Exhibit (a)(5)(J)

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF DELAWARE

| | | | |

JOSEPH PIETRAS, Individually and on Behalf of All Others Similarly Situated, Plaintiff, v. ESSENDANT INC., RICHARD D. PHILLIPS, CHARLES K. CROVITZ, DENNIS J. MARTIN, SUSAN J. RILEY, ALEXANDER M. SCHMELKIN, STUART A. TAYLOR, II, PAUL S. WILLIAMS, and ALEX D. ZOGHLIN, Defendants. | | | | Case No.: CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE SECURITIES EXCHANGE ACT OF 1934 DEMAND FOR JURY TRIAL |

Joseph Pietras (“Plaintiff”), on behalf of himself and all others similarly situated, by and through his attorneys, alleges the following upon information and belief, including investigation of counsel and review of publicly-available information, except as to those allegations pertaining to Plaintiff, which are alleged upon personal knowledge:

NATURE OF THE ACTION

1. This is a class action brought by Plaintiff on behalf of himself and all other similarly situated public shareholders of Essendant Inc. (“Essendant” or the “Company”) against Essendant and the members of the Essendant’s board of directors (collectively referred to as the “Board” or the “Individual Defendants,” and, together with Essendant, the “Defendants”) for their violations of Sections 14(d)(4), 14(e), and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78n(d)(4), 78n(e), 78t(a), U.S. Securities and Exchange Commission (“SEC”) Rule14d-9, 17 C.F.R.§240.14d-9(d) (“Rule14d-9”). Plaintiff seeks to enjoin the expiration of a tender offer (the “Tender Offer”) by Staples, Inc. (“Staples”), via its affiliate Egg Merger Sub Inc.,

to acquire all of the issued and outstanding shares of Essendant (the “Proposed Transaction”).

2. On September 14, 2018, Essendant entered into an Agreement and Plan of Merger (the “Merger Agreement”), whereby each shareholder of Essendant common stock will receive $12.80 per share in cash (the “Offer Price”).

3. On September 24, 2018, in order to convince Essendant shareholders to tender their shares, the Board authorized the filing of a materially incomplete and misleading Schedule14D-9 Solicitation/Recommendation Statement (the “Recommendation Statement”) with the SEC. In particular, the Recommendation Statement contains materially incomplete and misleading information concerning: (i) the background to the Proposed Transaction; (ii) the valuation analyses performed by the Company’s financial advisor, Citigroup Global Markets Inc. (“Citigroup”), in support of its fairness opinion; and (iii) the conflicts of interest Citigroup faced as a result of its ongoing dealings with Essendant, Staples and certain affiliates.

4. The Tender Offer is scheduled to expire at one minute after 11:59 p.m., New York City time, on October 22, 2018 (the “Expiration Time”). It is imperative that the material information that has been omitted from the Recommendation Statement is disclosed to the Company’s shareholders prior to the Expiration Time so they can properly determine whether to tender their shares.

5. For these reasons, and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from closing the Tender Offer or taking any steps to consummate the Proposed Transaction, unless and until the material information discussed below is disclosed to Essendant shareholders or, in the event the Proposed Transaction is consummated, to recover damages resulting from the Defendants’ violations of the Exchange Act.

2

JURISDICTION AND VENUE

6. This Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331 (federal question jurisdiction) as Plaintiff alleges violations of Sections 14(d)(4), 14(e), and 20(a) of the Exchange Act and SEC Rule14d-9 promulgated thereunder pursuant to Section 27 of the Exchange Act, 15 U.S.C. § 78aam.

7. This Court has jurisdiction over the Defendants because each Defendant is either a corporation that conducts business in and maintains operations within this District, or is an individual with sufficient minimum contacts with this District so as to make the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

8. Venue is proper in this District under 28 U.S.C. § 1391, because Essendant is incorporated in this District, and Defendants have received substantial compensation by doing business in this District via Essendant.

PARTIES

9. Plaintiff is, and has been at all times relevant hereto, a common shareholder of Essendant.

10. Defendant Essendant is a Delaware corporation with its principal executive offices located in Deerfield, Illinois. The Company is a leading national distributor of workplace items and provides access to a broad assortment of over 170,000 items, including janitorial and breakroom supplies, technology products, traditional office products, industrial supplies, cut sheet paper products, automotive products and office furniture. Essendant common stock is traded on the NASDAQ under the ticker symbol “ESND”.

11. Defendant Richard D. Phillips is, and has been at all relevant times, the President and Chief Executive Officer of Essendant and also serves as a director of the Company.

3

12. Defendant Charles K. Crovitz is, and has been at all relevant times, the Chairman of the board of directors of the Company.

13. Defendant Dennis J. Martin is, and has been at all relevant times, a director of the Company.

14. Defendant Susan J. Riley is, and has been at all relevant times, a director of the Company.

15. Defendant Alexander M. Schmelkin is, and has been at all relevant times, a director of the Company.

16. Defendant Stuart A. Taylor, II is, and has been at all relevant times, a director of the Company.

17. Defendant Paul S. Williams is, and has been at all relevant times, a director of the Company.

18. Defendant Alex D. Zoghlin is, and has been at all relevant times, a director of the Company.

19. The defendants identified in paragraphs 11 through 18 are collectively referred to herein as the “Individual Defendants” and/or the “Board,” and, collectively with Essendant, the “Defendants”.

CLASS ACTION ALLEGATIONS

20. Plaintiff brings this class action pursuant to Fed. R. Civ. P. 23 on behalf of himself and the other public shareholders of Essendant (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any Defendant.

21. This action is properly maintainable as a class action because:

4

| | (a) | the Class is so numerous that joinder of all members is impracticable. As of September 5, 2018, there were 37,644,198 shares of Essendant common stock outstanding, held by hundreds to thousands of individuals and entities scattered throughout the country. The actual number of public shareholders of Essendant will be ascertained through discovery; |

| | (b) | There are questions of law and fact that are common to the Class that predominate over any questions affecting only individual members, including the following: |

| | i. | whether Defendants have misrepresented or omitted material information concerning the Proposed Transaction in the Recommendation Statement, in violation of Sections 14(d)(4) and 14(e) of the Exchange Act; |

| | ii. | whether the Individual Defendants have violated Section 20(a) of the Exchange Act; and |

| | iii. | whether Plaintiff and other members of the Class will suffer irreparable harm if compelled to tender their shares based on the materially incomplete and misleading Recommendation Statement. |

| | (c) | Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class; |

| | (d) | Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class; |

| | (e) | the prosecution of separate actions by individual members of the Class would |

5

create a risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for the party opposing the Class;

| | (f) | Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole; and |

| | (g) | a class action is superior to other available methods for fairly and efficiently adjudicating the controversy. |

SUBSTANTIVE ALLEGATIONS

| | I. Company | Background and the Proposed Transaction |

22. Essendant is a Delaware corporation that supplies workplace essentials. The Company offers office and food service products, computer hardware, furniture, welding, safety, and janitorial and sanitation supplies. Essendant serves office furniture dealers, online retailers, janitorial and sanitation distributors, and omni-channel suppliers.

23. On April 12, 2018, Essendant and Genuine Parts Company announced that they had entered into a definitive agreement to combine Essendant and Genuine Parts Company’s S.P. Richards business. Together, Essendant and S.P. Richards intended to form a stronger, more competitive business products distributor with greater scale and service capabilities and an enhanced ability to support customers. The transaction combining Essendant and S.P. Richards was structured as a Reverse Morris Trust, in which Genuine Parts Company would separate S.P. Richards into a standalone company and spin off that standalone company to Genuine Parts Company shareholders, immediately followed by the merger of Essendant and thespun-off company. The transaction implied a valuation of S.P. Richards of approximately $680 million,

6

reflecting the value of the Essendant shares to be issued at closing plusone-time cash payments to Genuine Parts Company of approximately $347 million, subject to adjustments at closing. Upon closing, Genuine Parts Company shareholders were expected to own approximately 51% and Essendant shareholders were expected to own approximately 49% of the combined company on a diluted basis, with approximately 80 million diluted shares expected to be outstanding. The transaction was expected to betax-free to Essendant and Genuine Parts Company shareholders.

24. However, the Board ultimately abandoned its deal with Genuine Parts Company in favor of anall-cash buyout by one of its largest shareholders, Sycamore Partners, the owner of Staples. On September 14, 2018, Essendant issued a press release announcing the Proposed Transaction. The press release stated, in relevant part:

FRAMINGHAM, Mass. and DEERFIELD, Ill., Sept. 14, 2018 /PRNewswire/ -- Staples, Inc. and Essendant Inc. (NASDAQ: ESND) today announced that they have entered into a definitive agreement under which an affiliate of Staples, the world’s largest office solutions provider, will acquire all of the outstanding shares of Essendant common stock for $12.80 per share in cash, or a transaction value of $996 million including net debt.

The transaction follows the determination by Essendant’s Board of Directors, after consultation with Essendant’s legal and financial advisors, that the Staples proposal constituted a “Superior Proposal” as defined in Essendant’s previously announced merger agreement to combine with Genuine Parts Company’s (NYSE: GPC) (“GPC”) S.P. Richards business (the “S.P. Richards agreement”). Consistent with that determination, and following the expiration of the three-day waiting period during which GPC did not propose any amendments to the S.P. Richards agreement, Essendant terminated that agreement. In connection with the termination, GPC is entitled to a $12 millionbreak-up fee, which Staples is paying as part of its agreement with Essendant.

“We are excited about the opportunity to move forward with this agreement, and to work with the Essendant team to complete the partnership of these two great companies, which will ultimately deliver significant value to independent resellers and end customers across the U.S.,” Staples said.

7

“After carefully evaluating Staples’ revised offer, including taking into account the extended regulatory process and risks associated with the S.P. Richards transaction and the continued challenges presented by the rapidly changing industry dynamics on our ability to realize value in combination with S.P. Richards, we are confident that the Staples transaction is in the best interest of Essendant shareholders,” said Charles Crovitz, Chairman of Essendant. “While our agreement to merge with S.P. Richards presented an attractive opportunity, we believe the Staples transaction provides superior and immediate value to our shareholders.”

Ric Phillips, President and Chief Executive Officer of Essendant added, “We believe combining with Staples provides a tremendous opportunity to enhance our resources and ability to serve customers, while delivering compelling and certain value to shareholders. I want to thank all our associates for their continued commitment and dedication as we have navigated this process over the past several months.”

Transaction Terms

The $12.80 per share purchase price reflects a 51% premium to Essendant’s share price on April 11, 2018, the day before the company announced plans to merge with GPC’s S.P. Richards business, and a 10.3x multiple of last-twelve-months Adjusted EBITDA.

The transaction will be implemented through a cash tender offer at $12.80 per share. The transaction is conditioned upon, among other things, the number of Essendant shares included in the tender offer, together with the 11.15% of Essendant’s outstanding common shares currently owned by Staples and its affiliates, representing more than 50% of Essendant’s outstanding common shares, expiration of all applicable waiting periods under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976, and other customary closing conditions. If the tender offer is consummated, the tender offer will be followed by a merger in which any shares of Essendant common stock not purchased in the offer will be converted into the right to receive the same $12.80 per share in cash. The transaction is not subject to a financing condition and is expected to close in the fourth quarter.

Barclays and Morgan Stanley & Co. LLC are acting as financial advisors and Kirkland & Ellis LLP is acting legal counsel to Staples. Citigroup Global Markets Inc. is acting as financial advisor and

8

Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal counsel to Essendant.

25. According to theWall Street Journal, Staples was acquired a year ago by Sycamore Partners, a private-equity firm that also owns about 11% of Essendant.1 Thus, the Board faced pressure to agree to a buyout by one of its largest stockholders.

26. Staples’ offer has not been well received by Essendant’s largest stockholder, Pzena Investment Management (“Pzena”). On September 13, 2018, Pzena issued a press release stating:

As Essendant’s ESND,-0.39% largest shareholder, Pzena Investment Management believes that the proposal from Staples to acquire Essendant at $12.80 a share does not constitute a superior offer to the proposed merger with SP Richards, a subsidiary of Genuine Parts Company GPC,-1.47%nor does the offer of $12.80 adequately value the company independent of the SP Richards transaction.For that reason, Pzena Investment Management does not intend to support the Staples proposal as it currently stands if and when it is presented to shareholders.

27. Given the conflicting positions taken by the Board and the Company’s largest shareholder regarding the adequacy of Staples’ offer, it is imperative that the Company’s common stockholders have access to all material information necessary to properly assess Citi’s fairness opinion valuation analyses and the conflicts of interest that tainted the sales process. As set forth below, however, such information has not been sufficiently disclosed in the Recommendation Statement.

II. The Materially Incomplete and Misleading Recommendation Statement

28. On September 24, 2018, the Defendants filed a materially incomplete and misleading Recommendation Statement with the SEC and disseminated it to Essendant’s

1 Kimberly Chin,Staples to Acquire Essendant for $482.7 Million, THE WALL STREET JOURNAL (Sept. 14, 2018 9:51 a.m.),https://www.wsj.com/articles/staples-to-acquire-essendant-for-482-7-million-l536933114.

9

shareholders. The Recommendation Statement omits material information that is necessary for the Company’s shareholders to make an informed decision whether to tender their shares in connection with the Tender Offer, rendering certain statements within the Recommendation Statement incomplete and misleading.

29. First, the Recommendation Statement fails to disclose material information concerning the conflict of interest Essendant’s financial advisor, Citigroup, faced as a result of its ongoing ties to both the Company and Staples. Specifically, page39-40 of the Recommendation Statement states:

As the Company Board was aware, Citi and its affiliates in the past have provided,currently are providingand in the future may provide investment banking, commercial banking and other similar financial services to the Company and its affiliates unrelated to the proposed Offer and the Merger, for which services Citi and its affiliates have receivedand expect to receive compensation, including, during thetwo-year period prior to the date of Citi’s opinion,having acted or acting as financial advisor to the Company in connection with the Company’s proposed transaction involving the SPR Business of GPC announced in April 2018 and certain strategic advisory matters, for which financial advisory services Citi and its affiliatesreceived during suchtwo-year period aggregate fees of approximately $2.5 million.As the Company Board also was aware, Citi and its affiliates in the past have provided and in the future may provide investment banking, commercial banking and other similar financial services to Staples and its affiliates, for which services Citi and its affiliates have received and would expect to receive compensation, including, during thetwo-year period prior to the date of Citi’s opinion, having actedor acting as(i) joint bookrunning manager for certain debt offerings of Staples and (ii) as joint lead arranger for, and/or as a lender under, certain credit facilities of Staples and/or certain of its affiliates. As the Company Board further was aware, Citi and its affiliates in the past have provided and in the future may provide investment banking, commercial banking and other similar financial services to Sycamore Partners and/or its affiliates and portfolio companies, for which services Citi and its affiliates have received and would expect to receive compensation, including, during thetwo-year period prior to the date of Citi’s opinion, having actedor acting asjoint bookrunning manager for certain debt offerings and as joint lead arranger for, and as a lender under, a credit facility of Sycamore Partners in connection with Sycamore Partners’ acquisition of Staples. For the services described above for Staples and Sycamore Partners, Citi and its affiliates received during thetwo-year period prior to the date of Citi’s opinion aggregate fees of approximately $5 million.

10

30. As the emphasized words above indicate, the Recommendation Statement indicates that City is “currently” providing services to Essendant and its affiliates unrelated to the Proposed Transaction, but it only discloses fees that Citi has received from Essendant for thetwo-year periodpriorto the date of Citi’s fairness opinion. In other words, the Recommendation Statement fails to disclose how much money Citi expects to receivegoing-forwardin connection with its current ongoing work for Essendant and its affiliates.

31. Similarly, the Recommendation Statement notes that Citi is currently “acting” as a joint bookrunning manager for Staples and Sycamore Partners, but it again only discloses the fees Citi has earned from these entities during the pasttwo-year period, and fails to disclose how much money Citi expects to receive for the work it is currently performing going forward.

32. This information—the amount of fees Citi expects to receivein the near futurefor itspresently occurringwork for both Essendant, Staples, Sycamore Partners and their affiliates—is material to Essendant stockholders. It is imperative for the stockholders to be able to understand what factors might influence the financial advisor’s analytical efforts. A financial advisor’s own proprietary financial interest in a proposed transaction must be carefully considered in assessing how much credence to give its analysis. For that reason, the benefits of the merger to the investment banker, beyond its expected fee, must also be disclosed to the stockholders. It is not only the amount and nature of a contingent fee that is relevant to an investment bank’s interest in a transaction. The relationships between investment banks and corporate management can run deep, and an investment bank often has business with the corporation and its management that spans more than one transaction. Where an investment bank is providing a fairness opinion that involves long-standing clients, it may be influenced to find a transaction fair to avoid irritating management and other corporate actors who stand to benefit from the transaction, as this will

11

ensure future lucrative business. There is no rule that conflicts of interest must be disclosed only where there is evidence that the financial advisor’s opinion was actually affected by the conflict. Put simply, a reasonable stockholder would want to know an important economic motivation of the financial advisor employed by a board to opine on the fairness of the consideration to offered to stockholders, when that motivation could rationally lead that advisor to favor a deal at a less than optimal price, because the procession of a deal was more important to him, given his overall economic interest, than ensuring stockholders actually receive a truly fair price.

33. Additionally, the Recommendation Statement fails to provide sufficient information for Essendant stockholders to properly assess the conflict of interest certain executive officers and directors of the Company faced as a result of that fact that “such persons” have “possible ongoing roles with” Staples or its affiliates. Recommendation Statement at 4. While the Recommendation Statement notes the existence of this conflict in general terms, it fails to disclose precisely which of the Company’s executive officers and/or directors have discussed and/or been offered “ongoing roles” with Staples or its affiliates after the Proposed Transaction is consummated, and when such discussions occurred. This information is material to the Company’s stockholders because it is necessary for them to properly assess how this conflict of interest impacted the sales and negotiation process, and the omission of these key details make the vague reference to such persons “possible ongoing roles” on page 4 incomplete and misleading.

34. With respect to Citi’sDiscounted Cash Flow Analysis, the Recommendation Statement fails to disclose the following key assumptions and inputs for the analysis: (i) the basis for utilizing an unusually low perpetuity growth rate range of 0.0% to 1.5%; and (ii) the basis for utilizing a discount rate range of 9.0% to 10.4%. The bases for utilizing these particular ranges are material to Essendant’s common shareholders, and the omission of such information renders

12

the summary of Citi’sDiscounted Cash Flow Analysis incomplete and misleading. As a highly-respected professor explained in one of the most thorough law review articles regarding the fundamental flaws with the valuation analyses bankers perform in support of fairness opinions, in a discounted cash flow analysis a banker takes management’s forecasts, and then makes several key choices “each of which can significantly affect the final valuation.” Steven M. Davidoff,Fairness Opinions, 55 Am. U.L. Rev. 1557, 1576 (2006). Such choices include “the appropriate discount rate, and the terminal value...”Id. As Professor Davidoff explains:

There is substantial leeway to determine each of these, and any change can markedly affect the discounted cash flow value. For example, a change in the discount rate by one percent on a stream of cash flows in the billions of dollars can change the discounted cash flow value by tens if not hundreds of millions of dollars.... This issue arises not only with a discounted cash flow analysis, but with each of the other valuation techniques.This dazzling variability makes it difficult to rely, compare, or analyze the valuations underlying a fairness opinionunless full disclosure is made of the various inputs in the valuation process, the weight assigned for each, and the rationale underlying these choices. The substantial discretion and lack of guidelines and standards also makes the process vulnerable to manipulation to arrive at the “right” answer for fairness. This raises a further dilemma in light of the conflicted nature of the investment banks who often provide these opinions.

Id. at1577-78 (emphasis added). Without the above-mentioned information, Essendant shareholders cannot evaluate for themselves the reliability of Citi’s Discounted Cash Flow Analysis, make a meaningful determination of whether the implied per share equity value reference range reflects the true value of their shares or was the result of Citi’s unreasonable judgment, and make an informed decision regarding whether to tender their shares in the Proposed Transaction.

35. With respect to Citi’s Selected Precedent Transactions Analysis and Selected Public Companies Analysis, the Recommendation Statement fails to disclose the individual

13

multiples Citi calculated for each of the transactions and companies utilized. The omission of these multiples renders the summaries of these analyses and the corresponding implied per share equity value reference ranges materially incomplete and misleading. A fair summary of these analyses requires the disclosure of the individual multiples for each transaction and company utilized; without the individual multiples, Essendant shareholders are unable to assess whether the banker applied appropriate multiples, or, instead, applied unreasonably low multiples in order to drive down the implied share per price ranges.

36. Lastly, while the Recommendation Statement notes that Essendant had management-prepared “preliminary financial projections” as of February 15, 2018, the Recommendation Statement fails to disclose when the “Management Projections” included on page33-34 of the Recommended Statement were prepared. This information is material to Essendant stockholders, so that they can determine whether the projections utilized by Citi for its fairness opinion were prepared by management in the ordinary course of business, or instead, were prepared later during the sales process potentially in order to ensure Citi had “appropriate” projections to support its fairness opinion.

37. In sum, the omission of the above-referenced information renders the Recommendation Statement materially incomplete and misleading, in contravention of the Exchange Act. Absent disclosure of the foregoing material information prior to the Expiration Time, Plaintiff and the other members of the Class will be unable to make an informed decision regarding whether to tender their shares in the Proposed Transaction, and they are thus threatened with irreparable harm, warranting the injunctive relief sought herein.

14

COUNT I

(Against All Defendants for Violation of Section 14(e) of the Exchange Act

and 17 C.F.R. § 244.100 Promulgated Thereunder)

38. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein.

39. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading...” 15 U.S.C. §78n(e).

40. Defendants violated § 14(e) of the Exchange Act by issuing the Recommendation Statement in which they made untrue statements of material facts or failed to state all material facts necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading, in connection with the tender offer commenced in conjunction with the Proposed Transaction. Defendants knew or recklessly disregarded that the Recommendation Statement failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

41. The Recommendation Statement was prepared, reviewed, and/or disseminated by Defendants. It misrepresented and/or omitted material facts, including material information about the consideration offered to shareholders via the Tender Offer and the intrinsic value of the Company.

42. In so doing, Defendants made untrue statements of fact and/or omitted material facts necessary to make the statements made not misleading. Each of the Individual Defendants, by virtue of their roles as officers and/or directors, were aware of the omitted information but failed to disclose such information, in violation of Section 14(e). The Individual Defendants were

15

therefore reckless, as they had reasonable grounds to believe material facts existed that were misstated or omitted from the Recommendation Statement, but nonetheless failed to obtain and disclose such information to shareholders although they could have done so without extraordinary effort.

43. The omissions and incomplete and misleading statements in the Recommendation Statement are material in that a reasonable shareholder would consider them important in deciding whether to tender their shares or seek appraisal. In addition, a reasonable investor would view the information identified above which has been omitted from the Recommendation Statement as altering the “total mix” of information made available to shareholders.

44. Defendants knowingly or with deliberate recklessness omitted the material information identified above from the Recommendation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Transaction, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading.

45. The misrepresentations and omissions in the Recommendation Statement are material to Plaintiff, and Plaintiff will be deprived of their entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the tender offer.

16

COUNT II

(Against all Defendants for Violations of Section 14(d)(4) of the Exchange Act

and SEC Rule14d-9, 17 C.F.R. §240.14d-9)

46. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

47. Defendants have caused the Recommendation Statement to be issued with the intention of soliciting shareholder support of the Proposed Transaction.

48. Section 14(d)(4) of the Exchange Act and SEC Rule14d-9 promulgated thereunder require full and complete disclosure in connection with tender offers. Specifically, Section 14(d)(4) provides that:

Any solicitation or recommendation to the holders of such a security to accept or reject a tender offer or request or invitation for tenders shall be made in accordance with such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.

49. SEC Rule14d-9(d), which was adopted to implement Section 14(d)(4) of the Exchange Act, provides that:

Information required in solicitation or recommendation. Any solicitation or recommendation to holders of a class of securities referred to in section 14(d)(1) of the Act with respect to a tender offer for such securities shall include the name of the person making such solicitation or recommendation and the information required by Items 1 through 8 of Schedule14D-9 (§240.14d-101) or a fair and adequate summary thereof.

50. In accordance with Rule14d-9, Item 8 of a Schedule14D-9 requires a Company’s directors to:

Furnish such additional information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not materially misleading.

51. The omission of information from a recommendation statement will violate Section 14(d)(4) and Rule14d-9(d) if other SEC regulations specifically require disclosure of the omitted

17

information.

52. Item 1015 requires “[a]ny report, opinion or appraisal relating to the consideration or the fairness of the consideration to be offered to security holders or the fairness of the transaction to the issuer or affiliate or to security holders who are not affiliates” to “[d]escribe any material relationship that existed during the past two years or is mutually understood to be contemplated and any compensation received or to be received as a result of the relationship between: (i) The outside party, its affiliates, and/or unaffiliated representative; and (ii) The subject company or its affiliates.” 17 CFR § 229.1015.

53. The Recommendation Statement violates Section 14(d)(4) and Rule14d-9 because it omits material facts, including those set forth above, which omissions render the Recommendation Statement false and/or misleading. Defendants knowingly or with deliberate recklessness omitted the material information identified above from the Recommendation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Transaction, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading.

54. The misrepresentations and omissions in the Recommendation Statement are material to Plaintiff, and Plaintiff will be deprived of their entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the Expiration Date.

COUNT III

(Against the Individual Defendants for Violations of Section 20(a) of the Exchange Act)

55. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

18

56. The Individual Defendants acted as controlling persons of Essendant within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of Essendant and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false and misleading statements contained in the Recommendation Statement, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiff contends are false and misleading.

57. Each of the Individual Defendants was provided with or had unlimited access to copies of the Recommendation Statement alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

58. In particular, each of the Individual Defendants had direct and supervisory involvement in theday-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein, and exercised the same. The Recommendation Statement contains the unanimous recommendation of the Individual Defendants to approve the Transaction. They were thus directly involved in the making of the Recommendation Statement.

59. By virtue of the foregoing, the Individual Defendants violated Section 20(a) of the Exchange Act.

60. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(e) and 14(d)(4) of the Exchange Act and Rule14d-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the

19

Exchange Act. As a direct and proximate result of the Individual Defendants’ conduct, Plaintiff and the Class have suffered damage and actual economic losses (i.e., the difference between the Offer Price and the true value of Essendant shares) in an amount to be determined at trial.

61. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff prays for judgment and relief as follows:

A. Declaring that this action is properly maintainable as a Class Action and certifying Plaintiff as Class Representative and his counsel as Class Counsel;

B. Preliminarily and permanently enjoining Defendants and their counsel, agents, employees, and all persons acting under, in concert with, or for them, from proceeding with, consummating, or closing the Proposed Transaction, unless and until Defendants disclose the material information identified above which has been omitted from the Recommendation Statement;

C. Rescinding, to the extent already implemented, the Merger Agreement or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Defendants to account to Plaintiff and the Class for all damages suffered as a result of their wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and expert fees and expenses; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

20

JURY DEMAND

Plaintiff demands a trial by jury on all issues so triable.

Dated: September 27, 2018

| | |

| | COOCH AND TAYLOR, P.A. |

| |

| OF COUNSEL | | /s/ Blake A. Bennett |

| MONTEVERDE & ASSOCIATES PC | | Blake A. Bennett (#5133) |

Juan E. Monteverde | | The Brandywine Building |

The Empire State Building | | 1000 West Street, 10th Floor |

350 Fifth Avenue, Suite 4405 | | Wilmington, DE 19801 |

New York, NY 10118 | | Tel.: (302)984-3800 |

Tel.: (212)971-1341 | | |

Fax: (212)202-7880 | | Attorneys for Plaintiff |

Email: jmonteverde@monteverdelaw.com | | |

Attorneys for Plaintiff

21

DocuSign Envelope ID: C26E9667-37EF-4756-9150-AB648E7C941A

CERTIFICATION OF PROPOSED LEAD PLAINTIFF

I, Joseph pietras (“Plaintiff”), declare, as to the claims asserted under the federal securities laws, that:

| 1. | Plaintiff has reviewed a draft of the complaint and has authorized the filing of a complaint substantially similar to the one reviewed. |

| 2. | Plaintiff selects Monteverde & Associates PC and any firm with which it affiliates for the purpose of prosecuting this action as my counsel for purposes of prosecuting my claim against defendants. |

| 3. | Plaintiff did not purchase the security that is the subject of the complaint at the direction of Plaintiff’s counsel or in order to participate in any private action arising under the federal securities laws. |

| 4. | Plaintiff is willing to serve as a representative party on behalf of a class, including providing testimony at deposition and trial, if necessary. |

| 5. | Plaintiff sets forth in the attached chart all the transactions in the security that is the subject of the complaint during the class period specified in the complaint. |

| 6. | In the past three years, Plaintiff has not sought to serve nor has served as a representative party on behalf of a class in an action filed under the federal securities laws, unless otherwise specified below. |

| 7. | Plaintiff will not accept any payment for serving as a representative party on behalf of a class beyond Plaintiff’s pro rata share of any recovery, except such reasonable costs and expenses (including lost wages) directly relating to the representation of the Class as ordered or approved by the Court. |

I declare under penalty of perjury under the laws of the United States that the foregoing information is correct to the best of my knowledge.

Signed this 27 day of September, 2018.

| | | | | | |

Company Name/Ticker | | Transaction (Purchase or Sale) | | Trade Date | | Current Quantity |

| ESND | | Purchase | | Year 2000 (reinvest dividends) | | 228.78 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

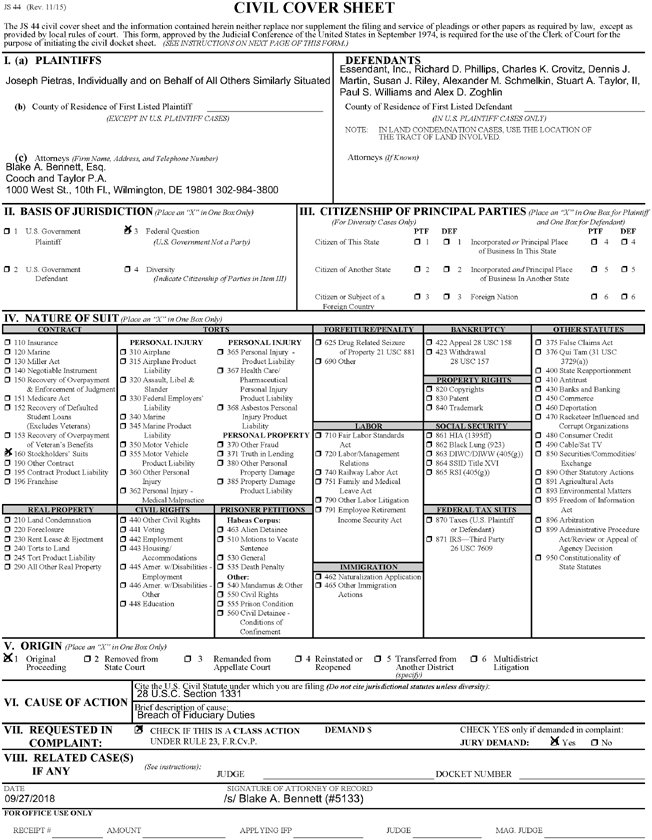

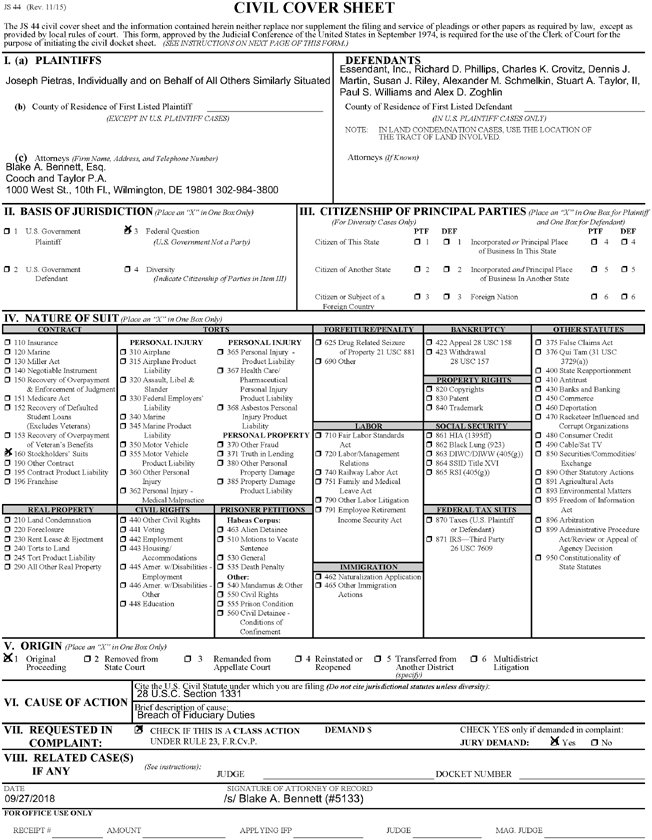

JS 44 (Rev. 11/15) CIVIL COVER SHEET The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet. (SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.) I. (a) PLAINTIFFS DEFENDANTS (b) County of Residence of First Listed Plaintiff County of Residence of First Listed Defendant (EXCEPT IN U.S. PLAINTIFF CASES) (IN U.S. PLAINTIFF CASES ONLY) NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. (c) Attorneys (Firm Name, Address, and Telephone Number) Attorneys (If Known) II. BASIS OF JURISDICTION (Place an “X” in One Box Only) III. CITIZENSHIP OF PRINCIPAL PARTIES (Place an “X” in One Box for Plaintiff (For Diversity Cases Only) and One Box for Defendant) 1 U.S. Government 3 Federal Question PTF DEF PTF DEF Plaintiff (U.S. Government Not a Party) Citizen of This State 1 1 Incorporated or Principal Place 4 4 of Business In This State 2 U.S. Government 4 Diversity Citizen of Another State 2 2 Incorporated and Principal Place 5 5 Defendant (Indicate Citizenship of Parties in Item III) of Business In Another State Citizen or Subject of a 3 3 Foreign Nation 6 6 Foreign Country IV. NATURE OF SUIT (Place an “X” in One Box Only) CONTRACT TORTS FORFEITURE/PENALTY BANKRUPTCY OTHER STATUTES 110 Insurance PERSONAL INJURY PERSONAL INJURY 625 Drug Related Seizure 422 Appeal 28 USC 158 375 False Claims Act 120 Marine 310 Airplane 365 Personal Injury - of Property 21 USC 881 423 Withdrawal 376 Qui Tam (31 USC 130 Miller Act 315 Airplane Product Product Liability 690 Other 28 USC 157 3729(a)) 140 Negotiable Instrument Liability 367 Health Care/ 400 State Reapportionment 150 Recovery of Overpayment 320 Assault, Libel & Pharmaceutical PROPERTY RIGHTS 410 Antitrust & Enforcement of Judgment Slander Personal Injury 820 Copyrights 430 Banks and Banking 151 Medicare Act 330 Federal Employers’ Product Liability 830 Patent 450 Commerce 152 Recovery of Defaulted Liability 368 Asbestos Personal 840 Trademark 460 Deportation Student Loans 340 Marine Injury Product 470 Racketeer Influenced and (Excludes Veterans) 345 Marine Product Liability LABOR SOCIAL SECURITY Corrupt Organizations 153 Recovery of Overpayment Liability PERSONAL PROPERTY 710 Fair Labor Standards 861 HIA (1395ff) 480 Consumer Credit of Veteran’s Benefits 350 Motor Vehicle 370 Other Fraud Act 862 Black Lung (923) 490 Cable/Sat TV 160 Stockholders’ Suits 355 Motor Vehicle 371 Truth in Lending 720 Labor/Management 863 DIWC/DIWW (405(g)) 850 Securities/Commodities/ 190 Other Contract Product Liability 380 Other Personal Relations 864 SSID Title XVI Exchange 195 Contract Product Liability 360 Other Personal Property Damage 740 Railway Labor Act 865 RSI (405(g)) 890 Other Statutory Actions 196 Franchise Injury 385 Property Damage 751 Family and Medical 891 Agricultural Acts 362 Personal Injury - Product Liability Leave Act 893 Environmental Matters Medical Malpractice 790 Other Labor Litigation 895 Freedom of Information REAL PROPERTY CIVIL RIGHTS PRISONER PETITIONS 791 Employee Retirement FEDERAL TAX SUITS Act 210 Land Condemnation 440 Other Civil Rights Habeas Corpus: Income Security Act 870 Taxes (U.S. Plaintiff 896 Arbitration 220 Foreclosure 441 Voting 463 Alien Detainee or Defendant) 899 Administrative Procedure 230 Rent Lease & Ejectment 442 Employment 510 Motions to Vacate 871 IRS—Third Party Act/Review or Appeal of 240 Torts to Land 443 Housing/ Sentence 26 USC 7609 Agency Decision 245 Tort Product Liability Accommodations 530 General 950 Constitutionality of 290 All Other Real Property 445 Amer. w/Disabilities - 535 Death Penalty IMMIGRATION State Statutes Employment Other: 462 Naturalization Application 446 Amer. w/Disabilities - 540 Mandamus & Other 465 Other Immigration Other 550 Civil Rights Actions 448 Education 555 Prison Condition 560 Civil Detainee - Conditions of Confinement V. ORIGIN (Place an “X” in One Box Only) 1 Original 2 Removed from 3 Remanded from 4 Reinstated or 5 Transferred from 6 Multidistrict Proceeding State Court Appellate Court Reopened Another District Litigation (specify) under which you are filing (Do not cite jurisdictional statutes unless diversity): VI. CAUSE OF ACTION VII. REQUESTED IN CHECK IF THIS IS A CLASS ACTION DEMAND $ CHECK YES only if demanded in complaint: COMPLAINT: UNDER RULE 23, F.R.Cv.P. JURY DEMAND: Yes No VIII. RELATED CASE(S) IF ANY (See instructions): JUDGE DOCKET NUMBER DATE SIGNATURE OF ATTORNEY OF RECORD FOR OFFICE USE ONLY RECEIPT # AMOUNT APPLYING IFP JUDGE MAG. JUDGE