UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3320

Fidelity Colchester Street Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | March 31 |

| |

Date of reporting period: | March 31, 2006 |

Item 1. Reports to Stockholders

Fidelity®

Institutional

Money Market

Funds

|

Annual Report

March 31, 2006

|

| Contents | | |

| |

| Fidelity Institutional Money Market Funds | | |

| Shareholder Expense Example | | 3 |

| Investment Changes, Schedules of Investments & Financial Statements | | |

| Treasury Only Portfolio | | 6 |

| Treasury Portfolio | | 12 |

| Government Portfolio | | 18 |

| Prime Money Market Portfolio | | 24 |

| Money Market Portfolio | | 34 |

| Tax Exempt Portfolio | | 44 |

| Notes to Financial Statements | | 72 |

| Report of Independent Registered Public Accounting Firm | | 81 |

| Trustees and Officers | | 82 |

| Distributions | | 88 |

| Board Approval of Investment Advisory Contracts and Management Fees | | 89 |

| | Fund Goals:

Treasury Only Portfolio, Treasury Portfolio, Government Portfolio, Prime Money Market Portfolio, and Money Market Portfolio seek to

obtain as high a level of current income as is consistent with the preservation of principal and liquidity within the limitations prescribed for

the fund.

Tax Exempt Portfolio seeks to obtain as high a level of interest income exempt from federal income tax as is consistent with liquidity and

stability of principal.

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the

Securities and Exchange Commission’s (SEC) website at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc. and have been licensed for use by

Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

|

| | Investments in the funds are neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the funds will maintain a stable

$1.00 share price.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not

authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N Q. Forms N Q are available

on the SEC’s web site at http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Informa

tion regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio hold-

ings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

Shareholder Expense Example

|

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution and/or service (12b 1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2005 to March 31, 2006).

The first line of the table below for each class of each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

|

The second line of the table below for each class of each fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | Expenses Paid |

| | | Beginning | | Ending | | During Period* |

| | | Account Value | | Account Value | | October 1, 2005 |

| | | October 1, 2005 | | March 31, 2006 | | to March 31, 2006 |

| Treasury Only Portfolio | | | | | | | | | | |

| Class I | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,018.90 | | | | $ 1.01 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.93 | | | | $ 1.01 |

| Class II | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,018.20 | | | | $ 1.76 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.19 | | | | $ 1.77 |

| Class III | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,017.70 | | | | $ 2.26 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,022.69 | | | | $ 2.27 |

| Select Class | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,018.70 | | | | $ 1.26 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.68 | | | | $ 1.26 |

| Treasury Portfolio | | | | | | | | | | |

| Class I | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,020.10 | | | | $ 1.01 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.93 | | | | $ 1.01 |

| Class II | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,019.40 | | | | $ 1.76 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.19 | | | | $ 1.77 |

| Class III | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,018.80 | | | | $ 2.26 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,022.69 | | | | $ 2.27 |

| Select Class | | | | | | | | | | |

| Actual | | $ 1,000.00 | | | | $ 1,019.90 | | | | $ 1.26 |

| HypotheticalA | | $ 1,000.00 | | | | $ 1,023.68 | | | | $ 1.26 |

33 Annual Report

| Shareholder Expense Example continued | | | | | | | | | | | | |

| |

| |

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | Ending | | During Period* |

| | | | | Account Value | | Account Value | | October 1, 2005 |

| | | | | October 1, 2005 | | March 31, 2006 | | to March 31, 2006 |

| Government Portfolio | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.50 | | | | $ 1.01 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.93 | | | | $ 1.01 |

| Class II | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,019.70 | | | | $ 1.76 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.19 | | | | $ 1.77 |

| Class III | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,019.20 | | | | $ 2.27 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,022.69 | | | | $ 2.27 |

| Select Class | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.20 | | | | $ 1.26 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.68 | | | | $ 1.26 |

| Prime Money Market Portfolio | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.80 | | | | $ 1.01 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.93 | | | | $ 1.01 |

| Class II | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.00 | | | | $ 1.76 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.19 | | | | $ 1.77 |

| Class III | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,019.50 | | | | $ 2.27 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,022.69 | | | | $ 2.27 |

| Select Class | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.50 | | | | $ 1.26 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.68 | | | | $ 1.26 |

| Money Market Portfolio | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.90 | | | | $ .91 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,024.03 | | | | $ .91 |

| Class II | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.10 | | | | $ 1.66 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.29 | | | | $ 1.66 |

| Class III | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,019.60 | | | | $ 2.17 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,022.79 | | | | $ 2.17 |

| Select Class | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,020.60 | | | | $ 1.16 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.78 | | | | $ 1.16 |

| Tax Exempt Portfolio | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,014.10 | | | | $ 1.00 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.93 | | | | $ 1.01 |

| Class II | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,013.40 | | | | $ 1.76 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.19 | | | | $ 1.77 |

| Class III | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,012.80 | | | | $ 2.26 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,022.69 | | | | $ 2.27 |

| Select Class | | | | | | | | | | | | | | |

| Actual | | | | | | $ 1,000.00 | | | | $ 1,013.90 | | | | $ 1.26 |

| HypotheticalA | | | | | | $ 1,000.00 | | | | $ 1,023.68 | | | | $ 1.26 |

| |

| A 5% return per year before expenses | | | | | | | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Treasury Only Portfolio | | |

| Class I | | 20% |

| Class II | | 35% |

| Class III | | 45% |

| Select Class | | 25% |

| Treasury Portfolio | | |

| Class I | | 20% |

| Class II | | 35% |

| Class III | | 45% |

| Select Class | | 25% |

| Government Portfolio | | |

| Class I | | 20% |

| Class II | | 35% |

| Class III | | 45% |

| Select Class | | 25% |

| Prime Money Market Portfolio | | |

| Class I | | 20% |

| Class II | | 35% |

| Class III | | 45% |

| Select Class | | 25% |

| Money Market Portfolio | | |

| Class I | | 18% |

| Class II | | 33% |

| Class III | | 43% |

| Select Class | | 23% |

| Tax Exempt Portfolio | | |

| Class I | | 20% |

| Class II | | 35% |

| Class III | | 45% |

| Select Class | | 25% |

55 Annual Report

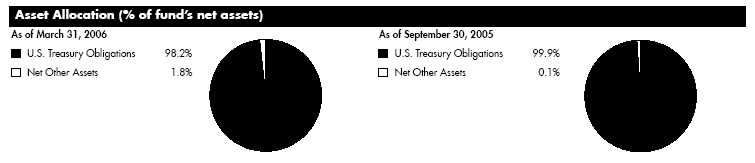

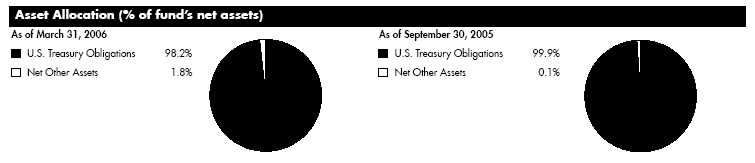

| Treasury Only Portfolio | | | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| 0 – 30 | | 28.2 | | 9.2 | | 38.9 |

| 31 – 90 | | 66.4 | | 83.4 | | 52.2 |

| 91 – 180 | | 5.4 | | 7.4 | | 8.9 |

Weighted Average Maturity | | | | | | |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| Treasury Only Portfolio | | 51 Days | | 50 Days | | 45 Days |

| All Taxable Money Market Funds Average* | | 38 Days | | 38 Days | | 38 Days |

*Source: iMoneyNet, Inc.

Annual Report 6

| Treasury Only Portfolio | | | | | | | | |

| Investments March 31, 2006 |

| Showing Percentage of Net Assets | | | | | | |

| |

| U.S. Treasury Obligations 98.2% | | | | |

| Due | | Annualized Yield at | | Principal | | | | Value (Note 1) |

| Date | | Time of Purchase | | Amount (000s) | | | | (000s) |

| U.S. Treasury Bills – 74.5% | | | | | | | | | | |

| 4/6/06 | | 4.37% | | | | $ 28,084 | | | | $ 28,067 |

| 4/6/06 | | 4.38 | | | | 30,000 | | | | 29,982 |

| 4/6/06 | | 4.43 | | | | 44,000 | | | | 43,973 |

| 4/13/06 | | 4.42 | | | | 12,031 | | | | 12,004 |

| 4/13/06 | | 4.43 | | | | 26,000 | | | | 25,962 |

| 4/13/06 | | 4.59 | | | | 40,000 | | | | 39,939 |

| 4/13/06 | | 4.61 | | | | 5,105 | | | | 5,097 |

| 4/17/06 | | 4.69 | | | | 40,000 | | | | 39,927 |

| 4/20/06 | | 4.59 | | | | 10,356 | | | | 10,331 |

| 4/20/06 | | 4.61 | | | | 2,666 | | | | 2,660 |

| 4/27/06 | | 4.58 | | | | 17,817 | | | | 17,756 |

| 4/27/06 | | 4.64 | | | | 69,500 | | | | 69,268 |

| 4/27/06 | | 4.65 | | | | 37,500 | | | | 37,375 |

| 5/11/06 | | 4.44 | | | | 45,000 | | | | 44,781 |

| 5/18/06 | | 4.49 | | | | 110,770 | | | | 110,128 |

| 5/25/06 | | 4.51 | | | | 87,000 | | | | 86,419 |

| 6/8/06 | | 4.54 | | | | 60,000 | | | | 59,490 |

| 6/8/06 | | 4.56 | | | | 65,000 | | | | 64,446 |

| 6/15/06 | | 4.58 | | | | 50,000 | | | | 49,529 |

| 6/22/06 | | 4.60 | | | | 100,000 | | | | 98,964 |

| 6/29/06 | | 4.55 | | | | 40,000 | | | | 39,555 |

| 7/27/06 | | 4.45 | | | | 12,000 | | | | 11,830 |

| 8/3/06 | | 4.50 | | | | 24,670 | | | | 24,296 |

| 8/17/06 | | 4.66 | | | | 24,000 | | | | 23,581 |

| | | | | | | | | | | 975,360 |

| U.S. Treasury Notes – 23.7% | | | | | | | | |

| 5/15/06 | | 4.43 | | | | 132,429 | | | | 132,453 |

| 5/15/06 | | 4.59 | | | | 72,000 | | | | 71,773 |

| 5/31/06 | | 4.45 | | | | 52,500 | | | | 52,332 |

| 5/31/06 | | 4.66 | | | | 44,000 | | | | 43,842 |

| 6/30/06 | | 4.27 | | | | 10,000 | | | | 9,963 |

| | | | | | | | | | | 310,363 |

| |

| |

| TOTAL INVESTMENT PORTFOLIO 98.2% | | | | |

| (Cost $1,285,723) | | | | | | | | 1,285,723 |

| |

| NET OTHER ASSETS 1.8% | | | | | | | | 23,183 |

| NET ASSETS 100% | | | | | | | | $ 1,308,906 |

Income Tax Information

At March 31, 2006, the fund had a capital loss carryforward of approximately $433,000 of which $47,000, $142,000, $184,000 and $60,000 will expire on March 31, 2011, 2012, 2013 and 2014, respectively.

See accompanying notes which are an integral part of the financial statements.

7 Annual Report

| Treasury Only Portfolio | | | | |

| |

| Financial Statements | | | | |

| |

| |

| Statement of Assets and Liabilities | | |

| Amounts in thousands (except per share amounts) | | March 31, 2006 |

| |

| Assets | | | | |

| Investment in securities, at value — | | | | |

| See accompanying schedule: | | | | |

| Unaffiliated issuers | | | | |

| (cost $1,285,723) | | | | $ 1,285,723 |

| Receivable for investments sold | | | | 39,949 |

| Receivable for fund shares sold | | | | 21,976 |

| Interest receivable | | | | 3,742 |

| Prepaid expenses | | | | 4 |

| Receivable from investment adviser | | | | |

| for expense reductions | | | | 36 |

| Total assets | | | | 1,351,430 |

| |

| Liabilities | | | | |

| Payable for investments purchased | | $ 39,927 | | |

| Payable for fund shares redeemed | | 401 | | |

| Distributions payable | | 1,887 | | |

| Accrued management fee | | 203 | | |

| Distribution fees payable | | 44 | | |

| Other affiliated payables | | 31 | | |

| Other payables and accrued | | | | |

| expenses | | 31 | | |

| Total liabilities | | | | 42,524 |

| |

| Net Assets | | | | $ 1,308,906 |

| Net Assets consist of: | | | | |

| Paid in capital | | | | $ 1,309,229 |

| Undistributed net investment income . | | | | 7 |

| Accumulated undistributed net | | | | |

| realized gain (loss) on investments | | | | (330) |

| Net Assets | | | | $ 1,308,906 |

| Class I: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($1,054,985 ÷ 1,054,957 | | | | |

| shares) | | | | $ 1.00 |

| Class II: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($101,507 ÷ 101,531 shares) | | | | $ 1.00 |

| Class III: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($119,600 ÷ 119,591 shares) | | | | $ 1.00 |

| Select Class: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($32,814 ÷ 32,818 shares) | | | | $ 1.00 |

| Statement of Operations | | | | | | |

| Amounts in thousands | | | | Year ended March 31, 2006 |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 40,912 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 2,334 | | |

| Transfer agent fees | | | | 208 | | |

| Distribution fees | | | | 600 | | |

| Accounting fees and expenses | | | | 138 | | |

| Independent trustees’ compensation | | . | | 5 | | |

| Custodian fees and expenses | | | | 20 | | |

| Registration fees | | | | 57 | | |

| Audit | | | | 40 | | |

| Legal | | | | 3 | | |

| Miscellaneous | | | | 14 | | |

| Total expenses before reductions | | | | 3,419 | | |

| Expense reductions | | | | (493) | | 2,926 |

| |

| Net investment income | | | | | | 37,986 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | (8) |

| Net increase in net assets resulting | | | | | | |

| from operations | | | | | | $ 37,978 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 8

| Statement of Changes in Net Assets | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Year ended | | | | Year ended |

| | | | | | | | | | | | | March 31, | | | | March 31, |

| Amounts in thousands | | | | | | | | | | | | 2006 | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | $ 37,986 | | | | $ 15,996 |

| Net realized gain (loss) | | | | | | | | | | | | | | (8) | | | | (242) |

| Net increase in net assets resulting from operations | | | | | | | | | | | | | | 37,978 | | | | 15,754 |

| Distributions to shareholders from net investment income | | | | | | | | | | | | | | (37,981) | | | | (16,000) |

| Distributions to shareholders from net realized gain | | | | | | | | | | | | | | — | | | | (110) |

| Total distributions | | | | | | | | | | | | | | (37,981) | | | | (16,110) |

| Share transactions - net increase (decrease) | | | | | | | | | | | | | | 205,080 | | | | (128,690) |

| Total increase (decrease) in net assets | | | | | | | | | | | | | | 205,077 | | | | (129,046) |

| |

| Net Assets | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | | | | | | | | | | | 1,103,829 | | | | 1,232,875 |

| End of period (including undistributed net investment income of $7 and distributions in excess of net investment income | | | | | | | | | | | | | | | | | | | | |

| of $6, respectively) | | | | | | | | | | | | | | $ 1,308,906 | | | | $ 1,103,829 |

| |

| Financial Highlights Class I | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 033 | | | | .014 | | | | .009 | | | | .015 | | | | .031 |

| Net realized and unrealized gain (loss)C | | — | | | | — | | | | — | | | | — | | | | — |

| Total from investment operations | | 033 | | | | .014 | | | | .009 | | | | .015 | | | | .031 |

| Distributions from net investment income | | (.033) | | | | (.014) | | | | (.009) | | | | (.015) | | | | (.031) |

| Distributions from net realized gain | | — | | | | —C | | | | — | | | | — | | | | — |

| Total distributions | | (.033) | | | | (.014) | | | | (.009) | | | | (.015) | | | | (.031) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.33% | | | | 1.45% | | | | .89% | | | | 1.50% | | | | | | 3.14% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 24% | | | | .24% | | | | .24% | | | | .24% | | | | | | .24% |

| Expenses net of fee waivers, if any | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Expenses net of all reductions | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Net investment income | | 3.30% | | | | 1.43% | | | | .89% | | | | 1.48% | | | | | | 3.00% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 1,055 | | | | $ 835 | | | | $ 982 | | | | $ 1,175 | | | | $ 1,199 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when reimburse

ments or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

C Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

|

9 Annual Report

| Financial Highlights Class II | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 031 | | | | .013 | | | | .007 | | | | .013 | | | | .029 |

| Net realized and unrealized gain (loss)C | | — | | | | — | | | | — | | | | — | | | | — |

| Total from investment operations | | 031 | | | | .013 | | | | .007 | | | | .013 | | | | .029 |

| Distributions from net investment income | | (.031) | | | | (.013) | | | | (.007) | | | | (.013) | | | | (.029) |

| Distributions from net realized gain | | — | | | | —C | | | | — | | | | — | | | | — |

| Total distributions | | (.031) | | | | (.013) | | | | (.007) | | | | (.013) | | | | (.029) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.18% | | | | 1.30% | | | | .74% | | | | 1.34% | | | | 2.98% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 39% | | | | .39% | | | | .39% | | | | .39% | | | | .39% |

| Expenses net of fee waivers, if any | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Expenses net of all reductions | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Net investment income | | 3.15% | | | | 1.28% | | | | .74% | | | | 1.33% | | | | 2.82% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 102 | | | | $ 121 | | | | $ 119 | | | | $ 225 | | | | $ 187 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

C Amount represents less than $.001 per share.

|

| Financial Highlights Class III | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 030 | | | | .012 | | | | .006 | | | | .012 | | | | .028 |

| Net realized and unrealized gain (loss)C | | — | | | | — | | | | — | | | | — | | | | — |

| Total from investment operations | | 030 | | | | .012 | | | | .006 | | | | .012 | | | | .028 |

| Distributions from net investment income | | (.030) | | | | (.012) | | | | (.006) | | | | (.012) | | | | (.028) |

| Distributions from net realized gain | | — | | | | —C | | | | — | | | | — | | | | — |

| Total distributions | | (.030) | | | | (.012) | | | | (.006) | | | | (.012) | | | | (.028) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.07% | | | | 1.20% | | | | .64% | | | | 1.25% | | | | 2.88% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 49% | | | | .49% | | | | .49% | | | | .49% | | | | .49% |

| Expenses net of fee waivers, if any | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Expenses net of all reductions | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Net investment income | | 3.05% | | | | 1.18% | | | | .64% | | | | 1.23% | | | | 2.72% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 120 | | | | $ 135 | | | | $ 126 | | | | $ 134 | | | | $ 234 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

C Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

| | |

| Annual Report | | 10 |

| Financial Highlights Select Class | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002D |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 032 | | | | .014 | | | | .008 | | | | .014 | | | | .004 |

| Net realized and unrealized gain (loss)F | | — | | | | — | | | | — | | | | — | | | | — |

| Total from investment operations | | 032 | | | | .014 | | | | .008 | | | | .014 | | | | .004 |

| Distributions from net investment income | | (.032) | | | | (.014) | | | | (.008) | | | | (.014) | | | | (.004) |

| Distributions from net realized gain | | — | | | | —F | | | | — | | | | — | | | | — |

| Total distributions | | (.032) | | | | (.014) | | | | (.008) | | | | (.014) | | | | (.004) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnB,C | | 3.28% | | | | 1.40% | | | | .84% | | | | 1.45% | | | | .36% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 29% | | | | .29% | | | | .28% | | | | .29% | | | | .28%A |

| Expenses net of fee waivers, if any | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Expenses net of all reductions | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Net investment income | | 3.25% | | | | 1.38% | | | | .84% | | | | 1.43% | | | | 1.78%A |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 32,814 | | | | $ 11,661 | | | | $ 6,090 | | | | $ 14,598 | | | | $ 100 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D For the period January 17, 2002 (commencement of sale of shares) to March 31, 2002.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

|

11 Annual Report

| Treasury Portfolio | | | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| 0 – 30 | | 91.7 | | 96.1 | | 88.8 |

| 31 – 90 | | 2.1 | | 0.0 | | 7.8 |

| 91 – 180 | | 5.0 | | 3.9 | | 3.4 |

| 181 – 397 | | 1.2 | | 0.0 | | 0.0 |

Weighted Average Maturity | | | | | | |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| Treasury Portfolio | | 14 Days | | 9 Days | | 12 Days |

| All Taxable Money Market Funds Average* | | 38 Days | | 38 Days | | 38 Days |

*Source: iMoneyNet, Inc.

Annual Report 12

| Treasury Portfolio | | | | | | | | |

| Investments March 31, 2006 |

| Showing Percentage of Net Assets | | | | | | |

| |

| U.S. Treasury Obligations 7.1% | | | | | | | | | | | | |

| Due | | Annualized Yield at | | Principal Amount | | | | Value (Note 1) |

| Date | | Time of Purchase | | (000s) | | | | (000s) |

| U.S. Treasury Bills – 6.1% | | | | | | | | |

| 5/18/06 | | 4.49% | | | | $ 80,000 | | | | $ 79,536 |

| 5/25/06 | | 4.51 | | | | 90,000 | | | | 89,399 |

| 7/27/06 | | 4.45 | | | | 160,000 | | | | 157,735 |

| 8/3/06 | | 4.50 | | | | 179,165 | | | | 176,450 |

| | | | | | | | | | | 503,120 |

| U.S. Treasury Notes – 1.0% | | | | | | | | |

| 6/30/06 | | 4.27 | | | | 80,000 | | | | 79,705 |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | 582,825 |

| |

| Repurchase Agreements 93.2% | | | | |

| | | | | Maturity | | | | |

| | | | | Amount (000s) | | | | |

| In a joint trading account (Collateralized | | | | | | |

| by U.S. Treasury Obligations) dated | | | | | | | | |

| 3/31/06 due 4/3/06 At: | | | | | | | | |

| 4.52% (a) | | | | | | $ 601,105 | | | | 600,879 |

| 4.54% (a) | | | | | | 6,142,724 | | | | 6,140,398 |

| With: | | | | | | | | | | |

| Merrill Lynch Government Securities, | | | | | | |

| Inc. At: | | | | | | | | | | |

| 4.75%, dated 3/31/06 due | | | | | | | | |

| 4/3/06 (Collateralized by U.S. | | | | | | |

| Treasury Obligations valued at | | | | | | | | |

| $412,005,173, 0% 3.875%, | | | | | | | | |

| 1/15/09 – 1/15/16) | | | | 400,158 | | | | 400,000 |

| 5.1%, dated 3/30/06 due | | | | | | | | |

| 3/30/07 (Collateralized by U.S. | | | | | | |

| Treasury Obligations valued at | | | | | | | | |

| $103,000,863, 1.88%, | | | | | | | | |

| 7/15/13) | | | | | | 105,171 | | | | 100,000 |

| Morgan Stanley & Co., Inc. At 4.75%, | | | | | | |

| dated 3/30/06 due 4/3/06 | | | | | | | | |

| (Collateralized by U.S. Treasury | | | | | | | | |

| Obligations valued at | | | | | | | | |

| $405,836,752, 7.13% 7.63%, | | | | | | | | |

| 8/15/22 – 2/15/23) | | | | 395,208 | | | | 395,000 |

| TOTAL REPURCHASE AGREEMENTS | | | | | | 7,636,277 |

| |

| TOTAL INVESTMENT PORTFOLIO 100.3% | | | | | | | | 8,219,102 |

| (Cost $8,219,102) | | | | | | | | |

| |

| NET OTHER ASSETS (0.3)% | | | | | | | | (21,591) |

| NET ASSETS 100% | | | | | | | | $ 8,197,511 |

Legend

(a) Additional information on each counterparty to the repurchase agreement

is as follows:

|

| Repurchase Agreement/ | | | | Value |

| Counterparty | | | | (000s) |

| $600,879,000 due 4/3/06 at 4.52% | | | | |

| Banc of America Securities LLC. | | | | $ 48,958 |

| Barclays Capital Inc. | | | | 113,582 |

| Credit Suisse First Boston LLC | | | | 195,831 |

| Deutsche Bank Securities Inc. | | | | 58,749 |

| Morgan Stanley & Co. Incorporated. | | | | 129,248 |

| State Street Bank and Trust Company | | | | 54,511 |

| | | | | $ 600,879 |

| |

| $6,140,398,000 due 4/3/06 at 4.54% | | | | |

| Banc of America Securities LLC. | | | | $ 63,456 |

| Bear Stearns & Co. Inc. | | | | 1,161,199 |

| BNP Paribas Securities Corp. | | | | 1,548,266 |

| Credit Suisse First Boston LLC | | | | 387,066 |

| Deutsche Bank Securities Inc. | | | | 270,946 |

| HBSC Securities, Inc | | | | 387,066 |

| J.P. Morgan Securities, Inc. | | | | 774,133 |

| Merrill Lynch, Pierce, Fenner & Smith | | | | 1,316,026 |

| Mizuho Securities USA, Inc | | | | 232,240 |

| | | | | $ 6,140,398 |

Income Tax Information

At March 31, 2006, the fund had a capital loss carryforward of approximately $660,000 of which $32,000, $191,000, $259,000 and $178,000 will expire on March 31, 2010, 2011, 2013 and 2014, respectively.

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Treasury Portfolio | | | | |

| |

| Financial Statements | | | | |

| |

| |

| Statement of Assets and Liabilities | | |

| Amounts in thousands (except per share amounts) | | March 31, 2006 |

| |

| Assets | | | | |

| Investment in securities, at value | | | | |

| (including repurchase agreements | | | | |

| of $7,636,277) — See | | | | |

| accompanying schedule: | | | | |

| Unaffiliated issuers | | | | |

| (cost $8,219,102) | | | | $ 8,219,102 |

| Receivable for fund shares sold | | | | 954 |

| Interest receivable | | | | 1,589 |

| Prepaid expenses | | | | 28 |

| Receivable from investment adviser | | | | |

| for expense reductions | | | | 161 |

| Total assets | | | | 8,221,834 |

| |

| Liabilities | | | | |

| Payable for fund shares redeemed | | $ 37 | | |

| Distributions payable | | 21,943 | | |

| Accrued management fee | | 1,365 | | |

| Distribution fees payable | | 743 | | |

| Other affiliated payables | | 203 | | |

| Other payables and accrued | | | | |

| expenses | | 32 | | |

| Total liabilities | | | | 24,323 |

| |

| Net Assets | | | | $ 8,197,511 |

| Net Assets consist of: | | | | |

| Paid in capital | | | | $ 8,198,119 |

| Undistributed net investment income . | | | | 52 |

| Accumulated undistributed net | | | | |

| realized gain (loss) on investments | | | | (660) |

| Net Assets | | | | $ 8,197,511 |

| Class I: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($4,297,337 ÷ 4,297,101 | | | | |

| shares) | | | | $ 1.00 |

| Class II: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($330,953 ÷ 330,746 shares) | | | | $ 1.00 |

| Class III: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($3,299,385 ÷ 3,299,960 | | | | |

| shares) | | | | $ 1.00 |

| Select Class: | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | |

| ($269,836 ÷ 269,848 shares) | | | | $ 1.00 |

| Statement of Operations | | | | |

| Amounts in thousands | | | | Year ended March 31, 2006 |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 307,409 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 16,547 | | |

| Transfer agent fees | | | | 1,324 | | |

| Distribution fees | | | | 8,571 | | |

| Accounting fees and expenses | | | | 724 | | |

| Independent trustees’ compensation | | | | 36 | | |

| Custodian fees and expenses | | | | 10 | | |

| Registration fees | | | | 107 | | |

| Audit | | | | 75 | | |

| Legal | | | | 20 | | |

| Miscellaneous | | | | 100 | | |

| Total expenses before reductions | | | | 27,514 | | |

| Expense reductions | | | | (2,358) | | 25,156 |

| |

| Net investment income | | | | | | 282,253 |

| Realized and Unrealized Gain | | | | | | |

| (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | (4) |

| Net increase in net assets resulting | | | | | | |

| from operations | | | | | | $ 282,249 |

See accompanying notes which are an integral part of the financial statements.

| | |

| Annual Report | | 14 |

| Statement of Changes in Net Assets | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Year ended | | | | Year ended |

| | | | | | | | | | | | | | | March 31, | | | | March 31, |

| Amounts in thousands | | | | | | | | | | | | | | 2006 | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | $ 282,253 | | | | $ 116,441 |

| Net realized gain (loss) | | | | | | | | | | | | | | (4) | | | | (433) |

| Net increase in net assets resulting from operations | | | | | | | | | | | | | | 282,249 | | | | 116,008 |

| Distributions to shareholders from net investment income | | | | | | | | | | | | | | (282,242) | | | | (116,452) |

| Share transactions - net increase (decrease) | | | | | | | | | | | | | | (852,279) | | | | 18,644 |

| Total increase (decrease) in net assets | | | | | | | | | | | | | | (852,272) | | | | 18,200 |

| |

| Net Assets | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | | | | | | | | | | | 9,049,783 | | | | 9,031,583 |

| End of period (including undistributed net investment income of $52 and undistributed net investment income of $50, | | | | | | | | |

| respectively) | | | | | | | | | | | | | | $ 8,197,511 | | | | $ 9,049,783 |

| |

| Financial Highlights Class I | | | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 035 | | | | .015 | | | | .009 | | | | .015 | | | | .030 |

| Distributions from net investment income | | | | (.035) | | | | (.015) | | | | (.009) | | | | (.015) | | | | (.030) |

| Net asset value, end of period | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | | | 3.55% | | | | 1.50% | | | | .91% | | | | 1.47% | | | | | | 3.00% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 23% | | | | .23% | | | | .23% | | | | .23% | | | | | | .23% |

| Expenses net of fee waivers, if any | | | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Expenses net of all reductions | | | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Net investment income | | | | 3.51% | | | | 1.48% | | | | .90% | | | | 1.46% | | | | | | 2.93% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | | | $ 4,297 | | | | $ 5,348 | | | | $ 4,567 | | | | $ 5,082 | | | | $ 4,400 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or

reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

|

15 Annual Report

| Financial Highlights Class II | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 033 | | | | .013 | | | | .008 | | | | .013 | | | | .028 |

| Distributions from net investment income | | (.033) | | | | (.013) | | | | (.008) | | | | (.013) | | | | (.028) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.39% | | | | 1.35% | | | | .76% | | | | 1.32% | | | | 2.85% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 38% | | | | .38% | | | | .38% | | | | .38% | | | | .38% |

| Expenses net of fee waivers, if any | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Expenses net of all reductions | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Net investment income | | 3.36% | | | | 1.33% | | | | .75% | | | | 1.31% | | | | 2.73% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 331 | | | | $ 180 | | | | $ 231 | | | | $ 274 | | | | $ 370 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

|

| Financial Highlights Class III | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 032 | | | | .012 | | | | .007 | | | | .012 | | | | .027 |

| Distributions from net investment income | | (.032) | | | | (.012) | | | | (.007) | | | | (.012) | | | | (.027) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.29% | | | | 1.25% | | | | .66% | | | | 1.22% | | | | 2.74% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 48% | | | | .48% | | | | .48% | | | | .48% | | | | .48% |

| Expenses net of fee waivers, if any | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Expenses net of all reductions | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Net investment income | | 3.26% | | | | 1.23% | | | | .65% | | | | 1.21% | | | | 2.65% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 3,299 | | | | $ 3,439 | | | | $ 4,132 | | | | $ 3,938 | | | | $ 4,520 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| | |

| Annual Report | | 16 |

| Financial Highlights Select Class | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002D |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 034 | | | | .014 | | | | .009 | | | | .014 | | | | .003 |

| Distributions from net investment income | | (.034) | | | | (.014) | | | | (.009) | | | | (.014) | | | | (.003) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnB,C | | 3.49% | | | | 1.45% | | | | .86% | | | | 1.42% | | | | .34% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 28% | | | | .29% | | | | .28% | | | | .28% | | | | .27%A |

| Expenses net of fee waivers, if any | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Expenses net of all reductions | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Net investment income | | 3.46% | | | | 1.43% | | | | .85% | | | | 1.40% | | | | 1.72%A |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 269,836 | | | | $ 82,134 | | | | $ 101,421 | | | | $ 2,223 | | | | $ 100 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D For the period January 17, 2002 (commencement of sale of shares) to March 31, 2002.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

|

17 Annual Report

| Government Portfolio | | | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| 0 – 30 | | 72.9 | | 67.2 | | 66.0 |

| 31 – 90 | | 16.6 | | 27.2 | | 20.1 |

| 91 – 180 | | 5.5 | | 3.4 | | 12.9 |

| 181 – 397 | | 5.0 | | 2.2 | | 1.0 |

| Weighted Average Maturity | | | | | | |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| Government Portfolio | | 34 Days | | 33 Days | | 36 Days |

| All Taxable Money Market Funds Average* | | 38 Days | | 38 Days | | 38 Days |

*Source: iMoneyNet, Inc.

Annual Report 18

| Government Portfolio | | | | | | |

| Investments March 31, 2006 |

| Showing Percentage of Net Assets | | | | | | |

| |

| Federal Agencies 24.6% | | | | | | |

| Due | | Annualized Yield at | | Principal | | Value (Note 1) |

| Date | | Time of Purchase | | Amount (000s) | | (000s) |

| Fannie Mae – 12.0% | | | | | | | | |

| Agency Coupons – 11.6% | | | | | | | | |

| 5/22/06 | | 4.67% (a) | | | | $ 150,000 | | $ 149,987 |

| 6/21/06 | | 4.81 (a) | | | | 250,000 | | 249,917 |

| 6/22/06 | | 4.81 (a) | | | | 405,000 | | 404,820 |

| | | | | | | | | 804,724 |

| Discount Notes – 0.4% | | | | | | | | |

| 7/28/06 | | 3.86 | | | | 25,855 | | 25,539 |

| | | | | | | | | 830,263 |

| Federal Home Loan Bank – 4.1% | | | | | | | | |

| Agency Coupons – 4.1% | | | | | | | | |

| 5/2/06 | | 4.57 (a) | | | | 62,000 | | 61,986 |

| 6/13/06 | | 4.77 (a) | | | | 225,000 | | 224,964 |

| | | | | | | | | 286,950 |

| Freddie Mac – 8.5% | | | | | | | | |

| Discount Notes – 8.5% | | | | | | | | |

| 7/25/06 | | 4.01 | | | | 72,100 | | 71,213 |

| 7/25/06 | | 4.60 | | | | 50,855 | | 50,124 |

| 7/25/06 | | 4.61 | | | | 46,015 | | 45,353 |

| 9/27/06 | | 4.26 | | | | 75,000 | | 73,477 |

| 9/29/06 | | 4.51 | | | | 32,000 | | 31,303 |

| 10/17/06 | | 4.53 | | | | 36,046 | | 35,181 |

| 10/23/06 | | 4.90 | | | | 45,925 | | 44,685 |

| 12/1/06 | | 4.72 | | | | 55,600 | | 53,900 |

| 1/9/07 | | 4.75 | | | | 26,660 | | 25,708 |

| 1/17/07 | | 4.76 | | | | 47,480 | | 45,735 |

| 1/18/07 | | 5.11 | | | | 70,000 | | 67,218 |

| 1/19/07 | | 4.81 | | | | 47,375 | | 45,602 |

| | | | | | | | | 589,499 |

| |

| TOTAL FEDERAL AGENCIES | | | | | | 1,706,712 |

| |

| U.S. Treasury Obligations 2.5% | | |

| |

| U.S. Treasury Bills – 2.5% | | | | | | |

| 5/25/06 | | 4.51 | | | | 65,000 | | 64,566 |

| 8/3/06 | | 4.50 | | | | 66,480 | | 65,472 |

| 8/3/06 | | 4.53 | | | | 47,300 | | 46,578 |

| TOTAL U.S. TREASURY OBLIGATIONS | | 176,616 |

| Repurchase Agreements 73.0% | | |

| | | Maturity | | Value (Note 1) |

| | | Amount | | (000s) |

| | | (000s) | | |

| In a joint trading account (Collateralized by | | | | |

| U.S. Government Obligations) dated | | | | |

| 3/31/06 due 4/3/06 At: | | | | |

| 4.85% (b) | | $ 331,424 | | $ 331,290 |

| 4.88% (b) | | 4,740,572 | | 4,738,644 |

| TOTAL REPURCHASE AGREEMENTS | | | | 5,069,934 |

| |

| TOTAL INVESTMENT PORTFOLIO 100.1% | | |

| (Cost $6,953,262) | | | | 6,953,262 |

| |

| NET OTHER ASSETS (0.1)% | | | | (7,569) |

| NET ASSETS 100% | | | | $ 6,945,693 |

Legend

(a) The coupon rate shown on floating or adjustable rate securities represents

the rate at period end. The due dates on these types of securities reflect

the next interest rate reset date or, when applicable, the final maturity

date.

(b) Additional information on each counterparty to the repurchase agreement

is as follows:

|

| Repurchase Agreement/ | | | | Value |

| Counterparty | | | | (000s) |

| |

| $331,290,000 due 4/3/06 at 4.85% | | | | |

| Banc of America Securities LLC | | | | $ 82,823 |

| Goldman, Sachs & Co. | | | | 150,586 |

| Morgan Stanley & Co. Incorporated | | | | 97,881 |

| | | | | $ 331,290 |

| $4,738,644,000 due 4/3/06 at 4.88% | | | | |

| Bank of America, National Association | | | | $ 895,165 |

| Barclays Capital Inc. | | | | 1,566,539 |

| Countrywide Securities Corporation. | | | | 447,582 |

| Goldman, Sachs & Co. | | | | 128,544 |

| Greenwich Capital Markets, Inc. | | | | 223,791 |

| HSBC Securities (USA), Inc. | | | | 447,583 |

| Merrill Lynch Government Securities, Inc. | | | | 55,948 |

| Morgan Stanley & Co. Incorporated. | | | | 749,701 |

| WestLB AG | | | | 223,791 |

| | | | | $ 4,738,644 |

Income Tax Information

At March 31, 2006, the fund had a capital loss carryforward of approximately $555,000 of which $55,000, $192,000 and $308,000 will expire on March 31, 2011, 2012 and 2013, respectively.

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Government Portfolio | | | | | | |

| |

| Financial Statements | | | | |

| |

| |

| Statement of Assets and Liabilities | | |

| Amounts in thousands (except per share amounts) | | March 31, 2006 |

| |

| Assets | | | | | | |

| Investment in securities, at value | | | | | | |

| (including repurchase agreements | | | | |

| of $5,069,934) — See | | | | | | |

| accompanying schedule: | | | | | | |

| Unaffiliated issuers | | | | | | |

| (cost $6,953,262) | | | | | | $ 6,953,262 |

| Receivable for fund shares sold | | | | | | 1,000 |

| Interest receivable | | | | | | 3,357 |

| Prepaid expenses | | | | | | 24 |

| Receivable from investment adviser | | | | |

| for expense reductions | | | | | | 135 |

| Other affiliated receivables | | | | | | 28 |

| Total assets | | | | | | 6,957,806 |

| |

| Liabilities | | | | | | |

| Distributions payable | | | | $ 10,577 | | |

| Accrued management fee | | | | 1,050 | | |

| Distribution fees payable | | | | 227 | | |

| Other affiliated payables | | | | 226 | | |

| Other payables and accrued | | | | | | |

| expenses | | | | 33 | | |

| Total liabilities | | | | | | 12,113 |

| |

| Net Assets | | | | | | $ 6,945,693 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 6,946,307 |

| Distributions in excess of net | | | | | | |

| investment income | | | | | | (59) |

| Accumulated undistributed net | | | | | | |

| realized gain (loss) on investments | | | | (555) |

| Net Assets | | | | | | $ 6,945,693 |

| Class I: | | | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | | | |

| ($5,256,833 ÷ 5,256,917 | | | | | | |

| shares) | | | | | | $ 1.00 |

| Class II: | | | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | | | |

| ($933,097 ÷ 932,920 shares) | | | | $ 1.00 |

| Class III: | | | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | | | |

| ($727,072 ÷ 726,992 shares) | | | | $ 1.00 |

| Select Class: | | | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | | | |

| ($28,691 ÷ 28,698 shares) | | | | | | $ 1.00 |

| Statement of Operations | | | | |

| Amounts in thousands | | | | Year ended March 31, 2006 |

| |

| Investment Income | | | | | | |

| Interest | | | | | | $ 250,997 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 13,371 | | |

| Transfer agent fees | | | | 1,096 | | |

| Distribution fees | | | | 2,518 | | |

| Accounting fees and expenses | | | | 593 | | |

| Independent trustees’ compensation | | | | 29 | | |

| Appreciation in deferred trustee | | | | | | |

| compensation account | | | | 2 | | |

| Custodian fees and expenses | | | | 30 | | |

| Registration fees | | | | 108 | | |

| Audit | | | | 67 | | |

| Legal | | | | 16 | | |

| Miscellaneous | | | | 65 | | |

| Total expenses before reductions | | . | | 17,895 | | |

| Expense reductions | | | | (2,019) | | 15,876 |

| |

| Net investment income | | | | | | 235,121 |

| Realized and Unrealized Gain | | | | | | |

| (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | 230 |

| Net increase in net assets resulting | | | | | | |

| from operations | | | | | | $ 235,351 |

See accompanying notes which are an integral part of the financial statements.

Annual Report 20

| Statement of Changes in Net Assets | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Year ended | | | | Year ended |

| | | | | | | | | | | | | | | March 31, | | | | March 31, |

| Amounts in thousands | | | | | | | | | | | | | | 2006 | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | $ 235,121 | | | | $ 105,816 |

| Net realized gain (loss) | | | | | | | | | | | | | | | | 230 | | | | (508) |

| Net increase in net assets resulting from operations | | | | | | | | | | | | | | | | 235,351 | | | | 105,308 |

| Distributions to shareholders from net investment income | | | | | | | | | | | | | | | | (235,235) | | | | (106,199) |

| Share transactions - net increase (decrease) | | | | | | | | | | | | | | | | 236,077 | | | | (1,319,771) |

| Total increase (decrease) in net assets | | | | | | | | | | | | | | | | 236,193 | | | | (1,320,662) |

| |

| Net Assets | | | | | | | | | | | | | | | | | | | | |

| Beginning of period | | | | | | | | | | | | | | | | 6,709,500 | | | | 8,030,162 |

| End of period (including distributions in excess of net investment income of $59 and undistributed net investment | | | | | | | | | | |

| income of $92, respectively) | | | | | | | | | | | | | | | | $ 6,945,693 | | | | $ 6,709,500 |

| |

| Financial Highlights Class I | | | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 036 | | | | .016 | | | | .010 | | | | .015 | | | | .031 |

| Distributions from net investment income | | | | (.036) | | | | (.016) | | | | (.010) | | | | (.015) | | | | (.031) |

| Net asset value, end of period | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | | | 3.62% | | | | 1.58% | | | | .97% | | | | 1.53% | | | | | | 3.16% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 23% | | | | .23% | | | | .23% | | | | .23% | | | | | | .23% |

| Expenses net of fee waivers, if any | | | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Expenses net of all reductions | | | | 20% | | | | .20% | | | | .20% | | | | .20% | | | | | | .20% |

| Net investment income | | | | 3.55% | | | | 1.53% | | | | .98% | | | | 1.52% | | | | | | 3.06% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | | | $ 5,257 | | | | $ 5,590 | | | | $ 6,024 | | | | $ 7,928 | | | | $ 8,604 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or

reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

|

21 Annual Report

| Financial Highlights Class II | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 034 | | | | .014 | | | | .008 | | | | .014 | | | | .030 |

| Distributions from net investment income | | (.034) | | | | (.014) | | | | (.008) | | | | (.014) | | | | (.030) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.47% | | | | 1.43% | | | | .82% | | | | 1.38% | | | | 3.01% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 38% | | | | .38% | | | | .38% | | | | .38% | | | | .38% |

| Expenses net of fee waivers, if any | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Expenses net of all reductions | | 35% | | | | .35% | | | | .35% | | | | .35% | | | | .35% |

| Net investment income | | 3.40% | | | | 1.38% | | | | .83% | | | | 1.37% | | | | 2.86% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 933 | | | | $ 499 | | | | $ 859 | | | | $ 917 | | | | $ 918 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

|

| Financial Highlights Class III | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 033 | | | | .013 | | | | .007 | | | | .013 | | | | .029 |

| Distributions from net investment income | | (.033) | | | | (.013) | | | | (.007) | | | | (.013) | | | | (.029) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnA | | 3.36% | | | | 1.32% | | | | .72% | | | | 1.27% | | | | 2.90% |

| Ratios to Average Net AssetsB | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 48% | | | | .48% | | | | .48% | | | | .48% | | | | .48% |

| Expenses net of fee waivers, if any | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Expenses net of all reductions | | 45% | | | | .45% | | | | .45% | | | | .45% | | | | .45% |

| Net investment income | | 3.30% | | | | 1.28% | | | | .73% | | | | 1.27% | | | | 2.76% |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ 727 | | | | $ 572 | | | | $ 1,109 | | | | $ 866 | | | | $ 1,326 |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses

paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| | |

| Annual Report | | 22 |

| Financial Highlights Select Class | | | | | | | | | | | | | | | | | | |

| Years ended March 31, | | 2006 | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002D |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | |

| Net investment income | | 035 | | | | .015 | | | | .009 | | | | .015 | | | | .004 |

| Distributions from net investment income | | (.035) | | | | (.015) | | | | (.009) | | | | (.015) | | | | (.004) |

| Net asset value, end of period | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 | | | | $ 1.00 |

| Total ReturnB,C | | 3.57% | | | | 1.53% | | | | .92% | | | | 1.47% | | | | .37% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | 28% | | | | .28% | | | | .28% | | | | .28% | | | | .27%A |

| Expenses net of fee waivers, if any | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Expenses net of all reductions | | 25% | | | | .25% | | | | .25% | | | | .25% | | | | .25%A |

| Net investment income | | 3.50% | | | | 1.48% | | | | .92% | | | | 1.47% | | | | 1.83%A |

| Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 28,691 | | | | $ 49,025 | | | | $ 38,785 | | | | $ 272,495 | | | | $ 100 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D For the period January 17, 2002 (commencement of sale of shares) to March 31, 2002.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the class during periods when

reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

|

23 Annual Report

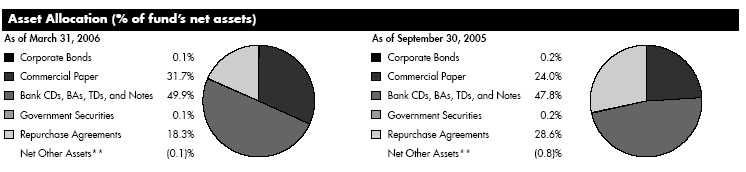

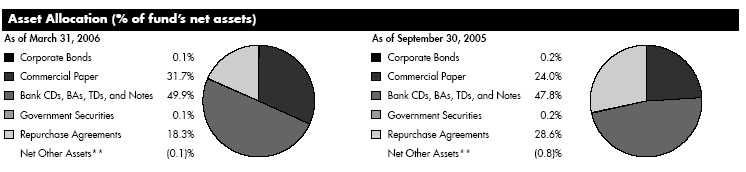

| Prime Money Market Portfolio | | | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| 0 – 30 | | 67.6 | | 58.7 | | 43.4 |

| 31 – 90 | | 21.8 | | 31.1 | | 36.2 |

| 91 – 180 | | 2.9 | | 8.4 | | 19.4 |

| 181 – 397 | | 7.7 | | 1.8 | | 1.0 |

Weighted Average Maturity | | | | | | |

| | | 3/31/06 | | 9/30/05 | | 3/31/05 |

| Prime Money Market Portfolio | | 40 Days | | 34 Days | | 49 Days |

| All Taxable Money Market Funds Average* | | 38 Days | | 38 Days | | 38 Days |

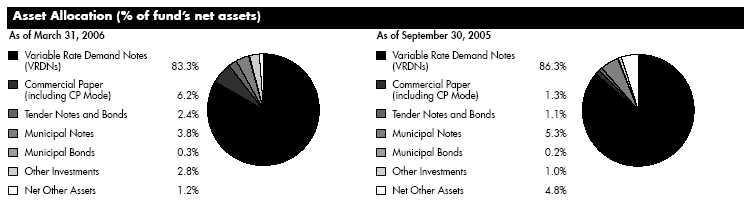

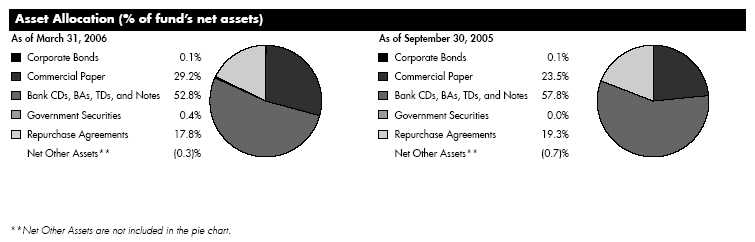

**Net Other Assets are not included in the pie chart.

*Source: iMoneyNet, Inc.

Annual Report 24

| Prime Money Market Portfolio | | | | | | |

| Investments March 31, 2006 |

| Showing Percentage of Net Assets | | | | | | | | |

| |

| Corporate Bonds 0.0% | | | | | | | | |

| Due | | Annualized Yield at | | Principal | | Value (Note 1) |

| Date | | Time of Purchase | | Amount (000s) | | (000s) |

| Morgan Stanley | | | | | | | | | | |

| 4/15/06 | | 4.05% | | | | $ 5,000 | | | | $ 5,004 |

| |

| Certificates of Deposit 23.9% | | | | | | | | | | |

| |

| London Branch, Eurodollar, Foreign Banks – 9.9% | | | | | | | | | | |

| Calyon | | | | | | | | | | |

| 10/24/06 | | 4.92 | | | | 65,000 | | | | 64,935 |

| 2/12/07 | | 5.00 | | | | 75,000 | | | | 75,000 |

| Credit Agricole SA | | | | | | | | | | |

| 5/15/06 | | 4.70 | | | | 50,000 | | | | 49,985 |

| Credit Industriel et Commercial | | | | | | | | | | |

| 6/8/06 | | 4.75 | | | | 70,000 | | | | 70,000 |

| 9/11/06 | | 5.00 | | | | 90,000 | | | | 90,000 |

| 9/29/06 | | 5.08 | | | | 100,000 | | | | 100,000 |

| 10/24/06 | | 4.77 | | | | 50,000 | | | | 50,000 |

| 11/7/06 | | 4.76 | | | | 40,000 | | | | 40,000 |

| 3/30/07 | | 5.22 | | | | 50,000 | | | | 50,000 |

| Deutsche Bank AG | | | | | | | | | | |

| 1/30/07 | | 4.86 | | | | 105,000 | | | | 105,000 |

| HBOS Treasury Services PLC | | | | | | | | | | |

| 5/8/06 | | 4.67 | | | | 40,000 | | | | 40,000 |

| Landesbank Hessen Thuringen | | | | | | | | | | |

| 5/8/06 | | 4.67 | | | | 90,000 | | | | 90,000 |

| Societe Generale | | | | | | | | | | |

| 5/10/06 | | 4.80 | | | | 225,000 | | | | 225,000 |

| 6/7/06 | | 4.75 | | | | 98,000 | | | | 97,966 |

| 11/7/06 | | 4.91 | | | | 85,000 | | | | 85,000 |

| 12/6/06 | | 4.80 | | | | 55,000 | | | | 55,000 |

| Unicredito Italiano Spa | | | | | | | | | | |

| 5/19/06 | | 4.87 | | | | 10,000 | | | | 9,998 |

| | | | | | | | | | | 1,297,884 |

| New York Branch, Yankee Dollar, Foreign Banks – 14.0% | | | | | | | | | | |

| Bank Tokyo Mitsubishi UFJ Ltd. | | | | | | | | | | |

| 4/20/06 | | 4.76 | | | | 45,000 | | | | 45,000 |

| 4/24/06 | | 4.78 | | | | 55,000 | | | | 55,000 |

| Barclays Bank PLC | | | | | | | | | | |

| 5/10/06 | | 4.80 | | | | 365,000 | | | | 364,994 |

| BNP Paribas SA | | | | | | | | | | |

| 10/30/06 | | 4.81 | | | | 105,000 | | | | 105,000 |

| 11/8/06 | | 4.93 | | | | 80,000 | | | | 80,000 |

| Canadian Imperial Bank of Commerce | | | | | | | | | | |

| 4/24/06 | | 4.78 (b) | | | | 170,000 | | | | 170,000 |

| Credit Suisse First Boston New York Branch | | | | | | | | | | |

| 4/19/06 | | 4.57 (b) | | | | 60,000 | | | | 60,000 |

| 4/19/06 | | 4.76 (b) | | | | 50,000 | | | | 50,000 |

| 6/26/06 | | 4.93 (b) | | | | 85,000 | | | | 85,000 |

| 11/7/06 | | 4.75 | | | | 35,000 | | | | 35,000 |

| Due | | Annualized Yield at | | Principal | | Value (Note 1) |

| Date | | Time of Purchase | | Amount (000s) | | (000s) |

| Deutsche Bank AG | | | | | | | | | | |

| 6/5/06 | | 4.80% (b) | | | | $ 65,000 | | | | $ 65,000 |

| 2/5/07 | | 4.90 | | | | 70,000 | | | | 70,000 |

| DZ Bank AG Deutsche Genosbank | | | | | | | | | | |

| 4/24/06 | | 4.79 | | | | 25,000 | | | | 25,000 |

| Mizuho Corporate Bank Ltd. | | | | | | | | | | |

| 5/8/06 | | 4.82 | | | | 95,000 | | | | 95,000 |

| 5/10/06 | | 4.83 | | | | 100,000 | | | | 100,000 |

| Skandinaviska Enskilda Banken AB | | | | | | | | | | |

| 4/6/06 | | 4.50 (b) | | | | 115,000 | | | | 114,995 |

| Sumitomo Mitsui Banking Corp. | | | | | | | | | | |

| 4/10/06 | | 4.68 | | | | 11,000 | | | | 11,000 |

| 4/17/06 | | 4.75 | | | | 22,000 | | | | 22,000 |

| 4/20/06 | | 4.77 | | | | 19,000 | | | | 19,000 |

| 4/21/06 | | 4.80 | | | | 18,000 | | | | 18,000 |

| 4/24/06 | | 4.80 | | | | 14,000 | | | | 14,000 |

| 4/28/06 | | 4.82�� | | | | 18,000 | | | | 18,000 |

| Toronto Dominion Bank | | | | | | | | | | |

| 4/7/06 | | 3.86 | | | | 30,000 | | | | 30,000 |

| 4/18/06 | | 3.92 | | | | 125,000 | | | | 125,000 |

| Unicredito Italiano Spa | | | | | | | | | | |

| 5/12/06 | | 4.69 (b) | | | | 75,000 | | | | 74,999 |

| | | | | | | | | | | 1,851,988 |

| |

| TOTAL CERTIFICATES OF DEPOSIT | | | | | | | | 3,149,872 |

| |

| Commercial Paper 31.7% | | | | | | | | | | |

| |

| Bavaria TRR Corp. | | | | | | | | | | |

| 4/4/06 | | 4.66 | | | | 145,000 | | | | 144,944 |

| 4/6/06 | | 4.68 | | | | 40,000 | | | | 39,974 |

| 4/17/06 | | 4.80 | | | | 1,142 | | | | 1,140 |

| 4/20/06 | | 4.78 | | | | 100,000 | | | | 99,749 |

| Charta LLC | | | | | | | | | | |

| 4/20/06 | | 4.66 | | | | 96,500 | | | | 96,265 |

| 5/16/06 | | 4.71 | | | | 40,000 | | | | 39,767 |

| CIESCO LP | | | | | | | | | | |

| 5/15/06 | | 4.70 | | | | 75,000 | | | | 74,574 |

| Citibank Credit Card Master Trust I (Dakota Certificate Program) | | | | | | | | | | |

| 4/3/06 | | 4.53 | | | | 85,000 | | | | 84,979 |

| 4/4/06 | | 4.53 | | | | 29,000 | | | | 28,989 |

| 4/4/06 | | 4.54 | | | | 30,000 | | | | 29,989 |

| 4/10/06 | | 4.63 | | | | 65,000 | | | | 64,925 |

| 5/8/06 | | 4.81 | | | | 10,000 | | | | 9,951 |

| 5/10/06 | | 4.82 | | | | 20,000 | | | | 19,901 |

| Credit Suisse First Boston New York Branch | | | | | | | | | | |

| 4/3/06 | | 4.61 | | | | 185,000 | | | | 184,953 |

| Cullinan Finance Corp. | | | | | | | | | | |