UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| | |

| FOR THE TRANSITION PERIOD FROM TO |

| |

| Commission file number 1‑8359 |

| |

| NEW JERSEY RESOURCES CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | |

| New Jersey | | 22‑2376465 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | |

| 1415 Wyckoff Road, Wall, New Jersey 07719 | | 732‑938‑1480 |

(Address of principal executive offices) | | (Registrant's telephone number, including area code) |

| | | |

| Securities registered pursuant to Section 12 (b) of the Act: |

| Common Stock ‑ $2.50 Par Value | | New York Stock Exchange |

| (Title of each class) | | (Name of each exchange on which registered) |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: x No: o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes: x No: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act.

|

| | | |

Large accelerated filer: x | Accelerated filer: o | Non-accelerated filer: o | Smaller reporting company: o |

| | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes: o No: x

The number of shares outstanding of $2.50 par value Common Stock as of May 2, 2014 was 42,136,052.

New Jersey Resources Corporation

TABLE OF CONTENTS

|

| | | |

| | | | Page |

| |

| |

| PART I. FINANCIAL INFORMATION | |

| | ITEM 1. | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | ITEM 2. | | |

| | ITEM 3. | | |

| | ITEM 4. | | |

| PART II. OTHER INFORMATION | |

| | ITEM 1. | | |

| | ITEM 1A. | | |

| | ITEM 2. | | |

| | ITEM 6. | | |

| | | | |

GLOSSARY OF KEY TERMS

|

| |

| AFUDC | Allowance for Funds Used During Construction |

| AIP | Accelerated Infrastructure Program |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| Bcf | Billion Cubic Feet |

| BGSS | Basic Gas Supply Service |

| BPU | New Jersey Board of Public Utilities |

| CIP | Conservation Incentive Program |

| CME | Chicago Mercantile Exchange |

| CR&R | Commercial Realty & Resources Corp. |

| Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act |

| DRP | NJR Direct Stock Purchase and Dividend Reinvestment Plan |

| EDA | New Jersey Economic Development Authority |

| EDA Bonds | Collectively, Series 2011A, Series 2011B and Series 2011C Bonds issued by the EDA |

| FASB | Financial Accounting Standards Board |

| FCM | Futures Commission Merchant |

| FERC | Federal Energy Regulatory Commission |

| FMB | First Mortgage Bonds |

| FRM | Financial Risk Management |

| GAAP | Generally Accepted Accounting Principles of the United States |

| ICE | Intercontinental Exchange |

| Iroquois | Iroquois Gas Transmission L.P. |

| ISDA | The International Swaps and Derivatives Association |

| ITC | Investment Tax Credit |

| JPMC Facility | NJNG's $100 million, four-year credit facility with JPMorgan Chase Bank, N.A. expiring in August 2015 |

| JPMC Term Loan | NJR's $100 million, one-year term loan credit agreement with JPMorgan Chase Bank, N.A. expiring in September 2014 |

| LNG | Liquefied Natural Gas |

| MetLife | Metropolitan Life Insurance Company |

| MetLife Facility | NJR's unsecured, uncommitted $100 million private placement shelf note agreement with MetLife, Inc. |

| MGP | Manufactured Gas Plant |

| MMBtu | Million Metric British Thermal Unit |

| Moody's | Moody's Investors Service, Inc. |

| MW | Megawatts |

| MWh | Megawatt Hour |

| NAESB | The North American Energy Standards Board |

| NJR Credit Facility | NJR's $425 million unsecured committed credit facility expiring in August 2017 |

| NFE | Net Financial Earnings |

| NGV | Natural Gas Vehicles |

| NJ RISE | New Jersey Reinvestment in System Enhancement |

| NJCEP | New Jersey's Clean Energy Program |

| NJDEP | New Jersey Department of Environmental Protection |

| NJNG | New Jersey Natural Gas Company |

| NJNG Credit Facility | The $250 million unsecured committed credit facility expiring in August 2014 |

|

| |

| NPNS | Normal Purchase/Normal Sale |

| NJR or The Company | New Jersey Resources Corporation |

| NJR Energy | NJR Energy Corporation |

| NJR Midstream | NJR Midstream Holdings Corporation |

| NJR Service | NJR Service Corporation |

| NJRCEV | NJR Clean Energy Ventures Corporation |

| NJRES | NJR Energy Services Company |

| NJRHS | NJR Home Services Company |

| Non-GAAP | Not in accordance with Generally Accepted Accounting Principles of the United States |

| NYMEX | New York Mercantile Exchange |

| O&M | Operating and Maintenance |

| OCI | Other Comprehensive Income |

| OPEB | Other Postemployment Benefit Plans |

| PIM | Pipeline Integrity Management |

| Prudential | Prudential Investment Management, Inc. |

| Prudential Facility | NJR's unsecured, uncommitted $75 million private placement shelf note agreement with Prudential |

| PTC | Production Tax Credit |

| RA | Remediation Adjustment |

| Retail and Other | Retail and Other Operations |

| Retail Holdings | NJR Retail Holdings Corporation |

| S&P | Standard & Poor's Financial Services LLC |

| SAFE | Safety Acceleration and Facility Enhancement |

| Sarbanes-Oxley | Sarbanes-Oxley Act of 2002 |

| SAVEGREEN | The SAVEGREEN Project® |

| SBC | Societal Benefits Clause |

| SEC | Securities and Exchange Commission |

| SREC | Solar Renewable Energy Certificate |

| Steckman Ridge | Collectively, Steckman Ridge GP, LLC and Steckman Ridge, LP |

| Superstorm Sandy | Post-Tropical Cyclone Sandy |

| The Exchange Act | The Securities Exchange Act of 1934, as amended |

| U.S. | The United States of America |

| USF | Universal Service Fund |

| VRDN | Variable Rate Demand Notes |

New Jersey Resources Corporation

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report, including, without limitation, statements as to management expectations and beliefs presented in Part I, Item 2. “Management's Discussion and Analysis of Financial Condition and Results of Operations,” Part I, Item 3. “Quantitative and Qualitative Disclosures about Market Risk,” Part II, Item I. “Legal Proceedings” and in the notes to the financial statements are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also be identified by the use of forward-looking terminology such as “anticipate,” “estimate,” “may,” “intend,” “expect,” “believe,” “will” “plan,” “should,” or “continue” or comparable terminology and are made based upon management's current expectations and beliefs as of this date concerning future developments and their potential effect upon the Company. There can be no assurance that future developments will be in accordance with management's expectations or that the effect of future developments on the Company will be those anticipated by management.

The Company cautions readers that the assumptions that form the basis for forward-looking statements regarding customer growth, customer usage, qualifications for ITCs, PTCs and SRECs, financial condition, results of operations, cash flows, capital requirements, future capital expenditures, market risk and other matters for fiscal 2014 and thereafter include many factors that are beyond the Company's ability to control or estimate precisely, such as estimates of future market conditions, the behavior of other market participants and changes in the debt and equity capital markets. The factors that could cause actual results to differ materially from NJR's expectations include, but are not limited to, those discussed in Item 1A. Risk Factors of NJR's Annual Report on Form 10-K for the year ended September 30, 2013, as well as the following:

| |

| • | weather and economic conditions; |

| |

| • | demographic changes in the NJNG service territory and their effect on NJNG's customer growth; |

| |

| • | volatility of natural gas and other commodity prices and their impact on NJNG customer usage, NJNG's BGSS incentive programs, NJRES operations and on the Company's risk management efforts; |

| |

| • | changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to the Company; |

| |

| • | the impact of volatility in the credit markets on our access to capital; |

| |

| • | the ability to comply with debt covenants; |

| |

| • | the impact to the asset values and resulting higher costs and funding obligations of NJR's pension and postemployment benefit plans as a result of potential downturns in the financial markets, lower discount rates or impacts associated with the Patient Protection and Affordable Care Act; |

| |

| • | accounting effects and other risks associated with hedging activities and use of derivatives contracts; |

| |

| • | commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties, liquidity in the wholesale energy trading market; |

| |

| • | regulatory approval of NJNG's planned infrastructure programs: |

| |

| • | the ability to obtain governmental approvals and/or financing for the construction, development and operation of certain non-regulated energy investments; |

| |

| • | risks associated with the management of the Company's joint ventures and partnerships; |

| |

| • | risks associated with our investments in distributed power projects and our investment in an on-shore wind developer, including the availability of regulatory and tax incentives, logistical risks and potential delays related to construction, permitting, regulatory approvals and electric grid interconnection, the availability of viable projects, NJR's eligibility for ITCs and PTCs, the future market for SRECs and operational risks related to projects in service; |

| |

| • | timing of qualifying for ITCs due to delays or failures to complete planned solar energy projects and the resulting effect on our effective tax rate and earnings; |

| |

| • | the level and rate at which NJNG's costs and expenses (including those related to restoration efforts resulting from Post Tropical Cyclone Sandy, commonly referred to as Superstorm Sandy) are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process; |

| |

| • | access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; |

| |

| • | operating risks incidental to handling, storing, transporting and providing customers with natural gas; |

| |

| • | risks related to our employee workforce, including a work stoppage; |

| |

| • | the regulatory and pricing policies of federal and state regulatory agencies; |

| |

| • | the possible expiration of the NJNG CIP; |

| |

| • | the costs of compliance with the proposed regulatory framework for over-the-counter derivatives; |

| |

| • | the costs of compliance with present and future environmental laws, including potential climate change-related legislation; |

| |

| • | risks related to changes in accounting standards; |

| |

| • | the impact of a disallowance of recovery of environmental-related expenditures and other regulatory changes; |

| |

| • | environmental-related and other litigation and other uncertainties; |

| |

| • | risks related to cyber-attack or failure of information technology systems; and |

| |

| • | the impact of natural disasters, terrorist activities, and other extreme events on our operations and customers, including any impacts to utility gross margin and restoration costs. |

While the Company periodically reassesses material trends and uncertainties affecting the Company's results of operations and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports, the Company does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

New Jersey Resources Corporation

Part I

ITEM 1. FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

|

| | | | | | | | | | | | | | |

| | Three Months Ended | Six Months Ended |

| | March 31, | March 31, |

| (Thousands, except per share data) | 2014 |

| 2013 | 2014 |

| 2013 |

| OPERATING REVENUES | | | | | | |

| Utility | $ | 394,528 |

| | $ | 351,750 |

| $ | 627,997 |

| | $ | 570,599 |

|

| Nonutility | 1,185,041 |

| | 609,135 |

| 1,829,977 |

| | 1,126,305 |

|

| Total operating revenues | 1,579,569 |

| | 960,885 |

| 2,457,974 |

| | 1,696,904 |

|

| OPERATING EXPENSES | | | | | | |

| Gas purchases: | | | | | | |

| Utility | 147,946 |

| | 189,040 |

| 259,148 |

| | 300,361 |

|

| Nonutility | 1,047,870 |

| | 611,567 |

| 1,711,400 |

| | 1,066,994 |

|

| Operation and maintenance | 61,273 |

| | 43,067 |

| 103,296 |

| | 83,137 |

|

| Regulatory rider expenses | 38,211 |

| | 23,774 |

| 58,043 |

| | 37,756 |

|

| Depreciation and amortization | 12,828 |

| | 11,721 |

| 25,394 |

| | 23,024 |

|

| Energy and other taxes | 24,429 |

| | 24,747 |

| 41,457 |

| | 41,472 |

|

| Total operating expenses | 1,332,557 |

| | 903,916 |

| 2,198,738 |

| | 1,552,744 |

|

| OPERATING INCOME | 247,012 |

| | 56,969 |

| 259,236 |

| | 144,160 |

|

| Other income | 712 |

| | 2,781 |

| 1,839 |

| | 3,046 |

|

| Interest expense, net of capitalized interest | 6,306 |

| | 5,746 |

| 12,601 |

| | 11,571 |

|

| INCOME BEFORE INCOME TAXES AND EQUITY IN EARNINGS OF AFFILIATES | 241,418 |

| | 54,004 |

| 248,474 |

| | 135,635 |

|

| Income tax provision | 71,680 |

| | 12,065 |

| 73,185 |

| | 36,045 |

|

| Equity in earnings of affiliates | 3,233 |

| | 3,530 |

| 5,375 |

| | 6,085 |

|

| NET INCOME | $ | 172,971 |

| | $ | 45,469 |

| $ | 180,664 |

| | $ | 105,675 |

|

| | | | | | | |

| EARNINGS PER COMMON SHARE | | | | | | |

| BASIC | $4.11 | | $1.09 | $4.30 | | $2.53 |

| DILUTED | $4.07 | | $1.08 | $4.26 | | $2.52 |

| DIVIDENDS PER COMMON SHARE | $0.42 | | $0.40 | $0.84 | | $0.80 |

| WEIGHTED AVERAGE SHARES OUTSTANDING | | | | | | |

| BASIC | 42,079 |

| | 41,789 |

| 42,050 |

| | 41,742 |

|

| DILUTED | 42,457 |

| | 41,972 |

| 42,428 |

| | 41,925 |

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

|

| | | | | | | | | | | | | | |

| | Three Months Ended | Six Months Ended |

| | March 31, | March 31, |

| (Thousands) | 2014 | | 2013 | 2014 | | 2013 |

| Net income | $ | 172,971 |

| | $ | 45,469 |

| $ | 180,664 |

| | $ | 105,675 |

|

| Other comprehensive income, net of tax | | | | | | |

| Unrealized gain (loss) on available for sale securities, net of tax of $(11), $(447), $203, and $(226), respectively | $ | 15 |

| | $ | 647 |

| (295 | ) | | 327 |

|

| Net unrealized (loss) on derivatives, net of tax of $89, $4, $109, and $10, respectively | (152 | ) | | (7 | ) | (186 | ) | | (17 | ) |

| Adjustment to postemployment benefit obligation, net of tax of $(112), $(202), $(223) and $(405), respectively | 161 |

| | 296 |

| 322 |

| | 709 |

|

| Other comprehensive income (loss) | $ | 24 |

| | $ | 936 |

| (159 | ) | | 1,019 |

|

| Comprehensive income | $ | 172,995 |

| | $ | 46,405 |

| $ | 180,505 |

| | $ | 106,694 |

|

See Notes to Unaudited Condensed Consolidated Financial Statements

New Jersey Resources Corporation

Part I

ITEM 1. FINANCIAL STATEMENTS (Continued)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

| | | | | | | |

| | Six Months Ended |

| | March 31, |

| (Thousands) | 2014 | | 2013 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income | $ | 180,664 |

| | $ | 105,675 |

|

| Adjustments to reconcile net income to cash flows from operating activities: | | | |

| Unrealized loss on derivative instruments | 52,394 |

| | 20,466 |

|

| Depreciation and amortization | 25,394 |

| | 23,024 |

|

| Allowance for equity used during construction | (603 | ) | | (1,333 | ) |

| Allowance for bad debt expense | 1,205 |

| | 1,341 |

|

| Deferred income taxes | 22,970 |

| | 14,639 |

|

| Manufactured gas plant remediation costs | (1,845 | ) | | (3,254 | ) |

| Equity in earnings of equity investees, net of distributions received | 1,626 |

| | 1,835 |

|

| Cost of removal - asset retirement obligations | (164 | ) | | (137 | ) |

| Contributions to postemployment benefit plans | (2,348 | ) | | (23,102 | ) |

| Changes in: | | | |

| Components of working capital | 96,040 |

| | (44,510 | ) |

| Other noncurrent assets | 6,038 |

| | 5,198 |

|

| Other noncurrent liabilities | 2,071 |

| | 8,539 |

|

| Cash flows from operating activities | 383,442 |

| | 108,381 |

|

| CASH FLOWS (USED IN) INVESTING ACTIVITIES | | | |

| Expenditures for | | | |

| Utility plant | (59,971 | ) | | (51,376 | ) |

| Solar and wind equipment | (45,403 | ) | | (24,865 | ) |

| Real estate properties and other | (477 | ) | | (298 | ) |

| Cost of removal | (10,914 | ) | | (14,323 | ) |

| Distribution from equity investees in excess of equity in earnings | 464 |

| | 648 |

|

| Proceeds from sale of asset | 6,000 |

| | — |

|

| Withdrawal from restricted cash construction fund | 85 |

| | — |

|

| Cash flows (used in) investing activities | (110,216 | ) | | (90,214 | ) |

| CASH FLOWS (USED IN) FINANCING ACTIVITIES | | | |

| Proceeds from issuance of common stock | 7,757 |

| | 6,922 |

|

| Tax benefit from stock options exercised | 94 |

| | 79 |

|

| Proceeds from sale-leaseback transaction | 7,576 |

| | 7,076 |

|

| Proceeds from long-term debt | 125,000 |

| | — |

|

| Payments of long-term debt | (65,017 | ) | | (3,833 | ) |

| Purchases of treasury stock | (4,387 | ) | | (1,311 | ) |

| Payments of common stock dividends | (35,264 | ) | | (33,913 | ) |

| Net (payments)/proceeds from short-term debt | (302,400 | ) | | 8,300 |

|

| Cash flows (used in) financing activities | (266,641 | ) | | (16,680 | ) |

| Change in cash and cash equivalents | 6,585 |

| | 1,487 |

|

| Cash and cash equivalents at beginning of period | 2,969 |

| | 4,509 |

|

| Cash and cash equivalents at end of period | $ | 9,554 |

| | $ | 5,996 |

|

| CHANGES IN COMPONENTS OF WORKING CAPITAL | | | |

| Receivables | $ | (294,939 | ) | | $ | (245,241 | ) |

| Inventories | 178,955 |

| | 92,822 |

|

| Recovery of gas costs | 6,866 |

| | (542 | ) |

| Gas purchases payable | 138,044 |

| | 88,263 |

|

| Prepaid and accrued taxes | 67,164 |

| | 46,900 |

|

| Accounts payable and other | 3,992 |

| | (5,070 | ) |

| Restricted broker margin accounts | (21,329 | ) | | (10,196 | ) |

| Customers' credit balances and deposits | (8,819 | ) | | (30,579 | ) |

| Other current assets | 26,106 |

| | 19,133 |

|

| Total | $ | 96,040 |

| | $ | (44,510 | ) |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOWS INFORMATION | | | |

| Cash paid for: | | | |

| Interest (net of amounts capitalized) | $ | 11,221 |

| | $ | 10,207 |

|

| Income taxes | $ | 8,648 |

| | $ | 4,111 |

|

| SUPPLEMENTAL SCHEDULE OF NONCASH INVESTING ACTIVITIES | | | |

| Accrued capital expenditures | $ | 1,347 |

| | $ | (9,463 | ) |

See Notes to Unaudited Condensed Consolidated Financial Statements

New Jersey Resources Corporation

Part I

ITEM 1. FINANCIAL STATEMENTS (Continued)

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

ASSETS

|

| | | | | | |

| (Thousands) | March 31,

2014 | September 30,

2013 |

| PROPERTY, PLANT AND EQUIPMENT | | |

| Utility plant, at cost | $ | 1,726,124 |

| $ | 1,681,585 |

|

| Construction work in progress | 135,721 |

| 114,961 |

|

| Solar equipment, real estate properties and other, at cost | 269,613 |

| 249,516 |

|

| Construction work in progress | 36,172 |

| 9,093 |

|

| Total property, plant and equipment | 2,167,630 |

| 2,055,155 |

|

| Accumulated depreciation and amortization, utility plant | (395,457 | ) | (383,895 | ) |

| Accumulated depreciation and amortization, solar equipment, real estate properties and other | (33,728 | ) | (28,144 | ) |

| Property, plant and equipment, net | 1,738,445 |

| 1,643,116 |

|

| CURRENT ASSETS | | |

| Cash and cash equivalents | 9,554 |

| 2,969 |

|

| Customer accounts receivable | | |

| Billed | 487,941 |

| 240,281 |

|

| Unbilled revenues | 53,664 |

| 7,429 |

|

| Allowance for doubtful accounts | (5,491 | ) | (5,330 | ) |

| Regulatory assets | 18,970 |

| 34,372 |

|

| Gas in storage, at average cost | 139,021 |

| 314,477 |

|

| Materials and supplies, at average cost | 10,835 |

| 14,334 |

|

| Prepaid and accrued taxes | 431 |

| 42,645 |

|

| Asset held for sale | — |

| 5,428 |

|

| Derivatives, at fair value | 45,182 |

| 53,327 |

|

| Restricted broker margin accounts | 38,490 |

| 6,581 |

|

| Deferred taxes | 11,859 |

| 8,432 |

|

| Other | 25,603 |

| 20,953 |

|

| Total current assets | 836,059 |

| 745,898 |

|

| NONCURRENT ASSETS | | |

| Investments in equity investees | 160,228 |

| 161,591 |

|

| Prepaid pension asset | 6,126 |

| 6,287 |

|

| Regulatory assets | 368,319 |

| 402,202 |

|

| Derivatives, at fair value | 2,270 |

| 2,761 |

|

| Other | 49,763 |

| 42,928 |

|

| Total noncurrent assets | 586,706 |

| 615,769 |

|

| Total assets | $ | 3,161,210 |

| $ | 3,004,783 |

|

See Notes to Unaudited Condensed Consolidated Financial Statements

New Jersey Resources Corporation

Part I

ITEM 1. FINANCIAL STATEMENTS (Continued)

CAPITALIZATION AND LIABILITIES

|

| | | | | | |

| (Thousands) | March 31,

2014 | September 30,

2013 |

| CAPITALIZATION | | |

Common stock, $2.50 par value; authorized 75,000,000 shares;

outstanding March 31, 2014-42,074,766; September 30, 2013-41,961,534 | $ | 112,706 |

| $ | 112,563 |

|

| Premium on common stock | 303,107 |

| 300,196 |

|

| Accumulated other comprehensive (loss), net of tax | (1,780 | ) | (1,621 | ) |

Treasury stock at cost and other;

shares March 31, 2014-3,007,914; September 30, 2013-3,060,356 | (125,085 | ) | (128,638 | ) |

| Retained earnings | 750,234 |

| 604,884 |

|

| Common stock equity | 1,039,182 |

| 887,384 |

|

| Long-term debt | 628,490 |

| 512,886 |

|

| Total capitalization | 1,667,672 |

| 1,400,270 |

|

| CURRENT LIABILITIES | | |

| Current maturities of long-term debt | 21,526 |

| 68,643 |

|

| Short-term debt | 63,200 |

| 365,600 |

|

| Gas purchases payable | 392,857 |

| 254,813 |

|

| Accounts payable and other | 65,263 |

| 60,342 |

|

| Dividends payable | 17,665 |

| 17,624 |

|

| Deferred and accrued taxes | 26,914 |

| 4,040 |

|

| Regulatory liabilities | 20,360 |

| 1,456 |

|

| New Jersey clean energy program | 5,979 |

| 14,532 |

|

| Derivatives, at fair value | 71,223 |

| 40,390 |

|

| Broker margin accounts | 10,573 |

| — |

|

| Customers' credit balances and deposits | 15,574 |

| 24,393 |

|

| Total current liabilities | 711,134 |

| 851,833 |

|

| NONCURRENT LIABILITIES | | |

| Deferred income taxes | 401,537 |

| 372,773 |

|

| Deferred investment tax credits | 5,423 |

| 5,584 |

|

| Deferred revenue | 4,402 |

| 4,763 |

|

| Derivatives, at fair value | 5,192 |

| 2,458 |

|

| Manufactured gas plant remediation | 183,600 |

| 183,600 |

|

| Postemployment employee benefit liability | 68,494 |

| 67,897 |

|

| Regulatory liabilities | 76,857 |

| 79,647 |

|

| Asset retirement obligation | 29,534 |

| 28,711 |

|

| Other | 7,365 |

| 7,247 |

|

| Total noncurrent liabilities | 782,404 |

| 752,680 |

|

| Commitments and contingent liabilities (Note 12) |

|

|

|

| Total capitalization and liabilities | $ | 3,161,210 |

| $ | 3,004,783 |

|

See Notes to Unaudited Condensed Consolidated Financial Statements

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

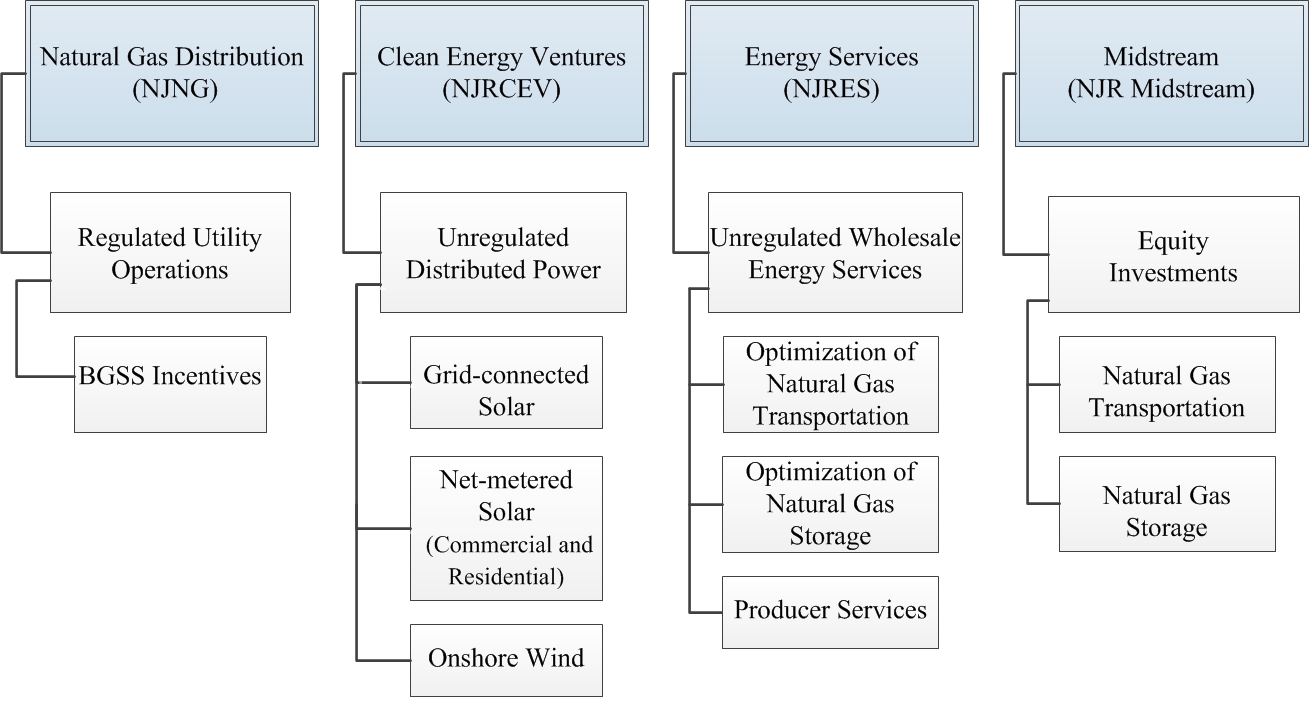

New Jersey Resources Corporation provides regulated gas distribution services and operates certain non-regulated businesses primarily through the following subsidiaries:

New Jersey Natural Gas Company provides natural gas utility service to approximately 503,700 retail customers in central and northern New Jersey and is subject to rate regulation by the BPU. NJNG comprises the Natural Gas Distribution segment;

NJR Energy Services Company comprises the Energy Services segment that maintains and transacts around a portfolio of natural gas storage and transportation positions and provides wholesale energy and energy management services;

NJR Clean Energy Ventures, the company’s unregulated distributed power subsidiary, comprises the Clean Energy Ventures segment and reports the results of operations and assets related to the Company's capital investments in distributed power projects, including commercial and residential solar projects and on-shore wind investments;

NJR Midstream Holdings Corporation primarily invests in energy-related ventures through its subsidiaries, NJR Steckman Ridge Storage Company, which holds the Company's 50 percent combined interest in Steckman Ridge and NJNR Pipeline Company, which holds the Company's 5.53 percent ownership interest in Iroquois Gas Transmission L.P. Steckman Ridge and Iroquois comprise the Midstream segment. On November 7, 2013, NJR Energy Holdings Corporation changed its name to NJR Midstream Holdings Corporation; and

NJR Retail Holdings Corporation has two principal subsidiaries, NJR Home Services Company and Commercial Realty & Resources Corporation. Retail Holdings and NJR Energy Corporation are included in Retail and Other operations.

| |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The accompanying Unaudited Condensed Consolidated Financial Statements have been prepared by NJR in accordance with the rules and regulations of the Securities and Exchange Commission and ASC 270. The September 30, 2013, Balance Sheet data is derived from the audited financial statements of the Company. These Unaudited Condensed Consolidated Financial Statements should be read in conjunction with the consolidated financial statements and the notes thereto included in NJR's 2013 Annual Report on Form 10-K.

The Unaudited Condensed Consolidated Financial Statements include the accounts of NJR and its subsidiaries. In the opinion of management, the accompanying Unaudited Condensed Consolidated Financial Statements reflect all adjustments necessary, for a fair presentation of the results of the interim periods presented. These adjustments are of a normal and recurring nature. Because of the seasonal nature of NJR's utility and wholesale energy services operations, in addition to other factors, the financial results for the interim periods presented are not indicative of the results that are to be expected for the fiscal year ended September 30, 2014.

Intercompany transactions and accounts have been eliminated.

Gas in Storage

The following table summarizes gas in storage, at average cost by company as of:

|

| | | | | | | | | | | | |

| | March 31,

2014 | September 30,

2013 |

| ($ in thousands) | Gas in Storage | | Bcf | Gas in Storage | | Bcf |

| NJNG | | $ | 12,582 |

| 2.1 |

| | $ | 104,979 |

| 20.4 |

|

| NJRES | | 126,439 |

| 23.2 |

| | 209,498 |

| 62.3 |

|

| Total | | $ | 139,021 |

| 25.3 |

| | $ | 314,477 |

| 82.7 |

|

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Available for Sale Securities

Included in other noncurrent assets on the Unaudited Condensed Consolidated Balance Sheets are certain investments in equity securities of a publicly traded energy company that have a fair value of $11.2 million and $11.7 million as of March 31, 2014 and September 30, 2013, respectively. Total unrealized gains associated with these equity securities, which are included as a part of accumulated other comprehensive income, a component of common stock equity, were $8.6 million ($5.1 million, after tax) and $9.1 million ($5.4 million, after tax) as of March 31, 2014 and September 30, 2013, respectively. Reclassifications of realized gains out of other comprehensive income into income are determined based on average cost.

Sale of Asset

On October 22, 2013, CR&R sold approximately 25.4 acres of undeveloped land located in Monmouth County with a net book value of $5.4 million for $6 million, generating a pre-tax gain after closing costs of $313,000, which was recognized in other income on the Unaudited Condensed Consolidated Statements of Operations.

Customer Accounts Receivable

Customer accounts receivable include outstanding billings from the following subsidiaries as of:

|

| | | | | | | | | | | |

| (Thousands) | March 31,

2014 | | September 30,

2013 |

| NJRES | $ | 328,544 |

| 67 | % | | $ | 194,263 |

| 81 | % |

NJNG (1) | 156,272 |

| 32 |

| | 43,045 |

| 18 |

|

| NJRCEV | 565 |

| — |

| | 293 |

| — |

|

| NJRHS and other | 2,560 |

| 1 |

| | 2,680 |

| 1 |

|

| Total | $ | 487,941 |

| 100 | % | | $ | 240,281 |

| 100 | % |

| |

| (1) | Does not include unbilled revenues of $53.7 million and $7.4 million as of March 31, 2014 and September 30, 2013, respectively. |

Loan Receivable

NJNG provides interest-free loans, with terms ranging from two to ten years, to customers that elect to purchase and install certain energy efficient equipment in accordance with its BPU-approved SAVEGREEN program. The loans are recognized at net present value on the Unaudited Condensed Consolidated Balance Sheets. The Company has recorded $3 million and $1.9 million in other current assets and $21.9 million and $14.3 million in other noncurrent assets as of March 31, 2014 and September 30, 2013, respectively, on the Unaudited Condensed Consolidated Balance Sheets.

NJR's policy is to establish an allowance for doubtful accounts when loan balances are outstanding for more than 60 days. As of March 31, 2014 and September 30, 2013, there was no allowance for doubtful accounts established.

Recent Updates to the Accounting Standards Codification

In December 2011, the FASB issued ASU No. 2011-11, an amendment to ASC Topic 210, Balance Sheet, requiring additional disclosures about the effect of an entity's rights of setoff and related master netting arrangements to its financial statements. ASU 2013-01, issued in January 2013, further clarified that the amended guidance was applicable to certain financial and derivative instruments. The Company applied the provisions of the amended guidance retrospectively effective October 1, 2013. The guidance did not impact the Company's financial position, results of operations or cash flows, however, it required additional disclosures that are included in Note 4. Derivative Instruments.

In July 2013, the FASB issued ASU No. 2013-11, an amendment to ASC Topic 740, Income Taxes, which clarifies financial statement presentation for unrecognized tax benefits. The ASU requires that an unrecognized tax benefit, or portion thereof, shall be presented in the balance sheet as a reduction to a deferred tax asset for a net operating loss carryforward, similar tax loss or a tax credit carryforward. To the extent such a deferred tax asset is not available or the company does not intend to use it to settle any additional taxes that would result from the disallowance of a tax position, the related unrecognized tax benefit will be presented as a liability in the financial statements. The amended guidance will become effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. The Company will apply the provisions of the new guidance at the effective date, if applicable, on a prospective basis.

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NJNG is subject to cost-based regulation, therefore, it is permitted to recover authorized operating expenses and earn a reasonable return on its utility investment based on the BPU's approval, in accordance with accounting guidance applicable to regulated operations. The impact of the ratemaking process and decisions authorized by the BPU allows NJNG to capitalize or defer certain costs that are expected to be recovered from its customers as regulatory assets and to recognize certain obligations representing amounts that are probable future expenditures as regulatory liabilities.

Regulatory assets and liabilities included on the Unaudited Condensed Consolidated Balance Sheets are comprised of the following:

|

| | | | | | |

| (Thousands) | March 31,

2014 | September 30,

2013 |

| Regulatory assets-current | | |

| Conservation Incentive Program | $ | — |

| $ | 18,887 |

|

| Underrecovered gas costs | 12,991 |

| 953 |

|

| New Jersey Clean Energy Program | 5,979 |

| 14,532 |

|

| Total current | $ | 18,970 |

| $ | 34,372 |

|

| Regulatory assets-noncurrent | | |

| Environmental remediation costs | | |

| Expended, net of recoveries | $ | 32,661 |

| $ | 46,968 |

|

| Liability for future expenditures | 183,600 |

| 183,600 |

|

| Deferred income taxes | 10,718 |

| 10,718 |

|

| Derivatives at fair value, net | — |

| 19 |

|

| SAVEGREEN | 23,988 |

| 30,004 |

|

| Postemployment and other benefit costs | 98,029 |

| 101,415 |

|

| Deferred Superstorm Sandy costs | 15,207 |

| 14,822 |

|

| Other | 4,116 |

| 14,656 |

|

| Total noncurrent | $ | 368,319 |

| $ | 402,202 |

|

| Regulatory liability-current | | |

| Conservation Incentive Program | $ | 5,964 |

| $ | — |

|

| Derivatives at fair value, net | 14,396 |

| 1,456 |

|

| Total current | $ | 20,360 |

| $ | 1,456 |

|

| Regulatory liabilities-noncurrent | | |

| Cost of removal obligation | $ | 75,327 |

| $ | 79,315 |

|

| Other | 1,530 |

| 332 |

|

| Total noncurrent | $ | 76,857 |

| $ | 79,647 |

|

NJNG's recovery of costs is facilitated through its base tariff rates, BGSS and other regulatory tariff riders. As recovery of regulatory assets is subject to BPU approval, if there are any changes in regulatory positions that indicate recovery is not probable, the related cost would be charged to income in the period of such determination.

Recent regulatory filings and/or actions include the following:

| |

| • | On September 18, 2013, the BPU approved NJNG's filing to reduce the USF recovery rate resulting in a .5 percent decrease for the average residential heating customer effective October 1, 2013. |

| |

| • | On October 16, 2013, the BPU provisionally approved NJNG's filing to maintain its current BGSS rate along with reductions to its CIP factors effective November 1, 2013 which resulted in a 1 percent reduction to an average residential heat customer's bill. |

| |

| • | On November 21, 2013, NJNG notified the BPU of its intent to reduce its BGSS rate, effective December 1, 2013, resulting in a 6 percent decrease to the average residential heating customer bill. |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

| |

| • | On November 22, 2013, the BPU provisionally approved a Stipulation of Settlement for SBC factors that included recovery of MGP expenditures through June 30, 2013 and a .2 percent reduction to the average residential heat customer related to the SBC RA factor to recover $18.7 million annually, and a 1.9 percent increase related to its NJCEP factor, effective December 1, 2013. |

| |

| • | On December 18, 2013, the BPU approved a gas service agreement which will allow NJNG to provide transportation service to Red Oak Power, LLC, an electric generation facility, through September 2022. |

| |

| • | On April 23, 2014, the BPU approved a petition filed by NJNG requesting authorization over a three-year period to issue up to $300 million of medium-term notes with a maturity of not more than 30 years, renew its revolving credit facility expiring August 2014 for up to five years, enter into interest rate risk management transactions related to debt securities and redeem, refinance or defease any of NJNG’s outstanding long-term debt securities. |

The Company is subject to commodity price risk due to fluctuations in the market price of natural gas, SREC, and electricity prices. To manage this risk, the Company enters into a variety of derivative instruments including, but not limited to, futures contracts, physical forward contracts, financial options and swaps to economically hedge the commodity price risk associated with its existing and anticipated commitments to purchase and sell natural gas, SRECs, and electricity. In addition, the Company may utilize foreign currency derivatives as cash flow hedges of Canadian dollar denominated gas purchases. These contracts, with a few exceptions as described below, are accounted for as derivatives. Accordingly, all of the financial and certain of the Company's physical derivative instruments are recorded at fair value on the Unaudited Condensed Consolidated Balance Sheets. For a more detailed discussion of the Company's fair value measurement policies and level disclosures associated with the NJR's derivative instruments, see Note 5. Fair Value.

Since the Company chooses not to designate its financial commodity and physical forward commodity derivatives as accounting hedges or to elect NPNS as appropriate, changes in the fair value of these derivative instruments are recorded as a component of gas purchases or operating revenues, as appropriate for NJRES, on the Unaudited Condensed Consolidated Statements of Operations as unrealized gains or (losses). For NJRES at settlement, realized gains and (losses) on all financial derivative instruments are recognized as a component of gas purchases and realized gains and (losses) on all physical derivatives follow the presentation of the related unrealized gains and (losses) as a component of either gas purchases or operating revenues.

NJRES also enters into natural gas transactions in Canada and, consequently, is exposed to fluctuations in the value of Canadian currency relative to the US dollar. NJRES utilizes foreign currency derivatives to lock in the currency translation rate associated with natural gas transactions denominated in Canadian currency. The derivatives may include currency forwards, futures, or swaps and are accounted for as derivatives. These derivatives are being used to hedge future forecasted cash payments associated with transportation and storage contracts along with purchases of natural gas. The Company has designated these foreign currency derivatives as cash flow hedges of that exposure, and expects the hedge relationship to be highly effective throughout the term. Since NJRES designates its foreign exchange contracts as cash flow hedges, changes in fair value of the effective portion of the hedge are recorded in OCI. When the foreign exchange contracts are settled and the related purchases are recognized in income, realized gains and (losses) are recognized in gas purchases on the Unaudited Condensed Consolidated Statements of Operations.

As a result of NJRES entering into transactions to borrow gas, commonly referred to as “park and loans,” an embedded derivative is created related to differences between the fair value of the amount borrowed and the fair value of the amount that may ultimately be repaid, based on changes in forward natural gas prices during the contract term. This embedded derivative is accounted for as a forward sale in the month in which the repayment of the borrowed gas is expected to occur, and is considered a derivative transaction that is recorded at fair value on the Unaudited Condensed Consolidated Balance Sheets, with changes in value recognized in current period earnings.

Changes in fair value of NJNG's financial derivative instruments are recorded as a component of regulatory assets or liabilities on the Unaudited Condensed Consolidated Balance Sheets, as NJNG has received regulatory approval to defer and to recover these amounts through future BGSS rates as an increase or decrease to the cost of natural gas in NJNG's tariff for gas service.

The Company elects NPNS accounting treatment on all physical commodity contracts at NJNG. These contracts are accounted for on an accrual basis. Accordingly, gains or (losses) are recognized in regulatory assets or liabilities on the Unaudited Condensed Consolidated Balance Sheets when the contract settles and the natural gas is delivered.

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NJRCEV hedges certain of its expected production of SRECs through forward sale contracts. The Company intends to physically deliver the SRECs upon settlement and therefore applies NPNS accounting treatment to the contracts. NJRCEV recognizes revenue for SRECs upon transfer of the certificate.

Fair Value of Derivatives

The following table reflects the fair value of NJR's derivative assets and liabilities recognized on the Unaudited Condensed Consolidated Balance Sheets as of:

|

| | | | | | | | | | | | | | | | | |

| | | | Fair Value |

| | | | March 31, 2014 | | September 30, 2013 |

| (Thousands) | Balance Sheet Location | Asset Derivatives | Liability Derivatives | Asset Derivatives | Liability Derivatives |

| Derivatives designated as hedging instruments: | | | | | | | | |

| NJRES: | | | | | | | | | |

| Foreign currency contracts | Derivatives - current | | $ | — |

| | $ | 277 |

| | $ | 16 |

| | $ | 3 |

|

| | Derivatives - noncurrent | | — |

| | 7 |

| | — |

| | 2 |

|

| Fair value of derivatives designated as hedging instruments | | $ | — |

| | $ | 284 |

| | $ | 16 |

| | $ | 5 |

|

| | | | | | | | | |

| Derivatives not designated as hedging instruments: | | | | | | | | |

| NJNG: | | | | | | | | | |

| Financial derivative contracts | Derivatives - current | | $ | 15,387 |

| | $ | 998 |

| | $ | 3,502 |

| | $ | 2,045 |

|

| | Derivatives - noncurrent | | — |

| | — |

| | 121 |

| | 140 |

|

| NJRES: | | | | | | | | | |

| Physical forward commodity contracts | Derivatives - current | | 5,634 |

| | 35,568 |

| | 11,282 |

| | 14,573 |

|

| | Derivatives - noncurrent | | 197 |

| | 111 |

| | 541 |

| | 22 |

|

| Financial derivative contracts | Derivatives - current | | 24,161 |

| | 34,380 |

| | 38,527 |

| | 23,769 |

|

| | Derivatives - noncurrent | | 2,073 |

| | 5,074 |

| | 2,099 |

| | 2,294 |

|

| Fair value of derivatives not designated as hedging instruments | | $ | 47,452 |

| | $ | 76,131 |

| | $ | 56,072 |

| | $ | 42,843 |

|

| Total fair value of derivatives | | | $ | 47,452 |

| | $ | 76,415 |

| | $ | 56,088 |

| | $ | 42,848 |

|

At March 31, 2014, the gross notional amount of the foreign currency transactions was approximately $6.9 million, and ineffectiveness in the hedge relationship is immaterial to the financial results of NJR.

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Offsetting of Derivatives

NJR transacts under master netting arrangements or similar agreements that allow it to offset derivative assets and liabilities with the same counterparty, however NJR's policy is to present its derivative assets and liabilities on a gross basis in the Unaudited Condensed Consolidated Balance Sheets. The tables below summarize the reported gross amounts, the amounts that NJR has the right to offset but elects not to, financial collateral, as well as the net amounts NJR could present in the Unaudited Condensed Consolidated Balance Sheets but elects not to.

|

| | | | | | | | | | | | | | | | |

| (Thousands) | Amounts Presented in Balance Sheets (1) | Offsetting Derivative Instruments (2) | Financial Collateral Received/Pledged (3) | Net Amounts (4) |

| As of March 31, 2014: | | | | | | | | |

| Derivative assets: | | | | | | | | |

| NJRES | | | | | | | | |

| Physical forward commodity contracts | | $ | 5,831 |

| | $ | (2,190 | ) | | $ | — |

| | $ | 3,641 |

|

| Financial commodity contracts | | 26,234 |

| | (26,234 | ) | | — |

| | — |

|

| Foreign currency contracts | | — |

| | — |

| | — |

| | — |

|

| Total NJRES | | $ | 32,065 |

| | $ | (28,424 | ) | | $ | — |

| | $ | 3,641 |

|

| NJNG | | | | | | | | |

| Financial commodity contracts | | $ | 15,387 |

| | $ | (998 | ) | | $ | (10,772 | ) | | $ | 3,617 |

|

| Derivative liabilities: | | | | | | | | |

| NJRES | | | | | | | | |

| Physical forward commodity contracts | | $ | 35,679 |

| | $ | (2,371 | ) | | $ | (500 | ) | | $ | 32,808 |

|

| Financial commodity contracts | | 39,454 |

| | (26,233 | ) | | (13,221 | ) | | — |

|

| Foreign currency contracts | | 284 |

| | — |

| | — |

| | 284 |

|

| Total NJRES | | $ | 75,417 |

| | $ | (28,604 | ) | | $ | (13,721 | ) | | $ | 33,092 |

|

| NJNG | | | | | | | | |

| Financial commodity contracts | | $ | 998 |

| | $ | (998 | ) | | $ | — |

| | $ | — |

|

| | | | | | | | | |

| As of September 30, 2013: | | | | | | | | |

| Derivative assets: | | | | | | | | |

| NJRES | | | | | | | | |

| Physical forward commodity contracts | | $ | 11,823 |

| | $ | (3,549 | ) | | $ | (100 | ) | | $ | 8,174 |

|

| Financial commodity contracts | | 40,626 |

| | (26,063 | ) | | 6,870 |

| | 21,433 |

|

| Foreign currency contracts | | 16 |

| | (5 | ) | | — |

| | 11 |

|

| Total NJRES | | $ | 52,465 |

| | $ | (29,617 | ) | | $ | 6,770 |

| | $ | 29,618 |

|

| NJNG | | | | | | | | |

| Financial commodity contracts | | $ | 3,623 |

| | $ | (2,185 | ) | | $ | 214 |

| | $ | 1,652 |

|

| Derivative liabilities: | | | | | | | | |

| NJRES | | | | | | | | |

| Physical forward commodity contracts | | $ | 14,595 |

| | $ | (3,549 | ) | | $ | (500 | ) | | $ | 10,546 |

|

| Financial commodity contracts | | 26,063 |

| | (26,063 | ) | | — |

| | — |

|

| Foreign currency contracts | | 5 |

| | (5 | ) | | — |

| | — |

|

| Total NJRES | | $ | 40,663 |

| | $ | (29,617 | ) | | $ | (500 | ) | | $ | 10,546 |

|

| NJNG | | | | | | | | |

| Financial commodity contracts | | $ | 2,185 |

| | $ | (2,185 | ) | | $ | — |

| | $ | — |

|

| |

(1) | Derivative assets and liabilities are presented on a gross basis in the balance sheet as the Company does not elect balance sheet offsetting under ASC 210-20. |

| |

(2) | Offsetting derivative instruments include: transactions with NAESB netting election, transactions held by FCM's with net margining and transactions with ISDA netting. |

| |

(3) | Financial collateral includes cash balances at FCM's as well as cash received from or pledged to other counterparties. |

| |

(4) | Net amounts represent presentation of derivative assets and liabilities if the Company were to elect balance sheet offsetting under ASC 210-20. |

NJRES utilizes financial derivatives to economically hedge the gross margin associated with the purchase of physical gas for injection into storage and the subsequent sale of physical gas at a later date. The gains or (losses) on the financial transactions that are economic hedges of the cost of the purchased gas are recognized prior to the gains or (losses) on the physical transaction,

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

which are recognized in earnings when the natural gas is sold. Therefore, mismatches between the timing of the recognition of realized gains or (losses) on the financial derivative instruments and gains or (losses) associated with the actual sale of the natural gas that is being economically hedged along with fair value changes in derivative instruments creates volatility in the results of NJRES, although the Company's intended economic results relating to the entire transaction are unaffected.

The following table reflects the effect of derivative instruments on the Unaudited Condensed Consolidated Statements of Operations as of:

|

| | | | | | | | | | | | | | | |

| (Thousands) | Location of gain (loss) recognized in income on derivatives | Amount of gain (loss) recognized in income on derivatives |

| | | Three Months Ended | Six Months Ended |

| | | March 31, | March 31, |

| Derivatives not designated as hedging instruments: | 2014 | | 2013 | 2014 | | 2013 |

| NJRES: | | | | | | | |

| Physical commodity contracts | Operating revenues | $ | (57,916 | ) | | $ | (2,224 | ) | $ | (57,998 | ) | | $ | (7,859 | ) |

| Physical commodity contracts | Gas purchases | (54,481 | ) | | 2,762 |

| (79,474 | ) | | 2,556 |

|

| Financial derivative contracts | Gas purchases | (101,629 | ) | | (30,669 | ) | (141,699 | ) | | (1,467 | ) |

| Total unrealized and realized (losses) | $ | (214,026 | ) | | $ | (30,131 | ) | $ | (279,171 | ) | | $ | (6,770 | ) |

Not included in the previous table, are gains associated with NJNG's financial derivatives that totaled $6.2 million and $12.4 million for the three months ended March 31, 2014 and 2013, respectively, and gains that totaled $12.8 million and $6.2 million for the six months ended March 31, 2014 and 2013, respectively. These derivatives are part of NJNG's risk management activities that relate to its natural gas purchases and BGSS incentive programs. As these transactions are entered into pursuant to and recoverable through regulatory riders, any changes in the value of NJNG's financial derivatives are deferred in regulatory assets or liabilities resulting in no impact to earnings.

As previously noted, NJRES designates its foreign exchange contracts as cash flow hedges, therefore, changes in fair value of the effective portion of the hedges are recorded in OCI and, upon settlement of the contracts, realized gains and (losses) are reclassified from OCI to gas purchases on the Unaudited Condensed Consolidated Statements of Operations. The following tables reflect the effect of derivative instruments designated as cash flow hedges on OCI as of March 31:

|

| | | | | | | | | | | | | | | | | | |

| (Thousands) | Amount of Gain or (Loss) Recognized in OCI on Derivatives (Effective Portion) | Amount of Gain or (Loss) Reclassified from OCI into Income (Effective Portion) | Amount of Gain or (Loss) Recognized on Derivative (Ineffective Portion and Amount Excluded from Effectiveness Testing) |

| | Three Months Ended | Three Months Ended | Three Months Ended |

| | March 31, | March 31, | March 31, |

| Derivatives in cash flow hedging relationships: | 2014 | 2013 | 2014 | 2013 | 2014 | 2013 |

| Foreign currency contracts | $ | (309 | ) | $ | 24 |

| $ | 68 |

| $ | (35 | ) | $ | — |

| $ | — |

|

|

| | | | | | | | | | | | | | | | | | |

| (Thousands) | Amount of Gain or (Loss) Recognized in OCI on Derivatives (Effective Portion) (1) | Amount of Gain or (Loss) Reclassified from OCI into Income (Effective Portion) | Amount of Gain or (Loss) Recognized on Derivative (Ineffective Portion and Amount Excluded from Effectiveness Testing) |

| | Six Months Ended | Six Months Ended | Six Months Ended |

| | March 31, | March 31, | March 31, |

| Derivatives in cash flow hedging relationships: | 2014 | 2013 | 2014 | 2013 | 2014 | 2013 |

| Foreign currency contracts | $ | (460 | ) | $ | (71 | ) | $ | 165 |

| $ | 44 |

| $ | — |

| $ | — |

|

| |

| (1) | The settlement of foreign currency transactions over the next twelve months is expected to result in the reclassification of $277,000 from OCI into earnings. The maximum tenor is April 2015. |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NJNG and NJRES had the following outstanding long (short) derivatives as of:

|

| | | | | | |

| | | | Volume (Bcf) |

| | | | March 31,

2014 | September 30,

2013 |

| NJNG | Futures | | 27.5 |

| 22.6 |

|

| NJRES | Futures | | (20.9 | ) | (64.2 | ) |

| | Options | | — |

| 1.5 |

|

| | Physical | | 31.0 |

| 7.3 |

|

Broker Margin

Generally, exchange-traded futures contracts require posted collateral, referred to as margin, usually in the form of cash. The amount of margin required is comprised of a fixed initial amount based on the contract and a variable amount based on market price movements from the initial trade price. The Company maintains separate broker margin accounts for NJNG and NJRES. The balances by company, are as follows:

|

| | | | | | | |

| (Thousands) | Balance Sheet Location | March 31,

2014 | September 30,

2013 |

| NJNG | Broker margin - Current assets | $ | — |

| $ | 213 |

|

| NJNG | Broker margin - Current (liabilities) | $ | (10,573 | ) | $ | — |

|

| NJRES | Broker margin - Current assets | $ | 38,490 |

| $ | 6,368 |

|

Wholesale Credit Risk

NJNG and NJRES are exposed to credit risk as a result of their wholesale marketing activities. In addition, NJRCEV engages in SREC sales. As a result of the inherent volatility in the prices of natural gas commodities, derivatives and SRECs, the market value of contractual positions with individual counterparties could exceed established credit limits or collateral provided by those counterparties. If a counterparty failed to perform the obligations under its contract (e.g., failed to deliver or pay for natural gas), then the Company could sustain a loss.

NJR monitors and manages the credit risk of its wholesale marketing operations through credit policies and procedures that management believes reduce overall credit risk. These policies include a review and evaluation of current and prospective counterparties' financial statements and/or credit ratings, daily monitoring of counterparties' credit limits and exposure, daily communication with traders regarding credit status and the use of credit mitigation measures, such as collateral requirements and netting agreements. Examples of collateral include letters of credit and cash received for either prepayment or margin deposit. Collateral may be requested due to NJR's election not to extend credit or because exposure exceeds defined thresholds. Most of NJR's wholesale marketing contracts contain standard netting provisions. These contracts include those governed by ISDA and the NAESB. The netting provisions refer to payment netting, whereby receivables and payables with the same counterparty are offset and the resulting net amount is paid to the party to which it is due.

The following is a summary of gross credit exposures grouped by investment and noninvestment grade counterparties, as of March 31, 2014. Internally-rated exposure applies to counterparties that are not rated by S&P or Moody's. In these cases, the Company's or guarantor's financial statements are reviewed, and similar methodologies and ratios used by S&P and/or Moody's are applied to arrive at a substitute rating. Gross credit exposure is defined as the unrealized fair value of physical and financial derivative commodity contracts, plus any outstanding wholesale receivable for the value of natural gas delivered and/or financial derivative commodity contract that has settled for which payment has not yet been received. The amounts presented below have not been reduced by any collateral received or netting and exclude accounts receivable for NJNG retail natural gas sales and services.

|

| | | | | |

| (Thousands) | Gross Credit Exposure |

| Investment grade | | $ | 299,185 |

| |

| Noninvestment grade | | 6,104 |

| |

| Internally rated investment grade | | 43,953 |

| |

| Internally rated noninvestment grade | | 27,356 |

| |

| Total | | $ | 376,598 |

| |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Conversely, certain of NJNG's and NJRES' derivative instruments are linked to agreements containing provisions that would require cash collateral payments from the Company if certain events occur. These provisions vary based upon the terms in individual counterparty agreements and can result in cash payments if NJNG's credit rating were to fall below its current level. NJNG's credit rating, with respect to S&P, reflects the overall corporate credit profile of NJR. Specifically, most, but not all, of these additional payments will be triggered if NJNG's debt is downgraded by the major credit agencies, regardless of investment grade status. In addition, some of these agreements include threshold amounts that would result in additional collateral payments if the values of derivative liabilities were to exceed the maximum values provided for in relevant counterparty agreements. Other provisions include payment features that are not specifically linked to ratings, but are based on certain financial metrics.

Collateral amounts associated with any of these conditions are determined based on a sliding scale and are contingent upon the degree to which the Company's credit rating and/or financial metrics deteriorate, and the extent to which liability amounts exceed applicable threshold limits. The aggregate fair value of all derivative instruments with credit-risk-related contingent features that were in a liability position on March 31, 2014 and September 30, 2013, was $200,000 and $2 million, respectively, for which the Company had not posted collateral. If all thresholds related to the credit-risk-related contingent features underlying these agreements had been invoked on March 31, 2014 and September 30, 2013, the Company would have been required to post an additional $200,000 and $1.1 million, respectively, to its counterparties. These amounts differ from the respective net derivative liabilities reflected on the Unaudited Condensed Consolidated Balance Sheets because the agreements also include clauses, commonly known as “Rights of Offset,” that would permit the Company to offset its derivative assets against its derivative liabilities for determining additional collateral to be posted, as previously discussed.

Fair Value of Assets and Liabilities

The fair value of cash and temporary investments, commercial paper and borrowings under revolving credit facilities are estimated to equal their carrying amounts due to the short maturity of those instruments. Non-current loan receivables are recorded based on what the company expects to receive, which approximates fair value. The Company regularly evaluates the credit quality and collection profile of its customers to approximate fair value.

The estimated fair value of long-term debt, including current maturities and excluding capital leases, is as follows:

|

| | | | | | |

| (Thousands) | March 31,

2014 | September 30,

2013 |

| Carrying value | $ | 594,845 |

| $ | 529,845 |

|

| Fair market value | $ | 622,213 |

| $ | 556,518 |

|

NJR utilizes a discounted cash flow method to determine the fair value of its debt. Inputs include observable municipal and corporate yields, as appropriate for the maturity of the specific issue and the Company's credit rating. As of March 31, 2014, NJR discloses its debt within Level 2 of the fair value hierarchy.

Fair Value Hierarchy

NJR applies fair value measurement guidance to its financial assets and liabilities, as appropriate, which include financial derivatives and physical commodity contracts qualifying as derivatives, available for sale securities and other financial assets and liabilities. In addition, authoritative accounting literature prescribes the use of a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value based on the source of the data used to develop the price inputs. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities and the lowest priority to inputs that are based on unobservable market data and include the following:

| |

| Level 1 | Unadjusted quoted prices for identical assets or liabilities in active markets. NJR's Level 1 assets and liabilities include exchange traded futures and options contracts, listed equities, and money market funds. Exchange traded futures and options contracts include all energy contracts traded on the NYMEX/CME and ICE that NJR refers internally to as basis swaps, fixed swaps, futures and options that are cleared through a FCM. |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

| |

| Level 2 | Other significant observable inputs such as interest rates or price data, including both commodity and basis pricing that is observed either directly or indirectly from publications or pricing services. NJR's Level 2 assets and liabilities include over-the-counter physical forward commodity contracts and swap contracts or derivatives that are initially valued using observable quotes and are subsequently adjusted to include time value, credit risk or estimated transport pricing components for which no basis price is available. Level 2 financial derivatives consist of transactions with non-FCM counterparties (basis swaps, fixed swaps and/or options). For some physical commodity contracts the Company utilizes transportation tariff rates that are publicly available and that it considers to be observable inputs that are equivalent to market data received from an independent source. There are no significant judgments or adjustments applied to the transportation tariff inputs and no market perspective is required. Even if the transportation tariff input was considered to be a “model”, it would still be considered to be a Level 2 input as: |

1) The data is widely accepted and public

2) The data is non-proprietary and sourced from an independent third party

3) The data is observable and published

These additional adjustments are generally not considered to be significant to the ultimate recognized values.

| |

| Level 3 | Inputs derived from a significant amount of unobservable market data; these include NJR's best estimate of fair value and are derived primarily through the use of internal valuation methodologies. |

Assets and liabilities measured at fair value on a recurring basis are summarized as follows:

|

| | | | | | | | | | | | | | | | | | |

| | Quoted Prices in Active Markets for Identical Assets | Significant Other Observable Inputs | Significant Unobservable Inputs | |

| (Thousands) | (Level 1) | (Level 2) | (Level 3) | Total |

| As of March 31, 2014: | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Physical forward commodity contracts | | $ | — |

| | | $ | 5,832 |

| | | $ | — |

| | $ | 5,832 |

|

| Financial derivative contracts - natural gas | | 41,620 |

| | | — |

| | | — |

| | 41,620 |

|

| Financial derivative contracts - foreign exchange | | — |

| | | — |

| | | — |

| | — |

|

Available for sale equity securities - energy industry (1) | | 11,218 |

| | | — |

| | | — |

| | 11,218 |

|

Other (2) | | 1,263 |

| | | — |

| | | — |

| | 1,263 |

|

| Total assets at fair value | | $ | 54,101 |

| | | $ | 5,832 |

| | | $ | — |

| | $ | 59,933 |

|

| Liabilities: | | | | | | | | | | |

| Physical forward commodity contracts | | $ | — |

| | | $ | 35,680 |

| | | $ | — |

| | $ | 35,680 |

|

| Financial derivative contracts - natural gas | | 40,451 |

| | | — |

| | | — |

| | 40,451 |

|

| Financial derivative contracts - foreign exchange | | — |

| | | 284 |

| | | — |

| | 284 |

|

| Total liabilities at fair value | | $ | 40,451 |

| | | $ | 35,964 |

| | | $ | — |

| | $ | 76,415 |

|

| As of September 30, 2013: | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| Physical forward commodity contracts | | $ | — |

| | | $ | 11,823 |

| | | $ | — |

| | $ | 11,823 |

|

| Financial derivative contracts - natural gas | | 44,249 |

| | | — |

| | | — |

| | 44,249 |

|

| Financial derivative contracts - foreign exchange | | — |

| | | 16 |

| | | — |

| | 16 |

|

Available for sale equity securities - energy industry (1) | | 11,716 |

| | | — |

| | | — |

| | 11,716 |

|

Other (2) | | 1,129 |

| | | — |

| | | — |

| | 1,129 |

|

| Total assets at fair value | | $ | 57,094 |

| | | $ | 11,839 |

| | | $ | — |

| | $ | 68,933 |

|

| Liabilities: | | | | | | | | | | |

| Physical forward commodity contracts | | $ | — |

| | | $ | 14,595 |

| | | $ | — |

| | $ | 14,595 |

|

| Financial derivative contracts - natural gas | | 28,248 |

| | | — |

| | | — |

| | 28,248 |

|

| Financial derivative contracts - foreign exchange | | — |

| | | 5 |

| | | — |

| | 5 |

|

| Total liabilities at fair value | | $ | 28,248 |

| | | $ | 14,600 |

| | | $ | — |

| | $ | 42,848 |

|

| |

| (1) | Included in Other noncurrent assets on the Unaudited Condensed Consolidated Balance Sheets. |

| |

| (2) | Includes various money market funds. |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

| |

| 6. | INVESTMENTS IN EQUITY INVESTEES |

Investment in equity investees includes NJR's equity method and cost method investments.

Equity Method Investments

|

| | | | | | |

| (Thousands) | March 31,

2014 | September 30,

2013 |

| Steckman Ridge | $ | 129,171 |

| $ | 129,707 |

|

| Iroquois | 23,166 |

| 23,084 |

|

| Total | $ | 152,337 |

| $ | 152,791 |

|

As of March 31, 2014, the investment in Steckman Ridge includes loans with a total outstanding principal balance of $70.4 million. The loans accrue interest at a variable rate that resets quarterly and are due October 1, 2023.

NJRES and NJNG have entered into transportation, storage and park and loan agreements with Steckman Ridge and Iroquois. See Note 14. Related Party Transactions for more information on these intercompany transactions.

Cost Method Investments

During the fourth quarter of fiscal 2012, NJR invested $8.8 million in OwnEnergy, a developer of on-shore wind projects, for an 18.7 percent ownership interest and the right, but not the obligation, to purchase certain qualified projects. This investment is accounted for in accordance with the cost method of accounting.

On October 11, 2013, NJRCEV acquired the development rights of the Two Dot wind project in Montana, which is its first onshore wind project. NJRCEV expects to invest approximately $22 million to construct the 9.7 MW wind project, which NJRCEV expects to be operational in the third quarter of fiscal 2014. In the second quarter of 2014, NJRCEV acquired the development rights to its second wind project, a $42 million, 20 MW wind farm currently under construction in Carroll County, Iowa, which NJRCEV expects to be operational in the second quarter of fiscal 2015.

The following table presents the calculation of the Company's basic and diluted earnings per share for:

|

| | | | | | | | | | | | |

| | Three Months Ended | Six Months Ended |

| | March 31, | March 31, |

| (Thousands, except per share amounts) | 2014 | 2013 | 2014 | 2013 |

| Net income | $ | 172,971 |

| $ | 45,469 |

| $ | 180,664 |

| $ | 105,675 |

|

| Basic earnings per share |

|

|

|

|

| Weighted average shares of common stock outstanding-basic | 42,079 |

| 41,789 |

| 42,050 |

| 41,742 |

|

| Basic earnings per common share | $4.11 | $1.09 | $4.30 | $2.53 |

| Diluted earnings per share |

|

|

|

|

| Weighted average shares of common stock outstanding-basic | 42,079 |

| 41,789 |

| 42,050 |

| 41,742 |

|

Incremental shares (1) | 378 |

| 183 |

| 378 |

| 183 |

|

| Weighted average shares of common stock outstanding-diluted | 42,457 |

| 41,972 |

| 42,428 |

| 41,925 |

|

Diluted earnings per common share (2) | $4.07 | $1.08 | $4.26 | $2.52 |

| |

| (1) | Incremental shares consist of stock options, stock awards and performance units. |

| |

| (2) | There were no anti-dilutive shares excluded from the calculation of diluted earnings per share for the three and six months ended March 31, 2014 and 2013. |

New Jersey Resources Corporation

Part I

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Changes in common stock equity during the six months ended March 31, 2014, are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | |

| (Thousands) | Number of Shares | Common Stock | Premium on Common Stock | Accumulated Other Comprehensive (Loss) Income | Treasury Stock And Other | Retained Earnings | Total |

| Balance as of September 30, 2013 | 41,962 |

| $ | 112,563 |

| $ | 300,196 |

| | $ | (1,621 | ) | | $ | (128,638 | ) | $ | 604,884 |

| $ | 887,384 |

|

| Net income | | | | | | | | 180,664 |

| 180,664 |

|

| Other comprehensive (loss) | | | | | (159 | ) | | | | (159 | ) |

| Common stock issued under stock plans | 224 |

| 143 |

| 2,817 |

| |

| | 6,741 |

|

| 9,701 |

|

| Tax benefits from stock plans | | | 94 |

| | | | | | 94 |

|

| Cash dividend declared ($.84 per share) | | | | | | | | (35,314 | ) | (35,314 | ) |

| Treasury stock and other | (111 | ) | | | | | | (3,188 | ) | | (3,188 | ) |

| Balance as of March 31, 2014 | 42,075 |

| $ | 112,706 |

| $ | 303,107 |

| | $ | (1,780 | ) | | $ | (125,085 | ) | $ | 750,234 |

| $ | 1,039,182 |

|

Accumulated Other Comprehensive Income

The following table presents the changes in the components of accumulated other comprehensive income, net of related tax effects:

|

| | | | | | | | | | | | | | | |

| (Thousands) | Available for Sale Securities | Cash Flow Hedges | Postemployment Benefit Obligation | Total |

| Balance as of September 30, 2013 | $ | 5,400 |

| | $ | 12 |

| | $ | (7,033 | ) | | $ | (1,621 | ) |

| Other comprehensive income, net of tax | | | | | | | |

| Other comprehensive (loss), before reclassifications, net of tax of $203, $169, $-, $372 | (295 | ) | | (291 | ) | | — |

| | (586 | ) |

| Amounts reclassified from accumulated other comprehensive income, net of tax of $-, $(60), $(223), $(283) | — |

| | 105 |

| (1) | 322 |

| (2) | 427 |

|

| Net current-period other comprehensive (loss) income, net of tax of $203, $109, $(223), $89 | (295 | ) | | (186 | ) | | 322 |

| | (159 | ) |

| Balance as of March 31, 2014 | $ | 5,105 |

| | $ | (174 | ) | | $ | (6,711 | ) | | $ | (1,780 | ) |

| | | | | | | | |

| Balance as of September 30, 2012 | $ | 4,921 |

| | $ | 51 |

| | $ | (15,743 | ) | | $ | (10,771 | ) |

| Other comprehensive income, net of tax | | | | | | | |

| Other comprehensive income, before reclassifications, net of tax of $(226), $26, $-, $(200) | 327 |

| | (45 | ) | | — |

| | 282 |

|

| Amounts reclassified from accumulated other comprehensive income, net of tax of $-, $(16) $(406), $(422) | — |

| | 28 |

| (1) | 709 |

| (2) | 737 |

|

| Net current-period other comprehensive income, net of tax of $(226), $10, $(406), $(622) | 327 |

| | (17 | ) | | 709 |

| | 1,019 |

|

| Balance as of March 31, 2013 | $ | 5,248 |

| | $ | 34 |

| | $ | (15,034 | ) | | $ | (9,752 | ) |

| |

| (1) | Consists of realized losses related to foreign currency derivatives, which are reclassified to gas purchases in the Unaudited Condensed Consolidated Statements of Operations. |

| |