Investor Presentation Second Quarter 2022 Richard P. Smith, President & Chief Executive Officer John S. Fleshood, EVP & Chief Operating Officer Peter G. Wiese, EVP & Chief Financial Officer Exhibit 99.2

Safe Harbor Statement Investor Presentation | Second Quarter 20222 The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There can be no assurance that future developments affecting us will be the same as those anticipated by management. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations on the Company's business condition and financial operating results; the impact of changes in financial services industry policies, laws and regulations; technological changes; weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on economic and business environments in which the Company operates; the continuing adverse impact on the U.S. economy, including the markets in which we operate due to the COVID-19 global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products; adverse developments with respect to U.S. or global economic conditions and other uncertainties, including the impact of supply chain disruptions, inflationary pressures and labor shortages on the economic recovery and our business; the impacts of international hostilities or geopolitical events; the costs or effects of mergers, acquisitions or dispositions we may make, whether we are able to obtain any required governmental approvals in connection with any such mergers, acquisitions or dispositions, and/or our ability to realize the contemplated financial business benefits associated with any such activities; the regulatory and financial impacts associated with exceeding $10 billion in total assets; the ability to execute our business plan in new lending markets; the future operating or financial performance of the Company, including our outlook for future growth and changes in the level of our nonperforming assets and charge-offs; the appropriateness of the allowance for credit losses, including the timing and effects of the implementation of the current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting standards and practices; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; our ability to attract and maintain deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; our noninterest expense and the efficiency ratio; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; the challenges of integrating and retaining key employees; the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber-attacks and the cost to defend against such attacks; change to U.S. tax policies, including our effective income tax rate; the effect of a fall in stock market prices on our brokerage and wealth management businesses; the discontinuation of the London Interbank Offered Rate and other reference rates; and our ability to manage the risks involved in the foregoing. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2021, which has been filed with the Securities and Exchange Commission (the “SEC”) and are available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. We undertake no obligation (and expressly disclaim any such obligation) to update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Investor Presentation | Second Quarter 20223 • Most Recent Quarter Recap • Company Overview • Lending Overview • Deposit Overview • Financials Agenda

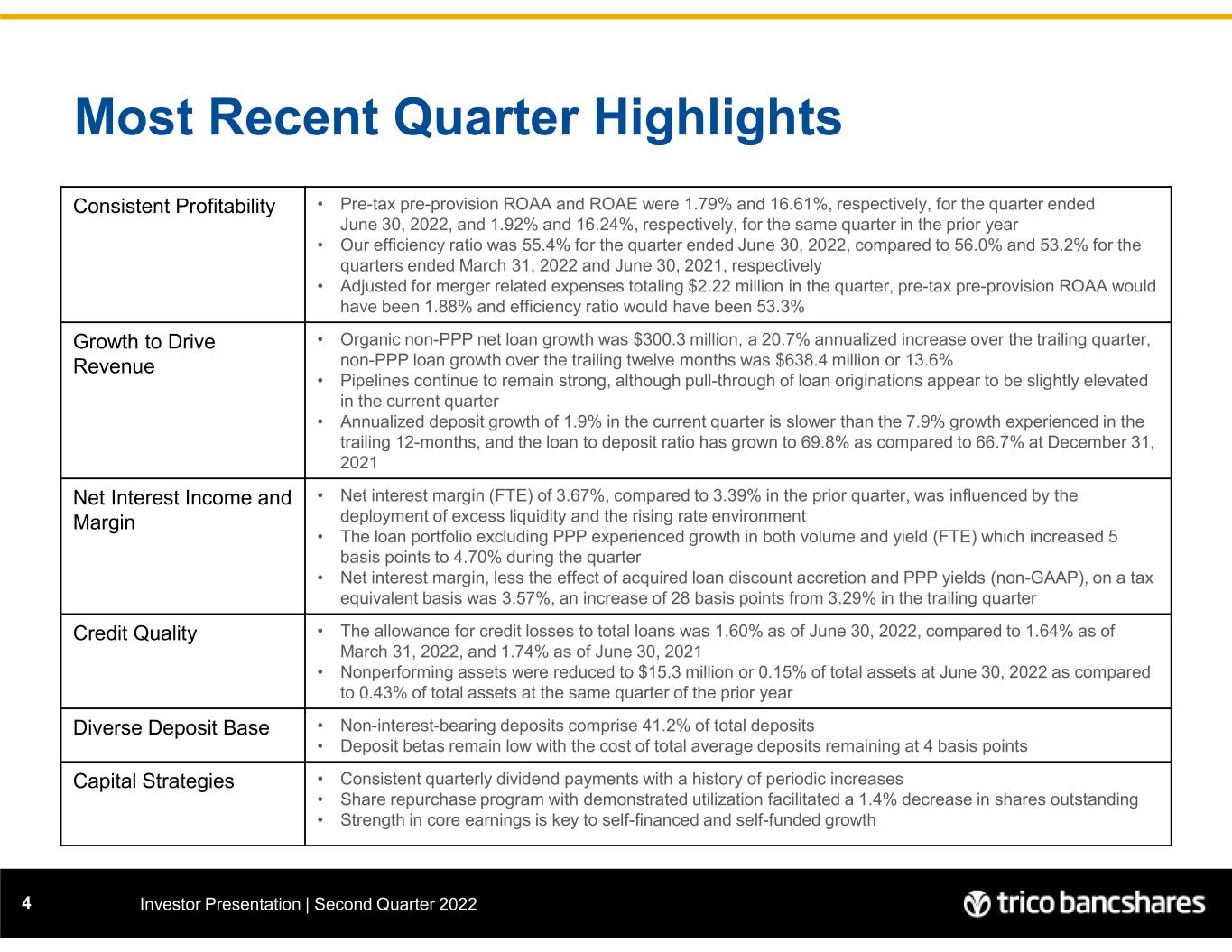

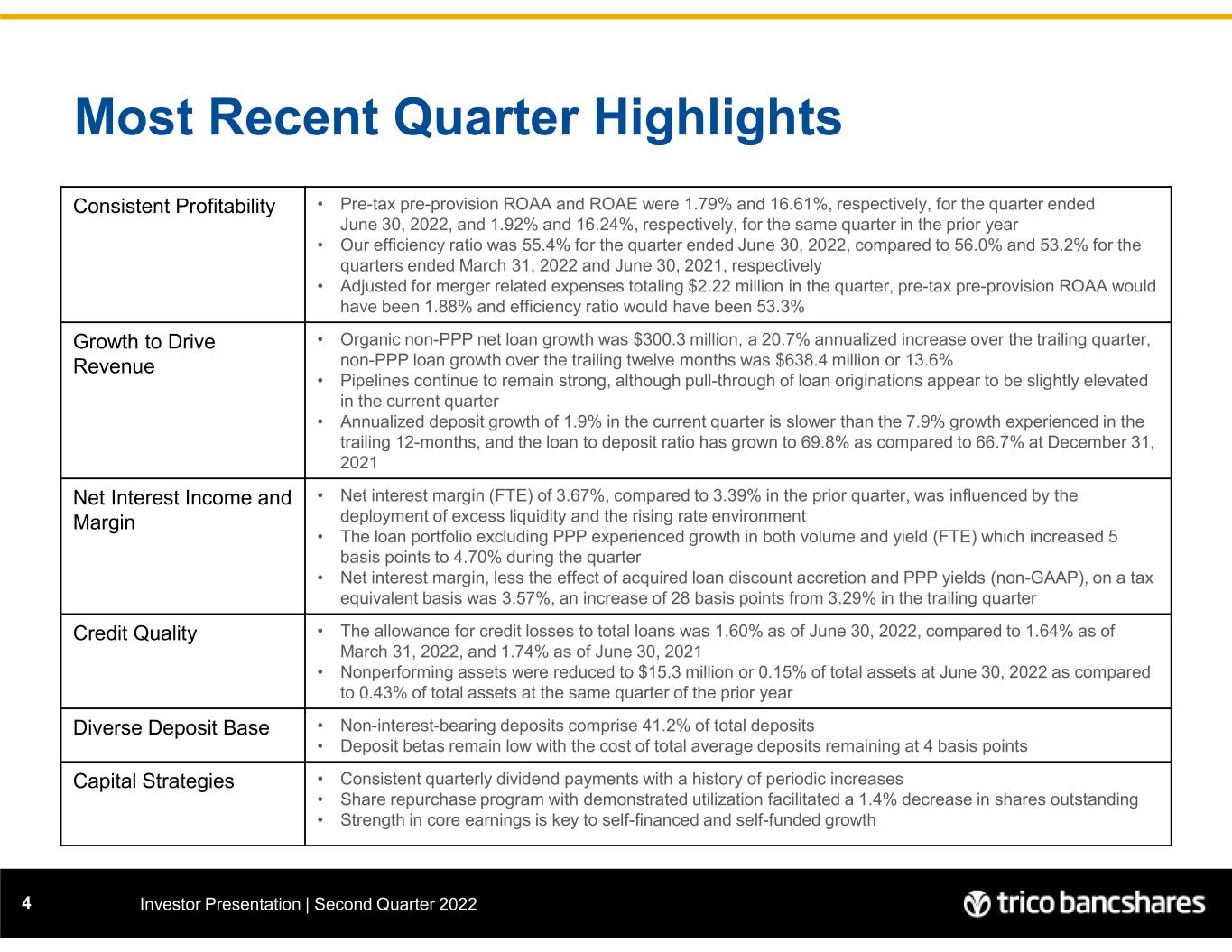

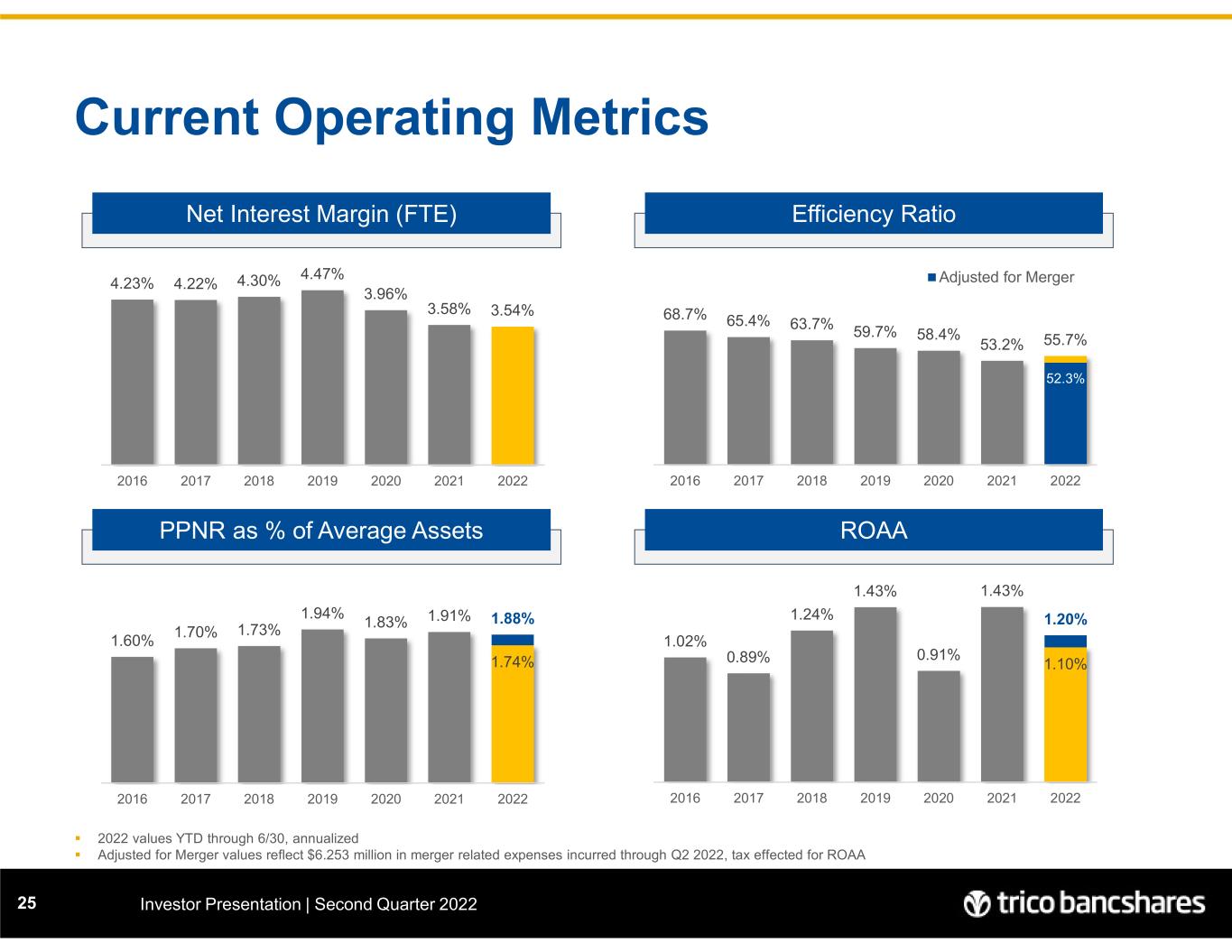

Most Recent Quarter Highlights Investor Presentation | Second Quarter 20224 Consistent Profitability • Pre-tax pre-provision ROAA and ROAE were 1.79% and 16.61%, respectively, for the quarter ended June 30, 2022, and 1.92% and 16.24%, respectively, for the same quarter in the prior year • Our efficiency ratio was 55.4% for the quarter ended June 30, 2022, compared to 56.0% and 53.2% for the quarters ended March 31, 2022 and June 30, 2021, respectively • Adjusted for merger related expenses totaling $2.22 million in the quarter, pre-tax pre-provision ROAA would have been 1.88% and efficiency ratio would have been 53.3% Growth to Drive Revenue • Organic non-PPP net loan growth was $300.3 million, a 20.7% annualized increase over the trailing quarter, non-PPP loan growth over the trailing twelve months was $638.4 million or 13.6% • Pipelines continue to remain strong, although pull-through of loan originations appear to be slightly elevated in the current quarter • Annualized deposit growth of 1.9% in the current quarter is slower than the 7.9% growth experienced in the trailing 12-months, and the loan to deposit ratio has grown to 69.8% as compared to 66.7% at December 31, 2021 Net Interest Income and Margin • Net interest margin (FTE) of 3.67%, compared to 3.39% in the prior quarter, was influenced by the deployment of excess liquidity and the rising rate environment • The loan portfolio excluding PPP experienced growth in both volume and yield (FTE) which increased 5 basis points to 4.70% during the quarter • Net interest margin, less the effect of acquired loan discount accretion and PPP yields (non-GAAP), on a tax equivalent basis was 3.57%, an increase of 28 basis points from 3.29% in the trailing quarter Credit Quality • The allowance for credit losses to total loans was 1.60% as of June 30, 2022, compared to 1.64% as of March 31, 2022, and 1.74% as of June 30, 2021 • Nonperforming assets were reduced to $15.3 million or 0.15% of total assets at June 30, 2022 as compared to 0.43% of total assets at the same quarter of the prior year Diverse Deposit Base • Non-interest-bearing deposits comprise 41.2% of total deposits • Deposit betas remain low with the cost of total average deposits remaining at 4 basis points Capital Strategies • Consistent quarterly dividend payments with a history of periodic increases • Share repurchase program with demonstrated utilization facilitated a 1.4% decrease in shares outstanding • Strength in core earnings is key to self-financed and self-funded growth

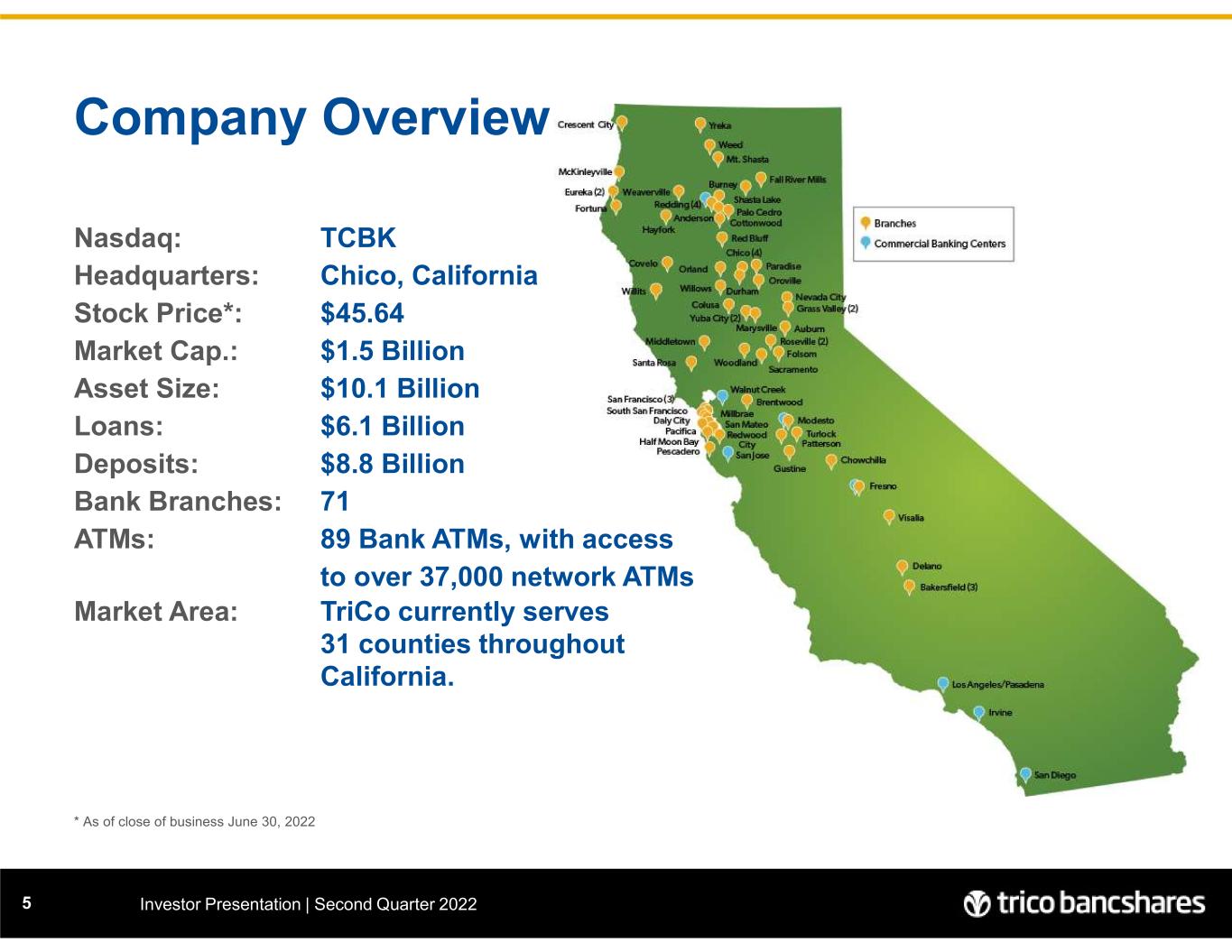

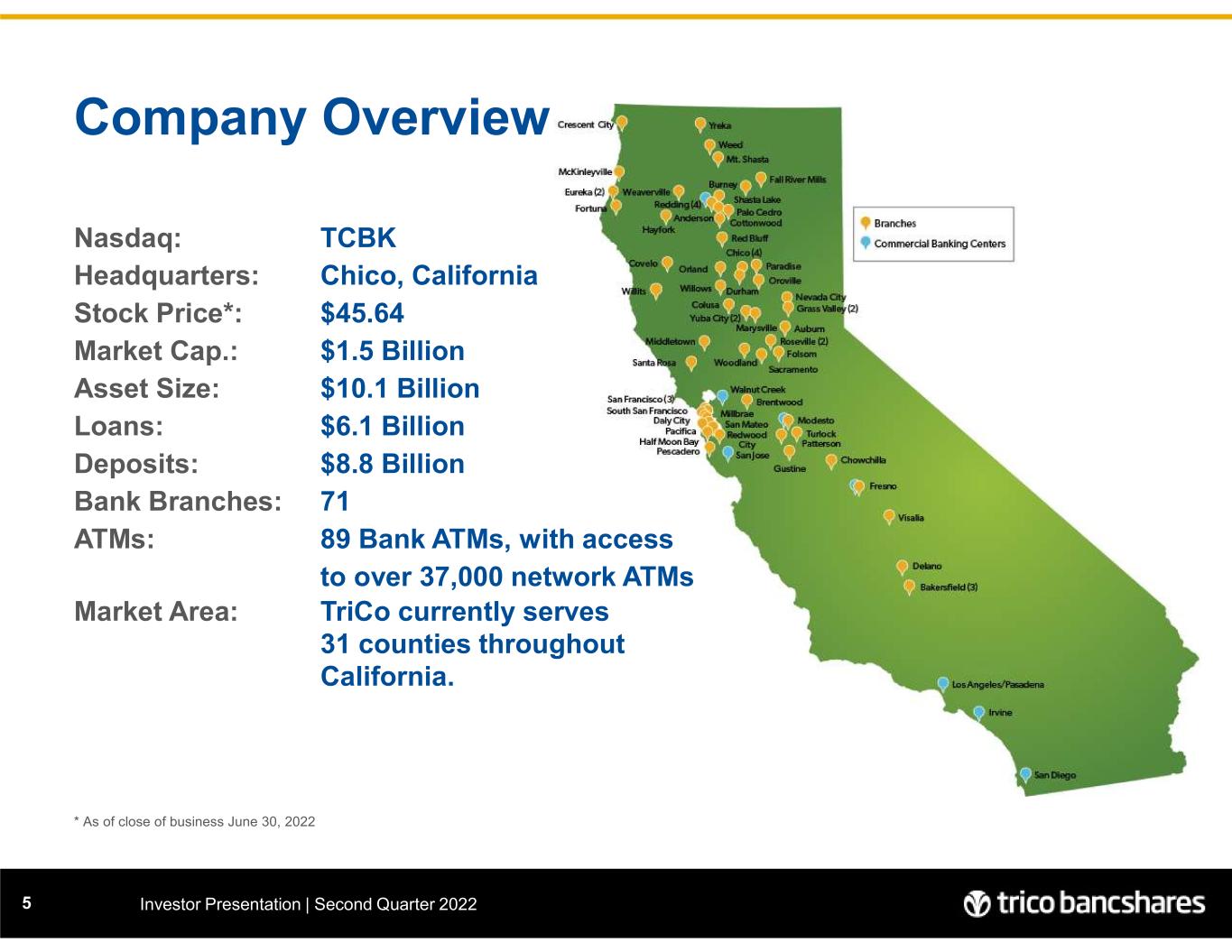

Company Overview Investor Presentation | Second Quarter 20225 Nasdaq: TCBK Headquarters: Chico, California Stock Price*: $45.64 Market Cap.: $1.5 Billion Asset Size: $10.1 Billion Loans: $6.1 Billion Deposits: $8.8 Billion Bank Branches: 71 ATMs: 89 Bank ATMs, with access to over 37,000 network ATMs Market Area: TriCo currently serves 31 counties throughout California. * As of close of business June 30, 2022

Executive Team Investor Presentation | Second Quarter 20226 Rick Smith President & CEO TriCo since 1993 John Fleshood EVP Chief Operating Officer TriCo since 2016 Dan Bailey EVP Chief Banking Officer TriCo since 2007 Craig Carney EVP Chief Credit Officer TriCo since 1996 Peter Wiese EVP Chief Financial Officer TriCo since 2018 Judi Giem SVP Chief HR Officer TriCo since 2020 Greg Gehlmann SVP General Counsel TriCo since 2017

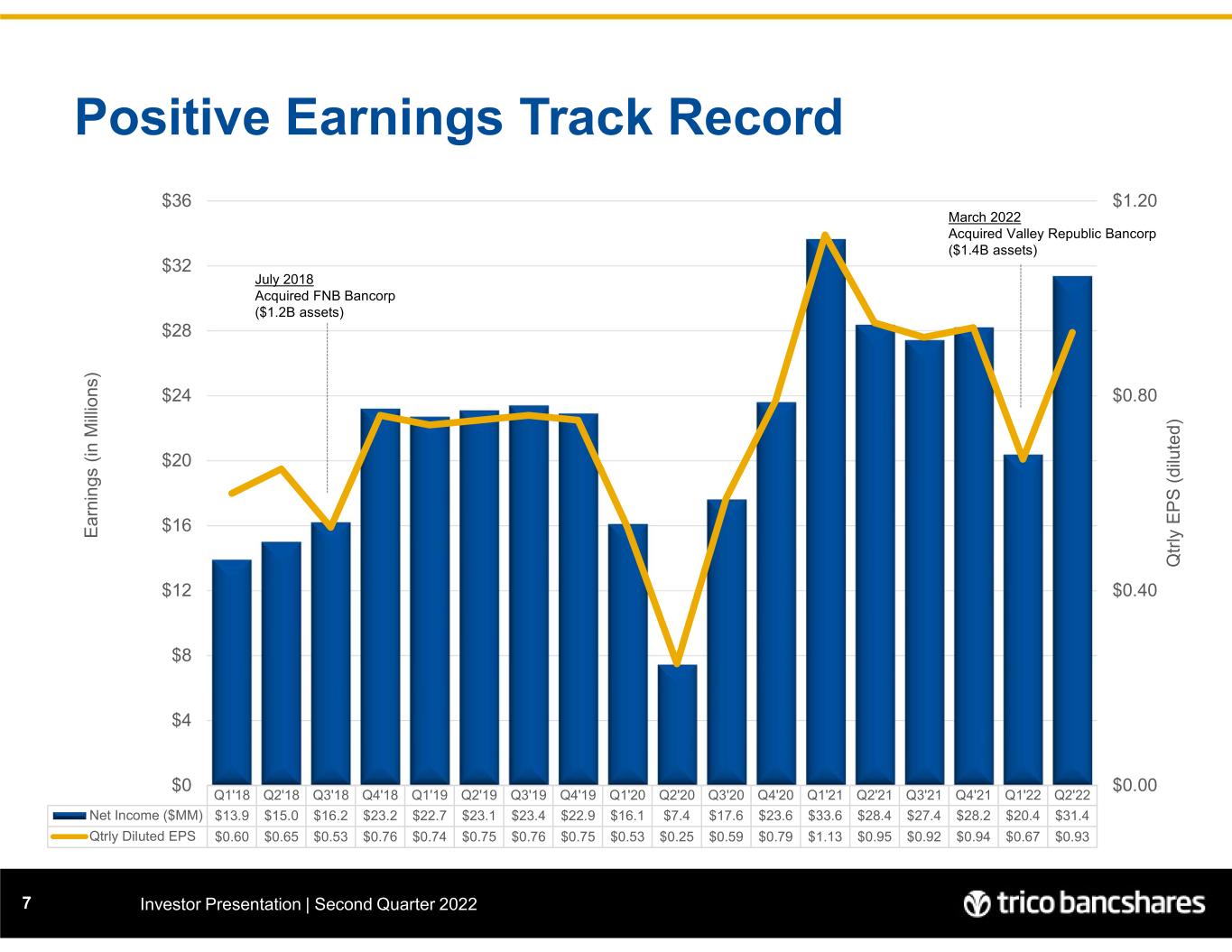

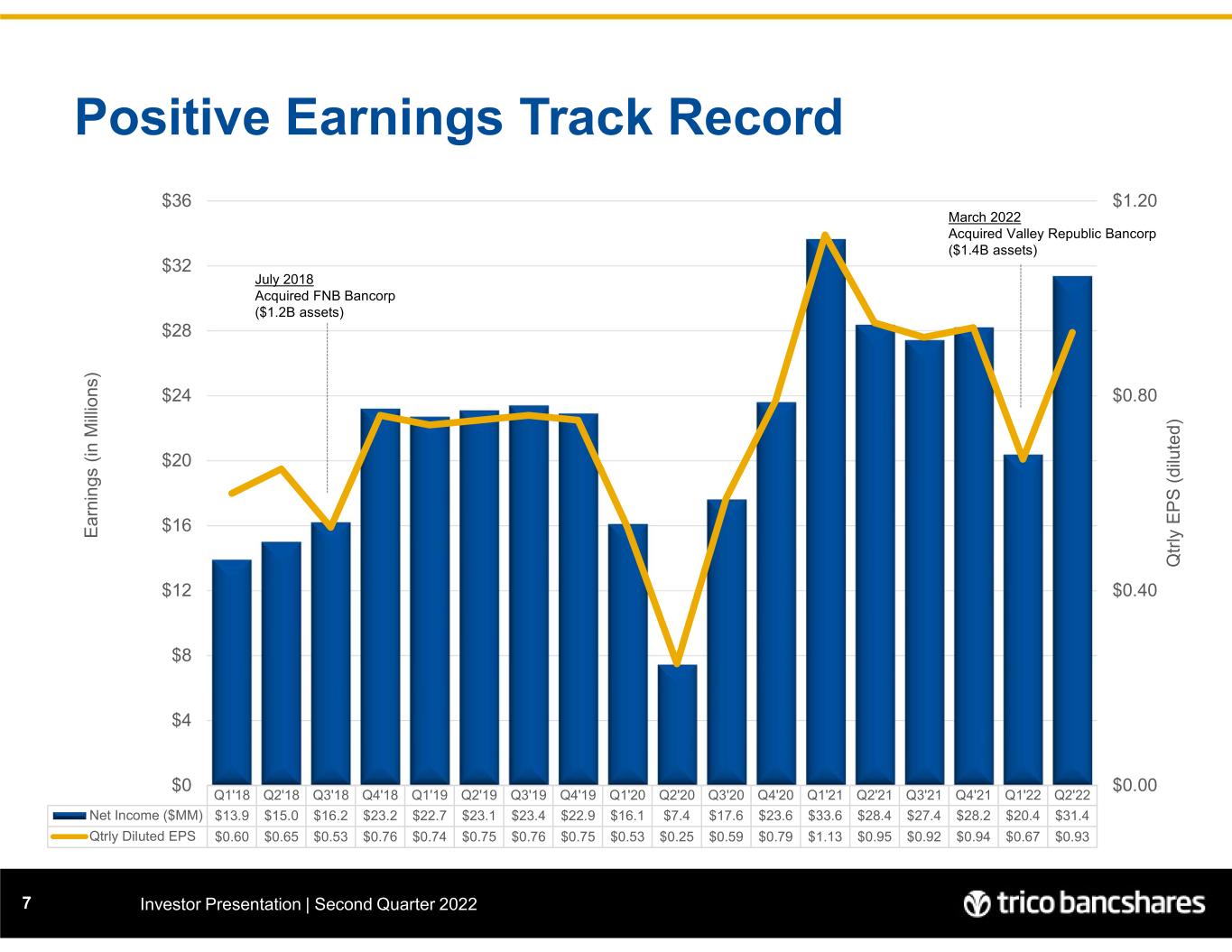

Positive Earnings Track Record Investor Presentation | Second Quarter 20227 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Net Income ($MM) $13.9 $15.0 $16.2 $23.2 $22.7 $23.1 $23.4 $22.9 $16.1 $7.4 $17.6 $23.6 $33.6 $28.4 $27.4 $28.2 $20.4 $31.4 Qtrly Diluted EPS $0.60 $0.65 $0.53 $0.76 $0.74 $0.75 $0.76 $0.75 $0.53 $0.25 $0.59 $0.79 $1.13 $0.95 $0.92 $0.94 $0.67 $0.93 $0.00 $0.40 $0.80 $1.20 $0 $4 $8 $12 $16 $20 $24 $28 $32 $36 Q tr ly E P S ( di lu te d) E ar ni n gs ( in M ill io ns ) July 2018 Acquired FNB Bancorp ($1.2B assets) March 2022 Acquired Valley Republic Bancorp ($1.4B assets)

Shareholder Returns Investor Presentation | Second Quarter 20228 Dividends per Share: 10.6% CAGR* Dividends as % of Earnings Return on Avg. Shareholder Equity Diluted EPS $0.15 $0.15 $0.17 $0.19 $0.22 $0.25 $0.25 $0.15 $0.17 $0.17 $0.19 $0.22 $0.25 $0.25 $0.15 $0.17 $0.17 $0.22 $0.22 $0.25 $0.15 $0.17 $0.19 $0.22 $0.22 $0.25 $0.60 $0.66 $0.70 $0.82 $0.88 $1.00 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 2016 2017 2018 2019 2020 2021 2022 Q1 Q2 Q3 Q4 31% 37% 27% 27% 41% 25% 31% 2016 2017 2018 2019 2020 2021 2022 $0.46 $0.52 $0.60 $0.74 $0.53 $1.13 $0.67 $0.41 $0.58 $0.65 $0.75 $0.25 $0.95 $0.93 $0.53 $0.51 $0.53 $0.76 $0.59 $0.92 $0.54 $0.76 $0.75 $0.79 $0.94 $1.94 $1.74 $2.54 $3.00 $2.16 $3.94 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 2016 2017 2018 2019 2020 2021 2022 Q1 Q2 Q3 Q4 9.47% 8.10% 10.75% 10.49% 7.18% 12.10% 9.93% 2016 2017 2018 2019 2020 2021 2022

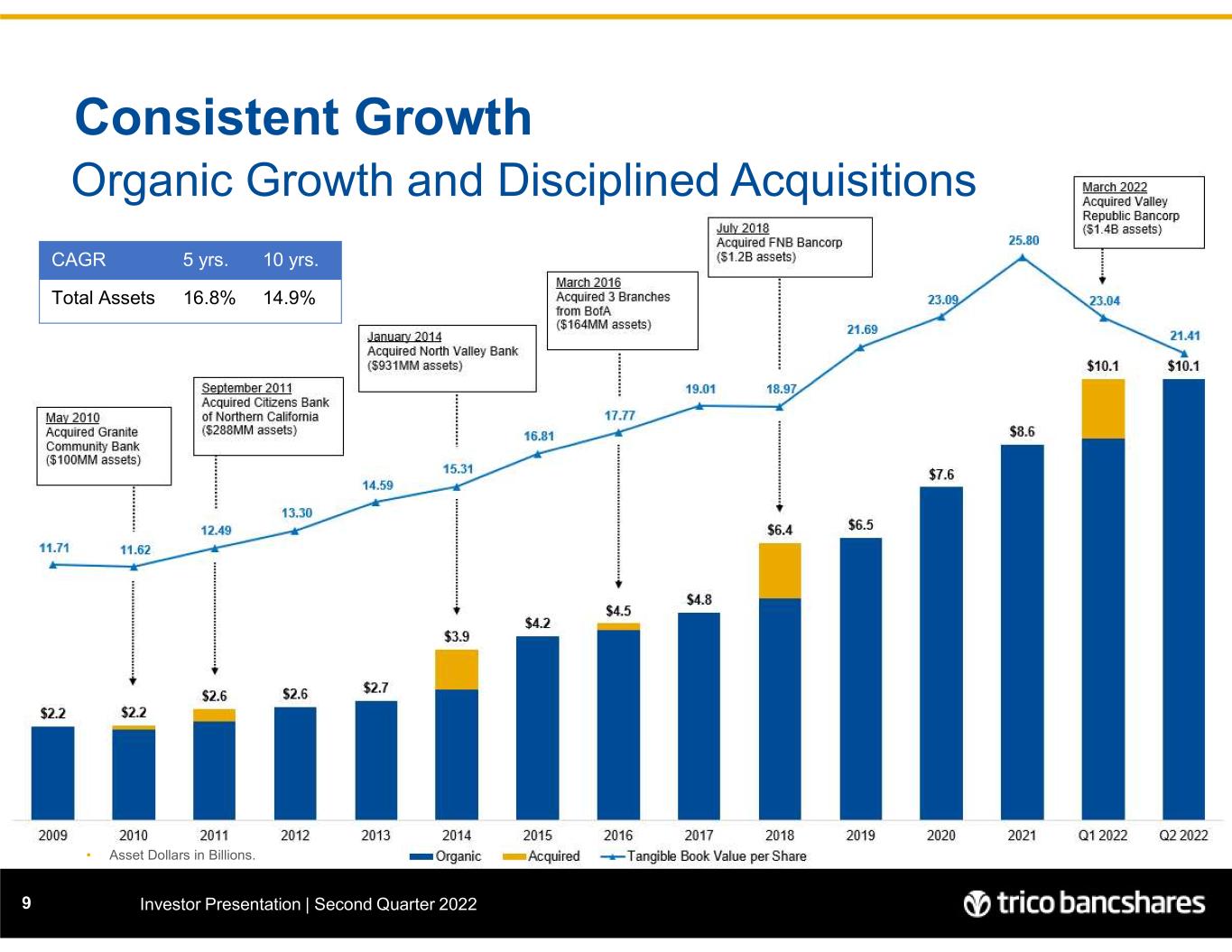

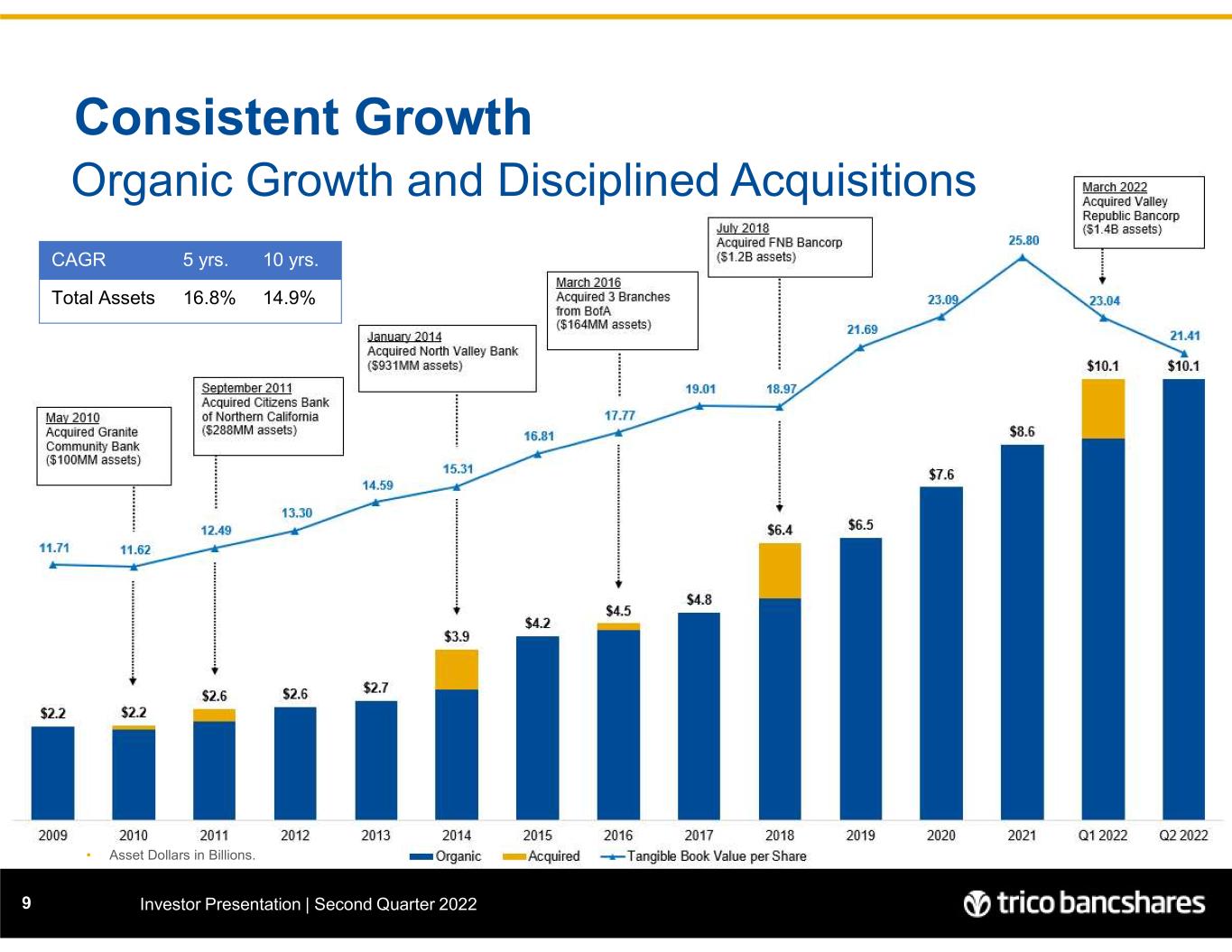

Consistent Growth Investor Presentation | Second Quarter 20229 CAGR 5 yrs. 10 yrs. Total Assets 16.8% 14.9% Organic Growth and Disciplined Acquisitions • Asset Dollars in Billions.

Investor Presentation | Second Quarter 2022 Loans and Credit Quality 1010

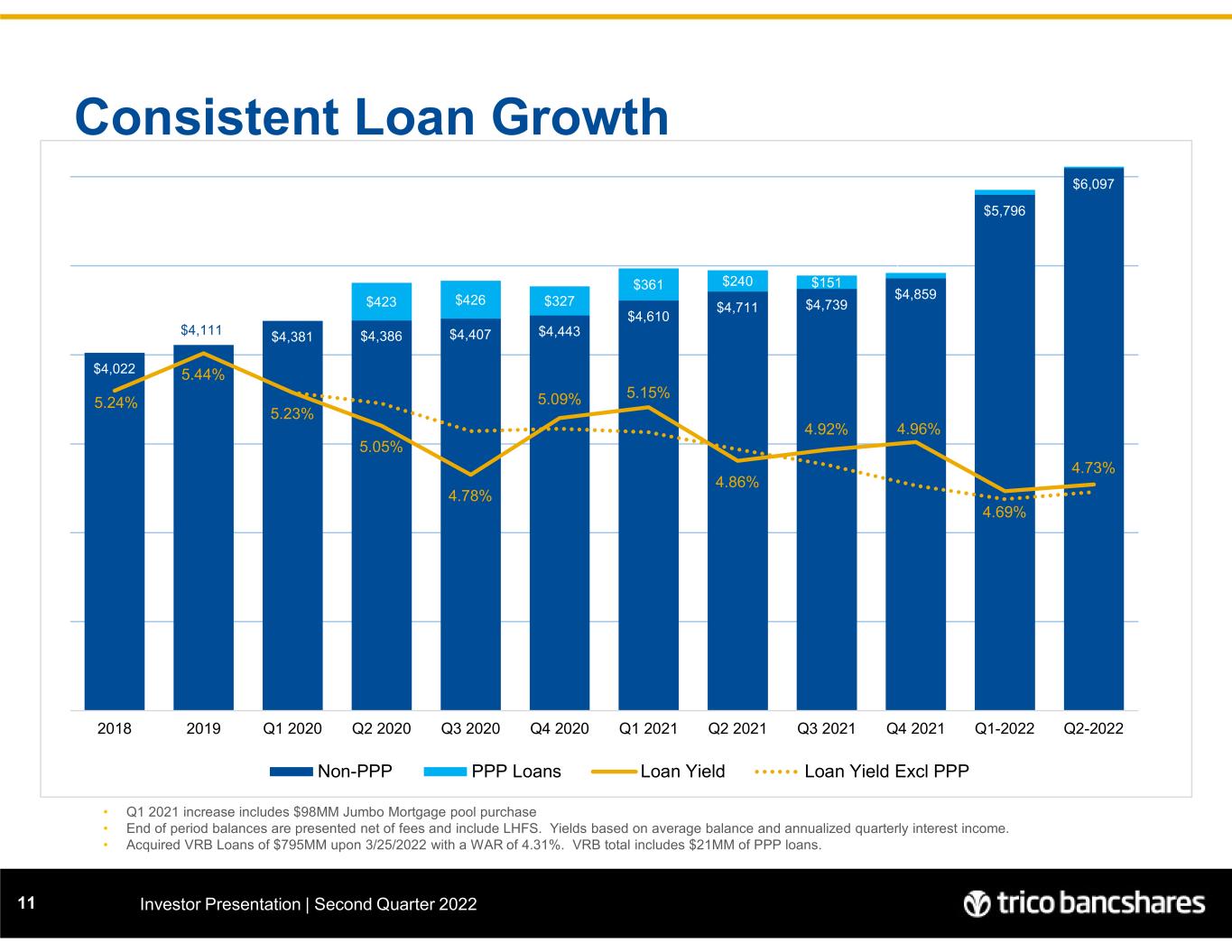

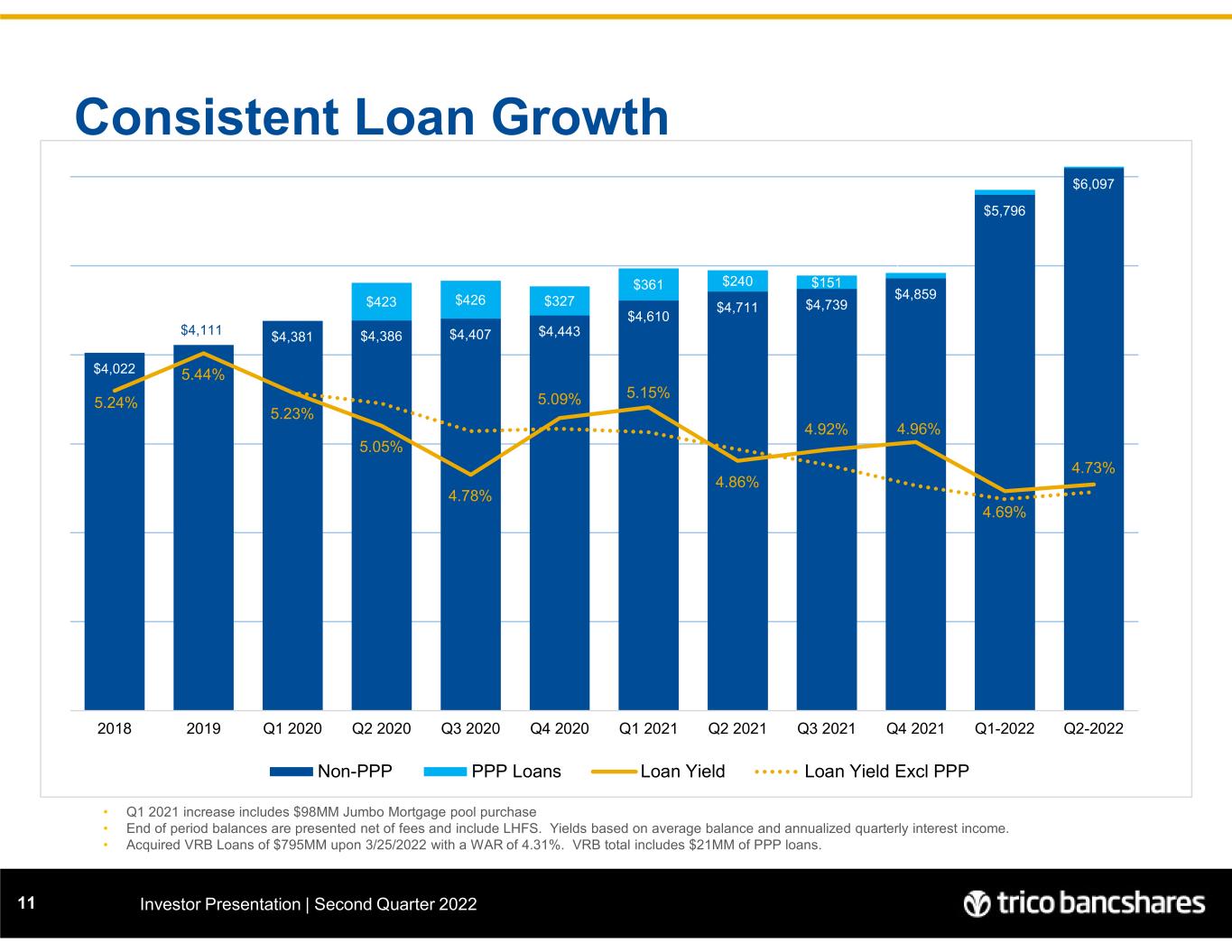

Consistent Loan Growth Investor Presentation | Second Quarter 202211 • Q1 2021 increase includes $98MM Jumbo Mortgage pool purchase • End of period balances are presented net of fees and include LHFS. Yields based on average balance and annualized quarterly interest income. • Acquired VRB Loans of $795MM upon 3/25/2022 with a WAR of 4.31%. VRB total includes $21MM of PPP loans. $4,022 $4,111 $4,381 $4,386 $4,407 $4,443 $4,610 $4,711 $4,739 $4,859 $5,796 $6,097 $423 $426 $327 $361 $240 $151 $61 5.24% 5.44% 5.23% 5.05% 4.78% 5.09% 5.15% 4.86% 4.92% 4.96% 4.69% 4.73% 3.50% 4.50% 5.50% 6.50% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2018 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1-2022 Q2-2022 Non-PPP PPP Loans Loan Yield Loan Yield Excl PPP

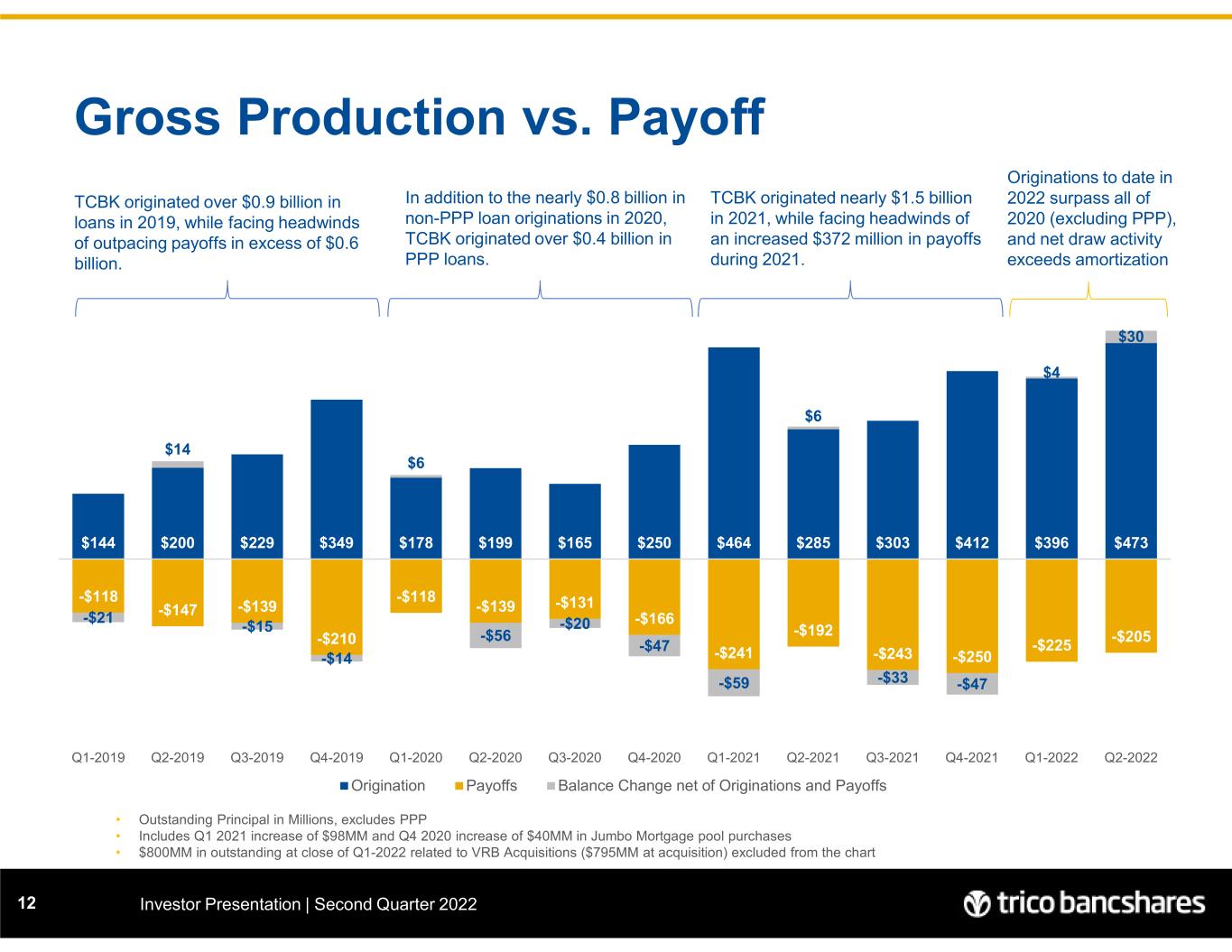

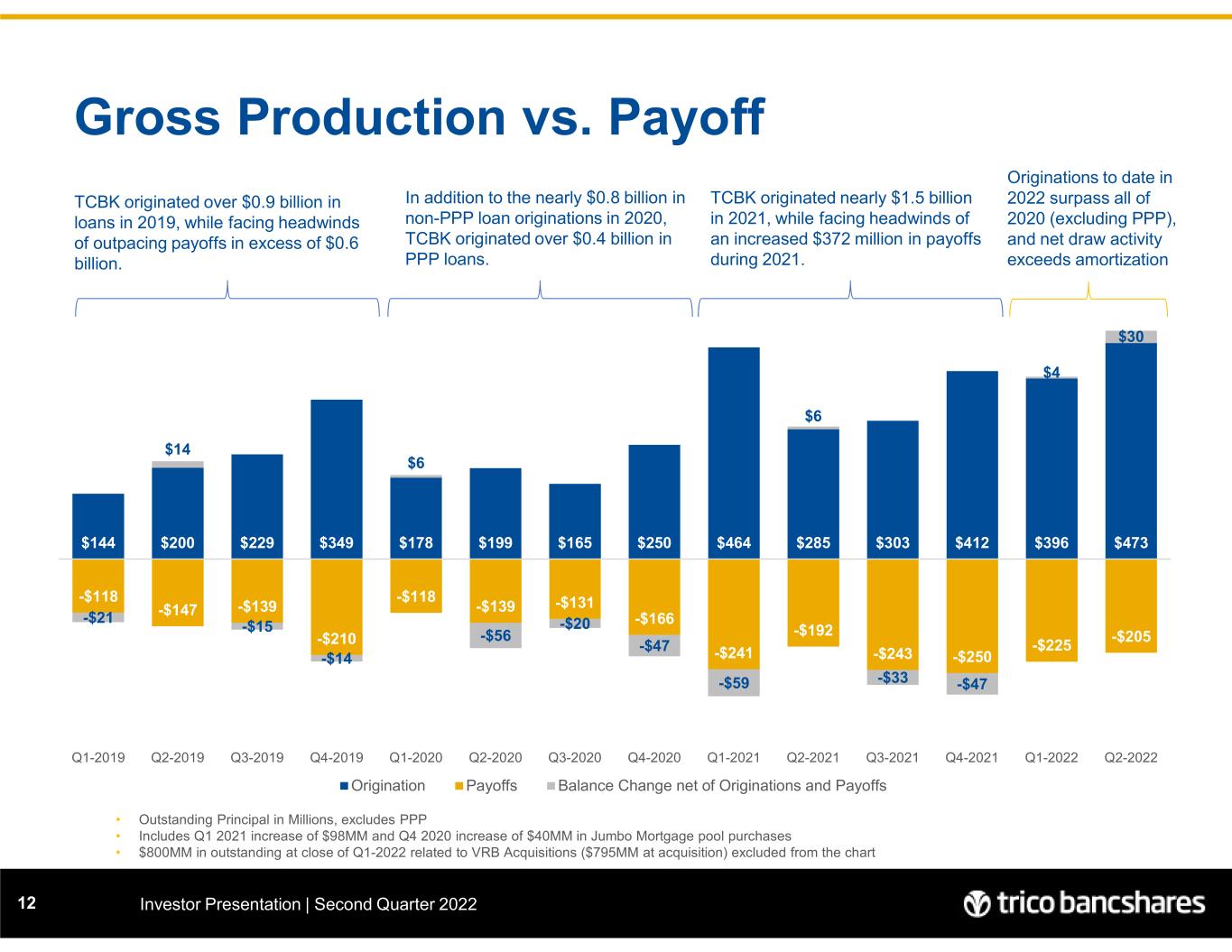

Gross Production vs. Payoff Investor Presentation | Second Quarter 202212 • Outstanding Principal in Millions, excludes PPP • Includes Q1 2021 increase of $98MM and Q4 2020 increase of $40MM in Jumbo Mortgage pool purchases • $800MM in outstanding at close of Q1-2022 related to VRB Acquisitions ($795MM at acquisition) excluded from the chart TCBK originated nearly $1.5 billion in 2021, while facing headwinds of an increased $372 million in payoffs during 2021. In addition to the nearly $0.8 billion in non-PPP loan originations in 2020, TCBK originated over $0.4 billion in PPP loans. TCBK originated over $0.9 billion in loans in 2019, while facing headwinds of outpacing payoffs in excess of $0.6 billion. $144 $200 $229 $349 $178 $199 $165 $250 $464 $285 $303 $412 $396 $473 -$118 -$147 -$139 -$210 -$118 -$139 -$131 -$166 -$241 -$192 -$243 -$250 -$225 -$205 -$21 $14 -$15 -$14 $6 -$56 -$20 -$47 -$59 $6 -$33 -$47 $4 $30 Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 Q2-2020 Q3-2020 Q4-2020 Q1-2021 Q2-2021 Q3-2021 Q4-2021 Q1-2022 Q2-2022 Origination Payoffs Balance Change net of Originations and Payoffs Originations to date in 2022 surpass all of 2020 (excluding PPP), and net draw activity exceeds amortization

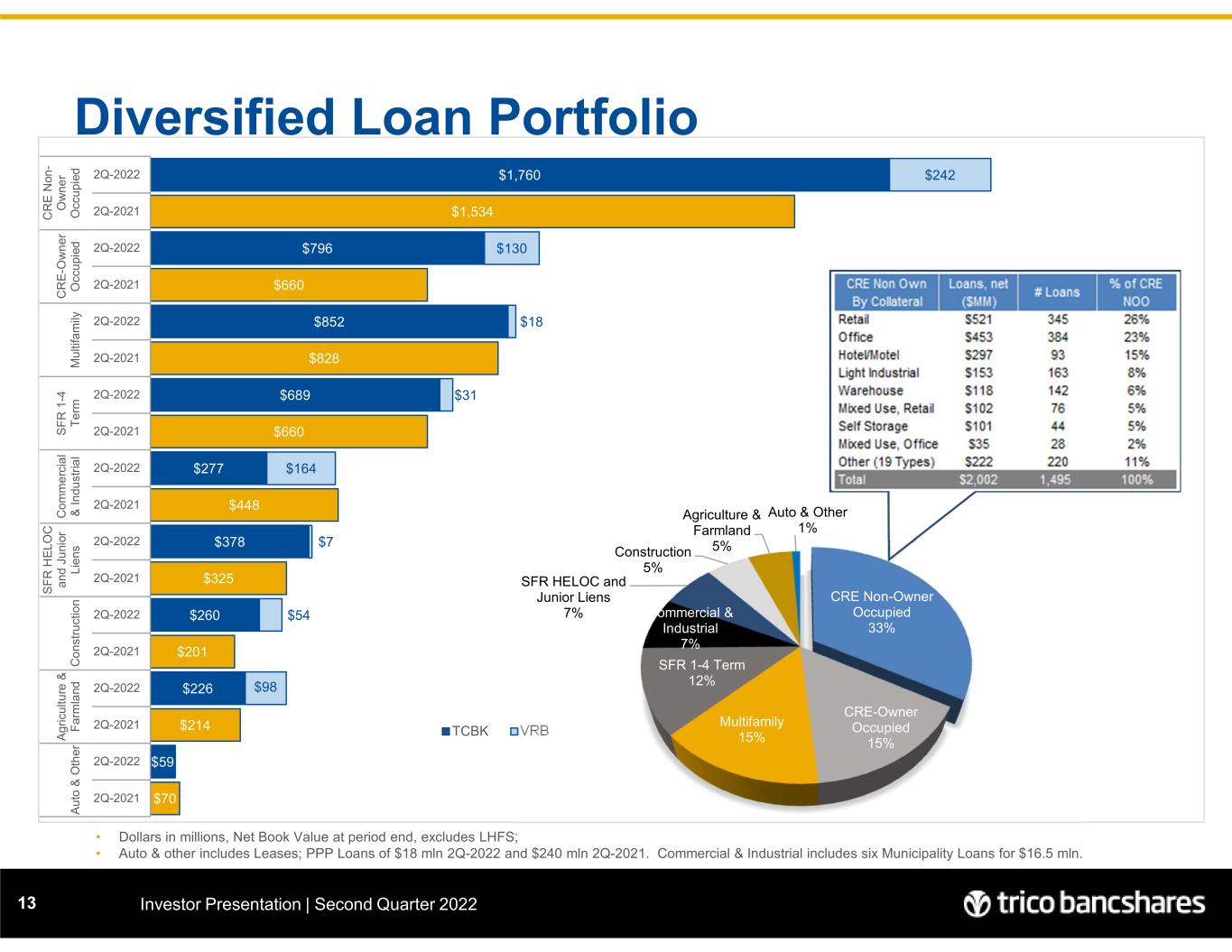

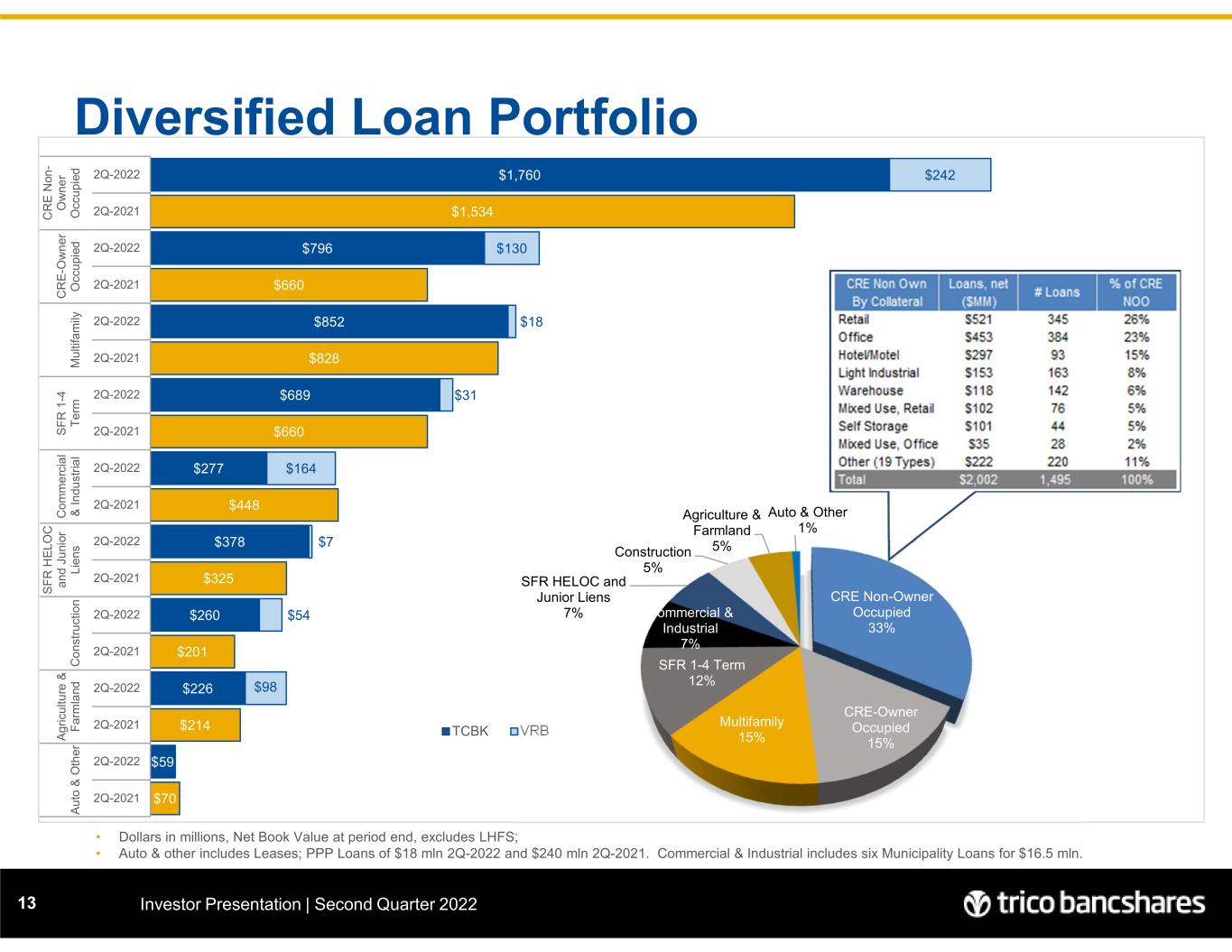

$1,760 $1,534 $796 $660 $852 $828 $689 $660 $277 $448 $378 $325 $260 $201 $226 $214 $59 $70 $242 $130 $18 $31 $164 $7 $54 $98 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 C R E N on - O w n e r O cc u pi ed C R E -O w n e r O cc u pi ed M u lti fa m ily S F R 1 -4 T e rm C o m m e rc ia l & In d u st ri a l S F R H E L O C a nd J u ni or L ie ns C o n st ru ct io n A g ric u ltu re & F a rm la nd A u to & O th e r TCBK VRB Diversified Loan Portfolio Investor Presentation | Second Quarter 202213 • Dollars in millions, Net Book Value at period end, excludes LHFS; • Auto & other includes Leases; PPP Loans of $18 mln 2Q-2022 and $240 mln 2Q-2021. Commercial & Industrial includes six Municipality Loans for $16.5 mln. CRE Non-Owner Occupied 33% CRE-Owner Occupied 15% Multifamily 15% SFR 1-4 Term 12% Commercial & Industrial 7% SFR HELOC and Junior Liens 7% Construction 5% Agriculture & Farmland 5% Auto & Other 1%

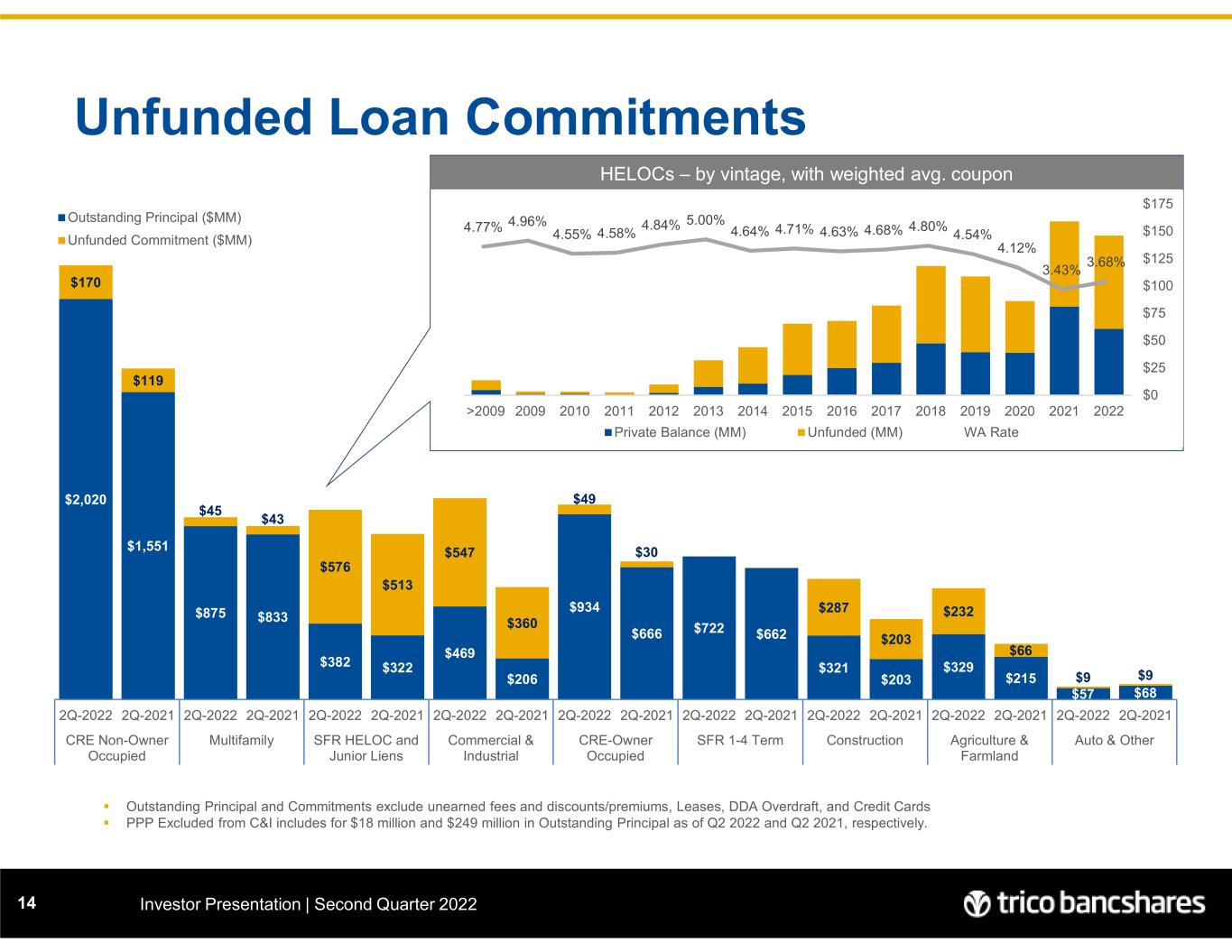

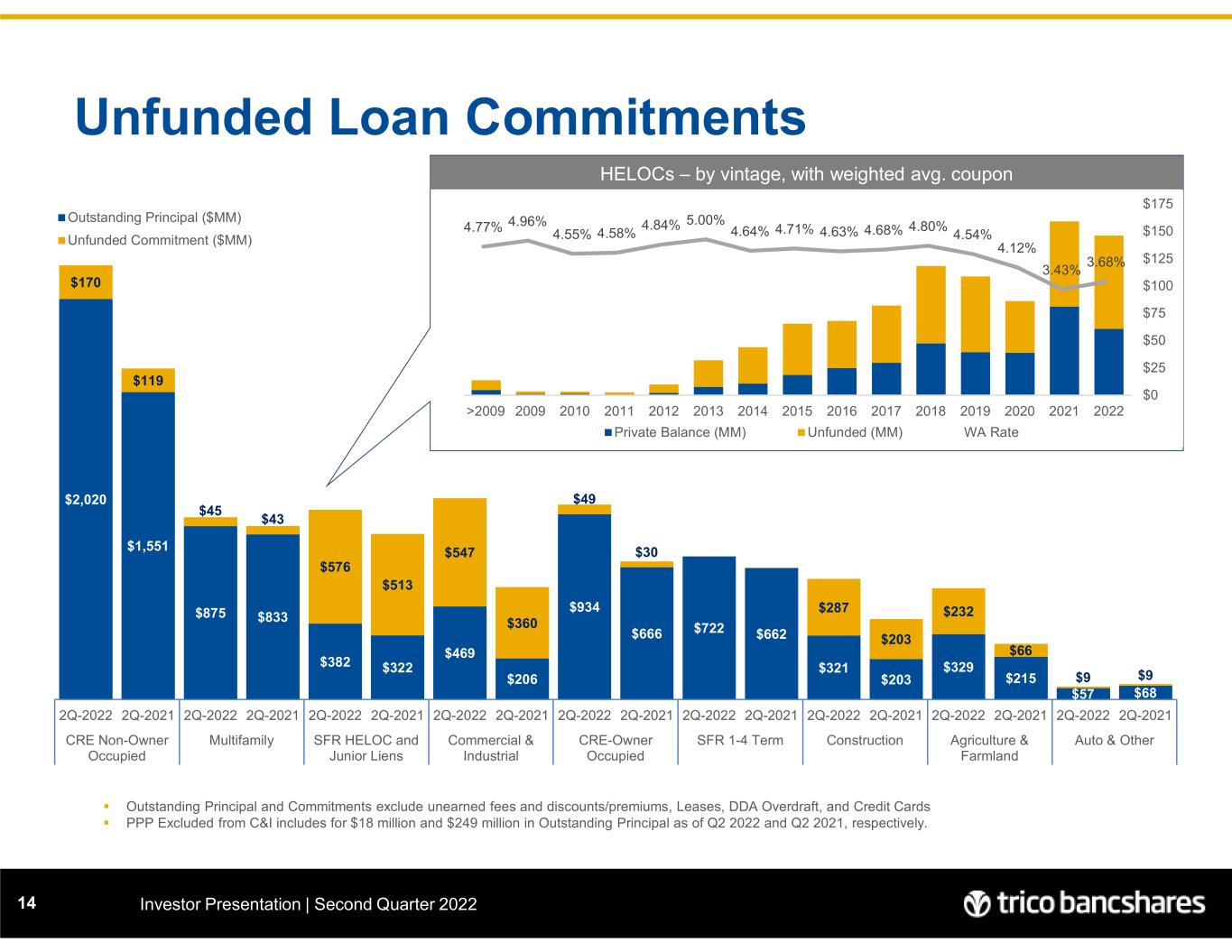

$2,020 $1,551 $875 $833 $382 $322 $469 $206 $934 $666 $722 $662 $321 $203 $329 $215 $57 $68 $170 $119 $45 $43 $576 $513 $547 $360 $49 $30 $287 $203 $232 $66 $9 $9 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 2Q-2022 2Q-2021 CRE Non-Owner Occupied Multifamily SFR HELOC and Junior Liens Commercial & Industrial CRE-Owner Occupied SFR 1-4 Term Construction Agriculture & Farmland Auto & Other Outstanding Principal ($MM) Unfunded Commitment ($MM) Unfunded Loan Commitments Investor Presentation | Second Quarter 202214 HELOCs – by vintage, with weighted avg. coupon Outstanding Principal and Commitments exclude unearned fees and discounts/premiums, Leases, DDA Overdraft, and Credit Cards PPP Excluded from C&I includes for $18 million and $249 million in Outstanding Principal as of Q2 2022 and Q2 2021, respectively. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $0 $25 $50 $75 $100 $125 $150 $175 20222021202020192018201720162015201420132012201120102009>2009 Private Balance (MM) Unfunded (MM) WA Rate 3.68% 3.43% 4.12% 4.54% 4.80%4.68%4.63%4.71%4.64% 5.00%4.84% 4.58%4.55% 4.96%4.77%

$98 $37 $54 $59 $42 $53 $28 $13 $10 $82$82 $115 $90 $45 $49 $36 $13 $22 $24 $70 54% 25% 37% 57% 46% 60% 68% 36% 31% 54% 0% 2000% 4000% 6000% 8000% 10000% 12000% 14000% 16000% 18000% 20000% Oil & Gas Extraction Construction Consumer Real Estate Wholesale Finance and Insurance Trans and Warehouse Healthcare Retail Trade Other (13 Categories) Outstanding (mln) Unfunded (mln) C&I Utilization Investor Presentation | Second Quarter 202215 Excludes PPP loans; Outstanding Principal excludes unearned fees and discounts/premiums ($ millions) • Benefits of the VRB merger include increased actual and potential utilization rate and balance growth • Treasury management service integration is key to most of these relationships C&I Utilization by NAICS Industry: 2Q-2022 $247 $262 $208 $205 $197 $187 $206 $186 $191 $448 $469 $254 $235 $265 $273 $372 $384 $360 $353 $339 $552 $547 49.3% 52.7% 44.0% 42.9% 34.5% 32.7% 36.4% 34.5% 36.0% 44.8% 45.8% 0% 10% 20% 30% 40% 50% 60% $0 $200 $400 $600 $800 $1,000 $1,200 4Q-2019 1Q-2020 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 Outstanding Principal ($MM) Unfunded Commitment Utilization

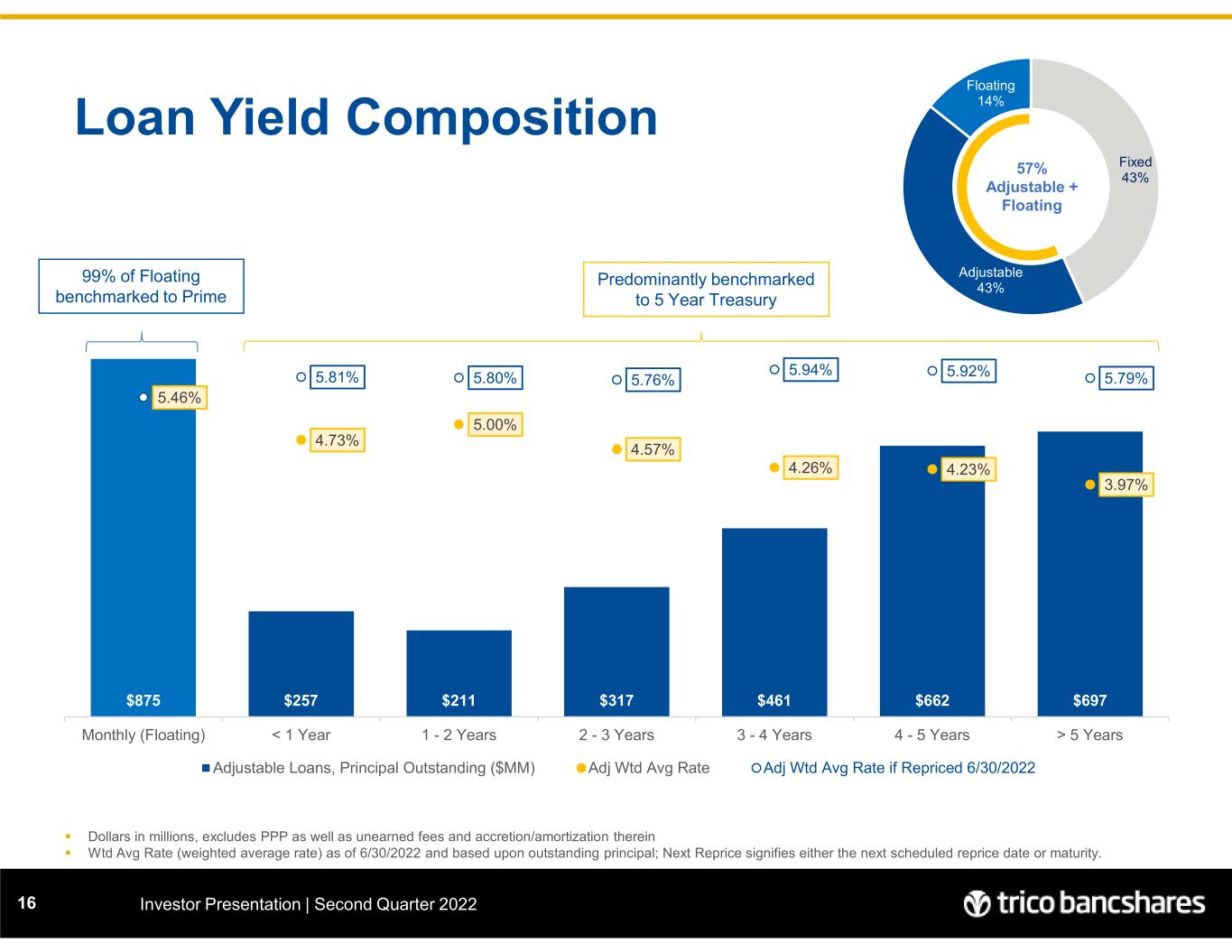

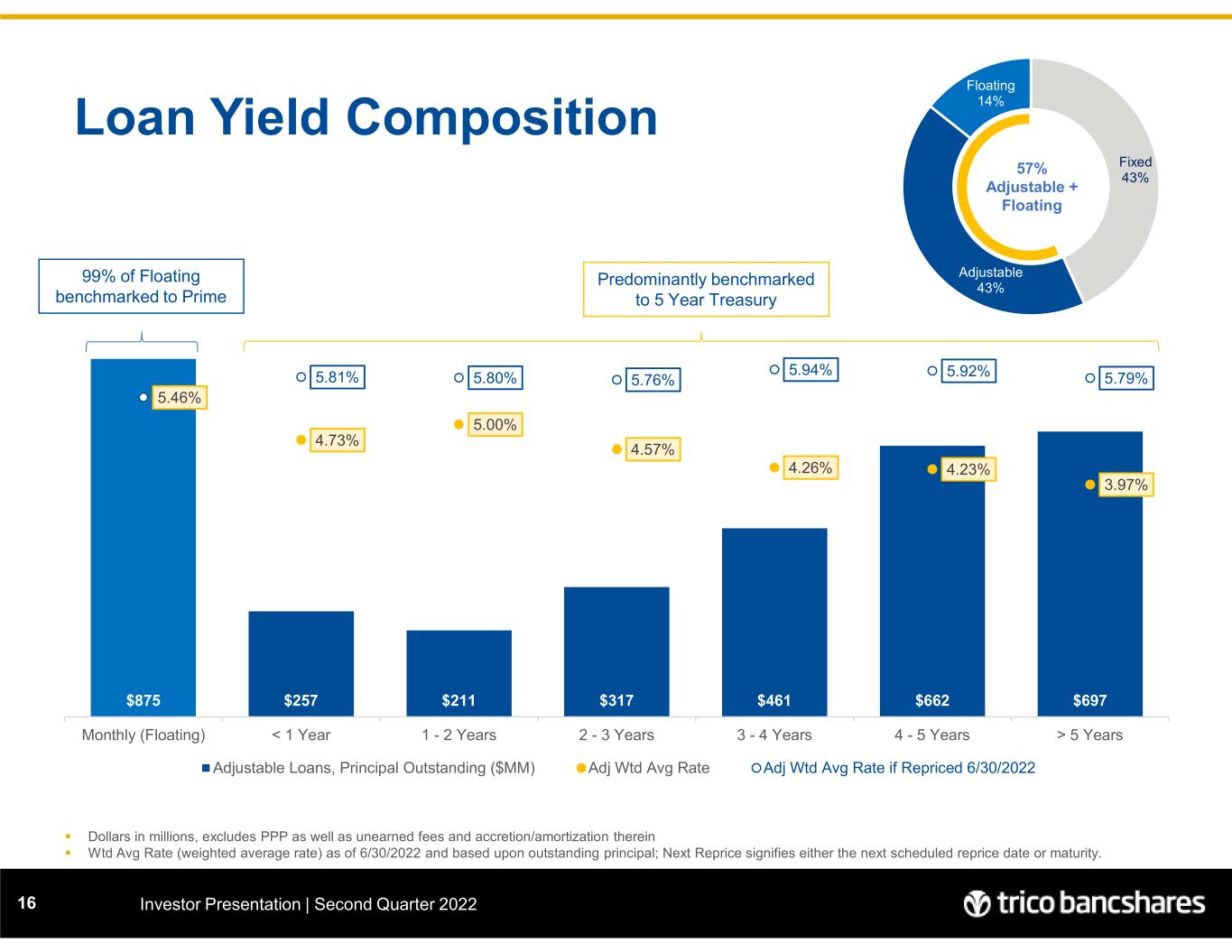

$875 $257 $211 $317 $461 $662 $697 5.46% 4.73% 5.00% 4.57% 4.26% 4.23% 3.97% 5.81% 5.80% 5.76% 5.94% 5.92% 5.79% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% - 100 200 300 400 500 600 700 800 900 1,000 Monthly (Floating) < 1 Year 1 - 2 Years 2 - 3 Years 3 - 4 Years 4 - 5 Years > 5 Years Adjustable Loans, Principal Outstanding ($MM) Adj Wtd Avg Rate Adj Wtd Avg Rate if Repriced 6/30/2022 Loan Yield Composition Investor Presentation | Second Quarter 202216 Dollars in millions, excludes PPP as well as unearned fees and accretion/amortization therein Wtd Avg Rate (weighted average rate) as of 6/30/2022 and based upon outstanding principal; Next Reprice signifies either the next scheduled reprice date or maturity. 99% of Floating benchmarked to Prime Predominantly benchmarked to 5 Year Treasury Fixed 43% Adjustable 43% Floating 14% 57% Adjustable + Floating

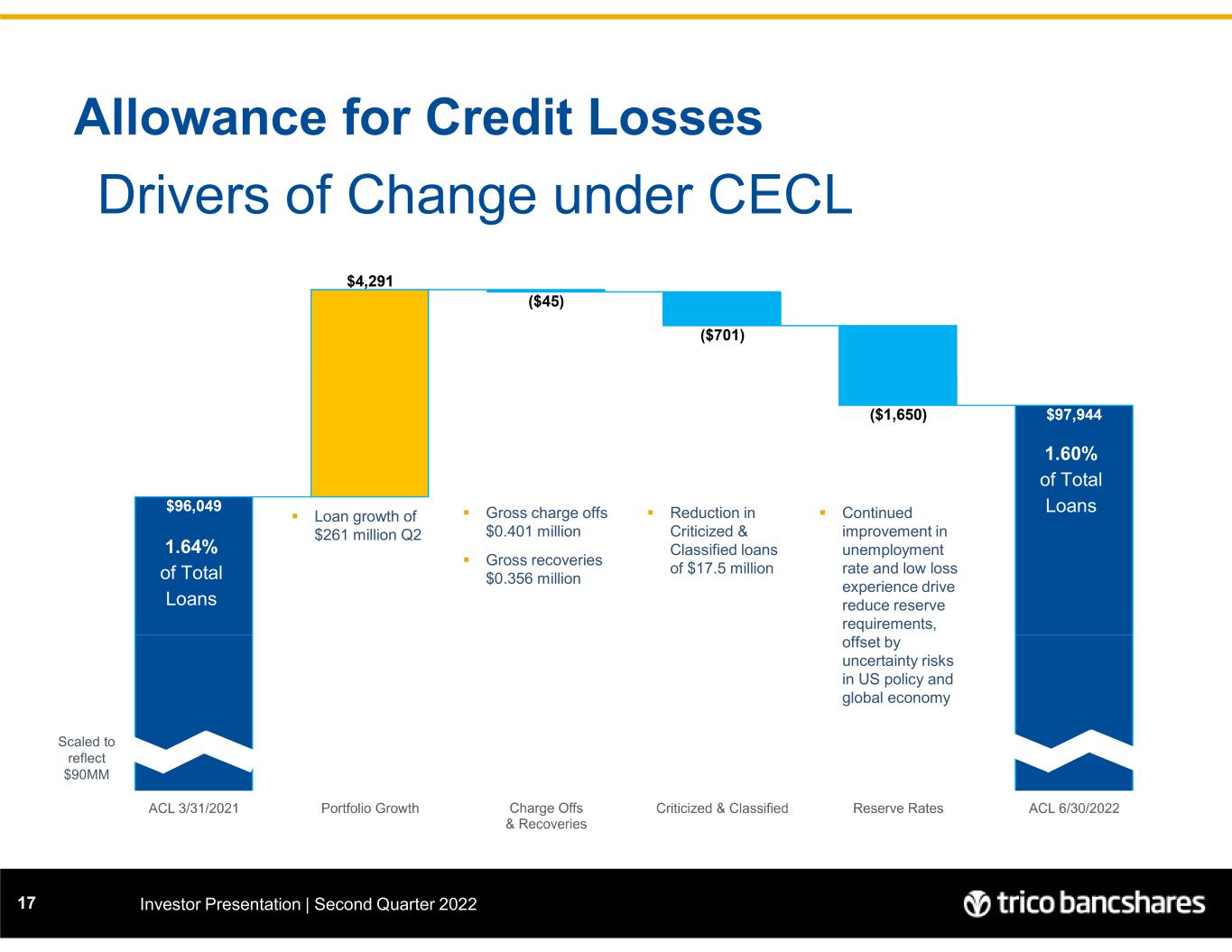

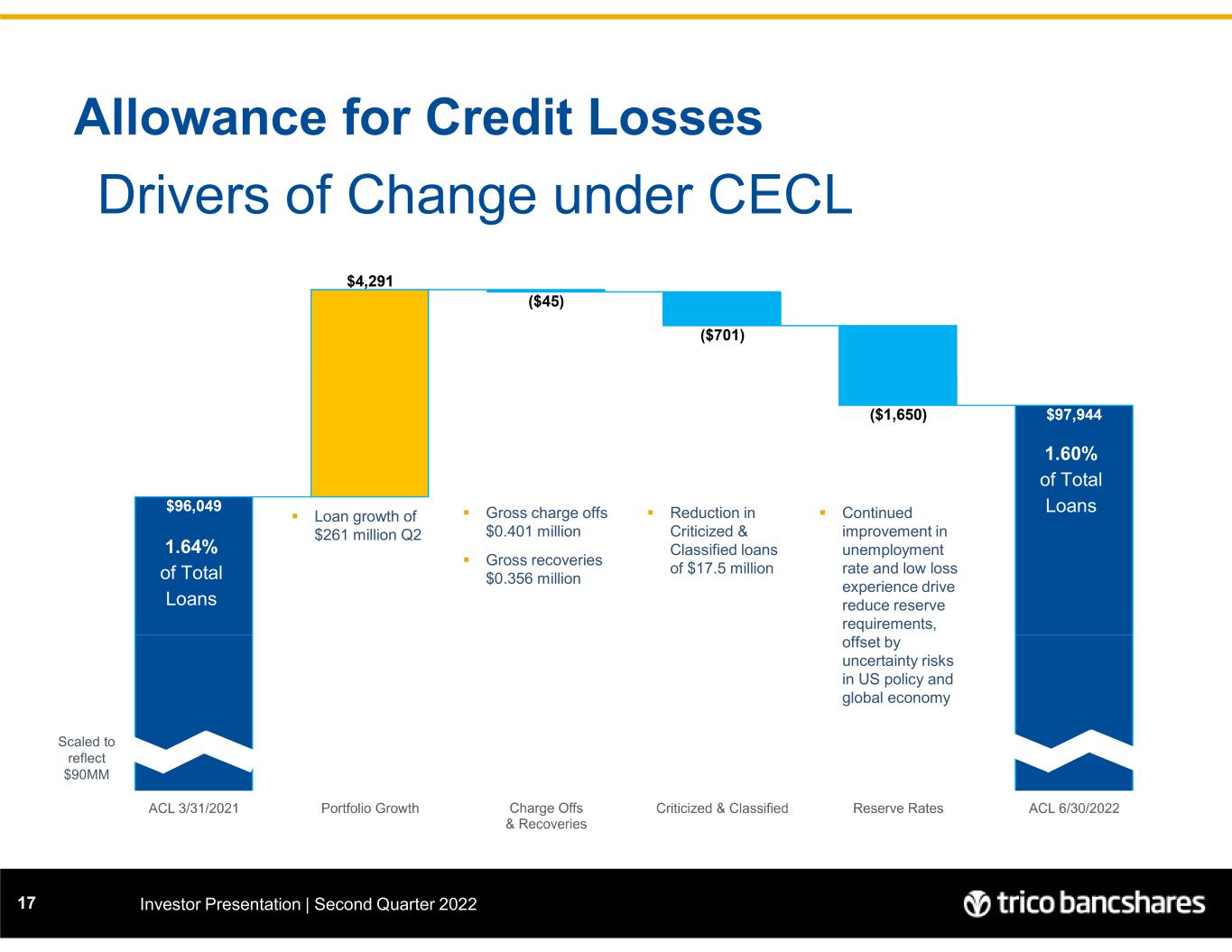

Allowance for Credit Losses Investor Presentation | Second Quarter 202217 Drivers of Change under CECL Loan growth of $261 million Q2 Continued improvement in unemployment rate and low loss experience drive reduce reserve requirements, offset by uncertainty risks in US policy and global economy Gross charge offs $0.401 million Gross recoveries $0.356 million 1.64% of Total Loans 1.60% of Total Loans Reduction in Criticized & Classified loans of $17.5 million Scaled to reflect $90MM

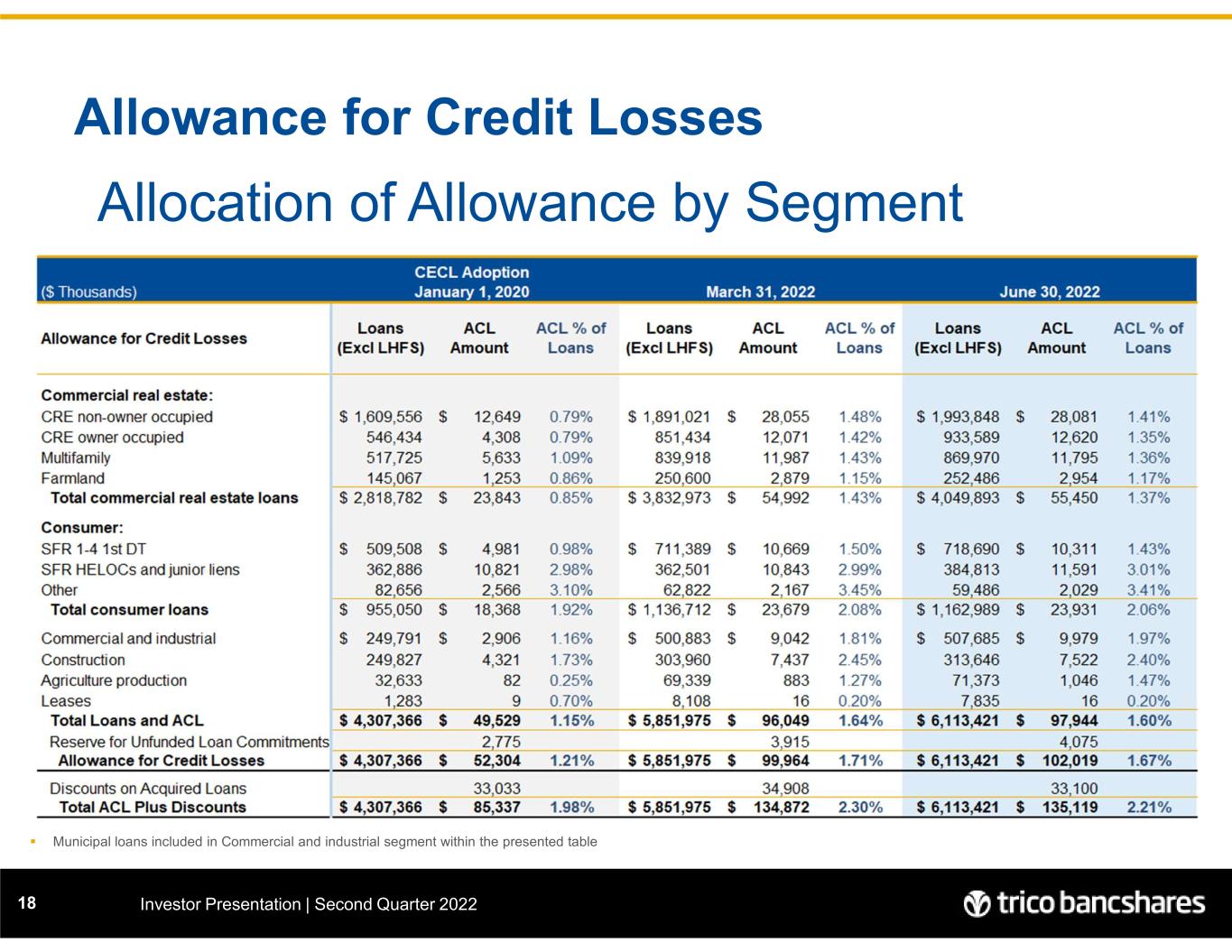

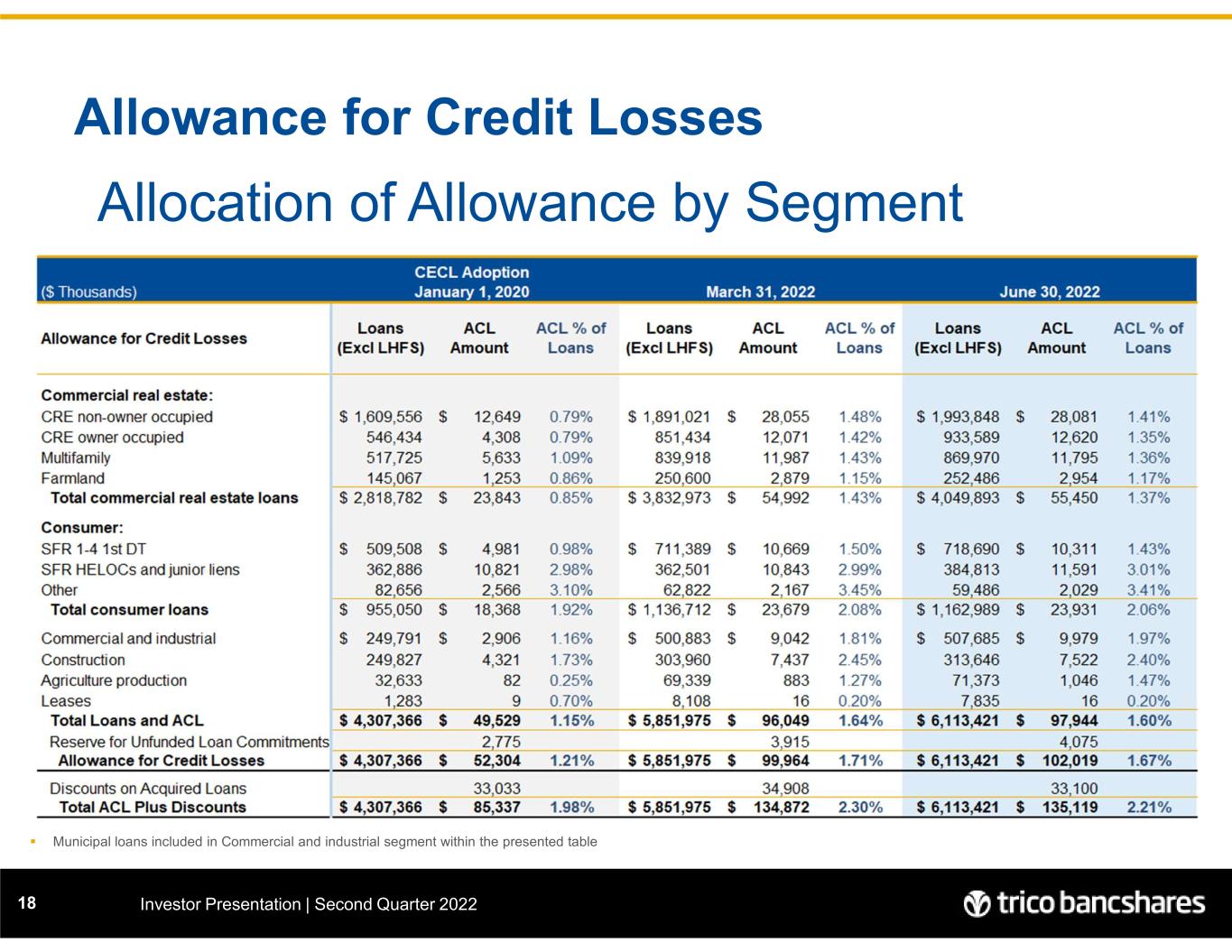

Allowance for Credit Losses Investor Presentation | Second Quarter 202218 Allocation of Allowance by Segment Municipal loans included in Commercial and industrial segment within the presented table

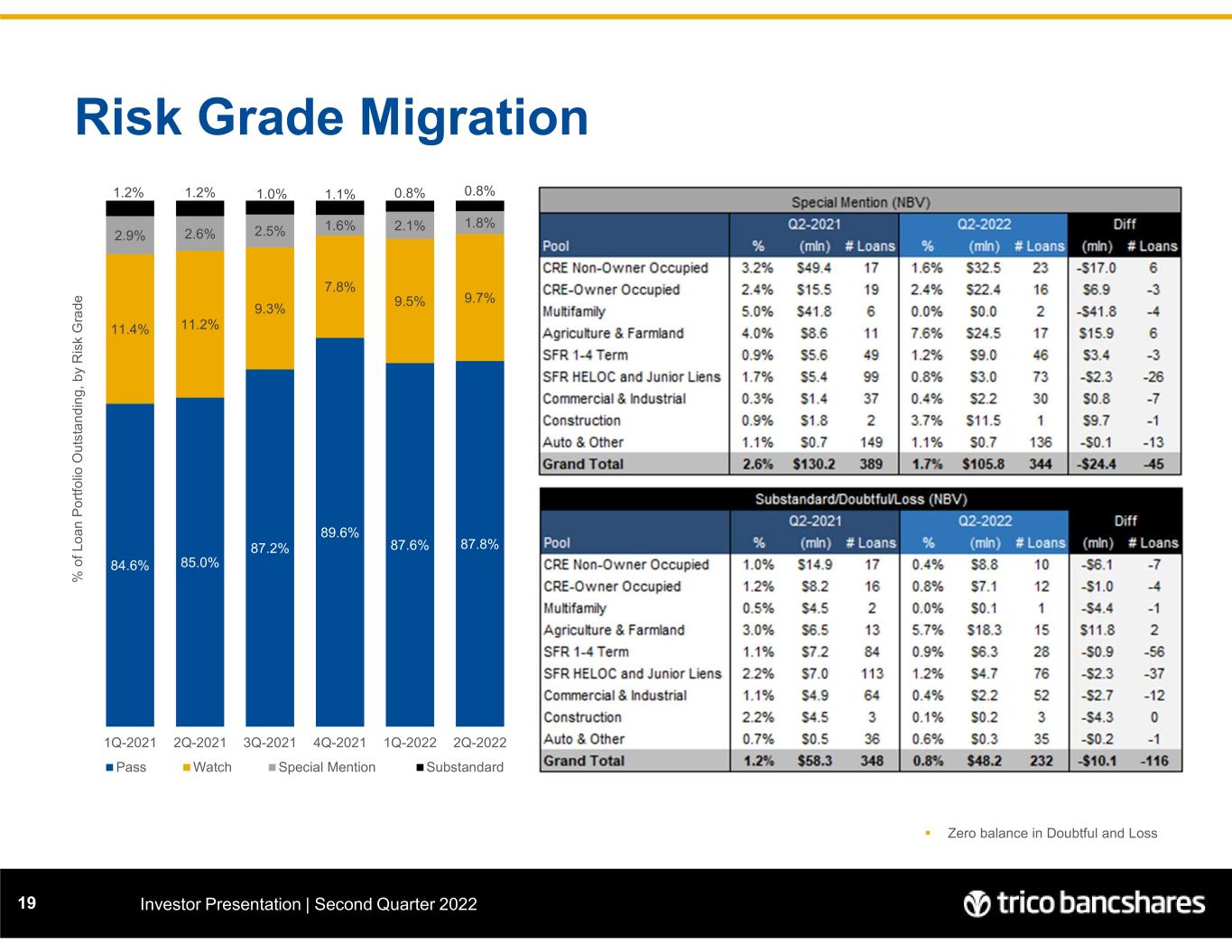

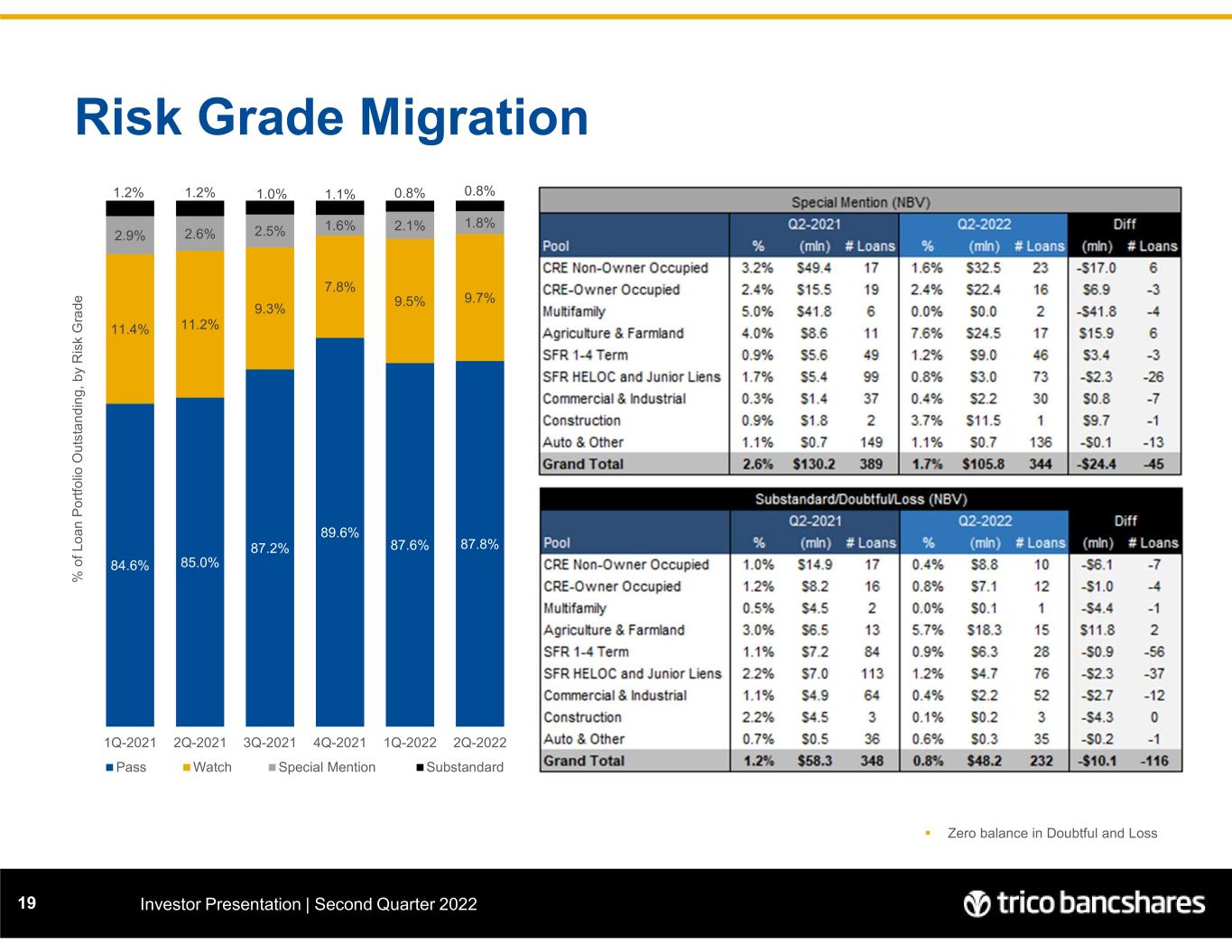

Risk Grade Migration Investor Presentation | Second Quarter 202219 Zero balance in Doubtful and Loss 87.8%87.6% 89.6% 87.2% 85.0%84.6% 9.7%9.5% 7.8% 9.3% 11.2%11.4% 1.8%2.1%1.6%2.5%2.6%2.9% 0.8%0.8%1.1%1.0%1.2%1.2% 2Q-20221Q-20224Q-20213Q-20212Q-20211Q-2021 % o f L o a n P o rt fo lio O u ts ta n d in g , b y R is k G ra d e Pass Watch Special Mention Substandard

159% 180% 193% 343% 385% 395% 342% 297% 263% 293% 281% 690% 831% 12 9% 14 5% 15 6% 13 9% 20 2% 19 1% 17 9% 18 7% 19 4% 19 7% 21 0% 21 7% 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 TCBK Peers Asset Quality Investor Presentation | Second Quarter 202220 Peer group consists of 99 closest peers in terms of asset size, range $6.0-13.7 Billion, source: BankRegData.com NPA and NPL ratios displayed are net of guarantees Coverage Ratio: Allowance as % of Non-Performing Loans NPAs have remained below peers while loss coverage has expanded, first with the adoption of CECL and expanded during the pandemic, forward-looking qualitative factors related to inflation and gross domestic product support management’s estimate of the current level of the reserve for credit losses. Non-Performing Assets as a % of Total Assets 0.32% 0.35% 0.30% 0.28% 0.30% 0.31% 0.33% 0.38% 0.38% 0.42% 0.37% 0.38% 0.17% 0.15% 0.59% 0.61% 0.54% 0.47% 0.73% 0.53% 0.58% 0.75% 0.73% 0.68% 0.64% 0.54% 0.54% 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 TCBK

Investor Presentation | Second Quarter 2022 Deposits 2121

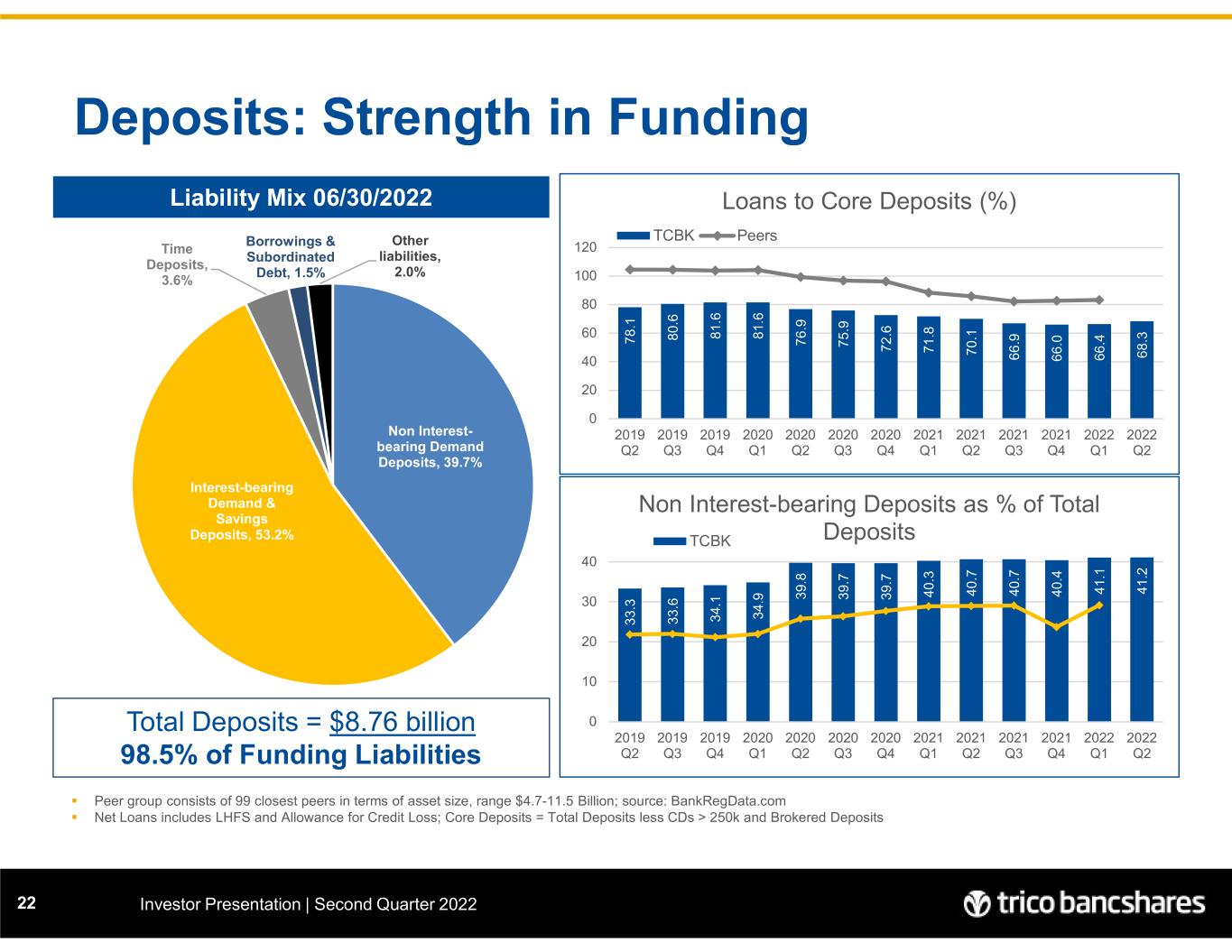

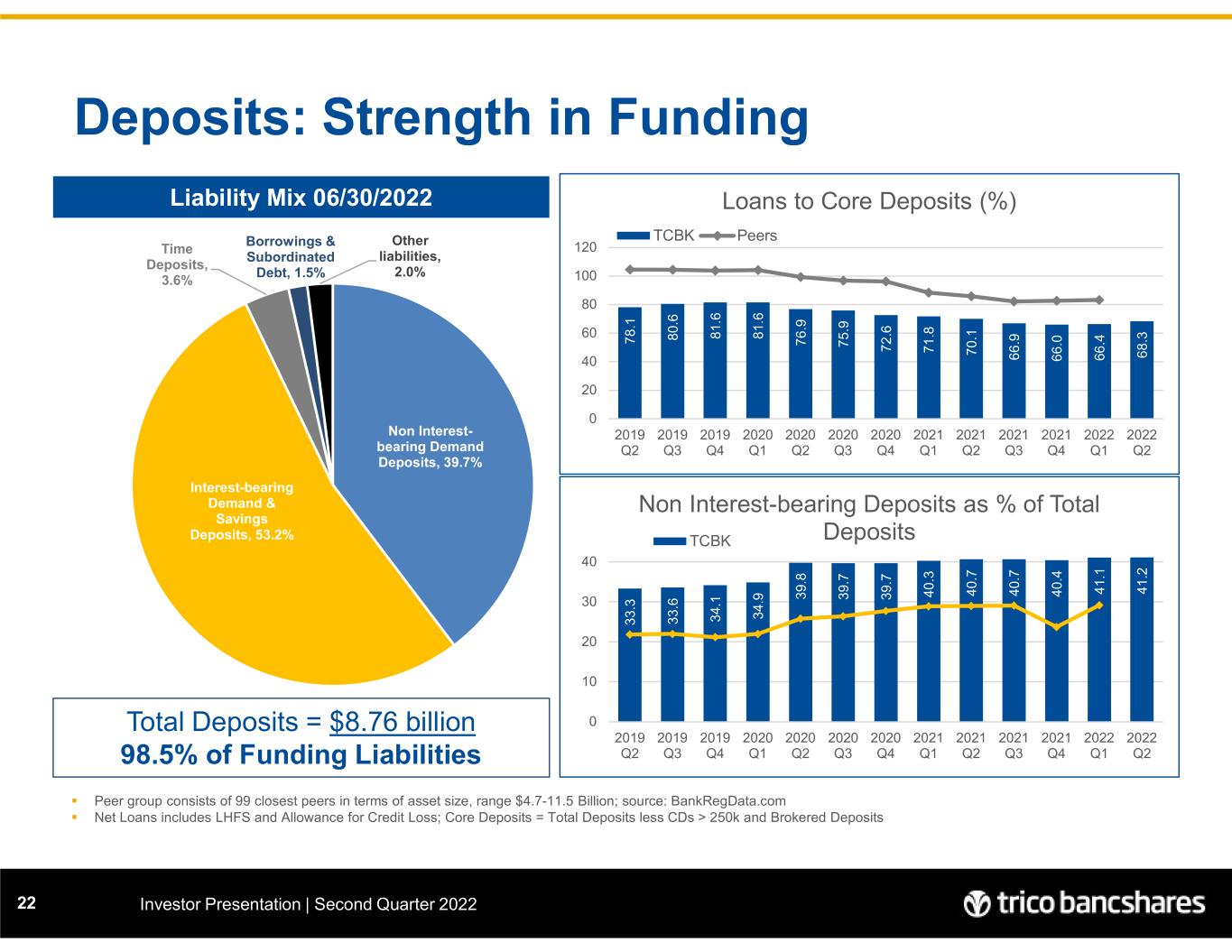

Deposits: Strength in Funding Investor Presentation | Second Quarter 202222 Total Deposits = $8.76 billion 98.5% of Funding Liabilities Liability Mix 06/30/2022 Peer group consists of 99 closest peers in terms of asset size, range $4.7-11.5 Billion; source: BankRegData.com Net Loans includes LHFS and Allowance for Credit Loss; Core Deposits = Total Deposits less CDs > 250k and Brokered Deposits (0.03% Funding Cost) Non Interest- bearing Demand Deposits, 39.7% Interest-bearing Demand & Savings Deposits, 53.2% Time Deposits, 3.6% Borrowings & Subordinated Debt, 1.5% Other liabilities, 2.0% 7 8 .1 8 0 .6 8 1 .6 8 1 .6 7 6 .9 7 5 .9 7 2 .6 7 1 .8 7 0 .1 6 6 .9 6 6 .0 6 6 .4 6 8 .3 0 20 40 60 80 100 120 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 Loans to Core Deposits (%) TCBK Peers 3 3 .3 3 3 .6 3 4 .1 3 4 .9 3 9 .8 3 9 .7 3 9 .7 4 0 .3 4 0 .7 4 0 .7 4 0 .4 4 1 .1 4 1 .2 0 10 20 30 40 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 Non Interest-bearing Deposits as % of Total DepositsTCBK

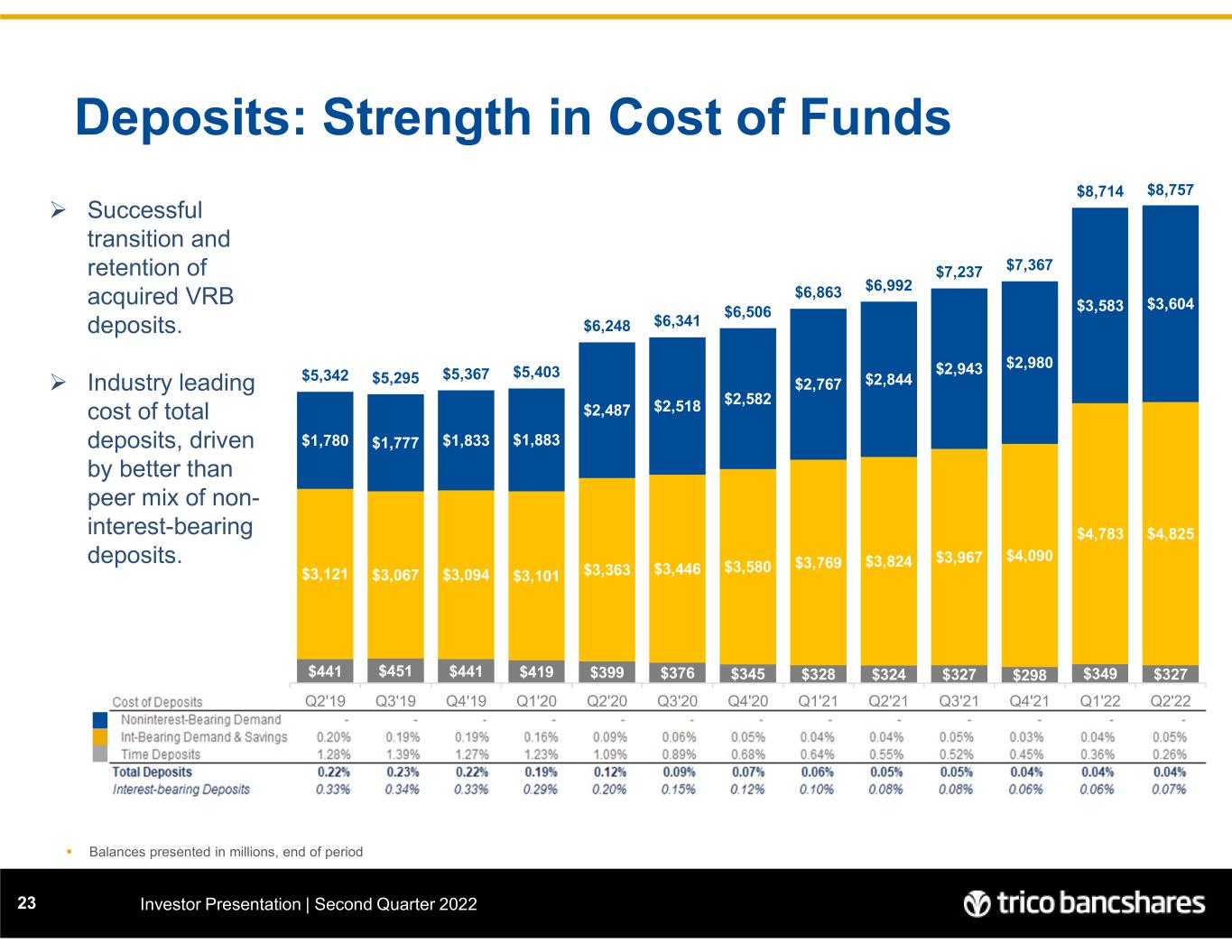

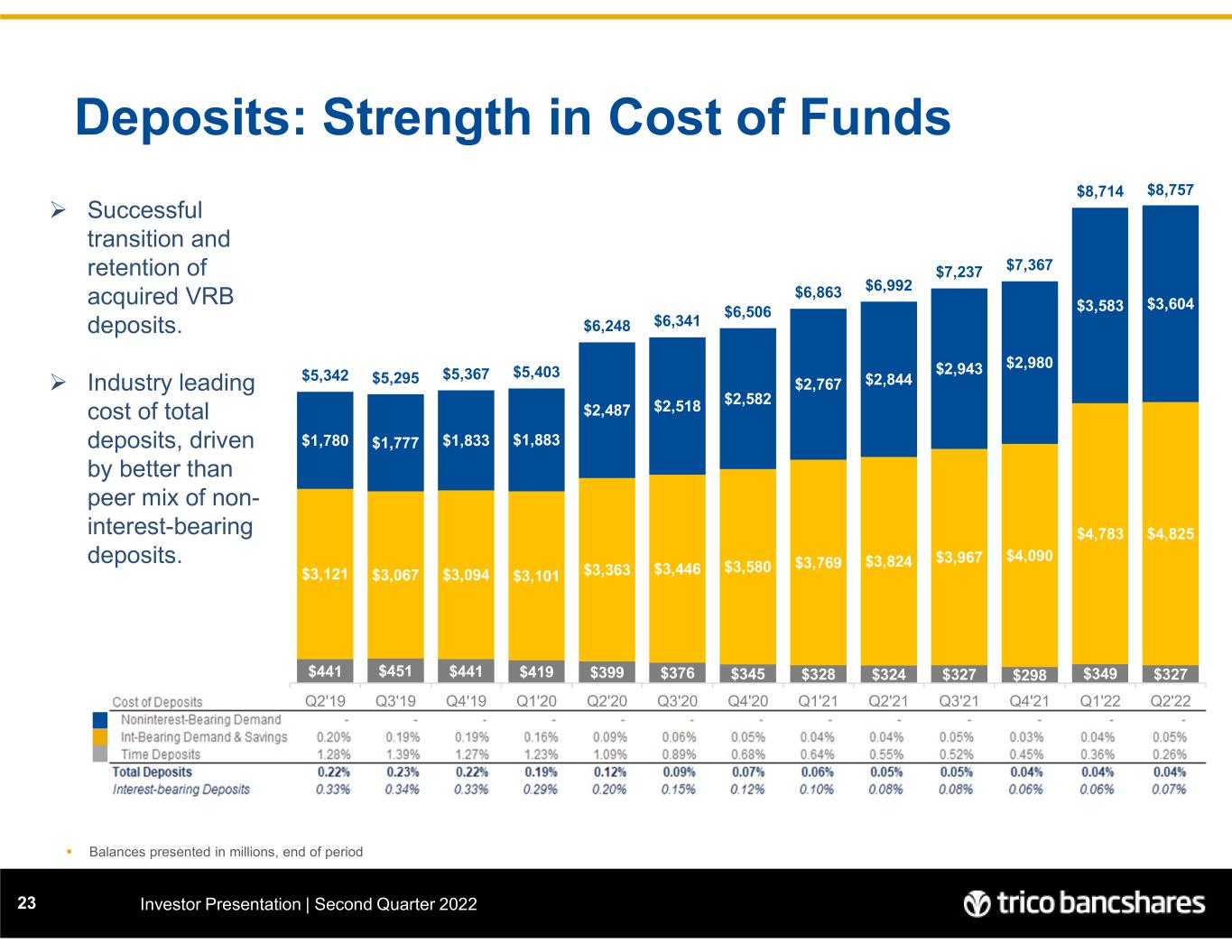

Deposits: Strength in Cost of Funds Investor Presentation | Second Quarter 202223 Balances presented in millions, end of period $441 $451 $441 $419 $399 $376 $345 $328 $324 $327 $298 $349 $327 $3,121 $3,067 $3,094 $3,101 $3,363 $3,446 $3,580 $3,769 $3,824 $3,967 $4,090 $4,783 $4,825 $1,780 $1,777 $1,833 $1,883 $2,487 $2,518 $2,582 $2,767 $2,844 $2,943 $2,980 $3,583 $3,604 $5,342 $5,295 $5,367 $5,403 $6,248 $6,341 $6,506 $6,863 $6,992 $7,237 $7,367 $8,714 $8,757 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Successful transition and retention of acquired VRB deposits. Industry leading cost of total deposits, driven by better than peer mix of non- interest-bearing deposits.

Financials 2424 Investor Presentation | Second Quarter 2022

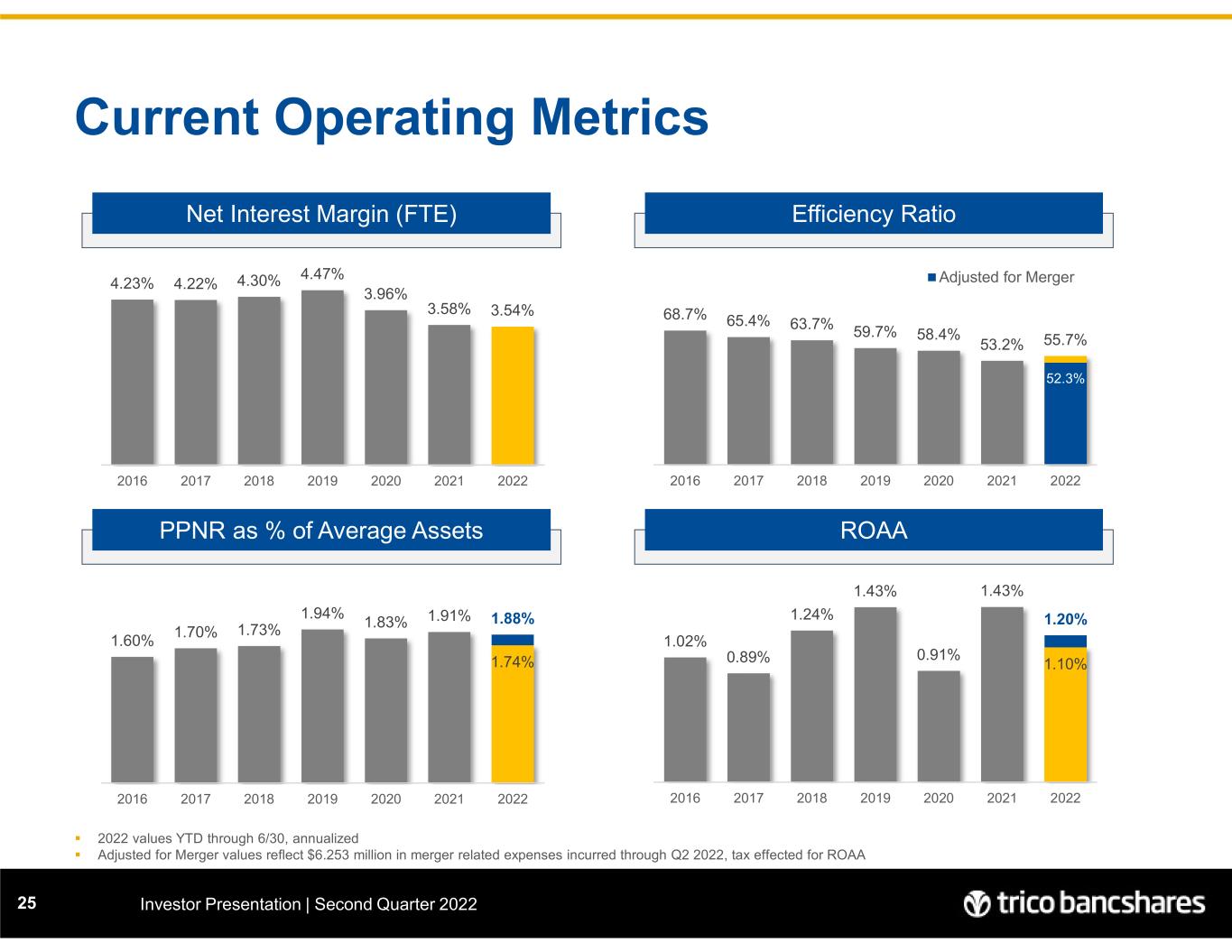

1.20% 1.02% 0.89% 1.24% 1.43% 0.91% 1.43% 1.10% 2016 2017 2018 2019 2020 2021 2022 Current Operating Metrics Investor Presentation | Second Quarter 202225 Net Interest Margin (FTE) PPNR as % of Average Assets Efficiency Ratio ROAA 2022 values YTD through 6/30, annualized Adjusted for Merger values reflect $6.253 million in merger related expenses incurred through Q2 2022, tax effected for ROAA 4.23% 4.22% 4.30% 4.47% 3.96% 3.58% 3.54% 2016 2017 2018 2019 2020 2021 2022 68.7% 65.4% 63.7% 59.7% 58.4% 53.2% 55.7% 52.3% 2016 2017 2018 2019 2020 2021 2022 Adjusted for Merger 1.88% 1.60% 1.70% 1.73% 1.94% 1.83% 1.91% 1.74% 2016 2017 2018 2019 2020 2021 2022

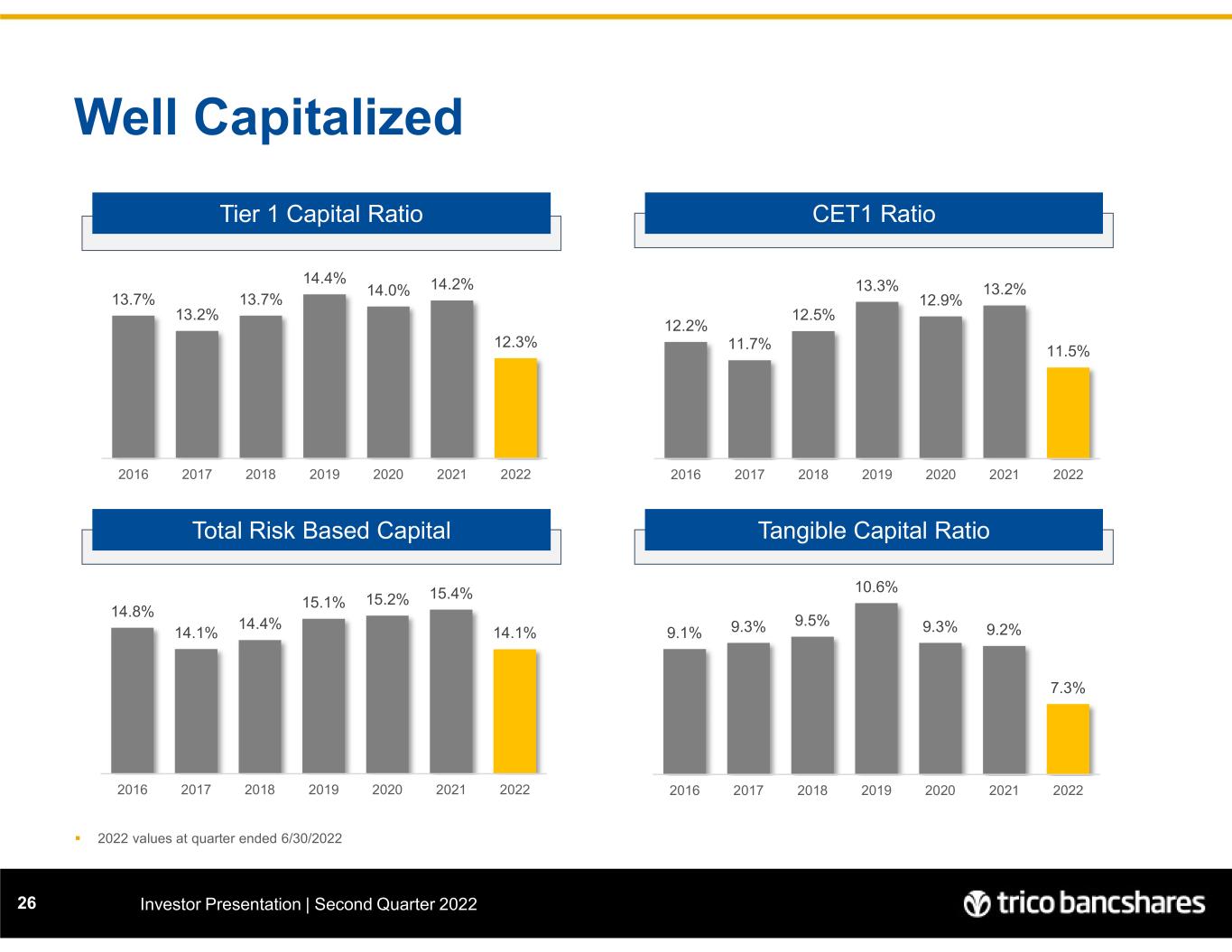

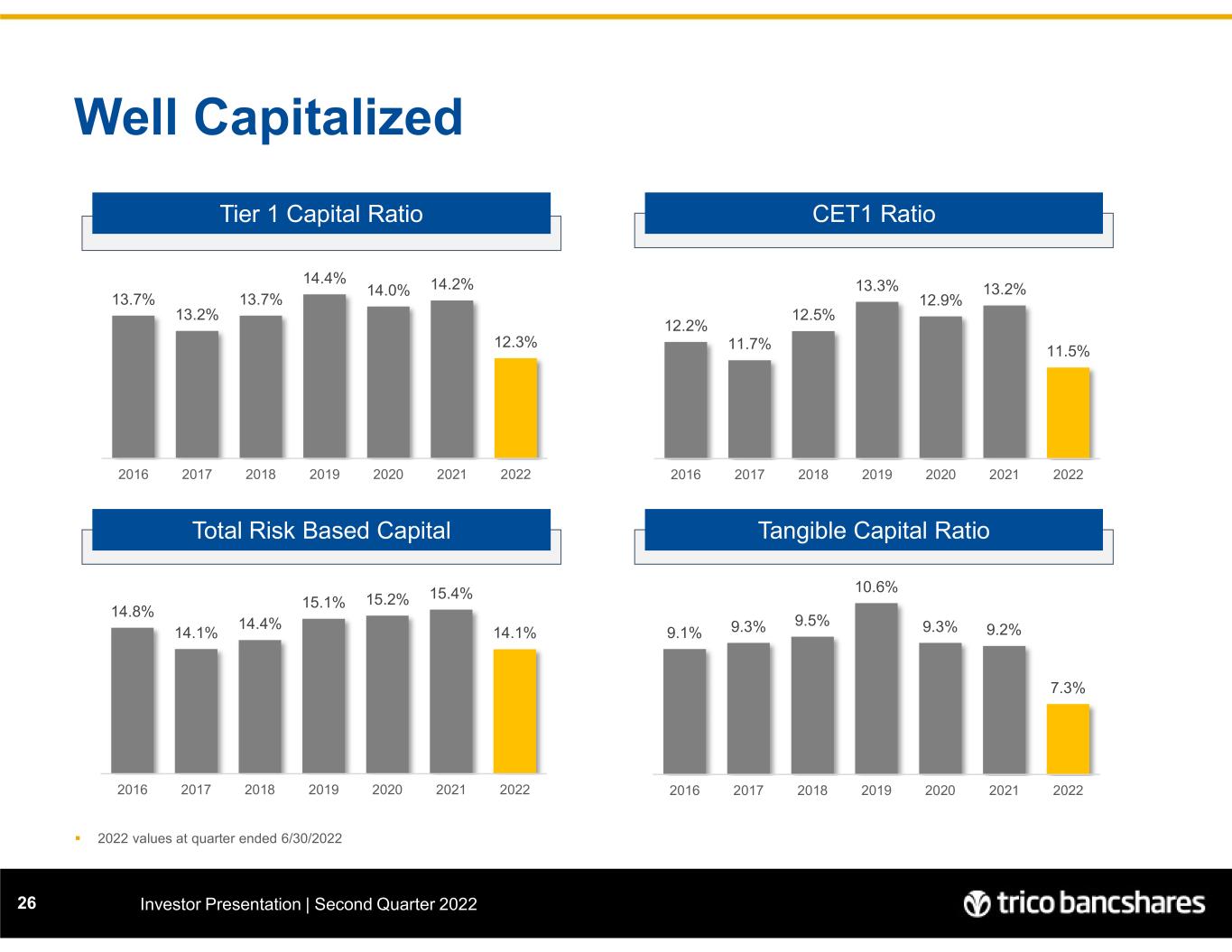

Well Capitalized Investor Presentation | Second Quarter 202226 Tier 1 Capital Ratio Total Risk Based Capital CET1 Ratio Tangible Capital Ratio 2022 values at quarter ended 6/30/2022 9.1% 9.3% 9.5% 10.6% 9.3% 9.2% 7.3% 2016 2017 2018 2019 2020 2021 2022 14.8% 14.1% 14.4% 15.1% 15.2% 15.4% 14.1% 2016 2017 2018 2019 2020 2021 2022 12.2% 11.7% 12.5% 13.3% 12.9% 13.2% 11.5% 2016 2017 2018 2019 2020 2021 2022 13.7% 13.2% 13.7% 14.4% 14.0% 14.2% 12.3% 2016 2017 2018 2019 2020 2021 2022

XYZ Investor Presentation | Second Quarter 202227 Pending update – no material change to format