SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ PreliminaryProxy Statement | ¨ Confidential, For Use Of The Commission | |

Only (as Permitted By Rule 14a-6(e)(2)) | ||

x Definitive Proxy Statement | ||

¨ DefinitiveAdditional Materials | ||

¨ SolicitingMaterial Pursuant to Rule 14a-11(c) or Rule 14a-12 | ||

PINNACLE ENTERTAINMENT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PINNACLE ENTERTAINMENT, INC.

3800 HOWARD HUGHES PARKWAY, SUITE 1800

LAS VEGAS, NV 89109

April 29, 2003

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Pinnacle Entertainment, Inc. (the “Company”), to be held at the Four Seasons Hotel at 3960 Las Vegas Boulevard South, Las Vegas, Nevada 89119 on June 3, 2003 at 10:00 a.m. local time.

At the annual meeting, you will be asked to consider and vote upon three matters: first, the election of nine directors to serve for the coming year on the Company’s Board of Directors; second, a proposal to approve an amendment to the Company’s 2002 Stock Option Plan that increases the aggregate number of shares that may be issued under that plan by 1,000,000; and third, a proposal to approve an amendment to the Company’s Certificate of Incorporation that increases the total number of authorized shares of Common Stock of the Company from 40,000,000 shares to 80,000,000 shares. Accompanying this letter is the formal Notice of Annual Meeting, Proxy Statement and Proxy Card relating to the annual meeting. The Proxy Statement contains important information concerning the directors to be elected at the annual meeting, the amendment to the Company’s 2002 Stock Option Plan and the amendment to the Company’s Restated Certificate of Incorporation that we would like you to approve.

Your vote is very important regardless of how many shares you own. We hope you can attend the annual meeting in person. However, whether or not you plan to attend the annual meeting, please complete, sign, date and return the Proxy Card in the enclosed envelope. If you attend the annual meeting, you may vote in person if you wish, even though you may have previously returned your Proxy Card.

Sincerely,

Daniel R. Lee

Chairman of the Board of Directors

and Chief Executive Officer

PINNACLE ENTERTAINMENT, INC.

3800 HOWARD HUGHES PARKWAY, SUITE 1800

LAS VEGAS, NEVADA 89109

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 3, 2003

TO THE STOCKHOLDERS OF PINNACLE ENTERTAINMENT, INC.:

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders of Pinnacle Entertainment, Inc., a Delaware corporation (“Pinnacle” or the “Company”), will be held on June 3, 2003, at 10:00 a.m. local time, at the Four Seasons Hotel at 3960 Las Vegas Boulevard South, Las Vegas, Nevada 89119 and at any adjournments or postponements thereof (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders will be asked to consider and vote upon:

1. The election of nine directors to serve on the Company’s Board of Directors for the coming year, each to hold office until the next annual meeting of stockholders (and until each such director’s successor shall have been duly elected and qualified);

2. The approval of an amendment to the Company’s 2002 Stock Option Plan that increases the aggregate number of shares that may be issued upon exercise of all options granted under that plan from 1,000,000 shares to 2,000,000 shares;

3. The approval of an amendment to the Company’s Restated Certificate of Incorporation that increases the total authorized number of shares of Common Stock of the Company from 40,000,000 to 80,000,000 shares; and

4. Such other business as may properly come before the Annual Meeting or before any adjournments or postponements thereof.

Information regarding the nine board nominees, the proposed amendment to the Company’s 2002 Stock Option Plan and the proposed amendment to the Company’s Restated Certificate of Incorporation is contained in the accompanying Proxy Statement, which you are urged to read carefully. A full copy of the Company’s 2002 Stock Option Plan, as it is proposed to be amended, is attached as Appendix A to such Proxy Statement and a full copy of the proposed amendment to the Company’s Restated Certificate of Incorporation is attached as Appendix B to such Proxy Statement.

Only holders of record of the Company’s Common Stock at the close of business on April 15, 2003 are entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

Your vote is very important. TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, YOU ARE URGED TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE PAID ENVELOPE PROVIDED, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON. YOUR PROXY CAN BE WITHDRAWN BY YOU AT ANY TIME BEFORE IT IS VOTED.

BY ORDER OF THE BOARD OF DIRECTORS

John A. Godfrey

Secretary

Las Vegas, Nevada

April 29, 2003

PINNACLE ENTERTAINMENT, INC.

3800 HOWARD HUGHES PARKWAY, SUITE 1800

LAS VEGAS, NEVADA 89109

PROXY STATEMENT RELATING TO

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 3, 2003

This Proxy Statement is being furnished to the stockholders of Pinnacle Entertainment, Inc., a Delaware corporation (“Pinnacle” or the “Company”), in connection with the solicitation of proxies by the Company’s Board of Directors for use at the Annual Meeting of the Company’s stockholders to be held on June 3, 2003, at 10:00 a.m. local time, at the Four Seasons Hotel at 3960 Las Vegas Boulevard South, Las Vegas, Nevada 89119, and at any adjournments or postponements thereof (the “Annual Meeting”).

At the Annual Meeting, holders of the Company’s Common Stock, $0.10 par value per share (“Pinnacle Common Stock”), will be asked to vote upon: (i) the election of nine directors to serve on the Company’s Board of Directors for the coming year, each to hold office until the next annual meeting of stockholders (and until each such director’s successor shall have been duly elected and qualified), (ii) the approval of an amendment to the Company’s 2002 Stock Option Plan (the “2002 Stock Option Plan”) that increases the aggregate number of shares that may be issued upon exercise of all options granted under the 2002 Stock Option Plan from 1,000,000 shares to 2,000,000 shares (the “Option Plan Amendment”), (iii) the approval of an amendment to the Company’s Restated Certificate of Incorporation that increases the total number of authorized shares of Pinnacle Common Stock from 40,000,000 shares to 80,000,000 shares (the “Charter Amendment”) and (iv) any other business that properly comes before the Annual Meeting.

This Proxy Statement and the accompanying Proxy Card are first being mailed to the Company’s stockholders on or about April 29, 2003. The address of the principal executive offices of the Company is 3800 Howard Hughes Parkway, Suite 1800, Las Vegas, Nevada 89109.

ANNUAL MEETING

Record Date; Outstanding Shares; Quorum

Only holders of record of Pinnacle Common Stock at the close of business on April 15, 2003 (the “Record Date”) will be entitled to receive notice of and to vote at the Annual Meeting. As of the close of business on the Record Date, there were 25,934,261 shares of Pinnacle Common Stock outstanding and entitled to vote, held of record by 2,841 stockholders. Pursuant to New York Stock Exchange requirements, a majority, or12,967,131, of these shares, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Each of the Company’s stockholders is entitled to one vote for each share of Pinnacle Common Stock held as of the Record Date.

Voting of Proxies; Votes Required

Stockholders are requested to complete, date, sign and return the accompanying Proxy Card in the enclosed envelope. All properly executed, returned and unrevoked Proxy Cards will be voted in accordance with the instructions indicated thereon. Executed but unmarked Proxy Cards will be voted FOR the election of each director nominee listed on the Proxy Card, FOR the approval of the Option Plan Amendment and FOR the approval of the Charter Amendment. The Company’s Board of Directors does not presently intend to bring any business before the Annual Meeting other than that referred to in this Proxy Statement and specified in the Notice

1

of the Annual Meeting. By signing the Proxy Cards, stockholders confer discretionary authority on the proxies (who are persons designated by the Board of Directors) to vote all shares covered by the Proxy Cards in their discretion on any other matter that may properly come before the Annual Meeting, including any motion made for adjournment of the Annual Meeting.

Any stockholder who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by (i) filing a written revocation with, or delivering a duly executed proxy bearing a later date to, the Secretary of the Company, 3800 Howard Hughes Parkway, Suite 1800, Las Vegas, Nevada 89109, or (ii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Elections of directors are determined by a plurality of shares of Pinnacle Common Stock represented in person or by proxy and voting at the Annual Meeting. The proposal to approve the Option Plan Amendment requires approval by the affirmative vote of the holders of a majority of the shares of Pinnacle Common Stock represented in person or by proxy and entitled to vote at the Annual Meeting. The Amended and Restated 2002 Stock Option Plan attached as Appendix A to this Proxy reflects (i) prior technical amendments that were made to the plan that did not require stockholder approval and (ii) the proposed Option Plan Amendment. Under the 2002 Stock Option Plan, stockholder approval is only necessary with respect to the proposed increase of the number of shares of Common Stock that may be issued under the plan from 1,000,000 shares to 2,000,000 shares. The proposal to approve the Charter Amendment requires approval by the affirmative vote of the holders of a majority of the issued and outstanding shares of Pinnacle Common Stock entitled to vote at the Annual Meeting.

Abstentions; Broker Non-Votes

If an executed proxy is returned and the stockholder has specifically abstained from voting on any matter, the shares represented by such proxy will be considered present at the Annual Meeting for purposes of determining a quorum and will be considered entitled to vote, but will not be considered to have been voted in favor of such matter. If an executed proxy is returned by a broker holding shares in street name that indicates that the broker does not have discretionary authority as to certain shares to vote on one or more matters, such shares will be considered present at the meeting for purposes of determining a quorum on all matters, but will not be considered entitled to vote with respect to such matter or matters. Thus, while abstentions and broker non-votes will have no effect on the outcome of the election of directors, abstentions will have the same effect as negative votes on the proposal to approve the Option Plan Amendment. Broker non-votes will have no effect on the proposal to approve the Option Plan Amendment. Furthermore, because the Charter Amendment requires approval by the affirmative vote of the holders of a majority of the issued and outstanding shares of Pinnacle Common Stock entitled to vote on the proposal, abstentions and broker non-votes will have the same effect as negative votes on the proposal to approve the Charter Amendment.

Solicitation of Proxies and Expenses

The Company will bear the cost of the solicitation of proxies from its stockholders in the enclosed form. The directors, officers and employees of the Company may solicit proxies by mail, telephone, telegram, letter, facsimile or in person. Following the original mailing of the proxies and other soliciting materials, the Company will request that brokers, custodians, nominees and other record holders forward copies of the Proxy Statement and other soliciting materials to persons for whom they hold shares of Pinnacle Common Stock and request authority for the exercise of proxies. In such cases, the Company will reimburse such record holders for their reasonable expenses. In addition, the Company has retained D.F. King & Co., Inc. to assist in the solicitation of proxies. The estimated total cost for such record holder expenses, broker expenses and D.F. King fees is $23,000.

2

PROPOSAL 1

ELECTION OF DIRECTORS

(Item No. 1 on Proxy Card)

At the Annual Meeting, holders of Pinnacle Common Stock will be asked to vote on the election of nine directors who will constitute the full Board of Directors of the Company. The nine nominees receiving the highest number of votes from holders of shares of Pinnacle Common Stock represented and voting at the Annual Meeting will be elected to the Board of Directors. Abstentions and broker non-votes will not be counted as voting at the meeting and therefore will not have an effect on the election of the nominees listed below.

Each director elected will hold office until the next annual meeting of stockholders (and until his or her successor shall have been duly elected and qualified). All of the nominees listed below currently serve on the Board of Directors of the Company.

General

Each proxy received will be voted for the election of the persons named below, unless the stockholder signing such proxy withholds authority to vote for one or more of these nominees in the manner described in the proxy. Although it is not contemplated that any nominee named below will decline or be unable to serve as a director, in the event any nominee declines or is unable to serve as a director, the proxies will be voted by the proxy holders as directed by the Board of Directors.

There are no family relationships between any director, nominee or executive officer and any other director, nominee or executive officer of the Company. There are no arrangements or understandings between any director, nominee or executive officer and any other person pursuant to which he or she has been or will be selected as a director and/or executive officer of the Company (other than arrangements or understandings with any such director, nominee and/or executive officer acting in his or her capacity as such). See “—Information Regarding the Director Nominees of the Company.”

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF ALL OF THE NOMINEES LISTED BELOW.

Information Regarding the Director Nominees of the Company

The following table lists the persons nominated by the Board of Directors for election as directors of the Company and provides their ages and current positions with the Company. All of the nominees currently serve on the Board of Directors of the Company. Biographical information for each nominee is provided below.

Name | Age | Position with the Company | ||

Daniel R. Lee (a) | 46 | Chairman of the Board of Directors and Chief Executive Officer | ||

John V. Giovenco (b) | 66 | Director | ||

Bruce A. Leslie | 52 | Director | ||

James L. Martineau (c) | 62 | Director | ||

Michael Ornest (b) | 45 | Director | ||

Timothy J. Parrott (a) | 55 | Director | ||

Bonnie Reiss (b) | 47 | Director | ||

Lynn P. Reitnouer (a), (c) | 70 | Director | ||

Marlin Torguson | 58 | Director |

| (a) | Member of the Executive Committee |

| (b) | Member of the Audit Committee |

| (c) | Member of the Compensation Committee |

3

Mr. Lee has been Chairman of the Board of Directors and Chief Executive Officer of the Company since April 10, 2002; owner of LVMR, LLC (developer of casino hotels) from 2001 to 2002; Chief Financial Officer and Senior Vice President of HomeGrocer.Com, Inc. (internet grocery service) from 1999 until the sale of the company in 2000; Chief Financial Officer, Treasurer and Senior Vice President of Finance and Development of Mirage Resorts, Incorporated (major operator and developer of casino resorts) from 1992 to 1999; Director-Equity Research of CS First Boston From 1990 to 1992 and held various positions to Managing Director of Drexel Burham Lambert from 1980 to 1990.

Mr. Giovenco has been a Director of the Company since February 20, 2003; Director, Great Western Financial Corporation from 1983 to 1997; President and Chief Operating Officer, Sheraton Hotels Corporation 1993; Director; Hilton Hotels Corporation from 1980 to 1992; President and Chief Operating Officer, Hilton Gaming Corporation from 1985 to 1993; Chief Financial Officer, Hilton Gaming Corporation from 1974 to 1985; Partner, Harris, Kerr, Forster, Certified Public Accountants (predecessor firm to PKF International) from 1968 to 1971.

Mr. Leslie has been a Director of the Company since October 29, 2002; Principal, Leslie & Campbell (law firm) since 2001; Principal, Bernhard & Leslie (law firm) from 1996 to 2001; Partner, Beckley, Singleton, Jemison & List (law firm) from 1986 to 1996; and Partner, Vargas & Bartlett (law firm) from 1979 to 1986.

Mr. Martineau has been a Director of the Company since May 1999; President and Founder, Viracon, Inc. (flat glass fabricator) from 1970 to 1996; Executive Vice President, Apogee Enterprises, Inc. (a glass design and development corporation that acquired Viracon, Inc. in 1973) from 1996 to 1998; Director, Apogee Enterprises, Inc. since 1973; Director, Northstar Photonics (telecommunications business) from 1998 to 2002; Chairman, Genesis Portfolio Partners, LLC, (start-up company development) since August 1998; Director, Borgen Systems since 1994; and Trustee, Owatonna Foundation since 1973.

Mr. Ornest has been a Director of the Company since October 1998; private investor since 1983; Director of the Ornest Family Partnership since 1983; Director of the Ornest Family Foundation since 1993; Director of the Toronto Argonauts Football Club from 1988 to 1990; President of the St. Louis Arena and Vice President of the St. Louis Blues Hockey Club from 1983 to 1986; and Managing Director of the Vancouver Canadians Baseball Club, Pacific Coast League from 1979 to 1980.

Mr. Parrott has been a Director of the Company since June 1997; Consultant to the Company from November 1998 to 2001; Chairman of the Board and Chief Executive Officer, On Stage Entertainment (entertainment production company) since October 2000, President, October 2000 to January 2002; Chairman of the Board and Chief Executive Officer, Boomtown, Inc. (Boomtown) (gaming operations) from September 1992 to October 1998; President and Treasurer, Boomtown from June 1987 to September 1992; Director, Boomtown from 1987 to October 1998; Chairman of the Board and Chief Executive Officer, Boomtown Hotel & Casino, Inc. since May 1988; Chief Executive Officer, Parrott Investment Company (a family-held investment company with agricultural interests in California) since April 1995; and Director, The Chronicle Publishing Company since April 1995.

Ms. Reiss has been a Director of the Company since December 17, 2002; Chief Executive Officer, Arnold Schwarzeneger’s Inner-City Games Foundation (non-profit organization offering after-school programs) since 1998; Keynote Speaker since 1994; Director of Arnold Schwarzenegger’s Inner-City Games Foundation since 1994; Director and Founder, Arnold’s All-Stars (a Los Angeles non-profit organization offering after-school programs) since September 2001; and Founder, Earth Communications Office (ECO) (non-profit organization promoting environmental awareness in entertainment industry) in 1988.

Mr. Reitnouer has been a Director of the Company since 1991; Director, Hollywood Park Operating Company from September 1991 to January 1992; Partner, Crowell Weedon & Co. (stock brokerage) since 1969;

4

Director and Chairman of the Board, COHR, Inc. from 1986 to 1999; Director and Chairman, Forest Lawn Memorial Parks Association since 1975; and Trustee, University of California Santa Barbara Foundation (and former Chairman) since 1992.

Mr. Torguson has been a Director of the Company since October 1998; a consultant to the Company from October 1998 to October 2001; Chairman of the Board, Casino Magic Corp. (gaming operations) from 1994 to April 2002; President and Chief Executive Officer, Casino Magic from April 1992 through November 1994; Chief Financial Officer and Treasurer, Casino Magic from April 1992 to February 1993; 50% owner and a Vice President, G.M.T. Management Co. (casino management and operations) from December 1983 to December 1994; and private investor.

Board Meetings, Board Committees and Director Compensation

The full Board of Directors of the Company had ten formal meetings in 2002 and acted by unanimous written consent on two occasions. During 2002, each incumbent director of the Company, during the period for which he or she was a director, attended at least 75% of the meetings of the Board of Directors and the committees of the Board on which he or she served.

The Company has a standing Executive Committee, which is chaired by Mr. Lee and currently consists of Messrs. Lee, Reitnouer, and Parrott. The Executive Committee has and may exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the Company to the fullest extent authorized by Delaware law. During 2002, the Executive Committee had two formal meetings in 2002 and acted by unanimous written consent on three occasions.

The Company has a standing Audit Committee, which is chaired by Mr. Giovenco and currently consists of Messrs. Giovenco and Ornest and Ms. Reiss. Mr. Ornest has served on the Audit Committee since January 1, 2002. Ms. Reiss and Mr. Giovenco were appointed to the Audit Committee on December 23, 2002 and February 20, 2003, respectively, and continue to serve on such committee. Mr. Parrott served on the Audit Committee from January 1, 2002 to February 20, 2003.Among the functions of the Audit Committee are to recommend to the Board of Directors each year the independent public accounting firm to be engaged to audit the Company’s financial statements; discuss with the independent auditors their independence; review and discuss with the Company’s independent auditors and management the Company’s audited financial statements; and recommend to the Company’s Board of Directors whether the Company’s audited financial statements should be included in the Company’s Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission (the “SEC”).

Messrs. Giovenco and Ornest and Ms. Reiss are independent as that term is defined in Section 303.01(B)(2)(a) and (3) of the New York Stock Exchange’s listing standards. The Board of Directors has adopted a written Charter for the Audit Committee. The Audit Committee met six times in 2002 and did not act by unanimous written consent.

The Company has a standing Compensation Committee, which is chaired by Mr. Reitnouer and currently consists of Messrs. Reitnouer and Martineau. The functions of the Compensation Committee are to make recommendations to the Board of Directors regarding the annual salaries and other compensation of the executive officers of the Company, to provide assistance and recommendations with respect to the compensation policies and practices of the Company and to assist with the administration of the Company’s compensation plans. The Compensation Committee met six times in 2002 and acted by unanimous written consent on three occasions.

The Executive Committee acts as the Company’s nominating committee. The Executive Committee generally does not consider nominees recommended by the Company’s stockholders.

5

Each director holds office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified, or until his or her earlier death, retirement, resignation or removal from office. Directors are entitled to receive an annual retainer of $30,000 per year plus $1,500 for each live Board meeting and $1,000 for each telephonic Board meeting attended, which they may receive in cash or in deferred compensation under the Company’s Amended and Restated Directors Deferred Compensation Plan as outlined below. Mr. Lee does not receive this annual retainer. Members of the Executive Committee (other than Mr. Lee), Audit Committee, Compensation Committee and directors serving on the Company’s Compliance Committee (which monitors the Company’s compliance with gaming laws in the jurisdictions in which it operates) receive an additional $1,000 for each committee meeting attended (whether live or telephonic), and such amounts are also eligible for the Amended and Restated Directors Deferred Compensation Plan. Messrs. Leslie, Parrott and Reitnouer currently serve on the Company’s Compliance Committee.

Amended and Restated Directors Deferred Compensation Plan

Participation in the Company’s Amended and Restated Directors Deferred Compensation Plan (the “Directors Plan”) is limited to directors of the Company, and each eligible director may elect to defer all or a portion of his or her annual retainer and any fees for meetings attended. Any such deferred compensation is credited to a deferred compensation account, either in cash or in shares of Pinnacle Common Stock, at each director’s election. Currently, directors electing to defer their compensation have each elected shares of Pinnacle Common Stock. As of the date the director’s compensation would otherwise have been paid, and depending on the director’s election, the director’s deferred compensation account will be credited with either (i) cash, (ii) the number of full and/or fractional shares of Pinnacle Common Stock obtained by dividing the amount of the director’s compensation for the calendar quarter or month which he elected to defer, by the average of the closing price of Pinnacle Common Stock on the New York Stock Exchange on the last ten business days of the calendar quarter or month for which such compensation is payable or (iii) a combination of cash and shares of Pinnacle Common Stock as described in clause (i) and (ii) above. Were a director to defer cash compensation, all such amounts credited to the director’s deferred compensation account would bear interest at an amount to be determined from time to time by the Board of Directors.

If a director has elected to receive shares of Pinnacle Common Stock in lieu of his or her retainer and the Company declares a dividend, such director’s deferred compensation account is credited at the end of each calendar quarter with the number of full and/or fractional shares of Pinnacle Common Stock obtained by dividing the dividends which would have been paid on the shares credited to the director’s deferred compensation account by the closing price of Pinnacle Common Stock on the New York Stock Exchange on the date such dividend was paid. In addition, if the Company declares a dividend payable in shares of Pinnacle Common Stock, the director’s deferred compensation account is credited at the end of each calendar quarter with the number of full and/or fractional shares of Pinnacle Common Stock for such stock dividend.

Participating directors do not have any interest in the cash and/or Pinnacle Common Stock credited to their deferred compensation accounts until distributed in accordance with the Directors Plan, nor do they have any voting rights with respect to such shares until shares credited to their deferred compensation accounts are distributed. The rights of a director to receive payments under the Directors Plan are no greater than the rights of an unsecured general creditor of the Company. Each participating director may elect to have the aggregate amount of cash and shares credited to his or her deferred compensation account distributed to him or her in one lump sum payment or in a number of approximately equal annual installments over a period of time not to exceed fifteen years. The lump sum payment or the first installment will be paid as of the first business day of the calendar quarter immediately following the cessation of the director’s service as a director of the Company. Prior to the beginning of any calendar year, a director may elect to change the method of distribution of any future interests in cash and/or Pinnacle Common Stock credited to his or her deferred compensation account in such calendar year. However, amounts credited to a director’s account prior to the effective date of any such change may not be affected by such change, but rather will be distributed following the cessation of the director’s service in accordance with the director’s election at the time such amounts were originally credited to the director’s deferred compensation account.

6

The maximum number of shares of Pinnacle Common Stock that can be issued pursuant to the Directors Plan is 275,000 shares, of which 203,349 have been issued. The Company is not required to reserve or set aside funds or shares of Pinnacle Common Stock for the payment of its obligations pursuant to the Directors Plan. The Company is obligated to make available, as and when required, a sufficient number of shares of Pinnacle Common Stock to meet the needs of the Directors Plan. The shares of Pinnacle Common Stock to be issued under the Directors Plan may be either authorized and unissued shares or reacquired shares.

Amendment, modification or termination of the Directors Plan may not (i) adversely affect any eligible director’s rights with respect to amounts then credited to his or her account or (ii) accelerate any payments or distributions under the Directors Plan (except with regard to bona fide financial hardships).

Compensation Committee Interlocks and Insider Participation

Messrs. Reitnouer and Martineau served on the Compensation Committee from January 1, 2002 to December 31, 2002. Robert T. Manfuso served on the Compensation Committee from January 1, 2002 to April 29, 2002. None of the members of the Compensation Committee were officers or employees or former officers or employees of the Company or its subsidiaries.

Executive Officers

Executive officers serve at the discretion of the Board of Directors, subject to rights, if any, under contracts of employment. See “—Executive Compensation.” The current executive officers of the Company are as follows:

Name | Age | Position | ||

Daniel R. Lee | 46 | Chairman of the Board of Directors and Chief Executive Officer | ||

Wade W. Hundley | 37 | Executive Vice President and Chief Operating Officer | ||

Stephen H. Capp | 41 | Executive Vice President and Chief Financial Officer | ||

John A. Godfrey | 53 | Senior Vice President, Secretary and General Counsel |

Biographical information for Mr. Lee is provided above. See “—Information Regarding the Director Nominees of the Company.”

Mr. Hundley has served as the Company’s Executive Vice President and Chief Operating Officer since September 2001; Executive Vice President and Office of the CEO, Harveys Casino Resorts (gaming operations) from December 2000 through July 2001; Principal, Colony Capital (private equity investment), June 1993 through November 2000.

Mr. Capp has served as its Executive Vice President and Chief Financial Officer since January 11, 2003; Managing Director, Bear, Stearns & Co. Inc. from 1999 to January 2003; Group Head, BancAmerica Securities’ Latin America debt distribution business from 1997 to 1999; Managing Director, BancAmerica Securities from 1992 to 1997; Vice President, Security Pacific Merchant Bank from 1989 to 1992.

Mr. Godfrey has served as its Senior Vice President, Secretary and General Counsel since August 28, 2002; Partner, Schreck Brignone Godfrey (law firm) from January 1997 to August 2002; Partner, Schreck, Jones, Bernhard, Woloson & Godfrey (law firm) from June 1984 to December 1996; Chief Deputy Attorney General, Nevada Attorney General’s Office, Gaming Division from 1983 to 1984; Deputy Attorney General, Nevada Attorney General’s Office, Gaming Division from 1980 to 1983; Deputy State Industrial Attorney for the State of Nevada from 1977 to 1980; Trustee, International Association of Gaming Attorneys (and former President) sinceOctober 2000; and Member, Executive Committee of the Nevada State Bar’s Gaming Law Section since June 2002.

7

Executive Compensation

The following table summarizes the annual and long-term compensation of, and options to purchase Pinnacle Common Stock (“Pinnacle Stock Options”) granted to, the Company’s current Chief Executive Officer during the fiscal year ended December 31, 2002, the Company’s former Chief Executive Officer during the 2002 fiscal year and the six additional most highly compensated executive officers whose annual salaries and bonuses exceeded $100,000 in total during the 2002 fiscal year (collectively, the “Named Officers”). None of the Named Officers held stock appreciation rights during the years reported in the table.

Summary Compensation Table

Name & Principal Position | Year | Annual Compensation (a) | Long Term Compensation Awards | All Other Compensation ($) (b) | ||||||||||||

Salary ($) | Bonus ($) | Securities Underlying Options (#) | ||||||||||||||

Daniel R. Lee | 2002 | $ | 435,616 | (c) | $ | 266,667 | 865,801 |

| $ | 2,483 |

| |||||

Chairman of the Board of Directors and Chief Executive Officer | ||||||||||||||||

Wade W. Hundley | 2002 | $ | 400,000 |

| $ | 275,000 | 200,000 |

| $ | 2,553 |

| |||||

Executive Vice President and Chief Operating Officer | 2001 | $ | 133,333 | (d) | $ | 85,000 | 200,000 |

| $ | 162 |

| |||||

John A. Godfrey | 2002 | $ | 120,000 | (e) | $ | 60,000 | 250,000 |

| $ | 414 |

| |||||

Senior Vice President, Secretary and General Counsel | ||||||||||||||||

R.D. Hubbard | 2002 | $ | 136,986 | (f) | $ | 0 | 40,000 |

| $ | 0 |

| |||||

Former Chairman of the Board (through April 10, | 2001 | $ | 500,000 |

| $ | 0 | 0 |

| $ | 6,317 |

| |||||

2002) and Director (through April 29, 2003) | 2000 | $ | 500,000 |

| $ | 500,000 | 0 |

| $ | 7,486 |

| |||||

Paul R. Alanis | 2002 | $ | 164,384 | (g) | $ | 0 | 40,000 |

| $ | 63,761 | (h) | |||||

Former Chief Executive Officer, President | 2001 | $ | 600,000 |

| $ | 100,000 | 0 |

| $ | 4,860 |

| |||||

and Director (through April 10, 2002) | 2000 | $ | 600,000 |

| $ | 300,000 | 0 |

| $ | 4,695 |

| |||||

G. Michael Finnigan | 2002 | $ | 400,000 |

| $ | 0 | 25,000 |

| $ | 81,131 | (i) | |||||

Former President and Chief Executive Officer of | 2001 | $ | 400,000 |

| $ | 0 | 0 |

| $ | 4,500 |

| |||||

Realty Investment Group, Inc. (through December 31, 2002) | 2000 | $ | 400,000 |

| $ | 400,000 | 0 |

| $ | 4,616 |

| |||||

Bruce C. Hinckley | 2002 | $ | 265,768 |

| $ | 50,000 | 40,000 |

| $ | 5,641 |

| |||||

Former Senior Vice President, Chief Financial | 2001 | $ | 250,000 |

| $ | 0 | 10,000 |

| $ | 4,249 |

| |||||

Officer and Treasurer (through January 11, 2003) | 2000 | $ | 250,000 |

| $ | 50,000 | 0 |

| $ | 4,121 |

| |||||

Loren S. Ostrow | 2002 | $ | 200,000 |

| $ | 35,000 | 110,000 | (j) | $ | 345,099 | (k) | |||||

Former Senior Vice President, Secretary and | 2001 | $ | 300,000 |

| $ | 0 | 0 |

| $ | 1,180 |

| |||||

General Counsel (through August 31, 2002) | 2000 | $ | 300,000 |

| $ | 50,000 | 0 |

| $ | 3,334 |

| |||||

| (a) | During the fiscal years shown, no Named Officer received perquisite compensation having an aggregate value equal to or in excess of $50,000 or 10% of such Named Officer’s salary and bonus for the applicable fiscal year. |

| (b) | For Fiscal 2002 includes 401(k) matching contribution and term life insurance premium payments of: Mr. Lee—$1,875 and $608; Mr. Hundley—$2,067 and $486; Mr. Godfrey—$0 and $414; Mr. Hubbard—$0 and $0; Mr. Alanis—$0 and $0; Mr. Finnigan—$4,250 and $1,242; Mr. Hinckley—$3,319 and $2,322; and Mr. Ostrow—$0 and $1,242. |

8

For Fiscal 2001 includes 401(k) matching contribution and term life insurance premium payments of: Mr. Hundley—$0 and $162; Mr. Hubbard—$3,134 and $3,183; Mr. Alanis—$3,825 and $1,035; Mr. Finnigan—$3,825 and $675; Mr. Hinckley—$3,776 and $473; and Mr. Ostrow—$734 and $446.

For Fiscal 2000 includes 401(k) matching contribution and term life insurance premium payments of: Mr. Hubbard—$3,371 and $4,115; Mr. Alanis—$3,626 and $1,069; Mr. Finnigan—$3,755 and $861; Mr. Hinckley—$3,531 and $590; and Mr. Ostrow—$2,822 and $512.

| (c) | Mr. Lee was employed by the Company as of April 10, 2002. Reflects proportionate share of his annual salary of $600,000. |

| (d) | Mr. Hundley was employed by the Company as of September 1, 2001. Reflects the proportionate share of his annual salary of $400,000. |

| (e) | Mr. Godfrey was employed by the Company as of August 28, 2002. Reflects proportionate share of his annual salary of $360,000. |

| (f) | Mr. Hubbard’s employment with the Company was terminated on April 10, 2002. Reflects proportionate share of his annual salary of $500,000. |

| (g) | Mr. Alanis’ employment with the Company was terminated on April 10, 2002. Reflects proportionate share of his annual salary of $600,000. |

| (h) | In addition to the 401(k) matching contribution and term life insurance noted in (b) above, amount includes the cash-out of accumulated vacation time. |

| (i) | In addition to the 401(k) matching contribution and term life insurance noted in (b) above, amount includes: (x) the cash out of accumulated vacation time in the amount of $61,539 (paid in 2003), (y) tax preparation services in the amount of $1,500 and (z) a car allowance in the amount of $12,600. |

| (j) | Mr. Ostrow was granted 110,000 options during the fiscal year ended December 31, 2002. Pursuant to his separation agreement, 86,667 of such options were forfeited on August 30, 2002. As a result, Mr. Ostrow only retained 23,333 of the options he was granted during the fiscal year ended December 31, 2002, all of which are vested. |

| (k) | In addition to the 401(k) matching contribution and term life insurance noted in (b) above, amount includes: (x) the cash out of accumulated vacation time in the amount of $43,857 and (y) $300,000 to be paid to Mr. Ostrow pursuant to his separation agreement, $100,000 of which had been paid to Mr. Ostrow as of December 31, 2002. |

9

Equity Compensation Plan Information

The following table sets forth information relating to equity securities authorized for issuance under the Company’s equity compensation plans as of December 31, 2002:

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

(a) | (b) | (c) | |||||||

Equity compensation plans approved by security holders | |||||||||

Stock options (1) | 3,636,277 |

| $ | 9.71 |

| 212,980 | |||

Directors plan | 74,664 | (2) | $ | 12.06 | (3) | 71,651 | |||

Total | 3,710,941 |

| $ | 9.76 |

| 284,631 | |||

Equity compensation plans not approved by security holders (4) | 317,176 |

| $ | 8.81 |

| 0 | |||

Total | 4,028,117 |

| $ | 9.68 |

| 284,631 | |||

| (1) | Consists of (i) shares of Pinnacle Common Stock to be issued upon the exercise of options granted pursuant to the Company’s 1993, 1996, 2001 and 2002 stock option plans; (ii) shares of Pinnacle Common Stock to be issued upon the exercise of options granted to members of the Company’s management team and approved by the Company’s stockholders; and (iii) shares of Pinnacle Common Stock to be issued upon the exercise of options granted pursuant to pre-merger stock option plans of Boomtown, Inc. and Casino Magic Corp. that the Company assumed.The Boomtown, Inc. and Casino Magic Corp. stock option plans were approved by the stockholders of Boomtown, Inc. and Casino Magic Corp., respectively, prior to the Company’s acquisition of such companies. |

| (2) | Consists of shares of Pinnacle Common Stock credited to directors’ deferred compensation accounts to be issued pursuant to the Directors Plan, described under “Amended and Restated Directors Deferred Compensation Plan” above. |

| (3) | Based on the purchase price of the shares credited to the directors’ deferred compensation accounts. |

| (4) | Consists of shares of Pinnacle Common Stock to be issued upon the exercise of 250,801 options granted to the Company’s Chairman and CEO in 2002, 54,375 options granted to current and former executives in 1998 and 12,000 issued to a director in 1996. |

Executive Deferred Compensation Plan

The Company has adopted the Executive Deferred Compensation Plan (“Executive Plan”), which allows certain highly compensated employees of the Company and its subsidiaries (each an “Employer”) to defer, on a pre-tax basis, a portion of their base annual salaries, bonuses and cash payments received upon a change in control (as defined in the Executive Plan) in consideration of the cancellation of stock options held by such persons (“Option Cancellation Payment”). The Executive Plan is administered by the Compensation Committee of the Board of Directors and participation in the Executive Plan is limited to employees who are (i) determined by an Employer to be includable within a select group of management or highly compensated employees, (ii) specifically selected by an Employer and (iii) approved by the Compensation Committee. A participating employee may elect to defer up to 75% of his or her base annual salary, up to 100% of his or her bonus per year and up to 100% of his or her Option Cancellation Payment. Any such deferred compensation is credited to a deferral contribution account. A participating employee is at all times fully vested in his or her deferred contributions, as well as any appreciation or depreciation attributable thereto. The Company does not make contributions to the Executive Plan for the benefit of such employees.

For purposes of determining the rate of return credited to a deferral contribution account, each participating employee must select from a list of hypothetical investment funds among which deferred contributions shall be

10

allocated. Although a participating employee’s deferred compensation will not be invested directly in the selected hypothetical investment funds, his or her deferral compensation account shall be adjusted according to the performance of such funds. Although the fund investment alternatives under the Executive Plan are different from those under the Company’s 401(k) plan, the Company does not believe the participants in the Executive Plan are entitled to a preferential return on amounts deferred in relation to the return available to employees generally under the 401(k) plan. The payment of benefits under the Executive Plan is an unsecured obligation of the Company. The Company is not obligated to acquire or hold any investment fund assets.

Participating employees may elect in advance to receive their deferral contribution account balances upon retirement in a lump sum within 30 days of a year-end or in annual payments over five, ten or fifteen years (except that, if an employee’s account balance is less than $50,000, such balance will be paid as a lump sum). A participating employee may make an advance election to defer retirement distributions until age 75. In the event a participating employee dies or suffers a disability (as defined in the Executive Plan) during employment, such employee’s account balance shall be paid (i) in one lump sum if the account balance is less than $50,000, or (ii) if the account balance is $50,000 or more, in five annual installments unless the employee has elected, in advance and with the Compensation Committee’s approval, to receive a lump sum distribution. In the event of a voluntary or involuntary termination of employment for any reason other than retirement, disability or death, a participating employee shall receive his or her account balance (i) in one lump sum if the account balance is less than $50,000, or (ii) if the account balance is $50,000 or more, in five annual installments unless the employee has elected, in advance and with the Compensation Committee’s approval, to receive a lump sum distribution; provided, however, that if such termination, retirement, disability or death occurs within 18 months of a change in control (as defined in the Executive Plan), then the employee’s deferral contribution account balance shall be paid in the form of one lump sum payment not later than 30 days after the termination, retirement, disability or death.

A participating employee may make an advance election to receive interim distributions from a deferral compensation account prior to retirement, but not earlier than three years after the election is made. Such interim distributions are distributed as lump sum payments. In the event of a financial emergency (such as a sudden illness or accident, a loss of property due to casualty or other extraordinary and unforeseeable events beyond the employee’s control), a participating employee may petition the Compensation Committee to suspend deferrals and/or to request withdrawal of a portion of the account to satisfy the emergency. A participating employee may request to receive all of his or her account balance, without regard to whether benefits are due or the occurrence of a financial emergency; any distribution made pursuant to such a request shall be subject to forfeiture of 10% of the total account balance and temporary suspension of the employee’s participation in the Executive Plan.

An Employer may terminate, amend or modify the Executive Plan with respect to its participating employees at any time, except that (i) no termination, amendment or modification may decrease or restrict the value of a participating employee’s account balance and (ii) no amendment or modification shall be made after a change in control which adversely affects the vesting, calculation or payment of benefits or any other rights or protections of any participating employee. Upon termination of the Executive Plan, all amounts credited to participating employees’ accounts shall be distributed in lump sums.

Stock Option Plans

In 1993, 1996, 2001 and 2002, the stockholders of the Company adopted stock option plans (“Stock Option Plans”), which provided for the issuance of up to 625,000, 900,000, 900,000 and 1,000,000 shares of Pinnacle Common Stock upon exercise of Pinnacle Stock Options, respectively. If the Option Plan Amendment is approved, the 2002 Stock Option Plan will provide for the issuance of up to 2,000,000 shares (including shares issuable upon the exercise of options approved prior to the Option Plan Amendment under such plan) of Pinnacle Common Stock upon exercise of Pinnacle Stock Options. Except for the provisions governing the number of shares issuable under the Stock Option Plans, the provisions of the Stock Option Plans are similar. The most important differences between the Stock Options Plans are (i) the 1993 and 1996 Stock Option Plans, but not the 2001 and 2002 Stock Option Plans, permit the granting of stock appreciation rights coupled with the grants of

11

Pinnacle Stock Options, (ii) under the 2001 and 2002 Stock Option Plans, but not the 1993 and 1996 Stock Option Plans, an optionee whose employment is terminated for “cause” cannot exercise any Pinnacle Stock Options, even if they are vested (unless, with respect to the 2002 Stock Option Plan, but not with respect to the 2001 Stock Option Plan, otherwise determined by the Committee or set forth in an individual option agreement or otherwise), (iii) the 2001 and 2002 Stock Option Plans permit more forms of payment of the option exercise price than the 1996 Stock Option Plan, which in turn permits more forms of payment of the option exercise price than the 1993 Stock Option Plan, and (iv) a number of technical changes have been made in the later Stock Option Plans, many of which reflect changes in tax and securities laws.

The Stock Option Plans are administered and terms of option grants are established by the Compensation Committee of the Board of Directors. Under the Stock Option Plans, Pinnacle Stock Options alone or (under the 1993 and 1996 Stock Option Plans) coupled with stock appreciation rights may be granted to selected employees, directors, consultants and advisors of the Company.

Pinnacle stock options granted under the 1993, 1996 and 2001 Stock Option Plans become exercisable according to a vesting period as determined by the Compensation Committee and, unless otherwise determined by the Compensation Committee, vested and exercisable options expire on the earlier of one month after termination of employment (three months in the case of an incentive stock option) of the optionee, six months after the death or permanent disability (one year in the case of an incentive stock option) of the optionee, or the expiration of the fixed option term set by the Compensation Committee at the grant date (not to exceed ten years from the grant date, or five years from the grant date in the case of an incentive stock option granted to a holder of more than ten percent of the outstanding Pinnacle Common Stock). Pinnacle stock options granted under the 2002 Stock Option Plan become exercisable according to a vesting period as determined by the Compensation Committee and, unless otherwise determined by the Compensation Committee in an individual option agreement or otherwise, vested and exercisable options expire on the earlier of 90 days after the termination of employment of the optionee, 12 months after the death or permanent disability of the optionee or the expiration of the fixed option term set by the Compensation Committee at the grant date (not to exceed ten years from the grant date, or five years from the grant date in the case of an incentive stock option granted to a holder of more than ten percent of the outstanding Pinnacle Common Stock).

The exercise prices of all Pinnacle Stock Options granted under the Stock Option Plans are determined by the Compensation Committee on the grant date, except that the exercise price of an incentive stock option may not be less than the fair market value of Pinnacle Common Stock at the date of the grant (or not less than 110% of the fair market value of Pinnacle Common Stock at the date of the grant of an incentive stock option granted to a holder of more than ten percent of the outstanding shares of Pinnacle Common Stock).

Under the Stock Option Plans, as of March 31, 2003, there were 2,771,467 million shares subject to outstanding Pinnacle Stock Options. Of these, 865,167 are held by former officers, directors and employees of the Company or companies acquired by the Company and 1,906,300 are held by current officers, directors and employees. As of March 31, 2003, there were 72,980 Pinnacle Stock Options remaining available for grant under Pinnacle’s various Stock Option Plans.

In addition, as of March 31, 2003, there were 194,811 shares subject to outstanding options under the pre-merger Boomtown, Inc. and Casino Magic Corp. stock option plans. No additional options can be granted under the Boomtown or Casino Magic plans. Finally, as of March 31, 2003, there were 1,082,040 shares subject to outstanding non-plan options granted to current and former officers.

No stock appreciation rights have been issued.

12

Options Grants in Last Fiscal Year

The following table summarizes the option grants to Named Officers during the year ended December 31, 2002. No stock appreciation rights were granted to Named Officers during the year ended December 31, 2002. All options granted during 2002 were at the closing market price of Pinnacle Common Stock on the day of grant.

Name | Number of Securities Underlying Options Granted (#) | Percent of Total Options Granted to Employees In The Fiscal Year | Exercise or Base Price ($/Sh) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||

5% ($) | 10% ($) | |||||||||||||||

Daniel Lee (a) | 865,801 | 35.14 | % | $ | 8.45 | 4/10/2012 | $ | 4,601,005 | $ | 11,659,849 | ||||||

Wade Hundley (b) | 75,000 | 3.04 | % | $ | 5.95 | 1/29/2012 | $ | 280,644 | $ | 711,208 | ||||||

Wade Hundley (c) | 125,000 | 5.07 | % | $ | 9.62 | 6/18/2012 | $ | 756,246 | $ | 1,916,475 | ||||||

John A. Godfrey (c) | 250,000 | 10.15 | % | $ | 7.02 | 8/13/2012 | $ | 1,103,710 | $ | 2,797,018 | ||||||

R.D. Hubbard | 40,000 | 1.62 | % | $ | 5.95 | 5/26/2010 | $ | 113,634 | $ | 272,174 | ||||||

Paul Alanis (d) | 40,000 | 1.62 | % | $ | 5.95 | 1/29/2012 | $ | 0 | $ | 0 | ||||||

G. Michael Finnigan (b) | 25,000 | 1.01 | % | $ | 5.95 | 1/29/2012 | $ | 93,548 | $ | 237,069 | ||||||

Bruce C. Hinckley (b) | 10,000 | 0.41 | % | $ | 5.95 | 1/29/2012 | $ | 37,419 | $ | 94,828 | ||||||

Bruce C. Hinckley (c) | 30,000 | 1.22 | % | $ | 9.62 | 6/18/2012 | $ | 181,499 | $ | 459,954 | ||||||

Loren Ostrow (e) | 10,000 | 0.41 | % | $ | 5.95 | 8/31/2005 | $ | 12,823 | $ | 27,614 | ||||||

Loren Ostrow (f) | 100,000 | 4.06 | % | $ | 9.62 | 8/31/2005 | $ | 151,635 | $ | 318,422 | ||||||

| (a) | The options granted to Mr. Lee vest in four equal installments beginning on April 10, 2003. |

| (b) | The options granted to Messrs. Hundley, Finnigan and Hinckley vest in three equal annual installments beginning January 29, 2003. |

| (c) | The options granted to Messrs. Hundley, Godfrey and Hinckley vest in five equal annual installments beginning on June 18, 2003, August 13, 2003 and June 18, 2003, respectively. |

| (d) | Mr. Alanis’ options were forfeited in 2002. |

| (e) | As a result of Mr. Ostrow’s separation agreement, 3,333 options granted were immediately vested and the remainder forfeited upon termination of his employment. |

| (f) | As a result of Mr. Ostrow’s separation agreement, 20,000 options granted were immediately vested and the remainder forfeited upon termination of his employment. |

The following table sets forth information with respect to the exercise of Pinnacle Stock Options by Named Officers during the year ended December 31, 2002, and the final year-end value of unexercised Pinnacle Stock Options. None of the Named Officers held stock appreciation rights during the year ended December 31, 2002.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Options Value

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options At Fiscal Year-End (#) | Value of Unexercised In-The-Money Options at Fiscal Year-End ($) (a) | |||||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Daniel R. Lee | 0 | $ | 0 | 0 | 865,801 | $ | 0 | $ | 0 | ||||||

Wade Hundley | 0 | $ | 0 | 66,666 | 333,334 | $ | 0 | $ | 73,500 | ||||||

John A. Godfrey | 0 | $ | 0 | 0 | 250,000 | $ | 0 | $ | 0 | ||||||

R. D. Hubbard | 0 | $ | 0 | 322,000 | 0 | $ | 39,200 | $ | 0 | ||||||

Paul R. Alanis | 0 | $ | 0 | 0 | 0 | $ | 0 | $ | 0 | ||||||

G. Michael Finnigan | 0 | $ | 0 | 135,000 | 25,000 | $ | 0 | $ | 24,500 | ||||||

Bruce C. Hinckley | 0 | $ | 0 | 28,333 | 46,667 | $ | 0 | $ | 9,800 | ||||||

Loren S. Ostrow | 0 | $ | 0 | 148,333 | 0 | $ | 3,266 | $ | 0 | ||||||

| (a) | Based on the closing price of Pinnacle Common Stock on December 31, 2002 of $6.93. |

13

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

The Company has entered into a four-year employment agreement with Daniel R. Lee, effective April 10, 2002. Mr. Lee’s annual compensation is $600,000, with annual bonuses of $300,000 based on Mr. Lee’s service to the Company during the applicable year and, in addition, at least $100,000 in targeted bonuses based upon meeting performance targets established annually by the Board of Directors in consultation with Mr. Lee. Pursuant to the employment agreement, Mr. Lee’s compensation includes grants of options to purchase an aggregate of 865,801 shares of Pinnacle Common Stock at an exercise price of $8.45 (the per share fair market value of Pinnacle Common Stock on the day of the grants). The options vest in four equal annual installments beginning April 10, 2003 and expire on April 10, 2012. The option to purchase 100,000 of such shares is intended to qualify as an incentive stock option within the meaning of Section 422 of the Internal Revenue Code under the 2002 Stock Option Plan. The additional option to purchase 765,801 shares of Pinnacle Common Stock was granted outside of any of the Stock Option Plans.

If Mr. Lee terminates his employment for good reason (including in the event of a change of control as defined in the employment agreement), or if the Company terminates Mr. Lee without cause, Mr. Lee will (a) so long as he does not compete with the Company or its subsidiaries in the gaming business prior to the end of the employment contract term, (i) receive an annual salary of $900,000 through the end of the employment contract term or, if the balance of the contract term is less than one year, for one year (which amount shall be payable in a lump sum in the event of termination by the Company or by Mr. Lee after a change of control), and (ii) retain his health and disability insurance until the earlier of (x) the end of the contract term or, if the balance of the contract term is less than one year, for one year, and (y) the date on which Mr. Lee obtains health or disability coverage under a plan not maintained by the Company or its subsidiaries, and (b) immediately vest in all Pinnacle Stock Options held by Mr. Lee.

The Company has entered into a four-year employment agreement with Wade W. Hundley, effective March 14, 2003. Mr. Hundley’s annual compensation is $400,000. Under this agreement, subject to the discretion of the Chief Executive Officer and the Board of Directors, Mr. Hundley will also be entitled to earn annual bonuses.

If Mr. Hundley terminates his employment for good reason (other than in the event of a change of control as defined in the employment agreement), or if the Company terminates Mr. Hundley without cause (other than in the event of a change of control as defined in the employment agreement), Mr. Hundley will (a) so long as he does not compete with the Company or its subsidiaries in the gaming business prior to the end of the employment contract term, (i) receive an annual salary of $400,000 through the end of the employment contract term or, if the balance of the contract term is less than one year, for one year (the “Hundley Severance Benefit”), and (ii) retain his health and disability insurance until the earlier of (x) the end of the contract term or, if the balance of the contract term is less than one year, for one year, and (y) the date on which Mr. Hundley obtains health or disability coverage under a plan not maintained by the Company or its subsidiaries, and (b) immediately vest in all Pinnacle Stock Options held by Mr. Hundley. If the Company terminates Mr. Hundley (other than in connection with a change of control), Mr. Hundley will have an affirmative obligation to mitigate the Hundley Severance Benefit. However, if the Company terminates Mr. Hundley, or Mr. Hundley terminates his employment for good reason, in connection with a change of control, Mr. Hundley will be entitled, in lieu of the Hundley Severance Benefit, to a lump sum payment equal to (x) two year’s base salary, plus (y) two times the largest annualized bonus that was paid to Mr. Hundley during the two years preceding the change of control (the “Hundley Change of Control Severance Benefit”). Mr. Hundley will have no obligation to mitigate the Hundley Change of Control Severance Benefit.

The Company has entered into a five-year employment agreement with Stephen H. Capp, effective January 11, 2003. Mr. Capp’s annual compensation is $360,000, with annual bonuses targeted at $180,000 based on Mr. Capp’s service to the Company during the applicable year and, provided that in the first two years of his employment, the annual bonuses will be at least $140,000 per year. The agreement also provided that the Company would pay Mr. Capp’s reasonable relocation expenses as well as a one-time starting and relocation bonus of $50,000. Pursuant to the employment agreement, Mr. Capp’s compensation includes grants of options to purchase an aggregate of 286,739 shares of Pinnacle Common Stock at an exercise price of $6.05 (the per

14

share fair market value of Pinnacle Common Stock on the day of the grants), 200,000 of which options were granted under the Company’s Stock Option Plans. The options vest in five equal annual installments beginning January 11, 2003 and expire on January 11, 2013.

If Mr. Capp terminates his employment for good reason (including in the event of a change of control as defined in the employment agreement), or if the Company terminates Mr. Capp without cause, Mr. Capp will (a) so long as he does not compete with the Company or its subsidiaries in the gaming business prior to the end of the employment contract term, (i) receive an annual salary of $360,000 through the end of the employment contract term (plus unpaid guaranteed bonuses applicable to the first two years of the term of the employment agreement) or, if the balance of the contract term is less than one year, for one year (which amount shall be payable in a lump sum in the event of termination by the Company or by Mr. Capp after a change of control) (the “Capp Severance Benefit”), and (ii) retain his health and disability insurance until the earlier of (x) the end of the contract term or, if the balance of the contract term is less than one year, for one year, and (y) the date on which Mr. Capp obtains health or disability coverage under a plan not maintained by the Company or its subsidiaries, and (b) immediately vest in all Pinnacle Stock Options held by Mr. Capp. If the Company terminates Mr. Capp other than in connection with a change of control, Mr. Capp will have an affirmative obligation to mitigate the Capp Severance Benefit. However, Mr. Capp will have no duty to mitigate the Capp Severance Benefit with respect to two year’s base salary and one year’s guaranteed bonus (to the extent such guaranteed bonuses have not been paid). In addition, if Mr. Capp’s employment is terminated in the middle of the year in connection with a change of control, he will be entitled to any bonus or prorated portion thereof that he would otherwise have been entitled to for such year.

The Company has entered into a five-year employment agreement with John A. Godfrey, effective August 13, 2002. Mr. Godfrey’s annual compensation is $360,000, with annual bonuses targeted at $180,000 based on Mr. Godfrey’s service to the Company during the applicable year. During the first two years of his employment, the annual bonuses will be at least $100,000 per year. Pursuant to the employment agreement, Mr. Godfrey’s compensation includes grants of options to purchase an aggregate of 250,000 shares of Pinnacle Common Stock at an exercise price of $7.02 (the per share fair market value of Pinnacle Common Stock on the day of the grants). The options vest in five equal annual installments beginning August 13, 2003 and expire on August 13, 2012.

If Mr. Godfrey terminates his employment for good reason (including in the event of a change of control as defined in the employment agreement), or if the Company terminates Mr. Godfrey without cause, Mr. Godfrey will (a) so long as he does not compete with the Company or its subsidiaries in the gaming business prior to the end of the employment contract term, (i) receive an annual salary of $360,000 through the end of the employment contract term (plus unpaid guaranteed bonuses applicable to the first two years of the term of the employment agreement) or, if the balance of the contract term is less than one year, for one year (which amount shall be payable in a lump sum in the event of termination by the Company or by Mr. Godfrey after a change of control) (the “Godfrey Severance Benefit”), and (ii) retain his health and disability insurance until the earlier of (x) the end of the contract term or, if the balance of the contract term is less than one year, for one year, and (y) the date on which Mr. Godfrey obtains health or disability coverage under a plan not maintained by the Company or its subsidiaries, and (b) immediately vest in all Pinnacle Stock Options held by Mr. Godfrey. If the Company terminates Mr. Godfrey other than in connection with a change of control, Mr. Godfrey will have an affirmative obligation to mitigate the Godfrey Severance Benefit. However, Mr. Godfrey will have no duty to mitigate the Godfrey Severance Benefit with respect to two year’s base salary and one year’s guaranteed bonus (to the extent such guaranteed bonuses have not been paid). In addition, if Mr. Godfrey’s employment is terminated in middle of the year in connection with a change of control, he will be entitled to any bonus or prorated portion thereof that he would otherwise have been entitled to for such year.

The Company entered into an employment and consulting agreement with G. Michael Finnigan, effective as of April 11, 2002. Under the agreement, effective January 1, 2003, Mr. Finnigan was retained by the Company as a consultant for a five-year term during which he will provide consulting services for the Company on a non-exclusive basis. During the term of the consultancy, Mr. Finnigan’s annual compensation will be $400,000, plus

15

fringe benefits comparable to those he received when he was employed as President and Chief Executive Officer of Realty Investment Group, Inc., a wholly-owned subsidiary of the Company. He is also eligible for bonuses or additional option grants at the discretion of the Board of Directors. In the event of a change of control (as defined in the agreement), Mr. Finnigan will receive a lump sum payment equal to his compensation through the end of the contract term (but not less than one year) and will have any unvested Pinnacle Stock Options held by him vested.

In August 2002, Loren S. Ostrow resigned from his position as Senior Vice President, Secretary and General Counsel. In accordance with the terms of his employment agreement, Mr. Ostrow received a severance payment of $380,099, which includes one year’s base salary, a pro-rated bonus and payment for any accrued but unused vacation time, 401(k) matching contributions and term life insurance premium. The Company also agreed to continue certain employee health insurance coverage until August 31, 2003. During the fiscal year ended December 31, 2002, Mr. Ostrow was granted 110,000 options. Pursuant to his employment agreement, 86,667 of these options were forfeited. The remaining 23,333 options are vested and remain exercisable until August 31, 2005.

The Audit Committee Report

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the fiscal year ended December 31, 2002, and the notes thereto.

The Audit Committee assists the Board of Directors in overseeing and monitoring the Company’s financial reporting process and the quality of its internal and external audit process.

Review with Management

The Audit Committee has reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31, 2002, and the notes thereto.

Review and Discussions with Independent Accountants

The Audit Committee has discussed with Deloitte & Touche LLP (“Deloitte”), the Company’s independent accountants, the matters required to be discussed by Statement on Auditing Standards No. 61, which includes, among other items, the auditors’ responsibilities, any significant issues arising during the audit, and any other matters related to the conduct of the audit of the Company’s financial statements.

The Audit Committee has received written disclosures and the letter from Deloitte regarding its independence as required by Independence Standards Board Standard No. 1 and has discussed with Deloitte its independence from the Company.

Conclusion

Based on the review and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

SUBMITTED BY THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

John V. Giovenco (Chairman)

Michael Ornest

Bonnie Reiss

March 30, 2003

16

On June 17, 2002, the Company engaged Deloitte to act as the Company’s independent auditors. Deloitte replaced Arthur Andersen LLP (“Andersen”), which the Company dismissed on May 28, 2002. The Audit Committee participated in and approved the decision to dismiss Andersen. The reports of Andersen on the financial statements of the Company for the two fiscal years ended December 31, 2000 and 2001 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the two fiscal years ended December 31, 2000 and 2001 and through May 28, 2002, there were no disagreements between the Company and Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Andersen, would have caused Andersen to make reference to the subject matter thereof in its report on the Company’s financial statements for such periods. During the two fiscal years ended December 31, 2000 and 2001 and through May 28, 2002, there were no reportable events (as defined in Item 304(a) (1) (v) of Regulation S-K).

During 2000 and 2001 and the subsequent interim period prior to engaging Deloitte, the Company did not consult with Deloitte regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, (ii) the type of audit opinion that might be rendered on the Company’s financial statements, or (iii) any subject matter of a disagreement or reportable event with the Company’s former auditors.

Audit and Related Fees

Audit Fees

The aggregate fees billed by Deloitte for professional services in connection with the audit of the Company’s financial statements for the fiscal year ended December 31, 2002, the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for the quarters ended June 30, 2002 and September 30, 2002 and the review of the quarterly period ended December 31, 2002 were $378,800. Deloitte had not been engaged by the Company at the time the Company filed its Quarterly Report on Form 10-Q for the quarter ended March 31, 2002.

Audit Related and Tax

The aggregate fees billed by Deloitte for professional services in connection with the Company’s Registration Statement on Form S-3 and the re-audits of the Company’s financial statements for the three-year period ended December 31, 2001 were $455,987. The aggregate fees billed for professional tax and other services rendered in 2002 were $123,420. The Audit Committee believes that the provision of these services is compatible with maintaining Deloitte’s independence.

Financial Information System Design and Implementation Fees

There were no fees billed by Deloitte to the Company for financial information systems design and implementation for the fiscal year ended December 31, 2002.

Compensation Committee Report on Executive Compensation for Fiscal Year 2002

The Compensation Committee of the Board of Directors, which is composed entirely of independent outside directors, is responsible for making recommendations to the Board regarding the annual salaries and other compensation of the key officers of the Company and providing assistance and recommendations with respect to compensation plans.

In order to attract and retain well-qualified key executives, which the Compensation Committee believes is crucial to the Company’s success, the Compensation Committee’s general approach to compensating such executives is to pay cash salaries that are commensurate with the executives’ experience and expertise and,

17

where relevant, are competitive with the salaries paid to key executives in the Company’s main industries and primary geographic locations, which are currently casinos in Nevada, Louisiana, Indiana, Mississippi and Argentina. In addition, to align its key executives’ compensation with the Company’s business strategies, values and management initiatives, both short and long term, the Compensation Committee may, with the Board’s approval, authorize the payment of discretionary bonuses based upon an assessment of each such executive’s contributions to the Company. In general, the Compensation Committee believes that these discretionary bonuses should be related to the Company’s and the executive’s performance, although specific performance criteria have not been established.

The Compensation Committee also believes that stock ownership by key executives provides a valuable incentive for such executives and helps align executives’ and stockholders’ interests. To facilitate these objectives, the Company adopted Stock Option Plans in 1993, 1996, 2001 and 2002 pursuant to which the Company may grant stock options to executives (as well as other employees and directors) to purchase up to 3,425,000 shares of Pinnacle Common Stock. If the Option Plan Amendment is approved, the Company will be able to grant stock options to executives (as well as other employees and directors) to purchase an additional 1,000,000 shares of Pinnacle Common Stock under the 2002 Stock Option Plan. The Compensation Committee believes that the key officers of the Company have provided excellent services and been diligent in their commitment to the Company. The Compensation Committee believes that stock ownership by such officers provides an important incentive for their continued efforts and diligence.

For 2002, Mr. Lee’s annual salary and pro rata bonus were $600,000 and $266,667, respectively, both in accordance with the terms of his employment agreement.

December 16, 2002

Compensation Committee

Lynn P. Reitnouer (Chairman)

James L. Martineau

18

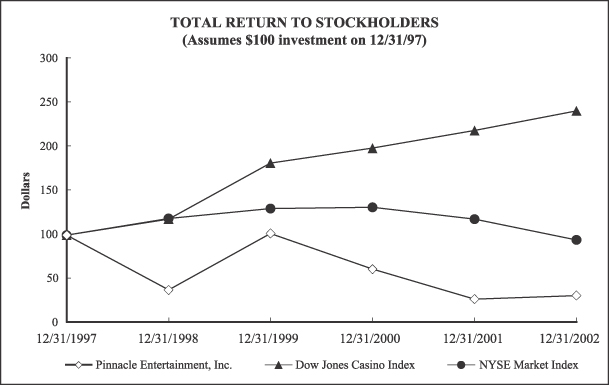

Performance Graph

Set forth below is a graph comparing the cumulative total stockholder return for Pinnacle Common Stock with the cumulative total returns for the Dow Jones Industry Group CNO—Casinos & Gambling (“Dow Jones Casino Index”) and the New York Stock Exchange Market Index (“NYSE Market Index”). The total cumulative return calculations are for the period commencing December 31, 1997 and ending December 31, 2002, and include the reinvestment of dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN* AMONG THE COMPANY, NYSE MARKET INDEX & DOW JONES CASINO INDEX

12/31/1997 | 12/31/1998 | 12/31/1999 | 12/31/2000 | 12/31/2001 | 12/31/2002 | |||||||||||||

Pinnacle Entertainment, Inc. | $ | 100.00 | $ | 37.77 | $ | 102.00 | $ | 61.38 | $ | 27.42 | $ | 31.51 | ||||||

Dow Jones Casino Index | $ | 100.00 | $ | 118.13 | $ | 181.84 | $ | 198.82 | $ | 219.09 | $ | 241.11 | ||||||

NYSE Market Index | $ | 100.00 | $ | 119.00 | $ | 130.30 | $ | 131.62 | $ | 118.18 | $ | 94.75 | ||||||

The above graph shows historical stock price performance (including reinvestment of dividends) and is not necessarily indicative of future performance.

| * | Assumes $100 invested on December 31, 1997 in Pinnacle Common Stock, Dow Jones Casino Index and NYSE Market Index. Total return assumes reinvestment of dividends. Values are as of December 31 of each year. |

19

Certain Relationships and Related Transactions

In 2002, the Company’s current Chairman was reimbursed $9,000 for business use of an aircraft he owns. In 2001 and 2002, the Company’s then-Chairman received reimbursement for the business use of aircraft he owns in the amount of $55,000 and $97,000, respectively.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of reports furnished to the Company during or with respect to the year ended December 31, 2002 pursuant to Rule 16a-3(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), all required reports on Form 3, Form 4 and Form 5 were timely filed by the Company’s directors, officers and 10% stockholders, except as indicated below.