Exhibit (c)(2)

Exhibit (c)(2)

Presentation to Special Committee of the Board of Directors

The Hallwood Group Incorporated

March 28, 2013

Preface

The information herein has been prepared by Southwest Securities, Inc. (“SWS”) as part of a presentation being

made in support of our opinion as to the fairness of the terms of the proposed transaction from a financial point of view.

The material in this presentation and our analyses contained herein are confidential and are for the use of the Special

Committee of the Board of Directors of The Hallwood Group Incorporated (“Hallwood Group” or the “Company”)

and its advisors only. Any publication or use of this material or the analyses contained herein without the express

written consent of SWS is strictly prohibited.

Among the activities conducted in the course of our engagement as financial advisor, SWS received and reviewed

business and financial information of Hallwood Group and held discussions with the management of the Company

regarding this information. In connection with the analyses contained herein, we have not independently verified

any such information and have relied on all such information as being complete and accurate in all material respects.

In addition, we have not obtained any independent appraisal of the assets of either entity. With regard to financial forecasts,

we have assumed that they have been reasonably prepared on bases reflecting the best currently available estimates and judgments

of management of the Company as to the future financial performance of the Company. We assume no responsibility for and

express no view as to such forecasts or the assumptions on which they are based. We have not received financial forecasts

beyond 2013 from management of the Company. SWS is not an expert on, and does not render opinions regarding, legal,

accounting, regulatory or tax matters. You should consult with your advisors concerning these matters before undertaking

the proposed transaction.

Several analytical methodologies have been employed herein and no one method of analysis should be regarded as critical

to the overall conclusion we have reached. Each analytical technique has inherent strengths and weaknesses, and the nature of

the available information may further affect the value of particular techniques. The conclusions we have reached are based on

all the analyses and factors presented herein taken as a whole and also on application of our own experience and judgment.

Such conclusions may involve significant elements of subjective judgment or qualitative analysis. We therefore give no

opinion as to the value or merit standing alone of any one or more parts of the material that follows. Our only opinion is

the formal written opinion we express as to the fairness from a financial point of view. The opinion, the analyses contained

herein and all conclusions drawn from such analyses are necessarily based upon market, economic and other conditions

that exist and can be evaluated as of the date of this book.

In the ordinary course of our business, SWS may actively trade shares of the common stock and/or other securities of Hallwood Group for our own account and the accounts of our customers and, accordingly, may at any

time hold a long or short position in such securities.

Table of Contents

Executive Summary 1

Overview of Hallwood Group 2

Trading Overview 3

Selected Comparable Public 4

Selected Precedent Transactions 5

Discounted Cash Flow Analysis 6

Premium Analysis 7

Summary Valuation and Rationale 8

Section 1

Executive Summary

Executive Summary

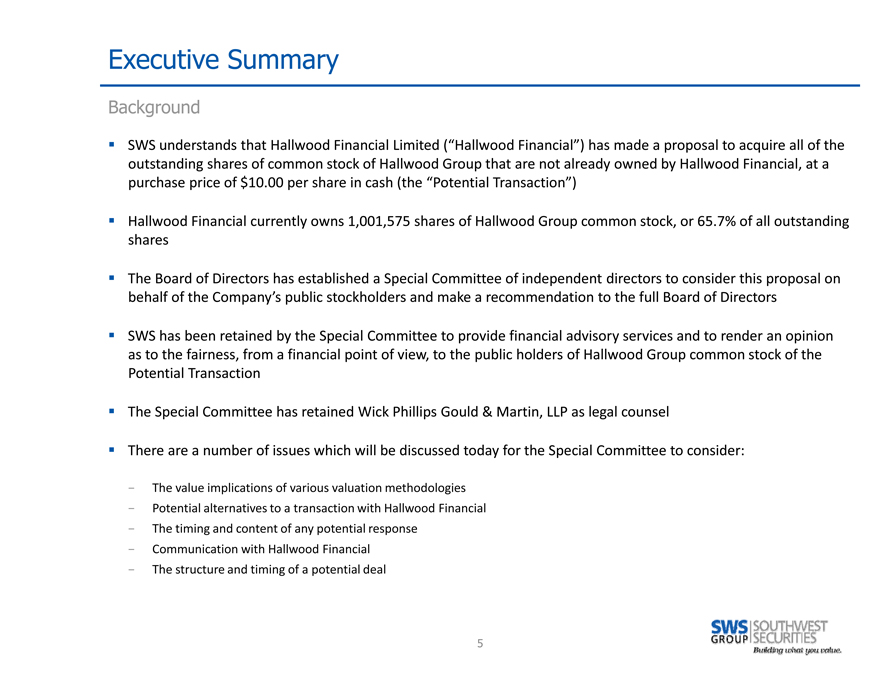

Background

SWS understands that Hallwood Financial Limited (“Hallwood Financial”) has made a proposal to acquire all of

the outstanding shares of common stock of Hallwood Group that are not already owned by Hallwood Financial, at

a purchase price of $10.00 per share in cash (the “Potential Transaction”)

Hallwood Financial currently owns 1,001,575 shares of Hallwood Group common stock, or 65.7% of all outstanding shares

The Board of Directors has established a Special Committee of independent directors to consider this proposal

on behalf of the Company’s public stockholders and make a recommendation to the full Board of Directors

SWS has been retained by the Special Committee to provide financial advisory services and to render an

opinion as to the fairness, from a financial point of view, to the public holders of Hallwood Group common stock

of the Potential Transaction

The Special Committee has retained Wick Phillips Gould & Martin, LLP as legal counsel

There are a number of issues which will be discussed today for the Special Committee to consider:

- The value implications of various valuation methodologies

- Potential alternatives to a transaction with Hallwood Financial

- The timing and content of any potential response

- Communication with Hallwood Financial

- The structure and timing of a potential deal

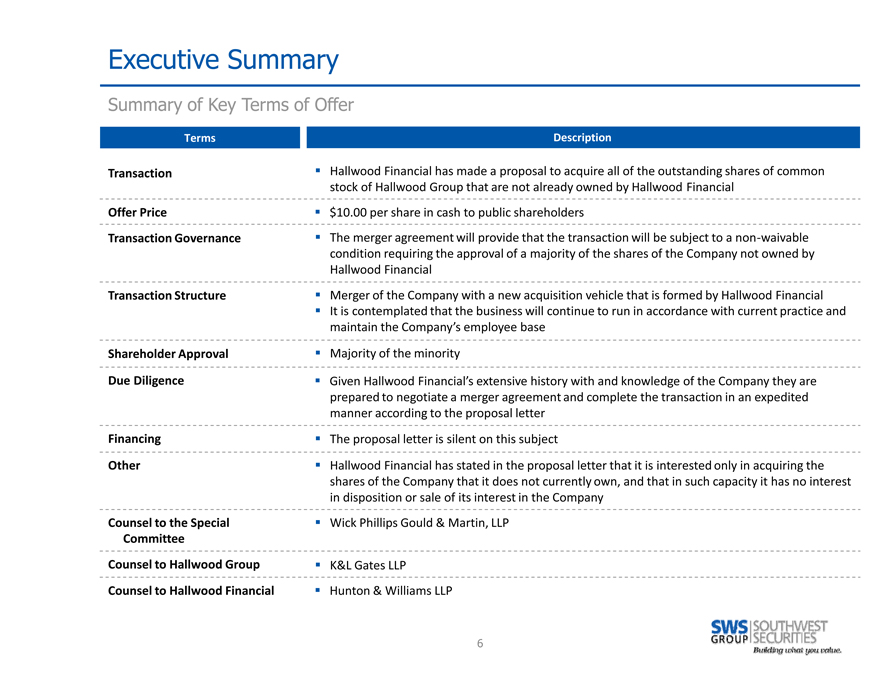

Executive Summary

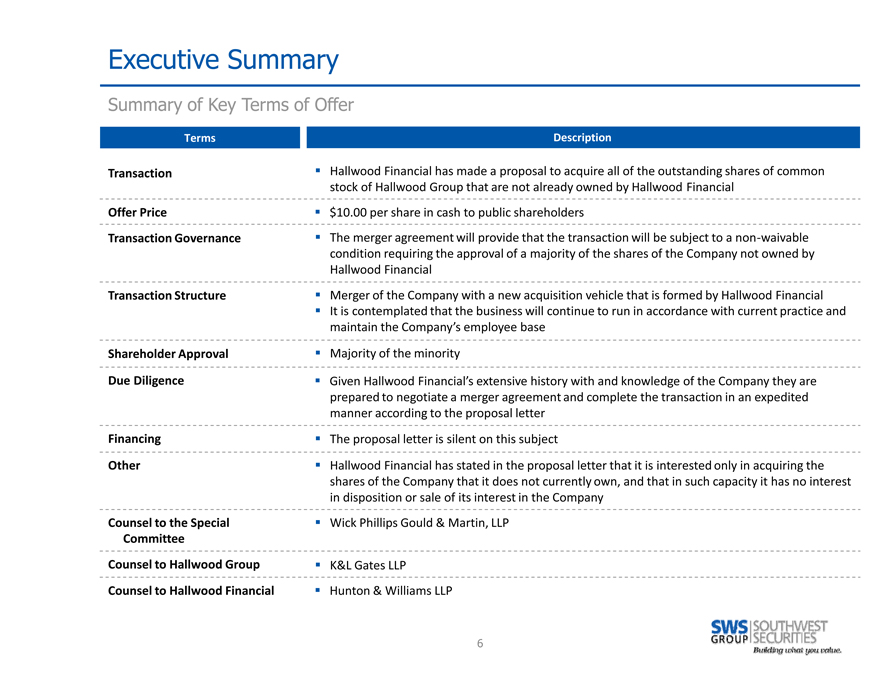

Summary of Key Terms of Offer

Terms Description

Transaction Hallwood Financial has made a proposal to acquire all of the outstanding shares of common

stock of Hallwood Group that are not already owned by Hallwood Financial

Offer Price $10.00 per share in cash to public shareholders

Transaction Governance The merger agreement will provide that the transaction will be subject to a non waivable

condition requiring the approval of a majority of the shares of the Company not owned by

Hallwood Financial

Transaction Structure Merger of the Company with a new acquisition vehicle that is formed by Hallwood Financial

It is contemplated that the business will continue to run in accordance with current practice and

maintain the Company’s employee base

Shareholder Approval Majority of the minority

Due Diligence Given Hallwood Financial’s extensive history with and knowledge of the Company they are

prepared to negotiate a merger agreement and complete the transaction in an expedited

manner according to the proposal letter

Financing The proposal letter is silent on this subject

Other Hallwood Financial has stated in the proposal letter that it is interested only in acquiring the

shares of the Company that it does not currently own, and that in such capacity it has no interest

in disposition or sale of its interest in the Company

Counsel to the Special Wick Phillips Gould & Martin, LLP

Committee

Counsel to Hallwood Group K&L Gates LLP

Counsel to Hallwood Financial Hunton & Williams LLP

Executive Summary

Summary Transaction Valuation and Implied Premiums

(Dollars in millions, except per share amounts)

Description Amounts

Current Offer Price Per Share: $10.00

% Premium to Current Price (03/26/13) 11.6%

% Premium to 1Day Prior (11/8/12) 78.3%

% Premium to 30Trading Day Average Prior 49.8%

% Premium to 60Trading Day Average Prior 27.5%

% Premium to 90Trading Day Average Prior 17.4%

% Premium to 120Trading Day Average Prior 15.7%

Minority Public Shares / Ownership 0.524 million or 34.3% ownership

Minority BuyIn Value $5.2

Implied Equity Value $15.3

Implied Enterprise Value $29.2

Transaction Type Merger

Financing Not provided in offer

Enterprise Value to Revenues: Revenues Multiple

Enterprise Value / 2012 Revenues 130.5 0.22x

Enterprise Value / 2013E Revenues 127.6 0.23x

Enterprise Value to Adjusted EBITDA(2) : Adjusted EBITDA Multiple

Enterprise Value / 2012 Adjusted EBITDA 1.2 24.6x

Enterprise Value / 2013E Adjusted EBITDA (0.9) NM

(1) Last trading day prior to the date on which the offer was announced.

(2) Adjusted to add back expenses associated with the Company’s Hallwood Energy and Nextec litigation matters.

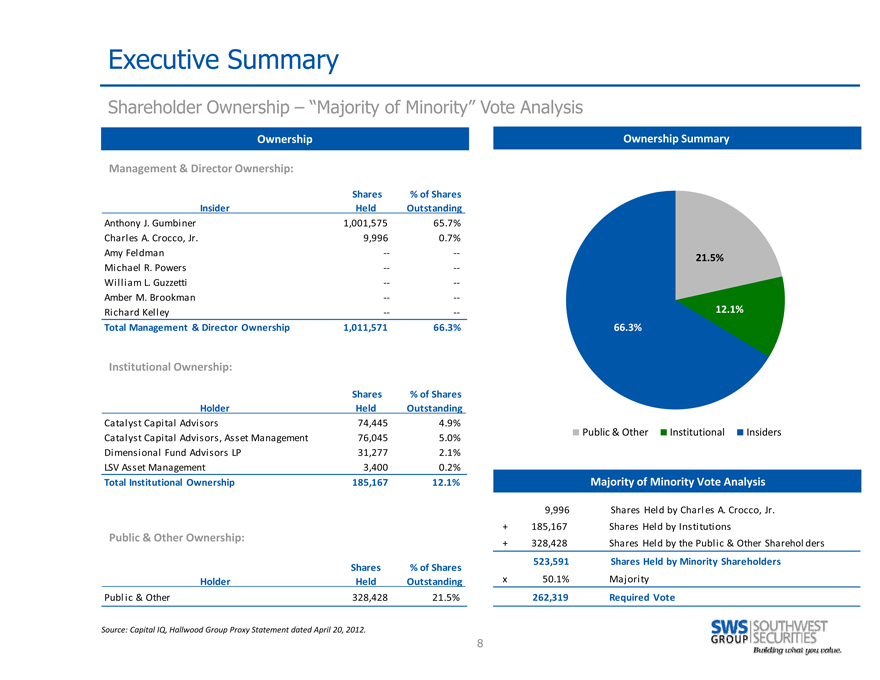

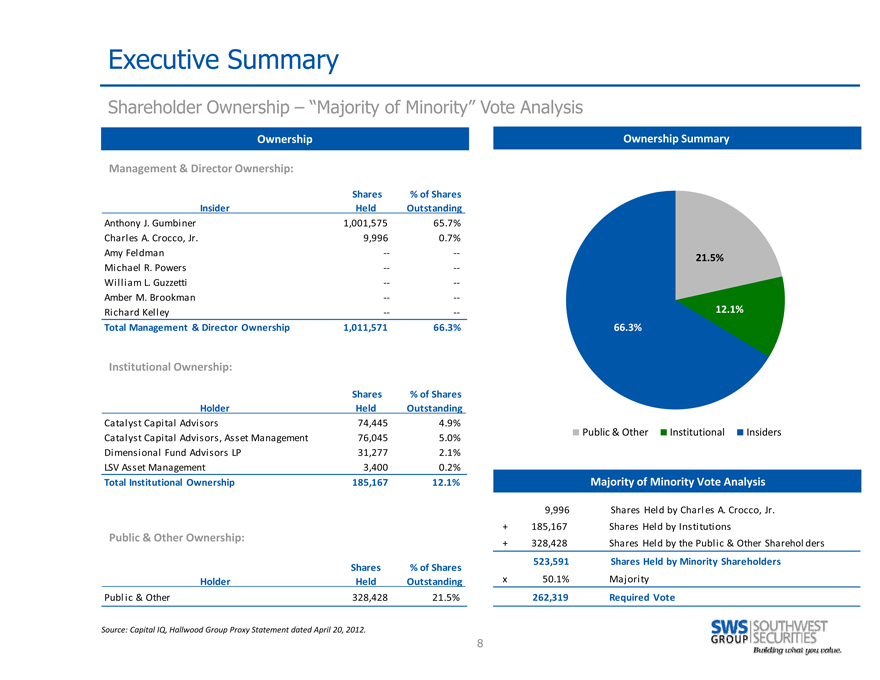

Executive Summary

Shareholder Ownership – “Majority of Minority” Vote Analysis

Ownership

Management & Director Ownership:

Shares % of Shares

Insider Held Outstanding

Anthony J. Gumbi ner 1,001,575 65.7%

Charl es A. Crocco, Jr. 9,996 0.7%

Amy Fel dman - - -

Mi chael R. Powers

Wi l l i am L. Guzzetti

Amber M. Brookma n

Ri chard Kel l ey

Total Management & Director Ownership 1,011,571 66.3%

Institutional Ownership:

Shares % of Shares

Holder Held Outstanding

Catal ys t Capi tal Advi s ors 74,445 4.9%

Catal ys t Capi tal Advi sors , Ass et Management 76,045 5.0%

Di mensi onal Fund Advi s ors LP 31,277 2.1%

LSV Ass et Management 3,400 0.2%

Total Institutional Ownership 185,167 12.1%

Public & Other Ownership:

Shares % of Shares

Holder Held Outstanding

Publ i c & Other 328,428 21.5%

Ownership Summary

21.5%

12.1%

66.3%

Public & Other Institutional Insiders

Majority of Minority Vote Analysis

9,996 Shares Hel d by Charl es A. Crocco, Jr.

+ 185,167 Shares Hel d by Insti tuti ons

+ 328,428 Shares Hel d by the Publ i c & Other Sharehol ders

523,591 Shares Held by Minority Shareholders

x 50.1% Majori ty

262,319 Required Vote

Source: Capital IQ, Hallwood Group Proxy Statement dated April 20, 2012.

Executive Summary

Valuation Approaches

Implied Valuation

Comparable Public

Trading Overview Precedent Transaction Discounted Cash Flow

Companies

“Trading Specific” “Public Market” valuation “Transaction Specific” Present value of projected

comparison valuation free cash flows

Value based on public

Reviews historical market trading multiples Values based on multiples “Inherent” value of the

common stock trading of comparable companies paid in comparable business

prices and volume to offer transactions

Does not include control Incorporates time value

premium Includes control premium and cost of capital

Represents freely tradable Comparability of considerations

minority interest transactions and / or Relies on management’s

target company relevant projections

Premium Analysis Other Considerations

“Trading Specific” Industry characteristics and

comparison trends (e.g. size, volatility,

Compares premiums paid growth prospects, etc.)

in comparable transactions Relative market position and

Reflects premium over competitive environment

pre announcement prices Consistency and visibility of

Comparability of historical and projected

earnings

transaction most relevant

9

Section 2

Overview of Hallwood Group

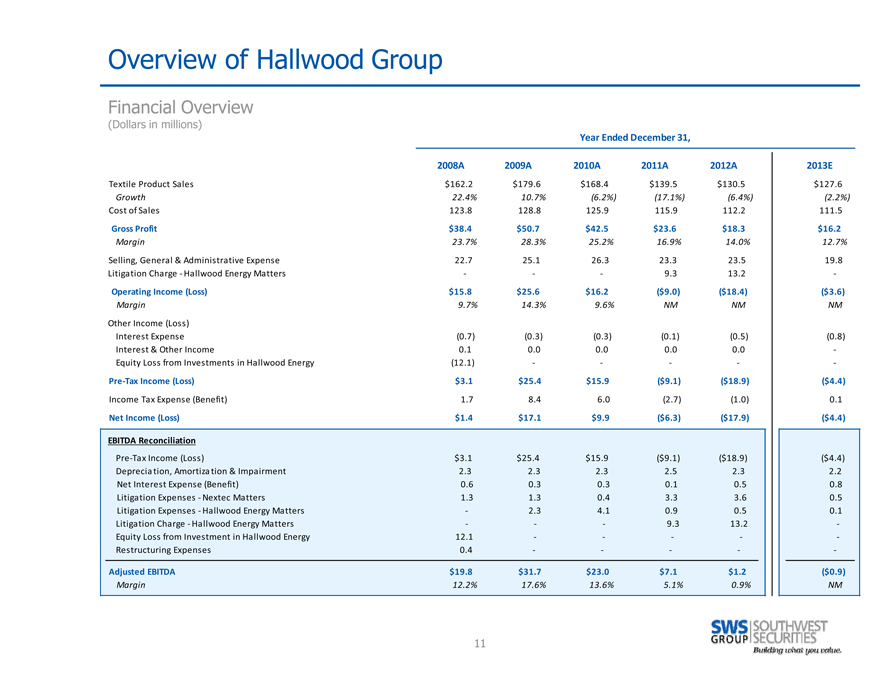

Overview of Hallwood Group

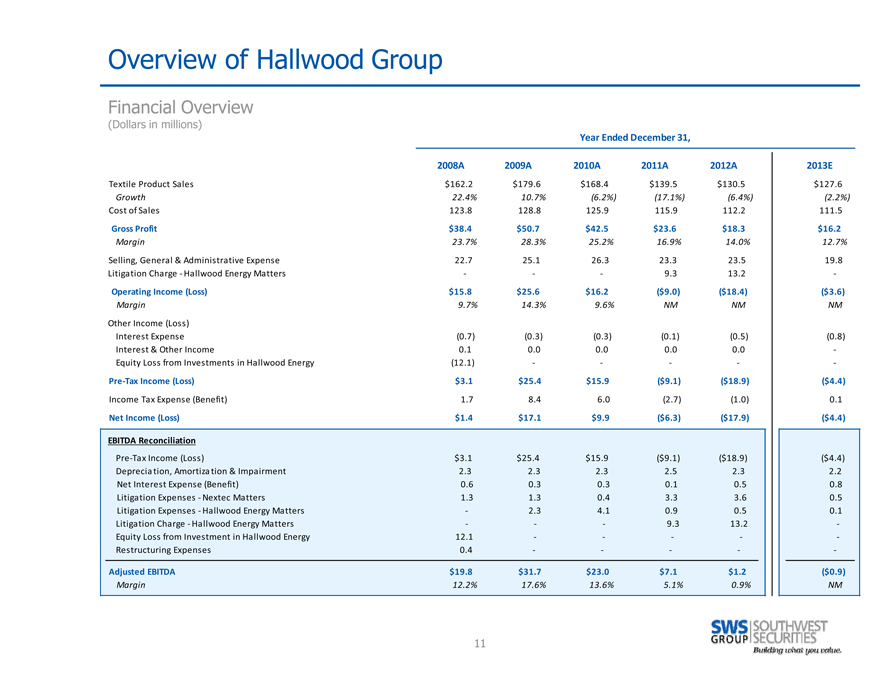

Financial Overview

(Dollars in millions)

Year Ended December 31,

2008A 2009A 2010A 2011A 2012A 2013E

Textile Product Sales $162.2 $179.6 $168.4 $139.5 $130.5 $127.6

Growth 22.4% 10.7% (6.2%) (17.1%) (6.4%) (2.2%)

Cost of Sales 123.8 128.8 125.9 115.9 112.2 111.5

Gross Profit $38.4 $50.7 $42.5 $23.6 $18.3 $16.2

Margin 23.7% 28.3% 25.2% 16.9% 14.0% 12.7%

Selling, General & Administrative Expense 22.7 25.1 26.3 23.3 23.5 19.8

Litiga tion Charge Hallwood Energy Matters 9.3 13.2

Operating Income (Loss) $15.8 $25.6 $16.2 ($9.0) ($18.4) ($3.6)

Margin 9.7% 14.3% 9.6% NM NM NM

Other Income (Loss)

Interest Expense (0.7) (0.3) (0.3) (0.1) (0.5) (0.8)

Interest & Other Income 0.1 0.0 0.0 0.0 0.0

Equity Loss from Investments in Hallwood Energy (12.1)

Pre Tax Income (Loss) $3.1 $25.4 $15.9 ($9.1) ($18.9) ($4.4)

Income Tax Expense (Benefit) 1.7 8.4 6.0 (2.7) (1.0) 0.1

Net Income (Loss) $1.4 $17.1 $9.9 ($6.3) ($17.9) ($4.4)

EBITDA Reconciliation

Pre Ta x Income (Loss) $3.1 $25.4 $15.9 ($9.1) ($18.9) ($4.4)

Deprecia tion, Amortiza tion & Impairment 2.3 2.3 2.3 2.5 2.3 2.2

Net Interest Expense (Benefit) 0.6 0.3 0.3 0.1 0.5 0.8

Litiga tion Expenses Nextec Matters 1.3 1.3 0.4 3.3 3.6 0.5

Litiga tion Expenses Hallwood Energy Matters 2.3 4.1 0.9 0.5 0.1

Litiga tion Charge Ha llwood Energy Ma tters 9.3 13.2

Equity Loss from Investment in Ha llwood Energy 12.1

Restructuring Expenses 0.4

Adjusted EBITDA $19.8 $31.7 $23.0 $7.1 $1.2 ($0.9)

Margin 12.2% 17.6% 13.6% 5.1% 0.9% NM

11

Section 3

Trading Overview

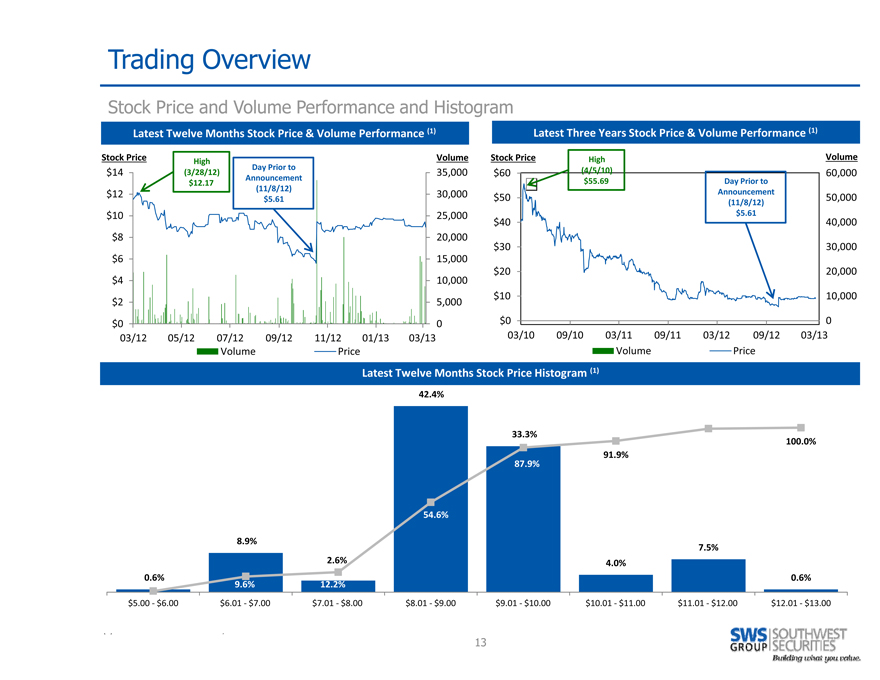

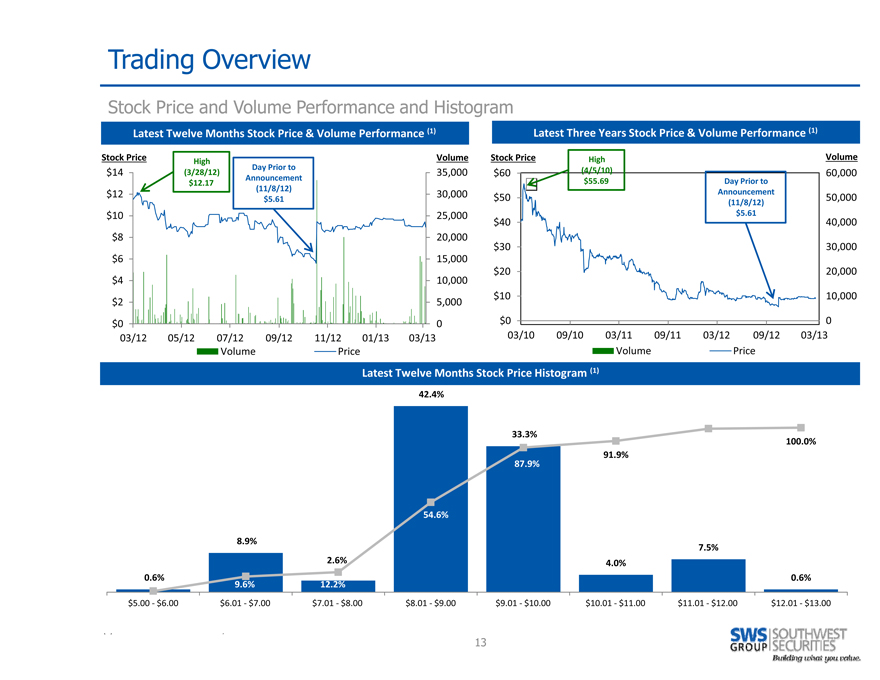

Trading Overview

Stock Price and Volume Performance and Histogram

Latest Twelve Months Stock Price & Volume Performance (1) Latest Three Years Stock Price & Volume Performance (1)

Stock Price Volume Stock Price High Volume

High

$14 (3/28/12) Day Prior to 35,000 $60 (4/5/10) 60,000

$12.17 Announcement $55.69 Day Prior to

$12 (11/8/12) 30,000 Announcement

$5.61 $50 50,000

(11/8/12)

$10 25,000 $5.61

$40 40,000

$8 20,000

$30 30,000

$6 15,000

$20 20,000

$4 10,000

$10 10,000

$2 5,000

$0 0 $0 0

03/12 05/12 07/12 09/12 11/12 01/13 03/13 03/10 09/10 03/11 09/11 03/12 09/12 03/13

Volume Price Volume Price

Latest Twelve Months Stock Price Histogram (1)

42.4%

33.3%

100.0%

91.9%

87.9%

54.6%

8.9% 7.5%

2.6% 4.0%

0.6% 0.6%

9.6% 12.2%

$5.00 $6.00 $6.01 $7.00 $7.01 $8.00 $8.01 $9.00 $9.01 $10.00 $10.01 $11.00 $11.01 $12.00 $12.01 $13.00

13

Section 4

Selected Comparable Public Companies

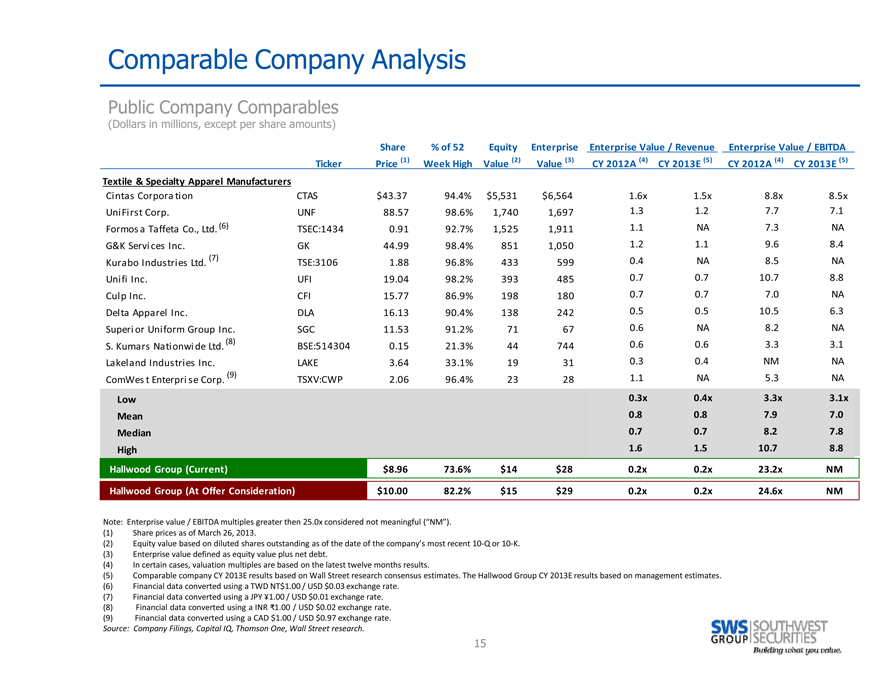

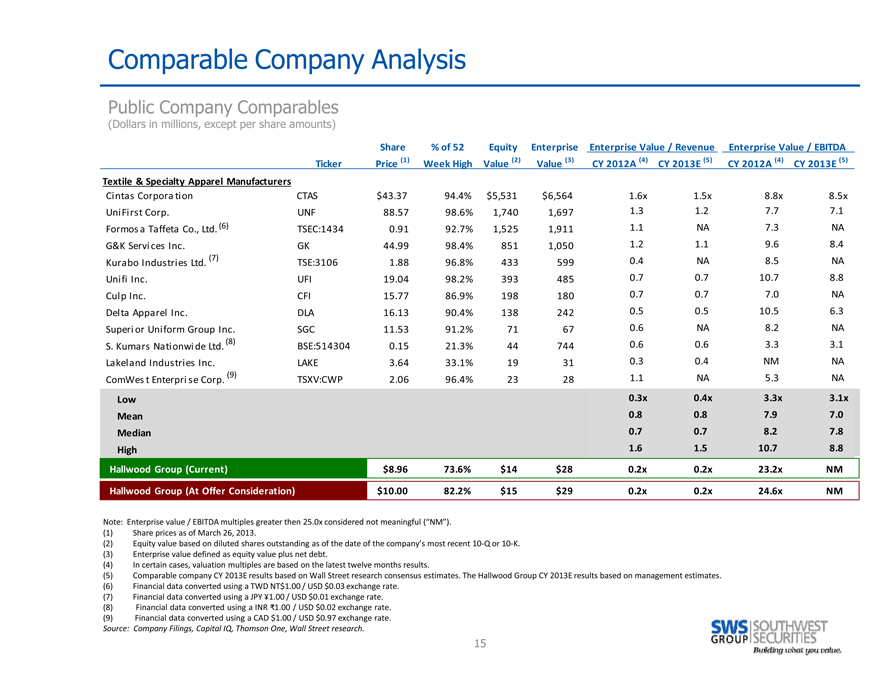

Comparable Company Analysis

Public Company Comparables

(Dollars in millions, except per share amounts)

Share % of 52 Equity Enterprise Enterprise Value / Revenue Enterprise Value / EBITDA

Ticker Price (1) Week High Value (2) Value (3) CY 2012A (4) CY 2013E (5) CY 2012A (4) CY 2013E (5)

Textile & Specialty Apparel Manufacturers

Cintas Corporation CTAS $43.37 94.4% $5,531 $6,564 1.6x 1.5x 8.8x 8.5x

UniFirst Corp. UNF 88.57 98.6% 1,740 1,697 1.3 1.2 7.7 7.1

Formos a Taffeta Co., Ltd. (6) TSEC:1434 0.91 92.7% 1,525 1,911 1.1 NA 7.3 NA

G&K Services Inc. GK 44.99 98.4% 851 1,050 1.2 1.1 9.6 8.4

Kurabo Industries Ltd. (7) TSE:3106 1.88 96.8% 433 599 0.4 NA 8.5 NA

Unifi Inc. UFI 19.04 98.2% 393 485 0.7 0.7 10.7 8.8

Culp Inc. CFI 15.77 86.9% 198 180 0.7 0.7 7.0 NA

Delta Apparel Inc. DLA 16.13 90.4% 138 242 0.5 0.5 10.5 6.3

Superior Uniform Group Inc. SGC 11.53 91.2% 71 67 0.6 NA 8.2 NA

S. Kumars Nationwide Ltd. (8) BSE:514304 0.15 21.3% 44 744 0.6 0.6 3.3 3.1

Lakel and Industries Inc. LAKE 3.64 33.1% 19 31 0.3 0.4 NM NA

ComWest Enterprise Corp. (9) TSXV:CWP 2.06 96.4% 23 28 1.1 NA 5.3 NA

Low 0.3x 0.4x 3.3x 3.1x

Mean 0.8 0.8 7.9 7.0

Median 0.7 0.7 8.2 7.8

High 1.6 1.5 10.7 8.8

Hallwood Group (Current) $8.96 73.6% $14 $28 0.2x 0.2x 23.2x NM

Hallwood Group (At Offer Consideration) $10.00 82.2% $15 $29 0.2x 0.2x 24.6x NM

Note: Enterprise value / EBITDA multiples greater then 25.0x considered not meaningful (“NM”).

(1) Share prices as of March 26, 2013.

(2) Equity value based on diluted shares outstanding as of the date of the company’s most recent 10 Q or 10 K.

(3) Enterprise value defined as equity value plus net debt.

(4) In certain cases, valuation multiples are based on the latest twelve months results.

(5) Comparable company CY 2013E results based on Wall Street research consensus estimates.

The Hallwood Group CY 2013E results based on management estimates.

(6) Financial data converted using a TWD NT$1.00 / USD $0.03 exchange rate.

(7) Financial data converted using a JPY Ą1.00 / USD $0.01 exchange rate.

(8) Financial data converted using a INR 1.00 / USD $0.02 exchange rate.

(9) Financial data converted using a CAD $1.00 / USD $0.97 exchange rate.

Source: Company Filings, Capital IQ, Thomson One, Wall Street research.

15

Selected Comparable Company Analysis

Summary Analysis

(Dollars in millions, except per share amounts)

Comparables Market Valuation Summary

Hallwood Implied per Share

Group Multiple Reference Range Equity Value (1)

Data Low Median High Low Median High

Adjusted EBITDA

CY 2012 $1.2 3.3x 8.2x 10.7x NM NM NM

CY 2013E (0.9) 3.1 7.8 8.8 NM NM NM

Reference Range NM NM NM

Offer Price $10.00

(1) Calculated based on implied enterprise value less net debt of $14.0 million divided by 1.5 million

total shares outstanding. The implied per share equity values based on CY 2012 and CY2013E EBITDA

resulted in negative values and therefore were determined to be not meaningful (“NM”).

16

Section 5

Selected Precedent Transactions

Selected Precedent Transactions

Precedent Merger and Acquisition Transactions

(Dollars in millions)

Date Date LTM LTM Enterprise Value/

Announced Closed Acquirer Target EV (1) Revenue EBITDA LTM Revenue LTM EBITDA

06/28/12 07/27/12 Qualium Investissement Kermel S.A. (2) $106 $47 $13 2.3x 8.2x

04/11/12 05/31/12 Lear Corp. (NYSE:LEA) Guil ford Performance Texti les , Inc. 257 400 0.6

05/11/11 07/31/11 Bangladesh Export Import Company Ltd. (DSE:BEXIMCO) Bextex Limited (3) 431 236 67 1.8 6.4

12/06/10 02/22/11 Gilde Buy Out Partners Gamma Holdi ng NV (4) 686 869 107 0.8 6.4

10/04/10 01/28/11 The Blackstone Group Polymer Group, Inc. 670 1,110 114 0.6 5.9

03/08/07 04/01/07 International Textile Group, Inc. (OTCPK:ITXN) Global Safety Textiles GmbH (5) 207 305 34 0.7 6.1

Low 0.6x 5.9x

Mean 1.1 6.6

Median 0.7 6.4

High 2.3 8.2

USD $1.23 exchnage rate.

USD $1.33 exchnage rate.

(1) Enterprise value (“EV”) based on the announced transaction terms and of the public information

available at the time of the announcement. (2) Financial data converted using a EUR €1.00 / USD $1.34 exchange rate.

(3) Financial data converted using a BDT €1.00 /USD $0.01 exchange rate. (4) Financial data converted using a EUR €1.00 /USD $1.23 exchange rate (5) Financial data converted using a EUR €1.00 / USD $1.33 exchange rate.

Source: Company Filings, Capital IQ, Thomson One, Wall Street research.

18

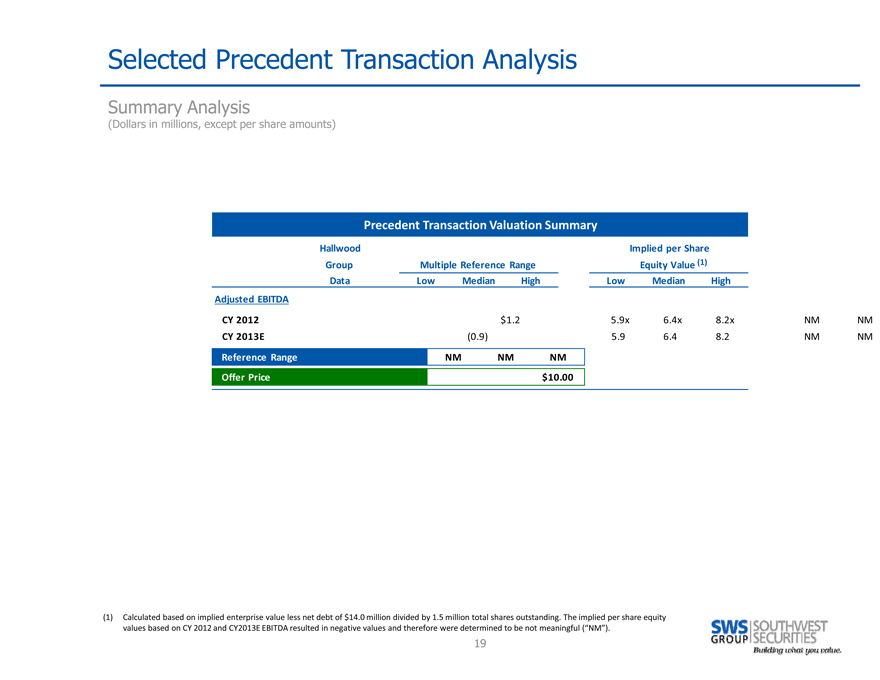

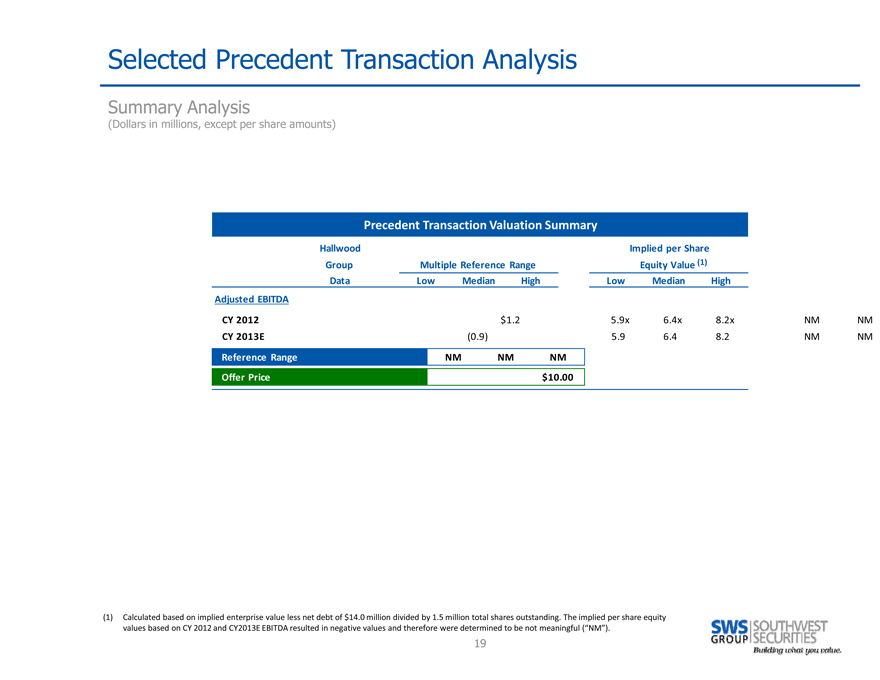

Selected Precedent Transaction Analysis

Summary Analysis

(Dollars in millions, except per share amounts)

Precedent Transaction Valuation Summary

Hallwood Implied per Share

Group Multiple Reference Range Equity Value (1)

Data Low Median High Low Median High

Adjusted EBITDA

CY 2012 $1.2 5.9x 6.4x 8.2x NM NM

CY 2013E (0.9) 5.9 6.4 8.2 NM NM

Reference Range NM NM NM

Offer Price $10.00

(1) Calculated based on implied enterprise value less net debt of $14.0 million divided by 1.5 million

total shares outstanding. The implied per share equity values based on CY 2012 and CY2013E EBITDA

resulted in negative values and therefore were determined to be not meaningful (“NM”).

19

Section 6

Discounted Cash Flow Analysis

Discounted Cash Flow Analysis

Management has not prepared or made available to SWS financial forecasts beyond 2013 and; therefore, a discounted cash flow analysis is not available.

21

Section 7

Premium Analysis

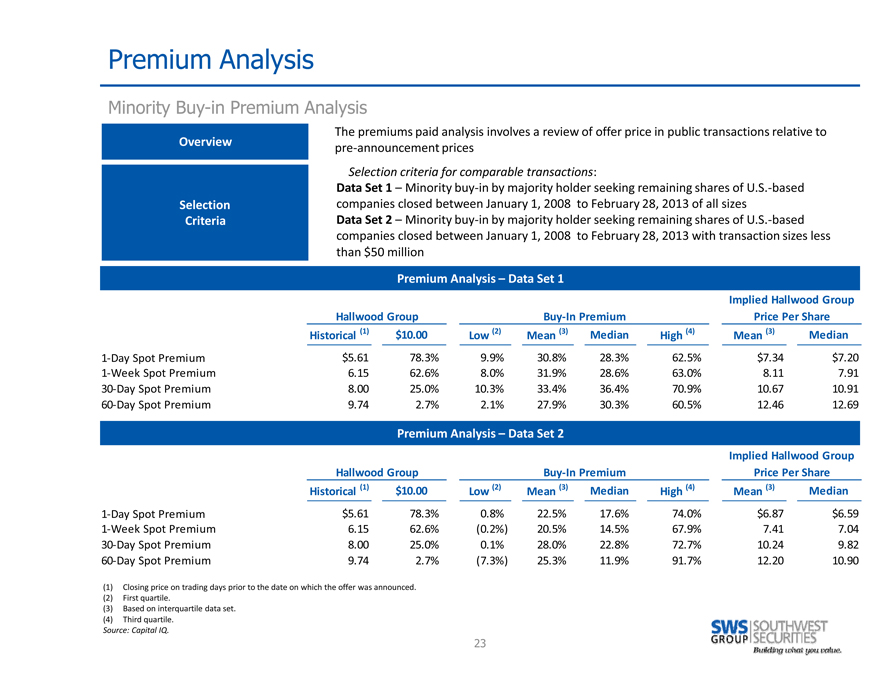

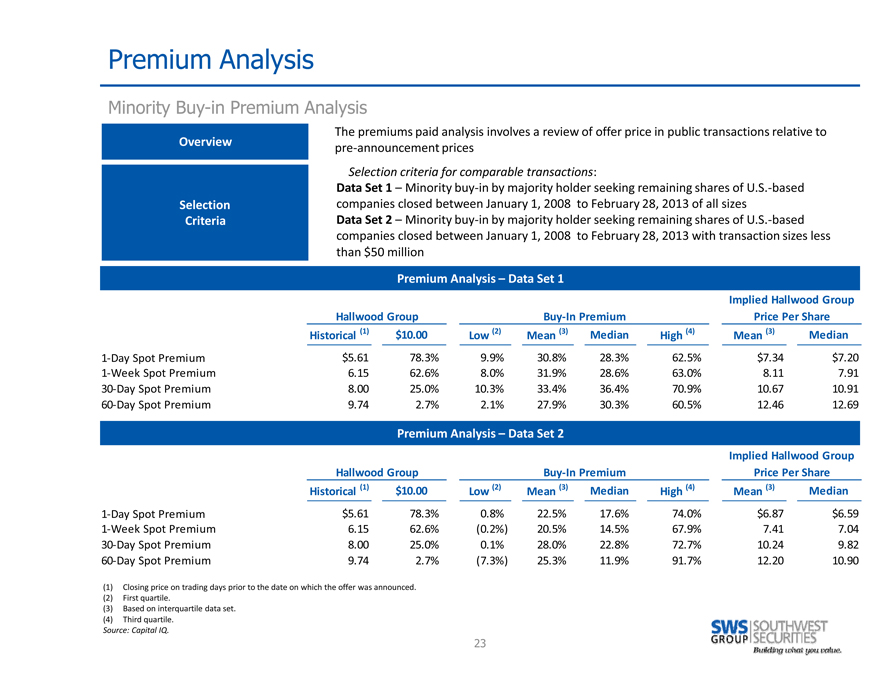

Premium Analysis

Minority Buy-in Premium Analysis

The premiums paid analysis involves a review of offer price in public transactions relative to

Overview pre announcement prices

Selection criteria for comparable transactions:

Data Set 1 – Minority buy in by majority holder seeking remaining shares of U.S. based

Selection companies closed between January 1, 2008 to February 28, 2013 of all sizes

Criteria Data Set 2 – Minority buy in by majority holder seeking remaining shares of U.S. based

companies closed between January 1, 2008 to February 28, 2013 with transaction sizes less

than $50 million

Premium Analysis – Data Set 1

Implied Hallwood Group

Hallwood Group Buy In Premium Price Per Share

Historical (1) $10.00 Low (2) Mean (3) Median High (4) Mean (3) Median

1 Day Spot Premium $5.61 78.3% 9.9% 30.8% 28.3% 62.5% $7.34 $7.20

1 Week Spot Premium 6.15 62.6% 8.0% 31.9% 28.6% 63.0% 8.11 7.91

30 Day Spot Premium 8.00 25.0% 10.3% 33.4% 36.4% 70.9% 10.67 10.91

60 Day Spot Premium 9.74 2.7% 2.1% 27.9% 30.3% 60.5% 12.46 12.69

Premium Analysis – Data Set 2

Implied Hallwood Group

Hallwood Group Buy In Premium Price Per Share

Historical (1) $10.00 Low (2) Mean (3) Median High (4) Mean (3) Median

1 Day Spot Premium $5.61 78.3% 0.8% 22.5% 17.6% 74.0% $6.87 $6.59

1 Week Spot Premium 6.15 62.6% (0.2%) 20.5% 14.5% 67.9% 7.41 7.04

30 Day Spot Premium 8.00 25.0% 0.1% 28.0% 22.8% 72.7% 10.24 9.82

60 Day Spot Premium 9.74 2.7% (7.3%) 25.3% 11.9% 91.7% 12.20 10.90

(1) Closing price on trading days prior to the date on which the offer was announced.

(2) First quartile.

(3) Based on interquartile data set.

(4) Third quartile.

Source: Capital IQ.

23

Section 8

Summary Valuation and Rationale

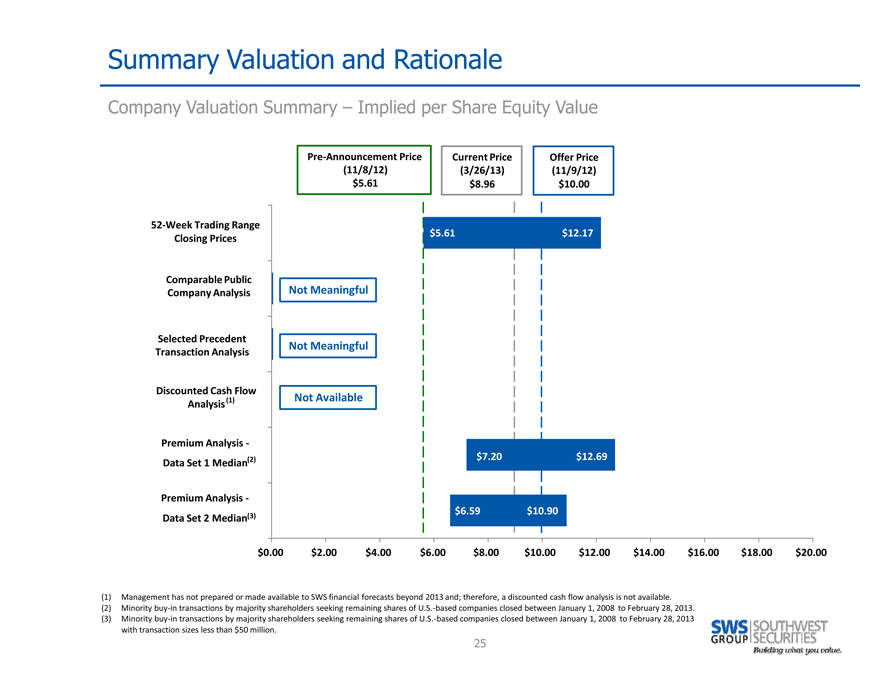

Summary Valuation and Rationale

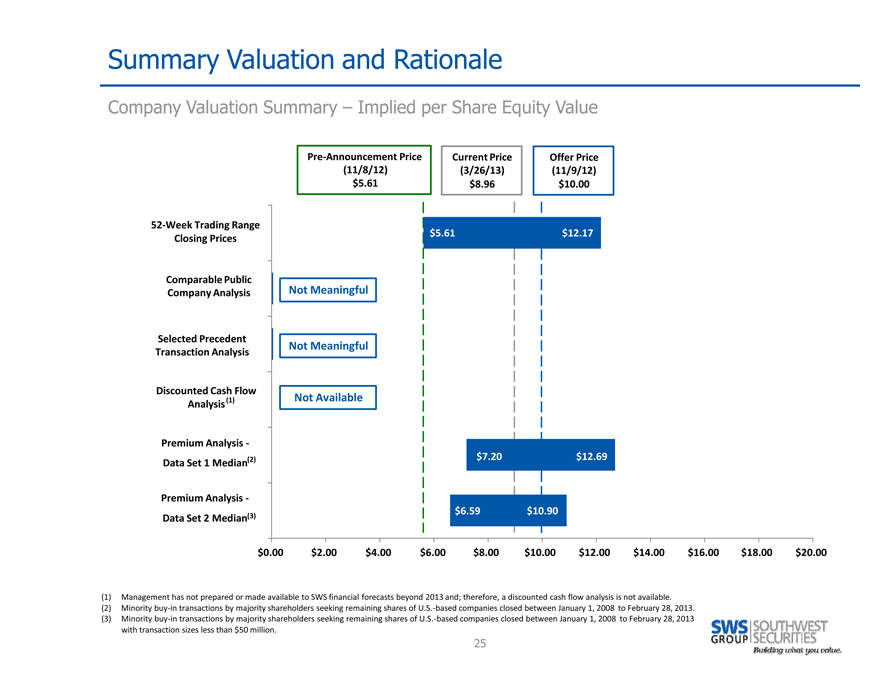

Company Valuation Summary – Implied per Share Equity Value

Pre Announcement Price Current Price Offer Price

(11/8/12) (3/26/13) (11/9/12)

$5.61 $8.96 $10.00

52 Week Trading Range

Closing Prices $5.61 $12.17

Comparable Public

Company Analysis Not Meaningful

Selected Precedent

Not Meaningful

Transaction Analysis

Discounted Cash Flow

Analysis

Premium Analysis

Data Set 1 Median(2) $7.20 $12.69

Premium Analysis

$6.59 $10.90

Data Set 2 Median(3)

$0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00

(1) Management has not prepared or made available to SWS financial forecasts beyond 2013

and; therefore, a discounted cash flow analysis is not available.

(2) Minority buy in transactions by majority shareholders seeking remaining shares of U.S. based companies closed between January 1, 2008 to February 28, 2013.

(3) Minority buy in transactions by majority shareholders seeking remaining shares of U.S. based companies closed between January 1, 2008 to February 28, 2013

with transaction sizes less than $50 million.

25

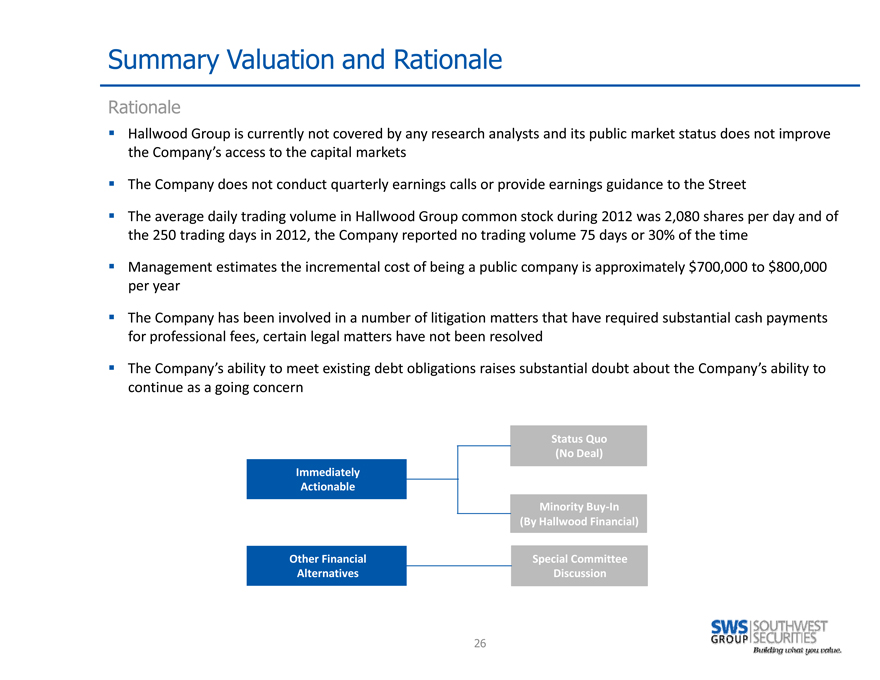

Summary Valuation and Rationale

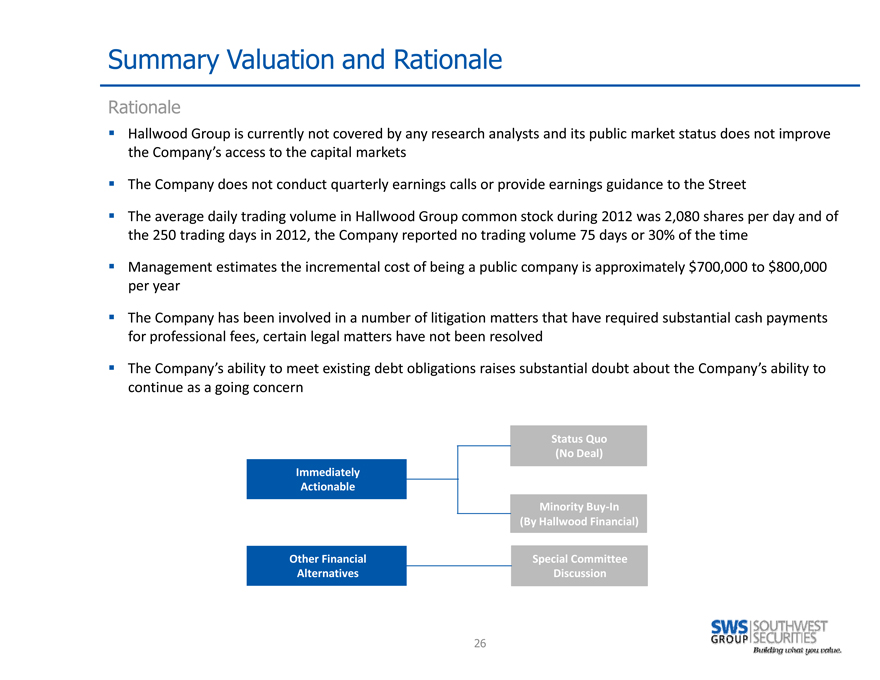

Rationale

Hallwood Group is currently not covered by any research analysts and its public market status does not improve

the Company’s access to the capital markets

The Company does not conduct quarterly earnings calls or provide earnings guidance to the Street

The average daily trading volume in Hallwood Group common stock during 2012 was 2,080 shares per day and of the

250 trading days in 2012, the Company reported no trading volume 75 days or 30% of the time

Management estimates the incremental cost of being a public company is approximately $700,000 to $800,000 per year

The Company has been involved in a number of litigation matters that have required substantial cash payments

for professional fees, certain legal matters have not been resolved

The Company’s ability to meet existing debt obligations raises substantial doubt about the Company’s ability

to continue as a going concern

Status Quo

(No Deal)

Immediately

Actionable

Minority Buy In

(By Hallwood Financial)

Other Financial Special Committee

Alternatives Discussion

26