PINNACLE SM

ENTERTAINMENT

Investor Day: L’Auberge Baton Rouge

September 2012

Safe Harbor/Non-GAAP Financial Disclosures

All statements included in this presentation, other than historical information or statements of historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including statements regarding the Company’s future operating performance, future growth, anticipated milestones, completion and opening schedules of various projects, construction schedules and budgets of the various projects, amenities and features of the various projects, continued improvement of operations at our properties, the Ho Tram Strip, potential growth for ACDL and potential growth of the gaming markets in Vietnam and throughout Asia, the completion of the first and second integrated resort of the Ho Tram Strip, the expected returns of the Company’s various development projects and investments, and the ability of the Company to borrow as it constructs its various projects under its Credit Facility, are based on management’s current expectations and are subject to risks, uncertainties and changes in circumstances that could significantly affect future results. Accordingly, Pinnacle cautions that the forward-looking statements contained herein are qualified by important factors that could cause actual results to differ materially from those reflected by such statements. Such factors include, but are not limited to: (a) the Company’s business is particularly sensitive to reductions in consumers’ discretionary spending as a result of downturns in the economy or other changes it cannot accurately predict; (b) the gaming industry is very competitive and increased competition could adversely affect our profitability; (c) many factors could prevent the Company from completing its construction and development projects as planned, including the escalation of construction costs beyond increments anticipated in construction budgets; (d) the Company’s substantial development plans for capital-intensive projects will require the Company to borrow significant amounts under the Company’s credit facility and, depending on which projects are pursued to completion, may cause the Company to incur substantial additional indebtedness; (e) the Company is subject to risks associated with geographic market concentration in Louisiana; (f) insufficient or lower-than-expected results generated from the Company’s new developments and acquired properties may not yield adequate or expected returns on the Company’s substantial investments; (g) the Company’s industry is highly regulated, which makes the Company dependent on obtaining and maintaining gaming licenses and subjects the Company to potentially significant fines and penalties; (h) we face many risks associated with our investment in a privately held company, ACDL, that is developing a complex of integrated resorts in Vietnam, such as ACDL’s ability to raise capital to complete the first phase of first integrated resort and to fund the development of subsequent phases of the planned resort complex, among other risks; (i) the Company operates in a highly taxed industry and may be subject to higher taxes in the future; (j) the Company may not realize gains on the Company’s proposed investment in a joint venture that is planning to develop gaming resorts in Vietnam; the Company’s involvement in Vietnam could expose us to risks associated with violations of the Foreign Corrupt Practices Act or applicable anti-money laundering regulations, which could have a negative impact on the Company; (k) the global financial crisis and recession has affected the Company’s business and financial condition, and may continue to affect the Company in ways that the Company currently cannot accurately predict; (l) adverse weather conditions, road construction, gasoline shortages and other factors affecting the Company’s facilities and the areas in which the Company operates could make it more difficult for potential customers to travel to the Company’s properties and deter customers from visiting the Company’s properties; and (m) other risks, including those as may be detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). For more information on the potential factors that could affect the Company’s financial results and business, review the Company’s filings with the SEC, including, but not limited to, its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8 -K.

*** Statements in this presentation may include adjusted financial measures governed by Regulation G. For a reconciliation of these measures, please see the end of this presentation or visit the Investor Relations section of our corporate website at www.pnkinc.com.

2

Opening Remarks

Anthony Sanfilippo, President & CEO

3

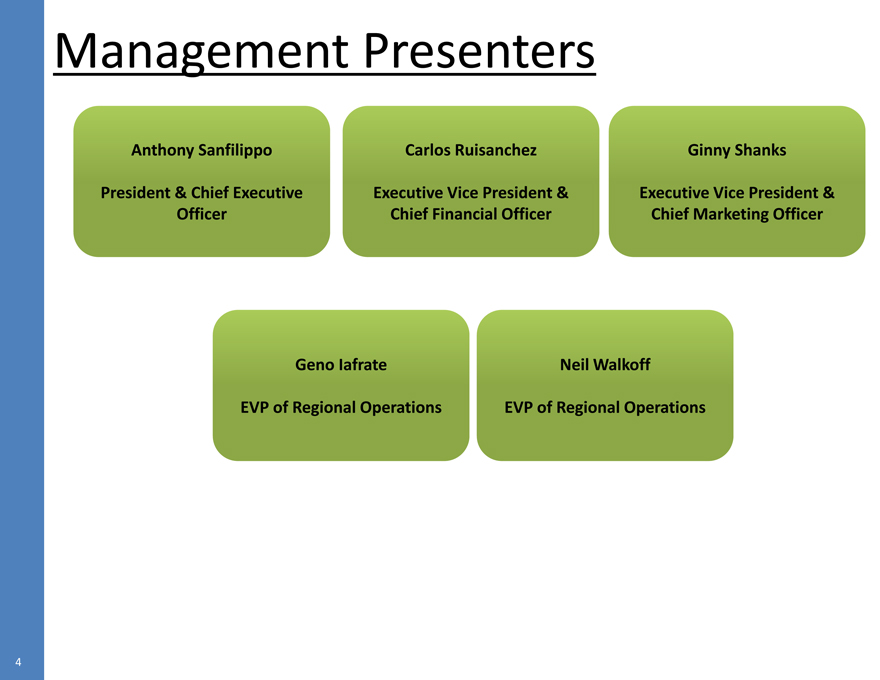

Management Presenters

Anthony Sanfilippo Carlos Ruisanchez Ginny Shanks

President & Chief Executive Officer Executive Vice President & Chief Financial Officer Executive Vice President & Chief Marketing Officer

Geno Iafrate Neil Walkoff

EVP of Regional Operations EVP of Regional Operations

4

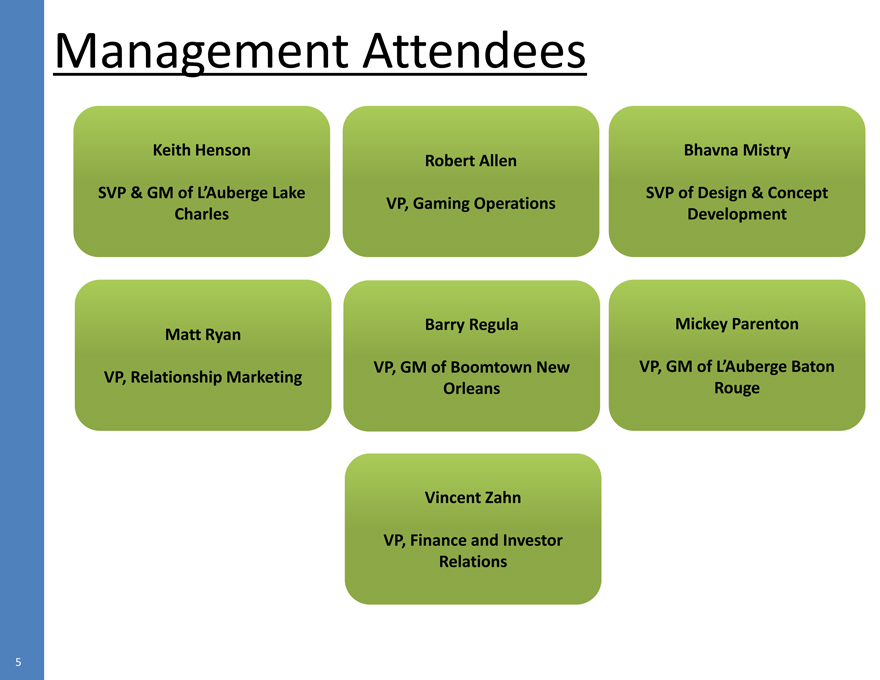

Management Attendees

Keith Henson Bhavna Mistry

Robert Allen

SVP & GM of L’Auberge Lake Charles VP, Gaming Operations SVP of Design & Concept Development

Matt Ryan Barry Regula Mickey Parenton

VP, Relationship Marketing VP, GM of Boomtown New Orleans VP, GM of L’Auberge Baton Rouge

Vincent Zahn

VP, Finance and Investor Relations

5

Pinnacle Entertainment Today

Established a “one team” culture Develop and attract top leadership

• Changes to 19 of top 20 leaders in the organization

• Align accountability with responsibility

Focus on our Guests

• Establish a clear brand and service identity in each market

• Provide a high level of value to targeted guests

• Personalize service to our highest worth guests

Continually review and rationalize cost structure

• Evaluate expenses through one lense: Does it add value to our guests, stakeholders, and team members?

Invest in our properties to maximize our advantages and limit challenges

6

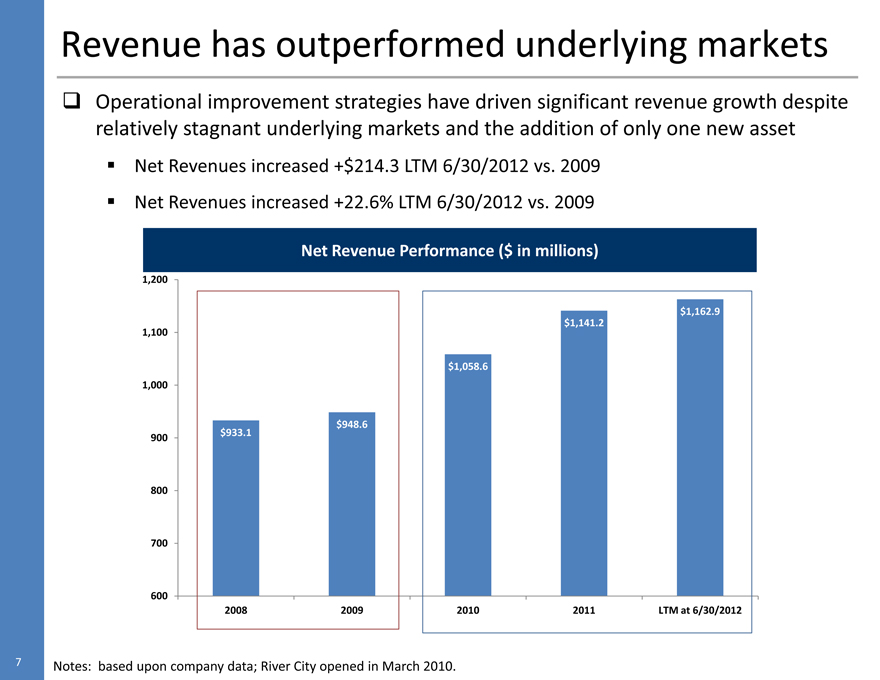

Revenue has outperformed underlying markets

Operational improvement strategies have driven significant revenue growth despite relatively stagnant underlying markets and the addition of only one new asset

Net Revenues increased +$214.3 LTM 6/30/2012 vs. 2009

Net Revenues increased +22.6% LTM 6/30/2012 vs. 2009

Net Revenue Performance ($ in millions)

1,200

$1,162.9

$1,141.2

1,100

$1,058.6

1,000

$948.6

900 $933.1

800

700

600

2008 2009 2010 2011 LTM at 6/30/2012

Notes: based upon company data; River City opened in March 2010.

7

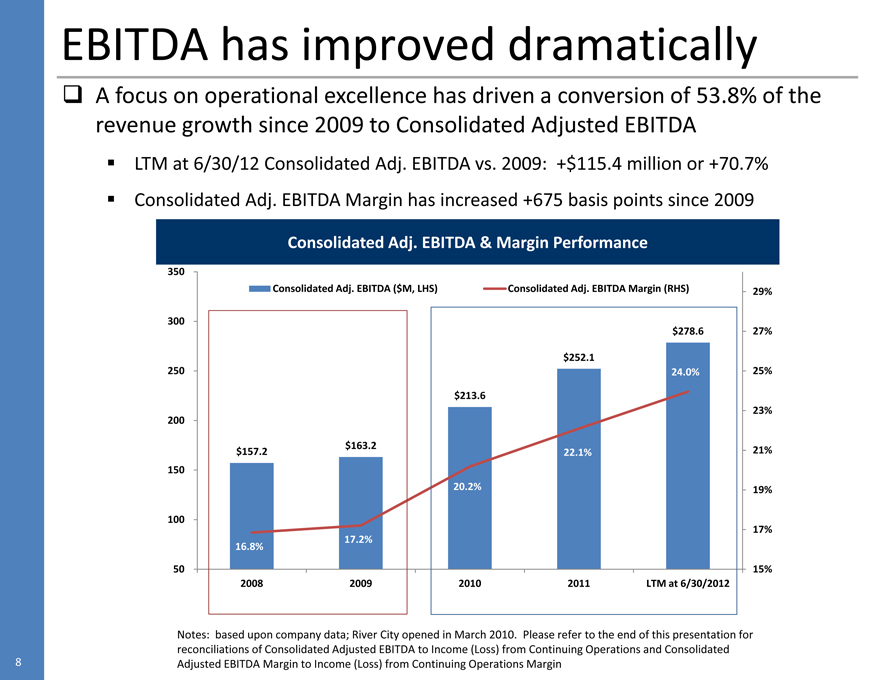

EBITDA has improved dramatically

A focus on operational excellence has driven a conversion of 53.8% of the revenue growth since 2009 to Consolidated Adjusted EBITDA

LTM at 6/30/12 Consolidated Adj. EBITDA vs. 2009: +$115.4 million or +70.7%

• Consolidated Adj. EBITDA Margin has increased +675 basis points since 2009

• Consolidated Adj. EBITDA & Margin Performance

350

Consolidated Adj. EBITDA ($M, LHS)

300

250

200

$157.2 $163.2

150

100

16.8% 17.2%

50

2008 2009

Consolidated Adj. EBITDA Margin (RHS) 29%

$278.6 27%

$252.1

24.0% 25%

$213.6

23%

22.1% 21%

20.2% 19%

17%

15%

2010 2011 LTM at 6/30/2012

Notes: based upon company data; River City opened in March 2010. Please refer to the end of this presentation for reconciliations of Consolidated Adjusted EBITDA to Income (Loss) from Continuing Operations and Consolidated Adjusted EBITDA Margin to Income (Loss) from Continuing Operations Margin

8

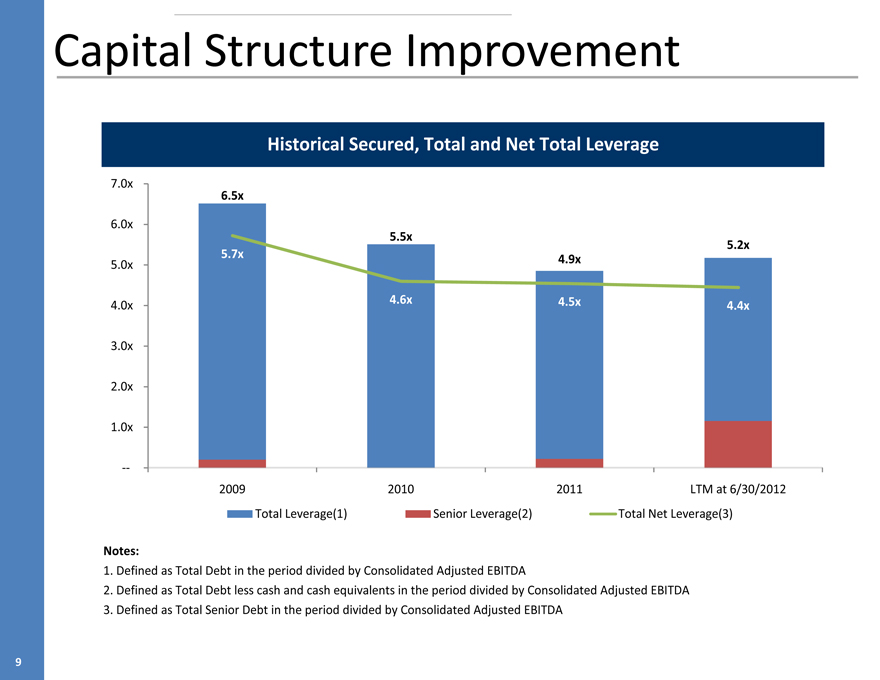

Capital Structure Improvement

Historical Secured, Total and Net Total Leverage

7.0x

6.5x

6.0x

5.5x 5.2x

5.7x 4.9x

5.0x

4.0x 4.6x 4.5x 4.4x

3.0x

2.0x

1.0x

--

2009 2010 2011 LTM at 6/30/2012

Total Leverage(1)

Senior Leverage(2)

Total Net Leverage(3)

Notes:

1. Defined as Total Debt in the period divided by Consolidated Adjusted EBITDA

2. Defined as Total Debt less cash and cash equivalents in the period divided by Consolidated Adjusted EBITDA

3. Defined as Total Senior Debt in the period divided by Consolidated Adjusted EBITDA

9

Our Strategy is simple

Best in category assets

• Develop and operate assets with sustainable competitive advantages

Rational growth

• Grow the enterprise through operational improvement in the existing asset portfolio and deploy capital on projects that generate returns materially in excess of our cost of capital

Focus on core constituencies

• Guests

• Stakeholders

• Team members

10

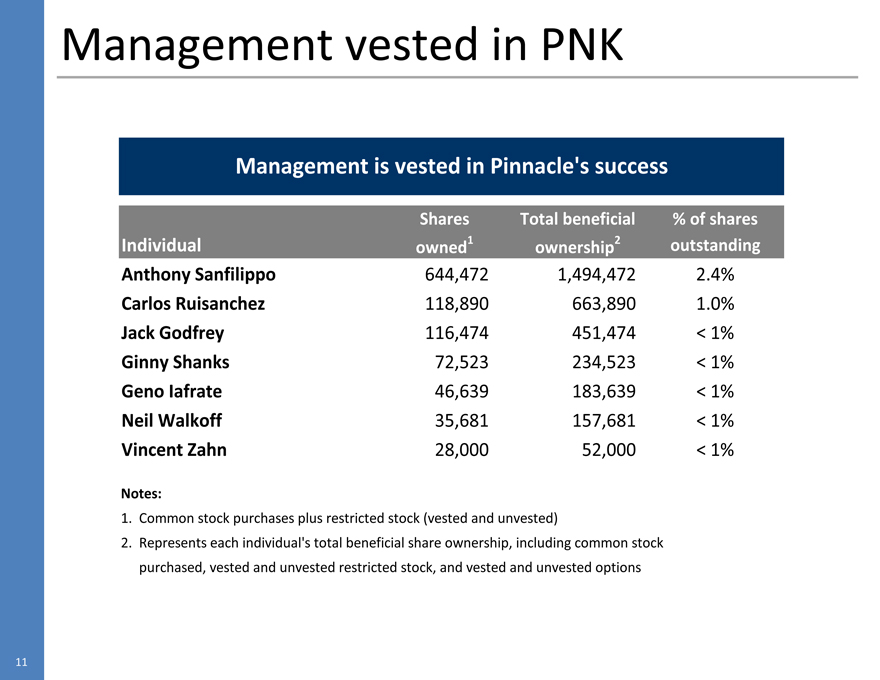

Management vested in PNK

Management is vested in Pinnacle’s success

Shares Total beneficial % of shares

Individual owned1 ownership2 outstanding

Anthony Sanfilippo 644,472 1,494,472 2.4%

Carlos Ruisanchez 118,890 663,890 1.0%

Jack Godfrey 116,474 451,474 < 1%

Ginny Shanks 72,523 234,523 < 1%

Geno Iafrate 46,639 183,639 < 1%

Neil Walkoff 35,681 157,681 < 1%

Vincent Zahn 28,000 52,000 < 1%

Notes:

1. Common stock purchases plus restricted stock (vested and unvested)

2. Represents each individual’s total beneficial share ownership, including common stock purchased, vested and unvested restricted stock, and vested and unvested options

11

Today, Management will discuss

1. Marketing and technology initiatives

2. Update on current markets and operations

3. Capital deployment and allocation strategy

4. New projects and developments

5. Non-EBITDA producing assets

6. Questions and answers

12

Marketing & Technology

Ginny Shanks, Chief Marketing Officer

13

Marketing priorities

Create distinct, ownable brand positions

Design a compelling player loyalty program

Develop enhanced infrastructure for revenue growth and expense control

14

Develop Brands…Not Just Casinos

All-You-Can-Eat

Whole Maine Lobster Buffet

$24.99 Friday & Saturday 5pm-11pm

($26.99 without mychoicesm card)

Ready for a tasty dinner deal? Then come fill your weekend with

an all-you-can-eat, buffet feast, which includes all the whole Maine lobster

you can handle and endless plates of all your buffet favorites!

BOOMTOWN

CASINO HOTEL

It just feels right.

Boomtownbossier.com 1.866.GO2TOWN (462-8696)

Generic casino

“Boomtown” – centric

IN HERE,

everyone’s a winner.

EXCEPT

YOUR DIET.

WELCOME TO

BOOMTOWN

CASINO HOTEL

15

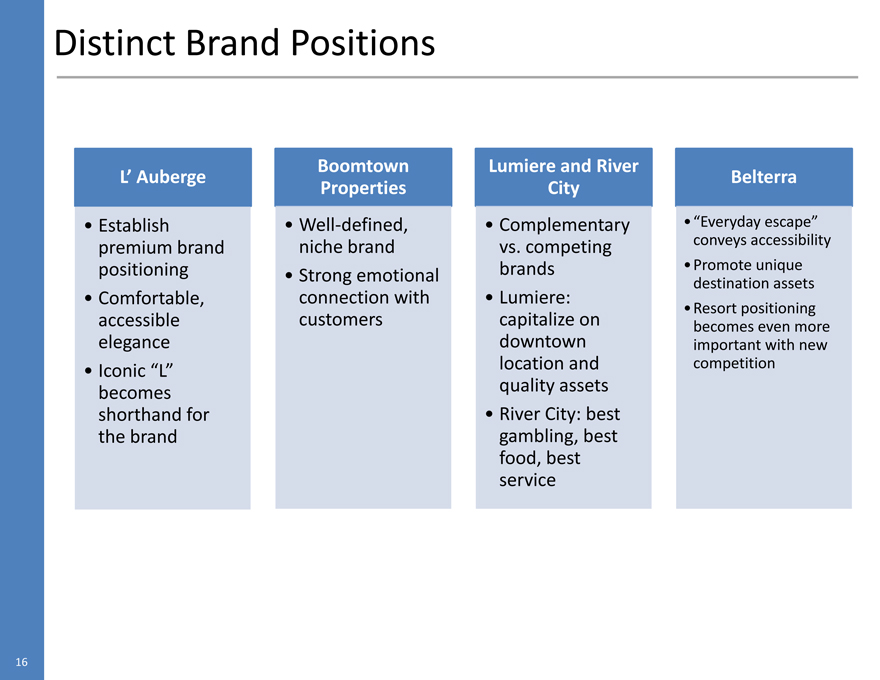

Distinct Brand Positions

L’ Auberge

Establish premium brand positioning

Comfortable, accessible elegance

Iconic “L” becomes shorthand for the brand

Boomtown Properties

Well-defined, niche brand

Strong emotional connection with customers

Lumiere and River City

Complementary vs. competing brands

Lumiere: capitalize on downtown location and quality assets

River City: best gambling, best food, best service

Belterra

”Everyday escape” conveys accessibility

Promote unique destination assets

Resort positioning becomes even more important with new competition

16

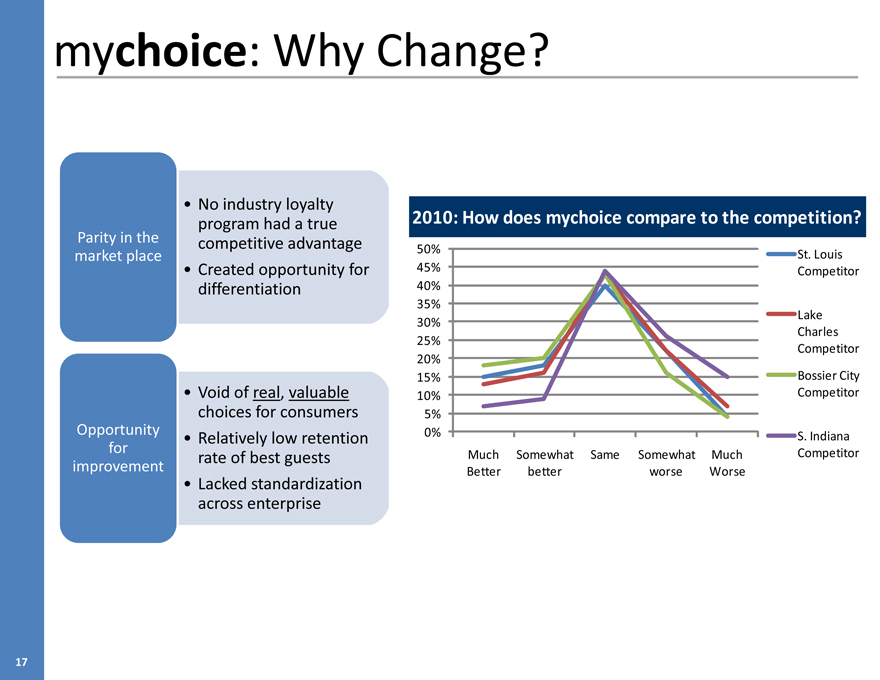

mychoice: Why Change?

Parity in the market place

No industry loyalty program had a true competitive advantage

Created opportunity for differentiation

Opportunity for improvement

Void of real, valuable choices for consumers

Relatively low retention rate of best guests

Lacked standardization across enterprise

2010: How does mychoice compare to the competition?

50% St. Louis

45% Competitor

40%

35%

30% Lake

Charles

25% Competitor

20%

15% Bossier City

10% Competitor

5%

0% S. Indiana

Much Somewhat Same Somewhat Much Competitor

Better better worse Worse

17

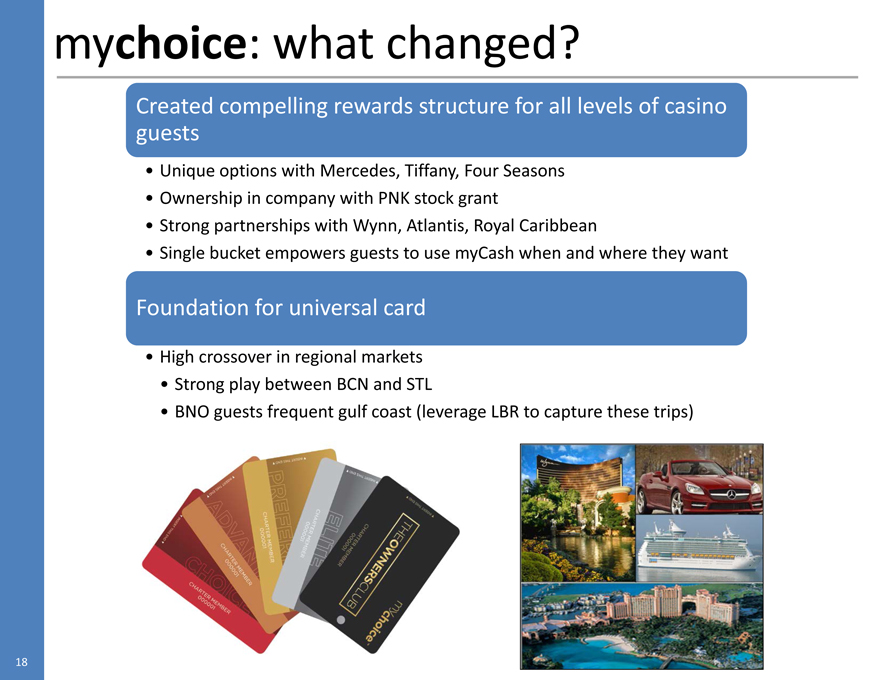

mychoice: what changed?

Created compelling rewards structure for all levels of casino guests

Unique options with Mercedes, Tiffany, Four Seasons

Ownership in company with PNK stock grant

Strong partnerships with Wynn, Atlantis, Royal Caribbean

Single bucket empowers guests to use myCash when and where they want

Foundation for universal card

High crossover in regional markets

Strong play between BCN and STL

BNO guests frequent gulf coast (leverage LBR to capture these trips)

18

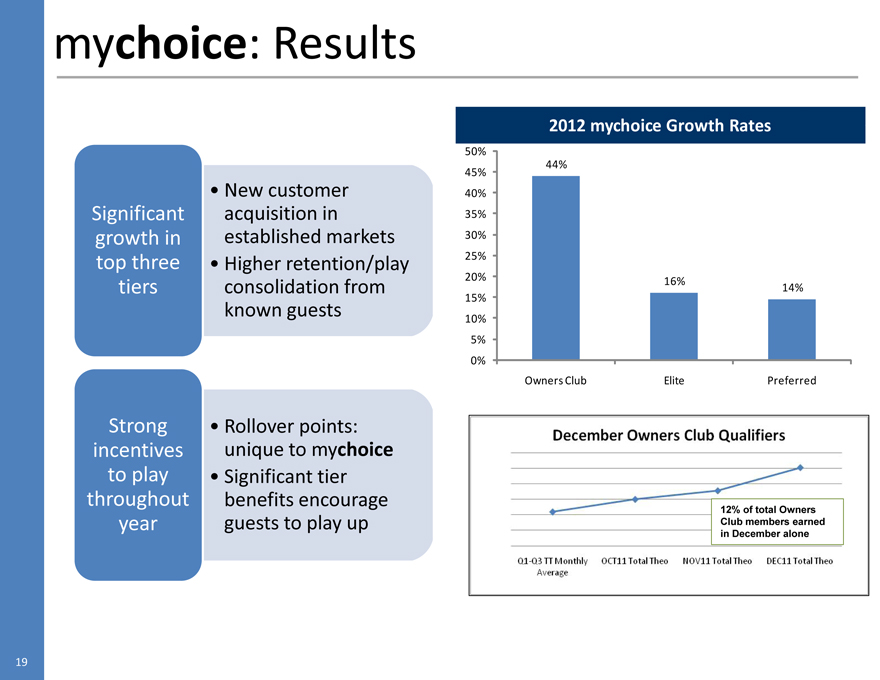

mychoice: Results

Significant growth in top three tiers

New customer acquisition in established markets

Higher retention/play consolidation from known guests

Strong incentives to play throughout year

Rollover points: unique to mychoice

Significant tier benefits encourage guests to play up

2012 mychoice Growth Rates

50%

45% 44%

40%

35%

30%

25%

20%

16%

14%

15%

10%

5%

0%

Owners Club

Elite Preferred

December Owners Club Qualifiers

12% of total Owners Club members earned in December alone

Q1-Q3 TT Monthly Average

OCT11 Total Theo

NOV11 Total Theo

DEC11 Total Theo

19

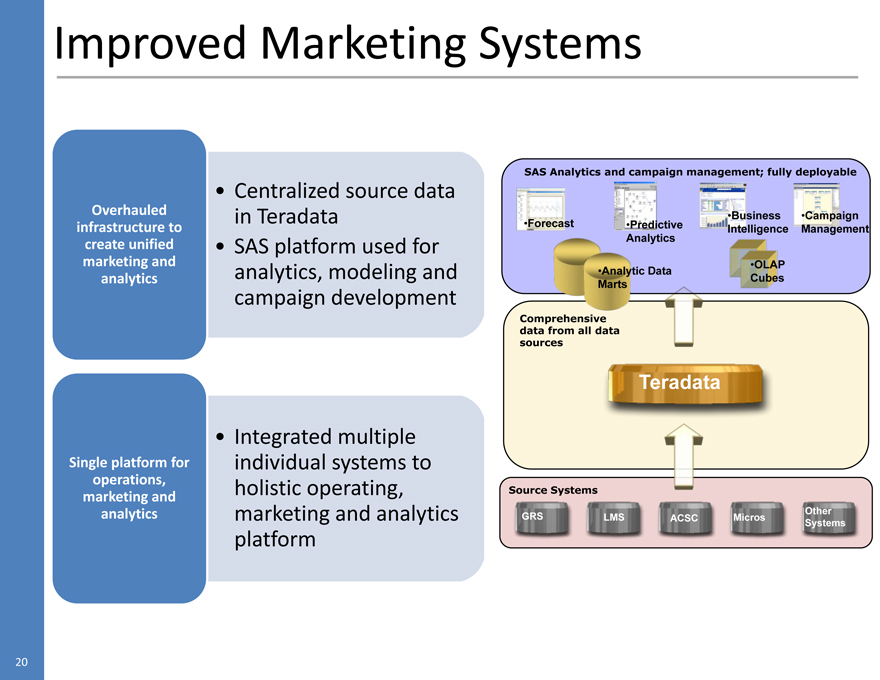

Improved Marketing Systems

Overhauled infrastructure to create unified marketing and analytics

Centralized source data in Teradata

SAS platform used for analytics, modeling and campaign development

Single platform for operations, marketing and analytics

Integrated multiple individual systems to holistic operating, marketing and analytics platform

SAS Analytics and campaign management; fully deployable

Forecast

Predictive

Business Intelligence

Analytics

Campaign Management

Analytic Data

OLAP

Marts

Cubes

Comprehensive

data from all data

sources

Teradata

Source Systems

Other

GRS

LMS

ACSC

Micros

Systems

20

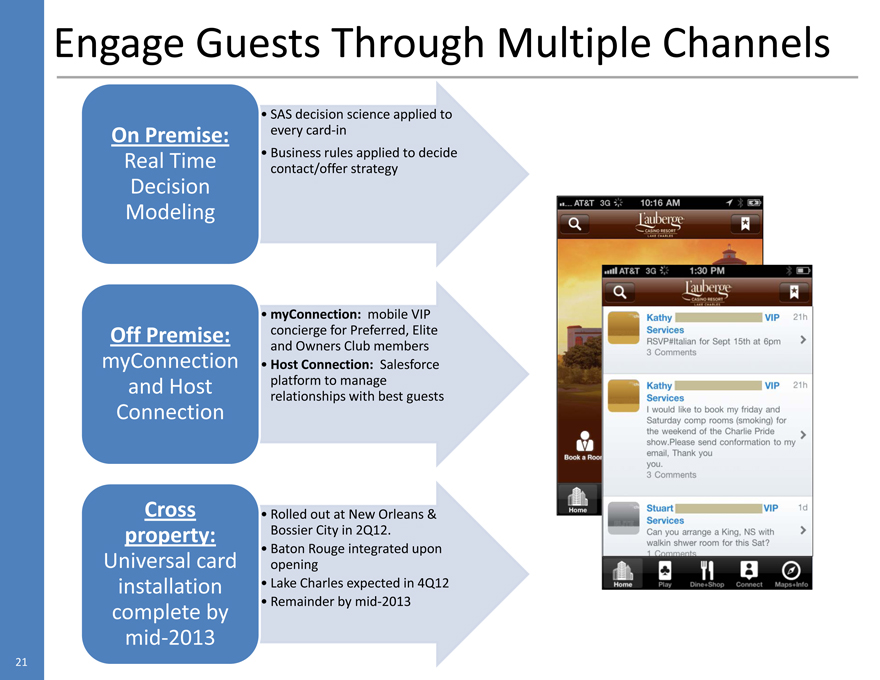

Engage Guests Through Multiple Channels

SAS decision science applied to

On Premise:

every card-in

Real Time

Business rules applied to decide

contact/offer strategy

Decision

Modeling

myConnection: mobile VIP

Off Premise:

concierge for Preferred, Elite

and Owners Club members

myConnection

Host Connection: Salesforce

and Host

platform to manage

relationships with best guests

Connection

Cross

Rolled out at New Orleans &

property:

Bossier City in 2Q12.

Baton Rouge integrated upon

Universal card

opening

installation

Lake Charles expected in 4Q12

complete by

Remainder by mid-2013

mid-2013

Kathy VIP 21h

Services RSVP#Italian for Sept 15th at 6pm 3 Comments

Kathy VIP 21h Services

I would like to book my friday and Saturday comp rooms (smoking) for the weekend of the Charlie Pride show.Please send conformation to my email. Thank you

you.

3 comments

Stuart VIP 1d Services

Can you arrange a King, NS with walkin shwer room for this Sat? 1 Comments

Home Play Dine-Shop Connect Maps-info

21

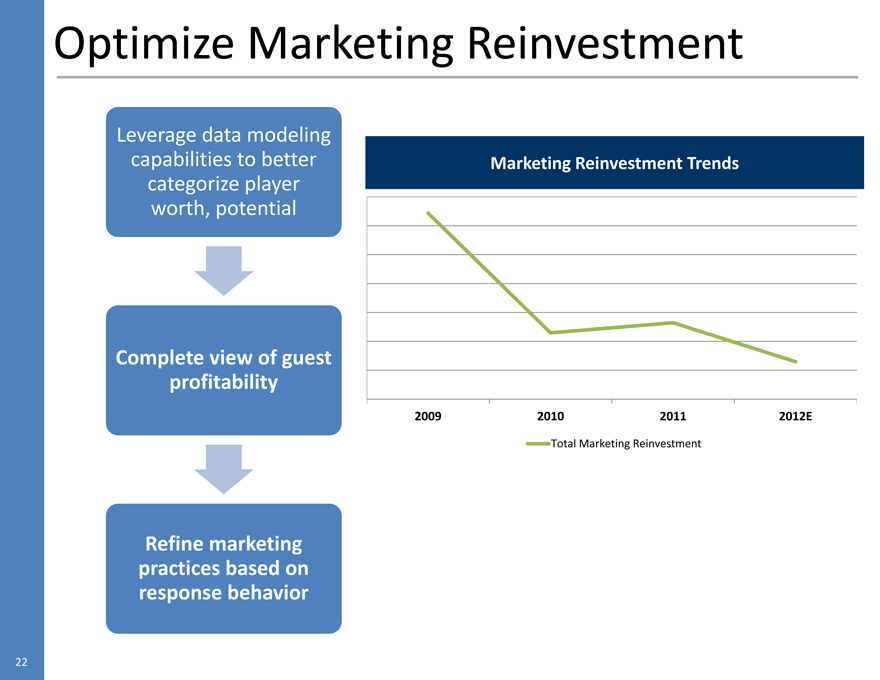

Optimize Marketing Reinvestment

Leverage data modeling capabilities to better categorize player worth, potential

Complete view of guest profitability

Refine marketing practices based on response behavior

Marketing Reinvestment Trends

2009

2010

2011

2012E

Total Marketing Reinvestment

22

Summary

Brand positioning

Clearly defined brand positioning lays the foundation for how we communicate, operate and compete

Redesigned mychoice program is valued by our guests

Increased play consolidation, growth in both quality and quantity of guests, and further differentiation with expanded proprietary rewards

IT & Enhanced Analytical Infrastructure

Enhanced capabilities in their early stages of deployment, improving marketing spend efficiency and effectiveness

23

Operations

24

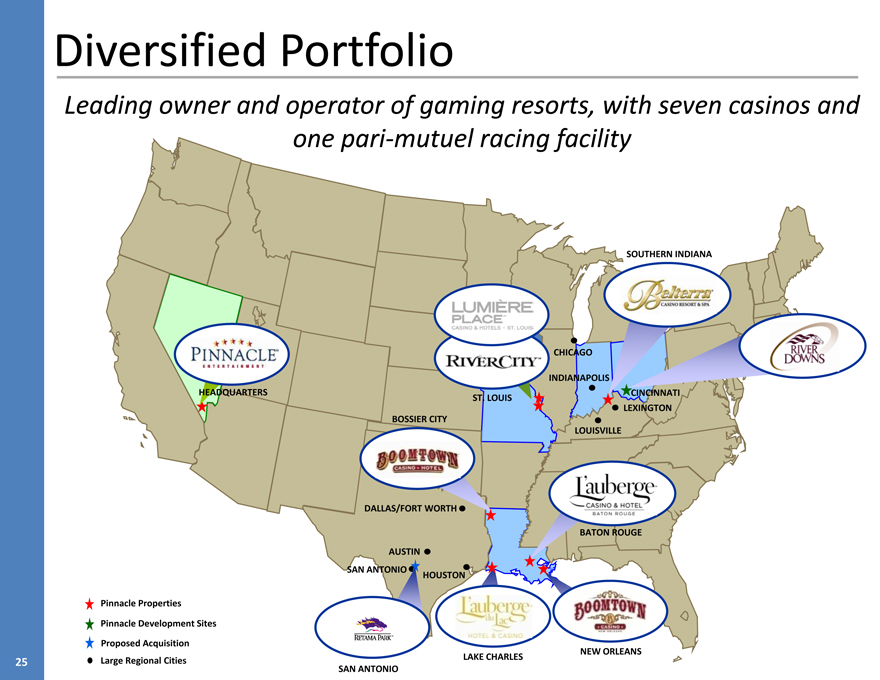

Diversified Portfolio

Leading owner and operator of gaming resorts, with seven casinos and one pari-mutuel racing facility

Pinnacle Properties

Pinnacle Development Sites Proposed Acquisition Large Regional Cities

25

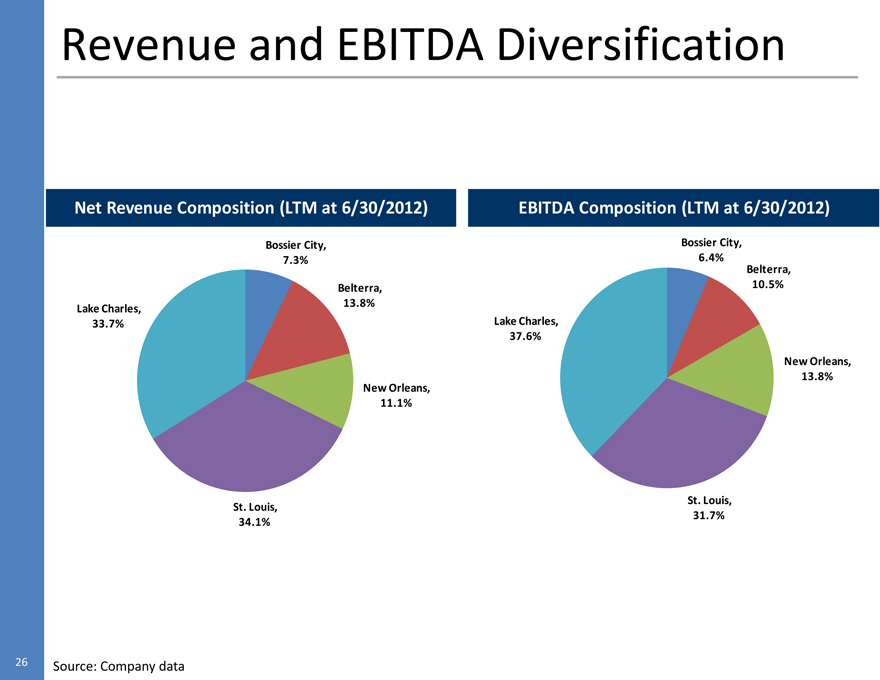

Revenue and EBITDA Diversification

Net Revenue Composition (LTM at 6/30/2012)

Bossier City,

7.3%

Belterra,

Lake Charles,

13.8%

33.7%

New Orleans,

11.1%

St. Louis,

34.1%

EBITDA Composition (LTM at 6/30/2012)

Bossier City,

6.4%

Belterra,

New Orleans,

10.5%

13.8%

Lake Charles,

37.6%

St. Louis,

31.7%

26

Louisiana

Geno Iafrate, EVP of Regional Operations

27

Baton Rouge

28

Overview

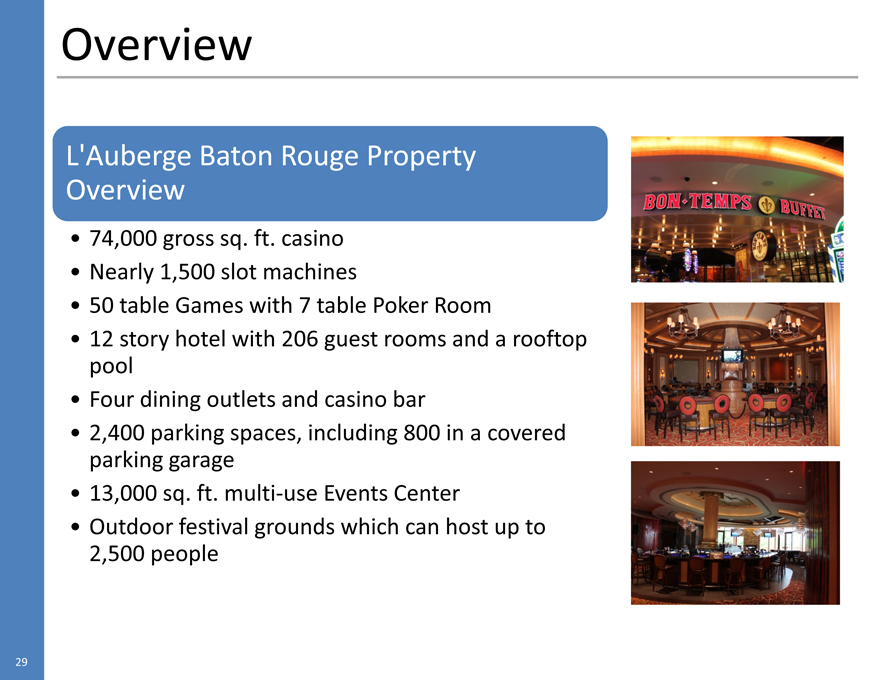

L’Auberge Baton Rouge Property Overview

74,000 gross sq. ft. casino Nearly 1,500 slot machines

50 table Games with 7 table Poker Room

12 story hotel with 206 guest rooms and a rooftop pool

Four dining outlets and casino bar

2,400 parking spaces, including 800 in a covered parking garage

13,000 sq. ft. multi-use Events Center

Outdoor festival grounds which can host up to 2,500 people

29

Baton Rouge Population Overview

2010 Census Data:

East Baton Rouge Parish, where L’Auberge Baton Rouge is located, is now the largest parish in the State with 440,000 and 6.6% growth.

Our two neighboring parishes had the most growth in the State with 39% each (Ascension and Livingston).

The nine parish capital region is now considered a major market with over 800,000 in population.

2.4M people live within a 90 minute drive of L’Auberge Baton Rouge

30

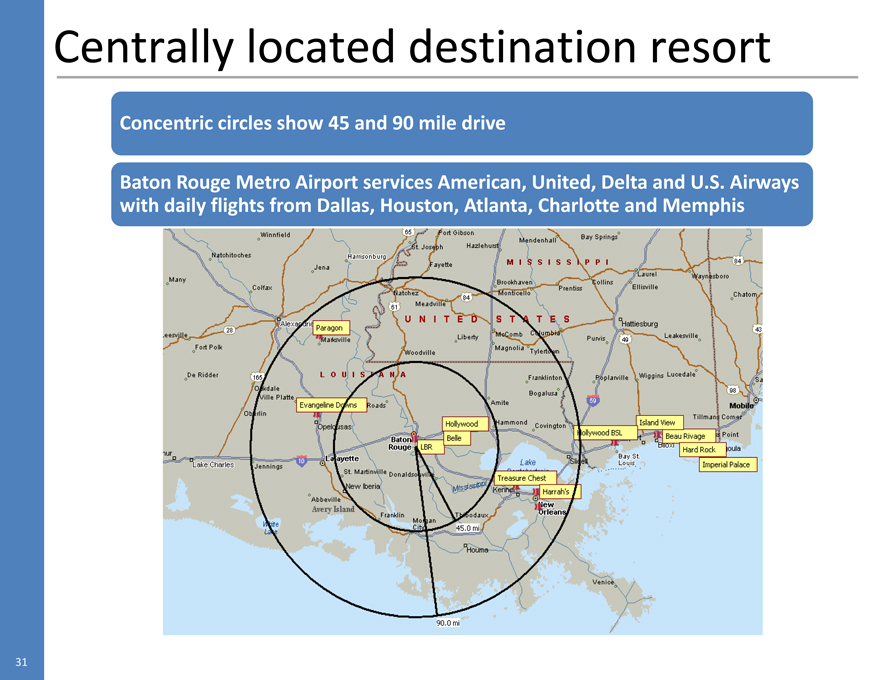

Centrally located destination resort

Concentric circles show 45 and 90 mile drive

Baton Rouge Metro Airport services American, United, Delta and U.S. Airways with daily flights from Dallas, Houston, Atlanta, Charlotte and Memphis

31

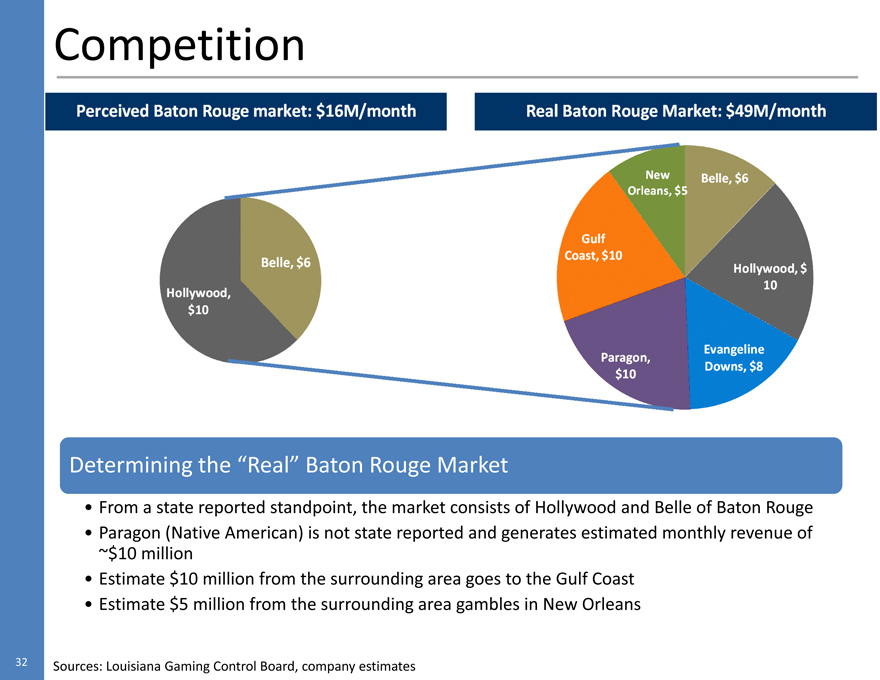

Competition

Perceived Baton Rouge market: $16M/month

Real Baton Rouge Market: $49M/month

Hollywood, $10

Gulf Coast, $10 New Orleans, $5 Belle, $6

Belle, $6

Paragon, $10 Evangeline Downs, $8 Hollywood, $10

Determining the ���Real” Baton Rouge Market

From a state reported standpoint, the market consists of Hollywood and Belle of Baton Rouge

Paragon (Native American) is not state reported and generates estimated monthly revenue of ~$10 million

Estimate $10 million from the surrounding area goes to the Gulf Coast

Estimate $5 million from the surrounding area gambles in New Orleans

32 Sources: Louisiana Gaming Control Board, company estimates

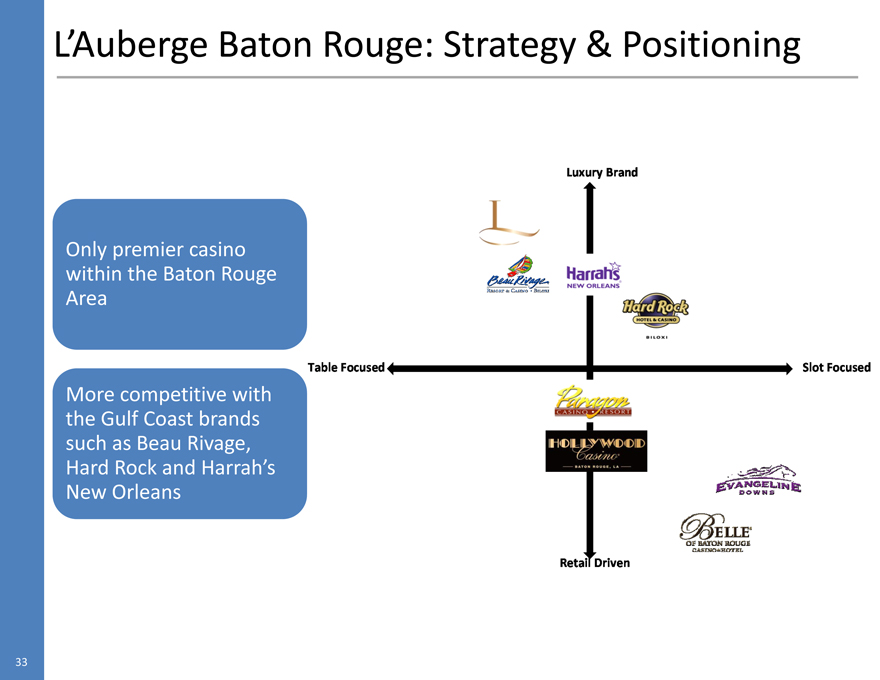

L’Auberge Baton Rouge: Strategy & Positioning

Only premier casino within the Baton Rouge Area

More competitive with the Gulf Coast brands such as Beau Rivage, Hard Rock and Harrah’s New Orleans

Luxury Brand Table Focused Retail Driven Slot Focused

33

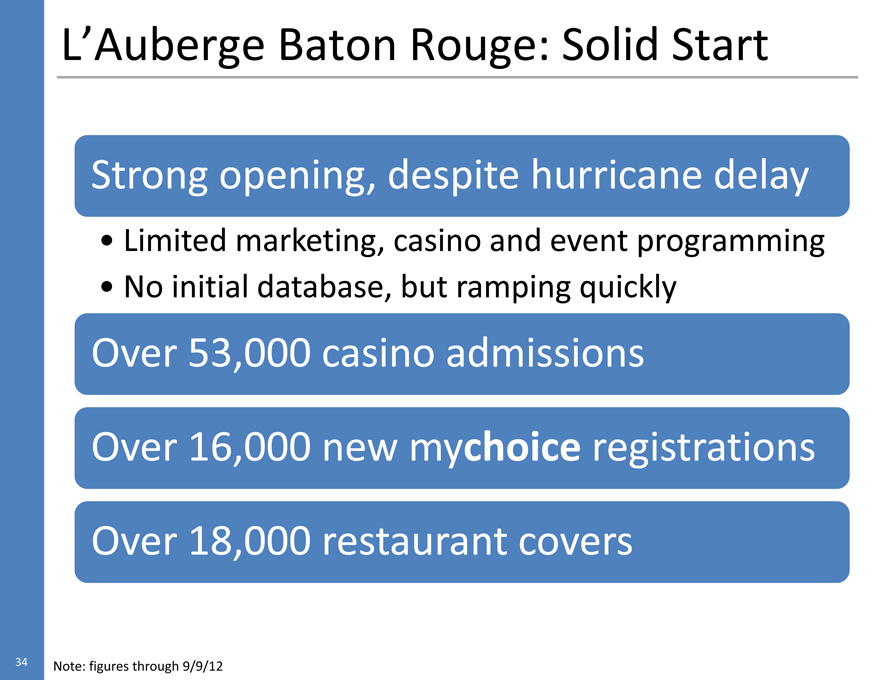

L’Auberge Baton Rouge: Solid Start

Strong opening, despite hurricane delay

Limited marketing, casino and event programming

No initial database, but ramping quickly

Over 53,000 casino admissions

Over 16,000 new mychoice registrations Over 18,000 restaurant covers

34 Note: figures through 9/9/12

Lake Charles

Geno Iafrate, EVP of Regional Operations

35

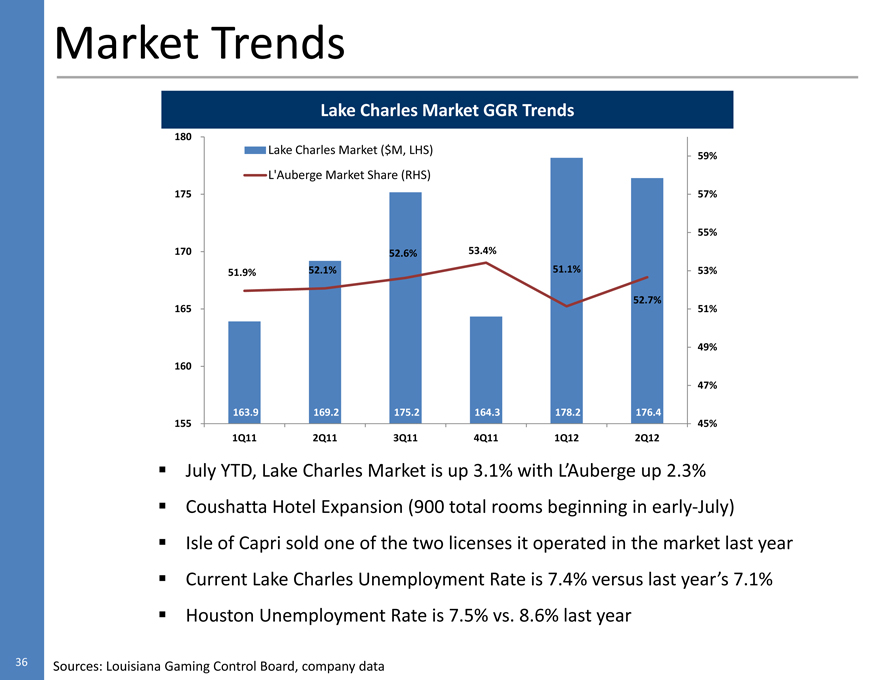

Market Trends

Lake Charles Market GGR Trends 180

Lake Charles Market ($M, LHS) 59%

L’Auberge Market Share (RHS)

175 57% 55% 170 52.6% 53.4%

51.9%

52.1% 51.1% 53% 52.7% 165 51%

49% 160 47% 163.9 169.2 175.2 164.3

178.2 176.4 155 45% 1Q11

2Q11 3Q11 4Q11 1Q12 2Q12

July YTD, Lake Charles Market is up 3.1% with L’Auberge up 2.3%

Coushatta Hotel Expansion (900 total rooms beginning in early-July)

Isle of Capri sold one of the two licenses it operated in the market last year

Current Lake Charles Unemployment Rate is 7.4% versus last year’s 7.1%

Houston Unemployment Rate is 7.5% vs. 8.6% last year

36 Sources: Louisiana Gaming Control Board, company data

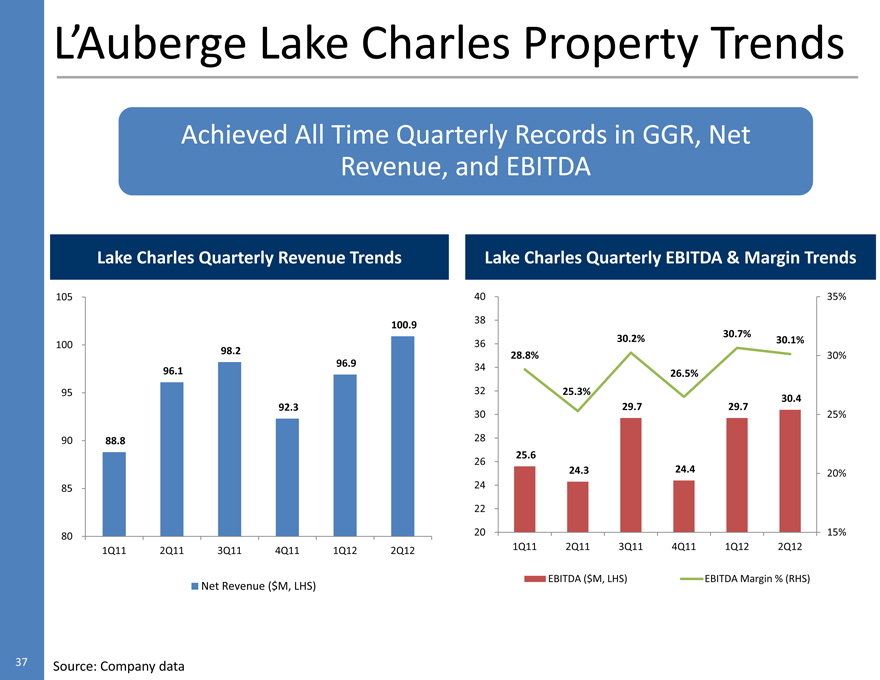

L’Auberge Lake Charles Property Trends

Achieved All Time Quarterly Records in GGR, Net Revenue, and EBITDA

105 100 95 90 85 80

Lake Charles Quarterly Revenue Trends 100.9 98.2 96.1 96.9 92.3 88.8

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

Net Revenue ($M, LHS)

Lake Charles Quarterly EBITDA & Margin Trends

40 35% 38 36 30.2% 30.7% 30.1% 28.8%

30%

34 26.5% 32 25.3% 30.4 29.7

29.7 30 25% 28 26 25.6

24.3 24.4 20% 24 22 20

15% 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

EBITDA ($M, LHS)

EBITDA Margin % (RHS)

37 Source: Company data

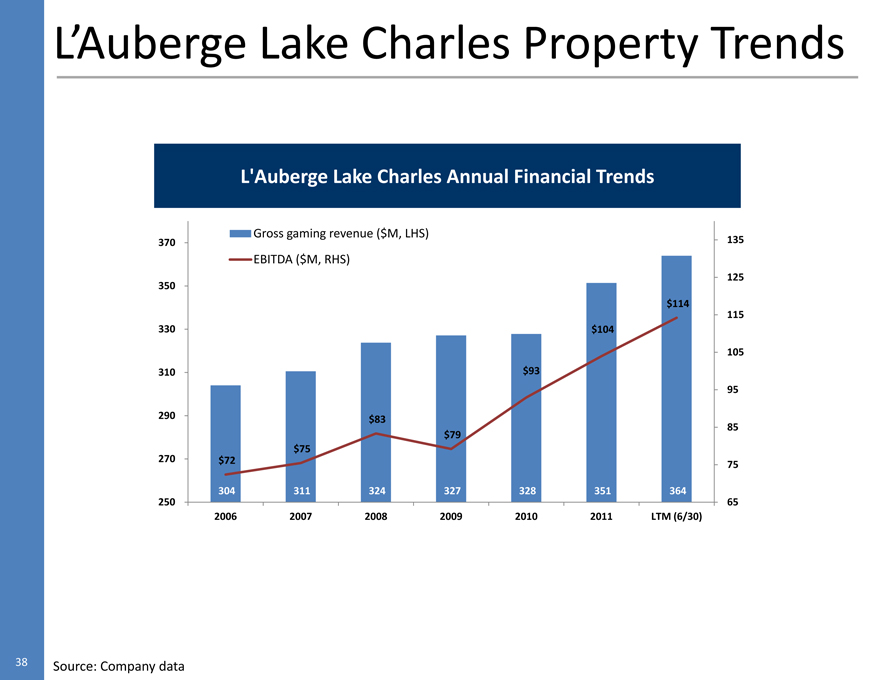

L’Auberge Lake Charles Property Trends

L’Auberge Lake Charles Annual Financial Trends

Gross gaming revenue ($M, LHS)

370 135

EBITDA ($M, RHS)

125 350 $114 115 330 $104 105 310 $93 95 290 $83 $79 85 $75 270 $72 75 304 311 324

327 328 351 364 250 65 2006 2007 2008 2009 2010 2011

LTM (6/30)

38 Source: Company data

Property Trends

Gaming

New floor layout / remodel has yielded solid results

Through the first seven months of 2012, slot win per unit per day is up more than 7% L’Auberge Lake Charles top poker room in the portfolio with revenues in excess of $3M in 12 months of operation

Hotel

Through the first two quarters of 2012, hotel cash revenue is up more than 10% driven by FIT

YTD through June, cash group sales account for ~20% of cash revenue YTD through June, worth PAR is up 3.4% to nearly $400

Through June 2012, midweek occupancy is 88.4% versus prior period of 85.7%, weekend occupancy is 97.7% versus 96.2% last year

Food

YTD through June, total food cash revenue has increased by ~15% from the prior year Total cash beverage is up ~25% through the first 6 months of 2012 versus the prior year

39

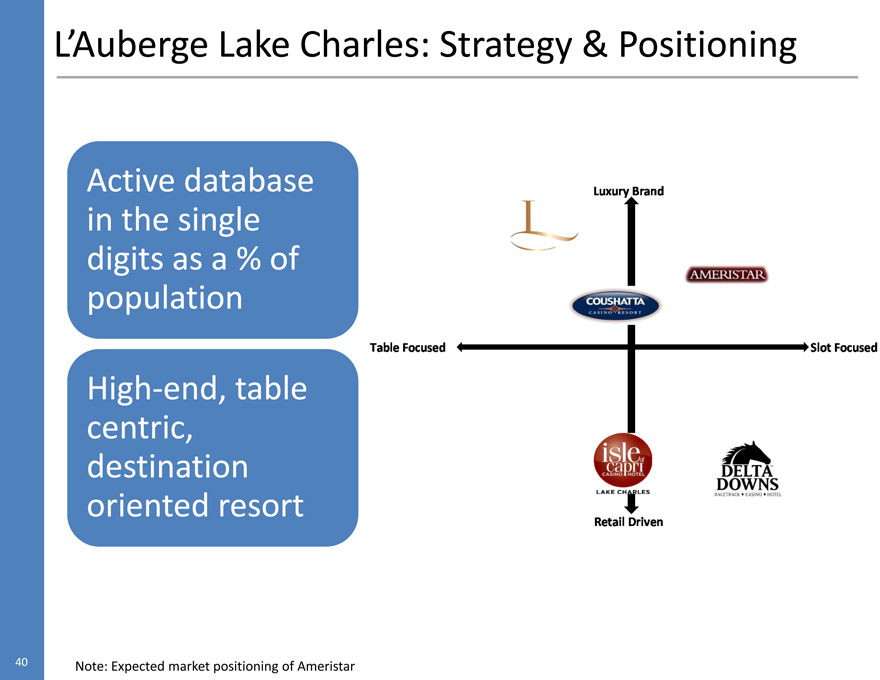

L’Auberge Lake Charles: Strategy & Positioning

Active database in the single digits as a % of population

High-end, table centric, destination oriented resort

Luxury Brand Table Focused Retail Driven Slot Focused

40 Note: Expected market positioning of Ameristar

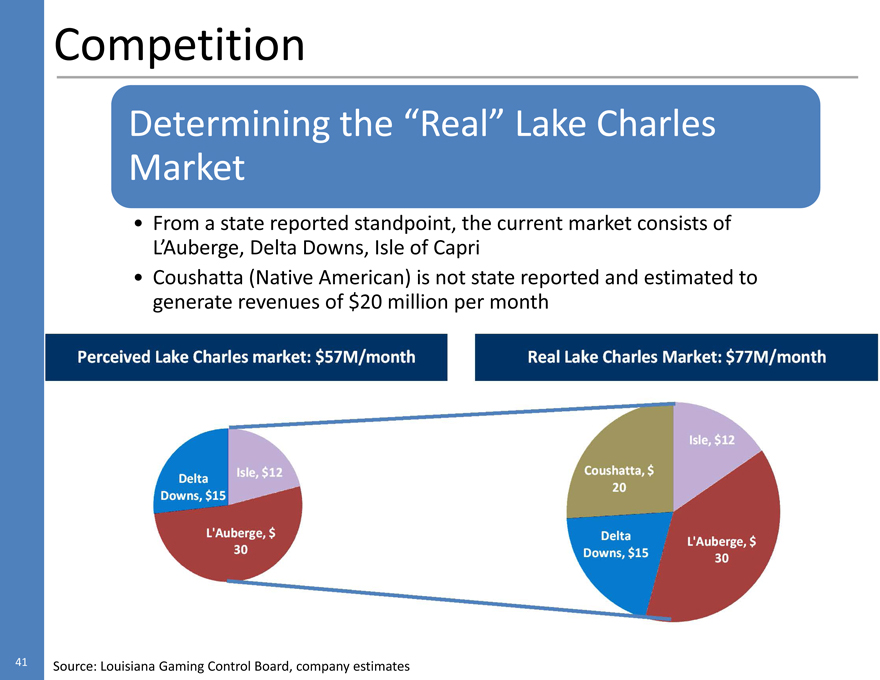

Competition

Determining the “Real” Lake Charles Market

From a state reported standpoint, the current market consists of L’Auberge, Delta Downs, Isle of Capri

Coushatta (Native American) is not state reported and estimated to generate revenues of $20 million per month

Perceived Lake Charles market: $57m/month Real Lake Charles Market: $77M/month

Delta Downs, $15 Isle $12 L’Auberge, $30 Coushatta, $20 Isle, $12 Delta Downs, $15 L’Auberge, $30

Source: Louisiana Gaming Control Board, company estimates

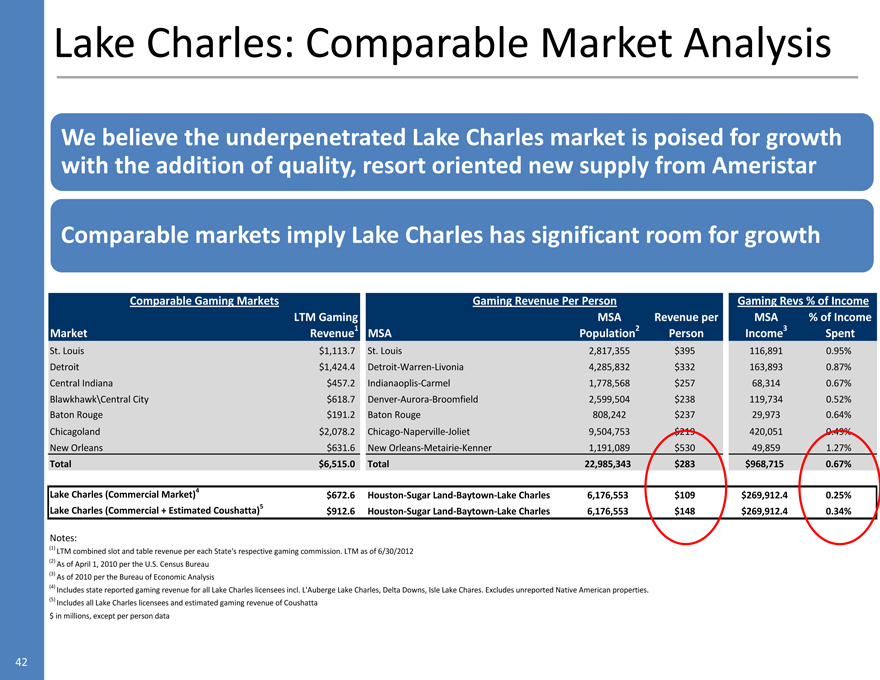

Lake Charles: Comparable Market Analysis

We believe the underpenetrated Lake Charles market is poised for growth with the addition of quality, resort oriented new supply from Ameristar

Comparable markets imply Lake Charles has significant room for growth

Comparable Gaming Markets

Gaming Revenue Per Person

Gaming Revs % of Income LTM Gaming

MSA Revenue per MSA % of Income

Market Revenue1

MSA Population2 Person Income3

Spent St. Louis $1,113.7 St. Louis

2,817,355 $395 116,891 0.95% Detroit $1,424.4

Detroit-Warren-Livonia 4,285,832 $332 163,893 0.87%

Central Indiana $457.2 Indianaoplis-Carmel 1,778,568 $257 68,314

0.67% Blawkhawk\Central City $618.7 Denver-Aurora-Broomfield

2,599,504 $238 119,734 0.52% Baton Rouge $191.2 Baton Rouge 808,242 $237

29,973 0.64% Chicagoland $2,078.2 Chicago-Naperville-Joliet 9,504,753 $219

420,051 0.49% New Orleans $631.6 New Orleans-Metairie-Kenner 1,191,089

$530 49,859 1.27% Total $6,515.0 Total 22,985,343 $283 $968,715 0.67%

Lake Charles (Commercial Market)4 $672.6 Houston-Sugar Land-Baytown-Lake Charles

6,176,553 $109 $269,912.4 0.25%

Lake Charles (Commercial + Estimated Coushatta)5 $912.6

Houston-Sugar Land-Baytown-Lake Charles 6,176,553 $148 $269,912.4 0.34%

Notes:

(1) LTM combined slot and table revenue per each State’s respective gaming commission. LTM as of 6/30/2012 (2) As of April 1, 2010 per the U.S. Census Bureau (3) As of 2010 per the Bureau of Economic Analysis

(4) Includes state reported gaming revenue for all Lake Charles licensees incl. L’Auberge Lake Charles, Delta Downs, Isle Lake Chares. Excludes unreported Native American properties.

(5) Includes all Lake Charles licensees and estimated gaming revenue of Coushatta $ in millions, except per person data

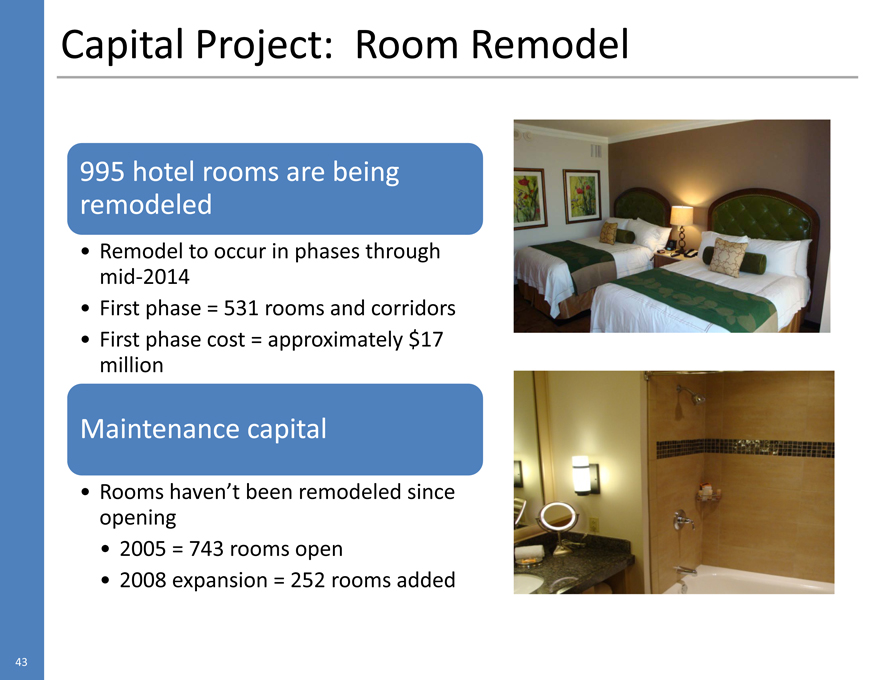

Capital Project: Room Remodel

995 hotel rooms are being remodeled

Remodel to occur in phases through mid-2014 First phase = 531 rooms and corridors First phase cost = approximately $17 million

Maintenance capital

Rooms haven’t been remodeled since opening 2005 = 743 rooms open 2008 expansion = 252 rooms added

New Orleans

44

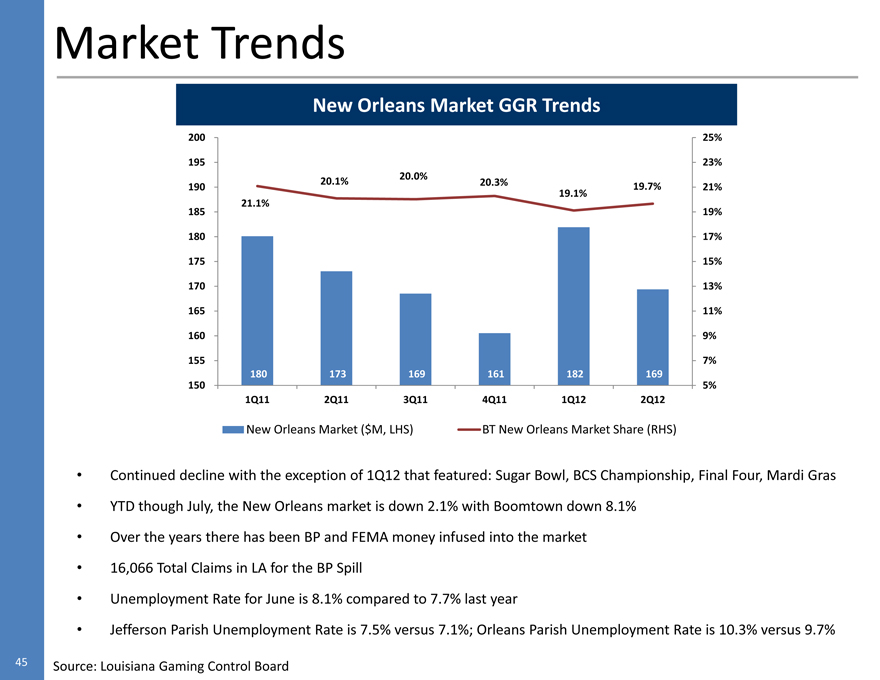

Market Trends

New Orleans Market GGR Trends

200 25% 195 23%

20.1% 20.0% 20.3%

190 19.7% 21%

19.1% 21.1% 185

19% 180 17% 175

15% 170 13% 165

11% 160 9% 155

7% 180 173 169

161 182 169 150 5%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

New Orleans Market ($M, LHS) BT New Orleans Market Share (RHS)

Continued decline with the exception of 1Q12 that featured: Sugar Bowl, BCS Championship, Final Four, Mardi Gras

YTD though July, the New Orleans market is down 2.1% with Boomtown down 8.1%

Over the years there has been BP and FEMA money infused into the market

16,066 Total Claims in LA for the BP Spill

Unemployment Rate for June is 8.1% compared to 7.7% last year

Jefferson Parish Unemployment Rate is 7.5% versus 7.1%; Orleans Parish Unemployment Rate is 10.3% versus 9.7%

Source: Louisiana Gaming Control Board

45

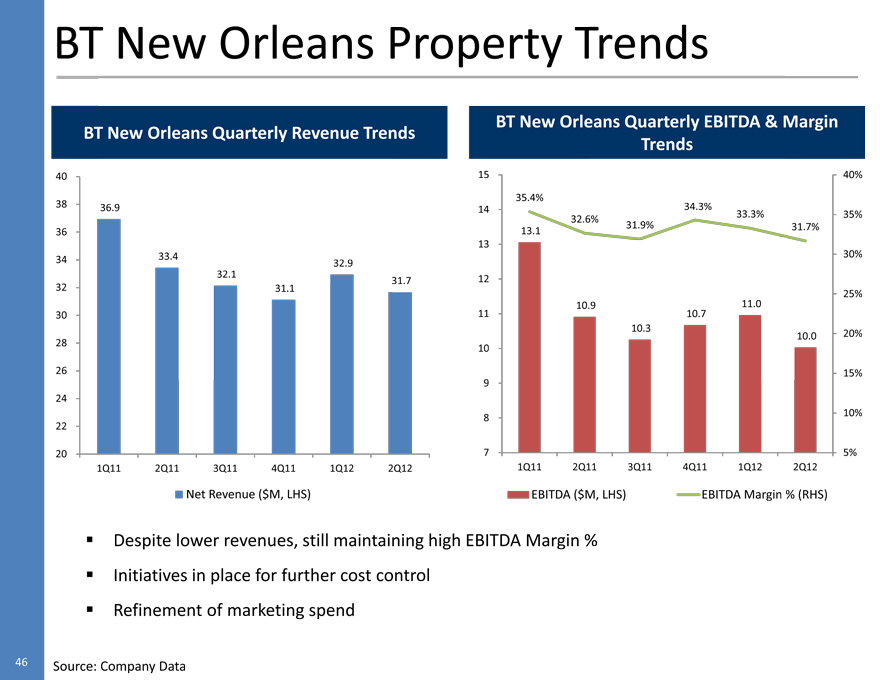

BT New Orleans Property Trends

BT New Orleans Quarterly Revenue Trends

40 38 36.9 36 34 33.4 32.9 32.1 31.7 32

31.1 30 28 26 24 22 20

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

Net Revenue ($M, LHS)

BT New Orleans Quarterly EBITDA & Margin

Trends

15 40% 35.4% 14 34.3%

33.3% 35% 32.6% 13.1

31.9% 31.7% 13 30% 12

25% 10.9 11.0 11 10.7 10.3

10.0 20% 10 15%

9 8 10% 7 5%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

EBITDA ($M, LHS)

EBITDA Margin % (RHS)

Despite lower revenues, still maintaining high EBITDA Margin %

Initiatives in place for further cost control

Refinement of marketing spend

45 Source: Company Data

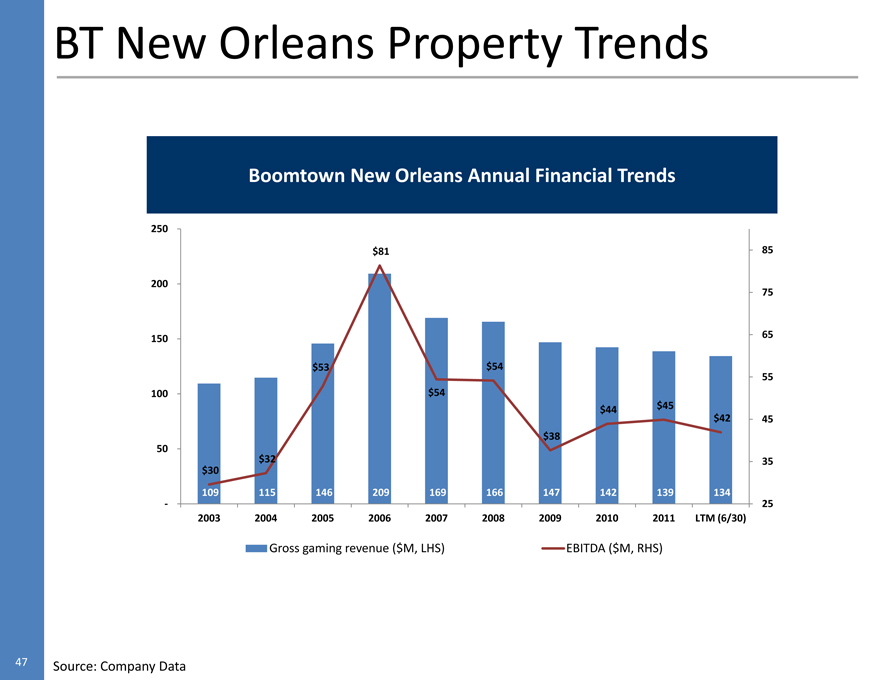

BT New Orleans Property Trends

Boomtown New Orleans Annual Financial Trends

250 $81 85 200

75 150 65 $53

$54 55 100 $54

$44 $45 $42

45 $38 50 $32 35

$30 109 115 146 209

169 166 147 142 139 134

— 25

2003 2004 2005 2006 2007 2008 2009 2010 2011

LTM (6/30)

Gross gaming revenue ($M, LHS)

EBITDA ($M, RHS)

Source: Company Data

47

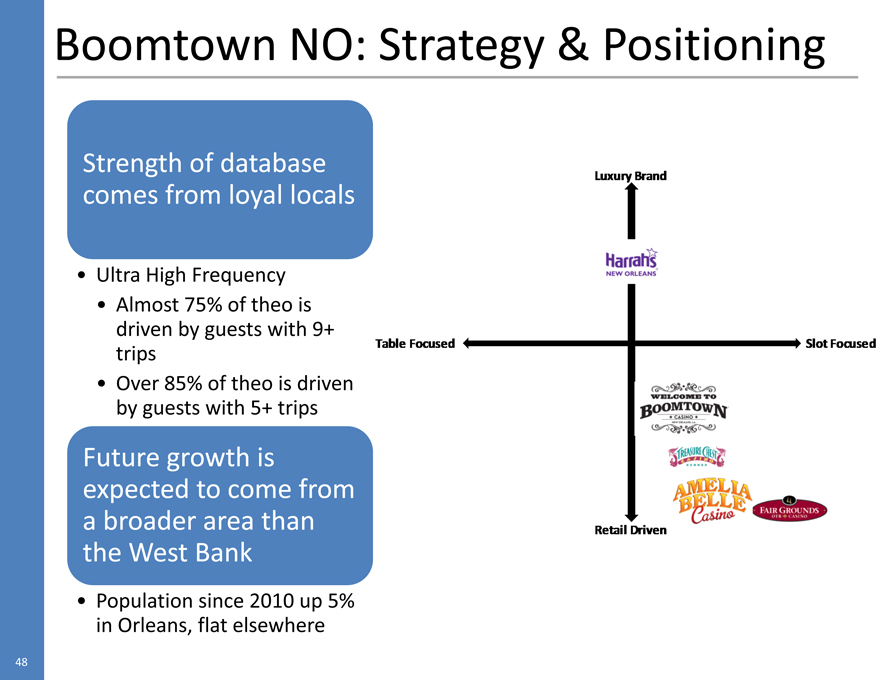

Boomtown NO: Strategy & Positioning

Strength of database comes from loyal locals

Ultra High Frequency

Almost 75% of theo is driven by guests with 9+ trips Over 85% of theo is driven by guests with 5+ trips

Future growth is expected to come from a broader area than the West Bank

Population since 2010 up 5% in Orleans, flat elsewhere

Luxury Brand

Harrahs New Orleans

Table Focused

Slot Focused

Retail Driven

48

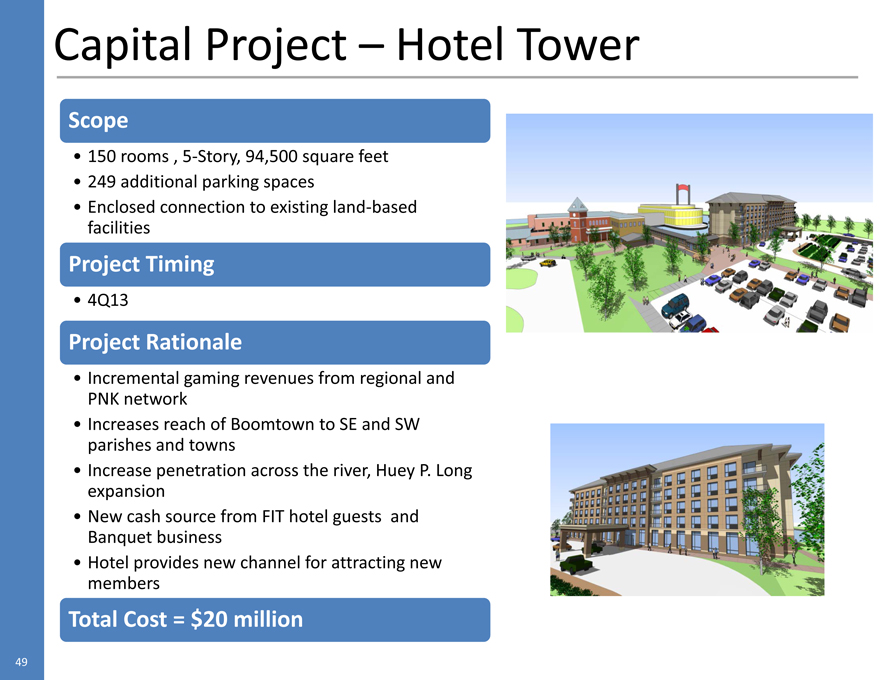

Capital Project – Hotel Tower

Scope

150 rooms , 5-Story, 94,500 square feet

249 additional parking spaces

Enclosed connection to existing land-based facilities

Project Timing

4Q13

Project Rationale

Incremental gaming revenues from regional and PNK network

Increases reach of Boomtown to SE and SW parishes and towns

Increase penetration across the river, Huey P. Long expansion

New cash source from FIT hotel guests and Banquet business

Hotel provides new channel for attracting new members

Total Cost = $20 million

49

Bossier City

50

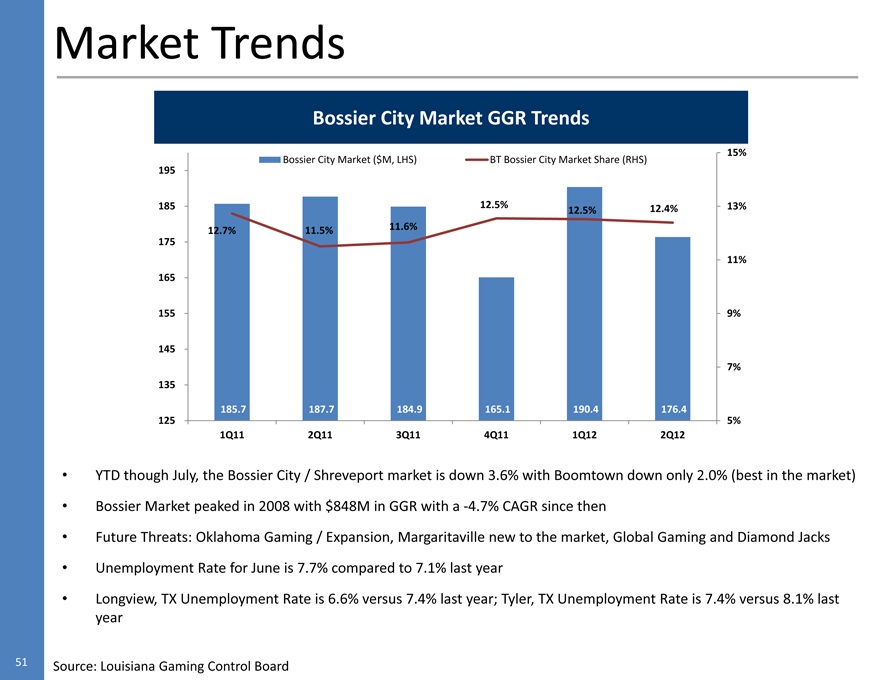

Market Trends

Bossier City Market GGR Trends

Bossier City Market ($M, LHS)

BT Bossier City Market Share (RHS)

15% 195 185

12.5% 12.5% 12.4%

13% 12.7% 11.5% 11.6%

175 11% 165

155 9% 145 7%

135 185.7 187.7 184.9

165.1 190.4 176.4

125 5% 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

YTD though July, the Bossier City / Shreveport market is down 3.6% with Boomtown down only 2.0% (best in the market)

Bossier Market peaked in 2008 with $848M in GGR with a -4.7% CAGR since then

Future Threats: Oklahoma Gaming / Expansion, Margaritaville new to the market, Global Gaming and Diamond Jacks

Unemployment Rate for June is 7.7% compared to 7.1% last year

Longview, TX Unemployment Rate is 6.6% versus 7.4% last year; Tyler, TX Unemployment Rate is 7.4% versus 8.1% last year

Source: Louisiana Gaming Control Board

51

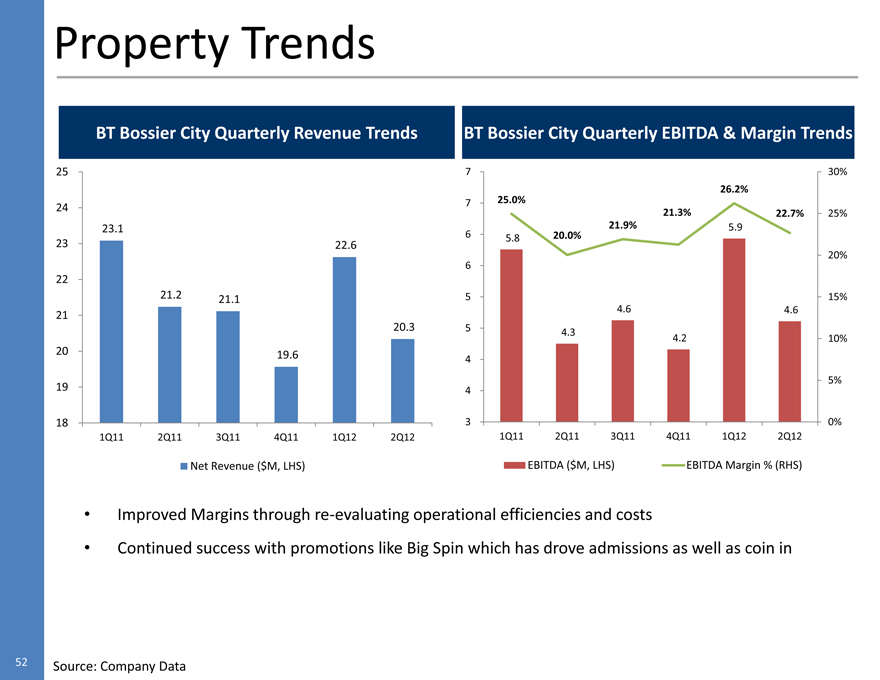

Property Trends

BT Bossier City Quarterly Revenue Trends

25 24 23.1 23 22.6

22 21.2 21.1

21 20.3

20 19.6 19 18

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

Net Revenue ($M, LHS)

BT Bossier City Quarterly EBITDA & Margin Trends

7 30% 26.2%

7 25.0% 21.3%

22.7% 25% 6

5.8 20.0% 21.9% 5.9

20% 6 5 15%

4.6 4.6 5

4.3 4.2 10%

4 5% 4 3 0%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

EBITDA ($M, LHS)

EBITDA Margin % (RHS)

Improved Margins through re-evaluating operational efficiencies and costs

Continued success with promotions like Big Spin which has drove admissions as well as coin in

Source: Company Data

52

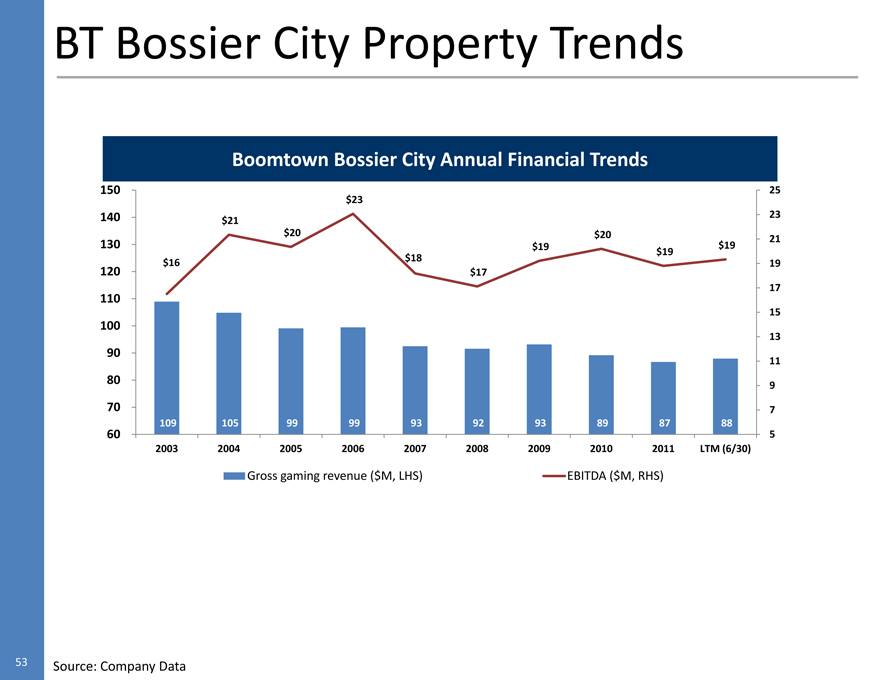

BT Bossier City Property Trends

Boomtown Bossier City Annual Financial Trends

150 25

$23

140 $21 23

$20 $20

130 $19 $19 $19 21

$16 $18 19

120 $17

17

110

15

100

13

90 11

80 9

70 7

109 105 99 99 93 92 93 89 87 88

60 5

2003 2004 2005 2006 2007 2008 2009 2010 2011 LTM (6/30)

Gross gaming revenue ($M, LHS) EBITDA ($M, RHS)

53 Source: Company Data

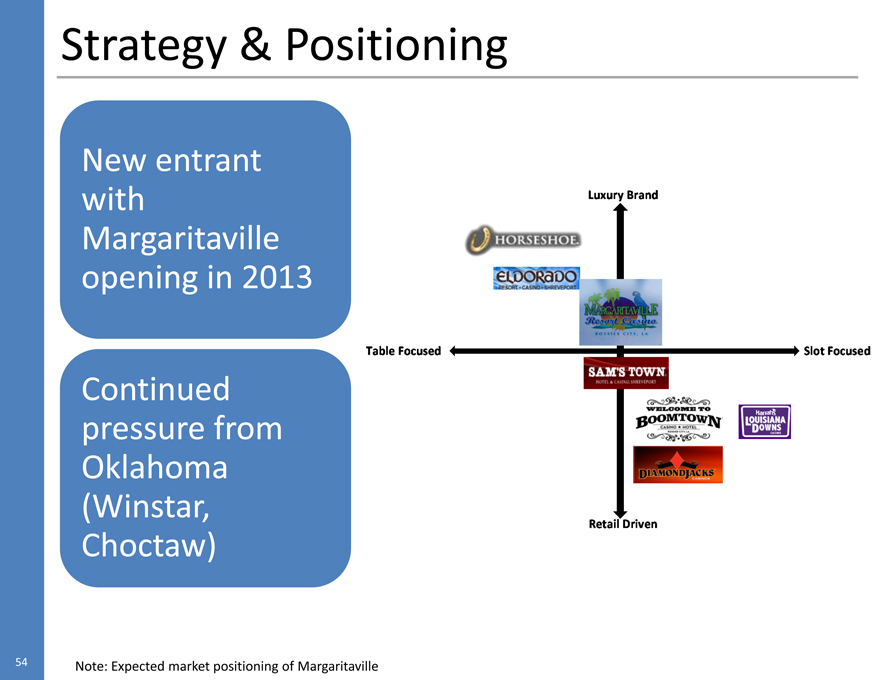

Strategy & Positioning

New entrant with Margaritaville opening in 2013

Continued pressure from Oklahoma (Winstar, Choctaw)

Luxury Brand

Table Focused Slot Focused

Retail Driven

54 Note: Expected market positioning of Margaritaville

Midwest

Neil Walkoff, EVP of Regional Operations

55

St. Louis

56

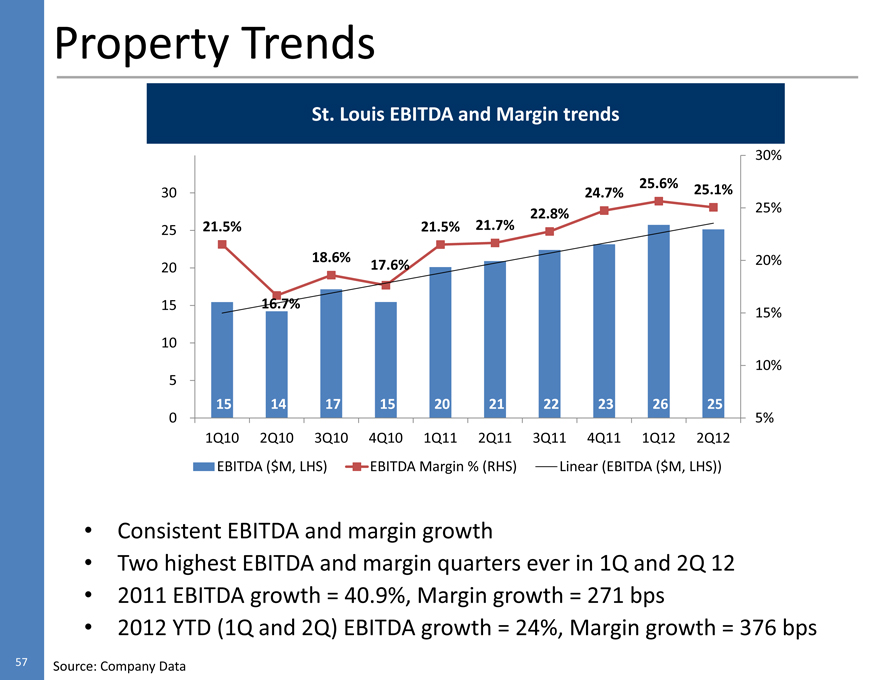

Property Trends

St. Louis EBITDA and Margin trends

30%

30 24.7% 25.6% 25.1%

22.8% 25%

25 21.5% 21.5% 21.7%

20 18.6% 17.6% 20%

15 16.7% 15%

10

10%

5

15 14 17 15 20 21 22 23 26 25

0 5%

1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12

EBITDA ($M, LHS) EBITDA Margin % (RHS) Linear (EBITDA ($M, LHS))

Consistent EBITDA and margin growth

Two highest EBITDA and margin quarters ever in 1Q and 2Q 12

2011 EBITDA growth = 40.9%, Margin growth = 271 bps

2012 YTD (1Q and 2Q) EBITDA growth = 24%, Margin growth = 376 bps

Source: Company Data

57

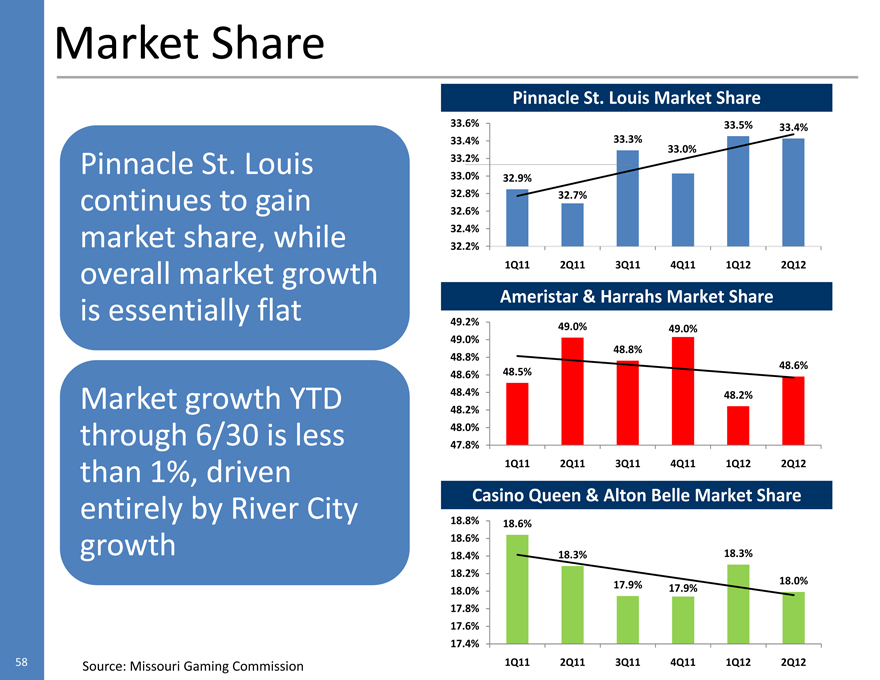

Market Share

Pinnacle St. Louis continues to gain market share, while overall market growth is essentially flat

Market growth YTD through 6/30 is less than 1%, driven entirely by River City growth

Pinnacle St. Louis Market Share

33.6%

33.5%

33.4%

33.4%

33.3%

33.0%

33.2%

33.0%

32.9%

32.8%

32.7%

32.6%

32.4%

32.2%

Ameristar & Harrahs Market Share

49.2%

49.0%

49.0%

49.0%

48.8%

48.8%

48.6%

48.5%

48.6%

48.4%

48.2%

48.2%

48.0%

47.8%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Casino Queen & Alton Belle Market Share

18.8%

18.6%

18.6%

18.4%

18.3%

18.3%

18.2%

18.0%

17.9%

17.9%

18.0%

17.8%

17.6%

17.4%

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Source: Missouri Gaming Commission

58

Positioning & Strategy – River City

River City CASINO

Upon completion of Phase 2, leverage best in market amenities to grow revenue and cash flow

Continue to build awareness; property is still relatively new in the market

To gamblers in suburban St. Louis, River City is the newest, most spectacular casino offering the best gambling, dining, and service in suburban St. Louis. River City understands St. Louis and what makes gamblers tick.

BEST CITY IN ST. LOUIS

59

Lumiere: Positioning & Strategy

LUMIERE PLACESM CASINO & HOTELS ST. LOUIS

Positioned as Regional / National Destination with luxury hotel (and only Five Diamond) in Missouri

Leverage non-gaming amenities as overall revenue driver

Take advantage of partnership with downtown activities (Convention Center, Cardinals, Rams)

To St. Louis gamblers, entertainment seekers, regional destination travelers, Lumiere is the classy, contemporary and electrifying casino destination. Lumiere provides a must-see experience with world-class amenities, biggest gambling action and more of the games players love. Lumiere is the center of action and excitement in St. Louis.

the PULSE of st. louis. LUMIERE PLACE CASINO & HOTELS

60

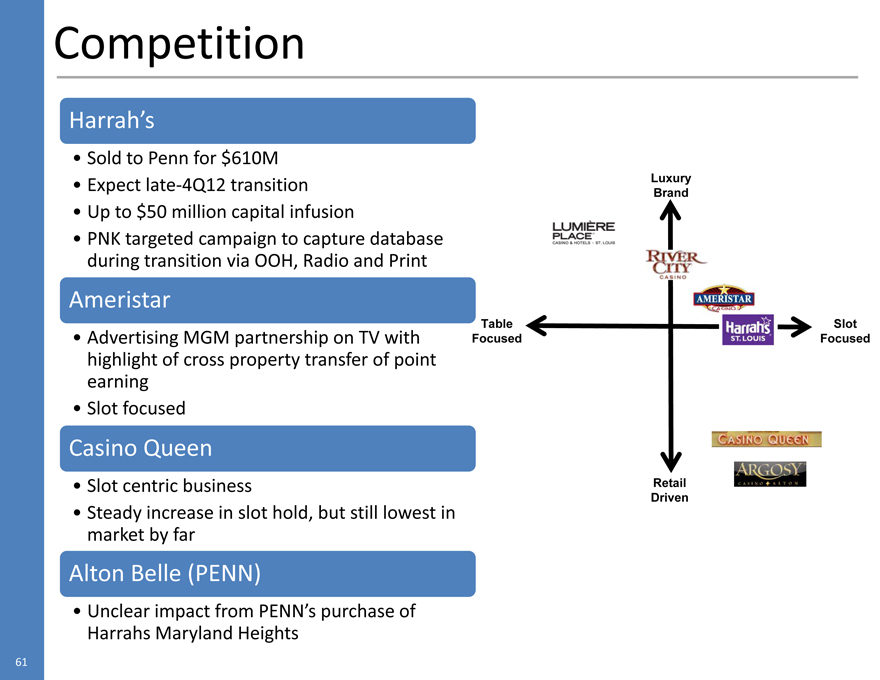

Competition

Harrah’s

Sold to Penn for $610M Expect late-4Q12 transition Up to $50 million capital infusion

PNK targeted campaign to capture database during transition via OOH, Radio and Print

Ameristar

Advertising MGM partnership on TV with highlight of cross property transfer of point earning Slot focused

Casino Queen

Slot centric business

Steady increase in slot hold, but still lowest in market by far

Alton Belle (PENN)

Unclear impact from PENN’s purchase of Harrahs Maryland Heights

Luxury Brand

Table Focused

Slot Focused

Retail Driven

61

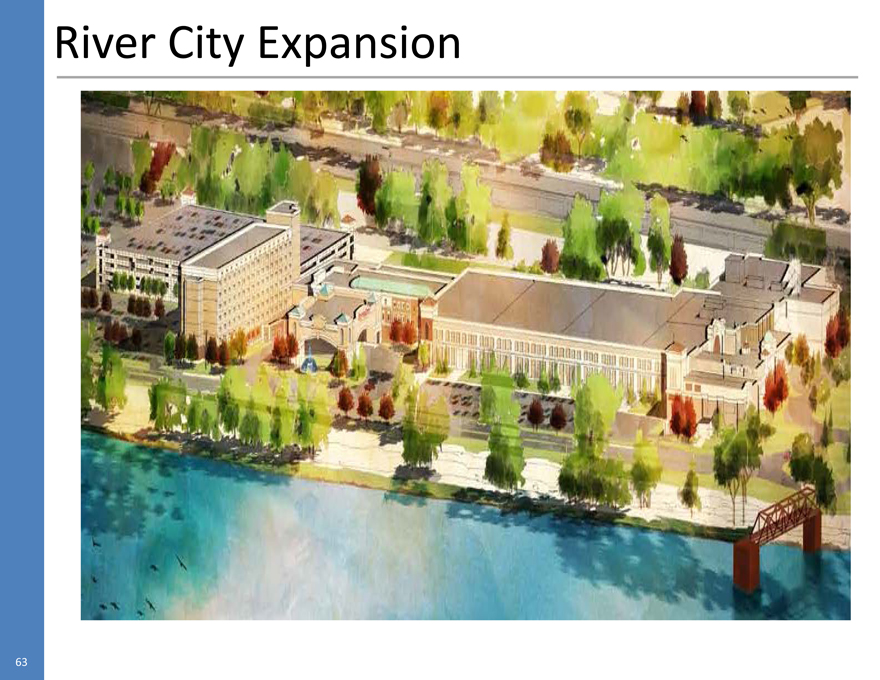

River City Expansion

River City Expansion:

1,600 space parking garage

Event center: 1,400 seats entertainment style / 750 seats banquet style

200 room hotel

Project Timing / Cost:

Parking Garage = 4Q12

Event center = 2H13

Hotel = 2H13

$82 million total cost

Generating a return

Hotel and garage finalize amenity set that will continue to drive visitation to River City

Garage will address current parking concerns

Hotel will attract new lodging guests that currently don’t visit and will increase length of stay of existing guests

Event center presents new non-gaming revenue opportunities and drives entertainment option

Unique positioning of River City and Lumiere will minimalize cannibalization of Lumiere as River City amenities come on line

Can leverage unique amenities at each property (Steakhouse and Event Center at River City, Four Seasons and Stadium at Lumiere)

Lumiere = regional / national destination

River City = local / regional destination

62

River City Expansion

63

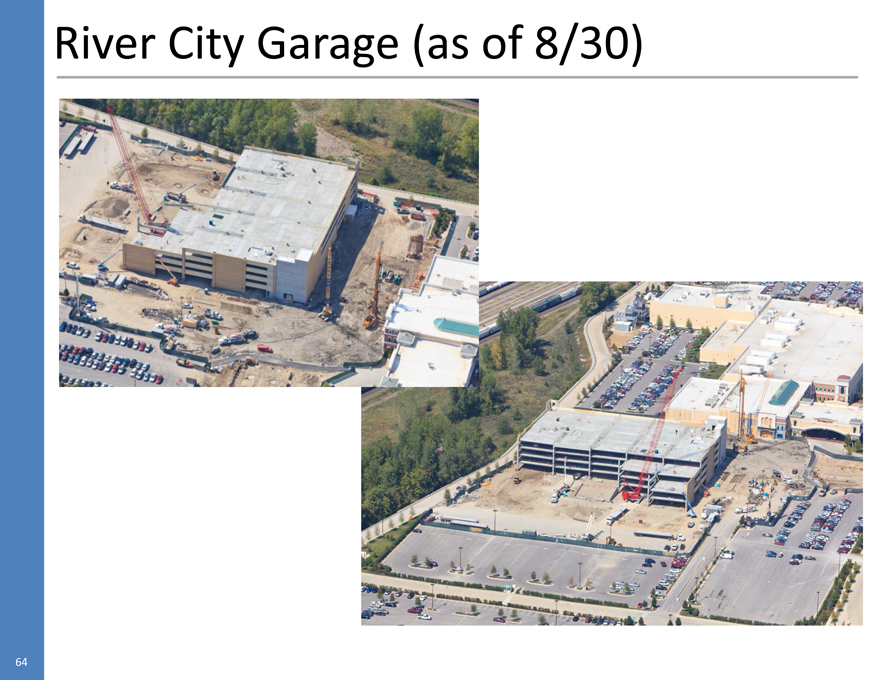

River City Garage (as of 8/30)

64

Multipurpose Room / Event Center

65

Front Desk

66

River City Typical Room

67

River City Hotel: 2 Bay Suite

68

Belterra

69

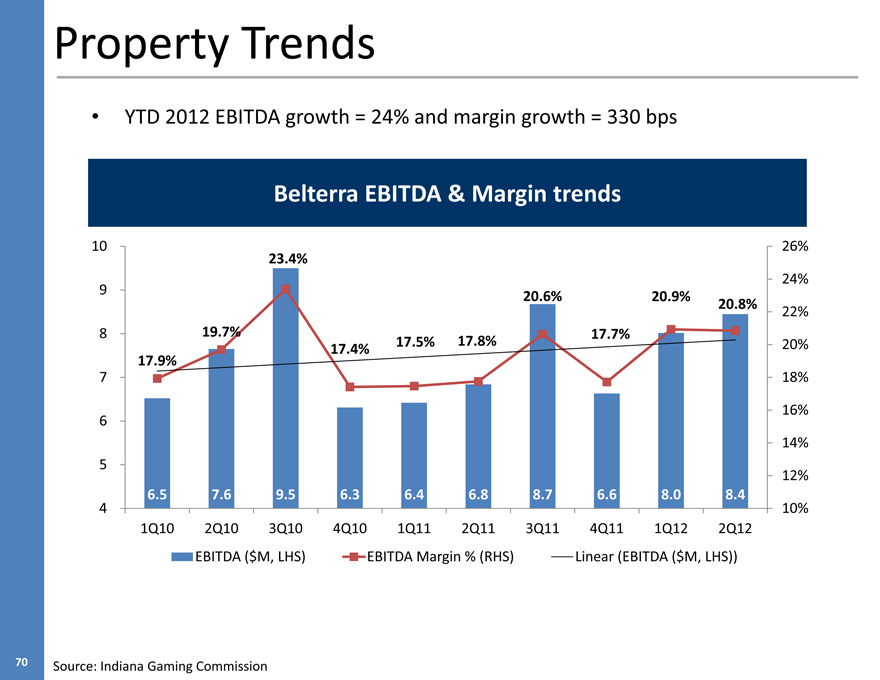

Property Trends

YTD 2012 EBITDA growth = 24% and margin growth = 330 bps

Belterra EBITDA & Margin trends

10 26%

23.4%

24%

9 20.6% 20.9% 20.8%

22%

8 19.7% 17.7%

17.5% 17.8% 20% 17.4% 17.9%

7 18% 16%

6

14%

5

12%

6.5 7.6 9.5 6.3 6.4 6.8 8.7 6.6 8.0 8.4

4 10% 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 EBITDA ($M, LHS) EBITDA Margin % (RHS) Linear (EBITDA ($M, LHS))

70 Source: Indiana Gaming Commission

|

P |

Ohio / Indiana Competitive Map

71

Positioning & Strategy

Positioned as resort destination with amenity set not replicated by any competitor Specific initiatives targeted at leveraging:

608 room hotel

Tom Fazio golf course

Event Center, Banquet / Meeting facilities

Jeff Ruby’s Steakhouse

Gaming Revenue Growth

Belterra’s primary market has no new competition

Under penetrated Regional markets present growth opportunities

PNK database grows with River Downs coming online ; cross marketing opportunities

New capital enhancements solidify resort positioning

72

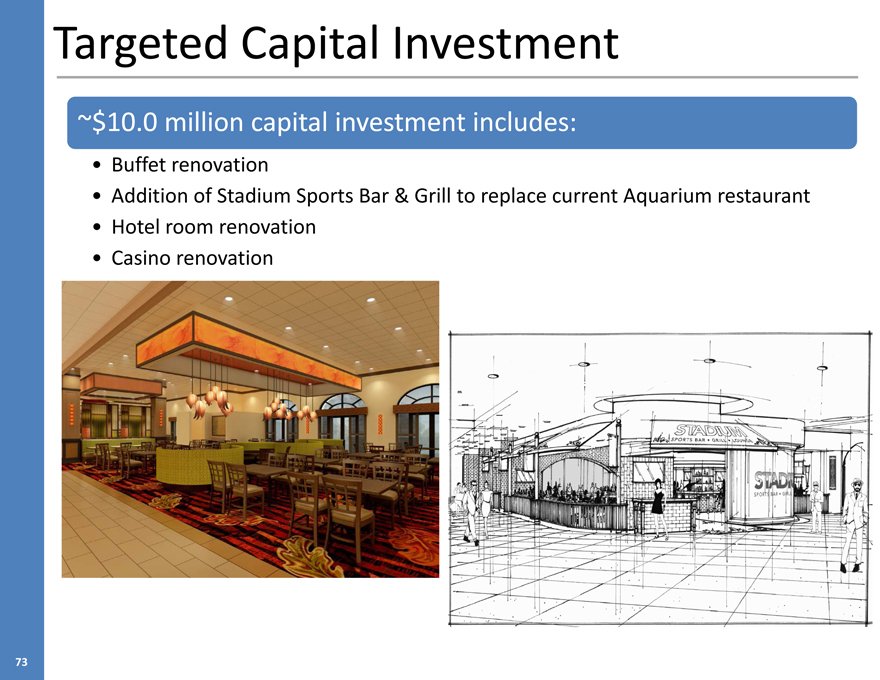

Targeted Capital Investment

~$10.0 million capital investment includes:

Buffet renovation

Addition of Stadium Sports Bar & Grill to replace current Aquarium restaurant

Hotel room renovation

Casino renovation

73

Summary – Midwest Region Focus

River City

Leverage new amenities that will make property truly best in market in every aspect; continue to increase market share

Manage disruption as construction progresses

Capitalize on transition of Harrahs to PENN and the exit of Total Rewards from St. Louis

Continue financial discipline

Lumiere

Position as regional destination with nicest hotel in downtown St. Louis and Missouri

Leverage non-gaming amenities to grow revenue

Continue financial discipline

Belterra

Capitalize on resort destination positioning

Own primary market and defend Cincinnati

Shared services and revenue opportunities with River Downs

Continue financial discipline

74

Capital Structure, Liquidity and Capital Allocation

Carlos Ruisanchez, EVP & Chief Financial Officer

75

Capital Structure Overview

76

Executive Summary

Capitalization

Strong balance sheet positioned for safety and flexibility

Debt seniority and term structure to balance cost of capital, while looking to match LT assets with LT liabilities

Will continue to actively and opportunistically manage the balance sheet

Maturities

Staggered capital commitments

Nearest significant funded maturity in 2017

Cash Flow & Liquidity

Ample available liquidity to fund existing growth pipeline and other capital initiatives

Current available liquidity is approximately $500 million post Baton Rouge

Cash on hand and cash flow generation represent significant liquidity resources, reducing reliance on revolver use

Term Loan introduces pre-payable debt to the capital structure

Leverage

Operational improvements and cash flow generation has permitted $465 million of investment in growth initiatives while being leverage neutral

Targeting net leverage in the 3.5x-5.0x range on a go forward basis, depending on timing of capital uses

77

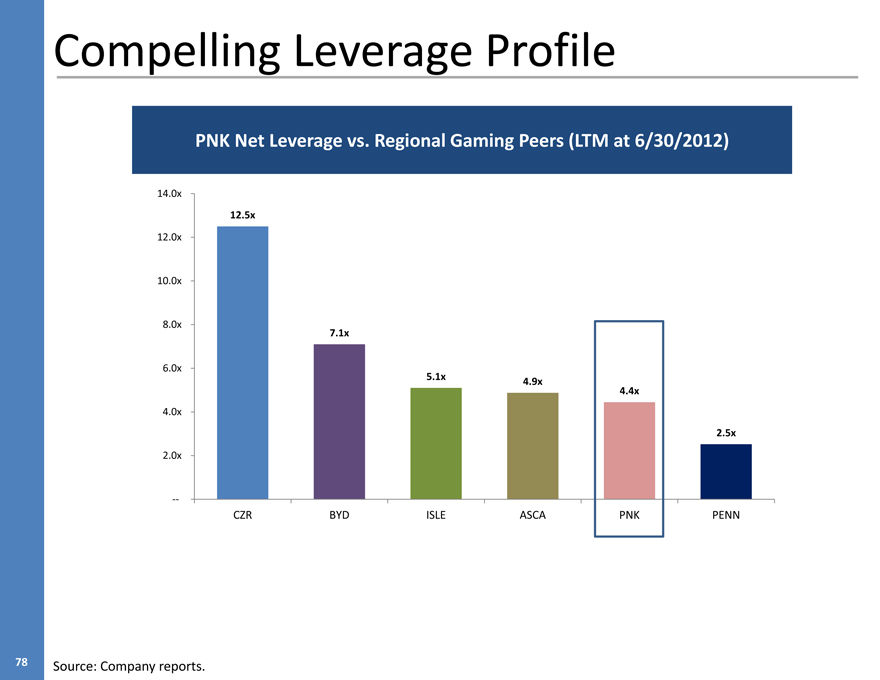

Compelling Leverage Profile

PNK Net Leverage vs. Regional Gaming Peers (LTM at 6/30/2012)

14.0x

12.5x

12.0x

10.0x

8.0x

7.1x

6.0x

5.1x 4.9x

4.4x

4.0x

2.5x

2.0x

—

CZR BYD ISLE ASCA PNK PENN

78 Source: Company reports.

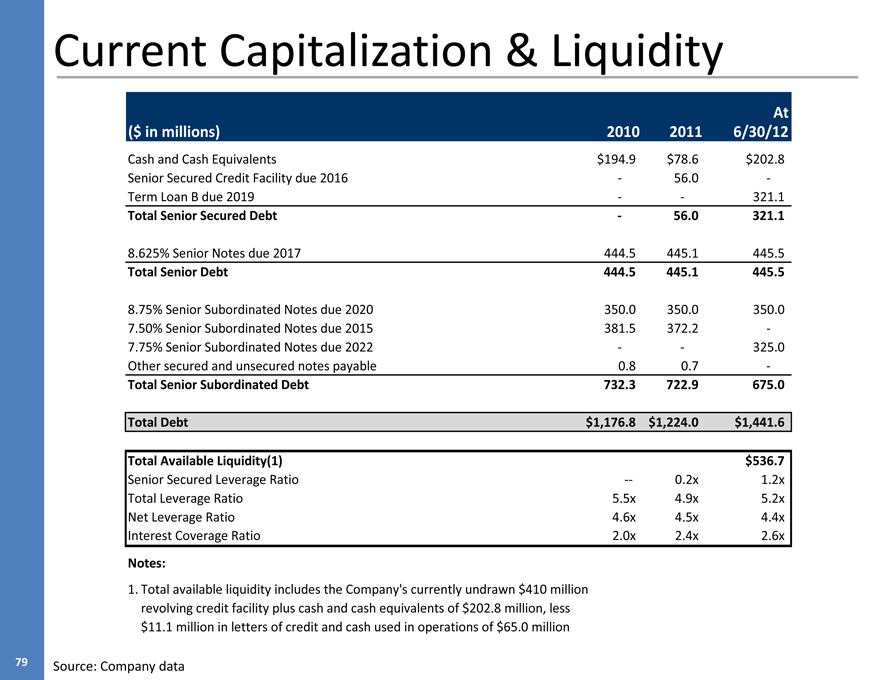

Current Capitalization & Liquidity

At ($ in millions) 2010 2011 6/30/12

Cash and Cash Equivalents $194.9 $78.6 $202.8 Senior Secured Credit Facility due 2016 — 56.0 — Term Loan B due 2019 — — 321.1

Total Senior Secured Debt — 56.0 321.1

8.625% Senior Notes due 2017 444.5 445.1 445.5

Total Senior Debt 444.5 445.1 445.5

8.75% Senior Subordinated Notes due 2020 350.0 350.0 350.0 7.50% Senior Subordinated Notes due 2015 381.5 372.2 — 7.75% Senior Subordinated Notes due 2022 — — 325.0 Other secured and unsecured notes payable 0.8 0.7 —

Total Senior Subordinated Debt 732.3 722.9 675.0

Total Debt $1,176.8 $1,224.0 $1,441.6

Total Available Liquidity(1) $536.7

Senior Secured Leverage Ratio — 0.2x 1.2x Total Leverage Ratio 5.5x 4.9x 5.2x Net Leverage Ratio 4.6x 4.5x 4.4x Interest Coverage Ratio 2.0x 2.4x 2.6x

Notes:

1. Total available liquidity includes the Company’s currently undrawn $410 million revolving credit facility plus cash and cash equivalents of $202.8 million, less $11.1 million in letters of credit and cash used in operations of $65.0 million

79 Source: Company data

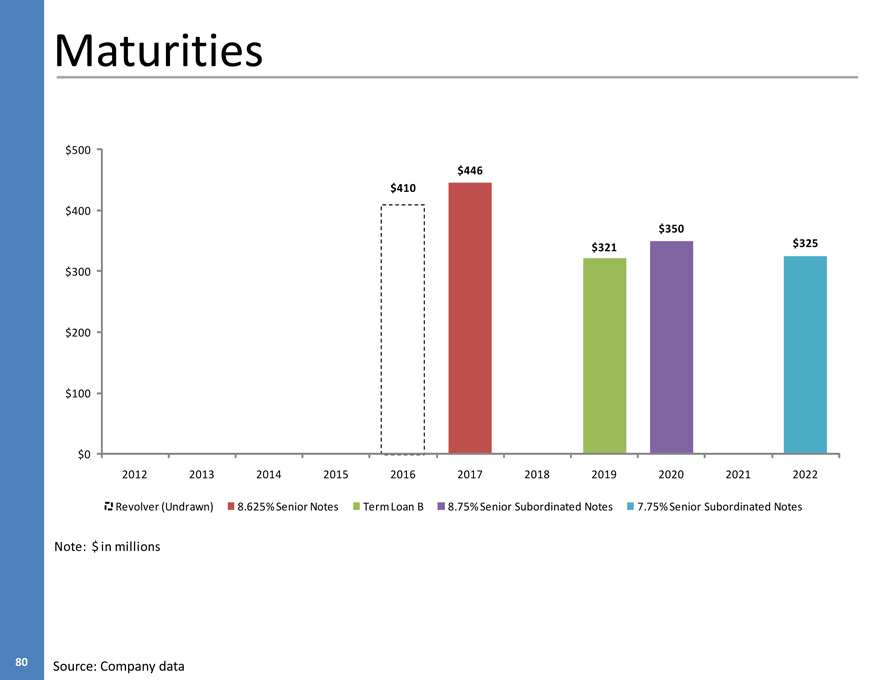

Maturities

$500 $446 $410 $400 $350 $321 $325 $300

$200

$100

$0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Revolver (Undrawn) 8.625% Senior Notes Term Loan B 8.75% Senior Subordinated Notes 7.75% Senior Subordinated Notes

Note: $ in millions

80 Source: Company data

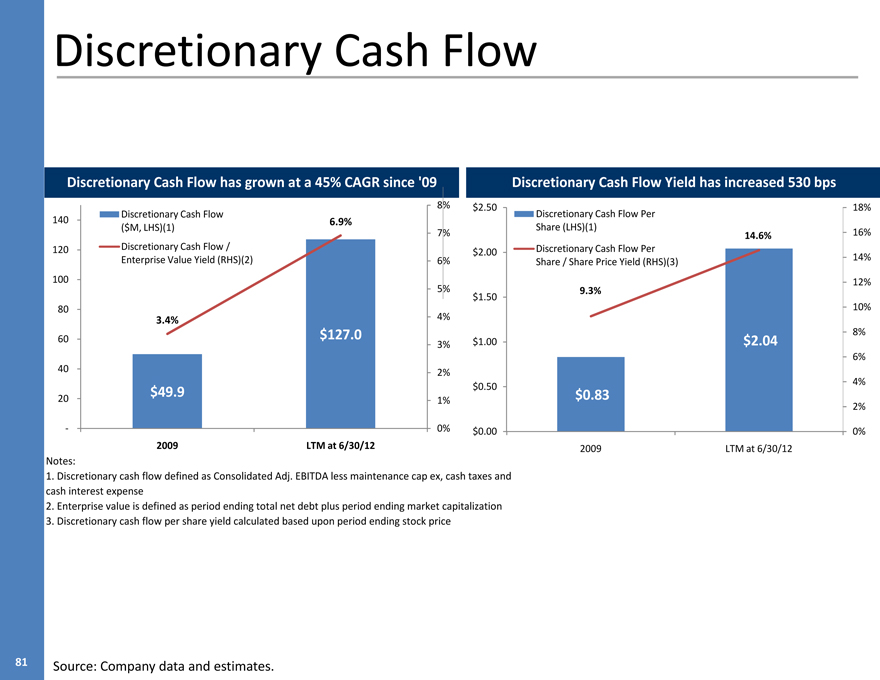

Discretionary Cash Flow

Discretionary Cash Flow has grown at a 45% CAGR since ‘09

8% Discretionary Cash Flow 140 6.9% ($M, LHS)(1) 7% 120 Discretionary Cash Flow / Enterprise Value Yield (RHS)(2) 6% 100 5% 80

3.4% 4%

60 $127.0

3%

40 2%

20 $49.9

1%

- 0%

2009 LTM at 6/30/12

Discretionary Cash Flow Yield has increased 530 bps

$2.50 18% Discretionary Cash Flow Per Share (LHS)(1) 16%

14.6% $2.00 Discretionary Cash Flow Per

Share / Share Price Yield (RHS)(3) 14% 12%

9.3% $1.50 10% $1.00 8%

$2.04

6%

$0.50 $0.83 4% 2%

$0.00 0% 2009 LTM at 6/30/12

Notes:

1. Discretionary cash flow defined as Consolidated Adj. EBITDA less maintenance cap ex, cash taxes and cash interest expense

2. Enterprise value is defined as period ending total net debt plus period ending market capitalization

3. Discretionary cash flow per share yield calculated based upon period ending stock price

81 Source: Company data and estimates.

Capital Allocation & Deployment Strategy

82

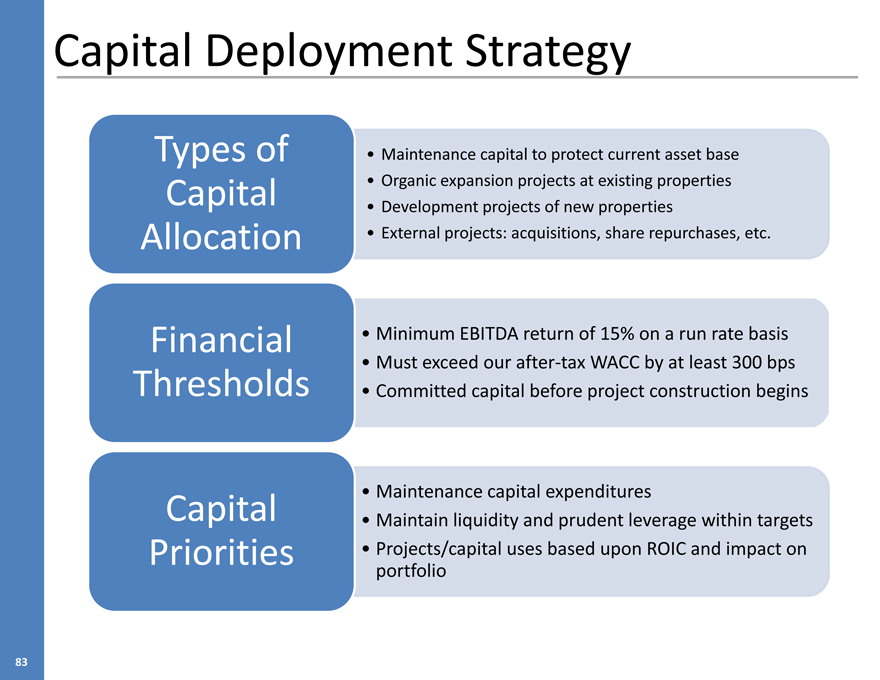

Capital Deployment Strategy

Types of

Maintenance capital to protect current asset base Capital

Organic expansion projects at existing properties

Development projects of new properties Allocation

External projects: acquisitions, share repurchases, etc.

Financial

Minimum EBITDA return of 15% on a run rate basis Thresholds

Must exceed our after-tax WACC by at least 300 bps

Committed capital before project construction begins

Capital

Maintenance capital expenditures

Maintain liquidity and prudent leverage within targets Priorities

Projects/capital uses based upon ROIC and impact on portfolio

83

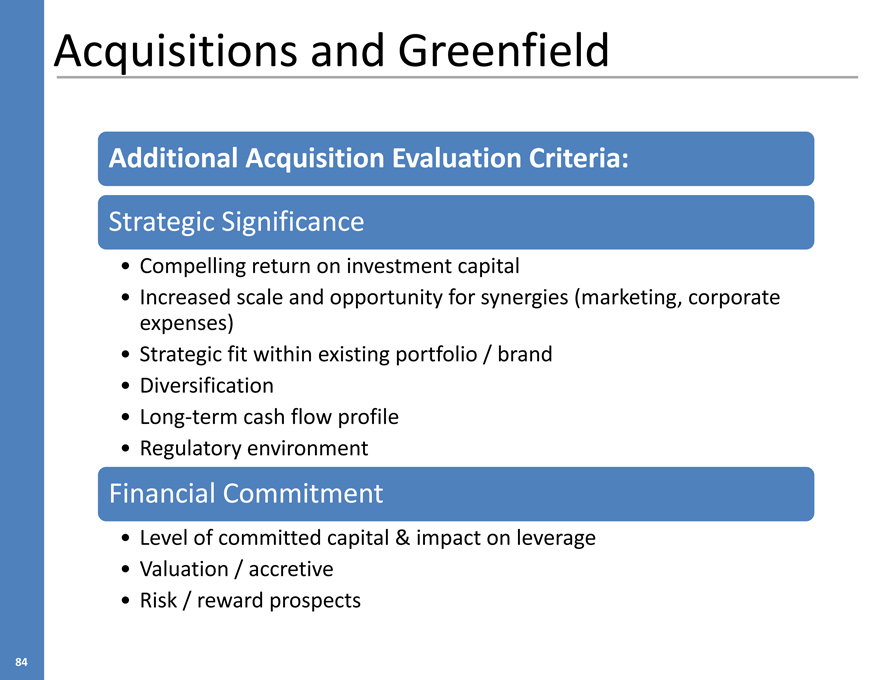

Acquisitions and Greenfield

Additional Acquisition Evaluation Criteria:

Strategic Significance

Compelling return on investment capital

Increased scale and opportunity for synergies (marketing, corporate expenses)

Strategic fit within existing portfolio / brand

Diversification

Long-term cash flow profile

Regulatory environment

Financial Commitment

Level of committed capital & impact on leverage

Valuation / accretive

Risk / reward prospects

84

Share Buyback Update

Number of shares repurchased (as of 9/10/12) : 1.9 million

Amount spent to date: $21.2 million Diluted Shares Outstanding: 60.7 million Reduction in Diluted Shares Outstanding: 3.0%

85

Enterprise Growth & Development

86

River Downs

Neil Walkoff, EVP of Regional Operations

87

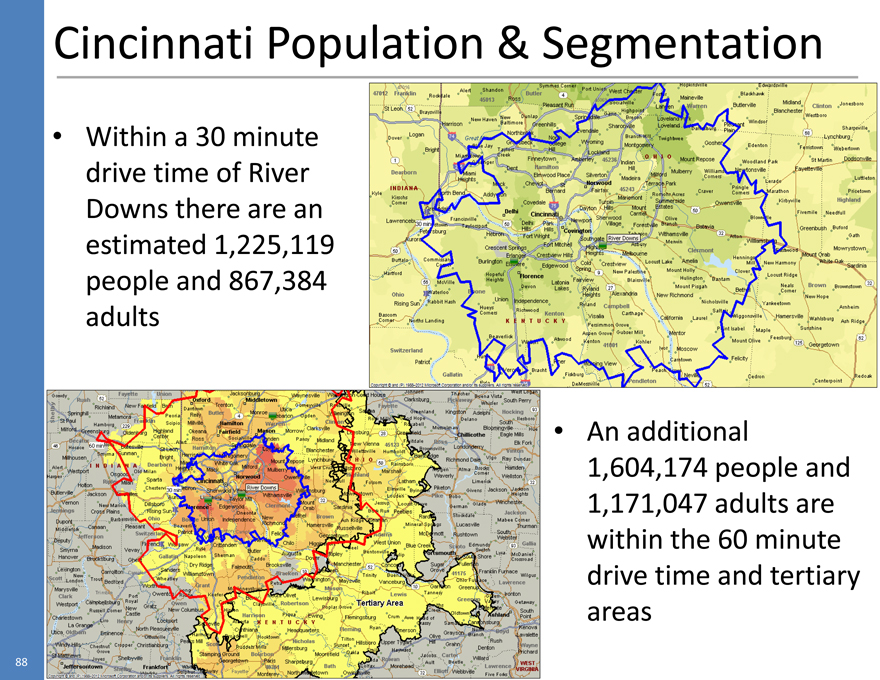

Cincinnati Population & Segmentation

Within a 30 minute drive time of River Downs there are an estimated 1,225,119 people and 867,384 adults

An additional 1,604,174 people and 1,171,047 adults are within the 60 minute drive time and tertiary areas

88

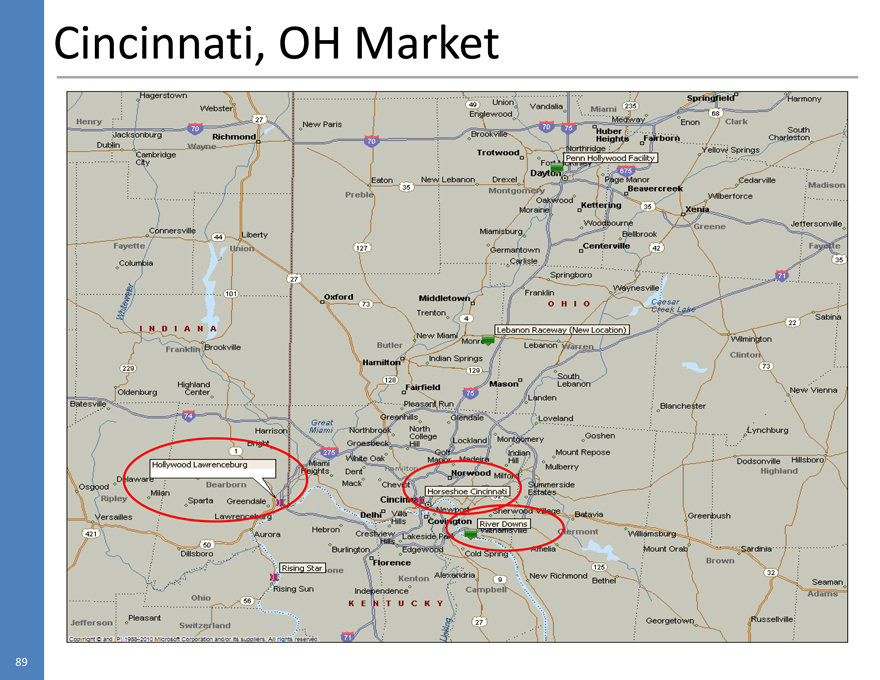

Cincinnati, OH Market

89

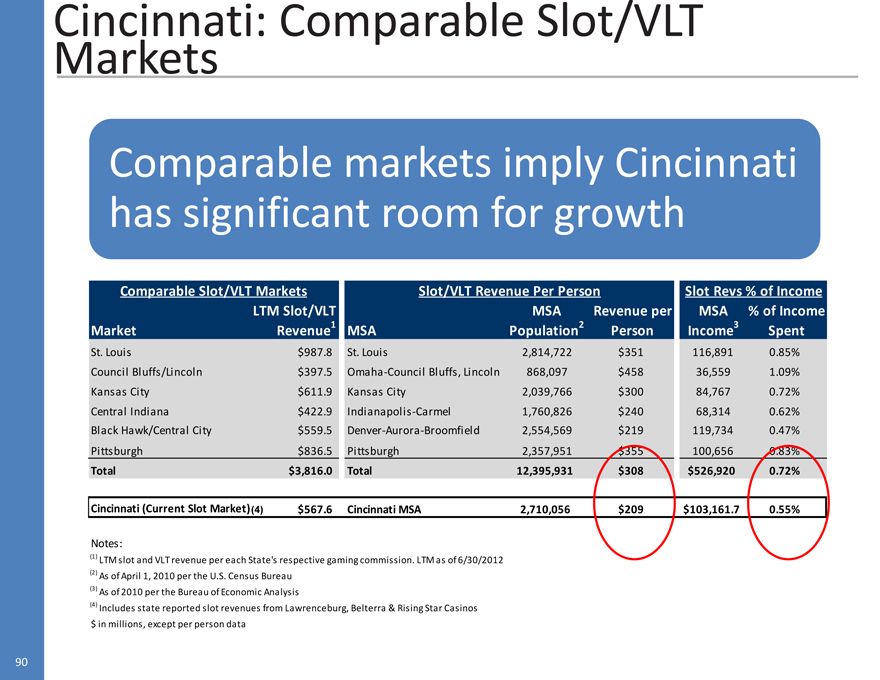

Cincinnati: Comparable Slot/VLI

Markets

Comparable markets imply Cincinnati has significant room for growth

Comparable Slot/VLT Markets Slot/VLT Revenue Per Person Slot Revs % of Income LTM Slot/VLT MSA Revenue per MSA % of Income Market Revenue1 MSA Population2 Person Income3 Spent

St. Louis $987.8 St. Louis 2,814,722 $351 116,891 0.85% Council Bluffs/Lincoln $397.5 Omaha-Council Bluffs, Lincoln 868,097 $458 36,559 1.09% Kansas City $611.9 Kansas City 2,039,766 $300 84,767 0.72% Central Indiana $422.9 Indianapolis-Carmel 1,760,826 $240 68,314 0.62% Black Hawk/Central City $559.5 Denver-Aurora-Broomfield 2,554,569 $219 119,734 0.47% Pittsburgh $836.5 Pittsburgh 2,357,951 $355 100,656 0.83%

Total $3,816.0 Total 12,395,931 $308 $526,920 0.72%

Cincinnati (Current Slot Market)(4) $567.6 Cincinnati MSA 2,710,056 $209 $103,161.7 0.55%

Notes:

(1) LTM slot and VLT revenue per each State’s respective gaming commission. LTM as of 6/30/2012 (2) As of April 1, 2010 per the U.S. Census Bureau (3) As of 2010 per the Bureau of Economic Analysis (4) Includes state reported slot revenues from Lawrenceburg, Belterra & Rising Star Casinos $ in millions, except per person data

90

Project Rationale

Site Accessibility

Located approximately 30 seconds off of I-275 Beltway’s Kellogg Ave exit

Suburban location

Surrounded by Cincinnati’s best demographic zip codes

Established market presence

Belterra’s established regional database in Ohio and Northern Kentucky

Belterra synergies

Ability to position and cross market two unique properties

Adjacent entertainment amenities

Ability to leverage visitation to neighboring 21,000 seat concert venue and water park

mychoice

Extend the mychoice player loyalty program database; leverage its partnerships

Leverage experience in the region

Leverage experience operating casinos in the Cincinnati market

Diversification

Diversifies enterprise operating base

91

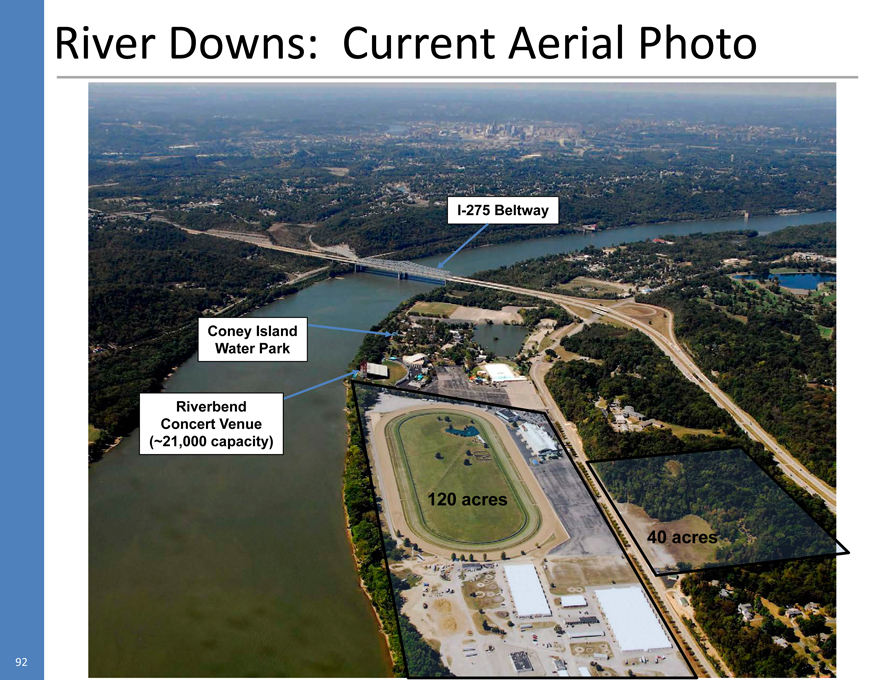

River Downs: Current Aerial Photo

I-275 Beltway

Coney Island Water Park

Riverbend Concert Venue (~21,000 capacity)

120 acres

40 acres

92

River Downs Project Summary

Construction Budget

$250-$280 million, including license fees, over multiple phases

Phase 1:

Amenities: at least 1,250 video lottery terminals, food & beverage outlets, at least 1,400 parking spaces

Commencement: 3Q12

Completion: by the end of 2013

Phase 2 and beyond:

Additional VLTs

Additional food & beverage venues

Additional guest parking

93 Note: Ohio VLT license fee = $50 million

Asian Coast Development (ACDL)

Anthony Sanfilippo, President & CEO

94

ACDL Overview

First of its kind Investment Certificate in Vietnam Robust tourism and gaming market in Asia Addressable mass market segments Favorable expected gaming tax environment

PNK management agreement until 2058, with a 20 year extension

95

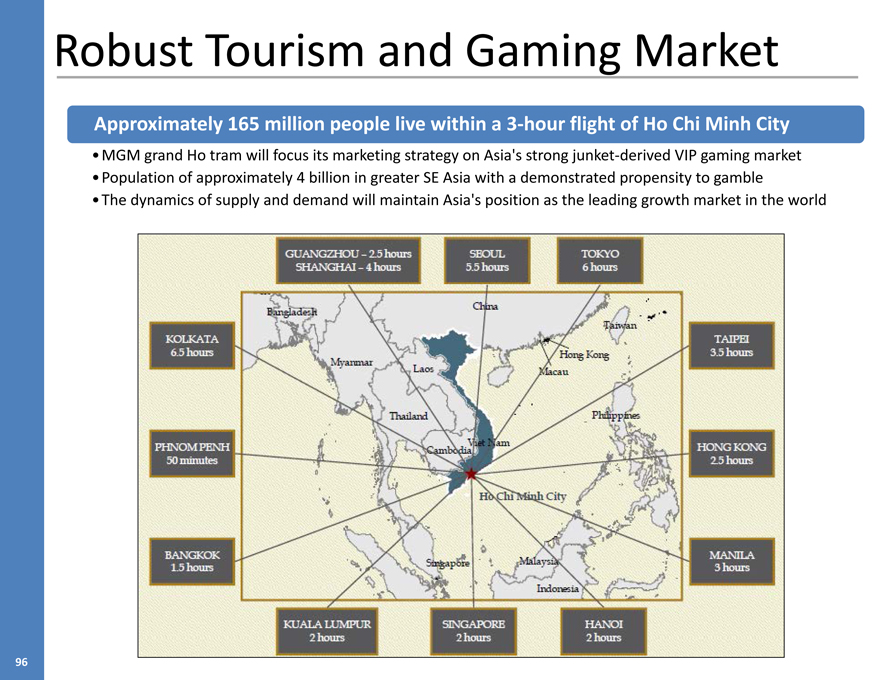

Robust Tourism and Gaming Market

Approximately 165 million people live within a 3-hour flight of Ho Chi Minh City

MGM grand Ho tram will focus its marketing strategy on Asia’s strong junket-derived VIP gaming market

Population of approximately 4 billion in greater SE Asia with a demonstrated propensity to gamble

The dynamics of supply and demand will maintain Asia’s position as the leading growth market in the world

96

Asia Market Supply

Asia

People 3,300,000,000 Gaming Positions 92,172

People / Position 35,803 National Income $12.91T

United States

People 307,000,000 Gaming Positions 454,916

People / Position 675 National Income $12.83T

Phnom Penh

Casinos: 1 Positions: 2,320

Malaysia

Casinos: 1 Positions: 6,500

Singapore

Casinos: 2 Positions: 6.900

S. Korea

Casinos: 19 Positions: 5,700

Macau

Casinos: 38 Positions: 56,710

Philippines

Casinos: 24 Positions: 18,486

Cambodia (border)

Casinos: 16 Positions: 8,980

97

Tax structure is a key competitive advantage

Vietnam offers an attractive taxation environment Gaming taxes

Expect junket commissions and rebates to be deductible, substantially lowering the effective gaming tax rate

30% gaming revenue tax

Junket commission deductibility permits more competitive junket commissions compared to other regional operators

Enterprise income taxes

25% tax on gaming derived profits

2-year tax holiday on non-gaming taxable income

10% tax rate on non-gaming income for the following 3 years, 20% for subsequent 5 years, 25% thereafter

98

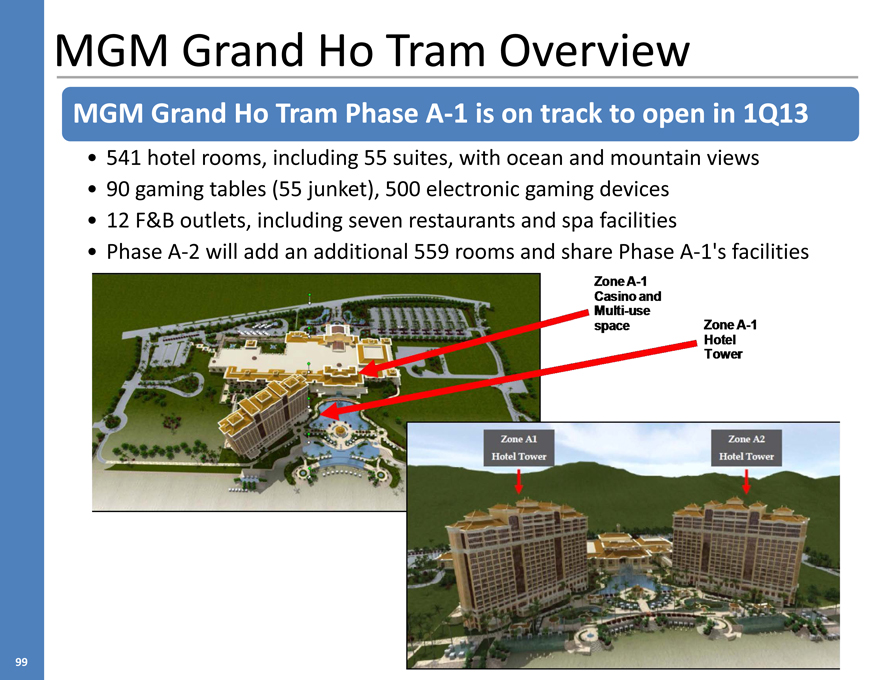

MGM Grand Ho Tram Overview

MGM Grand Ho Tram Phase A-1 is on track to open in 1Q13

541 hotel rooms, including 55 suites, with ocean and mountain views

90 gaming tables (55 junket), 500 electronic gaming devices

12 F&B outlets, including seven restaurants and spa facilities

Phase A-2 will add an additional 559 rooms and share Phase A-1’s facilities

99

MGM Grand Ho Tram Progress

100

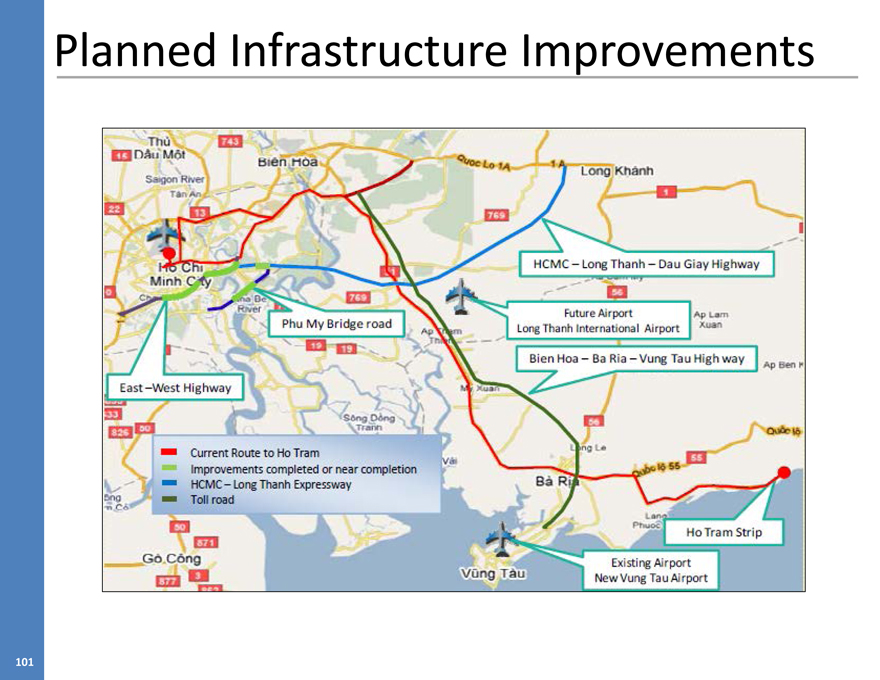

Planned Infrastructure Improvements

101

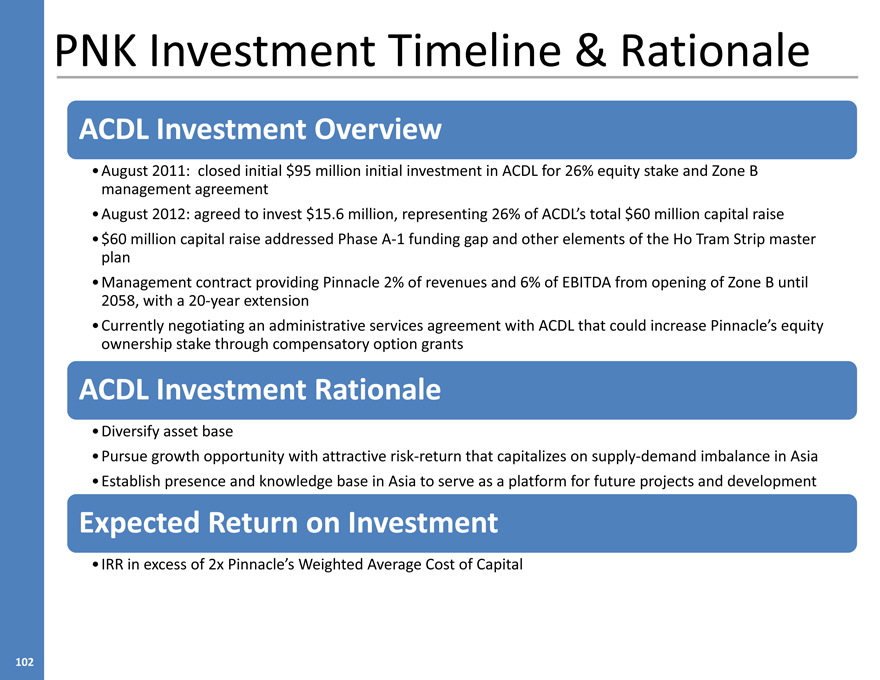

PNK Investment Timeline & Rationale

ACDL Investment Overview

August 2011: closed initial $95 million initial investment in ACDL for 26% equity stake and Zone B management agreement

August 2012: agreed to invest $15.6 million, representing 26% of ACDL’s total $60 million capital raise

$60 million capital raise addressed Phase A-1 funding gap and other elements of the Ho Tram Strip master plan

Management contract providing Pinnacle 2% of revenues and 6% of EBITDA from opening of Zone B until 2058, with a 20-year extension

Currently negotiating an administrative services agreement with ACDL that could increase Pinnacle’s equity ownership stake through compensatory option grants

ACDL Investment Rationale

Diversify asset base

Pursue growth opportunity with attractive risk-return that capitalizes on supply-demand imbalance in Asia

Establish presence and knowledge base in Asia to serve as a platform for future projects and development

Expected Return on Investment

IRR in excess of 2x Pinnacle’s Weighted Average Cost of Capital

102

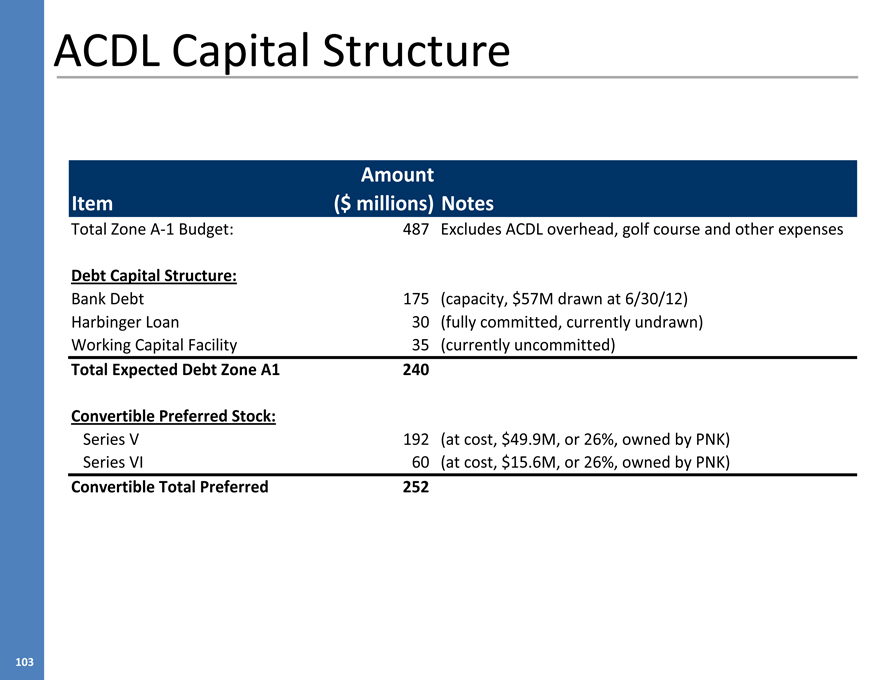

ACDL Capital Structure

Amount Item ($ millions) Notes

Total Zone A-1 Budget: 487 Excludes ACDL overhead, golf course and other expenses

Debt Capital Structure:

Bank Debt 175 (capacity, $57M drawn at 6/30/12) Harbinger Loan 30 (fully committed, currently undrawn) Working Capital Facility 35 (currently uncommitted)

Total Expected Debt Zone A1 240

Convertible Preferred Stock:

Series V 192 (at cost, $49.9M, or 26%, owned by PNK) Series VI 60 (at cost, $15.6M, or 26%, owned by PNK)

Convertible Total Preferred 252

103

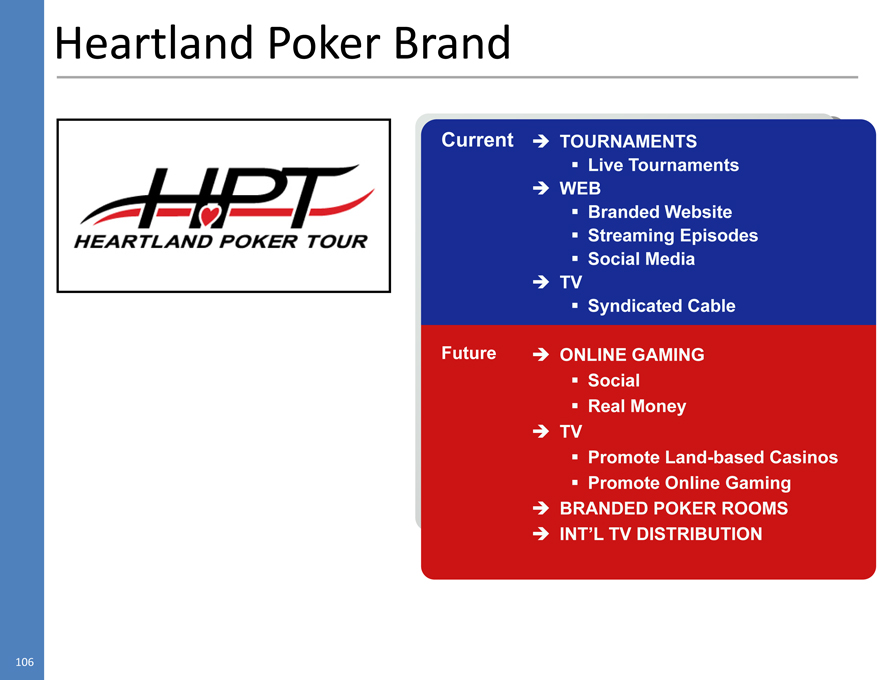

Heartland Poker Tour

104

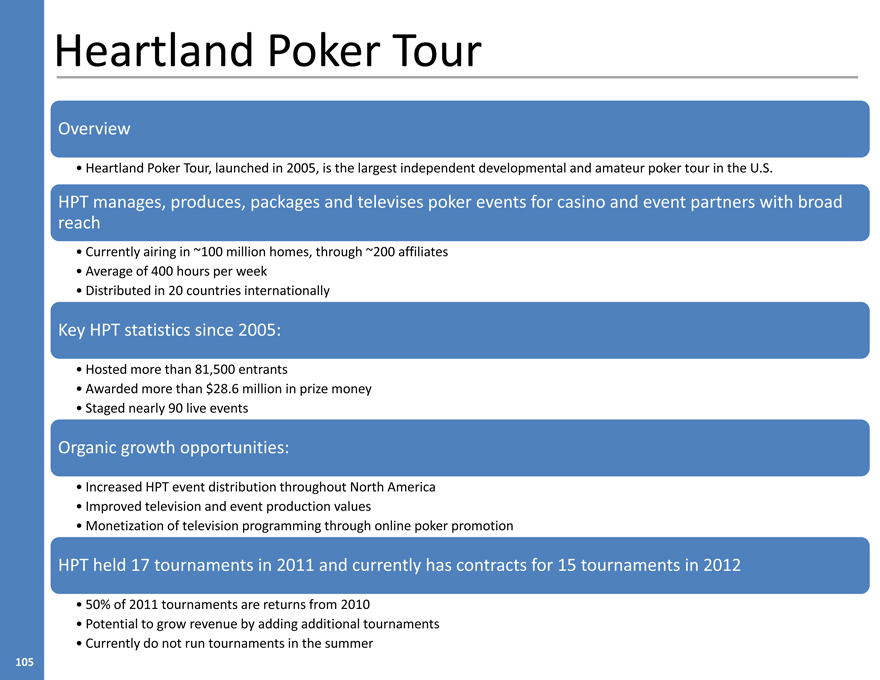

Heartland Poker Tour

Overview

Heartland Poker Tour, launched in 2005, is the largest independent developmental and amateur poker tour in the U.S.

HPT manages, produces, packages and televises poker events for casino and event partners with broad reach

Currently airing in ~100 million homes, through ~200 affiliates

Average of 400 hours per week Distributed in 20 countries internationally

Key HPT statistics since 2005:

Hosted more than 81,500 entrants

Awarded more than $28.6 million in prize money

Staged nearly 90 live events

Organic growth opportunities:

Increased HPT event distribution throughout North America

Improved television and event production values

Monetization of television programming through online poker promotion

HPT held 17 tournaments in 2011 and currently has contracts for 15 tournaments in 2012

50% of 2011 tournaments are returns from 2010

Potential to grow revenue by adding additional tournaments

Currently do not run tournaments in the summer

105

Heartland Poker Brand

HEARTLAND POKER TOUR

Current

TOURNAMENTS

Live Tournaments

WEB

Branded Website

Streaming Episodes

Social Media

TV

Syndicated Cable

Future

ONLINE GAMING

Social

Real Money

TV

Promote Land-based Casinos

Promote Online Gaming

BRANDED POKER ROOMS

INT’L TV DISTRIBUTION

106

Non-EBITDA Producing Assets

Carlos Ruisanchez, EVP & Chief Financial Officer

107

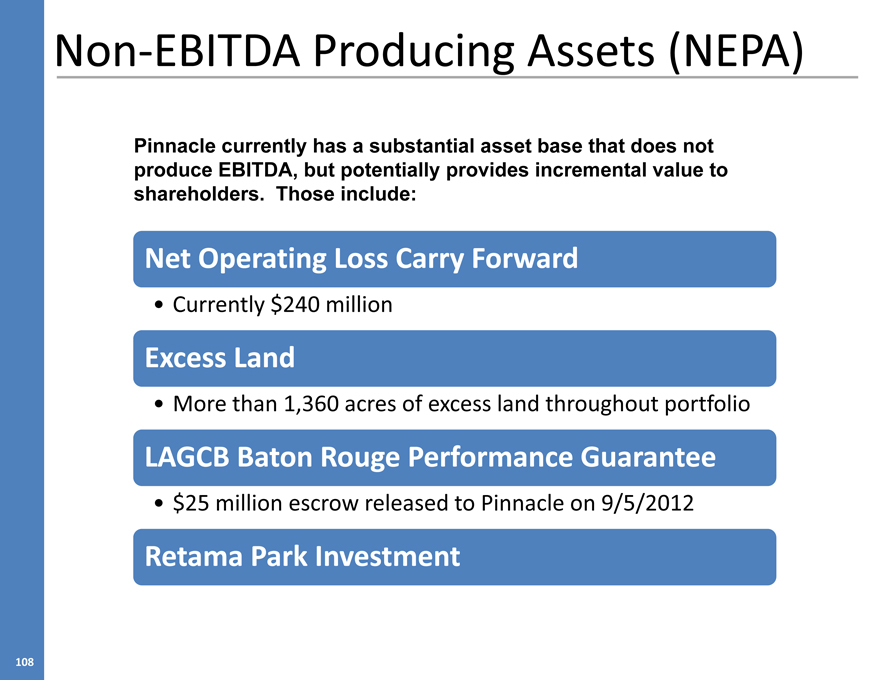

Non-EBITDA Producing Assets (NEPA)

Pinnacle currently has a substantial asset base that does not produce EBITDA, but potentially provides incremental value to shareholders. Those include:

Net Operating Loss Carry Forward

Currently $240 million

Excess Land

More than 1,360 acres of excess land throughout portfolio

LAGCB Baton Rouge Performance Guarantee

$25 million escrow released to Pinnacle on 9/5/2012

Retama Park Investment

108

NOLs to Benefit Cash Flow

Pinnacle currently has $240 million of net operating loss carry forwards to limit taxes paid in the 2012 tax year and beyond

LTM pre-tax income of $44.5 million expected to grow meaningfully in coming years

Total cumulative potential cash flow benefit of approximately $4.00 per share once benefits are fully realized

Tax rate of approximately 40.25%, comprised of a 35% Federal corporate rate and 5.25% state tax rate

109

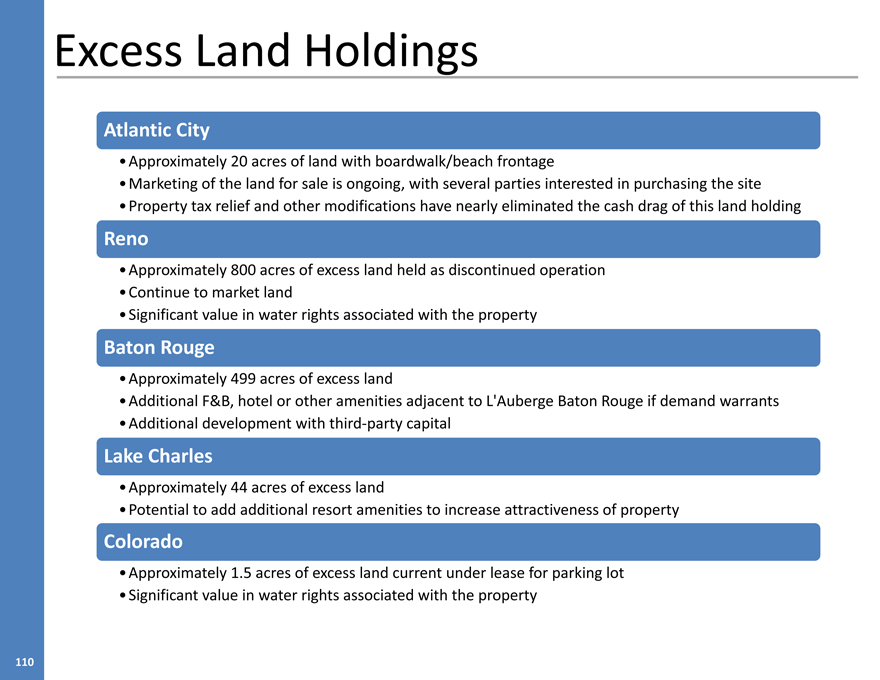

Excess Land Holdings

Atlantic City

Approximately 20 acres of land with boardwalk/beach frontage

Marketing of the land for sale is ongoing, with several parties interested in purchasing the site

Property tax relief and other modifications have nearly eliminated the cash drag of this land holding

Reno

Approximately 800 acres of excess land held as discontinued operation

Continue to market land

Significant value in water rights associated with the property

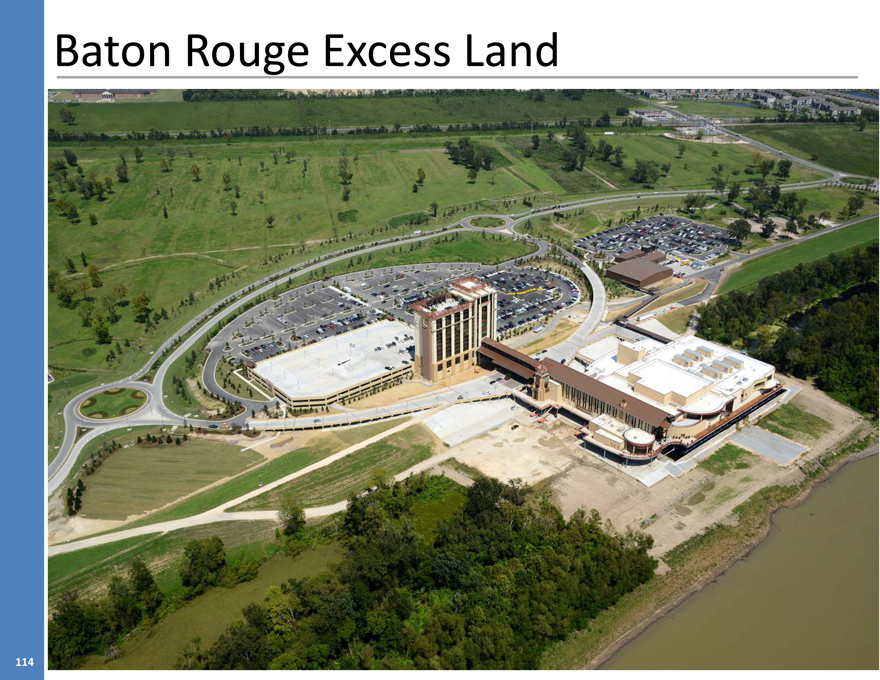

Baton Rouge

Approximately 499 acres of excess land

Additional F&B, hotel or other amenities adjacent to L’Auberge Baton Rouge if demand warrants

Additional development with third-party capital

Lake Charles

Approximately 44 acres of excess land

Potential to add additional resort amenities to increase attractiveness of property

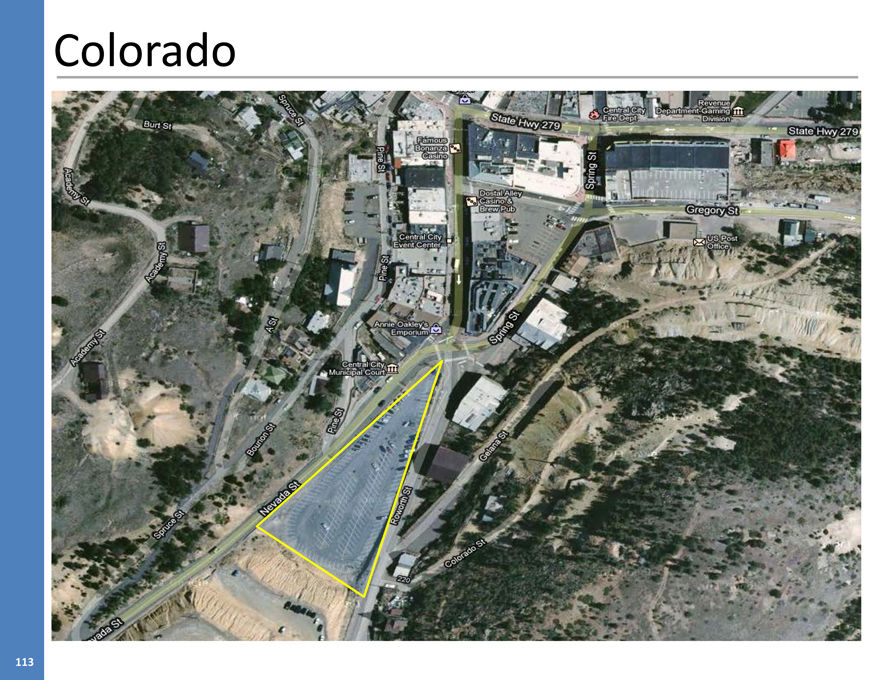

Colorado

Approximately 1.5 acres of excess land current under lease for parking lot

Significant value in water rights associated with the property

110

Reno

111

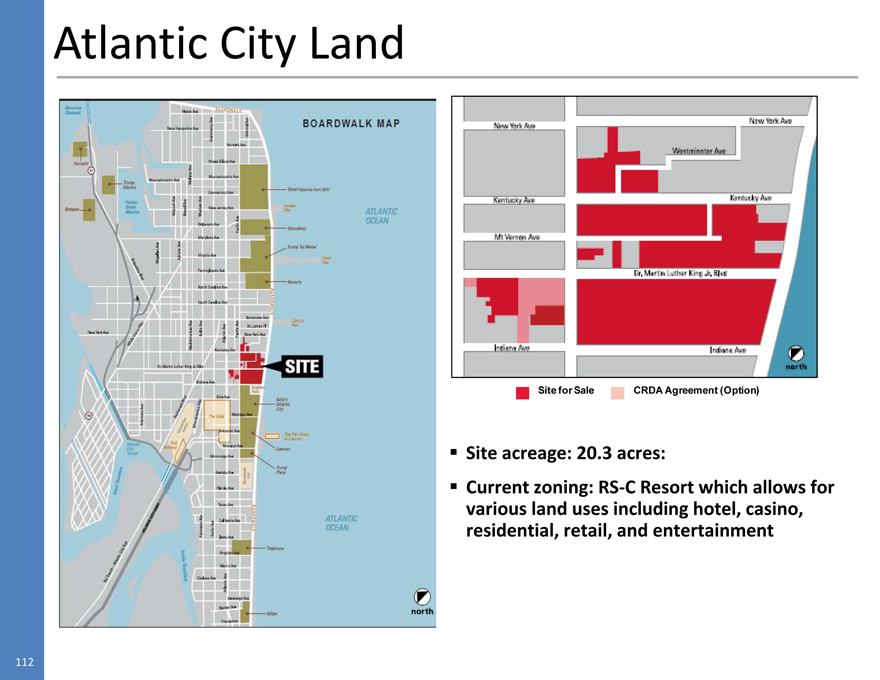

Atlantic City Land

Site for Sale

CRDA Agreement (Option)

Site acreage: 20.3 acres:

Current zoning: RS-C Resort which allows for various land uses including hotel, casino, residential, retail, and entertainment

112

Colorado

113

Baton Rouge Excess Land

114

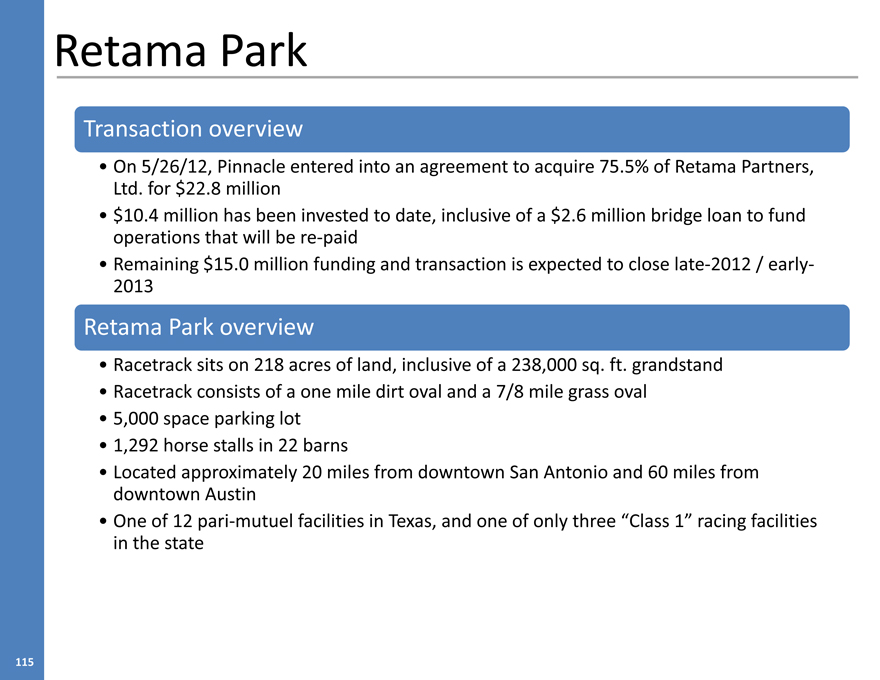

Retama Park

Transaction overview

On 5/26/12, Pinnacle entered into an agreement to acquire 75.5% of Retama Partners, Ltd. for $22.8 million

$10.4 million has been invested to date, inclusive of a $2.6 million bridge loan to fund operations that will be re-paid

Remaining $15.0 million funding and transaction is expected to close late-2012 / early-2013

Retama Park overview

Racetrack sits on 218 acres of land, inclusive of a 238,000 sq. ft. grandstand

Racetrack consists of a one mile dirt oval and a 7/8 mile grass oval

5,000 space parking lot

1,292 horse stalls in 22 barns

Located approximately 20 miles from downtown San Antonio and 60 miles from downtown Austin

One of 12 pari-mutuel facilities in Texas, and one of only three “Class 1” racing facilities in the state

115

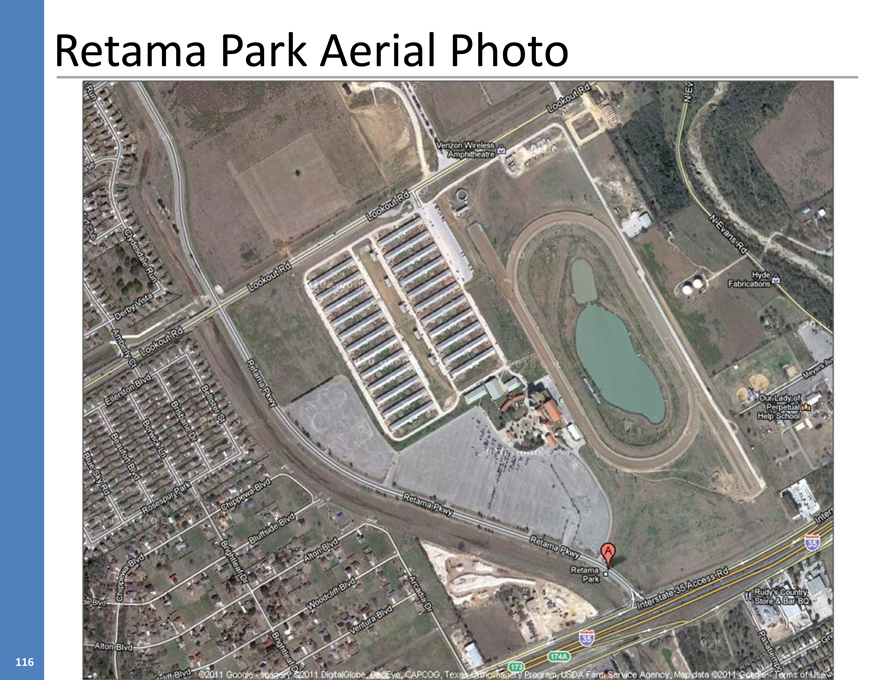

Retama Park Aerial Photo

116

Retama Park

Retama Park Investment Rationale:

One of only three Class 1 pari-mutuel facilities in Texas

Extends growth pipeline in the event of gaming legalization at Texas pari-mutuel facilities

Ability to market L’Auberge Lake Charles to Austin & San Antonio markets via Retama Park

Large addressable population, with 3.8 million people in the Austin & San Antonio metroplex

Significant real estate value provides a value floor for investment

Capitalizes on institutional knowledge of Texas markets and regional operating experience

Potential hedge on Texas exposure in the current portfolio

Diversifies operating base

117

Closing Remarks

Anthony Sanfilippo, President & CEO

118

Closing Remarks

We have come a long way in only two and a half years and we intend to take the company to new heights

Leadership team, culture, infrastructure are valuable assets of the company

Great growth prospects with strong cash flow dynamics

Diversified portfolio with strong market positions

Strong balance sheet and getting stronger

Thank you for your time and interest in our Company

119

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin are non-GAAP measurements. The Company defines Consolidated Adjusted EBITDA as earnings before interest income and expense, income taxes, depreciation, amortization, pre-opening and development expenses, non-cash share-based compensation, asset impairment costs, write-downs, reserves, recoveries, corporate-level litigation settlement costs, gain (loss) on sale of certain assets, loss on early extinguishment of debt, gain (loss) on sale of equity security investments, minority interest and discontinued operations. The Company defines Consolidated Adjusted EBITDA margin as Consolidated Adjusted EBITDA divided by revenues on a consolidated basis. Not all of the aforementioned benefits and costs occur in each reporting period, but have been included in the definition based on historical activity.

The Company uses Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin as relevant and useful measures to compare operating results between accounting periods. The presentation of Consolidated Adjusted EBITDA has economic substance because it is used by management as a performance measure to analyze the performance of its business and is especially relevant in evaluating large, long-lived casino-hotel projects because it provides a perspective on the current effects of operating decisions separated from the substantial, non-operational depreciation charges and financing costs of such projects. Management eliminates the results from discontinued operations as they are discontinued. Management also reviews pre-opening and development expenses separately, as such expenses are also included in total project costs when assessing budgets and project returns, and because such costs relate to anticipated future revenues and income. Management believes some investors consider Consolidated Adjusted EBITDA to be a useful measure in determining a company’s ability to service or incur indebtedness, service debt, and fund capital expenditures, acquisitions and operations and for estimating a company’s underlying cash flows from operations before capital costs, taxes and capital expenditures. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare operating performance and value of companies within our industry. Consolidated Adjusted EBITDA also approximates the measures used in the debt covenants within the Company’s debt agreements. Consolidated Adjusted EBITDA does not include depreciation or interest expense and therefore does not reflect current or future capital expenditures or the cost of capital. The Company compensates for these limitations by using other comparative measures to assist in the evaluation of operating performance.

EBITDA measures, such as Consolidated Adjusted EBITDA and Consolidated Adjusted EBITDA margin are not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure of comparing performance among different companies. See the attached “supplemental information” tables for a reconciliation of Consolidated Adjusted EBITDA to Income (loss) from continuing operations and a reconciliation of Consolidated Adjusted EBITDA margin to Income (loss) from continuing operations margin.

The Company defines Adjusted EBITDA for each operating segment as earnings before interest income and expense, income taxes, depreciation, amortization, pre-opening and development expenses, non-cash share-based compensation, asset impairment costs, write-downs, reserves, recoveries, gain (loss) on sale of certain assets, gain (loss) on early extinguishment of debt, gain (loss) on sale of discontinued operations, and discontinued operations. The Company defines Adjusted EBITDA margin for each operating segment as Adjusted EBITDA divided by revenues for such segment. The Company uses Adjusted EBITDA and Adjusted EBITDA margin to compare operating results among its properties and between accounting periods.

120

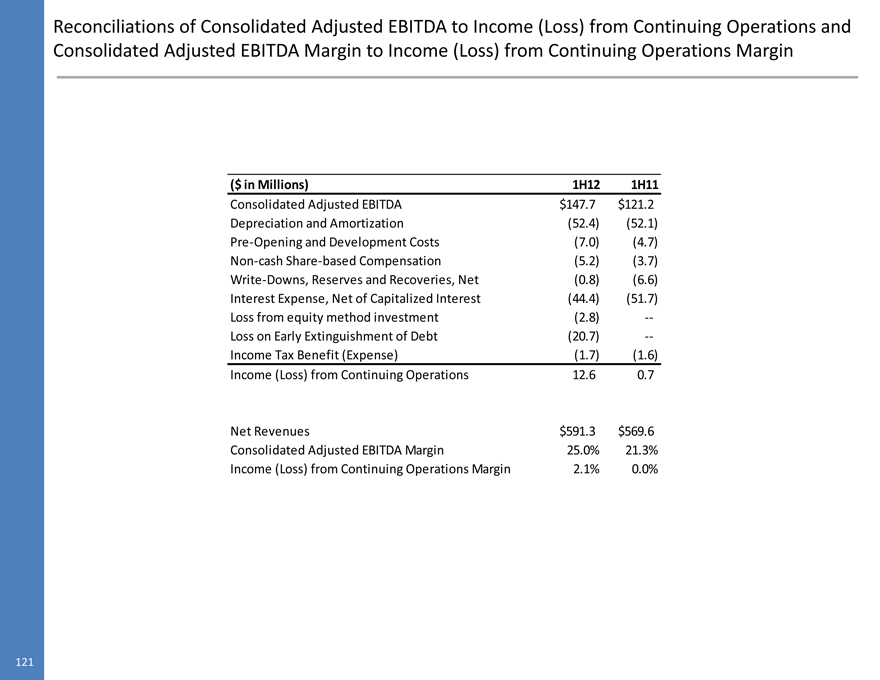

Reconciliations of Consolidated Adjusted EBITDA to Income (Loss) from Continuing Operations and Consolidated Adjusted EBITDA Margin to Income (Loss) from Continuing Operations Margin

($ in Millions) 1H12 1H11

Consolidated Adjusted EBITDA $147.7 $121.2 Depreciation and Amortization (52.4) (52.1) Pre-Opening and Development Costs (7.0) (4.7) Non-cash Share-based Compensation (5.2) (3.7) Write-Downs, Reserves and Recoveries, Net (0.8) (6.6) Interest Expense, Net of Capitalized Interest (44.4) (51.7) Loss from equity method investment (2.8) — Loss on Early Extinguishment of Debt (20.7) —Income Tax Benefit (Expense) (1.7) (1.6) Income (Loss) from Continuing Operations 12.6 0.7

Net Revenues $591.3 $569.6 Consolidated Adjusted EBITDA Margin 25.0% 21.3% Income (Loss) from Continuing Operations Margin 2.1% 0.0%

121

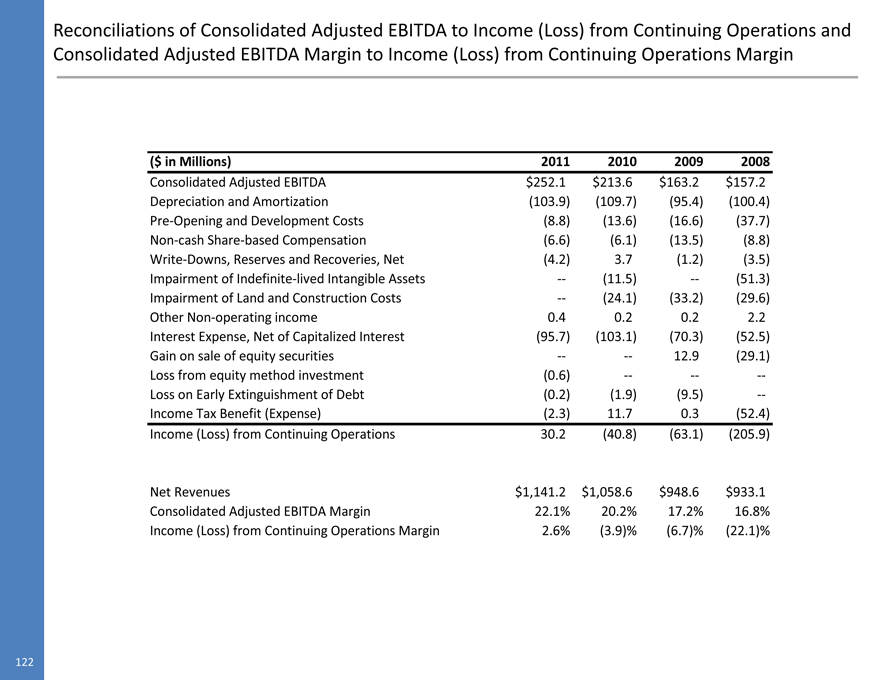

Reconciliations of Consolidated Adjusted EBITDA to Income (Loss) from Continuing Operations and Consolidated Adjusted EBITDA Margin to Income (Loss) from Continuing Operations Margin

($ in Millions) 2011 2010 2009 2008

Consolidated Adjusted EBITDA $252.1 $213.6 $163.2 $157.2 Depreciation and Amortization (103.9) (109.7) (95.4) (100.4) Pre-Opening and Development Costs (8.8) (13.6) (16.6) (37.7) Non-cash Share-based Compensation (6.6) (6.1) (13.5) (8.8) Write-Downs, Reserves and Recoveries, Net (4.2) 3.7 (1.2) (3.5) Impairment of Indefinite-lived Intangible Assets — (11.5) — (51.3) Impairment of Land and Construction Costs — (24.1) (33.2) (29.6) Other Non-operating income 0.4 0.2 0.2 2.2 Interest Expense, Net of Capitalized Interest (95.7) (103.1) (70.3) (52.5) Gain on sale of equity securities — — 12.9 (29.1) Loss from equity method investment (0.6) — — — Loss on Early Extinguishment of Debt (0.2) (1.9) (9.5) — Income Tax Benefit (Expense) (2.3) 11.7 0.3 (52.4) Income (Loss) from Continuing Operations 30.2 (40.8) (63.1) (205.9)

Net Revenues $1,141.2 $1,058.6 $948.6 $933.1 Consolidated Adjusted EBITDA Margin 22.1% 20.2% 17.2% 16.8% Income (Loss) from Continuing Operations Margin 2.6% (3.9)% (6.7)% (22.1)%

122