UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material under Rule 14a-12 |

ESSENDANT INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Essendant Inc.

One Parkway North Boulevard

Deerfield, Illinois 60015

April 13, 2016

Dear Stockholder:

On behalf of the Board of Directors and management of Essendant Inc., I cordially invite you to attend the 2016 Annual Meeting of Stockholders. The Annual Meeting will be held on Wednesday, May 25, 2016, at 2:00 p.m. Central Time, at the Company’s offices located at One Parkway North Boulevard, Deerfield, Illinois.

At this year’s Annual Meeting, the matters to be considered by stockholders are the election of three Class III directors to serve for a three-year term expiring in 2019, the ratification of the selection of the Company’s independent registered public accounting firm for 2016, an advisory vote on executive compensation and the transaction of such other business as may properly come before the meeting. The Board of Directors has unanimously recommended a vote “FOR” election of the nominees named in the accompanying Proxy Statement, “FOR” ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm, and “FOR” approval of our executive compensation.

Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying Proxy Statement and vote promptly. To ensure that your shares are represented at the meeting, we recommend that you submit a proxy to vote your shares through the Internet by following the instructions set forth in the Notice of Internet Availability of Proxy Materials. You may also vote by telephone or mail by requesting a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote. The Notice of Internet Availability of Proxy Materials contains instructions on how to request paper copies of the proxy materials. This way, your shares will be voted even if you are unable to attend the meeting. This will not, of course, limit your right to attend the meeting or prevent you from voting in person at the meeting if you wish to do so.

Your Directors and management look forward to personally meeting those of you who are able to attend.

Sincerely yours,

Charles K. Crovitz

Chairman of the Board

Essendant Inc.

One Parkway North Boulevard

Deerfield, Illinois 60015

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | |

| |

| Date: | | Wednesday, May 25, 2016, at 2:00 p.m. Central Time |

| |

| Location: | | Company’s offices located at One Parkway North Boulevard, Deerfield, Illinois |

| | |

| Items of Business: | | 1. | | To elect three Class III directors to serve for a three-year term expiring in 2019; |

| | |

| | 2. | | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2016; |

| | |

| | 3. | | To cast an advisory vote on executive compensation; and |

| | |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

The Board of Directors has unanimously recommended a vote “FOR” election of the nominees, “FOR” ratification of the selection of the independent registered public accounting firm, and “FOR” approval of our executive compensation.

The record date for the Annual Meeting is the close of business on Monday, March 28, 2016. Only stockholders of record as of that time and date are entitled to notice of, and to vote at, the meeting. Record holders of the Company’s Common Stock as of the record date may submit their proxies by following the voting instructions set forth in the Notice of Internet Availability of Proxy Materials.

By Order of the Board of Directors,

Eric A. Blanchard

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2016

The proxy statement and Form 10-K are available at

essendant.com/proxymaterials

TABLE OF CONTENTS

Table of Contents

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | |

| | | | | | | |

TABLE OF CONTENTS

| | | | | | | | |

| | | | | | | | |

| | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROXY SUMMARY

Proxy Summary

This summary highlights selected information that is provided in more detail throughout this Proxy Statement. This summary does not contain all of the information you should consider before voting, and you should read the full Proxy Statement before casting your vote.

| | |

| Annual Meeting Information |

| Date | | May 25, 2016 |

| Time | | 2:00 p.m. Central Time |

| Location | | Company’s offices located at One Parkway North Boulevard, Deerfield, Illinois |

| How to Vote | | |

• By Internet | | Access www.proxyvote.com |

• By Telephone | | You must request a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote by telephone. |

• By Mail | | You must request a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote by mail. |

• In Person | | Attend the Annual Meeting and vote |

Additional information about the Annual Meeting and voting can be found beginning on page 5.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 1 |

| | | | | | | |

PROXY SUMMARY

Voting Matters and Board Recommendations

At this year’s Annual Meeting, our shareholders will vote on the following matters:

| | | | |

Proposal | | Board Recommendation | | Additional Information |

Proposal 1: Election of Directors | | FOR | | See pages 9 through 13 for more information on the nominees. |

Proposal 2: Ratification of Selection of the Company’s Independent Registered Public Accounting Firm | | FOR | | See pages 68 and 69 for details. |

Proposal 3: Advisory Vote on Executive Compensation | | FOR | | See page 70 for details. |

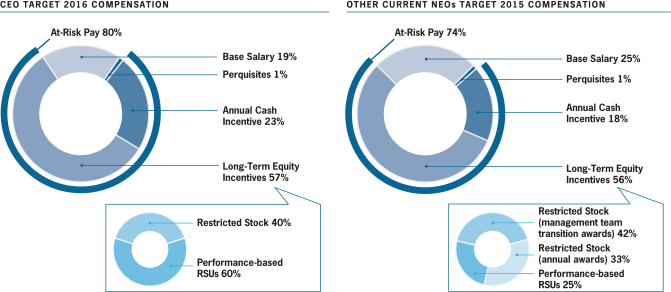

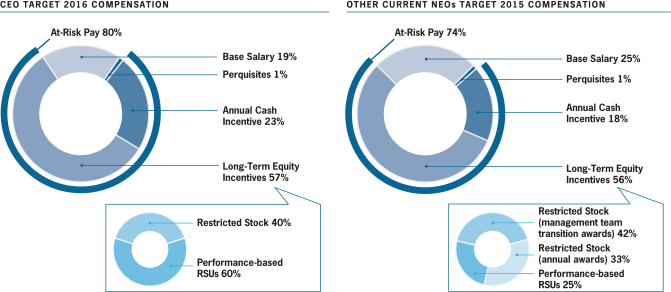

Executive Compensation Highlights

| | • | | The primary elements of our compensation program are base salary, annual cash incentive awards and long-term equity incentive awards. |

| | • | | We delivered solid financial performance in 2015 in the face of a challenging economic and industry environment. |

| | • | | However, our performance was below our internal performance goals and as a result our payouts to executives were below target. |

| | • | | Essendant’s compensation philosophy to pay for performance guided the 2015 executive compensation plan. |

| | | | | | | | |

| | | | | | | | |

2 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROXY SUMMARY

Compensation Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings ($) | | | All Other Compensation ($) | | | Total Compensation ($) | |

Robert B. Aiken, Jr. | | | 530,768 | | | | 166,000 | | | | 2,060,502 | | | | 166,667 | | | | — | | | | 19,147 | | | | 2,943,084 | |

President and Chief Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Earl C. Shanks | | | 63,035 | | | | — | | | | 249,995 | | | | 15,833 | | | | — | | | | 290,094 | | | | 618,956 | |

Senior Vice President and Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Timothy P. Connolly | | | 471,417 | | | | 53,624 | | | | 1,221,059 | | | | 105,150 | | | | — | | | | 29,578 | | | | 1,880,827 | |

Senior Vice President and Chief Operating Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Eric Blanchard | | | 375,000 | | | | 2,856 | | | | 656,220 | | | | 56,250 | | | | 1,001 | | | | 31,306 | | | | 1,122,633 | |

Senior Vice President, General Counsel and Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard D. Phillips | | | 375,000 | | | | — | | | | 656,220 | | | | 46,875 | | | | — | | | | 28,748 | | | | 1,106,843 | |

Senior Vice President, Strategy and President, ORS Industrial | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

P. Cody Phipps | | | 775,127 | | | | — | | | | 1,439,989 | | | | — | | | | — | | | | 518,021 | | | | 2,733,137 | |

Former President and Chief Executive Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Todd A. Shelton | | | 440,000 | | | | 3,879 | | | | 1,077,974 | | | | 77,000 | | | | — | | | | 30,470 | | | | 1,613,923 | |

Former Senior Vice President and Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 3 |

| | | | | | | |

PROXY SUMMARY

Changes to Executive Compensation Program

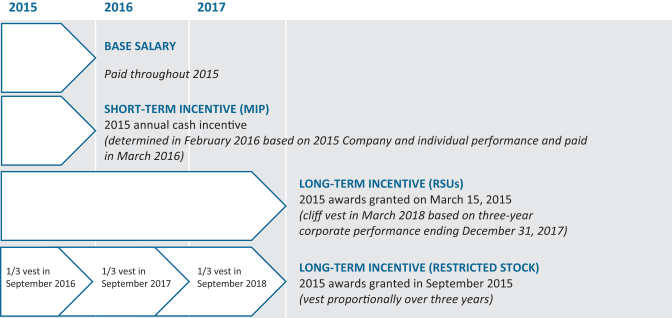

| | • | | In 2015 we revised the Management Cash Incentive Awards Plan, replacing Adjusted Net Income with Adjusted EBIT as a more appropriate annual performance measure and changing the weightings of Adjusted Cost Factor and Adjusted Working Capital Efficiency. |

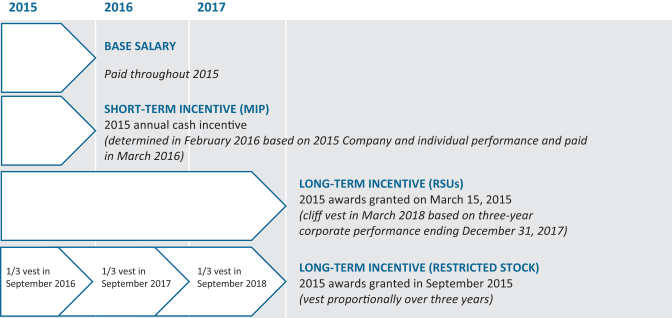

| | • | | In 2015 we changed our Long-Term Incentive Plan, adopting three-year cliff vesting for performance-based awards, adding Adjusted Working Capital Efficiency as a second performance metric for performance-based awards, and adjusting the allocation of the target value of annual grants between performance-based restricted stock units and time-based restricted stock. |

| | • | | In 2016 we introduced relative Total Stockholder Return (“TSR”) as a performance metric for performance-based awards under our Long-Term Incentive Plan. |

Corporate Governance Highlights

| | |

Board Independence | | |

Independent Directors | | 8 out of 9 |

Independent Chair of the Board | | Charles Crovitz |

Evaluating and Improving Board Performance | | |

Board evaluations | | Annual |

Committee evaluations | | Annual |

Aligning Director and Executive Interest with Shareholder Interests | | |

Director stock ownership requirements | | Yes |

Executive officer stock ownership requirements | | Yes |

Policy restricting trading and prohibiting hedging and short-selling of ESND stock | | Yes |

Compensation clawback policy for executive officers | | Yes |

| | | | | | | | |

| | | | | | | | |

4 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROXY AND VOTING INFORMATION

Proxy and Voting Information

The Board of Directors of Essendant Inc. (referred to as “we”, “our” or the “Company” in this Proxy Statement) is soliciting your proxy for use at our 2016 Annual Meeting of Stockholders and any adjournments or postponements thereof (the “Annual Meeting”).

What is a Notice of Internet Availability of Proxy Materials

Under rules of the Securities and Exchange Commission, we are furnishing proxy materials to our stockholders on the Internet, rather than mailing printed copies to our stockholders. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request one as instructed in that notice. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials on the Internet as well as vote your shares online. You may also vote by telephone or mail by requesting a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote. The Notice of Internet Availability of Proxy Materials contains instructions on how to request paper copies of the proxy materials. We expect to commence mailing the Notice of Internet Availability of Proxy Materials to our stockholders on or about April 13, 2016.

Who May Vote

Holders of record of our Common Stock at the close of business on Monday, March 28, 2016 (the “Record Date”) may vote at the Annual Meeting. On that date, 37,102,335 shares of our Common Stock were issued and outstanding. Each share entitles the holder to one vote.

How to Vote

If you are a holder of record of our Common Stock (meaning, the shares are registered by our transfer agent directly in your own name) on the Record Date, you may submit a proxy with your voting instructions by the applicable deadline shown on the Notice of Internet Availability of Proxy Materials or proxy card using any of the following methods:

| | • | | Through the Internet: Go to the websitehttp://www.proxyvote.comand follow the instructions on the Notice of Internet Availability of Proxy Materials to view the proxy materials online and vote your shares through the Internet. |

| | ¡ | | You must request a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote by telephone. |

| | ¡ | | Please review the Notice of Internet Availability of Proxy Materials for instructions on how to order paper copies of the proxy materials. |

| | ¡ | | You must request a paper copy of the proxy materials, which will include a proxy card with instructions on how to vote by mail. |

| | ¡ | | Please review the Notice of Internet Availability of Proxy Materials for instructions on how to order paper copies of the proxy materials. |

If you choose to submit your proxy with voting instructions by telephone or through the Internet, you will be required to provide your assigned control number shown on the Notice of Internet Availability of Proxy Materials or proxy card before your proxy and voting instructions will be accepted. Once you

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 5 |

| | | | | | | |

PROXY AND VOTING INFORMATION

have indicated how you want to vote in accordance with those instructions, you will receive confirmation that your proxy has been submitted successfully by telephone or through the Internet.

If you hold your shares of our Common Stock in “street name” through a broker, bank, custodian, fiduciary or other nominee, you should review the separate Notice of Internet Availability of Proxy Materials supplied by that firm to determine whether and how you may vote by mail, telephone or through the Internet. To vote these shares, you must use the appropriate voting instruction form or toll-free telephone number or website address specified on that firm’s voting instruction form for beneficial owners.

How Proxies Work

Giving your proxy means that you authorize the persons named as proxies to vote your shares at the Annual Meeting in the manner you direct. If you hold any shares in the Company’s Employee Stock Purchase Plan (“ESPP”), your proxy (whether given by mailing the proxy card or voting by telephone or through the Internet) will also serve as voting instructions to Computershare Trust Company, as nominee holder under the ESPP, with respect to the shares allocated to your account in the ESPP.

If you sign and return a proxy card, or use telephone or Internet voting, but do not specify how you want to vote your shares, the proxies will vote your shares “FOR” the election of each of the three director nominees, “FOR” the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2016, and “FOR” approval of our executive compensation. If you specify how you want to vote your shares on some matters but not others, the proxies will vote your shares as directed on the matters that you specify and as indicated above on the other matters described in this proxy statement. However, if you hold shares in the ESPP, Computershare Trust Company, as nominee holder under the ESPP, will not vote shares allocated to your ESPP account unless you indicate your voting instructions. The proxies will also vote your shares in their discretion on any other business that may properly come before the meeting.

Revocation of Proxies

If you have voted by submitting a proxy, you may revoke your proxy at any time before it is exercised at the Annual Meeting by any of the following methods:

| | • | | Requesting and submitting a new proxy card that is properly signed with a later date; |

| | • | | Voting again at a later date by telephone or through the Internet — your latest voting instructions received before the deadline for telephone or Internet voting, 11:59 p.m. Eastern Time on May 24, 2016, will be counted and your earlier instructions revoked; |

| | • | | Sending a properly signed written notice of your revocation to the Secretary of the Company at Essendant Inc., One Parkway North Boulevard, Deerfield, Illinois 60015-2559; or |

| | • | | Voting in person at the Annual Meeting. Attendance at the Annual Meeting will not itself revoke an earlier submitted proxy. |

A proxy card with a later date or written notice of revocation shall not constitute a revocation of a previously submitted proxy unless it is received by the Secretary of Essendant Inc. before the previously submitted proxy is exercised at the Annual Meeting.

Quorum

To conduct the business of the Annual Meeting, we must have a quorum. Under our current Bylaws, a quorum for the Annual Meeting requires the presence, in person or by proxy, of the holders of a majority

| | | | | | | | |

| | | | | | | | |

6 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROXY AND VOTING INFORMATION

of the 37,102,335 shares of our Common Stock issued and outstanding on the Record Date. Under Delaware law and our Bylaws, we count instructions to withhold voting authority for director nominees, any abstentions and broker non-votes as present at meetings of our stockholders for the purpose of determining the presence of a quorum.

Shares Held Through Broker or Other Nominee

In general, a broker who holds securities as a nominee in street name has limited authority to vote on matters submitted at a stockholders’ meeting in the absence of specific instructions from the beneficial owner. In the absence of instructions from the beneficial owner or authorization from the regulatory agency of which the broker is a member to vote on specific matters without the need to obtain instructions from the beneficial owner, a broker will specify a “non-vote” on those matters. Brokers are typically permitted to vote for the ratification of the selection of the independent registered public accounting firm if they have not received instructions from the beneficial owner; however, brokers may not vote on the other matters described in this Proxy Statement without specific instructions from the beneficial owner.

Required Votes

Election of Directors

The nominees for director will be elected by a plurality of the votes cast at the Annual Meeting. This means that the three nominees who receive the greatest number of votes will be elected as directors. Broker non-votes and instructions to withhold authority to vote for one or more nominees are not counted for this purpose and will not affect the outcome of this election.

We have adopted a so-called “plurality-plus” standard. In accordance with procedures set forth in the Company’s Corporate Governance Principles, any incumbent director (including the three nominees standing for election at the Annual Meeting) who receives a greater number of votes withheld from his or her election than votes “FOR” his or her election in an uncontested election will be expected to tender his or her resignation for consideration by the Company’s Governance Committee. The Governance Committee will consider the resignation and, within 45 days following the date of the applicable annual meeting, make a recommendation to the Board concerning the acceptance or rejection of the resignation. The Board will then take formal action on the Governance Committee’s recommendation no later than 90 days following the date of the annual meeting. Following the Board’s decision on the Committee’s recommendation, we will publicly disclose the Board’s decision together with an explanation of the process by which the decision was made and, if applicable, the Board’s reason or reasons for rejecting the tendered resignation.

Ratification of Ernst & Young

Ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm will require the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting and entitled to vote on such matter. Abstentions will be counted as represented and entitled to vote for purposes of determining the total number of shares that are represented and entitled to vote with respect to this proposal. As a result, an abstention from voting on this proposal will have the same effect as a vote “AGAINST” the matter. Broker non-votes will not be considered as represented and entitled to vote with respect to this proposal and will have no effect on the voting on this matter.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 7 |

| | | | | | | |

PROXY AND VOTING INFORMATION

Advisory Vote on Executive Compensation

The vote on the approval of our executive compensation is advisory and non-binding. However, we will consider our stockholders to have approved our executive compensation if the number of votes “FOR” this proposal exceeds the number of votes “AGAINST” this proposal. Accordingly, abstentions and broker non-votes will not affect the outcome of this advisory vote.

We do not know of any other matters to be submitted for stockholder action at the Annual Meeting.

Costs of Proxy Solicitation

We will bear the costs of soliciting proxies for the Annual Meeting. In addition to the solicitation by mail, proxies may be solicited personally or by telephone, facsimile or electronic communication by our directors, officers and other employees. Directors, officers and other employees of the Company who participate in soliciting proxies will not receive any additional compensation from the Company for doing so. Upon request, we will reimburse brokers, banks, custodians and other nominee record holders for their out-of-pocket expenses in forwarding proxy materials to their principals who are the beneficial owners of our Common Stock as of the Record Date.

| | | | | | | | |

| | | | | | | | |

8 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Proposal 1: Election of Directors

General

The Company’s business and affairs are managed under the direction of our Board of Directors. The Board has responsibility for establishing broad corporate policies relating to the Company’s overall performance rather than day-to-day operating details.

Our Board of Directors currently consists of nine members. The Board is divided into three classes, each of which is elected for a three-year term. The terms of the three current Class III Directors expire in 2016. The Class III Directors are current directors standing as nominees at the Annual Meeting for reelection to a three-year term expiring in 2019.

The nominees have indicated that they are willing and able to serve as Company Directors. If any nominee becomes unavailable for election for any reason, the persons named as proxies in the enclosed proxy card will have discretionary authority to vote the shares they represent for any substitute nominee designated by the Board of Directors, upon recommendation of the Governance Committee.

Information regarding each of the Director nominees and the Directors continuing in office, including his or her age, principal occupation, other business experience during at least the last five years, directorships in other publicly held companies during the last five years and period of service as a Company Director, is set forth below. Also included below is a discussion of the specific experience, qualifications, attributes and skills that led to the conclusion that the Director nominee or Director should serve on the Board.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 9 |

| | | | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Nominees

The nominees for election as Class III Directors at this year’s Annual Meeting, each to serve for a three-year term expiring in 2019, are set forth below:

| | |

Susan J. Riley Ms. Riley is Chair of the Human Resources Committee and a member of the Audit Committee. Ms. Riley is the Chief Financial Officer of Vestis Retail LLC, a private equity-owned holding company for Bob’s Store, Eastern Mountain Sports, and Sport Chalet. She previously served as a financial consultant for several retail and other companies. From April 2006 through February 2011 Ms. Riley held several senior executive positions, including Executive Vice President, Finance and Administration, at The Children’s Place Retail Stores, Inc., a children’s clothing and accessories retailer. Previously she served as Executive Vice President and Chief Financial Officer of Klinger Advanced Aesthetics, Senior Vice President and Chief Financial Officer of Abercrombie & Fitch Company, Executive Vice President of Business and Finance of Mount Sinai Medical Center of New York, Vice President and Treasurer of Colgate-Palmolive Company, Executive Vice President and Chief Financial Officer of Dial Corporation and Senior Vice President and Chief Financial Officer of Tambrands, Inc. Ms. Riley is also designated as one of the financial experts on the Company’s Audit Committee. | | Qualification: Ms. Riley’s extensive knowledge in financial matters and her experience as chief financial officer of several companies contribute to the financial expertise on our Board and the Audit Committee. Her experience from serving as a senior executive and board member of several companies, including as the chair of the human resources committee of another board, enables Ms. Riley to provide key insights to our Human Resources Committee and to the Board operations in general. Ms. Riley earned a bachelor’s degree in accounting from the Rochester Institute of Technology and an MBA from Pace University. Age: 57 Director since: 2012 |

| | |

Alexander M. Schmelkin Mr. Schmelkin is a member of the Human Resources and Technology Advisory Committees. Mr. Schmelkin is Co-Founder, Chief Executive Officer and a member of the board of directors of Alexander Interactive, a web design and engineering firm, and has held these positions since 2002. Before founding Alexander Interactive, Mr. Schmelkin co-founded New York-based Davanita Design, which was later acquired by Avatar Technology, where he served as President and Chief Executive Officer of the New York division. | | Qualification: Mr. Schmelkin brings to the Board and the Technology Advisory Committee extensive experience in technology and e-business, digital expertise and entrepreneurial insights as a CEO. Mr. Schmelkin earned a bachelor’s degree from Cornell University. Age: 39 Director since: 2012 |

| | |

Alex D. Zoghlin Mr. Zoghlin was re-elected to the Company’s Board of Directors in May 2008. Mr. Zoghlin serves as Chair of the Technology Advisory Committee. Mr. Zoghlin is the Group President, Global Operations Center for Hyatt Hotels Corporation, a global hospitality company. Prior to joining Hyatt, Mr. Zoghlin served as the Chief Executive Officer of VHT, Inc., a marketing services provider for the real estate industry, from 2009 to February 2013. He previously served on the Board from November of 2000 until May 2006. He resigned at that time to focus primarily on building G2 Switchworks, a Chicago-based travel/technology firm, where he was President and Chief Executive Officer until its change of ownership in 2008. He previously served as Chairman, President and Chief Executive Officer of neoVentures Inc., a venture capital investment company for emerging technology companies. Prior to that, he was Chief Technology Officer of Orbitz, LLC, a consumer-oriented travel industry portal backed by major airline companies. | | Qualification: Mr. Zoghlin has a history of demonstrated leadership in enterprise technology and e-commerce. His experience in enterprise-wide programming, developing and implementing web-based solutions enables Mr. Zoghlin to offer key insights to our Technology Advisory Committee, which provides critical guidance on the Company’s portfolio of information technology assets and systems. Mr. Zoghlin also brings an entrepreneurial orientation to the Board’s deliberations. Mr. Zoghlin previously served as a director of State Farm Insurance Co., an insurance and financial services company. Age: 46 Director since: 2008 (previously served from November 2000 to May 2006) |

THE COMPANY’S BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH OF THE INDIVIDUALS NOMINATED ABOVE.

| | | | | | | | |

| | | | | | | | |

10 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Continuing Directors

The other Directors, whose terms will continue after this year’s Annual Meeting, are as follows:

Class I Directors — Continuing in Office until 2017 Annual Meeting

| | |

Jean S. Blackwell Ms. Blackwell serves as Chair of the Governance Committee and a member of the Finance Committee. Ms. Blackwell served as the Chief Executive Officer of the Cummins Foundation and Executive Vice President, Corporate Responsibility of Cummins Inc., an engine manufacturer, from 2008 until her retirement in March 2013. From 2003 until May of 2008, Ms. Blackwell served as the Executive Vice President and Chief Financial Officer for Cummins. Ms. Blackwell also served as Vice President and General Counsel; Vice President, Human Resources; and Vice President, Cummins Business Services. Ms. Blackwell was appointed as Executive Vice President of Cummins in 2005. Prior to joining Cummins, Ms. Blackwell was a partner in the Indianapolis law firm of Bose McKinney & Evans and also worked for the State of Indiana as Budget Director and for the State Lottery Commission as Executive Director. | | Qualification: Ms. Blackwell has an in-depth knowledge of the business operations of a publicly-traded company from her long tenure at Cummins and a strong financial acumen from her senior management experience. She also brings significant knowledge of human resource practices having served as Vice President of Human Resources at Cummins. Ms. Blackwell holds a BA degree in economics from the College of William and Mary and a law degree (Cum Laude) from the University of Michigan. Ms. Blackwell is a member of the board of directors of Celanese, Inc., a specialty chemicals company, and serves on its audit and nominating and governance committees. She previously served as a director of The Phoenix Companies, a life insurance company. Age: 61 Director since: 2007 |

| | |

Paul S. Williams Mr. Williams is a member of the Audit and Human Resources Committees. Mr. Williams has been a partner at Major, Lindsey & Africa, LLC, a legal executive search firm, since 2005. Prior to joining Major, Lindsey & Africa he served as Executive Vice President, Chief Legal Officer and Secretary of Cardinal Health, Inc. | | Qualification: Mr. Williams brings extensive experience and knowledge of the business operations of publicly traded companies having served as a business executive and a director of several public company boards. His experience as an executive recruiter allows him to make significant contributions to the Human Resources Committee in its evaluation of compensation practices and succession planning. He also brings deep governance and M&A expertise. Mr. Williams holds a BA degree from Harvard University and a law degree from Yale University. Mr. Williams currently serves on the board of directors of Compass Minerals International, Inc., a salt and specialty fertilizer products company, and serves on its compensation and audit committees. He also serves on the Board of Directors of Bob Evans Farms, Inc., a food service processing and retail company, and serves on its compensation and nominating and governance committees. He previously served as a Director of State Auto Financial Corporation. Age: 56 Director since: 2014 |

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 11 |

| | | | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Class II Directors — Continuing in Office until 2018 Annual Meeting

| | |

Robert B. Aiken, Jr. Mr. Aiken serves as a member of the Executive Committee. He previously served on the Company’s Board of Directors from December 2010 to May 2014, at which time he stepped down from the Board due to the demands of his position as the Chief Executive Officer of Feeding America, the nation’s leading hunger relief organization. Mr. Aiken was CEO of Feeding America from November 2012 to February 2015. Prior to this role, Mr. Aiken was the CEO of the food company portfolio at Bolder Capital, a private equity firm. Mr. Aiken previously served as Managing Director of Capwell Partners LLC, a private-equity firm focused on companies offering health and wellness products and services. Mr. Aiken was in the private-equity business from February 2010 until his appointment at Feeding America. Prior to that time, Mr. Aiken was the President and Chief Executive Officer of U.S. Foodservice, one of the country’s premier foodservice distributors. Mr. Aiken joined U.S. Foodservice in 2004 and held several senior executive positions including President and Chief Operating Officer and Executive Vice President of Strategy and Governance before being named Chief Executive Officer in 2007. From 2000 until 2004, Mr. Aiken also served as President and Principal of Milwaukee Sign Co., a privately-held manufacturing firm. From 1994 to 2000, Mr. Aiken was an executive with Specialty Foods Corporation, where he held several positions, including President and Chief Executive Officer of Metz Baking Company. Early in Mr. Aiken’s career, he worked as a business lawyer. | | Qualification: Mr. Aiken brings to the Board of Directors and to the Executive Committee his experience as a chief executive officer of both public and private corporations with significant operations and a large, labor-intensive workforce. He has a broad background in foodservice distribution, with particular expertise in acquisitions, finance, merchandising, operations, sales force effectiveness, supply chain and private label products. Mr. Aiken also holds accounting and law degrees from Georgetown University. Since February 2010, Mr. Aiken has served as a director of Red Robin Gourmet Burgers, a chain of casual dining restaurants. Age: 53 Director since: 2015 |

| | |

Charles K. Crovitz Mr. Crovitz serves as Chair of the Executive Committee and as a member of the Technology Advisory and Governance Committees. In September 2007, Mr. Crovitz was appointed as the Interim Chief Executive Officer of The Children’s Place Retail Stores, Inc., a children’s clothing and accessories retailer, which position he held until his retirement in January 2010. Prior to this appointment, Mr. Crovitz was a member of the executive leadership team of Gap Inc. from 1993 until 2003, most recently serving as Executive Vice President and Chief Supply Chain Officer. During his ten-year career with Gap, Mr. Crovitz was also Executive Vice President, Supply Chain and Technology and Senior Vice President, Strategy and Business Development. Prior to that, he held various positions with Safeway Inc., including serving as a member of the operating committee, Senior Vice President and Chief Information Officer, and Vice President, Director of Marketing for Safeway Manufacturing Group. Mr. Crovitz also spent several years with McKinsey & Company, Inc. where he was an Engagement Manager, leading client service teams in retail, forest products, steel and personal computer industries. | | Qualification: Mr. Crovitz’ responsibility for information technology during his tenure at Gap and Safeway and his experience in supply chain management are particularly relevant to the strategic direction of the Company. His extensive operating experience allows him to make significant contributions to the Company’s continuing efforts to pursue growth strategies, increase productivity and reduce its cost structure making him an effective Chairman of the Board. Mr. Crovitz also holds an MBA and a law degree from Stanford University. Mr. Crovitz previously served as a board member for The Children’s Place Retail Stores, Inc. Age: 62 Director since: 2005 |

| | | | | | | | |

| | | | | | | | |

12 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

| | |

Roy W. Haley Mr. Haley serves as Chair of the Audit Committee and a member of the Finance and Executive Committees. Mr. Haley also serves as the Non-Executive Chairman of the board of directors of Bluelinx Corporation, a wholesale supplier of building materials. Until his retirement in May 2011, Mr. Haley served as the Executive Chairman of WESCO International, Inc. (“WESCO”), a wholesale supplier of electrical and other industrial supplies and services, and, until September 2009, was the Chief Executive Officer. Prior to joining WESCO in February 1994, he was President and Chief Operating Officer of American General Corporation, one of the nation’s largest consumer financial services organizations. Mr. Haley has served as the Chair of the Company’s Audit Committee for the past 14 years, and served as the chair of the audit committee of Cambrex Corporation. Mr. Haley is also designated as one of the financial experts on the Company’s Audit Committee. | | Qualification: Mr. Haley has a history of public company board membership and leadership with significant knowledge and operating experience in a distribution company as Chairman and Chief Executive Officer of WESCO. This experience allows him to provide highly informed guidance and counsel regarding the operations and value proposition of a wholesale supplier supplemented with his direct knowledge of the Company’s lines of products. Through his present and past business experiences, Mr. Haley has acquired significant understanding and experience in financial matters of a publicly traded company, internal controls and the functions of an audit committee. Mr. Haley holds a Bachelor of Science in industrial management from Massachusetts Institute of Technology. In addition to his service as a director of WESCO, Mr. Haley served as a director of Cambrex Corporation, a supplier of pharmaceutical and life science industry products and services, for twelve years until his retirement in April 2010. He also served as a director of the Federal Reserve Bank of Cleveland until his retirement in December 2010. Age: 69 Director since: 1998 |

| | |

Stuart A. Taylor, II Mr. Taylor is Chair of the Finance Committee and a member of the Governance Committee. Mr. Taylor is Chief Executive Officer of The Taylor Group LLC, a private equity firm, and has been with The Taylor Group since 2002. Prior to founding The Taylor Group in 2002, Mr. Taylor was Senior Managing Director of Bear Stearns Companies Inc., a brokerage firm. Over a span of 19 years, Mr. Taylor served as Managing Director of CIBC World Markets (US), Managing Director, Automotive Industry Group, BT Alex Brown, Inc. of Bankers Trust Company and as Vice President, Corporate Finance Department of Morgan Stanley & Company, Inc. | | Qualification: Mr. Taylor has demonstrated leadership as a CEO and is a seasoned investment banker. His extensive experience in finance, business development, strategic diversification and mergers and acquisitions allows him to make significant contributions to the company’s strategic initiatives and to the Finance and Governance Committees. Mr. Taylor holds an MBA in finance from Harvard Business School and an undergraduate degree from Yale University. Mr. Taylor currently serves as a director of Ball Corporation, a metal packaging company, and serves as chair of its human resources committee and a member of its audit committee. He also serves on the board of directors of Hillenbrand, Inc., an industrial company, and serves as the chair of the M&A committee and a member of the audit committee. Age: 55 Director since: 2011 |

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 13 |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

Governance and Board Matters

Corporate Governance Principles

The Company is committed to the use of sound corporate governance principles and practices in the conduct of its business. The Company’s Board has adopted the Essendant Inc. Corporate Governance Principles (the “Governance Principles”) to address certain fundamental corporate governance issues. The Governance Principles provide a framework for Company governance activities and initiatives and cover, among other topics, Director independence and qualifications, Board and Committee composition and evaluation, Board access to members of management and independent outside advisors, Board meetings (including meetings in executive session without management present) and succession planning. These principles also provide for the separation of the position of Chairman of the Board, who would normally serve as the Company’s lead independent Director, from that of Chief Executive Officer. The Governance Principles are included under “Governance” as part of the “Investors” section available through the Company’s website at http://www.essendant.com. Neither the Governance Principles nor any other information contained on or available through the Company’s website and referred to in this Proxy Statement is incorporated by reference in, or considered to be part of, this Proxy Statement.

Code of Conduct

The Company’s Board of Directors also has adopted the Essendant Inc. Code of Business Conduct (the “Code of Conduct”). The Code of Conduct applies to all Directors, officers and employees, and covers topics such as compliance with laws and regulations, proper use of the Company’s assets, treatment of confidential information, ethical handling of actual or apparent conflicts of interest, accurate and timely public disclosures, prompt internal reporting of violations and accountability for adherence to its guidelines. A copy of the Code of Conduct is included under “Governance” as part of the “Investors” section available through the Company’s website at http://www.essendant.com.

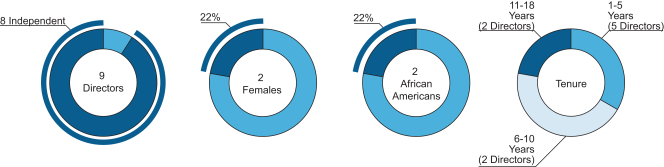

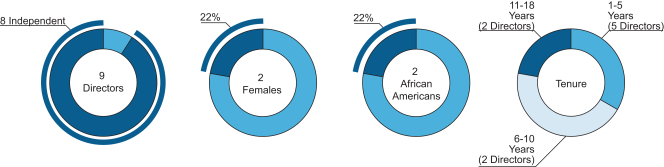

Board Independence

The Company’s Board of Directors has affirmatively determined that all of its members and the nominees, other than Mr. Aiken, the Company’s President and Chief Executive Officer, are independent within the meaning of the Company’s independence standards set forth in its Governance Principles. The Company’s Governance Principles incorporate the director independence standards of The NASDAQ Stock Market, Inc. (“NASDAQ”), and reflect the Board’s policy that a substantial majority of the Directors who serve on the Company’s Board should be independent Directors. Indeed, for a number of years, a substantial majority of the Company’s Board of Directors has been comprised of independent Directors.

In determining that Mr. Taylor is independent, the Board considered that Mr. Taylor and his spouse are owners of Taylor Made Business Solutions (“TMBS”), where his spouse also serves as the Chief Executive Officer, and that TMBS purchased $11,280 of products and services from Essendant Co. (“ECO”), a wholly-owned subsidiary of the Company, during 2015. The amount of purchases was less than 5% of gross revenues of ECO. The Board concluded that such transactions constituted an insignificant percentage of TMBS’ purchases and the Company’s sales, that Mr. Taylor had no direct involvement in such transactions and that such transactions, therefore, did not affect Mr. Taylor’s independence. Based on the same information and the representations from the Company’s management that such transactions were in the ordinary course of business at the same prices and on the same terms as are available to customers of the Company generally, the Audit Committee of the

| | | | | | | | |

| | | | | | | | |

14 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

Board concluded that such transactions were exempt under the Company’s related person transaction approval policy. The Governance Committee also reviewed the relationship and determined that there is no conflict with the Company’s Corporate Governance Principles, and that the relationship did not impair Mr. Taylor’s independence.

Board Leadership Structure

The Company’s Bylaws call for the Chairman of the Board to be elected by the Board from among its members and to have the powers and duties customarily associated with the position of a non-executive Chairman. Consistent with the Company’s Corporate Governance Principles, the Board expects that in most circumstances the only member of the Company’s management who would be invited to serve on the Board would be the Company’s chief executive officer. However, the Company’s Bylaws also provide that, while the Chairman may hold an officer position, under no circumstances may the Chairman also serve as the President or Chief Executive Officer of the Company. The Chairman of the Board normally serves as the Company’s lead independent Director and chairs executive sessions of the Board. Charles K. Crovitz has served as the Company’s independent Chairman since December 2011.

These principles are further enhanced in the Company’s Corporate Governance Principles which assist the Board in the exercise of its responsibilities and in serving the best interests of the Company and its stockholders. This structure is intended to serve as a framework within which the Board may conduct its business in accordance with applicable laws, regulations, and other corporate governance requirements.

Board Diversity

The Governance Committee is responsible for evaluating potential candidates for Board membership. In its evaluation process and to ensure that the Board benefits from diverse perspectives, the Committee considers such factors as the experience, perspective, background, skill sets, race, and gender makeup of the current Board as well as the candidate’s individual qualities in leadership, character, judgment and ethical standards. The Committee does not have a separate policy on diversity. However, pursuant to the Company’s Corporate Governance Principles, diversity is one of the criteria to be positively considered for board membership. For this purpose, the Committee considers diversity broadly as set forth above. The Governance Committee believes our directors represent a diverse base of perspectives and reflect the racial and gender diversity of the Company’s employees, customers and shareholders, as well as an appropriate level of tenure, as further illustrated below.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 15 |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

Board’s Role in Risk Management

The Board of Directors takes an active role in risk oversight of the Company both as a full Board and through its Committees.

Strategic risk, which is risk related to the Company properly defining and achieving its high-level goals and mission, as well as operating risk, which is risk relating to the effective and efficient use of resources and pursuit of opportunities, are regularly monitored by the full Board through regular and consistent review of the Company’s operating performance and strategic plan. For example, at each of the Board’s five regularly scheduled meetings throughout the year, management provides to the Board presentations on the Company’s various business units as well as the Company’s performance as a whole. In addition, the Board discusses risks related to the Company’s business strategy at the Board’s strategic planning meetings every year in July and September and at other meetings as appropriate. Similarly, significant transactions, such as acquisitions and financings, are brought to the Board and Finance Committee for approval.

Reporting risk and compliance risk are primarily overseen by the Audit Committee. Reporting risk relates to the reliability of the Company’s financial reporting, and compliance risk relates to the Company’s compliance with applicable laws and regulations. The Audit Committee meets at least four times per year and, pursuant to its charter and established processes, receives input directly from management as well as from the Company’s independent registered public accounting firm, Ernst & Young LLP, regarding the Company’s financial reporting process, internal controls, and public filings. The Company’s internal audit function leads an annual risk assessment to refresh its ongoing risk-based work plan which includes coverage of financial, operational, and compliance risks, reporting results to the Audit Committee on a regular basis. The Company’s Disclosure Committee, Compliance Committee, and Enterprise Risk Management Committee, each consisting of senior level staff from the legal, finance, human resources, and information technology departments, as well as each business unit, meet regularly to address financial reporting, compliance issues, and other enterprise-wide risks and identify any additional actions required to mitigate these risks. Each of these management committees reports its activities regularly to the Audit Committee. The Audit Committee also receives regular updates from the Company’s in-house attorneys regarding any Hotline reports, Code of Conduct issues or other legal compliance concerns. See “Board Committees — Audit Committee” below for further information on how the Audit Committee fulfills, and assists the Board of Directors’ oversight of, reporting and compliance risks.

Additionally, the Finance Committee, Technology Advisory Committee, and Human Resources Committee each provide risk oversight and monitoring with respect to the Company’s capital structure and corporate finance, cyber security, deployment of technology, and structure of compensation programs, respectively. See the individual descriptions of these committees for further information regarding their roles.

Executive Sessions

Non-management Directors meet regularly in executive sessions without management. In accordance with the Company’s Governance Principles, executive sessions are held at least four times a year. The Company’s independent Chairman of the Board presides at such sessions.

Self-Evaluation

The Board and each of the Audit, Governance, Human Resources, Executive, Finance, and Technology Advisory Committees conduct an annual self-evaluation, as contemplated by the

| | | | | | | | |

| | | | | | | | |

16 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

Company’s Governance Principles and the charters of such Board committees. The Board also obtains peer evaluations of individual Director performance in the course of its self-evaluation process.

Board Meetings and Attendance

The Board of Directors held 13 meetings during 2015. Each Director attended more than 75% of the aggregate number of meetings of the Board of Directors and of the Board Committees on which he or she served.

Board Committees

General

The Board of Directors has established six standing committees — an Audit Committee, a Governance Committee, a Human Resources Committee, a Finance Committee, a Technology Advisory Committee, and an Executive Committee. The Governance Committee serves as and performs the functions of a Board nominating committee. Each of the standing committees operates under a written charter adopted by the Board. The charters for the committees are available at essendant.com/proxymaterials.

The current membership and number of meetings held by each such standing committee during 2015 are as follows:

| | | | | | | | | | | | |

Name | | Audit | | Governance | | Human

Resources | | Executive | | Finance | | Technology

Advisory |

Robert B. Aiken, Jr.(1) Director Since: 2015 Previously served as Director from December 2010 to May 2014. | | | | | | | | ü | | | | |

Jean S. Blackwell(2) Director Since: 2007 | | | | ü(C) | | | | | | ü | | |

Charles K. Crovitz Director Since: 2005 | | | | ü | | | | ü(C) | | | | ü |

Roy W. Haley Director Since: 1998 | | ü(C) | | | | | | ü | | ü | | |

Susan J. Riley Director Since: 2012 | | ü | | | | ü(C) | | | | | | |

Alexander M. Schmelkin Director Since: 2012 | | | | | | ü | | | | | | ü |

Stuart A. Taylor, II Director Since: 2011 | | | | ü | | | | | | ü(C) | | |

Paul S. Williams Director Since: 2014 | | ü | | | | ü | | | | | | |

Alex D. Zoghlin Director Since: 2008 Previously served as Director from November 2000 to May 2006. | | | | | | | | | | | | ü(C) |

| Number of Meetings in 2015 | | 7 | | 7 | | 8 | | 6 | | 6 | | 5 |

| (1) | On May 4, 2015, Robert B. Aiken, Jr. stepped off the Finance Committee. |

| (2) | On May 20, 2015, Jean S. Blackwell became a member of the Finance Committee. |

Audit Committee. The Board has determined that all of the above members of the Audit Committee are independent pursuant to NASDAQ’s current listing standards and Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”). No member of the Audit Committee received any compensation from

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 17 |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

the Company during 2015 other than for services as a member of the Board or one or more of its committees. The Board also has determined that all Audit Committee members are financially literate and have financial management expertise, in accordance with NASDAQ listing standards. In addition, the Board of Directors has determined that Roy W. Haley and Susan J. Riley qualify as “audit committee financial experts” within the meaning of applicable SEC regulations.

The principle functions of the Audit Committee involve assisting the Company’s Board of Directors in fulfilling its oversight responsibilities relating to: (1) the integrity of the Company’s financial statements; (2) the soundness of the Company’s internal control systems; (3) assessment of the independence, qualifications and performance of the Company’s independent registered public accounting firm; (4) performance of the internal audit function; and (5) the Company’s enterprise risk management, legal, regulatory, and ethical compliance programs. The Audit Committee’s seven meetings during 2015 included reviews with management and the Company’s independent registered public accounting firm regarding the Company’s financial statements before their inclusion in the Company’s annual and quarterly reports filed with the SEC. For additional information, see “Report of the Audit Committee.”

The Audit Committee operates under a written charter most recently amended as of October 5, 2015. The charter was last reviewed by the Committee in October 2015.

Governance Committee. The Governance Committee evaluates corporate governance principles and makes recommendations to the full Board regarding governance matters, including evaluating and recommending Director compensation, overseeing the evaluation by the Board of Directors of the performance of the Company’s Chief Executive Officer and the Board, and reviewing succession planning with respect to the Chief Executive Officer. The Company’s Board has determined that all of the members of the Governance Committee are independent pursuant to current NASDAQ listing standards. In performing the functions of a nominating committee, the Governance Committee reviews and makes recommendations to the full Board concerning the qualifications and selection of Director candidates, including any candidates that may be recommended by Company stockholders.

The Governance Committee operates under a written charter most recently amended as of December 8, 2015. The charter was last reviewed by the Committee in December 2015.

Human Resources Committee. The Human Resources Committee of the Board of Directors generally acts as a Board compensation committee. It reviews and approves or makes recommendations to the Board of Directors with respect to compensation, employment agreements, and benefits applicable to executive officers. The Human Resources Committee also oversees the development and administration of compensation and benefits.

The agendas, meetings, and calendar are developed and set by the Chair of the Human Resources Committee with input from the Human Resources Department and the Chief Executive Officer. The Chairman, Chief Executive Officer, other members of management, and outside advisors may be invited to attend all or a portion of a Human Resources Committee meeting, other than an executive session of the Human Resources Committee members, depending on the nature of the agenda items. Neither the Chief Executive Officer nor any other member of management votes on items before the Human Resources Committee; however, the Human Resources Committee and the Board of Directors solicit the views of the Chief Executive Officer on compensation matters, including the compensation of our executive officers.

Among its executive compensation oversight responsibilities, the Human Resources Committee approves the base salaries, annual incentive compensation targets, benefits, and perquisites of our executive officers, other than the Chief Executive Officer. In the case of compensation for the Chief

| | | | | | | | |

| | | | | | | | |

18 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

Executive Officer, the Human Resources Committee makes a recommendation to the full Board of Directors for approval. The Human Resources Committee generally oversees the development and administration of our compensation and benefits plans, programs, and practices and reviews and makes determinations based on applicable data and analysis. Recommendations are made by the Committee to the Board on overall compensation and benefits objectives. With respect to our annual incentive programs, the Human Resources Committee approves performance targets under our 2015 Long-Term Incentive Plan or criteria applicable to other executive officer bonuses and reviews attainment of such targets or satisfaction of other relevant criteria. The Human Resources Committee also administers and approves equity grants to our executive officers under our 2015 Long-Term Incentive Plan. The Committee also advises and consults with the Governance Committee and the Board on non-employee director compensation.

At the request of the Board, a risk analysis of 2015 compensation policies and practices was conducted. The Human Resources Committee received a report from the Company’s Internal Audit department regarding Aon Hewitt’s analysis of whether the Company’s compensation policies and practices for all employees, including executive officers, are reasonably likely to incent employees to take excessive risks or other actions inconsistent with Company policy that would result in a material adverse effect on the Company. Aon Hewitt identified all compensation policies and practices, analyzed whether they might motivate employees to take inappropriate risks and also considered internal controls that mitigate any such risks. After completion of this analysis, Aon Hewitt and management reported to the Committee their conclusion that none of the Company’s compensation policies and practices is reasonably likely to incent employees to take excessive risks that would result in a material adverse effect on the Company, and the Committee concurred with their conclusion.

The Human Resources Committee may establish its own procedural rules except as otherwise prescribed by the Company’s Bylaws, applicable law, or the NASDAQ listing standards. The Human Resources Committee may delegate any of its responsibilities to a subcommittee comprised of one or more members of the Human Resources Committee, subject to such terms and conditions (including required reporting back to the full Committee) as the Human Resources Committee may prescribe.

The Human Resources Committee has the authority to retain directly (and terminate the engagement of) any outside compensation consultants, outside counsel, or other advisors that the Human Resources Committee in its discretion deems appropriate to assist it in the performance of its functions, with the sole authority to approve related retention terms and fees for any such advisors. We will provide for appropriate funding, as determined by the Human Resources Committee, for payment of compensation to such outside advisors the Human Resources Committee retains.

During 2015 the Human Resources Committee engaged the services of an independent consultant, Meridian Compensation Partners, LLC (“Meridian”). Meridian provided the Human Resources and Governance Committees with updates on compensation trends and regulatory developments, advice on proxy disclosures with regard to compensation matters, and other assistance in related items as requested by the Committees, including review of various materials prepared for the Committees by management. In completing its work, Meridian was engaged directly on behalf of the Committees, did no other work for the Company or any of its senior executives, and had no other ties to the Company. For additional information, see “Executive Compensation — Compensation Discussion and Analysis — Use of Consultants.”

The Human Resources Committee has assessed the independence of Meridian pursuant to the rules of the U.S. Securities and Exchange Commission and NASDAQ and concluded that no conflict of interest exists that would prevent Meridian from independently representing the Human Resources Committee.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 19 |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

The Human Resources Committee operates under a written charter most recently amended as of June 1, 2015. The charter was last reviewed by the Committee in February 2014.

Executive Committee. The Executive Committee has the authority to act upon any corporate matters that require Board approval, except where Delaware law requires action by the full Board or where the matter is required to be approved by a committee of independent Directors in accordance with applicable regulatory requirements.

Finance Committee.The purpose of the Finance Committee is to review and provide guidance to the Company’s Board of Directors and management with respect to the Company’s: (1) present and future capital structure requirements and opportunities; (2) plans, strategies, policies, proposals, and transactions related to corporate finance; (3) potential acquisitions and divestitures; and (4) Company financial risk management activities and plans.

The Finance Committee operates under a written charter most recently amended as of June 1, 2015. The charter was last reviewed by the Committee in February 2014.

Technology Advisory Committee. The purpose of the Technology Advisory Committee is to assist the Company’s Board of Directors in fulfilling its oversight responsibilities relating to: (1) alignment of the Company’s information technology (“IT”) strategic direction, investment needs, and priorities with its overall business and marketing strategies; (2) the Company’s marketing initiatives, including Digital-based marketing and merchandising efforts; (3) assessment of the Company’s portfolio of IT assets and systems; (4) promotion of an effective, efficient, scalable, flexible, secure, and reliable IT infrastructure; and (5) consideration of the impact of emerging IT developments that may affect the IT function’s ability to support the needs of the business.

The Technology Advisory Committee operates under a written charter most recently amended as of February 10, 2016. The charter was last reviewed by the Committee in February 2016.

Consideration of Director Nominees

The Governance Committee periodically assesses the Board’s size and composition and whether there may be any near-term vacancies on the Board due to retirement or otherwise. The Governance Committee uses a variety of methods to identify and evaluate potential Director nominees when the need for a new or additional Director is identified. It may seek or receive candidate recommendations from other Board members, members of the Company’s senior management, stockholders, or other persons. In addition, if and when it deems appropriate, the Governance Committee may retain an independent executive search firm to assist it in identifying potential Director candidates. Any such candidates may be evaluated at regular or special meetings of the Governance Committee and the Governance Committee may solicit input from other Directors.

In evaluating any identified or submitted candidates for the Board, the Governance Committee seeks to achieve a balance of knowledge, skills, experience, and capability on the Board and to address the Board membership criteria set forth in the Company’s Governance Principles. In addition, the Governance Committee believes that candidates must have high personal and professional ethics and integrity, with values compatible with those of the Company; broad and substantial experience at a senior managerial or policy-making level as a basis for contributing wisdom and practical insights; the ability to make significant contributions to the Company’s success; and sufficient time to devote to their duties as a Director. In addition, the Governance Committee believes it is important that each Director represent the interests of all stockholders.

| | | | | | | | |

| | | | | | | | |

20 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

GOVERNANCE AND BOARD MATTERS

The Governance Committee’s policy is to consider properly submitted stockholder nominations for Director candidates in the same manner as a committee-recommended nominee. To recommend any qualified candidate for consideration by the Governance Committee, a stockholder should submit a supporting written statement to the Company’s Secretary at Essendant Inc., One Parkway North Boulevard, Deerfield, Illinois 60015-2559 in accordance with the procedures described later in this Proxy Statement under the heading “Stockholder Proposals”. This written statement must contain: (i) as to each nominee, his or her name and all such other information as would be required to be disclosed in a proxy statement with respect to the election of such person as a Director pursuant to the Exchange Act; (ii) the name and address of the stockholder providing such recommendation, a representation that the stockholder is the record owner of shares entitled to vote at the meeting, the number of shares owned, the period of such ownership, and a representation that the stockholder intends to appear in person or by proxy to nominate the person specified in the statement; (iii) whether the nominee meets the objective criteria for independence of directors under applicable NASDAQ listing standards and the Company’s Governance Principles; (iv) a description of all arrangements or understandings, and any relationships, between the stockholder and the nominee or any other person or persons (naming such person(s)) pursuant to which the nomination is to be made by the stockholder; and (v) the written consent of each nominee to serve as a Director if so elected.

Communications with the Board and Annual Meeting Attendance

Any stockholder who desires to contact the Company’s Chairman of the Board, who serves as its lead independent Director, or the other members of the Board of Directors may do so by writing to: Chairman of the Board, or Board of Directors, Essendant Inc., One Parkway North Boulevard, Deerfield, Illinois 60015-2559. All such written communications will be forwarded to and collected by the Company’s Secretary and delivered in the form received to the Chairman of the Board or, if so addressed or deemed appropriate based on the facts and circumstances outlined in the communication, to another member of the Board or a chair of one of its standing committees. However, unsolicited advertisements, invitations or promotional materials may not be forwarded to Directors, in the discretion of the Secretary.

Directors are encouraged to attend annual meetings of the Company’s stockholders. All of the Company’s Directors then serving on the Board of Directors attended the 2015 Annual Meeting of Stockholders.

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 21 |

| | | | | | | |

EXECUTIVE COMPENSATION

Executive Compensation – Table of Contents

Compensation Discussion and Analysis

| | | | | | | | |

| | | | | | | | |

22 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

EXECUTIVE COMPENSATION

Other Compensation Information

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 23 |

| | | | | | | |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion & Analysis (“CD&A”) describes the background, objectives and structure of our 2015 executive compensation programs. This CD&A is intended to be read in conjunction with the tables beginning on page 43, which provide further historical compensation information for our following named executive officers (“NEOs”):

| | |

Name | | Title |

NEOS – Current Employees | | |

Robert B. Aiken Jr. | | President and Chief Executive Officer |

Timothy P. Connolly | | Senior Vice President and Chief Operating Officer |

Earl C. Shanks | | Senior Vice President and Chief Financial Officer |

Eric A. Blanchard | | Senior Vice President, General Counsel and Secretary |

Richard D. Phillips | | Senior Vice President, Strategy, and President, ORS Industrial |

NEOS – Former Employees | | |

P. Cody Phipps | | Former President and Chief Executive Officer |

Todd A. Shelton | | Former Senior Vice President and Chief Financial Officer |

Cody Phipps resigned effective May 4, 2015.

Todd Shelton resigned as SVP and CFO as of November 12, 2015 and his employment terminated January 15, 2016.

Executive Summary

2015 Business Highlights

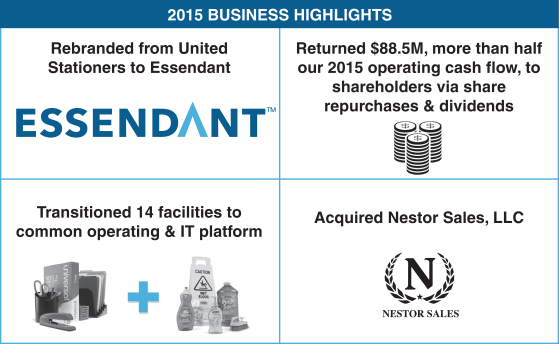

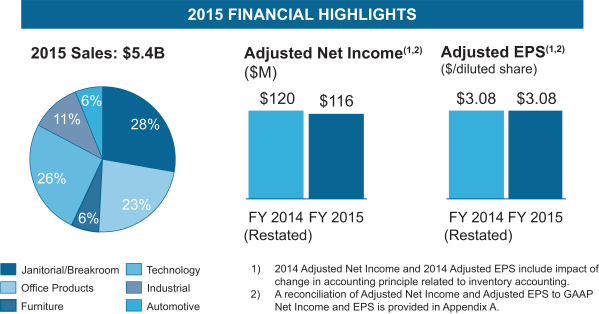

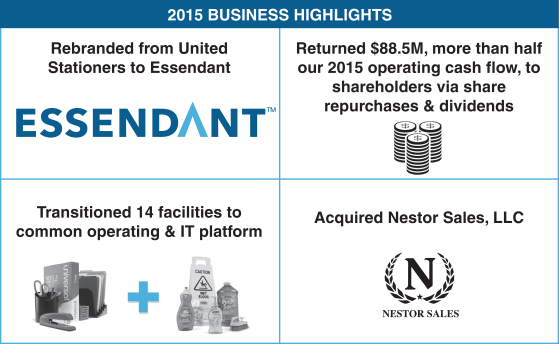

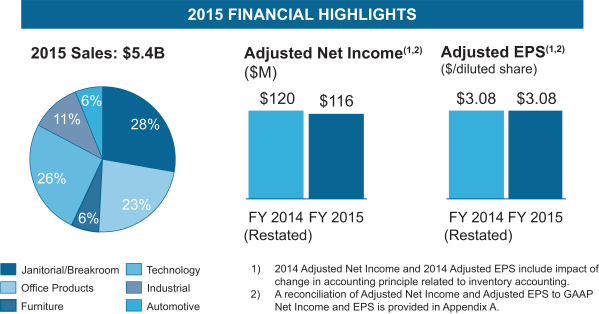

Essendant is a leading national wholesale distributor of workplace essentials including traditional office products and office furniture, janitorial, sanitation and breakroom supplies, technology products, industrial supplies, automotive aftermarket tools and equipment. We operated in a challenging environment in 2015. In addition to the continuing secular decline in office products consumption, we responded to a severe downturn in the oilfield and energy sectors that significantly affected the revenues and earnings of our ORS Industrial business. Despite these challenges, we achieved a number of financial, operational, and strategic goals in 2015:

| | • | | Achieved adjusted earnings per share of $3.08, equal to 2014 performance.1 |

| | • | | Generated $131.3 million of free cash flow. |

| | • | | Beat our expense budget by $13.8 million. |

| | • | | Returned $88.5 million to stockholders via dividends and share repurchases. |

| | • | | Converted 14 distribution centers to a common operating and IT platform as of year-end 2015. |

| | • | | Restructured the business to create a platform for growth in 2016. |

| | • | | Rebranded the Company as Essendant, reflecting our goal of being the fastest, most convenient solution for workplace essentials. |

| | • | | Acquired Nestor Sales to strengthen our position in the automotive category. |

| | • | | Exited non-strategic businesses. |

| 1 | A reconciliation of adjusted EPS to GAAP EPS is provided in Appendix A. |

| | | | | | | | |

| | | | | | | | |

24 | | | |

| | | 2016 PROXY STATEMENT |

| | | | | | | |

EXECUTIVE COMPENSATION

We believe our pay-for-performance compensation structure, which puts a substantial percentage of executives’ compensation at risk, and our compensation philosophy, which is designed to focus executives on building long-term stockholder value, were key drivers of the Company’s accomplishments in the face of significant market headwinds.

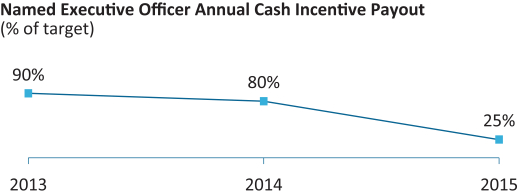

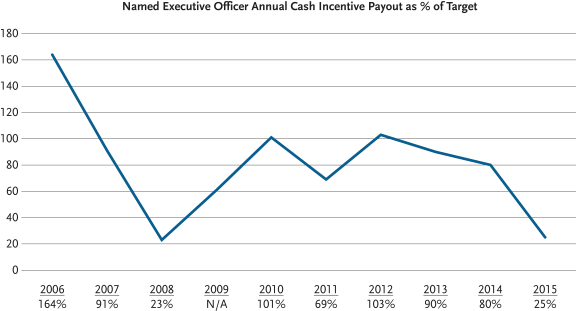

2015 Incentive Payouts

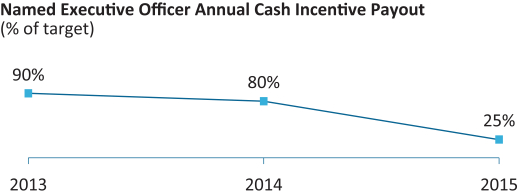

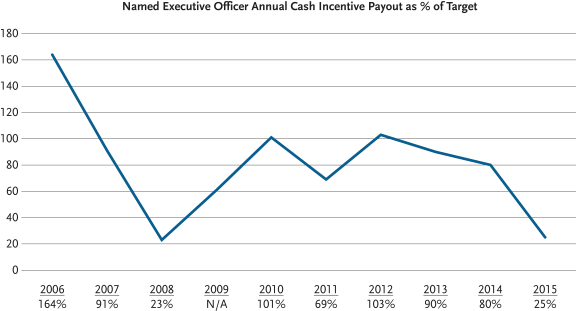

While we delivered solid financial performance in 2015, our performance was below our internal performance goals, which resulted in below-target incentive payouts under our annual cash incentive plan and under outstanding performance-based equity awards.

| | • | | The Human Resources Committee and the Board assessed the stockholder value created by the management accomplishments and actions described above as well as the performance against the metrics under the 2015 Management Cash Incentive Award Plan (“MIP”). |

| | ¡ | | Based on this assessment, the Human Resources Committee and the Board approved a payout of 25% of the target payout under the MIP. |

| | • | | Based on the Company’s adjusted net income for the two-year period ended December 31, 2015, no additional shares vested as of March 1, 2016 under the performance-based restricted stock unit (“RSU”) awards issued in March 2014. See “—Elements of Compensation—No Performance-Based Restricted Stock Units Earned in 2015” |

| | • | | Based on the Company’s cumulative economic profit for the three-year period ended December 31, 2015, no additional shares vested as of March 1, 2016 under the RSU awards issued in March 2013. See “—Elements of Compensation—No Performance-Based Restricted Stock Units Earned in 2015” |

Key Leadership Changes

We made several changes to our management team in 2015:

| | • | | On May 4, 2015, the Board of Directors appointed Mr. Aiken Interim President and Chief Executive Officer, following Mr. Phipps’ resignation. Mr. Aiken is a proven executive with a record of successfully leading large distribution companies. He was also integral in driving the Company’s strategic initiatives and achieving corporate objectives as a member of our Board from 2010 to May 2014, and he continued making these contributions upon rejoining the Board in February 2015. After assessing Mr. Aiken’s performance in the interim role, the Board appointed him President and CEO effective July 22, 2015. |

| | • | | On November 12, 2015, Mr. Shanks joined the Company as Senior Vice President and Chief Financial Officer, following Mr. Shelton’s resignation. To ensure a smooth transition, Mr. Shelton remained with Essendant as a vice president through January 15, 2016. |

| | • | | On November 12, 2015, we named Mr. Phillips President of our Industrial business. Under Mr. Phillips’ leadership we are refining the industrial channel value proposition to diversify and lessen its dependence on the oilfield and energy sectors. |

| | • | | Other management changes included several internal promotions, including the promotions of Timothy Connolly to Senior Vice President and Chief Operating Officer, Girisha Chandraraj to Senior Vice President, Marketing and Chief Digital Officer; and Janet Zelenka to Senior Vice President and Chief Information Officer. |

| | | | | | | | |

| | | | | | | | |

| | 2016 PROXY STATEMENT | |  | | | 25 |

| | | | | | | |

EXECUTIVE COMPENSATION

2015 Key Compensation Decisions

The Company’s executive compensation program is designed to attract and retain talented executives and to reward them appropriately for their contributions to the Company. In making compensation decisions, the Human Resources Committee consults Meridian Compensation Partners, LLC, the Committee’s independent compensation consultant, and analyzes the Company’s compensation practices compared to the practices of a comparison group of companies.

The Human Resources Committee took into consideration several factors to determine 2015 compensation levels for our named executive officers, including our financial and business results and comparative compensation information. Key compensation decisions include: