records of the Portfolios compare?

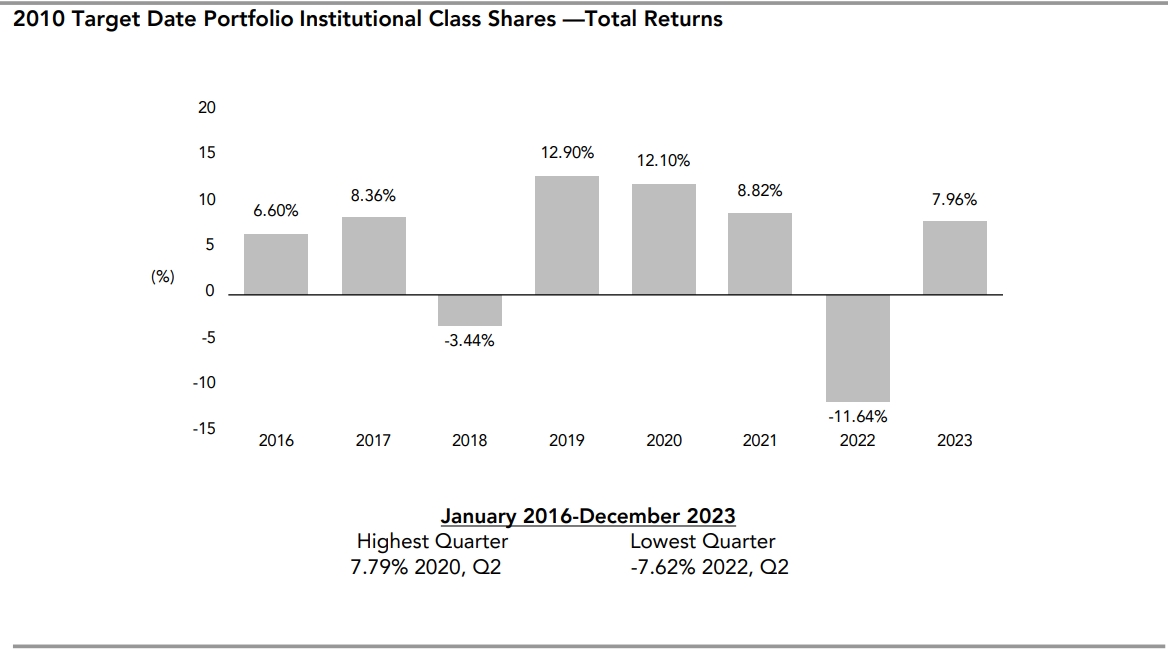

The bar charts and tables below illustrate the variability of the Portfolios’ returns and are meant to provide some indication of the risks of investing in the Portfolios. The bar charts show the changes in performance from year to year. The tables illustrate how annualized one year, five year and since inception returns, both before and after taxes, compare with those of a broad measure of market performance. The table also includes the performance of additional indexes with similar investment universes of each Portfolio, or certain portions of each Portfolio. Past performance (before and after taxes) is not an indication of future results. The indexes in each table do not reflect a deduction for fees, expenses, or any applicable taxes related to the sale of securities at index reconstitutions. If applicable, the indexes’ returns do, however, reflect the deduction of estimated withholding taxes with respect to the reinvestment of dividends paid by index holdings, with the estimates of withholding tax rates and the resulting change in valuations and returns computed by the relevant index provider.

The after-tax returns presented for the Portfolios are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown in the tables. In addition, the after-tax returns shown are not relevant to investors who hold shares of the Portfolios through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

The accounting survivor of the Reorganization will be the Acquiring Portfolio. As a result, the combined Portfolio will continue the performance history of the Acquiring Portfolio after the closing of the Reorganization.

Target Portfolio—Dimensional 2010 Target Date Retirement Income Fund

Year to date returns as of September 30, 2024: 7.67%

Annualized Returns (%)

Periods ending December 31, 2023

| | 1 Year | 5 Years | Since

Inception |

| 2010 Target Date Portfolio | | | |

| Return Before Taxes | 7.96% | 5.61% | 4.55%1 |

| Return After Taxes on Distributions | 6.62% | 4.21% | 3.37%1 |

| Return After Taxes on Distributions and Sale of Portfolio Shares | 4.76% | 3.86% | 3.11%1 |

Bloomberg U.S. TIPS Index (reflects no deduction for fees, expenses or taxes on sales) | 3.90% | 3.15% | 2.60%1 |

ICE BofA 1-3 Year Global Government Index (hedged to USD)2 (reflects no deduction for fees, expenses or taxes on sales) | 4.84% | 1.48% | 1.42%1 |

S&P Global BMI Index (net dividends) (reflects no deduction for fees, expenses or taxes on sales) | 21.32% | 11.23% | 8.82%1 |

Bloomberg Global Aggregate Bond Index (hedged to USD)3 (reflects no deduction for fees, expenses or taxes on sales) | 7.15% | 1.40% | 1.91%1 |

1. Since inception November 2, 2015.

2. ICE BofA index data copyright 2023 ICE Data Indices, LLC. Prior to July 1, 2022, index returns reflect no deduction for transaction costs. Effective July 1, 2022, index returns include transaction costs (as determined and calculated by the index provider), which may be higher or lower than the actual transaction costs incurred by the Portfolio.

3. Effective February 28, 2024, the Portfolio incorporated this broad-based securities market index to reflect the overall applicable securities market of the Portfolio.

Acquiring Portfolio—Dimensional Retirement Income Fund

Year to date returns as of September 30, 2024: 7.55%

Annualized Returns (%)

Periods ending December 31, 2023

| | 1 Year | 5 Years | Since Inception |

| Retirement Income Portfolio | | | |

| Return Before Taxes | 7.75% | 4.64% | 3.75%1 |

| Return After Taxes on Distributions | 6.46% | 3.56% | 2.82%1 |

| Return After Taxes on Distributions and Sale of Portfolio Shares | 4.64% | 3.18% | 2.55%1 |

Bloomberg U.S. TIPS Index (reflects no deduction for fees, expenses or taxes on sales) | 3.90% | 3.15% | 2.60%1 |

ICE BofA US 3-Month Treasury Bill Index2 (reflects no deduction for fees, expenses or taxes on sales) | 5.01% | 1.88% | 1.53%1 |

S&P Global BMI Index (net dividends) (reflects no deduction for fees, expenses or taxes on sales) | 21.32% | 11.23% | 8.82%1 |

Bloomberg Global Aggregate Bond Index (hedged to USD)3 (reflects no deduction for fees, expenses or taxes on sales) | 7.15% | 1.40% | 1.91%1 |

1. Since inception November 2, 2015.

2. ICE BofA index data copyright 2023 ICE Data Indices, LLC. Prior to July 1, 2022, index returns reflect no deduction for transaction costs. Effective July 1, 2022, index returns include transaction costs (as determined and calculated by the index provider), which may be higher or lower than the actual transaction costs incurred by the Portfolio.

3. Effective February 28, 2024, the Portfolio incorporated this broad-based securities market index to reflect the overall applicable securities market of the Portfolio.

What are the fees and expenses of the Portfolios and what might they be after the Reorganization?

Shareholders of the Portfolios pay various fees and expenses, either directly or indirectly. The table below shows the fees and expenses that you would pay if you were to buy and hold shares of each Portfolio. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below. The fees and expenses in the table appearing below are based on the expenses of the Portfolios for the fiscal year ended October 31, 2023. The table also shows the pro forma expenses of the combined Acquiring Portfolio after giving effect to the Reorganization, based on pro forma net assets as of October 31, 2023. Pro forma numbers are estimated in good faith and are hypothetical. The tables below reflect the expenses of each Portfolio. Actual expenses may vary significantly. You will not pay any sales load, contingent deferred sales charge, commission, redemption fee, or other transaction fee in connection with the Reorganization.

| | Target Portfolio | Acquiring Portfolio | Pro Forma—Acquiring Portfolio after Reorganization |

Shareholder Fees (fees paid directly from your investment): | None | None | None |

Annual Portfolio Operating Expenses for Target Portfolio and Acquiring Portfolio

(expenses deducted from Portfolio assets)

| | Target Portfolio | Acquiring Portfolio | Pro Forma—Acquiring Portfolio after Reorganization |

Management Fee | None | None | None |

Other Expenses | 0.18% | 0.09% | 0.09% |

Acquired Fund Fees and Expenses | 0.12% | 0.13% | 0.13% |

Total Annual Operating Expenses | 0.30% | 0.22% | 0.22% |

Expense Reimbursements | 0.12%* | 0.03%** | 0.03%** |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 0.18% | 0.19% | 0.19% |

| * | Dimensional has agreed in certain instances to assume certain expenses of the Target Portfolio. The Expense Assumption Agreement for the Target Portfolio will remain in effect through February 28, 2025, and may only be terminated by the Fund’s Board of Directors prior to that date. Under certain circumstances and only prior to the Reorganization, Dimensional retains the right to seek reimbursement for any expenses previously assumed up to thirty-six months after such expense assumption. Following the Reorganization, Dimensional will not seek reimbursement of previously waived fees and/or assumed expenses of the Target Portfolio. |

| ** | Dimensional has agreed in certain instances to assume certain expenses of the Acquiring Portfolio. The Expense Assumption Agreement for the Acquiring Portfolio will remain in effect through February 28, 2026, and may only be terminated by the Fund’s Board of Directors prior to that date. Under certain circumstances, Dimensional retains the right to seek reimbursement for any fees previously waived and/or expenses previously assumed of the Acquiring Portfolio up to thirty-six months after such expense assumption, only if the expense ratio following such reimbursement would be less than the expense limitation that was in place when such prior year expenses assumed, and less than the current expense limitation in place for the Acquiring Portfolio. |

Expense Example

This Example is meant to help you compare the cost of investing in the Acquiring Portfolio with the cost of investing in the Target Portfolio.

The Example assumes that you invest $10,000 in the Portfolios for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that a Portfolio’s operating expenses remain the same. The costs for each Portfolio reflect the net expenses of the Portfolio that result from the contractual expense waiver and assumption in the first year only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

Target Portfolio | $18 | $84 | $157 | $369 |

Acquiring Portfolio | $19 | $68 | $121 | $277 |

Pro Forma—Acquiring Portfolio after Reorganization | $19 | $68 | $121 | $277 |

What are the Portfolios’ dividend payment policies and pricing arrangements?

The dividend payment policies of the Portfolios are identical. Dividends from net investment income of each Portfolio are generally distributed quarterly (on a calendar basis) and any net realized capital gains (after any reductions for capital loss carryforwards) are distributed annually, typically in December. The Portfolios intend to make distributions that may be taxed as ordinary income and capital gains (which may be taxable at different rates, depending on the length of time a Portfolio holds the assets). The Portfolios may distribute such income dividends and capital gains more frequently, if necessary, in order to reduce or eliminate federal excise or income taxes on the Portfolios. Shareholders of each Portfolio automatically receive all income dividends and capital gains distributions in additional shares of the Portfolio at NAV, unless, upon written notice to Dimensional and completion of the requisite account information, another option is selected by shareholders. All Portfolios notify

their shareholders annually of the source and tax status of all dividends and distributions for federal income tax purposes. For additional information, you may refer to the Acquiring Portfolio’s Prospectus, which accompanies this Information Statement/Prospectus, under the section titled “Dividends, Capital Gains Distributions and Taxes.”

The Portfolios have identical procedures for calculating their share prices and valuing their portfolio securities. The Portfolios determine their NAV per share after the close of the NYSE (normally, 4:00 p.m., Eastern Time). The Portfolios will not be priced on days that the NYSE is closed for trading. DFAIDG has adopted identical policies and procedures for valuing the Portfolios’ portfolio assets. For more information about the Acquiring Portfolio’s pricing procedures, you may refer to the Acquiring Portfolio’s Prospectus, which accompanies this Information Statement/Prospectus, under the section titled “Valuation of Shares.”

Who manages the Portfolios?

The management of the business and affairs of each Portfolio is the responsibility of the Board. The Board elects officers, who are responsible for the day-to-day operations of the Portfolios.

Dimensional serves as investment advisor to each Portfolio and their respective Underlying Funds. Pursuant to an Investment Management Agreement with each Portfolio and Underlying Fund, Dimensional is responsible for the management of its assets. There are no material differences between the Target Portfolio’s and Acquiring Portfolio's Investment Management Agreements. The Portfolios are managed using a team approach. The investment team includes the Investment Committee of Dimensional, portfolio managers, and trading personnel.

The Investment Committee is composed primarily of certain officers and directors of Dimensional who are appointed annually. As of the date of this Information Statement/Prospectus, the Investment Committee has fourteen members. Investment strategies for the Portfolios and the Underlying Funds are set by the Investment Committee, which meets on a regular basis and also as needed to consider investment issues. The Investment Committee also sets and reviews all investment-related policies and procedures and approves any changes in regards to approved countries, security types, and brokers.

Each Portfolio does not pay a management fee to Dimensional for the services provided by Dimensional to the Portfolio pursuant to its Investment Management Agreement. As a shareholder of the Underlying Funds, however, each Portfolio pays its proportionate shares of the management fees paid to Dimensional by the Underlying Funds.

In accordance with the team approach used to manage the Portfolios and the Underlying Funds, the portfolio managers and portfolio traders implement the policies and procedures established by the Investment Committee. The portfolio managers and portfolio traders also make daily investment decisions regarding the Portfolios based on the parameters

established by the Investment Committee. The individuals named below coordinate the efforts of all other portfolio managers or trading personnel with respect to the day-to-day management of the Portfolios.

Jed S. Fogdall is Global Head of Portfolio Management, Chairman of the Investment Committee, a Vice President, and Senior Portfolio Manager of Dimensional. Mr. Fogdall has an MBA from the University of California, Los Angeles and a BS from Purdue University. Mr. Fogdall joined Dimensional as a portfolio manager in 2004 and has been responsible for the Portfolios since inception (2015).

Joseph F. Kolerich is Head of Fixed Income, Americas, a member of the Investment Committee, Vice President, and Senior Portfolio Manager of Dimensional. Mr. Kolerich has an MBA from the University of Chicago Booth School of Business and a BS from Northern Illinois University. Mr. Kolerich joined Dimensional as a portfolio manager in 2001 and has been responsible for the Portfolios since inception (2015).

David A. Plecha is Global Head of Fixed Income Portfolio Management, a member of the Investment Committee, Vice President, and Senior Portfolio Manager of Dimensional. Mr. Plecha received his BS from the University of Michigan at Ann Arbor in 1983 and his MBA from the University of California at Los Angeles in 1987. Mr. Plecha has been a portfolio manager since 1989 and has been responsible for the Portfolios since inception (2015).

Allen Pu is Deputy Head of Portfolio Management, North America, a member of the Investment Committee, Vice President, and Senior Portfolio Manager of Dimensional. Mr. Pu has an MBA from the University of California, Los Angeles, an MS and PhD from Caltech, and a BS from Cooper Union for the Advancement of Science and Art. Mr. Pu joined Dimensional as a portfolio manager in 2006 and has been responsible for the Portfolios since inception (2015).

Mary T. Phillips is Deputy Head of Portfolio Management, North America, a member of the Investment Committee, Vice President, and Senior Portfolio Manager of Dimensional. Ms. Phillips holds an MBA from the University of Chicago Booth School of Business and a BA from the University of Puget Sound. Ms. Phillips joined Dimensional in 2012, has been a portfolio manager since 2014, and has been responsible for the Portfolios since 2017.

Ashish P. Bhagwanjee is a Vice President and Senior Portfolio Manager of the Advisor. Mr. Bhagwanjee holds an MBA from the University of Chicago and a BS from Purdue University. Mr. Bhagwanjee joined the Advisor in 2014, has been a portfolio manager since 2017, and has been responsible for the Portfolios since 2020.

Dimensional provides the Underlying Funds with a trading department and selects brokers and dealers to effect securities transactions. Securities transactions are placed with a view to obtaining the best price and execution of such transactions. A discussion regarding the basis for the Board of Directors approving the Investment Management Agreement with respect to each Portfolio is available in the semi-annual report for the Portfolios for the fiscal

period ending April 30, 2024. Dimensional’s address is 6300 Bee Cave Road, Building One, Austin, TX 78746. Dimensional has been engaged in the business of providing investment management services since May 1981. Dimensional is currently organized as a Delaware limited partnership and is controlled and operated by its general partner, Dimensional Holdings Inc., a Delaware corporation. As of September 30, 2024, assets under management for all Dimensional affiliated advisors totaled approximately $794 billion.

Pursuant to an Expense Assumption Agreement for the Target Portfolio, Dimensional has contractually agreed through February 28, 2025 to assume the ordinary operating expenses of the Institutional Class of the Target Portfolio (excluding the expenses that the Target Portfolio incurs indirectly through its investment in other investment companies managed by Dimensional) (“Portfolio Expenses”) to the extent necessary to limit the Portfolio Expenses of such Institutional Class to 0.06% of the average net assets of such Class of the Target Portfolio on an annualized basis. Following the Reorganization, Dimensional will not seek reimbursement of assumed expenses of the Target Portfolio.

Pursuant to an Expense Assumption Agreement for the Acquiring Portfolio, Dimensional has contractually agreed through February 28, 2026 to assume the ordinary operating expenses of the Institutional Class of the Acquiring Portfolio (excluding the expenses that the Acquiring Portfolio incurs indirectly through its investment in other investment companies managed by Dimensional) to the extent necessary to limit the Portfolio Expenses of such Institutional Class to 0.06% of the average net assets of such Class of the Acquiring Portfolio on an annualized basis. Dimensional retains the right to seek reimbursement for any expenses previously assumed of the Acquiring Portfolio up to thirty-six months after such expense assumption, only if the expense ratio following such reimbursement would be less than the expense limitation that was in place when such prior year expenses assumed, and less than the current expense limitation in place for the Acquiring Portfolio.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

Each Portfolio has the same investment objective and is part of Dimensional’s suite of target date retirement income funds. As the Target Portfolio reaches its final static allocation in 2025, it is expected to have approximately the same asset allocation as the Acquiring Portfolio. The Target Portfolio will have an identical investment objective, investment restrictions and risks, and substantially identical investment strategies as the Acquiring Portfolio. Because of the similarities in the Portfolios, Dimensional proposed the Reorganization for approval by the Board because the Reorganization would create opportunities for increased operational efficiency that may translate into fund cost savings. Dimensional also recognized that the Reorganization would eliminate the administrative and regulatory costs of operating each of the Portfolios as separate mutual funds.

The Board considered the Reorganization and approved the Plan. In considering the Plan, the Board requested and received detailed information from the officers of DFAIDG, and representatives of Dimensional regarding the Reorganization, including: (1) the specific terms of the Plan; (2) the investment objectives, investment strategies, and investment policies of the Target Portfolio and the Acquiring Portfolio; (3) comparative data analyzing the fees and expenses of the Portfolios; (4) the proposed plans for ongoing management, distribution, and operation of the Acquiring Portfolio; (5) the management, financial position, and business of Dimensional and its affiliates; (6) the impact of the Reorganization on the Portfolios and their shareholders; and (7) the relative asset sizes of the Portfolios, including the benefits of a Portfolio combining with another Portfolio; and (8) historical performance data for the Portfolios.

With respect to the information listed above, the Board considered that, among other information: (1) the Plan was designed to be a tax-free reorganization and the shares of the Acquiring Portfolio that would be received by the shareholders of the Target Portfolio in the exchange will be equal in aggregate net asset value to the aggregate net asset value of their shares of the Target Portfolio as of the closing date of the Reorganization; (2) the investment objectives and policies of the Target Portfolio and the Acquiring Portfolio are identical and their investment strategies will be identical in 2025 when the Target Portfolio reaches its final static asset allocation; (3) the fees and expenses of the Portfolios are identical, other than the 0.01% (one basis point) difference in acquired fund fees and expenses; (4) the plans for the ongoing management, distribution, and operation of the Acquiring Portfolio are identical to those of the Target Portfolio; (5) Dimensional is the adviser of both Portfolios; (6) the Reorganization presents opportunities for increased operational efficiency that may translate into fund cost savings for the Portfolios and their shareholders; (7) the Acquiring Portfolio is larger than the Target Portfolio and the combined Portfolio will create a larger portfolio that may benefit from increased economies of scale in its operating costs; and (8) the differences in the historical performance data for the Portfolios is largely a product of each Portfolio’s relative position on the evolving asset allocation “glide path” for Dimensional’s suite of target date retirement income funds.

The Board also considered that the proposed Reorganization has been contemplated for the Target Portfolio and disclosed to shareholders of the Target Portfolio in its prospectus since inception and, accordingly, did not consider other alternatives to the proposed Reorganization for the Target Portfolio.

In approving the Reorganization with respect to the Target Portfolio, the Board, including all of the Independent Directors, determined that (i) participation in the Reorganization is in the best interest of the Target Portfolio’s shareholders, and (ii) the interests of the Target Portfolio’s shareholders will not be diluted as a result of the Reorganization.

In making these determinations, the Board, including all of the Independent Directors, considered a number of factors, including the potential benefits and costs of the Reorganization to the shareholders of the Target Portfolio. These considerations included the following:

| • | As originally intended and disclosed in the Target Portfolio’s prospectus since inception, the shareholders of the Target Portfolio will remain invested in the landing point fund for Dimensional’s suite of target date retirement income funds, which will have approximately the same asset allocation as the Target Portfolio in 2025; |

| • | The same investment adviser and portfolio managers that currently manage the Target Portfolio are expected to manage the Combined Portfolio following the closing of the Reorganization; |

| • | In addition to having the same investment adviser and administrator, the Target Portfolio and the Acquiring Portfolio have the same service providers, such as the custodian, accounting services provider, dividend disbursing and transfer agent, legal counsel and independent auditor; |

| • | The Target Portfolio and the Acquiring Portfolio have the same expense structure, the same types of fees and the same fee rates, although the Board noted that the Acquiring Portfolio’s fees were 0.01% (one basis point) higher due to its acquired fund fees and expenses, which are excluded from each Portfolio’s expense assumption agreement; |

| • | No increase in the advisory, administration or other service provider fees, as a percentage of daily net assets, will occur as a result of the Reorganization, nor will there be any change in the contractual terms of the existing investment management agreement with Dimensional or other service agreements with any affiliates of Dimensional as a result of the Reorganization, and Dimensional does not anticipate that the Reorganization will result in any decline in the level of services from that historically provided to the Portfolios; |

| • | Shareholders of the Target Portfolio likely will benefit from economies of scale as fixed costs are shared, and operating efficiencies may be achieved; |

| • | The Reorganization will eliminate the administrative and regulatory costs of operating each Portfolio as a separate mutual fund; |

| • | The investment objectives of the Target Portfolio and the Acquiring Portfolio are identical; |

| • | The Target Portfolio will pay the costs of the Reorganization, however, in light of the current expense assumption agreement that is in place for the Target Portfolio, Dimensional will pay the Target Portfolio’s allocation of the Reorganization expenses; |

| • | The Reorganization is intended to be tax-free for federal income tax purposes for shareholders of the Target Portfolio, although the Board noted the potential tax implications for former Target Portfolio shareholders, as discussed below in the “What are the tax consequences of the Reorganization?” section; and |

| • | The alternatives available for shareholders of the Target Portfolio, including the ability to redeem their shares in the Target Portfolio prior to the Reorganization. |

Based upon their evaluation of the relevant information presented to it, and in light of its fiduciary duties under federal and state law, the Board, including all of the Independent Directors, concluded that completing the Reorganization is in the best interests of the shareholders of the Target Portfolio and that no dilution of value would result to the shareholders of the Portfolio from the Reorganization. The Board, including all of the Independent Directors, also concluded that (i) participation in the Reorganization is in the best interest of shareholders of the Acquiring Portfolio, and (ii) the interests of shareholders of the Acquiring Portfolio will not be diluted as a result of the Reorganization. Consequently, the Board approved the Plan on behalf of each Portfolio.

INFORMATION ABOUT THE PLAN

This is only a summary of the Plan. You should read the form of the Plan, which is attached as

Exhibit A to this Information Statement/Prospectus and is incorporated by reference, for complete information about the Reorganization.

How will the Reorganization be carried out?

The Reorganization will take place after various conditions are satisfied, including the preparation of certain documents. DFAIDG will determine a specific date, called the “closing date,” for the Reorganization to take place. Under the Plan, the Target Portfolio will transfer substantially all of its assets, free and clear of all liens, encumbrances, and claims whatsoever (other than shareholders’ rights of redemption), to the Acquiring Portfolio on the closing date, which is scheduled to occur on or about February 7, 2025, but which may occur on an earlier or later date as the parties may agree. The Acquiring Portfolio shall not assume any liability of the Target Portfolio. In exchange, DFAIDG will issue shares of the Acquiring Portfolio that have an aggregate NAV equal to the dollar value of the assets delivered to the Acquiring Portfolio by the Target Portfolio. DFAIDG will distribute the Acquiring Portfolio shares it receives to the shareholders of the Target Portfolio. Each shareholder of the Target Portfolio will receive a number of Acquiring Portfolio shares with an aggregate NAV equal to the aggregate NAV of his or her shares of the Target Portfolio. The share transfer books of the Target Portfolio will be permanently closed as of 4:00 p.m., Eastern Time, on the closing date. The Target Portfolio will accept requests for redemptions only if received in proper form before 4:00 p.m., Eastern Time, on the closing date. Requests received after that time will be considered requests to redeem shares of the Acquiring Portfolio. As soon as reasonably practicable after the transfer of its assets, the Target Portfolio will pay or make provision for payment of all its remaining liabilities, if any. The Target Portfolio will then terminate its existence as a separate series of DFAIDG.

The parties may agree to amend the Plan to the extent permitted by law. If the parties agree, the Plan may be terminated or abandoned at any time before the Reorganization.

DFAIDG has made representations and warranties in the Plan that are customary in matters such as the Reorganization. The obligations of DFAIDG under the Plan with respect to each Portfolio are subject to various conditions, including:

| • | The registration statement on Form N-14 under the Securities Act of 1933 with respect to the Acquiring Portfolio, of which this Information Statement/Prospectus is a part, shall have been filed with the SEC and such registration statement shall have become effective and shall not have been withdrawn or terminated, and no stop-order suspending the effectiveness of the registration statement shall have been issued, and no proceeding for that purpose shall have been initiated or threatened by the SEC; and |

| • | DFAIDG shall have received a tax opinion described below that the consummation of the Reorganization will not result in the recognition of gain or loss for federal income tax purposes for the Target Portfolio, the Acquiring Portfolio, or their shareholders. |

Although shareholder approval of the Reorganization is not required and Dimensional does not anticipate that the Reorganization will be terminated, if the Reorganization is terminated, shareholders would be notified of the change and the Target Portfolio would continue to operate as a series of DFAIDG.

Who will pay the expenses of the Reorganization?

The Target Portfolio will pay all of the costs and expenses resulting from the Reorganization. The expenses of the Reorganization are estimated to be $95,000. Because the Portfolios are funds of funds that invest in their respective Underlying Funds, it is not anticipated that there will be any brokerage costs as a result of the Reorganization. In light of the current expense assumption agreement that is in place for the Target Portfolio beyond the anticipated closing date of the Reorganization, however, Dimensional will pay all of the Portfolio’s allocation of the Reorganization expenses.

What are the tax consequences of the Reorganization?

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes under Section 368(a)(1) of the Code. Neither the Target Portfolio nor the Acquiring Portfolio have requested or will request an advance ruling from the IRS as to the federal income tax consequences of the Reorganization. Based on certain assumptions made and representations to be made on behalf of each of the Portfolios, it is expected that Stradley Ronon will opine that, for federal income tax purposes: (i) shareholders of the Target Portfolio will not recognize any gain or loss as a result of the exchange of their shares of the Target Portfolio for shares of the Acquiring Portfolio; (ii) the Acquiring Portfolio and its shareholders

will not recognize any gain or loss upon receipt of the Target Portfolio’s assets; (iii) the holding period and aggregate tax basis for Acquiring Portfolio shares that are received by the Target Portfolio shareholder will be the same as the holding period and aggregate tax basis of the shares of the Target Portfolio previously held by such shareholder; (iv) the Target Portfolio will not recognize any gain or loss upon the transfer of its assets to the Acquiring Portfolio in exchange for Acquiring Portfolio shares or upon the distribution of those Acquiring Portfolio shares to the Target Portfolio shareholders; and, (v) the basis of the assets of the Target Portfolio received by the Acquiring Portfolio will be the same as the basis of those assets in the hands of the Target Portfolio immediately prior to the Reorganization, and the Acquiring Portfolio’s holding period in such assets will include the period during which such assets were held by the Target Portfolio.

Notwithstanding the foregoing, no opinion will be expressed as to the effect of the Reorganization on the Target Portfolio or Acquiring Portfolio with respect to any transferred asset as to which unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on termination or transfer thereof) under a mark to market system of accounting. Neither Portfolio has requested or will request an advance ruling from the Internal Revenue Service (“IRS”) as to the U.S. federal income tax consequences of the Reorganization.

Prior to the closing of the Reorganization, the Target Portfolio but not the Acquiring Portfolio will distribute to its shareholders all of its investment company taxable income and net realized capital gain (after reduction by any available capital loss carryforwards), if any, and at least 90 percent of its net tax-exempt income, if any, that have not previously been distributed to them. Any distributions of investment company taxable income and net realized capital gain will be taxable to the shareholders.

Opinions of counsel are not binding upon the IRS or the courts. If the Reorganization is consummated but does not qualify as a tax free reorganization under the Code, and thus is taxable, the Target Portfolio would recognize gain or loss on the transfer of its assets to the Acquiring Portfolio and each shareholder of the Target Portfolio would recognize a taxable gain or loss equal to the difference between its tax basis in its Target Portfolio shares and the fair market value of the shares of the Acquiring Portfolio it received.

The tax attributes, including capital loss carryovers, of the Target Portfolio move to the Acquiring Portfolio in the Reorganization. The capital loss carryovers of the Target Portfolio and the Acquiring Portfolio are available to offset future gains recognized by the combined Portfolio, subject to limitations under the Code. Where these limitations apply, all or a portion of a Portfolio’s capital loss carryovers may become unavailable, the effect of which may be to accelerate the recognition of taxable gain to the combined Portfolio and its shareholders post-closing. First, the capital loss carryovers of a Portfolio that experiences a more than 50% ownership change in the Reorganization (e.g., the smaller Portfolio), increased by any current year loss or decreased by any current year gain, together with any net unrealized depreciation in the value of its portfolio investments (collectively, its “aggregate capital loss carryovers”), are

expected to become subject to an annual limitation. Losses in excess of that limitation may be carried forward to succeeding tax years. The annual limitation will generally equal the NAV of the smaller Portfolio in the Reorganization on the Closing Date multiplied by the “long-term tax-exempt rate” published by the IRS.

In the case of a Portfolio with net unrealized built-in gains at the time of closing of the Reorganization (i.e., unrealized appreciation in value of the Portfolio’s investments), the annual limitation for a taxable year will be increased by the amount of such built-in gains that are recognized in the taxable year. Second, if a Portfolio has built-in gains at the time of closing that are realized by the combined Portfolio in the five-year period following the Reorganization, such built-in gains, when realized, may not be offset by the losses (including any capital loss carryovers and “built in losses”) of another Portfolio. Third, the capital losses of the Target Portfolio that may be used by the Acquiring Portfolio (including to offset any recognized “built-in gains” of the Target Portfolio itself) for the first taxable year ending after the Closing Date will be limited to an amount equal to the capital gain net income of the Acquiring Portfolio for such taxable year (excluding capital loss carryovers) treated as realized post-closing based on the number of days remaining in such year unless an election is made to use an alternative method permitted by the Code.

As of October 31, 2023, the Target Portfolio and Acquiring Portfolio had capital loss carryovers of (amounts in thousands) $359 and $1,494, respectively.

Shareholders of the Target Portfolio will receive a proportionate share of any taxable income and gains realized by the Acquiring Portfolio and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Portfolio. As a result, shareholders of the Target Portfolio may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred. In addition, if the Acquiring Portfolio following the Reorganization has proportionately greater unrealized appreciation in its portfolio investments as a percentage of its NAV than the Target Portfolio, shareholders of the Target Portfolio, post-closing, may receive greater amounts of taxable gain as such portfolio investments are sold than they otherwise might have if the Reorganization had not occurred.

CAPITAL STRUCTURE AND SHAREHOLDER RIGHTS

Capital Structure

Each Portfolio is a series of DFAIDG. DFAIDG is an open-end, registered management investment company, commonly referred to as a “mutual fund.” DFAIDG was organized as a Maryland corporation on June 15, 1981. (DFAIDG is also referred to as the “Company” herein.)

The operations of the Company are governed by its Charter, Bylaws, and Maryland state law. The Company also must adhere to the 1940 Act, the rules and regulations promulgated by the Commission thereunder, and any applicable state securities laws.

Shares of the Acquiring Portfolio and the Target Portfolio have identical legal characteristics with respect to such matters as voting rights, assessability, conversion rights, and transferability. When issued for such consideration as the Board deems advisable, shares of each Portfolio are fully paid and non-assessable, and shall have no preemptive or subscription rights other than such, if any, as the Board may determine and at such price or prices and upon such other terms as the Board may fix. Shareholders of the Target Portfolio and the Acquiring Portfolio have no appraisal rights. Each share issued by a Portfolio is entitled to one full vote, and each fractional share is entitled to a proportionate fractional vote.

Upon the closing of the Reorganization, former shareholders of the Target Portfolio whose shares are represented by outstanding share certificates will not receive certificates for shares in the Acquiring Portfolio and all outstanding Target Portfolio share certificates shall be cancelled.

Rights of Target Portfolio and Acquiring Portfolio Shareholders

Shareholders of the Target Portfolio and the Acquiring Portfolio have substantially identical rights. There are no material differences between the rights of shareholders under the Charter and Bylaws of the Company. Accordingly, shareholders of each Portfolio have equal rights with respect to dividends and distributions, voting, and protection from liability. For example, shareholders of each Portfolio generally have the power to vote only: (i) for the election or removal of Directors; (ii) with respect to any contract as to which shareholder approval is required by the 1940 Act; (iii) with respect to certain amendments of the Charter; (iv) with respect to such additional matters relating to DFAIDG as may be required by the 1940 Act, the Charter, the Bylaws, or any registration of DFAIDG with the Commission or any state, or as the Directors may consider necessary or desirable.

Neither Portfolio is required to hold an annual shareholder meeting under the Company’s Charter or Bylaws. If a shareholder meeting is held, the Portfolios have identical notice, quorum and adjournment requirements and voting standards. The Company generally requires a majority vote of the shares present to decide any questions related to a particular matter, except a plurality shall elect a Director.

Neither the Charter nor the By-Laws of the Company contains specific provisions regarding the personal liability of shareholders. However, under the Maryland corporate law, shareholders of a Maryland corporation generally will not be held personally liable for the acts or obligations of the corporation, except that a shareholder may be liable to the extent that (i) consideration for the shares has not been paid, (ii) the shareholder knowingly accepts a distribution in violation of the charter or Maryland law, or (iii) the shareholder receives assets of the corporation upon its liquidation and the corporation is unable to meet its debts and obligations, in which case the shareholder may be liable for such debts and obligations to the extent of the assets received in the distribution.

What is the capitalization of the Portfolios?

The following table sets forth the unaudited capitalization of the Target Portfolio and Acquiring Portfolio as of April 30, 2024, and the unaudited pro forma combined capitalization of each Acquiring Portfolio as adjusted to give effect to the proposed Reorganization. The following are examples of the number of shares of the Acquiring Portfolio that would have been exchanged for the shares of the Target Portfolio if the Reorganization had been consummated on April 30, 2024, and do not reflect the number of shares or value of shares that would actually be received if the Reorganization, as described, occurs. Each shareholder of the Target Portfolio will receive the number of full and fractional shares of the Acquiring Portfolio equal in value to the value (as of the last valuation date) of the shares of the Target Portfolio.

| | Target Portfolio | Acquiring Portfolio | Pro Forma Adjustments+ | Pro Forma—Acquiring Portfolio after Reorganization (estimated) |

Net assets (thousands) | $11,363 | $68,778 | – | $80,141 |

Total shares outstanding | 1,018,804 | 6,172,666 | 1,214 | 7,192,684 |

Net asset value per share | $11.15 | $11.14 | – | $11.14 |

+ Adjustments reflect the remaining costs of the Reorganization to be incurred by the Target Portfolio. In light of the current expense assumption agreement that is in place for the Target Portfolio, however, Dimensional will pay all of the Portfolio’s allocation of the Reorganization expenses.

This information is for informational purposes only. There is no assurance that the Reorganization will be consummated. Moreover, if consummated, the capitalization of the Target Portfolio and the Acquiring Portfolio is likely to be different at the closing date as a result of daily share purchase and redemption activity in the Target Portfolio. Accordingly, the foregoing should not be relied upon to reflect the number of shares of an Acquiring Portfolio that actually will be received on or after such date.

ADDITIONAL INFORMATION ABOUT THE ACQUIRING PORTFOLIO

AND THE TARGET PORTFOLIO

Comparison of the Portfolios’ Investment Objectives, Principal Investment Strategies, and Principal Risks

The following summarizes the investment objectives, strategies and risks of the Target Portfolio and the Acquiring Portfolio. Further information about the Target Portfolio’s and Acquiring Portfolio’s investment objectives, strategies and risks are contained in prospectuses and SAIs of the Target Portfolio and Acquiring Portfolio, which are on file with the SEC. The

prospectuses and

SAIs of the Target Portfolio and Acquiring Portfolio are also incorporated herein by reference.

Investment Objectives and Strategies. The investment objectives of the Portfolios are identical. Each Portfolio’s investment objective is to provide total return consistent with the Portfolio’s asset allocation. Total return is composed of income and capital appreciation.

The Target Portfolio and Acquiring Portfolio employ substantially the same principal investment strategies in seeking to achieve their respective objectives, although there are certain differences. The Portfolios are funds of funds that seek to achieve their investment objectives by allocating their assets to the other mutual funds advised by Dimensional (the “Underlying Funds”).

The Portfolios are designed for investors currently in retirement. To achieve its investment objective, the Target Portfolio allocates its assets to Underlying Funds according to an asset allocation strategy designed for investors that retired in or within a few years of 2010 (the target date) and are planning to withdraw the value of the investment in the Portfolio over many years after the target date. Over time, the Target Portfolio’s allocation to the Underlying Funds changes based on an asset allocation strategy that becomes generally more conservative (reducing its allocation to equity Underlying Funds and increasing its allocation to fixed income Underlying Funds) until reaching the final “landing point,” which is 15 years after the target date (i.e., 2025 in the case of the Target Portfolio), at which time the Portfolio reaches its final static asset allocation.

As of October 31, 2024, as it nears its landing point and final static asset allocation, the Target Portfolio has a target allocation of 15% to 25% to equity Underlying Funds and a target allocation of approximately 75% to 85% to fixed income Underlying Funds, including exposure through those fixed income Underlying Funds to long-term and intermediate-term U.S. Treasury Inflation-Protected Securities (“TIPS”), which as of October 31, 2024, was the same target asset allocation of the Acquiring Portfolio. The asset allocation strategy for each Portfolio reflects the need for reduced equity risk and lower volatility of the inflation-adjusted income the Portfolio may be able to support in retirement in the years beyond the retirement target date.

As of October 31, 2024, each Portfolio may invest in: (1) domestic equity Underlying Funds that purchase a broad and diverse portfolio of securities of U.S. operating companies; (2) international equity Underlying Funds that purchase a broad and diverse portfolio of securities of companies in developed and emerging markets; and (3) fixed income Underlying Funds that may purchase U.S. and foreign debt securities such as obligations issued or guaranteed by the U.S. and foreign governments, their agencies and instrumentalities, long-, intermediate- and short-term TIPS, bank obligations, commercial paper, repurchase agreements, money market funds, obligations of other domestic and foreign issuers, securities of domestic and foreign issuers denominated in U.S. dollars but not trading in the United States, obligations of supranational organizations, and inflation-protected securities. The fixed income Underlying Funds primarily invest in securities that are considered investment grade at the time of purchase and which have a range of maturities, including ultra-short, intermediate, and long-term. Certain equity Underlying Funds purchase a broad and diverse group of securities of companies with a greater emphasis on smaller capitalization, lower relative price, and higher profitability companies as compared to their representation in the universe of securities such Underlying Funds invest in.