1 2016 Investor Meetings August – October

2 Cautionary Note Regarding Forward-Looking Statements The Private Securities Litigation Reform Act of 1995 provides issuers the opportunity to make cautionary statements regarding forward-looking statements. Accordingly, any forward-looking statement contained in this presentation is based on management’s current beliefs, assumptions and expectations of the Company’s future performance, taking into account all information currently available to management. These beliefs, assumptions and expectations can change as the result of many possible events or factors, not all of which are known to management. If a change occurs, the Company’s business, financial condition, liquidity, results of operations, plans and objectives may vary materially from those expressed in the forward-looking statements. The risks and uncertainties that may affect the actual results of the Company include, but are not limited to, the following: • catastrophic events and the occurrence of significant severe weather conditions; • the adequacy of loss and settlement expense reserves; • state and federal legislation and regulations; • changes in the property and casualty insurance industry, interest rates or the performance of financial markets and the general economy; • rating agency actions; • “other-than-temporary” investment impairment losses; and • other risks and uncertainties inherent to the Company’s business, including those discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K. Management intends to identify forward-looking statements when using the words “believe,” “expect,” “anticipate,” “estimate,” “project,” or similar expressions. Undue reliance should not be placed on these forward-looking statements. The Company disclaims any obligation to update such statements or to announce publicly the results of any revisions that it may make to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

3 Table of Contents Page/Slide Number Who We Are 4 Key Reasons to Invest in EMCI 5 Award-Winning Workplace 6 Corporate Structure 7 Benefits of Pooling Agreement 8 Benefits of Quota Share Agreement with EMCC 9 2015 Premiums Earned 10 Diversified Book of Business 11-12 New in 2016 13 Personal Lines Focused Accountability 14 Accelerate Commercial Auto Profitability 15 Value of Local Market Presence 16 2015 Direct Premiums Written by Branch (CL) 17 Page/Slide Number 2015 Premium Distribution by Account Size (CL) 18 Strength in Group Programs 19 Unique and Powerful Rate Compare System 20 Commercial Rate Changes Outpace Industry 21 GAAP Combined Ratios 22 Intercompany Reinsurance Programs 23 Loss Cost Trend 24 Investment Portfolio 25 Stockholder Dividends 26 Maximizing Stockholder Value 27 Attractive Returns for Stockholders 28 Improving Valuation 29 Appendix 30-38

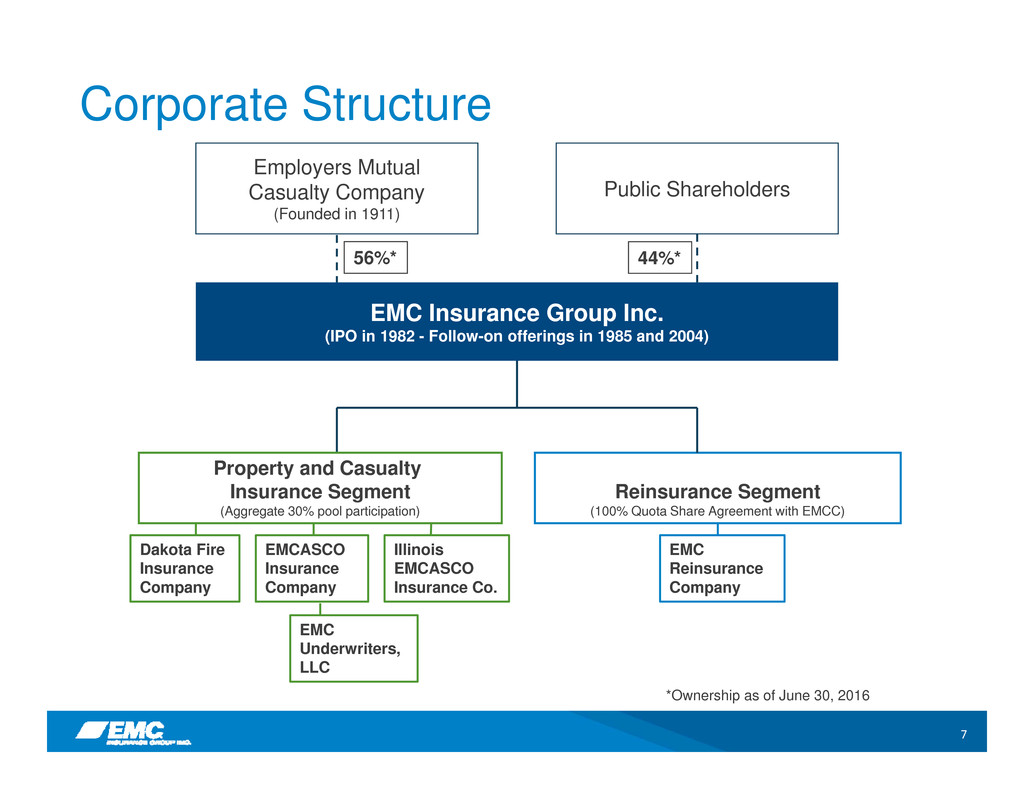

4 • Downstream holding company of Employers Mutual Casualty Company (EMCC) • Trade on NASDAQ: EMCI • Enterprise began in 1911, IPO in 1982 • Property and Casualty Insurance Segment (78% of premiums earned) • 2,070 independent agency relationships • 41 state distribution network, licensed in all 50 states and District of Columbia • 30% participation in EMCC pool • Diversified premiums (90% commercial / 10% personal) • Reinsurance Segment (22% of premiums earned) • EMCC has assumed reinsurance business since 1950s • 100% Quota Share Agreement with EMCC, but some contracts written directly • 83% of business from 19 brokers (e.g. AON, Guy Carpenter, etc.) • 17% of business from participation in MRB underwriting association Who We Are

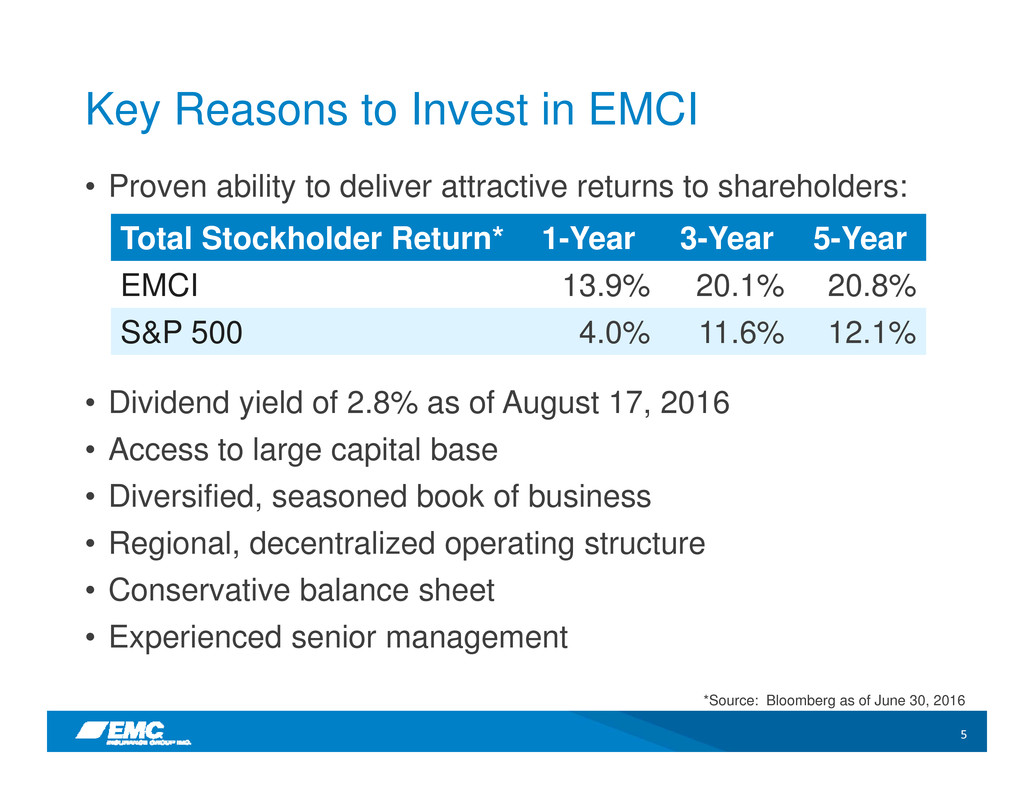

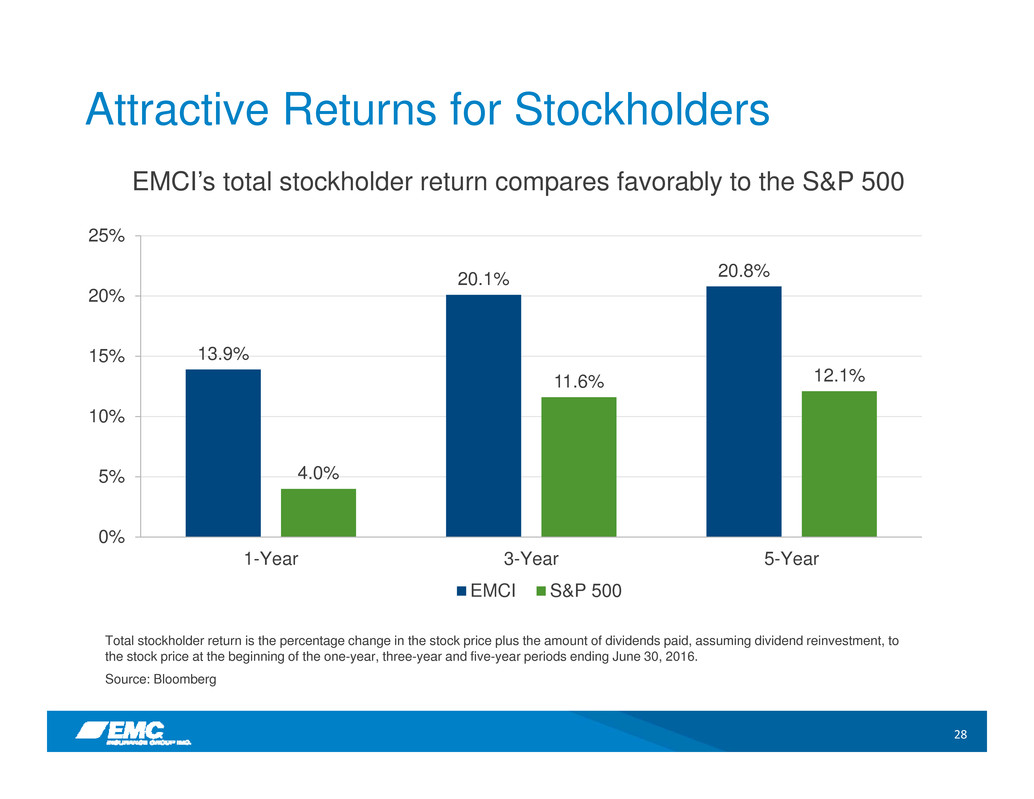

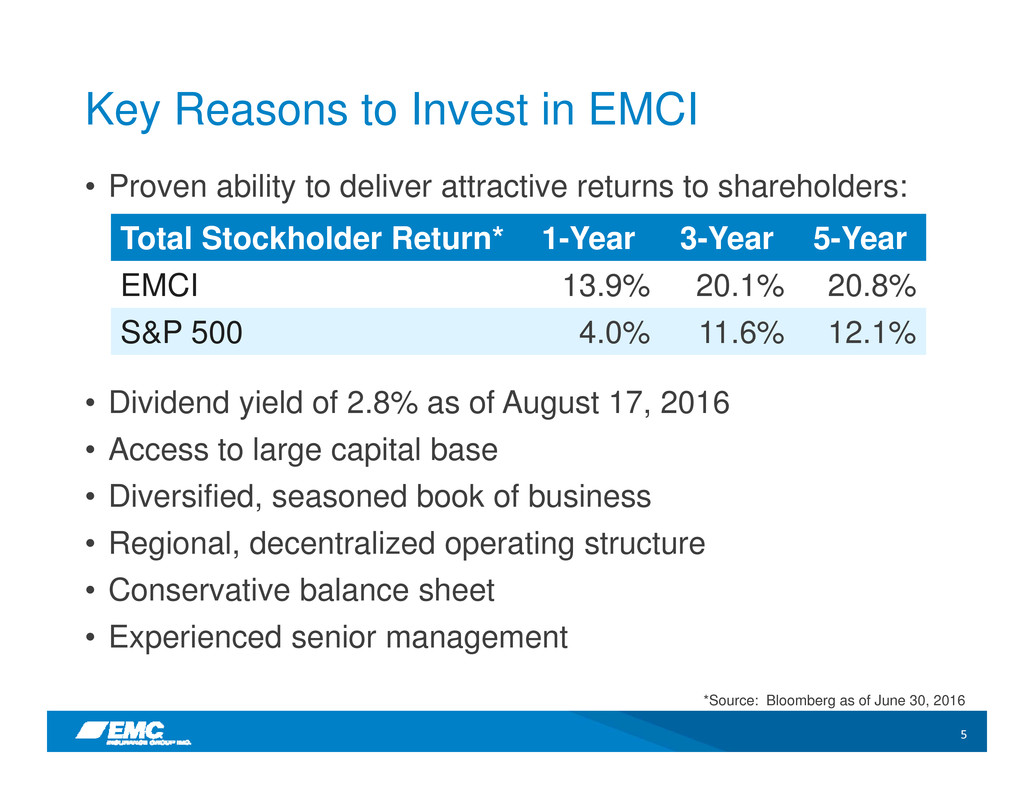

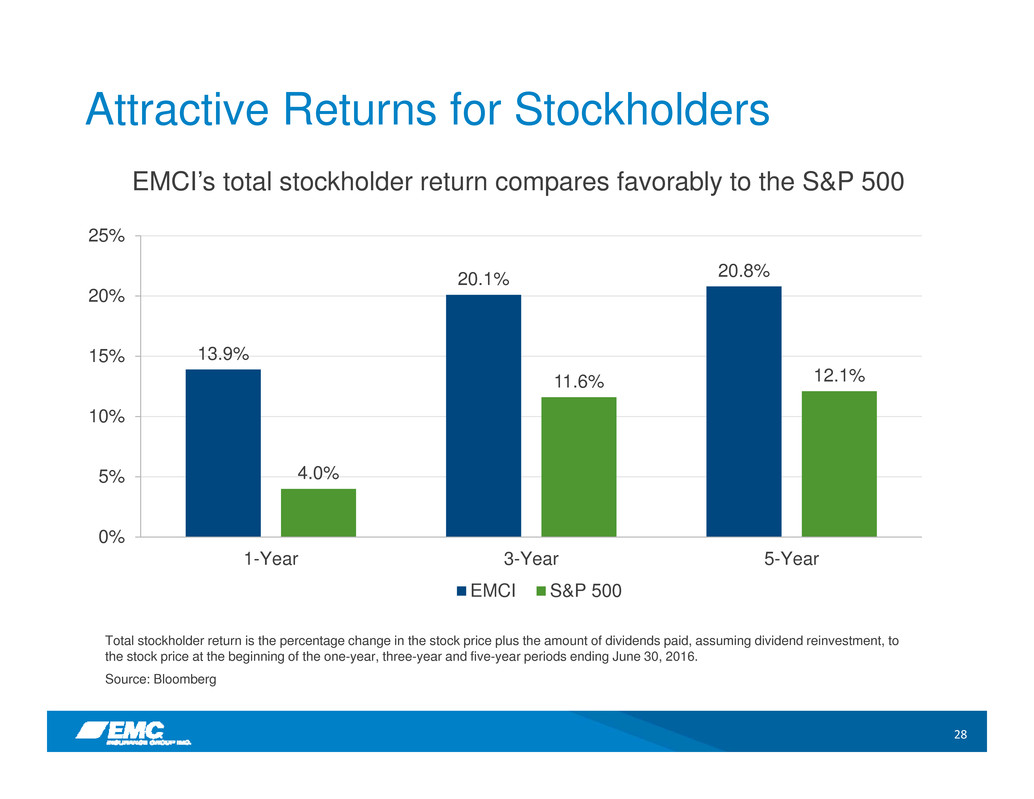

5 Key Reasons to Invest in EMCI • Proven ability to deliver attractive returns to shareholders: • Dividend yield of 2.8% as of August 17, 2016 • Access to large capital base • Diversified, seasoned book of business • Regional, decentralized operating structure • Conservative balance sheet • Experienced senior management *Source: Bloomberg as of June 30, 2016 Total Stockholder Return* 1-Year 3-Year 5-Year EMCI 13.9% 20.1% 20.8% S&P 500 4.0% 11.6% 12.1%

6 Award-Winning Workplace • No. 2 Best Companies for Leaders (Chief Executive) • 50 Most Trustworthy Financial Companies (Forbes) • No. 16 Top Workplaces in Iowa (The Des Moines Register) • Best Property/Casualty Company in Des Moines (Business Record) • Child Support Lien Network Partnership Award • American Heart Association’s Platinum Level Fit-Friendly Worksite

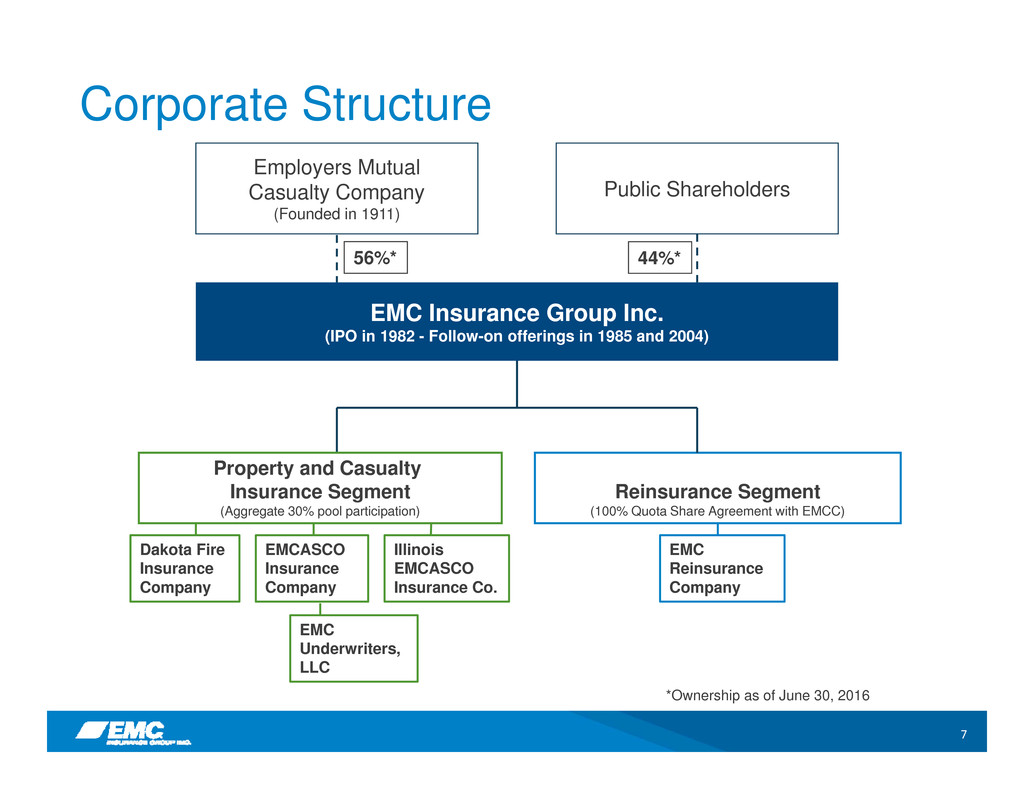

7 Corporate Structure Reinsurance Segment (100% Quota Share Agreement with EMCC) Employers Mutual Casualty Company (Founded in 1911) Public Shareholders EMC Insurance Group Inc. (IPO in 1982 - Follow-on offerings in 1985 and 2004) 56%* 44%* *Ownership as of June 30, 2016 Dakota Fire Insurance Company EMCASCO Insurance Company Illinois EMCASCO Insurance Co. EMC Reinsurance Company EMC Underwriters, LLC Property and Casualty Insurance Segment (Aggregate 30% pool participation)

8 Benefits of Pooling Agreement • “A” (Excellent) rating with stable outlook from A.M. Best Company • Risks spread risk over a wide range of geographic locations, lines of insurance written, rate filings, commission plans and policy forms • Benefits from capacity of the entire pool • $1.6 billion in direct premiums written in 2015 • $1.4 billion of statutory surplus as of Dec. 31, 2015 • Merger and acquisition flexibility • Economies of scale in operations and purchase of reinsurance

9 Benefits of Quota Share Agreement with EMCC • EMCC’s surplus ($1.3 billion as of Dec. 31, 2015) and financial strength exhibits ability to pay claims owed to ceding companies • Name recognition and long-standing domestic and international relationships with EMCC • Competitive advantage being licensed in all 50 states and District of Columbia • Utilize EMCC’s “A” (Excellent) rating from A.M. Best Company (EMC Re also rated “A”)

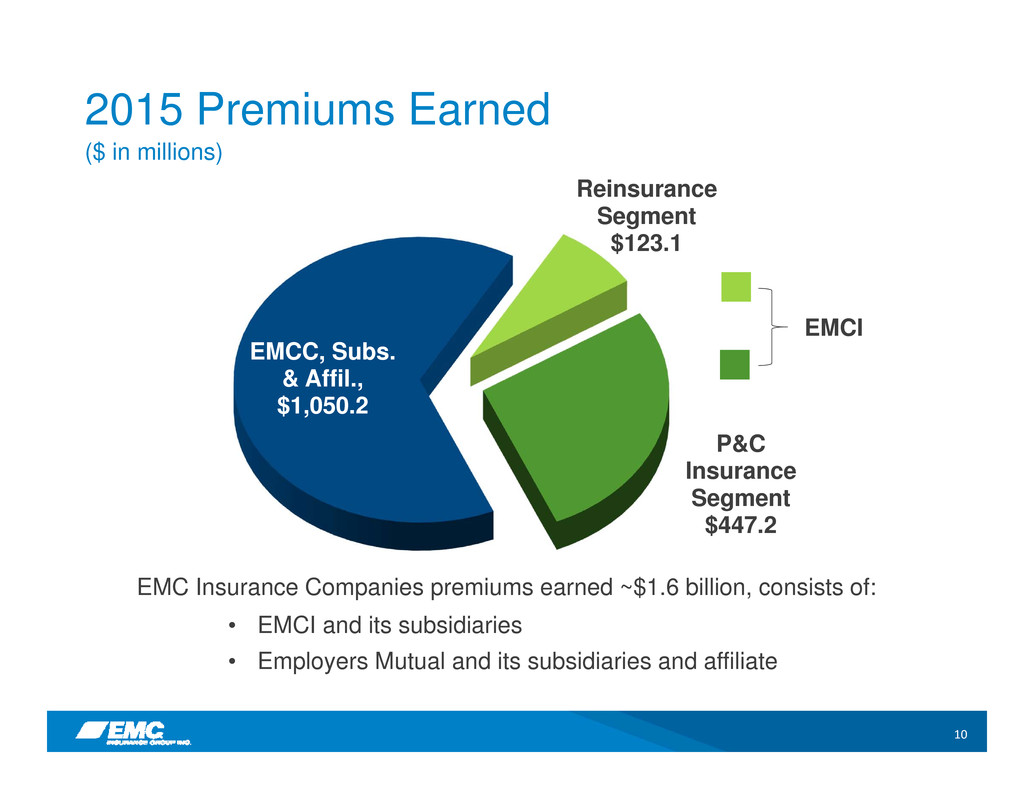

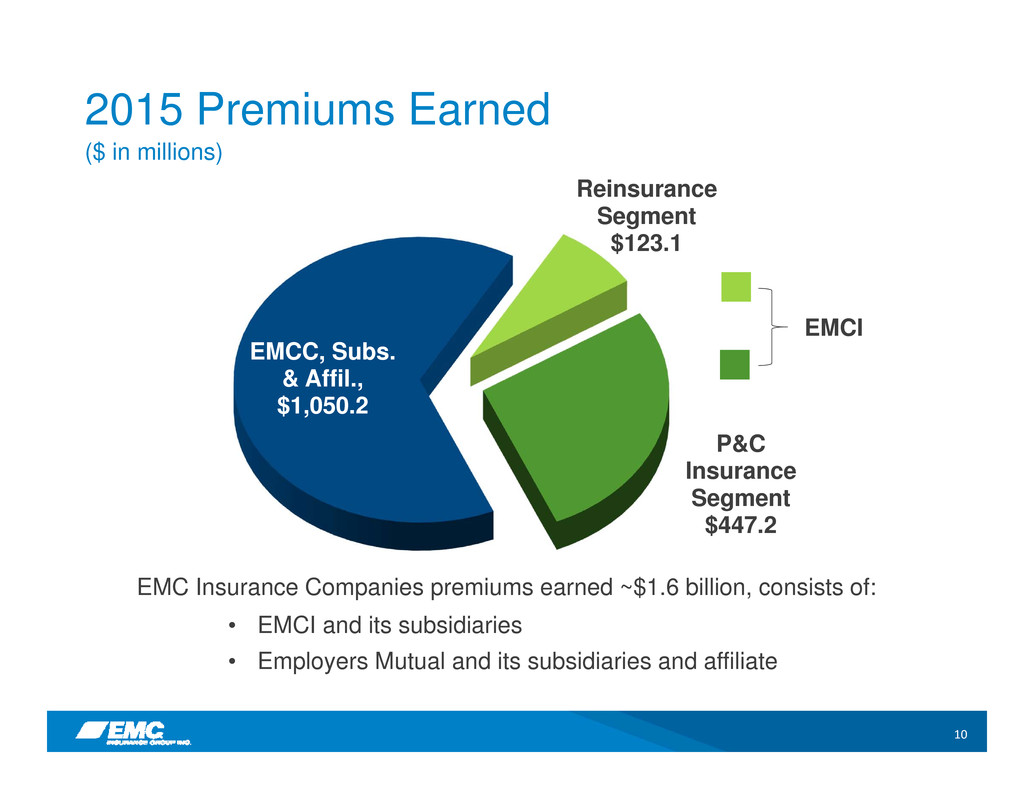

10 2015 Premiums Earned Reinsurance Segment $123.1 P&C Insurance Segment $447.2 EMCC, Subs. & Affil., $1,050.2 EMCI EMC Insurance Companies premiums earned ~$1.6 billion, consists of: ($ in millions) • EMCI and its subsidiaries • Employers Mutual and its subsidiaries and affiliate

11 Diversified Book of Business Reinsurance Segment Premiums Earned Domestic 87% International (mainly Europe & Japan) 13% P&C Insurance Segment $447.2 million Reinsurance Segment $123.1 million Excess of Loss 61.5% Pro Rata 38.5%

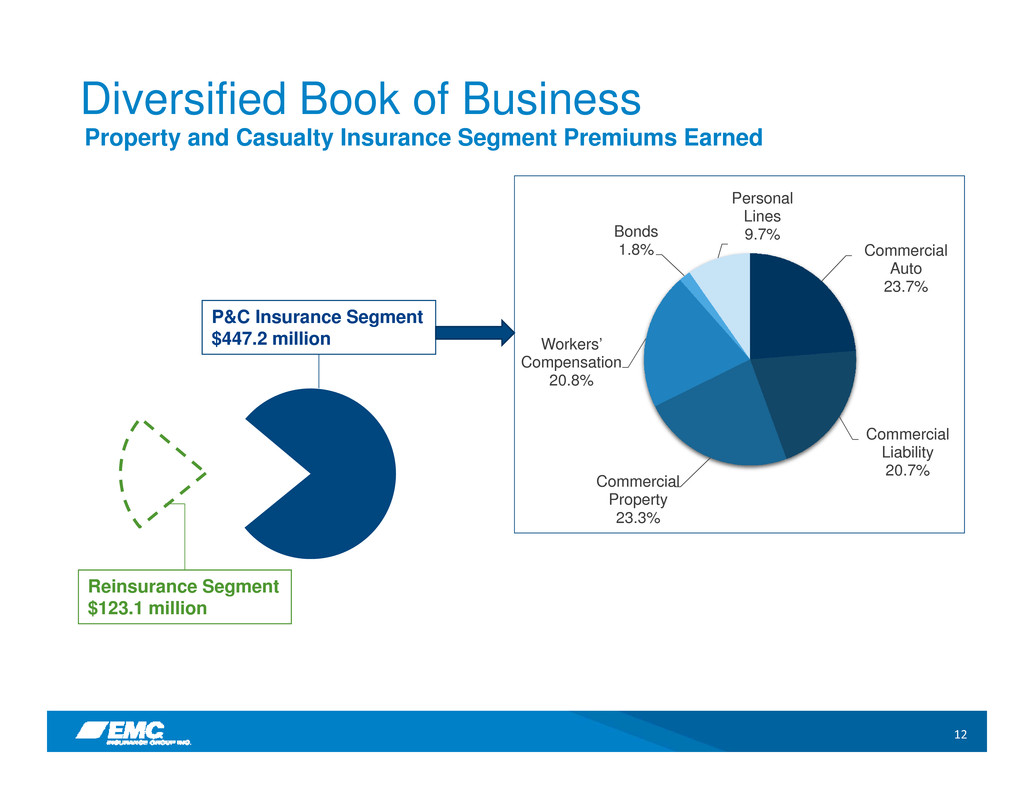

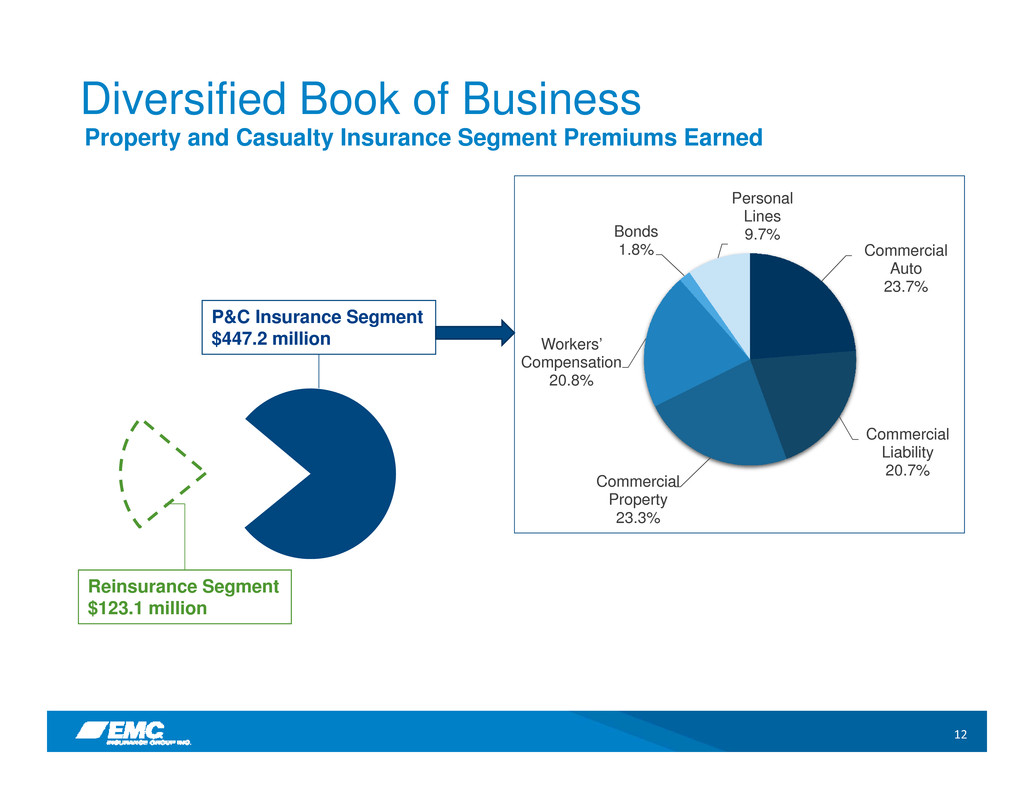

12 Reinsurance Segment $123.1 million P&C Insurance Segment $447.2 million Diversified Book of Business Property and Casualty Insurance Segment Premiums Earned Commercial Auto 23.7% Commercial Liability 20.7% Commercial Property 23.3% Workers’ Compensation 20.8% Bonds 1.8% Personal Lines 9.7%

13 • New reserving methodology (beginning in third quarter) – Accident year ultimate estimate approach • Increased transparency of drivers of performance • Better conform to industry practices • Personal lines focused accountability • Accelerate commercial auto profitability • Agency differentiation through telematics • New and revised intercompany reinsurance agreements New in 2016

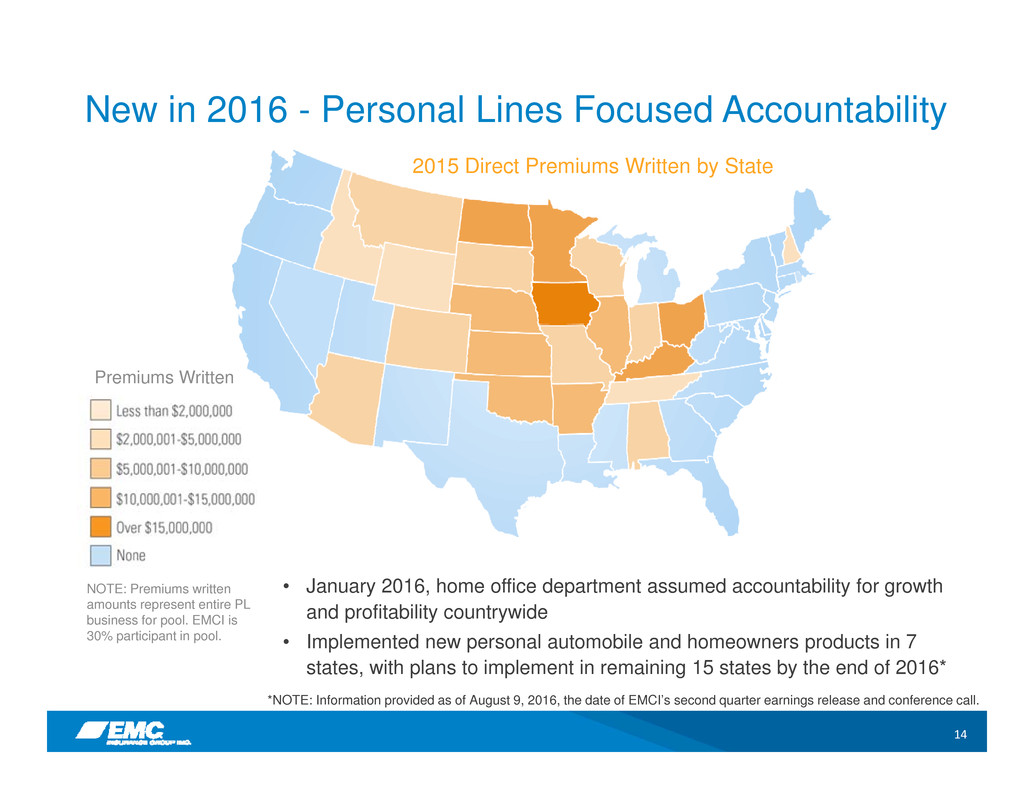

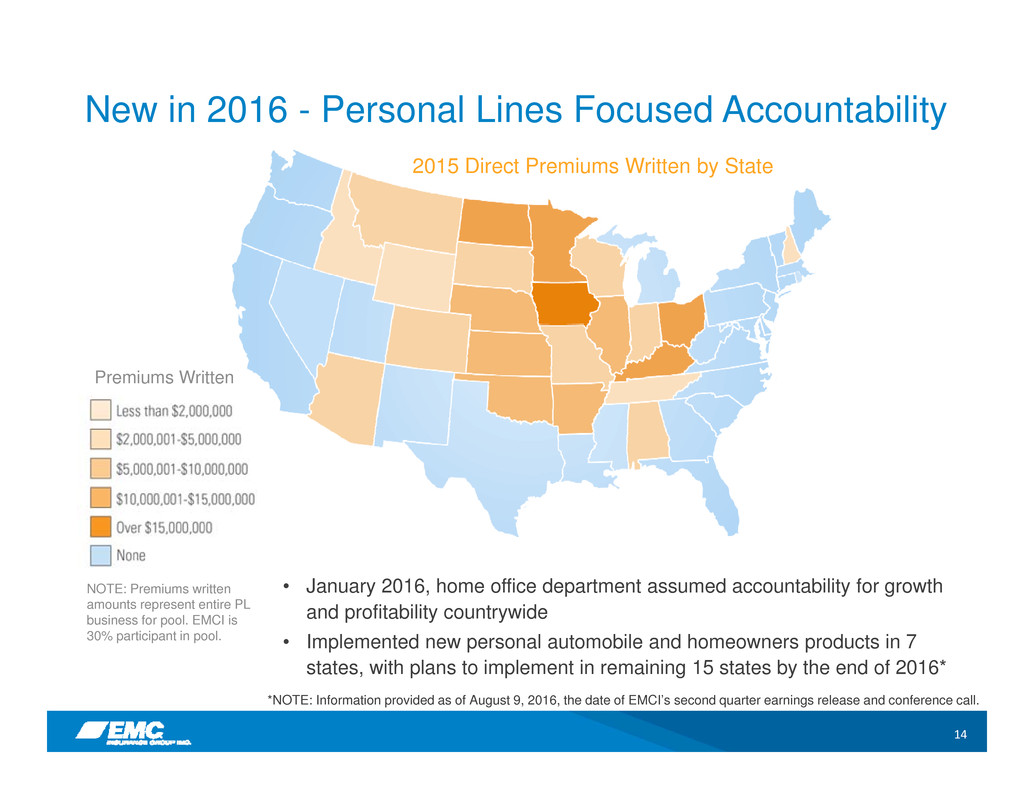

14 New in 2016 - Personal Lines Focused Accountability • January 2016, home office department assumed accountability for growth and profitability countrywide • Implemented new personal automobile and homeowners products in 7 states, with plans to implement in remaining 15 states by the end of 2016* NOTE: Premiums written amounts represent entire PL business for pool. EMCI is 30% participant in pool. 2015 Direct Premiums Written by State *NOTE: Information provided as of August 9, 2016, the date of EMCI’s second quarter earnings release and conference call. Premiums Written

15 New in 2016 - Accelerate Commercial Auto Profitability • Commercial auto represents ~25% of property and casualty insurance segment’s commercial business • Projected combined ratio of 109% for industry in 2017 • Lower gas prices led to increase in miles driven and loss frequency, coupled with increase in severity • Forecasting similar deterioration in our book of business if no steps taken to improve profitability • Implemented multi-year Accelerate Commercial Auto Profitability project • Anticipate returning to underwriting profitability within next three years, with improvement starting in 2016 • Eight teams to complement local branch efforts, each focused on different opportunities such as underwriting, pricing and claims handling • Introduce better tools to help agencies struggling with commercial auto profitability, such as telematics solution (see appendix)

16 Value of Local Market Presence • Decentralized Decision Making/Guided Autonomy: • Marketing • Underwriting • Risk Improvement • Claims • Strengthens agency relationships, get to quote best business generally resulting in superior loss ratio • Develop products, marketing strategies and pricing targeted to specific territories • Individual approaches within EMC risk appetite and framework • Retention levels consistently stay between 80%-90% • 86.6% at June 30, 2016

17 2015 Direct Premiums Written by Branch Property and Casualty Insurance Segment Commercial Lines 5.8% 4.2% 14.1% 7.3% 3.5% 4.1% 5.1% 3.9% 15.2% 4.6% 5.1% 4.1% 4.9% 5.3% 9.1% 3.7%

18 2015 Premium Distribution by Account Size 37% 30% 33% $1-$25K $25-$100K $100K+ • Approximately 90% of commercial accounts are under $25,000 in account premium, but only represent 37% of commercial lines premiums written volume • Invest more than most carriers on loss control services - available to all commercial policyholders Property and Casualty Insurance Segment Commercial Lines

19 Strength in Group Programs Target Markets Branch and industry specific programs such as: • Schools • Municipalities • Petroleum marketers • Manufacturing housing • Local towing Safety Groups • Similar to Target Markets, except offer dividends for favorable loss experience of the group $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2011 2012 2013 2014 2015 Target Market Safety Group ( $ i n t h o u s a n d s ) Direct Premiums Written Target Market Loss Ratio Safety Group Loss Ratio Total Program Loss Ratio 2015 46.8% 50.5% 48.6% 5-Year 52.7% 52.8% 52.7%

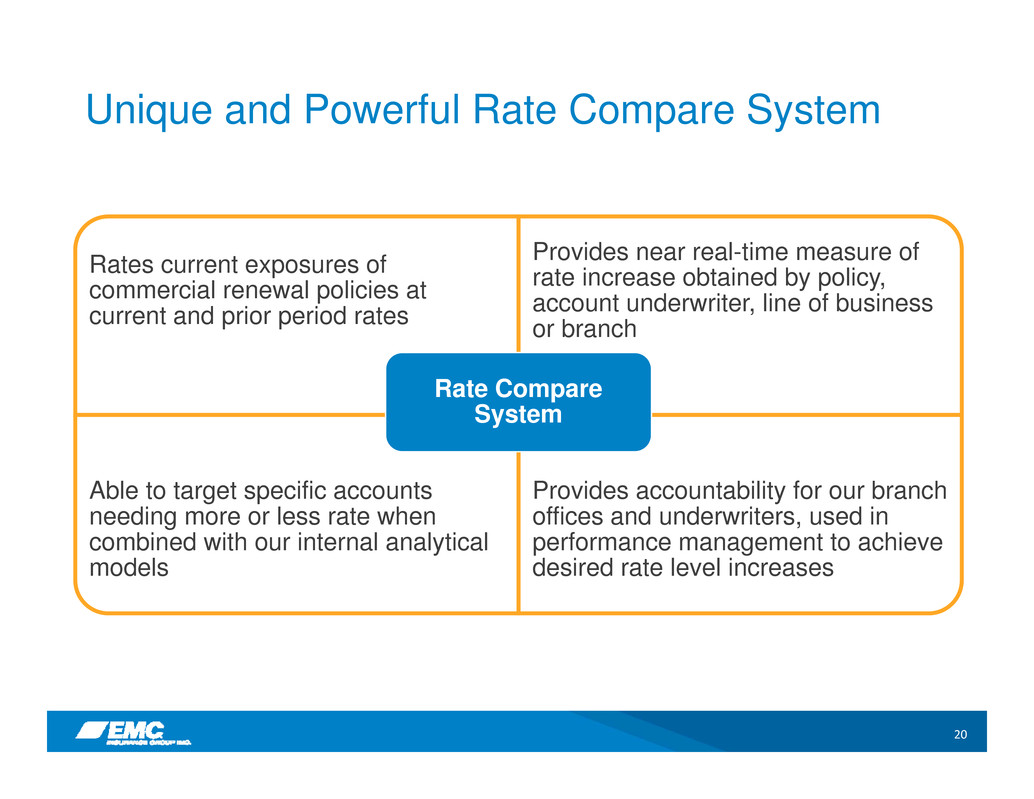

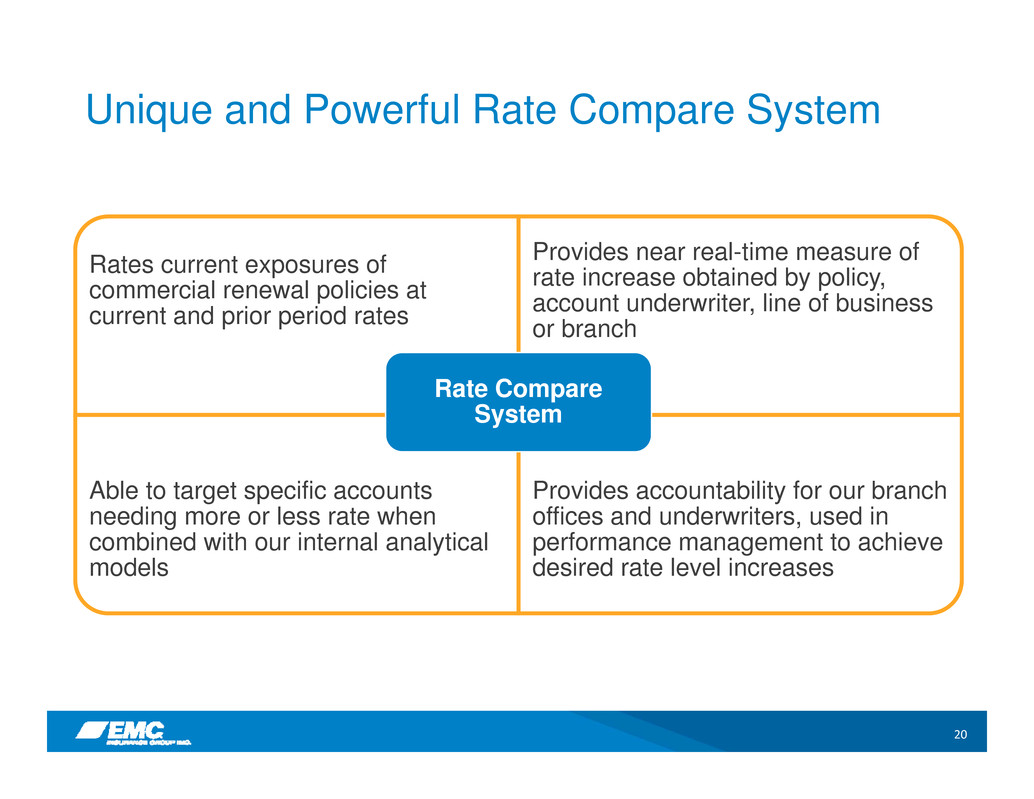

20 Unique and Powerful Rate Compare System Rates current exposures of commercial renewal policies at current and prior period rates Provides near real-time measure of rate increase obtained by policy, account underwriter, line of business or branch Able to target specific accounts needing more or less rate when combined with our internal analytical models Provides accountability for our branch offices and underwriters, used in performance management to achieve desired rate level increases Rate Compare System

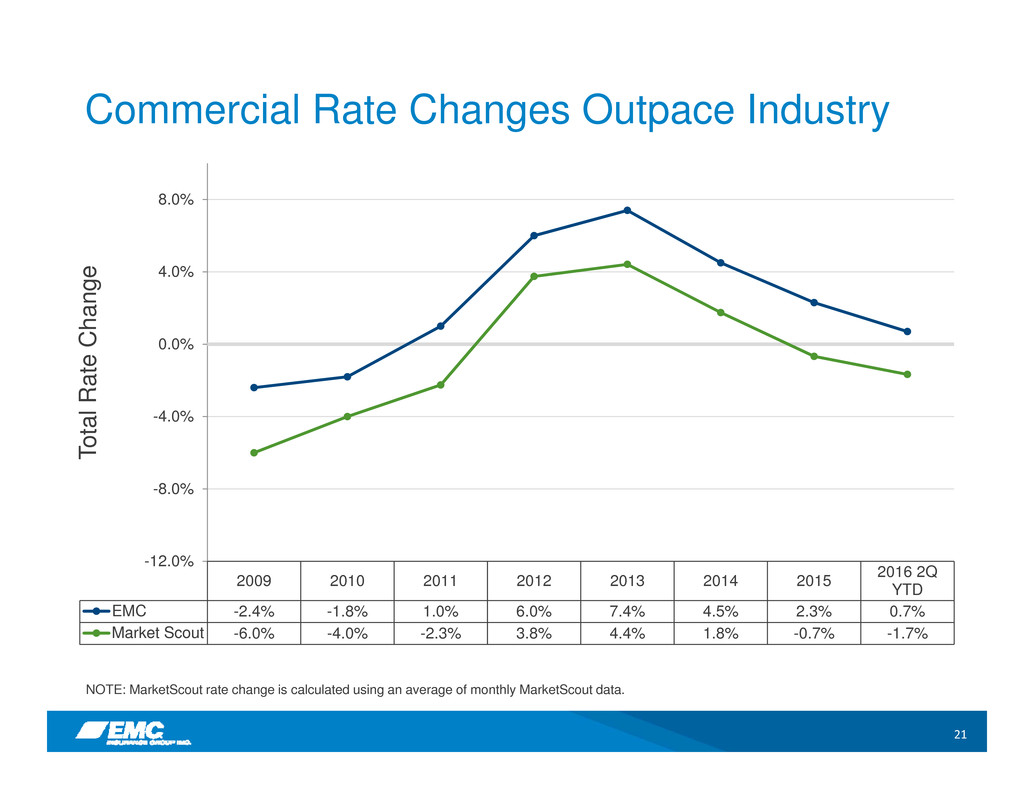

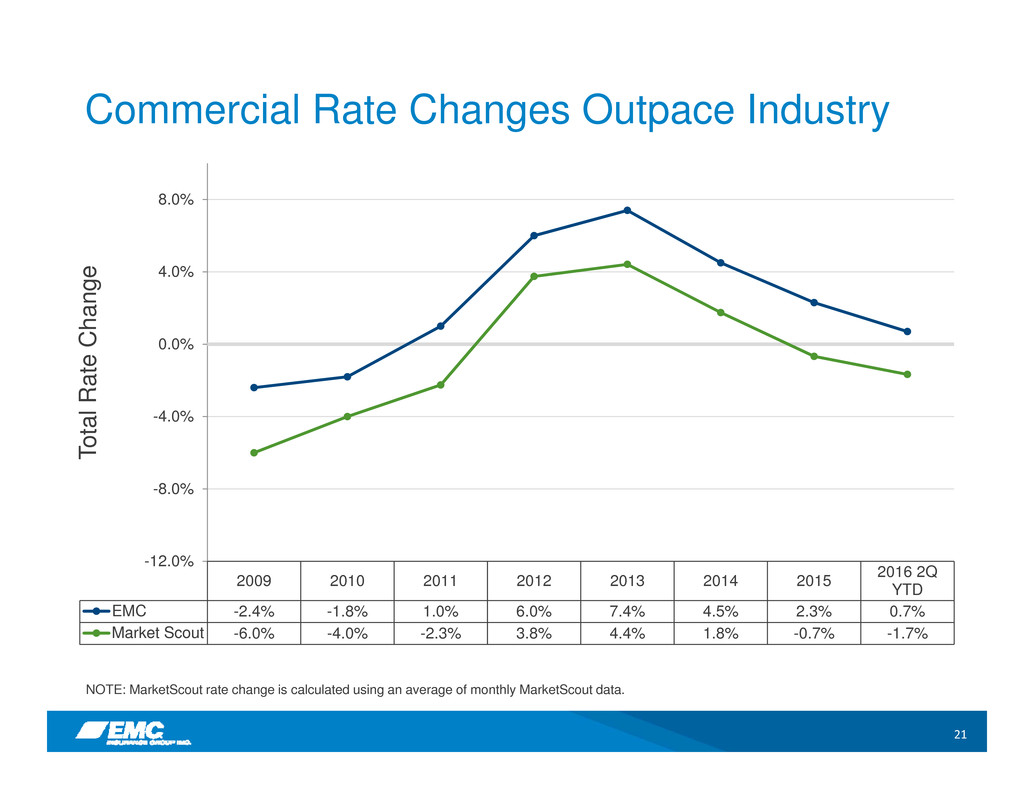

21 Commercial Rate Changes Outpace Industry NOTE: MarketScout rate change is calculated using an average of monthly MarketScout data. 2009 2010 2011 2012 2013 2014 2015 2016 2QYTD EMC -2.4% -1.8% 1.0% 6.0% 7.4% 4.5% 2.3% 0.7% Market Scout -6.0% -4.0% -2.3% 3.8% 4.4% 1.8% -0.7% -1.7% -12.0% -8.0% -4.0% 0.0% 4.0% 8.0% T o t a l R a t e C h a n g e

22 GAAP Combined Ratios NOTE: Record catastrophe and storm losses were reported in 2008 and again in 2011. Over the most recent 10-year period, catastrophe and storm losses have annually averaged 10.3 percentage points of the combined ratio, calculated as of Dec. 31, 2015. However, excluding the record losses reported in 2008 and 2011, catastrophe and storm losses would have annually averaged 8.8 percentage points of the combined ratio. 90.2% 83.3% 84.2% 84.7% 82.5% 83.8% 19.3% 11.7% 9.4% 10.6% 7.8% 9.8% 5.8% 4.6% 4.3% 6.6% 6.0% 4.5% 0% 20% 40% 60% 80% 100% 120% 2011 2012 2013 2014 2015 2016 Q2 YTD Large losses (greater than $500,000 for EMC Insurance Companies' Pool, excluding catastrophe losses) Catastrophe and Storm Losses GAAP Combined Ratio Excluding Catastrophe and Storm Losses, and Large Losses 99.6% 97.9% 101.9% 98.1%96.3% 115.3%

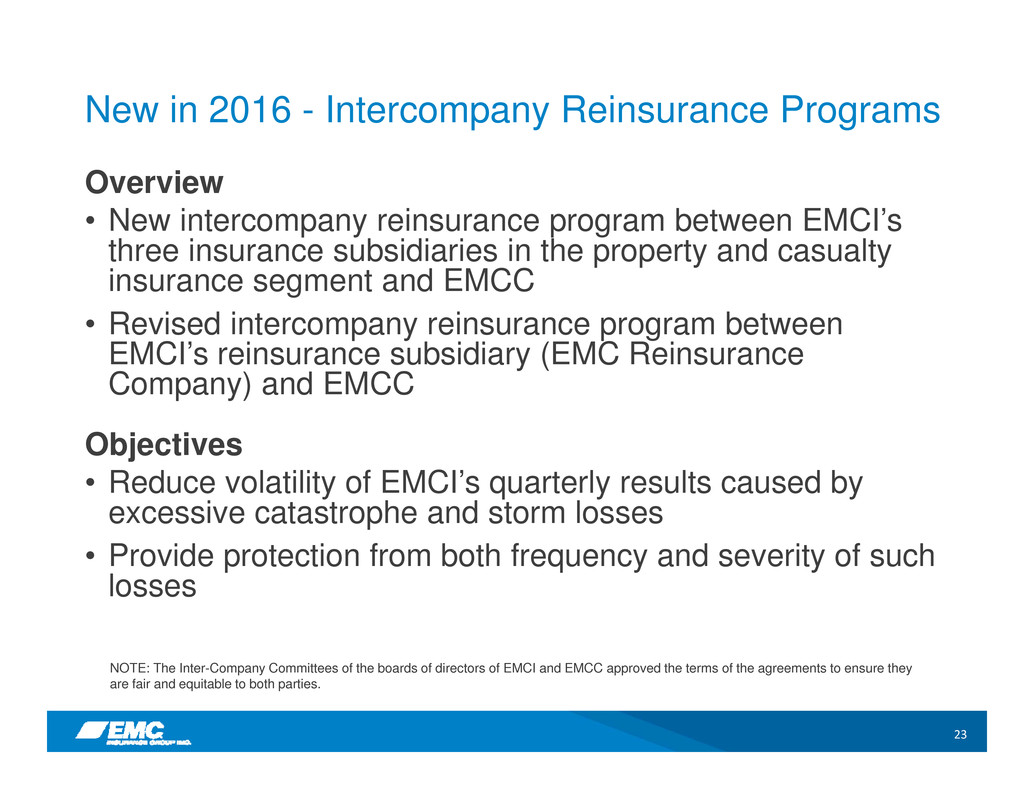

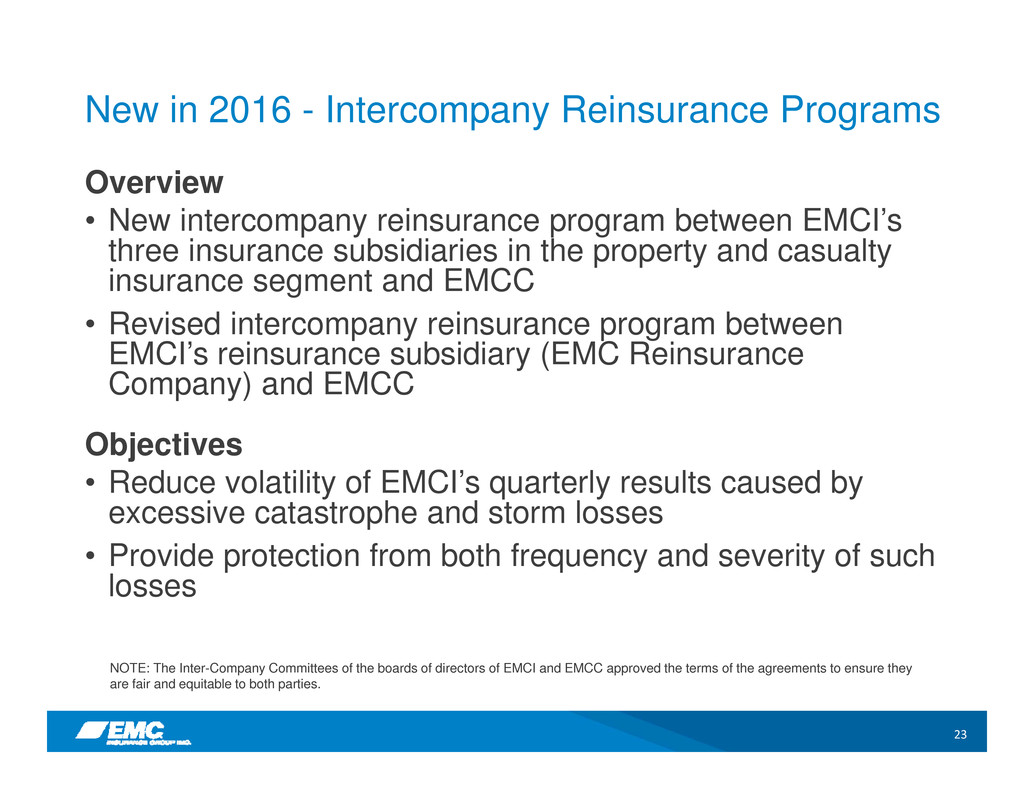

23 New in 2016 - Intercompany Reinsurance Programs Overview • New intercompany reinsurance program between EMCI’s three insurance subsidiaries in the property and casualty insurance segment and EMCC • Revised intercompany reinsurance program between EMCI’s reinsurance subsidiary (EMC Reinsurance Company) and EMCC Objectives • Reduce volatility of EMCI’s quarterly results caused by excessive catastrophe and storm losses • Provide protection from both frequency and severity of such losses NOTE: The Inter-Company Committees of the boards of directors of EMCI and EMCC approved the terms of the agreements to ensure they are fair and equitable to both parties.

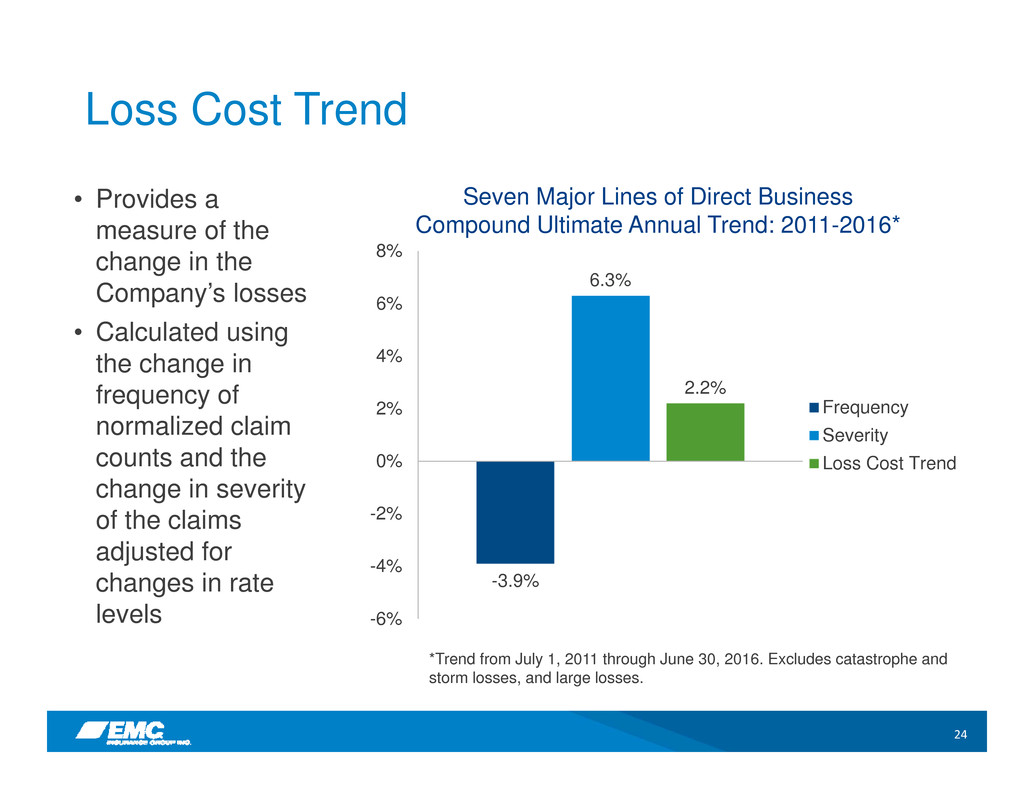

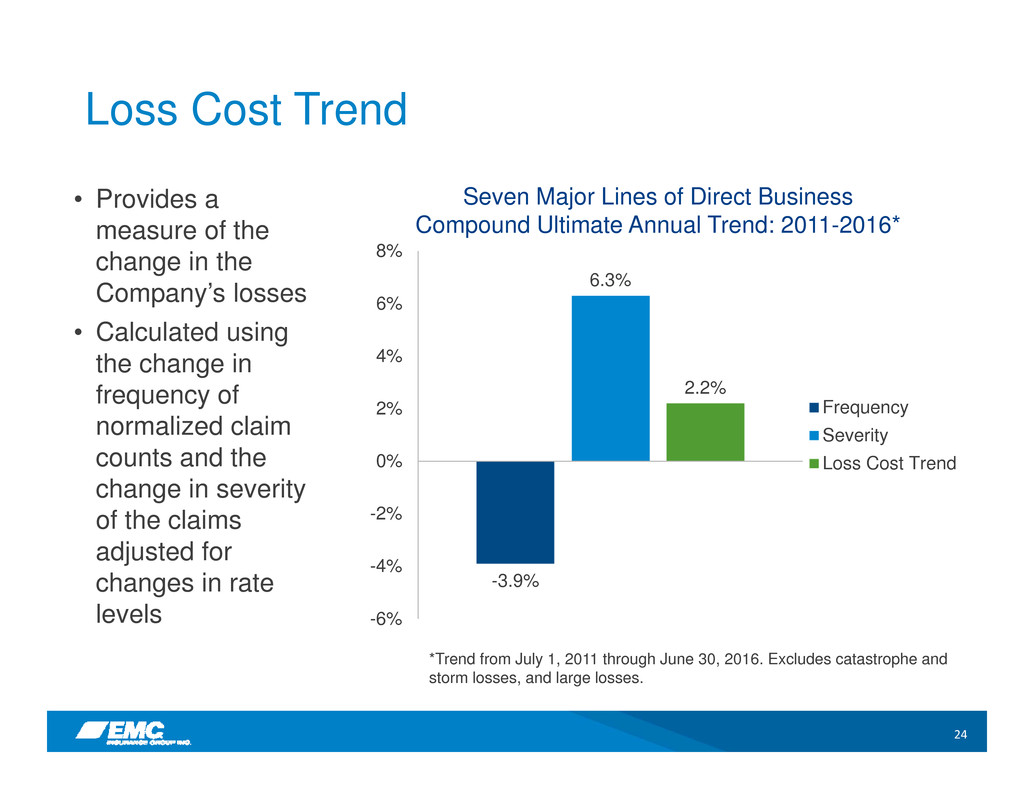

24 Loss Cost Trend • Provides a measure of the change in the Company’s losses • Calculated using the change in frequency of normalized claim counts and the change in severity of the claims adjusted for changes in rate levels Seven Major Lines of Direct Business Compound Ultimate Annual Trend: 2011-2016* -3.9% 6.3% 2.2% -6% -4% -2% 0% 2% 4% 6% 8% Frequency Severity Loss Cost Trend *Trend from July 1, 2011 through June 30, 2016. Excludes catastrophe and storm losses, and large losses.

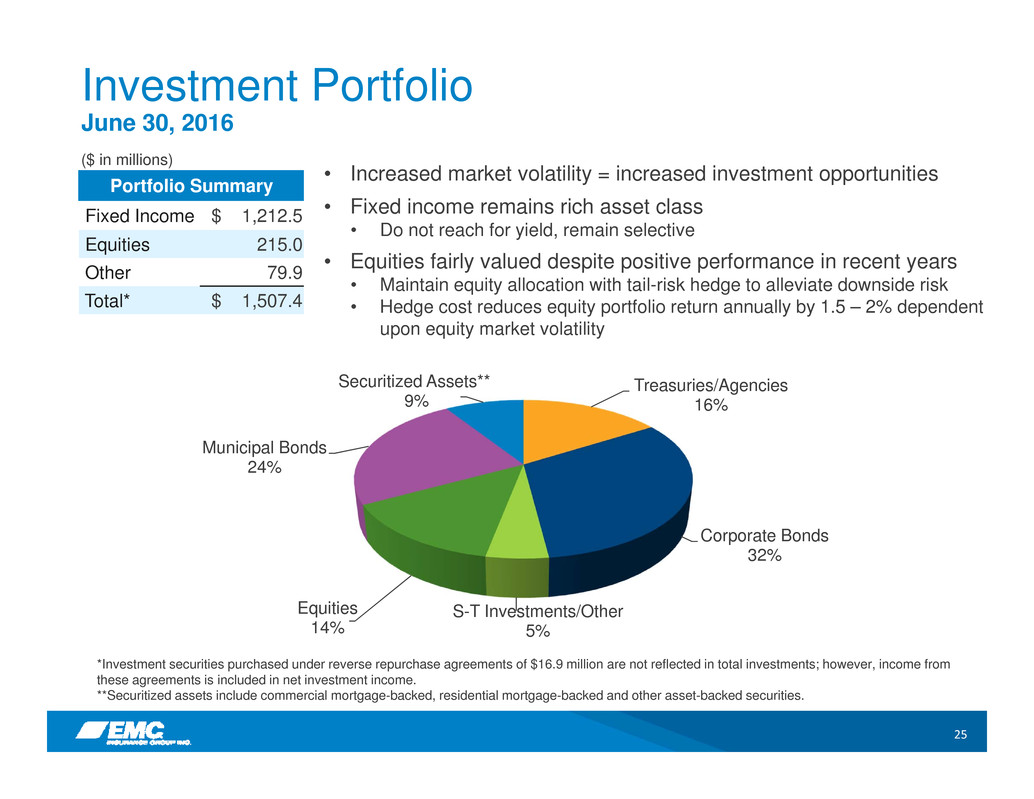

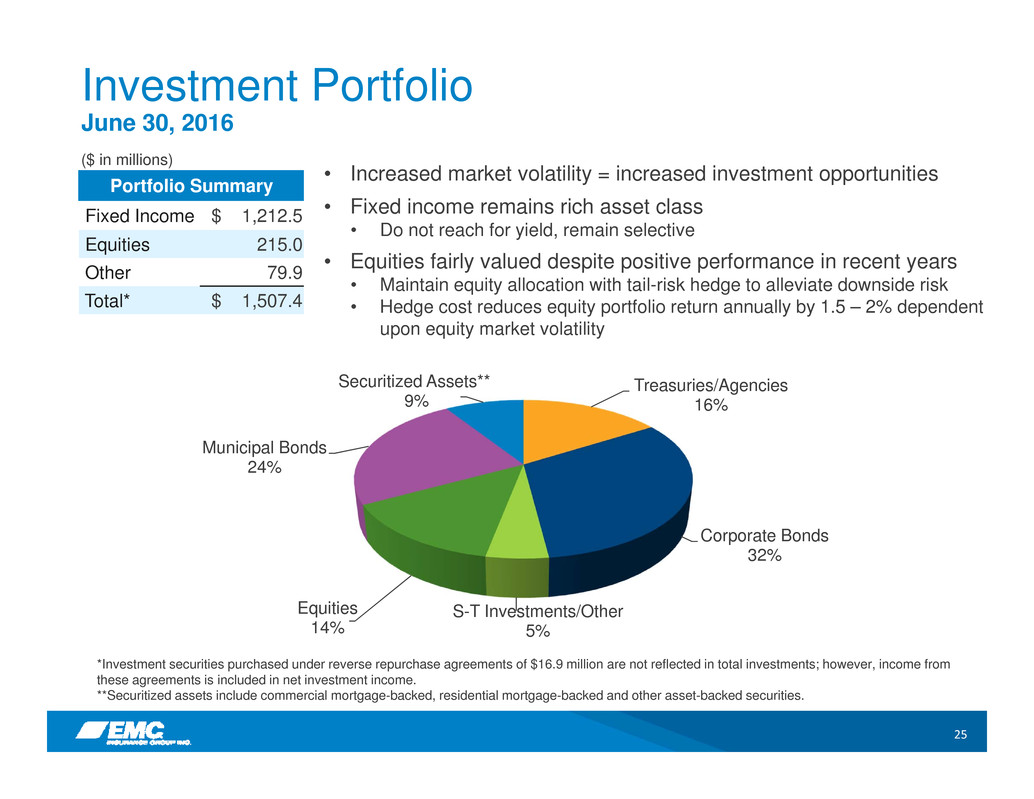

25 Investment Portfolio June 30, 2016 ($ in millions) *Investment securities purchased under reverse repurchase agreements of $16.9 million are not reflected in total investments; however, income from these agreements is included in net investment income. **Securitized assets include commercial mortgage-backed, residential mortgage-backed and other asset-backed securities. • Increased market volatility = increased investment opportunities • Fixed income remains rich asset class • Do not reach for yield, remain selective • Equities fairly valued despite positive performance in recent years • Maintain equity allocation with tail-risk hedge to alleviate downside risk • Hedge cost reduces equity portfolio return annually by 1.5 – 2% dependent upon equity market volatility Portfolio Summary Fixed Income $ 1,212.5 Equities 215.0 Other 79.9 Total* $ 1,507.4 Treasuries/Agencies 16% Corporate Bonds 32% S-T Investments/Other 5% Equities 14% Municipal Bonds 24% Securitized Assets** 9%

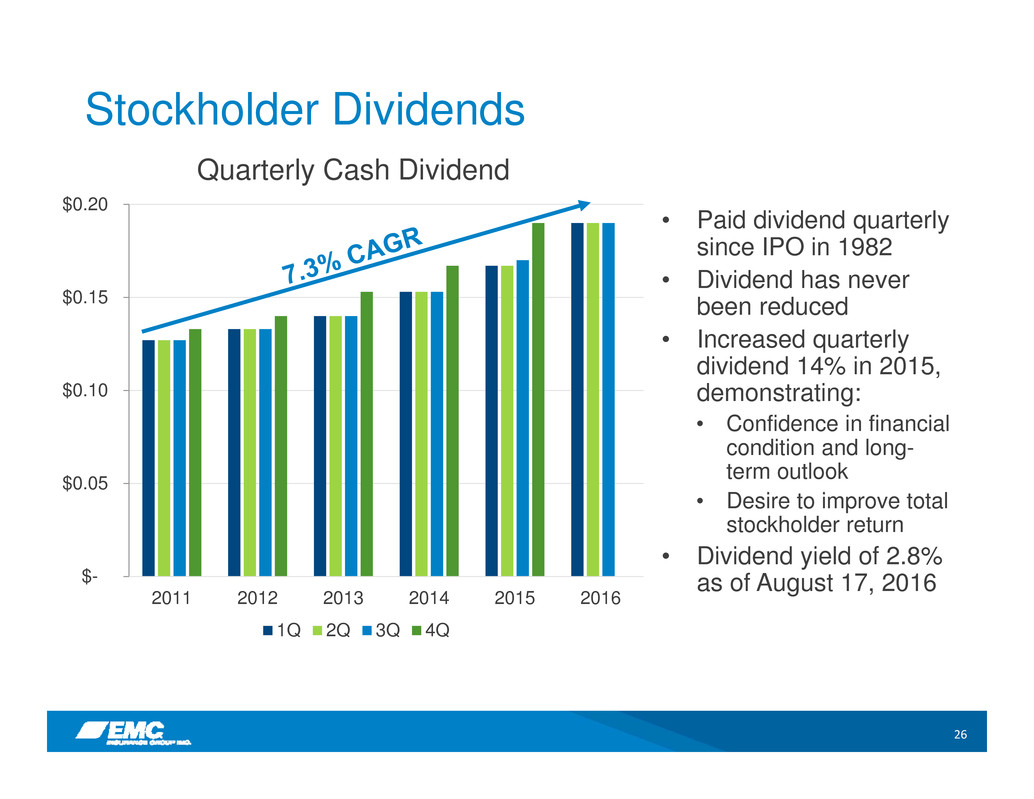

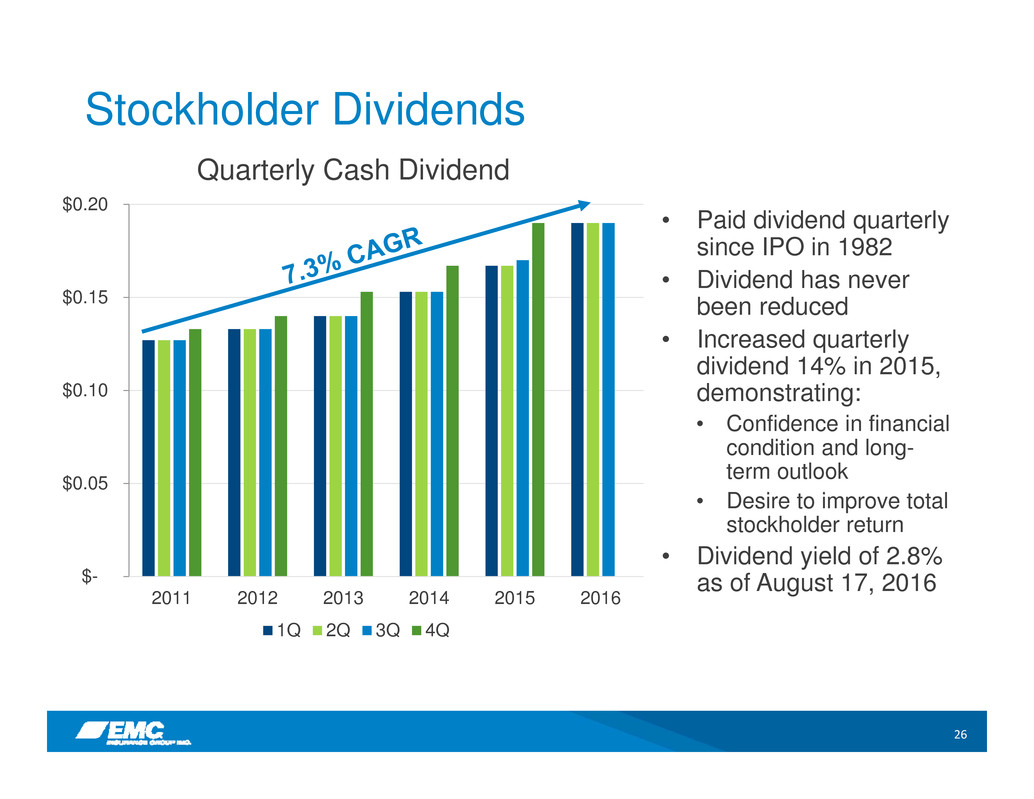

26 $- $0.05 $0.10 $0.15 $0.20 2011 2012 2013 2014 2015 2016 Quarterly Cash Dividend 1Q 2Q 3Q 4Q Stockholder Dividends • Paid dividend quarterly since IPO in 1982 • Dividend has never been reduced • Increased quarterly dividend 14% in 2015, demonstrating: • Confidence in financial condition and long- term outlook • Desire to improve total stockholder return • Dividend yield of 2.8% as of August 17, 2016

27 Maximizing Stockholder Value * Approximately $0.88 per share of the increase in 2013 is attributable to a change in EMCC’s postretirement healthcare plan. NOTE: All prior period per share amounts have been adjusted to reflect the three for two stock split completed on June 23, 2015. * $18.24 $20.72 $22.81* $24.72 $25.26 $26.81 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 2011 2012 2013 2014 2015 2016 Q2 YTD Book Value Per Share Cumulative Dividends $18.75 $21.77 $24.44 $26.97 $28.21 $30.14

28 Attractive Returns for Stockholders EMCI’s total stockholder return compares favorably to the S&P 500 Total stockholder return is the percentage change in the stock price plus the amount of dividends paid, assuming dividend reinvestment, to the stock price at the beginning of the one-year, three-year and five-year periods ending June 30, 2016. Source: Bloomberg 13.9% 20.1% 20.8% 4.0% 11.6% 12.1% 0% 5% 10% 15% 20% 25% 1-Year 3-Year 5-Year EMCI S&P 500

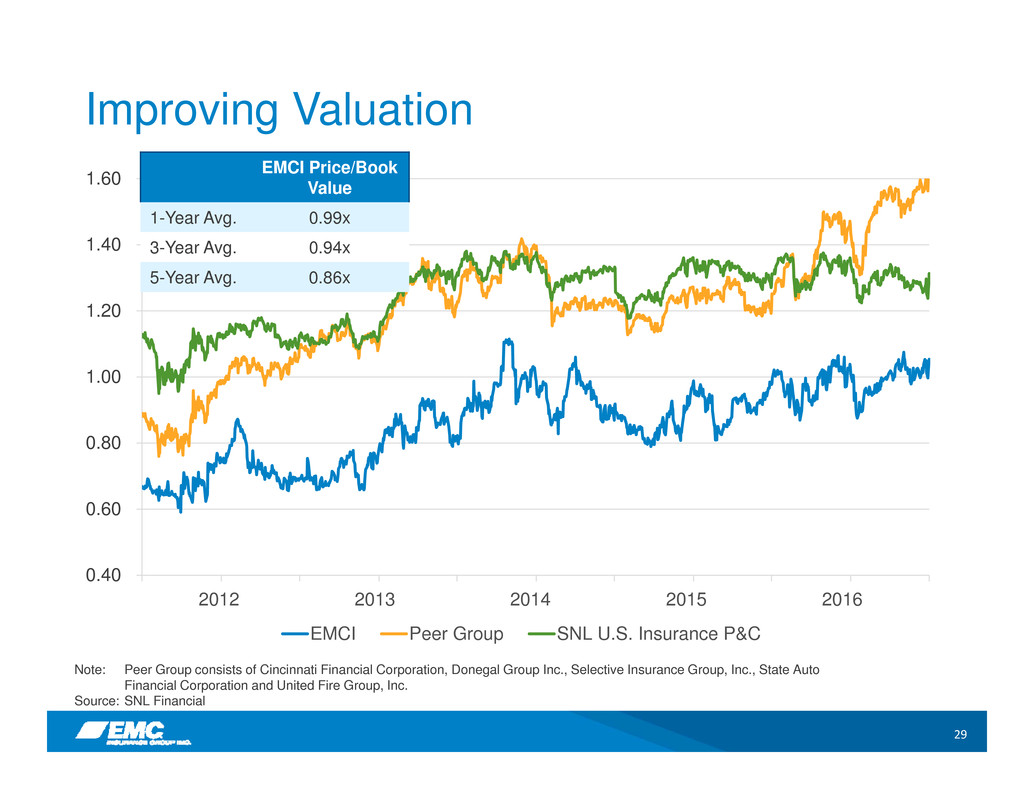

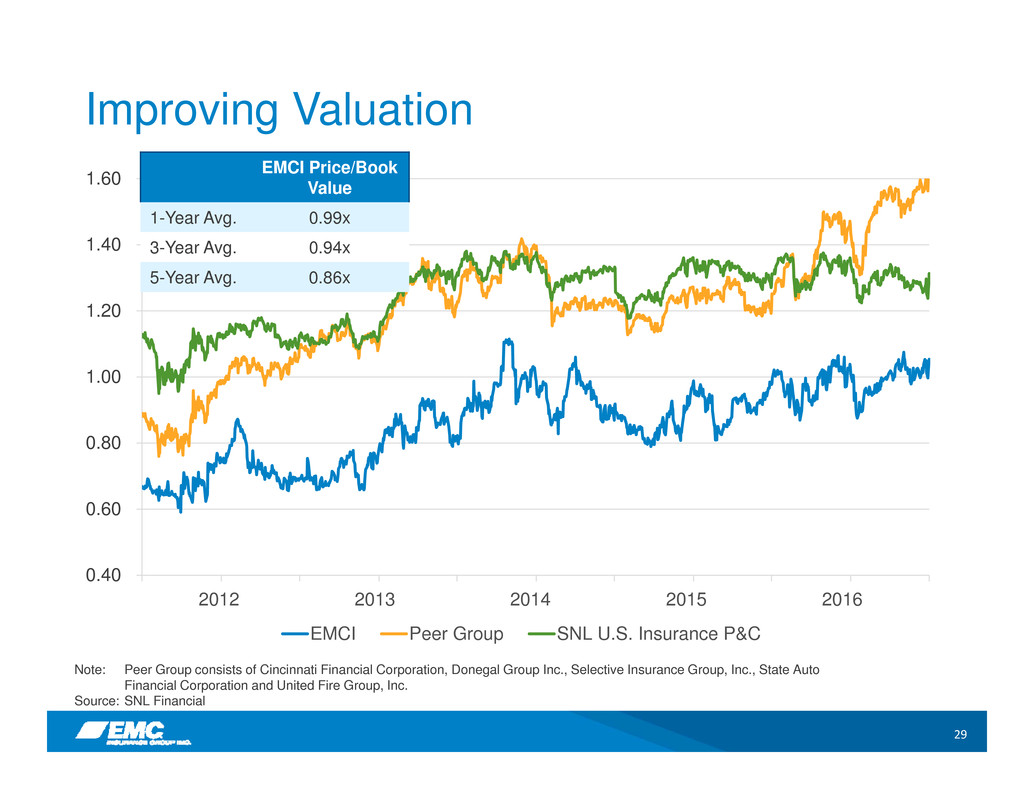

29 Improving Valuation 0.40 0.60 0.80 1.00 1.20 1.40 1.60 2011 2011 2012 2012 2013 2013 2014 2014 2015 2015 2016 EMCI Peer Group SNL U.S. Insurance P&C EMCI Price/Book Value 1-Year Avg. 0.99x 3-Year Avg. 0.94x 5-Year Avg. 0.86x 2 13 014 2015 2016 Note: Peer Group consists of Cincinnati Financial Corporation, Donegal Group Inc., Selective Insurance Group, Inc., State Auto Financial Corporation and United Fire Group, Inc. Source: SNL Financial

30 Appendix

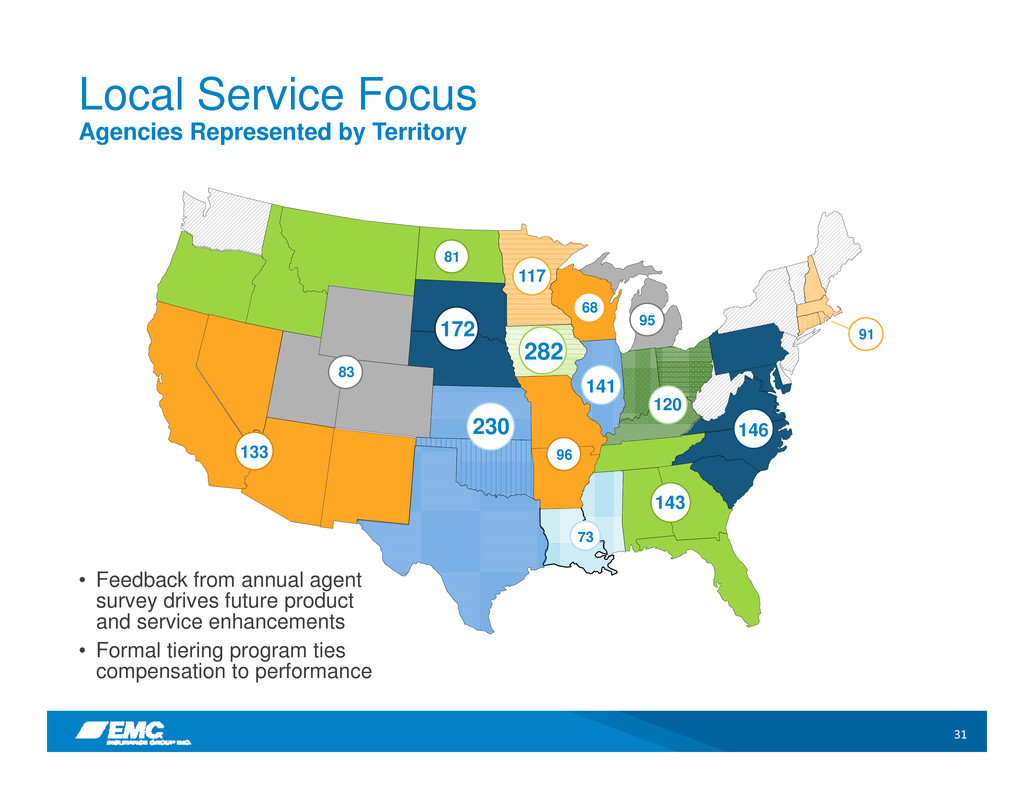

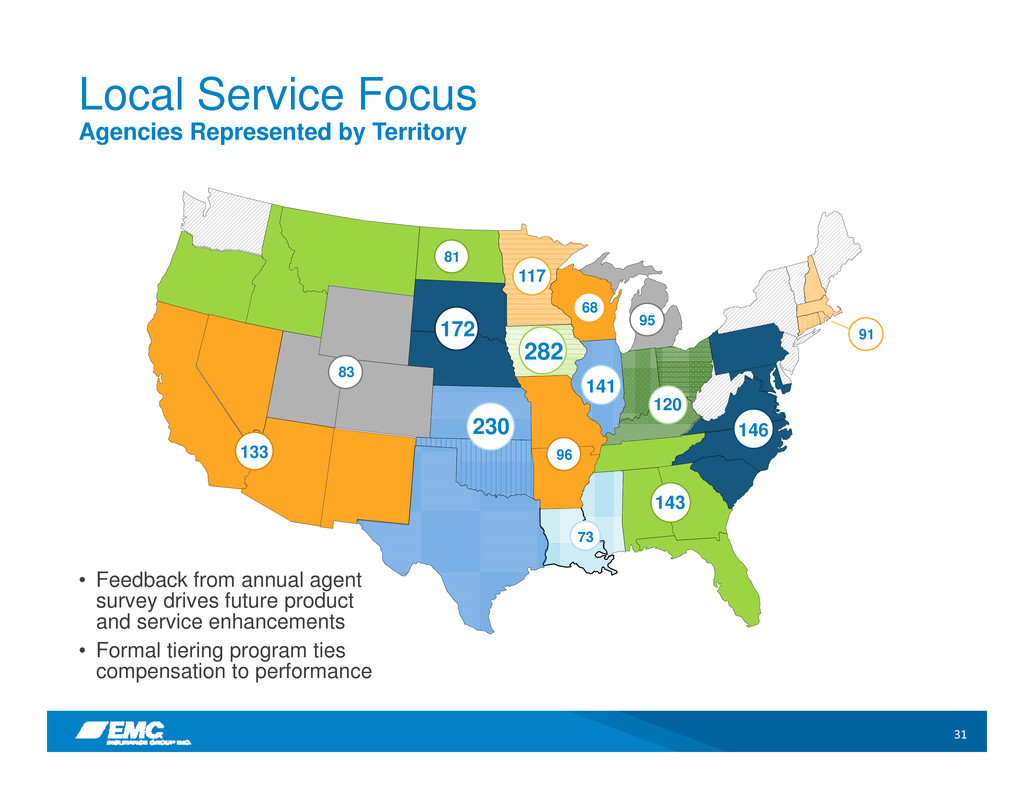

31 Local Service Focus Agencies Represented by Territory z68 117 141 81 133 83 96 95 73 143 120 146 91172 282 230 • Feedback from annual agent survey drives future product and service enhancements • Formal tiering program ties compensation to performance

32 2016 Intercompany Reinsurance Treaties $20M $15M $24M $12M JANUARY 1 - JUNE 30 AGGREGATE TREATY JULY 1 - DECEMBER 31 AGGREGATE TREATY Retention Limit Cost: $6.3M Property and Casualty Insurance Segment Catastrophe Treaties Between EMCI and EMCC Cost: $1.5M $10M $20M $10M $100M ONE ‐T IME PER OCCURRENCE TREATY ANNUAL AGGREGATE TREATY Retention Limit Reinsurance Segment Catastrophe Treaties Between EMCI and EMCC Cost: $2.0M Cost: $3.1M Per Occurrence Treaty Annual Aggregate Treaty Jan. 1 – June 30 Aggregate Treaty July 1 – Dec. 31 Aggregate Treaty 20% Co-participation • EMC Re will purchase additional reinsurance protections (Industry Loss Warranties) in peak exposure territories • Ceded premiums earned of approximately $3.5 million in 2016

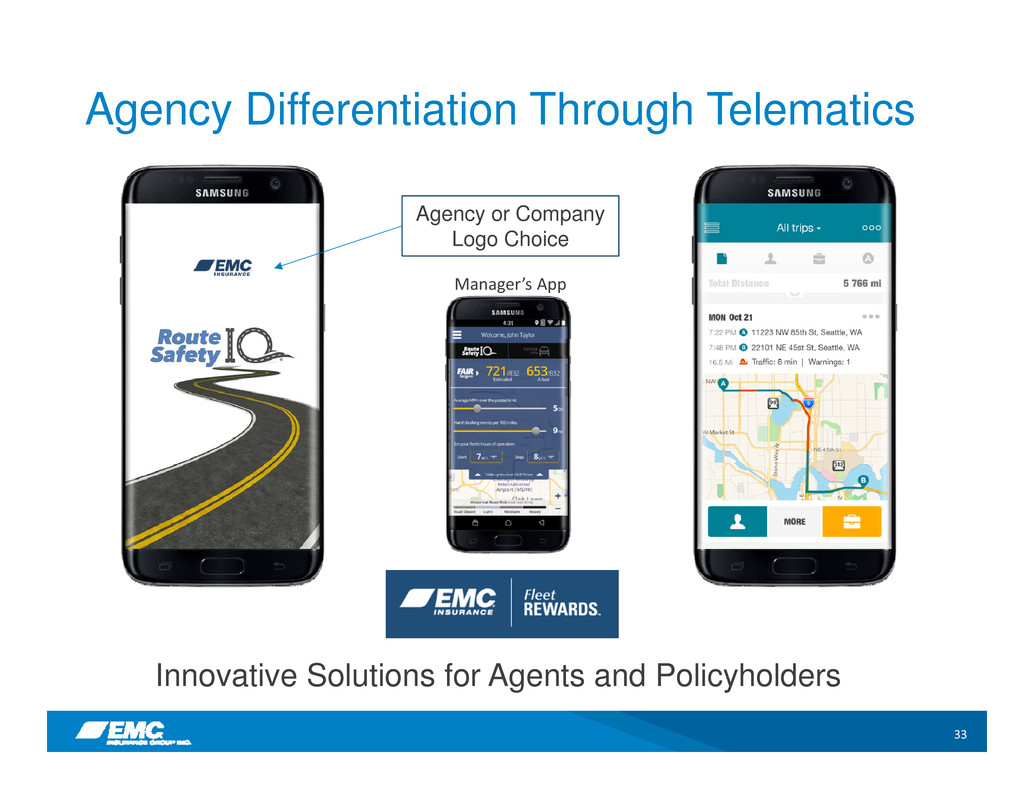

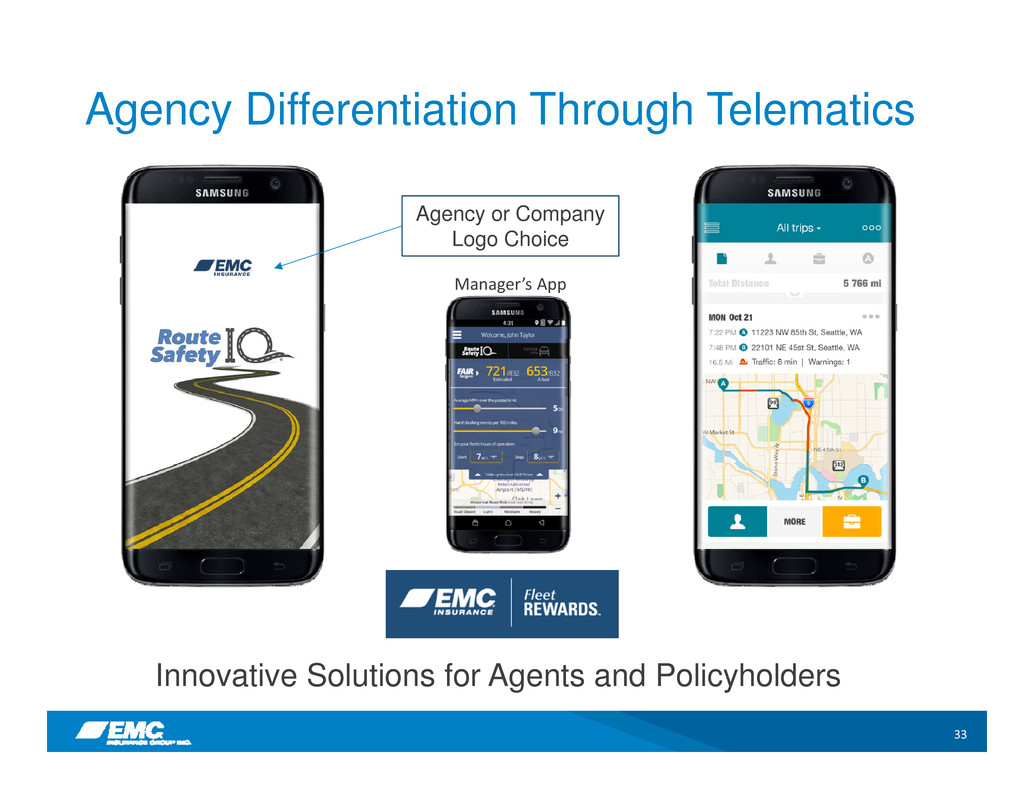

33 Agency Differentiation Through Telematics Agency or Company Logo Choice Manager’s App Innovative Solutions for Agents and Policyholders

34 Benefits of Telematics • Ability to brand the app • Solution for all their clients, not just business EMC writes, maximizing benefits to agencies and society Agency Differentiation • Improving fuel economy • Improving uptime • Improving driver retention through improved CSA driver scores Focus on Policyholder Value • With other commercial auto initiatives, potential for significant improvement in results • Improving society by making roadways safer and reducing emissions with better fuel economy Other Benefits • In partnership with ATG Risk Solutions, currently working with pilot agencies

35 Kevin J. Hovick CPCU Executive Vice President & Chief Operating Officer 37 years with EMC Experienced Executive Management Team Scott R. Jean FCAS, MAAA Executive Vice President for Finance & Analytics 25 years with EMC Mick A. Lovell CPCU Executive Vice President for Corporate Development 13 years with EMC Bruce G. Kelley J.D., CPCU, CLU President, Chief Executive Officer & Director 31 years with EMC Jason R. Bogart CPCU, ARM Senior Vice President/ Branch Operations 23 years with EMC AVERAGE YEARS With EMC: 26

36 39% 12%12% 18% 13% 6% Fixed Income Securities Expected Maturity 0-2 Years 2-4 Years 4-6 Years 6-8 Years 8-10 Years 10+ Years Fixed Income Portfolio June 30, 2016 Bond Ratings AAA 34.2% AA 32.2% A 26.8% BAA 6.5% BA and below 0.3% Total 100.0% Portfolio Characteristics Average Life: 4.7 Years Duration: 4.3 Pre-tax Book Yield: 3.5%

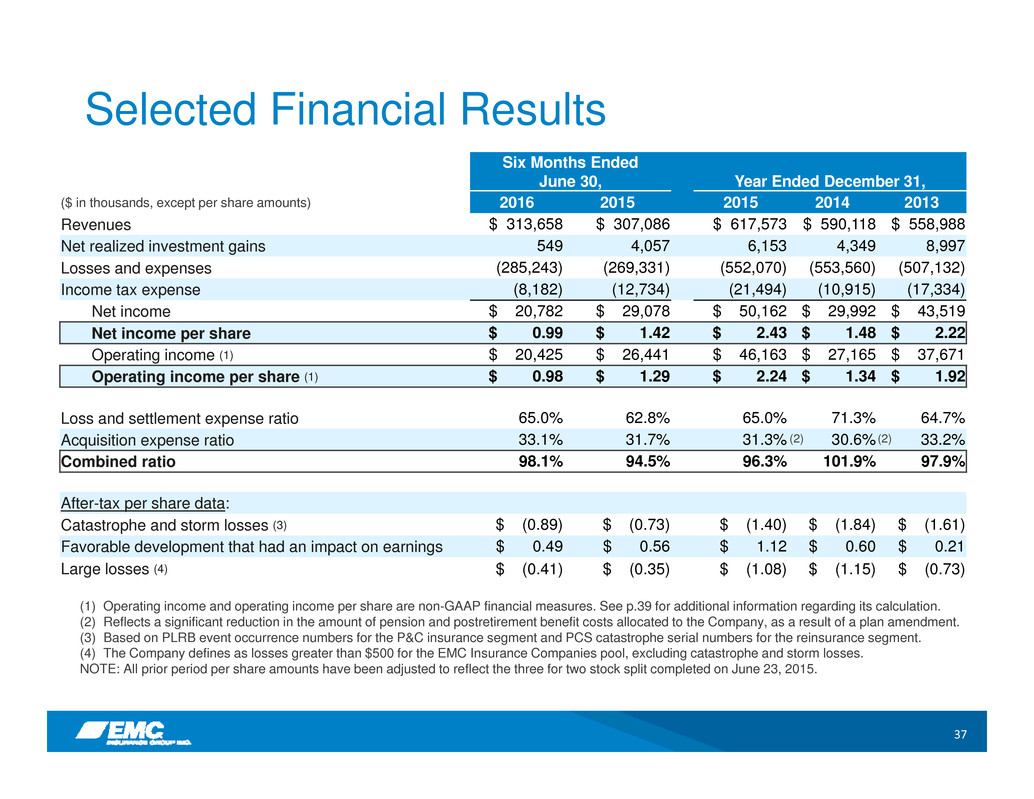

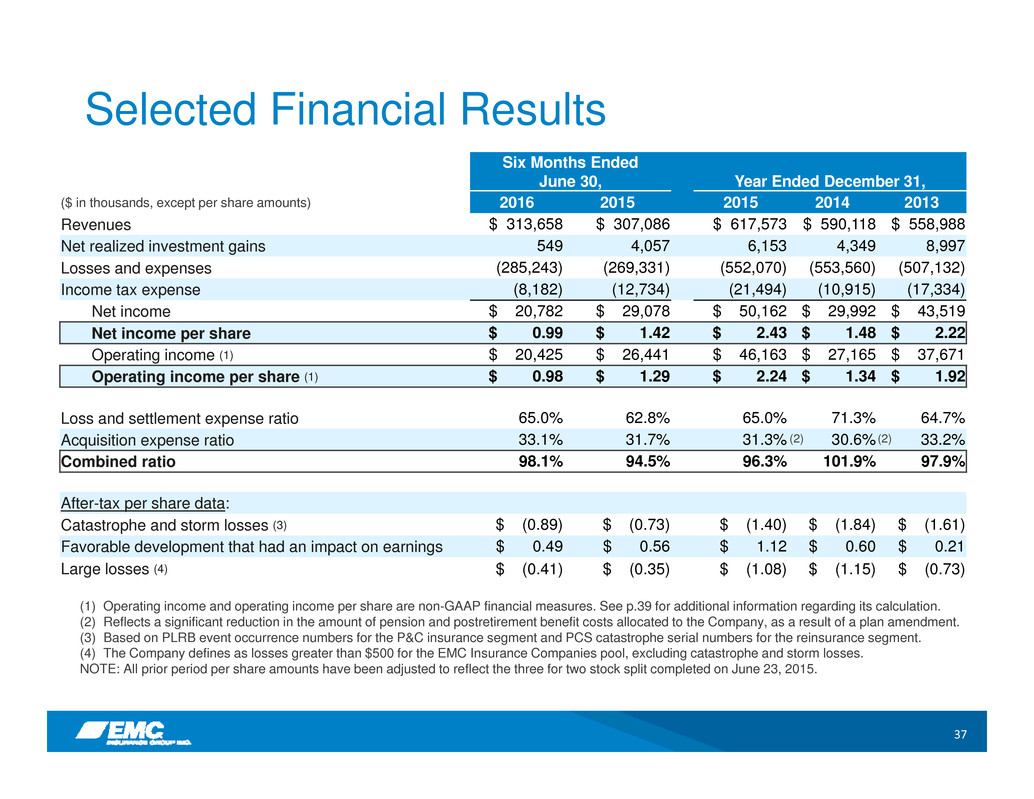

37 Selected Financial Results (1) Operating income and operating income per share are non-GAAP financial measures. See p.39 for additional information regarding its calculation. (2) Reflects a significant reduction in the amount of pension and postretirement benefit costs allocated to the Company, as a result of a plan amendment. (3) Based on PLRB event occurrence numbers for the P&C insurance segment and PCS catastrophe serial numbers for the reinsurance segment. (4) The Company defines as losses greater than $500 for the EMC Insurance Companies pool, excluding catastrophe and storm losses. NOTE: All prior period per share amounts have been adjusted to reflect the three for two stock split completed on June 23, 2015. Six Months Ended June 30, Year Ended December 31, ($ in thousands, except per share amounts) 2016 2015 2015 2014 2013 Revenues $ 313,658 $ 307,086 $ 617,573 $ 590,118 $ 558,988 Net realized investment gains 549 4,057 6,153 4,349 8,997 Losses and expenses (285,243) (269,331) (552,070) (553,560) (507,132) Income tax expense (8,182) (12,734) (21,494) (10,915) (17,334) Net income $ 20,782 $ 29,078 $ 50,162 $ 29,992 $ 43,519 Net income per share $ 0.99 $ 1.42 $ 2.43 $ 1.48 $ 2.22 Operating income (1) $ 20,425 $ 26,441 $ 46,163 $ 27,165 $ 37,671 Operating income per share (1) $ 0.98 $ 1.29 $ 2.24 $ 1.34 $ 1.92 Loss and settlement expense ratio 65.0% 62.8% 65.0% 71.3% 64.7% Acquisition expense ratio 33.1% 31.7% 31.3% 30.6% 33.2% Combined ratio 98.1% 94.5% 96.3% 101.9% 97.9% After-tax per share data: Catastrophe and storm losses (3) $ (0.89) $ (0.73) $ (1.40) $ (1.84) $ (1.61) Favorable development that had an impact on earnings $ 0.49 $ 0.56 $ 1.12 $ 0.60 $ 0.21 Large losses (4) $ (0.41) $ (0.35) $ (1.08) $ (1.15) $ (0.73) (2) (2)

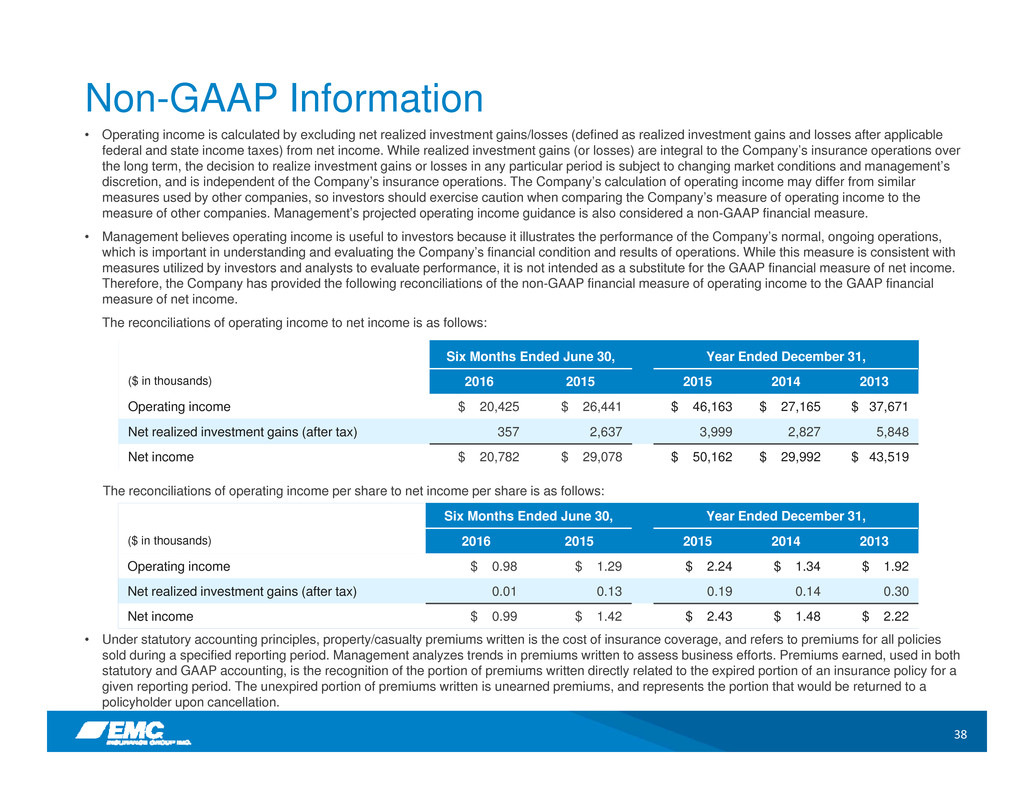

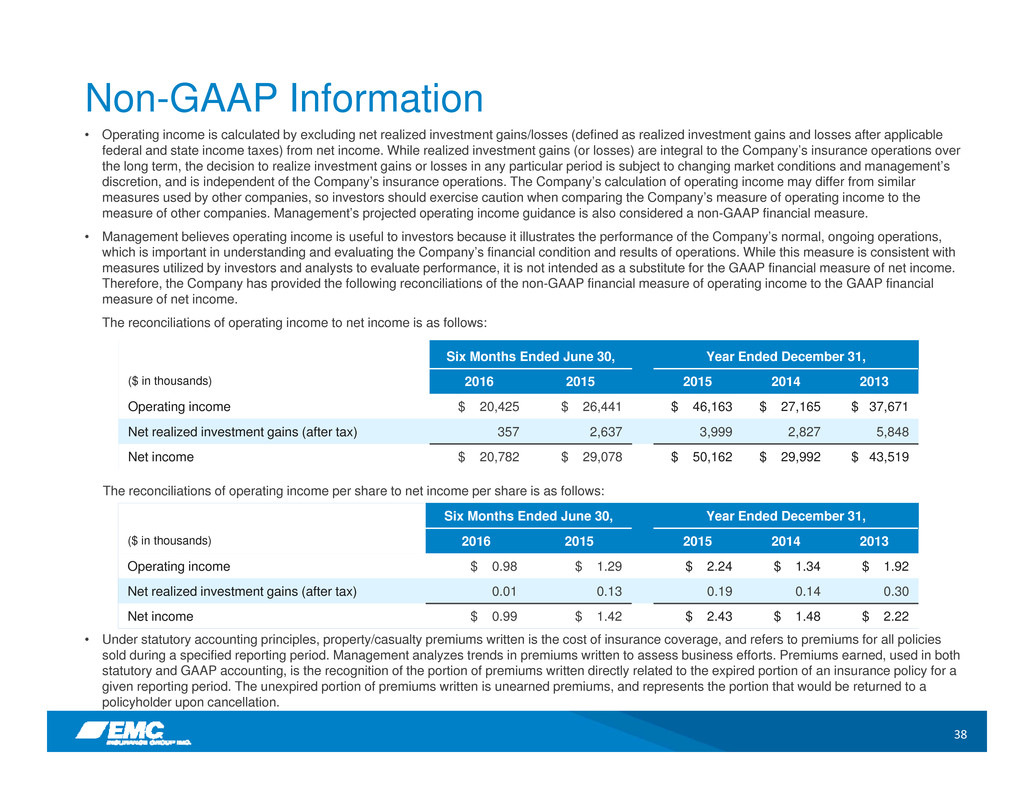

38 Non-GAAP Information • Operating income is calculated by excluding net realized investment gains/losses (defined as realized investment gains and losses after applicable federal and state income taxes) from net income. While realized investment gains (or losses) are integral to the Company’s insurance operations over the long term, the decision to realize investment gains or losses in any particular period is subject to changing market conditions and management’s discretion, and is independent of the Company’s insurance operations. The Company’s calculation of operating income may differ from similar measures used by other companies, so investors should exercise caution when comparing the Company’s measure of operating income to the measure of other companies. Management’s projected operating income guidance is also considered a non-GAAP financial measure. • Management believes operating income is useful to investors because it illustrates the performance of the Company’s normal, ongoing operations, which is important in understanding and evaluating the Company’s financial condition and results of operations. While this measure is consistent with measures utilized by investors and analysts to evaluate performance, it is not intended as a substitute for the GAAP financial measure of net income. Therefore, the Company has provided the following reconciliations of the non-GAAP financial measure of operating income to the GAAP financial measure of net income. The reconciliations of operating income to net income is as follows: Six Months Ended June 30, Year Ended December 31, ($ in thousands) 2016 2015 2015 2014 2013 Operating income $ 20,425 $ 26,441 $ 46,163 $ 27,165 $ 37,671 Net realized investment gains (after tax) 357 2,637 3,999 2,827 5,848 Net income $ 20,782 $ 29,078 $ 50,162 $ 29,992 $ 43,519 Six Months Ended June 30, Year Ended December 31, ($ in thousands) 2016 2015 2015 2014 2013 Operating income $ 0.98 $ 1.29 $ 2.24 $ 1.34 $ 1.92 Net realized investment gains (after tax) 0.01 0.13 0.19 0.14 0.30 Net income $ 0.99 $ 1.42 $ 2.43 $ 1.48 $ 2.22 • Under statutory accounting principles, property/casualty premiums written is the cost of insurance coverage, and refers to premiums for all policies sold during a specified reporting period. Management analyzes trends in premiums written to assess business efforts. Premiums earned, used in both statutory and GAAP accounting, is the recognition of the portion of premiums written directly related to the expired portion of an insurance policy for a given reporting period. The unexpired portion of premiums written is unearned premiums, and represents the portion that would be returned to a policyholder upon cancellation. The reconciliations of operating income per share to net income per share is as follows: