Exhibit 99.2

PINNACLE

ENTERTAINMENT

Sale of Real Estate to Gaming and Leisure Properties, Inc.

July 21, 2015

Disclaimer

Forward Looking Statements

All statements included in this presentation, other than historical information or statements of historical fact, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Words such as, but not limited to, “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “could,” “may,” “will,” “should,” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements, may include, without limitation, statements regarding (A) the transaction between the Company and Gaming and Leisure Properties, Inc. (“GLPI”) whereby the Company would sell its real estate assets to GLPI, including the plans, projections and estimates regarding the Company (and any operating business of the Company that would be spun-off to stockholders) following a transaction with GLPI and the consummation of any transaction and the timing thereof; the ability of the Company to complete the contemplated financing transactions and reorganizations in connection with the transaction, and the ability of the Company to obtain required regulatory approvals and a private letter ruling from the IRS regarding the transaction; the stock price of the Company and GLPI following the consummation of a transaction with GLPI; the potential advantages, benefits and impact of, and opportunities created by, the transaction, the strategy and growth of the resulting companies, and the future earnings and profits of the resulting companies (including the Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDAR, and Free Cash Flows); and (B) with respect to the Company’s business generally, expected results of operations and future operating performance and future growth (including the Company’s 2015 projected Net Revenue, Year End Debt, Implied Total Leverage ratio, and Consolidated Adjusted EBITDA), adequacy of resources to fund development and expansion projects, liquidity, financing options, including the state of the capital markets and our ability to access the capital markets, the state of the credit markets and economy, cash needs, cash reserves, operating and capital expenses, expense reductions, the sufficiency of insurance coverage, anticipated marketing costs at various projects, the future outlook of the Company and the gaming industry and pending regulatory and legal matters, the ability of the Company to continue to meet its financial and other covenants governing its indebtedness, the Company’s anticipated future capital expenditures, the ability to implement strategies to improve revenues and operating margins at the Company’s properties, reduce costs and debt, the Company’s ability to successfully implement marketing programs to increase revenue at the Company’s properties, the Company’s ability to improve operations and performance at Belterra Park Gaming and Entertainment Center, and Boomtown New Orleans and the potential impact of the Golden Nugget’s Lake Charles resort on the Company’s results of operations. All forward-looking statements rely on a number of assumptions, estimates and data concerning future results and events and are subject to a number of uncertainties and other factors, many of which are outside the Company’s control that could cause actual results to differ materially from actual those reflected in such statements. There is no assurance that a transaction with GLPI will be completed on any particular timeframe or at all. Accordingly, Pinnacle cautions that the forward-looking statements contained herein are qualified by these and other important factors and uncertainties that could cause results to differ materially from those reflected by such statements. Additional factors and uncertainties include, but are not limited to: the Company’s sensitivity to reductions in consumers’ discretionary spending as a result of downturns in the economy; significant competition in the gaming industry in all of the Company’s markets, which could adversely affect the Company’s revenues and profitability; harm to the Company from cyber security attacks, which could adversely affect the Company’s revenues and profitability; the implementation and operational complexities regarding the transaction with GLPI, including obtaining required regulatory approvals, financings and possible internal reorganizations; the operating and financial restrictions on the Company imposed by the terms of the Company’s credit facility and the indentures governing its senior and subordinated indebtedness; and other risks, including those as may be detailed from time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). For more information on the potential factors that could affect the Company’s financial results and business, review the Company’s filings with the SEC, including, but not limited to, its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K.

The guidance in this presentation is only effective as of the date given, and will not be updated or affirmed unless and until the Company publicly announces updated or affirmed guidance. The Company undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect actual outcomes.

References in this press release to “Pinnacle Entertainment, Inc.,” “Pinnacle, “ “Company,” “we,” “our” or “us” refer to Pinnacle Entertainment, Inc. and its subsidiaries, except where stated or the context otherwise indicates. Ameristar, Belterra, Boomtown, Casino Magic, Heartland Poker Tour, L’Auberge, River City, and Belterra Park are registered trademarks of Pinnacle Entertainment, Inc. All rights reserved.

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles (“GAAP”), the Company uses non-GAAP financial measures that exclude certain items. Non-GAAP financial measures are not prepared in accordance with GAAP and are not calculated in the same way by all companies; therefore, this information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, financial measures calculated in accordance with GAAP. The Company has provided guidance with respect to Consolidated Adjusted EBITDA, which is a non-GAAP financial measure and certain illustrative financial analysis based on, among other things Consolidated Adjusted EBITDA, EBITDAR and Free Cash Flows, which are also non-GAAP financial measures. The Company has not provided a reconciliation of these preliminary and forward-looking non-GAAP financial measures due to the difficulty in forecasting and quantifying the exact amount of the items to be excluded from the non-GAAP financial measures that will be included in the comparable GAAP financial measures for those future periods. Reconciliations of historical non-GAAP financials can be found at Pages 34 and 35 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and Pages 28 and 29 of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015.

Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA Margin, EBITDAR and Free Cash Flows are non-GAAP measurements. The Company defines Consolidated Adjusted EBITDA as earnings before interest income and expense, income taxes, depreciation, amortization, pre-opening, development and other costs, non-cash share-based compensation, asset impairment costs, write-downs, reserves, recoveries, corporate-level litigation settlement costs, gain (loss) on sale of certain assets, loss on early extinguishment of debt, gain (loss) on sale of equity security investments, income (loss) from equity method investments, non-controlling interest and discontinued operations. The Company defines Consolidated Adjusted EBITDA margin as Consolidated Adjusted EBITDA divided by revenues on a consolidated basis. The Company defines Consolidated Adjusted EBITDA, as adjusted, as Consolidated Adjusted EBITDA as defined above excluding expenses associated with the Lake Charles employee retention program and the negative impact of the flooding in Bossier City. The Company defines EBITDAR as Consolidated Adjusted EBITDA excluding rent expense associated with the Master Lease to be entered into with GLPI. The Company defines Free Cash Flow as Consolidated Adjusted EBITDA less rent, cash paid for interest expense, cash paid for taxes, and maintenance capital expenditures.

The Company uses these non-GAAP financial measures as relevant and useful measures to compare operating results between accounting periods. The presentation of these Non-GAAP financial measures have economic substance because they are used by management as a performance measure to analyze the performance of its business and is especially relevant in evaluating large, long-lived casino-hotel projects because it provides a perspective on the current effects of operating decisions separated from the substantial, non-operational depreciation charges and financing costs of such projects. Management eliminates the results from discontinued operations as they are discontinued. Management also reviews pre-opening, development and other costs separately, as such expenses are also included in total project costs when assessing budgets and project returns, and because such costs relate to anticipated future revenues and income. Management believes that Consolidated Adjusted EBITDA is a useful measure for investors because it is an indicator of the strength and performance of ongoing business operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare operating performance and value of companies within our industry. Consolidated Adjusted EBITDA also approximates the measures used in the debt covenants within the Company’s debt agreements. Consolidated Adjusted EBITDA does not include depreciation or interest expense and therefore does not reflect current or future capital expenditures or the cost of capital. The Company compensates for these limitations by using other comparative measures to assist in the evaluation of operating performance.

1

Executive Summary

Pinnacle Entertainment, Inc. (“PNK” or “Pinnacle”) has entered into a definitive agreement with Gaming and Leisure Properties, Inc. (“GLPI”) regarding the sale leaseback of its real estate assets

Pinnacle will spin-off its operations to existing shareholders in a taxable transaction, thereby separating its operating assets (“Op Co”) and its real estate assets (“Prop Co”)

Pinnacle shareholders will receive one share of Op Co common stock per share of PNK common stock upon the spin-off

Transaction Pinnacle shareholders will receive a fixed exchange ratio of 0.85 shares of GLPI common stock per Overview share of PNK common stock as consideration for Prop Co

Pinnacle Op Co will continue to operate its gaming entertainment facilities, and will lease its properties under a triple-net master lease with GLPI with initial annual rent of $377 million

Pinnacle will continue to wholly-own Belterra Park and its real property, Retama Park, and in excess of 450 acres of developable land in Lake Charles and Baton Rouge adjacent to the leased property

The transaction is expected to close by the end of 1Q16, subject to customary closing conditions and regulatory approvals

Pinnacle’s core gaming business continues to exceed expectations in 2015, which further enhances the value creation opportunity at the spun-off Op Co

2015 Herein, financial guidance is provided for 2Q15 and FY 2015, including:

Guidance 2Q15 Net Revenue of approximately $582.0 million and Consolidated Adj. EBITDA, as adjusted, of approximately $155.4 million1

2015 full year Consolidated Adj. EBITDA guidance range of $630 to $640 million

(1) The 2015 second quarter was negatively impacted by $0.6 million of Lake Charles retention program costs and by $0.6 million from flooding at Bossier City

2

Transaction Rationale

1 Monetizes real estate and accelerates separation from Pinnacle’s operating business

Unlocks Unlocks significant embedded real estate value with total consideration of approximately $5.0 billion Value of Pinnacle shareholders to receive $29.63 per share of GLPI stock for its real estate1

Real Estate

Accelerates the planned separation of Pinnacle’s real estate from its operating assets to 1Q16, or sooner, and provides greater certainty of real estate value realization

Pinnacle Op Co will be well capitalized with significant growth potential

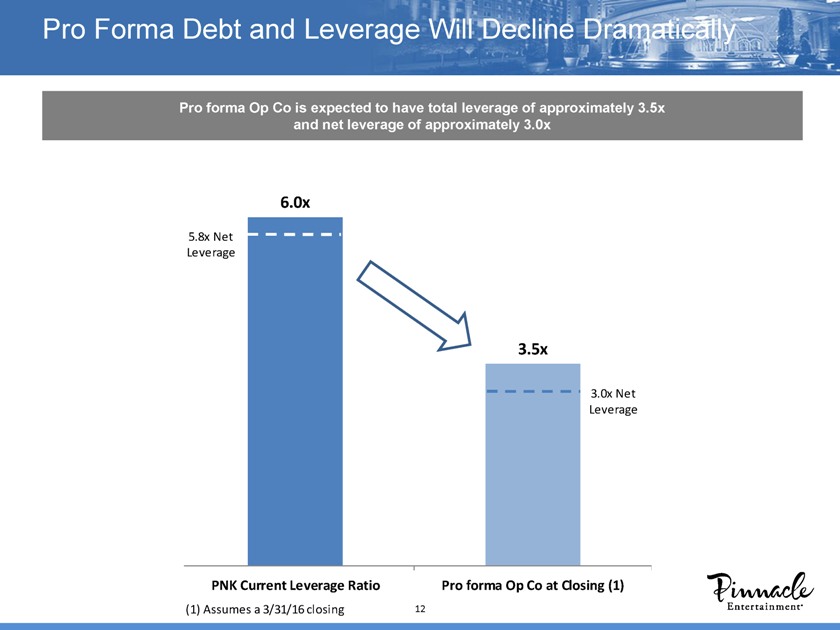

2Significantly reduced debt balance with expected pro forma total leverage of approximately 3.5x and net leverage of 3.0x at closing

Creates Well

Strong pro forma free cash flow at Op Co in excess of $100 million

Positioned

Operating Continued focus on operational excellence and maximizing property financial performance

Company

Well positioned to benefit from improving regional gaming demand trends? Financial flexibility to capitalize on internal and external growth opportunities? Experienced management team with a proven track record

Ownership in a substantially larger, more diversified triple-net lease REIT

3 27% pro ownership in Pinnacle shareholders can benefit from transaction accretion through forma

Ownership in a GLPI Larger, More

Diversified REIT GLPI will have enhanced scale and diversification through the combination of two high quality real estate portfolios, creating the third largest triple-net lease REIT

GLPI is well positioned to leverage its stable cash flows, large scale and established platform to grow

(1) Based upon GLPI’s closing share price of $34.86 on July 17, 2015 and 0.85 exchange ratio

3

Transaction Details

Initial annual rent of $377 million

Key

Anticipated initial rent coverage of 1.9x (property-level)

Lease Terms

10 year initial term with five, five-year extension periods

GLPI will refinance $2.70 billion of principal amount of Pinnacle debt, with Op Co refinancing the remaining outstanding debt at closing

Pinnacle has secured committed debt financing to facilitate a refinancing for Op Co at closing

Financing

Pinnacle expects to incur all-in fees and expenses related to the transaction of approximately $70 million, net of expenses reimbursed by GLPI

There will be no equity issued by Pinnacle to finance this transaction

Sale leaseback transaction requires gaming regulatory approval

Op Co financing requires gaming regulatory approval

Approvals

PNK and GLPI shareholder approvals

Other customary regulatory approvals

4

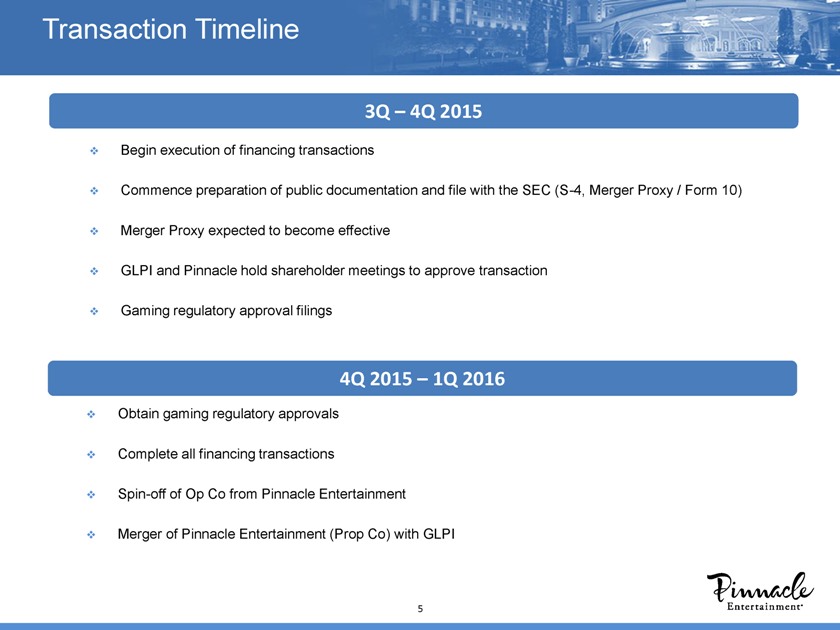

Transaction Timeline

3Q – 4Q 2015

Begin execution of financing transactions

Commence preparation of public documentation and file with the SEC (S-4, Merger Proxy / Form 10)Merger Proxy expected to become effective GLPI and Pinnacle hold shareholder meetings to approve transaction? Gaming regulatory approval filings

4Q 2015 – 1Q 2016

Obtain gaming regulatory approvals

Complete all financing transactions

Spin-off of Op Co from Pinnacle Entertainment

Merger of Pinnacle Entertainment (Prop Co) with GLPI

5

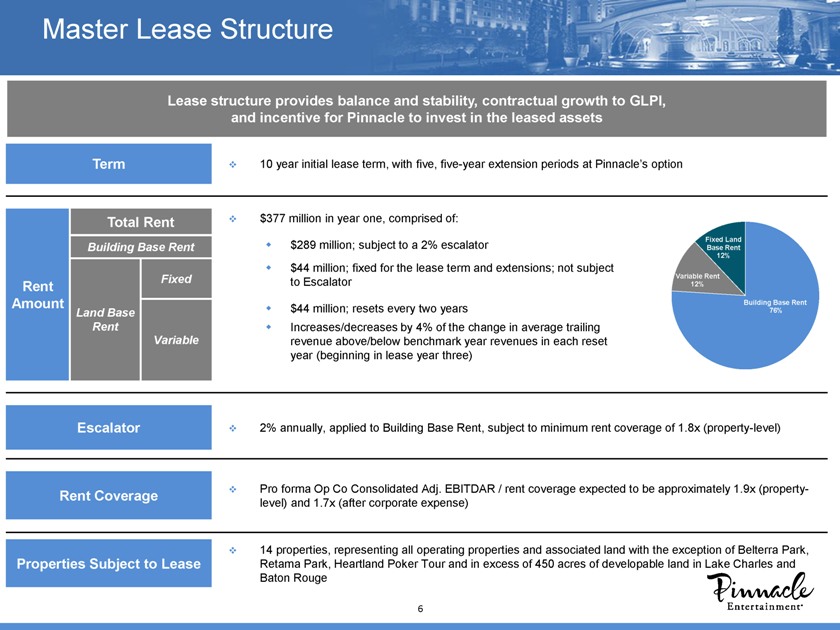

Master Lease Structure

Lease structure provides balance and stability, contractual growth to GLPI, and incentive for Pinnacle to invest in the leased assets

Term 10 year initial lease term, with five, five-year extension periods at Pinnacle’s option

Total Rent $377 million in year one, comprised of:

$289 million; subject to a 2% escalator ?Fixed Land

Building Base Rent Base Rent

12%

$44 million; fixed for the lease term and extensions; not subject

Fixed Variable Rent

Rent to Escalator 12%

Amount Building Base Rent

Land Base $44 million; resets every two years 76% Rent? Increases/decreases by 4% of the change in average trailing

Variable revenue above/below benchmark year revenues in each reset year (beginning in lease year three)

Escalator 2% annually, applied to Building Base Rent, subject to minimum rent coverage of 1.8x (property-level)

Pro forma Op Co Consolidated Adj. EBITDAR / rent coverage expected to be approximately 1.9x (property-

Rent Coverage

level) and 1.7x (after corporate expense)

14 properties, representing all operating properties and associated land with the exception of Belterra Park,

Properties Subject to Lease Retama Park, Heartland Poker Tour and in excess of 450 acres of developable land in Lake Charles and Baton Rouge

6

Overview of Pro Forma Pinnacle

High Quality, Diversified Portfolio

Pinnacle has a diverse operating base of high quality properties across 9 states and 12 distinct gaming markets

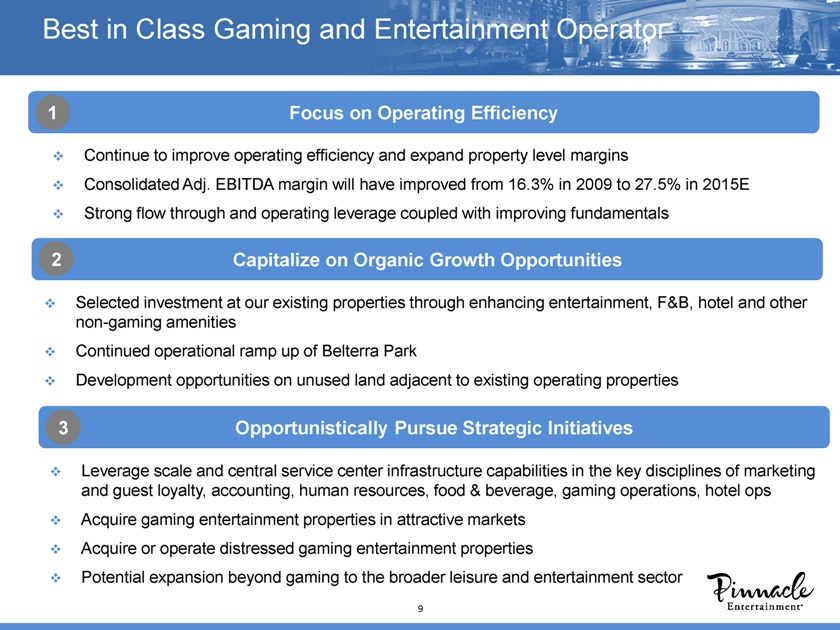

Best in Class Gaming and Entertainment Operator

1 Focus on Operating Efficiency

Continue to improve operating efficiency and expand property level margins

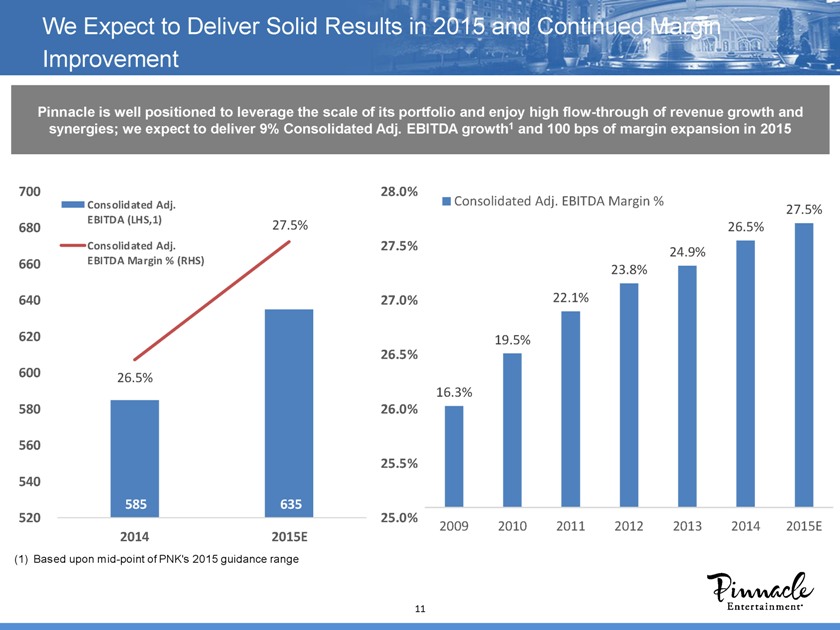

Consolidated Adj. EBITDA margin will have improved from 16.3% in 2009 to 27.5% in 2015E Strong flow through and operating leverage coupled with improving fundamentals

2 Capitalize on Organic Growth Opportunities

Selected investment at our existing properties through enhancing entertainment, F&B, hotel and other non-gaming amenities Continued operational ramp up of Belterra Park Development opportunities on unused land adjacent to existing operating properties

3 Opportunistically Pursue Strategic Initiatives

Leverage scale and central service center infrastructure capabilities in the key disciplines of marketing and guest loyalty, accounting, human resources, food & beverage, gaming operations, hotel ops Acquire gaming entertainment properties in attractive markets Acquire or operate distressed gaming entertainment properties Potential expansion beyond gaming to the broader leisure and entertainment sector

9

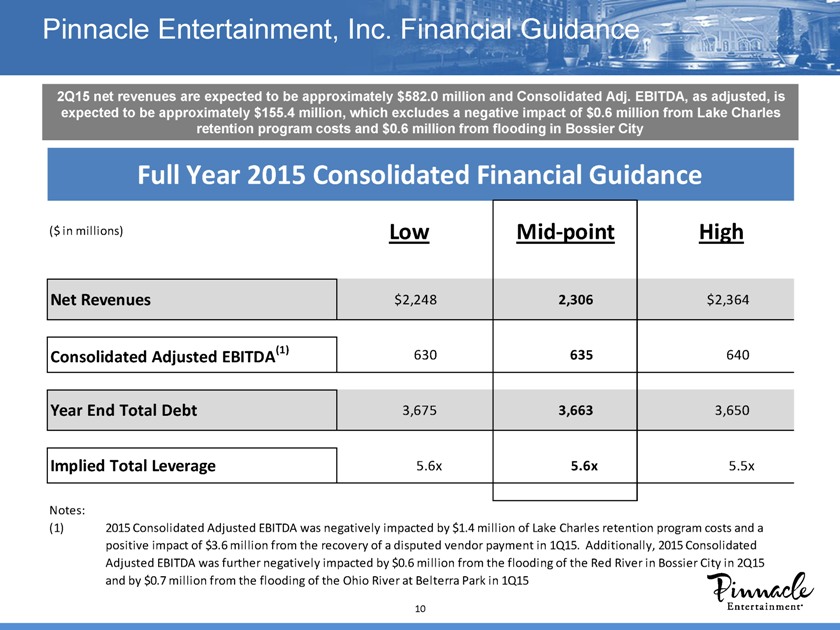

Pinnacle Entertainment, Inc. Financial Guidance

2Q15 net revenues are expected to be approximately $582.0 million and Consolidated Adj. EBITDA, as adjusted, is expected to be approximately $155.4 million, which excludes a negative impact of $0.6 million from Lake Charles retention program costs and $0.6 million from flooding in Bossier City

Full Year 2015 Consolidated Financial Guidance

($ in millions) Low Mid-point High

Net Revenues $2,248 2,306 $2,364 Consolidated Adjusted EBITDA(1) 630 635 640 Year End Total Debt 3,675 3,663 3,650 Implied Total Leverage 5.6x 5.6x 5.5x

Notes:

(1) 2015 Consolidated Adjusted EBITDA was negatively impacted by $1.4 million of Lake Charles retention program costs and a positive impact of $3.6 million from the recovery of a disputed vendor payment in 1Q15. Additionally, 2015 Consolidated Adjusted EBITDA was further negatively impacted by $0.6 million from the flooding of the Red River in Bossier City in 2Q15 and by $0.7 million from the flooding of the Ohio River at Belterra Park in 1Q15

10

We Expect to Deliver Solid Results in 2015 and Continued Margin Improvement

Pinnacle is well positioned to leverage the scale of its portfolio and enjoy high flow-through of revenue growth and synergies; we expect to deliver 9% Consolidated Adj. EBITDA growth1 and 100 bps of margin expansion in 2015

700 28.0%

Consolidated Adj. Consolidated Adj. EBITDA Margin %

27.5%

EBITDA (LHS,1) 27.5%

680 26.5%

Consolidated Adj. 27.5%

24.9%

660 EBITDA Margin % (RHS)

23.8%

640 27.0% 22.1%

620 19.5%

26.5%

600 26.5%

16.3%

580 26.0%

560

25.5% 540 585 635 520 25.0%

2014 2015E 2009 2010 2011 2012 2013 2014 2015E

(1) Based upon mid-point of PNK’s 2015 guidance range

11

Pro Forma Debt and Leverage Will Decline Dramatically

Pro forma Op Co is expected to have total leverage of approximately 3.5x and net leverage of approximately 3.0x

6.0x

5.8x Net Leverage

3.5x

3.0x Net Leverage

PNK Current Leverage Ratio Pro forma Op Co at Closing (1)

(1) Assumes a 3/31/16 closing 12

Attractive Pro Forma Free Cash Flow Generation

Pro forma Op Co free cash flow expected to remain strong and in excess of $100 million annually, positioning the balance sheet for investment, leverage reduction or return of capital to shareholders

$ 700 $ 635 $ 377 $ 600

$ 500

Equates to $ 400 approximately $1.50 per Op $ 300 Co share $ 38 $ 19 $ 200 $ 100 $ 101 $ 100

$ 0

EBITDAR (1) Less: Rent Less: Cash Less: Cash Less: Pro forma Interest Taxes (3) Maintenance Op Co Expense (2) CapEx Free Cash Flow $ in millions (1) The mid-point of PNK’s 2015 guidance range assuming no growth in 2016 (2) Assumes initial total leverage of approximately 3.5x (3) Assumes a tax rate of 40% of Op Co’s 2016 pro forma taxable income

13

Conclusions

Unlocks • Monetizes real estate and accelerates separation from

Value of Pinnacle’s operating business

Real Estate

Creates a Well

Capitalized • Pro forma Pinnacle will be well capitalized with significant growth potential

Operating Company

Ownership in a

Larger, More • Ownership in a substantially larger, more diversified triple-net lease REIT

Diversified REIT

14

Disclaimer

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction in connection with Pinnacle’s proposed merger with GLPI or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Information For Investors And Stockholders

In connection with the transactions referred to in this material, Gaming & Leisure Properties, Inc. (“GLPI”) expects to file a registration statement on Form S-4 with the Securities and Exchange Commission (“SEC”) containing a preliminary joint proxy statement of GLPI and Pinnacle that also constitutes a preliminary prospectus of GLPI. After the registration statement is declared effective GLPI and Pinnacle will mail a definitive proxy statement/prospectus to shareholders of GLPI and stockholders of Pinnacle. This material is not a substitute for the joint proxy statement/prospectus or registration statement or for any other document that GLPI or Pinnacle may file with the SEC and send to GLPI’s shareholders and/or Pinnacle’s stockholders in connection with the proposed transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus (when available) and other documents filed with the SEC by GLPI or Pinnacle through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by GLPI will be available free of charge on GLPI’s website at http://investors.glpropinc.com or by contacting GLPI’s Investor Relations Department at 610-401-2900. Copies of the documents filed with the SEC by Pinnacle will be available free of charge on Pinnacle’s website at http://investors.pnkinc.com or by contacting Pinnacle’s Investor Relations Department at 702-541-7777.

GLPI and Pinnacle and their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies with respect to the proposed transactions under the rules of the SEC. Information about the directors and executive officers of GLPI is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015, and its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on April 30, 2015. Information about the directors and executive officers of Pinnacle is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on March 2, 2015 and its proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 10, 2015. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC when they become available.

15