Shareholders Should Not Tender Their Shares The Staples Offer Undervalues Essendant This presentation contains forward-looking statements, including statements regarding the proposed acquisition of Essendant Inc. (“Essendant”) by Staples, Inc. (“Staples”). From time to time, oral or written forward-looking statements may also be included in other information we release to the public. These forward-looking statements are intended to provide Pzena Investment Management, LLC’s (“Pzena”) current expectations of Essendant’s future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements often contain words such as “expects,” “anticipates,” “estimates,” “intends,” “plans,” “believes,” “seeks,” “will,” “is likely to,” “scheduled,” “positioned to,” “continue,” “forecast,” “predicting,” “projection,” “potential” or similar expressions. Forward-looking statements may include references to plans, strategies, objectives, projected costs or savings, anticipated future performance, results, events or transactions of Essendant and other statements that are not strictly historical in nature. These forward-looking statements are based on Pzena’s current expectations, forecasts and assumptions relating to Essendant. This means the forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including, but not limited to: the failure of Essendant to meet its previously stated efforts to drive sales growth and rationalize costs and capacity. There can be no assurance that the proposed improvements described above will in fact be accomplished in the manner described or at all. Stockholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete.

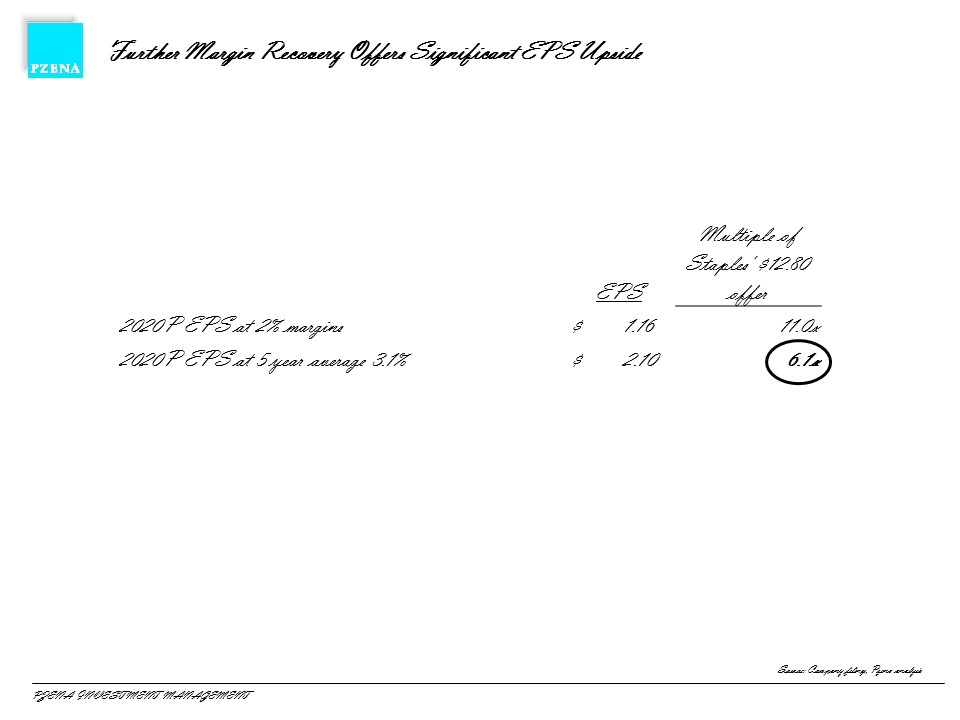

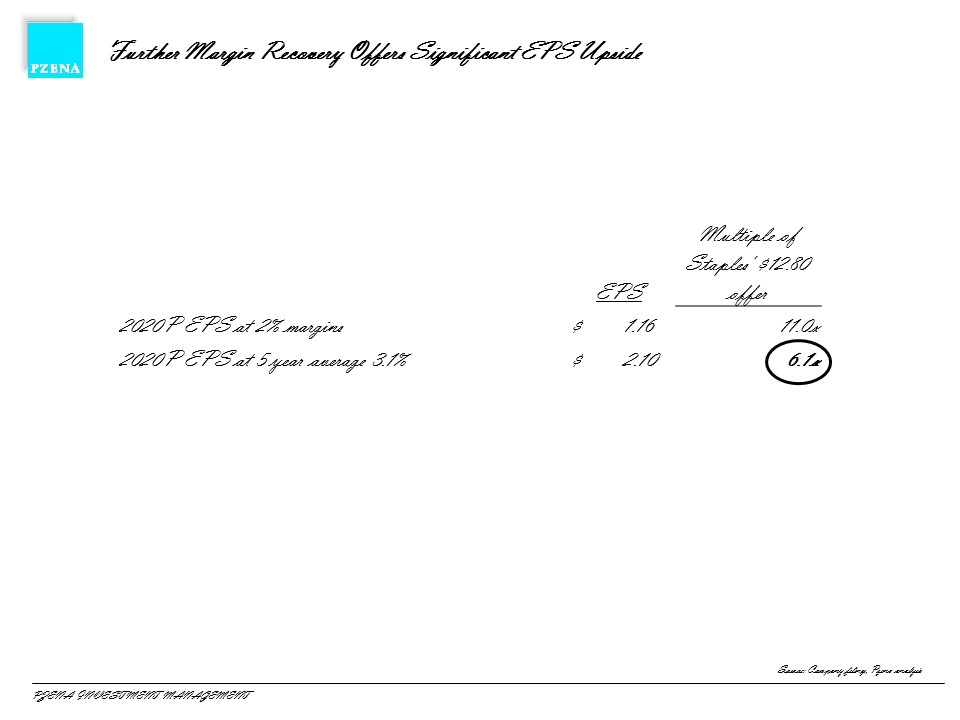

Staples and Sycamore Partners Are Getting a Sweetheart Deal Staples and Sycamore have pressured Essendant’s (ESND) Board of Directors to accept offer materially below intrinsic value and the recent trading history of ESND Shareholders are not given the opportunity to participate in meaningful value creation as the company continues to execute against it’s strategic plan The Board of Directors walked away from a merger with S.P. Richards that offered compelling synergies Offer represents only 11.0x 2020E EPS even with margins dramatically below recent history

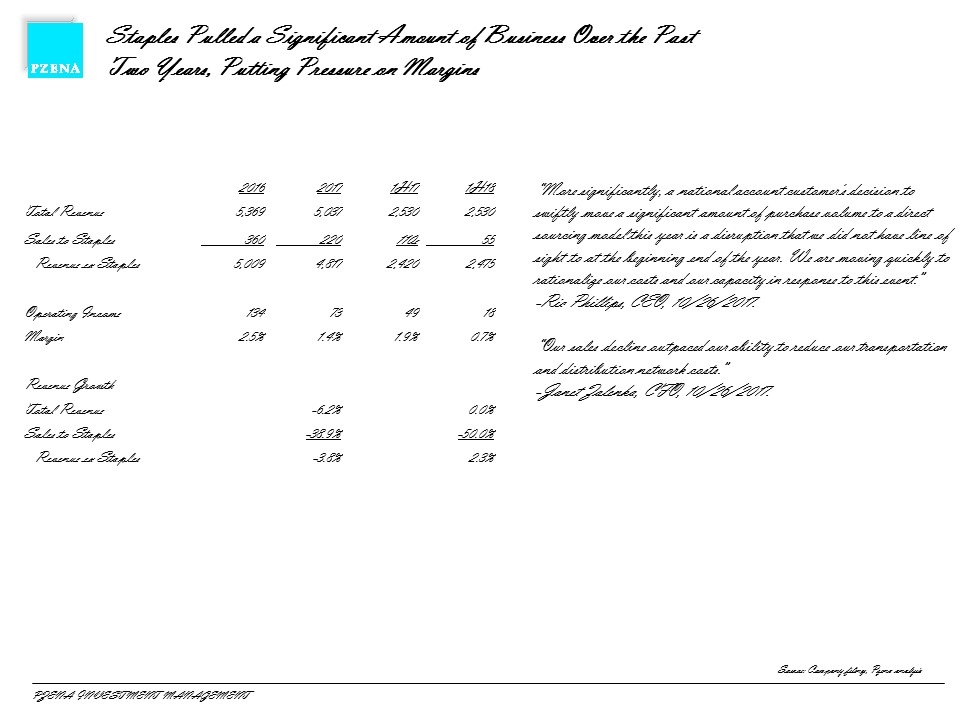

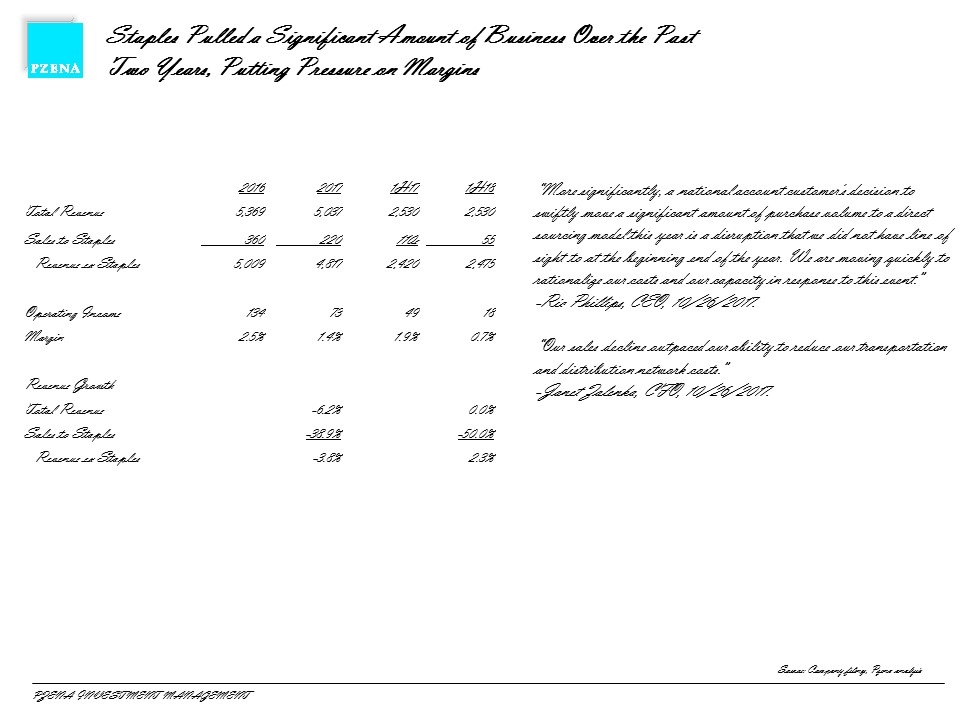

Staples Pulled a Significant Amount of Business Over the Past Two Years, Putting Pressure on Margins 2016 2017 1H17 1H18 Total Revenue 5,369 5,037 2,530 2,530 Sales to Staples 360 220 110e 55 Revenue ex Staples 5,009 4,817 2,420 2,475 Operating Income 134 73 49 18 Margin 2.5% 1.4% 1.9% 0.7% Revenue Growth Total Revenue -6.2% 0.0% Sales to Staples -38.9% -50.0% Revenue ex Staples -3.8% 2.3% “More significantly, a national account customer's decision to swiftly move a significant amount of purchase volume to a direct sourcing model this year is a disruption that we did not have line of sight to at the beginning end of the year. We are moving quickly to rationalize our costs and our capacity in response to this event.” -Ric Phillips, CEO, 10/26/2017. “Our sales decline outpaced our ability to reduce our transportation and distribution network costs.” -Janet Zalenka, CFO, 10/26/2017. Source: Company filings, Pzena analysis

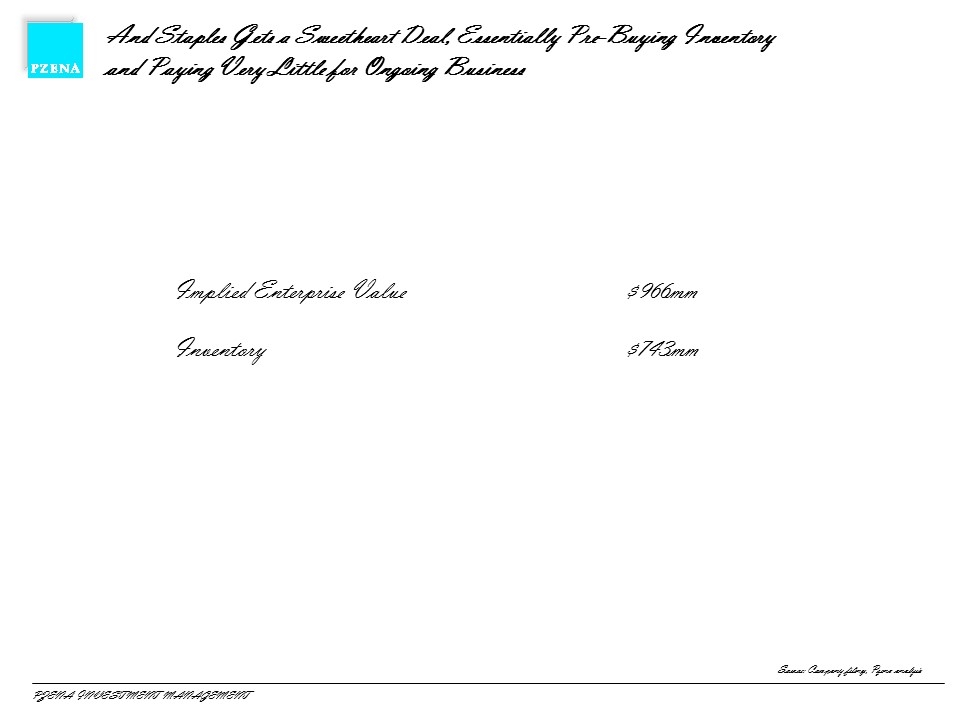

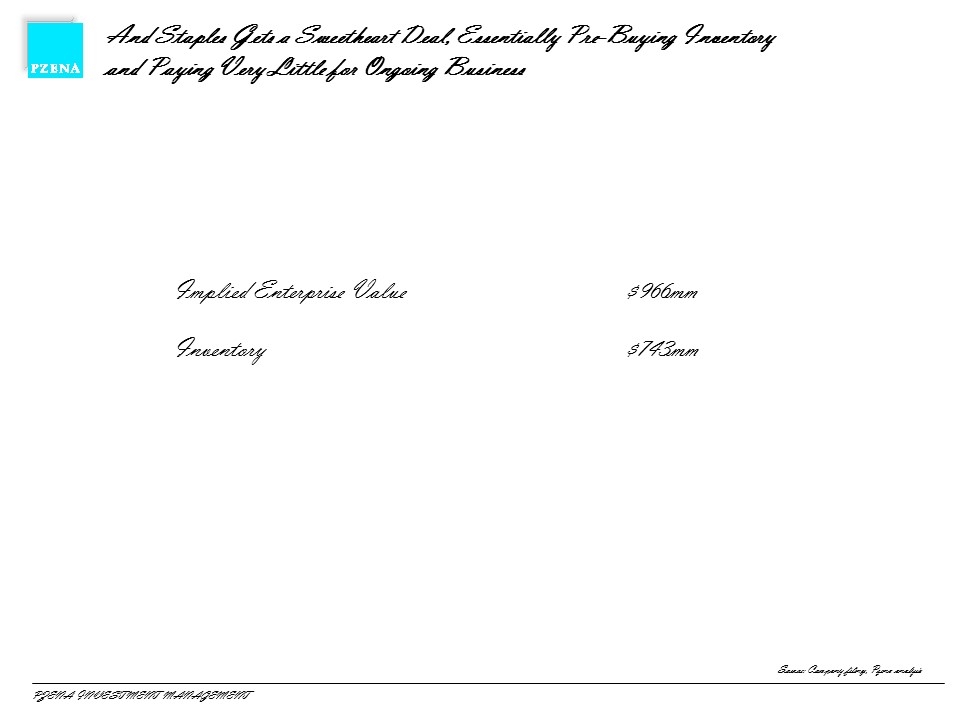

And Staples Gets a Sweetheart Deal, Essentially Pre-Buying Inventory and Paying Very Little for Ongoing Business Implied Enterprise Value $966mm Inventory $743mm Source: Company filings, Pzena analysis

However, Restructuring Efforts Are Beginning to Take Hold, as Management Highlighted in 2Q18 Earnings “Our second quarter results give us confidence that our strategy is working. Our efforts to drive sales growth in key channels began to offset the decline from national resellers. Our cost reduction efforts are successfully ramping, and our restructuring program continues to deliver expected results. We expect to deliver an annualized run rate of cost savings over $50 million by 2020, with more than half of those savings realized this year. “ - Ric Phillips, President and CEO, 7/26/2018 “On the top line, we are continuing to see momentum in the channels that we are really focused on growing, and we feel like we're well positioned.” - Ric Phillips, President and CEO, 7/27/2018 “As Ric mentioned, the restructuring program we launched in the first quarter to support our strategic drivers is on track . . . As a result of our overall cost savings initiatives and the restructuring program, we remain on track to deliver an annualized run rate of cost savings over $50 million in 2020, with more than half of those savings realized this year.” - Janet Zelenka, CFO, 7/27/2018

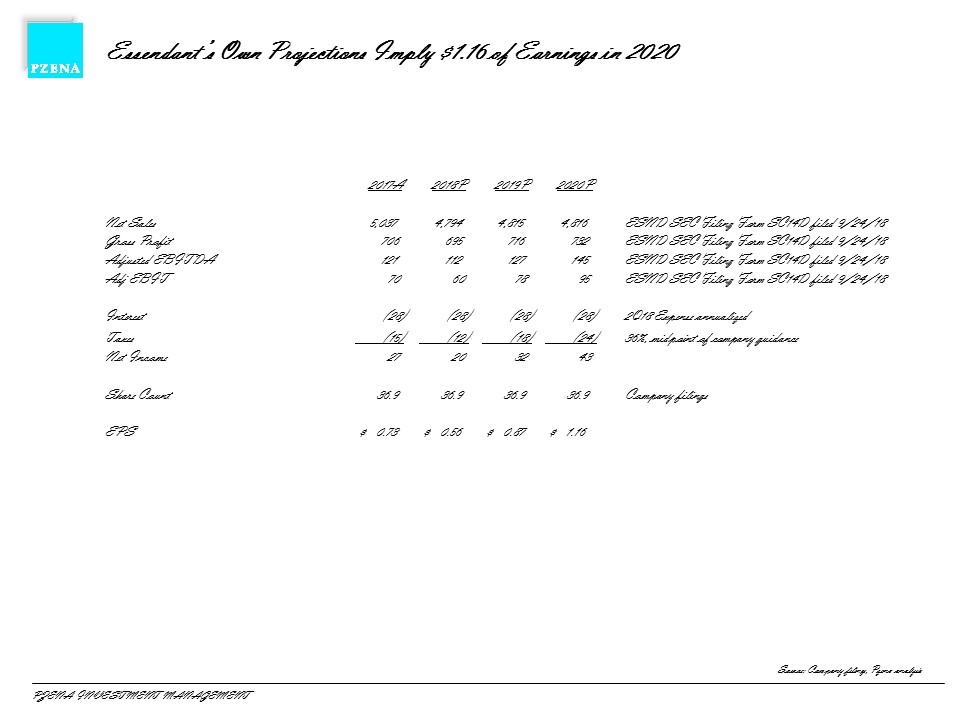

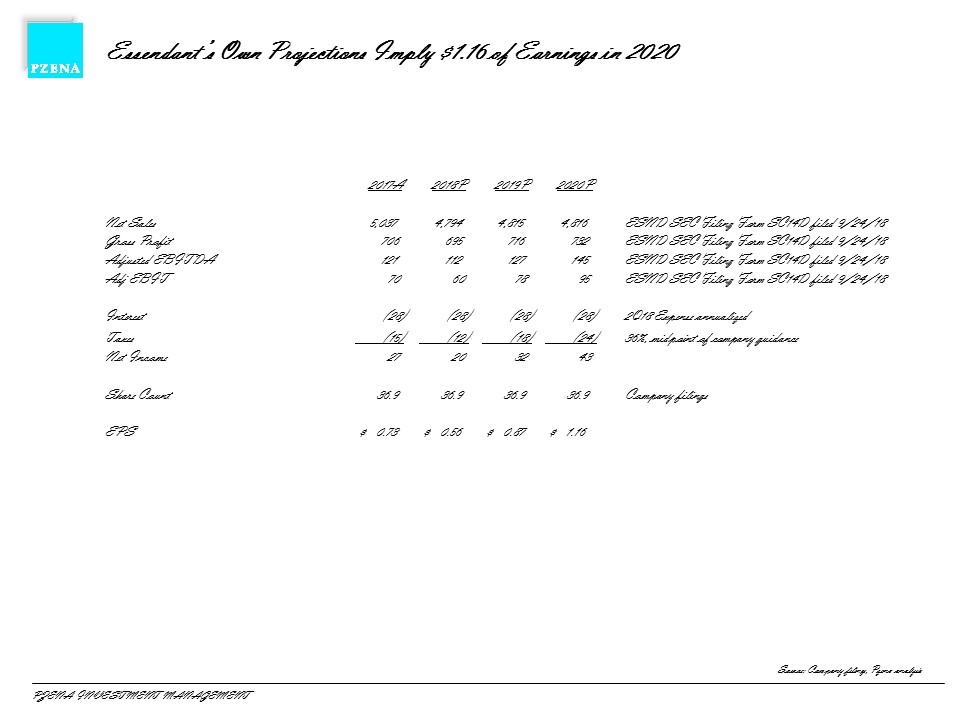

Essendant’s Own Projections Imply $1.16 of Earnings in 2020 Source: Company filings, Pzena analysis 2017A 2018P 2019P 2020P Net Sales 5,037 4,794 4,815 4,816 ESND SEC Filing Form SC14D filed 9/24/18 Gross Profit 706 695 716 732 ESND SEC Filing Form SC14D filed 9/24/18 Adjusted EBITDA 121 112 127 145 ESND SEC Filing Form SC14D filed 9/24/18 Adj EBIT 70 60 78 95 ESND SEC Filing Form SC14D filed 9/24/18 Interest (28) (28) (28) (28) 2Q18 Expense annualized Taxes (15) (12) (18) (24) 36%, midpoint of company guidance Net Income 27 20 32 43 Share Count 36.9 36.9 36.9 36.9 Company filings EPS $ 0.73 $ 0.56 $ 0.87 $ 1.16

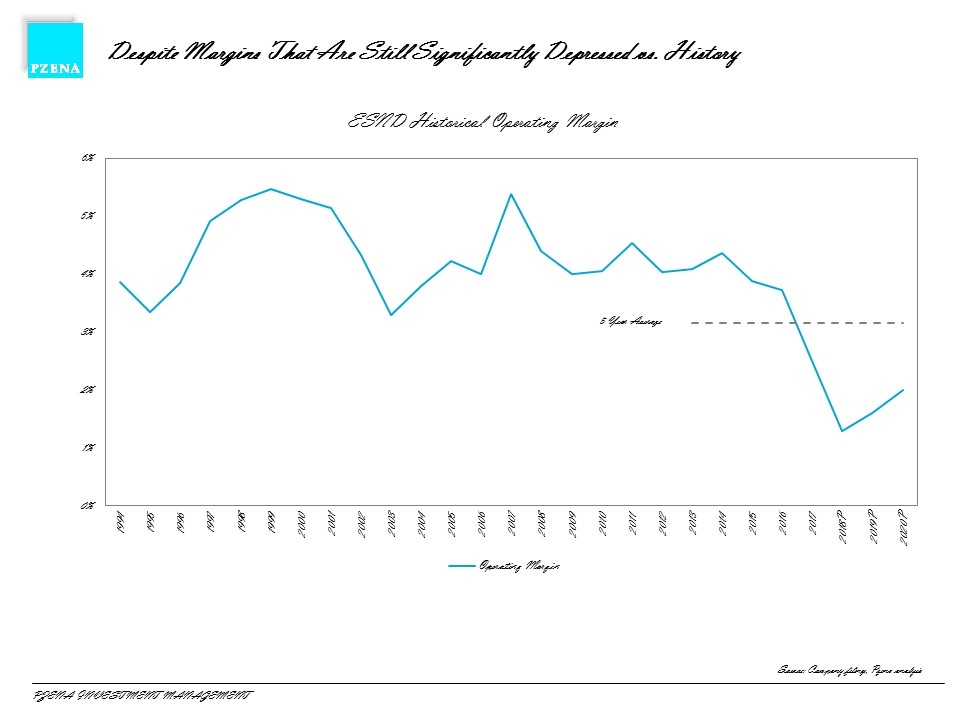

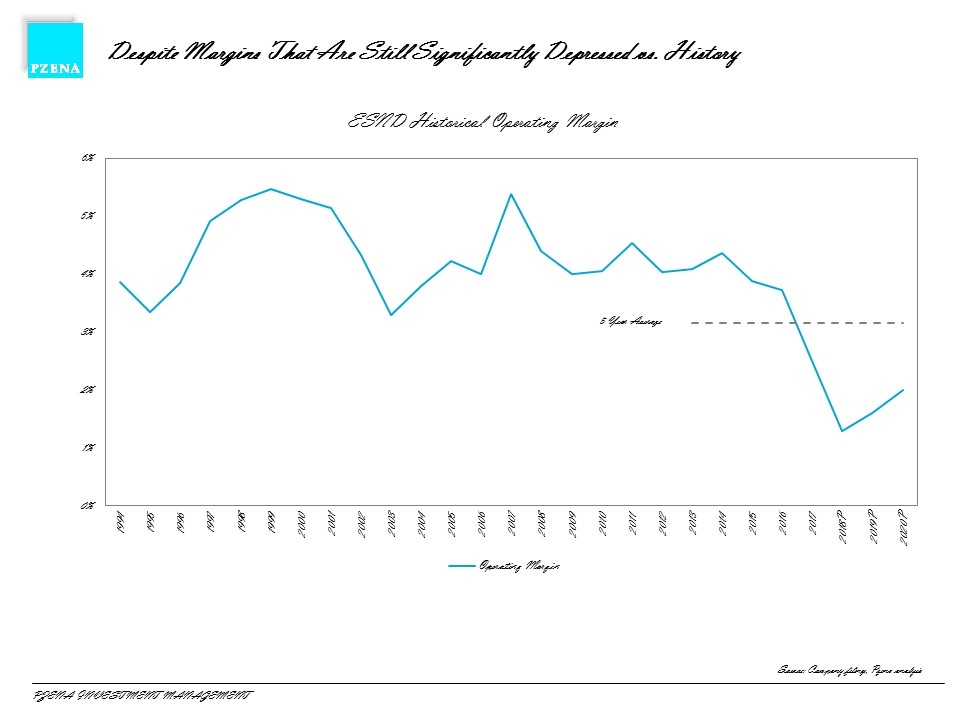

Despite Margins That Are Still Significantly Depressed vs. History Source: Company filings, Pzena analysis

Further Margin Recovery Offers Significant EPS Upside Source: Company filings, Pzena analysis EPS Multiple of Staples' $12.80 offer 2020P EPS at 2% margins $ 1.16 11.0x 2020P EPS at 5 year average 3.1% $ 2.10 6.1x

As a Standalone Company, There is Significant Downside Protection Source: Company filings, Pzena analysis $11.90 / share of book value The transaction price is at just 11.0x Management’s implied 2020 EPS

With Significant Upside Opportunities Taken From Shareholders Source: Company filings, Pzena analysis Margins continue to expand from trough today through execution on strategic initiatives Potential for EPS in excess of $2.10 Management could re-engage with S.P. Richards Opportunities to realize meaningful synergies Synergies in excess of $0.50 / share Additional upside from longer-term margin recovery

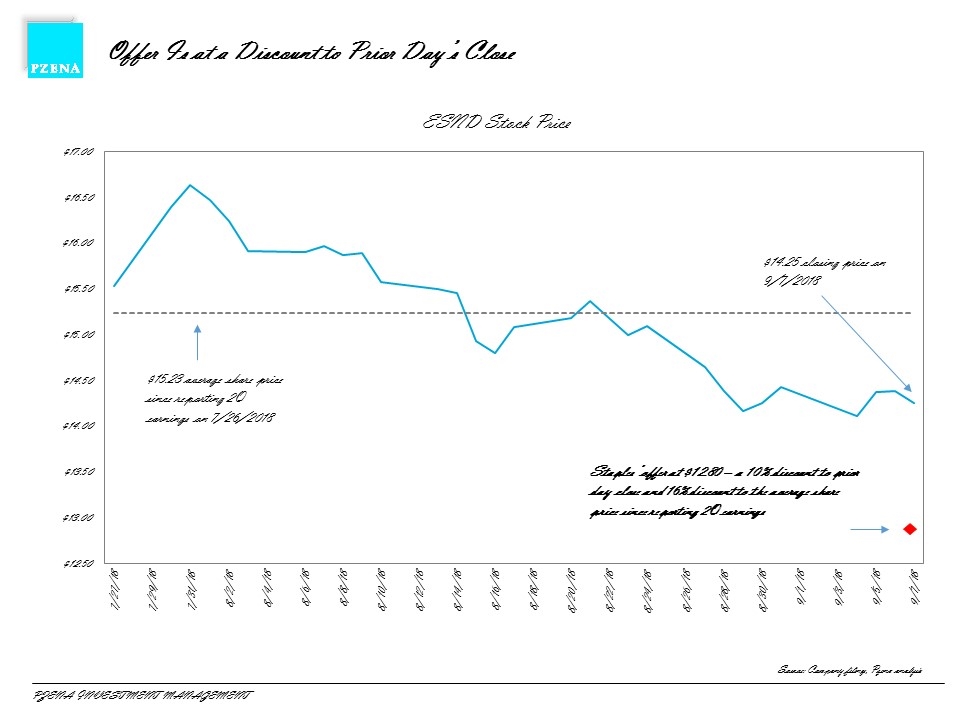

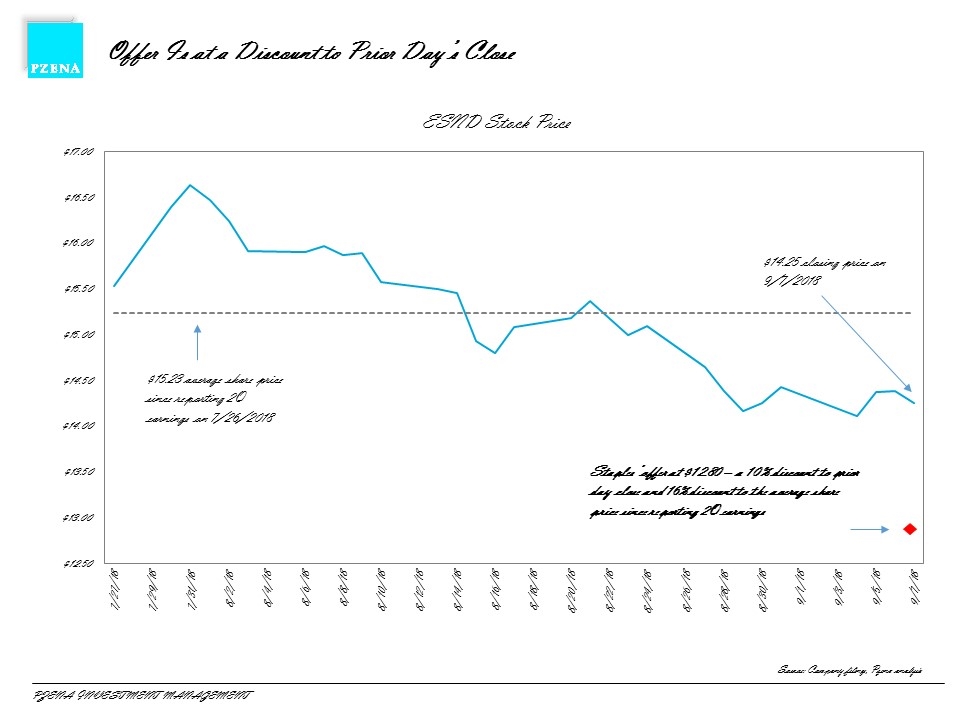

Offer Is at a Discount to Prior Day’s Close Source: Company filings, Pzena analysis $14.25 closing price on 9/7/2018 Staples’ offer at $12.80 – a 10% discount to prior day close and 16% discount to the average share price since reporting 2Q earnings

Independent Dealers Are Strongly Opposed to Staples – Essendant Combination and Are Reaching Out to FTC 10/1/18 headline on www.opi.net: Dealer organisations unite for FTC letter Four leading independent dealer organisations in the US have joined forces to voice their concerns to the Federal Trade Commission (FTC) regarding Staples’ acquisition of Essendant.

Shareholders SHOULD NOT Participate in Staples’ / Sycamore’s Tender Offer Staples is taking advantage of near term operating issues Management has been executing against a strategic plan and is beginning to see results Offer price dramatically undervalues company and caps shareholder upside opportunity Tender offer is open through October 22, 2018