Investor Presentation | Third Quarter 2024 Investor Presentation Third Quarter 2024 Richard P. Smith, President & Chief Executive Officer Daniel K. Bailey, EVP & Chief Banking Officer John S. Fleshood, EVP & Chief Operating Officer Peter G. Wiese, EVP & Chief Financial Officer EXHIBIT 99.2

Investor Presentation | Third Quarter 2024 2 Safe Harbor Statement The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the conditions of the United States economy in general and the strength of the local economies in which we conduct operations; the impact of any future federal government shutdown and uncertainty regarding the federal government’s debt limit or changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; the impacts of inflation, interest rate, market and monetary fluctuations on the Company's business condition and financial operating results; the impact of changes in financial services industry policies, laws and regulations; regulatory restrictions affecting our ability to successfully market and price our products to consumers; the risks related to the development, implementation, use and management of emerging technologies, including artificial intelligence and machine learning; extreme weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on the Company's customers and the economic and business environments in which the Company operates; the impact of a slowing U.S. economy, decreases in housing and commercial real estate prices, and potentially increased unemployment on the performance of our loan portfolio, the market value of our investment securities and possible other-than-temporary impairment of securities held by us due to changes in credit quality or rates; the availability of, and cost of, sources of funding and the demand for our products; adverse developments with respect to U.S. or global economic conditions and other uncertainties, including the impact of supply chain disruptions, commodities prices, inflationary pressures and labor shortages on the economic recovery and our business; the impacts of international hostilities, wars, terrorism or geopolitical events; adverse developments in the financial services industry generally such as the recent bank failures and any related impact on depositor behavior or investor sentiment; risks related to the sufficiency of liquidity; the possibility that our recorded goodwill could become impaired, which may have an adverse impact on our earnings and capital; the costs or effects of mergers, acquisitions or dispositions we may make, as well as whether we are able to obtain any required governmental approvals in connection with any such activities, or identify and complete favorable transactions in the future, and/or realize the anticipated financial and business benefits; the regulatory and financial impacts associated with exceeding $10 billion in total assets; the negative impact on our reputation and profitability in the event customers experience economic harm or in the event that regulatory violations are identified; the ability to execute our business plan in new markets; the future operating or financial performance of the Company, including our outlook for future growth and changes in the level and direction of our nonperforming assets and charge-offs; the appropriateness of the allowance for credit losses, including the assumptions made under our current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effectiveness of the Company's asset management activities managing the mix of earning assets and in improving, resolving or liquidating lower-quality assets; the effect of changes in the financial performance and/or condition of our borrowers; changes in accounting standards and practices; changes in consumer spending, borrowing and savings habits; our ability to attract and maintain deposits and other sources of liquidity; the effects of changes in the level or cost of checking or savings account deposits on our funding costs and net interest margin; increasing noninterest expense and its impact on our financial performance; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional competitors including retail businesses and technology companies; the challenges of attracting, integrating and retaining key employees; the vulnerability of the Company's operational or security systems or infrastructure, the systems of third-party vendors or other service providers with whom the Company contracts, and the Company's customers to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and data/security breaches and the cost to defend against and respond to such incidents; the impact of the 2023 cyber security ransomware incident, including the pending litigation, on our operations and reputation; increased data security risks due to work from home arrangements and email vulnerability; failure to safeguard personal information, and any resulting litigation; the effect of a fall in stock market prices on our brokerage and wealth management businesses; the transition from the LIBOR to new interest rate benchmarks; the emergence or continuation of widespread health emergencies or pandemics; the Company’s potential judgments, orders, settlements, penalties, fines and reputational damage resulting from pending or future litigation and regulatory investigations, proceedings and enforcement actions; and our ability to manage the risks involved in the foregoing. There can be no assurance that future developments affecting us will be the same as those anticipated by management. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the Securities and Exchange Commission (the “SEC”) and all subsequent filings with the SEC under Sections 13(a), 13(c), 14, and 15(d) of the Securities Act of 1934, as amended. Such filings are also available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. We undertake no obligation (and expressly disclaim any such obligation) to update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Investor Presentation | Third Quarter 2024 3 Tri Counties Bank Awards S&P Global Market Intelligence Top Community Bank with $3 billion to $10 billion in assets 2022, 2023 Grass Valley Union Best of Nevada County Awarded annually 2011-2023 Forbes Magazine America’s Best Banks 2024 Sacramento Business Journal Best Places to Work 2024 Sacramento Rainbow Chamber of Commerce Corporate Advocate of the Year 2024 Cen Cal Business Finance Group SBA-504 Lender of the Year 2023 Chico Enterprise Record Readers’ Choice Best Bank Awarded annually 2019-2024 Gustine Press-Standard Best Bank 2023 Style Magazine Reader's Choice – Roseville, Granite Bay & Rocklin Awarded annually 2011-2024 California Black Chamber of Commerce Top Partner Award 2023 Chico News & Review Best Bank Awarded annually 2008- 2019, then 2022 and 2023 Record Searchlight Best Bank in the North State 2015, 2016, 2018, 2022, 2023

Investor Presentation | Third Quarter 2024 4 Executive Team Greg Gehlmann SVP General Counsel Craig Carney EVP Chief Credit Officer Rick Smith President & Chief Executive Officer Dan Bailey EVP Chief Banking Officer John Fleshood EVP Chief Operating Officer Angela Rudd SVP Chief Risk Officer Judi Giem SVP Chief Human Resources Officer Jason Levingston SVP Chief Information Officer Peter Wiese EVP Chief Financial Officer Bret Funderburgh SVP Deputy Chief Credit Officer Scott Robertson SVP Chief Community Banking Officer Scott Myers SVP Head of Wholesale Banking

Investor Presentation | Third Quarter 2024 Agenda 5 Most Recent Quarter Recap Company Overview Lending Overview Deposit Overview Financials

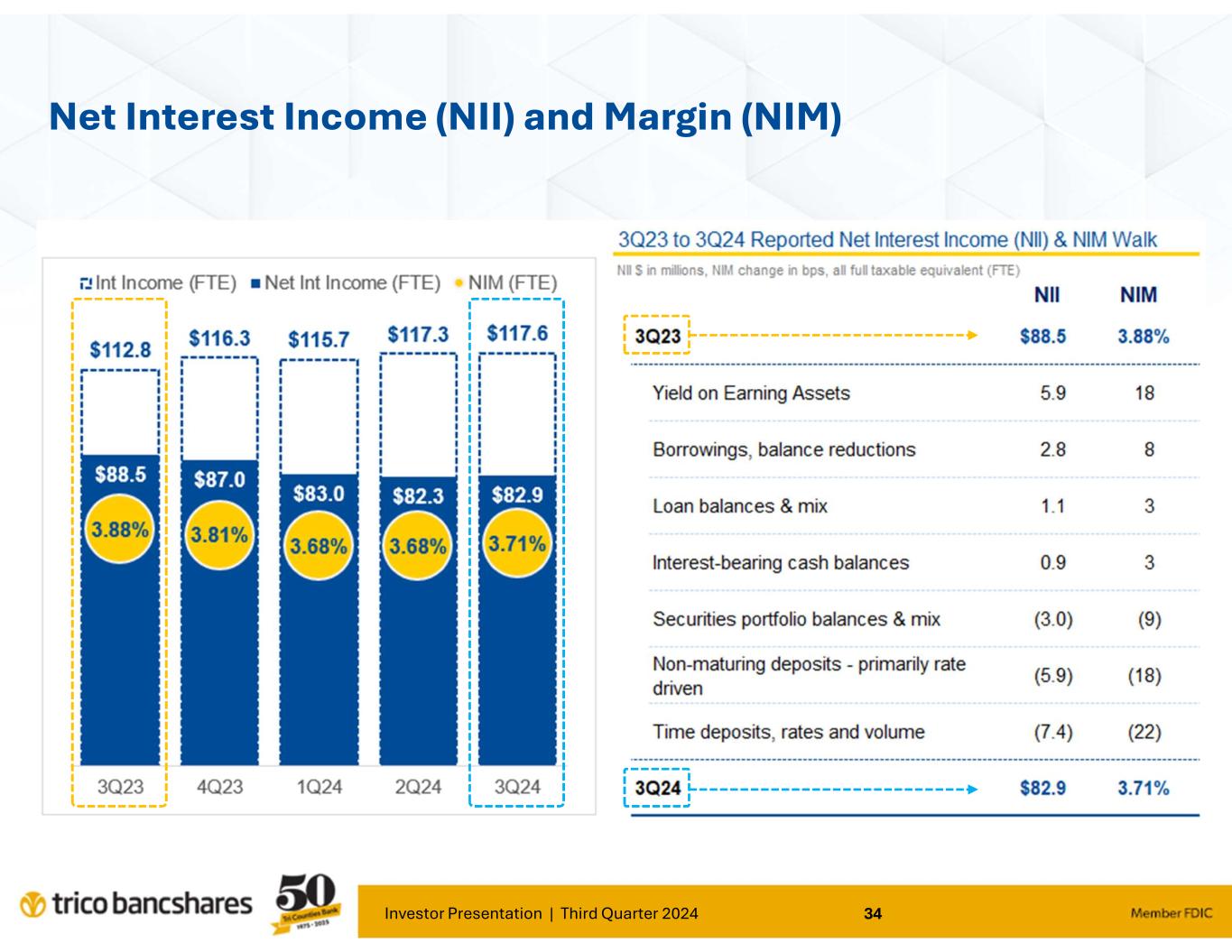

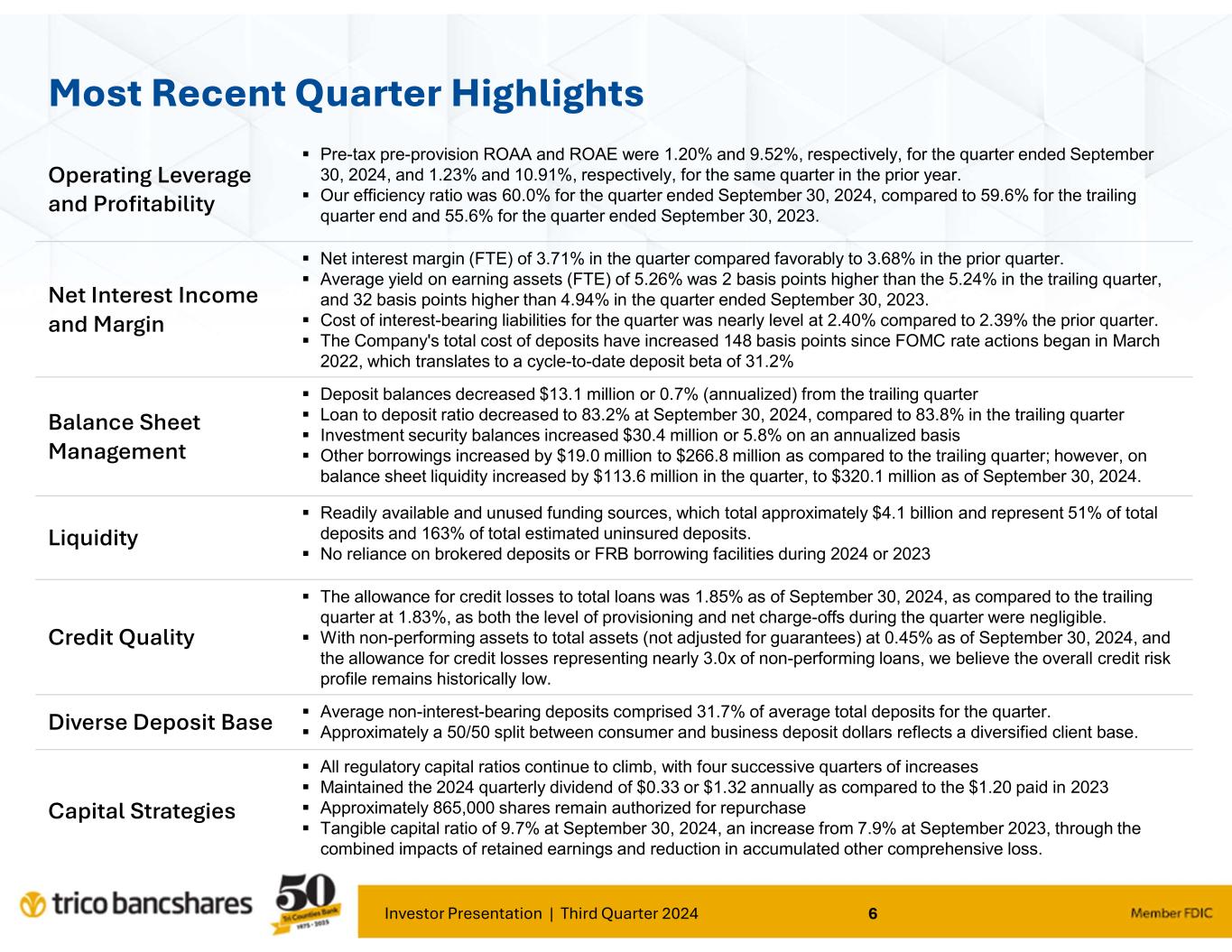

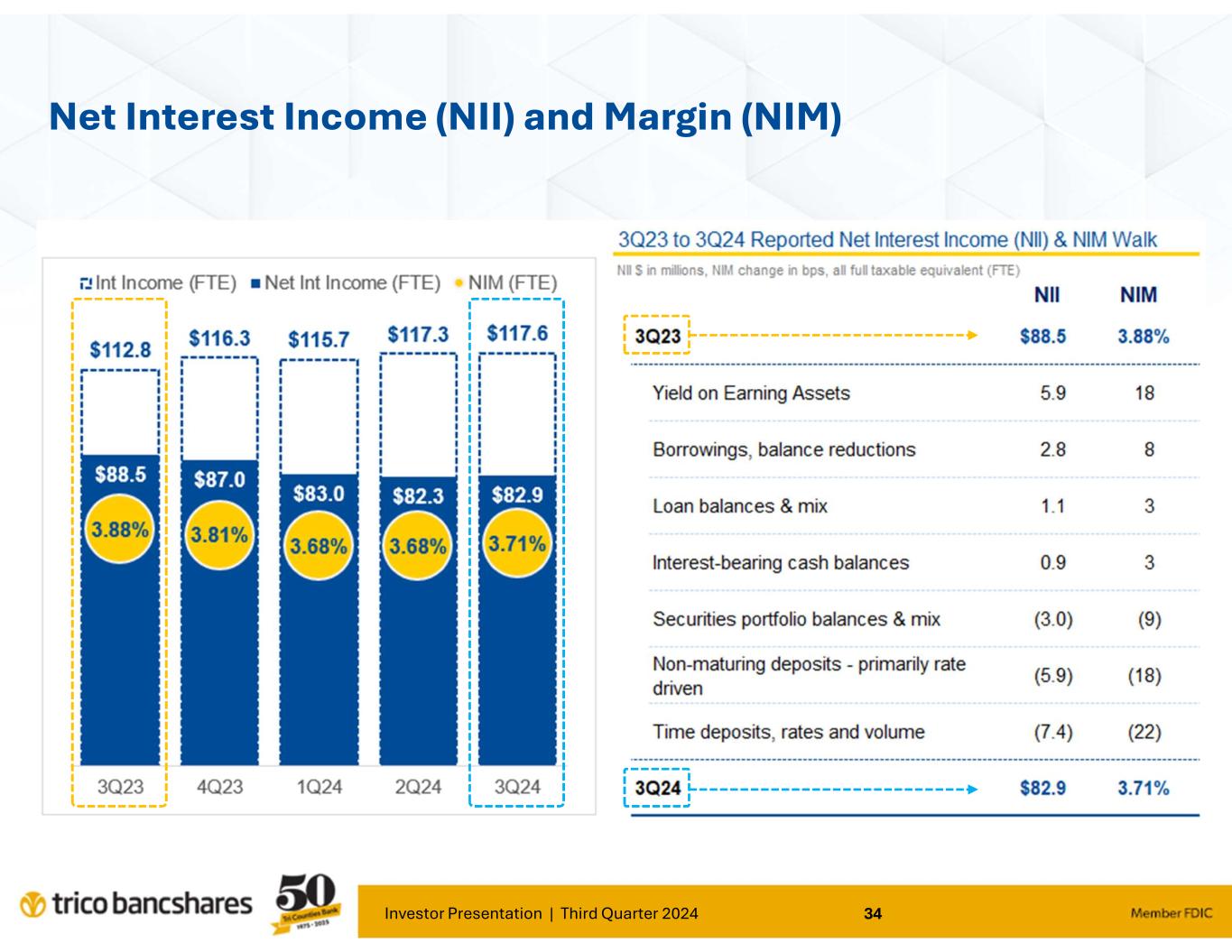

Investor Presentation | Third Quarter 2024 6 Most Recent Quarter Highlights Pre-tax pre-provision ROAA and ROAE were 1.20% and 9.52%, respectively, for the quarter ended September 30, 2024, and 1.23% and 10.91%, respectively, for the same quarter in the prior year. Our efficiency ratio was 60.0% for the quarter ended September 30, 2024, compared to 59.6% for the trailing quarter end and 55.6% for the quarter ended September 30, 2023. Operating Leverage and Profitability Net interest margin (FTE) of 3.71% in the quarter compared favorably to 3.68% in the prior quarter. Average yield on earning assets (FTE) of 5.26% was 2 basis points higher than the 5.24% in the trailing quarter, and 32 basis points higher than 4.94% in the quarter ended September 30, 2023. Cost of interest-bearing liabilities for the quarter was nearly level at 2.40% compared to 2.39% the prior quarter. The Company's total cost of deposits have increased 148 basis points since FOMC rate actions began in March 2022, which translates to a cycle-to-date deposit beta of 31.2% Net Interest Income and Margin Deposit balances decreased $13.1 million or 0.7% (annualized) from the trailing quarter Loan to deposit ratio decreased to 83.2% at September 30, 2024, compared to 83.8% in the trailing quarter Investment security balances increased $30.4 million or 5.8% on an annualized basis Other borrowings increased by $19.0 million to $266.8 million as compared to the trailing quarter; however, on balance sheet liquidity increased by $113.6 million in the quarter, to $320.1 million as of September 30, 2024. Balance Sheet Management Readily available and unused funding sources, which total approximately $4.1 billion and represent 51% of total deposits and 163% of total estimated uninsured deposits. No reliance on brokered deposits or FRB borrowing facilities during 2024 or 2023 Liquidity The allowance for credit losses to total loans was 1.85% as of September 30, 2024, as compared to the trailing quarter at 1.83%, as both the level of provisioning and net charge-offs during the quarter were negligible. With non-performing assets to total assets (not adjusted for guarantees) at 0.45% as of September 30, 2024, and the allowance for credit losses representing nearly 3.0x of non-performing loans, we believe the overall credit risk profile remains historically low. Credit Quality Average non-interest-bearing deposits comprised 31.7% of average total deposits for the quarter. Approximately a 50/50 split between consumer and business deposit dollars reflects a diversified client base.Diverse Deposit Base All regulatory capital ratios continue to climb, with four successive quarters of increases Maintained the 2024 quarterly dividend of $0.33 or $1.32 annually as compared to the $1.20 paid in 2023 Approximately 865,000 shares remain authorized for repurchase Tangible capital ratio of 9.7% at September 30, 2024, an increase from 7.9% at September 2023, through the combined impacts of retained earnings and reduction in accumulated other comprehensive loss. Capital Strategies

Investor Presentation | Third Quarter 2024 7 Company Overview Nasdaq: TCBK Headquarters: Chico, California Stock Price*: $42.65 Market Cap.: $1.41 Billion Asset Size: $9.82 Billion Loans: $6.68 Billion Deposits: $8.04 Billion Bank Branches: 68 ATMs: 84 Bank ATMs, with access to ~ 40,000 in network Market Area: TriCo currently serves 31 counties throughout California * As of close of business September 30, 2024

Investor Presentation | Third Quarter 2024 8 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Net Income ($MM) $23.4 $22.9 $16.1 $7.4 $17.6 $23.6 $33.6 $28.4 $27.4 $28.2 $20.4 $31.4 $37.3 $36.3 $35.8 $24.9 $30.6 $26.1 $27.7 $29.0 $29.1 Qtrly Diluted EPS $0.76 $0.75 $0.53 $0.25 $0.59 $0.79 $1.13 $0.95 $0.92 $0.94 $0.67 $0.93 $1.12 $1.09 $1.07 $0.75 $0.92 $0.78 $0.83 $0.87 $0.88 $0.00 $0.40 $0.80 $1.20 $0 $4 $8 $12 $16 $20 $24 $28 $32 $36 $40 Q tr ly E P S ( di lu te d) E a rn in gs ( in M ill io n s) Positive Earnings Track Record March 2022 Acquired Valley Republic Bancorp ($1.4B assets) 2020 Elevated ACL Provisioning Associated with COVID Related Risks

Investor Presentation | Third Quarter 2024 9 27% 27% 41% 25% 29% 34% 38% 2018 2019 2020 2021 2022 2023 2024 $0.60 $0.74 $0.53 $1.13 $0.67 $1.07 $0.83 $0.65 $0.75 $0.25 $0.95 $0.93 $0.75 $0.87 $0.53 $0.76 $0.59 $0.92 $1.12 $0.92 $0.88 $0.75 $0.79 $0.94 $1.09 $0.78 $2.54 $3.00 $2.16 $3.94 $3.83 $3.52 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 2018 2019 2020 2021 2022 2023 2024 Q1 Q2 Q3 Q4 10.75% 10.49% 7.18% 12.10% 11.67% 10.65% 9.67% 2018 2019 2020 2021 2022 2023 2024 $0.17 $0.19 $0.22 $0.25 $0.25 $0.30 $0.33 $0.17 $0.19 $0.22 $0.25 $0.25 $0.30 $0.33 $0.17 $0.22 $0.22 $0.25 $0.30 $0.30 $0.33 $0.19 $0.22 $0.22 $0.25 $0.30 $0.30 $0.70 $0.82 $0.88 $1.00 $1.10 $1.20 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 2018 2019 2020 2021 2022 2023 2024 Q1 Q2 Q3 Q4 Shareholder Returns Dividends per Share: 10% CAGR* Dividends as % of Earnings Return on Avg. Shareholder Equity Diluted EPS *Compound Annual Growth Rate, 5 years

Investor Presentation | Third Quarter 2024 10 Asset Growth Organic Growth and Disciplined Acquisitions • Asset Dollars in Billions 10 yrs.5 yrs. 13.4%9.0% CAGR, Assets Trailing 10 years Trailing 5 quarters

Investor Presentation | Third Quarter 2024 Deposits 11

Investor Presentation | Third Quarter 2024 12 Non Interest- bearing Demand Deposits, 29.7% Interest-bearing Demand & Savings Deposits, 51.2% Time Deposits, 12.7% Borrowings & Subordinated Debt, 4.3% Other liabilities, 2.1% Liability Mix: Strength in Funding Total Deposits = $8.04 billion 95.6% of Funding Liabilities Liability Mix 09/30/2024 Peer group consists of 99 closest peers in terms of total deposits, range $5.1 to 11.1 Billion; source: BankRegData.com Net Loans includes LHFS and Allowance for Credit Loss; Core Deposits = Total Deposits less CDs > 250k and Brokered Deposits 6 6 .9 6 6 .0 6 6 .4 6 9 .1 7 2 .1 7 6 .5 7 9 .5 8 0 .4 8 4 .0 8 7 .7 8 7 .7 8 6 .6 8 6 .5 0 20 40 60 80 100 120 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 Loans to Core Deposits (%) TCBK Peers 4 0 .7 4 0 .4 4 1 .1 4 1 .2 4 2 .5 4 2 .0 4 0 .3 3 8 .0 3 5 .7 3 4 .8 3 2 .6 3 1 .8 3 1 .7 0 10 20 30 40 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 Non Interest-bearing Deposits as % of Total Deposits TCBK Peers

Investor Presentation | Third Quarter 2024 13 Deposits: Strength in Cost of Funds • Balances presented in millions, end of period $327 $298 $349 $327 $304 $224 $346 $492 $588 $697 $972 $1,035 $1,091 $3,967 $4,090 $4,783 $4,825 $4,674 $4,603 $4,443 $4,530 $4,564 $4,414 $4,415 $4,458 $4,399 $2,943 $2,980 $3,583 $3,604 $3,678 $3,502 $3,237 $3,073 $2,858 $2,723 $2,600 $2,557 $2,548 $7,237 $7,367 $8,714 $8,757 $8,656 $8,329 $8,026 $8,095 $8,010 $7,834 $7,988 $8,050 $8,037 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24

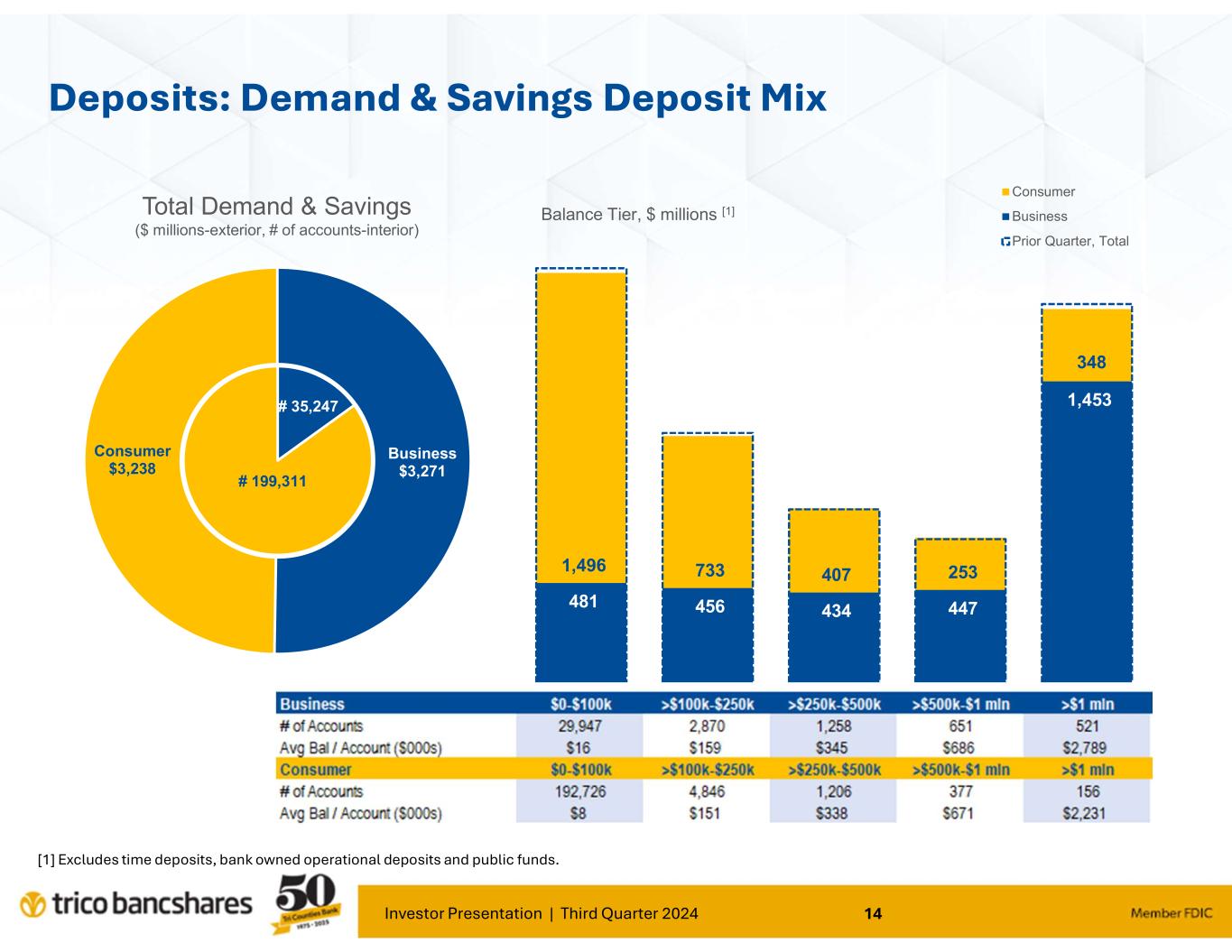

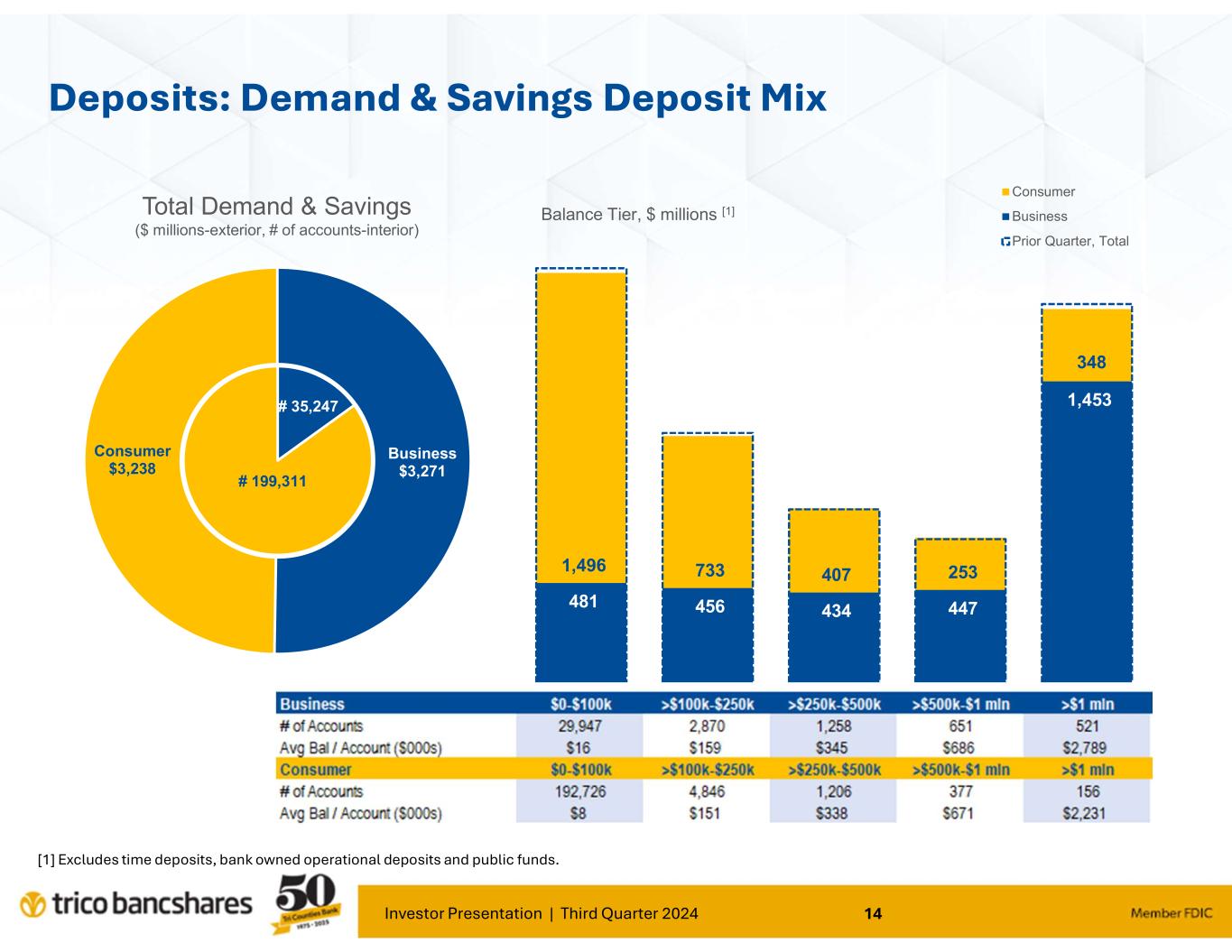

Investor Presentation | Third Quarter 2024 14 481 456 434 447 1,453 1,496 733 407 253 348 Consumer Business Prior Quarter, Total # 35,247 # 199,311 Deposits: Demand & Savings Deposit Mix [1] Excludes time deposits, bank owned operational deposits and public funds. Balance Tier, $ millions [1]Total Demand & Savings ($ millions-exterior, # of accounts-interior) Business $3,271 Consumer $3,238

Investor Presentation | Third Quarter 2024 15 $575 $358 $80 $28 4.40% 4.30% 3.99% 1.78% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0 $100 $200 $300 $400 $500 $600 <3 Months 3-6 Months 6-12 Months >12 Months Current Balance Wtd Avg Rate CDs by Remaining Maturity $203 $198 $284 $426 $530 $630 $904 $979 $1,041 0.19% 0.47% 1.68% 2.76% 3.22% 3.63% 4.15% 4.31% 4.26% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $0.00 $200.00 $400.00 $600.00 $800.00 $1,000.00 Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 Q3-2024 Current Balance Weighted Average Rate CD Growth Deposits: CD Balance and Maturity Composition • Note: Excludes CDARS * CD special as of September 30, 2024, subject to change

Investor Presentation | Third Quarter 2024 16 Liquidity [1] $ millions, as of 9/30/2024, cash based upon total held at or in transit with FRB [2] Based upon estimated uninsured deposits reported in Call Report schedule RC-O includes demand and time deposits [3] Peer group consists of closest 99 peers in terms of assets, sourced from BankRegData.com $4.1 Billion 163% of estimated uninsured deposits In addition to a strong deposit base, Tri Counties Bank maintains a variety of easily accessible funding sources. $2,508 $1,313 $275 Liquidity Sources [1] Total Borrow Capacity Unpledged Securities AFS Cash 71.2 70.3 66.3 66.3 66.5 67.6 71.2 68.9 70.1 69.9 69.5 69.3 68.7 63.7 62.8 62.1 62.7 62.7 63.7 68.3 68.4 68.5 68.0 68.8 68.2 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Insured Deposits as % of Total Deposits [2][3] TCBK Peers 19.0 17.6 18.6 19.8 21.8 22.8 25.3 25.3 25.3 30.7 33.6 36.5 37.6 35.7 34.9 37.1 36.3 35.7 39.6 50.4 56.3 55.7 55.8 54.9 52.9 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Pledged Securities as % of Total Securities [3] TCBK Peers

Investor Presentation | Third Quarter 2024 Loans and Credit Quality 1717

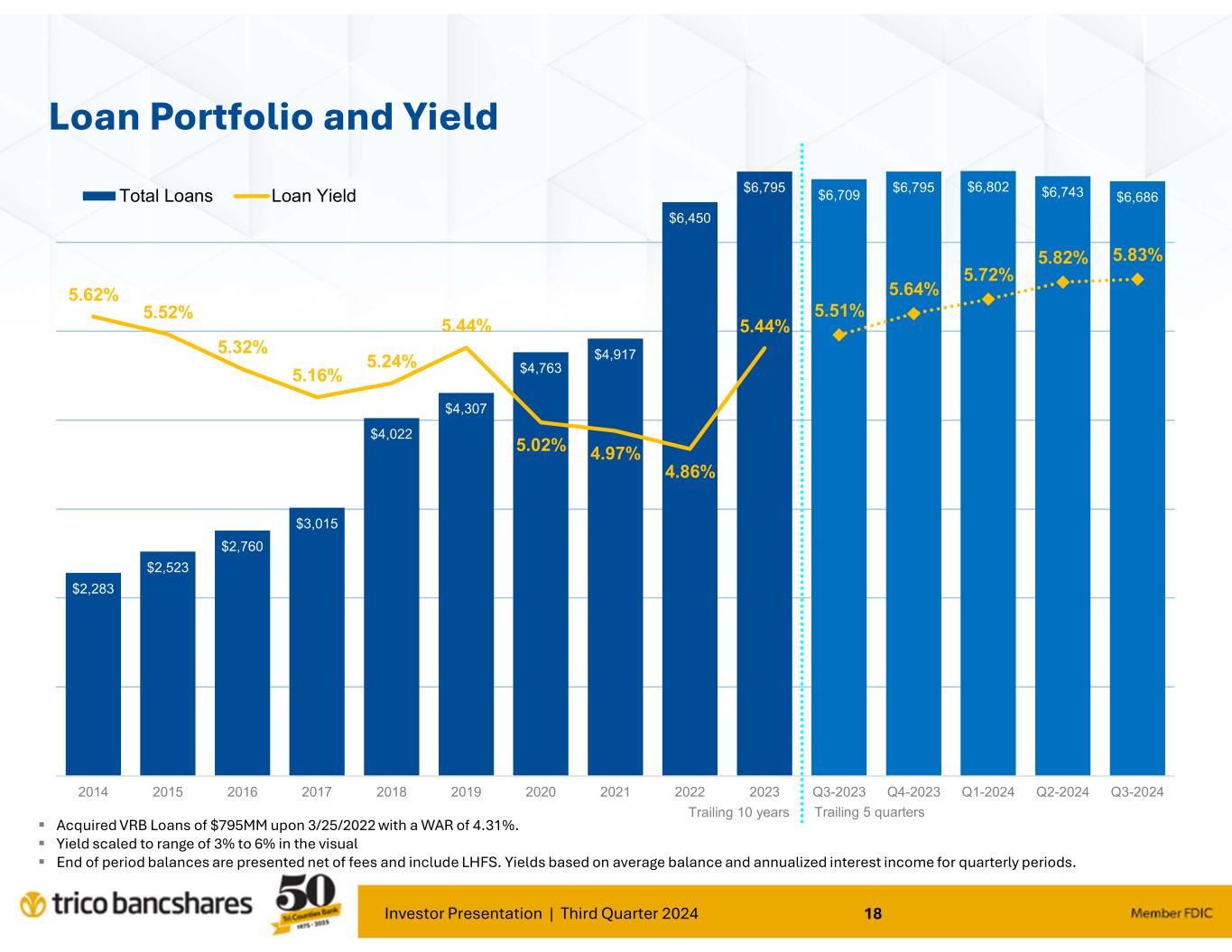

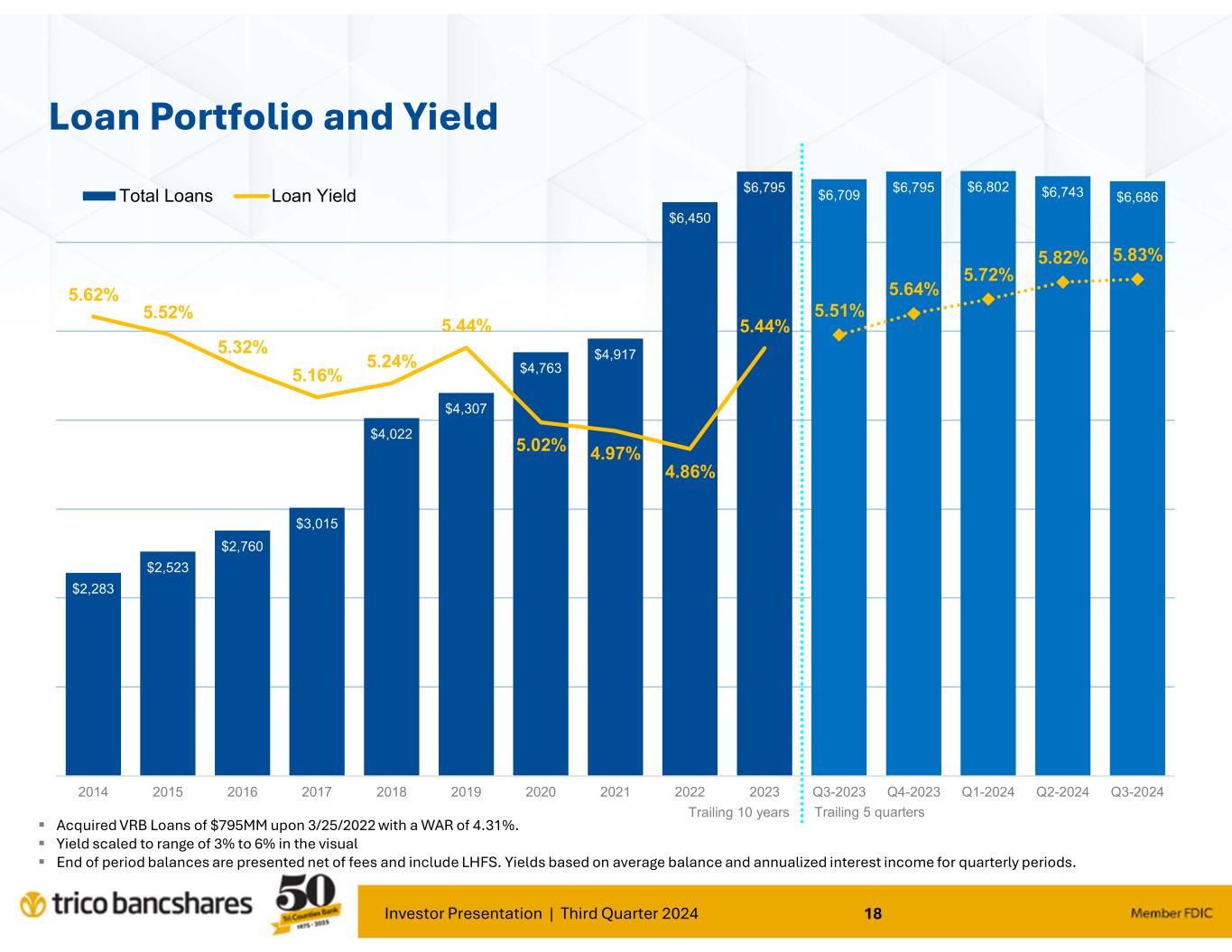

Investor Presentation | Third Quarter 2024 18 Loan Portfolio and Yield Acquired VRB Loans of $795MM upon 3/25/2022 with a WAR of 4.31%. Yield scaled to range of 3% to 6% in the visual End of period balances are presented net of fees and include LHFS. Yields based on average balance and annualized interest income for quarterly periods. $2,283 $2,523 $2,760 $3,015 $4,022 $4,307 $4,763 $4,917 $6,450 $6,795 $6,709 $6,795 $6,802 $6,743 $6,686 5.62% 5.52% 5.32% 5.16% 5.24% 5.44% 5.02% 4.97% 4.86% 5.44% 5.51% 5.64% 5.72% 5.82% 5.83% 3.00% 4.00% 5.00% 6.00% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 Q3-2024 Total Loans Loan Yield Trailing 10 years Trailing 5 quarters

Investor Presentation | Third Quarter 2024 19 $464 $285 $303 $412 $396 $473 $446 $250 $159 $170 $247 $193 $114 $121 $146 -$241 -$192 -$243 -$250 -$225 -$205 -$270 -$110 -$92 -$107 -$83 -$110 -$83 -$137 -$113 -$59 $6 -$33 -$47 $4 $33 $42 -$4 -$94 $36 $22 -$24 -$41 -$86 Q1-2021 Q2-2021 Q3-2021 Q4-2021 Q1-2022 Q2-2022 Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 Q1-2024 Q2-2024 Q3-2024 Origination Payoffs Balance Change net of Originations and Payoffs Gross Production vs. Payoff Outstanding Principal in Millions, excludes PPP and Credit Card balances Includes Q1 2021 increase of $98MM and Q4 2020 increase of $40MM in Jumbo Mortgage pool purchases $800MM in outstanding at close of Q1-2022 related to VRB Acquisitions ($795MM at acquisition) excluded from the chart TCBK originated nearly $1.5 billion in 2021, while facing headwinds of an increased $372 million in payoffs during 2021. Originations and net loan growth in 2022 were supportive of the positive mix shift in earning assets and facilitated both NII and NIM expansion. Slower pace of originations commensurate with market rate changes, liquidity management, and NIM preservation.

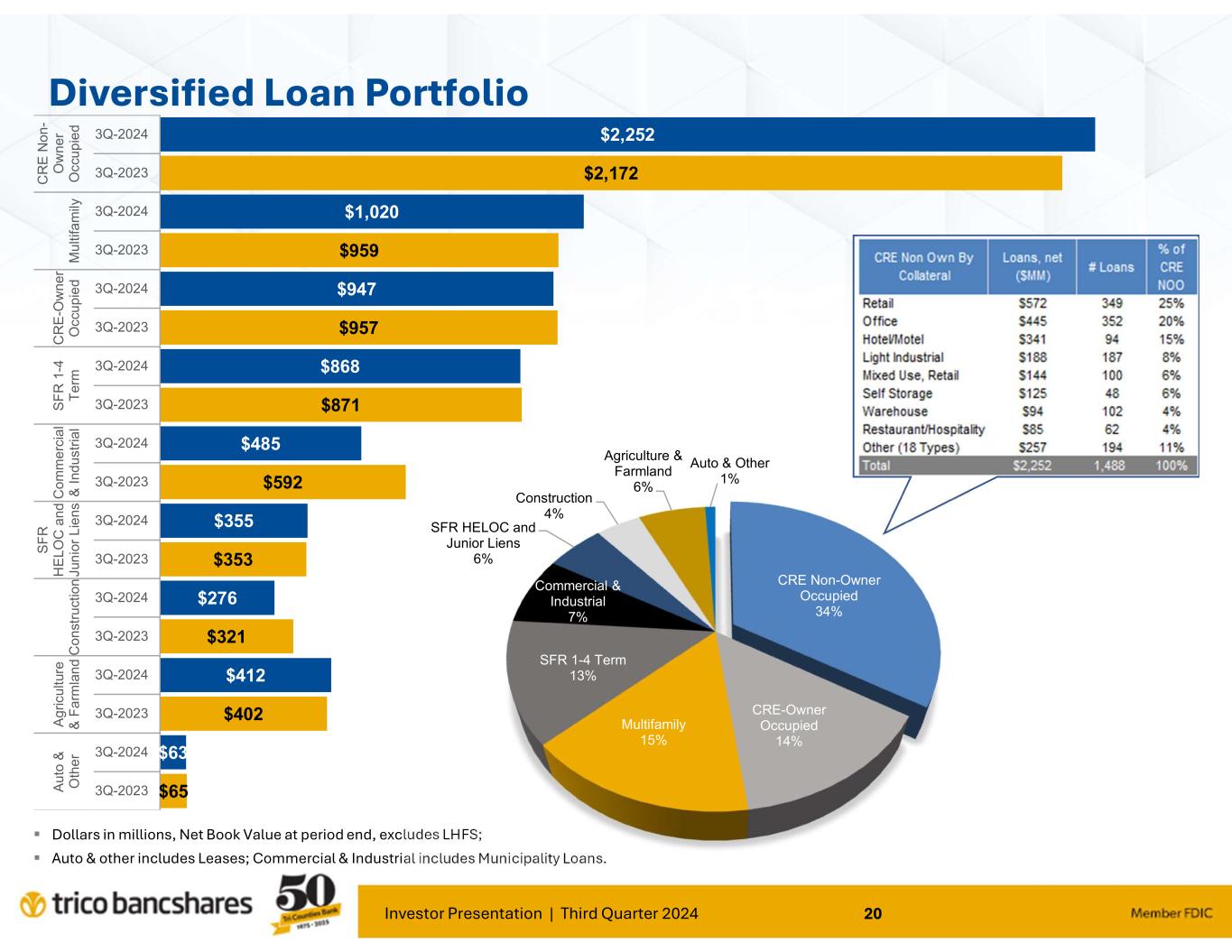

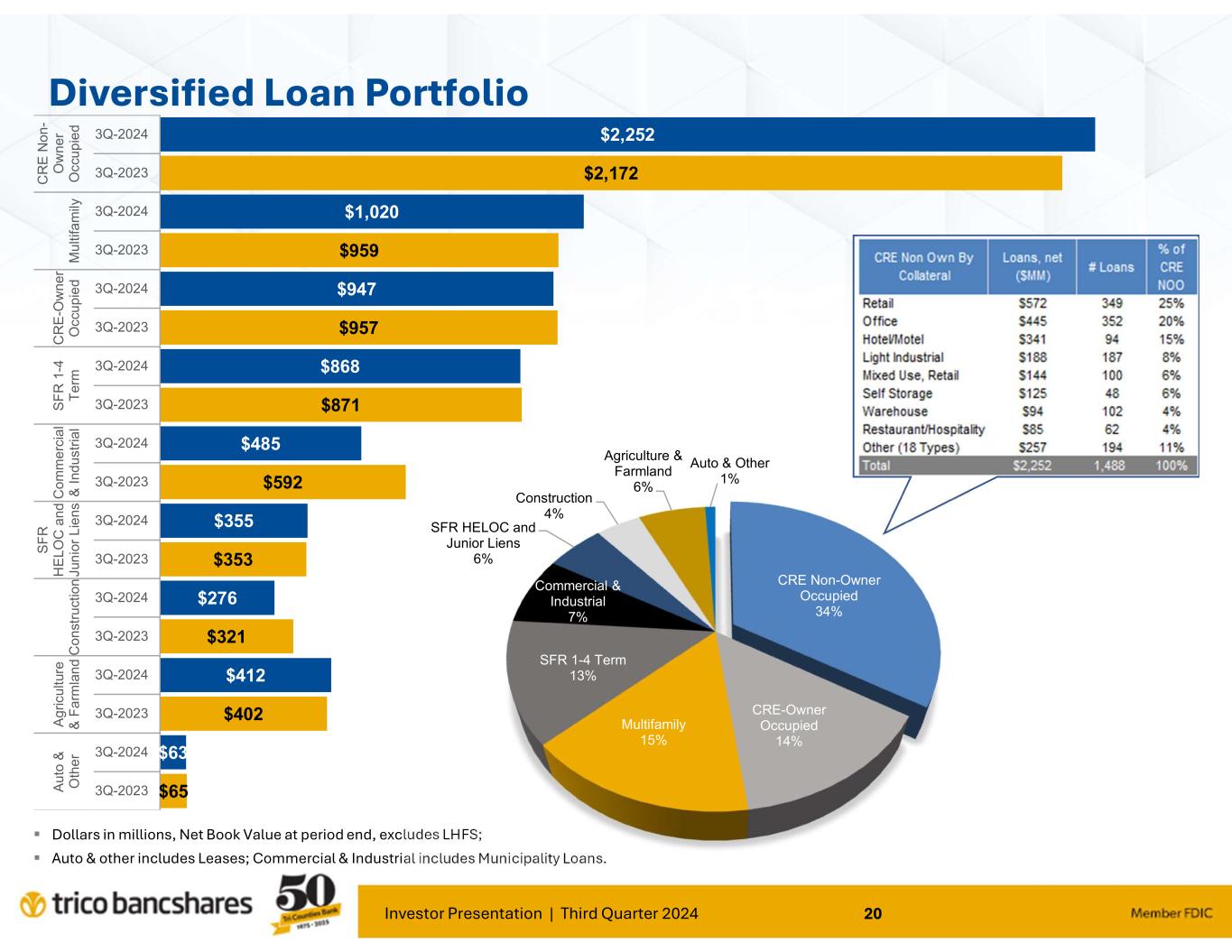

Investor Presentation | Third Quarter 2024 20 $2,252 $2,172 $1,020 $959 $947 $957 $868 $871 $485 $592 $355 $353 $276 $321 $412 $402 $63 $65 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 C R E N o n - O w n e r O cc u p ie d M u lti fa m ily C R E -O w n e r O cc u p ie d S F R 1 -4 T e rm C o m m e rc ia l & I nd u st ri a l S F R H E L O C a n d Ju n io r L ie n s C o n st ru ct io n A g ric u ltu re & F a rm la n d A u to & O th e r Diversified Loan Portfolio Dollars in millions, Net Book Value at period end, excludes LHFS; Auto & other includes Leases; Commercial & Industrial includes Municipality Loans. CRE Non-Owner Occupied 34% CRE-Owner Occupied 14% Multifamily 15% SFR 1-4 Term 13% Commercial & Industrial 7% SFR HELOC and Junior Liens 6% Construction 4% Agriculture & Farmland 6% Auto & Other 1%

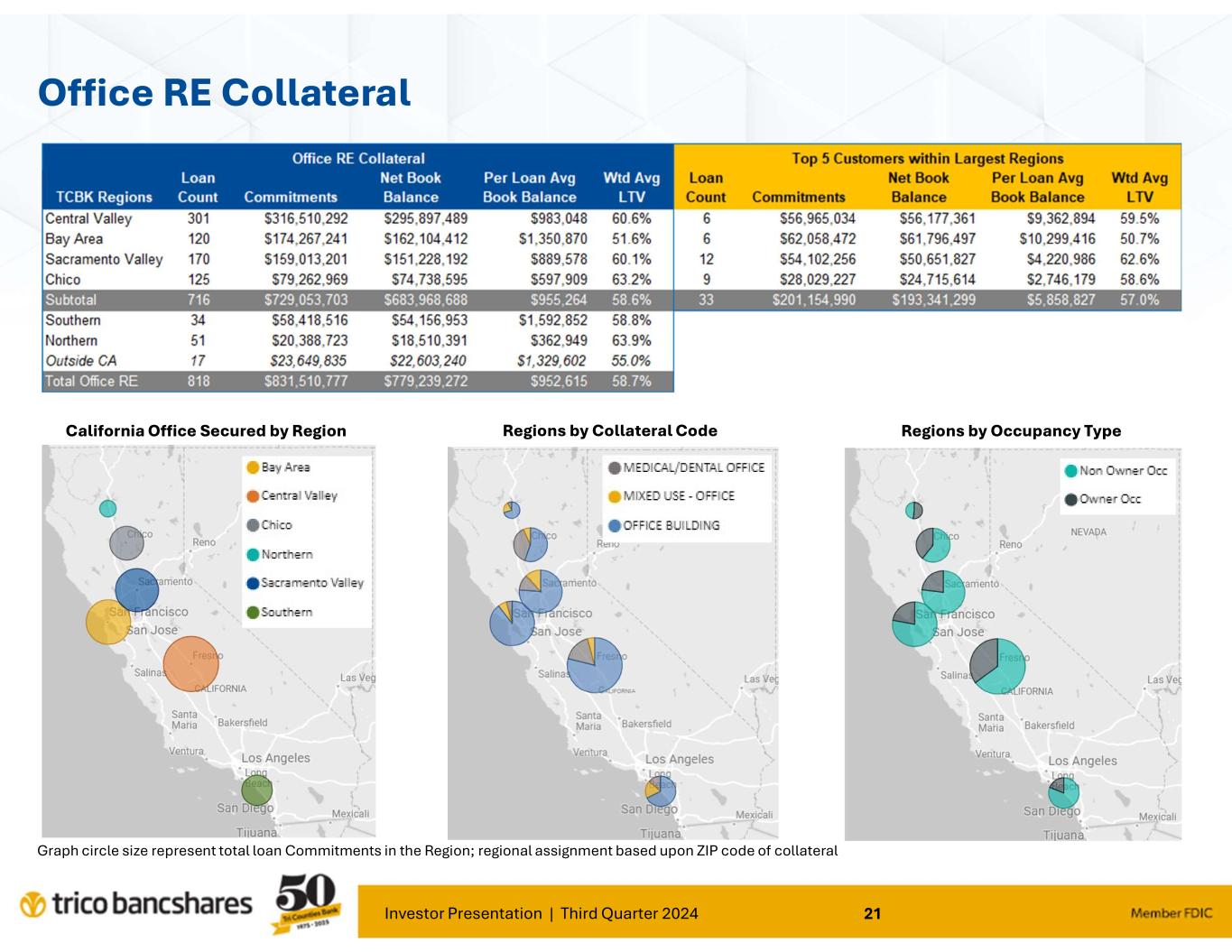

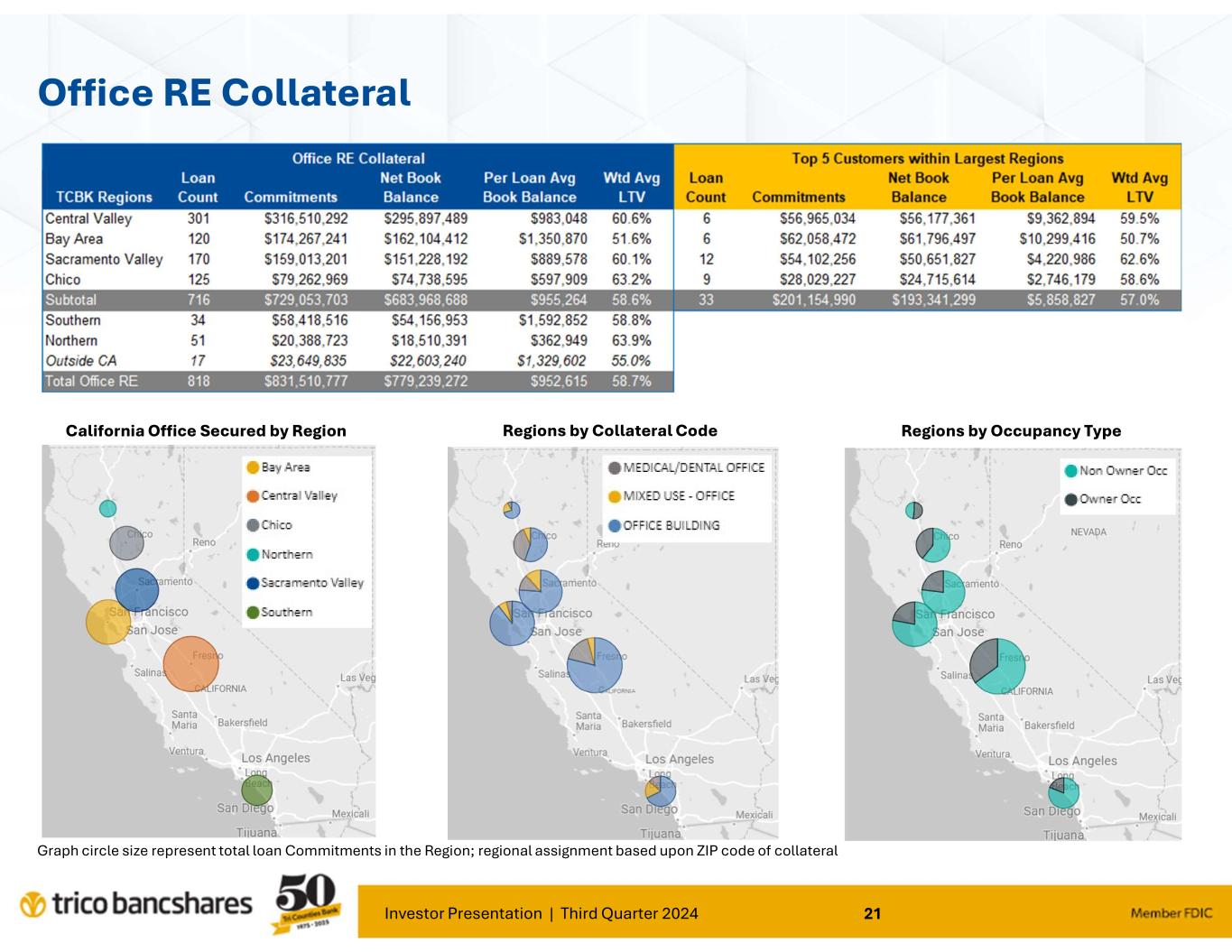

Investor Presentation | Third Quarter 2024 21 Office RE Collateral Graph circle size represent total loan Commitments in the Region; regional assignment based upon ZIP code of collateral California Office Secured by Region Regions by Collateral Code Regions by Occupancy Type

Investor Presentation | Third Quarter 2024 22 69% 54% 78% 64% 79% 73% 43% 50% 30% 43% 22% 36% 21% 24% 56% 43% 1% 3% 0% 0% 0% 3% 1% 7% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Retail Building Office Building Hotel/Motel Light Industrial Mixed Use - Retail Other Multifamily CRE Owner Occupied <= 60% > 60% - 75% > 75% CRE Collateral Values Distribution by LTV (1) LTV Range (1) LTV as of most recent origination or renewal date. CRE Non-Owner Occupied by Collateral Type

Investor Presentation | Third Quarter 2024 23 $2,279 $2,193 $1,025 $964 $353 $350 $468 $596 $954 $964 $873 $872 $279 $325 $416 $407 $59 $63 $158 $174 $60 $65 $663 $659 $732 $647 $66 $60 $266 $367 $158 $134 $8 $8 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 3Q-2024 3Q-2023 CRE Non-Owner Occupied Multifamily SFR HELOC and Junior Liens Commercial & Industrial CRE-Owner Occupied SFR 1-4 Term Construction Agriculture & Farmland Auto & Other Outstanding Principal ($MM) Unfunded Commitment ($MM) Unfunded Loan Commitments HELOCs – by vintage, with weighted avg. coupon (9.17% total WAC) Outstanding Principal and Commitments exclude unearned fees and discounts/premiums, Leases, DDA Overdraft, and Credit Cards 8.20% 8.40% 8.60% 8.80% 9.00% 9.20% 9.40% 9.60% 9.80% 10.00% $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 20242023202220212020201920182017201620152014201320122011<2011 Private Balance (MM) Unfunded (MM) WA Rate 9.51% 9.59% 9.09% 8.87%8.94% 9.02% 9.19% 9.31% 9.42%9.37% 9.21% 8.71%8.77% 9.73% 8.85%

Investor Presentation | Third Quarter 2024 24 C&I Utilization • Outstanding Principal excludes unearned fees and discounts/premiums ($ millions) Utilization has remained stable throughout the rising rate environment C&I yields are generally tied to changes in the Prime Rate. Paired with treasury management services, C&I customers will be a continued source of fee income and deposits. C&I Utilization by NAICS Industry: 3Q-2024 $164 $35 $44 $61 $26 $15 $19 $15 $63 $180 $106 $58 $49 $57 $51 $10 $23 $188 48% 25% 43% 56% 32% 23% 66% 40% 25% 0% 5000% 10000% 15000% 20000% Oil & Gas Extraction Construction Finance and Insurance Real Estate Wholesale Healthcare Trans and Warehouse Retail Trade Other (14 Categories) Outstanding (mln) Unfunded (mln) $186 $191 $448 $476 $509 $544 $527 $550 $574 $560 $523 $521 $443 $353 $339 $552 $547 $603 $593 $628 $653 $647 $670 $663 $686 $722 35% 36% 45% 47% 46% 48% 46% 46% 47% 46% 44% 43% 38% 4.97% 4.96% 4.46% 5.12% 6.11% 6.79% 7.31% 7.60% 7.89% 7.88% 8.00% 7.99% 7.69% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 4Q-2023 1Q-2024 2Q-2024 3Q-2024 Outstanding Principal ($MM) Unfunded Commitment Utilization WAR

Investor Presentation | Third Quarter 2024 25 $892 $512 $493 $623 $665 $668 $299 8.81% 5.81% 4.40% 4.48% 5.33% 5.39% 5.41% 8.66% 6.89% 6.74% 6.53% 6.50% 6.57% 6.94% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% - 100 200 300 400 500 600 700 800 900 1,000 Monthly (Floating) < 1 Year 1 - 2 Years 2 - 3 Years 3 - 4 Years 4 - 5 Years > 5 Years Adjustable Loans, Principal Outstanding ($MM) Adj Wtd Avg Rate Adj Wtd Avg Rate if Repriced 09/30/2024 Loan Yield Composition Dollars in millions, excludes PPP as well as unearned fees and accretion/amortization therein. Wtd Avg Rate (weighted average rate) as of 09/30/2024 and based upon outstanding principal; Next Reprice signifies either the next scheduled reprice date or maturity. 99% of Floating benchmarked to Prime Predominantly benchmarked to 5 Year Treasury 62% Adjustable + Floating Fixed 38% Adjustable 49% Floating 13%

Investor Presentation | Third Quarter 2024 26 $3,242 $3,259 $84 ($52) ($15) 6/30/2024 Originations Payoffs Paydowns 9/30/2024 $3,101 ($147) $12 $3,259 $293 9/30/2023 Originations Payoffs Paydowns 9/30/2024 Adjustable Rate Loans Dollars in millions, principal outstanding, excludes unearned fees; Draws are net of Paydowns in YoY view, Paydowns are net of Draws on existing loans in second quarter WAR (weighted average rate) based upon outstanding principal, excludes unearned fees 4.80% WAR Scaled to $3,000MM Scaled to $2,500MM 4.80% WAR Year-over-year change Quarter-over-quarter change 5.12% WAR 5.07% WAR 6.73% 5.58% 7.02% 5.66% 5.12% WAR 4.80% 5.07% 5.12% 4.40% 4.60% 4.80% 5.00% 5.20% $2,600 $2,800 $3,000 $3,200 $3,400 Adj Rate Loans WAR

Investor Presentation | Third Quarter 2024 27 $2,597 $2,555 $40 ($22) ($60) 6/30/2024 Originations Payoffs Paydowns 9/30/2024 $2,700 $2,555 $176 ($142) ($179) 9/30/2023 Originations Payoffs Paydowns 9/30/2024 Fixed Rate Loans Dollars in millions, principal outstanding, excludes unearned fees; Paydowns are net of draws on existing loans within period WAR (weighted average rate) based upon outstanding principal, excludes unearned fees Year-over-year change Quarter-over-quarter change Scaled to $2,400MM Scaled to $2,400MM 4.62% WAR 4.80% WAR 4.80% WAR 4.80% WAR 7.56% 5.90% 6.89% 6.47% Includes principal amortization as well as transfers of loans out of construction 4.62% 4.80% 4.80% 4.40% 4.45% 4.50% 4.55% 4.60% 4.65% 4.70% 4.75% 4.80% $2,400 $2,450 $2,500 $2,550 $2,600 $2,650 $2,700 $2,750 Balance WAR

Investor Presentation | Third Quarter 2024 28 ($1,434) ($77) ($2,399) $123,517 $4,154 $123,760 ACL 6/30/2024 Portfolio Growth/Mix Charge Offs & Recoveries Criticized & Classified Reserve Rates ACL 9/30/2024 $115,000 $117,000 $119,000 $121,000 $123,000 $125,000 $127,000 Allowance for Credit Losses Drivers of Change under CECL Loan portfolio declined $59 million in Q3 C&I declines were the driver of reductions in ACL due to volume Primarily driven by Qualitative factors CRE concentrations Gross charge-offs $0.444 million Gross recoveries $0.367 million 1.83% of Total Loans 1.85% of Total Loans Driven by specific reserve increases of $3.7 million Excludes gross charge-offs Scaled to reflect $115MM

Investor Presentation | Third Quarter 2024 29 Allowance for Credit Losses Allocation of Allowance by Segment

Investor Presentation | Third Quarter 2024 30 Risk Grade Migration Zero balance in Doubtful and Loss 82.6%83.6%83.5%85.0%86.0%87.8% 14.1%13.3%13.8%12.1%11.4%8.8% 1.6%1.5%1.6%1.5%1.4%2.4% 1.8%1.6%1.1%1.3%1.2%1.0% 0% 20% 40% 60% 80% 100% 3Q-20242Q-20241Q-20244Q-20233Q-20232Q-2023 Pass Watch Special Mention Substandard

Investor Presentation | Third Quarter 2024 31 0.37% 0.38% 0.17% 0.15% 0.21% 0.25% 0.20% 0.40% 0.32% 0.35% 0.37% 0.35% 0.44% 0.60% 0.50% 0.46% 0.34% 0.34% 0.32% 0.37% 0.39% 0.48% 0.53% 0.53% 0.55% 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 TCBK Peers 293% 281% 682% 821% 581% 496% 676% 312% 389% 381% 363% 377% 297% 18 1% 19 1% 17 8% 19 9% 21 1% 14 9% 20 4% 22 4% 19 1% 18 9% 17 4% 16 7% 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 TCBK Peers Peer group consists of 99 closest peers in terms of asset size, range $6.2-13.4 Billion, source: BankRegData.com NPAs as presented are net of guarantees, NPLs as presented are not adjusted for guarantees. Asset Quality The Bank continues to actively and aggressively address potential credit issues with short resolution timelines. Over the past three years, both the Bank’s total non-performing assets and coverage ratio have remained better than peers. Non-Performing Assets as a % of Total Assets Coverage Ratio: Allowance as % of Non-Performing Loans

Investor Presentation | Third Quarter 2024 Financials 3232

Investor Presentation | Third Quarter 2024 33 Net Interest Income (NII) and Margin (NIM)

Investor Presentation | Third Quarter 2024 34 Net Interest Income (NII) and Margin (NIM)

Investor Presentation | Third Quarter 2024 35 1.24% 1.43% 0.91% 1.43% 1.28% 1.19% 1.17% 2018 2019 2020 2021 2022 2023 2024 1.73% 1.94% 1.83% 1.91% 1.97% 1.87% 1.66% 2018 2019 2020 2021 2022 2023 2024 63.7% 59.7% 58.4% 53.2% 53.0% 55.8% 59.0% 2018 2019 2020 2021 2022 2023 2024 4.30% 4.47% 3.96% 3.58% 3.88% 3.96% 3.69% 2018 2019 2020 2021 2022 2023 2024 Current Operating Metrics Net Interest Margin (FTE) PPNR as % of Average Assets Efficiency Ratio ROAA 2024 values through the 9 months ended 9/30/2024, annualized where applicable

Investor Presentation | Third Quarter 2024 36 9.5% 10.6% 9.3% 9.2% 7.6% 8.8% 9.7% 2018 2019 2020 2021 2022 2023 2024 14.4% 15.1% 15.2% 15.4% 14.2% 14.7% 15.6% 2018 2019 2020 2021 2022 2023 2024 12.5% 13.3% 12.9% 13.2% 11.7% 12.2% 13.1% 2018 2019 2020 2021 2022 2023 2024 13.7% 14.4% 14.0% 14.2% 12.4% 12.9% 13.8% 2018 2019 2020 2021 2022 2023 2024 Well Capitalized Tier 1 Capital Ratio Total Risk Based Capital CET1 Ratio Tangible Capital Ratio 2024 values at quarter ended 9/30/2024

Investor Presentation | Third Quarter 2024 37 Our Mission Tri Counties Bank exists for just one purpose: to improve the financial success and well-being of our shareholders, customers, communities and employees. Core Values Trust Respect Integrity Communication Opportunity Team Ethos We are one team, aligned, customer-focused and collaborative to achieve next-level performance.