Use these links to rapidly review the document

TABLE OF CONTENTS

United States Securities and Exchange Commission

Washington, DC 20549

FORM 10-K

| (Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number:0-10653

UNITED STATIONERS INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 36-3141189 (I.R.S. Employer Identification No.) | |

One Parkway North Boulevard Suite 100 Deerfield, Illinois 60015-2559 (847) 627-7000 (Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) | ||

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.10 par value per share

(Title of Class)

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No ý

The aggregate market value of the common stock of United Stationers Inc. held by non-affiliates as of June 30, 2006 was approximately $1,482,581,887.

On February 8, 2007, United Stationers Inc. had 29,691,256 shares of common stock outstanding.

Documents Incorporated by Reference:

Certain portions of United Stationers Inc.'s definitive Proxy Statement relating to its 2007 Annual Meeting of Stockholders, to be filed within 120 days after the end of United Stationers Inc.'s fiscal year, are incorporated by reference into Part III.

UNITED STATIONERS INC.

FORM 10-K

For The Year Ended December 31, 2006

General

United Stationers Inc. is North America's largest broad line wholesale distributor of business products, with consolidated net sales of approximately $4.5 billion. United offers a broad and deep line of nearly 46,000 products in these categories: technology products, traditional business products, office furniture, janitorial and sanitation products, and foodservice consumables. The company's network of 63 distribution centers allows it to ship these items to approximately 20,000 reseller customers, reaching more than 90% of the U.S. and major cities in Mexico on an overnight basis.

Except where otherwise noted, the terms "United" and "the Company" refer to United Stationers Inc. and its consolidated subsidiaries. The parent holding company, United Stationers Inc. (USI), was incorporated in 1981 in Delaware. USI's only direct wholly owned subsidiary—and its principal operating company—is United Stationers Supply Co. (USSC), incorporated in 1922 in Illinois.

Products

United distributes approximately 46,000 stockkeeping units ("SKUs") in these categories:

Technology Products. The Company is a leading wholesale distributor of computer supplies and peripherals in North America. It offers approximately 12,000 items, including printer cartridges, data storage, computer accessories and computer hardware items such as printers and other peripherals. United provides these products to value-added computer resellers, office products dealers, drug stores, grocery chains and e-commerce merchants. Technology products generated approximately 39% of the Company's 2006 consolidated net sales.

Traditional Office Products. The Company is one of the largest national wholesale distributors of a broad range of office supplies. It carries approximately 22,000 brand-name and private label products, such as document management products, business machines, presentation products, writing instruments, paper products, organizers, calendars and general office accessories. These products contributed approximately 29% of net sales during the year.

Janitorial/Sanitation Products and Foodservice Consumables. United is a leading wholesaler of janitorial and sanitation supplies throughout the U.S. The Company offers about 7,000 items in these lines: janitorial and sanitation supplies, foodservice consumables (such as disposable tableware), safety and security items, and paper and packaging supplies. This product category provided approximately 19% of the latest year's net sales and is the fastest growing category of the business.

Office Furniture. United is one of the largest office furniture wholesaler distributors in North America. It provides over 5,000 products from more than 60 of the industry's leading manufacturers including, desks, filing and storage solutions, seating and systems furniture, along with a variety of products for niche markets such as education, government, healthcare and professional services. Innovative marketing programs and related services help drive this business across multiple customer channels. This product category represented approximately 12% of net sales for the year.

The remaining 1% of the Company's consolidated net sales came from freight and advertising revenue.

United offers private brand products within each of its product categories to help resellers provide quality value-priced items to their customers. These include Innovera™ technology products, Universal® office products, Windsoft® paper products, UniSan® janitorial and sanitation products, and Alera™ office furniture. During 2006, private brand products accounted for almost 11% of United's net sales.

1

Customers

United serves a diverse group of over 20,000 customers. They include independent office products dealers, contract stationers, national mega-dealers, office products superstores, computer products resellers, office furniture dealers, mass merchandisers, mail order companies, sanitary supply distributors, drug and grocery store chains and e-commerce merchants. No single customer accounted for more than 6.5% of 2006 consolidated net sales.

Independent resellers accounted for approximately 80% of consolidated net sales. The Company provides these customers with specialized services designed to help them market their products and services while improving operating efficiencies and reducing costs.

Marketing and Customer Support

United's customers can purchase most of the products it distributes at similar prices from many other sources. As a matter of fact, many reseller customers purchase their products from more than one source, frequently using "first call" and "second call" distributors. A "first call" distributor typically is a reseller's primary wholesaler and has the first opportunity to fill an order. If the "first call" distributor cannot meet the demand, or do so on a timely basis, the reseller will contact its "second call" distributor.

United's marketing efforts differentiate the company from its competitors by providing an unmatched level of value-added services to resellers:

- •

- A broad line of products for one-stop shopping;

- •

- High levels of products in stock, with an average line fill rate greater than 97% in 2006;

- •

- Efficient order processing, resulting in a 99.5% order accuracy rate for the year;

- •

- High-quality customer service from several state-of-the-art customer care centers;

- •

- National distribution capabilities that enable same-day or overnight delivery to more than 90% of the U.S. and major cities in Mexico, providing a 99% on-time delivery rate in 2006;

- •

- Training programs designed to help resellers improve their operations;

- •

- End-consumer research to help resellers better understand their market.

United's marketing programs emphasize two other major strategies. First, the Company produces product content that is used to populate an extensive array of print and electronic catalogs for commercial dealers, contract stationers and retail dealers. The printed catalogs usually are customized with each reseller's name, then sold to the resellers who, in turn, distribute them to their customers. The Company markets its broad product offering primarily through a General Line catalog. This is available in both print and electronic versions, produced twice a year, and can include various selling prices (rather than the manufacturer's suggested retail price). In addition, the Company typically produces a number of promotional catalogs each quarter. United also develops separate quarterly flyers covering most of its product categories, including its private brand lines that offer a large selection of popular commodity products. Since catalogs and electronic content provide product exposure to end consumers and generate demand, United tries to maximize their distribution.

Second, United provides its resellers with a variety of dealer support and marketing services. These programs are designed to help resellers differentiate themselves by making it easier for customers to buy from them, and often allow resellers to reach customers they had not traditionally served.

Resellers can place orders with the Company through the Internet, by phone, fax and e-mail and through a variety of electronic order entry systems. Electronic order entry systems allow resellers to forward their customers' orders directly to United, resulting in the delivery of pre-sold products to the reseller. In 2006, United received approximately 90% of its orders electronically.

2

Distribution

The Company uses a network of 63 distribution centers to provide nearly 46,000 items to its approximately 20,000 reseller customers. This network, combined with the Company's depth and breadth of inventory in technology products, traditional office products and office furniture, janitorial and sanitation products, and foodservices consumables, enables the Company to ship products on an overnight basis to more than 90% of the U.S. and major cities in Mexico. United's domestic operations generated $4.4 billion of its $4.5 billion in 2006 consolidated net sales, with its international operations contributing another $0.1 billion to 2006 net sales.

Regional distribution centers are supplemented with 27 local distribution points across the U.S., which serve as re-distribution points for orders filled at the regional centers. United has a dedicated fleet of approximately 550 trucks, most of which are under contract to the Company. This enables United to make direct deliveries to resellers from regional distribution centers and local distribution points.

United's inventory locator system allows it to provide resellers with timely delivery of the products they order. If a reseller asks for an item that is out of stock at the nearest distribution center, the system has the capability to automatically search for the product at other facilities within the shuttle network. When the item is found, the alternate location coordinates shipping with the primary facility. For most resellers, the result is a single on-time delivery of all items. This system gives United added inventory support while minimizing working capital requirements. As a result, the Company can provide higher service levels to its reseller customers, reduce back orders, and minimize time spent searching for substitute merchandise. These factors contribute to a high order fill rate and efficient levels of inventory. To meet its delivery commitments and to maintain high order fill rates, United carries a significant amount of inventory, which contributes to its overall working capital requirements.

The "Wrap and Label" program is another important service for resellers. It gives resellers the option to receive individually packaged orders ready to be delivered to their end consumers. For example, when a reseller places orders for several individual consumers, United can pick and pack the items separately, placing a label on each package with the consumer's name, ready for delivery to the end consumer by the reseller. Resellers appreciate the "Wrap and Label" program because it eliminates the need to break down bulk shipments and repackage orders before delivering them to consumers.

In addition to providing value-adding programs for resellers, United also remains committed to reducing its operating costs. Its "War on Waste (WOW)" program is meeting the goal of removing over time an average of $20 million in costs per year through a combination of new and continuing activities. These include a workforce reduction to lower the Company's cost structure. In addition, WOW includes process improvement and work simplification activities that will help increase efficiency throughout the business and improve customer satisfaction.

Purchasing and Merchandising

As the largest broad line wholesale business products distributor in North America, United leverages its broad product selection as a key merchandising strategy. The Company orders products from approximately 550 manufacturers. This purchasing volume means United receives substantial supplier allowances and can realize significant economies of scale in its logistics and distribution activities. In 2006, United's largest supplier was Hewlett-Packard Company, which represented approximately 22% of its total purchases.

The Company's centralized Merchandising Department is responsible for selecting merchandise and for managing the entire supplier relationship. Product selection is based on three factors: end-consumer acceptance; anticipated demand for the product; and the manufacturer's total service, price and product quality. As part of its effort to create an integrated supplier approach, United introduced the "Preferred Supplier Program." In exchange for working closely with United to reduce overall supply chain costs, participating suppliers' products are treated as preferred brands in the Company's marketing efforts.

3

Competition

There is only one other nationwide broad line office products competitor in North America. United and this firm compete on the basis of breadth of product lines, availability of products, speed of delivery to resellers, order fill rates, net pricing to resellers, and the quality of marketing and other value-added services.

United competes with other national, regional and specialty wholesalers of office products, office furniture, technology products, and janitorial and sanitation and foodservice consumable supplies. Its competition also includes local and regional office products wholesalers and furniture, janitorial/sanitation and foodservice consumables distributors, which typically offer more limited product lines. In addition, United competes with various national distributors of computer consumables. In most cases, competition is based primarily upon net pricing, minimum order quantity, speed of delivery, and value-added marketing and logistics services.

The Company also competes with manufacturers who often sell their products directly to resellers and may offer lower prices. United believes that it provides an attractive alternative to manufacturer direct purchases by offering a combination of value-added services, including 1) Wrap and Label capabilities, 2) marketing and catalog programs, 3) same-day and next-day delivery, 4) a broad line of business products from multiple manufacturers on a "one-stop shop" basis, and 5) lower minimum order quantities.

Seasonality

United's sales generally are relatively steady throughout the year. However, sales also reflect seasonal buying patterns for consumers of office products. In particular, the Company's sales usually are higher than average during January, when many businesses begin operating under new annual budgets and release previously deferred purchase orders.

Employees

As of February 28, 2007, United employed approximately 5,700 people.

Management believes it has good relations with its associates. Approximately 600 of the shipping, warehouse and maintenance associates at certain of the Company's Baltimore, Los Angeles and New Jersey facilities are covered by collective bargaining agreements. In 2006, United successfully renegotiated agreements with associates in the Baltimore facility. The bargaining agreements for the Los Angeles and New Jersey facilities are scheduled to expire in 2007 and 2008, respectively. The Company has not experienced any work stoppages during the past five years.

Availability of the Company's Reports

The Company's principal Web site address iswww.unitedstationers.com. This site provides United's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K—as well as amendments and exhibits to those reports filed or furnished under Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") for free as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, copies of these filings (excluding exhibits) may be requested at no cost by contacting the Investor Relations Department:

United Stationers Inc.

Attn: Investor Relations Department

One Parkway North Boulevard

Suite 100

Deerfield, IL 60015-2559

Telephone: (847) 627-7000

E-mail:IR@ussco.com

4

Any of the risks described below could have a material adverse effect on the Company's business, financial condition or results of operations. These risks are not the only risks facing United; the Company's business operations could also be materially adversely affected by risks and uncertainties that are not presently known to United or that United currently deems immaterial.

United may not achieve its cost-reduction and margin enhancement goals.

United has set goals to improve its profitability over time by reducing expenses and enhancing gross margins. There can be no assurance that United will achieve its enhanced profitability goals. Factors that could have a significant effect on the Company's efforts to achieve these goals include the following:

- •

- Inability to achieve the Company's annual WOW initiatives to reduce expenses and improve productivity and quality;

- •

- Impact on gross margin from competitive pricing pressures;

- •

- Failure to maintain or improve the Company's sales mix between lower margin and higher margin products;

- •

- Inability to pass along cost increases from United's suppliers to its customers;

- •

- Failure to increase sales of United's private brand products; and

- •

- Failure of customers to adopt the Company's product pricing and marketing programs.

The loss of a significant customer could significantly reduce United's revenues and profitability.

United's top five customers accounted for approximately 25% of the Company's 2006 net consolidated sales. The loss of one or more key customers, deterioration in the Company's relations with any of them or a significant downturn in the business or financial condition of any of them could significantly reduce United's sales and profitability.

United relies on independent dealers for a significant percentage of its net sales.

Sales to independent office product dealers accounted for a significant portion of United's 2006 sales. For many years independent dealers have been under significant competitive pressures from national retailers that have substantially greater financial resources and technical and marketing capabilities. More recently, several of the Company's independent dealer customers have been acquired by national retailers. If United's customer base of independent dealers declines, the Company's business and results of operations may be adversely affected.

If United is not able to compete successfully, its sales and profitability may decline.

The Company operates in a highly competitive environment. Competition is based largely upon price and customer service, as many of the Company's competitors are distributors that offer the same or similar products that the Company offers to the same customers or potential customers. United also faces competition from some of its own suppliers, which sell their products directly to United's customers. Increased competition could result in lower sales volume, which would have a negative impact on the Company's financial condition and results of operations.

United's operating results depend on the strength of the general economy.

The customers that United serves are affected by changes in economic conditions outside the Company's control, including national, regional and local slowdowns in general economic activity and job markets. Demand for the products and services the Company offers, particularly in office products, is affected by the number of white collar and other workers employed by the businesses United's customers serve. An interruption of growth in these markets or a reduction of white collar and other jobs may adversely affect the Company's operating results. Any future general economic downturn, together

5

with the negative effect this has on the number of white collar workers employed, may adversely affect United's business, financial condition and results of operations.

The loss of key suppliers or supply chain disruptions could decrease United's revenues and profitability.

United believes its ability to offer a combination of well-known brand name products as well as competitively priced private brand products is an important factor in attracting and retaining customers. The Company's ability to offer a wide range of products is dependent on obtaining adequate product supply from manufacturers or other suppliers. United's agreements with its suppliers are generally terminable by either party on limited notice. The loss of, or a substantial decrease in the availability of products from key suppliers at competitive prices could cause the Company's revenues and profitability to decrease. In addition, supply interruptions could arise due to transportation disruptions, labor disputes or other factors beyond United's control. Disruptions in United's supply chain could result in a decrease in revenues and profitability.

United's reliance on supplier allowances and promotional incentives could impact profitability.

Supplier allowances and promotional incentives which, are often based on volume, contribute significantly to United's profitability. If United does not comply with suppliers' terms and conditions, or does not make requisite purchases to achieve certain volume hurdles, United may not earn certain allowances and promotional incentives. In addition, if United's suppliers reduce or otherwise alter their allowances or promotional incentives, United's profit margin for the sale of the products it purchases from those suppliers may be harmed. The loss or diminution of supplier allowances and promotional support could have an adverse effect on the Company's results of operation.

United must manage inventory effectively in order to maximize supplier allowances while minimizing excess and obsolete inventory.

United's profitability depends heavily on supplier allowances, which United earns based on the volume of merchandise its purchases. To maximize supplier allowances and minimize excess and obsolete inventory, United must project end-consumer demand for approximately 46,000 SKUs. If United underestimates demand for a particular manufacturer's products, the Company will lose sales, reduce customer satisfaction, and earn a lower level of allowances from that manufacturer. If United overestimates demand, it may have to liquidate excess or obsolete inventory at a loss.

Interruptions in the proper functioning of the Company's information systems or delays in implementing new systems could disrupt United's business and result in increased costs and decreased revenue.

The Company relies on information technology in all aspects of its business, including managing and replenishing inventory, filling and shipping customer orders and coordinating sales and marketing activities. United began moving its data center in 2006 and expects to complete the move in late 2007. The operations of the data center could be negatively affected by the data center move. A significant disruption or failure of the Company's existing information technology systems or in its development and implementation of new systems could put it at a competitive disadvantage and could adversely affect its results of operations.

United may not be successful in identifying, consummating and integrating future acquisitions.

Historically, part of United's growth and expansion into new product categories or markets has come from targeted acquisitions. Going forward, United may not be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms and conditions. Furthermore, competition for attractive acquisition candidates may limit the number of acquisition candidates or increase the overall costs of making acquisitions. Acquisitions involve significant risks and uncertainties, including difficulties integrating acquired business systems and personnel with United's business; the potential loss of key employees, customers

6

or suppliers; the assumption of liabilities and exposure to unforeseen liabilities of acquired companies; the difficulties in achieving target synergies; and the diversion of management attention and resources from existing operations. Difficulties in identifying, completing or integrating acquisitions could impede United's revenues and profitability.

The Company relies heavily on its key executives and the loss of one or more of these individuals could harm the Company's ability to carry out its business strategy.

United's ability to implement its business strategy depends largely on the efforts, skills, abilities and judgment of the Company's executive management team. United's success also depends to a significant degree on its ability to recruit and retain sales and marketing, operations and other senior managers. The Company may not be successful in attracting and retaining these employees, which may in turn have an adverse effect on the Company's results of operations and financial condition.

Unexpected events could disrupt normal business operations, which might result in increased costs and decreased revenues.

Unexpected events, such as hurricanes, fire, war, terrorism, and other natural or man-made disruptions, may increase the cost of doing business or otherwise impact United's financial performance. In addition, damage to or loss of use of significant aspects of the Company's infrastructure due to such events could have an adverse affect on the Company's operating results and financial condition.

United is subject to an informal inquiry by the SEC regarding its discontinued Canadian division.

In March 2005, the staff of the SEC advised United that it was conducting an informal inquiry of United in connection with the Company's Azerty United Canada division and its financial reporting relating to supplier allowances, customer rebates and trade receivables, inventory and other items associated with the Canadian Division. United has cooperated with the SEC, which has recently informed the Company that it has satisfied the SEC's requests for information. United is unable to predict the ultimate scope or outcome. In June 2006 United sold the assets of its Azerty United Canada division and discontinued its operations.

The Company considers its properties to be suitable with adequate capacity for their intended uses. The Company evaluates its properties on an ongoing basis to improve efficiency and customer service and leverage potential economies of scale. Substantially all owned facilities are subject to liens under USSC's debt agreements (see the information under the caption "Liquidity and Capital Resources" included below under Item 7). As of December 31, 2006, these properties consisted of the following:

Offices. The Company owns approximately 49,000 square feet of office space in Orchard Park, New York and a 136,000 square foot facility in Des Plaines, Illinois. The Des Plaines, Illinois location previously housed the Company's corporate headquarters. During 2006, the Company relocated its corporate headquarters from Des Plaines, Illinois to Deerfield, Illinois. As a result, the Company entered into an 11-year commercial lease for approximately 205,000 square feet of office space. The Company is actively marketing its former corporate headquarters in Des Plaines, Illinois. In addition, the Company leases approximately 22,000 square feet of office space in Harahan, Louisiana.

Distribution Centers. The Company utilizes 63 distribution centers totaling approximately 12.1 million square feet of warehouse space. Of the 12.1 million square feet of distribution center space, 2.3 million square feet is owned and 9.8 million square feet is leased. During 2006, the Company sold its Edison, NJ and Pennsauken, NJ owned distribution centers with a combined total square footage of nearly 0.5 million. Net proceeds from the sale of Edison and Pennsauken facilities totaled $14.6 million. The Company replaced these two facilities under a plan that included the opening of its 573,000 square foot distribution center located in Cranbury, NJ during 2005.

7

For information with respect to legal proceedings, see Note 2 to the Company's Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

As previously disclosed, the staff of the SEC began conducting an informal inquiry in March 2005 regarding the Company in connection with its Azerty United Canada division and related financial reporting matters. The Company has cooperated with the SEC, which has recently informed the Company that it has satisfied the SEC's requests for information. United is unable to predict the ultimate scope or outcome.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matters were submitted to a vote of security holders during the fourth quarter of 2006.

EXECUTIVE OFFICERS OF THE REGISTRANT (as of February 20, 2007)

The executive officers of the Company are as follows:

| Name, Age and Position with the Company | Business Experience | |

|---|---|---|

| Richard W. Gochnauer 57, President and Chief Executive Officer | Richard W. Gochnauer became the Company's President and Chief Executive Officer in December 2002, after joining the Company as its Chief Operating Officer and as a Director in July 2002. From 1994 until he joined the Company, Mr. Gochnauer held the positions of Vice Chairman and President, International, and President and Chief Operating Officer of Golden State Foods, a privately-held food company that manufactures and distributes food, and paper products. Prior to that, he served as Executive Vice President of the Dial Corporation, with responsibility for its Household and Laundry Consumer Products businesses. | |

S. David Bent 46, Senior Vice President and Chief Information Officer | S. David Bent joined the Company as its Senior Vice President and Chief Information Officer in May 2003. From August 2000 until such time, Mr. Bent served as the Corporate Vice President and Chief Information Officer of Acterna Corporation, a multi-national telecommunications test equipment and services company, and also served as General Manager of its Software Division from October 2002. Previously, he spent 18 years with the Ford Motor Company. During his Ford tenure, Mr. Bent most recently served during 1999 and 2000 as the Chief Information Officer of Visteon Automotive Systems, a tier one automotive supplier, and from 1998 through 1999 as its Director, Enterprise Processes and Systems. | |

8

Ronald C. Berg 47, Senior Vice President, Inventory Management | Ronald C. Berg is the Senior Vice President, Inventory Management, of the Company, since Inventory Management May 2006. From May 2005 to May 2006 he served as Senior Vice President, Business Transformation. He previously served as Senior Vice President, Inventory Management and Facility Support from October, 2001 until May 2005. He also served as the Company's Vice President, Inventory Management, since 1997, and as a Director, Inventory Management, since 1994. He began his career with the Company in 1987 as an Inventory Rebuyer, and spent several years thereafter in various product and furniture or general inventory management positions. Prior to joining the Company, Mr. Berg managed Solar Cine Products, Inc., a family-owned, photographic equipment business. | |

Eric A. Blanchard 50, Senior Vice President, General Counsel and Secretary | Eric A. Blanchard joined the Company as its Senior Vice President, General Counsel and Secretary in January 2006. From November 2002 until December 2006 he served as the Vice President, General Counsel and Secretary at Tennant Company. Previously Mr. Blanchard was with Dean Foods Company where he held the positions of Chief Operating Officer, Dairy Division from January 2002 to October 2002, Vice President and President, Dairy Division from 1999 to 2002 and General Counsel and Secretary from 1988 to 1999. | |

Patrick T. Collins 46, Senior Vice President, Sales | Patrick T. Collins joined the Company in October 2004 as Senior Vice President, Sales. Prior to joining the Company, Mr. Collins was employed by Ingram Micro, a global technology distribution company, in various senior sales and marketing roles, serving most recently as its Senior Group Vice President of Sales and Marketing from January 2000 through August 2004. In that capacity, Mr. Collins had operating responsibility for sales, marketing, purchasing and supplier relations for Ingram Micro's North American division. Prior to joining Ingram Micro in early 2000, Mr. Collins was with the Frito-Lay division of PepsiCo, Inc., a global food and beverage consumer products company, for nearly 15 years, where he held various accounting, planning, sales and general management positions. | |

Timothy P. Connolly 43, Senior Vice President, Operations | Timothy P. Connolly has served as Senior Vice President, Operations since December 2006. From February 2006 to such time, Mr. Connolly was Vice President, Field Operations Support and Facility Engineering at the Field Support Center. He joined the Company in August 2003 as Region Vice President Operations, Midwest. Before joining the Company, Mr. Connolly was the Regional Vice President, Midwest Region for Cardinal Health where he directed operations, sales, human resources, finance and customer service for one of Cardinal's largest pharmaceutical distribution centers. | |

9

Brian S. Cooper 50, Senior Vice President and Treasurer | Brian S. Cooper has served as the Company's Senior Vice President and Treasurer since February 2001. From 1997 until he joined the Company, he was the Treasurer of Burns International Services Corporation, a provider of physical security systems and services. Prior to that time, Mr. Cooper spent twelve years in U.S. and international finance assignments with Amoco Corporation, a global petroleum and chemicals company. He also held the position of chief financial officer for Amoco's operations in Norway. | |

Kathleen S. Dvorak 50, Senior Vice President and Chief Financial Officer | Kathleen S. Dvorak has been the Company's Senior Vice President and Chief Financial Officer since October 2001. In that role, she oversees the Company's financial planning, accounting, treasury and investor relations activities and serves as its primary liaison to the financial/investor community. Ms. Dvorak previously served as the Senior Vice President of Investor Relations and Financial Administration from October 2000, and as Vice President, Investor Relations, from July 1997. Ms. Dvorak has been with the Company since 1982, and has been involved in various aspects of the financial function at the Company. As announced in September 2006 Ms. Dvorak will be leaving the Company on or before June 30, 2007 unless extended by mutual agreement of both parties. | |

James K. Fahey 56, Senior Vice President, Merchandising | James K. Fahey is the Company's Senior Vice President, Merchandising, with responsibility for category management and merchandising, global sourcing, and supplier revenue management. From September 1992 until he assumed that position in October 1998, Mr. Fahey served as Vice President, Merchandising of the Company. Prior to that time, he served as the Company's Director of Merchandising. Before he joined the Company in 1991, Mr. Fahey had an extensive career in both retail and consumer direct-response marketing. | |

Mark J. Hampton 53, Senior Vice President, Marketing | Mark J. Hampton is the Company's Senior Vice President, Marketing, with responsibility for marketing, pricing and advertising activities. He previously served as Senior Vice President, Marketing and Field Support Services, from late 2001 until early 2003, Senior Vice President, Marketing, and President and Chief Operating Officer of The Order People Company, during 2001 and Senior Vice President, Marketing, from October 2000. Mr. Hampton began his career with the Company in 1980 and left the Company to work in the office products dealer community in 1991. Upon his return to the Company in 1992, he served as Midwest Regional Vice President, Vice President and General Manager of the Company's MicroUnited division and, from 1994, Vice President, Marketing. | |

10

Jeffrey G. Howard 51, Senior Vice President, National Accounts and Channel Management | Jeffrey G. Howard has served as the Company's Senior Vice President, National Accounts and Channel Management, since October 2004. From early 2003 until such time, he was Senior Vice President, National Accounts and New Business Development. Mr. Howard previously held the positions of Senior Vice President, Sales and Customer Support Services from October 2001, Senior Vice President, National Accounts, from late 2000 and Vice President, National Accounts, from 1994. He joined the Company in 1990 as General Manager of its Los Angeles distribution center, and was promoted to Western Region Vice President in 1992. Mr. Howard began his career in the office products industry in 1973 with Boorum & Pease Company, which was acquired by Esselte Pendaflex in 1985. | |

Kenneth M. Nickel 39, Vice President, Controller and Chief Accounting Officer | On February 20, 2007, Kenneth M. Nickel was appointed Chief Accounting Officer adding to his responsibilities as Vice President and Controller. Mr. Nickel has been the Company's Vice President and Controller since November 2002. Prior to that, Mr. Nickel served as the Company's Vice President and Field Support Center Controller from November 2001 to October 2002 and as its Vice President and Assistant Controller from April 2001 to October 2001. Mr. Nickel has been with the Company since November 1989 and has held progressively more responsible accounting positions within the Company's Finance department. | |

P. Cody Phipps 45, President, United Stationers Supply | P. Cody Phipps was promoted to President, United Stationers Supply in October, 2006. He joined the Company in August 2003 as its Senior Vice President, Operations. Prior to joining the Company, Mr. Phipps was a partner at McKinsey & Company, Inc., a global management consulting firm. During his tenure at McKinsey from and after 1990, he became a leader in the firm's North American Operations Effectiveness Practice and co-founded and led its Service Strategy and Operations Initiative, which focused on driving significant operational improvements in complex service and logistics environments. Prior to joining McKinsey, Mr. Phipps worked as a consultant with The Information Consulting Group, a systems consulting firm, and as an IBM account marketing representative. | |

Stephen A. Schultz 40, Senior Vice President, President, Lagasse, Inc. | Stephen A. Schultz is the President of Lagasse, Inc., a wholly owned subsidiary of USSC, a position he has held since August 2001. In October 2003, he assumed the additional position of Vice President, Category Management-Janitorial/Sanitation, of the Company. Mr. Schultz joined Lagasse in early 1999 as Vice President, Marketing and Business Development, and became a Senior Vice President of Lagasse in late 2000. Before joining Lagasse, he served for nearly 10 years in various executive sales and marketing roles for Hospital Specialty Company, a manufacturer and distributor of hygiene products for the institutional janitorial and sanitation industry. | |

11

Joseph R. Templet 60, Senior Vice President, Trade Development | Joseph R. Templet has served as Senior Vice President, since October Trade Development 2004. From October 2001 until such time, Mr. Templet was the Company's Senior Vice President, Field Sales. He previously served as the Company's Senior Vice President, Field Sales and Operations from October 2001, Senior Vice President, South Region, from October 2000, and Vice President, South Region, from 1992. Mr. Templet joined the Company in 1985 and thereafter held various managerial positions, including Vice President, Central Region, and Vice President, Marketing and Corporate Sales. Prior to joining the Company, Mr. Templet held sales and sales management positions with the Parker Pen Company, Polaroid Corporation and Procter & Gamble. |

Executive officers are elected by the Board of Directors. Except as required by individual employment agreements between executive officers and the Company, there exists no arrangement or understanding between any executive officer and any other person pursuant to which such executive officer was elected. Each executive officer serves until his or her successor is appointed and qualified or until his or her earlier removal or resignation.

12

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Common Stock Information

USI's common stock is quoted through the NASDAQ Global Select Market ("NASDAQ") under the symbol USTR. The following table shows the high and low closing sale prices per share for USI's common stock as reported by NASDAQ:

| | High | Low | ||||

|---|---|---|---|---|---|---|

| 2006 | ||||||

| First Quarter | $ | 53.10 | $ | 48.22 | ||

| Second Quarter | 56.01 | 44.77 | ||||

| Third Quarter | 51.00 | 44.95 | ||||

| Fourth Quarter | 49.07 | 45.58 | ||||

2005 | ||||||

| First Quarter | $ | 46.62 | $ | 42.03 | ||

| Second Quarter | 50.75 | 41.45 | ||||

| Third Quarter | 53.62 | 45.36 | ||||

| Fourth Quarter | 50.42 | 43.42 | ||||

On February 8, 2007, there were approximately 693 holders of record of common stock. A greater number of holders of USI common stock are "street name" or beneficial holders, whose shares are held of record by banks, brokers and other financial institutions.

Common Stock Repurchases

As of December 31, 2006, the Company had $51.8 million under share repurchase authorizations from its Board of Directors. During 2006, the Company repurchased 2,626,275 shares of common stock at an aggregate cost of $124.7 million.

Purchases may be made from time to time in the open market or in privately negotiated transactions. Depending on market and business conditions and other factors, the Company may continue or suspend purchasing its common stock at any time without notice.

Acquired shares are included in the issued shares of the Company and treasury stock, but are not included in average shares outstanding when calculating earnings per share data.

The following table summarizes purchases of the Company's common stock during the fourth quarter of 2006:

| Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10/1/2006—10/31/2006 | 397,800 | $ | 47.79 | 397,800 | $ | 67,473,530 | |||||

| 11/1/2006—11/30/2006 | 330,125 | 47.80 | 330,125 | 51,693,564 | |||||||

| Total | 727,925 | $ | 47.79 | 727,925 | |||||||

- (1)

- All share purchases were executed under share repurchase authorizations given by the Company's Board of Directors and made under a 10b-5 plan.

13

Stock Performance Graph

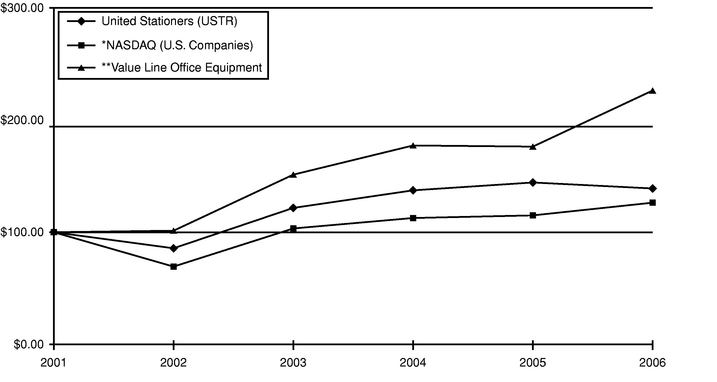

The following graph compares the performance of the Company's common stock over a five-year period with the cumulative total returns of (1) The NASDAQ Stock Market Index (U.S. companies), and (2) a group of companies included within Value Line's Office Equipment Industry Index. The graph assumes $100 was invested on December 31, 2001 in the Company's common stock and in each of the indicies and assumes reinvestment of all dividends. The stock price performance reflected in this graph is not necessarily indicative of future performance.

| Company/Index | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| United Stationers (USTR) | 100.00 | 85.59 | 121.60 | 137.30 | 144.13 | 138.75 | ||||||

| *NASDAQ (U.S. Companies) | 100.00 | 69.13 | 103.36 | 112.49 | 114.88 | 126.21 | ||||||

| **Value Line Office Equipment | 100.00 | 101.18 | 151.08 | 177.36 | 176.09 | 226.08 |

Dividends

The Company's policy has been to reinvest earnings to enhance its financial flexibility and to fund future growth. Accordingly, USI has not paid cash dividends and has no plans to declare cash dividends on its common stock at this time. Furthermore, as a holding company, USI's ability to pay cash dividends in the future depends upon the receipt of dividends or other payments from its operating subsidiary, USSC. The Company's debt agreements impose limited restrictions on the payment of dividends. For further information on the Company's debt agreements, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" in Item 7, and Note 10 to the Consolidated Financial Statements included in Item 8 of this Annual Report.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by Item 201(d) of Regulation S-K (Securities Authorized for Issuance under Equity Compensation Plans) is included in Item 12 of this Annual Report.

14

ITEM 6. SELECTED FINANCIAL DATA.

The selected consolidated financial data provided below for prior periods has been restated to reflect discontinued operations. See Note 1 to the Consolidated Financial Statements. The selected consolidated financial data of the Company for the years ended December 31, 2002 through 2006 have been derived from the Consolidated Financial Statements of the Company, which have been audited by Ernst & Young LLP, an independent registered public accounting firm. The selected consolidated financial data below should be read in conjunction with, and is qualified in its entirety by, Management's Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements of the Company included in Items 7 and 8, respectively, of this Annual Report. Except for per share data, all amounts presented are in thousands:

| | Years Ended December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2006(1) | 2005 | 2004(2) | 2003 | 2002 | ||||||||||||

| Income Statement Data: | |||||||||||||||||

| Net sales | $ | 4,546,914 | $ | 4,279,089 | $ | 3,838,701 | $ | 3,652,413 | $ | 3,522,564 | |||||||

| Cost of goods sold | 3,792,833 | 3,637,065 | 3,254,169 | 3,105,635 | 2,995,349 | ||||||||||||

| Gross profit | 754,081 | 642,024 | 584,532 | 546,778 | 527,215 | ||||||||||||

| Operating expenses: | |||||||||||||||||

| Warehousing, marketing and administrative expenses | 516,234 | 471,193 | 422,595 | 406,446 | 408,296 | ||||||||||||

| Restructuring and other charges (reversal), net(3) | 1,941 | (1,331 | ) | — | — | 6,510 | |||||||||||

| Total operating expenses | 518,175 | 469,862 | 422,595 | 406,446 | 414,806 | ||||||||||||

| Operating Income | 235,906 | 172,162 | 161,937 | 140,332 | 112,409 | ||||||||||||

| Interest expense | (8,276 | ) | (3,050 | ) | (3,324 | ) | (6,816 | ) | (16,695 | ) | |||||||

| Interest income | 970 | 342 | 362 | 262 | — | ||||||||||||

| Loss on early retirement of debt(4) | — | — | — | (6,693 | ) | — | |||||||||||

| Other expense, net(5) | (12,786 | ) | (7,035 | ) | (3,488 | ) | (4,826 | ) | (2,421 | ) | |||||||

| Income from continuing operations before income taxes and cumulative effect of a change in accounting principle | 215,814 | 162,419 | 155,487 | 122,259 | 93,293 | ||||||||||||

| Income tax expense | 80,510 | 60,949 | 57,523 | 46,480 | 34,991 | ||||||||||||

| Income from continuing operations before cumulative effect of a change in accounting principle | 135,304 | 101,470 | 97,964 | 75,779 | 58,302 | ||||||||||||

| (Loss) income from discontinued operations, net of tax | (3,091 | ) | (3,969 | ) | (7,993 | ) | 3,331 | 1,926 | |||||||||

| Income before cumulative effect of a change in accounting principle | 132,213 | 97,501 | 89,971 | 79,110 | 60,228 | ||||||||||||

| Cumulative effect of a change in accounting principle(6) | — | — | — | (6,108 | ) | — | |||||||||||

| Net income | $ | 132,213 | $ | 97,501 | $ | 89,971 | $ | 73,002 | $ | 60,228 | |||||||

| Net income per share—basic: | |||||||||||||||||

| Income from continuing operations before cumulative effect of a change in accounting principle | $ | 4.37 | $ | 3.08 | $ | 2.93 | $ | 2.29 | $ | 1.75 | |||||||

| (Loss) income from discontinued operations, net of tax | (0.10 | ) | (0.12 | ) | (0.24 | ) | 0.10 | 0.06 | |||||||||

| Cumulative effect of a change in accounting principle | — | — | — | (0.19 | ) | — | |||||||||||

| Net income per common share—basic | $ | 4.27 | $ | 2.96 | $ | 2.69 | $ | 2.20 | $ | 1.81 | |||||||

| Net income per share—diluted: | |||||||||||||||||

| Income from continuing operations before cumulative effect of a change in accounting principle | $ | 4.31 | $ | 3.02 | $ | 2.88 | $ | 2.27 | $ | 1.73 | |||||||

| (Loss) income from discontinued operations, net of tax | (0.10 | ) | (0.12 | ) | (0.23 | ) | 0.10 | 0.06 | |||||||||

| Cumulative effect of a change in accounting principle | — | — | — | (0.19 | ) | — | |||||||||||

| Net income per common share—diluted | $ | 4.21 | $ | 2.90 | $ | 2.65 | $ | 2.18 | $ | 1.78 | |||||||

| Cash dividends declared per share | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||

Balance Sheet Data: | |||||||||||||||||

| Working capital(7) | $ | 551,556 | $ | 421,005 | $ | 545,552 | $ | 498,523 | $ | 476,204 | |||||||

| Total assets(7) | 1,553,394 | 1,542,201 | 1,413,108 | 1,299,492 | 1,349,716 | ||||||||||||

| Total debt(8) | 117,300 | 21,000 | 18,000 | 17,324 | 211,249 | ||||||||||||

| Total stockholders' equity | 800,940 | 768,512 | 737,071 | 677,460 | 559,371 | ||||||||||||

Statement of Cash Flows Data: | |||||||||||||||||

| Net cash provided by operating activities | $ | 13,994 | $ | 236,067 | $ | 50,701 | $ | 171,015 | $ | 110,940 | |||||||

| Net cash used in investing activities | (18,624 | ) | (171,748 | ) | (13,378 | ) | (14,279 | ) | (28,249 | ) | |||||||

| Net cash provided by (used in) financing activities | 2,198 | (62,680 | ) | (32,032 | ) | (164,416 | ) | (93,917 | ) | ||||||||

Other Data: | |||||||||||||||||

| Pro forma amounts assuming the accounting change for EITF Issue No. 02-16:(6) | |||||||||||||||||

| Net income | $ | 132,213 | $ | 97,501 | $ | 89,971 | $ | 79,110 | $ | 58,862 | |||||||

| Earnings per share: | |||||||||||||||||

| Basic | $ | 4.27 | $ | 2.96 | $ | 2.69 | $ | 2.39 | $ | 1.77 | |||||||

| Diluted | $ | 4.21 | $ | 2.90 | $ | 2.65 | $ | 2.37 | $ | 1.74 | |||||||

- (1)

- In 2006, the Company recorded $60.6 million, or $1.21 per diluted share in one-time favorable benefits from the Company's product content syndication program and certain marketing program changes.

15

- (2)

- During 2004, the Company recorded a pre-tax write-off of approximately $13.2 million in supplier allowances, customer rebates and trade receivables, inventory and other items associated with the Company's Canadian Division. See Note 1 to the Consolidated Financial Statements included in Item 8 of this Annual Report.

- (3)

- Reflects restructuring and other charges in the following years:2006—$6.0 million charge for the 2006 Workforce Reduction Program, partially offset by a $4.1 million reversal of previously established restructuring reserves.2005—$1.3 million reversal of previously established restructuring reserves. 2002—$8.9 million restructuring reserve established for the 2002 Restructuring Plan (as defined), partially offset by a $2.4 million reversal of previously established restructuring reserves. See Note 5 to the Consolidated Financial Statements included in Item 8 of this Annual Report.

- (4)

- During 2003, the Company redeemed its 8.375% Senior Subordinated Notes and replaced its then existing credit agreement with a new Five-Year Revolving Credit Agreement. As a result, the Company recorded a loss on early retirement of debt totaling $6.7 million, of which $5.9 million was associated with the redemption of the 8.375% Senior Subordinated Notes and $0.8 million related to the write-off of deferred financing costs associated with replacing the prior credit agreement.

- (5)

- Primarily represents the loss on the sale of certain trade accounts receivable through the Company's Receivables Securitization Program (as defined and further described as noted in the next sentence). For further information on the Company's Receivables Securitization Program, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Off-Balance Sheet Arrangements—Receivables Securitization Program" under Item 7 of this Annual Report.

- (6)

- Effective January 1, 2003, the Company adopted EITF Issue No. 02-16. As a result, during the first quarter of 2003 the Company recorded a non-cash, cumulative after-tax charge of $6.1 million, or $0.19 per diluted share, related to the capitalization into inventory of a portion of fixed promotional allowances received from vendors for participation in the Company's advertising publications. See Note 2 to the Consolidated Financial Statements.

- (7)

- In accordance with Generally Accepted Accounting Principles ("GAAP"), total assets exclude $225.0 million in 2006 and 2005, $118.5 million in 2004, $150.0 million in 2003, $105.0 million in 2002 and $125.0 million in 2001 of certain trade accounts receivable sold through the Company's Receivables Securitization Program. For further information on the Company's Receivables Securitization Program, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Off-Balance Sheet Arrangements—Receivables Securitization Program" under Item 7 of this Annual Report.

- (8)

- Total debt includes current maturities.

FORWARD LOOKING INFORMATION

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. Forward-looking statements often contain words such as "expects," "anticipates," "estimates," "intends," "plans," "believes," "seeks," "will," "is likely," "scheduled," "positioned to," "continue," "forecast," "predicting," "projection," "potential" or similar expressions. Forward-looking statements include references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These forward-looking statements are based on management's current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, without limitation, those set forth above under the heading "Risk Factors."

Readers should not place undue reliance on forward-looking statements contained in this Annual Report on Form 10-K. The forward-looking information herein is given as of this date only, and the Company undertakes no obligation to revise or update it.

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with both the information at the end of Item 6 of this Annual Report on Form 10-K appearing under the caption, "Forward Looking Information," and the Company's Consolidated Financial Statements and related notes contained in Item 8 of this Annual Report.

Overview and Recent Results

The Company is North America's largest broad line wholesale distributor of business products, with 2006 net sales of $4.5 billion. The Company sells its products through a national distribution network of 63 distribution centers to approximately 20,000 resellers, who in turn sell directly to end consumers.

As reported in the Company's press release on February 15, 2007, net sales for 2007 were up approximately 5.5% compared with the same period last year.

Key Company and Industry Trends

The following is a summary of selected trends, events or uncertainties that the Company believes may have a significant impact on its future performance.

- •

- The macroeconomic environment that supports business-related spending appears to be relatively stable as measured by employment levels, job creation and office space utilization. While these trends are positive indicators of potential demand for business products, any impact on the Company's ability to grow its sales depends on whether these trends are sustainable over a longer period.

- •

- Total Company sales for 2006 grew 6.3% to $4.5 billion. Adjusted for one fewer sales day in 2006, sales were up 6.7% over 2005. The 2006 results included a full year of the Sweet Paper acquisition, which closed on May 31, 2005. The acquisition added approximately 2.5% to the overall sales growth rate for the year.

- •

- Gross margin as a percent of sales for 2006 was 16.6%, representing a significant increase over the prior year. Gross margin in 2006 benefited from $60.6 million, or $1.21 per share, of one-time gains related to the Company's product content syndication program and certain marketing program changes. Excluding these one-time items, gross margin for 2006 was 15.3%, compared with 15.0% in 2005.

- •

- In June 2006, the Company completed the sale of certain net assets of its Canadian Division for $14.3 million. In 2006, the Company recorded a total pre-tax loss of $6.7 million ($3.1 million after-tax) under discontinued operations related to the Canadian Division.

- •

- The Company recorded a charge of $6.0 million in the fourth quarter of 2006 related to a workforce reduction. The Company anticipates recording an additional charge of approximately $1.5 million in the first quarter of 2007 related to this action.

- •

- Management continues to focus on improving productivity, reducing distribution costs and leveraging the Company's existing infrastructure. The Company is reviewing and optimizing its distribution network and inventory stocking strategies to promote overall supply chain efficiencies.

- •

- During 2006, the Company invested in improvements to its pricing management capabilities. This effort has proven successful as pricing margin (invoice price less standard cost, including customer rebates) has stabilized.

17

- •

- The Sweet Paper acquisition in May 2005 was important to the Company's strategy for building a national distribution platform for foodservice consumables. While the integration is complete, the Company has lost some sales volume from Sweet Paper customers. Additional product line rationalization, implementation of certain marketing-related programs and consistent operating stability should help lead to a recovery of this volume within the next 12 months.

- •

- Cash flows decreased in 2006, primarily reflecting the timing impact of the change in the Company's supplier allowance program as well as a high level of capital spending and investments in working capital through increases in accounts receivable, inventory and reductions in accounts payable.

- •

- During the fourth quarter and total year 2006, the Company acquired approximately 728,000 shares and 2.6 million shares, respectively, of common stock under its publicly announced share repurchase programs. As of February 15, 2007, the Company had approximately $27 million remaining under its September 2006 Board authorization.

- •

- In November 2005, the Company announced a joint marketing agreement with SAP America to create the SAP Hosted Solution for Business Products Resellers (the "Solution"). The Solution is aimed at providing independent dealers with an enhanced shopping experience for their customers to effectively run their businesses. The roll-out process of this technology platform has been slowed to more fully develop the functionality and capabilities of the system, which has put the Company six to eight months behind its original plan.

Critical Accounting Policies, Judgments and Estimates

The Company's significant accounting policies are more fully described in Note 2 of the Consolidated Financial Statements. As described in Note 2, the preparation of financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes. Future events and their effects cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results may differ from those estimates. The Company believes that such differences would have to vary significantly from historical trends to have a material impact on the Company's financial results.

The Company's critical accounting policies are most significant to the Company's financial condition and results of operations and require especially difficult, subjective or complex judgments or estimates by management. In most cases, critical accounting policies require management to make estimates on matters that are uncertain at the time the estimate is made. The basis for the estimates is historical experience, terms of existing contracts, observance of industry trends, information provided by customers or vendors, and information available from other outside sources, as appropriate. These critical accounting policies include the following:

Supplier Allowances

Supplier allowances (fixed and variable) are common practice in the business products industry and have a significant impact on the Company's overall gross margin. Gross margin is determined by, among other items, file margin (determined by reference to invoiced price), as reduced by estimated customer discounts and rebates as discussed below, and increased by estimated supplier allowances and promotional incentives. These allowances and incentives are estimated on an ongoing basis and the potential variation between the actual amount of these margin contribution elements and the Company's estimates of them could be material to its financial results. Reported results include management's current estimate of such allowances and incentives.

18

In 2006, approximately 25% of the Company's estimated annual supplier allowances and incentives were fixed, based on supplier participation in various Company advertising and marketing publications. Fixed allowances and incentives are taken to income through lower cost of goods sold as inventory is sold.

The remaining 75% of the Company's estimated supplier allowances and incentives in 2006 were variable, based on the volume and mix of the Company's product purchases from suppliers. These variable allowances are recorded based on the Company's annual inventory purchase volumes and product mix and are included in the Company's financial statements as a reduction to cost of goods sold, thereby reflecting the net inventory purchase cost. Supplier allowances and incentives attributable to unsold inventory are carried as a component of net inventory cost. The potential amount of variable supplier allowances often differs based on purchase volumes by supplier and product category. As a result, lower Company sales volume (which reduce inventory purchase requirements) and product sales mix changes (primarily because higher-margin products often benefit from higher supplier allowance rates) can make it difficult to reach supplier allowance growth hurdles.

Fixed supplier allowances traditionally represented 40% to 45% of the Company's total annual supplier allowances, compared to the 25% referenced above. This ratio has declined significantly as the Company's 2006 supplier contracts eliminate the majority of the historical fixed component and replaced it with a variable allowance based on product purchases. The Company expects the fixed component of its supplier allowance programs to drop to approximately 10% and the variable component is expected to increase to 90% in 2007. In addition, the Company transitioned to a calendar year program with its 2006 Supplier Allowance Program for product content syndication. This change altered the year-over-year timing on recognizing related income, and has resulted in a one-time positive impact on gross margin during 2006 of $41.6 million related to this program.

Customer Rebates

Customer rebates and discounts are common in the business products industry and have a significant impact on the Company's overall sales and gross margin. Such rebates are reported in the Consolidated Financial Statements as a reduction of sales.

Customer rebates include volume rebates, sales growth incentives, advertising allowances, participation in promotions and other miscellaneous discount programs. These rebates are paid to customers monthly, quarterly and/or annually. Volume rebates and growth incentives are based on the Company's annual sales volumes to its customers. The aggregate amount of customer rebates depends on product sales mix and customer mix changes.

During 2006, the Company changed the timing of certain marketing programs, which resulted in a one-time year-over-year favorable impact to gross margin of $19.0 million.

Revenue Recognition

Revenue is recognized when a service is rendered or when title to the product has transferred to the customer. Management establishes a reserve and records an estimate for future product returns related to revenue recognized in the current period. This estimate requires management to make certain estimates and judgments, including estimating the amount of future returns of products sold in the current period. This estimate is based on historical product-return trends and the loss of gross margin associated with those returns. This methodology involves some risk and uncertainty due to its dependence on historical information for product returns and gross margins to record an estimate of future product returns. If actual product returns on current period sales differ from historical trends, the amounts estimated for product returns (which reduce net sales) for the period may be overstated or understated, causing actual results of operation or financial condition to differ from those expected.

19

Valuation of Accounts Receivable

The Company makes judgments as to the collectability of accounts receivable based on historical trends and future expectations. Management estimates an allowance for doubtful accounts. This allowance adjusts gross trade accounts receivable downward to its estimated collectible or net realizable value. To determine the appropriate allowance for doubtful accounts, management undertakes a two-step process. First, a set of general allowance percentages are applied to accounts receivable generated as a result of sales. These percentages are based on historical trends for customer write-offs. Periodically, management reviews these allowance percentages, adjusting for current information and trends. Second, management reviews specific customer accounts receivable balances and specific customer circumstances to determine whether a further allowance is necessary. As part of this specific-customer analysis, management considers items such as bankruptcy filings, litigation, government investigations, historical charge-off patterns, accounts receivable concentrations and the current level of receivables compared with historical customer account balances.

The primary risks in the methodology used to estimate the allowance for doubtful accounts are its dependence on historical information to predict the collectability of accounts receivable and timeliness of current financial information from customers. To the extent actual collections of accounts receivable differ from historical trends, the allowance for doubtful accounts and related expense for the current period may be overstated or understated.

Insured Loss Liability Estimates

The Company is primarily responsible for retained liabilities related to workers' compensation, vehicle, property and general liability and certain employee health benefits. The Company records expense for paid and open claims and an expense for claims incurred but not reported based upon historical trends and certain assumptions about future events. The Company has an annual per-person maximum cap, provided by a third-party insurance company, on certain employee medical benefits. In addition, the Company has both a per-occurrence maximum loss and an annual aggregate maximum cap on workers' compensation claims.

Inventories

Inventory constituting approximately 82% and 81% of total inventory as of December 31, 2006 and 2005, respectively, has been valued under the last-in, first-out ("LIFO") accounting method. LIFO results in a better matching of costs and revenues. The remaining inventory is valued under the first-in, first-out ("FIFO") accounting method. Inventory valued under the FIFO and LIFO accounting methods is recorded at the lower of cost or market. If the Company had valued its entire inventory under the lower of FIFO cost or market, inventory would have been $52.2 million and $38.8 million higher than reported as of December 31, 2006 and December 31, 2005, respectively. The Company also records adjustments for shrinkage. Inventory that is obsolete, damaged, defective or slow moving is recorded to the lower of cost or market. These adjustments are determined using historical trends and are adjusted, if necessary, as new information becomes available.

Income taxes

The Company accounts for income taxes in accordance with FASB Statement No. 109,Accounting for Income Taxes. The Company estimates actual current tax expense and assesses temporary differences that exist due to differing treatments of items for tax and financial statement purposes. These differences result in the recognition of deferred tax assets and liabilities. The tax balances and income tax expense recognized by the Company are based on management's interpretation of the tax laws of multiple jurisdictions. Income tax expense also reflects the Company's best estimates and assumptions regarding, among other things, the level of future taxable income, interpretation of tax laws, and tax

20

planning. Future changes in tax laws, changes in projected levels of taxable income, and tax planning could impact the effective tax rate and tax balances recorded by the Company. Management's estimates as of the date of the Consolidated Financial Statements reflect its best judgment giving consideration to all currently available facts and circumstances. As such, these estimates may require adjustment in the future, as additional facts become known or as circumstances change.

Pension and Postretirement Health Benefits

Calculating the Company's obligations and expenses related to its pension and postretirement health benefits requires using certain actuarial assumptions. As more fully discussed in Notes 12 and 13 to the Consolidated Financial Statements included in Item 8 of this Annual Report, these actuarial assumptions include discount rates, expected long-term rates of return on plan assets, and rates of increase in compensation and healthcare costs. To select the appropriate actuarial assumptions, management relies on current market trends and historical information. The expected long-term rate of return on plan assets assumption is based on historical returns and the future expectation of returns for each asset category, as well as the target asset allocation of the asset portfolio. Pension expense for 2006 was $8.8 million, compared to $8.1 million in 2005 and $6.8 million in 2004. A one percentage point decrease in the expected long-term rate of return on plan assets and the assumed discount rate would have resulted in an increase in pension expense for 2006 of approximately $2.7 million and increased the year-end projected benefit obligation by $18.6 million.

Costs associated with the Company's postretirement health benefits plan were $0.1 million, $0.9 million and $0.8 million for 2006, 2005 and 2004, respectively. A one-percentage point decrease in the assumed discount rate would have resulted in incremental postretirement healthcare expenses for 2006 of approximately $0.1 million and increased the year-end accumulated postretirement benefit obligation by $0.5 million. Current rates of medical cost increases are trending above the Company's medical cost increase cap of 3% provided by the plan. Accordingly, a one percentage point increase in the assumed average healthcare cost trend would not have a significant impact on the Company's postretirement health plan costs.

The following tables summarize the Company's actuarial assumptions for discount rates, expected long-term rates of return on plan assets, and rates of increase in compensation and healthcare costs for the years ended December 31, 2006, 2005 and 2004:

| | 2006 | 2005 | 2004 | ||||

|---|---|---|---|---|---|---|---|

| Pension plan assumptions: | |||||||

| Assumed discount rate | 6.00 | % | 6.00 | % | 6.00 | % | |

| Rate of compensation increase | 3.75 | % | 3.75 | % | 3.75 | % | |

| Expected long-term rate of return on plan assets | 8.25 | % | 8.25 | % | 8.25 | % | |

| Postretirement health benefits assumptions: | |||||||

| Assumed average healthcare cost trend | 3.00 | % | 3.00 | % | 3.00 | % | |

| Assumed discount rate | 6.00 | % | 6.00 | % | 6.00 | % |

To select the appropriate actuarial assumptions, management relied on current market conditions, historical information and consultation with and input from the Company's outside actuaries. The expected long-term rate of return on plan assets assumption is based on historical returns and the future expectation of returns for each asset category, as well as the target asset allocation of the asset portfolio.

21

Results for the Years Ended December 31, 2006, 2005 and 2004

The following table presents the Consolidated Statements of Income as a percentage of net sales:

| | Years Ended December 31, | |||||||

|---|---|---|---|---|---|---|---|---|

| | 2006 | 2005 | 2004 | |||||

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||

| Cost of goods sold | 83.4 | 85.0 | 84.8 | |||||

| Gross margin | 16.6 | 15.0 | 15.2 | |||||

Operating expenses: | ||||||||

| Warehousing, marketing and administrative expenses | 11.3 | 11.0 | 11.0 | |||||

| Restructuring and other charges, net | 0.1 | — | — | |||||

| Total operating expenses | 11.4 | 11.0 | 11.0 | |||||

| Operating income | 5.2 | 4.0 | 4.2 | |||||

| Interest expense | (0.2 | ) | (0.1 | ) | — | |||

| Other expense, net | (0.3 | ) | (0.1 | ) | (0.1 | ) | ||

| Income from continuing operations before income taxes | 4.7 | 3.8 | 4.1 | |||||

| Income tax expense | 1.7 | 1.4 | 1.5 | |||||

| Income from continuing operations | 3.0 | 2.4 | 2.6 | |||||

| Loss from discontinued operations, net of tax | (0.1 | ) | (0.1 | ) | (0.3 | ) | ||

| Net income | 2.9 | % | 2.3 | % | 2.3 | % | ||

Comparison of Results for the Years Ended December 31, 2006 and 2005

Net Sales. Net sales for the year ended December 31, 2006 were $4.5 billion, up 6.3%, compared with $4.3 billion in 2005. The twelve-month period ended December 31, 2006 had one less selling day compared with the same period of 2005. The acquisition of Sweet Paper added approximately 2.5% to the overall net sales growth. The following table shows net sales by product category for 2006 and 2005 (in millions):

| | Years Ended December 31, | |||||