KBW Winter Financial Services Symposium Richard P. Smith – President & Chief Executive Officer John S. Fleshood – EVP & Chief Operating Officer February 2019 Exhibit 99.1

Safe harbor statement The statements contained herein that are not historical facts are forward-looking statements based on management's current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There can be no assurance that future developments affecting us will be the same as those anticipated by management. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the impact of changes in financial services policies, laws and regulations; technological changes; mergers and acquisitions; changes in the level of our nonperforming assets and charge-offs; any deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting standards and practices; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; our ability to attract deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; the impact of competition from other financial service providers; the possibility that any of the anticipated benefits of our recent merger with FNBB will not be realized or will not be realized within the expected time period, or that integration of FNBB’s operations will be more costly or difficult than expected; the challenges of integrating and retaining key employees; unanticipated regulatory or judicial proceedings; the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; and our ability to manage the risks involved in the foregoing. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2017, which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. KBW Winter Financial Services Symposium February 2019

agenda Most Recent Quarter Recap Company Overview Lending Overview Deposit Overview Financials KBW Winter Financial Services Symposium February 2019

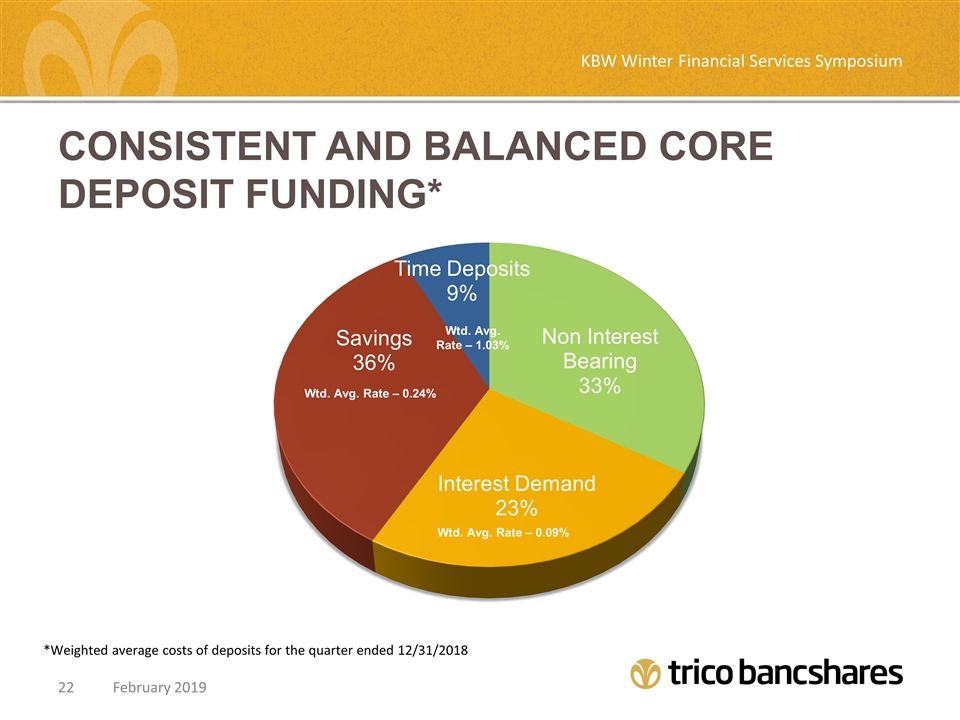

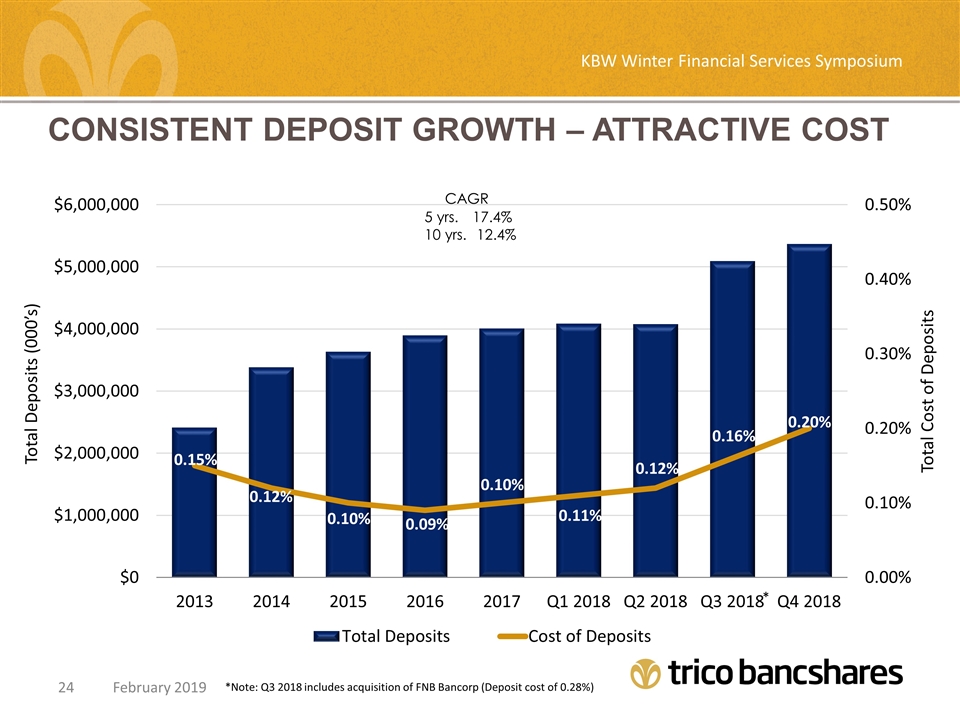

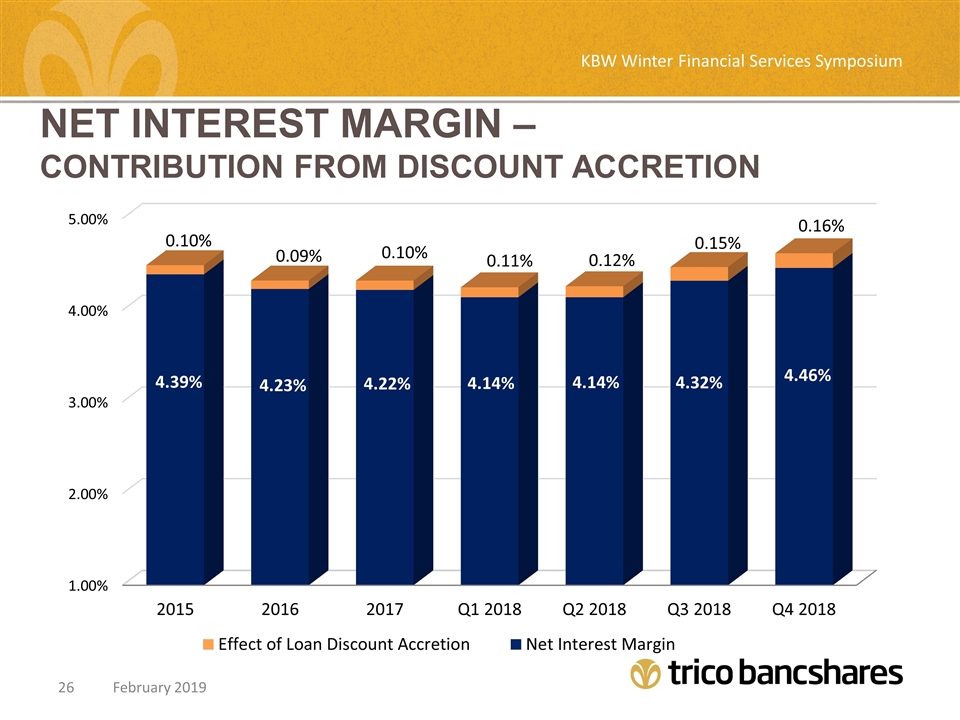

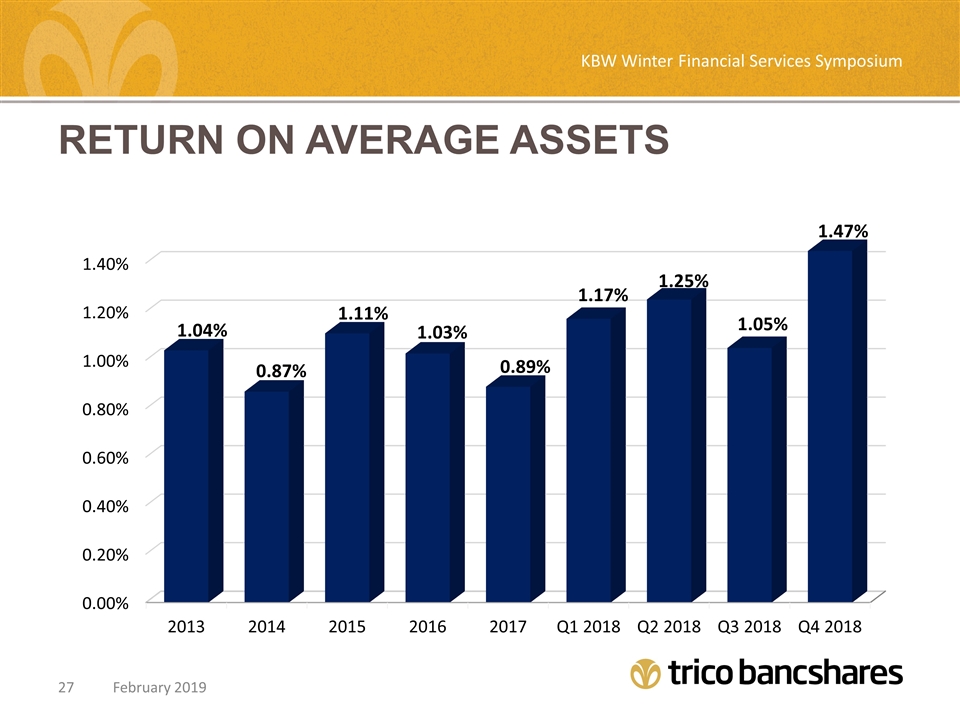

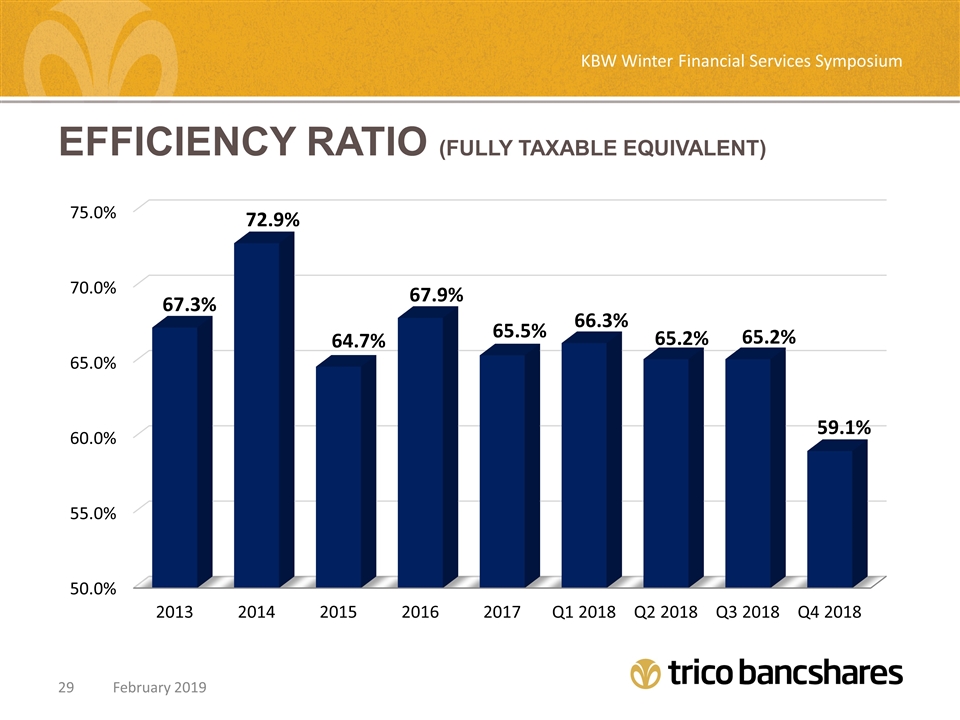

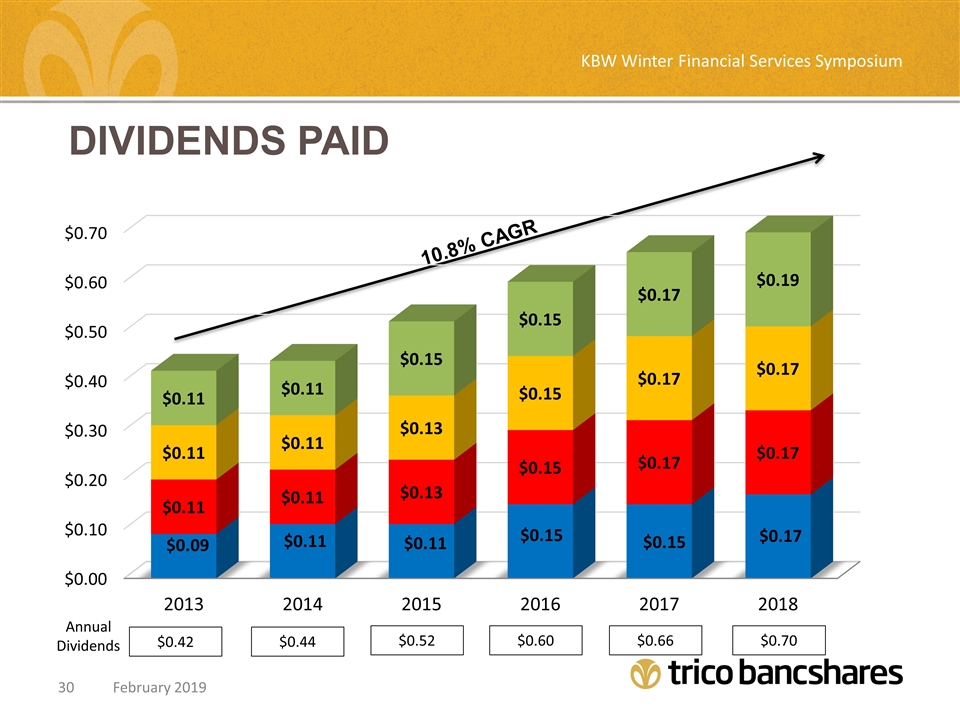

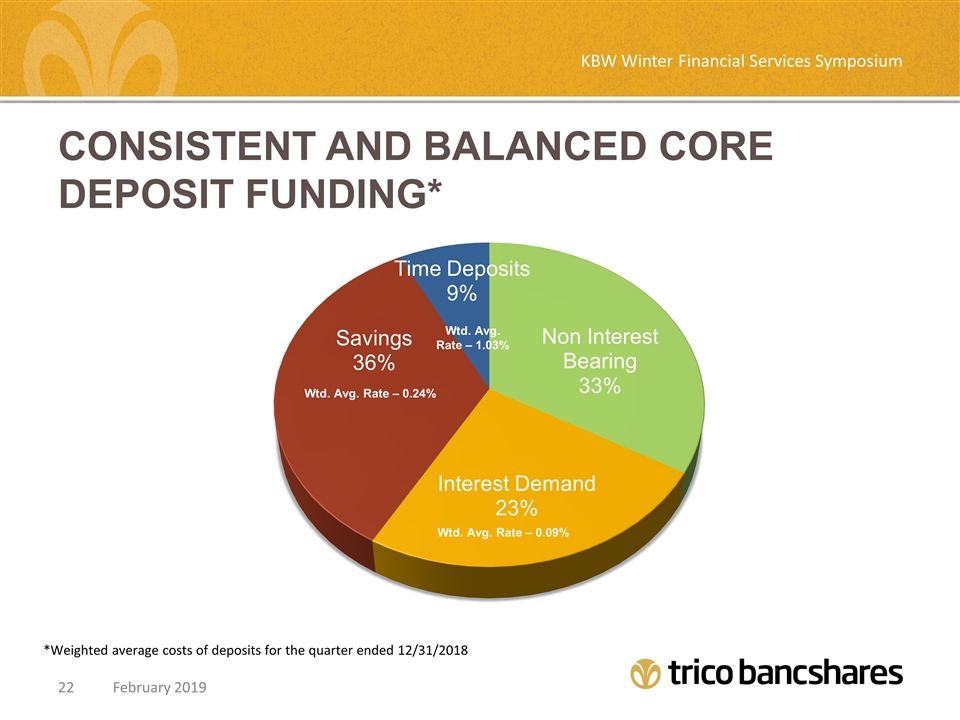

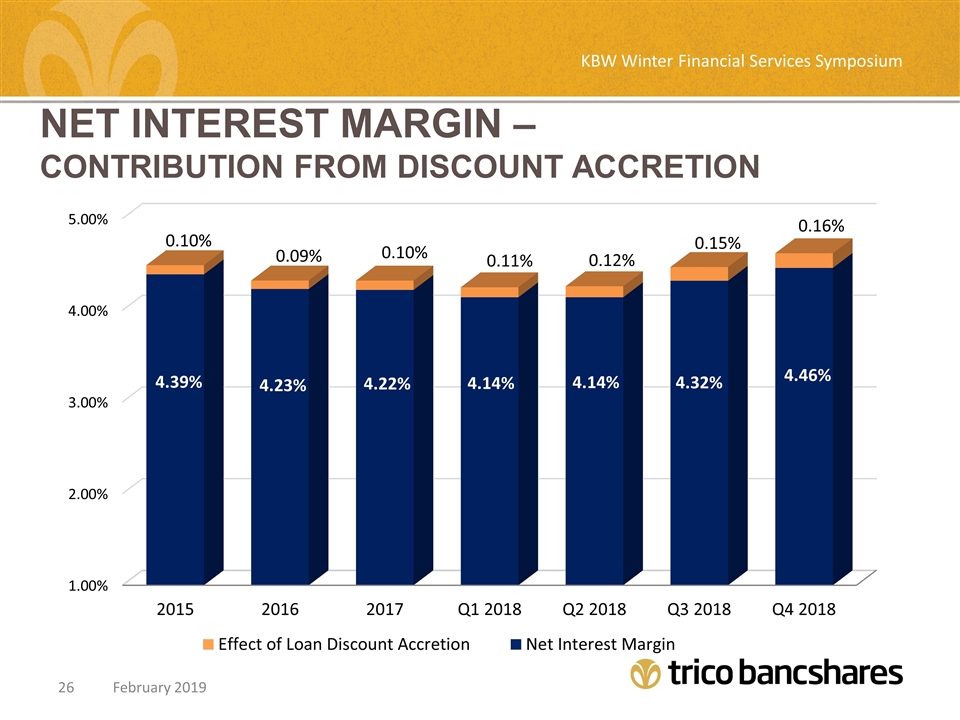

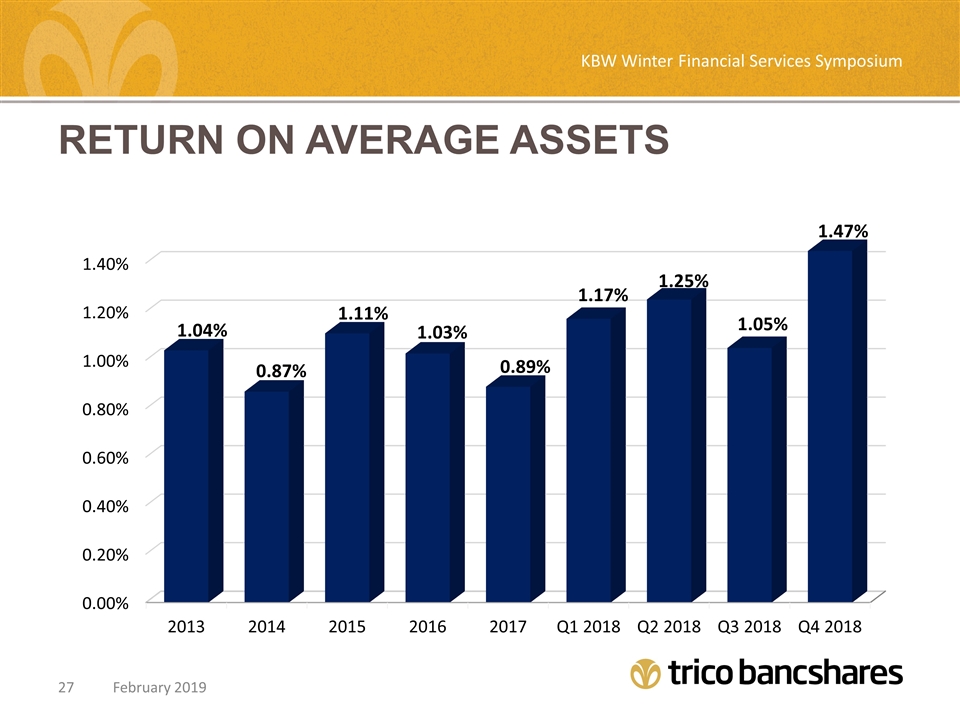

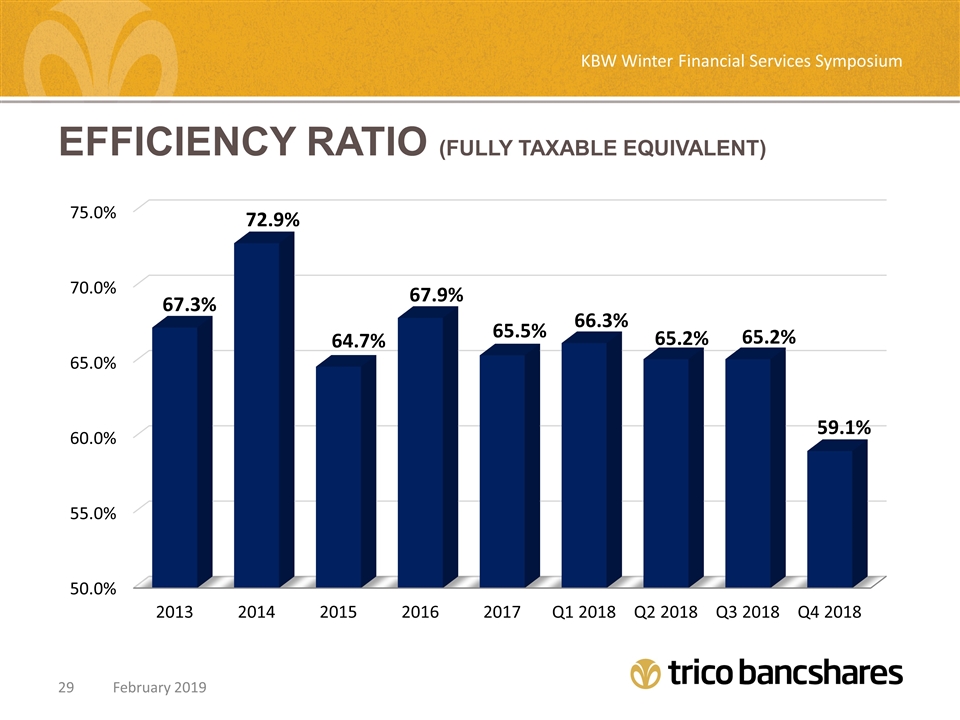

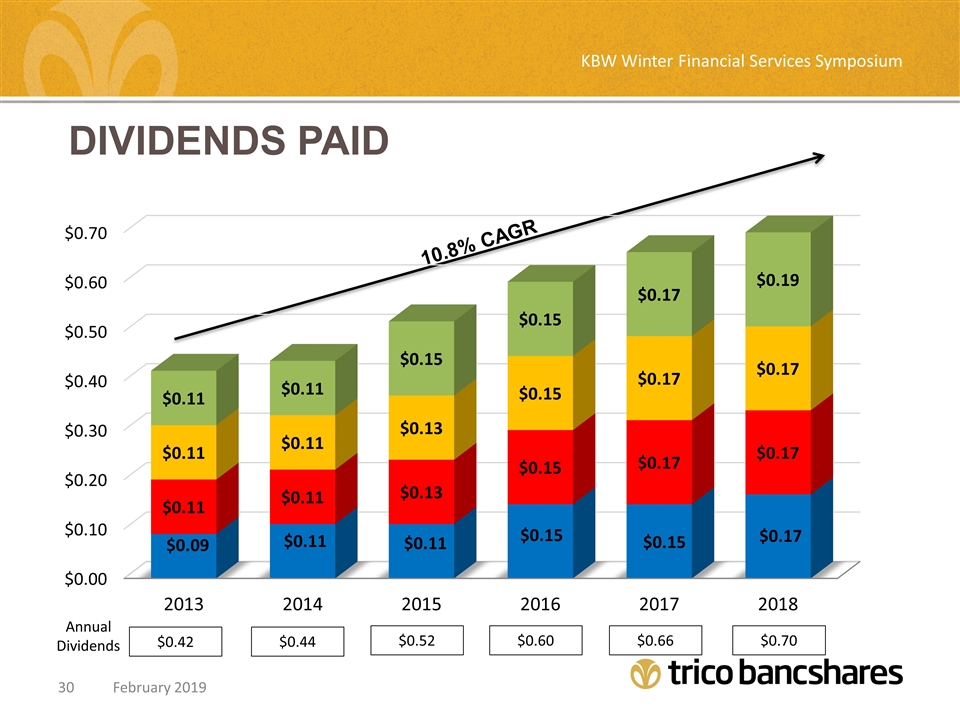

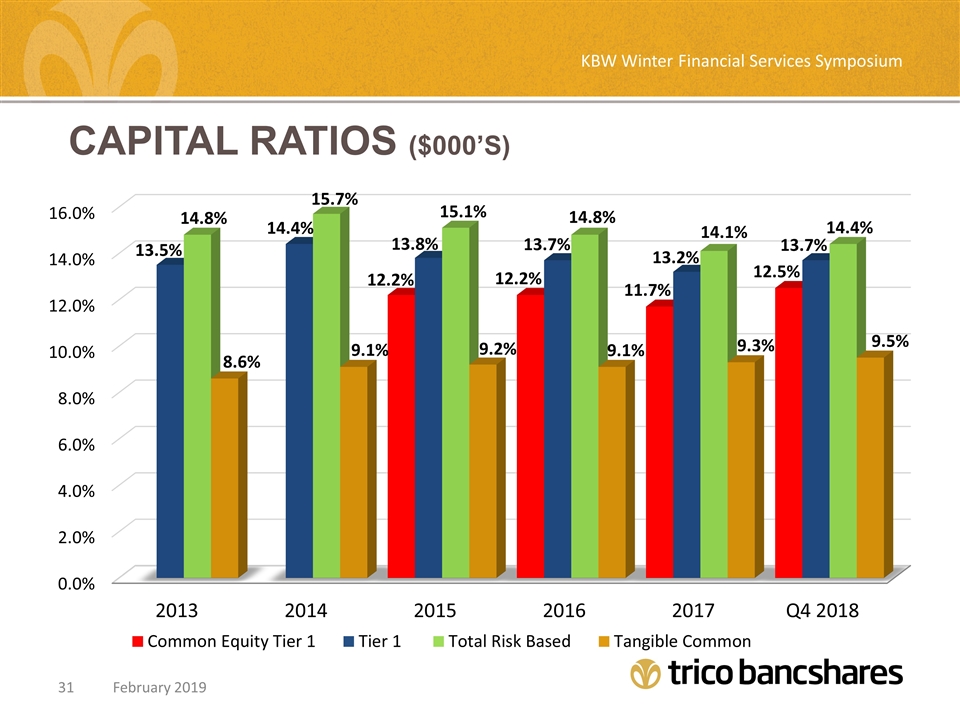

Most recent quarter highlights KBW Winter Financial Services Symposium February 2019 Robust Earnings Q4 2018 return on average assets of 1.47% versus 1.05% linked quarter. Loans to deposits ratio of 75% in Q4 2018, down slightly from 79% in Q3 2018. Industry Leading Net Interest Margin Net Interest Margin increased 14 bps versus Q3 2018 and 20 bps versus Q4 2017. Net Interest Income grew 23.2% on an annualized linked quarter basis versus prior quarter. Yield on loans increased by 26 basis points linked quarter and 35 basis points versus prior year. Low Efficiency Ratio Revenue growth and operating expense management resulted in improvement in the efficiency ratio to 59.1% for Q4 compared to 65.2% in the prior quarter and 66.1% for the prior year. Profitable Deposit Base Average cost of total deposits rose 4 bps versus the prior quarter to 0.20%. Total deposits grew 21.5% on an annualized linked quarter basis, with non-interest bearing demand deposits comprising 33% of total deposits. Strong Capital Levels Tangible capital consistent at 9.5%. Common dividend increased to $0.19 during Q4 2018, and 11.8% increase over Q4 2017.

COMPANY overview February 2019 KBW Winter Financial Services Symposium

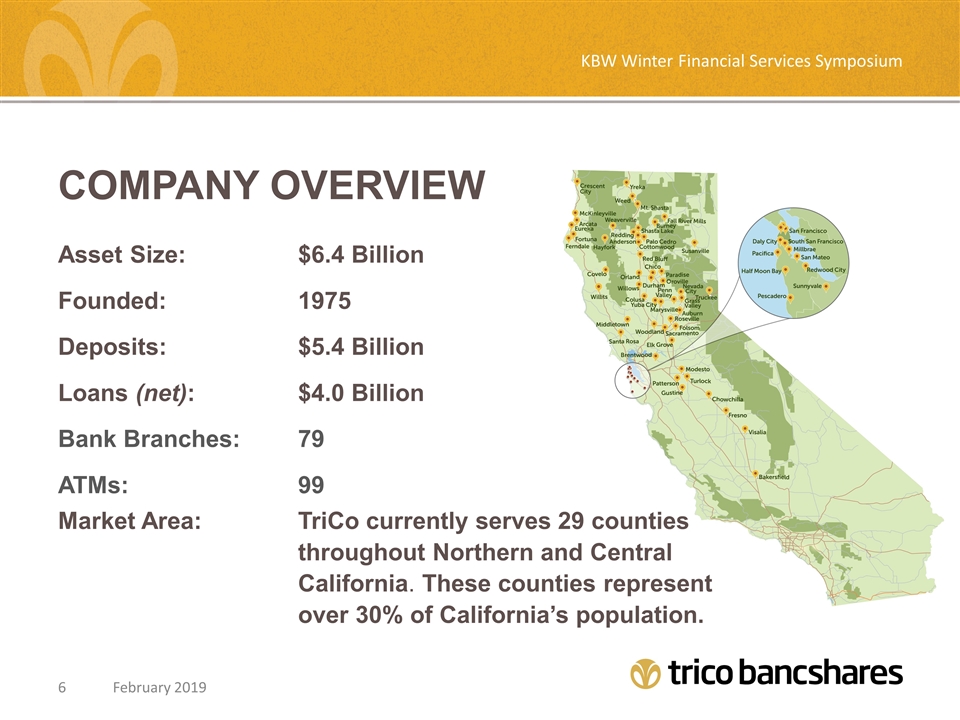

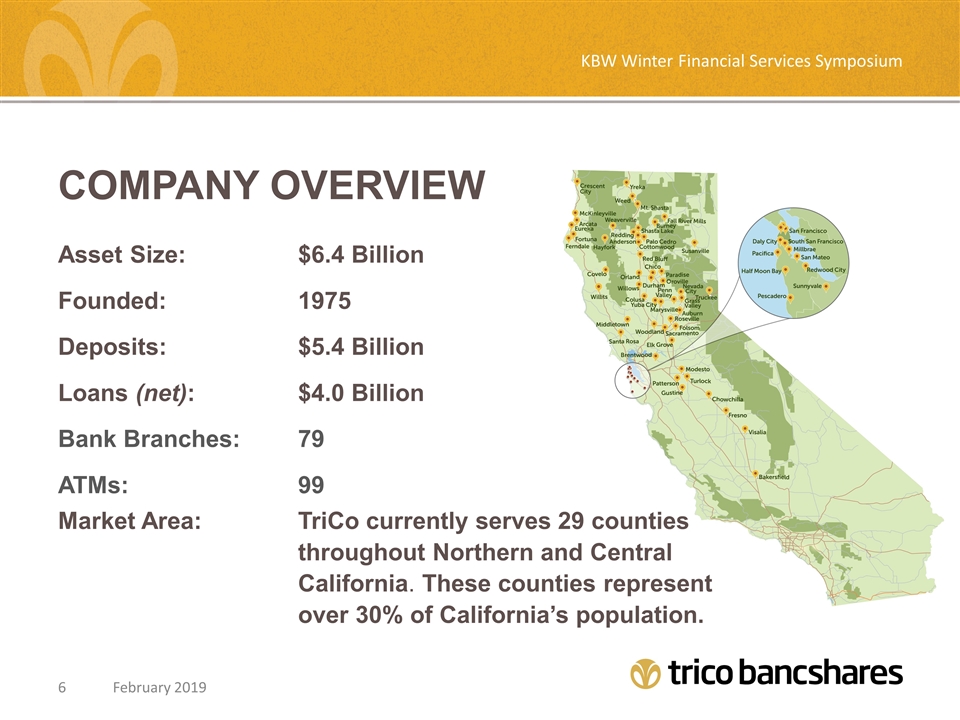

COMPANY overview Asset Size:$6.4 Billion Founded:1975 Deposits:$5.4 Billion Loans (net):$4.0 Billion Bank Branches:79 ATMs:99 Market Area: TriCo currently serves 29 counties throughout Northern and Central California. These counties represent over 30% of California’s population. KBW Winter Financial Services Symposium February 2019

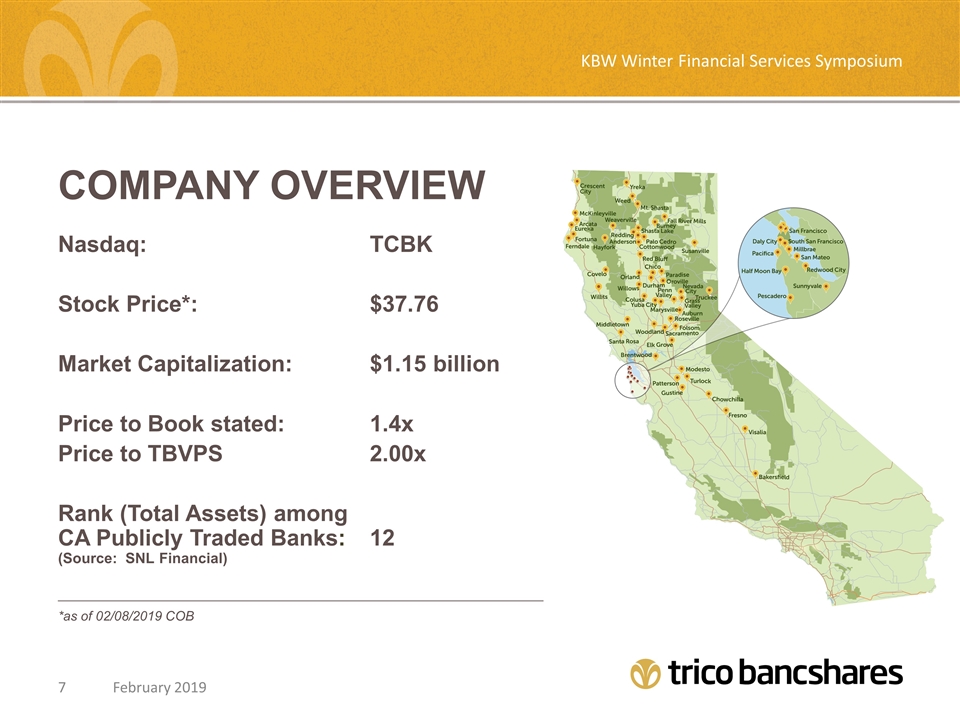

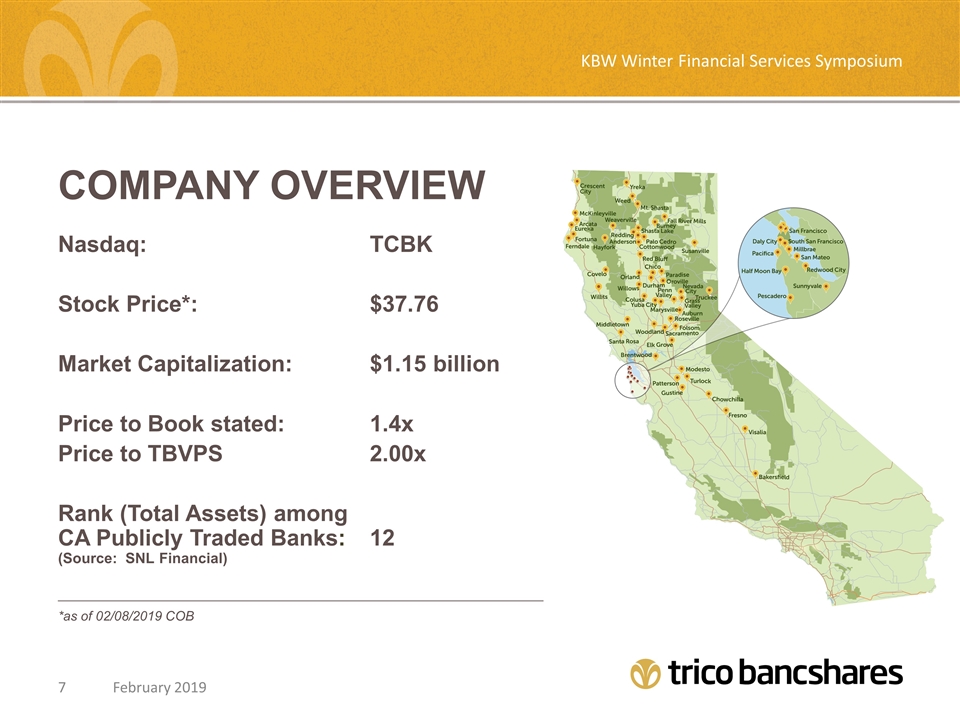

COMPANY overview Nasdaq:TCBK Stock Price*:$37.76 Market Capitalization:$1.15 billion Price to Book stated:1.4x Price to TBVPS2.00x Rank (Total Assets) among CA Publicly Traded Banks:12 (Source: SNL Financial) KBW Winter Financial Services Symposium February 2019 _________________________________________________________________________ *as of 02/08/2019 COB

Executive Team Rick Smith President & CEO TriCo since 1993 John Fleshood EVP Chief Operating Officer TriCo since 2016 Dan Bailey EVP Chief Retail Banking Officer TriCo since 2007 Craig Carney EVP Chief Credit Officer TriCo since 1996 Peter Wiese EVP Chief Financial Officer TriCo since 2018 Richard O’Sullivan EVP Chief Commercial Lending Officer TriCo since 1984 KBW Winter Financial Services Symposium February 2019

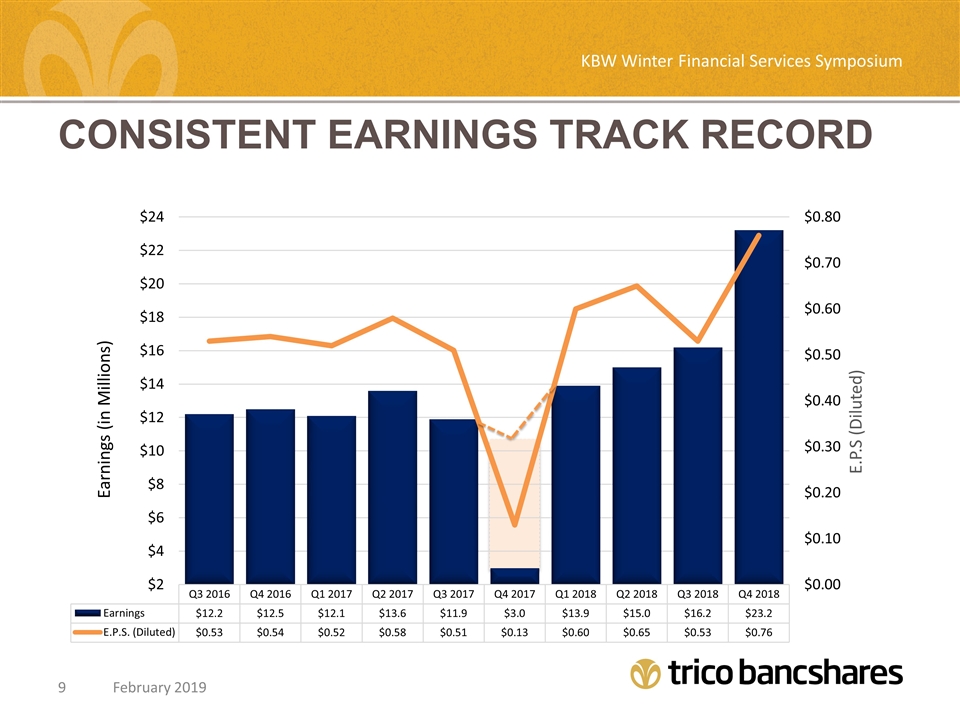

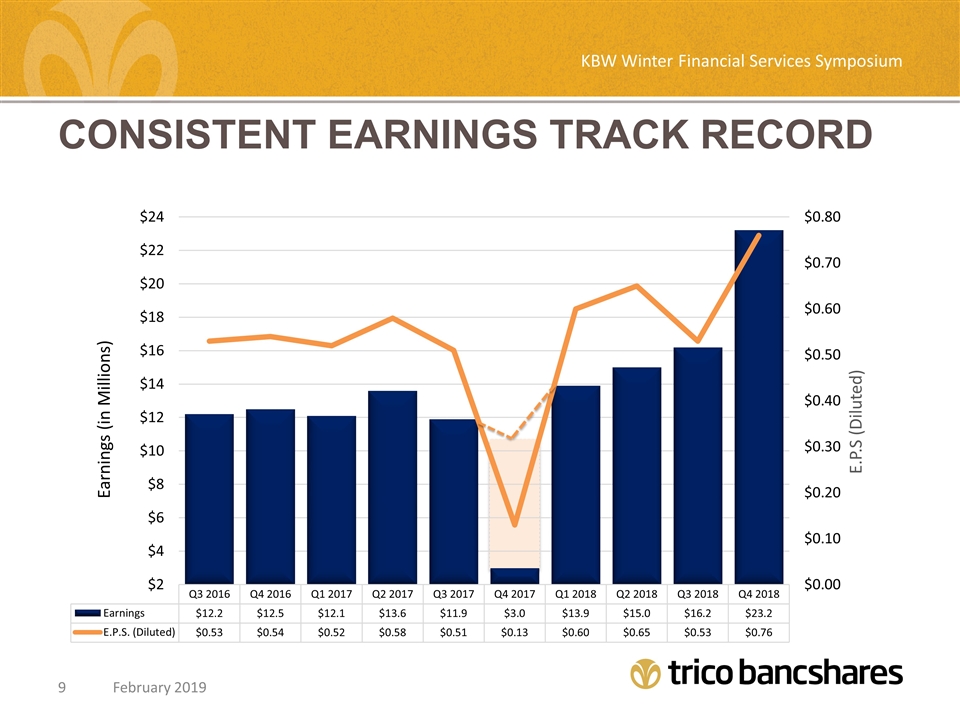

Consistent earnings track record February 2019 KBW Winter Financial Services Symposium

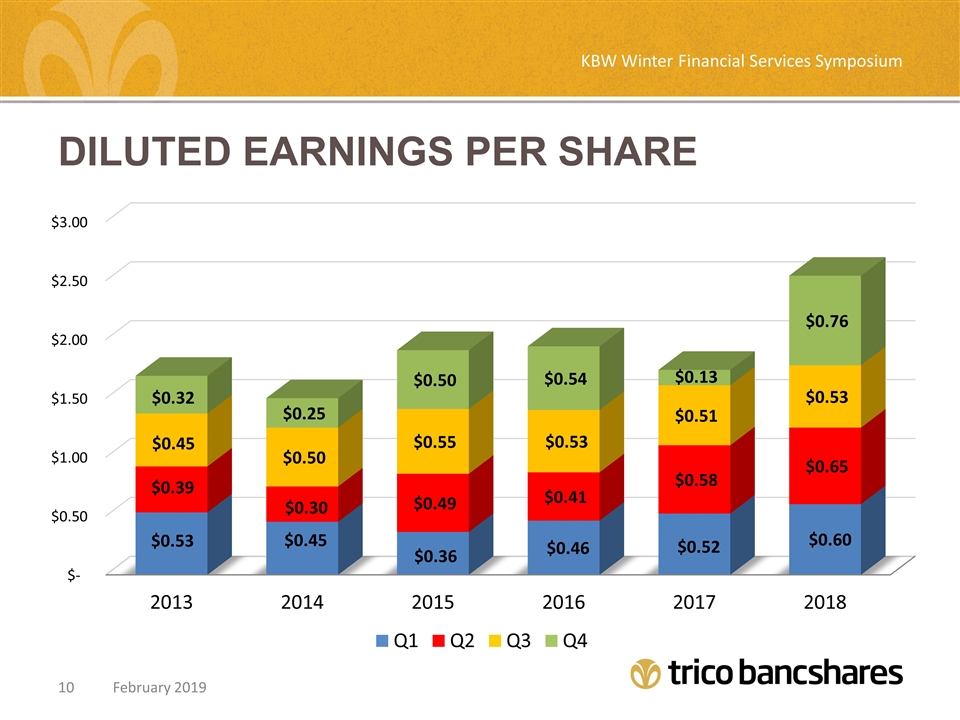

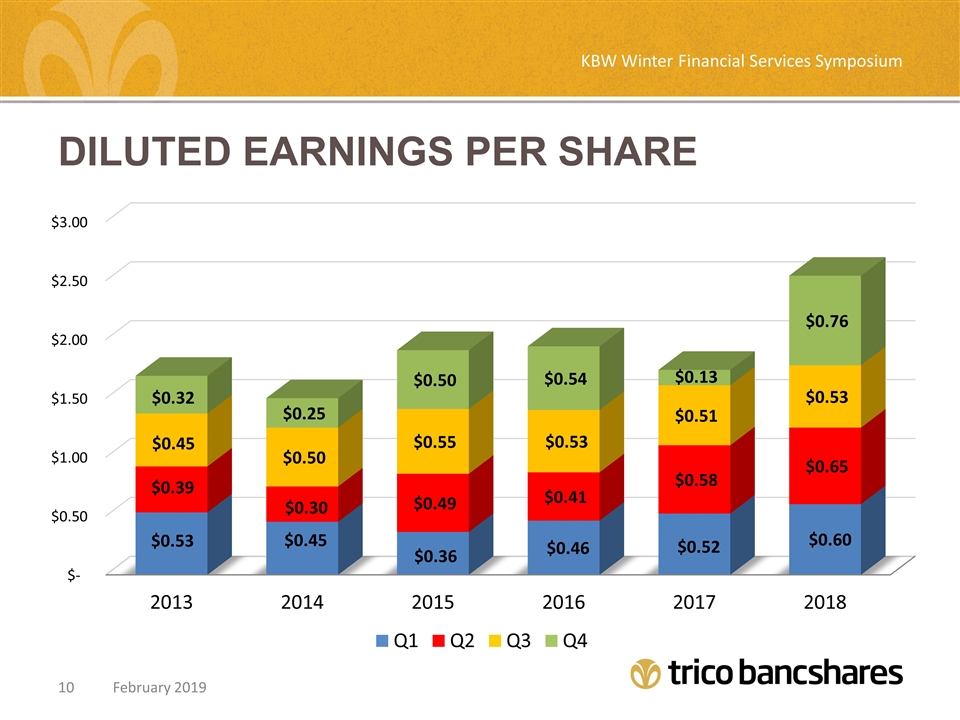

Diluted Earnings per share February 2019 KBW Winter Financial Services Symposium

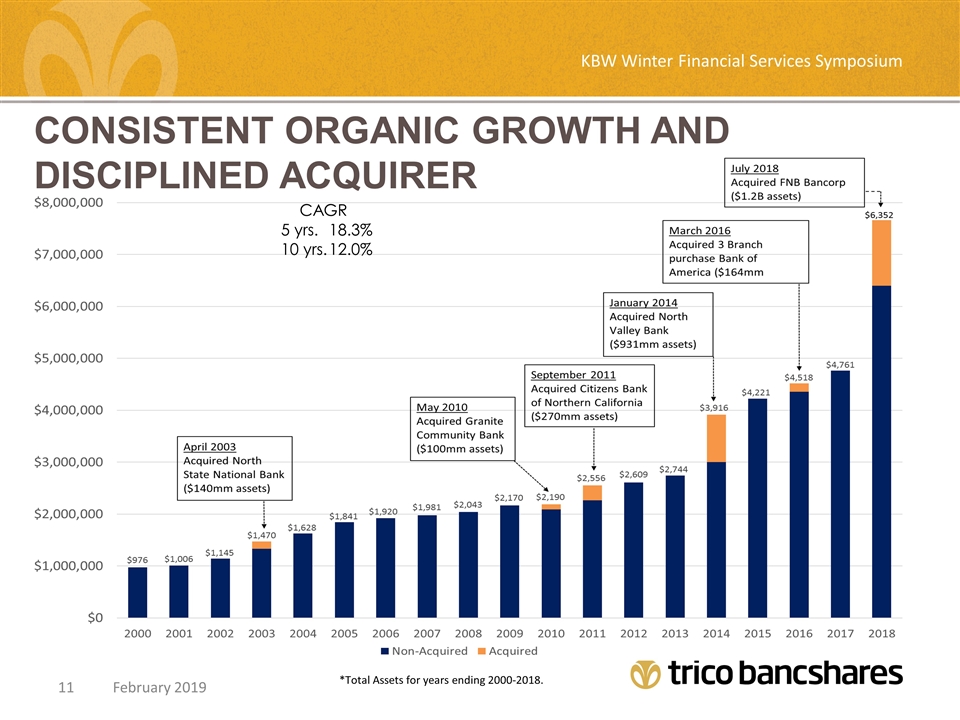

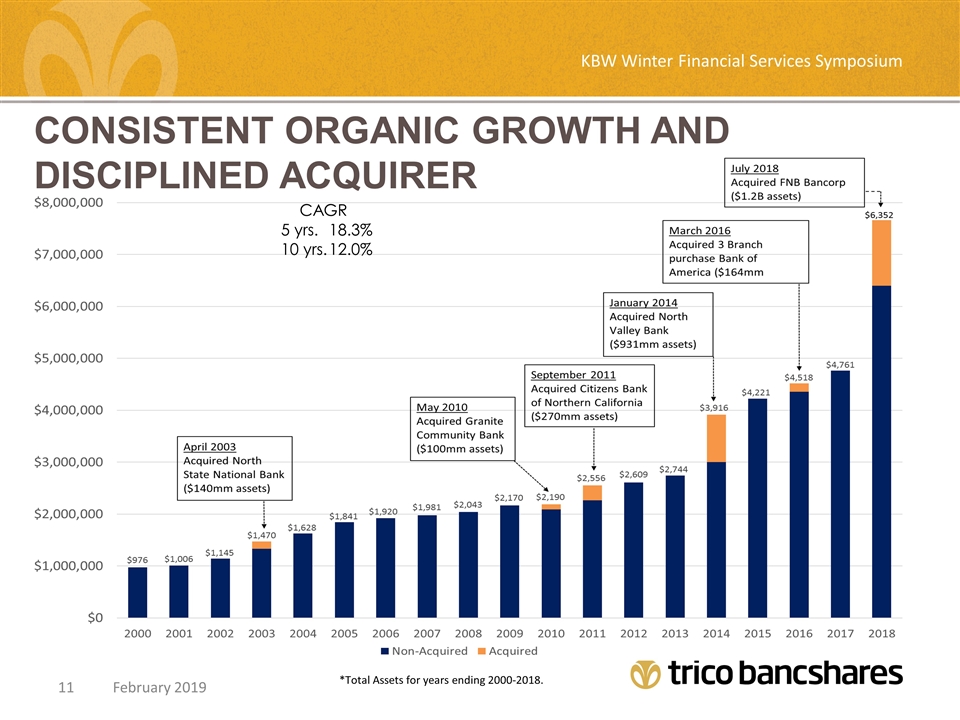

KBW Winter Financial Services Symposium February 2019 *Total Assets for years ending 2000-2018. CAGR 5 yrs.18.3% 10 yrs.12.0% Consistent Organic growth and disciplineD acquirer

Deposit Betas Ability to Increase Loan Yields Interest Rate Risk Aggressive Competitors The Cost of Compliance with New Regulations Dysfunction in Washington What keeps us up at night? KBW Winter Financial Services Symposium February 2019

Loans KBW Winter Financial Services Symposium February 2019

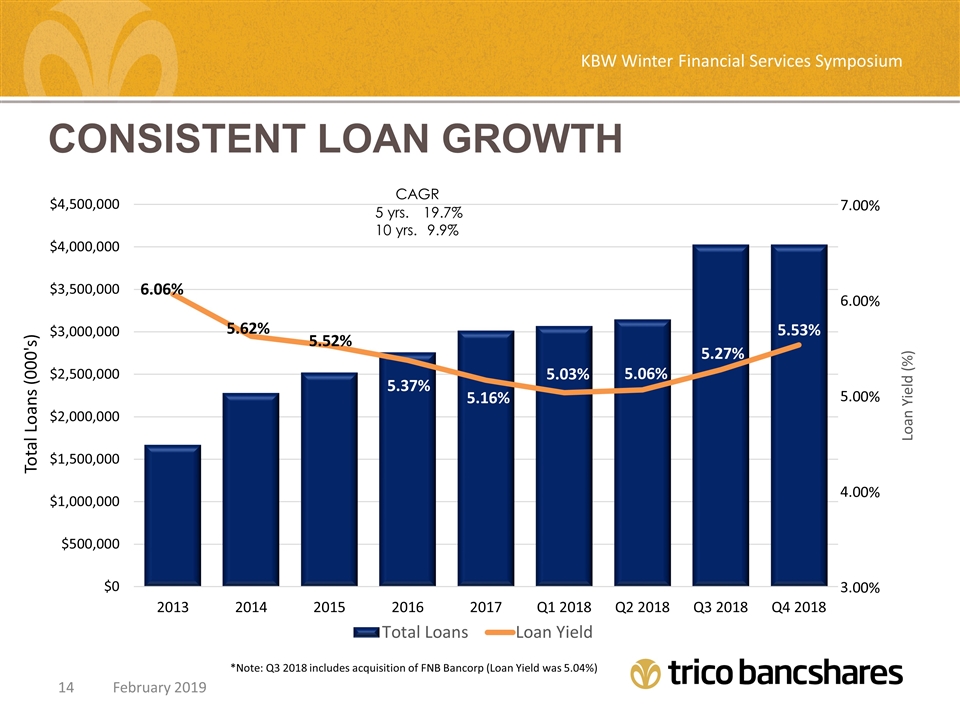

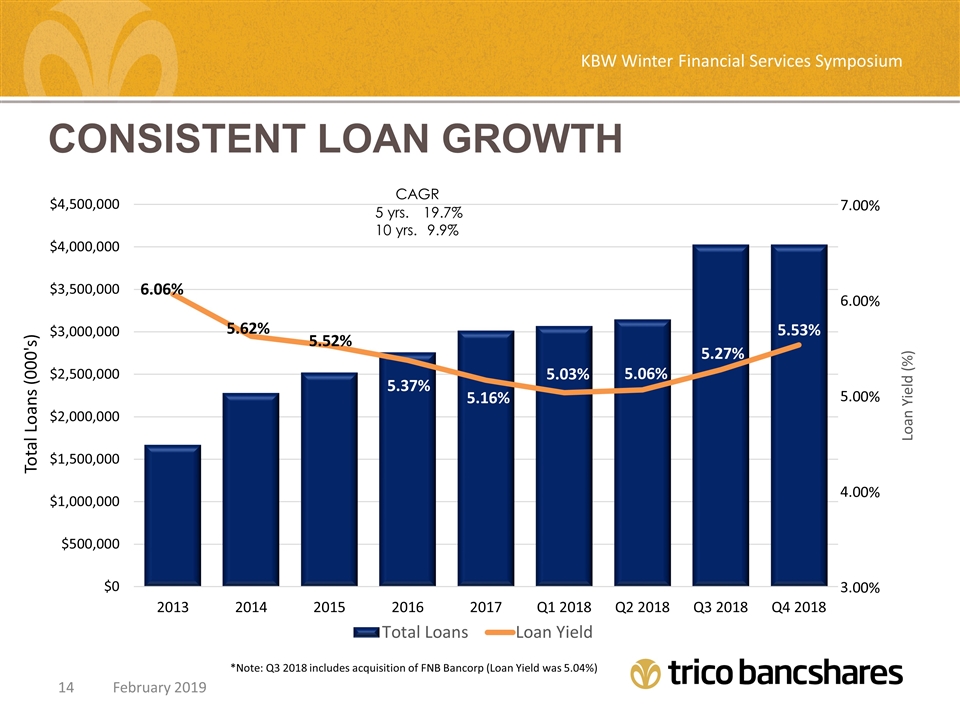

CONSISTENT LOAN GROWTH KBW Winter Financial Services Symposium February 2019 *Note: Q3 2018 includes acquisition of FNB Bancorp (Loan Yield was 5.04%)

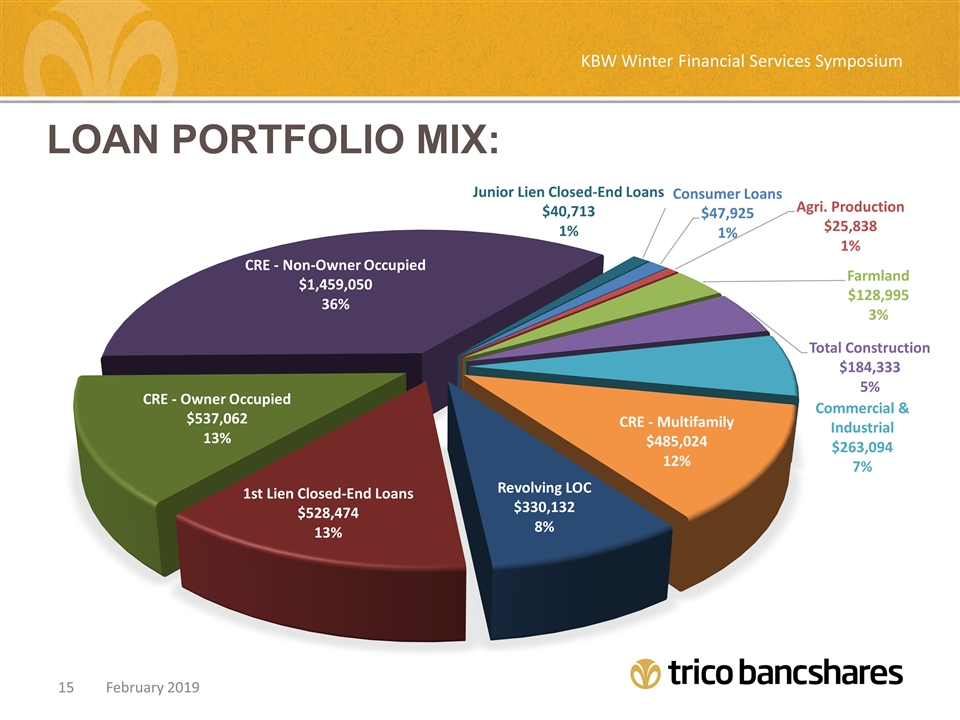

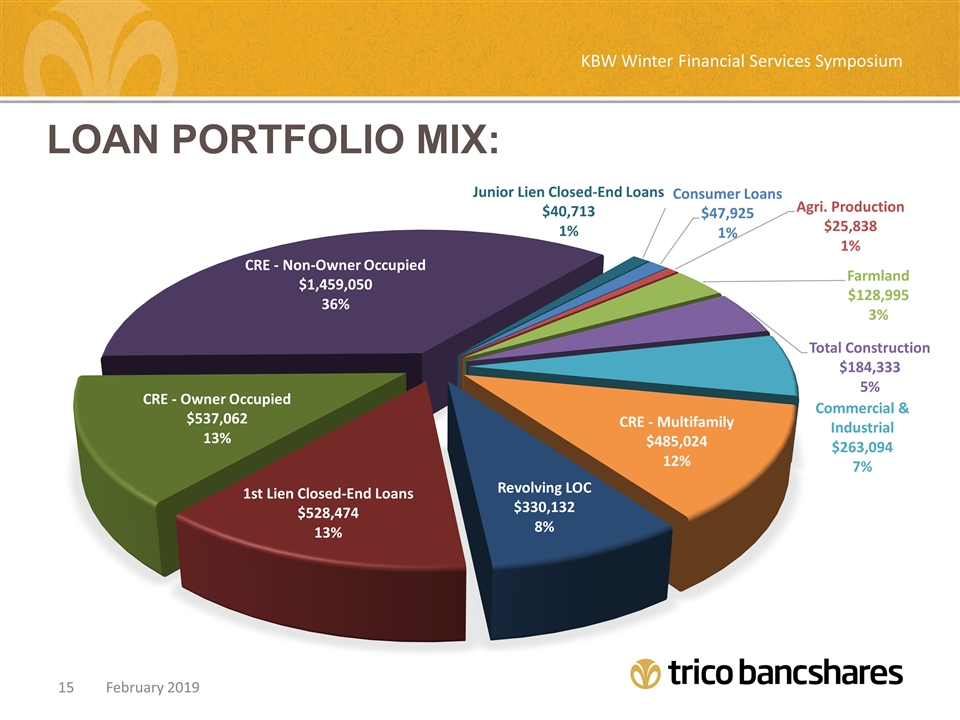

Loan portfolio MIX: February 2019 KBW Winter Financial Services Symposium

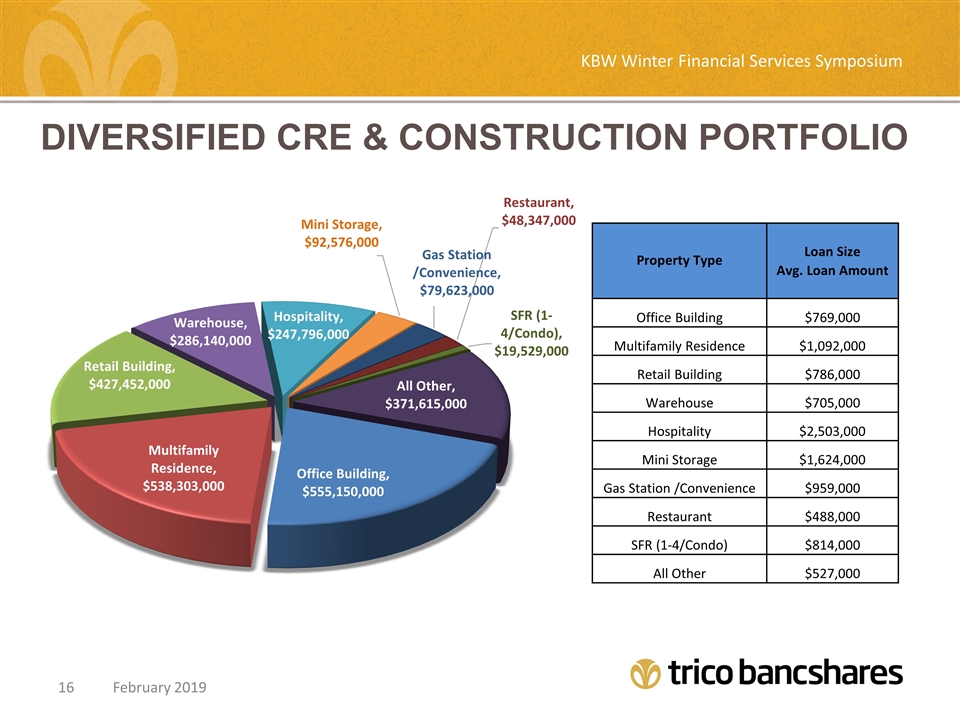

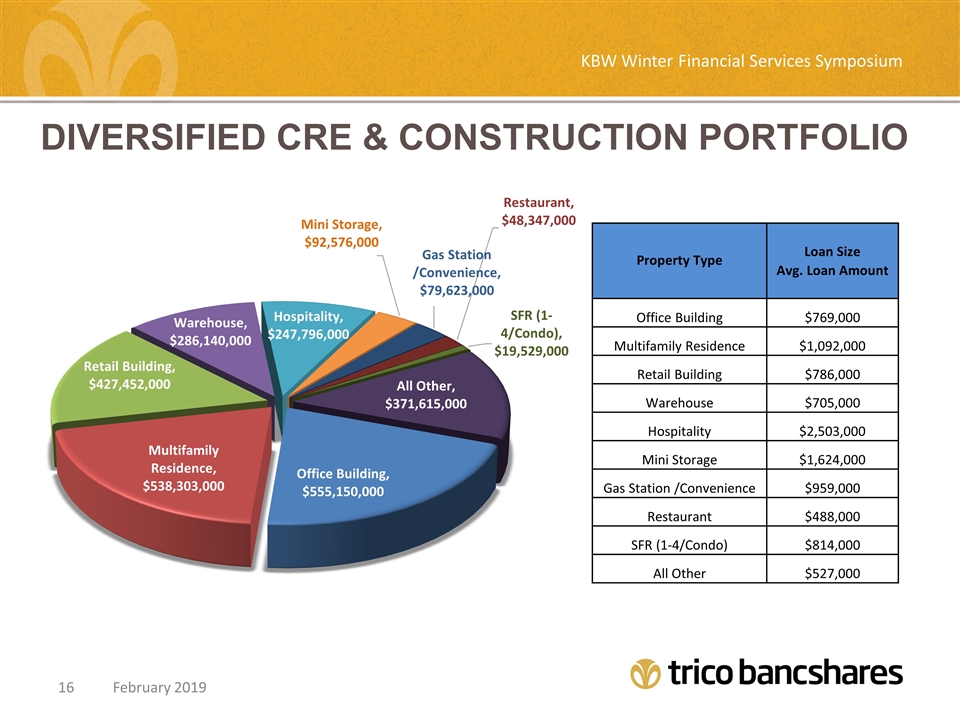

Diversified cre & construction portfolio February 2019 KBW Winter Financial Services Symposium Property Type Loan Size Avg. Loan Amount Office Building $769,000 Multifamily Residence $1,092,000 Retail Building $786,000 Warehouse $705,000 Hospitality $2,503,000 Mini Storage $1,624,000 Gas Station /Convenience $959,000 Restaurant $488,000 SFR (1-4/Condo) $814,000 All Other $527,000

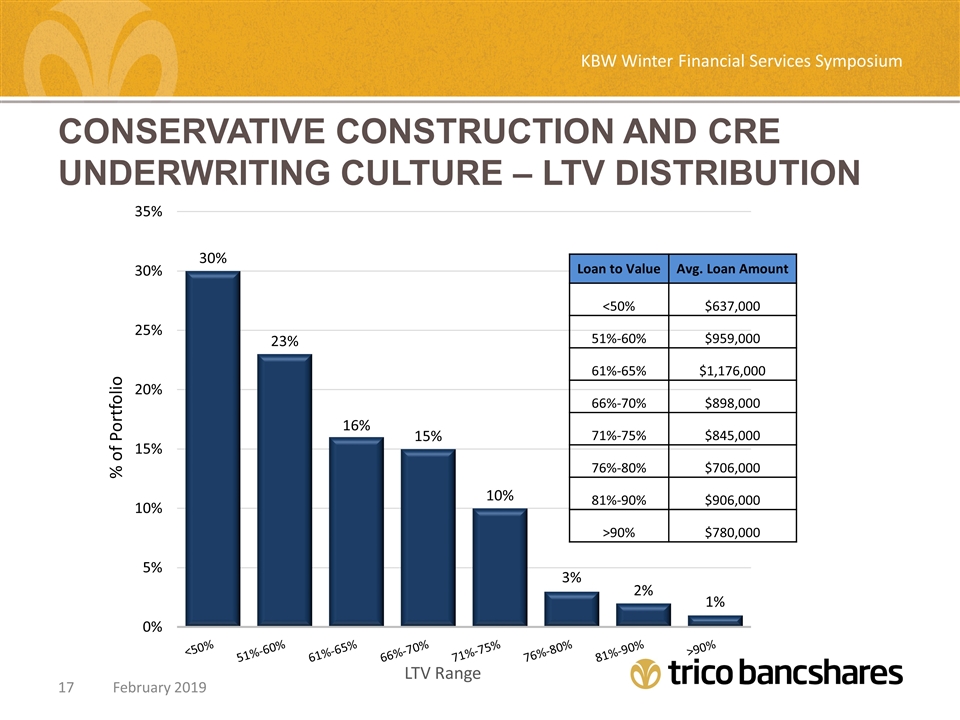

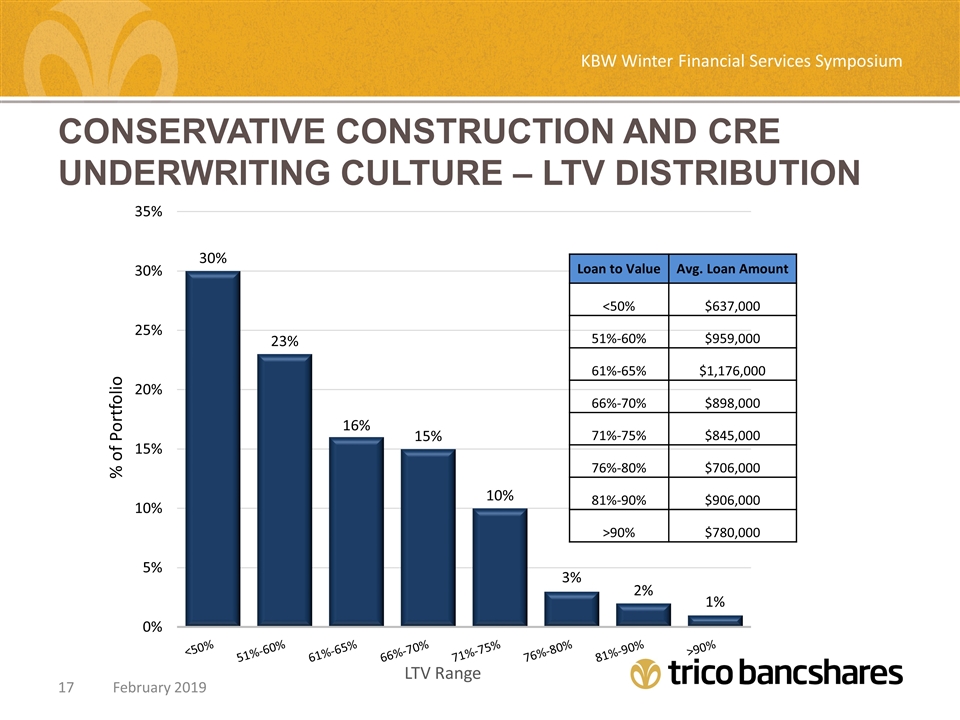

CONSERVATIVE Construction and CRE UNDERWRITING CULTURE – Ltv distribution February 2019 KBW Winter Financial Services Symposium Loan to Value Avg. Loan Amount <50% $637,000 51%-60% $959,000 61%-65% $1,176,000 66%-70% $898,000 71%-75% $845,000 76%-80% $706,000 81%-90% $906,000 >90% $780,000

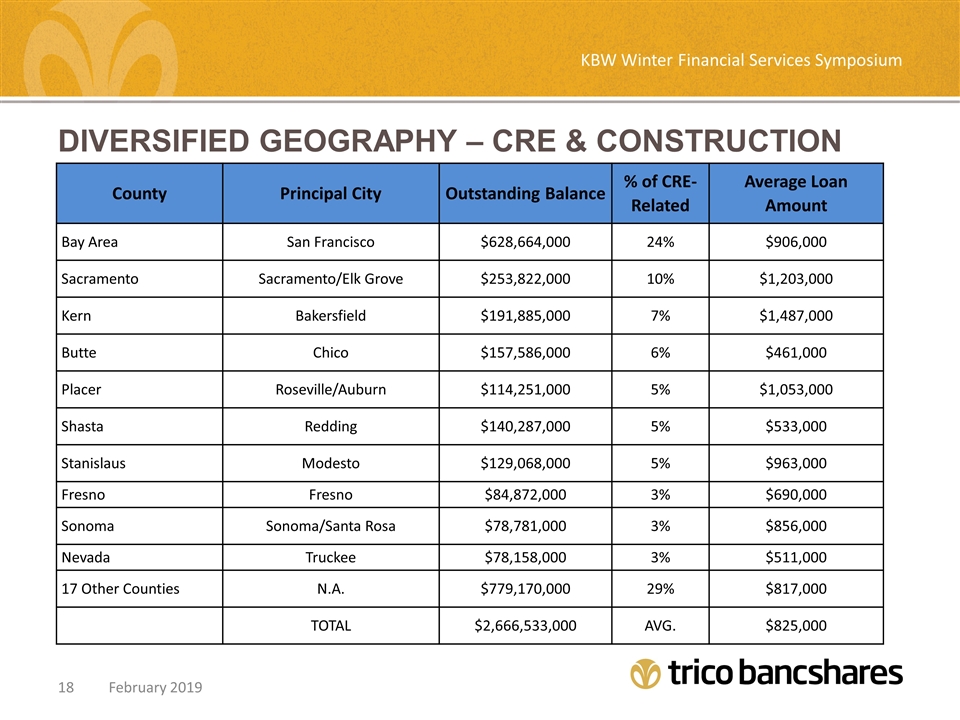

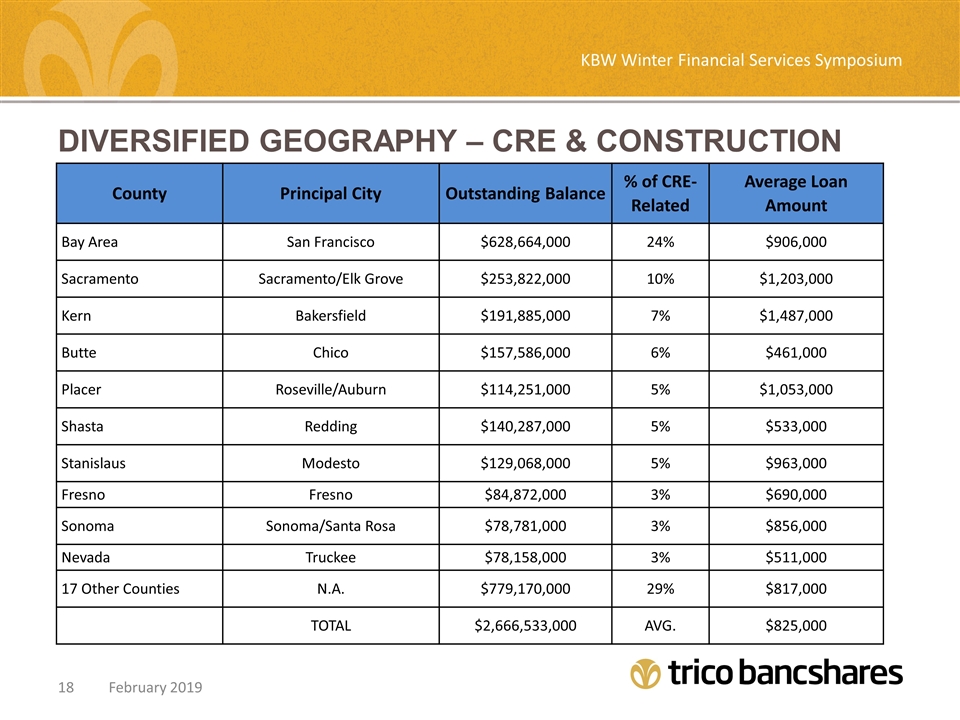

Diversified geography – CRE & Construction February 2019 KBW Winter Financial Services Symposium County Principal City Outstanding Balance % of CRE-Related Average Loan Amount Bay Area San Francisco $628,664,000 24% $906,000 Sacramento Sacramento/Elk Grove $253,822,000 10% $1,203,000 Kern Bakersfield $191,885,000 7% $1,487,000 Butte Chico $157,586,000 6% $461,000 Placer Roseville/Auburn $114,251,000 5% $1,053,000 Shasta Redding $140,287,000 5% $533,000 Stanislaus Modesto $129,068,000 5% $963,000 Fresno Fresno $84,872,000 3% $690,000 Sonoma Sonoma/Santa Rosa $78,781,000 3% $856,000 Nevada Truckee $78,158,000 3% $511,000 17 Other Counties N.A. $779,170,000 29% $817,000 TOTAL $2,666,533,000 AVG. $825,000

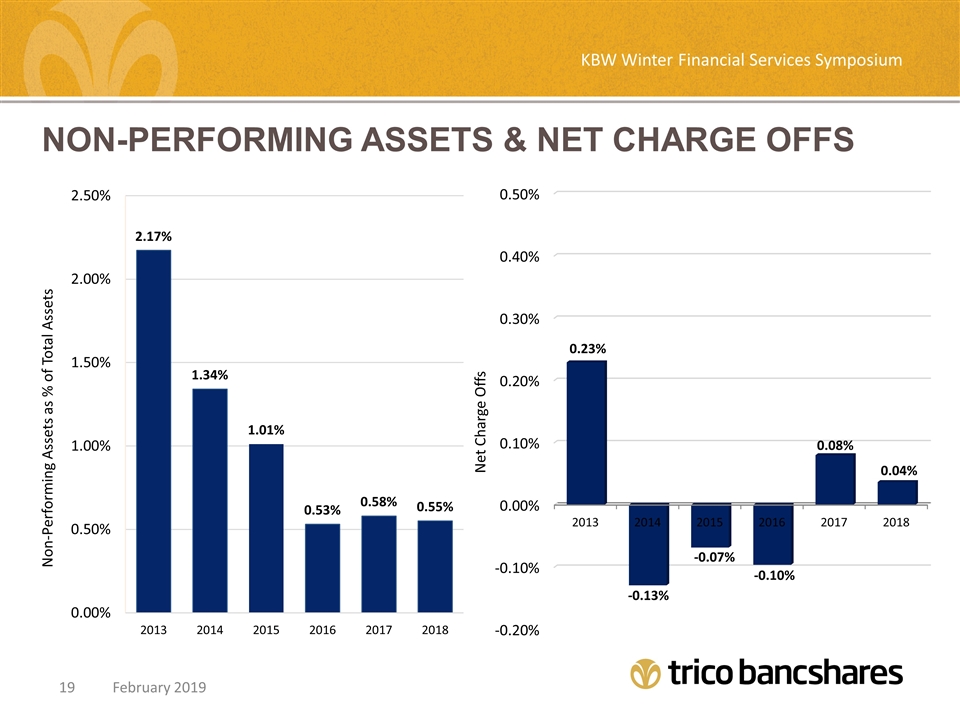

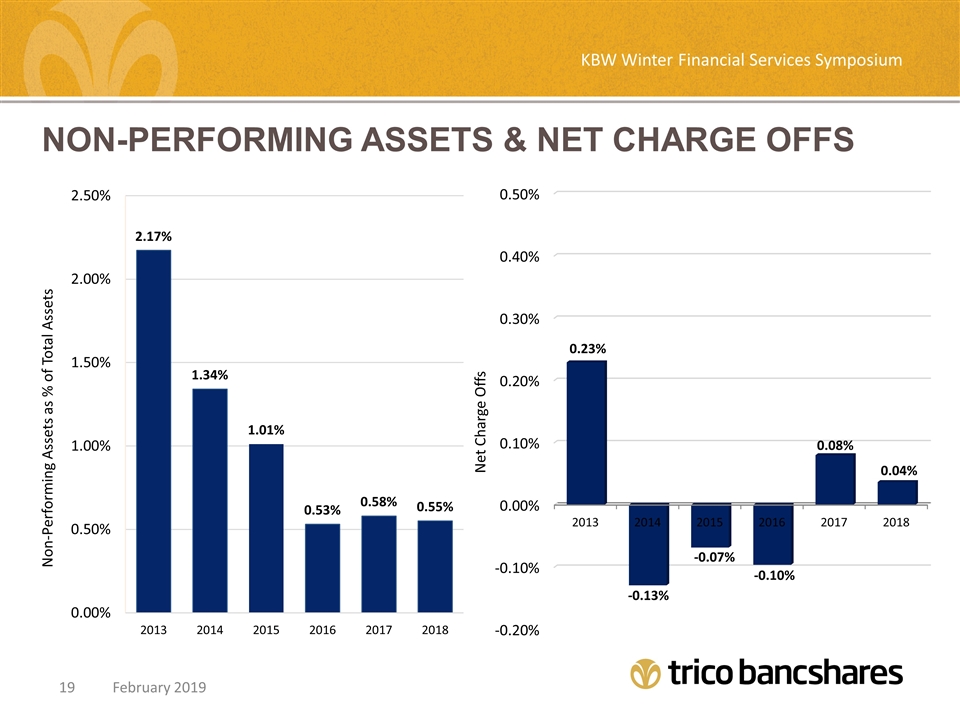

non-performing assets & NET charge offs KBW Winter Financial Services Symposium February 2019

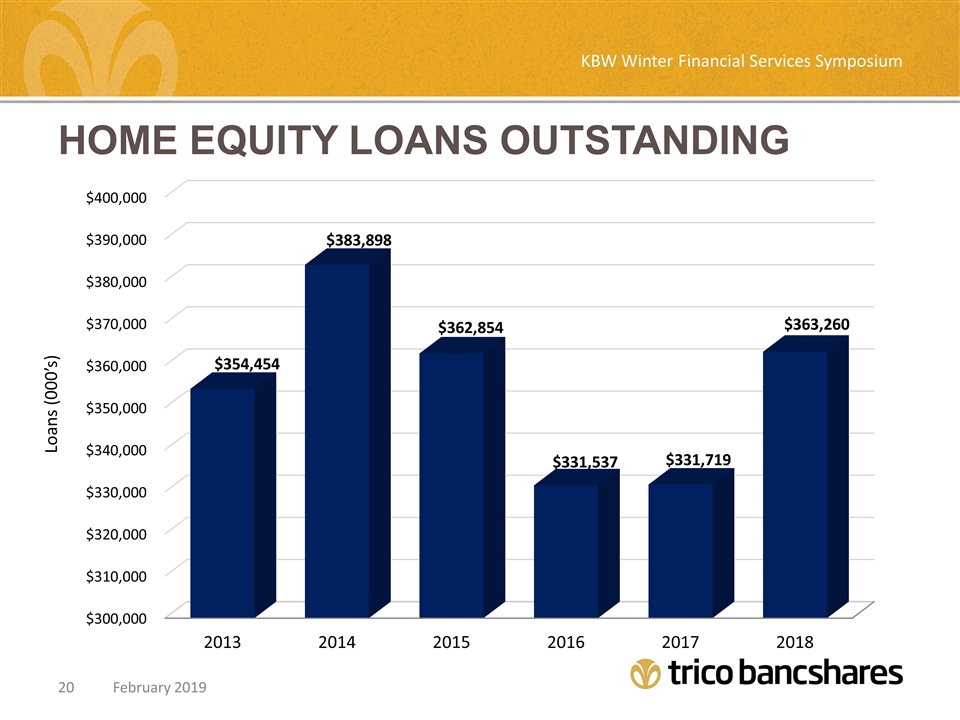

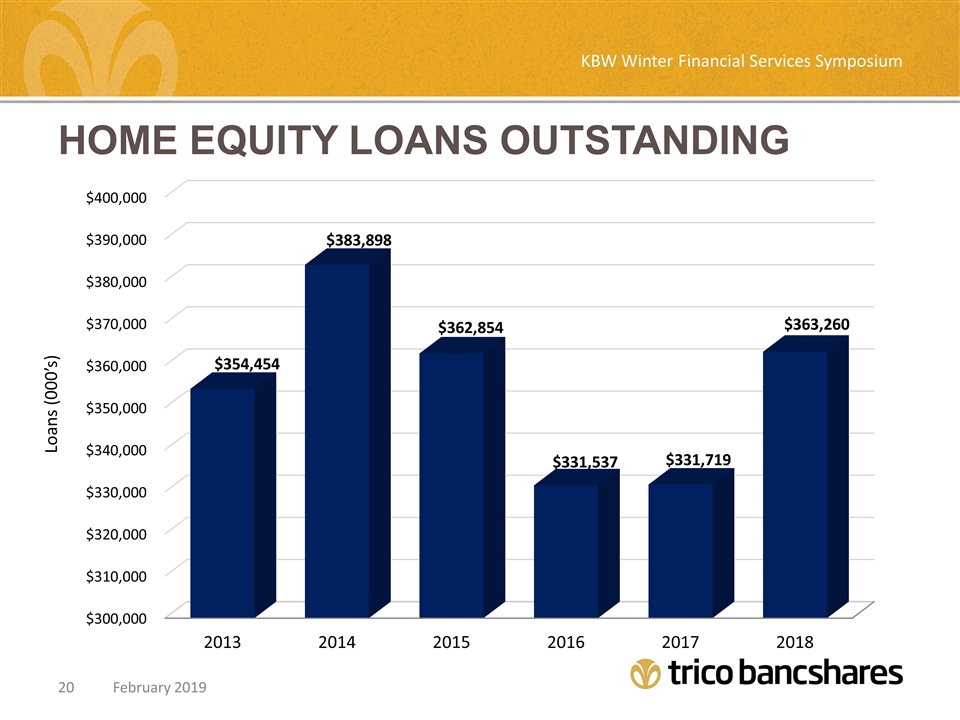

Home equity loans outstanding KBW Winter Financial Services Symposium February 2019

deposits KBW Winter Financial Services Symposium February 2019

Consistent and balanced core deposit funding* KBW Winter Financial Services Symposium February 2019

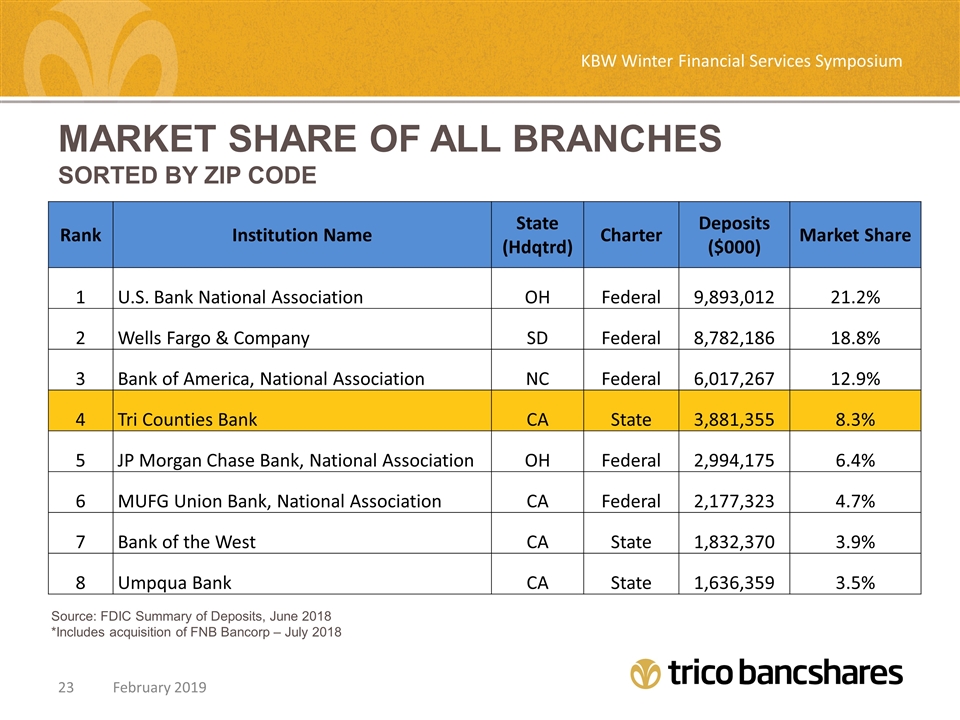

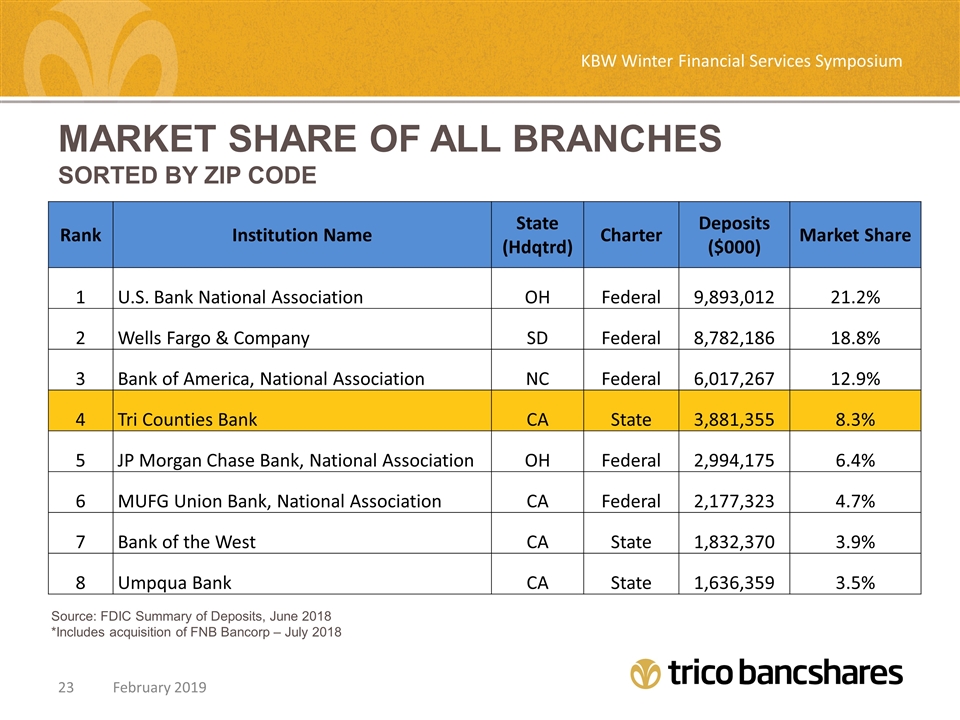

Market share of all branches sorted by zip code KBW Winter Financial Services Symposium February 2019 Source: FDIC Summary of Deposits, June 2018 *Includes acquisition of FNB Bancorp – July 2018 Rank Institution Name State (Hdqtrd) Charter Deposits ($000) Market Share 1 U.S. Bank National Association OH Federal 9,893,012 21.2% 2 Wells Fargo & Company SD Federal 8,782,186 18.8% 3 Bank of America, National Association NC Federal 6,017,267 12.9% 4 Tri Counties Bank CA State 3,881,355 8.3% 5 JP Morgan Chase Bank, National Association OH Federal 2,994,175 6.4% 6 MUFG Union Bank, National Association CA Federal 2,177,323 4.7% 7 Bank of the West CA State 1,832,370 3.9% 8 Umpqua Bank CA State 1,636,359 3.5%

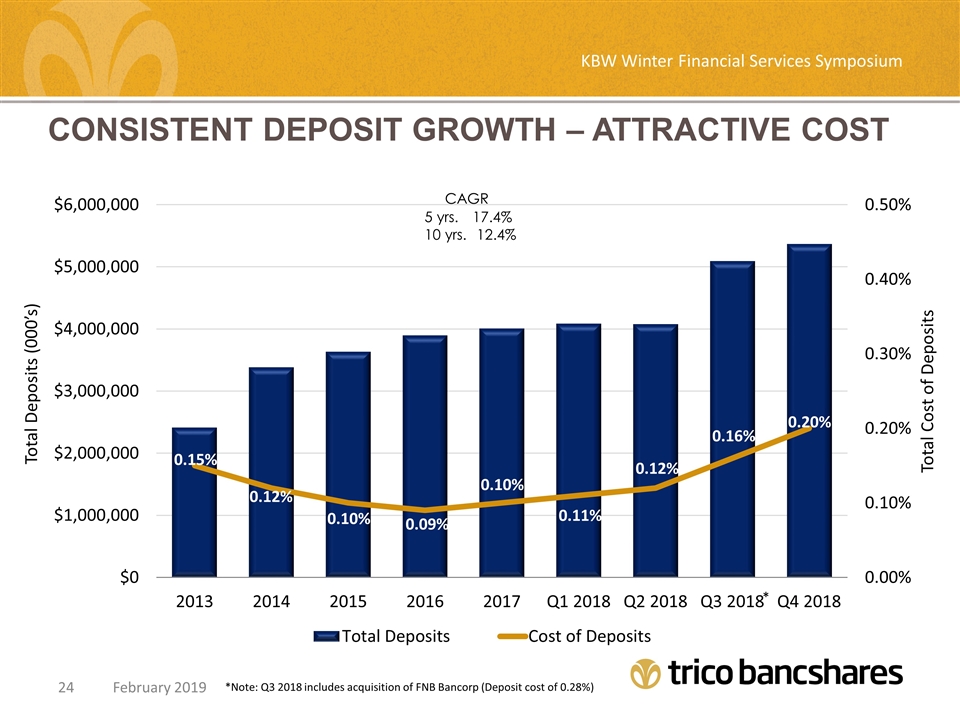

CONSISTENT DEPOSIT GROWTH – ATTRACTIVE COST KBW Winter Financial Services Symposium February 2019 *Note: Q3 2018 includes acquisition of FNB Bancorp (Deposit cost of 0.28%)

Financials KBW Winter Financial Services Symposium February 2019

Net interest margin – contribution from discount accretion KBW Winter Financial Services Symposium February 2019

Return on average assets KBW Winter Financial Services Symposium February 2019

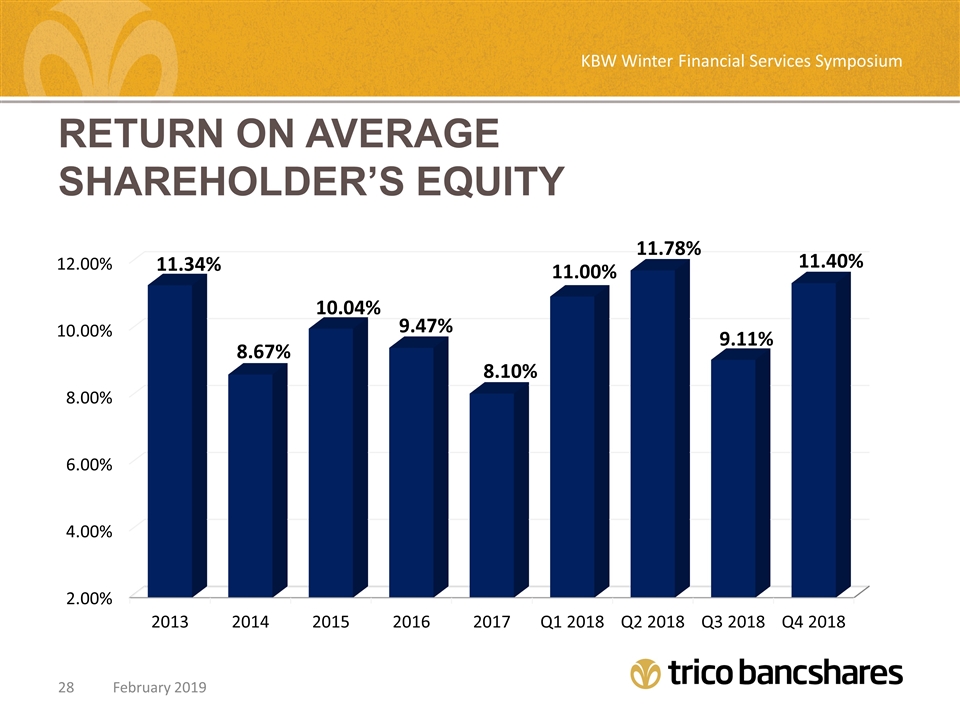

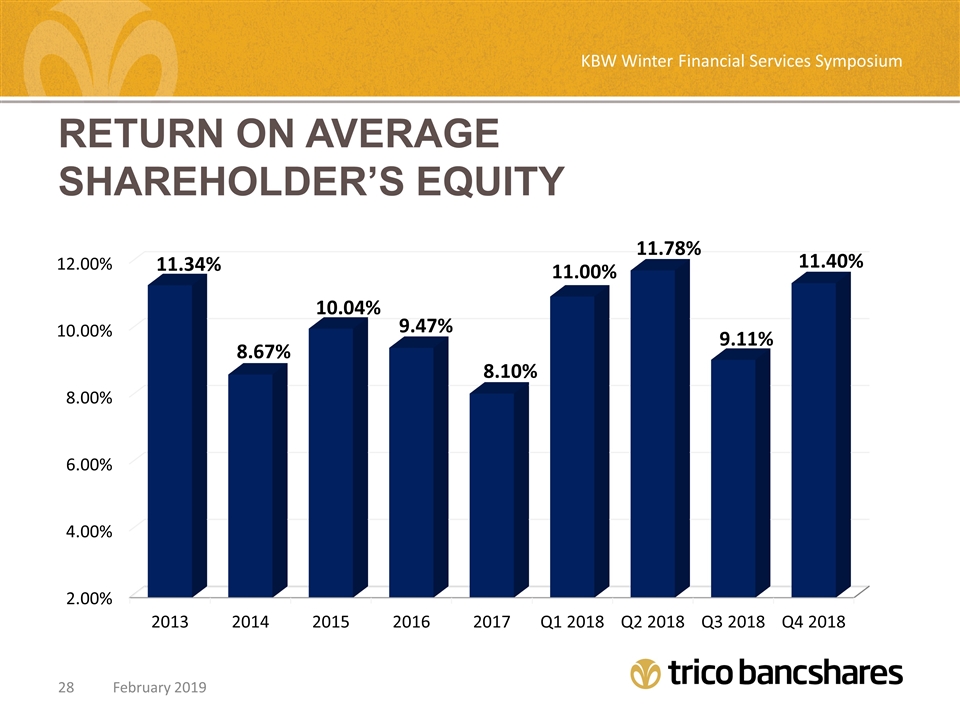

Return on average shareholder’s equity KBW Winter Financial Services Symposium February 2019

Efficiency ratio (fully taxable equivalent) KBW Winter Financial Services Symposium February 2019

DividendS PAID KBW Winter Financial Services Symposium February 2019 10.8% CAGR $0.60 $0.42 $0.44 $0.52 $0.66

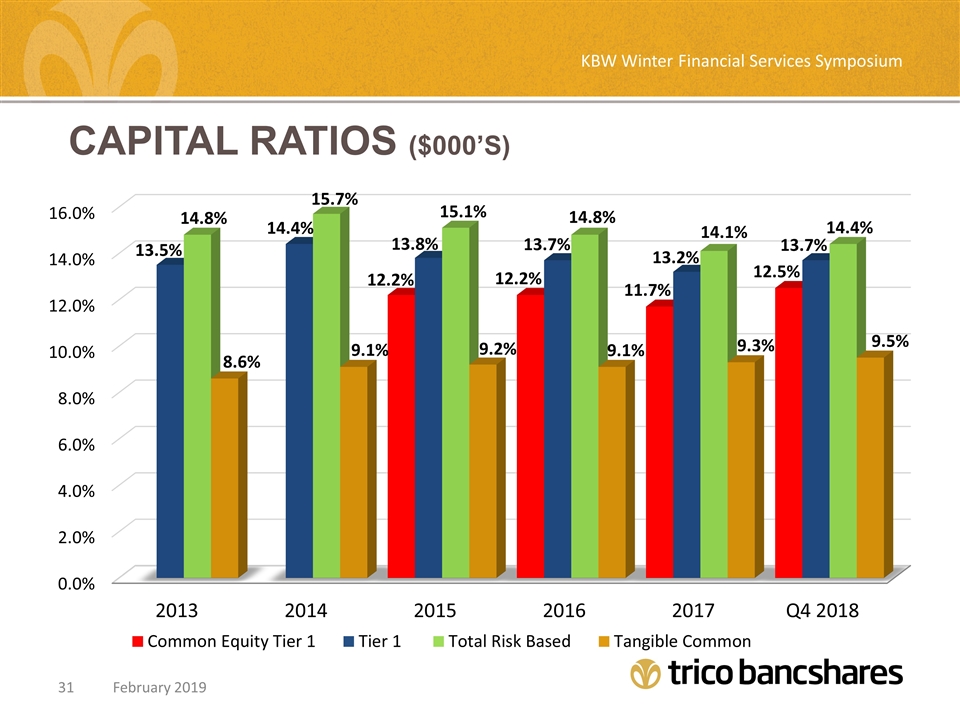

Capital ratios ($000’s) KBW Winter Financial Services Symposium February 2019

KBW Winter Financial Services Symposium February 2019 TriCo Bancshares is committed to: Improving the financial success and well-being of our shareholders, customers, communities and employees.