UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03290

Name of Fund: BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Variable Series

Funds, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2012

Date of reporting period: 06/30/2012

EXPLANATORY NOTE

The Registrant is filing this amendment to its amended Form N-CSR for the period ended June 30, 2012, filed with the Securities and Exchange Commission on September 5, 2012 (Accession Number 0001193125-12-380442).

The Class III Shares BlackRock Balanced Capital V.I. Fund of BlackRock Variable Series Funds, Inc. are scheduled to re-open to new investors effective January 22, 2013.

Item 1 – Report to Stockholders

JUNE 30, 2012

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | |  |

BlackRock Variable Series Funds, Inc.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Dear Shareholder

One year ago, risk assets were in a broad retreat as sovereign debt problems loomed over Europe and confidence in both the US and global economic recoveries was waning. Last summer’s prolonged debt ceiling debate in Washington, DC ended with Standard & Poor’s historic downgrade of US government debt, an event that triggered financial-market turmoil all over the world. Extraordinary levels of volatility persisted in the months that followed as the debt situation in Europe intensified. Macro-level news drove asset prices broadly up and down in lockstep, in a “risk on” — “risk off” trading pattern. Equity markets crumbled while safe-haven assets such as US Treasuries and gold rallied to historic highs by the end of the third quarter of 2011.

By October, however, improving economic data and more concerted efforts among European leaders toward stemming the region’s debt crisis drew investors back to the markets. Improving sentiment carried over into early 2012 as investors saw some relief from the world’s financial woes. Risk assets (including stocks, commodities and high yield bonds) moved boldly higher through the first two months of 2012 while climbing Treasury yields pressured higher-quality fixed income assets.

However, risk assets reversed course in the spring when Europe’s debt problems boiled over once again. Markets became highly volatile as political instability in Greece threatened the country’s membership in the euro zone. Spain faced severe deficit issues while the nation’s banks clamored for liquidity. Yields on Spanish and Italian government debt rose to levels deemed unsustainable. European leaders conferred and debated vehemently over the need for fiscal integration among the 17 euro-zone nations to resolve the crisis for the long term.

Alongside the drama in Europe, investors were discouraged by gloomy economic reports from various parts of the world. A slowdown in China, a key powerhouse for global growth, became particularly worrisome. In the United States, disappointing jobs reports dealt a crushing blow to sentiment. Risk assets sold off through April and May as investors ran back to safe havens including US, German and UK government debt as well as gold. As the period drew to a close, risk assets were beginning to rebound modestly as European leaders stepped up their efforts to move toward fiscal unity and investors anticipated additional stimulus from central banks on both sides of the Atlantic.

All asset classes posted gains for the 6-month period ended June 30, 2012, with US stocks delivering the largest returns. On a 12-month basis, US large-cap stocks generated positive results; however, small-cap stocks finished in negative territory and international and emerging equities, which experienced significant downturns in 2011, lagged the broader rebound. Among fixed income asset classes, safe-haven US Treasury bonds and municipal bonds outperformed corporate credits for the 12-month period. Continued low short-term interest rates kept yields on money market securities near their all-time lows.

We know that investors continue to face a world of uncertainty and highly volatile markets, but we also believe these challenging times present many opportunities. We remain committed to working with you and your financial professional to identify actionable ideas for your portfolio. We encourage you to visit blackrock.com/newworld for more information.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“We know that investors continue to face a world of uncertainty and highly volatile markets, but we also believe these challenging times present many opportunities.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

Total Returns as of June 30, 2012 | |

| | | 6-month | | | 12-month | |

US large cap equities

(S&P 500® Index) | | | 9.49 | % | | | 5.45 | % |

US small cap equities

(Russell 2000® Index) | | | 8.53 | | | | (2.08 | ) |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | 2.96 | | | | (13.83 | ) |

Emerging market equities

(MSCI Emerging

Markets Index) | | | 3.93 | | | | (15.95 | ) |

3-month Treasury bill

(BofA Merrill Lynch

3-Month Treasury Bill Index) | | | 0.04 | | | | 0.05 | |

US Treasury securities

(BofA Merrill Lynch

10-Year US Treasury Index) | | | 3.44 | | | | 17.36 | |

| US investment grade bonds (Barclays US Aggregate Bond Index) | | | 2.37 | | | | 7.47 | |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | | 4.14 | | | | 10.16 | |

US high yield bonds

(Barclays US Corporate High Yield 2% Issuer Capped Index) | | | 7.23 | | | | 7.21 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | |

| | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | |

JUNE 30, 2012

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | |  |

BlackRock Balanced Capital V.I. Fund

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

Fund Summary as of June 30, 2012

Investment Objective

BlackRock Balanced Capital V.I. Fund’s (the “Fund”) investment objective is to seek a level of current income and degree of stability of principal not normally available from an investment solely in equity securities, as well as the opportunity for capital appreciation greater than is normally available from an investment solely in debt securities.

On February 27, 2012, the Fund eliminated its non-fundamental policy that had prevented the Fund from investing in securities of foreign issuers if at the time of acquisition more than 20% of the Fund’s total assets would be invested in such securities.

Portfolio Management Commentary

How did the Fund perform?

| | — | | For the six-month period ended June 30, 2012, the Fund underperformed its blended benchmark (60% Russell 1000® Index/40% Barclays US Aggregate Bond Index). |

What factors influenced performance?

| | — | | From an asset class perspective, the Fund benefited from its allocation decisions during the first half of the year. Early in 2012, as equities advanced, the Fund benefited from a slight overweight in equities versus fixed income. In the latter half of the period, the Fund allowed its equity allocation to drift downward with falling stock market prices. |

| | — | | The Fund underperformed its blended benchmark due primarily to security selection in the equity portion of the Fund, most notably in the financials and information technology (“IT”) sectors. In financials, stock selection within diversified financial services, commercial banks and capital markets hurt returns, as did overexposure to life insurers as the industry struggled amid the sharp declines in interest rates and emerging underwriting quality concerns. Relative to the Russell 1000® Index, the Fund’s broad underweight to the financials sector hindered returns, especially during the first half of the reporting period, when riskier assets outperformed amid improved economic data and investor confidence. In the IT sector, the Fund was underweight in select mega-cap benchmark names that performed well during the period, while it was biased toward commodity-exposed hardware securities that lagged on weakness in enterprise and personal computer demand. |

| | — | | Positive performance in the equity portion of the Fund was derived from stock selection in the materials sector, where the Fund’s chemicals industry holdings were standout performers. Stock selection also contributed positively in the consumer discretionary sector, with particularly strong returns from the Fund’s travel-related holdings. |

| | — | | The fixed income portion of the Fund outperformed the Barclays US Aggregate Bond Index, primarily due to an overweight to non-government spread sectors. More specifically, an overweight to commercial mortgage-backed securities (“CMBS”) boosted returns as well as allocations to the high yield debt and non-agency residential mortgage-backed securities (“MBS”) sectors, which are not represented in the benchmark index. An overweight to investment grade credit, security selection within industrials and active trading within the agency MBS sector also had positive impacts. |

| | — | | The Fund maintained a short duration bias relative to the Barclays US Aggregate Bond Index, which detracted slightly from performance as concerns about Europe’s sovereign debt trouble dominated financial markets and US Treasury yields reached new all-time lows. However, the Fund’s yield curve-flattening bias more than offset the negative effect of its short duration stance as longer-dated bonds rallied significantly. |

Describe recent portfolio activity.

| | — | | During the period, the Fund maintained a general cautious stance given concerns about the global economy. From an asset allocation perspective, the Fund’s equity position was |

| | | | |

| | | | | |

| 2 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

| | reduced in favor of fixed income. Within equities, the Fund increased exposure to financials, industrials and energy, and reduced its weightings in consumer staples and health care. In fixed income, the Fund actively managed duration while maintaining a short duration bias relative to the benchmark index. The Fund slightly reduced risk by decreasing its net exposure to corporate credit and adding to its US Treasury positions. Also during the period, the Fund slightly reduced exposure to the agency MBS sector, and increased exposure to high quality CMBS and auto loan asset-backed securities (“ABS”). |

Describe portfolio positioning at period end.

| | — | | The Fund ended the period broadly neutral to its blended benchmark, with a slight underweight in equities and corresponding overweight in fixed income. Within equities, the Fund’s largest sector overweights relative to |

| | | the Russell 1000® Index were in health care and consumer discretionary, while consumer staples and financials were the largest underweights. Relative to the Barclays US Aggregate Bond Index, the fixed income segment was overweight in CMBS, ABS, investment grade corporate credit and agency MBS, and underweight in US Treasuries and agency debentures. The Fund also held out-of-index allocations to non-agency residential MBS and high yield corporate credit. The Fund ended the period with a shorter duration relative to the benchmark index. The outlook for the global economy is fragmented, with Europe in recession and the US and emerging markets expected to outperform other parts of the world. However, sluggish aggregate global growth does not necessarily mean a poor outlook for risk assets. Nevertheless, Fund management remains conscious of downside risk from policy mistakes and negative economic surprises. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 3 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

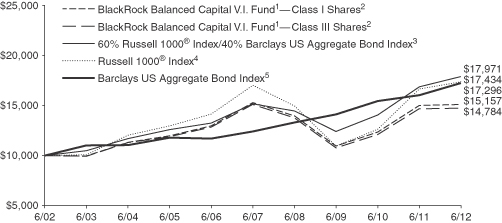

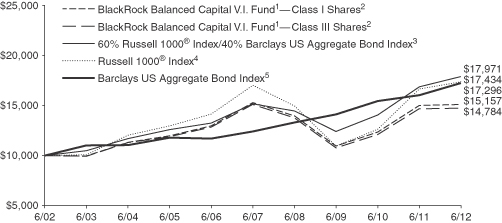

Total Return Based on a $10,000 Investment

| 1 | The Fund invests in equity securities and fixed income securities. |

| 2 | Assuming transaction costs, if any, and other operating expenses, including investment advisory fees. Does not include insurance- related fees and expenses. The returns for Class III Shares, which have not recommenced operations as of the date of this report, are based upon performance of the Fund’s Class I Shares. The returns for Class III Shares, however, are adjusted to reflect the distribution (12b-1) fees applicable to Class III Shares. |

| 3 | The Fund compares its performance to that of a customized weighted index comprised of the returns of the Russell 1000® Index (60%) and Barclays US Aggregate Bond Index (40%). |

| 4 | This unmanaged broad-based index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 91% of the total market capitalization of the Russell 3000® Index. |

| 5 | This unmanaged index is a widely recognized market-weighted index comprised of investment grade corporate bonds, rated BBB or better, mortgages and US Treasury and US government agency issues with at least one year to maturity. |

Performance Summary for the Period Ended June 30, 2012

| | | | | | | | | | | | | | | | |

| | | 6-Month Total Returns7 | | | Average Annual Total Returns | |

| | | | 1 Year7 | | | 5 Years7 | | | 10 Years7 | |

Class I Shares6 | | | 4.65 | % | | | 0.59 | % | | | (0.25 | )% | | | 4.25 | % |

Class III Shares6 | | | 4.52 | 8 | | | 0.34 | 8 | | | (0.50 | )8 | | | 3.99 | 8 |

60% Russell 1000® Index/40% Barclays US Aggregate Bond Index | | | 6.67 | | | | 6.07 | | | | 3.39 | | | | 6.04 | |

Russell 1000® Index | | | 9.38 | | | | 4.37 | | | | 0.39 | | | | 5.72 | |

Barclays US Aggregate Bond Index | | | 2.37 | | | | 7.47 | | | | 6.79 | | | | 5.63 | |

| 6 | Average annual and cumulative total investment returns are based on changes in net asset value for the periods shown, and assume reinvestment of all dividends and capital gains distributions at net asset value on the ex-dividend date. Insurance-related fees and expenses are not reflected in these returns. |

| 7 | For a portion of the period, the Fund’s investment advisor waived a portion of its fees. Without such waiver, the Fund’s performance would have been lower. |

| 8 | The returns for Class III Shares, which have not recommenced operations as of the date of this report, are based upon performance of the Fund’s Class I Shares. The returns for Class III Shares, however, are adjusted to reflect the distribution (12b-1) fees applicable to Class III Shares. |

Past performance is not indicative of future results.

| | | | |

| | | | | |

| 4 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

Fund Information as of June 30, 2012

| | | | |

| Portfolio Composition | | Percent of

Long-Term Investments | |

Common Stocks | | | 49 | % |

US Government Sponsored Agency Securities | | | 24 | |

US Treasury Obligations | | | 11 | |

Corporate Bonds | | | 10 | |

Non-Agency Mortgage-Backed Securities | | | 3 | |

Asset-Backed Securities | | | 2 | |

Foreign Agency Obligations | | | 1 | |

Disclosure of Expenses

Shareholders of the Fund may incur the following charges: (a) expenses related to transactions, including sales charges and exchange fees; and (b) operating expenses, including advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense example shown below (which is based on a hypothetical investment of $1,000 invested on January 1, 2012 and held through June 30, 2012) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in this Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges or exchange fees, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical2 | | | | |

| | | Beginning

Account Value

January 1, 2012 | | | Ending

Account Value

June 30, 2012 | | | Expenses Paid

During the Period1 | | | Beginning

Account Value

January 1, 2012 | | | Ending

Account Value

June 30, 2012 | | | Expenses Paid

During the Period1 | | | Annualized

Expense Ratio | |

Class I | | $ | 1,000.00 | | | $ | 1,046.50 | | | $ | 6.16 | | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.07 | | | | 1.21 | % |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown). |

| 2 | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 366. |

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 5 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

The Benefits and Risks of Leveraging

The Fund may utilize leverage to seek to enhance the yield and net asset value (“NAV”). However, these objectives cannot be achieved in all interest rate environments.

The Fund may utilize leverage through entering into reverse repurchase agreements and treasury roll transactions. In general, the concept of leveraging is based on the premise that the financing cost of assets to be obtained from leverage, which will be based on short-term interest rates, will normally be lower than the income earned by the Fund on its longer-term portfolio investments. To the extent that the total assets of the Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Fund’s shareholders will benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is paid to shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share NAV. However, in order to benefit shareholders, the yield curve must be positively sloped; that is, short-term interest rates must be lower than long-term interest rates. If the yield curve becomes negatively sloped, meaning short-term interest rates exceed long-term interest rates, income to shareholders will be lower than if the Fund had not used leverage.

If short-term interest rates rise, narrowing the differential between short-term and long-term interest rates, the incremental net income pickup will be reduced or eliminated completely. Furthermore, if prevailing short-term interest rates rise above long-term interest rates, the yield curve has a negative slope. In this case, the Fund pays higher short-term

interest rates whereas the Fund’s total portfolio earns income based on lower long-term interest rates.

Furthermore, the value of the Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of the portfolio investments. As a result, changes in interest rates can influence the Fund’s NAV positively or negatively in addition to the impact on Fund performance from leverage discussed above.

The use of leverage may enhance opportunities for increased income to the Fund, but as described above, it also creates risks as short- or long-term interest rates fluctuate. Leverage also will generally cause greater changes in the Fund’s NAVs and dividend rates than comparable portfolios without leverage. If the income derived from securities purchased with assets received from leverage exceeds the cost of leverage, the Fund’s net income will be greater than if leverage had not been used. Conversely, if the income from the securities purchased is not sufficient to cover the cost of leverage, the Fund’s net income will be less than if leverage had not been used, and therefore the amount available for distribution to shareholders will be reduced. The Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit the Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. The Fund will incur expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income.

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts, options and swaps, as specified in Note 2 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity, credit, interest rate and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of

the derivative financial instrument. The Fund’s ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require the Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation the Fund can realize on an investment, may result in lower dividends paid to shareholders or may cause the Fund to hold an investment that it might otherwise sell. The Fund’s investments in these instruments are discussed in detail in the Notes to Financial Statements.

| | | | |

| | | | | |

| 6 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments June 30, 2012 (Unaudited) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

Common Stocks | | Shares | | | Value | |

| Aerospace & Defense — 2.9% | |

General Dynamics Corp. | | | | | 2,775 | | | $ | 183,039 | |

L-3 Communications Holdings, Inc. | | | | | 2,575 | | | | 190,576 | |

Lockheed Martin Corp. | | | | | 2,200 | | | | 191,576 | |

Northrop Grumman Corp. | | | | | 2,975 | | | | 189,775 | |

| | | | | | | | | | |

| | | | | | | | | | 754,966 | |

| Beverages — 0.1% | |

The Coca-Cola Co. | | | | | 200 | | | | 15,638 | |

| Capital Markets — 0.8% | |

The Goldman Sachs Group, Inc. | | | | | 2,200 | | | | 210,892 | |

| Chemicals — 0.7% | |

CF Industries Holdings, Inc. | | | | | 900 | | | | 174,366 | |

| Commercial Banks — 0.7% | |

Regions Financial Corp. | | | | | 26,225 | | | | 177,019 | |

Wells Fargo & Co. | | | | | 500 | | | | 16,720 | |

| | | | | | | | | | |

| | | | | | | | | | 193,739 | |

| Computers & Peripherals — 5.4% | |

Apple, Inc. (a) | | | | | 1,350 | | | | 788,400 | |

Dell, Inc. (a) | | | | | 14,100 | | | | 176,532 | |

Hewlett-Packard Co. | | | | | 8,550 | | | | 171,940 | |

Lexmark International, Inc., Class A | | | | | 2,375 | | | | 63,128 | |

QLogic Corp. (a) | | | | | 6,250 | | | | 85,562 | |

Western Digital Corp. (a) | | | | | 4,375 | | | | 133,350 | |

| | | | | | | | | | |

| | | | | | | | | | 1,418,912 | |

| Construction & Engineering — 0.6% | |

Chicago Bridge & Iron Co. NV | | | | | 2,200 | | | | 83,512 | |

Fluor Corp. | | | | | 1,400 | | | | 69,076 | |

| | | | | | | | | | |

| | | | | | | | | | 152,588 | |

| Consumer Finance — 0.8% | |

Discover Financial Services | | | | | 5,850 | | | | 202,293 | |

| Diversified Consumer Services — 1.1% | |

Apollo Group, Inc., Class A (a) | | | | | 4,775 | | | | 172,807 | |

ITT Educational Services, Inc. (a) | | | | | 1,845 | | | | 112,084 | |

| | | | | | | | | | |

| | | | | | | | | | 284,891 | |

| Diversified Financial Services — 2.2% | |

Citigroup, Inc. | | | | | 9,200 | | | | 252,172 | |

JPMorgan Chase & Co. | | | | | 9,050 | | | | 323,357 | |

| | | | | | | | | | |

| | | | | | | | | | 575,529 | |

| Diversified Telecommunication Services — 1.5% | |

AT&T, Inc. | | | | | 2,000 | | | | 71,320 | |

Verizon Communications, Inc. | | | | | 7,050 | | | | 313,302 | |

| | | | | | | | | | |

| | | | | | | | | | 384,622 | |

| Energy Equipment & Services — 0.6% | |

Nabors Industries Ltd. (a) | | | | | 11,825 | | | | 170,280 | |

| | | | | | | | | | |

| | |

Common Stocks | | Shares | | | Value | |

| Food & Staples Retailing — 1.2% | | | | | |

The Kroger Co. | | | | | 7,350 | | | $ | 170,446 | |

Safeway, Inc. | | | | | 8,650 | | | | 156,998 | |

| | | | | | | | | | |

| | | | | | | | | | 327,444 | |

| Health Care Equipment & Supplies — 0.7% | |

Zimmer Holdings, Inc. | | | | | 2,875 | | | | 185,035 | |

| Health Care Providers & Services — 4.2% | |

Aetna, Inc. | | | | | 3,875 | | | | 150,234 | |

AmerisourceBergen Corp. | | | | | 4,475 | | | | 176,091 | |

Cardinal Health, Inc. | | | | | 4,275 | | | | 179,550 | |

Humana, Inc. | | | | | 2,100 | | | | 162,624 | |

McKesson Corp. | | | | | 2,000 | | | | 187,500 | |

UnitedHealth Group, Inc. | | | | | 4,075 | | | | 238,387 | |

| | | | | | | | | | |

| | | | | | | | | | 1,094,386 | |

| Hotels, Restaurants & Leisure — 0.6% | |

Wyndham Worldwide Corp. | | | | | 3,175 | | | | 167,450 | |

| Household Products — 0.2% | |

The Procter & Gamble Co. | | | | | 900 | | | | 55,125 | |

| Independent Power Producers & Energy Traders — 1.0% | |

The AES Corp. (a) | | | | | 13,600 | | | | 174,488 | |

NRG Energy, Inc. (a) | | | | | 4,775 | | | | 82,894 | |

| | | | | | | | | | |

| | | | | | | | | | 257,382 | |

| Industrial Conglomerates — 1.3% | |

3M Co. | | | | | 659 | | | | 59,046 | |

General Electric Co. | | | | | 4,375 | | | | 91,175 | |

Tyco International Ltd. | | | | | 3,475 | | | | 183,654 | |

| | | | | | | | | | |

| | | | | | | | | | 333,875 | |

| Insurance — 3.4% | |

The Allstate Corp. | | | | | 600 | | | | 21,054 | |

Assurant, Inc. | | | | | 2,500 | | | | 87,100 | |

The Chubb Corp. | | | | | 2,675 | | | | 194,793 | |

Lincoln National Corp. | | | | | 7,450 | | | | 162,932 | |

MetLife, Inc. | | | | | 5,950 | | | | 183,557 | |

Protective Life Corp. | | | | | 2,100 | | | | 61,761 | |

The Travelers Cos., Inc. | | | | | 2,975 | | | | 189,924 | |

| | | | | | | | | | |

| | | | | | | | | | 901,121 | |

| Internet & Catalog Retail — 0.6% | |

Expedia, Inc. | | | | | 3,325 | | | | 159,833 | |

| Internet Software & Services — 1.3% | |

Google, Inc., Class A (a) | | | | | 575 | | | | 333,540 | |

| IT Services — 2.7% | |

Accenture Plc, Class A | | | | | 1,200 | | | | 72,108 | |

Alliance Data Systems Corp. (a) | | | | | 1,300 | | | | 175,500 | |

International Business Machines Corp. | | | | | 1,100 | | | | 215,138 | |

Total System Services, Inc. | | | | | 3,275 | | | | 78,371 | |

Portfolio Abbreviations

To simplify the listings of portfolio holdings in the Schedule of Investments, the names and descriptions of many of the securities have been abbreviated according to the following list:

| | |

| AUD | | Australian Dollar |

| CAD | | Canadian Dollar |

| CBA | | Canadian Bankers Acceptances |

| CDO | | Collateralized Debt Obligation |

| CHF | | Swiss Franc |

| CNY | | Chinese Renminbi |

| | |

| EUR | | Euro |

| JPY | | Japanese Yen |

| LIBOR | | London Interbank Offered Rate |

| RB | | Revenue Bonds |

| TBA | | To Be Announced |

| USD | | US Dollar |

See Notes to Financial Statements.

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 7 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

Common Stocks | | Shares | | | Value | |

| IT Services (concluded) | |

The Western Union Co. | | | | | 9,825 | | | $ | 165,453 | |

| | | | | | | | | | |

| | | | | | | | | | 706,570 | |

| Machinery — 1.9% | |

AGCO Corp. (a) | | | | | 3,375 | | | | 154,339 | |

Ingersoll-Rand Plc | | | | | 4,200 | | | | 177,156 | |

Parker Hannifin Corp. | | | | | 2,200 | | | | 169,136 | |

| | | | | | | | | | |

| | | | | | | | | | 500,631 | |

| Media — 1.9% | |

DISH Network Corp., Class A | | | | | 5,550 | | | | 158,453 | |

Gannett Co., Inc. | | | | | 9,525 | | | | 140,303 | |

Time Warner Cable, Inc. | | | | | 2,475 | | | | 203,197 | |

| | | | | | | | | | |

| | | | | | | | | | 501,953 | |

| Metals & Mining — 0.6% | |

Alcoa, Inc. | | | | | 17,275 | | | | 151,156 | |

| Multi-Utilities — 0.6% | |

Ameren Corp. | | | | | 4,875 | | | | 163,508 | |

| Multiline Retail — 1.1% | |

Dillard’s, Inc., Class A | | | | | 2,300 | | | | 146,464 | |

Nordstrom, Inc. | | | | | 3,075 | | | | 152,797 | |

| | | | | | | | | | |

| | | | | | | | | | 299,261 | |

| Office Electronics — 0.7% | |

Xerox Corp. | | | | | 22,650 | | | | 178,256 | |

| Oil, Gas & Consumable Fuels — 7.4% | |

Apache Corp. | | | | | 2,375 | | | | 208,739 | |

Chevron Corp. | | | | | 3,875 | | | | 408,812 | |

ConocoPhillips | | | | | 4,575 | | | | 255,651 | |

Denbury Resources, Inc. (a) | | | | | 10,425 | | | | 157,522 | |

Devon Energy Corp. | | | | | 2,975 | | | | 172,520 | |

Exxon Mobil Corp. | | | | | 4,575 | | | | 391,483 | |

Marathon Oil Corp. | | | | | 5,950 | | | | 152,141 | |

Marathon Petroleum Corp. | | | | | 4,375 | | | | 196,525 | |

| | | | | | | | | | |

| | | | | | | | | | 1,943,393 | |

| Paper & Forest Products — 0.5% | |

International Paper Co. | | | | | 5,075 | | | | 146,718 | |

| Pharmaceuticals — 5.3% | |

Abbott Laboratories | | | | | 4,275 | | | | 275,609 | |

Eli Lilly & Co. | | | | | 5,100 | | | | 218,841 | |

Forest Laboratories, Inc. (a) | | | | | 4,875 | | | | 170,576 | |

Johnson & Johnson | | | | | 800 | | | | 54,048 | |

Merck & Co., Inc. | | | | | 7,700 | | | | 321,475 | |

Pfizer, Inc. | | | | | 15,601 | | | | 358,823 | |

| | | | | | | | | | |

| | | | | | | | | | 1,399,372 | |

| Semiconductors & Semiconductor Equipment — 0.0% | |

Advanced Micro Devices, Inc. (a) | | | | | 1,501 | | | | 8,601 | |

| Software — 2.2% | |

Microsoft Corp. | | | | | 13,900 | | | | 425,201 | |

Symantec Corp. (a) | | | | | 10,025 | | | | 146,465 | |

| | | | | | | | | | |

| | | | | | | | | | 571,666 | |

| Specialty Retail — 3.1% | |

Advance Auto Parts, Inc. | | | | | 2,200 | | | | 150,084 | |

Best Buy Co., Inc. | | | | | 6,950 | | | | 145,672 | |

Foot Locker, Inc. | | | | | 1,800 | | | | 55,044 | |

GameStop Corp., Class A | | | | | 2,061 | | | | 37,840 | |

The Gap, Inc. | | | | | 6,150 | | | | 168,264 | |

| | | | | | | | | | |

| | |

Common Stocks | | Shares | | | Value | |

| Specialty Retail (concluded) | |

Limited Brands, Inc. | | | | | 3,475 | | | $ | 147,792 | |

PetSmart, Inc. | | | | | 1,500 | | | | 102,270 | |

| | | | | | | | | | |

| | | | | | | | | | 806,966 | |

| Tobacco — 1.1% | |

Philip Morris International, Inc. | | | | | 3,475 | | | | 303,229 | |

| Total Common Stocks — 61.0% | | | | | | | | | 16,035,187 | |

|

| |

| | | |

| Fixed Income Securities | | | | | | | | | | |

| | |

| Asset-Backed Securities | | Par (000) | | | | |

AmeriCredit Automobile Receivables Trust: | | | | | | | | | | |

Series 2011-5, Class C,

3.44%, 10/08/17 | | USD | | | 25 | | | | 25,585 | |

Series 2012-2, Class C,

2.64%, 10/10/17 | | | | | 10 | | | | 10,183 | |

Series 2012-2, Class D,

3.38%, 4/09/18 | | | | | 15 | | | | 15,084 | |

Series 2012-3, Class C,

2.42%, 5/08/18 | | | | | 10 | | | | 9,999 | |

Series 2012-3, Class D,

3.03%, 7/09/18 | | | | | 10 | | | | 9,996 | |

Capital Trust Re CDO, Ltd.,

Series 2006-4A, Class A1,

0.55%, 10/20/43 (b)(c) | | | | | 21 | | | | 17,520 | |

CarMax Auto Owner Trust: | | | | | | | | | | |

Series 2012-1, Class B,

1.76%, 8/15/17 | | | | | 5 | | | | 5,020 | |

Series 2012-1, Class C,

2.20%, 10/16/17 | | | | | 5 | | | | 5,043 | |

Series 2012-1, Class D,

3.09%, 8/15/18 | | | | | 5 | | | | 5,018 | |

Countrywide Asset-Backed Certificates,

Series 2004-5, Class A,

0.70%, 10/25/34 (c) | | | | | 8 | | | | 7,118 | |

Ford Credit Floorplan Master Owner Trust: | | | | | | | | | | |

Series 2010-5, Class C,

2.07%, 9/15/15 (b) | | | | | 20 | | | | 20,126 | |

Series 2010-5, Class D,

2.41%, 9/15/15 (b) | | | | | 10 | | | | 10,062 | |

Series 2011-2, Class C,

2.37%, 9/15/15 | | | | | 30 | | | | 30,047 | |

Series 2011-2, Class D,

2.86%, 9/15/15 | | | | | 20 | | | | 20,030 | |

Globaldrive BV, Series 2008-2, Class A,

4.00%, 10/20/16 | | EUR | | | 5 | | | | 5,953 | |

Hyundai Auto Receivables Trust,

Series 2012-A, Class D,

2.61%, 5/15/18 | | USD | | | 10 | | | | 10,066 | |

Morgan Stanley ABS Capital I,

Series 2005-HE1, Class A2MZ,

0.55%, 12/25/34 (c) | | | | | 8 | | | | 6,602 | |

New Century Home Equity Loan Trust,

Series 2005-2, Class A2MZ,

0.51%, 6/25/35 (c)(d) | | | | | 21 | | | | 20,281 | |

See Notes to Financial Statements.

| | | | |

| | | | | |

| 8 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| Asset-Backed Securities | |

Par (000) | | | Value | |

Santander Consumer Acquired Receivables Trust (b): | | | | | | | | | | |

Series 2011-S1A, Class B,

1.66%, 8/15/16 | | USD | | | 35 | | | $ | 34,626 | |

Series 2011-S1A, Class C,

2.01%, 8/15/16 | | | | | 32 | | | | 32,127 | |

Series 2011-WO, Class C,

3.19%, 10/15/15 | | | | | 20 | | | | 20,112 | |

Santander Drive Auto Receivables Trust:

Series 2010-2, Class C,

3.89%, 7/17/17 | | | | | 30 | | | | 31,077 | |

Series 2011-S1A, Class B,

1.48%, 5/15/17 (b)

| | | | | 30 | | | | 29,600 | |

Series 2012-1, Class B,

2.72%, 5/16/16 | | | | | 5 | | | | 5,082 | |

Series 2012-1, Class C,

3.78%, 11/15/17 | | | | | 10 | | | | 10,290 | |

Series 2012-3, Class B,

1.94%, 12/15/16 | | | | | 40 | | | | 40,019 | |

Series 2012-3, Class C,

3.01%, 4/16/18 | | | | | 60 | | | | 60,091 | |

Series 2012-3, Class D,

3.64%, 5/15/18 | | | | | 45 | | | | 45,141 | |

Series 2012-4, Class C,

2.94%, 12/15/17 (e) | | | | | 10 | | | | 9,998 | |

Series 2012-4, Class D,

3.50%, 6/15/18 (e) | | | | | 10 | | | | 9,998 | |

Scholar Funding Trust, Series 2011-A, Class A,

1.37%, 10/28/43 (b)(c) | | | | | 89 | | | | 87,169 | |

Structured Asset Investment Loan Trust,

Series 2004-8, Class M4,

1.75%, 9/25/34 (c) | | | | | 18 | | | | 8,729 | |

Structured Asset Securities Corp. (c): | | | | | | | | | | |

Series 2004-23XS, Class 2A1,

0.55%, 1/25/35 | | | | | 20 | | | | 14,547 | |

Series 2005-GEL2, Class A,

0.53%, 4/25/35 | | | | | 6 | | | | 5,430 | |

| Total Asset-Backed Securities — 2.6% | | | | 677,769 | |

|

| |

| | | |

| Corporate Bonds | | | | | | | | |

| Aerospace & Defense — 0.1% | | | | | | | | | | |

United Technologies Corp.: | | | | | | | | | | |

3.10%, 6/01/22 | | | | | 5 | | | | 5,239 | |

4.50%, 6/01/42 | | | | | 10 | | | | 10,984 | |

| | | | | | | | | | |

| | | | | | | | | | 16,223 | |

| Auto Components — 0.0% | | | | | | | | | | |

BorgWarner, Inc., 4.63%, 9/15/20 | | | | | 10 | | | | 10,892 | |

| Capital Markets — 0.1% | | | | | | | | | | |

Credit Suisse AG, 5.40%, 1/14/20 | | | | | 10 | | | | 10,401 | |

The Goldman Sachs Group, Inc.,

5.75%, 1/24/22 | | | | | 25 | | | | 26,390 | |

| | | | | | | | | | |

| | | | | | | | | | 36,791 | |

| Chemicals — 0.0% | | | | | | | | | | |

The Dow Chemical Co., 4.13%, 11/15/21 | | | | | 10 | | | | 10,726 | |

| Commercial Banks — 0.6% | | | | | | | | | | |

BNP Paribas Home Loan Covered Bonds SA, 2.20%, 11/02/15 (b) | | | | | 90 | | | | 90,129 | |

HSBC Holdings Plc, 6.10%, 1/14/42 | | | | | 10 | | | | 12,247 | |

| | | | | | | | | | |

| | |

| Corporate Bonds | |

Par (000) | | | Value | |

| Commercial Banks (concluded) | | | | | | | | | | |

VTB Capital SA, 6.55%, 10/13/20 (b) | | USD | | | 20 | | | $ | 20,125 | |

Wells Fargo & Co., 3.50%, 3/08/22 | | | | | 30 | | | | 30,869 | |

| | | | | | | | | | |

| | | | | | | | | | 153,370 | |

| Construction Materials — 0.0% | | | | | | | | | | |

Lafarge SA, 7.13%, 7/15/36 | | | | | 4 | | | | 3,960 | |

| Consumer Finance — 0.1% | | | | | | | | | | |

SLM Corp., 6.25%, 1/25/16 | | | | | 25 | | | | 26,250 | |

| Diversified Financial Services — 1.1% | | | | | | | | | | |

Bank of America Corp.: | | | | | | | | | | |

3.88%, 3/22/17 | | | | | 20 | | | | 20,374 | |

5.70%, 1/24/22 | | | | | 50 | | | | 55,065 | |

Citigroup, Inc.: | | | | | | | | | | |

4.59%, 12/15/15 | | | | | 80 | | | | 83,686 | |

4.45%, 1/10/17 | | | | | 10 | | | | 10,482 | |

General Electric Capital Corp.,

6.15%, 8/07/37 | | | | | 25 | | | | 29,536 | |

JPMorgan Chase & Co., 3.15%, 7/05/16 | | | | | 100 | | | | 102,840 | |

| | | | | | | | | | |

| | | | | | | | | | 301,983 | |

| Diversified Telecommunication Services — 0.3% | |

Level 3 Financing, Inc., 8.13%, 7/01/19 | | | | | 31 | | | | 31,814 | |

Verizon Communications, Inc.: | | | | | | | | | | |

3.50%, 11/01/21 | | | | | 20 | | | | 21,293 | |

6.40%, 2/15/38 | | | | | 27 | | | | 35,062 | |

| | | | | | | | | | |

| | | | | | | | | | 88,169 | |

| Electric Utilities — 1.0% | | | | | | | | | | |

Alabama Power Co., 3.95%, 6/01/21 | | | | | 15 | | | | 16,400 | |

The Cleveland Electric Illuminating Co.: | | | | | | | | | | |

8.88%, 11/15/18 | | | | | 2 | | | | 2,673 | |

5.95%, 12/15/36 | | | | | 9 | | | | 10,175 | |

Duke Energy Carolinas LLC, 4.25%, 12/15/41 | | | | | 5 | | | | 5,390 | |

Florida Power & Light Co., 5.95%, 2/01/38 | | | | | 25 | | | | 33,212 | |

Georgia Power Co., 3.00%, 4/15/16 | | | | | 25 | | | | 26,733 | |

Hydro-Quebec: | | | | | | | | | | |

8.40%, 1/15/22 | | | | | 25 | | | | 36,168 | |

8.05%, 7/07/24 | | | | | 65 | | | | 96,147 | |

Jersey Central Power & Light Co.,

7.35%, 2/01/19 | | | | | 5 | | | | 6,336 | |

Southern California Edison Co.,

5.63%, 2/01/36 | | | | | 6 | | | | 7,578 | |

Trans-Allegheny Interstate Line Co.,

4.00%, 1/15/15 (b) | | | | | 10 | | | | 10,502 | |

| | | | | | | | | | |

| | | | | | | | | | 251,314 | |

| Energy Equipment & Services — 0.6% | |

Ensco Plc, 4.70%, 3/15/21 | | | | | 11 | | | | 11,982 | |

MEG Energy Corp., 6.50%, 3/15/21 (b) | | | | | 30 | | | | 30,637 | |

Peabody Energy Corp., 6.25%, 11/15/21 (b) | | | | | 15 | | | | 14,850 | |

Pride International, Inc., 6.88%, 8/15/20 | | | | | 10 | | | | 12,270 | |

Transocean, Inc.: | | | | | | | | | | |

5.05%, 12/15/16 | | | | | 30 | | | | 32,539 | |

6.00%, 3/15/18 | | | | | 20 | | | | 22,340 | |

6.50%, 11/15/20 | | | | | 20 | | | | 22,686 | |

| | | | | | | | | | |

| | | | | | | | | | 147,304 | |

| Food Products — 0.2% | | | | | | | | | | |

Kraft Foods Group, Inc. (b): | | | | | | | | | | |

3.50%, 6/06/22 | | | | | 13 | | | | 13,340 | |

5.00%, 6/04/42 | | | | | 6 | | | | 6,350 | |

See Notes to Financial Statements.

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 9 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| Corporate Bonds | |

Par (000) | | | Value | |

| Food Products (concluded) | | | | | | | | | | |

Kraft Foods, Inc.: | | | | | | | | | | |

6.50%, 8/11/17 | | USD | | | 6 | | | $ | 7,280 | |

6.50%, 2/09/40 | | | | | 20 | | | | 25,692 | |

| | | | | | | | | | |

| | | | | | | | | | 52,662 | |

| Health Care Equipment & Supplies — 0.2% | |

Boston Scientific Corp., 6.25%, 11/15/15 | | | | | 43 | | | | 48,160 | |

| Health Care Providers & Services — 0.2% | |

HCA, Inc.: | | | | | | | | | | |

6.50%, 2/15/20 | | | | | 10 | | | | 10,838 | |

7.25%, 9/15/20 | | | | | 20 | | | | 22,000 | |

Tenet Healthcare Corp.: | | | | | | | | | | |

6.25%, 11/01/18 | | | | | 15 | | | | 15,862 | |

8.88%, 7/01/19 | | | | | 10 | | | | 11,225 | |

UnitedHealth Group, Inc., 3.38%, 11/15/21 | | | | | 5 | | | | 5,259 | |

| | | | | | | | | | |

| | | | | | | | | | 65,184 | |

| Hotels, Restaurants & Leisure — 0.2% | |

MGM Resorts International: | | | | | | | | | | |

10.38%, 5/15/14 | | | | | 10 | | | | 11,275 | |

11.13%, 11/15/17 | | | | | 20 | | | | 22,450 | |

Wyndham Worldwide Corp., 4.25%, 3/01/22 | | | | | 15 | | | | 15,104 | |

| | | | | | | | | | |

| | | | | | | | | | 48,829 | |

| Independent Power Producers & Energy Traders — 0.2% | |

Energy Future Intermediate Holding Co. LLC, 10.00%, 12/01/20 | | | | | 40 | | | | 43,500 | |

Laredo Petroleum, Inc., 7.38%, 5/01/22 (b) | | | | | 10 | | | | 10,400 | |

| | | | | | | | | | |

| | | | | | | | | | 53,900 | |

| Industrial Conglomerates — 0.0% | | | | | | | | | | |

Sequa Corp., 11.75%, 12/01/15 (b) | | | | | 10 | | | | 10,550 | |

| Insurance — 2.2% | | | | | | | | | | |

Allianz Finance II BV, 5.75%, 7/08/41 | | EUR | | | 100 | | | | 113,980 | |

American International Group, Inc.: | | | | | | | | | | |

3.80%, 3/22/17 | | USD | | | 21 | | | | 21,407 | |

5.45%, 5/18/17 | | | | | 10 | | | | 10,856 | |

4.88%, 6/01/22 | | | | | 41 | | | | 41,952 | |

Fairfax Financial Holdings Ltd.,

5.80%, 5/15/21 (b) | | | | | 17 | | | | 16,642 | |

Hartford Financial Services Group, Inc.,

6.00%, 1/15/19 | | | | | 10 | | | | 10,712 | |

Hartford Life Global Funding Trusts,

0.65%, 6/16/14 (c) | | | | | 50 | | | | 49,083 | |

Lincoln National Corp., 7.00%, 6/15/40 | | | | | 10 | | | | 11,795 | |

Manulife Financial Corp., 3.40%, 9/17/15 | | | | | 20 | | | | 20,554 | |

Metropolitan Life Global Funding I (b): | | | | | | | | | | |

2.50%, 1/11/13 | | | | | 185 | | | | 186,731 | |

5.13%, 6/10/14 | | | | | 25 | | | | 26,809 | |

Prudential Financial, Inc.: | | | | | | | | | | |

4.75%, 9/17/15 | | | | | 30 | | | | 32,298 | |

4.50%, 11/15/20 | | | | | 30 | | | | 31,800 | |

| | | | | | | | | | |

| | | | | | | | | | 574,619 | |

| IT Services — 0.0% | | | | | | | | | | |

First Data Corp. (b): | | | | | | | | | | |

7.38%, 6/15/19 | | | | | 5 | | | | 5,100 | |

8.25%, 1/15/21 | | | | | 5 | | | | 5,000 | |

| | | | | | | | | | |

| | | | | | | | | | 10,100 | |

| Life Sciences Tools & Services — 0.1% | |

Life Technologies Corp., 6.00%, 3/01/20 | | | | | 15 | | | | 17,598 | |

| | | | | | | | | | |

| | |

| Corporate Bonds | |

Par (000) | | | Value | |

| Machinery — 0.1% | | | | | | | | | | |

UR Merger Sub Corp., 7.63%, 4/15/22 (b) | | USD | | | 30 | | | $ | 31,425 | |

| Media — 1.3% | | | | | | | | | | |

CBS Corp.: | | | | | | | | | | |

4.63%, 5/15/18 | | | | | 5 | | | | 5,456 | |

8.88%, 5/15/19 | | | | | 10 | | | | 13,224 | |

5.75%, 4/15/20 | | | | | 10 | | | | 11,631 | |

CCH II LLC, 13.50%, 11/30/16 | | | | | 20 | | | | 22,300 | |

Clear Channel Worldwide Holdings, Inc.: | | | | | | | | | | |

9.25%, 12/15/17 | | | | | 7 | | | | 7,612 | |

Series B, 9.25%, 12/15/17 | | | | | 38 | | | | 41,420 | |

Comcast Corp.: | | | | | | | | | | |

5.88%, 2/15/18 | | | | | 25 | | | | 29,562 | |

6.45%, 3/15/37 | | | | | 23 | | | | 27,970 | |

4.65%, 7/15/42 | | | | | 10 | | | | 10,005 | |

Cox Communications, Inc.,

8.38%, 3/01/39 (b) | | | | | 35 | | | | 49,255 | |

CSC Holdings LLC, 8.50%, 4/15/14 | | | | | 10 | | | | 11,000 | |

DIRECTV Holdings LLC: | | | | | | | | | | |

6.38%, 3/01/41 | | | | | 15 | | | | 17,174 | |

5.15%, 3/15/42 | | | | | 5 | | | | 5,032 | |

Intelsat Jackson Holdings SA, 7.25%, 4/01/19 | | | | | 12 | | | | 12,600 | |

NBC Universal Media LLC, 5.15%, 4/30/20 | | | | | 37 | | | | 42,479 | |

Time Warner Cable, Inc.: | | | | | | | | | | |

5.88%, 11/15/40 | | | | | 15 | | | | 16,788 | |

5.50%, 9/01/41 | | | | | 20 | | | | 21,762 | |

Time Warner, Inc., 4.70%, 1/15/21 | | | | | 10 | | | | 11,143 | |

| | | | | | | | | | |

| | | | | | | | | | 356,413 | |

| Metals & Mining — 0.2% | | | | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc.,

2.15%, 3/01/17 | | | | | 5 | | | | 4,930 | |

Newcrest Finance Property Ltd.,

4.45%, 11/15/21 (b) | | | | | 15 | | | | 15,392 | |

Novelis, Inc., 8.75%, 12/15/20 | | | | | 20 | | | | 21,550 | |

| | | | | | | | | | |

| | | | | | | | | | 41,872 | |

| Multi-Utilities — 0.1% | | | | | | | | | | |

Dominion Resources, Inc., 1.95%, 8/15/16 | | | | | 20 | | | | 20,381 | |

| Multiline Retail — 0.3% | | | | | | | | | | |

Dollar General Corp., 11.88%, 7/15/17 (c) | | | | | 25 | | | | 26,531 | |

Macy’s Retail Holdings, Inc.: | | | | | | | | | | |

5.90%, 12/01/16 | | | | | 30 | | | | 34,580 | |

7.45%, 7/15/17 | | | | | 11 | | | | 13,394 | |

| | | | | | | | | | |

| | | | | | | | | | 74,505 | |

| Oil, Gas & Consumable Fuels — 1.9% | |

Anadarko Petroleum Corp.: | | | | | | | | | | |

5.95%, 9/15/16 | | | | | 39 | | | | 44,256 | |

6.38%, 9/15/17 | | | | | 30 | | | | 34,849 | |

BP Capital Markets Plc, 3.13%, 10/01/15 | | | | | 10 | | | | 10,631 | |

Consol Energy, Inc., 8.25%, 4/01/20 | | | | | 9 | | | | 9,450 | |

El Paso Pipeline Partners Operating Co. LLC, 6.50%, 4/01/20 | | | | | 15 | | | | 17,409 | |

Energy Transfer Partners LP, 6.50%, 2/01/42 | | | | | 20 | | | | 21,433 | |

Enterprise Products Operating LLC, Series L,

6.30%, 9/15/17 | | | | | 50 | | | | 59,681 | |

KeySpan Gas East Corp., 5.82%, 4/01/41 (b) | | | | | 15 | | | | 19,158 | |

Kinder Morgan Energy Partners LP: | | | | | | | | | | |

5.95%, 2/15/18 | | | | | 25 | | | | 28,990 | |

6.55%, 9/15/40 | | | | | 5 | | | | 5,702 | |

Linn Energy LLC, 6.25%, 11/01/19 (b) | | | | | 20 | | | | 19,600 | |

Marathon Petroleum Corp., 6.50%, 3/01/41 | | | | | 20 | | | | 22,729 | |

See Notes to Financial Statements.

| | | | |

| | | | | |

| 10 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| Corporate Bonds | |

Par (000) | | | Value | |

| Oil, Gas & Consumable Fuels (concluded) | |

MidAmerican Energy Holdings Co.,

5.95%, 5/15/37 | | USD | | | 25 | | | $ | 31,008 | |

Nexen, Inc., 7.50%, 7/30/39 | | | | | 5 | | | | 5,827 | |

Petrobras International Finance Co.: | | | | | | | | | | |

3.88%, 1/27/16 | | | | | 40 | | | | 41,298 | |

5.75%, 1/20/20 | | | | | 44 | | | | 48,131 | |

Plains Exploration & Production Co.,

10.00%, 3/01/16 | | | | | 5 | | | | 5,450 | |

Range Resources Corp.: | | | | | | | | | | |

7.25%, 5/01/18 | | | | | 25 | | | | 26,500 | |

5.75%, 6/01/21 | | | | | 5 | | | | 5,225 | |

Rockies Express Pipeline LLC,

3.90%, 4/15/15 (b) | | | 4 | | | | 3,850 | |

Valero Energy Corp., 6.63%, 6/15/37 | | | | | 10 | | | | 11,213 | |

Western Gas Partners LP: | | | | | | | | | | |

5.38%, 6/01/21 | | | | | 22 | | | | 24,352 | |

4.00%, 7/01/22 | | | | | 10 | | | | 10,000 | |

| | | | | | | | | | |

| | | | | | | | | | 506,742 | |

| Paper & Forest Products — 0.1% | | | | | | | | | | |

International Paper Co.: | | | | | | | | | | |

4.75%, 2/15/22 | | | | | 10 | | | | 10,916 | |

6.00%, 11/15/41 | | | | | 10 | | | | 11,274 | |

| | | | | | | | | | |

| | | | | | | | | | 22,190 | |

| Pharmaceuticals — 0.2% | | | | | | | | | | |

Teva Pharmaceutical Finance Co. BV,

Series 2, 3.65%, 11/10/21 | | | | | 5 | | | | 5,259 | |

Teva Pharmaceutical Finance II BV/Teva Pharmaceutical Finance III LLC,

3.00%, 6/15/15 | | | | | 20 | | | | 21,048 | |

Teva Pharmaceutical Finance IV BV,

3.65%, 11/10/21 | | | | | 15 | | | | 15,776 | |

| | | | | | | | | | |

| | | | | | | | | | 42,083 | |

| Real Estate Investment Trusts (REITs) — 0.3% | |

ERP Operating LP, 4.63%, 12/15/21 | | | | | 15 | | | | 16,293 | |

Hospitality Properties Trust, 5.63%, 3/15/17 | | | | | 7 | | | | 7,454 | |

Ventas Realty LP/Ventas Capital Corp.,

4.75%, 6/01/21 | | | | | 10 | | | | 10,388 | |

Vornado Realty LP, 5.00%, 1/15/22 | | | | | 35 | | | | 37,010 | |

| | | | | | | | | | |

| | | | | | | | | | 71,145 | |

| Real Estate Management & Development — 0.1% | | | | | |

Realogy Corp., 7.88%, 2/15/19 (b) | | | | | 25 | | | | 24,437 | |

| Software — 0.0% | | | | | | | | | | |

Oracle Corp., 5.38%, 7/15/40 | | | | | 5 | | | | 6,126 | |

| Specialty Retail — 0.1% | | | | | | | | | | |

QVC, Inc., 7.50%, 10/01/19 (b) | | | | | 15 | | | | 16,650 | |

| Thrifts & Mortgage Finance — 0.1% | | | | | | | | | | |

Radian Group, Inc., 5.38%, 6/15/15 | | | | | 40 | | | | 27,800 | |

| Transportation Infrastructure — 0.1% | | | | | | | | |

Penske Truck Leasing Co. LP/PTL Finance Corp., 3.13%, 5/11/15 (b) | | | | | 25 | | | | 25,149 | |

| Wireless Telecommunication Services — 0.7% | |

Cricket Communications, Inc.,

7.75%, 5/15/16 | | | | | 14 | | | | 14,857 | |

MetroPCS Wireless, Inc., 7.88%, 9/01/18 | | | | | 5 | | | | 5,188 | |

SBA Tower Trust, 5.10%, 4/15/42 (b) | | | | | 120 | | | | 131,461 | |

Sprint Capital Corp., 6.88%, 11/15/28 | | | | | 5 | | | | 4,025 | |

| | | | | | | | | | |

| | |

| Corporate Bonds | |

Par (000) | | | Value | |

| Wireless Telecommunication Services (concluded) | |

Sprint Nextel Corp., 9.00%, 11/15/18 (b) | | USD | | | 20 | | | $ | 22,350 | |

| | | | | | | | | | |

| | | | | | | | | | 177,881 | |

| Total Corporate Bonds — 12.8% | | | | | | | | | 3,373,383 | |

|

| |

| | | |

| Foreign Agency Obligations | | | | | | | | | | |

Deutsche Bundesrepublik Inflation Linked Bond, 0.10%, 4/15/23 | | EUR | | | 128 | | | | 163,088 | |

Kreditanstalt fuer Wiederaufbau,

1.38%, 7/15/13 | | USD | | | 20 | | | | 20,197 | |

Mexico Government International Bond: | | | | | | | | | | |

6.38%, 1/16/13 | | | | | 15 | | | | 15,420 | |

5.63%, 1/15/17 | | | | | 15 | | | | 17,456 | |

5.13%, 1/15/20 | | | | | 40 | | | | 46,900 | |

Poland Government International Bond,

5.00%, 3/23/22 | | | | | 10 | | | | 10,915 | |

Russia Government International Bond,

7.50%, 3/31/30 (f) | | | | | 48 | | | | 57,989 | |

| Total Foreign Agency Obligations — 1.3% | | | | | | | 331,965 | |

|

| |

|

| Non-Agency Mortgage-Backed Securities | |

| Collateralized Mortgage Obligations — 0.7% | |

Countrywide Home Loan Mortgage

Pass-Through Trust: | | | | | |

Series 2006-0A5, Class 2A1,

0.45%, 4/25/46 (c) | | | | | 14 | | | | 7,578 | |

Series 2006-0A5, Class 3A1,

0.45%, 4/25/46 (c) | | | | | 27 | | | | 16,062 | |

Series 2007-J3, Class A10,

6.00%, 7/25/37 | | | | | 75 | | | | 55,184 | |

Credit Suisse Mortgage Capital Certificates (b)(c): | | | | | | | | |

Series 2011-2R, Class 2A1,

2.63%, 7/27/36 | | | | | 38 | | | | 36,789 | |

Series 2011-5R, Class 2A1,

2.88%, 8/27/46 | | | | | 32 | | | | 27,692 | |

First Horizon Asset Securities, Inc.,

Series 2005-AR3, Class 3A1,

3.82%, 8/25/35 (c) | | | | | 15 | | | | 13,035 | |

Impac Secured Assets CMN Owner Trust,

Series 2004-3, Class 1A4,

1.05%, 11/25/34 (c) | | | | | 8 | | | | 7,673 | |

| | | | | | | | | | |

| | | | | | | | | | 164,013 | |

| Commercial Mortgage-Backed Securities — 2.5% | | | | | |

Bear Stearns Commercial Mortgage Securities,

Series 2007-PW17, Class A3,

5.74%, 6/11/50 | | | | | 30 | | | | 31,366 | |

Commercial Mortgage Pass-Through Certificates: | | | | | | | | | | |

Series 2006-C7, Class AM,

5.77%, 6/10/46 (c) | | | | | 40 | | | | 41,560 | |

Series 2006-C8, Class AM,

5.35%, 12/10/46 | | | | | 15 | | | | 15,328 | |

Credit Suisse First Boston Mortgage Securities Corp., Series 2005-C3, Class AJ,

4.77%, 7/15/37 | | | | | 20 | | | | 17,748 | |

See Notes to Financial Statements.

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 11 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| Non-Agency Mortgage-Backed Securities | |

Par (000) | | | Value | |

| Commercial Mortgage-Backed Securities (concluded) | |

Credit Suisse Mortgage Capital Certificates,

Series 2010-RR2, Class 2A,

5.97%, 9/15/39 (b)(c) | | USD | | | 30 | | | $ | 33,197 | |

GMAC Commercial Mortgage Securities, Inc.,

Series 2004-C3, Class AAB,

4.70%, 12/10/41 | | | | | 129 | | | | 133,662 | |

JPMorgan Chase Commercial Mortgage

Securities Corp.: | | | | | | | | | | |

Series 2004-LN2, Class A2,

5.12%, 7/15/41 | | | | | 30 | | | | 31,841 | |

Series 2006-CB14, Class AM,

5.64%, 12/12/44 (c) | | | | | 15 | | | | 15,254 | |

Series 2007-CB18, Class A3,

5.45%, 6/12/47 | | | | | 21 | | | | 21,982 | |

Series 2008-C2, Class ASB,

6.13%, 2/12/51 (c) | | | | | 50 | | | | 53,330 | |

LB-UBS Commercial Mortgage Trust: | | | | | | | | | | |

Series 2004-C8, Class C,

4.93%, 12/15/39 (c) | | | | | 40 | | | | 42,274 | |

Series 2007-C1, Class AM,

5.46%, 2/15/40 | | | | | 10 | | | | 10,431 | |

Merrill Lynch/Countrywide Commercial Mortgage Trust, Series 2007-9, Class A4,

5.70%, 9/12/49 | | | | | 40 | | | | 43,917 | |

Morgan Stanley Capital I (c): | | | | | | | | | | |

Series 1998-WF2, Class G,

6.34%, 7/15/30 (b) | | | | | 50 | | | | 52,216 | |

Series 2007-HQ12, Class A2FX,

5.78%, 4/12/49 | | | | | 18 | | | | 18,545 | |

RBSCF Trust, Series 2010-RR3, Class WBTA,

6.10%, 2/16/51 (b)(c) | | | | | 50 | | | | 55,774 | |

UBS-Barclays Commercial Mortgage Trust,

Series 2012-C2, Class A4,

3.53%, 5/10/63 | | | | | 10 | | | | 10,157 | |

Wachovia Bank Commercial Mortgage Trust,

Series 2007-C33, Class A4,

6.10%, 2/15/51 (c) | | | | | 30 | | | | 33,619 | |

| | | | | | | | | | |

| | | | | | | | | | 662,201 | |

| Interest Only Commercial Mortgage-Backed Securities — 0.0% | |

Morgan Stanley Capital I, Series 2012-C4, Class XA, 2.89%, 3/15/45 (b)(c) | | | | | 125 | | | | 18,751 | |

| Total Non-Agency Mortgage-Backed Securities — 3.2% | | | | 844,965 | |

|

| |

|

| Taxable Municipal Bonds | |

New York City Municipal Water Finance Authority, Refunding RB, Second General Resolution, Series EE: | | | | | | | | | | |

5.38%, 6/15/43 | | | | | 10 | | | | 11,481 | |

5.50%, 6/15/43 | | | | | 15 | | | | 17,431 | |

| Total Taxable Municipal Bonds — 0.1% | | | | | | | 28,912 | |

|

| |

|

| US Government Sponsored Agency Securities | |

| Agency Obligations — 0.8% | | | | | | | | | | |

Fannie Mae: | | | | | | | | | | |

5.13%, 1/02/14 | | | | | 100 | | | | 106,742 | |

2.91%, 10/09/19 (g) | | | | | 35 | | | | 28,370 | |

| | | | | | | | | | |

| | |

| US Government Sponsored Agency Securities | |

Par (000) | | | Value | |

| Agency Obligations (concluded) | |

Tennessee Valley Authority, 5.25%, 9/15/39 | | USD | | | 60 | | | $ | 78,232 | |

| | | | | | | | | | |

| | | | | | | | | | 213,344 | |

| Collateralized Mortgage Obligations — 0.4% | | | | | |

Freddie Mac Mortgage-Backed Securities: | | | | | | | | | | |

Series K013, Class A2,

3.97%, 1/25/21 (c) | | | | | 30 | | | | 33,645 | |

Series K017, Class A2, 2.87%, 12/25/21 | | | | | 55 | | | | 57,417 | |

| | | | | | | | | | |

| | | | | | | | | | 91,062 | |

| Commercial Mortgage-Backed Securities — 0.0% | | | | | |

Freddie Mac Mortgage-Backed Securities,

Series K706, Class C,

4.02%, 11/25/44 (b)(c) | | | 10 | | | | 8,682 | |

| Federal Deposit Insurance Corporation Guaranteed — 0.1% | | | | | |

General Electric Capital Corp.,

2.13%, 12/21/12 | | | | | 25 | | | | 25,215 | |

| Interest Only Collateralized Mortgage Obligations — 0.0% | |

Freddie Mac Mortgage-Backed Securities, Series K707, Class X1,

1.70%, 12/25/18 (c) | | | | | 72 | | | | 5,937 | |

| Mortgage-Backed Securities — 29.2% | | | | | | | | |

Fannie Mae Mortgage-Backed Securities: | | | | | | | | | | |

3.00%, 7/12/42 (h) | | | | | 400 | | | | 410,188 | |

3.31%, 12/01/40 (c) | | | | | 19 | | | | 20,134 | |

3.50%, 11/01/26-7/15/42 (h) | | | | | 754 | | | | 794,099 | |

4.00%, 9/01/25-7/15/42 (h) | | | | | 1,408 | | | | 1,508,008 | |

4.50%, 6/01/26-7/15/42 (h) | | | | | 862 | | | | 928,780 | |

4.80%, 8/01/38 (c) | | | | | 34 | | | | 36,778 | |

5.00%, 7/01/34-8/15/42 (h) | | | | | 486 | | | | 526,779 | |

5.50%, 9/01/34-8/15/42 (h) | | | | | 507 | | | | 555,684 | |

6.00%, 12/01/31-8/15/42 (h) | | | | | 1,280 | | | | 1,408,601 | |

6.50%, 5/01/40 | | | | | 150 | | | | 169,377 | |

Freddie Mac Mortgage-Backed Securities: | | | | | | | | | | |

4.00%, 7/15/42 (h) | | | | | 100 | | | | 106,109 | |

4.50%, 7/15/42-8/15/42 (h) | | | 200 | | | | 213,547 | |

5.00%, 3/01/38-7/15/42 (h) | | | 300 | | | | 322,432 | |

5.50%, 4/01/38-1/01/40 | | | 92 | | | | 100,080 | |

6.00%, 6/01/35 | | | | | 27 | | | | 29,308 | |

Ginnie Mae Mortgage-Backed Securities (h): | | | | | | | | | | |

4.00%, 7/15/42 | | | | | 100 | | | | 109,203 | |

4.50%, 7/15/42 | | | | | 200 | | | | 218,656 | |

5.00%, 7/15/42 | | | | | 200 | | | | 220,062 | |

| | | | | | | | | | |

| | | | | | | | | | 7,677,825 | |

Total US Government Sponsored Agency

Securities — 30.5% | | | | 8,022,065 | |

|

| |

| | | |

| US Treasury Obligations | | | | | | | | | | |

US Treasury Bonds: | | | | | | | | | | |

3.13%, 2/15/42 | | | | | 192 | | | | 206,220 | |

3.00%, 5/15/42 | | | | | 485 | | | | 507,962 | |

US Treasury Inflation Indexed Bonds,

0.75%, 2/15/42 | | | | | 36 | | | | 37,381 | |

US Treasury Notes: | | | | | | | | | | |

0.63%, 1/31/13 (i) | | | | | 115 | | | | 115,292 | |

0.25%, 5/31/14 | | | | | 115 | | | | 114,856 | |

0.50%, 8/15/14 | | | | | 45 | | | | 45,151 | |

2.50%, 4/30/15 | | | | | 35 | | | | 37,048 | |

See Notes to Financial Statements.

| | | | |

| | | | | |

| 12 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| US Treasury Obligations | |

Par (000) | | | Value | |

US Treasury Notes: (concluded) | | | | | | | | | | |

0.38%, 6/15/15 | | USD | | | 260 | | | $ | 259,777 | |

0.63%, 5/31/17 (j) | | | | | 260 | | | | 258,802 | |

0.63%, 6/30/17 | | | | | 510 | | | | 510,518 | |

1.13%, 5/31/19 | | | | | 150 | | | | 150,234 | |

1.00%, 6/30/19 | | | | | 150 | | | | 148,805 | |

1.75%, 5/15/22 (j) | | | | | 1,020 | | | | 1,028,287 | |

| Total US Treasury Obligations — 13.0% | | | | 3,420,333 | |

| Total Fixed Income Securities — 63.5% | | | | 16,699,392 | |

|

| |

| | | |

| Preferred Securities | | | | | | | | | | |

| | | |

| Capital Trusts | | | | | | | | |

| Commercial Banks — 0.1% | |

Fifth Third Capital Trust IV,

6.50%, 4/15/67 (c) | | | | | 15 | | | | 14,906 | |

JPMorgan Chase Capital XXV,

Series Y, 6.80%, 10/01/37 | | | | | 5 | | | | 5,000 | |

| | | | | | | | | | |

| | | | | | | | | | 19,906 | |

| Consumer Finance — 0.1% | |

Capital One Capital VI,

8.88%, 5/15/40 | | | | | 30 | | | | 30,488 | |

| Insurance — 0.1% | |

American International Group, Inc.,

8.18%, 5/15/58 (c) | | | | | 5 | | | | 5,425 | |

Swiss Re Capital I LP, 6.85% (b)(c)(k) | | | | | 15 | | | | 13,818 | |

XL Group Plc, Series E, 6.50% (c)(k) | | | | | 20 | | | | 16,250 | |

| | | | | | | | | | |

| | | | | | | | | | 35,493 | |

| Total Capital Trusts — 0.3% | | | | | | | 85,887 | |

|

| |

| | |

| Trust Preferred | | Shares | | | | |

| Commercial Banks — 0.1% | |

Citigroup Capital XIII, 7.88%, 10/30/40 | | | | | 481 | | | | 12,971 | |

| Total Preferred Securities — 0.4% | | | | | | | 98,858 | |

Total Long-Term Investments (Cost — $31,440,114) — 124.9% | | | | | | | 32,833,437 | |

|

| |

| | |

| Short-Term Securities | | Beneficial

Interest

(000) | | | | |

Bank of New York Cash Reserves, 0.01% (l) | | USD | | | 87 | | | | 87,216 | |

Total Short-Term Securities

(Cost — $87,216) — 0.3% | | | | | | | 87,216 | |

|

| |

| | |

| Options Purchased | | Contracts | | | | |

| Exchange-Traded Call Options — 0.0% | |

Euro-Dollar 3-Year Mid-Curve Options, Strike Price USD 99.00, Expires 8/10/12 | | | | | 7 | | | | 788 | |

| | | | | | | | | | |

| | |

| Options Purchased | |

Contracts | | | Value | |

| Exchange-Traded Put Options — 0.0% | |

10-Year US Treasury Note,

Strike Price USD 131.00,

Expires 7/27/12 | | | | | 5 | | | $ | 547 | |

| | |

| | | Notional

Amount

(000) | | | | |

| Over-the-Counter Call Options — 0.0% | |

USD Currency: | | | | | | | | | | |

Strike Price JPY 85.00,

Expires 8/24/12,

Broker Citibank NA | | USD | | | 185 | | | | 181 | |

Strike Price JPY 85.00,

Expires 8/24/12,

Broker Goldman Sachs Group, Inc. | | | | | 185 | | | | 181 | |

| | | | | | | | | | |

| | | | | | | | | | 362 | |

| Over-the-Counter Interest Rate Put Swaptions — 0.1% | |

Pay a fixed rate of 2.70% and receive a floating rate based on 3-month LIBOR, Expires 07/23/12, Broker Deutsche

Bank AG | | | | | 100 | | | | — | |

Pay a fixed rate of 4.50% and receive a floating rate based on 3-month LIBOR, Expires 03/20/17, Broker Deutsche

Bank AG | | | | | 100 | | | | 2,632 | |

Pay a fixed rate of 2.13% and receive a floating rate based on 3-month LIBOR, Expires 03/21/13, Broker Deutsche

Bank AG | | | | | 200 | | | | 312 | |

| | | | | | | | | | |

| | | | | | | | | | 2,944 | |

Total Options Purchased (Cost — $17,078) — 0.1% | | | | | | | 4,641 | |

Total Investments Before TBA Sale Commitments and Options Written (Cost — $31,544,408) — 125.3% | | | | | | | 32,925,294 | |

|

| |

| | |

| TBA Sale Commitments (h) | | Par (000) | | | | |

Fannie Mae Mortgage-Backed Securities: | | | | | | | | | | |

3.00%, 7/15/42 | | | | | 300 | | | | (307,641 | ) |

3.50%, 7/15/42 | | | | | 600 | | | | (630,656 | ) |

4.00%, 7/15/42 — 8/15/42 | | | | | 1,100 | | | | (1,170,453 | ) |

4.50%, 7/15/42 | | | | | 200 | | | | (214,531 | ) |

5.00%, 7/15/42 | | | | | 200 | | | | (216,438 | ) |

5.50%, 7/15/42 | | | | | 200 | | | | (218,156 | ) |

6.00%, 7/15/42 | | | | | 800 | | | | (879,125 | ) |

Freddie Mac Mortgage-Backed Securities: | | | | | | | | | | |

4.50%, 7/15/42 | | | | | 100 | | | | (106,797 | ) |

5.00%, 7/15/42 | | | | | 200 | | | | (214,969 | ) |

Total TBA Sale Commitments (Proceeds — $3,950,605) — (15.1)% | | | | | | | (3,958,766 | ) |

|

| |

| | |

| Options Written | | Contracts | | | | |

| Exchange-Traded Call Options — (0.0)% | |

Euro-Dollar 3-Year Mid-Curve Options,

Strike Price USD 99.13, Expires 8/10/12 | | | 7 | | | | (262 | ) |

| Exchange-Traded Put Options — (0.0)% | |

10-Year US Treasury Note,

Strike Price USD 129.50, Expires 7/27/12 | | | 5 | | | | (156 | ) |

See Notes to Financial Statements.

| | | | |

| | | | | |

| JUNE 30, 2012 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | 13 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | (Percentages shown are based on Net Assets) |

| | | | | | | | | | |

| | |

| Options Written | | Notional

Amount

(000) | | | Value | |

| Over-the-Counter Call Options — (0.0)% | |

EUR Currency, Strike Price USD 1.28, Expires 7/31/12, Broker Goldman Sachs Group, Inc. | | EUR | | | 92 | | | $ | (2,071 | ) |

USD Currency: | | | | | | | | | | |

Strike Price JPY 90.00, Expires 8/24/12, Broker Goldman Sachs International | | USD | | | 185 | | | | (21 | ) |

Strike Price JPY 90.00, Expires 8/24/12, Broker Citibank NA | | | | | 370 | | | | (41 | ) |

| | | | | | | | | | |

| | | | | | | | | | (2,133 | ) |

| Over-the-Counter Interest Rate Call Swaptions — (0.0)% | |

Pay a fixed rate of 1.25% and receive a floating rate based on 3-month LIBOR, Expires 6/20/14, Broker Barclays Plc | | | | | 100 | | | | (881 | ) |

| Over-the-Counter Interest Rate Put Swaptions — (0.0)% | |

Receive a fixed rate of 6.00% and pay a floating rate based on 3-month LIBOR,

Expires 3/20/17, Broker Deutsche

Bank AG | | | 200 | | | | (2,646 | ) |

| | | | | | | | | | |

| | |

| Options Written | | Notional

Amount

(000) | | | Value | |

| Over-the-Counter Interest Rate Put Swaptions (concluded) | |

Receive a fixed rate of 1.55% and pay a floating rate based on 3-month LIBOR, Expires 10/29/12, Broker Morgan Stanley | | USD | | | 200 | | | $ | (189 | ) |

Receive a fixed rate of 2.25% and pay a floating rate based on 3-month LIBOR, Expires 6/20/14, Broker Barclays Plc | | | | | 100 | | | | (1,170 | ) |

| | | | | | | | | | |

| | | | | | | | | | (4,005 | ) |

Total Options Written

(Premiums Received — 13,065) — 0.0% | | | | | | | (7,437 | ) |

| Total Investments, Net of TBA Sale Commitments and Options Written — 110.2% | | | | 28,959,091 | |

| Liabilities in Excess of Other Assets — (10.2)% | | | | (2,669,929 | ) |

| | | | | | | | | | |

| Net Assets — 100.0% | | | $ | 26,289,162 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Variable rate security. Rate shown is as of report date. |

| (d) | Represents a payment-in-kind security which may pay interest/dividends in additional par/shares. |

| (e) | When-issued security. Unsettled when-issued transactions were as follows: |

| | | | | | | | |

| Counterparty | | Value | | | Unrealized

Appreciation

(Depreciation) | |

Barclays Plc | | $ | 19,996 | | | | — | |

UBS AG | | $ | 10,157 | | | | — | |

| (f) | Represents a step-up bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate shown is as of report date. |

| (g) | Represents a zero-coupon bond. Rate shown reflects the current yield as of report date. |

| (h) | Represents or includes a TBA transaction. Unsettled TBA transactions as of June 30, 2012 were as follows: |

| | | | | | | | |

| Counterparty | | Value | | | Unrealized

Appreciation

(Depreciation) | |

Bank of America Corp. | | | — | | | $ | (218 | ) |

Barclays Plc | | | — | | | $ | 66 | |

Citigroup, Inc. | | $ | 4,125 | | | $ | (1,469 | ) |

Credit Suisse Group AG | | $ | 116,859 | | | $ | (555 | ) |

Goldman Sachs Group, Inc. | | $ | 123,015 | | | $ | (1,664 | ) |

JPMorgan Chase & Co. | | $ | 108,672 | | | $ | 336 | |

Morgan Stanley | | $ | 206,031 | | | $ | 133 | |

Nomura Trust and Banking Co., Ltd. | | $ | 220,063 | | | $ | (984 | ) |

Royal Bank of Scotland Group Plc | | | — | | | $ | 23 | |

| (i) | All or a portion of security has been pledged as collateral in connection with open financial futures contracts. |

| (j) | All or a portion of security has been pledged as collateral in connection with open reverse repurchase agreements. |

| (k) | Security is perpetual in nature and has no stated maturity date. |

| (l) | Represents the current yield as of report date. |

| — | Investments in companies considered to be an affiliate of the Portfolio during the period, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| | | | | | | | | | | | | | | | |

| Affiliate | | Shares Held at

December 31,

2011 | | | Net Activity | | | Shares

Held at

June 30,

2012 | | | Income | |

BlackRock Liquidity Funds, TempFund, Institutional Class | | | 272,440 | | | | (272,440 | ) | | | — | | | $ | 195 | |

| — | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

See Notes to Financial Statements.

| | | | |

| | | | | |

| 14 | | BLACKROCK VARIABLE SERIES FUNDS, INC. | | JUNE 30, 2012 |

BlackRock Variable Series Funds, Inc.

BlackRock Balanced Capital V.I. Fund

| | |

| Schedule of Investments (continued) | | |

| — | | Reverse repurchase agreements outstanding as of June 30, 2012 were as follows: |

| | | | | | | | | | | | | | | | |

| Counterparty | | Interest

Rate | | | Trade Date | | Maturity

Date | | Net Closing

Amount | | | Face

Amount | |

BNP Paribas SA | | | (0.08 | )% | | 6/29/12 | | 7/02/12 | | $ | 260,323 | | | $ | 260,325 | |

Credit Suisse Group AG | | | (0.09 | )% | | 6/29/12 | | 7/02/12 | | | 1,031,467 | | | | 1,031,475 | |

Total | | | | | | | | | | $ | 1,291,790 | | | $ | 1,291,800 | |

| | | | | | | | | | | | | | | | |

| — | | Financial futures contracts purchased as of June 30, 2012 were as follows: |

| | | | | | | | | | | | | | |

| Contracts | | Issue | | Exchange | | Expiration | | Notional

Value | | | Unrealized

Depreciation | |

| 2 | | 10-Year Australian Treasury Bond | | Australian Securities Exchange | | September 2012 | | USD | 256,812 | | | $ | (1,721 | ) |

| 2 | | 30-Year US Treasury Bond | | Chicago Board of Trade | | September 2012 | | USD | 295,938 | | | | (1,879 | ) |

| 5 | | 2-Year US Treasury Note | | Chicago Board of Trade | | September 2012 | | USD | 1,100,938 | | | | (299 | ) |

| 3 | | 5-Year US Treasury Note | | Chicago Board of Trade | | September 2012 | | USD | 371,906 | | | | (649 | ) |

| 2 | | 90-Day Euro-Dollar | | Chicago Mercantile | | March 2015 | | USD | 495,525 | | | | (80 | ) |

| 2 | | 90-Day Euro-Dollar | | Chicago Mercantile | | June 2015 | | USD | 494,975 | | | | (105 | ) |

| 2 | | 90-Day Euro-Dollar | | Chicago Mercantile | | September 2015 | | USD | 494,350 | | | | (143 | ) |

| 2 | | 90-Day Euro-Dollar | | Chicago Mercantile | | December 2015 | | USD | 493,625 | | | | (205 | ) |

| Total | | | | | | | | | | | | $ | (5,081 | ) |

| | | | | | | | | | | | | | |

| — | | Financial futures contracts sold as of June 30, 2012 were as follows: |

| | | | | | | | | | | | | | |

| Contracts | | Issue | | Exchange | | Expiration | | Notional Value | | | Unrealized

Appreciation

(Depreciation) | |

| 3 | | German Euro-Bund | | Eurex | | September 2012 | | USD | 534,927 | | | $ | 8,108 | |

| 5 | | 3-Year Australian Treasury Bond | | Australian Securities Exchange | | September 2012 | | USD | 564,926 | | | | 2,263 | |

| 3 | | 10-Year US Treasury Note | | Chicago Board of Trade | | September 2012 | | USD | 400,125 | | | | 210 | |

| 4 | | Ultra-Long US Treasury Bond | | Chicago Board of Trade | | September 2012 | | USD | 667,375 | | | | (9,363 | ) |

| 2 | | 90-Day Australia Bank Bill | | Australian Securities Exchange | | December 2012 | | USD | 2,031,769 | | | | 542 | |

| 2 | | 3-Month Canada Bankers Acceptance | | Montreal Exchange | | June 2013 | | USD | 485,021 | | | | (2,132 | ) |

Total | | | | | | | | | | $ | (372 | ) |

| | | | | | | | | | | | | | |

| — | | Foreign currency exchange contracts as of June 30, 2012 were as follows: |

| | | | | | | | | | | | | | |

| Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement Date | | Unrealized

Appreciation

(Depreciation) | |

| CHF | 96,028 | | | EUR | 80,000 | | | UBS AG | | 7/11/12 | | $ | (55 | ) |

| EUR | 40,000 | | | CHF | 48,039 | | | Citibank NA | | 7/11/12 | | | 2 | |

| EUR | 40,000 | | | CHF | 48,034 | | | UBS AG | | 7/11/12 | | | 6 | |

| USD | 26,307 | | | EUR | 20,000 | | | Citibank NA | | 7/25/12 | | | 993 | |

| USD | 94,384 | | | EUR | 71,500 | | | JPMorgan Chase & Co. | | 7/25/12 | | | 3,885 | |

| USD | 142,162 | | | EUR | 110,000 | | | Royal Bank of Scotland Group Plc | | 7/25/12 | | | 2,933 | |

| USD | 50,221 | | | AUD | 50,000 | | | UBS AG | | 7/31/12 | | | (819 | ) |